DK Goel Solutions Chapter 5 Accounting Ratios

Read below DK Goel Solutions for Class 12 Chapter 5 Accounting Ratios. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

There are various types of ratios which are generally called accounting ratios which are being used to better understand the financial position of a company.

In this chapter, students will understand the basic concepts of these accounting ratios, their usage, and conditions in which type of accounting ratio can be utilized. This is a very important chapter as accounting ratios are utilized almost in all types of conditions in the future so that you are able to clearly understand the financial situation of a company.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Accounting Ratios DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Q1.

Solution 1 The quantitative assessment of a company’s performance is ratio analysis. This lacks the qualitative variables. For instance, he may warrant the credit to be given on the basis of financial statements provided by him while measuring the credit analysis of a consumer requesting credit, but in fact his character and credit worthiness mat is questionable.

Q2

Solution 2

(a) Liquidity Ratio for analysis for short term debts.

(b) Solvency Ratio for analysis for long term debts.

Q3.

Solution 3 A company’s current ratio of 3:1 means that a company’s current assets are three times the current liabilities. The higher the percentage, the better it is, so it would be easier for the company to pay its existing liabilities. However, for the following reasons, a much higher ratio might be perceived to be detrimental from the point of view of management:

1.) A much higher ratio suggests that because of low performance, inventory may be pilling up.

2.) Due to an ineffective collection policy, significant sums are locked away in trade receivables.

Q4.

Solution 4 Window Dressing: Certain businesses turn to window dressing, i.e., displaying a better position than the one that actually exists, to cover up their poor financial position. They adjust their balance sheet in such a manner that it is possible to mask the essential facts and fact.

Q5.

Solution 5 In attempt to cover up a poor financial situation, some businesses turn to window dressing, i.e., demonstrating a different position than the one that actually exists. They adjust their balance sheet in such a manner that it is possible to mask the essential facts and fact. For instance, the current assets of a company are Rs. 2,00,000 and its current liabilities are Rs. 1,00,000, so the current ratio is 2:1. After this, it purchased goods for Rs. 50,000 for credit in the month of March. If it records the purchases, the current assets will increase to Rs. 2,50,000 and current liabilities will increase to Rs. 1,50,000. As a result, the current ratio will be reduced to 5:3. The company may pass the entry for purchase in the beginning of the next year or may postpone the purchase itself for a few days.

Q6.

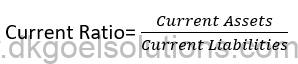

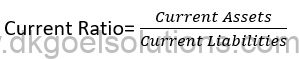

Solution 6. Present Ratio:- The ratio describes the relation between a company’s current assets and current liabilities. The ratio estimation formula is

Current Ratio = (Current Assets)/(Current Liabilites)

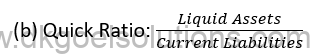

Quick Ratio:- The Fast Ratio shows whether the company is in a position to pay its existing obligations immediately or within a month. As such, by dividing liquid assets (Quick Current Assets) by current liabilities, the quick ratio is calculated:

Quick Ratio = (Liquid Assets)/(Current Liabilites)

Quick Ratio:- The Fast Ratio shows whether the company is in a position to pay its existing obligations immediately or within a month. As such, by dividing liquid assets (Quick Current Assets) by current liabilities, the quick ratio is calculated:

Quick Ratio = (Liquid Assets)/(Current Liabilites)

Q7.

Solution 7 The Fast Ratio is a better test of the company’s short-term financial condition than the current ratio, since it recognizes only certain properties that can quickly and easily be turned into cash. Liquid assets do not involve inventory since it can take a lot of time before it is translated into currency.

Q8.

Solution 8 Share Capital and Balance & Surplus is found in shareholder accounts.

Q9.

Solution 9 Equity Share Capital was included in the equity partner portfolio.

Q10.

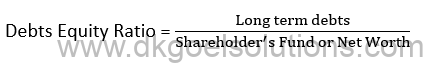

Solution 10 This ratio illustrates the relationship between long-term debt and funds from lenders. It displays the amount of assets acquired by long-term borrowings as opposed to shareholder capital. To assess the soundness of the company’s long-term financial plans, this ratio is determined.

Q11.

Solution 11 The higher inventory turnover ratio suggests a fast sale of products. In an organization where the product turnover ratio is high, products may be sold at a low profit margin and the profitability may be very high even then.

A poor inventory turnover ratio means that for such a long time, inventory does not sell easily and stays lying in the godown. This results in higher costs of transportation, the blocking of funds and losses on goods accounts being redundant or capable of un-sale.

Q12.

Solution 12. Calculation of Trade receivables turnover ratio:-

Total Revenue from Operations for the year (Total Sales) Rs. 2,00,000

Cash Revenue from Operations for the year (Cash Sales) Rs. 40,000

Trade Receivables at the beginning of the year Rs. 20,000

Trade Receivables at the end of the year Rs. 60,000

Solution:-

Working Note:-

Q13.

Solution 13 I. The management’s liberal and inefficient credit and collection approach would imply that the exchange receivables turnover ratio is too poor. It indicates that more cash is locked-up in exchange receivables, resulting in higher bad debts, increased recovery costs, and even loss of interest on cash receivables attributable to trade type.

II. The higher inventory turnover ratio suggests a fast sale of products. In an organization where the product turnover ratio is high, products may be sold at a low profit margin and the profitability may be very high even then.

Q14.

Solution 14 .The management’s liberal and inefficient credit and collection approach would imply that the exchange receivables turnover ratio is too poor. It indicates that more cash is locked-up in exchange receivables, resulting in higher bad debts, increased recovery costs, and even loss of interest on cash receivables attributable to trade type.

Q15.

Solution 15. A high turnover ratio of trade receivables implies the timely reimbursement by trade receivables, however a too high ratio can be the result of management’s stringent credit and recovery policies that may curtail revenue and thereby adversely impact income.

Q16.

Solution 16. With regard to the provision of depreciation, development of provision for uncertain debts, system of assessment of closing inventory, etc., there may be various accounting practices followed by different businesses. For example, one organization might, on a straight-line basis, follow the strategy of charging depreciation, while on a written-down value system otherwise charges. This contrast makes the accounting ratios incomparable.

Q17.

Solution 17. The price range continues to be paid over the years, so the ratio of different years will not be compared. For eg, in 2017, one company sold 1,000 machines for Rs. 10 Lakhs; in 2018, it sold 1,000 machines of the same kind again, but the selling price was Rs. 15 Lakhs due to the rising price. On the basis of the percentages, it will be inferred that revenues have increased by 50%, while sales have not increased at all in practical terms. Therefore, in view of market level adjustments, the estimates for the last year must be changed before the ratios for those years are compared.

Q18.

Solution 18 I) Debt-Equity Ratio:- The relationship between long-term debt and shareholder funds is reflected in this ratio. It displays the amount of assets acquired by long-term borrowings as opposed to shareholder capital. To assess the soundness of the company’s long-term financial plans, this ratio is determined.

The Debt Equity Significance Ratio is determined to determine the company’s ability to satisfy its long-term obligations. A debt-equity ratio of 2:1 is usually considered stable.

(ii) Ratio of inventory turnover:- This ratio reveals the relationship between the cost of operational profits for the year and the total inventory retained during the year:

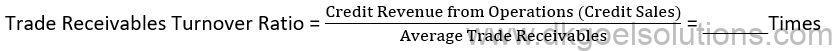

(iii) Trade Earned Turnover Ratio:- This ratio reveals the relationship between the Operating Sales loan and the average year-round trade receivables:

Q19.

Solution 19

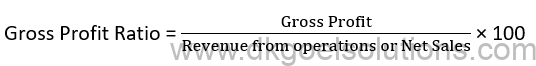

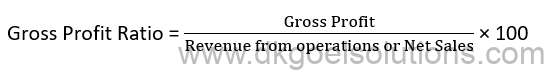

(i) Gross Profit Ratio:- This ratio provides a correlation between Gross Profit and Operating Revenue, i.e. Sales of Net. This ratio is measured and seen in proportion. To compute this percentage, the formula is:

(ii) Ratio of inventory turnover:- This ratio reveals the relationship between the cost of operational profits for the year and the total inventory retained during the year:

(iii) Current Ratio:- The relationship between current assets and a company’s current liabilities is clarified in this Ratio.

Q20.

Solution 20

(i) Debt-Equity Ratio:- This ratio illustrates the relationship between long-term debt and funds from lenders. It displays the amount of assets acquired by long-term borrowings as opposed to shareholder capital. To assess the soundness of the company’s long-term financial plans, this ratio is determined.

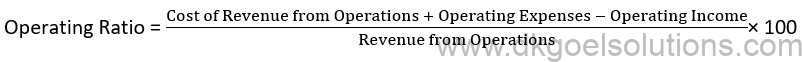

(ii) Operating Ratio:- This ratio calculates the percentage of the cost of operational revenue and operating costs of a company relative to the operating income:

(iii) Trade Received Turnover Ratio:- The relationship between credit income from operations and average exchange receivables during the year is demonstrated by this ratio:

Q21.

Solution 21

(i) Gross Profit Ratio:- This ratio provides a correlation between Gross Profit and Operating Revenue, i.e. Sales of Net. This ratio is measured and seen in proportion. To compute this percentage, the formula is:

(ii) Quick Ratio:- The Fast Ratio shows whether the company is in a position to pay its existing obligations immediately or within a month. As such, by dividing liquid assets by current liabilities, the rapid ratio is calculated:

(iii) Inventory Turnover Ratio = This ratio reveals the relation between the cost of operational sales for the year and the average inventory carried during that year:

Numerical Questions:-

Question 1.

Solution1

Current Assets= Inventories + Trade Receivables + Current Inventories + Cash & cash equivalents

=Rs. 70,000 + Rs. 90,000 + Rs. 35,000 + Rs. 5,000

= Rs. 2,00,000

Current liabilities = Trade Payables + Short term Borrowings + Provision for tax + Outstanding Expenses

= Rs. 46,000 + Rs. 20,000 + Rs. 10,000 + Rs. 4,000

= RS. 80,000

Question 2.

Solution2

Current Assets= Current Investments + Inventories (except loose tools) + Trade Receivables + Short term loans & Advances + Prepaid Insurance + Advance Payment of Tax + cash and cash equivalents

=Rs. 80,000 + Rs. 4,10,000 + Rs. 3,30,000 + Rs. 10,000 + Rs. 18,000 + Rs. 20,000 + Rs. 28,000

= Rs. 8,96,000

Current liabilities = Trade Payables + Short term Borrowings + short term provisions + Other Current Liabilities

= Rs. 1,80,000 + Rs. 60,000 + Rs. 25,000 + Rs. 15,000

= RS. 2,80,000

Liquid Assets: Current Assets – Inventories – Prepaid Insurance – Advance Payment of Tax

= Rs. 8,96,000 – Rs. 4,10,000 – Rs. 18,000 – Rs. 20,000

= Rs. 4,48,000

Question 3.

Solution3.

Current Assets= Inventories + Trade Receivables + Short term Investments + Payment in Advance + Cash and cash equivalents + Accrued Income

=Rs. 2,50,000 + Rs. 1,30,000 + Rs. 30,000 + Rs. 20,000 + Rs. 40,000 + Rs. 10,000

= Rs. 4,80,000

Current liabilities = Short term Borrowings + Short term provisions + Trade Payables + expenses payable

= Rs. 20,000 + Rs. 30,000 + Rs. 95,000 + Rs. 5,000

= RS. 1,50,000

Liquid Assets: Current Assets – Inventories – Payment in advance

= Rs. 4,80,000 – Rs. 2,50,000 – Rs. 20,000

= Rs.2,10,000

Comment: The short term financial position of the company is quite satisfactory because its current ratio is 3;2;1, which is more than the ideal current ratio of 2:1. Liquid ratio of the company is 1.4:1, which is also more than the ideal liquid ratio of 1:1.

Therefore, it can be said that the company is in a position to pat its current liabilities instantly.

Question 4

Solution 4

Current Assets= Cash and cash equivalents + Trade Receivables + Short term Investments + Inventory of raw Materials + Inventory of Finished Goods + Prepaid Expenses

=Rs. 10,000 + Rs. 71,000 + Rs. 20,000 + Rs. 80,000 + Rs. 60,000 + Rs. 9,000

= Rs. 2,50,000

Current liabilities =Trade Payables + Provision for Taxation +outstanding Expenses

= Rs. 1,00,000 + Rs. 25,000 + Rs. 5,000

= RS. 1,30,000

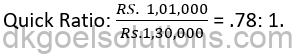

Liquid Assets: Cash & Cash Equivalents +Trade Receivables + Short Term Investments

= Rs. 10,000 – Rs. 71,000 – Rs. 20,000

= Rs.1,01,000

Comment: The ideal current ratio should be 2:1. But in this case the current ratio is 1.92:1 which is less than the ideal ratio. Therefore, it can be said that the short-term financial position of the company is not satisfactory.

The ideal quick ratio should be 1:1. But in this case the quick ratio is .78: 1, hence, the short- term financial position cannot be said to be satisfactory.

Question 5.

Solution 5

Current Assets= Total Assets – Non- Current Assets

=Rs. 40,00,000 – Rs. 22,00,000

= Rs. 18,00,000

Current liabilities = Total Assets – Share Capital – Reserve & Surplus – Non-Current Liabilities

= Rs. 40,00,000 + Rs. 24,00,000 + Rs. 3,00,000 – Rs. 8,00,000

= RS. 5,00,000

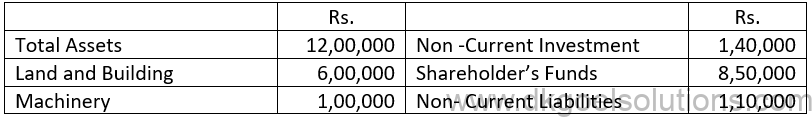

Question 6. Calculate Current Ratio from the following information:

Solution6

Current Assets= Total Assets – Fixed Assets – Non- Current Investments

=Rs. 12,00,000 – Rs. 6,00,000 – Rs. 1,00,000 – Rs. 1,40,000

= Rs. 3,60,000

Total Assets will be equal to the Total of Equity & Liabilities Hence,

Current liabilities = Total Assets – Shareholder’s Funds – Non-Current Liabilities

= Rs. 12,00,000 + Rs. 8,50,000 + Rs. 1,10,000

= Rs. 2,40,000

Question 7(A)

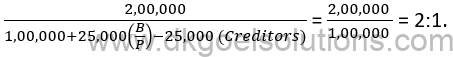

Solution7(A) Current Ratio as given in the question is 2:1. In order to understand the question in a simple manner, it may be assured that current assets are Rs. 2,00,000 and current liabilities are Rs. 1,00,000.

- Purchase of goods on Credit: Suppose, goods for Rs. 25,000 is purchased on credit, the revised current ratio would be:

the current ratio is reduced.

Purchase of goods against Cheque: Suppose, goods for Rs. 25,000 is purchased for cash, the revised current ratio would be:

the current ratio has not changed.

l. Sale of Goods coasting Rs. 50,000 for Rs. 60,000 on Credit: the effect of the above will be decrease in Inventory by Rs. 50,000 and increase in Trade Receivables by Rs. 60,000. Thus, the revised current ratio would be:

the current ratio is improved.

l. To sell a fixed asset at a slight loss: Sale of a fixed assets results in the increase in Cash balance even through the asset is sold at a slight loss. Suppose the fixed asset worth Rs. 50,000 is sold at a loss Rs. 1,500 i.e., at Rs. 48,500, the revised current ratio would be:

the current ratio is improved.

l. To borrow money on a promissory note (B/P): Borrowing money on the basis of a promissory note increases cash on one hand and increases B/P on the other hand. Thus, if Rs. 40,000 are borrowed on the basis of a promissory, then the revised current ratio would be:

the current ratio is reduced.

IV To give a promissory note a creditor: Suppose a promissory note for ES. 25,000 is given to a creditor. Its effect would be an increased in B/P by RS. 25,000 and decreased in the trade payables by RS. 25,000. Thus the revised ratio would ne:

the current ratio has not is reduced.

Question 7(B)

Solution7(B)

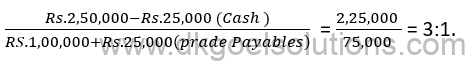

Current Ratio as given in the question 2.5:2. Hence, it may be assured that Current Assets are Rs. 2,50,000 and current Liabilities are RS. 1,00,000.

i. Payment to trade payables: Suppose, trade payables amounting to RS. 25,000 are repaid, the revised current ratio would be:

The current ratio is improved.

i. Sell machinery against cheque: Suppose a machinery is solid for Rs. 50,000, the revised current ratio would be:

The current ratio is improved.

ii. Sale of inventory at loss against Cheque: Suppose, inventory costing 50,000 is sold for RS. 40,000 ON credit, the revised current ratio would be:

The current ratio is reduced.

iii. Cash collected from trade receivables: Suppose cash amounting to Rs. 50,000 is collected from received trade received, the revised current ratio would be:

iv. B/P dishonored: Suppose, a B/R for RS. 50,000 is dishonored, it will result in decrease in B/R and increases in trade receivables. Hence, the revised current ratio would bd:

Issue of shares: Suppose: shares for Rs. 1,00,000 are issued for cash:

The current ratio is improved.

vi. Issue of shares against the purchase of a building: Suppose, share of RS. 1,00,000 are issued against the purchase of Building. It will result increase in Capital on the one hand and increase in building on the other hand Since there is no either on Current assets or a current liabilities, the current ratio would not change.

vii. Redemption (Repayment) of Debentures: Debentures, which are to be redeemed are included in current liabilities. Hence. The current assets as well as current liabilities will be reduced. Suppose, debentures for RRs. 50,000 are redeemed:

The current ratio is improved.

Question 8.

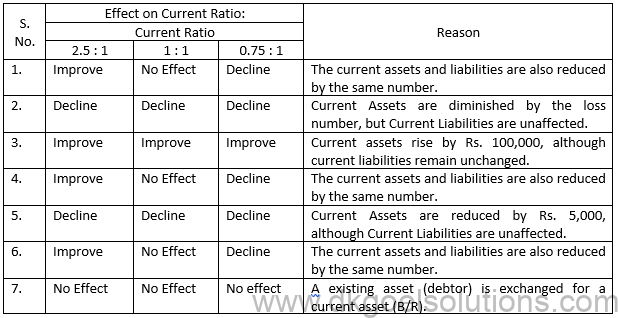

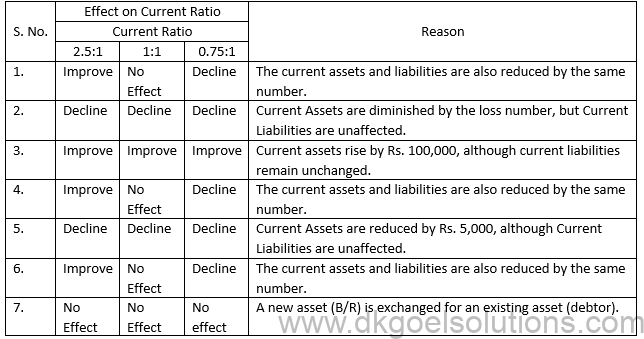

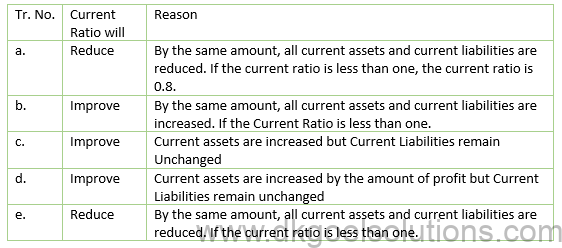

Solution8 Statement showing the effect of various transactions on Current Ratio:

Question 9.

Solution 9 Statement showing the effect of various transactions on Current Ratio;

Question 10.

Solution10:

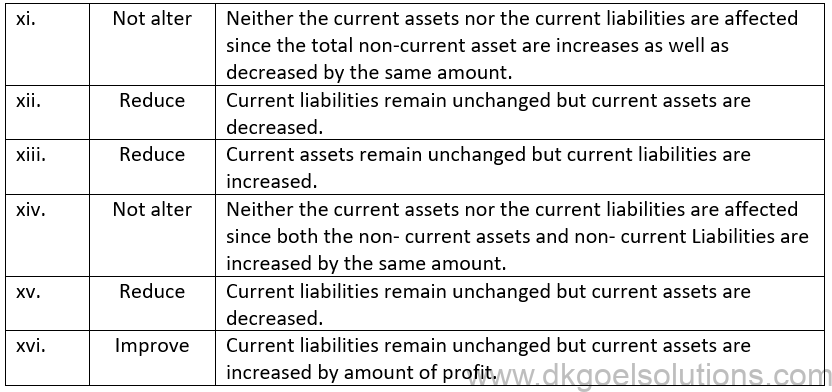

The influence of different transactions on the Current Ratio is seen in this statement:

Question 11.

Solution 11:

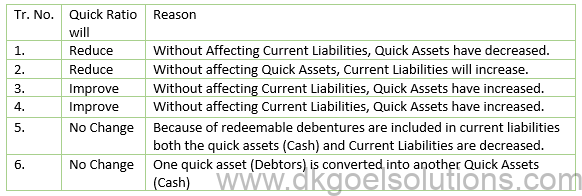

The influence of various transactions on the Quick Ratio is seen in this sentence:-

Question 12.

Solution 12

Calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = (RS.3,12,000)/(Rs.1,20,000)

Current Ratio = 2.6:1

So, the Current Ratio is 2.6 : 1.

Below is the Calculation of Current Liabilities:-

Current liabilities = Total debt – Long term Debt

Current liabilities = Rs. 2,00,000 – Rs. 80,000

Current liabilities = Rs. 1,20,000

Below is the Calculation of Current Assets:-

Current Assets = Working Capital + Current Liabilities

Current Assets = Rs. 1,92,000 + Rs. 1,20,000

Current liabilities = Rs. 3,12,000

Question 13.

Solution 13:

Calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = (RS.7,20,000)/(Rs.2,40,000)

Current Ratio = 3:1

So, the Current Ratio is 3 : 1.

Below is the Calculation of Current Liabilities:-

Current liabilities = Trade Payables – Bank Overdraft

Current liabilities = Rs. 2,00,000 – Rs. 40,000

Current liabilities = Rs. 2,40,000

Below is the Calculation of Current Assets:-

Current Assets = Working Capital + Current Liabilities

Current Assets = Rs. 4,80,000 + Rs. 2,40,000

Current Assets = Rs. 7,20,000

Question 14.

Solution14.

Calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = (Rs. 6,00,000)/(Rs. 1,20,000)

Current Ratio = 5:1

So, the Current Ratio is 5:1.

Below is the Calculation of Current Liabilities:-

Current liabilities = Current Assets – Working Capital

Current liabilities = Rs. 6,00,000 – Rs. 4,80,000

Current liabilities = Rs. 2,20,000

Question 15 (A)

Solution 15 (A)

By the formula of calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Liabilities = (Current Assets)/(Current Ratio)

Current Liabilities = (Rs.3,60,000)/2.4

Current Liabilities = Rs. 1,50,000

Below is the Calculation of Current Assets:-

Current Assets = Rs. 4,10,000 – Rs. 50,000

Current Assets = Rs. 3,60,000

Below is the Calculation of Working Capital:-

Working Capital = Current Assets – Current Liabilities

Working Capital = Rs. 3,60,000 – Rs. 1,50,000

Working Capital = Rs. 2,10,000

Question 15 (B)

Solution 15 (B)

By the formula of calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Liabilities = (Current Assets)/(Current Ratio)

Current Liabilities = (Rs.7,50,000)/3

Current Liabilities = Rs. 2,50,000

Below is the Calculation of Current Assets:-

Current Assets = Rs. 7,20,000 – Rs. 30,000

Current Assets = Rs. 7,50,000

Below is the Calculation of Working Capital:-

Working Capital = Current Assets – Current Liabilities

Working Capital = Rs. 7,50,000 – Rs. 2,50,000

Working Capital = Rs. 5,00,000

Question 16 (A)

Solution 16 (A)

By the formula of calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

It is given that,

Current Ratio = 2,

Current Liabilities = Rs. 1,60,000

Putting the values in formula:-

2 = (Current Assets)/(Rs.1,60,000)

Current Assets = Rs. 1,60,000 × 2

Current Assets = Rs. 3,20,000

So, the Current Assets is Rs. 3,20,000.

Calculation of Quick ratio:-

Quick Ratio = (liquid Assets)/(Current Liabilities)

It is given that,

Quick Ratio=1.5

Current Liabilities = Rs. 1,60,000

1.5 = (Quick Assets)/1,60,000

Quick Assets = Rs. 1,60,000 × 1.5

Quick Assets = Rs. 2,40,000

So, the Quick Assets is Rs. 2,40,000

Calculation of Inventory:-

Inventory = Current Assets – liquid Assets

Inventory = Rs. 3,20,000 – Rs. 2,40,000

Inventory = Rs. 80,000

Question 16.(B)

Solution 16 (B)

By the formula of current ratio we get:-

Current Ratio = (Current Assets)/(Current Liabilities)

It is given that,

Current Ratio =2.5

Current Assets = Rs. 17,00,000

2.5 = (Rs.17,00,000)/(Current Liabilities)

Current liabilities = (Rs.17,00,000)/2.5

Current liabilities = Rs. 17,00,000 × 10/25

Current liabilities = Rs. 6,80,000

So, the current liabilities are Rs. 6,80,000.

By the formula of current ratio we get:-

Quick Ratio = (Quick Assets)/(Current Liabilities)

It is given that,

Quick Ratio = 0.95

Current Liabilities = Rs. 6,80,000

0.95 = (Quick Assets)/(Rs.6,80,000)

Quick Assets = Rs. 6,80,000 × 0.95

Quick Assets = Rs. 6,46,000

Calculation of Inventor:-

Inventory = Current Assets – liquid Assets

Inventory = Rs. 17,00,000 – Rs. 6,46,000

Inventory = Rs. 10,54,000

Question 16(C)

Solution 16 (C)

(i) Calculation of Woking Capital:-

Working Capital = Current Assets – Current liabilities

It is given that,

Current Ratio = 2.8: 1

Working capital Ratio = 2.8 – 1 = 1.8

So, the Working Capital is 1.8

Current Assets = 2.8

Calculation of Current Assets:-

Current Assets = 2.8/1.8 × 5,40,000

Current Assets = Rs. 8,40,000

So, the current assets of the company is Rs. 8,40,000.

(ii) Below is the Calculation of Current Liabilities:-

Current Liabilities = Current Assets – Working Capital

Current Liabilities = Rs. 8,40,000 – Rs. 5,40,000

Current Liabilities = Rs. 3,00,000

So, the current Liabilities of the company is Rs. 3,00,000.

(iii) Below is the Calculation of Quick Ratio:-

Quick Ratio = (liquid Assets)/(Current Liabilities)

Quick Ratio = 5,10,000/3,00,000

Quick Ratio = 1.7:1

Calculation of Liquid Assets:-

Liquid Assets = Current Assets – Inventory

Liquid Assets = Rs. 8,40,000 – Rs. 3,30,000

Liquid Assets = Rs. 5,10,000

Question 17

Solution 17

Calculation of Working Capital:-

Working Capital = Current Assets – Current Liabilities

It is given that,

Current Ratio = 4:1

Current ratio to the working capital is 4 – 1 = 3

Working Capital is 3, Current Assets = 4

So, the ratio of working capital and current assets is

Below is the Calculation of Current Assets:-

Current Assets = 4/3 × Rs. 1,80,000

Current Assets = Rs. 2,40,000

Below is the Calculation of Current Liabilities:-

Current Liabilities = Current Assets – Working Capital

Current Liabilities = Rs. 2,40,000 – Rs. 1,80,000

Current Liabilities = Rs. 60,000

It is given that,

Quick Ratio= 1.2,

Current Liabilities = Rs. 60,000

Quick Ratio = (liquid Assets)/(Current Liabilities)

1.2 = (liquid Assets)/(RS.60,000)

Liquid Assets = Rs. 60,000 × 1.2

Liquid Assets = Rs. 72,000

Calculation of Inventory:-

Inventory = Current Assets – Liquid Assets

Inventory = Rs. 2,40,000 – Rs. 72,000 = Rs. 1,68,000

Question 18.

Solution18

Calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

2.4 = (Rs.1,81,10,400)/(Current Liabilities)

Current Liabilities = 75,46,000

It is given that,

Current Ratio = 2.4

Current Assets = Rs. 1,81,10,400

Liquid Ratio = (liquid Assets)/(Current Liabilities)

Liquid Ratio = 1,01,87,100/75,46,000

Liquid Ratio = 1.35:1.

Calculation of Liquid Assets:-

Liquid Assets = Current Assets – Inventories

Liquid Assets = Rs. 1,81,10,400 – Rs. 79,23,300

Liquid Assets = Rs. 1,01,87,100

Comment:

The company’s short-term financial situation is adequate, since its liquid ratio is 1.35:1, which is greater than the optimal ratio of 1:1.

Question 19.

Solution 19

It is given that,

Quick ratio = 1.5

Current Liabilities=40,000;

Formula of Quick Ratio:-

Quick Ratio = (liquid Assets)/(Current Liabilities)

1.5 = (liquid Assets)/(Rs.40,000)

Liquid Assets = Rs. 40,000 × 1.5 = Rs. 60,000

Inventory – Current Assets- Liquid Assets

Inventory = Rs. 1,00,000 – Rs. 60,000

Inventory = Rs. 40,000.

So, the value of Inventory is 40,000.

Question 20.

Solution 20

It is given that,

Quick ratio = 2

Liquid assets=8,00,000;

Quick Ratio = (liquid Assets)/(Current Liabilities)

2= (Rs.8,00,000)/(Current Liabilities)

Current Liabilities = (Rs.8,00,000)/2

Current Liabilities = Rs. 4,00,000

Below is the Calculation of Current Assets:-

Current Assets = Liquid Assets + Inventory

Current Assets = Rs. 8,00,000 + Rs. 2,00,000

Current Assets = Rs. 10,00,000

Calculation of Current Ratio is :-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = 10,00,000/4,00,000

Current Ratio = 2.5:1

Question 21.

Solution21

It is given that,

Current Ratio is 4.5

Quick ratio is 3

Inventory is the difference between the current and quick ratios.

Inventory = 4.5 – 3

Inventory = 1.5

If Inventory is 1.5 and Current Assets = 4.5 then the ratio of current assets and inventory is

Current Assets = 4.5/1.5

Inventory = 72,000

Current Assets = 4.5/1.5 × 72,000

Current Assets = Rs. 2,16,000

So, the Current Assets is Rs. 2,16,000

Calculation of Current Liabilities:-

Current Liabilities = (Rs.2,16,000)/4.5

Current Liabilities = Rs. 48,000.

So, the value of Current Liabilities is Rs. 48,000.

Question 22.(A)

Solution 22 (A)

Calculation of Quick Assets:-

Quick Assets = Current Assets – Inventory – Prepaid Expenses

Quick Assets = Rs. 85,000 – Rs. 22,000 – Rs. 3,000

Quick Assets = Rs. 60,000

Calculation of Current Liabilities:-

Current Liabilities = Current Assets – working Capital

Current Liabilities = Rs. 85,000 -Rs. 45,000

Current Liabilities = Rs. 40,000

Computation of Quick Ratio:-

Quick Ratio = (Quick Assets)/(Current Liabilities)

Quick Ratio = (Rs.60,000)/(Rs.40,000)

Quick Ratio = 1.5:1.

Question 22.(B)

Solution 22 (B):

Calculation of current ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = (Rs. 2,00,000)/(Rs.450,000)

Current Ratio = 4:1.

So, the current ratio is 4:1.

Calculation of Current Assets:

Current Assets = Quick Assets – Inventory – Prepaid Expenses

Current Assets = Rs. 90,000 – Rs. 1,08,000 – Rs. 2,000

Current Assets = Rs. 2,00,000

Below is the Calculation of Current Liabilities:-

Current Liabilities = Current Assets – Working Capital

Current Liabilities = Rs. 2,00,000 -Rs. 1,50,000

Current Liabilities = Rs. 50,000

Question 23.

Solution23.

Calculation of Liquid ratio:-

Liquid Ratio = (Liquid Assets)/(Current Liabilities)

Liquid Ratio = (Rs. 7,20,000)/(Rs.6,00,000)

Liquid Ratio = 1.2

So, the Liquid Ratio is 1.2.

Below is the Calculation of Current Liabilities:-

Current Liabilities = Total debt – Long term Debt

Current Liabilities = Rs. 16,00,000 – Rs. 10,00,000

Current Liabilities = Rs. 6,00,000

Below is the Calculation of Current Assets:-

Current Assets = Current Liabilities + working Capital

Current Assets = Rs. 6,00,000 -Rs. 4,80,000

Current Assets = Rs. 10,80,000

Below is the Calculation of Liquid Assets:-

Liquid Assets = Current Assets – Inventory – prepaid Insurance

Liquid Assets = Rs. 10,80,000 – Rs. 3,40,000 – Rs. 20,00

Liquid Assets = Rs. 7,20,000

Question 24

Solution24

It if given that the Current Ratio of the company is 2.

Payment of existing liabilities would result in a decrease of both current assets and current liabilities.

Suppose the amount of current liabilities is = x

Current Ratio = (Current Assets)/(Current Liabilities)

Current Ratio = (Rs.32,00,000-x)/(Rs.20,00,000-x)

2 = (Rs.32,00,000-x)/(Rs.20,00,000-x)

2 × (Rs. 20,00,000-x) = Rs. 32,00,000-x

Rs. 40,00,000 – 2 x=32,00,000- x

Rs. 40,00,000 – 32,00,000=2 x- x

8,00,000 = x

To reach a Current Ratio of 2:1, current liabilities to the extent of Rs. 8,00,000 should be charged.

Question 25.

Solution25

It is given that the current Ratio of the company is 2.5 and Current Assets is 5,00,000.

Calculation of Current Ratio:-

Current Ratio = (Current Assets)/(Current Liabilities)

2.5 = (Rs.5,00,000)/(Current Liabilities)

Current Liabilities = (Rs.5,00,000)/2.5

Current Liabilities = Rs. 2,00,000

Comment:-

Current Assets must be bought on credit in order to reduce the Current Ratio. However, an increase in existing assets on credit is followed by an increase in current liabilities. Assume that the volume of current assets to be purchased is x. Following the purchase, the acquirer has Existing Assets of Rs. x on credit.

Current Assets = Rs. 5,00,000 + x

Current liabilities = Rs. 2,00,000 + x

Current ratio = (Current Assets)/(Current Liabilities)

2 = (Rs. 5,00,000+x )/( Rs. 2,00,000+x )

Rs. 4,00,000 + 2x = Rs. 5,00,000 + x

2x-x = Rs. 1,00,000

x = Rs. 1,00,000

Comment:-

To sustain a Current Ratio of 2:1, current assets worth Rs. 1,00,000 should be purchased on credit.

Question 26.

Solution 26:

Calculation of Debt-Equity Ratio:-

Debt- Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.2,60,000 )/( Rs.4,60,000 )

Debt Equity Ratio = 0.57:1.

So, the Debt Equity Ratio is 0.57:1.

Below is the Calculation of Long term Debts:-

Long term Debts = Long term Borrowings + Long term Provisions

Long term Debts = Rs. 2,00,000 + Rs. 60,000 = Rs. 2,60,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Equity Share Capital + Preference Share Capital + Reserve – Profit & Loss Balance

Shareholder’s Funds = Rs. 3,00,000 + Rs. 50,000 + Rs. 1,60,000 – Rs. 50,000

Shareholder’s Funds = Rs. 4,60,000

Point for Students:-

Other formula of Debt- Equity Ratio is (Debt )/( Equity )

Question 27.

Solution 27:

Calculation of Debt-Equity Ratio:-

Debt- Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.9,52,000 )/( Rs.11,20,000 )

Debt Equity Ratio = 0.85:1.

So, the Debt Equity Ratio is 0.85:1.

Below is the Calculation of Long term Debts:-

Long term Debts = 8% Debentures + 10% Long term loan + Long term Provisions

Long term Debts = Rs. 5,00,000 + Rs. 3,40,000 + Rs.1,12,000

Long term Debts = Rs. 9,52,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Share Capital + Capital Reserve + General Reserve + Profit & Loss Balance

Shareholder’s Funds = Rs. 6,00,000 + Rs. 3,20,000 + Rs. 60,000 + Rs. 1,40,000

Shareholder’s Funds = Rs. 11,20,000

Point for Students:-

Other formula of Debt- Equity Ratio is (Debt )/( Equity )

Question 28.

Solution 28:

(i) The Debt-Equity Ratio can be used to measure a company’s long-term financial condition.

Debt- Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.50,00,000 )/( Rs.25,00,000 )

Debt Equity Ratio = 2:1.

So, the Debt Equity Ratio is 2:1.

Below is the Calculation of Long term Debts:-

Long term Debts = Long term Borrowings + Public Deposits

Long term Debts = Rs. 10,00,000 + Rs. 15,00,000

Long term Debts = Rs. 50,00,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Share Capital + Reserve and Surplus

Shareholder’s Funds = Rs. 10,00,000 + Rs. 15,00,000

Shareholder’s Funds = Rs. 25,00,000

(ii) The short-term financial health of an organisation can be determined by measuring:-

Current Ratio = (Current Assets )/( Current Liabilities)

Current Ratio = (16,00,000 )/( 10,00,000)

Current Ratio = 1.6 : 1

So, the Current Ratio is 1.6 : 1

Point for Students:-

Other formula of Debt- Equity Ratio is (Debt )/( Equity )

Question 29.

Solution29

Calculation of Debt-Equity Ratio:-

Debt-Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt-Equity Ratio =(Rs.17,50,000 )/( Rs.12,50,000)

Debt-Equity Ratio = 1.4 : 1.

So, the Debt-Equity Ratio is 1.4 : 1.

Below is the Calculation of Long term Debts:-

Long term Debts = Long term Borrowings + Long term Provisions

Long term Debts = Rs. 16,00,000 + Rs. 1,50,000

Long term Debts = Rs. 17,50,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Non-Current Assets + Working Capital – Non- Current Liabilities

Non- Current Assets = Tangible Fixed Assets + Intangible Fixed Assets

Non- Current Assets = Rs. 24,50,000 + Rs. 3,00,000

Non- Current Assets = Rs. 27,50,000

Below is the Calculation of Working Capital:-

Working Capital = Current Assets – Current Liabilities

Working Capital = Rs. 3,34,000 – Rs. 84,000

Working Capital = Rs. 2,50,000

Long-term obligations are referred to as non-current liabilities:-

Shareholder’s Funds = Rs. 27,50,000 + Rs. 2,50,000 – Rs. 17,50,000

Shareholder’s Funds = Rs. 12,50,000

Question 30.

Solution 30

Calculation of Debt-Equity Ratio:-

Debt Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.1,20,000 )/( Rs.80,000 )

Debt Equity Ratio = 1.5:1.

So, the Debt Equity Ratio is 1.5:1.

Below is the Calculation of Long term Debts:-

Long Term Debt = Total Debts- Current Liabilities

Long Term Debt = Rs. 1,50,000 + Rs. 30,000

Long Term Debt = Rs. 1,20,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds =Total Assets + Total debt

Shareholder’s Funds = Rs. 2,30,000 + Rs. 1,50,000

Shareholder’s Funds = Rs. 80,000

Point in Mind:-

The relationship between long-term debts and shareholder funds is represented by this ratio. It displays the percentage of funds acquired by long-term borrowings as opposed to shareholder funds. This ratio is used to decide a company’s ability to fulfil long-term obligations. A debt-to-equity ratio of 2:1 is commonly regarded as safe.

Question 31.

Solution 31:

Debt Equity Ratio =(Debt )/( Equity ) or (Long term Debt )/( Shareholder’ s Funds)

Since the Debt – Equity Ratio in the above issue is 1:2, it is fair to conclude that long-term loans total Rs. 1,00,000 and share holders’ fund shares total Rs. 2,00,000.

(i) Issue of Equity Shares: If Rs. 1,00,000 worth of equity shares are released, the shareholder’s funds will increase to Rs. 2,00,000 + Rs. 1,00,000 = Rs. 3,00,000. As a result, the updated ratio would be as follows:

(Rs.1,00,000 )/( Rs.3,00,000 ) = .33:1

The ratio was 1:2 or (.5:1) before the issue of equity shares, but it has now been reduced to.33:1, suggesting that the ratio has decreased. As a result, it is possible to assume that an increase in shareholder assets lowered the ratio.

(ii) Cash Received from Trade Receivables: Only the cash and trade receivables will be impacted by obtaining cash from trade receivables. As a result, the debt equity ratio will not adjust because neither the long-term debt nor the shareholder funds are affected.

(iii) Sale of goods on cash Basis: Only the inventories and cash would be impacted by products exchanged for cash. As a result, the debt-to-equity ratio will not adjust because neither the long-term obligations nor the Shareholders’ Funds are affected.

(iv) Repayment of long term Borrowings: If a long-term loan of Rs. 50,000 is repaid, the Long-Term Debts will be reduced by Rs. 50,000, leaving the overall debt at Rs. 1,00,000 – Rs. 50,000 = Rs. 50,000. As a result, the new ratio would be:

(Rs.50,000 )/( Rs.2,00,000 ) =.25:1.

Prior to the repayment of long-term debt, the ratio was 1:2 (.5:1), but it is now.25:1. It signifies a decline in the ratio.

(v) Purchase of Goods on credit: Only inventories and trade payables would be impacted by products bought on credit. As a result, the debt-to-equity ratio will not adjust because neither the long-term obligations nor the Shareholders’ Funds are affected.

Question 32.

Solution 32:

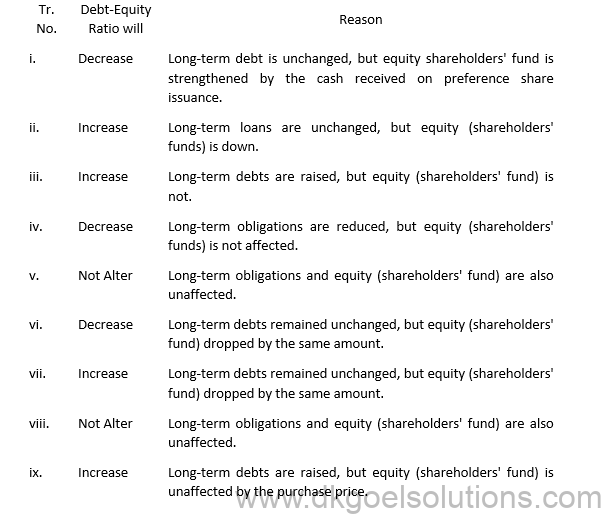

The influence of various transactions on the Debt-Equity Ratio is shown in the following table:-

Question 33.

Solution 33:

Calculation of Debt-Equity Ratio:-

Total Assets to Debt ratio = (Total assets )/( Debt )

Total Assets to Debt Ratio = 35,00,000/( 28,00,000)

Total Assets to Debt Ratio = 1.25 : 1

So, the Debt Equity Ratio is 1.25 : 1.

Below is the Calculation of Long term Debts:-

Long term debts = total Debts- Creditors – Bills payables- Short term Borrowings – Outstanding Exp.

Long term debts = Rs.32,00,000 – Rs.2,50,000 – Rs.20,000 – Rs.1,00,000 – Rs. 30,000

Long term debts = Rs. 28,00,000

Question 34.

Solution 34.

Calculation of Debt-Equity Ratio:-

Total Assets to Debt ratio = (total assets )/( Debt (i.e.,Long Term Debts) )

Total Assets to Debt Ratio = 56,00,000/( 18,00,000)

Total Assets to Debt Ratio = 3.11:1

So, the Debt Equity Ratio is 3.11:1.

Below is the Calculation of Long term Debts:-

Total Term debts = Total Debts- Trade Payables – Bank Overdraft

Total Term debts = Rs.24,00,000 – Rs.5,60,000 – Rs.40,000

Total Term debts = Rs. 18,00,000

Below is the Calculation of Shareholder’s Funds:-

Total Assets = Shareholder’s Funds + Total Debts

Total Assets = Rs. 32,00,000 + Rs. 24,00,000

Total Assets = Rs. 56,00,000

Working Note:-

Since Reserve and Surplus are already included in Shareholder’s Fund, they will be overlooked.

Question 35.

Solution 35

Calculation of Debt-Equity Ratio:-

Total Assets to Debt ratio = (total assets )/( Debt (i.e.,Long Term Debts) )

Total Assets = (Rs.73,60,000)/( 40,00,000)

Total Assets = 1.84:1

So, the Debt Equity Ratio is 1.84:1.

Below is the Calculation of Long term Debts:-

Long Term debts = 8% debentures + Loan from Bank

Long Term debts = Rs.30,00,000 – Rs.10,00,000

Long Term debts = Rs. 40,00,000

Below is the Calculation of Total Assets:-

Total Assets = Shareholder’s Funds (i.e., Share Capital + Reserve and Surplus) + Total Debts (i.e., 8% Debentures + Loan from Bank + Short term Borrowings)

Total Assets = Rs. 20,00,000 + Rs. 5,00,000 + Rs. 30,00,000 + Rs. 10,00,000 + Rs. 8,60,000

Total Assets = Rs. 73,60,000

Working Note:-

The surplus, i.e., the balance in the profit and loss statement, would be overlooked since it is already contained in the Reserve ad Surplus.

Question 36.

Solution 36:

Calculation of Debt-Equity Ratio:-

Total Assets to Debt ratio = (Total assets )/( Debt )

Total Assets to Debt Ratio = 63,00,000/( 35,00,000)

Total Assets to Debt Ratio = 1.8:1

So, the Debt Equity Ratio is 0.57:1.

Below is the Calculation of Long term Debts:-

Total Term debts = Total Debts – current Liabilities

Total Term debts = Rs.40,00,000 – Rs.5,00,000

Total Term debts = Rs. 35,00,000

Below is the Calculation of Total Assets:-

Total Assets = Total debt + Share Capital + Reserve and Surplus

Total Assets = Rs. 40,00,000 + Rs.15,00,000 + Rs. 8,00,000

Total Assets = Rs. 63,00,000

Point in Mind:-

The relationship between long-term debts and shareholder funds is represented by this ratio. It displays the percentage of funds acquired by long-term borrowings as opposed to shareholder funds. This ratio is used to decide a company’s ability to fulfil long-term obligations. A debt-to-equity ratio of 2:1 is commonly regarded as safe.

Question 37.

Solution37.

Calculation of Total Assets to Debt ratio:-

Total Assets to Debt ratio = (Total assets )/( Debt )

Total Assets to Debt Ratio = 68,40,000/( 24,00,000)

Total Assets to Debt Ratio = 2.85 : 1

So, the Debt Equity Ratio is 2.85 : 1.

Below is the Calculation of Capital Employed:-

Capital Employed = Shareholder’s funds + Long term debts

Rs. 60,00,000 = Rs.20,00,000 + Rs.16,00,000 + Long term debts

Long term debts = Rs. 24,00,000

Below is the Calculation of Total Assets:-

Total Assets = Shareholder’s funds + Long term debts + Current liabilities

Total Assets = Rs. 20,00,000 + Rs.16,00,000 + Rs. 24,00,000 + Rs. 8,00,000 + Rs. 40,000

Total Assets = Rs. 68,40,000

Point in Mind:

Shareholder funds includes = Share Capital + Reserve and Surplus

Current Liabilities includes = Trade Payables + Outstanding Exp.

Shareholders Fund includes = Share Capital + Reserve and Surplus

Question 38.

You are required to work out the following ratios:-

(i) Debt- Equity Ratio; (ii) Total Assets; (iii) Proprietary Ratio; (iv) Quick Ratio

Solution38

(i) Calculation of Debt-Equity Ratio:-

Debt Equity Ratio = (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.1,20,000 )/( Rs. 4,68,000 )

Debt Equity Ratio = .26:1.

So, the Debt Equity Ratio is 0.26:1.

Below is the Long term Debts:-

Long Term Debt = 9% Debentures = Rs. 1,20,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Share Capital + General Reserve + Profit & Loss Balance

Shareholder’s Funds = Rs. 3,20,000 + Rs. 1,00,000 + Rs. 48,000

Shareholder’s Funds = Rs. 4,68,000

(ii) Calculation of Total Assets to Debt Ratio:-

Total Assets to Debt Ratio = (Total assets )/( Lonf Term Debt )

Total Assets or Debt Ratio = (Rs.8,92,000 )/( Rs.1,20,000)

Total Assets or Debt Ratio = 7.43:1

So, the Total Assets to Debts Ratio is 0.26:1.

Below is the Calculation of Total Assets:-

Total Assets = Non-Current Assets + Current Assets

Total Assets = Rs. 3,60,000 + Rs. 1,76,000 + Rs. 3,28,000 + Rs. 28,000

Total Assets = Rs. 8,92,000

(iii) Calculation of Proprietary Ratio:-

Proprietary Ratio = (Equity )/( Total assets ) or (Shareholder^’ sFunds )/( Total assets )

Proprietary Ratio = (Rs.4,68,000 )/( Rs.8,92,000 )

Proprietary Ratio =.5247 or 52.47 %

So, the Proprietary Ratio is 0.26:1.

(iv) Calculation of Quick Ratio:-

Quick Ratio = (Liquid Assets )/( Current Liabilities )

Quick Ratio = (RS.3,56,000 )/( Rs.3,04,000)

Quick Ratio = 1.17:1

So, the Quick Ratio is 0.57:1.

Below is the Calculation of Liquid Ratio:-

Liquid Assets = Trade Receivables + Cash & Cash Equivalents

Liquid Assets = Rs. 3,28,000 + Rs. 28,000

Liquid Assets = Rs. 3,56,000

Below is the Calculation of Current Liabilities:-

Current liabilities = Rs. 3,04,000

Question 39.

Solution 39:

(i) Calculation of Debt-Equity Ratio:-

Debt Equity Ratio = (Debt )/( Equity ) or (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = 25,00,000/( 44,00,000)

Debt Equity Ratio = 0.568 : 1

So, the Debt Equity Ratio is 0.568:1.

Below is the Calculation of Long term Debts:-

Long Term Debt = 5% Debentures + Loan from IDBI

Long Term Debt = Rs. 15,00,000 + Rs. 10,00,000

Long Term Debt = Rs. 25,00,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Equity Shares Capital + Reserves + P & L Balance

Shareholder’s Funds = Rs. 28,00,000 + Rs. 12,00,000 + Rs. 4,00,000

Shareholder’s Funds = Rs. 44,00,000

(ii) Calculation of Proprietary Ratio:-

Proprietary Ratio = (Shareholder^’ sFunds )/( Total assets )

Proprietary Ratio = (Rs.44,00,000 )/( Rs.80,00,000 )

Proprietary Ratio = .55 or 55%

Below is the Calculation of Total Assets:-

Total Assets = Goodwill + Other Non-Current Assets + Current Assets

Total Assets = Rs. 6,00,000 + Rs. 46,00,000 + Rs. 28,00,000

Total Assets = Rs. 80,00,000

(iii) Calculation of Total Assets to Debt Ratio:-

Total Assets to Debt Ratio = (Total Assets )/( Long Term Debts )

Total Assets to Debt Ratio = (Rs. 80,00,000 )/( Rs. 25,00,000)

Total Assets to Debt Ratio = 3.2:1

So, the Total Assets to Debt Ratio is 0.57:1.

Point in Mind:-

The Other formula for Proprietary ratio is (Equity )/( Total assets )

Question 40.

Solution 40

(i) Calculation of Debt Equity Ratio:-

Debt Equity Ratio= (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.9,25,000 )/( Rs.6,75,000 )

Debt Equity Ratio = 1.37

So, the Debt Equity Ratio is 1.37:1.

Below is the Calculation of Long term Debts:-

Long Term Debt = Long term borrowings + Long term provisions

Long Term Debt = Rs. 7,00,000 + Rs. 2,25,000

Long Term Debt = Rs. 9,25,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Non-Current Assets + Working Capital – Non-current Liabilities

Working Capital = Current Assets – Current Liabilities

Working Capital = Rs. 5,40,000 – Rs. 1,40,000

Working Capital = Rs. 4,00,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Rs. 12,00,000 + Rs. 4,00,000 – Rs. 9,25,000

Shareholder’s Funds = Rs. 6,75,000

(ii) Calculation of Total Assets to Debt Ratio:-

Total Assets to Debt Ratio = (Total Assets )/( Debts )

Total Assets to Debt Ratio = (Rs. 17,40,000 )/( Rs. 9,25,000)

Total Assets to Debt Ratio = 1.88:1

So, the total assets to debt ratio is 1.88:1

Calculation of Total Assets:-

Total Assets = Non-Current Assets + Current Assets

Total Assets = Rs. 12,00,000 + Rs. 5,40,000

Total Assets = Rs. 17,40,000

(iii) Calculation of Proprietary Ratio:-

Proprietary Ratio = (Proprietar^’ sFunds )/( total Assets )

Proprietary Ratio = (RS.6,75,000 )/( Rs.17,40,000) × 100

Proprietary Ratio = 38.79 %

So, the Debt Equity Ratio is 38.79%.

Point in Mind:-

The other formula of Debt Equity Ratio is (Debt )/( Equity )

Question 41.

Solution 41

Calculation of Proprietary Ratio:-

Proprietary Ratio = (shareholder^’ s Funds )/( Total Assets )

0.75 = (25,00,000+5,00,000+8,00,000-2,00,000 )/( Total Assets )

0.75 = 36,00,000/( Total Assets )

Total Assets = 36,00,000/( 0.75 )

Total Assets = Rs. 48,00,000

So, the Value of total assets is 48,00,000.

Below is the Calculation of Current Assets:-

Current Assets = Total Assets – Fixed Assets

Current Assets = Rs. 48,00,000 – Rs. 30,00,000

Current Assets = Rs. 18,00,000

Question 42.

Solution 42:

The Formula of Proprietary Ratio is (Shareholder^’ s Funds )/( Total Assets )

A higher proprietary ratio is generally treated an indicator of sound financial position from long-term point of view, because it means that a large proportion of total assets is provided by equity and hence the firm is less dependent on external sources.

Question 43.

Solution 43:

Calculation of Interest Coverage Ratio:-

Interest Coverage Ratio = (Net Profit before Interest & tncome Tax )/( Fixed Interest Charges)

Interest Coverage Ratio = (Rs. 2,67,000 )/( Rs. 27,000)

Interest Coverage Ratio = 9.89Times.

So, the Interest Coverage Ratio is 9.89 times.

Working Note:-

Calculation of Interest on Mortgage Loan:

Interest on Mortgage Loan = 1,00,000 × 12%

Interest on Mortgage Loan = 12,000

Calculation of Interest on Debentures:

Interest on Debentures = 1,00,000 × 15%

Interest on Debentures = 15,000

Total Interest = 12,000 + 15,000 = 27,000

Calculation of Tax:-

The net profit after interest and tax is given in the above question, but net profit before interest and tax is required to calculate this ratio.

If the profit after taxes is 50, the profit before taxes must be equal to 100.

If the profit after taxes is 1,20,000, the profit before taxes must be

= (100 )/( 50) × 1,20,000

= Rs. 2,40,000

Calculation of Profit before payment of interest and Tax:-

Profit before payment of interest and Tax = Rs. 2,40,000 + Rs. 27,000

Profit before payment of interest and Tax = Rs. 2,67,000.

Question 44.

Solution 44

(i) Calculation of Debt-Equity Ratio:-

Debt Equity Ratio = (Debt )/( Equity ) or (Long term Debt )/( Shareholder^’ s Funds)

Debt Equity Ratio = (Rs.6,00,000 )/( Rs.2,50,000 )

Debt Equity Ratio = 2.4 :1

So, the Debt Equity Ratio is 2.4 : 1.

Below is the Calculation of Long term Debts:-

Long Term Debt = Loans + Debentures

Long Term Debt = Rs. 1,00,000 + Rs. 1,50,000

Long Term Debt = Rs. 2,50,000

Below is the Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Share Capital + Reserve & Surplus

Shareholder’s Funds = Rs. 1,00,000 + Rs. 1,50,000

Shareholder’s Funds = Rs. 2,50,000

Comment: The Company’s debt-to-equity ratio is unsatisfactory because it exceeds the acceptable norms of 2:1. From a long-term viewpoint, it reveals a risky financial situation.

(ii) Calculation of Proprietary Ratio:-

Proprietary Ratio = (Equity )/( Total Assets ) or (Shareholder^’ s funds)/(Total Assets ) ×100

Proprietary Ratio = (Rs.2,50,000 )/( Rs.12,50,000 ) × 100

Proprietary Ratio = 20 %

So, the Proprietary Ratio is 20%.

Below is the Calculation Total Assets:-

Total Assets = Current Assets + Tangible Fixed Assets

Total Assets = Rs. 5,50,000 + Rs. 7,00,000

Total Assets = Rs. 12,50,000

Comment: The Proprietary Ratio is just 20%, indicating that the company’s long-term financial situation is unsatisfactory since only 20% of the company’s overall assets are financed through equity.

(iii) Calculation of Interest Coverage Ratio:-

Interest Coverage Ratio = (Net Profit before interest and Tax )/(Fixed Interest Charges)

Interest Coverage ratio = (Rs.2,56,000)/( Rs.64,000)

Interest Coverage ratio = 4 times.

So, the Interest Coverage Ratio is 4 times.

Working Note:-

Calculation of Interest:-

Interest on Loan = Rs. 4,00,000 × 10%

Interest on Loan = Rs. 40,000

Interest on Debenture = Rs. 2,00,000 × 12%

Interest on Debenture = Rs. 24,000

Total Interest = Rs. 64,000

Calculation of Net profit before interest and tax is calculated as follows:-

Net profit after interest and Tax = Rs. 96,000

Net profit before interest = Rs.96,000 ×100/( 50)

Net profit before interest = Rs. 1,92,000

Net Profit before Interest and Tax = Rs. 1,92,000 + Fixed Interest Charges

Net Profit before Interest and Tax = Rs. 1,92,000 + Rs. 64,000

Net Profit before Interest and Tax = Rs. 2,56,000

Comment: A reasonable interest-coverage ratio is 6 or 7, but this company’s actual ratio is 4. In the event of a decline in earnings, the corporation will have trouble paying the interest on long-term loans on a regular basis.

Question 45.

Solution 45:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover ratio = (Cost of revenue From Operations )/(Average Inventory)

Inventory Turnover Ratio = (Rs. 3,00,000 )/( Rs. 80,000)

Inventory Turnover Ratio = 3.75 times.

So, the Debt Equity Ratio is 3.75.

Below is the Calculation of Cost of Sales from Operations Activity:-

Cost of Sales from Operations Activity = Rs. 92,400 + Rs. 2,75,200 – Rs. 67,600

Cost of Sales from Operations Activity = Rs. 3,00,000

Below is the Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs. 92,400 + Rs. 67,600 )/( 2)

Average Inventory = (Rs. 1,60,000 )/( 2)

Average Inventory = Rs. 80,000

Question 46.

Solution 46

Calculation of Inventory turnover Ratio:-

Inventory turnover ratio = (Cost of revenue From Operations )/(Average Inventory)

Inventory Turnover Ratio = 3,60,000/80,000

Inventory Turnover Ratio = 4.5 times

So, the Inventory turnover Ratio is 4.5 times.

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Opening Inventory + Net purchases + Carriage Inwards + Wages – Closing Inventory

Cost of revenue from Operations = 72,000 + 3,36,000 + 15,000 + 25,000 – 88,000

Cost of revenue from Operations = Rs. 3,60,000

Below is the Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (72,000 +88,000 )/2

Average Inventory = Rs. 80,000

Working Note:

When measuring Inventory Turnover Ratio, Carriage outwards, Wages, and Rent would be overlooked.

Question 47.

Solution 47

Calculation of Inventory turnover Ratio:-

Inventory turnover Ratio = (Cost of revenue From Operations )/(Average Inventory)

Inventory Turnover Ratio = (Rs.5,61,000)/(Rs.82,500)

Inventory Turnover Ratio = 6.8 times

So, the Debt Equity Ratio is 6.8 times.

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Purchase of Stock in Trade + Change in Inventory of stock in Trade

Cost of revenue from Operations = Rs. 5,36,000 + Rs. 25,000

Cost of revenue from Operations = Rs. 5,61,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory+Closing Inventory )/2

Average Inventory = (Rs.95,000 + Rs. 70,000 )/2

Average Inventory = Rs. 82,500

Working Note:

When measuring Inventory Turnover Ratio, Carriage outwards, Wages, and Rent would be overlooked.

Question 48.

Solution 48

Calculation of Inventory turnover Ratio:-

Inventory turnover Ratio = (Cost of revenue From Operations(cost of goods sold))/(Average Inventory)

Inventory turnover Ratio = (Rs.8,40,000)/(Rs. 1,40,000)

Inventory turnover Ratio = 6 times

So, the Inventory turnover Ratio is 0.57:1.

Below is the Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Purchase of Stock in Trade + Change in Inventory of stock in Trade + wages + Manufacturing Exp.

Cost of revenue from Operations = Rs. 6,50,000 – Rs. 30 ,000 + Rs. 1,48,000 + Rs. 72,000

Cost of revenue from Operations = Rs. 8,40,000

Below is the Calculation of Average Inventory:-

Average Inventory =(Opening Inventory+Closing Inventory )/2

Average Inventory = (Rs.1,25,000 +RS. 1,55,000 )/2

Average Inventory = Rs. 1,40,000

(ii) Calculation of Average age of Inventory:-

Average age of Inventory = (Days in a year)/(Inventory Turnover Ratio )

Average age of Inventory = 365/6

Average age of Inventory = 61 Days

Hence, the Average age of Inventory is 61 Days.

Question 49.

Solution 49

Calculation of Inventory turnover Ratio:-

Inventory turnover ratio = (Cost of revenue From Operations)/(Average Inventory)

Inventory Turnover Ratio = (Rs.3,000,000)/(Rs. 30,000)

Inventory Turnover Ratio = 10 times

So, the Inventory Turnover Ratio is 10 times.

Calculation of Revenue from Operations:-

Revenue from Operations = Cash Sales + Credit Sales – Return Inward

Revenue from Operations = Rs. 1,50,000 + Rs. 2,50,000 – Rs. 25,000

Revenue from Operations = Rs. 3,75,000

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from Operations (Sales) – Gross Profit

Cost of revenue from Operations = Rs. 3,75,000 – 20% of Rs. 3,75,000

Cost of revenue from Operations = Rs. 3,75,000 – Rs. 75,000

Cost of revenue from Operations = Rs. 3,00,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory+Closing Inventory )/2

Average Inventory = (Rs.25,000 +RS. 35,000 )/2

Average Inventory = Rs. 30,000

Question 50.

Solution 50:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio =( Cost of Revenue from Operations )/(Average Inventory)

Inventory Turnover Ratio = (Rs.3,00,000)/(Rs. 60,000)

Inventory Turnover Ratio = 5 times

So, the Inventory Turnover Ratio 5 times.

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from Operations (Sales) – Gross Profit

Cost of revenue from Operations = Rs. 5,00,000 – 40% of 5,00,000

Cost of revenue from Operations = Rs. 5,00,000 – Rs. 2,00,000

Cost of revenue from Operations = Rs. 3,00,000

Below is the Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs.54,000 +RS. 66,000 )/2

Average Inventory = Rs. 60,000

(ii) Calculation of Average age of Inventory:-

Average age of Inventory = (Days in a year)/(Inventory Turnover Ratio )

Average age of Inventory = 365/5

Average age of Inventory = 73 Days

So, the Average age of Inventory is 73 Days.

Question 51.

Solution 51:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = ( Cost of Revenue from Operations )/(Average Inventory)

Inventory Turnover Ratio = (Rs.2,50,000)/(Rs. 40,000)

Inventory Turnover Ratio = 6.25 times

So, the Inventory Turnover Ratio is 6.25 times.

Working Note:-

Calculation of Cost of Goods sold:-

It is given that the gross profit is 20% on cost.

If revenue from operations is Rs. 3,00,000,

Cost of goods sold = (100 )/120 × 3,00,000 = Rs. 2,50,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs. 42,500 + Rs. 37,500 )/2

Average Inventory = Rs. 40,000

Question 52.

Solution 52

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = ( Cost of Revenue from Operations )/(Average Inventory)

Inventory Turnover Ratio = (Rs.10,20,000)/(Rs. 1,50,000)

Inventory Turnover Ratio = 6.8 times

So, the Inventory Turnover Ratio is 6.8 times.

Working Note:-

Calculation of Gross Profit:-

Gross Profit = Revenue from Operations × Rate

Gross Profit = 12,00,000 × 15%

Gross Profit = 1,80,000

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from Operations – Gross Profit

Cost of revenue from Operations = Rs. 12,00,000 – (15% of 12,00,000)

Cost of revenue from Operations = 10,20,000

Calculation of Opening Inventory:-

Cost of revenue from Operations = Opening Inventory + Purchases + Direct Expenses – Closing Inventory

Rs. 10,20,000 = Opening Inventory + Rs. 10,00,000 + Rs. 48,000 – Rs. 1,64,000

Rs. 10,20,000 = Opening Inventory + Rs. 8,84,000

Opening Inventory = Rs. 1,36,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs.1,36,000 +RS. 1,64,000 )/2

Average Inventory = Rs. 1,50,000

Question 53.

Solution 53:

Calculation of Opening Inventory:-

Cost of revenue from Operations = Opening Inventory + Purchases + Freight – Closing Inventory

Rs. 5,80,000 = Opening Inventory + Rs. 5,70,000 + Rs. 20,000 – Rs. 70,000

Rs. 5,80,000 = Opening Inventory + Rs. 5,20,000

Opening Inventory = Rs. 60,000

So, the Opening Inventory is Rs. 60,000.

Calculation of Gross Profit:-

Gross Profit = Revenue from Operations × Rate

Gross Profit = 5,00,000 × 16%

Gross Profit = 80,000

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from Operations + Gross Profit

Cost of revenue from Operations = Rs. 5,00,000 + 80,000

Cost of revenue from Operations = Rs. 5,80,000

Question 54.

Solution 54:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Goods sold)/(Average Inventory)

Inventory Turnover Ratio = (Rs.4,40,000)/(Rs.55,000)

Inventory Turnover Ratio = 8 times.

So, the Inventory Turnover Ratio is 8 times.

Working Note:-

Calculation of Gross Loss:-

Revenue from Operations = Rs. 4,00,000

Gross Loss = Rs. 4,00,000 × 10%

Gross Loss = Rs. 40,000

Calculation of Cost of Revenue from Operations:-

Cost of Revenue from Operations = Revenue from Operations + Gross Loss

Cost of Revenue from Operations = Rs. 4,00,000 + Rs. 40,000

Cost of Revenue from Operations = 4,40,000

Question 55.

Solution 55:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory )

Inventory Turnover Ratio = (Rs.5,60,000 )/(RS.87,500)

Inventory Turnover Ratio = 6.4 times

So, the Inventory Turnover Ratio is 6.4 times.

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Opening Inventory + Purchases + Direct Charges – Closing Inventory

Rs. 5,60,000 = Rs. 75,000 + Rs. 4,40,000 + Rs. 1,30,000 + Rs. 15,000 – Closing Inventory

Closing Inventory = Rs. 6,60,000 – Rs. 5,60,000

Closing inventory = Rs. 1,00,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory+Closing inventory )/2

Average Inventory = (Rs.75,000+ Rs.1,00,000 )/2

Average Inventory = Rs. 87,500

Question 56.

Solution 56:

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory )

Inventory Turnover Ratio = (Rs. 1,50,000 )/(Rs. 50,000)

Inventory Turnover Ratio = 3 times

So, the Inventory Turnover Ratio is 3 times.

Working Note:-

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from operations – Gross profit

Cost of revenue from Operations = Rs. 2,00,000 – 25% of 2,00,000

Cost of revenue from Operations = Rs. 2,00,000 – Rs. 50,000

Cost of revenue from Operations = Rs. 1,50,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs.20,000 + Rs.80,000 )/2

Average Inventory = Rs. 50,000

Closing Inventory = ( 40 )/100 × 2,00,000

Closing Inventory = Rs.80,000

Opening Inventory =(1 )/4× 80,000 = Rs. 20,000

Question 57.

Solution 57

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (cost of Revenue from Operations )/(Average Inventory )

Inventory Turnover Ratio =(8,00,000 )/(1,60,000 )

Inventory Turnover Ratio = 5 times

So, the Inventory Turnover Ratio = 5 times.

Calculation of Cost of Revenue from Operations:-

Gross Profit is 25% on cost.

Revenue from Operations = Rs. 10,00,000

Cost of Revenue from Operations = 10,00,000 × (100 )/125

Cost of Revenue from Operations = Rs. 8,00,000

Opening Inventory is 10% of cost of Revenue from Operations

Opening Inventory = 8,00,000 × (10 )/100

Opening Inventory = Rs. 80,000

Closing Inventory = 80,000 × 3 = Rs. 2,40,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (80,000 + 2,40,000 )/2

Average Inventory = Rs. 1,60,000

Question 58.

Solution 58:

Calculation of Average Inventory:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory )

7 = (Rs. 5,60,000 )/(Average Inventory )

Average Inventory = (Rs.5,60,000 )/(7 )

Average Inventory = Rs. 80,000

So, the Average Inventory is Rs. 80,000

Calculation of Cost of revenue from Operations:-

Cost of revenue from Operations = Revenue from operations – Gross profit

Cost of revenue from Operations = Rs. 7,00,000 – Rs. 1,40,000

Cost of revenue from Operations = Rs. 5,60,000

It is given that Closing stock is more than opening stock:-

Calculation of Opening Inventory:-

Opening Inventory = Rs. 80,000 + Rs. 16,000 × 1/2

Opening Inventory = Rs. 88,000

Calculation of Closing Inventory:-

Closing Inventory

Closing Inventory = Rs. 10,000 – Rs. 16,000 × 1/2

Closing Inventory = Rs. 72,000

Question 59

Solution59

Calculation of Average inventory:-

Inventory Turnover Ratio = (cost of Revenue from Operations )/(Average Inventory )

4 = (Rs .4,80,000 )/(Average Inventory )

Average Inventory =(Rs. 4,80,000 )/4

Average Inventory = Rs. 1,20,000

Calculation of Cost of Revenue from Operations:-

Cost of Revenue from Operations = Cash Revenue from Operations + Credit Revenue from operations – Gross Profit

Cost of Revenue from Operations = Rs. 1,00,000 + Rs. 5,00,000 – Rs. 1,20,000

Cost of Revenue from Operations = Rs. 4,80,000

Case I : If Closing inventory was Rs. 1,00,000 in excess of opening inventory.

Opening Inventory = Rs. 1,20,000 – (1 )/2× Rs.1,00,000

Opening Inventory = Rs. 20,000

Closing Inventory = Rs. 1,20,000 + (1 )/2×Rs.1,00,000

Closing Inventory = Rs. 1,70,000

Case II: If closing inventory was 2 times that in the beginning.

(Average Inventory) × 2 = Opening Inventory + Closing Inventory

1,20,000 × 2 = Opening Inventory + Closing Inventory

Rs. 2,40,000 Opening Inventory + Closing Inventory

Since Closing Inventory was twice as much as Opening Inventory at the start, the ratio between Opening and Closing Inventory would be 1:2.

Opening Inventory = Rs. 2,40,000 × (1 )/3

Opening Inventory = Rs. 80,000

Closing Inventory = Rs. 2,40,000 × (2 )/3

Closing Inventory = Rs. 1,60,000

Case III: If closing inventory was 2 times more than that in the beginning.

Since Closing Inventory was twice as much as Opening Inventory at the start, the ratio between Opening and Closing Inventory would be 1:3.

Opening Inventory = Rs. 2,40,000 × (1 )/4

Opening Inventory = Rs. 60,000

Closing Inventory = Rs. 2,40,000 × (3 )/4

Opening Inventory = Rs. 1,80,000

Case IV: If Closing inventory was 3 times that in the beginning.

Since Closing Inventory was three times that at the start, the ratio between Opening and Closing Inventory would be one-third.

Opening Inventory = Rs. 2,40,000 × (1 )/4

Opening Inventory = Rs. 60,000

Closing Inventory = Rs. 2,40,000 × (3 )/4

Opening Inventory = Rs. 1,80,000

Q60 (A)

Solution 60 (A)

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (cost of Revenue from Operations )/(Average Inventory )

8 times =(RS.3,00,000 (given))/(Average Inventory )

Inventory Turnover Ratio = (Rs.3,00,000 )/(8 )

Average Inventory = Rs. 37,500

So, the Inventory is Rs. 37,500.

Calculation of Average Invemtory:-

Average Inventory × 2 = Opening Inventory + Closing Inventory

Rs. 37,500 × 2 = Opening Inventory + Closing Inventory

Rs. 75,000 = Opening Inventory + Closing Inventory

Since opening inventory is two times that of closing inventory, the ratio between opening and closing inventory would be 3:1.

Opening Inventory = Rs. 75,000 × (3 )/4

Opening Inventory = Rs. 56,250

Closing Inventory = Rs. 75,000 × (1 )/4

Opening Inventory = Rs. 18,750

Question 60 (B)

Solution 60 (B)

Calculation of Average Inventory:-

Inventory Turnover Ratio = (cost of Revenue from Operations )/(Average Inventory )

8 Times = (Rs. 1,50,000 )/(Average Inventory )

Average Inventory = (RS.1,50,000 )/(8 )

Average Inventory = Rs. 18,750

Calculation of Closing Inventory and Opening Inventory:-

Opening Inventory + Closing Inventory = Average Inventory × 2

Rs. 18,750 × 2 = Opening Inventory + Closing Inventory

Rs. 37,500 = Opening Inventory + Closing Inventory

Since opening inventory is 1.5 times that of closing inventory, the ratio between opening and closing inventory would be 2.5:1.

Opening Inventory = Rs. 37,500 × (2.5 )/3.5

Opening Inventory = Rs. 26,786

Closing Inventory = Rs. 37,500 × 1/3.5

Closing Inventory = Rs. 10,714

Question 61.

Solution 61

Calculation of Cost of Revenue from Operations:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory )

10 Times = (Cost of Revenue from Operations)/60,000

Cost of Revenue from Operations = Rs. 60,000 × 10

Cost of Revenue from Operations = Rs. 6,00,000

Calculation of Gross Profit:-

It is given that 10% Gross profit on Sale

Selling Price = Rs. 6,00,000 × 110/100

Selling Price = Rs. 6,60,000

Gross Profit = Sale – COGS

Gross Profit = 6,60,000 – 6,00,000

Hence, Gross Profit is Rs. 60,000

Question 62.

Solution 62

Calculation of Cost of Revenue from Operations:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory )

6 times = (Cost of Revenue from Operations )/60,000

Cost of Revenue from Operations = 6 × 60,000

Cost of Revenue from Operations = Rs. 3,60,000

So, the Cost of Revenue from Operations is Rs. 3,60,000

Calculation of Average Inventory:-

Opening Inventory = Rs. 40,000

It is given that Closing Inventory is 2 times of Opening Inventory.

Closing Inventory = 2 × 40,000

Closing Inventory = 80,000

Average Inventory = (Opening Inventory + Closing Inventory )/2

Average Inventory = (Rs. 40,000 + Rs. 80,000 )/2

Average Inventory = Rs. 60,000

Calculation of Revenue from Operations:-

Gross profit is 20% on Sales.

Cost of Revenue from Operations is 3,60,000

Revenue from Operations = 3,60,000 × 100/80

Revenue from Operations = Rs. 4,50,000

Question. 63

Solution 63:

It is given that Gross profit is 25% on cost.

(i) Revenue from Operations = Rs.3,00,000,

Cost of Goods Sold = 3,00,000 × 100/125

Cost of Goods Sold = Rs. 2,40,000

Average Inventory = (Rs.2,40,000)/5=RS.48,000

(ii) Calculation of Opening Inventory:-

Average Inventory = (Rs. 2,40,000)/5

Average Inventory = Rs. 48,000

Opening Inventory = Rs. 48,000 – 4,000 × 1/2

Opening Inventory = Rs. 48,000 – 2,000

Opening Inventory = Rs. 46,000

(iii) Calculation of Closing Inventory:-

Closing Inventory = Rs. 48,000 + 4,000 × 1/2

Closing Inventory = Rs. 48,000 + 2,000

Closing Inventory = Rs. 50,000

(iv) Calculation of Quick Assets:-

Current Liabilities are Rs. 50,000 and Quick Ratio is 1.

Quick Assets = Rs. 50,000 × 1

Quick Assets = Rs. 50,000

(v) Calculation of Current Assets:-

Current Assets = Quick Assets + Closing Inventory

Current Assets = Rs. 50,000 + Rs. 50,000

Current Assets = Rs. 1,00,000

Question 64.

Solution 64:

(i) Calculation of Liquid Ratio:-

Liquid Ratio = (Liquid Assets)/(Current Liabilities)

Liquid Ratio = (Rs. 2,00,000)/(Rs. 1,60,000)

Liquid Ratio = 1.25:1

Calculation of Liquid Assets:-

Liquid Assets = Trade receivables + Cash & Cash Equivalents

Liquid Assets = Rs. 1,75,000 + Rs. 25,000

Liquid Assets = Rs. 2,00,000

Calculation of Current Liabilities:-

Current Liabilities = Trade payables + Outstanding Expenses

Current Liabilities = Rs. 1,50,000 + Rs. 10,000

Current Liabilities = Rs. 1,60,000

(ii) Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average inventory)

Inventory Turnover Ratio = (RS.6,24,000)/(Rs.52,000)

Inventory Turnover Ratio = 12 Times

So, Inventory Turnover Ratio is 12 Times

Calculation of Cost of Revenue from Operations:-

Cost of Revenue from Operations = Revenue from operations – Gross Profit

Cost of Revenue from Operations = Rs. 8,00,000 – Rs. 1,76,000

Cost of Revenue from Operations = Rs. 6,24,000

Calculation of Average Inventory:-

Average Inventory =(Opening Inventory+Closing Inventory)/2

Average Inventory = (Rs. 44,000 +Rs. 60,000)/2

Average Inventory = Rs. 52,000

(iii) Calculation of Debt Equity Ratio:-

Debt Equity Ratio = (Long Term Debts)/(Shareholder^’ sFunds)

Debt Equity Ratio = 2,00,000/6,40,000

Debt Equity Ratio = 0.3125 : 1

So, the Debt Equity Ratio is 0.3125 : 1.

It is given that Long Term Debts are (Debentures) = Rs. 2,00,000

Calculation of Shareholder’s Funds:-

Shareholder’s Funds = Share Capital + General Reserve + Profit and Loss Balance

Shareholder’s Funds = Rs. 4,50,000 + Rs. 1,20,000 + Rs. 70,000

Shareholder’s Funds = Rs. 6,40,000

Question 65.

Solution 65

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory)

Inventory Turnover Ratio = (20,000 + 2,40,000 – 60,000 )/40,000

Inventory Turnover Ratio = 2,00,000/40,000

Inventory Turnover Ratio = 5 Times

So, the Inventory Turnover Ratio is 5 times.

Calculation of Cost of Revenue from Operations:-

Cost of Revenue from Operations = Opening Inventory + Purchases – Closing Inventory

Cost of Revenue from Operations = 20,000 + 2,40,000 – 60,000

Cost of Revenue from Operations = 2,00,000

Calculation of Average Inventory:-

Average Inventory = (Opening Inventory+Closing Inventory)/2

Average Inventory = (20,000 + 60,000)/2

Average Inventory = 40,000

(i) Goods purchased for Rs. 40,000.

Opening Inventory = Rs. 20,000

Purchase = Rs. 2,40,000 + Rs. 40,000 = Rs. 2,80,000

Closing Inventory = Rs. 60,000 + 40,000 = Rs. 1,00,000

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory)

Inventory turnover ratio = (2,00,000 )/60,000

Inventory turnover ratio = 3.33 times

Calculation of Average Inventory:-

Average Inventory = (20,000+1,00,000 )/2

Average Inventory = Rs. 60,000

Effect of Transaction:- Inventory Turnover Ratio is Decrease.

Reason:- Purchases and Closing Inventory is increases but Cost of revenue from operations will remain unchanged.

(ii) Sale of goods for Rs. 25,000 (Cost Rs. 30,000).

Opening Inventory = Rs. 20,000

Purchase = Rs. 2,40,000

Closing Inventory = Rs. 60,000 – 30,000 = Rs. 30,000

Calculation of Inventory Turnover Ratio:-

Inventory Turnover Ratio = (Cost of Revenue from Operations )/(Average Inventory)

Inventory turnover ratio = (2,30,000 )/25,000

Inventory turnover ratio = 9.2 times

So, the Inventory turnover ratio is 9.2 times.

Calculation of Cost of Revenue from Operations:-

Cost of Revenue from Operations = Opening Inventory + Purchases – Closing Inventory

Cost of Revenue from Operations = 20,000 + 2,40,000 – 30,000

Cost of Revenue from Operations = 2,30,000

Calculation of Average Inventory:-

Average Inventory = (20,000+30,000 )/2

Average Inventory = Rs. 25,000