DK Goel Solutions Chapter 5 Retirement or Death of a Partner

Read below DK Goel Solutions Class 12 Chapter 5 Retirement or Death of a Partner. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

Whenever there is a retirement or death of a partner there can be an accounting impact of this change. students should be able to understand how to account for such kind of events in a partnership form and correctly pass the accounting entries so that the statements reflect the correct position of the partnership firm.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Retirement or Death of a Partner DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Question 1.

Solution 1

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 2.

Solution 2

The handling of a partner’s goodwill at the time of retirement can be achieved in the capital account of the partner. The capital account of the retired or dead partner will be paid with his share of goodwill and the capital account of the continuing partner will be debited into their earnings ratio.

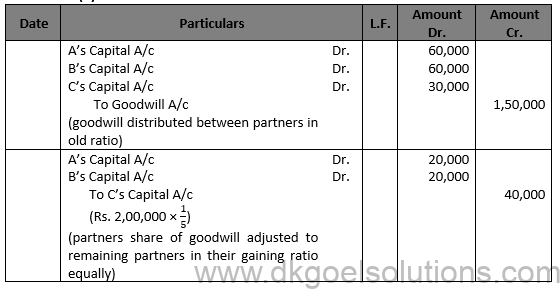

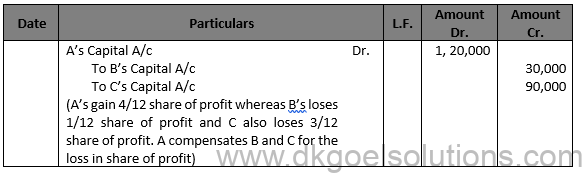

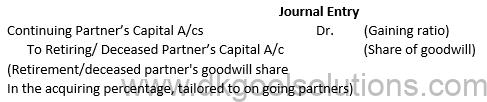

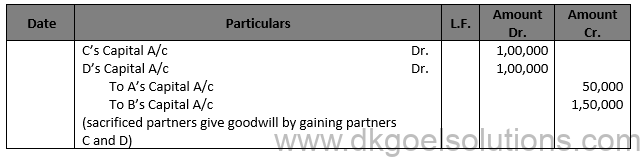

Journal Entry

Continuing Partner’s Capital A/cs Dr. (Gaining ratio)

To Retiring/ Deceased Partner’s Capital A/c (Share of goodwill)

(Retirement/deceased partner’s goodwill share

In the acquiring percentage, tailored to on going partners)

Question 3.

Solution 3

The following modifications include the retirement of a partner from the company:

(i) Calculate the current percentage of gains for all other partners.

(ii) The new ratio of the remaining partners is determined.

(iii) Measurement of the firm’s goodwill and accounting care.

iv) Asset and obligation revaluation.

(v) Sharing between all partners of combined gains and losses and reserves.

(vi) Shared Life Strategy Treatment.

(vii) Settlement of the balance due to the spouse retiring.

(iii) Transfer of the remaining partners’ capital accounts to a current profit-sharing ratio.

Question 4.

Solution 4

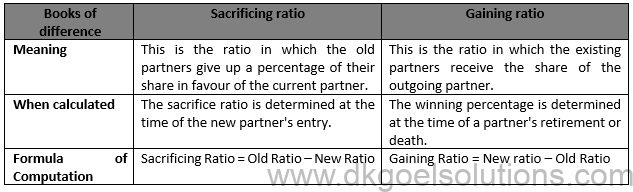

The gaining ratio is the ratio in which the on-going partners receive the share of the withdrawing partner. It is determined by deducting the old proportion from the current proportion.

Formula for Calculating Gaining Ratio:

Gaining ratio = New ratio – Old ratio.

Question 5.

Solution 5

Question 6.

Solution 6

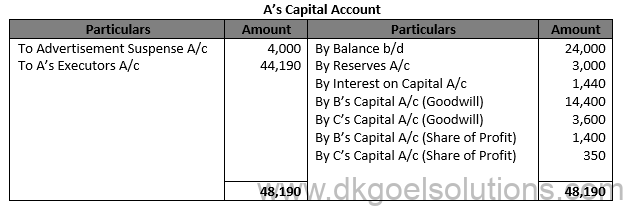

The deceased partner’s legal executive is entitled to the balance number of the capital account of the deceased partner.

The following things are posted in the deceased partner’s capital account on the debit side:

(a) Credit balance in a capital account or current account of the deceased spouse.

(b) The profit share of the deceased spouse up to the date of his or her death.

(c) The share of goodwill of the deceased partner.

(d) The share of the deceased spouse in the net reserves and the taxable account.

(e) The share of the deceased partner in the gains from the revaluation of assets and liabilities.

(f) The share of the deceased partner in the shared life policy.

(g) Capital interest and salary or commission, if any, before the date of death.

The following things are posted on the credit side of the deceased partner’s capital account:

(a) Debit balance for the capital account and current account of the deceased partner.

(b) The sum withheld in the form of drawings before the day of the partner’s death.

(c) Curiosity in paintings up to the date of death, if any.

(d) The proportion of losses of the deceased partner in the revaluation of assets and liabilities.

(e) The share of the loss of the deceased spouse up to the date of death.

(f) The dead partner’s share of the company’s cumulative damages.

Question 7.

Solution 7

The executors of the deceased partner shall now be entitled to the share of earnings gained by the company from the beginning of the year until the day of his death if the death of the partner occurred on any day during the year. From any of the following methods, such benefit can be determined:

(a) Dependent on Time.

(b) On a revenue or turnaround basis.

Question 8.

Solution 8

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

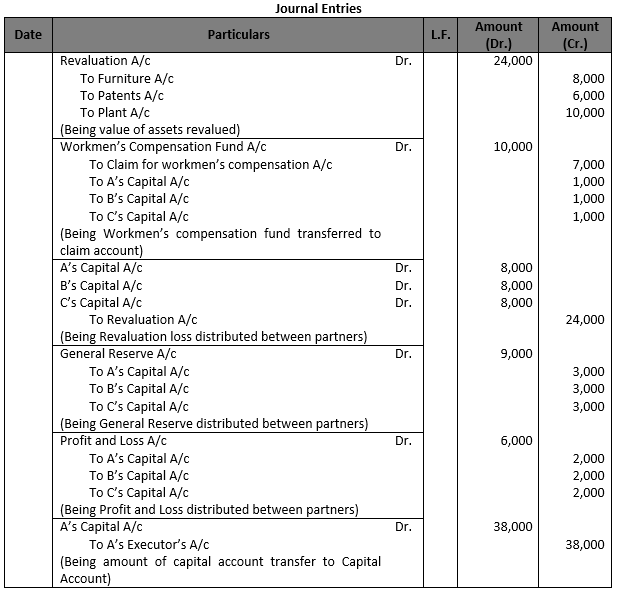

Practical Questions:-

Question 1. (A)

Solution 1 (A)

It is given that old Ratio = 6 : 5 : 4.

By striking out the share of the withdrawing partner, the current percentage of the remaining partners is determined.

The current ratio between B and C will be 5:4 as A retires.

The current ratio between A and C will be 6:4 after B retires.

The current ratio between A and B will be 6:5 after C retires.

Question 1. (B)

Solution 1 (B)

It is given that old Ratio = 5:3:1:2.

The new ratio between A and D would be 5:2 if B and C are excluded.

Question 2.

Solution 2

It is given that the old ratio of X, Y and Z is 2/3:1/4:1/12

Take LCM of Denominator 3, 4 and 12 is 12.

New ratio is (8 ∶ 3 ∶ 1)/12

New ratio = 8:3:1

The current ratio between Y and Z would be 3:1 after X is removed.

Question 3.

Solution 3

It is given that the old Ratio of L, M and O are 3:2:2.

M’s Share will be divided into L and O equally.

L’s Gaining and New Ratio:-

Gaining Ration of L = 2/7 of 1/2 = 2/14 or 1/7

New Ratio of L = 3/7+1/7=(3+1)/7= 4/7

O’s Gaining and New Ratio:-

Gaining Ratio of O = 2/7 of 1/2 = 2/14 or 1/7

New Ratio is O = 2/7+1/7=(2+1)/7= 3/7

Hence, the New Ratio of L and O = 4/7:3/7 or 4 : 3

Question 4.

Solution 4

bIt is given that old Ratio of A, B and C = 4:3:2

We can write it as old Ratio of A, B and C = 4/9:3/9:2/9

The share of B would be split between A and C at a ratio of 3:2.

Gaining Ratio of A = 3/5 of 3/9= 9/45

New Ratio of A = 4/9+9/45=(20+9)/45=29/45

Gaining Ratio of C = 2/5 of 3/9= 6/45

New Ratio of C = 2/9+6/45=(10 + 6)/45=16/45

Hence, the new ratio of A and C = 29/45:16/45 or 29 : 16

Question 5. (A)

Solution 5 (A)

It is given that old ratio of A, B and C = 4:3:1

We can write is as old ratio of A, B and C = 4/8:3/8:2/8

A’s share would be split evenly between B and C.

Gaining Ratio of B = 1/2 of 4/8= 1/4

New Ratio B = 3/8+1/4=(3+2)/8=5/8

Gaining Ratio of C = 1/2 of 4/8= 1/4

New Ratio C = 1/8+1/4=(1 + 2)/8=3/8

Hence, the new ratio of B and C = 5/8:3/8 or 5 : 3

Question 5. (B)

Solution 5 (B)

It is given that old ratio of A, B and C = 1/2:1/3:1/6

B’s share will be split in a 5:3 ratio between A and C.

Gaining Ratio of A = 5/8 of 1/3= 5/24

New Ratio of A = 1/2+5/24=(12+5)/24=17/24

Gaining Ratio of C = 3/8 of 1/3= 3/24

New Ratio of C = 1/6+3/24=(4 + 3)/24=7/24

Hence, the new ratio of A and C = 17/24:7/24 or 17 : 7

Question 6.

Solution 6

It is given that old ratio = 2:2:1

We can write it is as old ratio = 2/5:2/5:1/5

Z has fully taken over Y’s share.

New Share of X = 2/5

New Share of Y = 1/5+ 2/5=3/5

Hence, the new ratio of X and Z = 2/5:3/5 or 2:3

Question 7.

Solution 7

It is given that the existing ratio of P and Q = 1/2 and 2/6

P’s acquired from R = 1/6×2/3=2/18

Q’s acquired form R = 1/6×1/3=1/18

New Share of P = 1/2+2/18=11/18

New Share of Q = 2/6+1/18=7/18

Share given by P and S = 1/4×1/3=1/12

Remaining share = 1/4-1/12=(3-1)/12=2/12 = 1/6

S gets it from both P and Q in equal amounts.

P and Q each give S 1/2 of 1/6 = 1/12 each.

New Share of P = 11/18-1/12-1/12=(22-3-3)/36=16/36

New Share of Q = 7/18-1/12=(14-3)/36=11/36

P, Q, and S have a new profit-sharing ratio = 16/36:11/36:1/4

P, Q, and S have a new profit-sharing ratio = 16 : 11 : 9.

Question 8.

(A)

Solution 8

(A)

It is given that old Ratio of A, B and C = 7:5:3

(i) As A retires, B and C have a 5:3 gaining ratio. A retires, resulting in a new 5:3 ratio between B and C.

(ii) As B retires, A and C will have a 7:3 benefit ratio. B retires, resulting in a new 7:3 ratio between A and C.

(iii) After C retires, A and B will have a 7:5 benefit ratio. C retires, resulting in a new 7:5 ratio between A and B.

Question 8.

(B)

Solution 8

(B)

It is given that old ratio of X, Y and Z is 1/2:3/10:1/5

We can write it as old ratio of X, Y and Z is 5:3:2

(i) The gaining ratio between Y and Z when X dies is 3:2. When X dies, the new Y:Z ratio is 3:2.

(ii) The gaining ratio between X and Z is 5:2 when Y dies. When Y dies, the new X:Z ratio is 5:2.

(iii) The gaining ratio between X and Y is 3:2 when Z dies. When Z dies, the new X:Y ratio is 5:3.

Question 8.

(C)

Solution 8

(C)

It is given that old ratio of P, Q, R and S is 5:4:3:1

P and S retire:

Q and R’s Gaining Ratio is 4 : 3

Q and R’s New Ratio is 4 : 3

Question 9.

(A)

Solution 9

(A)

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of Ashish = 3/4-2/5=(15 – 8)/20=7/20

Gaining Ratio of Aman = 1/4-1/5=(5 – 4)/20=1/20

Hence, the gaining ratio of Ashish and Aman of 7 : 1

Question 9.

(B)

Solution 9

(B)

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of A = 3/5-5/10=(6 – 5)/10=1/10

Gaining Ratio of B = 2/5-2/10=(4 – 2)/10=2/20

Hence, the gaining ratio of A and B of 1 : 2

Question 10. (A)

Solution 10

(A)

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of A = 1/2-1/2=0

Gaining Ratio of B = 1/2-1/3=(3 – 2)/6=1/6

Hence, the gaining ratio B of 1/6

Question 10. (B)

Solution 10

(B)

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of B = 1/3-4/14=(14 – 12)/42=2/42

Gaining Ratio of C = 1/2-3/14=(14 – 9)/42=5/42

Gaining Ratio of D = 1/3-2/14=(14 – 6)/42=8/42

Gaining Ratio of B, C and D = 2/42 ∶ 5/42 ∶8/42

Hence, the gaining ratio of B, C and D = 2 : 5 : 8

Question 11.

Solution 11

Gain from Rekha = 2/5 of 1/3= 2/15

New share Rekha = 1/3+2/15=(5 + 2)/15=7/15

Gain from Suruchi = 3/5 of 1/3= 3/15

New share Suruchi = 1/3+3/15=(5 + 3)/15=8/15

New Ratio of Rekha and Suruchi = 7/15 and 8/15

Hence, the new ratio of Rekha and Suruchi = 7 : 8

Question 12.

Solution 12

Z’s share will be split between X and Y in the following ratio 3/4 ∶ 1/4

Gaining Ratio of X = 3/4 of 5/9= 15/36

New Share of X = 1/9+15/36=(4 + 15)/36=19/36

Gaining Ratio of Y = 1/4 of 5/9= 5/36

New Share of Y = 1/3+5/36=(12 + 5)/36=17/36

New Ratio of X and Y = 19/36 : 17/36

New Ratio of Rekha and Suruchi = 19 : 17

Hence, the gaining ratio of X and Y is 3 : 1

Question 13.

Solution 13

S’s share will be split between Q and R in the following ratio 3 : 2.

Gaining Ratio of Q = 3/5 of 2/12= 6/60

New Share of Q = 3/12+6/60=(15 + 6)/60=21/60

Gaining Ratio of R = 2/5 of 2/12= 4/60

New Share of R = 5/12+4/60=(25 + 4)/60=29/60

P’s share will not change 2/12

New Ratio of P, Q and R = 2/12 : 21/60:29/60

New Ratio of P, Q and R = (10 ∶ 21 ∶ 29)/60

Hence, the new ratio of P, Q and R is 10 : 21 : 29 and Gaining Ratio of Q and R = 3 : 2

Question 14.

Solution 14:

Computation of Sacrificing Ratio:-

Sacrificing Ratio of A = 3/5 of 1/4 = 3/20

Sacrificing Ratio B = 2/5 of 1/4 = 2/20

Computation of New Profit Ratio of A, B and C:-

New Profit Sharing Ratio of A = 5/8-3/20=(25-6)/40=19/40

New Profit Sharing Ratio of B = 3/8-2/20=(15-4)/40=11/40

New Profit Sharing Ratio of C = 1/4

New Profit Sharing of A, B and C = 19/40:11/40:1/4

New Profit Sharing A, B and C = (19 ∶ 11 ∶ 10)/40

Hence, The New Profit Sharing of A, B and C = 19 : 11 : 10

(ii) New Profit Sharing Ratio of A, B, C and D:-

New Profit Ratio of A = 19/40-1/10=(19-4)/40=15/40

New Profit Ratio of B = 11/40

New Profit Ratio of C = 10/40-1/15=(30-8)/120=20/120

New Profit Ratio of D = 1/6

New Ratio of A, B, C and D = 15/40:11/40:22/120:1/6

New Ratio of A, B, C and D = (45 ∶ 33 ∶ 22 ∶ 20)/120

Hence, The New Ratio of A, B, C and D = 45 : 33 : 22 : 20

(iii) New Profit Sharing Ratio on A’s death:-

Equally share divided in between B, C and D of A’s Share = 45/120×1/3=15/120

New Profit Sharing Ratio B = 33/120+15/120=48/120

New Profit Sharing Ratio C = 22/120+15/120=37/120

New Profit Sharing Ratio D = 20/120+15/120=35/120

New Ratio of B, C and D = 48 : 37 : 35

Question 15.

Solution 15

New Ratio of Y and Z will also be 5 : 4

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of Y = 5/9-4/12=(20 – 12)/36=8/36

Gaining Ratio of Z = 4/9-3/12=(16 – 9)/36=7/36

Gaining Ratio of Y and Z = 8/36:7/36

Hence, the gaining ratio of Y and Z = 8 : 7

Question 16. (A)

Solution 16 (A)

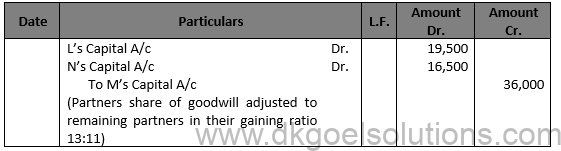

Working Note:-

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of L = 5/8-4/9=(45-32)/72=13/72

Gaining Ratio of N = 3/8-2/9=(27 – 16)/72=11/72

Hence, the gaining ratio = 13 : 11

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 16. (B)

Solution 16 (B)

Point for Students:-

The retiring or decreased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profits will be accruing because of the present goodwill and the retiring of deceased partner will not be sharing future profits, it will be fair to compensate the retiring or decreased partner for the same.

Question 17.

Solution 17

Question 18.(A)

Solution 18

Points for Students:-

The following modifications include the retirement of a partner from the company:

(i) Calculate the current percentage of gains for all other partners.

(ii) The new ratio of the remaining partners is determined.

(iii) Measurement of the firm’s goodwill and accounting care.

iv) Asset and obligation revaluation.

(v) Sharing between all partners of combined gains and losses and reserves.

(vi) Shared Life Strategy Treatment.

(vii) Settlement of the balance due to the spouse retiring.

(iii) Transfer of the remaining partners’ capital accounts to a current profit-sharing ratio.

Question 18.(B)

Solution 18 (B)

Point for Students:-

The retiring or decreased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profits will be accruing because of the present goodwill and the retiring of deceased partner will not be sharing future profits, it will be fair to compensate the retiring or decreased partner for the same.

Question 19.(A)

Solution 19

(A)

Valuation of Goodwill:-

Total Profit for 4 Years = Rs. 1,20,000 + Rs. 60,000 – Rs. 20,000 + Rs. 80,000 = Rs. 2,40,000

Profit to R’s Capital A/c = Rs. 2,40,000 × 3/8 = Rs. 90,000

R’s share of Goodwill = Rs. 90,000 × 1/2 = Rs. 45,000

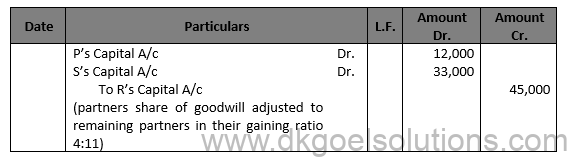

Working Note:-

Computation of Gaining Ratio :-

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of P = 3/5-4/8=(24-20)/40=4/40

Gaining Ratio of S = 2/5-1/8=(16 – 5)/40=11/40

Hence, Gaining ratio = 4 : 11

Points for Students:-

The following modifications include the retirement of a partner from the company:

(i) Calculate the current percentage of gains for all other partners.

(ii) The new ratio of the remaining partners is determined.

(iii) Measurement of the firm’s goodwill and accounting care.

iv) Asset and obligation revaluation.

(v) Sharing between all partners of combined gains and losses and reserves.

(vi) Shared Life Strategy Treatment.

(vii) Settlement of the balance due to the spouse retiring.

(iii) Transfer of the remaining partners’ capital accounts to a current profit-sharing ratio.

Question 19.(B)

Solution 19

(B)

Working Note:-

Computation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of B = 2/6-5/8=(8-15)/24=7/24

Gaining Ratio of D’s gaining = 1/6-3/8=(4 – 9)/24=5/24

Gaining ratio of B and D = 7 : 5

A’s Share of Goodwill = Rs. 90,000 × 2/6 = Rs. 30,000

C’s Share of Goodwill = Rs. 90,000 × 1/6 = Rs. 15,000

Total Goodwill = Rs. 30,000 + Rs. 15,000 = Rs. 45,000

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 20.

Solution 20

Working Note:-

Computation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of Surender = 1/3-2/6=(2-2)/6=0

Gaining Ratio of Ramesh = 1/3-1/6=(2 – 1)/6=1/6

Gaining Ratio of Mohan = 1/3-1/6=(2 – 1)/6=1/6

Gaining Ratio of Ramesh and Mohan is 1:1.

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 21.

Solution 21

Working Note:-

Valuation of Goodwill:-

Total Profit for 3 Years = (Rs. 50,000 + Rs. 60,000 + Rs. 55,000)/3 = Rs. 55,000

Super Profit = Average Profit – Normal Profits

Super Profit = Rs. 55,000 – Rs. 30,000

Super Profit = Rs. 25,000

Goodwill = Rs. 50,000 × 5/25 = Rs. 10,000

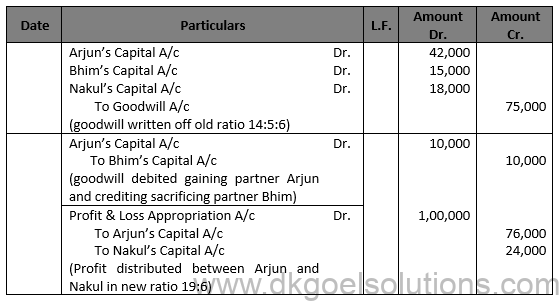

Computation of New Ratio:-

A Gaining Ratio of rjun = 14/25+5/25=(14 + 5)/25=19/25

A Gaining Ratio of rjun Nakul = 6/25+0=6/25

Gaining ratio = 19 : 6

Point for Students:-

The retiring or decreased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profits will be accruing because of the present goodwill and the retiring of deceased partner will not be sharing future profits, it will be fair to compensate the retiring or decreased partner for the same.

Question 22 (A).

Solution 22

(A)

Working Note:-

Computation of Gaining Ratio :-

Gaining Ratio = New Ratio – Old Ratio

A’s gaining Ratio = 11/15-6/15=(11 – 6)/15=5/15 (Gain)

B’s gaining Ratio = 0-4/15= (-4)/15 (Sacrifice)

C’s gaining Ratio = 4/15-5/15=(4 – 5)/15=(-1)/15 (Sacrifice)

A’s has gained 5/15 and B and C will sacrificed in the ratio of 4:1.

Question 22. (B)

Solution 22 (B)

Working Note:-

1.) Z’s Share in goodwill = Rs. 30,000 × 1/6 = Rs. 5,000

2.) Computation of Gaining Ratio :-

Gaining Ratio = New Ratio – Old Ratio

X’s Sacrifice Ratio = 1/3-3/6=(2 – 3)/6=1/6 (Sacrifice)

Y’s gaining Ratio = 2/3-2/6= (4 – 2)/6=2/6 (Gain)

Y’s will gained 2/6 and X will sacrificed 1/6 in favour of Y.

Question 23.

Solution 23

Working Note:-

1.) C’s Share in goodwill = Rs. 3,60,000 × 3/12 = Rs. 90,000

2.) Computation of Gaining Ratio :-

Gaining Ratio = New Ratio – Old Ratio

A’s Sacrifice Ratio = 9/12-5/12=(9 – 5)/12=4/12 (Gain)

B’s gaining Ratio = 2/12-3/12= (2 – 3)/12=(-1)/12 (Sacrifice)

C’s Sacrifice Ratio = 0-3/6=(0 – 3)/6=(-3)/6 (Sacrifice)

D’s Sacrifice Ratio = 1/12-1/12=(1 – 1)/12=0

A’s will gained 4/12.

Question 24.

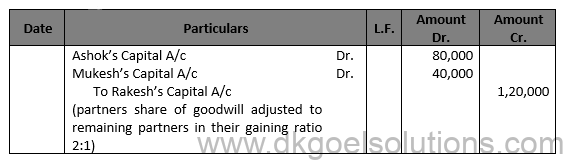

Solution 24

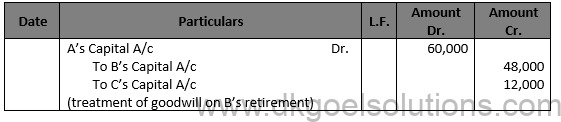

Working Note:-

1.) B’s share of Goodwill = Rs. 3,00,000 × 3/10 = Rs. 90,000

2.) Computation of Gaining Ratio :-

Gaining Ratio = New Ratio – Old Ratio

Sacrifice Ratio A = 1/3-4/10=(10 – 12)/30=(-2)/30 (Sacrifice)

Sacrifice Ratio B = 0-3/10= (0 – 3)/10=(-3)/10 (Sacrifice)

Sacrifice Ratio C = 1/3-2/10=(10 – 6)/30=4/30 (Gain)

Sacrifice Ratio D = 1/3-1/10=(10 – 3)/30=7/30 (Gain)

C and D will be debited for their gains, while A and B will be awarded for their sacrifices in the ratio of 2:9.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 25.

Solution 25

(i) Record the sale of Y’s share to X and Z:-

(ii) X and Z purchased Y‘s share for Rs. 1,60,000, out of which X pays 1,00,000 and Z pays Rs. 60,000, i.e., X and Z will share Y’s shale of profit in the ratio of 1,00,000 : 60,000 = 5 : 3.

New Profit sharing ratios of X and Z will be:

X gets 5/8th of Y’s share of 2/6 = 5/8 ×2/6=5/24

X’s old share = 3/6

X’s New share = 3/6+5/24=(12 + 5)/24=17/24

Z gets 3/8th of Y’s share of 2/6 = 3/8 ×2/6=3/24

X’s old share = 1/6

X’s New share = 1/6+3/24=(4 + 3)/24=7/24

New Ratio between X and Z = 17/24:7/24=17:7

(iii) Division of Profit between X and Z:

Profit = Rs. 2,40,000

X’s Share = Rs. 2,40,000 × 17/24 = Rs. 1,70,000

Z’s Share = Rs. 2,40,000 × 7/24 = Rs. 70,000

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 26 (new).

Solution 26 (new).

Question 26.

Solution 26

Working Note:-

Average Profit :- (Rs.40,000 – Rs.10,000 + Rs.1,00,000 + Rs.1,50,000)/4 = Rs. 70,000

Super Profit = Average Profit – Normal Profits

Super Profit = Rs. 70,000 – Rs. 56,000

Super Profit = Rs. 14,000

Goodwill = Rs. Super Profit × Number of year Purchases

Goodwill = Rs. 14,000 × 2

Goodwill = Rs. 28,000

C’s Share of goodwill = Rs. 28,000 × 3/10 = Rs. 8,400

Point for Students:-

The handling of a partner’s goodwill at the time of retirement can be achieved in the capital account of the partner. The capital account of the retired or dead partner will be paid with his share of goodwill and the capital account of the continuing partner will be debited into their earnings ratio.

Question 27.

Solution 27

Working Note:-

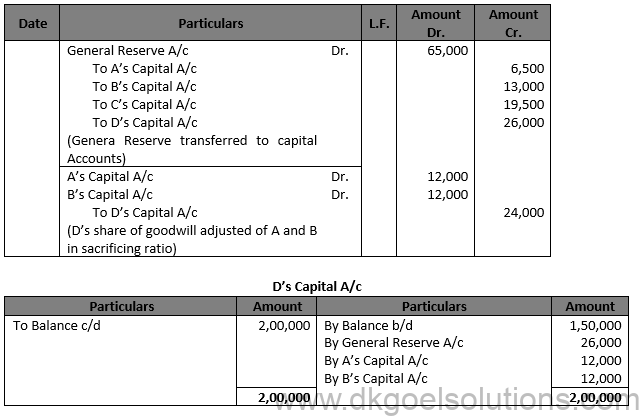

D’s Share of Goodwill = Rs. 60,000 × 4/10 = Rs. 24,000

Computation of New Ratio:-

D’s share will be split evenly between A and B:

A’s Gain = 1/2 of 4/10=2/10

New Share of A = 1/10+2/10=3/10

B’s Gain = 1/2 of 4/10=2/10

New Share of B = 2/10+2/10=4/10

C’s share will remain the same 3/10

New Ratio of A, B and C = 3/10:4/10:3/10

Hence, the new ratio of A, B and C is 3:4:3

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 28.

Solution 28

Question 29.

Solution 29

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 30.

Solution 30

Working Note:-

Computation of Net Effect:-

Net Effect = General Reserve + Profit & Loss Account – Advertisement Suspense Account

Net Effect = Rs. 1,00,000 + Rs. 45,000 – Rs. 25,000

Net Effect = Rs. 1,20,000

Computation of Sacrifice or Gaining Ratio:-

A’s Share = 3/6-3/4=(6 – 9)/12=-3/12 (Gain)

B’s Share = 2/6-1/4=(4 – 3)/12=1/12 (Sacrifice)

Point for Students:-

The retiring or decreased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profits will be accruing because of the present goodwill and the retiring of deceased partner will not be sharing future profits, it will be fair to compensate the retiring or decreased partner for the same.

Question 31.

Solution 31

Working Note:-

Valuation of Goodwill:-

Average Profit = (10,000 + 25,000 – 15,000 + 36,000 + 44,000)/5=Rs.20,000

Goodwill of 2 year Purchases = Rs. 20,000 × 2 = Rs. 40,000

C’s Share = Rs. 40,000 × 2/10 = Rs. 8,000

Computation of Gaining and Sacrificing Ratio:-

A’s Share = 6/10-5/10=1/10

B’s Share = 4/10-3/10=1/10

Gaining Ratio = 1 : 1

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 32. (A)

Solution 32

(A)

Working Note:-

Goodwill = (Rs. 1,20,000+Rs. 1,00,000+Rs.95,000)/3 = Rs. 1,05,000

Z’s Share of goodwill = Rs. 1,05,000 × 1/3 = Rs. 35,000

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 32. (B)

Solution 32

(B)

Working Note:

C’s share of Goodwill = 9,000 x 1/6 = Rs. 1,500.

It will be credited to C’s Capital A/c and debited to A and B’s Capital A/cs in their gaining ratio of 3 : 2.

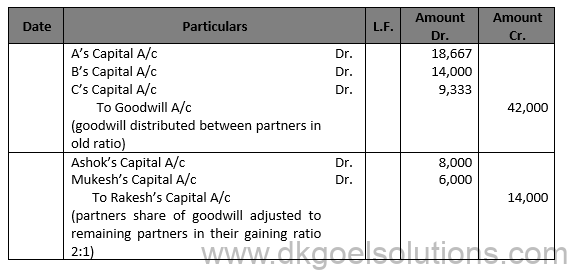

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 33.

Solution 33

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 34.

Solution 34

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 35 (new).

Solution 35 (new).

Question 35. .

Solution 35.

Working Note:-

1.) Computation of Gaining Ratio:-

Yasmin’s Gaining Ratio = 3/5-3/10=(6 – 3)/10=3/10

Saloni’s Gaining Ratio = 2/5-3/10=(4-3)/10=1/10

Gaining Ratio = 3 : 1

2.) Net Debtors = Rs. 90,000 – Rs. 4,000 = Rs. 86,000

| Provision @ 5% on Rs. 86,000 | Rs. 4,300 |

| Less: Current Provision Rs. 10,000 – Rs. 4,000 | Rs. 6,000 |

| Excess Provision Credited to Revaluation | Rs. 1,700 |

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 36.

Solution 36.

Working Note:-

1.) Y’s Share of goodwill = Rs. 80,000 × 3/8 = Rs. 30,000

X and Z in their Gaining Ratio of 3:2

X’s Gain = Rs. 80,000 × 3/5 = Rs. 18,000

Z’s Gain = Rs. 30,000 × 2/5 = Rs. 12,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 37. (A)

Solution 37.

(A)

Working Note:-

1.) Z’s Share of goodwill = Rs. 60,000 × 2/10 = Rs. 12,000

X and Z in their Gaining Ratio of 5:3

X’s Gain = Rs. 12,000 × 5/8 = Rs. 7,500

Z’s Gain = Rs. 12,000 × 3/8 = Rs. 4,500

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 37. (B)

Solution 37. (B)

Working Note:-

1.) Computation of Gaining Ratio:

B’s Share = 5/8-2/5=(25- 16)/40=9/40

C’s Share = 3/8-1/5=(15- 8)/40=7/40

Gaining Ratio = 9 : 7

2.) A’s Share of Goodwill = Rs. 60,000 × 2/5 = Rs. 24,000

B will be debited by Rs. 24,000 × 9/16 = Rs. 13,500

C will be debited by Rs. 24,000 × 7/16 = Rs. 10,500

3.) Computation of Bank Overdraft:

Bank Overdraft = Bank Balance as per Balance Sheet – Amount required to pay off

Bank Overdraft = Rs. 44,800 – Rs. 1,24,800

Bank Overdraft = Rs. 80,000

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 38.

Solution 38.

Question 39.

Solution 39.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 40.

Solution 40.

Question 41.

Solution 41.

Working Note:-

Computation of Gaining Ratio:-

X’s Gain = 1/2-5/12=(6-5)/12=1/12

Z’s Gain = 1/2-3/12=(6-3)/12=3/12

Y’s Share of goodwill = Rs. 16,200 × 4/12 = Rs. 5,400

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

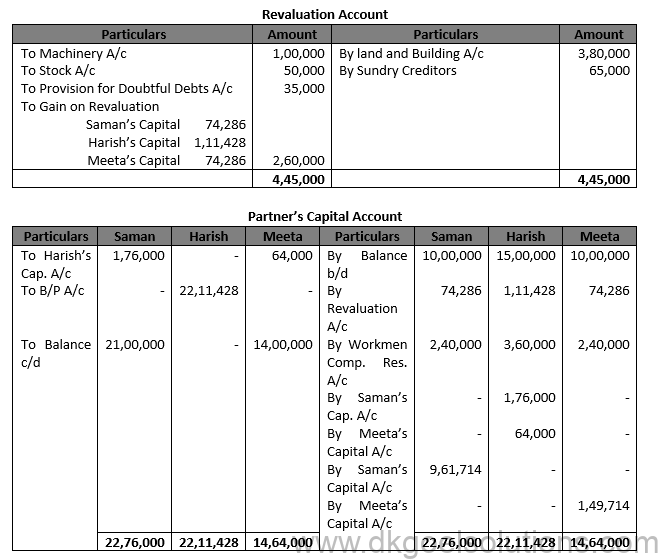

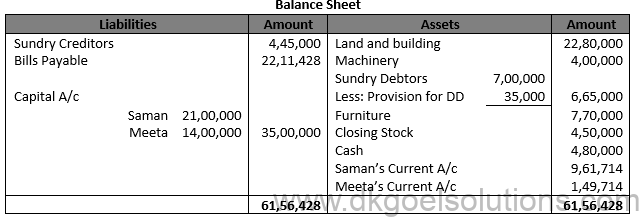

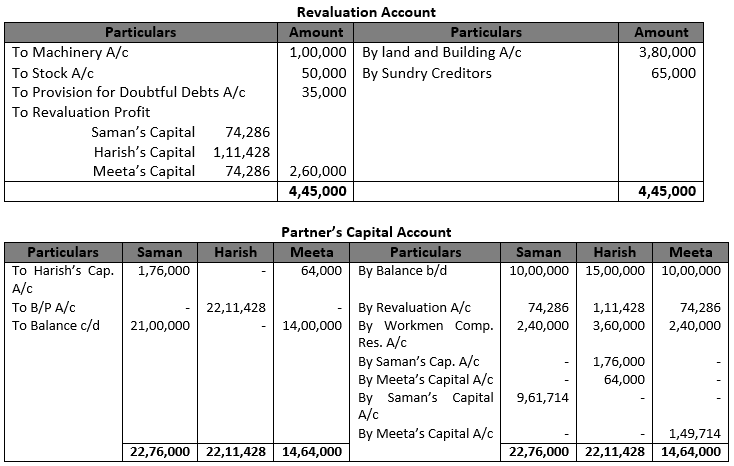

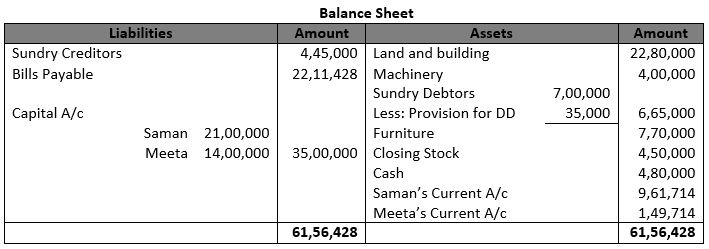

Question 42.

Solution 42.

Working Note:-

1.) Computation of Gaining Ratio:-

Saman’s Gain = 3/5-2/7=(21-10)/35=11/35

Meeta’s Gain = 2/5-2/7=(14-10)/35=4/35

Gaining Ratio = 11:4

2.) Harish’s Share of goodwill = Rs. 5,60,200 × 3/7 = Rs. 2,40,000

Saman’s Share = Rs. 2,40,000 × 11/15 = Rs. 1,76,000

Meeta’s Share = Rs. 2,40,000 × 4/15 = Rs. 64,000

3.) Total Capital new firm = Rs. 35,00,000

Saman’s Capital = Rs. 35,00,000 × 3/5 = Rs. 21,00,000

Meeta’s Capital = Rs. 35,00,000 × 2/5 = Rs. 14,00,000

Question 43 (new).

Solution 43 (new).

Working Note:-

1.) Calculation of Gaining Ratio:-

Saman’s Gain = 3/5-2/7=(21-10)/35=11/35

Meeta’s Gain = 2/5-2/7=(14-10)/35=4/35

Gaining Ratio = 11:4

2.) Harish’s Share of goodwill = Rs. 5,60,200 × 3/7 = Rs. 2,40,000

Saman’s Share = Rs. 2,40,000 × 11/15 = Rs. 1,76,000

Meeta’s Share = Rs. 2,40,000 × 4/15 = Rs. 64,000

3.) Total Capital new firm = Rs. 35,00,000

Saman’s Capital = Rs. 35,00,000 × 3/5 = Rs. 21,00,000

Meeta’s Capital = Rs. 35,00,000 × 2/5 = Rs. 14,00,000

Question 43.

Solution 43.

Total Capital of Ajay and Sanjay = Rs. 2,00,000 + Rs. 1,00,000 = Rs. 3,00,000

Profit Sharing Ratio = 5:3

Ajay’s Capital = Rs. 3,00,000 × 5/8 = Rs. 1,87,500

Cash withdrawn by Ajay = Rs. 2,00,000 – Rs. 1,87,500 = Rs. 12,500

Sanjay’s Capital = Rs. 3,00,000 × 3/8 = Rs. 1,12,500

Cash bought by Sanjay = Rs. 1,12,500 – Rs. 1,00,000 = Rs. 12,500

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 44.

Solution 44.

After X’s retirement, the new ratio of Y and Z is 2:1.

Y’s Capital in the new firm should be = Rs. 2,10,000 × 2/3= Rs. 1,40,000

Cash withdrawn by Y = Y’s New Capital – Y’s existing Capital

Cash withdrawn by Y = Rs. 1,40,000 – Rs. 1,45,000

Cash withdrawn by Y = Rs. 5,000

Z’s Capital in the new firm should be = Rs. 2,10,000 × 1/3 = Rs. 70,000

Cash withdrawn by Y = Y’s New Capital – Y’s existing Capital

Cash withdrawn by Y = Rs. 70,000 – Rs. 63,000

Cash withdrawn by Y = Rs. 7,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 45.

Solution 45.

Working Note:-

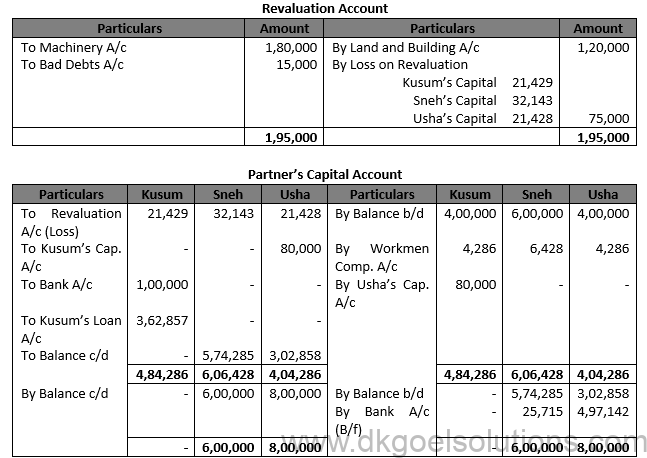

Computation of Gaining Ratio:-

Sneh’s Gain = 3/7-3/7=0

Usha’s Gain = 4/7-2/7=(4-2)/17=2/7

Total Capital of Ajay and Sanjay = Rs. 2,00,000 + Rs. 6,00,000 + Rs. 3,00,000 = Rs. 14,00,000

Profit Sharing Ratio = 5:4

Sneh’s Capital = Rs. 14,00,000 × 3/7 = Rs. 6,00,000

Ush’s Capital = Rs. 144,00,000 × 4/7 = Rs. 8,00,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 46.

Solution 46.

Working Note:-

C’s Share of Goodwill = Rs. 80,000 × 3/10 = Rs. 24,000

Old Ratio A, B and C = 4:3:3

New Ratio of A and B = 6:4

Computation of Gaining ratio:-

A’s Gain = 6/10-4/10=2/10

B’s Gain = 4/10-3/10=1/10

Gaining Ratio = 2:1

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

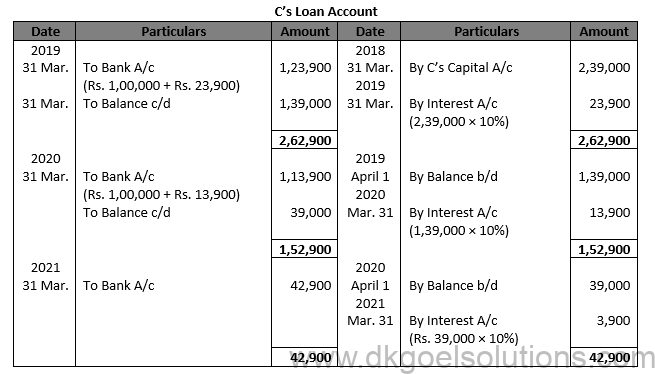

Question 47.

Solution 47.

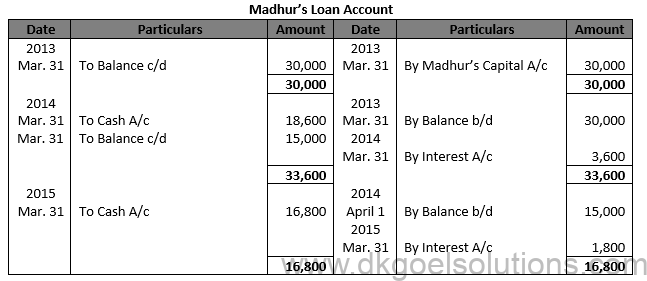

Working Note:-

Computation of Gaining Ratio:-

Madhur’s Share of Goodwill = Rs. 51,000 × 3/10 = Rs. 15,300

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 48.

Solution 48

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 49.

Solution 49.

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 50 A (new).

Solution 50 A (new).

Working Note:-

G’s share in Goodwill = Rs. 15,000 × 3/6 = Rs. 7,500

Question 50. (A)

Solution 50

(A)

Question 50.

(B)

Solution 50 (B)

Working Note:-

1.) Computation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

P’s Gaining Ratio = 3/5-5/10=(6 – 5)/10=1/10

R’s Gaining Ratio = 2/5-2/10=(4-2)/10=2/10

Gaining Ratio = 1 : 2

2.) Total Capital of the New Firm = Rs. 21,600 + Rs. 17,800 + Rs. 5,600 = Rs. 45,000

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 51.

Solution 51.

(i)

(ii)

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 52.

Solution 52.

Working Note:-

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 53.

Solution 53.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

Question 54.

Solution 54.

Working Note:-

Computation of New Capital:

New Profit = A’s Capital Account + C’s Capital Account – Amount payable to B

Total Capital = Rs. 1,90,000 + Rs. 80,000 – 1,50,000

Total Capital = Rs. 4,20,000

A’s New Ratio = Rs. 4,20,000 × 5/7 = Rs. 3,00,000

C’s New Ratio = Rs. 4,20,000 × 2/7 = Rs. 12,00,000

| A (Rs.) | B (Rs.) | |

| Capital required | 3,00,000 | 1,20,000 |

| Less: – Existing Capital | 1,90,000 | 80,000 |

| Rs. 110,000 | Rs. 40,000 |

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 55.

Solution 55.

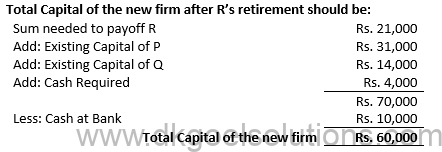

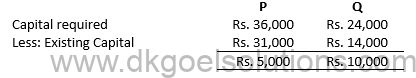

Working Note:-

P’s New Capital = Rs. 6,00,000 × 3/5 = Rs. 36,000

Q’s New Capital = Rs. 6,00,000 × 2/5 = Rs. 24,000

Amount to be brought in P and Q:

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 56.

Solution 56.

Working Note:-

Gaining Ratio =New Ratio – Old Ratio

A’s Gain = 1/2-1/3=(3-2)/6=1/2

B’s Gain = 1/2-1/3=(3-2)/6=1/6

B’s Share of Goodwill = Rs. 57,600 × 1/3 = Rs. 19,200

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 57.

Solution 57.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

Question 58.

Solution 58.

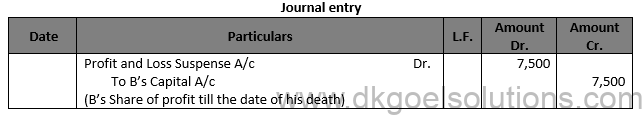

Average Profit = (Rs.40,000 + 50,000 +72,000 )/3 = Rs. 54,000

Five month’s profit, i.e, from 1st April, 2018 to 31st August, 2018= Rs. 54,000 X 5/12 = Rs. 22,500

Share of B till his death = Rs. 22,500 X 1/3 = Rs. 7,500.

(i) when there is no change in the profit sharing ratio of A and C;

(ii) When there is change in the profit sharing ratio of A and C and the new ratio is 7 : 5.

A Gains: 7/12- 1/3 = (7-4)/12 =3/12

C Gains: 5/12 – 1/3 = (5-4 )/12 = 1/12

Hence, Gaining Ratio of A and C = 3:1

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 59.

Solution 59.

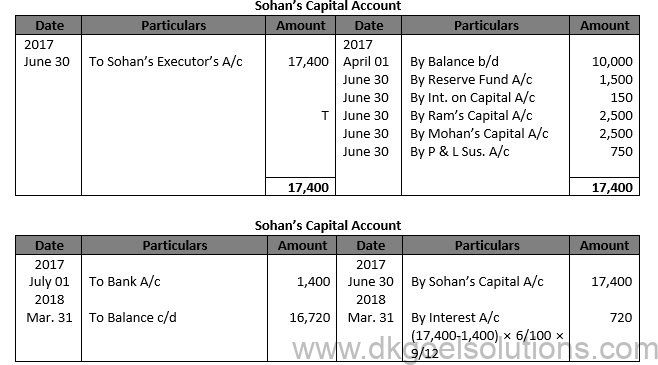

Working Notes:

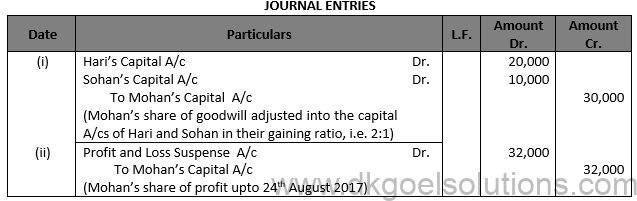

(i) Mohan’s share of goodwill = Rs. 75,000 X2/5 = Rs. 30,000. It will be debited to the Capital Accounts of hari and Sohan in their gaining ratio, i.e., 2:1.

(ii) Number of days from March 31 to August 24 = 146

Mohan’s share of profit = 2,00,000 X 146/(365 ) X 2/5 = Rs. 32,000.

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 60.

Solution 60. Profit from 1st April 2019 to 31st December, 2019 on the basis of sales If sales are Rs. 4,00,000, profit is Rs. 60,000

If sales are Rs. 3,30,000 profit will be 60,000/(4,00,000 ) × 3,30,000= Rs. 49,500

A’s share will be = Rs. 49,500 × 4/(9 ) = Rs. 22,000

Question 61.

Solution 61.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

Question 62 (new).

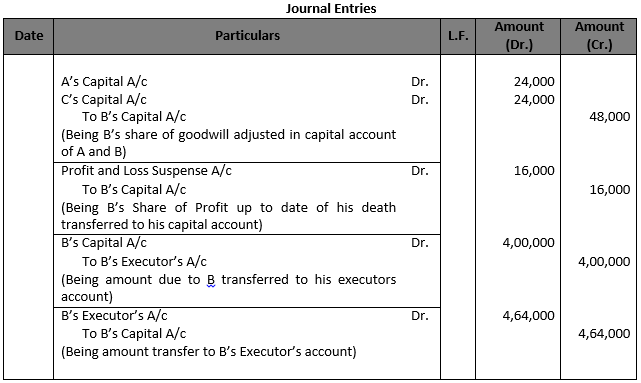

Solution 62 (new).

Working Note:-

Calculation of Goodwill:-

Total goodwill of firm = Rs. 80,000 × 1.5 year

Total goodwill of firm = Rs. 1,20,000

B’s share in goodwill = Rs. 1,20,000 × 2/5 = 48,000

Calculation of Profit:-

Profit of the firm = Rs. 80,000

B’s Profit = Rs. 80,000 × 2/5 × 6/12 = Rs. 16,000

Question 62.

Solution 62.

Working Note:

1.Computation of Goodwill:

Goodwill = 2 year’s purchase of average profit of the last three years

Goodwill = 2 X Rs. 80,000

Goodwill = Rs. 1,60,000

Sindhu’s Share of Goodwill = Rs. 1,60,000 × 3/10 = Rs. 48,000

Gaining ratio = 3 : 4

Rahul’s Contribution = Rs. 48,000 × 3/7 = Rs. 20,571

Kamlesh’s Contribution = Rs. 48,000 × 4/7 = Rs. 27,429

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 63 (new).

Solution 63 (new).

Working Note:

1.Calculation of Goodwill:

Goodwill = 2 year’s purchase of average profit of the last three years

Goodwill = 2 × Rs. 80,000

Goodwill = Rs. 1,60,000

Sindhu’s Share of Goodwill = Rs. 1,60,000 × 3/10 = Rs. 48,000

Gaining ratio = 3 : 4

Rahul’s Contribution = Rs. 48,000 × 3/7 = Rs. 20,571

Kamlesh’s Contribution = Rs. 48,000 × 4/7 = Rs. 27,429

Question 63.

Solution 63.

Working Note:-

(i) Computation of Gaining Ratio:-

B’s Share = 7/10-3/10=4/10

C’s Share = 3/10-2/10=1/10

Gaining Ratio = 4:1

(ii) Valuation of Goodwill:-

Total Profit = Rs. 8,000 + Rs. 12,000 + Rs. 7,000

Total Profit = Rs. 27,000

Average Profit = (Total Profit )/(Number of years)

Average Profit = (Rs. 27,000 )/3

Average Profit = Rs. 9,000

Goodwill at 4 year purchases = Rs. 9,000 × 4 = Rs. 36,000

A’s Goodwill = Rs. 36,000 × 5/10 = Rs. 18,000

(iii) Share of profit payable to A = Rs. 7,000 × 6/12 × 5/10 = Rs. 1,750

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

Question 64.

Solution 64.

Working Note:-

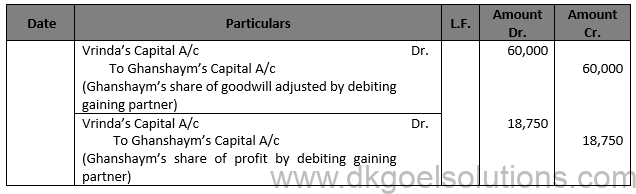

(i) Computation of gaining Ratio:-

Gaining Ratio = New Share – Old Share

Ram’s Share = 1/2-4/8=Nil

Vrinda’s Share = 1/2-1/8=(4-1)/8=3/8

Vrinda is the only gaining partner.

(2) Computation of Gaining ratio:-

Total Profit of last 4 year = Rs. 1,20,000 + Rs. 80,000 + Rs. 40,000 + Rs. 80,000 = Rs. 3,20,000

Firms Goodwill = Rs. 3,20,000 × 3/8 = Rs. 1,20,000

Ghanshaym’s Goodwill = Rs. 1,20,000 × 1/2 = Rs. 60,000

(3) Ghanshaym’s share of profit:-

Average profit of past two years = (Rs.40,000+Rs.80,000)/2 = Rs. 60,000

Profit for 10 months (from 1st April, 2014 to 1st February 2015)

= Rs. 60,000 × 10/12 = Rs. 50,000

Ghnashaym’s Profit = Rs. 50,000 × 3/8 = Rs. 18,750

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 65.

Solution 65.

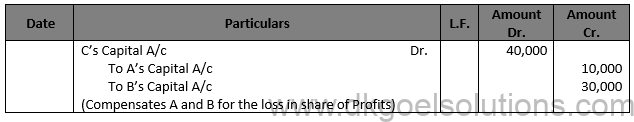

Working Note:-

Computation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

A’s Share = 1/3-4/9=(3-4)/9=1/9 (Sacrifice)

B’s Share = 2/3-2/9=(6-2)/9 = 4/9 (Gain)

Total Goodwill of the Firm = Rs. 30,000 × 3/1 = Rs. 90,000

A’s share = Rs. 90,000 × 1/9 = Rs. 10,000

C’s share = Rs. 90,000 × 4/9 = Rs. 40,000

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 66 (new).

Solution 66 (new).

Question 66.

Solution 66.

Working Note:-

Computation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

A’s Share = 1/3-5/12=(4-3)/12=1/12(Sacrifice)

B’s Share = 0-3/12=3/12 (Sacrifice)

C’s Share = 1/3-2/12=(4-2)/12=2/12 (Gain)

D’s Share = 1/3-2/12=(4-2)/12=2/12 (Gain)

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

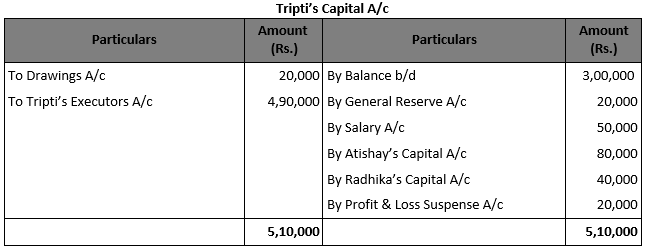

Question 67 A (new).

Solution 67 A (new).

Working Notes:-

(1) Calculation of Goodwill:-

Average Profit = (1,00,000 + 1,50,000 + 2,00,000)/3

Average Profit = Rs. 1,50,000

Goodwill of the firm = Average Profits of the last three years × Number of Years’ Purchase

Goodwill of the firm = Rs. 1,50,000 × 2

Goodwill of the firm = Rs. 3,00,000

Tripti’s share of goodwill = Rs. 3,00,000 × 2/5

Tripti’s share of goodwill = Rs. 1,20,000

(2) Calculation of Tripti’s Share of Profit

Last Year’s profit = Rs. 2,00,000

Profit till the date of death = Rs. 2,00,000 × 3/12 = Rs. 50,000

Tripti’s Share of Profits = Rs. 50,000 × 2/5 = Rs. 20,000

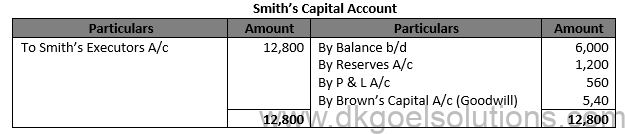

Question 67(A).

Solution 67 (A).

Working Note:-

Profit Sharing Ratio of Brown and Smith = 1/2:1/3

Profit Sharing Ratio of Brown and Smith =3 : 2

(ii) Share in Profit:-

Average Profit = (Total Profit )/(Number of years)

Average Profit = (Rs. 4,200 +Rs. 3,900 + Rs. 4,500 )/3

Average Profit = Rs. 4,200

Share in Profit = Rs. 4,200 × 4/12 × 2/5 = Rs. 560

(iii) Share in Goodwill:-

Goodwill = Rs. 4,200 + Rs. 3,900 + Rs. 4,500 = Rs. 12,600

Share in goodwill = Rs. 12,600 × 2/5 = Rs. 5,040

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

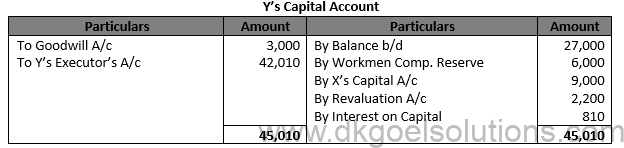

Question 67. (B)

Solution 67. (B)

Working Note:-

Share in Goodwill:-

Average Profit = (Total Profit )/(Number of years)

Average Profit = (Rs. 9,000 +Rs. 20,000 + Rs. 16,000 )/3

Average Profit = Rs. 15,000

Total Goodwill of the firm = Rs. 15,000 × 90/1000×2 = Rs. 27,000

Y’s Share = Rs. 27,000 ×1/3 = Rs. 9000

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 68.

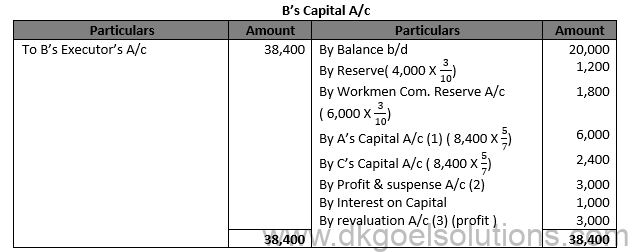

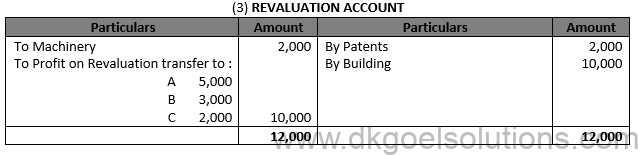

Solution 68

Working Note:

(1) Firm’s Goodwill = (10,0000 + 13,000 + 12,000 +15,000+20,000)/5 X 2

= 14,000 X 2 = Rs. 28,000

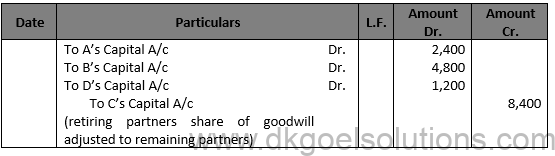

B’s share of Goodwill = Rs. 28,000 X 3/10 = Rs. 8,400 which is contributed by A and C in their gaining ratio i.e. 5:2.

(2) B’s Share of profit till the date of death = 20,000 X 6/12 X 3/10 = Rs. 3,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 69.

Solution 69

(i) Computation of Goodwill:-

Goodwill = (33,500 + 41,000 + 40,500 )/3 X 2 = Rs. 77,000

A’s share of Goodwill = Rs. 77,000 X 2/3 = Rs. 51,333

It will be credited to A and will be debited to B and C in their gaining ratio i.e., 1/6:1/6 or equally.

(ii) Share of profit:-

A ‘s share = 40,500 × 3/12 × 2/3 = Rs. 6,750.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 70.

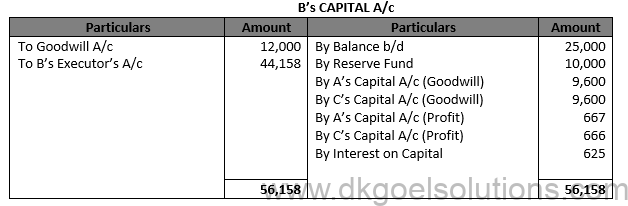

Solution 70.

Working Note:-

1.) Valuation of Goodwill

Total Profit = Rs. 15,000 + Rs. 17,000 + Rs. 19,000 + Rs. 13,000 = Rs. 64,000

Average Profit = 64,000/4

Average Profit = Rs. 16,000

Goodwill of Firm = 3 × Average Profit

Goodwill of Firm = 3 × Rs. 16,000

Goodwill of Firm = Rs. 48,000

B’s Share = Rs. 48,000 × 2/5 = Rs. 19,200

Profit and Loss = (Rs. 64,000)/4×2/5×2.5/12 = Rs. 1,333

Interest on Capital = Rs. 25,000 × 12/100×2.5/12 = Rs. 625

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 71.

Solution 71.

Working Note:-

1.) Total Profit for last three Years = Rs. 80,000 + Rs. 1,30,000 + Rs. 1,50,000 = Rs. 3,60,000

Average Profit = (Rs. 3,60,000)/3

Average Profit = Rs. 1,20,000

Profit from 1st April to 31st July, 2018 = Rs. 1,20,000 × 4/12 = Rs. 40,000

Y’s Share of Profit = Rs. 40,000 × 2/6 = Rs. 13,333

Less = 10% of Rs. 13,333 = 1,333

Y’s Share of Profit = 13,333 – Rs. 1,333

Y’s Share of Profit = Rs. 12,000

(2) Y’s Share of Goodwill:-

Total Profits of last three year = Rs. 3,60,000

Y’s Share in Profit = Rs. 3,60,000 × 2/6

Y’s Share in Profit = Rs. 1,20,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 72.

Solution 72.

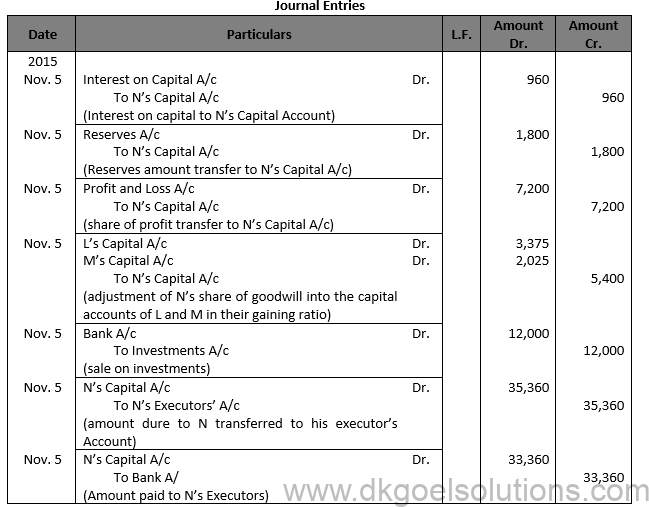

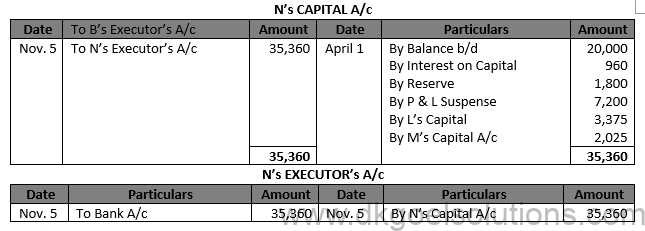

Working Note:

(1) Computation of Interest on Capital :

Number of days from April 1,2025 to November 5,2015 = 2019

Interest on Capital = 20,000 X 219/365 X 8/100 = Rs. 960

(2) Computation of Goodwill:

Average Profit = (10,500 + 12,000 + 12,500 +13,000)/4 = 12,000

Less: 25% of 12,000 = 3,000

Goodwill = 9,000 X 3 = Rs. 27,000

N’s share of Goodwill = 27,000 X 2/(10 ) =Rs. 5,400

It will be credited to the Capital Account of N and will be debited to the Capital Account of L and M in their gaining ratio i.e., 5:3.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 73 (new).

Solution 73 (new).

Working Notes:

(1) Valuation of Firm’s Goodwill:

Average Profit = (Rs. 2,20,000 + Rs. 1,10,000 + Rs. 80,000 – Rs. 1,60,000 )/5 = Rs. 66,000

Values of Firm’s Goodwill = Average Profit X Number Of Years’ Purchase

Firm’s Goodwill = Rs. 66,000 × 3 = Rs. 1,98,000

R’s Share of Goodwill = Rs. 1,98,000 × 9/(20 ) = Rs. 89,100

(2) R’s Share of Profit/ Loss till the date of his death:

R’s Share of Profit /Loss will be Calculated on the basis of the profit or loss for the year ending 31-3-2016. In this year firm incurred a loss of Rs. 1,60,000

Hence, R’s Share of Loss = Rs. 1,60,000 × 1/12 × 9/(20 ) = Rs. 6,000

Question 73.

Solution 73.

Working Notes:

(1) Valuation of Firm’s Goodwill:

Average Profit = (Rs. 2,20,000 + Rs. 1,10,000 + Rs. 80,000 – Rs. 1,60,000 )/5 = Rs. 66,000

Values of Firm’s Goodwill = Average Profit X Number Of Years’ Purchase

Firm’s Goodwill = Rs. 66,000 × 3 = Rs. 1,98,000

R’s Share of Goodwill = Rs. 1,98,000 × 9/(20 ) = Rs. 89,100

(2) R’s Share of Profit/ Loss till the date of his death:

R’s share of benefit / loss will be determined for the year ending 31-3-2016 on the basis of profit or loss. A loss of Rs. 1,60,000 was suffered by the company this year.

Hence, R’s Share of Loss = Rs. 1,60,000 × 1/12 × 9/(20 ) = Rs. 6,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 74.

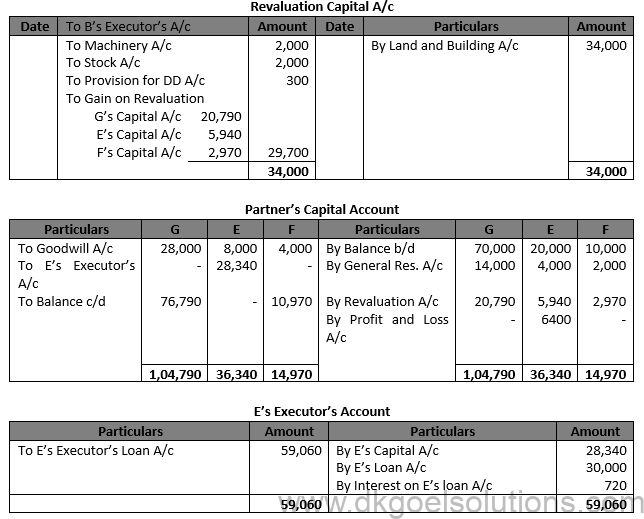

Solution 74

Working Note:-

1.) Computation of E’s Share in profit for 146 days:-

= Rs. 80,000 × 2/10×146/365 = Rs. 6,400

2.) Interest o E’s Loan = Rs. 30,000 × 6/10×146/365 = Rs. 720

3.) Computation of adjusted Capitals of G and F:

G’s Capital + F’s Capital = Rs. 76,790 + Rs. 10,970 = Rs. 87,760

New Profit sharing ratio of G and F = 7:1

G’s Capital = Rs. 87,760 × 7/8 = Rs. 76,790

F’s Capital = Rs. 87,760 × 1/8 = Rs. 10,970

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

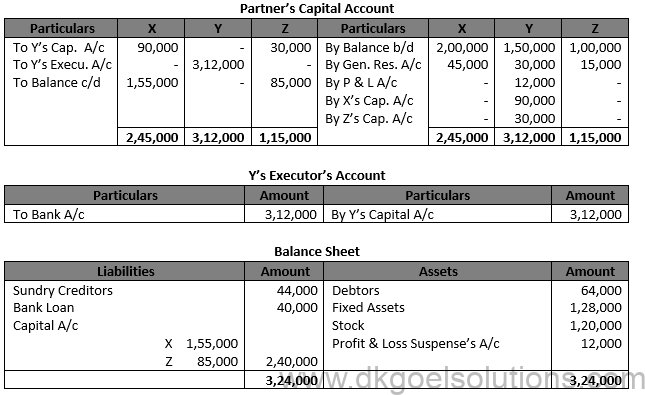

Question 75.

Solution 75.

Question 76.

Solution 76.

Old Ratio of A, B, C and D = 4 :3 :2 : 1.

When A and C retire, the new ratio between B and D 3 : 1.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 77.

Solution 77.

Old Ratio of A, B and C = 1/2:3/8:1/8

It can be written as = (4∶ 3 ∶ 1)/8

So, when C retires, the new ratio between A and B will be 4 : 3.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 78.

Solution 78.

B’s share will be divided between A and C in the ratio of 1 : 1

A’s Gain 1/2 of 4/15 = 2/15

A’s New Share = 8/15+2/15=(8+2)/15=10/15

C’s Gain 1/2 of 4/15 = 2/15

C’s New Share = 3/15+2/15=(3+2)/15=5/15

New Ratio of A and C = 10/15 ∶ 5/15

New Ratio of A and C = 2 : 1.

Point for Students:-

The products that are attributed to a deceased partner’s account when determining the balance owed to his legal representatives:-

1.) His share of the increase in the appreciation of the company’s goodwill.

2.) The sum that is attributable to his capital account credit.

3.) If given in the partnership deed, interest on money.

4.) His share of gains on asset and obligation revaluation.

5.) His share of the benefit or reserves that are undistributed.

Question 79.

Solution 79.

Old Ratio of Shiv, Mohan and Hari = 5 : 5 : 4

Mohan’s share will be divided between Shiv and Hari in the ratio of 1 : 1

Shiv’s Gain 1/2 of 5/14 = 28/28

Shiv’s New Share = 5/14+5/28=(10+5)/28=15/28

Hari’s Gain 1/2 of 5/14 = 5/28

Hari’s New Share = 4/14+5/28=(8+5)/28=13/28

New Ratio of A and C = 15/28 ∶ 13/28

New Ratio of A and C = 15 : 13.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 80.

Solution 80.

Old Ratio of A, B and C = 1/5 : 1/3 7/15

Mohan’s share will be divided between A and B in the ratio of 3 : 2

A’s Gain 3/5 of 7/15 = 21/75

A’s New Share = 1/5+21/75=(15+21)/75=36/75

B’s Gain 2/5 of 7/15 = 14/75

B’s New Share = 1/3+14/75=(25+14)/75=39/75

New Ratio of A and B = 36/75 ∶ 39/75

New Ratio of A and B = 36 : 39 = 12 : 13

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 81.

Solution 81.

Old Ratio of X, Y and Z = 4/9 ∶3/9 ∶2/9

X’s share will be divided between Y and Z in the ratio 2:1

Y will gain 2/3 of 4/9 = 8/27

Y’s New Share = 3/9+8/27=(9 + 8)/27=17/27

Z will gain 1/3 of 4/9 = 4/27

Z’s New Share = 2/9+4/27=(6 + 4)/27=10/27

New ratio between Y and Z = 17/27:10/27

New ratio between Y and Z = 17 : 10.

Question 82.

Solution 82.

Old Ratio of A, B and C = 4 : 3 : 2 = 4/9 ∶3/9 ∶2/9

(i) When B’s share is taken up by A and C in the ratio of 2:1

A will gain 2/3 of 3/9 = 2/27

A’s New Share = 4/9+2/9=(4 + 2)/9=6/9

C will gain 1/3 of 3/9 = 1/9

C’s New Share = 2/9+1/9=(2 + 1)/9=3/9

New ratio between Y and Z = 6/9:3/9

New ratio between Y and Z = 2 : 1.

(ii) When B’s share is taken up by A and C equally.

A will gain 1/2 of 3/9 = 1/6

New Share of A = 4/9+1/6=(8 + 3)/18=11/18

C will gain 1/2 of 3/9 = 1/6

New Share of C = 2/9+1/6=(4 + 3)/18=7/18

New ratio between A and C = 11/18:7/18

New ratio between Y and Z = 11 : 7.

(iii) When B’s share is taken up by A alone:-

New Share of A = 4/9+3/6=(4 + 3)/9=7/9

New Share of C = 2/9

New ratio between A and C = 7/9:2/9

Hence, the new ratio between Y and Z = 7 : 2.

Point for Students:-

The retiring or decreased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profits will be accruing because of the present goodwill and the retiring of deceased partner will not be sharing future profits, it will be fair to compensate the retiring or decreased partner for the same.

Question 83.

Solution 83.

Ratio of H, P and S is 4 : 3 : 3.

H’s Gain = 3/10×20/100=3/50

H’s new share = 4/10+3/50= (20 + 3)/50=23/50

S’s Gain = 3/10×80/100=12/50

S’s new share = 3/10+12/50= (15 + 12)/50=27/50

New Profit sharing Ratio of H and S is 23:27

Question 84.

Solution 84.

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of Mangli = 3/8-3/9=(45 – 24)/72=21/72

Gaining Ratio of Sanvali = 3/8-2/9=(27 – 16)/72=11/72

Hence, the gaining ratio between of Mangli and Sanvali 21 : 11.

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 85.

Solution 85.

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of A = 7/12-1/3

Gaining Ratio of A =(7 – 4)/12

Gaining Ratio of A =3/12

Gaining Ratio of C = 5/12-1/3

Gaining Ratio of C =(5 – 4)/12

Gaining Ratio of C =1/12

Gaining Ratio between A and C is 3 : 1.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 86.

Solution 86

Old Ratio of A, B and C is 1,00,000 : 75,000 : 50,000 or 4 : 3 : 2 or 4/9:3/9:2/9

C’s share will be split in a 2:1 ratio between A and B.

A will gain 2/3 of 2/9 = 4/27

New Share of A = 4/9+4/27=(12 + 4)/27=16/27

B will gain 1/3 of 2/9 = 2/27

New Share of B = 3/9+2/27=(9 + 2)/27=11/27

New ratio between A and B = 16/27:11/27

New ratio between A and B = 16 : 11

Hence, the gaining ratio = 2:1

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 87.

Solution 87.

Old Ratio of A, B and C = 1/3:1/3:1/3

C’s share will be split in a 2:1 ratio between A and B.

Gaining ratio of A 3/5 of 1/3 = 3/15

New Share of A = 1/3+3/15=(5 + 3)/15=8/15

Gaining ratio of B 2/5 of 1/3 = 2/15

New Share of B = 1/3+2/15=(5 + 2)/15=7/15

New ratio between A and B = 8/15:7/15

New ratio between A and B = 8 : 7

Gaining Ratio = 3:2

Point for Students:-

It is calculated when a partner retires or dies. When a partner retires or dies, his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increase is called the gaining ratio. Gaining Ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

Question 88.

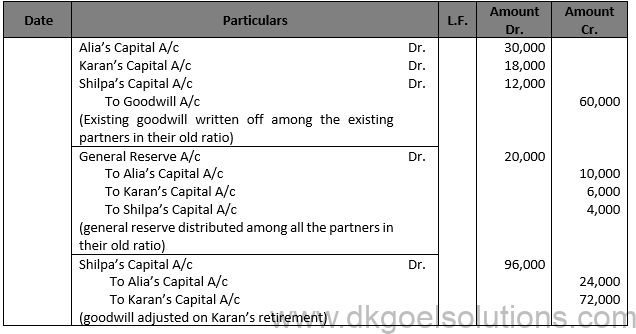

Solution 88.

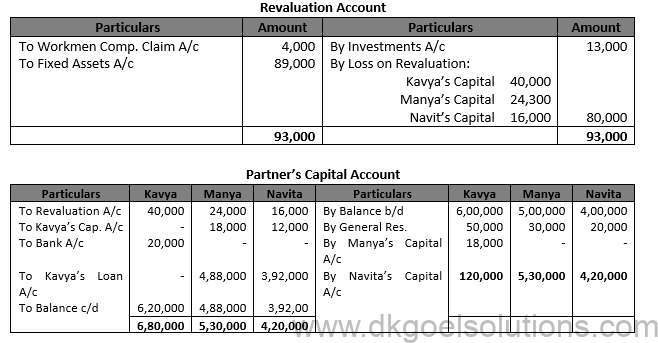

Working Note:-

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of Alia’s = 2/5-5/10=(4 – 5)/10=-1/10 (sacrifice)

Gaining Ratio of Shilpa’s = 3/5-2/10=(6 – 2)/10=4/10 (Gain)

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 89.

Solution 89.

Working Note:-

Computation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of M = 1/2-3/6=(3 – 3)/6=0

Gaining Ratio of O = 1/2-1/6=(3 – 1)/6=2/6 (Gain)

Points for Students:-

If the death of a partner occurs on any day during the year, the executors of the deceased partner will also be entitled to the share of profits earned by the firm from the beginning of the year till the date of his death. Such profit may be ascertained from any of the following methods:

(A) On time Basis

(B) On Turnover or Sales Basis.

Question 90.

Solution 90.

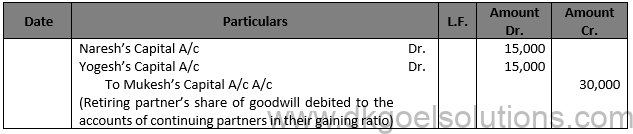

Working Note:-

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of Ravi = 1/3-2/6=(2 – 2)/6=0

Gaining Ratio of Naresh = 1/3-1/6=(2 – 1)/6=1/6 (Gain)

Gaining Ratio Yogesh = 1/3-1/6=(2 – 1)/6=1/6 (Gain)

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 91.

Solution 91.

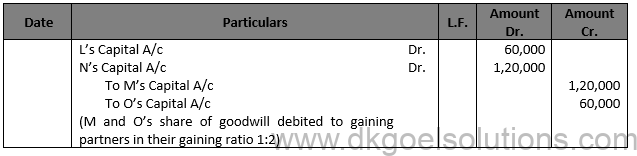

Working Note:-

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio — Old Ratio

Gaining Ratio of L = 2/6-1/2=(2 – 3)/6=1/6 (Gain)

Gaining Ratio of N = 1/6-1/2=(1 – 3)/6=2/6 (Gain)

M’s Share of Goodwill = Rs. 3,60,000 × 2/6 = 1,20,000

O’s Share of Goodwill = Rs. 3,60,000 × 1/6 = 60,000

Points for Students:-

If the death of a partner occurs on any day during the year, the executors of the deceased partner will also be entitled to the share of profits earned by the firm from the beginning of the year till the date of his death. Such profit may be ascertained from any of the following methods:

(A) On time Basis

(B) On Turnover or Sales Basis.

Question 92.

Solution 92.

(a) A’s Share is taken up by B and C equally.

B’s Gain = 1/2×5/10=5/20

B’s new share = 3/10+5/20= (6 + 5)/20=11/20

C’s Gain = 1/2×5/10=5/20

C’s new share = 2/10+5/20= (4 + 5)/20=9/20

New Profit sharing Ratio of B and C is 11/20:9/20 or 11 : 9

Gaining ratio = 1:1.

(b) A’s share of Goodwill = Rs. 2,00,000 × 5/10= Rs. 1,00,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 93.

Solution 93.

Working Note:-

Gaining Ratio of O = 2/3-2/6=2/6

Sacrifices Ratio of M = 1/3-3/6=1/6

O gains 2/6, including 1/6 that M sacrificed in favour of O. As a result, O must reimburse M for such a sacrifice.

Points for Students:-

If the death of a partner occurs on any day during the year, the executors of the deceased partner will also be entitled to the share of profits earned by the firm from the beginning of the year till the date of his death. Such profit may be ascertained from any of the following methods:

(A) On time Basis

(B) On Turnover or Sales Basis.

Question 94.

Solution 94.

Working Note:-

X will get only 1/2 of his previous share.

X’s New share = 1/2 of 3/6=1/4

Remaining 1/4 will be divided between Y and Z equally.

Gaining Ratio of Y = 1/2 of 1/4=1/8

New share of Y = 2/6+1/8= (8 + 3)/24=11/24

Gaining Ratio of Z = 1/2 of 1/4=1/8

New share of Z = 1/6+1/8= (4 + 3)/24=7/24

New Share of X, Y and Z = 1/4:11/24:7/24

New Share of X, Y and Z = (6 ∶ 11 ∶ 7)/24

Hence, The New Share of X, Y and Z = 6 : 11 : 7.

Point for Students:-

The product of the contributions of all current collaborators in the past is goodwill received by the organization. A percentage of potential gains will accrue regardless of the current goodwill and future earnings will not be shared by the retired or deceased partner. The surviving partners should then reward the retired or deceased partner by entitling him or her to a share of the goodwill of the company.

Question 95.

Solution 95.

Points for Students:-

If the death of a partner occurs on any day during the year, the executors of the deceased partner will also be entitled to the share of profits earned by the firm from the beginning of the year till the date of his death. Such profit may be ascertained from any of the following methods:

(A) On time Basis

(B) On Turnover or Sales Basis.

Question 96.

Solution 96.

Working Note:-

Calculation of Valuation of Goodwill:

Valuation of Goodwill = Profit for 2013-14 + Profit for 2014-15 – Loss for 2015-16

Valuation of Goodwill = Rs. 1,00,000 + Rs. 1,30,000 – Rs. 20,000

Valuation of Goodwill = Rs. 2,10,000

Calculation of Average Profit:-

Average Profit = 2,10,000/3

Average Profit =Rs.70,000

2 year’s Purchase of goodwill = Rs. 70,000 × 2 = Rs. 1,40,000

Kanika’s share of goodwill = Rs. 1,40,000 × 2/4 = Rs. 70,000

Point for Students:-

The goodwill is not shown in the books of a firm. However, if at the time of retirement of death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partner’s capital accounts in their old profit sharing ratio and crediting the goodwill account.

Question 97 (new).

Solution 97 (new).

Question 97.

Solution 97.

Working Note:-

1.) Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of K = 2/3-5/10=(20 – 15)/30=5/30

Gaining Ratio of M = 1/3-2/10=(10 – 6)/30=4/30

Gaining Ratio = 5 : 4

2.) L’s Goodwill Contribution = Rs. 72,000 × 3/10 = Rs. 21,600

Points for Students:-

If the death of a partner occurs on any day during the year, the executors of the deceased partner will also be entitled to the share of profits earned by the firm from the beginning of the year till the date of his death. Such profit may be ascertained from any of the following methods:

(A) On time Basis

(B) On Turnover or Sales Basis.

Question 98.