DK Goel Solutions Chapter 6 Cash Flow Statements

Read below DK Goel Solutions for Class 12 Chapter 6 Cash Flow Statements. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

Cash flow statements are generally Prepared in all organizations to understand the cash situation of an organization.

In this chapter, the students will understand basic concepts of cash flow statements and their usage. they will also understand how to create basic cash flow statements and with the help of questions given at the end of the chapter they will be able to practice and gain more understanding of these topics.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Cash Flow Statements DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Q1.

Solution 1

(a) Increase in Trade Receivable:- Less

(b) Decrease in Inventory:- Add

(c) Decrease in Bills Payable:- Less

(d) Increase in Trade Payables:- Add

Q2.

Solution 2

(a) the redemption of debentures:- No effect

(b) decrease in outstanding expenses:- Less

(c) increase in cash balance:- No effect

(d) decrease in inventory:- Add

Q3.

Solution 3

The main revenue-generating activities of a company are its operating operations. As a result, they include cash flows from operations and events that are used to calculate the company’s net profit or loss. Here are some examples of cash flows produced by corporate activities:

(a) Receipts in cash from the selling of goods and the provision of services.

(b) Taxes, fees, commissions, and other income in cash.

c) Receipts of cash from debtors and payables.

d) Receipts for the purchase of goods and services in cash.

e) Contributions to creditors in cash and payable bills.

f) Wages, bonuses, and other payments to workers in cash.

(g) Cash transfers or tax refunds unless they can be directly linked to funding or investment activities.

Q4.

Solution 4

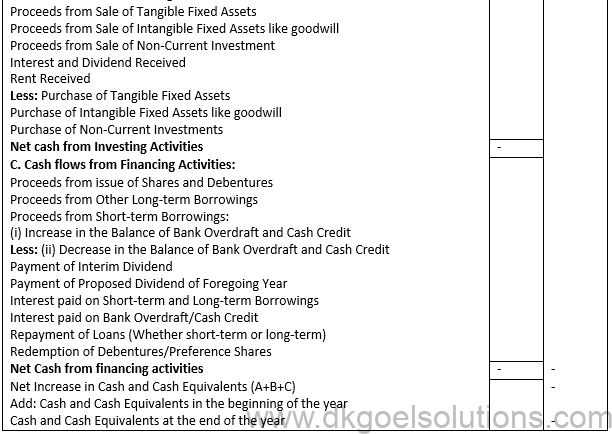

Below is the format of Cash Flow Statement by indirect method:-

Cash Flow Statement of Ltd. for the year ended______

Q5.

Solution 5

Cash from Operating Activities:- Payment of Income Tax

Cash from Investing Activities:- Purchase of Fixed Assets, Sale of Long-term Investments, Interest Received, Dividend Received

Cash from Financing Activities:- Issue of Share Capital, Payment of Divided, Payment of Interest, Repayment of Long-term Loans

Q6.

Solution 6

(i) Machinery Purchased = Rs. 2,50,000 × 20% = Rs. 50,000

Cash used in Investing Activities:- Rs. 50,000

(ii) Rs. Paid = Rs. 2,50,000

Dividend Received = Rs. 50,000

Net Rs. Paid = Rs. 2, 50,000 – Rs. 50,000 = Rs. 2,00,000

Cash used in Investing Activities:- Rs. 2,00,000

(iii) Cash received by sale of machinery.

Cash from Investing Activities:- Rs. 60,000

Numerical Questions

Q1.

Solution 1

Below are the items classification of transactions of Operating Activity, Investing Activity and Financial Activity:-

(i) Operating Activities:- Finance Company, Interest received on Investments by a bank, Dividend received by a Mutual Fund Company, Purchases of Investments by a finance Company.

(ii) Investing Activities:- Interest received, Interest received in investments by a manufacturing company, Dividend received, Purchase of Investments, Purchases of Investment by a non-finance company.

(iii) Financing Activities:- Interest paid, Non-finance Company, Bank Overdraft.

(iv) Cash Equivalents:- Bank Balance, Short-term deposit in banks, Marketable Securities.

Points for Students:-

Bank, Investment Companies and Mutual Funds are financing companies. All trading Companies, manufacturing companies and other business establishments are non-financing companies.

Q2.

Solution 2

Below are the items classification of transactions of Operating Activity, Investing Activity and Financial Activity:-

Financing Enterprise:-

(i) Operating Activities:-

1. Purchase of Shares of a Company.

2. Proceeds from sale of Shares.

3. Brokerage paid on purchase of Shares.

4. Loans and Advances made to third parties.

5. Dividend and interest received on Securities.

6. Salary paid to employees.

7. Interest paid on debentures.

(ii) Financing Activities:-

8. Dividend paid to Shareholders.

For Manufacturing Enterprise:-

(i) Operating Activities:-

1. Purchase of Shares of a Company.

2. Proceeds from sale of Shares.

3. Brokerage paid on purchase of Shares.

4. Loans and Advances made to third parties.

5/ Dividend and interest received on Securities.

(ii) Investing Activities:-

6. Salary paid to employees.

(iii) Financing Activities:-

7. Interest paid on debentures.

8. Dividend paid to Shareholders.

Points for Students:-

An Investment Company is a Financial Enterprise since purchases and sale of securities are its main revenue-producing activity. Similarly, giving and taking loans is also revenue producing activity for a financial enterprise.

Q3.

Solution 3

Below are the items classification of transactions of Operating Activity, Investing Activity and Financial Activity:-

(i) Operating Activities : Discount allowed to Customers, Discount received from Suppliers, Rent received by a Company whose main business in Real Estate Business.

(ii) Investing Activities : Rent received by a Company whose main business in manufacturing, Purchase of Shares

(iii) Financing Activities : Buy-back of Equity Shares, Payment of Share issue expenses, Increase in balance of Cash Credit, Repayment of Long-term Loan, Repayment of Short-term Loan, Proceeds from Short-term Borrowings, Dividend paid on Preference Shares.

(iv) Cash Equivalents : Short-term deposits in Bank

Points for Students:-

For an Insurance Company, receipt of premium and payment of claim shall be classified as Operating Activities since they relate to main revenue

producing activity for it.

For a Real Estate Enterprise, purchase and sale of land and rent received shall be classified as Operating Activities since they relate to its main revenue producing activity.

Q4.

Solution 4

Statement showing the effect of transactions on Cash and Cash Equivalents:

1. Purchases of Goods on Credit.

Effect on Cash – No Effect

Reason – Cash not affected

2. Sale of Goods costing Rs. 20,000 for Rs. 15,000 for cash.

Effect on Cash – Inflow

Reason – Rs. 15,000 increased in Cash

3. Purchases of a fixed asset on long-term deferred payment basis.

Effect on Cash – No Effect

Reason – Cash not affected

4. Issue of shares against purchase of fixed assets.

Effect on Cash – No Effect

Reason – Cash not affected

5. Cash received from a Trade Receivable Rs. 10,000 discount allowed Rs. 1,000.

Effect on Cash – Inflow

Reason – Rs. 10,000 increased in Cash

6. Sale of Fixed assets (book value Rs. 25,000) for Rs. 20,000 for cash.

Effect on Cash – Inflow

Reason – Rs. 20,000 increased in Cash

7. Old Furniture (book value Rs. 10,000) written off.

Effect on Cash – No Effect

Reason – Cash not affected

8. Bill Receivable endorsed to trade payables.

Effect on Cash – No Effect

Reason – Cash not affected

9. Discount of Rs. 2,000 received while making payment to a creditor of Rs. 20,000.

Effect on Cash – Outflow

Reason – Rs. 18,000 decreased in Cash

10. Cash deposited into Bank.

Effect on Cash – No Effect

Reason – Cash not affected

11. Sale of Marketable Securities for cash.

Effect on Cash – No Effect

Reason – Cash not affected

12. Sale of Long-term Investments for cash.

Effect on Cash – Inflow

Reason – Cash Increased

13. Converting of Debentures into Shares.

Effect on Cash – No Effect

Reason – Cash not affected

14. Declaration of Dividend.

Effect on Cash – No Effect

Reason – Cash not affected

15. Payment of Dividend.

Effect on Cash – Outflow

Reason – Cash Decreased

16. Receipt of Interest on Investment.

Effect on Cash – Inflow

Reason – Cash Increased

17. Receipt of Dividend.

Effect on Cash – Inflow

Reason – Cash Increased

Points for Students:-

According to AS-3 Revised, the cash flow statement summarizes the cash inflows and cash outflow and the net changes in cash and cash equivalents resulting from operating, investing and financing activities of a firm during a period.

Q5.

Solution 5

Statement showing the effect of transactions on Cash and Cash Equivalents:

1. A long-term loan from a bank

Effect on Cash – Inflow

Reason – Cash increased

2. Repayment of long-term loan.

Effect on Cash – Outflow

Reason – Cash decreased

3. Payment of interest on loan.

Effect on Cash – Outflow

Reason – Cash decreased

4. Conversion of debentures into preference shares.

Effect on Cash – No effect

Reason – Cash is not affected

5. Interest received on investments.

Effect on Cash – Inflow

Reason – Cash increased

6. Interest due on dentures.

Effect on Cash – No effect

Reason – Cash is not affected

7. Receipt of accrued interest.

Effect on Cash – Inflow

Reason – Cash increased

8. Purchase of securities of a company.

Effect on Cash – Outflow

Reason – Cash decreased

9. Buy-back of Equity Shares.

Effect on Cash – Outflow

Reason – Cash decreased

10. Purchase of Goodwill.

Effect on Cash – Outflow

Reason – Cash decreased

11. Goodwill written off.

Effect on Cash – No effect

Reason – Cash is not affected

12. Patents written off.

Effect on Cash – No effect

Reason – Cash is not affected

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q6.(A)

Solution 6

(A)

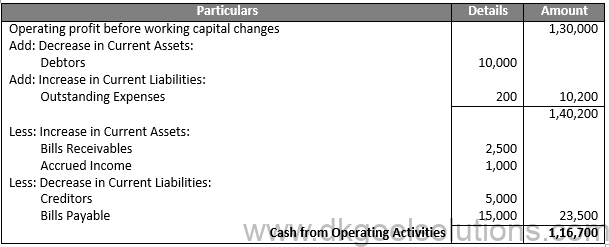

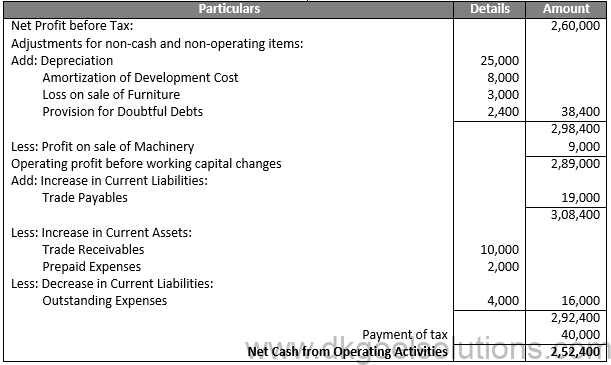

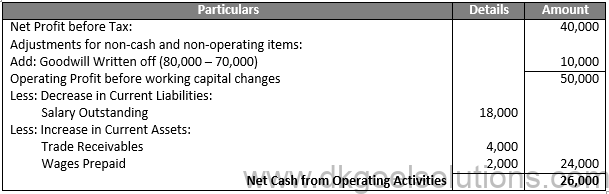

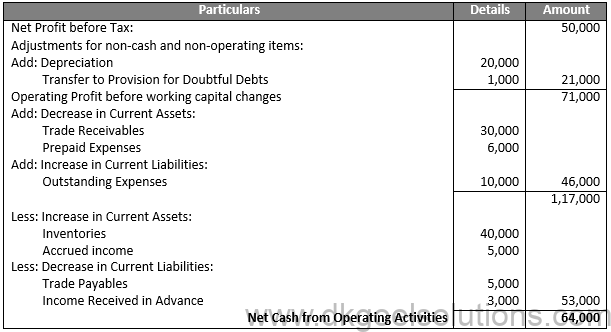

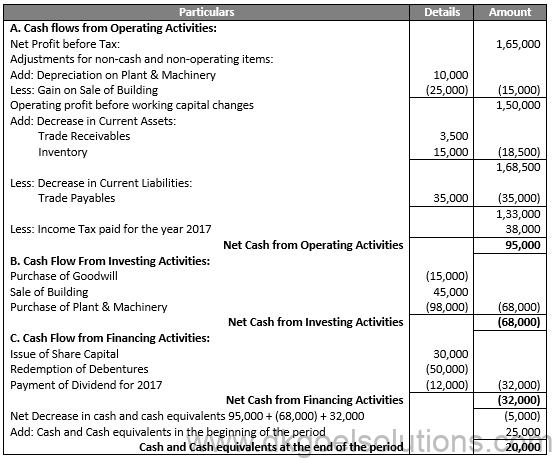

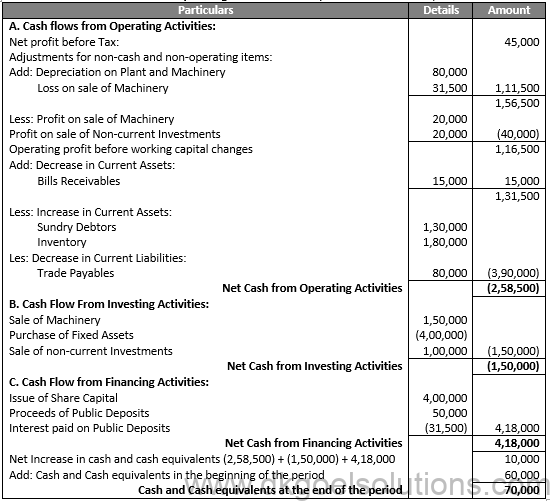

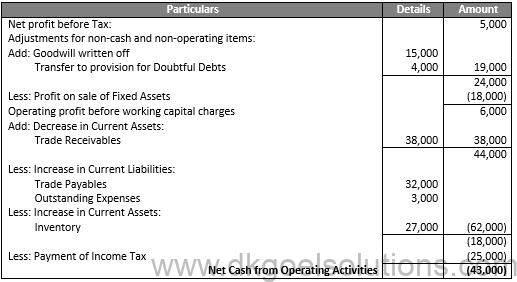

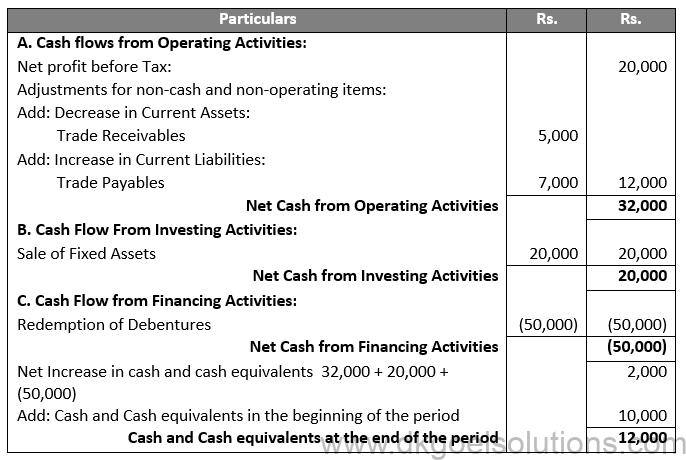

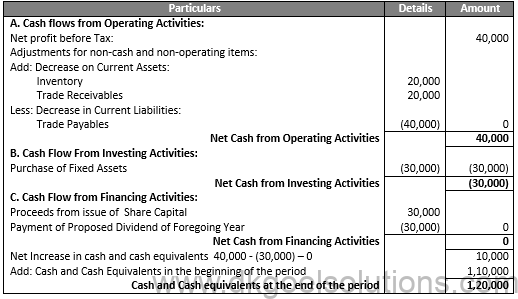

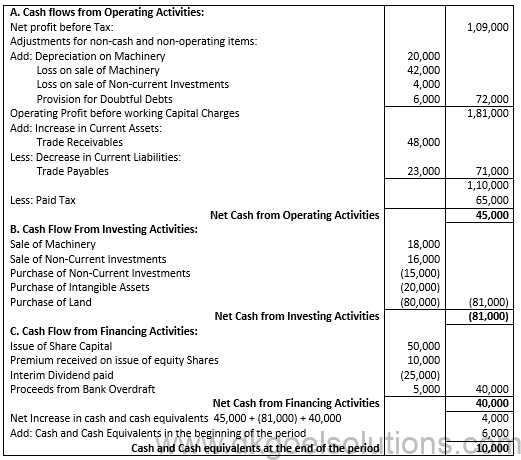

Cash Flows from Operating Activities for the year ended 31st March, 2017

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables

Q6.

(B)

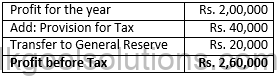

Solution 6

(B)

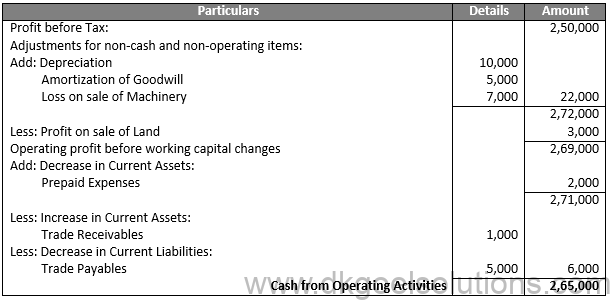

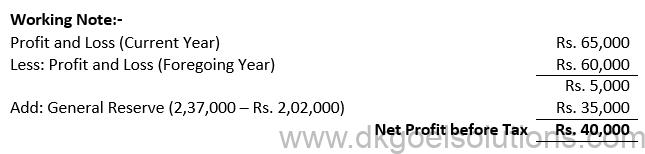

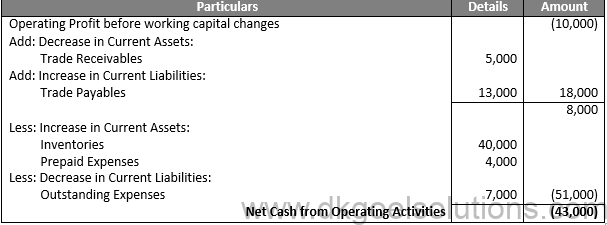

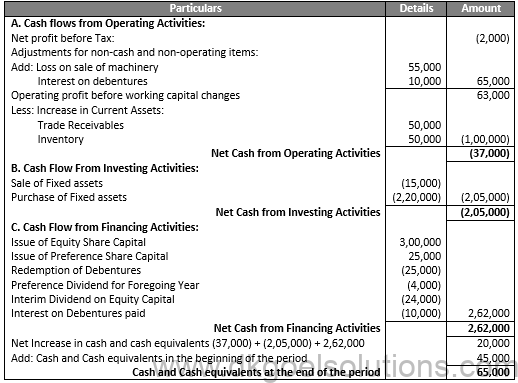

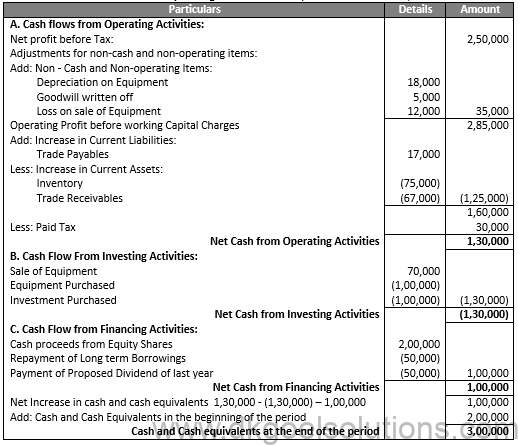

Cash Flows from Operating Activities for the year ended 31st March, 2017

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q7.

Solution 7

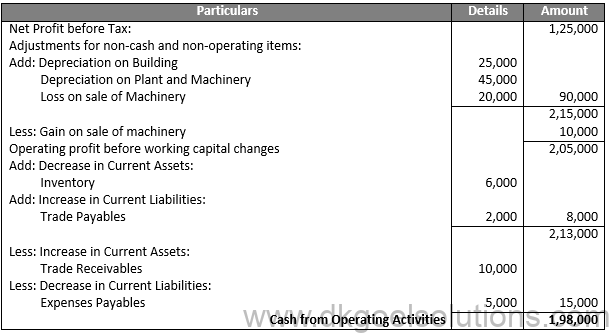

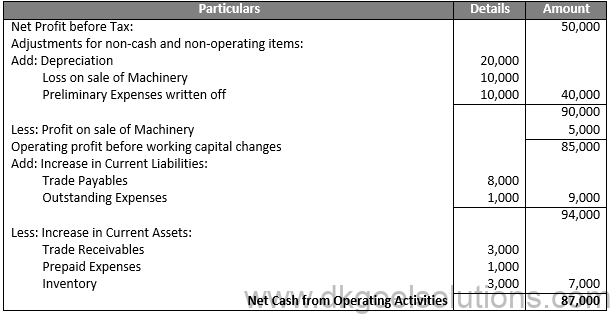

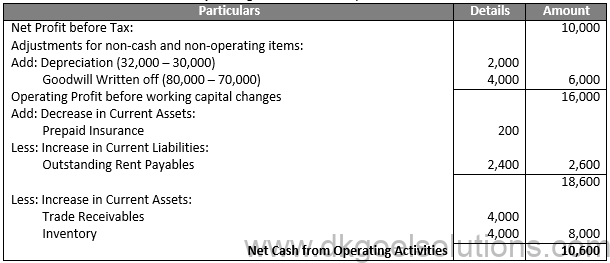

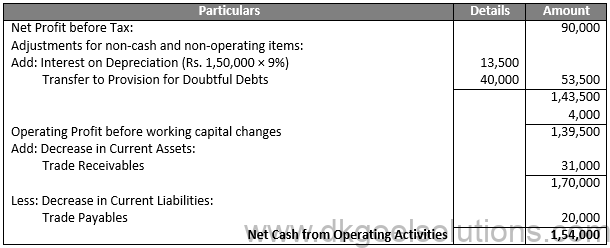

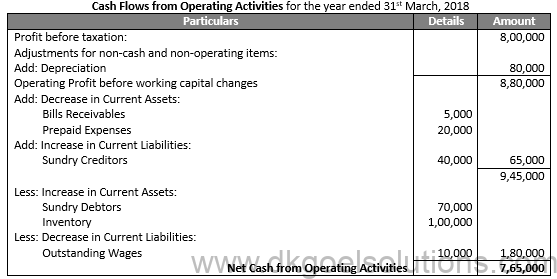

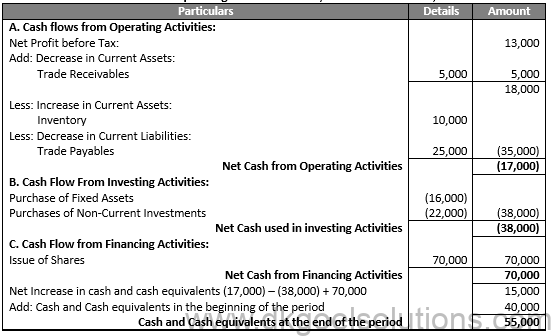

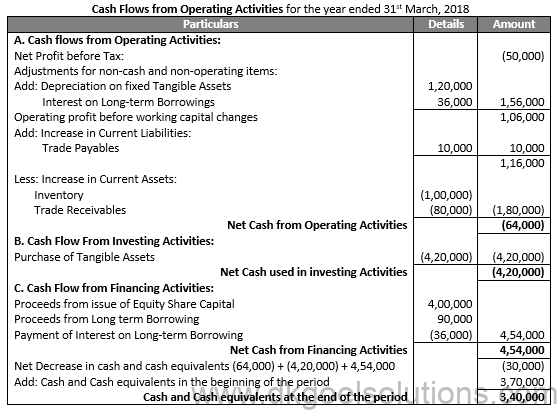

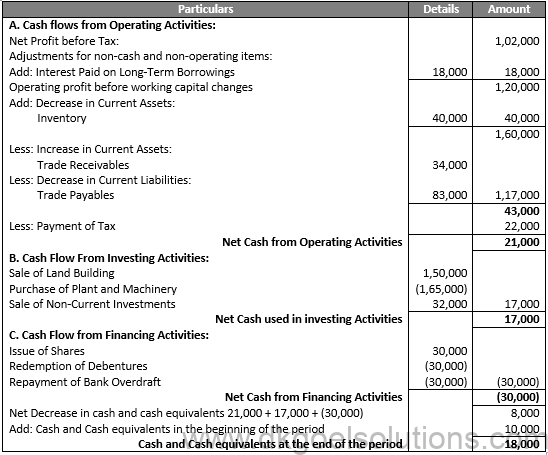

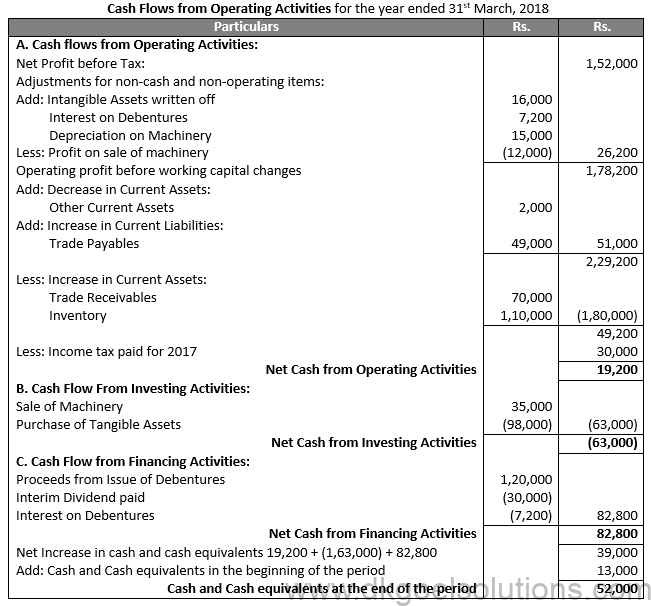

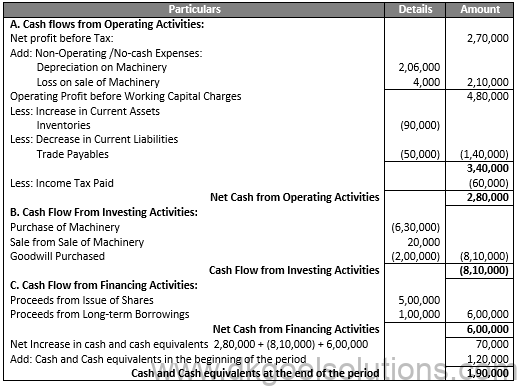

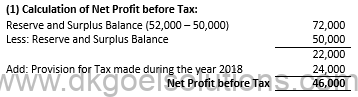

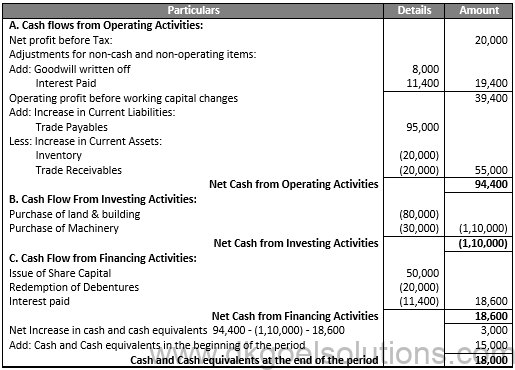

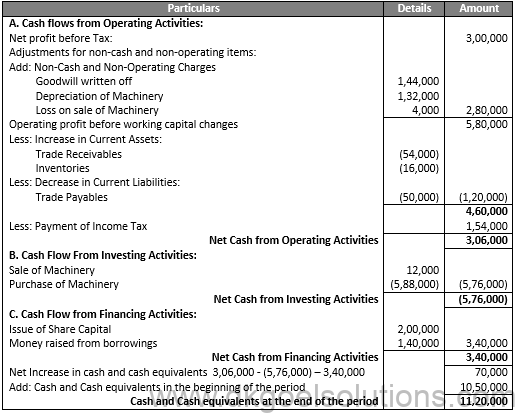

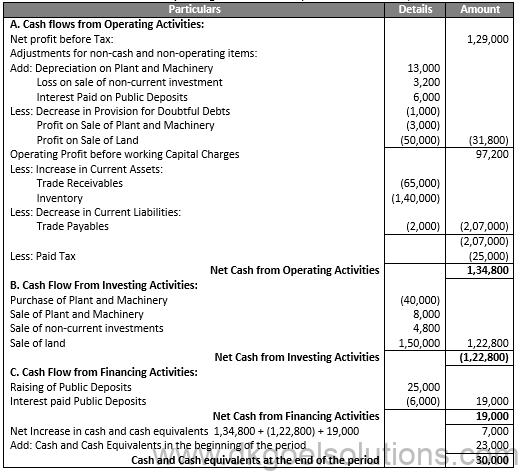

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q8.

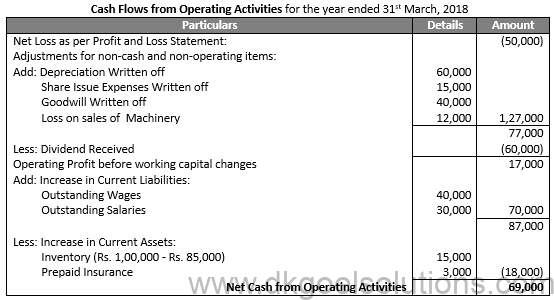

Solution 8

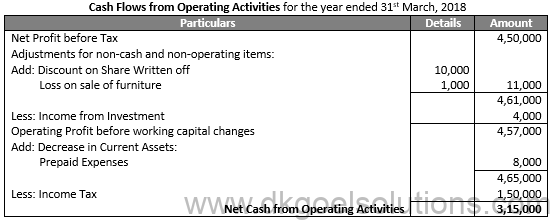

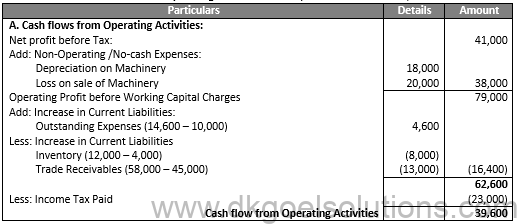

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q9. (A)

Solution 9

(A)

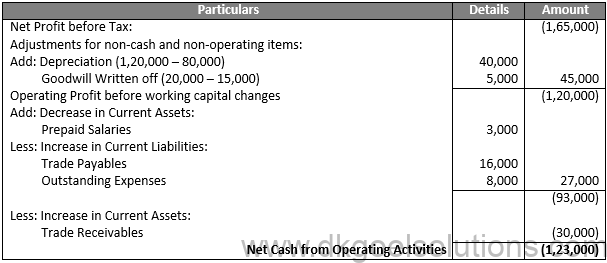

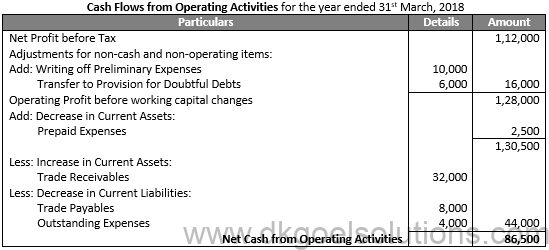

Cash Flows from Operating Activities for the year ended 31st March, 2018

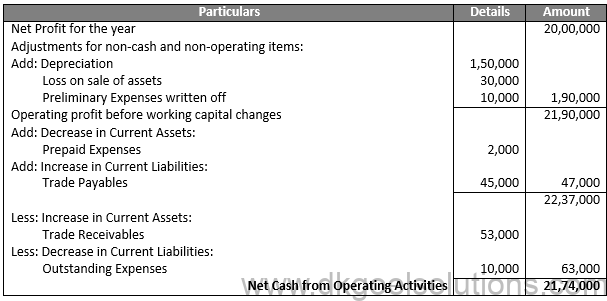

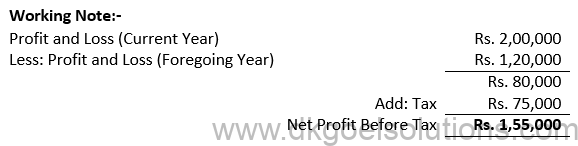

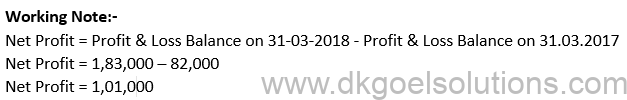

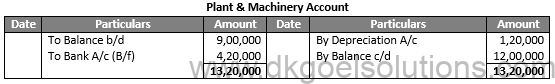

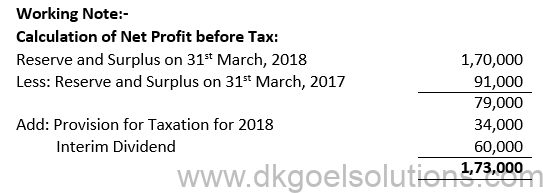

Working Note:-

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q9. (B)

Solution 9

(B)

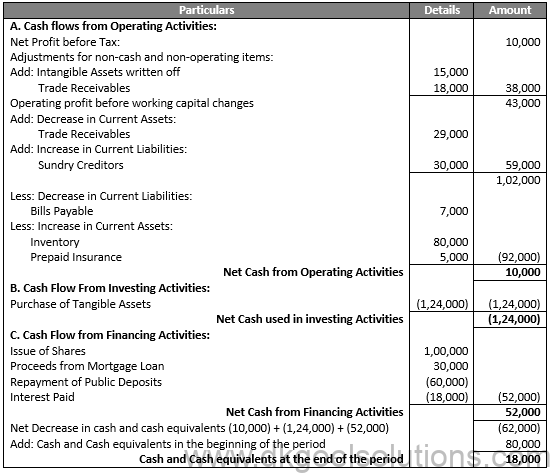

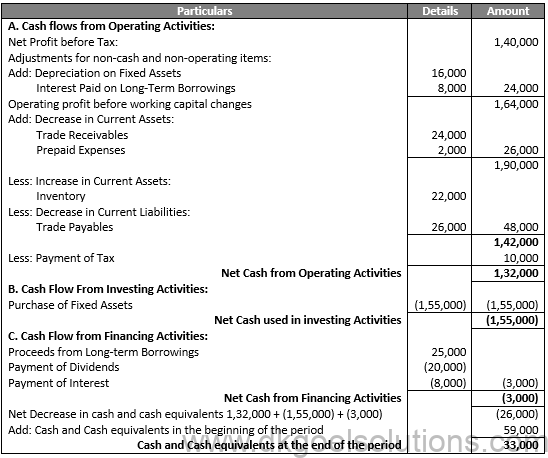

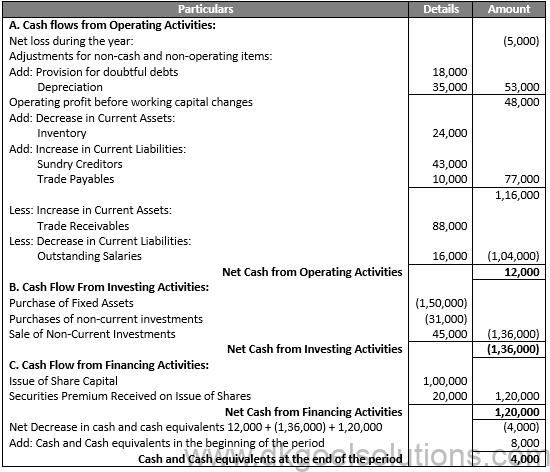

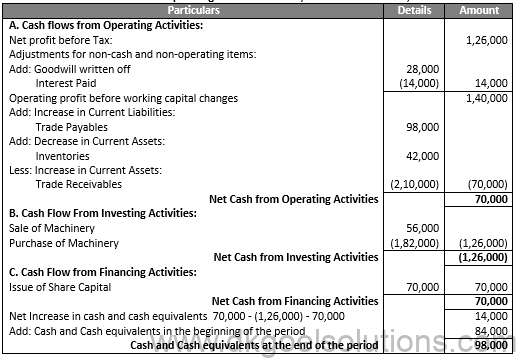

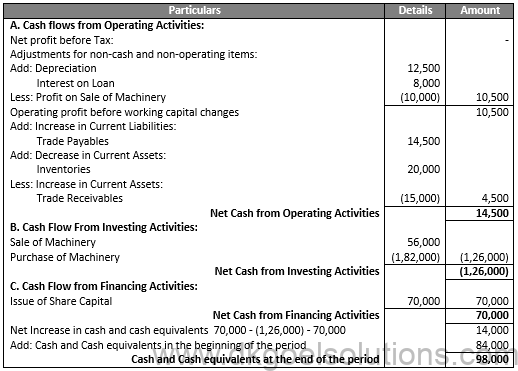

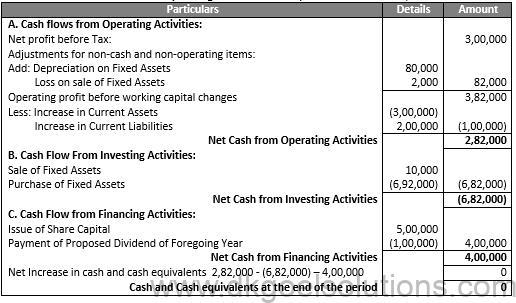

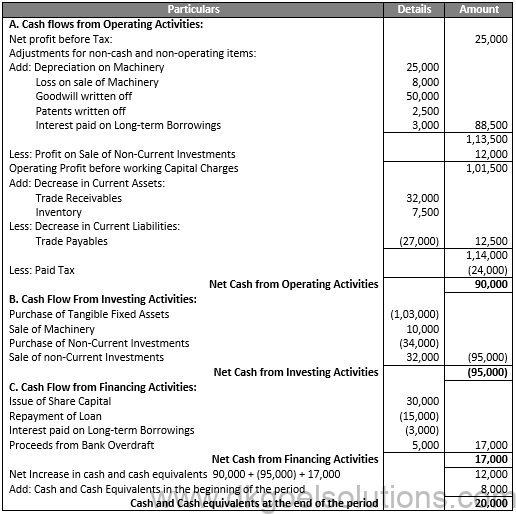

Cash Flows from Operating Activities for the year ended 31st March, 2017

Q10.

Solution 10

Cash Flows from Operating Activities for the year ended 31st March, 2017

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q11.

(A)

Solution 11

(A)

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q11.

(B)

Solution 11

(B)

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q11.

(C)

Solution 11

(C)

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q11.

(D)

Solution 11

(D)

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows

Q12.

Solution 12

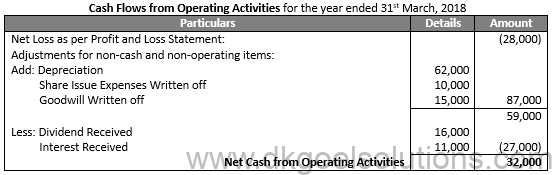

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

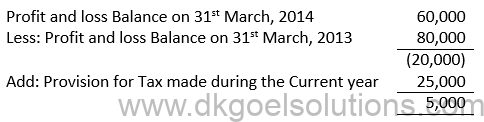

Operating Loss for the year = Profit and Loss (Current Year) – Less: Profit and Loss (Foregoing Year)

Operating Loss for the year = 50,000 – 60,000

Operating Loss for the year = (10,000)

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q13.

Solution 13

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q14.

Solution 14

Working Note:-

Operating Loss for the year = Profit and Loss (Current Year) – Profit and Loss (Foregoing Year)

Operating Loss for the year = (20,000) – 50,000

Operating Loss for the year = (70,000)

Net Profit = Operating Loss for the year + Transfer to General Reserve

Net Profit = 70,000 + 20,000

Net Profit = 90,000

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q15.

Solution 15

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q16.

Solution 16

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q17.

Solution 17

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q18.

Solution 18

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q19.

Solution 19

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q20.

(A)

Solution 20

(A)

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q20.

(B)

Solution 20 (B)

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q21.

Solution 21

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q22.

Solution 22

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q23.

Solution 23

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q24.

Solution 24

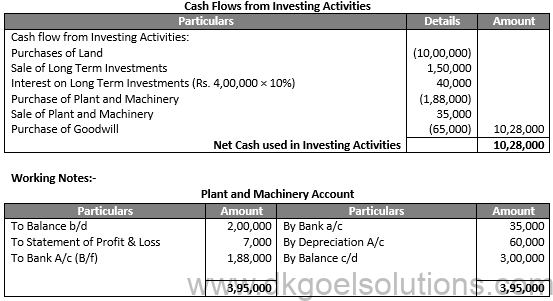

Working Note:-

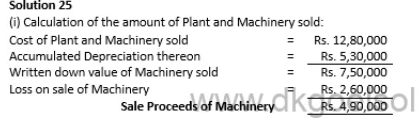

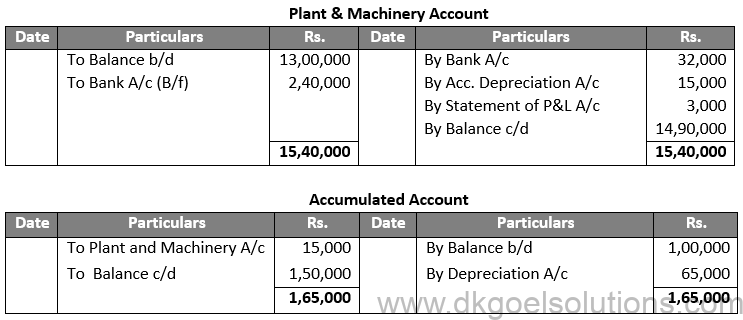

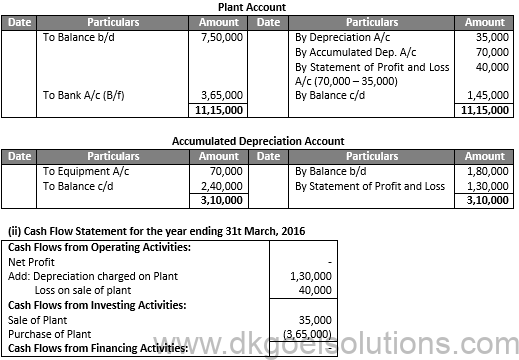

Q25. The balance in Plant and Machinery account and Accumulated depreciation account as on March 31, 2015 and 2016 stood as follows:

Q26.

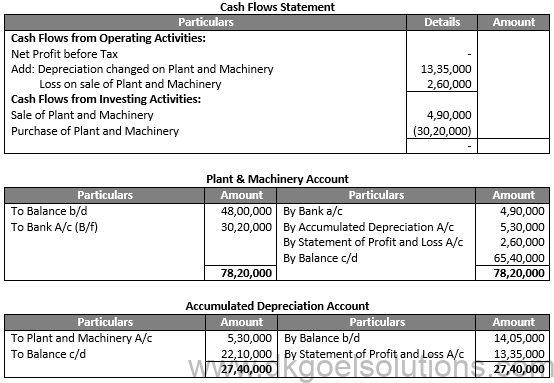

Solution 26

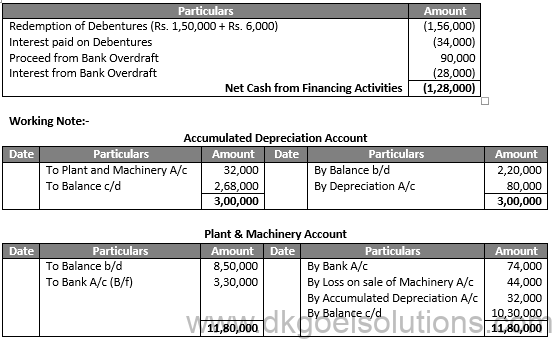

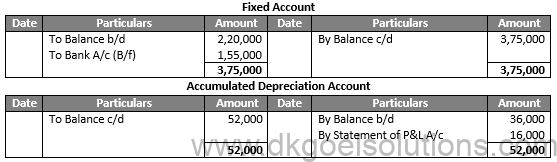

Working Notes:-

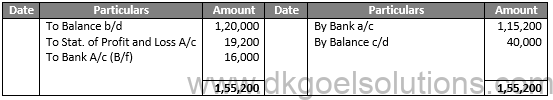

Accumulated Depreciation Account

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q27. (A)

Solution 27

(A)

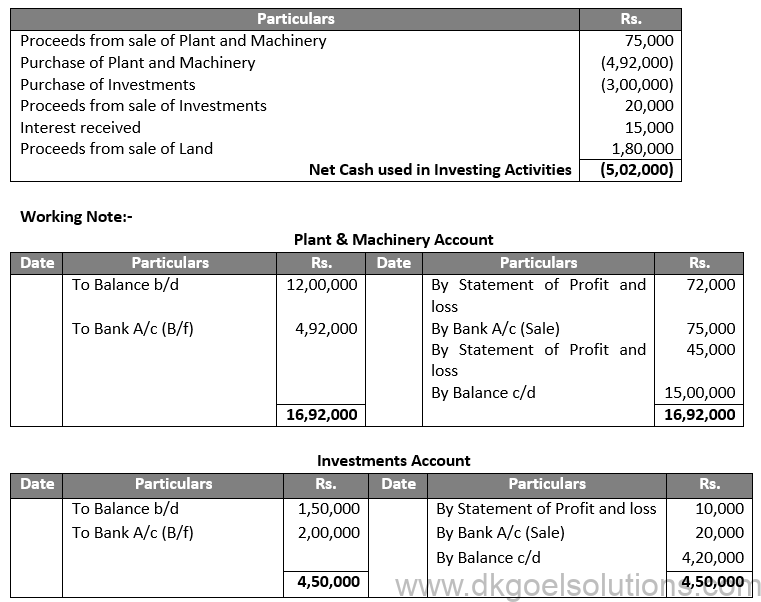

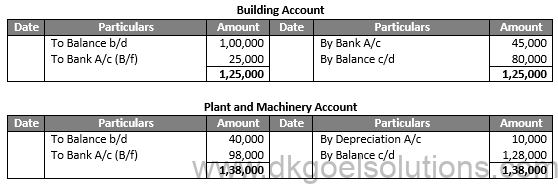

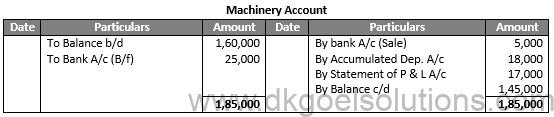

Plant & Machinery Account

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q27. (B)

Solution 27

(B)

Cost of Investments Sold:

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q28.

Solution 28

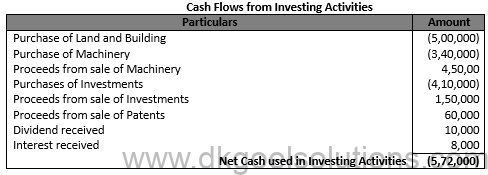

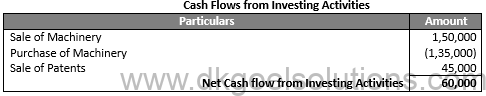

Cash Flows From Investing Activities

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q29.

Solution 29

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q30.

Solution 30

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q31.

Solution 31

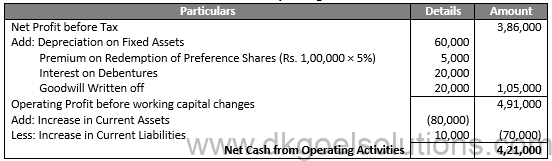

Cash Flows from Operating Activities

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

32.

Solution 32

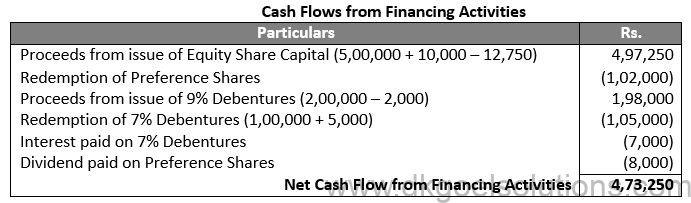

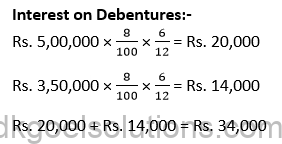

Cash Flows From Financing Activities

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q33.

Solution 33

Cash Flows From Investing Activities

Cash Flows From Financing Activities

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q34.

Solution 34

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q35. (A)

Solution 35

(A)

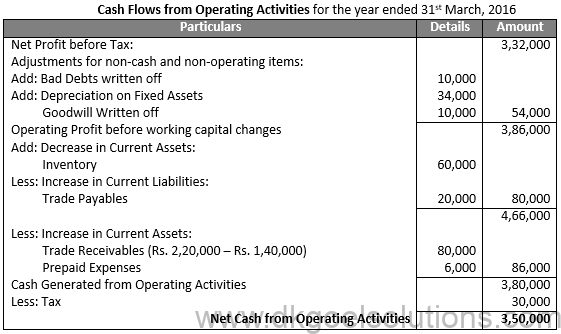

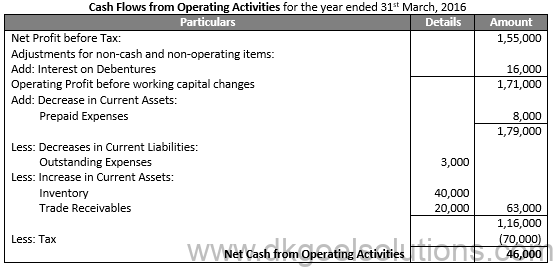

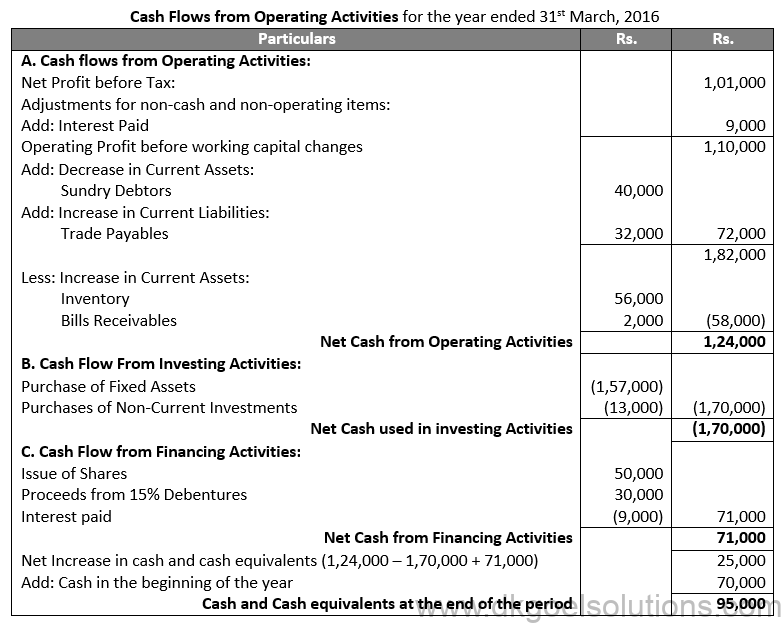

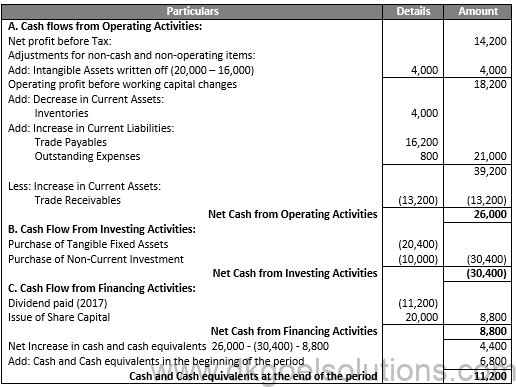

Cash Flows from Operating Activities for the year ended 31st March, 2016

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q35. (B)

Solution 35 (B)

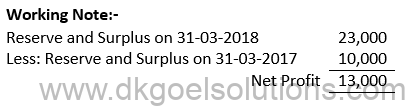

Working Note:-

Net Profit = Retained Earnings on 31-03-2018 – Retained Earnings on 31-03-2017

Net Profit = 60,000 – 50,000

Net Profit = 10,000

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q36.

Solution 36

Working Note:-

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q37. (A)

Solution 37 (A)

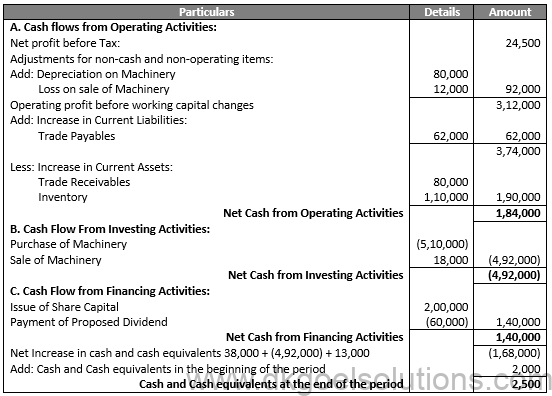

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q37.

(B)

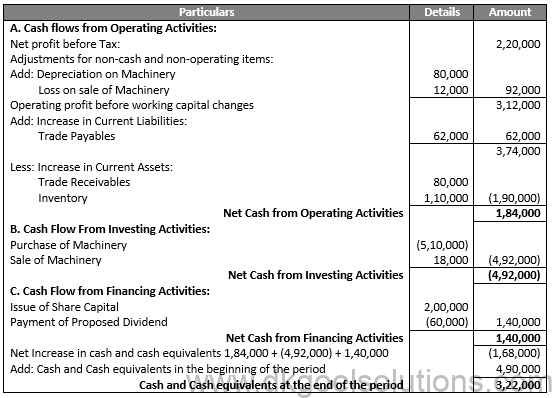

Solution 37

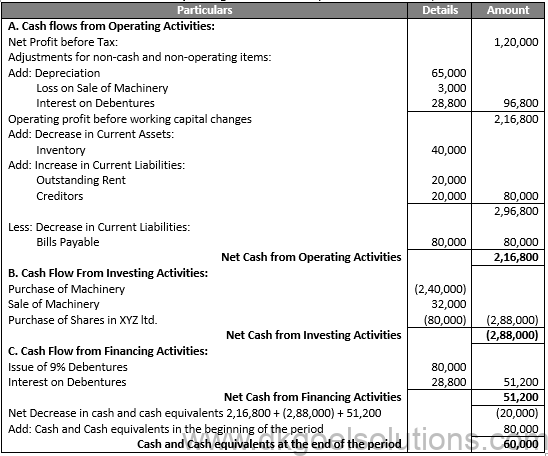

(B) Cash Flows from Operating Activities for the year ended 31st March, 2018

Q38.

Solution 38

Cash Flows from Operating Activities for the year ended 31st March, 2017

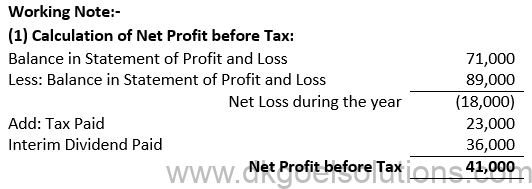

Working Note:-

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

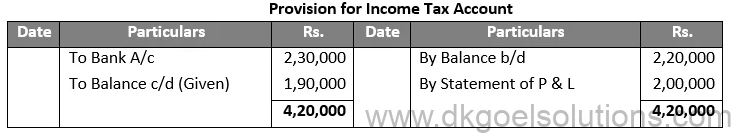

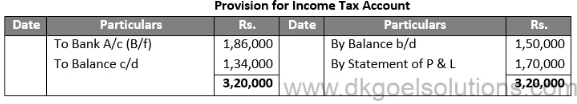

Q39. Prepare ‘Provision for Income Tax Account’ from the following information’s for preparing Cash Flow Statements:

Solution 39

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q40.

Solution 40

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q41.

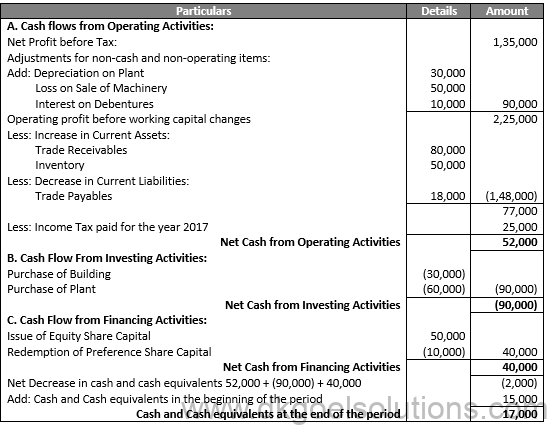

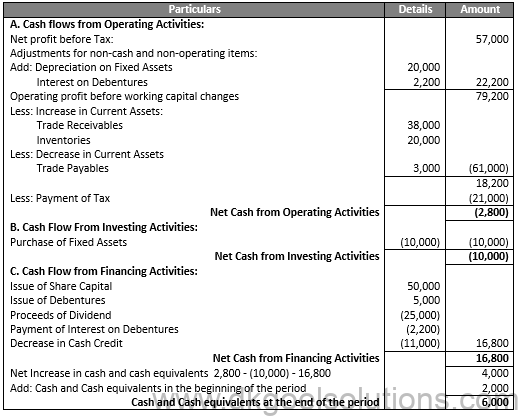

Solution 41 Cash Flows from Operating Activities for the year ended 31st March, 2017

Particulars Details Amount

Working Note:-

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q42.

Solution 42 Cash Flows from Operating Activities for the year ended 31st March, 2018

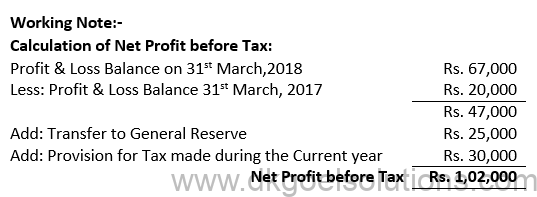

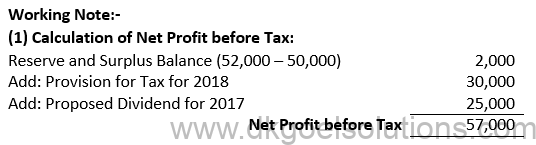

Working Note:-

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q43. (A)

Solution 43 (A) Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q43. (B)

Solution 43

(B) Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q44. (A)

Solution 44

(A)

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q44. (B)

Solution 44

(B)

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q45.

Solution 45

Cash Flows from Operating Activities

for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q46.

Solution 46 Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q47.

Solution 47 Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q48.

Solution 48 Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q49.

Solution 49 Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q50.

Solution 50

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

Q51.

Solution 51

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q52.

Solution 52

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q53.

Solution 53

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q54.

Solution 54

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q55.

Solution 55

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q56.

Solution 56

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q57.

Solution 57

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q58.

Solution 58

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q59.

Solution 59

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q60.

Solution 60

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q61.

Solution 61

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q62.

Solution 62

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. Borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q63.

Solution 63

Cash Flows from Operating Activities for the year ended 31st March, 2018

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q64.

Solution 64

Cash Flows from Operating Activities for the year ended 31st March, 2018

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q65.

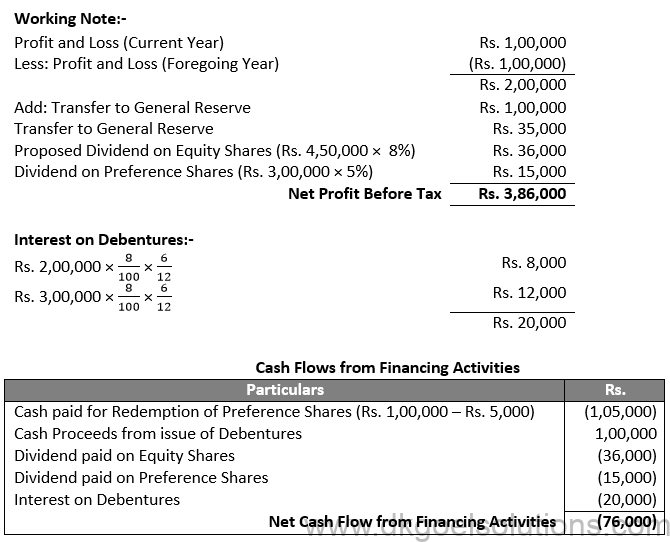

Solution 65

Cash Flows from Operating Activities for the year ended 31st March, 2018

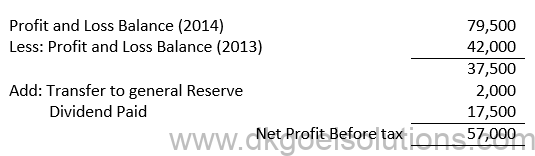

Working Note:-

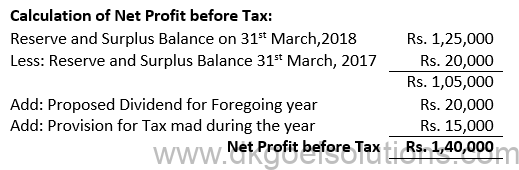

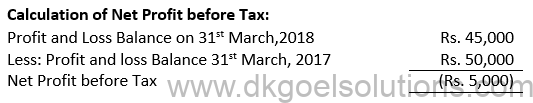

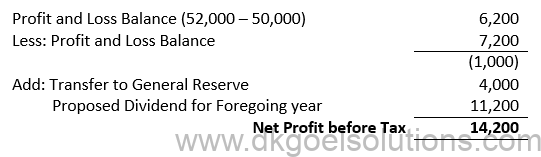

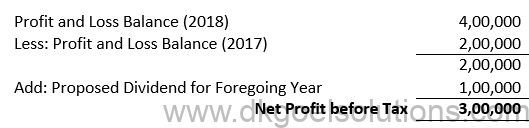

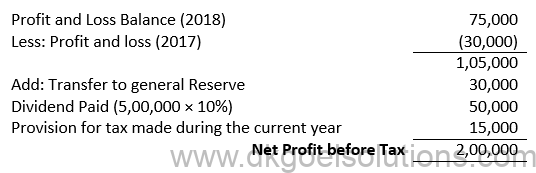

Calculation of Net Profit before Tax:-

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q66.

Solution 66

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q67.

Solution 67

Q68.

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q69.

Solution 69

Cash Flows from Operating Activities for the year ended 31st March, 2018

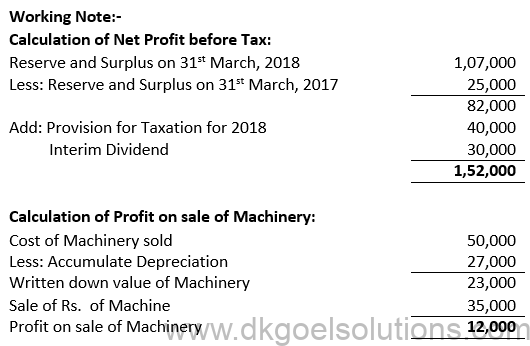

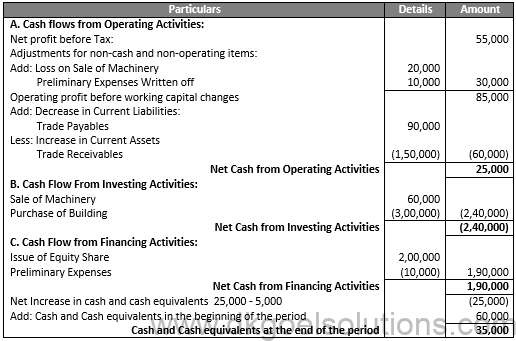

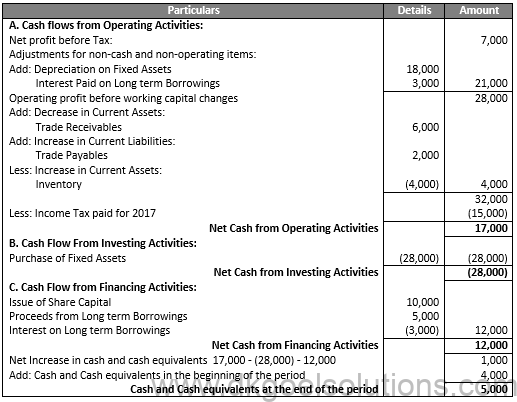

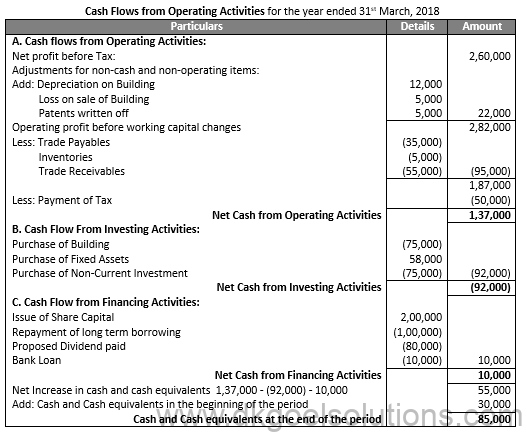

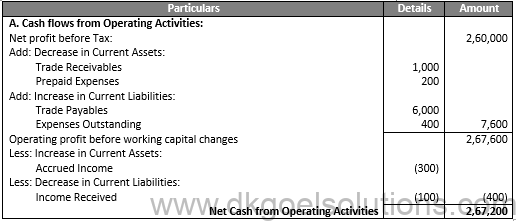

Working Note:-

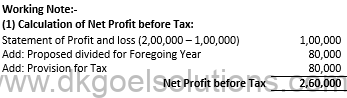

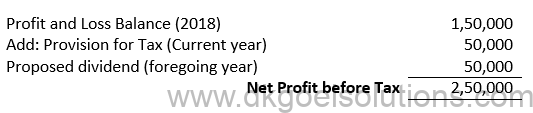

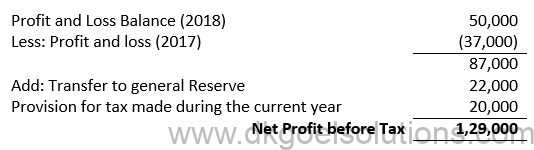

(1) Calculation of Net Profit before Tax:

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

Q70.

Solution 70

Cash Flows from Operating Activities for the year ended 31st March, 2018

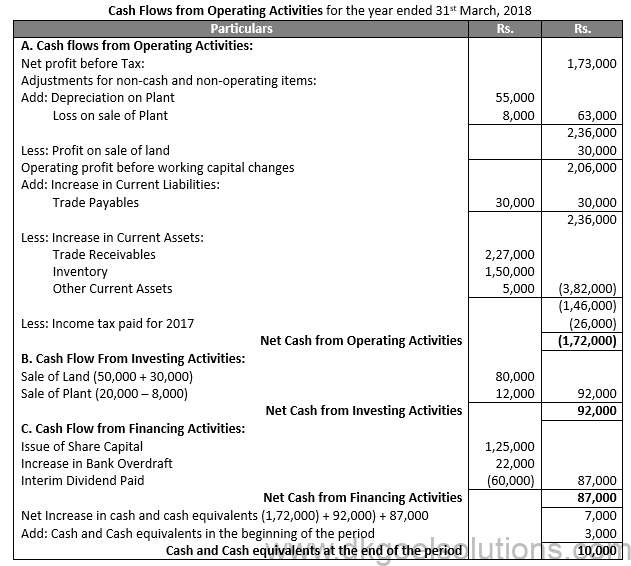

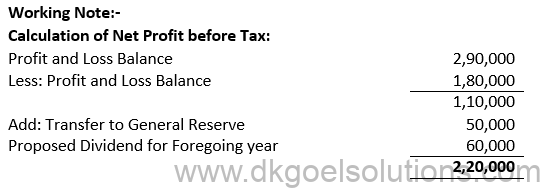

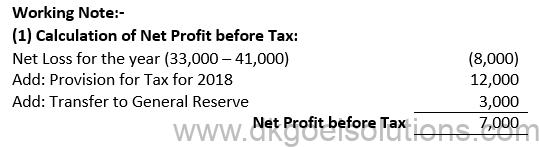

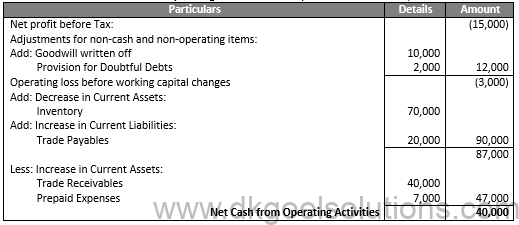

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q71.

Solution 71

Cash Flows from Operating Activities for the year ended 31st March, 2018

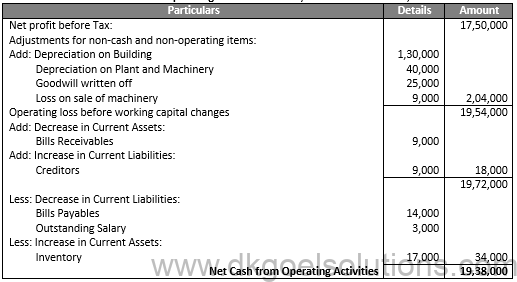

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q72.

Solution 72

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q73.

Solution 73

Cash Flows from Operating Activities for the year ended 31st March, 2018

Q74.

Solution 74

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q75.

Solution 75

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q76.

Solution 76

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

Investing activities includes the purchases and sale of long-term assets such as land, building, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows.

Q77.

Solution 77

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q78.

Solution 78

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q79.

Solution 79

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q80.

Solution 80

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q81.

Solution 81

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

Cash flow arising from operating activities are:

1.) Cash receipts from the sale of goods and rendering of services.

2.) Cash receipts from royalties, fees, commission and other revenue.

3.) Cash receipts from Debtors and Bills Receivables.

4.) Cash payment for purchase of goods and services.

5.) Cash payments to creditors and bills payables.

Q82.

Solution 82

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Point for Students:-

Financing activities are the activities that result in change in capital and borrowings of the enterprise. Some Examples of cash flow arising from financing activities are:

a) Cash receipts from issuing shares or other similar instruments.

b) Cash receipts from issuing debentures, loans, bonds and other short term or long term borrowings.

c) Cash Payment for Buy-back of equity shares.

d) Cash repayment of the Rs. borrowed including redemption of debentures, bonds, preference shares etc.

e) Cash Payments of dividends both on preference and equity shares.

f) Cash payments for interest on debentures and loans.

Q83.

Solution 83

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Points for Students:-

In case of financial enterprise such as Bank or Mutual Fund Company cash outflow and cash inflow arising from the purchase and sale of securities will be treated as flow from Operating Activities. This is, because, purchase and sale of securities is a part of main revenue generating activities in case of financial enterprises.

Q84.

Solution 84

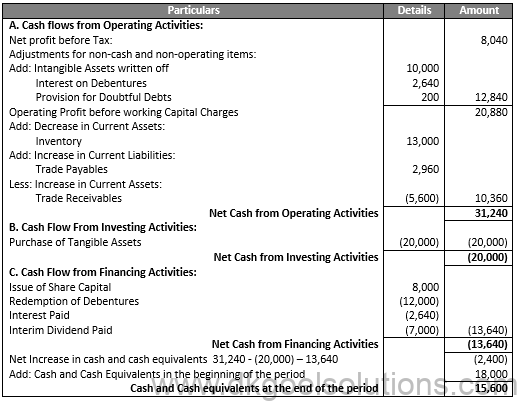

Cash Flows from Operating Activities for the year ended 31st March, 2018

Working Note:-

(1) Calculation of Net Profit before Tax:

Net Profit before Tax = Operating Profit + Dividend Paid

Net Profit before Tax = 1,040 + 7,000

Net Profit before Tax = 8040

Calculation of Operating Profit:-

Operating Profit = Profit and Loss Balance for Current Year – Profit and Loss Balance Previous year

Operating Profit = 21,120 – 20,080

Operating Profit = 1,040

Point for Students:-

There are some investing and financing activities which do not require the use of cash or cash equivalents. Such non-cash activities should be excluded from the cash flow statement.

A Cash Flow Statement can be defined as the statement that records the flow of incoming and outgoing cash within a business. The cash flow statements are one of the most efficient tools to calculate the liquidity and solvency of the firms. These statements allow determining the capacity of a firm to generate and employ the cash to generate fruitful outputs.

The merits of cash flow statements are as follows –

● Cash Flow Statements, when compiled with other important financial documents, helps the companies to analyze their assets. It helps them to track their stability, liquidity, and capability to handle cash.

● Cash Flow Statements allow the firms to evaluate the cash flowing through their business. It helps them to frame better strategies to utilize the funds. more effectively.

The inflow and outflow of cash within a business can be primarily classified into the following types –

● Cash flow generated through operating activities of the business

● Cash flow coming from investing activities

● Cash flow resulting from financial activities

Here are the primary objectives of cash flow statements –

● To help businesses frame short-term financial plans.

● To design beneficial business policies.

● To create a practical cash budget and promote cash management.

● To help companies utilize the cash in the best way possible to generate incredible results.

The limitations of cash flow statements are as follows –

● It is designed on the basis of historical cost prices of products or services.

● It overlooks non-cash transactions.

● It is not designed under the basic accounting principles.

● It is framed on the basis of secondary data.

Financial Activities – These define the procedures that output in the change of capital of the firms.

Investing activities – It portrays the activities that include the cash-less acquisition or elimination of any long-term investments or assets of a business.

Also refer to TS Grewal Solutions for Class 12