DK Goel Solutions Chapter 12 Books of Original Entry – Special Purpose Subsidiary Books

Read below DK Goel Solutions Class 11 Chapter 12 Books of Original Entry Special Purpose Subsidiary Books. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter of DK Goel Accounting Solutions presents a huge variety of sums related to subsidiary book posting of transactions and purchase book which can be very helpful to understand the concepts of Subsidiary Books accounting.

The chapter also has lot of best quality problems or questions which can be very helpful to understand the concepts for Class 11 students of Accountancy and will also help build a strong foundation.

DK Goel Solutions Class 11 Chapter 12 solutions are free and will help you to prepare for Class 11 Accountancy

Books of Original Entry – Special Purpose Subsidiary Books DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 12

Question 1:

(i) Purchase Book, (ii) Purchases Return Book.

Solution 1:

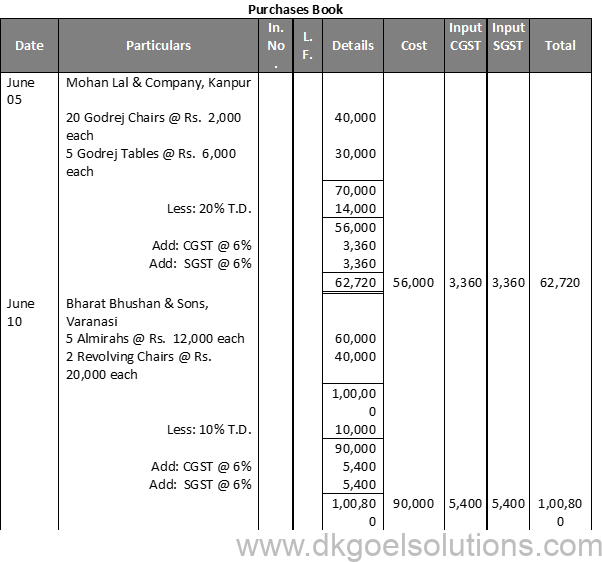

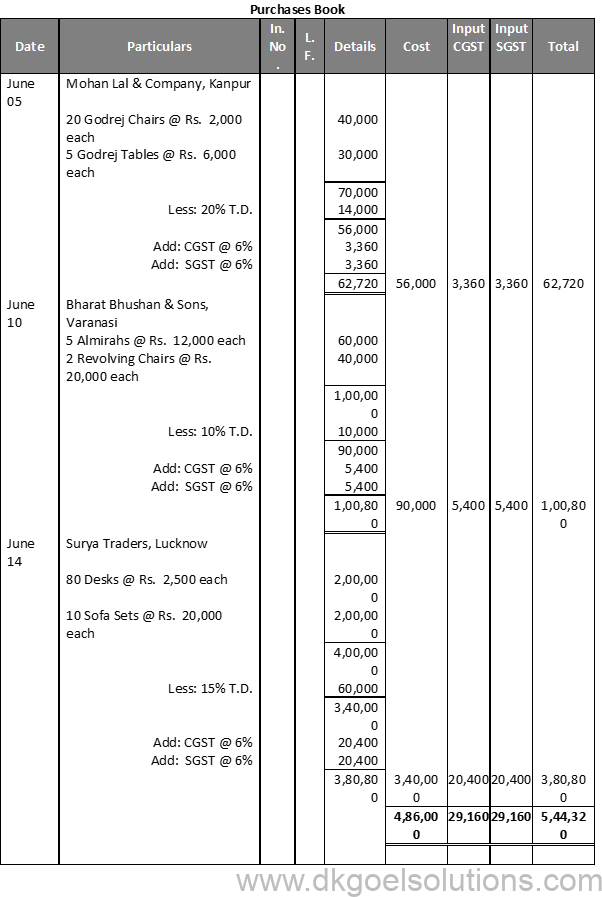

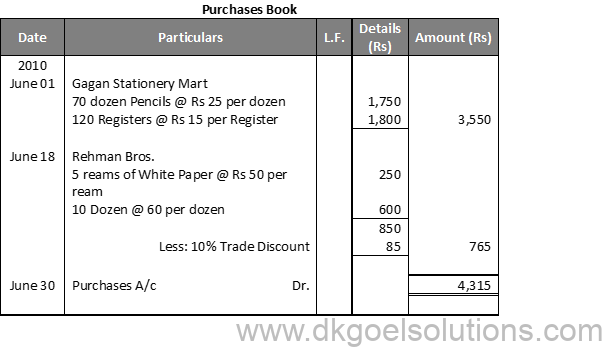

Purchases Book:-

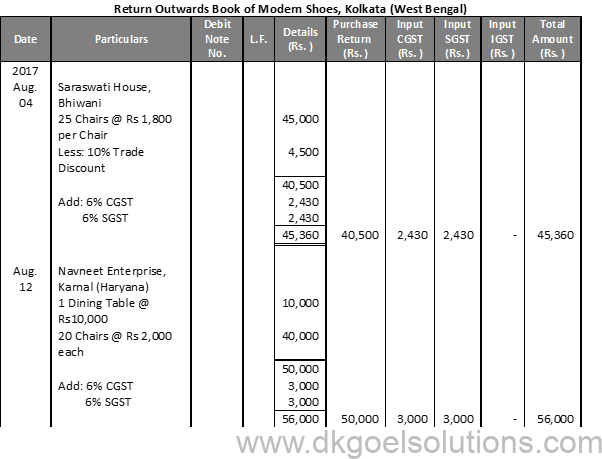

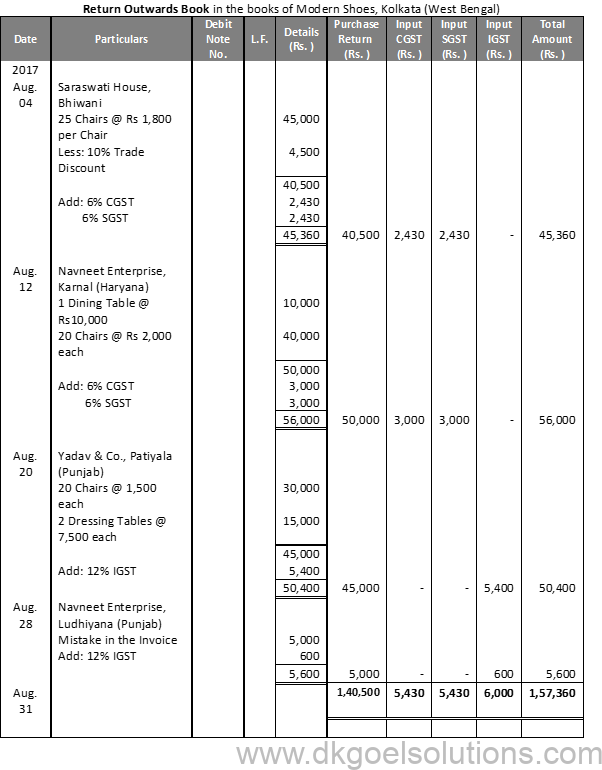

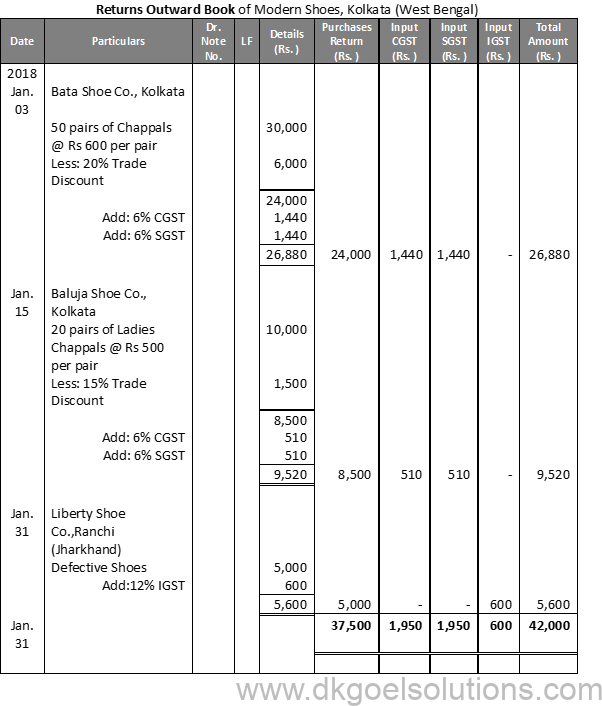

Purchases Return Book:- Return Outwards Book of Modern Shoes, Kolkata (West Bengal)

Question 2:

Solution 2: Debit note:- When items are returned by the consumer, a debit note is prepared by the buyer which is considered a debit note since the account of the party is debited with the sum written in it.

Credit note:- When the items exchanged are retrieved, a credit note is prepared by the vendor. It is referred to as a credit note since the account of the party from whom items are returned is paid with the amount written in the note.

Question 3:

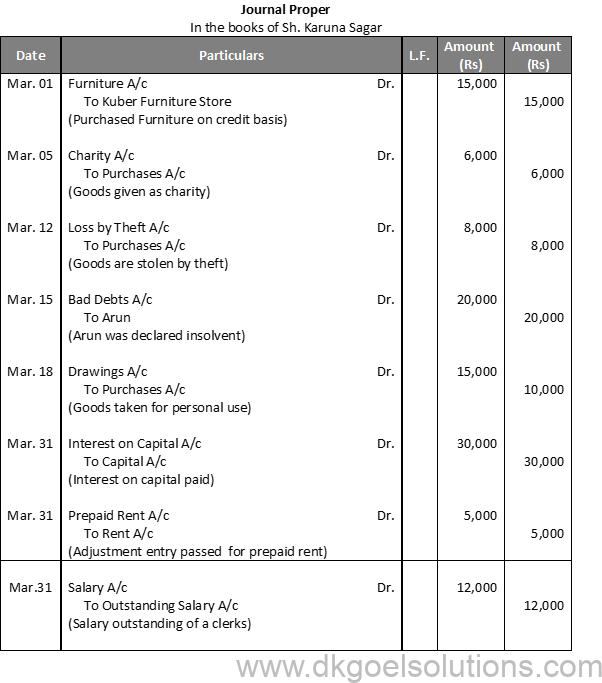

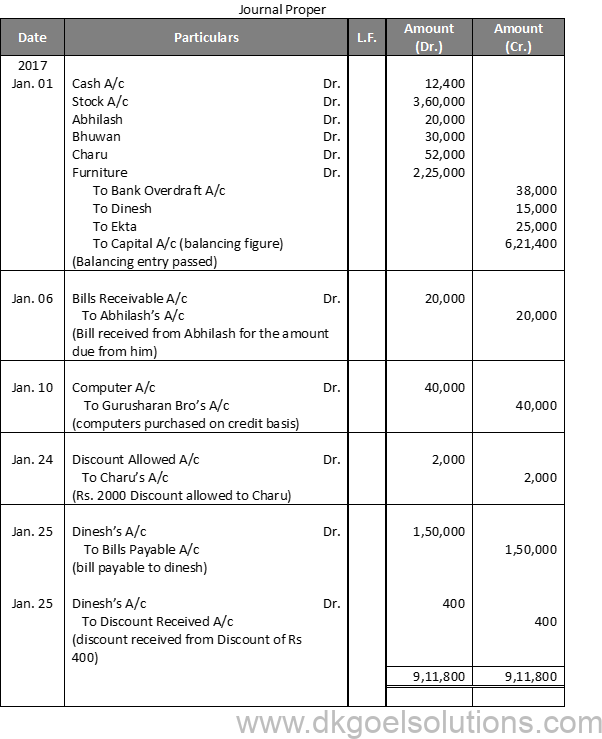

Solution 3: Below are the entries from which we should have maintained all the subsidiary books in the organization in a journal:-

1.) Fixed asset acquisitions on credit, i.e. Credit-based acquisitions of equipment.

2.) Making arrangements for loans in question.

3.) Providing Commodity Depreciation.

Question 1:

| 2017 | DK Goel Solutions Class 11 Chapter 12 |

| Jun-05 | Bought from Mohan Lal & Co., Kanpur (U.P) :- |

| 20 Godrej Chairs @ Rs. 2,000 each | |

| 5 Godrej Tables @ Rs. 6,000 each | |

| Trade Discount 20% | |

| 10 | Purchased from Bharat Bhushan & Sons, Varanasi (U.P) :- |

| 5 Almirahs @ Rs. 12,000 each | |

| 2 Revolving Chairs @ Rs. 20,000 each | |

| Trade Discount 10% | |

| 14 | Purchased from Surya Traders, Lucknow (U.P) |

| 80 Desks @ Rs. 2,500 each | |

| 10 Sofa Sets @ Rs. 20,000 each | |

| Trade Discount @ 15% | |

| 20 | Purchased for cash from Gopi Chand Haldi Ram, Delhi :- |

| 4 Tables @ Rs. 5,000 each | |

| 25 | Bought Furniture for office use from New Furniture House, Faridabad on Credit : |

| 5 Chairs @ Rs. 2,500 per Chair. | |

| 2 Tables @ Rs. 5,000 per Table. |

Solution 1:

Working Note:-

Price of a chair = Rs. 2,000

Price of 20 chairs = Rs. 2,000 × 20

Price of 20 chairs = Rs. 40,000

Price of a table = Rs. 6,000

Price of 5 tables = Rs. 6,000 × 5

Price of 5 tables = Rs. 30,000

Price of a Almirah = Rs. 12,000

Price of 5 chairs = Rs. 12,000 × 5

Price of 5 chairs = Rs. 60,000

Price of a Revolving chairs = Rs. 20,000

Price of 2 tables = Rs. 20,000 × 2

Price of 2 tables = Rs. 40,000

Question 2:

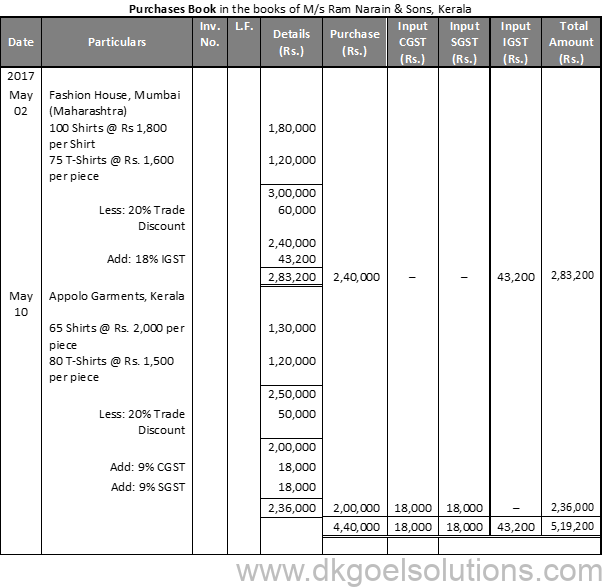

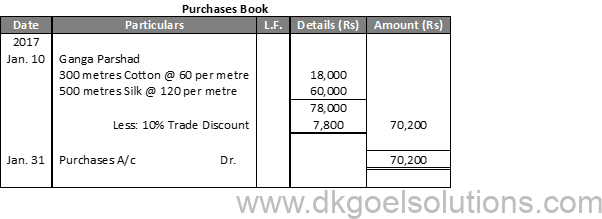

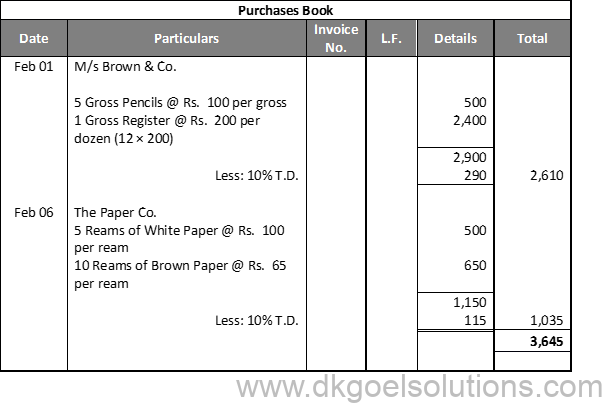

Solution 2: Purchases Book in the books of M/s Ram Narain & Sons, Kerala

Working Note:-

Question 3:

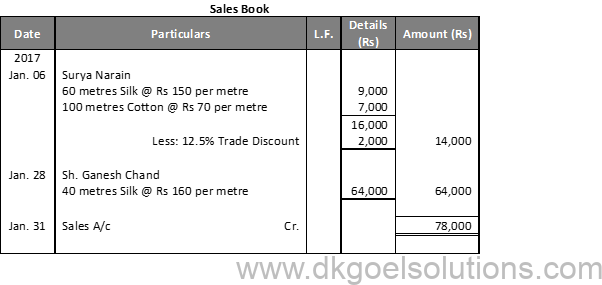

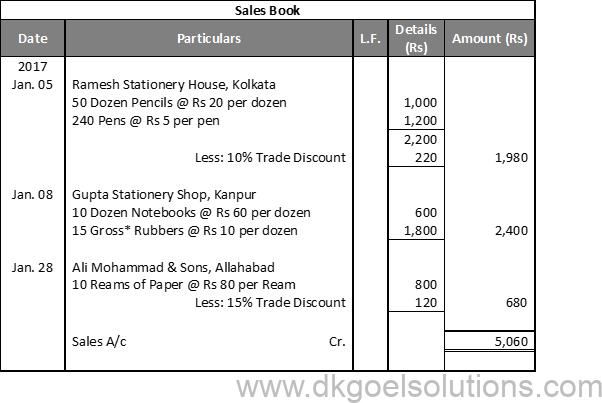

Solution 3: Sales Book in the books of Ganesh & Co. of Jaipur, (Rajasthan)

Working Note:-

- Price of a chair = Rs. 2,500

Price of 120 such chairs = Rs. 2,500 × 120 = Rs. 3,00,000

Price of a table = Rs. 8,000

Price of 25 such tables = Rs. 8,000 × 25 = Rs. 2,00,000 - Price of a Almirah = Rs. 15,000

Price of 8 such chairs = Rs. 15,000 × 8 = Rs. 1,20,000

Price of a Steel cabinet = Rs. 20,000

Price of 9 such tables = Rs. 20,000 × 9 = Rs. 1,80,000

Question 4:

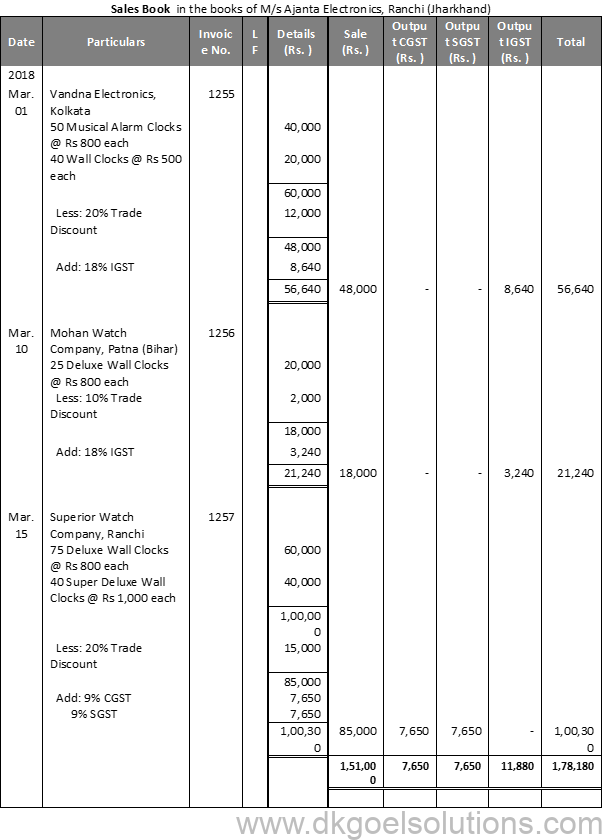

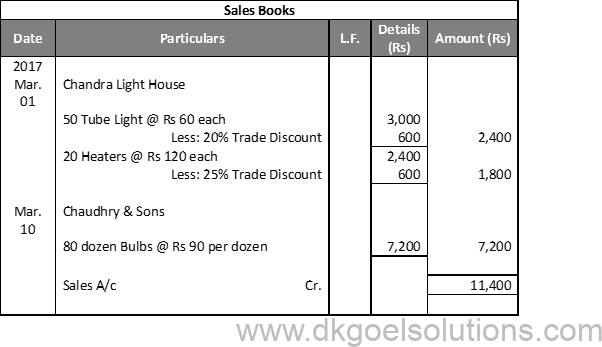

Solution 4: Sales Book in the books of M/s Ajanta Electronics, Ranchi (Jharkhand)

Working Note:-

- Price of a Musical Alarm Clock = Rs. 800

Price of 50 such Musical Alarm Clock = Rs. 800 × 50 = Rs. 40,000

Price of a Wallclock = Rs. 500

Price of 40 such Wallclock = Rs. 500 × 40 = Rs. 20,000 - Price of a Deluxe Wall Clocks = Rs. 800

Price of 75 such Deluxe Wall Clocks = Rs. 800 × 75 = Rs. 60,000

Price of a Super Deluxe Wall Clocks = Rs. 1,000

Price of 40 such tables = Rs. 1,000 × 40 = Rs. 40,000

Question 5:

Solution 5:

Point in Mind:–

A ‘Debit Note’ is written by the customer and forwarded to the seller. A Debit Note is prepared for the return of merchandise by the seller for whatever reason. As the party’s account is debited with the sum written in this file, it is considered a Debit Note. The ‘Debit Note’ is the basis for writing in the Return or Return Outward Book for Transactions.

Question 6:

Solution 6:

Question 7:

Solution 7:

Question 8:

Solution 8:

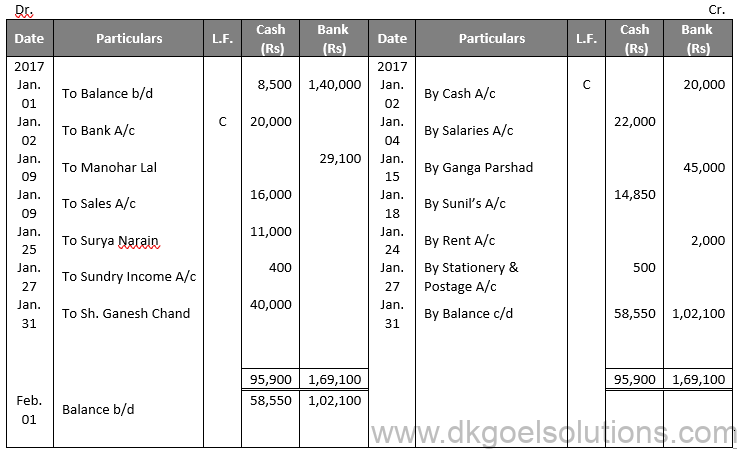

Question 9:

Solution 9:

Question 10:

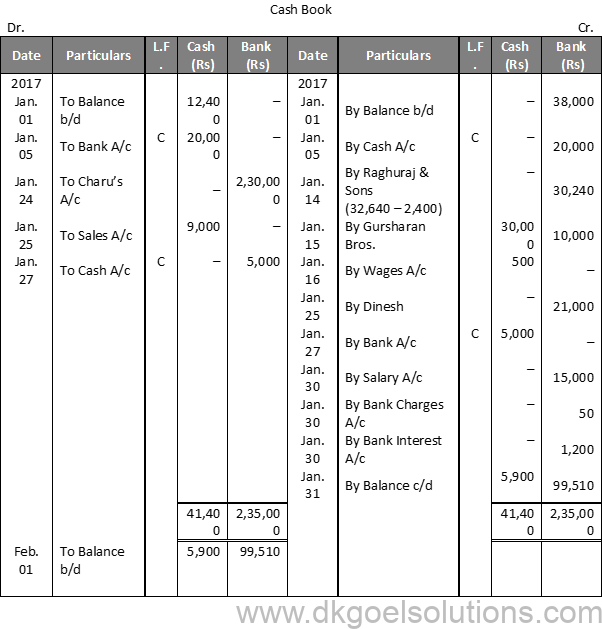

Solution 10:

Question 11:

Solution 11:

Working Note:-

1dozen = 12units

120 pen will be = 120/12 = 10 dozen

Price of 1 dozen pen = Rs. 60

Price of 10 dozen pen = Rs. 60 × 10 = Rs. 600

Question 12:

Solution 12:

Question 13:

Solution 13:

Working Note:-

1 gross = 12 Dozen

15 Gross Rubbers = 15 × 12 = 180 dozen

Price of 1 dozen = Rs. 10

Price of 180 dozen = 180 × Rs. 10 = Rs. 1800

Question 14:

Question 15:

Solution 15:

Question 16:

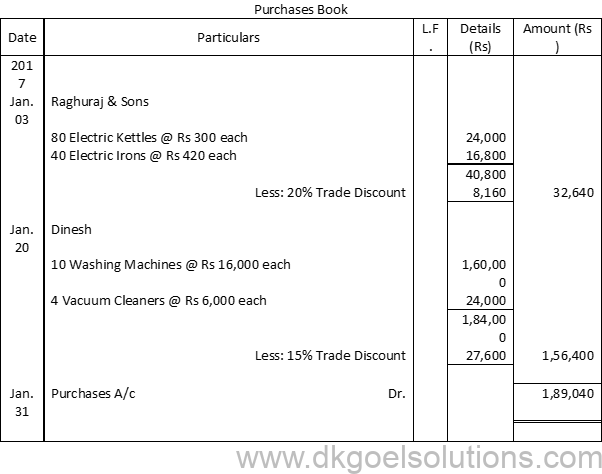

Solution 16:

A Purchase Book is a type of subsidiary book that keeps track of the transactions of credit purchases of goods and services. In simple words, a purchase book is a register that records the credit purchases of products or services of an organization. A purchase book comes with five columns that define the date, details of the creditors, Ledger Folio number, Invoice number, price, and other details of the purchase.

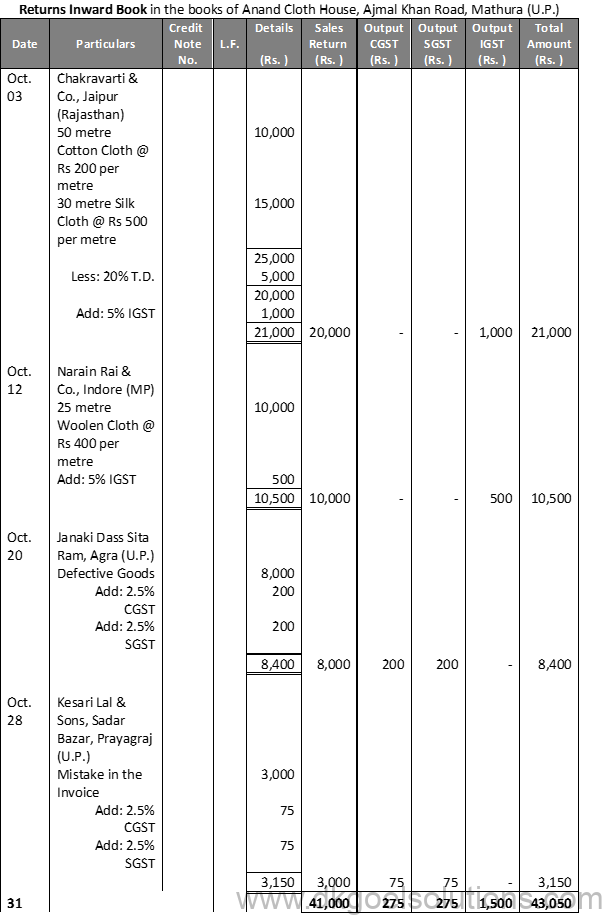

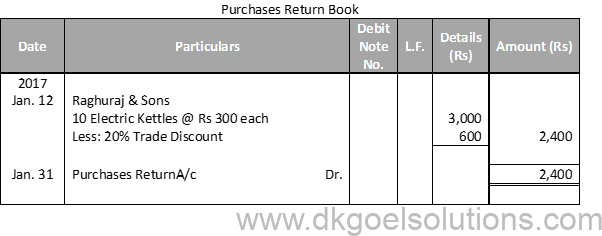

In several cases, the customers require to return certain items to the trader or supplier due to a bunch of reasons, including poor product quality, damaged product, and many more. All the types of returns are recorded in a book termed the Purchase Return Book. It is a daybook that keeps track of each purchase returns, and it is also titled the “Return Outward Book” or “Purchase Returns Day Book.”

Here are the primary reasons for purchase returns –

● The purchaser acquired an excessive quantity of products, and now he desires to return the unused.

● Wrong goods were delivered to the buyer.

● The goods do not meet the benchmark of quality or maybe inaccurate or non-functional.

As explained in DK Goel Solutions class 11 Chapter 12, When a good is eligible for a return, and the buyer desires to return them to the suppliers, a debit note is issued for the seller. The seller account gets debited, and the purchase return account gets credited on the successful return of the goods to the supplier.

A debit note is a note issued by the purchaser in case he desires to return goods to the suppliers. The debit note is supplied to the seller, and the seller’s account is debited with the amount mentioned in the debit note, and the purchaser’s account gets credited with the same amount.

A credit note is basically a receipt or credit memo supplied by the seller to the purchaser to confirm that the goods have been acknowledged as return inwards and a credit has been released for the buyer’s account with the eligible amount.

Thank you this notes is very helpful to me