DK Goel Solutions Chapter 1 Financial Statements of Not for Profit Organisations

Read below DK Goel Solutions for Class 12 Chapter 1 Financial Statements of Not for Profit Organisations. These not for profit organisation class 12 solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

In this chapter you will be able to understand the concepts of non-profit organisations and the process of doing accounting for such organisations. Students should note that the accounting process for companies is slightly different from accounting of non profit organisations. This chapter and the questions given at the end will help the students to clearly understand the entire accounting process.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Financial Statements of Not for Profit Organisations (NPO) DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Question 1.

Solution 1

Receipts and Payments Account Features:

1.) Capital and revenue: all receipts and payments are registered, whether in terms of revenue or capital.

2.) Period: Cash and bank deposits are reported without discriminating between present, recent or consecutive (next) accounting cycles.

3.) Opening and closing balance: At the beginning of the accounting period, the opening balance of this account shows cash in hand and/or at the bank and the closing balance shows cash in hand and/or at the bank at the end of the accounting period.

Question 2.

Solution 2

Features of the Account for Revenue and Expenditure:—

1.) Nature: It is an account of a nominal account. It is also debited with costs and liabilities and profits and gains are attributed it.

2.) Opening and closing balance: No opening balance is available. The balance is either a surplus or a loss at the p. It is moved from the balance sheet the Capital Budget.

3.) Adjustment: This account shall be prepared on an accrual accounting basis and all changes shall be rendered in respect of prepaid or outstanding costs and sales, depreciation clauses or questionable debts.

Question 3.

Solution 3

| Basis | Receipt and Payment Account | Income and Expenditure Account |

| Nature | A list of cash transactions showing receipts and transfers is listed under separate headings for the time. | It’s like an account of Profit and Loss. |

| Nature of item | This account’s debit side tracks refunds and logs transfers on the credit side. | This account’s debit side reports costs and losses, and sales and profits are reported on the credit side. |

| Period | If they refer the prior, present or successive year, it displays refunds and transfers over the year. | It indicates the current year’s revenue and spending alone. |

Question 4.

Solution 4

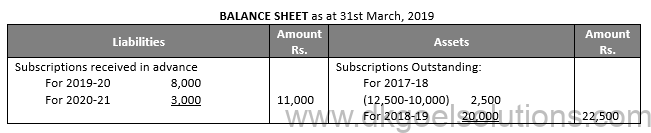

(i) Outstanding Subscription:- Outstanding Subscription Revenue and Expense A/c of the year is reported on the debit side and is also displayed on the Assets Side of the Balance Sheet of the current year.

(ii) Subscriptions received in advance:- Subscriptions received in advance for the coming year are displayed on the balance sheet side of the liabilities.

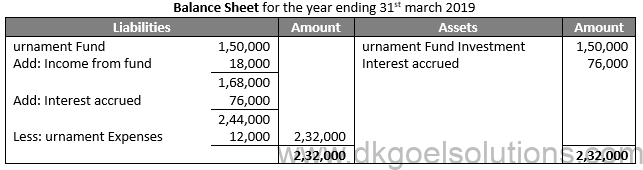

(iii) urnament Fund:- The urnament Fund will be viewed in line with the changes on the debt side of the balance sheet.

Question 5.

Solution 5

- Cash/bank reserves have been omitted for opening and closing.

- The payment of capital spending for the acquisition of government securities has been removed.

- The number of subscriptions earned was omitted for the years 2013-14 and 2014-15.

- The life membership fee is an object of receipt of capital and is therefore exempt.

- Construction donation is a receipt for a particular reason and is therefore exempt.

Question 6.

Solution 6

(i) Capital Fund:- The Capital Fund has no limitations on its use. In other words, management can, as it deems necessary, use the sums in the fund serve the reason for which the company operates.

(ii) Legacy:- Legacy is the sum earned a non-profit entity under the will of a dead citizen as a gift. Conditions for its use should or may not be specified the donor. If no condition is stated, the ‘Common Contribution’ is paid for. And it is counted as ‘Unique Donation’ if a provision is stated.

(iii) Particular gift:- If the donor states the reason for which the gift will be used, it is a specific gift. For instance, Donation received Rs. 2,00,000 for a library. It means the donation received can be used only for library, i.e. it is a specific donation.

Question 7.

Solution 7

The selling of an asset can result in a benefit if the value of the sale is greater than the value of the book; or a loss if the value of the sale is less than the value of the book; or neither a profit nor a loss if the value of the sale is equal the value of the book. Book The value of the asset as of the date of selling shall be assessed after depreciation has been paid up the date of sale. Selling value is attributed the Asset Account, while benefit, if any, is credited the Revenue and Expense Account or loss, if any.

Question 8.

Solution 8

(i) Entry fees:- The payment charged an applicant at the time of becoming a member of a not-for-profit entity is the entrance fee or membership fee. A tax refund is an entry charge or entry fee which is thus paid for as an income and added the Income and Expense Account.

(ii) Life Membership Fees:- Life Membership Fees are reported on the liability side of the Balance Sheet as a Capital Receipt and added the Capital Fund. It is not counted as wages since a life member pays a one-time contribution during his life and requires resources.

(iii) Legacy:- Legacy is the sum earned a not-for-profit entity under the will of the deceased citizen as a gift. The donor may or may not specify conditions for its use. In case, no condition is specified, it is accounted as ‘General Donation’. And if a condition is specified, it is accounted as ‘Specific Donation’.

(iv) General donation:- General donation is a donation in which no requirement for its use is specified the donor. The general contribution sum is paid for as revenue and added the account of income and spending.

Question 9.

Solution 9

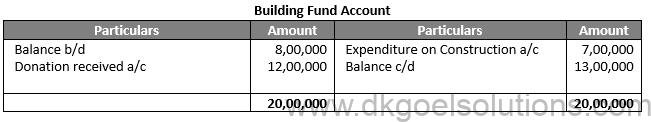

(i) Donation for Construction:- Donation for Construction means that the donation received will only be used as a particular donation for construction. The same donation is capitalized and is displayed on the hand of the balance sheet’s liabilities.

(ii) Selling of publications:- The money paid for newspapers, magazines, newspapers, etc. is credited the revenue and spending budget, which is the cost of income. Thus, the Revenue and Expense Account is credited with the money realized from the selling of old newspapers, books, periodicals, etc.

(iii) Investment Purchased:- Investment investments are viewed as capital spending and are shown on the asset side of the balance sheet.

Question 10.

Solution 10

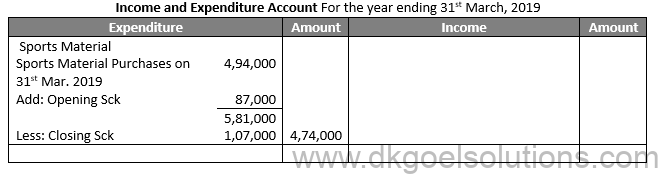

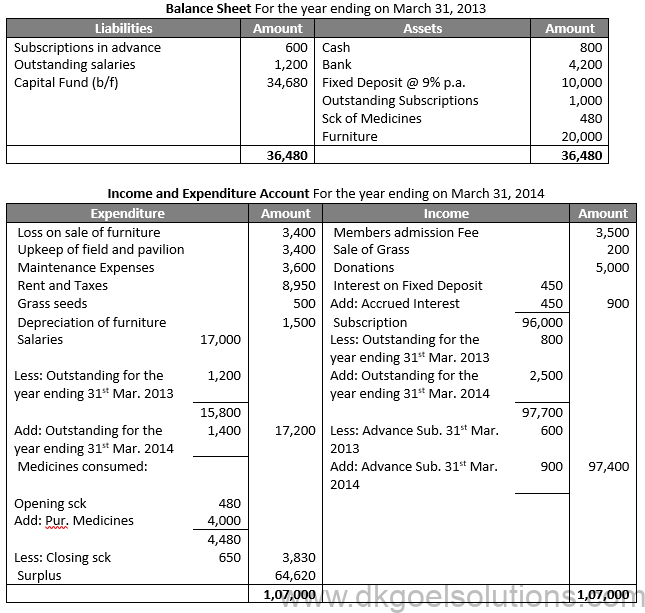

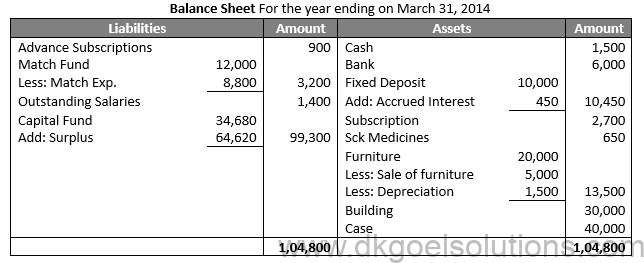

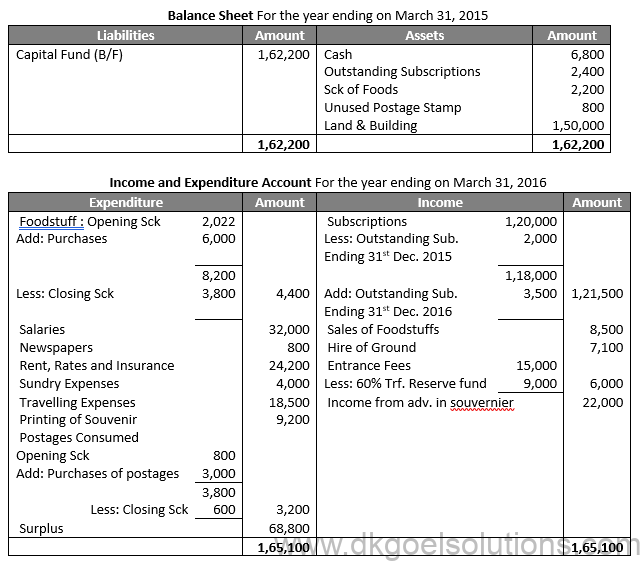

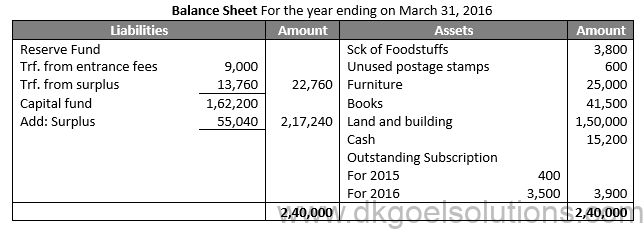

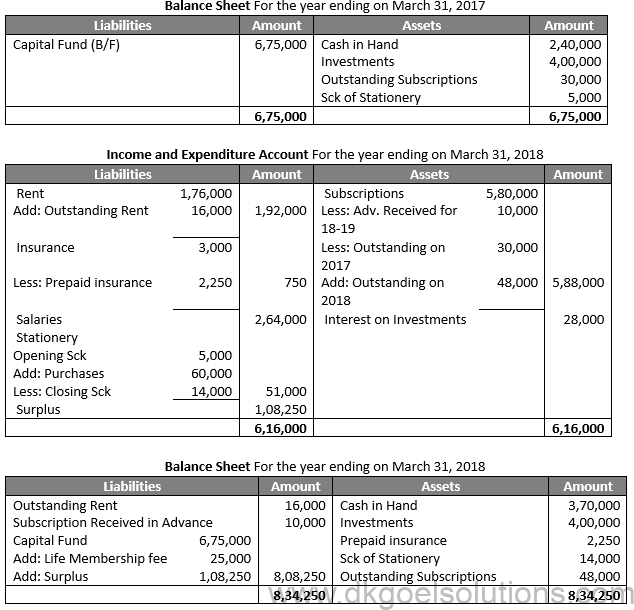

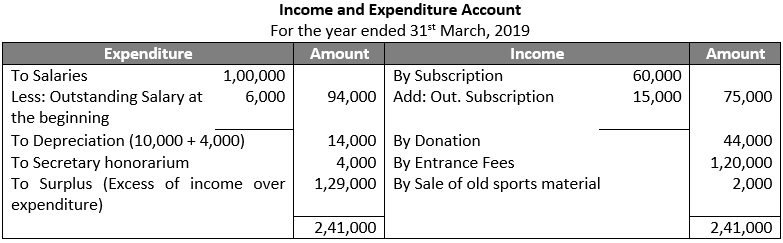

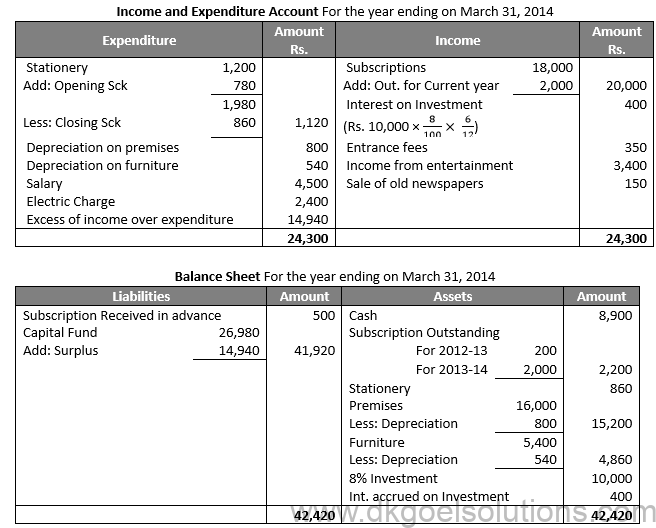

Income and Expenditure Account for the year ending 31st march 2019

Working Note:-

Subscriptions Outstanding = Rs. 18,000 – Rs.15,000 = Rs. 3,000

Question 11.

Solution 11

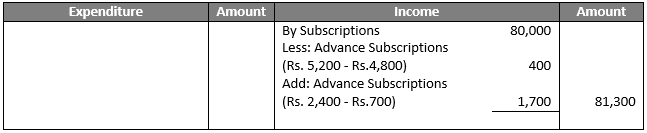

Income and Expenditure Account for the year ending 31st march 2019

Working Note:-

Advance Subscriptions = Rs. 8,000 – Rs.2,000 = Rs. 6,000

Question 12.

Solution 12

Income and Expenditure Account for the year ending 31st march 2019

Working Note:-

Subscriptions Outstanding = Rs. 6,000 – Rs.4,000 = Rs. 2,000

Advance Subscriptions = Rs. 20,000 – Rs.15,000 = Rs. 5,000

Question 13.

Solution 13

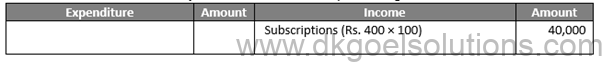

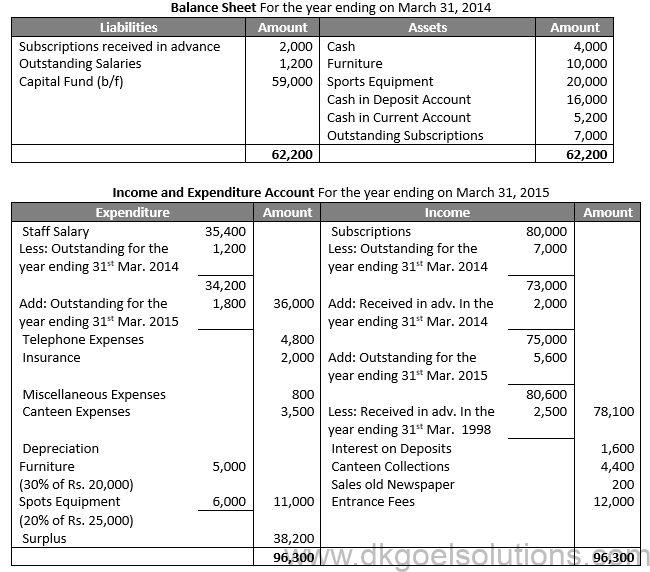

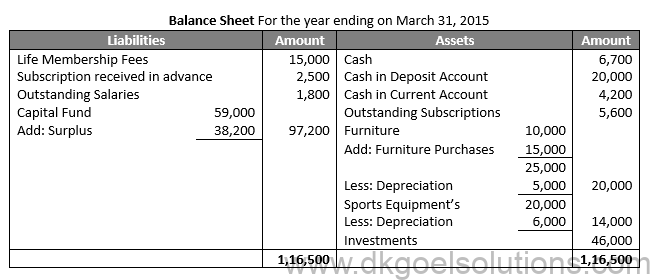

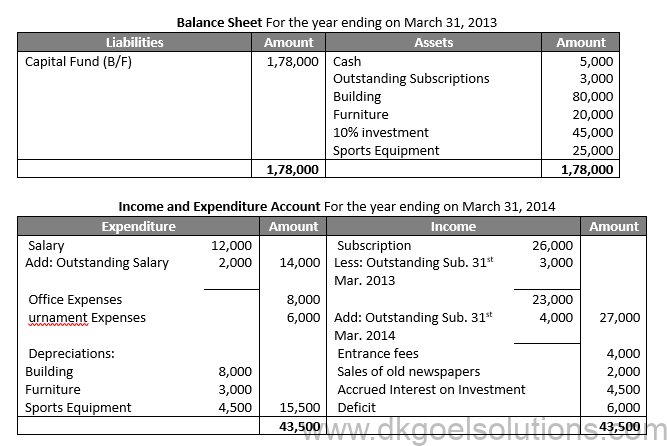

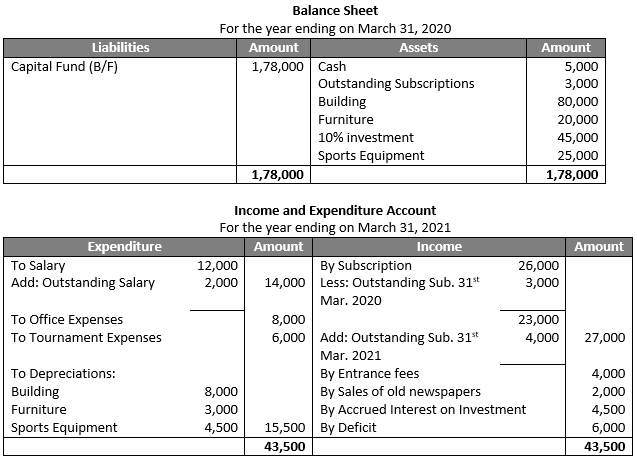

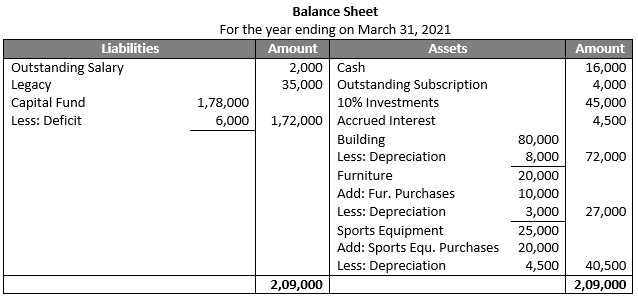

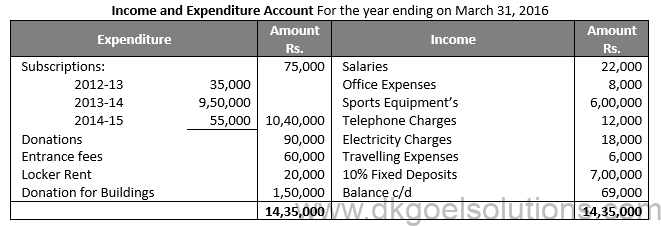

Income and Expenditure Account for the year ending 31st march 2021

Question 14.

Solution 14

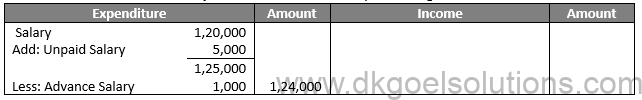

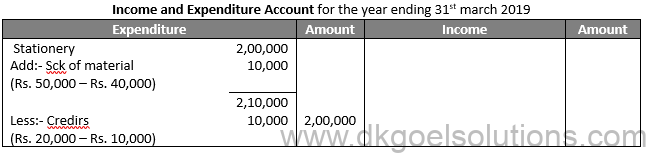

Income and Expenditure Account for the year ending 31st march 2019

Question 15.

Solution 15

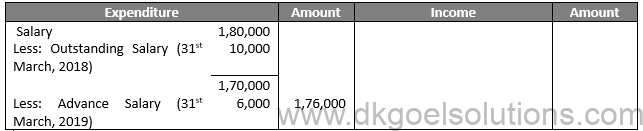

Income and Expenditure Account for the year ending 31st march 2019

Question 16.

Solution 16

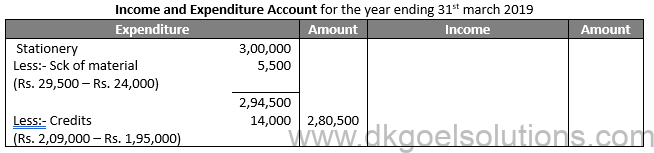

Income and Expenditure Account for the year ending 31st march 2019

Question 17.

Solution 17

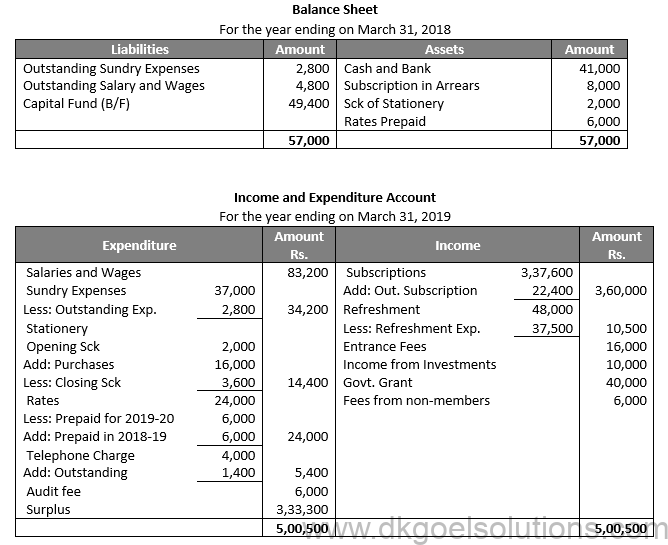

Income and Expenditure Account for the year ending 31st march 2019

Question 18.

Solution 18

Income and Expenditure Account for the year ending 31st march 2019

Question 19.

Solution 19

Income and Expenditure Account for the year ending 31st march 2019

Question 20.

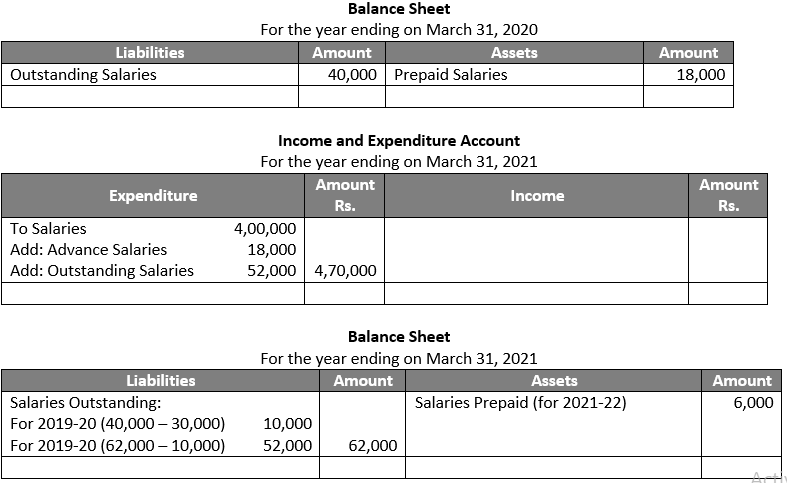

Solution 20

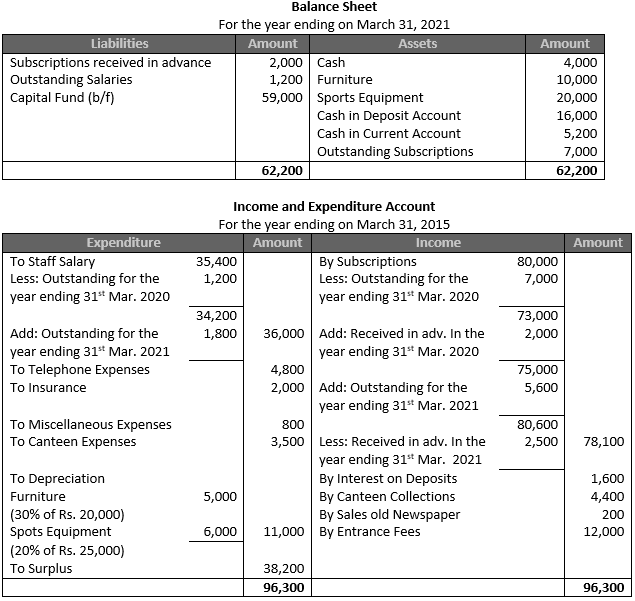

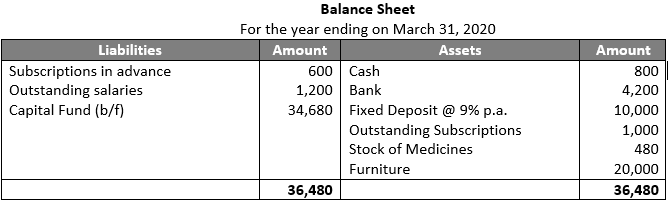

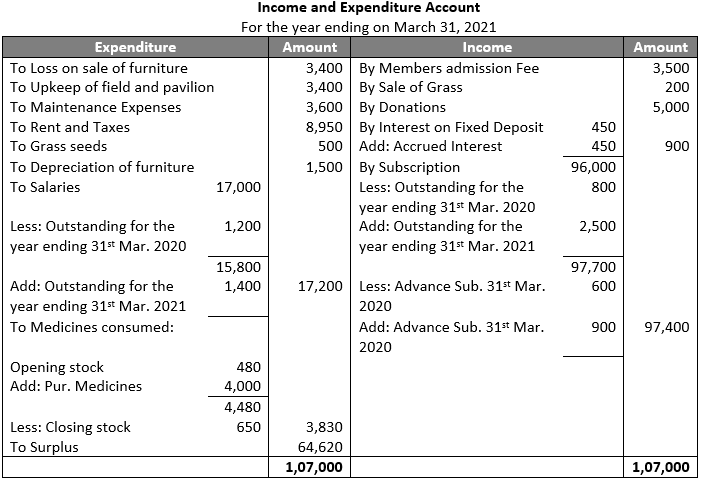

Income and Expenditure Account for the year ending 31st march 2021

Working Note:-

Outstanding Salary 31st March, 2020 = Rs. 4,500 – Rs. 3,000 = Rs. 1,500

Prepaid Salary 31st March, 2021 = Rs. 1,800 – Rs. 1,400 = Rs. 400

Question 21.

Solution 21

Income and Expenditure Account for the year ending 31st march 2021

Question 22.

Solution 22

Question 23.

Solution 23

Question 24.

Solution 24

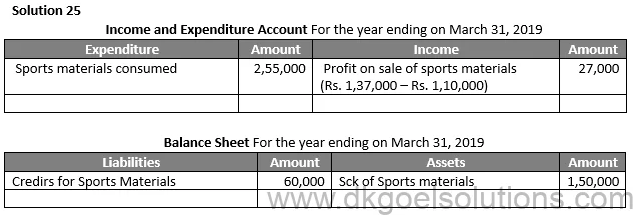

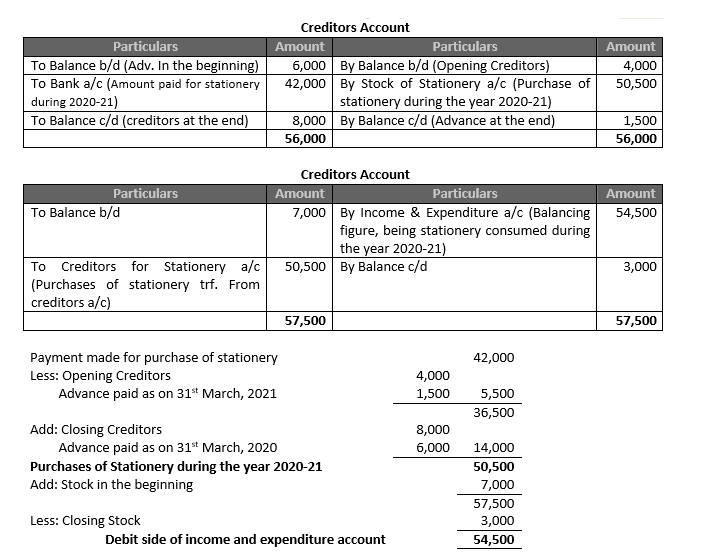

Question 25.

Solution 25

Question 26.

Solution 26

Question 27.

Solution 27

Question 28.

Solution 28

Question 29.

Solution 29

Numerical Questions:-

Question 1.

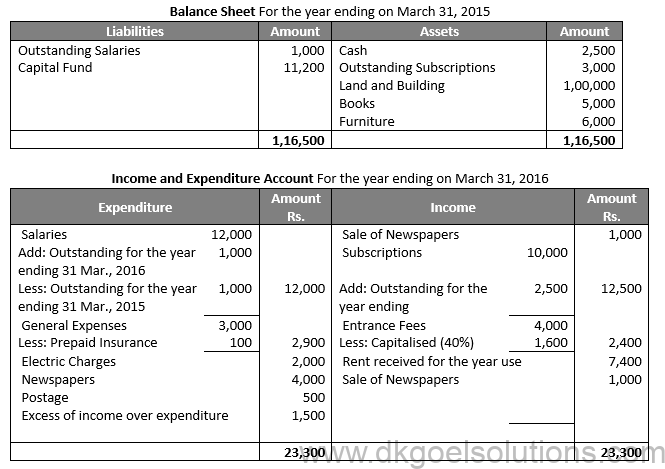

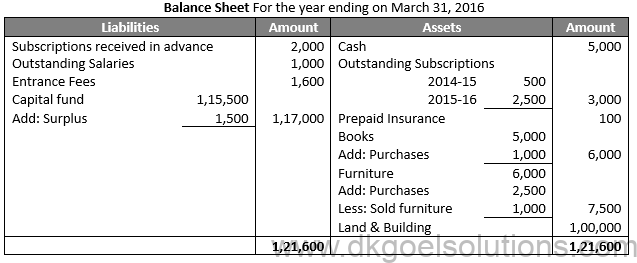

Solution 1

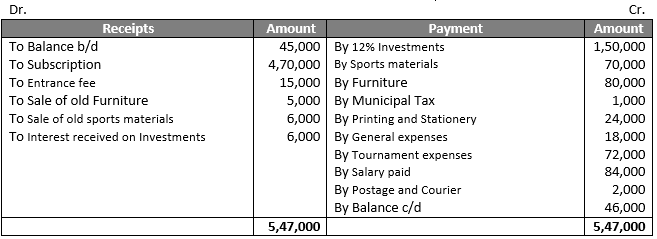

In the Books of Modern Club

Receipts and Payments Account

For the year ended 31st Mar. 2021

Point of Knowledge:-

Sale of an asset may result in gain, if sale value is more than the book value; or loss, if sale value is less than the book value; or neither profit nor loss, if sale value is equal to the book value. Book Value of an asset as on the date of sale is determined after charging depreciation up to the date of sale. Sale Value is credited to the Asset Account while gain, if any, is credited or loss, if any is debited to the Income and Expenditure Account.

Question 2.

Solution 2 In the Books Entertainment Club

Income and Expenditure Account

for the year ending 31st march 2021

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows cash in hand and/or at bank in the beginning of the accounting period and closing balance shows cash in hand and/or at bank at the end of the accounting period.

Question 3.

Solution 3

Point of Knowledge:-

Receipts and Payments Account is merely a summary of the transactions appearing in the Cash Book According to William Pickles, “Receipts and Payments Account” is nothing more than a summary of the cash book over a certain period, analysed and classified under suitable headings. It is the form of account most commonly adopted by the treasures of societies clubs, associations etc. when preparing the results of the year’s working.

Question 4.

Solution 4

Point of Knowledge:-

A receipt and payment account is prepared at the end of the year from the Cash Book. All receipts and payments which are entered in the cash book are also entered in the receipts and payments account, of course, in a summary form. For example, if a club received subscriptions from its members on different dates, they will be recorded in the cash book in a chronological order, whereas the Receipt and Payment Account will contain the total subscriptions received during the year. Any transaction which is not recorded in the Cash Book will not be entered in the receipt and payment account also

Question 5.

Solution 5

Point of Knowledge:-

The Opening balance of cash in hand and at bank appears at the start of the Dr. side of Receipt and Payment account. It should not be taken to the Income and Expenditure Account but written on the assets side of the Opening Balance Sheet.

The Closing balance of cash in hand and at bank appears at the end of the Cr. side of Receipts and payments account. It should be taken to the Assets side of the closing balance sheet.

Question 6

Solution 6 (new)

Question 6.

Solution 6

Point of Knowledge:-

The Opening balance of cash in hand and at bank appears at the start of the Dr. side of Receipt and Payment account. It should not be taken to the Income and Expenditure Account but written on the assets side of the Opening Balance Sheet.

The Closing balance of cash in hand and at bank appears at the end of the Cr. side of Receipts and payments account. It should be taken to the Assets side of the closing balance sheet.

Question 7

Solution 7 (new).

Question 7.

Solution 7

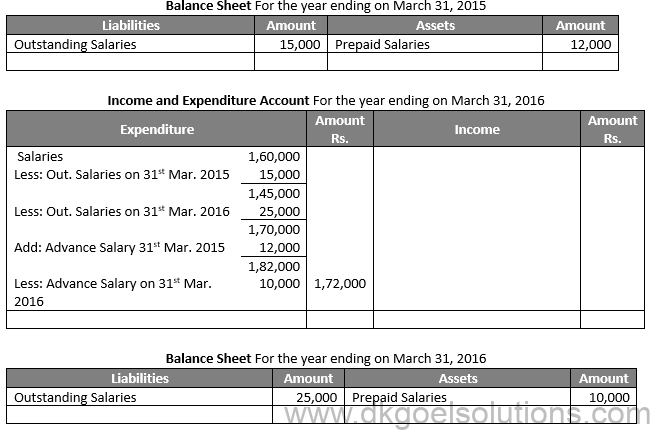

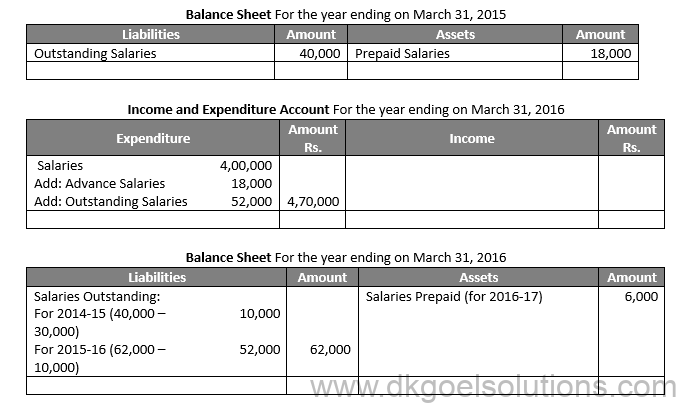

Point of Knowledge:-

Example of Outstanding Expenses:-

Rent paid during the year

Add: Closing Outstanding Rent

Less: Closing Outstanding Rent

Net amount to be transferred to the Dr. side of Income and Expenditure A/c

The amount of outstanding rent at the end of the year will also be shown on the liabilities side of the Closing Balance Sheet and the outstanding rent at the beginning of the year will be shown on the liabilities side of the Opening Balance Sheet.

Question 8.

Solution 8

Point of Knowledge:-

A subscription is an annual membership fee paid by the member. Such organisations’ primary source of revenue is this.

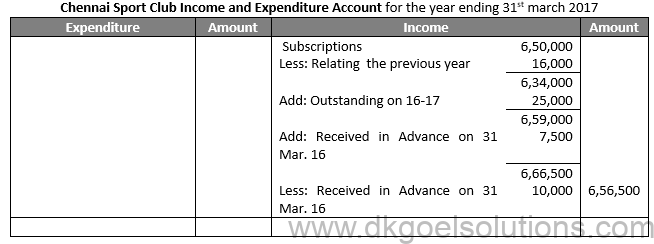

For example, a Kolhi & club got Rs. 2,00,000 in subscriptions in 2016-17, of which Rs. 30,000 relates to 2015-16 and Rs. 20,000 to 2017-18, and Rs. 60,000 is still owed at the end of the year.

Question 9.

Solution 9

Point of Knowledge:-

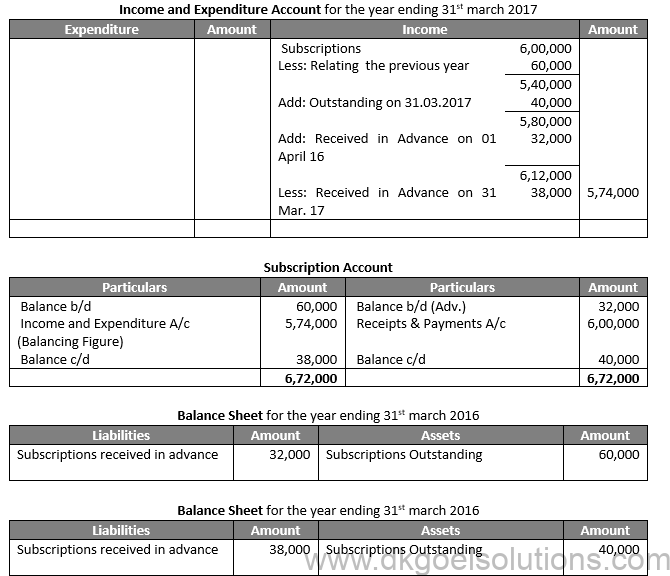

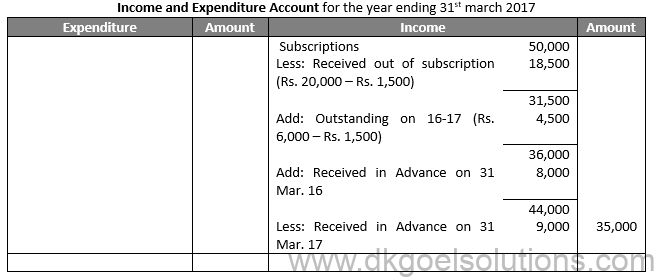

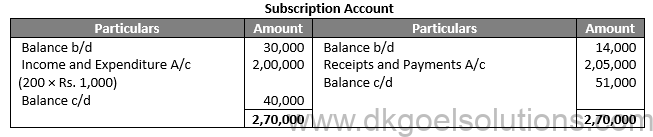

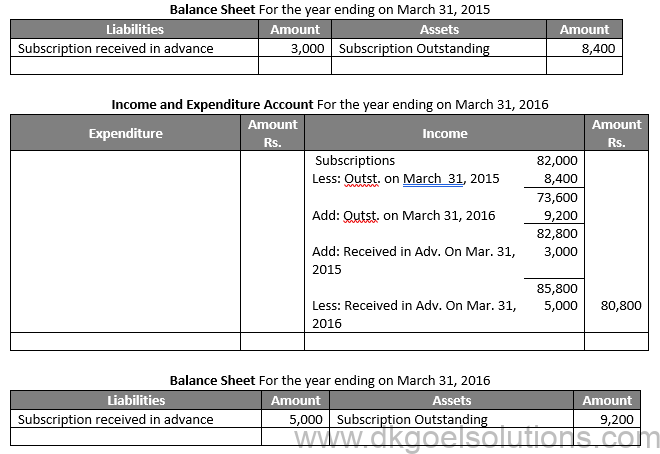

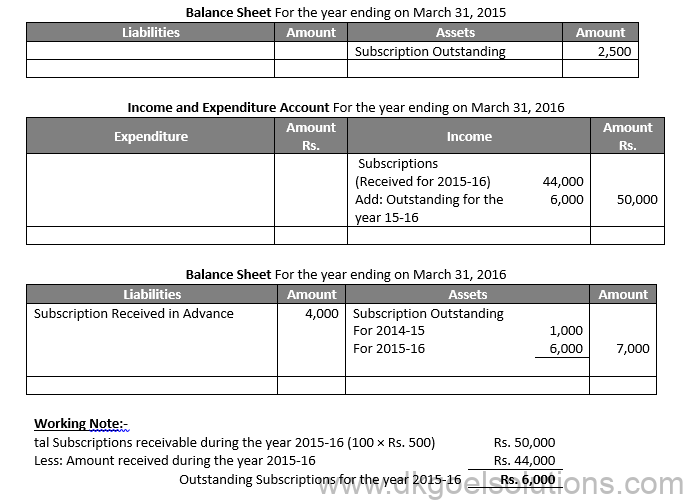

When determining the current period’s subscription, the previous period’s advance subscription and the current period’s outstanding subscription are added to the current period’s subscription. On the other hand, advance subscriptions for the next accounting period obtained during the current period, as well as outstanding subscriptions from the previous period, are deducted from the current period subscription.

Question 10.

Solution 10

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows cash in hand and/or at bank in the beginning of the accounting period and closing balance shows cash in hand and/or at bank at the end of the accounting period.

Question 11.

Solution 11

Point of Knowledge:-

There will be a profit if the selling price is higher than the book price; there will be no profit if the selling price is lower than the book price; and there will be no profit or loss if the selling price is equal to the book price. The book value of an asset is calculated after depreciation has been applied up to the date of sale. The sale value is credited to the Asset Account, and any benefit or loss is debited to the Income and Expenditure Account.

Question 12. (A)

Solution 12

(A)

Point of Knowledge:-

When determining the current period’s subscription, the previous period’s advance subscription and the current period’s outstanding subscription are added to the current period’s subscription. On the other hand, advance subscriptions for the next accounting period obtained during the current period, as well as outstanding subscriptions from the previous period, are deducted from the current period subscription.

Opening and Closing Balance: Opening balance of this account shows cash in hand and/or at bank in the beginning of the accounting period and closing balance shows cash in hand and/or at bank at the end of the accounting period.

Question 12. (B)

Solution 12

(B)

Point of Knowledge:-

When determining the current period’s subscription, the previous period’s advance subscription and the current period’s outstanding subscription are added to the current period’s subscription. On the other hand, advance subscriptions for the next accounting period obtained during the current period, as well as outstanding subscriptions from the previous period, are deducted from the current period subscription.

When determining the current period’s subscription, the previous period’s advance subscription and the current period’s outstanding subscription are added to the current period’s subscription. On the other hand, advance subscriptions for the next accounting period obtained during the current period, as well as outstanding subscriptions from the previous period, are deducted from the current period subscription.

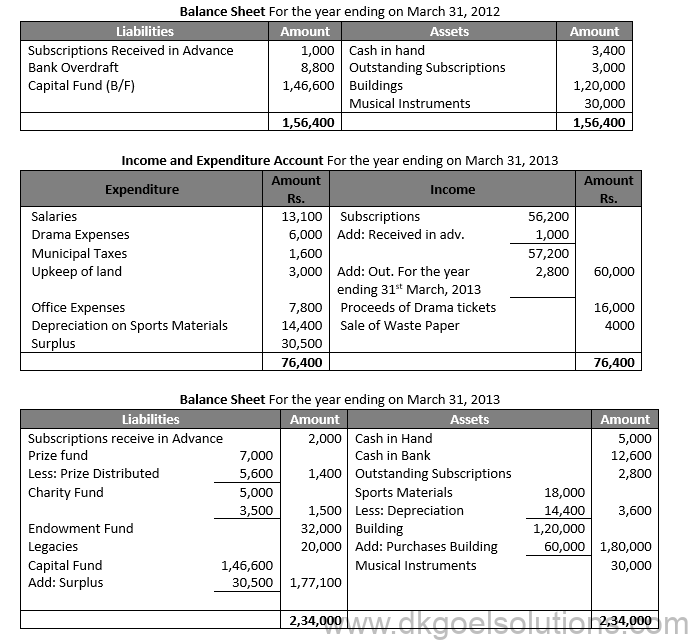

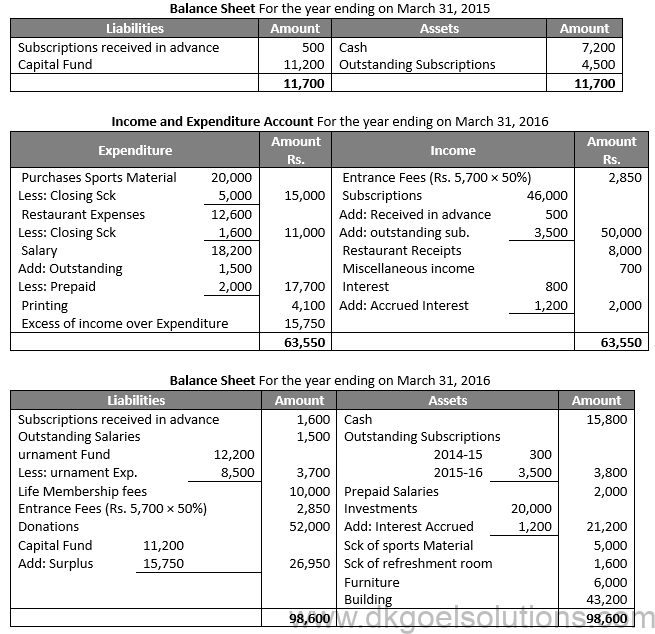

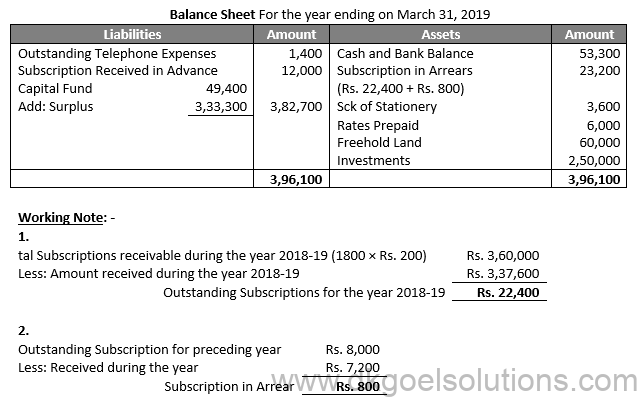

Question 13.

Solution 13

Point of Knowledge:-

Subscription Outstanding at the end of the current year:- It will be (i) added to the amount of subscription on the credit side of the income and expenditure account and (ii) will also be shown on the assets side of the closing balance sheet.

Question 14.

Solution 14

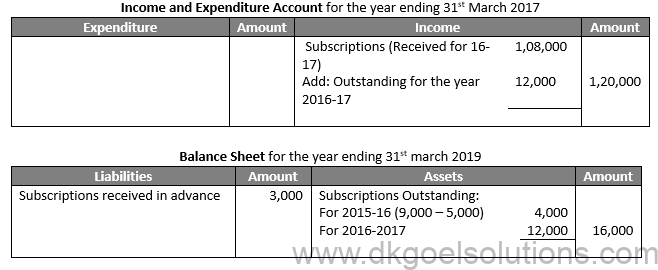

Working Note:-

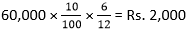

tal subscription received during the year 2016-17 Rs. 1,20,000

Less: Amount received during the year 2016-17 Rs. 1,08,000

Outstanding subscriptions for the year 2016-17 Rs. 12,000

Point of Knowledge:-

A receipt and payment account is prepared at the end of the year from the Cash Book. All receipts and payments which are entered in the cash book are also entered in the receipts and payments account, of course, in a summary form. For example, if a club received subscriptions from its members on different dates, they will be recorded in the cash book in a chronological order, whereas the Receipt and Payment Account will contain the total subscriptions received during the year. Any transaction which is not recorded in the Cash Book will not be entered in the receipt and payment account also.

Question 15.

Solution 15

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

Question 16 (new).

Solution 16 (new).

Question 16.

Solution 16

Point of Knowledge:-

Outstanding Subscription:- It will be (i) deducted from the amount of subscription on the credit side of income and expenditure account, and (ii) will also be shown on the assets side of the opening balance sheet.

Question 17.

Solution 17

Point of Knowledge:-

A Balance Sheet is also prepared even by non-profit organisation;s to show the financial position on the last date of the accounting year. It is prepared from the balance remaining after the transfer of all revenue incomes and expenditures to the income and expenditure account.

Question 18.

Solution 18

Point of Knowledge:-

General Donation of small amount is shown on the credit side of the Income and Expenditure Account because small donations can be expected every year. Whether the amount of donation is big or small depends on the size and nature of the institution.

Question 19.

Solution 19

Point of Knowledge:-

It is an income pertaining to the next year. As such, it will be (i) deducted from the amount of subscription on the credit side of Income and Expenditure Account and (ii) will also be shown on the liabilities side of the closing balance sheet

Question 20.

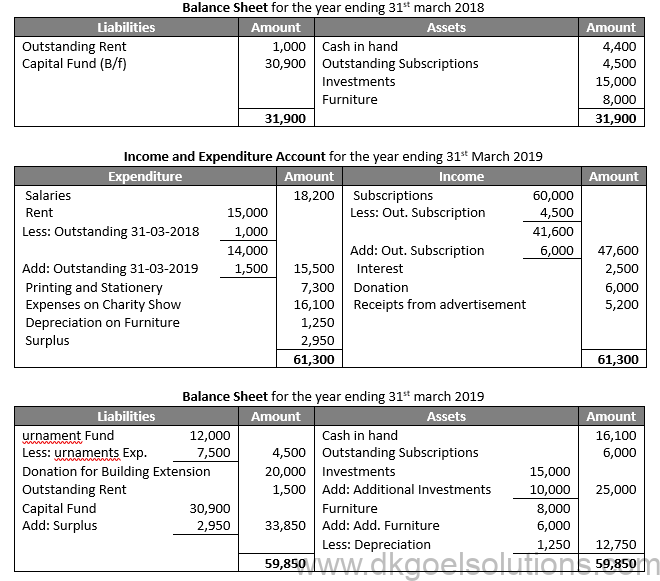

Solution 20

Point of Knowledge:-

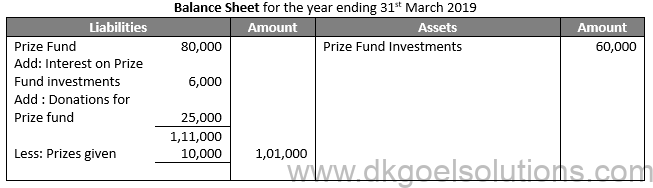

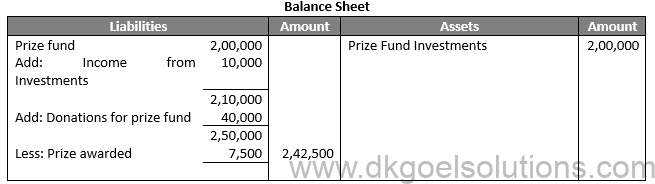

Any receipt related to a specific fund or reserve is treated as capital receipt such as Charity Fund. Match Fund, Prize fund, Sports Fund, Tournament Fund, Pension Fund etc. All these reserves or fund should be shown on the liabilities side of the balance sheet after deducting the expenses in respect of these funds.

Question 21.

Solution 21

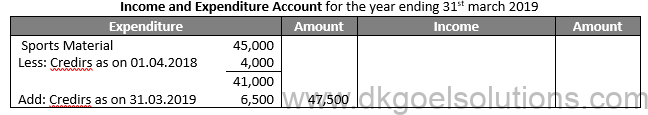

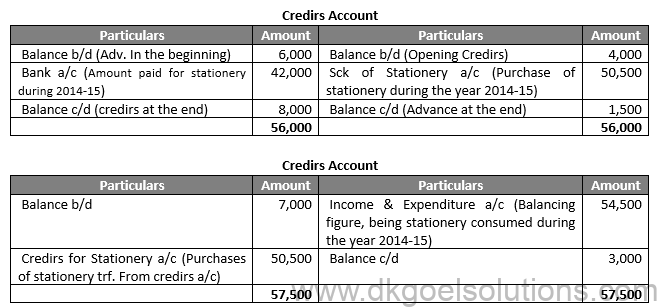

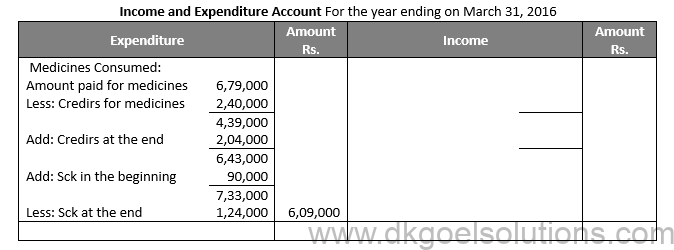

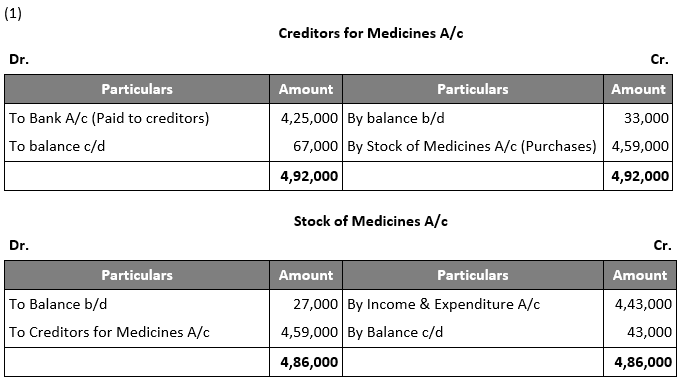

Point of Knowledge:-

Amount paid for during the year

Add: Opening Stock

Less: Closing Stock

Less: Opening Creditors

Add: Closing Creditors

Amount during the year 2018-19

Question 22 (new).

Solution 22 (new).

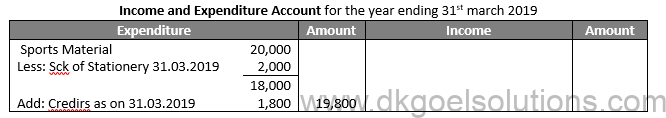

Question 22.

Solution 22

Working Note:-

Credirs for Sports Materials will be ignored because purchased of sports materials given in the question.

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

Question 23 (new).

Solution 23 (new).

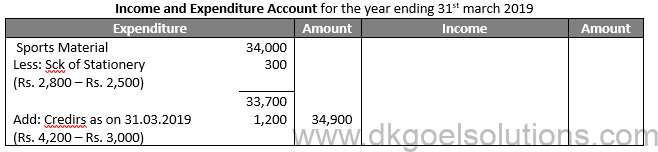

Question 23.

Solution 23

Point of Knowledge:-

Amount paid for during the year

Add: Opening Stock

Less: Closing Stock

Less: Opening Creditors

Add: Closing Creditors

Amount Consumed during the year

Question 24.

Solution 24

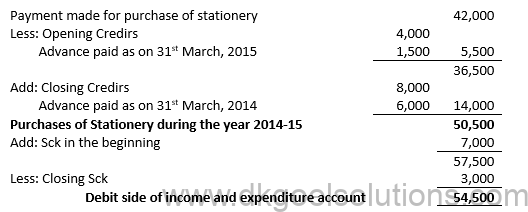

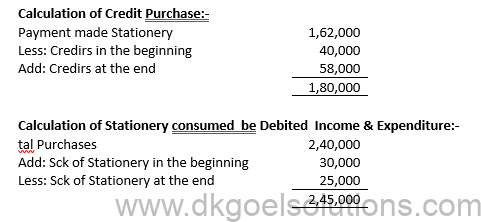

Calculation of Stationery consumed be Debited Income & Expenditure:-

tal Purchases 2,40,000

Add: Sck of Stationery in the beginning 30,000

Less: Sck of Stationery at the end 25,000

2,45,000

Calculation of Cash Purchase of Stationery:-

Let tal Purchases is Rs. 100

Cash Purchases will be Rs. 25

Credit Purchases Rs. 75

If Credit Purchase is Rs. 1,80,000 Cash Purchases = Rs. 1,80,000 × 25/75

Cash Purchases = Rs. 60,000

tal Purchases = Credit Purchases + Cash Purchases

tal Purchases = Rs. 1,80,000 + Rs. 60,000

tal Purchases = Rs. 2,40,000

Point of Knowledge:-

There are some items, of which the opening and closing stock is given in the question and also the payment made for such items is given in the Receipts and Payments Account. Such items are known as ‘Consumable Goods’. In other words, the items are consumed during the year such as Foodstuffs, Medicines, Sports Materials, Postage, Stationery etc. The amount to be shown in income and expenditure account in respect of such items will be calculated as follows:-

Question 25.

Point of Knowledge:-

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side.

Question 26 (new).

Solution 26 (new).

Question 26.

Solution 26

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

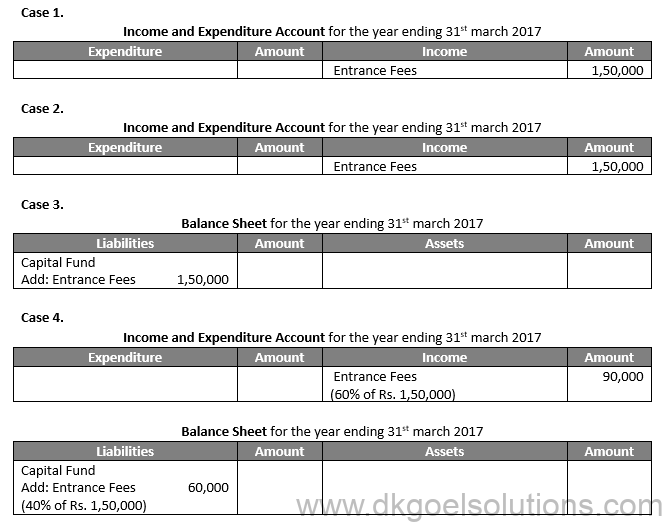

Question 27.

Solution 27

Point of Knowledge:-

In the absence of any specific instructions in the examination, entrance fees may be treated as revenue receipt and as such may be shown on the credit side of Income and Expenditure Account.

However, if an instruction is given in the question to treat it as ‘Capital Receipt’ it should be shown on the liabilities side of current year’s Balance Sheet.

Question 28.

Solution 28

Point of Knowledge:-

A Balance Sheet is also prepared even by non-profit organisations to show the financial position on the last date of the accounting year. It is prepared from the balance remaining after the transfer of all revenue incomes and expenditures to the income and expenditure account.

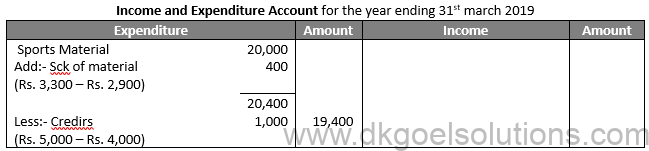

Question 29 A (new).

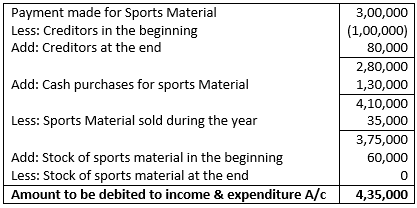

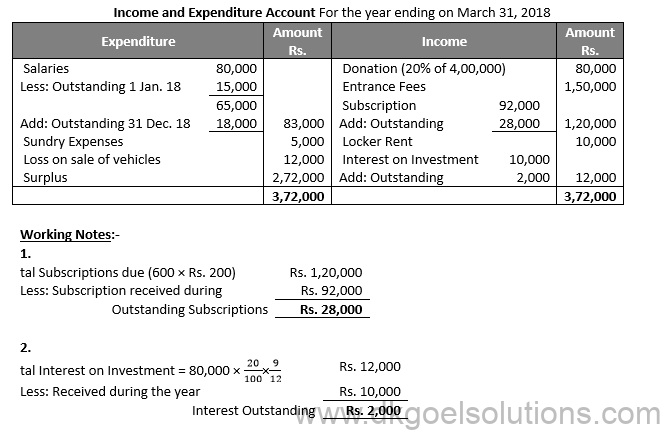

Solution 28 A (new). Calculation of Sports Material Consumed to be Debited to Income and Expenditure A/c:-

Points of Knowledge:-

Calculation of the Cost of Consumable Goods:-

Question 29 B (new).

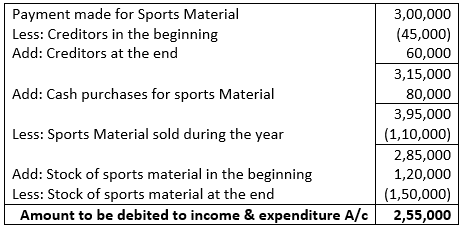

Solution 28 B (new). Calculation of Sports Material Consumed to be Debited to Income and Expenditure A/c:-

Assets side of the balance sheet stock of sports materials = Rs. 1,50,000

Liabilities side of the balance sheet creditors of sports materials = Rs. 60,000

Question 29.

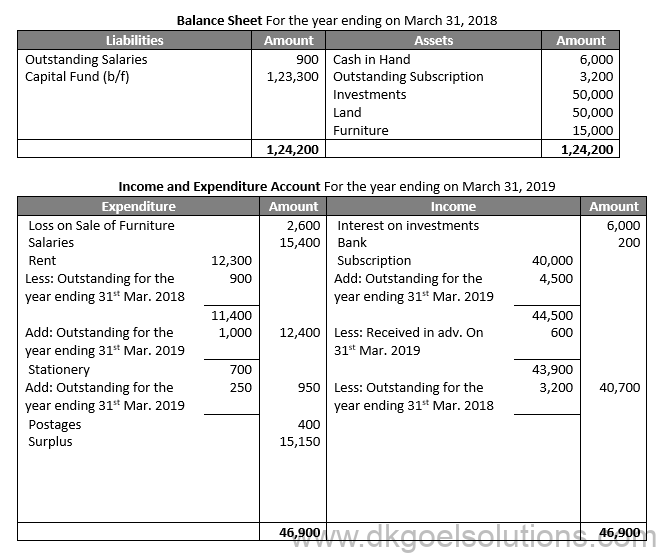

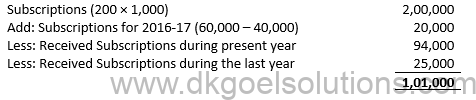

Solution 29

Working Note:-

Outstanding Subscription = Rs. 41,500 – Rs. 1,500 = Rs. 40,000

Point of Knowledge:-

When determining the current period’s subscription, the previous period’s advance subscription and the current period’s outstanding subscription are added to the current period’s subscription. On the other hand, advance subscriptions for the next accounting period obtained during the current period, as well as outstanding subscriptions from the previous period, are deducted from the current period subscription.

Question 30 (new).

Solution 30 (new).

Question 30.

Solution 30

Point of Knowledge:-

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side.

Question 31 (new).

Solution 30 (new).

Question 31.

Solution 31

Point of Knowledge:-

Subscription Amount during the year

Add: Received in advance in previous year

Less: Received in advance in current year

Less: Outstanding in previous year

Total Subscription

Question 32.

Solution 32

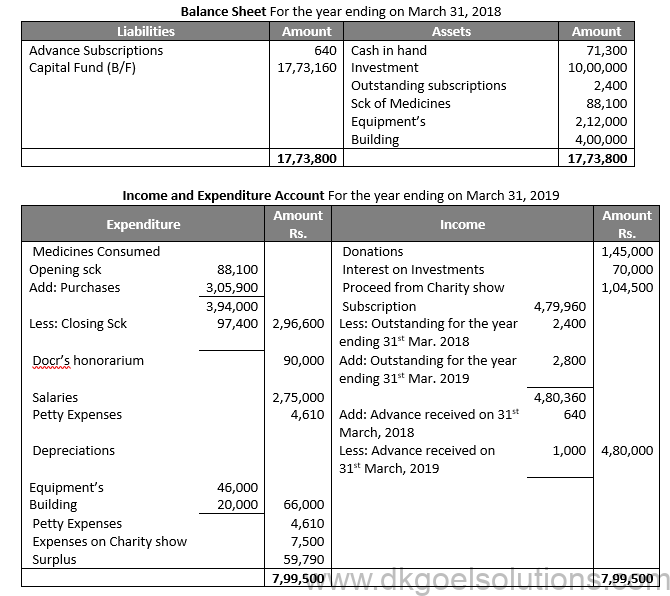

Working Note: –

Calculation of Investment

Investment = Interest × 100/Rate

Investment = Rs. 70,000 × 100/7

Investment = Rs. 10,00,000

Point of Knowledge:-

Sometimes, an Income and Expenditure Account is given in the question and the students are required to prepare Receipt and Payment Account with its help. It is worth repeating here that all receipts of cash whether capital or revenue and whether it is for current or previous or future period should be debited to receipts and payments account. Similarly, all expenditures whether capital or revenue or relating to the current, previous or future period should be credited to Receipts and Payments account.

Question 33.

Solution 33

Point of Knowledge:-

Amount paid for during the year

Add: Opening

Less: Closing

Amount during the year

Question 34 (new).

Solution 34 (new).

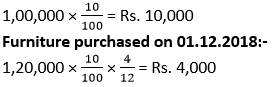

Working Note:-

Calculation of depreciation on furniture:-

Question 34.

Solution 34

Point of Knowledge:-

Any receipt related to a specific fund or reserve is treated as capital receipt such as Charity Fund. Match Fund, Prize fund, Sports Fund, Tournament Fund, Pension Fund etc. All these reserves or fund should be shown on the liabilities side of the balance sheet after deducting the expenses in respect of these funds.

Question 35 (new).

Solution 35 (new).

Working Note:-

Calculation of depreciation:-

Machinery purchased on 01.oct.2018:-

Question 35.

Solution 35

Point of Knowledge:-

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side.

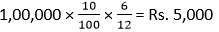

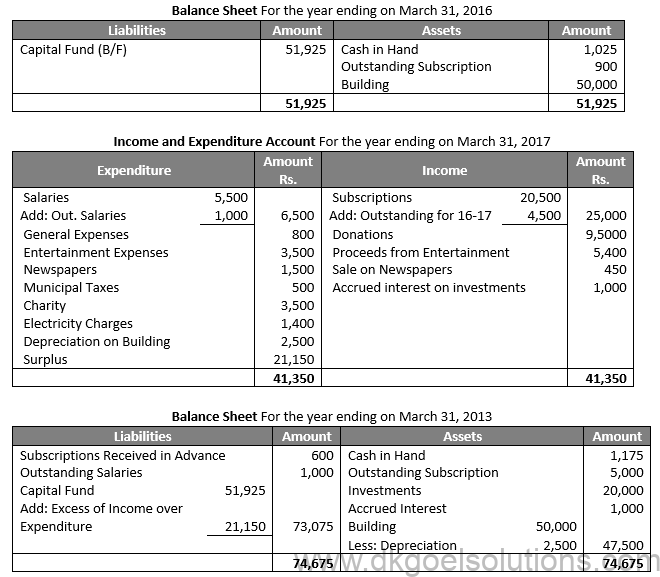

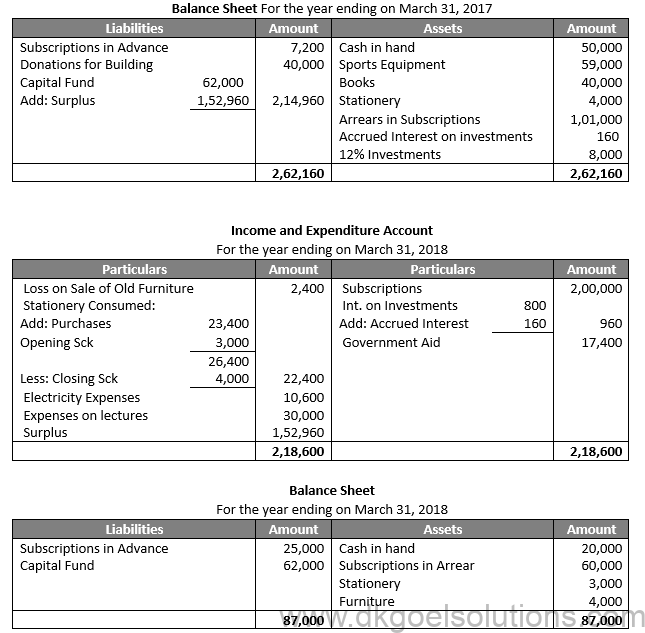

Question 36.

Solution 36

Working Note: –

tal subscriptions receivable during the year 16-17 (500 × 50) 25,000

Less: Amount received during the year 2016-17 20,500

Outstanding subscriptions for the year 2016-17 4,500

Point of Knowledge:-

Subscription Amount during the year

Add: Received in advance in previous year

Less: Received in advance in current year

Less: Outstanding in previous year

Total Subscription

Question 37.

Solution 37

Point of Knowledge:-

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side.

Question 38 (new).

Solution 38 (new).

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows cash in hand and/or at bank in the beginning of the accounting period and closing balance shows cash in hand and/or at bank at the end of the accounting period.

Question 38.

Solution 38

Point of Knowledge:-

A receipt and payment account is prepared at the end of the year from the Cash Book. All receipts and payments which are entered in the cash book are also entered in the receipts and payments account, of course, in a summary form. For example, if a club received subscriptions from its members on different dates, they will be recorded in the cash book in a chronological order, whereas the Receipt and Payment Account will contain the total subscriptions received during the year. Any transaction which is not recorded in the Cash Book will not be entered in the receipt and payment account also.

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side

Question 39 (new).

Solution 39 (new).

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows cash in hand and/or at bank in the beginning of the accounting period and closing balance shows cash in hand and/or at bank at the end of the accounting period.

Question 39.

Solution 39

Point of Knowledge:-

Capital Receipts are those receipts which will yield benefits to the entity in the current year as well as in future years. They are of non-recurring nature or in other words, they are not received at regular intervals.

Amount paid for during the year

Add: Opening Stock

Less: Closing Stock

Amount Consumed during the year

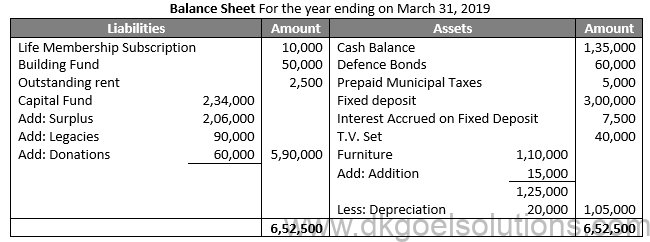

Question 40.

Solution 40

Working Note:-

Interest Accrued shown on the assets side Rs. 10,000.

Point of Knowledge:-

Capital Receipts are those receipts which will yield benefits to the entity in the current year as well as in future years. They are of non-recurring nature or in other words, they are not received at regular intervals.

Amount paid for during the year

Add: Opening Stock

Less: Closing Stock

Amount Consumed during the year

Question 41.

Solution 41

Point of Knowledge:-

Subscription Amount during the year

Add: Received in advance in previous year

Less: Received in advance in current year

Less: Outstanding in previous year

Total Subscription

Question 42.

Solution 42

Point of Knowledge:-

ncome and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

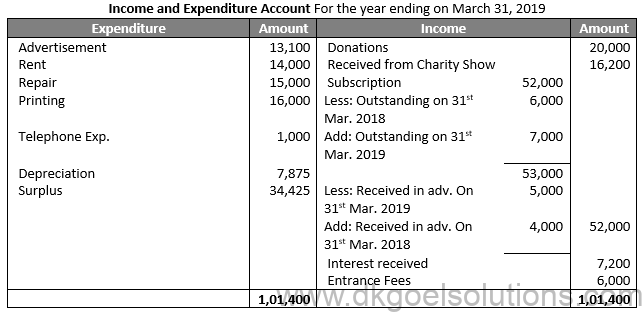

Question 43.

Solution 43

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

Question 44.

Solution 44

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

A Balance Sheet is also prepared even by non-profit organisations to show the financial position on the last date of the accounting year. It is prepared from the balance remaining after the transfer of all revenue incomes and expenditures to the income and expenditure account

Question 45.

Solution 45

Point of Knowledge:-

If the total credit side of the income and expenditure Account exceeds the debit, the difference will be termed as surplus or excess of income over expenditure and will be added to the Capital Fund on the liabilities side of the Balance Sheet. On the contrary, if the debit side of the income and expenditure account exceeds the credit, the difference is known as deficit or excess of expenditure over income and will be deducted from the Capital Fund on the liabilities side.

Question 46 (new).

Solution 46 (new).

Question 46.

Solution 46

Point of Knowledge:-

The Opening balance of cash in hand and at bank appears at the start of the Dr. side of Receipt and Payment account. It should not be taken to the Income and Expenditure Account but written on the assets side of the Opening Balance Sheet.

The Closing balance of cash in hand and at bank appears at the end of the Cr. side of Receipts and payments account. It should be taken to the Assets side of the closing balance sheet.

Question 47 (new).

Solution 47 (new). Calculation of Subscription credited to Income and Expenditure A/c:-

Question 47.

Solution 47

Point of Knowledge:-

Income and Expenditure Account is similar of a profit and loss account of a profit seeking entity and is prepared to ascertain whether the current income are in excess of current expenditure or vice-versa. In other words, it reveals the surplus or deficit arising out of the organisation’s activities during a particular period. It is prepared in the same manner in which a Trading and Profit and Loss Account is prepared in case of trading organisations.

A Balance Sheet is also prepared even by non-profit organisations to show the financial position on the last date of the accounting year. It is prepared from the balance remaining after the transfer of all revenue incomes and expenditures to the income and expenditure account.

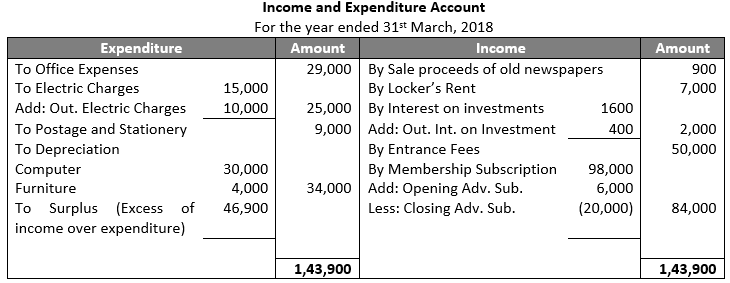

Question 48.

Solution 48

Point of Knowledge:-

Sometimes, an Income and Expenditure Account is given in the question and the students are required to prepare Receipt and Payment Account with its help. It is worth repeating here that all receipts of cash whether capital or revenue and whether it is for current or previous or future period should be debited to receipts and payments account. Similarly, all expenditures whether capital or revenue or relating to the current, previous or future period should be credited to Receipts and Payments account.

Question 49.

Solution 49

Point of Knowledge:-

Capital Receipts are those receipts which will yield benefits to the entity in the current year as well as in future years. They are of non-recurring nature or in other words, they are not received at regular intervals.

Question 50 (new).

Solution 50 (new).

Working Note:-

1. Calculation of Depreciation:-

Computer purchased on 01.10.2017:-

2. Calculation of Interest on investment:-

Question 50.

Solution 50

Point of Knowledge:-

Any receipt related to a specific fund or reserve is treated as capital receipt such as Charity Fund. Match Fund, Prize fund, Sports Fund, Tournament Fund, Pension Fund etc. All these reserves or fund should be shown on the liabilities side of the balance sheet after deducting the expenses in respect of these funds.

Question 51.

Solution 51

Working Note:-

Point of Knowledge:-

When Receipts & Payment and Income & Expenditure Accounts are already given:

The items appearing on the debit side of receipts and payments accounts are compared with the items on the credit side of income and expenditure accounts. By comparing each item one by one conclusion regarding assets and liabilities are drawn and then recorded in the relevant Balance Sheet. If the amount of an item is equal in both, it will not be recorded in any of the two Balance sheets. However, if the amount is unequal it will be recorded on either of the two Balance sheets.

Question 52 (new).

Solution 52 (new).

Question 52.

Solution 52

Point of Knowledge:-

Capital Receipts are those receipts which will yield benefits to the entity in the current year as well as in future years. They are of non-recurring nature or in other words, they are not received at regular intervals.

Question 53.

Solution 53

Point of Knowledge:-

Donations are credited to a separate Fund Account and are displayed on the liabilities side of the Balance Sheet. These funds’ earnings or donations are credited to their respective Fund Accounts. Expenses or payments made from these funds, on the other hand, are debited. Fund-based accounting is what it’s called when accounting is done this way.

Question 54 (new).

Solution 54

Working Note:-

Calculation of Sports Material Consumed to be Debited to Income and Expenditure A/c:-

Question 54.

Solution 54

Point of Knowledge:-

A receipt and payment account is prepared at the end of the year from the Cash Book. All receipts and payments which are entered in the cash book are also entered in the receipts and payments account, of course, in a summary form. For example, if a club received subscriptions from its members on different dates, they will be recorded in the cash book in a chronological order, whereas the Receipt and Payment Account will contain the total subscriptions received during the year. Any transaction which is not recorded in the Cash Book will not be entered in the receipt and payment account also.

Question 55 (new).

Solution 55 (new).

Question 55.

Solution 55

Working Note:-

Calculation of Subscription: –

Point of Knowledge:-

Closing Balance Sheet may be drawn up by means of the following Procedure:- The opening balance of cash in hand and at the bank appears at the start of the Dr. side of Receipt and Payments Account. It should not be taken to the Income and Expenditure Account but written on the assets side of the Opening Balance Sheet. The Closing balance of cash in hand and at the bank appears at the end of the Cr. side of Receipts and Payments Account. It is taken to the assets side of Closing balance sheet.

A not-for-profit organization can be defined as an organization that does not blend out funds through profits. Instead, it supplies donations it receives from various sources to meet its objectives and goals. To stay up running and function efficiently, a not-for-profit organization depends solely upon donations. Most of these organizations are tax-exempt, i.e., they are not subjected to most of the taxes. These types of organizations are basically formed on the grounds of religion, education, public service, or any particular cause.

Not-for-profit organizations do not earn any revenue through gains or profits. The only source of funds that keeps them running smoothly and efficiently is donations. These organizations get various types of donations from tons of sources like individual donations, paid sponsorships, government aids, membership charges, and many more.

Here are some of the important features of a Not-For-Profit Organization –

● The sole objective of a not-for-profit organization is to serve the nation. These organizations are mostly created for a public cause or on religious and educational fronts.

● The organizations receive a major part of their funding from contributions and donations from individuals, government, or sponsorships.

● The not-for-profit organizations are also quoted as separate legal entities.

● The management and administration of the organizations are supervised by elected members.

Financial Statements of a not-for-profit organization depict a detailed report about the financial position, clearly highlighting the organization’s assets and liabilities. These final statements are designed for those organizations whose primary aim is not to gain or distribute any profits. Therefore, these organizations are inclined toward public service and do not undergo any business activities.

The financial statements of a not-for-profit organization comprise –

● Income and Expenditure Account

● Receipts and Payments Account

● Balance Sheet

Here are the features of Receipts and Payments Account –

● All the receipts are registered, whether as capital or revenue.

● Cash payments are credited, and cash receipts are generally debited.

● Receipt and Payment Accounts track the cash and bank transactions only.

Capital funds are the amounts with no restrictions on useability. In simple words, the organization can use the funds for any purpose as long as the purpose is related to the organization.

Also refer to TS Grewal Solutions for Class 12