DK Goel Solutions Chapter 18 Bills of Exchange

Read below DK Goel Solutions Class 11 Chapter 18 Bills of Exchange. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter of DK Goel depicts the clear picture of topics like due dates, interest amounts, discounting charges, and many more, its important to understand the concepts of Bills of Exchange as this will help you to do correct accounting.

The chapter also contains lot of questions which can be very helpful for Class 11 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

DK Goel Solutions Class 11 Chapter 18 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Bills of Exchange DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 18

Short Answer Questions for DK Goel Solutions Class 11 Chapter 18

Question 1:

Solution 1:

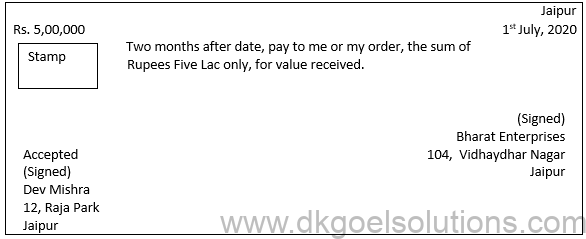

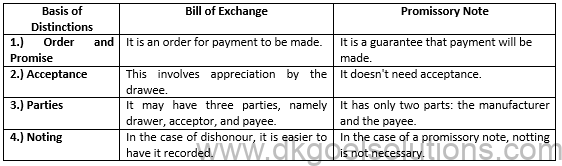

“A Bill of Exchange is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.” A bill of exchange is a written instrument containing an unconditional order signed by the manufacturer directing a person to pay a certain amount of money either to a certain person or to the holder of the instrument, or to the order of that person.

Bill of Trade characteristics or attributes include:

- A paper order is a Bill of Trade.

- The trade bill is drawn and signed by the bill’s manufacturer or drawer.

- The bill of exchange is an absolute order to pay the sum stated to an entity or drawee. To make it a valuable text, the drawee must welcome it.

- The sum mentioned is payable to, or to the bearer, the person named in the bill or his order.

Question 2:

Solution 2:

The parties to the trade bills:-

1.) Drawer:- The seller or borrower is entitled to collect somebody’s money. The bill is written or drawn and is known as a cabinet.

2.) Drawee or Acceptor:- The buyer or debtor on which the bill is drawn and who is responsible for paying the sum alluded to in the bill. By writing the word “Accepted” on the bill and then signing it, he decides to pay the number.

3.) Payee:- The person of which the charge is to be made is considered the payee. The payee may be the payee of the bill itself or a third party.

Question 3:

Solution 3:

The benefits of exchange bills are listed below:-

1.) Beneficial in the purchase and selling of loaned goods:- A bill of exchange shall act as a written proof of debt. It is evidence that the sum written in it is attributed to the seller of products. As such, without trouble, the items can be exchanged on lease.

2.) Legal Record:- In the light of laws, it is a legitimate document. In contrast to a written pledge, it will be easier to reclaim the balance legitimately if the drawee failed to make the payment.

Question 4:

Solution 4: A bill is considered as a draft when its acceptance is made.

Question 5:

Solution 5:

Question 6:

Solution 6:

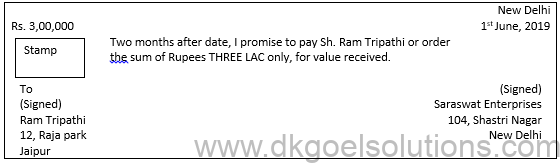

Sometimes, the purchaser of the goods or debtor himself writes a note, signs it and gives it to the seller of the goods. It is called a ‘Promissory Note’.

Features of a Promissory Note:-

1.) It must be in writing.

2.) The amount to be paid must be specified.

3.) It must be signed by the maker or promisor.

4.) The name of the payee must be mentioned in it.

Question 7:

Solution 7:

Parties to a Promissory Note:-

1.) Maker:- He is the person who writes a promissory note and signs it.

2.) Payee:- He is the person who is entitled to get the payment.

Question 8:

Solution 8:

Question 9:

Solution 9:

Question 10:

Solution 10:

Question 11:

Solution 11:

The uses of bills receivable are below:—

1.) Until the date of maturity, he may hold it.

2.) Before the date of maturity, the banker can discount it.

3.) Before the date of maturity, he may support it for any other faction.

4.) He may send it out for collection to his banker.

Question 12:

Solution 12:

If the drawee pays the bill past its due date, it is called the removal of the bill. The holder of the bill normally gives him a refund in such a situation, legally called a voucher.

Question 13:

Solution 13:

(i) Endorsement of a bill:- Endorsement indicates that an exchange bill is signed for the purpose of being passed to another bill. Through placing his signature on the back of the document, the holder of a bill receivable may support the bill to another person.

(ii) Renewal of a bill:- The bill collector considers himself unable to comply with the bill on the due date. In any case, the owners of the bill will be asked to cancel the original bill and draw up a new bill in place of the existing one.

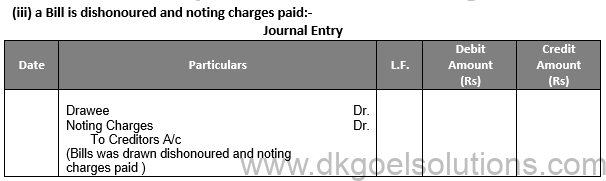

(iii) Dishonour of a debt:- If the bill collector refuses to pay the bill balance on the day of maturity or becomes insolvent, the bill is considered dishonour.

(iv) Day of maturity:- The ‘due date’ or ‘date of maturity’ is considered the date on which the balance of the bill becomes due. In other words, the due date is considered the date at which the term of the bill expires.

Question 14:

Solution 14:

(i) Retiring of the bill of exchange:- If the drawee makes payment before the due date of the bill, it is called withdrawal of the bill. The holder of the bill typically gives him a refund in such a situation, legally called ‘rebate’.

(ii) Exchange bill discount:- If the holder of a B/R wants money before the maturity date, he will discount the bank’s bill in order to obtain cash for it. Discount involves en-cashing the bill for the protection of the bill before the date of its maturity or borrowing from the bank.

(iii) Bill sent to the bank for collection:- Often the bill is sent to the bank with the instructions to hold the bill until maturity and recover its balance from the recipient on that date instead of discounting the bill.

(iv) Noting Charge:- The bill is typically turned over to an individual entitled ‘Noting Public’ assigned by the court to determine the fact that the bill was duly addressed and dishonoured.

Question 15:

Solution 15:

(i) a Bill is drawn:-

Question 16:

Solution 16:

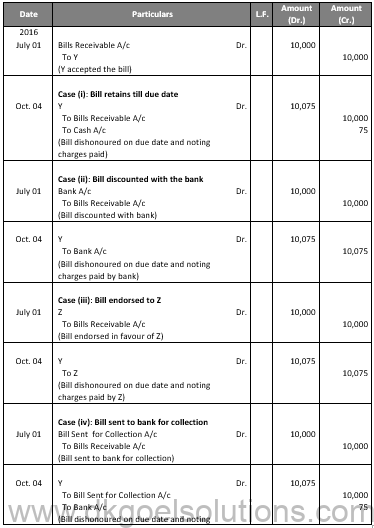

(i) Bill is with the drawer himself:-

Journal Entry

(ii) Bill is discounted with the Bank:-

Journal Entry

(iii) The Bill is with the endorser: endorsement means the transfer to another person of the Bill of Exchange or Promissory Note. To collect the invoice, the person receiving the Bill of Exchange or Promissory Note is approved. An endorser is the one who passes the Bill of Exchange or Promissory Note in favor of another person. The individual who is endorsed by the Bill of Exchange or Promissory Note is called the endorser.

(iv) Bill sent to the bank for collection:- Often the bill is sent to the bank with orders to hold the bill until maturity and recover its balance from the recipient on that date instead of discounting the bill.

Question 17:

Solution 17:

A bill can be approved without thought in order to obligate a neighbor. Such a bill is referred to as an accommodation bill.

Question 18:

Solution 18:

Practical Questions

Question 1:

Solution 1:

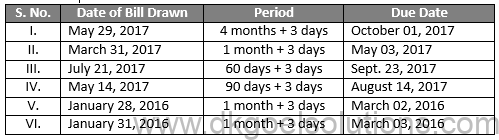

Point in Mind:–

Bills Due Date = Date of Bill Drawn + Period + Grace Days

Question 2:

Solution 2:

Point in Mind:-

Bills Due Date = Date of Bill Drawn + Period + Grace Days

Question 3:

Solution 3:

Journal Entries in the Books of Ajay

Journal Entries in the books of Bhushan

Question 4:

Solution 4:

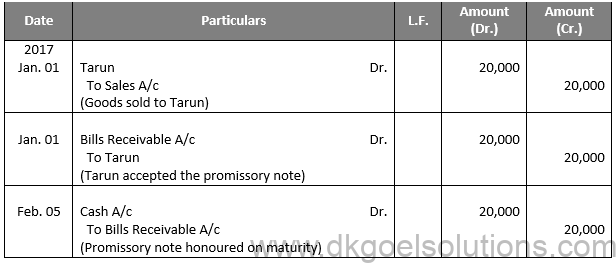

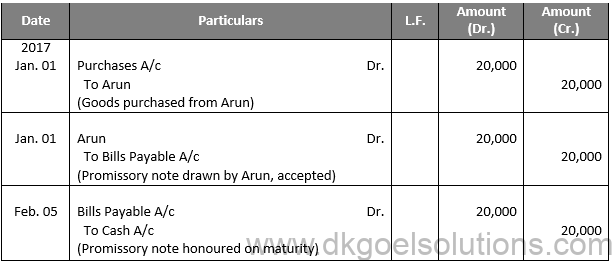

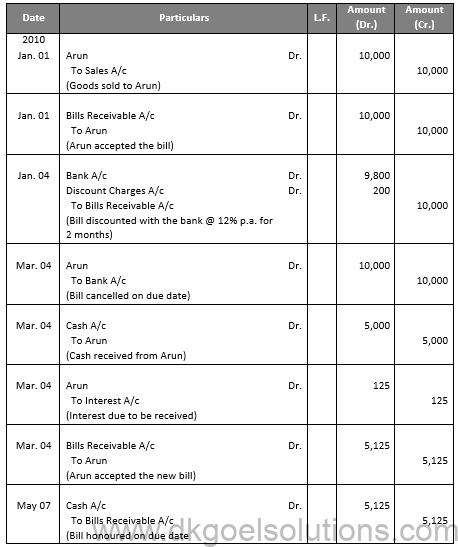

Journal Entries in the books of Arun

Journal Entries in the books of Tarun

Question 5:

Solution 5:

Journal Entries in the books of ………….

Journal Entries in the books of …………

Working Note:-

Here the due date is 11 March, 2017 which is a holiday then the due date is 10 March, 2017

Point in mind:-

If due date falls on holiday, then due date is succeeding date.

Question 6 (A):

Solution 6 (A):

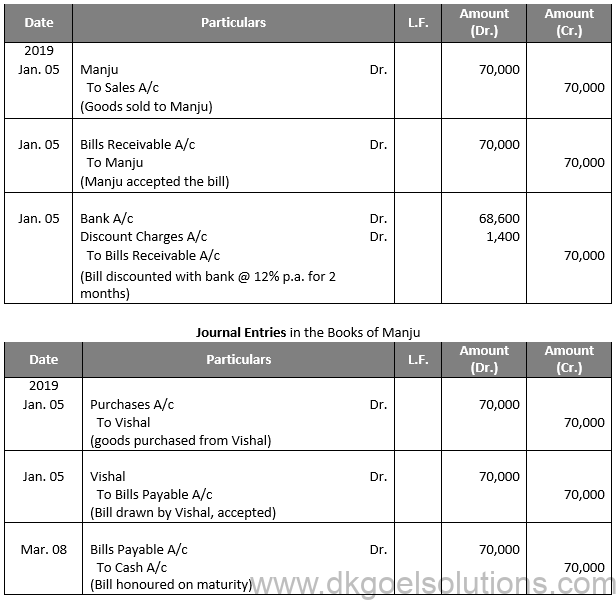

Journal Entries in the Books of Vishal

Working Note:-

Calculation of Discount:-

Discount Charges = Rs. 7,000 × 12% × 2/12

Discount Charges = Rs 14

Question 6 (B):

Solution 6 (B):

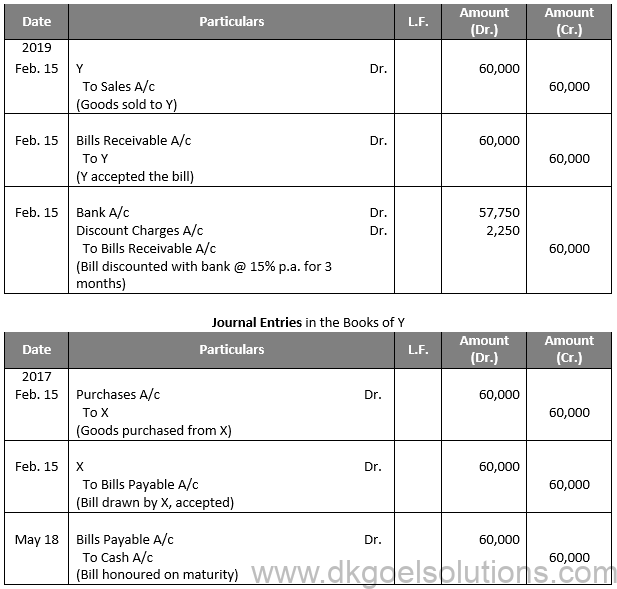

Journal Entries in the Books of X

Working Note:-

Calculation of Discount Charges:-

Discount Charges = Rs. 6,000 × 15% ×3/12

Discount Charges = Rs 225

Question 7:

Solution 7:

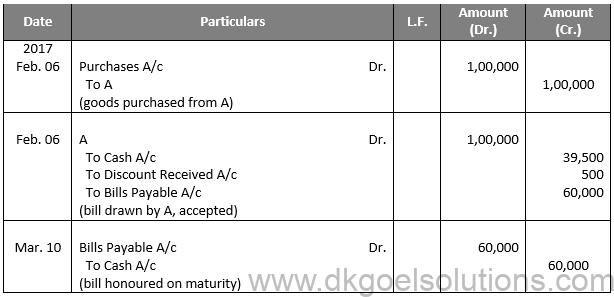

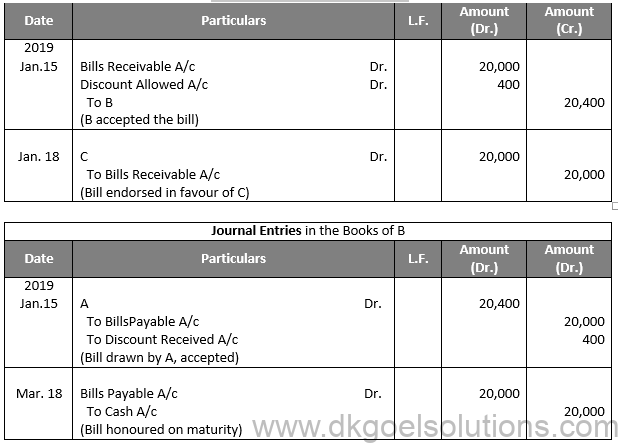

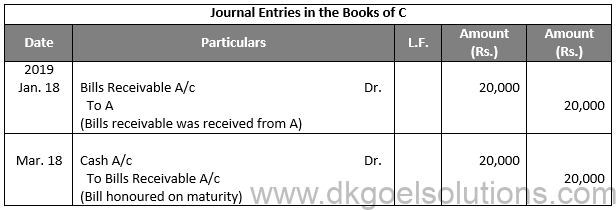

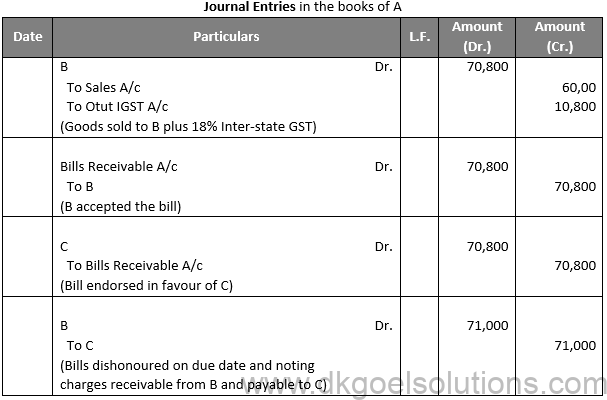

Journal Entries in the Books of A

Question 8:

Solution 8:

Question 9:

Solution 9:

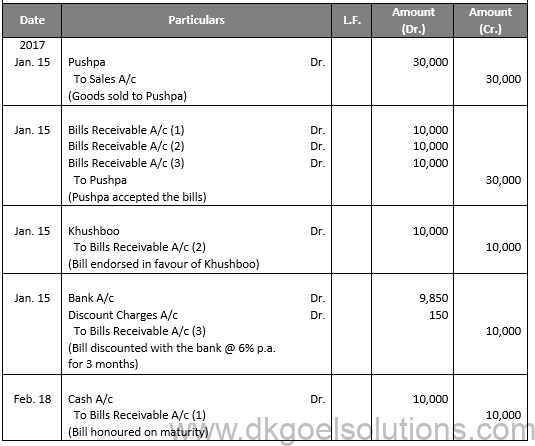

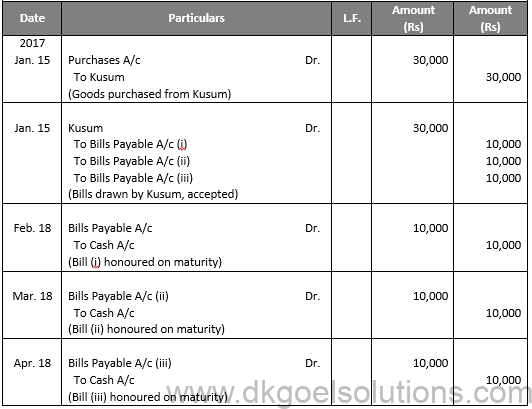

Journal Entries in the Books of Kusum

Journal Entry in the books of Pushpa

Working Note:-

Calculation of Discount Charges:-

Discount Charges = Rs. 10,000 × 6% × 3/12

Discount Charges = Rs 150

Question 10:

Solution 10:

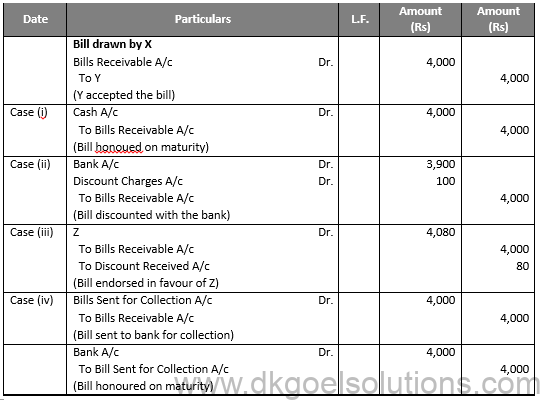

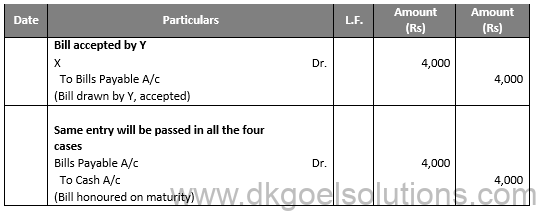

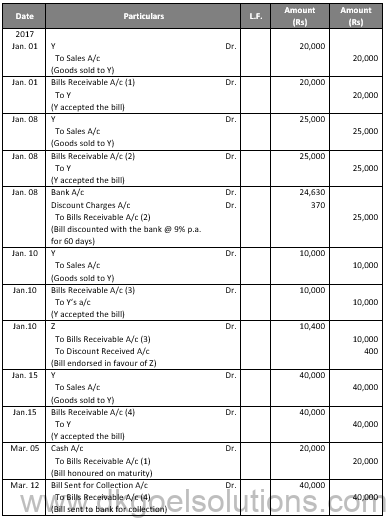

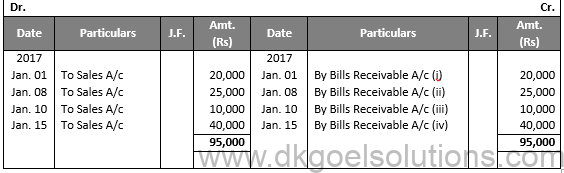

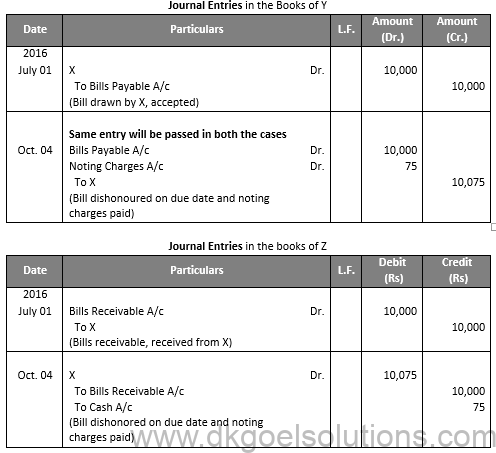

Journal Entries in the books of X

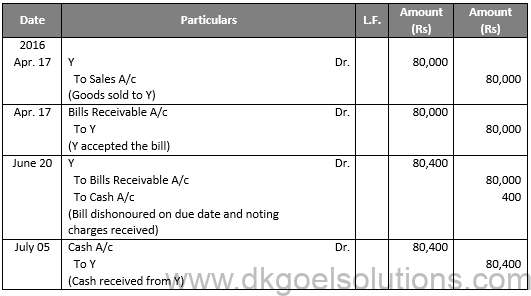

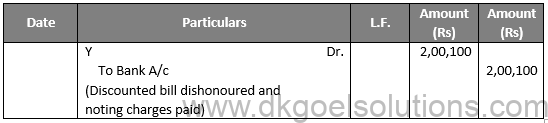

Journal Entries in the Books of Y

Question 11:

Solution 11:

Journal Entries in the Books of X

Y’s Account

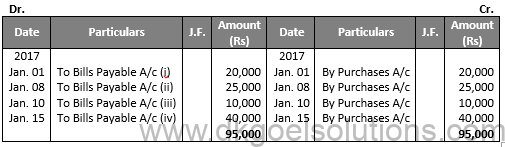

Journal Entries in the Books of Y

X’s Account

Working Note:-

Calculation of Discount Charges:-

Discount Charges = Rs. 25,000 × 9/100 × 60/365

Discount Charges = Rs 370.

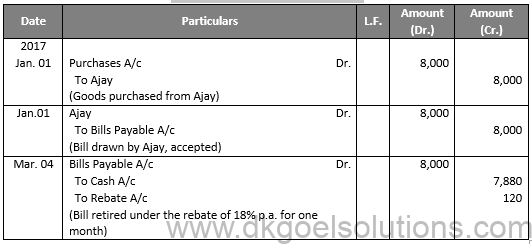

Question 12:

Solution 12:

Journal Entries in the Books of Balbir

Working Note:-

Calculation of amount of Rebate:-

Amount of Rebate = Rs. 8,000 × 18/100 × 112

Amount of Rebate = Rs. 120

Question 13:

Solution 13:

Journal Entries in the books of X

Journal Entries in the Books of Y

Question 14 (A):

Solution 14 (A):

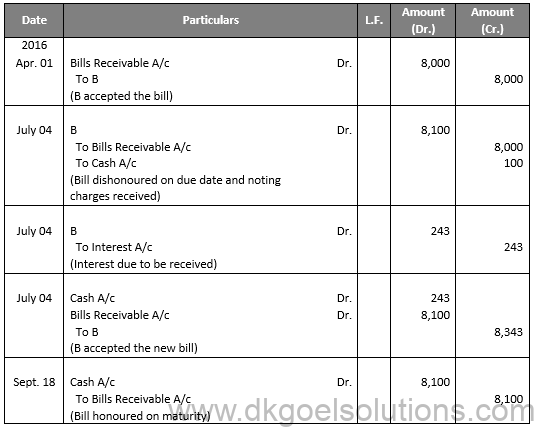

Journal Entries in the Books of A

Journal Entries in the Books of B

Working Note:-

Amount of Interest = Rs. 8,100 × 15% × 73/365

Amount of Interest = Rs. 243

Question 14 (B):

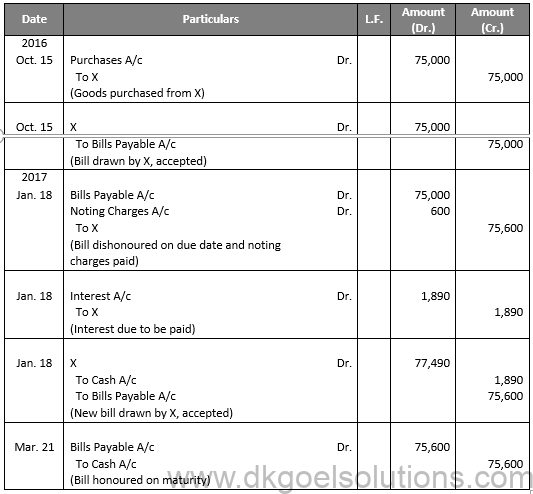

Solution 14 (B):

Journal Entries in the books of Y

Working Note:-

Amount of Interest = Rs. 75,600 × 15% × 2/12

Amount of Interest = Rs. 1,890

Question 15:

Solution 15:

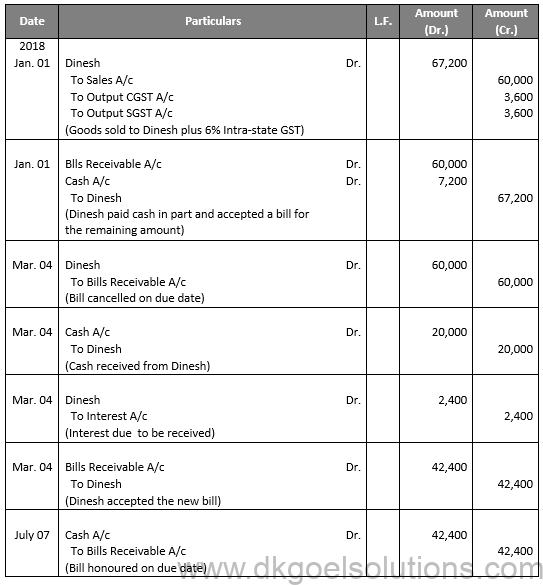

Journal Entries in the books of Chander

Journal Entries in the Books of Dinesh

Working Note:

Amount of Interest = Rs. 40,000 × 18% × 4/12 = Rs. 2,400

Question 16:

Solution 16:

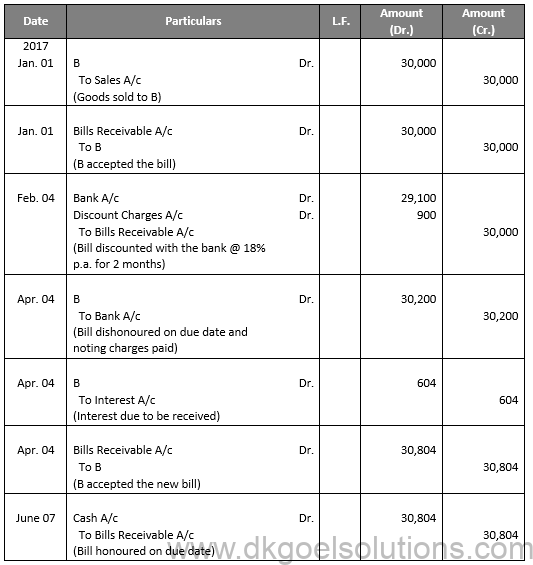

Journal Entries in the Books of A

Journal Entries in the Books of B

Working Note:

Discount Charges = Rs. 30,000 × 18% × 2/12 = Rs. 900

Amount of Interest = Rs. 30,200 × 12% × 2/12 = Rs. 604

Question 17:

Solution 17:

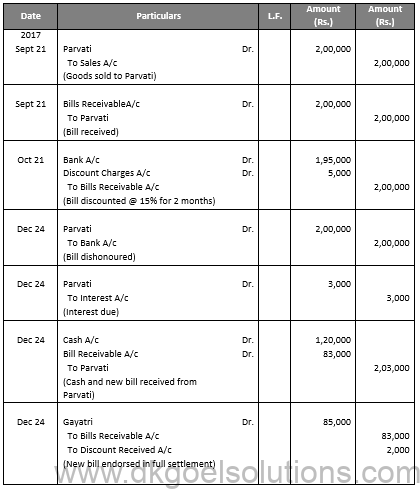

Journal Entries in the books of Radhika

Question 18:

Solution 18:

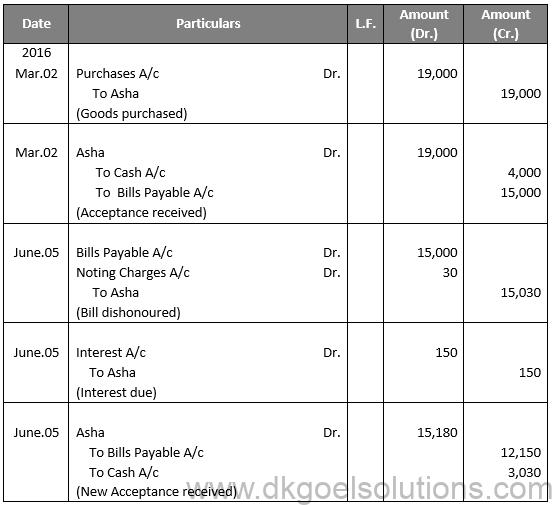

Journal Entries in the books of Asha

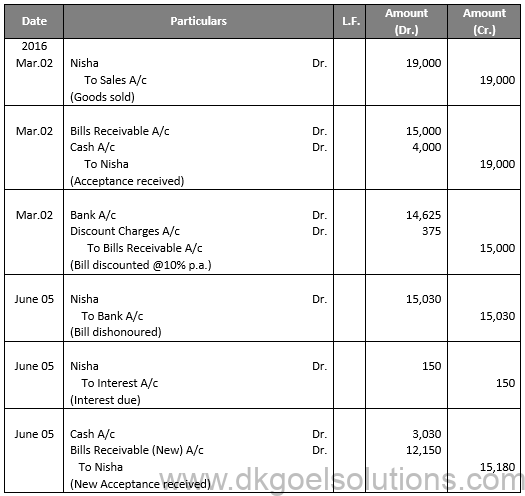

Working Notes:-

Amount of Interest = Rs. 12, 000 × 15% × 1/12 = Rs. 150

Amount of Discount = Rs. 15, 000 × 10% × 3/12 = Rs 375

Journal Entries in the books Nisha

Question 19:

Solution 19:

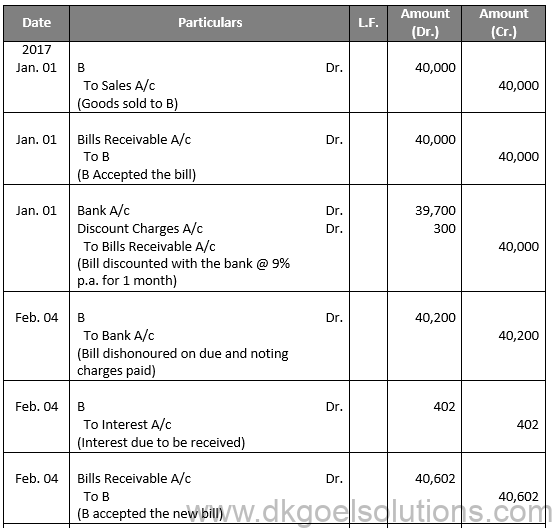

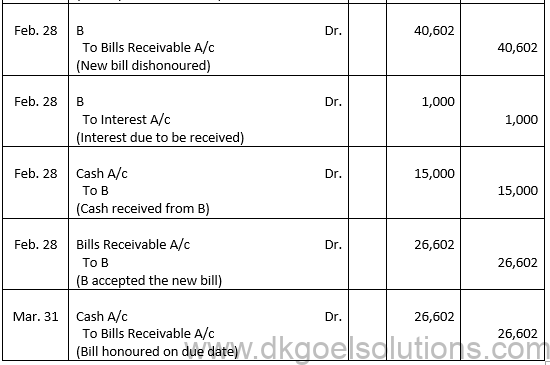

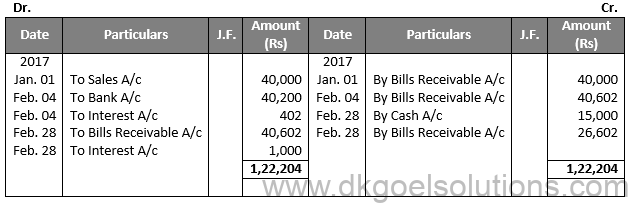

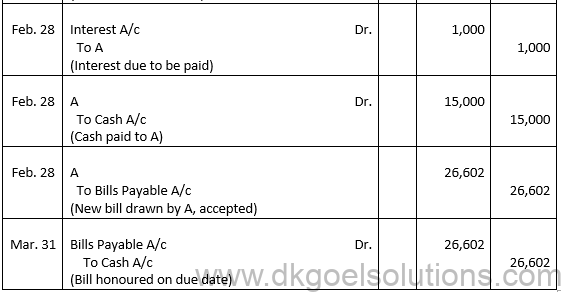

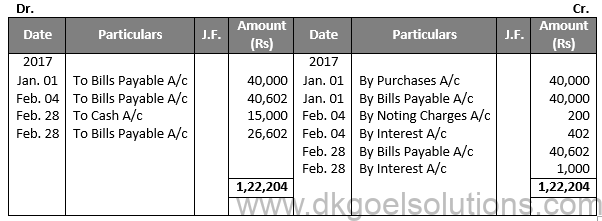

In the Books of A

Journal Entries

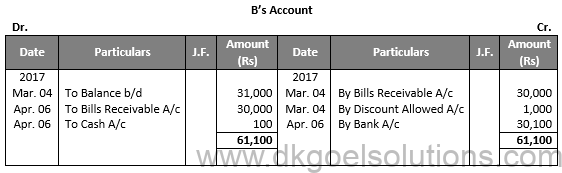

B’s Account

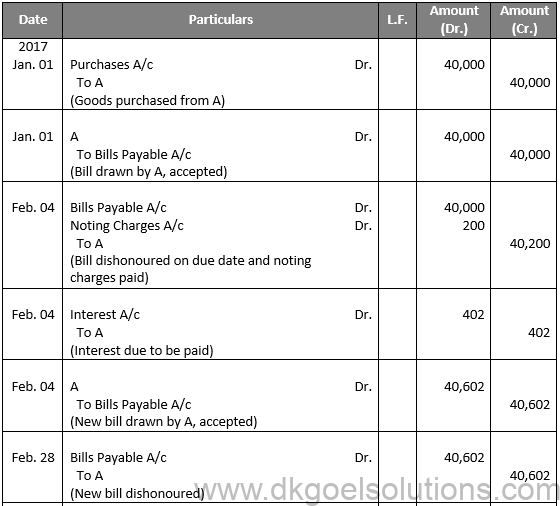

In the books of B

Journal Entries

A’s Account

Working Notes:-

Discount Charges = Rs. 40,000 × 9% × 1/12 = Rs. 300

Amount of Interest = Rs. 40,200 × 1% × 1/12 = Rs. 402

Question 20:

Solution 20:

Journal Entries in the books of Rajni

Question 21 (A):

Solution 21 (A):

Journal Entries in the books of Drawer

Journal Entries in the Books of Drawee

Question 21 (B):

Solution 21 (B):

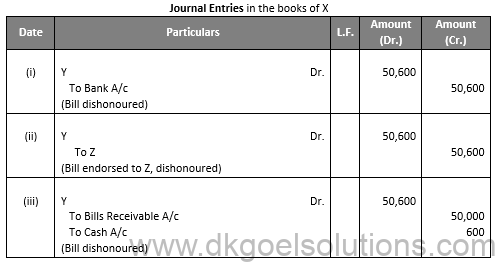

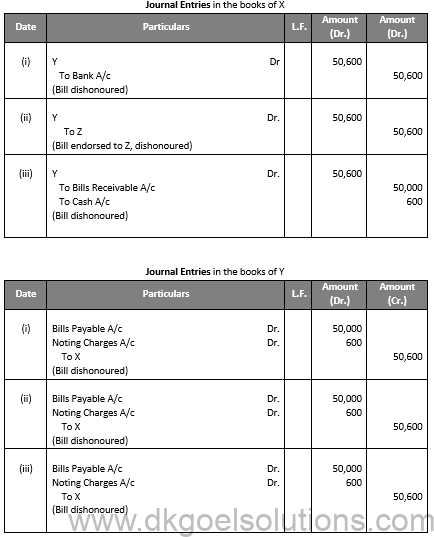

Journal Entries in the Books of X

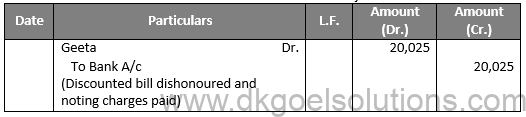

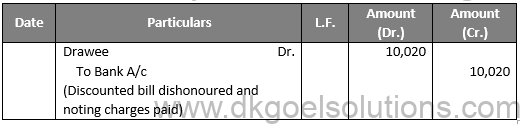

Question 22:

Solution 22:

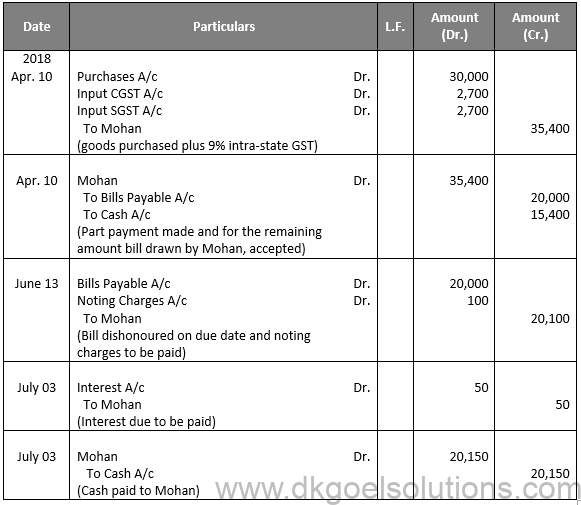

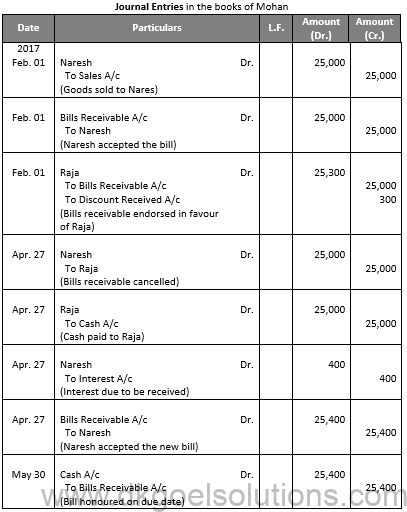

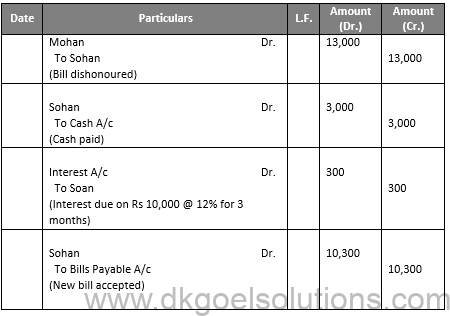

Journal Entries in the books of Mohan

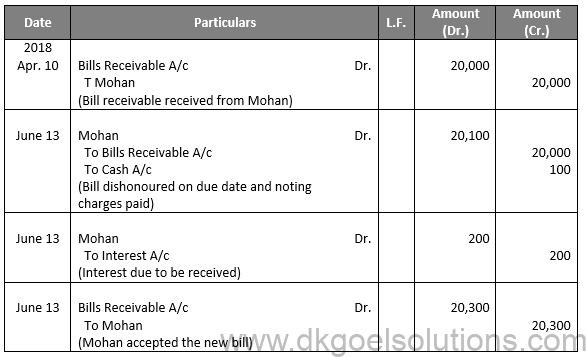

Journal Entries in the books of Ravi

Journal Entries in the books of Rakesh

Question 23:

Solution 23:

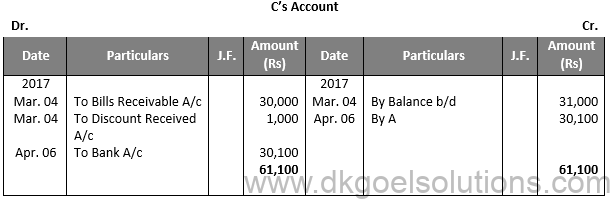

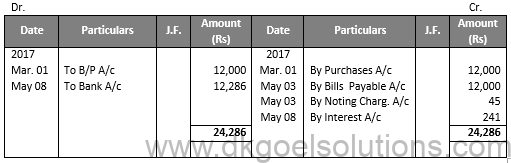

C’s Account

Dr. Cr.

Journal Entries in the books of A

Question 24:

Solution 24:

Question 25:

Solution 25:

Question 26:

Solution 26:

Question 27:

Solution 27:

Journal Entries in the Books of X

Question 28:

Solution 28:

Question 29:

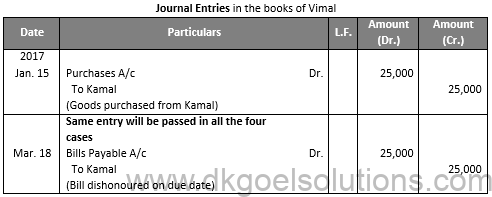

Solution 29:

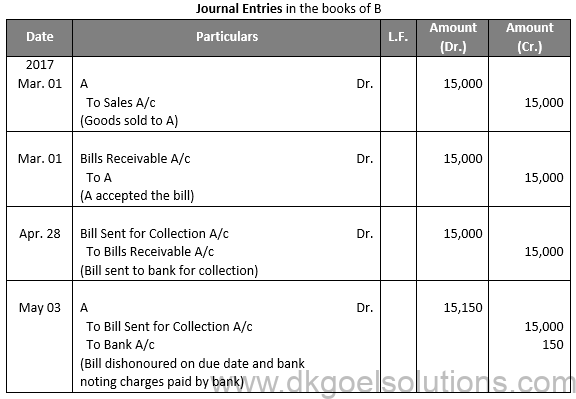

Journal Entries in the books of B

Journal Entries in the books of D

Question 30:

Solution 30:

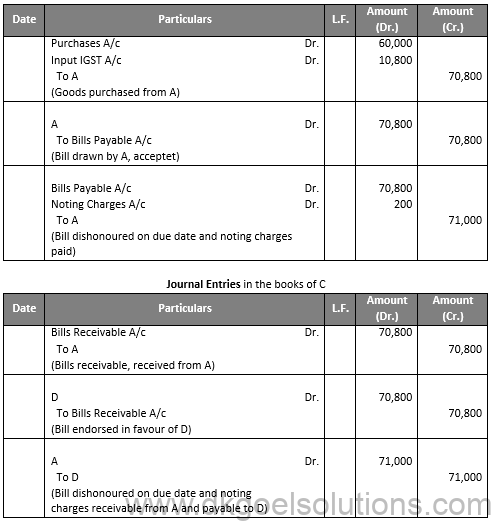

Journal Entries in the Books of Satish

Journal Entries in the Books of Harish

Question 31:

Solution 31:

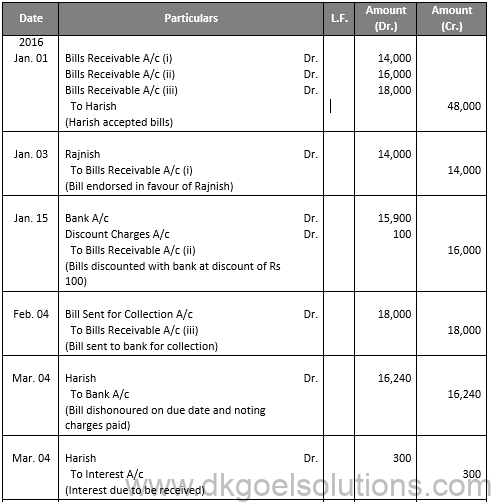

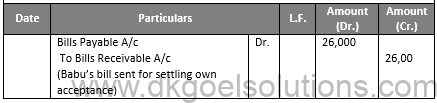

Journal Entries in the Books of Barun

Working Note:-

Discount Charges = Rs. 10,000 × 12% × 2/12 = Rs. 200

Amount of Interest = Rs. 5,000 × 15% × 2/12 = Rs. 125

Question 32:

Solution 32:

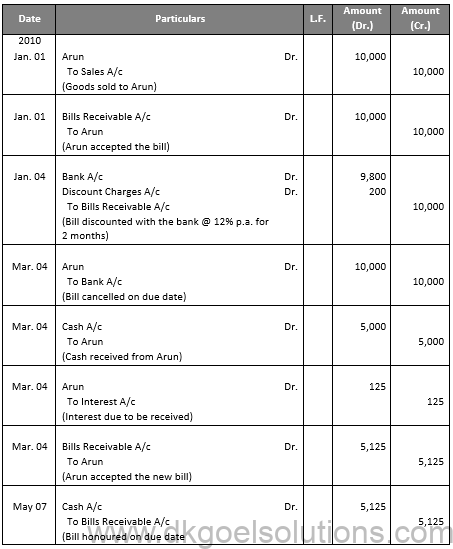

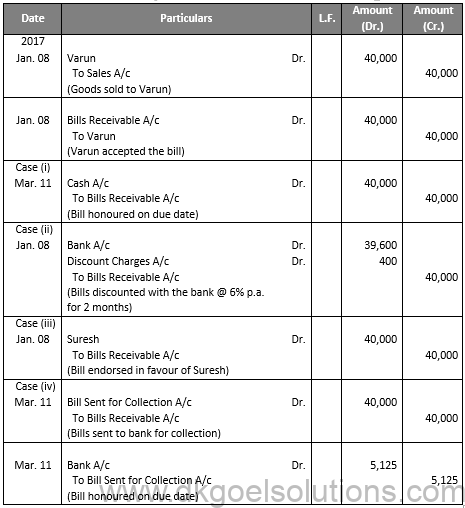

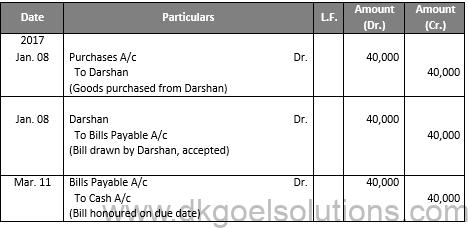

Journal Entries in the Books of Darshan

Journal Entries in the Books of Varun

Working Note:-

Discount Charges = Rs. 40,000 × 6% × 2/12

Discount Charges = Rs. 400

Question 33:

Solution 33:

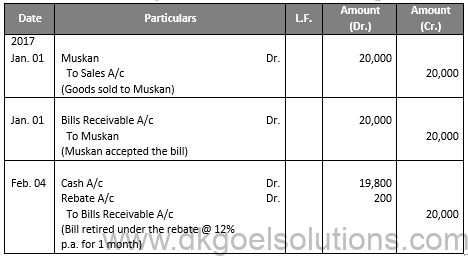

Journal Entries in the Books of Neha

Journal Entries in the books of Muskan

Working Note:-

Amount of Rebate = Rs. 20,000 × 12% × 2/12

Amount of Rebate = Rs. 200

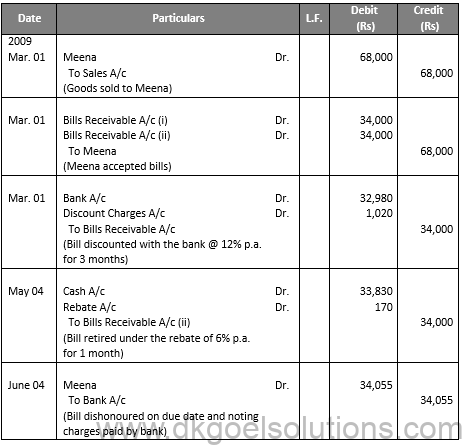

Question 34:

Solution 34:

Journal Entries in the books of Leena

Journal Entries in the Books of Meena

Working Notes:-

(1) Discount Charges = Rs. 34,000 × 12% × 3/12

Discount Charges = Rs. 1,020

(2) Amount of Rebate = Rs. 34,000 × 6% × 1/12

Amount of Rebate = Rs. 170

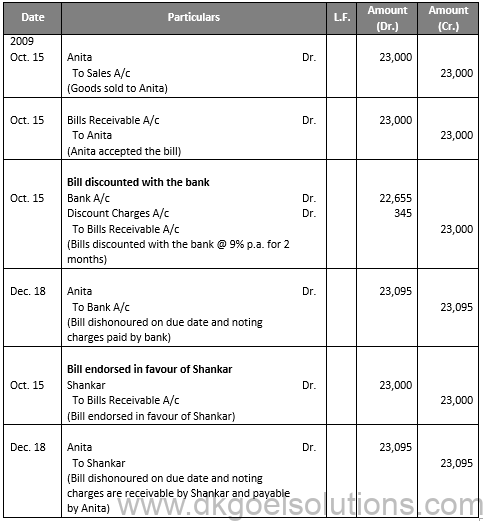

Question 35:

Solution 35:

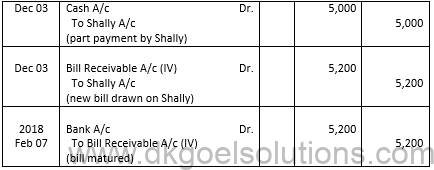

Journal Entries in the Books of Kavita

Journal Entries in the books of Anita

Working Note:-

Calculation of Discount Charges

Discount Charges = Rs. 23,000 × 9% × 2/12

Discount Charges = Rs. 345

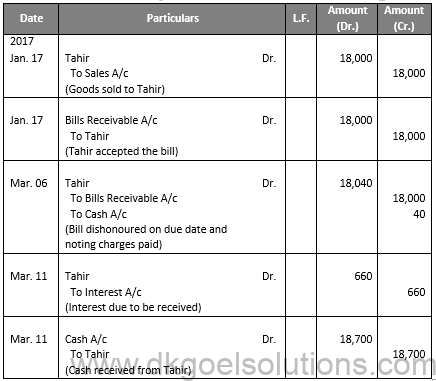

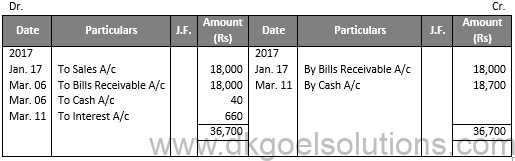

Question 36:

Solution 36:

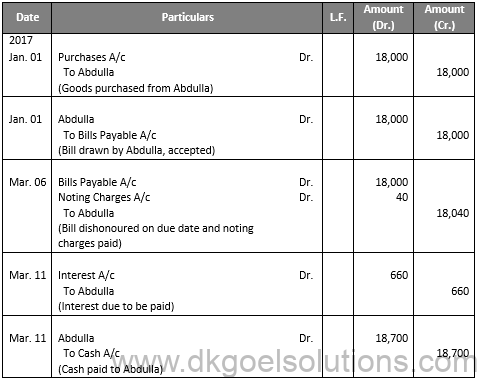

Journal Entries in the books of Abdulla

Tahir’s Account

Journal Entries in the books of Tahir

Abdulla’s Account

Question 37:

Solution 37:

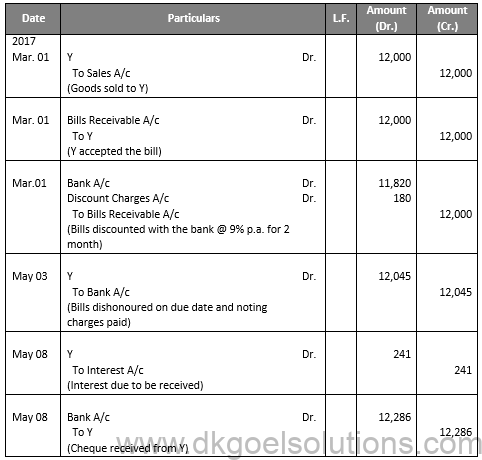

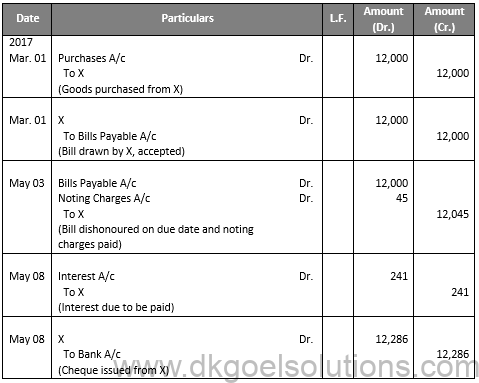

Journal Entries in the books of X

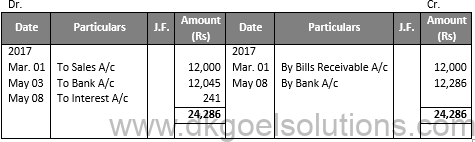

Y’s Account

Journal Entries in the books of Y

X’s Account

Working Notes:-

Calculation of Discount Charges

Discount Charges = Rs. 12,000 × 9% × 2/12

Discount Charges = Rs. 180

Calculation of amount of Interest

Amount of Interest = Rs. 12,045 × 12% × 2/12

Amount of Interest = Rs 241

Point of Knowledge:-

Here the due date is May 04, 2017 which is a holiday then the due date is 03 May, 2017. If due date falls on Public holiday, then due date is preceding date.

Question 38:

Solution 38:

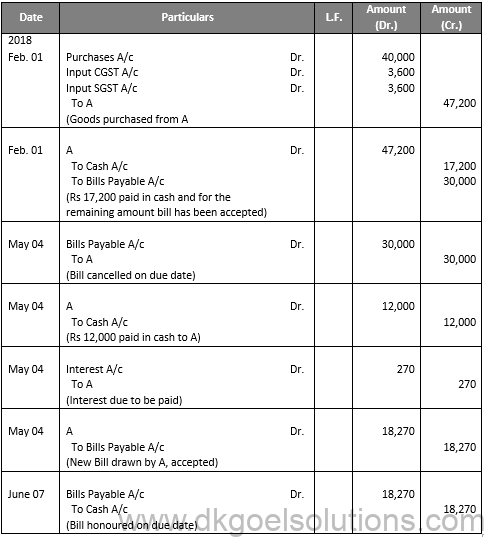

Journal Entries in the books of A

In the books of B

Journal Entries

Working Note:-

Calculation of amount of Interest

Amount of Interest = Rs. 18,000 × 18% ×1/12

Amount of Interest = Rs 270

Question 39:

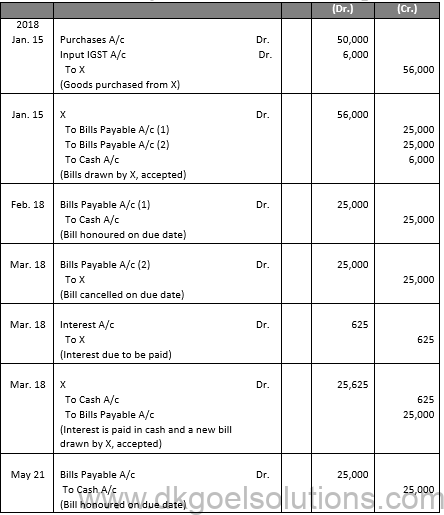

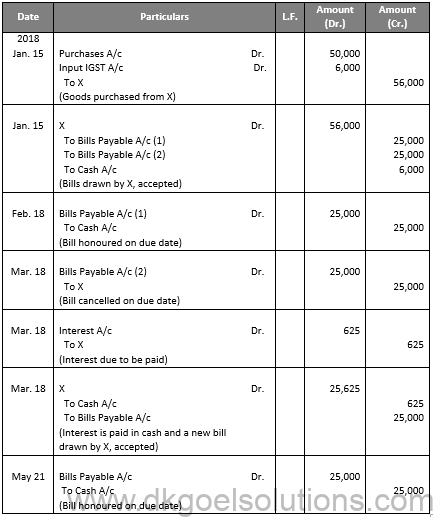

Solution 39:

Journal Entries in the books of X

Journal Entries in the Books of Y

Working Note:-

Calculation of amount of Interest

Amount of Interest = Rs. 25,000 × 15% × 2/12

Amount of Interest = Rs. 625

Question 40:

Solution 40:

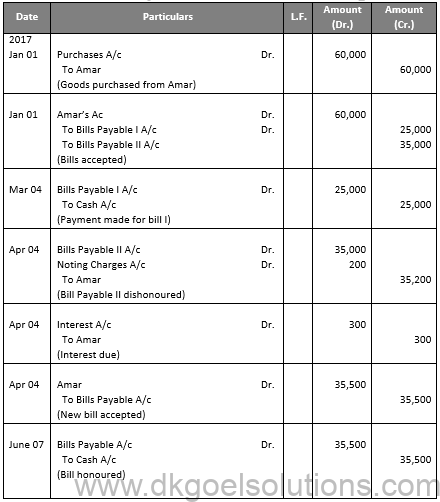

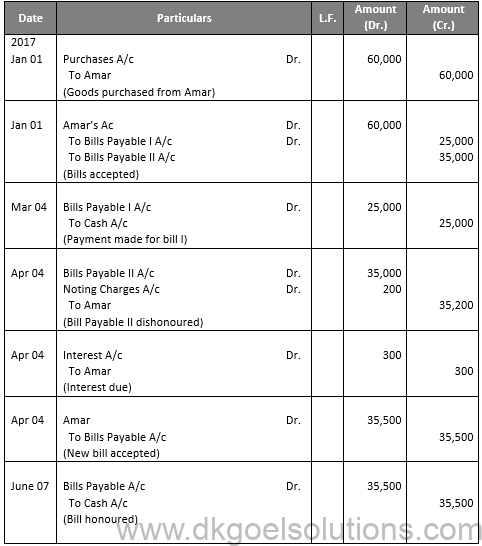

In the books of Amar (Drawer)

Journal Entries

Journal Entries in the books of Akbar (Drawee)

Journal Entries in the books of Anthony

Question 41:

Solution 41:

Journal Entries in the Books of Manohar

Journal Entries in the Books of Pushkar

Working Note:-

Calculation of Discount Charges:-

Discount Charges = Rs. 20,000 × 15% × 1/12

Discount Charges = Rs. 250

Question 42:

Solution 42:

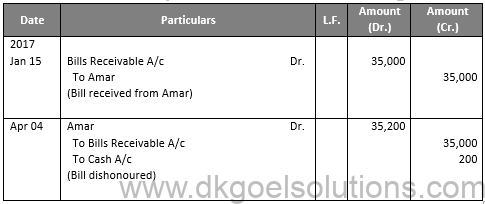

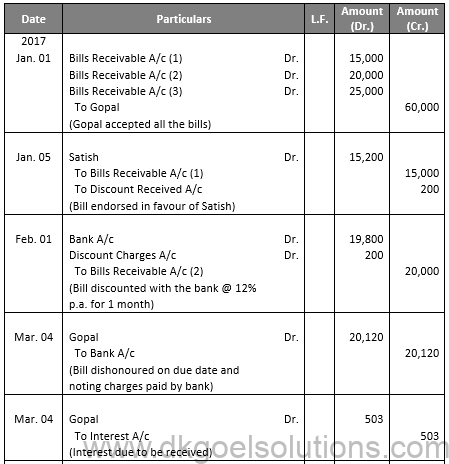

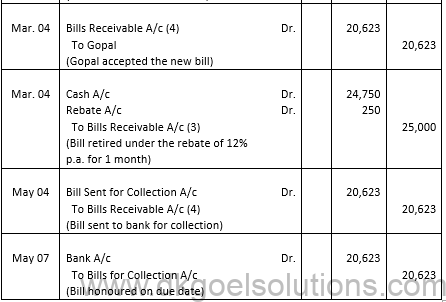

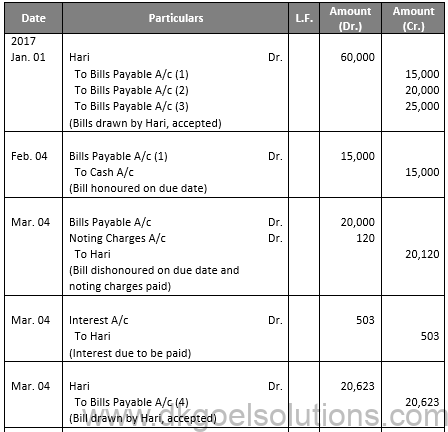

Journal Entries in the Books of Hari

Journal Entries in the books of Gopal

Journal Entries in the Books of Satish

Working Note:-

Calculation of Discount Charges:-

Discount Charges = Rs. 20,000 × 12% × 1/12

Discount Charges = Rs 200

Calculation of amount of Interest:-

Amount of Interest = Rs. 20,120× 15% × 1/12

Amount of Interest = Rs 503

Question 43:

Solution 43:

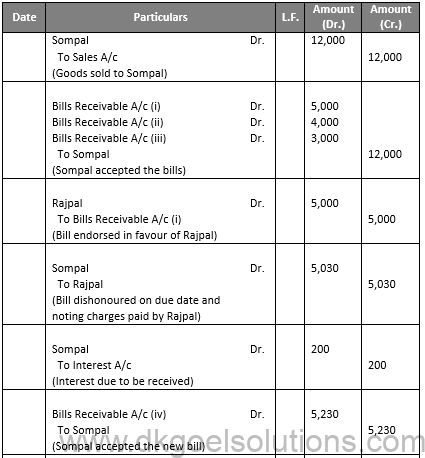

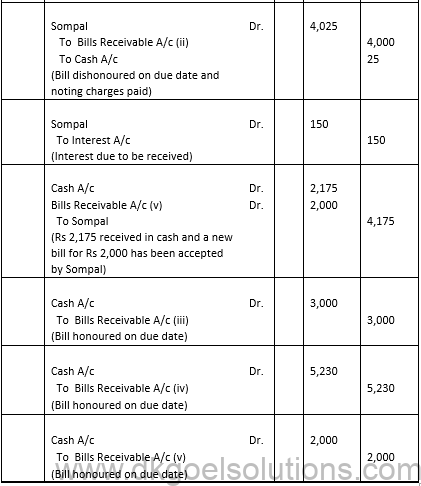

Journal Entries in the books of Harpal

Sompal’s Account

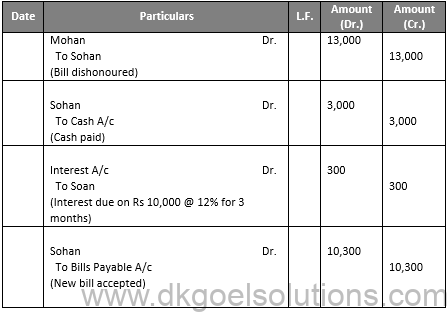

Question 44: (A)

Solution 44: (A)

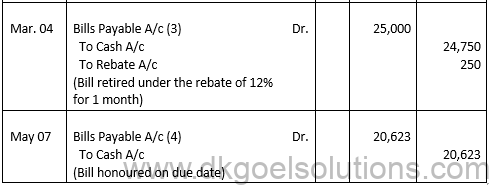

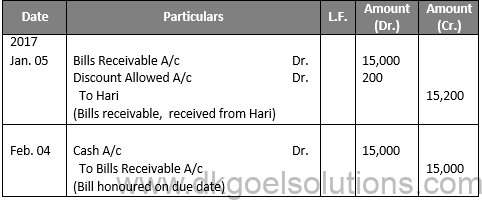

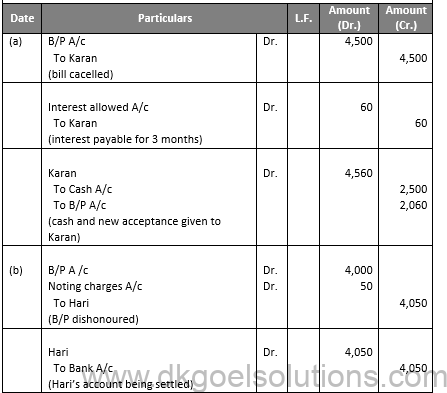

Journal Entries in the books of Hari

Question 44: (B)

Solution 44: (B)

Question 45:

Solution 45:

Journal Entries In books of Hari

Question 44: (B)

Solution 44: (B)

Journal Entries

Question 45:

Solution 45:

Journal Entries In books of Hari

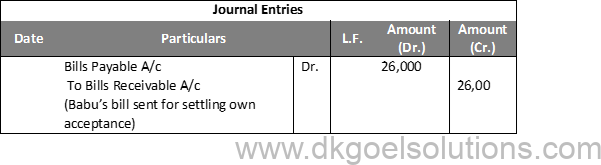

Question 46:

Solution 46:

Journal Entries

Bill of Exchange is a written instrument utilized between the buyer and seller as per the pre-defined terms and conditions as a mark of the authenticity of due payments. In simple words, a bill of exchange is a written document containing a set of conditions approved by the seller directing a purchase on credit.

Here are the characteristics of the Bills of Exchange –

● A Bill of exchange is a paper order or written document.

● The bill is issued and approved by the seller or the manufacturer.

● The bill of exchange defines a sum to be paid to the entity.

● The due is to be cleared by paying the amount to the person specified in the bill of exchange.

Here are the advantages of the Bills of Exchange –

Useful during the transaction of loaned goods – A bill of exchange acts as a mark of authentication reflecting a debt. It is proof that the buyer needs to clear the due payment to the seller for a pre-purchased product or service. This enables easy and convenient leasing of goods.

Acts as a legal record – A bill of exchange is a legalized document. Therefore, it is pretty easy for the seller to claim the payments legitimately to the buyer.

A bill is a raw document highlighting certain legal points. Whereas the bill, once approved, turns to a draft.

A promissory note is a written document issued by the buyer himself. It acts as a note of trust signed by the buyer and supplied to the seller on the purchase of goods on a credit basis.

Here are some of the prominent features of promissory notes –

● It is a written document created by the buyer.

● It highlights the complete details of the purchase, including the amount to be paid.

● It must have a mark of authentication for the promisor.

● It must feature the names of the buyer and the seller.

Promissory Note involves two parties – One is the maker, who creates the note, and the other is the payee, the seller who is entitled to the payment.