DK Goel Solutions Chapter 1 Financial Statements of Companies

Read below DK Goel Solutions for Class 12 Chapter 1 Financial Statements of Companies. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

In this chapter, students will understand the different types of financial statements of a company. it is important for the students to get a detailed understanding of different types of statements that are prepared at the end of the accounting period based on which the overall financial position of a company is understood. these financial statements are being used by people who run the company as well as various other stakeholders. students should understand this chapter very carefully as this will help them in long run.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Financial Statements of Companies DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Question 1

Solution 1

Point for Students:-

As per Section 2(41) of the Companies Act, 2013, all companies are required to have a uniform financial year which shall be a period from 1st April to 31st March every year. Only companies which are a holding or subsidiary of a foreign company required to follow different financial year for the purpose of consolidation of its accounts outside India may apply to the Tribunal for a different financial year.

Question 2.

Solution 2

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 3.

Solution 3

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 4.

Solution 4

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 5.

Solution 5

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 6.

Solution 6

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 7

Solution 7

Point for Students:-

As per Section 2(41) of the Companies Act, 2013, all companies are required to have a uniform financial year which shall be a period from 1st April to 31st March every year. Only companies which are a holding or subsidiary of a foreign company required to follow different financial year for the purpose of consolidation of its accounts outside India may apply to the Tribunal for a different financial year.

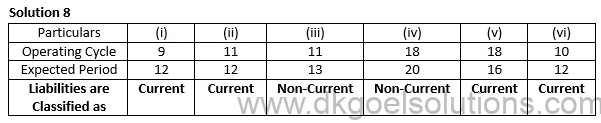

Question 8

Point of Student:-

As per Schedule-III: “An operating cycle is the time between the acquisition of assets for processing and their realization in cash or cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have duration of 12 months.”

Question 9

Solution 9

Point for Students:-

There is distinction between ‘Reserves’ and ‘Provision’. Reserves means accumulated profits and it is created to strengthen the financial position of the Company and to meet unforeseen liabilities and losses.

‘Provision’ is an amount provided for any known liability whose amount as yet is uncertain. Provision is made to meet a specific liability of which the amount cannot be determined with substantial accuracy. Provision is also made for known losses such as ‘Provision for Depreciation’.

Question 10

Solution 10 Both will be classified under ‘Shareholder’s Funds’.

Question 11 A (new)

Solution A 11 (new) (i) Outstanding Salary shows in Current Liabilities under Other Current Liabilities.

(ii) Bank Balance shows in Current Assets under Cash and Cash Equivalents.

(iii) Unpaid Matured Deposits shows in Current Liabilities under Other Current Liabilities.

(iv) Preliminary Expenses not shown in balance sheet.

(v) Bills Payable shows in Current Liabilities under Trade Payables.

Question 11 B (new)

Solution 11 i) Patents and Trade Marks shows in Non-current assets under fixed assets (intangible assets).

(ii) Income Received in Advance shows in Current liabilities under Other current Liabilities.

(iii) Debentures issued by the Company shows in Non-Current Liabilities under Long-term Borrowing.

(iv) Stores and Spare-parts shows in Current Assets under Inventories.

(v) Motor Vehicles show in Non-Current Assets under Fixed Assets (Tangible Assets).

(vi) Forfeited Shares Account shows in Shareholder’s Fund added to Subscribed Capital.

(vii) Government Securities shows in Non-Current Assets under Non-Current Investments.

(viii) Uncalled Liabilities on Partly paid shares shows in Commitments in notes to accounts.

Question 11

Solution 11 The sub-headings under which Current Liabilities shall be classified in a Company’s Balance Sheet are:

i. Short term Borrowing

ii. Trade Payable

iii. Other Current Liability

iv. Short Term Provision

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 12 (new)

Solution 12 (new)

Question 12

Solution 12 (i) Items:- Unclaimed Dividend

Major-Heading:- Current liabilities

Sub-Heading:- Other Current Liabilities

(ii) Items:- Proposed dividend

Major-Heading:- Contingent Liabilities in notes to accounts

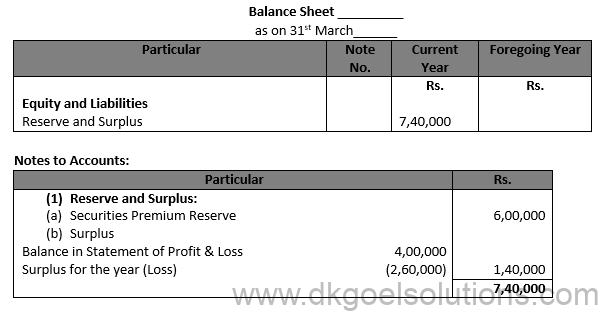

(iii) Items:- Security Premium Reserve

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserve and Surplus

(iv) Items:- Share forfeited Account

Major-Heading:- Shareholder’s Fund added to ’Subscribed Capital

(v) Items:- Public Deposits

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long -Term Liabilities

(vi) Items:- Debentures

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long Term provision

(vii) Items:- Bills discounted but not matured

Major-Heading:- Contingent Liabilities in notes to accounts

Question 13 (new)

Solution 13 (new)

Question 13

Solution 13 (i) Items:- Shares options outstanding Account

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserve and Surplus

(ii) Items:- Excess Application money due for refund

Major-Heading:- Current liabilities

Sub-Heading:- Other Current Liabilities

(iii) Items:- GST payable

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

(iv) Items:- Debenture redemption

Major-Heading:- Reserve Shareholder’s Fund

Sub-Heading:- Reserve and Surplus

(v) Items:- Premium Payable on Redemption of debentures

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Other Long -Term Liabilities

(vi) Items:- Provision for Gratuity

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long Term provision

(vii) Items:- Outstanding Expenses

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

Question 14 (new)

Solution 14 (new)

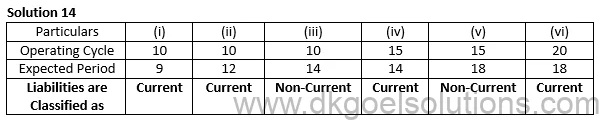

Question 14

Point of Student:-

As per Schedule-III: “An operating cycle is the time between the acquisition of assets for processing and their realization in cash or cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have duration of 12 months.”

Question 15 (new)

Solution 15 (new)

Question 15.

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 16 (new)

Solution 16 (new)

Question 16.

Solution 16. Sub-Headings Under Current Assets: Current Investment

Inventories

Trade receivables

Cash and cash equivalents

Short-term loans and advances

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 17 A (new)

Solution 17 A (new)

Question 17 B (new)

Solution 17 B (new)

Question 17.

Solution 17

Point for Students:-

As per Section 2(41) of the Companies Act, 2013, all companies are required to have a uniform financial year which shall be a period from 1st April to 31st March every year. Only companies which are a holding or subsidiary of a foreign company required to follow different financial year for the purpose of consolidation of its accounts outside India may apply to the Tribunal for a different financial year.

Question 18 (new)

Solution 18 (new)

Question 18

Solution 18

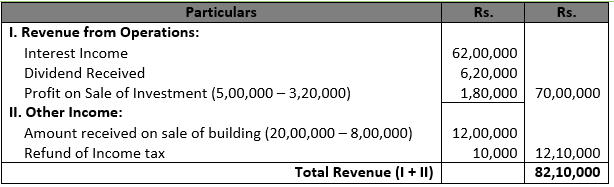

Revenue from Operations:

Sales

Revenue from services rendered

Other Income:

Interest on Loans given,

Divided income,

Sale of miscellaneous items

Refund of income tax.

Question 19 (new)

Solution 19 (new)

Question 19

Solution 19

i. Revenue from Operations:

ii Revenue from serviced rendered

iii. Interest on loan given

vi. Dividend income

Other Income:

Refund on income tax

Sale of miscellaneous items

Question 20 (new)

Solution 20 (new)

Question 20

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 20 (new)

Solution 21 (new)

Question 21

Solution 21

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 22 (new)

Solution 22 (new)

Question 22

Solution 22

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

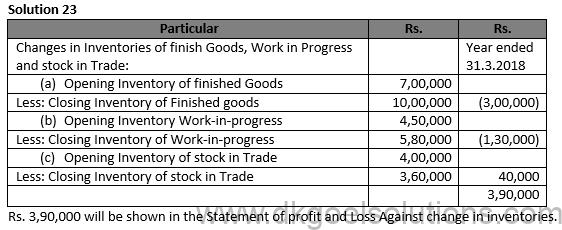

Question 23 (new)

Solution 23 (new)

Question 23

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes

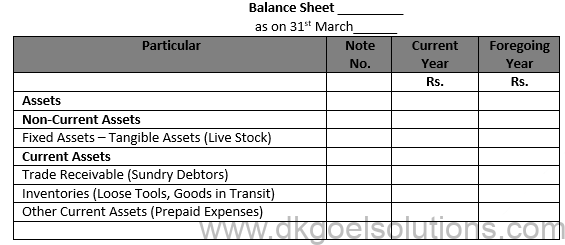

Question 24 (new) Show the following items in a company’s Balance Sheet as at 31st, March,2017:

Particular Rs.

i. Deferred Tax Assets 2,00,000

ii. Loose Tools 1,20,000

iii. Goods in Transit 5,00,000

iv. Prepaid Expenses 15,000

v. Interest Accrued on investments 10,000

Solution 24 (new)

Question 24

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 25 (new)

Solution 25 (new) Revenue from Operations: Sales and Revenue from services rendered

Other Income: Interest on Loans given, Divided income, Sale of miscellaneous items and Refund of income tax.

Question 25

Solution 25

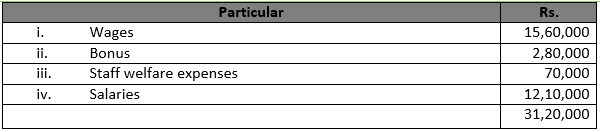

Employee Benefit Expenses:

i. Salaries

ii. Medical Expenses

iv. Gratuity paid

vi. Contribution on provident fund.

Point for Students:-

Financial statements are related to the past periods and hence are historical documents. They are expressed in terms of money. The financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

Question 26 (new)

Solution 26 (new) Revenue from Operations: Revenue from serviced rendered, Interest on loan given, and Dividend income

Other Income: Refund on income tax and Sale of miscellaneous items.

Question 26

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 27 (new)

Solution 27 (new)

Question 27

Solution 27

The following items shown in the Notes of Accounts on Finance Costs:

i. Interest paid in bank overdraft

ii. Interest paid on borrowings

iii. Deposit on issue of debentures written off

iv. Interest paid on term loan

Point for Students:-

Financial statements are related to the past periods and hence are historical documents. They are expressed in terms of money. The financial statement shows profitability through the Statement of Profit and Loss and financial position through the Balance Sheet.

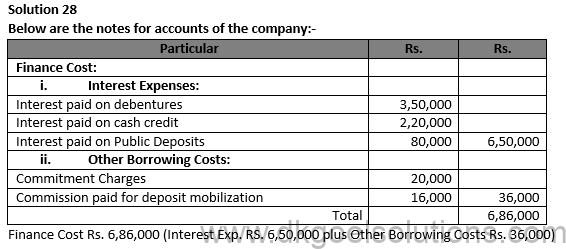

Question 28 (new)

Solution 28 (new)

Question 28

Point for Students:-

As per Section 2 (40) of the Companies Act, 2013, ‘Financial Statements’ in relation to a Company, include the following:

(i) A balance sheet as at the end of the financial year.

(ii) A statement of profit and loss for the financial year.

(iii) Cash flow statement for the financial year.

(iv) A statement of changes in equity, if applicable.

(v) Explanatory notes.

Question 29 (new)

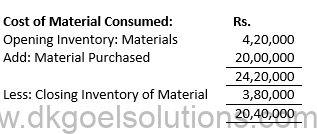

Solution 29 (new) Cost of Material Consumed: Rs.

Opening Inventory: Materials 4,20,000

Add: Material Purchased 20,00,000

24,20,000

Less: Closing Inventory of Material 3,80,000

20,40,000

Question 29

Solution 29 Below are the items will be shown in the notes of accounts on ‘other expense’:-

i. Consumptions of loose tools

iv. Courier expenses

v. Carriage outwards

vi. Discount allowed

vii. Bank Charges

viii. Rent for Warehouse

Question 30 (new)

Solution 30 (new)

Rs. 3,90,000 will be shown in the Statement of profit and Loss Against change in inventories.

Question 30

Solution 30 (i) Items:- Loss processing charges

Major-Heading:- Finance Costs

(ii) Items:- Sale of products

Major-Heading:-Revenue from Operations

(iii) Items:- Leave encashment expenses

Major-Heading:-Employee Benefit Expenses

(iv) Items:- Courier expenses

Major-Heading:-Other Expenses

(v) Items:- Computer software amortized

Major-Heading:-Depreciation and amortization exp.

(vi) Items:- Interest on cash credit

Major-Heading:-Finance costs

(vii) Items:- Materials purchased

Major-Heading:-Cost of Materials Consumed

Question 31 (new)

Solution 31 (new)

Question 31

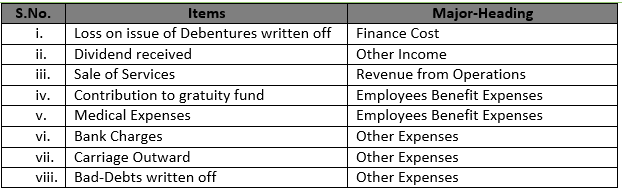

Solution 31 (i) Item:- Loss on issue of debentures written off

Major Head:- Finance Costs

(ii) Item:- Dividend received

Major Head:- Other Income

(iii) Item:- Sale of services

Major Head:- Revenue from Operations

(iv) Item:- Contribution of gratuity fund

Major Head:- Employee Benefit Expenses

(v) Item:- Medical expenses

Major Head:- Employee Benefit Expenses

(vi) Item:- Bank charges

Major Head:- Other Expenses

(vii) Item:- Carriage outwards

Major Head:- Other Expenses

(viii) Item:- Bad-Debts written off

Major Head:- Other Expenses

Question 32 (new)

Solution 32 (new) Employee Benefit Expenses:

i. Salaries

ii. Medical Expenses

iv. Gratuity paid

vi Contribution on provident fund.

Question 32

Solution 32 (i) Items:- Commission paid for deposit mobilization

Major-Heading:- Finance Costs

(ii) Items:- Dividend received

Major-Heading:- Revenue from Operations

(iii) Items:-Refund of income tax

Major-Heading:-Other Income

(iv) Items:-Lease rent

Major-Heading:-Other Expenses

(v) Items:-Gain on sale of investments

Major-Heading:-Revenue from Operations

(vi) Items:-Expenses on employee’s stock option scheme

Major-Heading:-Employee Benefit Expenses

(vii) Items:-Audit fee

Major-Heading:-Other Expenses

(viii) Items:-Premium payable on redemption of debentures written off

Major-Heading:-Finance Costs

Question 33 A (new)

Solution 33 A (new)

Question 33 (A)

Solution 33 (A)

1. Outstanding salary: Current Liabilities under other Current Liabilities

2. Bank balance: Current Assets under cash and cash Equivalents.

3. Unpaid matured deposits: Current Liabilities under Other Current Liabilities.

4. Preliminary expenses: Not Shown in Balance Sheet since they are written off in the same year.

5. Bills payable: Current Liabilities under Trade payables

6. Sale of services: Revenue from Operations.

7. Goodwill written off: Depreciation and Amortization Expenses.

8. Medical Expenses: Employee Benefit Expenses.

Point for Students:-

Financial statements are related to past period and hence are historical documents. They are expressed in terms of money. Financial statement shows profitability through Statement of Profit and Loss and financial position through Balance Sheet.

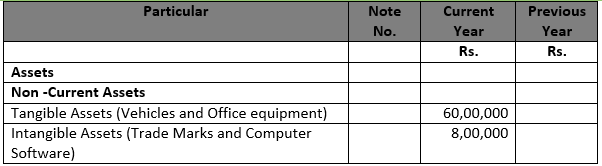

Question 33 (B)

Solution 33 (B) i. Patents and Trade Marks

Major- Heading: Non-Current Assets

Sub-Heading: Fixed Assets- Intangible Assets

ii. Income Received in Advance

Major- Heading: Current Liabilities

Sub-Heading: Other Current Liabilities

iii. Debentures issued in Advance

Major- Heading: Non-Current Liabilities

Sub-Heading: Long Term Borrowings

iv. Stores and Spare-parts

Major- Heading: Current Assets

Sub-Heading: Inventories

v. Motor vehicles

Major- Heading: Non-Current Assets

Sub-Heading: Fixed Assets- Tangible Assets

vi. Forfeited Shares Account

Major- Heading: Shareholder’s Funds; added to ‘Subscribed Capital’

vii. Government Securities

Major- Heading: Non-Current Assets

Sub-Heading: Non-Current Investments

viii. Uncalled Liabilities on Partly paid shares.

Major- Heading: Commitment (to be shown in Notes to Accounts)

Question 34 (new)

Solution 34 (new) Finance Cost:

i. Interest paid in bank overdraft

ii. Interest paid on borrowings

iii. Deposit on issue of debentures written off

iv. Interest paid on term loan

Question 34

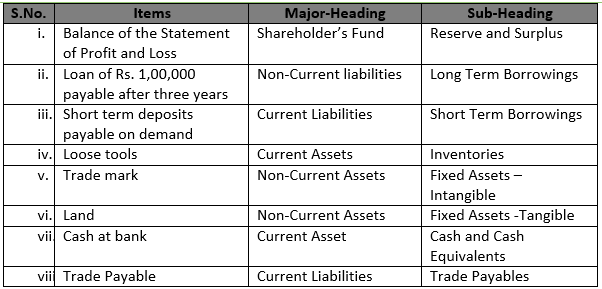

Solution 34 i) Balance of the Statement of Profit and Loss

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserve and Surplus

ii) Loan of Rs. 1,00,000 payable after three years

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserve and Surplus

iii) Short term deposits payable on demand

Major-Heading:- Current Liabilities

Sub-Heading:- Short Term Borrowings

iv) Loose tools

Major-Heading:- Current Assets

Sub-Heading:- Inventories

v) Trade mark

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets – Intangible

vi) Land

ajor-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets -Tangible

vii) Cash at bank

Major-Heading:- Current Asset

Sub-Heading:- Cash and Cash Equivalents

viii) Trade Payable

Major-Heading:- Current Liabilities

Sub-Heading:- Trade Payables

Question 35 (new)

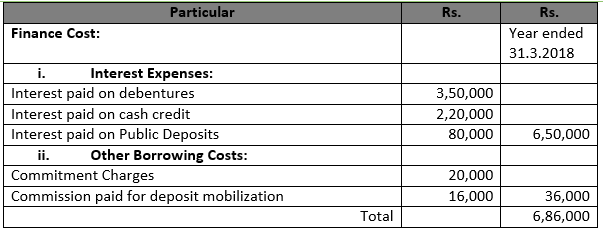

Solution 35

Finance Cost Rs. 6,86,000 (Interest Exp. RS. 6,50,000 plus Other Borrowing Costs Rs. 36,000)

Question 35

Solution 35 i) Public deposits

Major-Heading:- Non- Current Liabilities

Sub-Heading:- Long Term Borrowings

ii) Sinking fund

Major-Heading:- Shareholder Funds’

Sub-Heading:- Reserve and Surplus

iii) Office equipment

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

iv) Prepaid expenses

Major-Heading:- Current Assets

Sub-Heading:- Other Current Assets

v) Outstanding salaries

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

vi) Motor car

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

Question 36 (new)

Solution 36 (new) Other Expenses:

i. Consumptions of loose tools

iv. Courier expenses

v. Carriage outwards

vi. Discount allowed

vii. Bank Charges

viii. Rent for Warehouse

Question 36

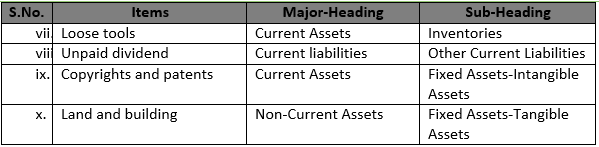

Solution 36 i) Loose tools

Major-Heading:- Current Assets

Sub-Heading:- Inventories

ii) Unpaid dividend

Major-Heading:- Current liabilities

Sub-Heading:- Other Current Liabilities

iii) Copyrights and patents

Major-Heading:-Current Assets

Sub-Heading:- Fixed Assets-Intangible Assets

iv) Land and building

Major-Heading:-Non-Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

Question 37 (new)

Solution 37 (new)

Question 37. Classify the following items under Major Head and Sub- Head in the Balance Sheet of a company as per schedule III part I of the companies Act, 2013/

i. Capital Work in Progress

ii. Provision for Warranties

iii. Income received in advance

iv. Capital Advances

v. Capital Reserve

vi. Bank Overdraft

Solution 37 i) Capital Work in Progress

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets

ii) Provision for Warranties

Major-Heading:- Non-Current liabilities

Sub-Heading:- Long Term Provision

iii) Income received in advance

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

iv) Capital Advances

Major-Heading:- Non-Current Assets

Sub-Heading:- Long Term Loan and Advances

v) Capital Reserve

Major-Heading:- Shareholder’s Find

Sub-Heading:- Reserve and Surplus

vi) Bank Overdraft

Major-Heading:- Current Liabilities

Sub-Heading:- Short Term Borrowings

Question 38 (new)

Solution 38 (new)

Question 38.

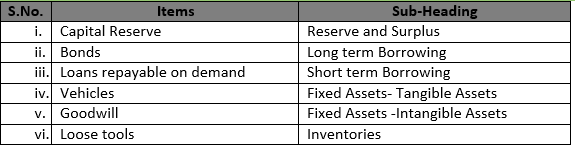

Solution 38 i) Capital Reserve

Sub-Heading:- Reserve and Surplus

ii) Bonds

Sub-Heading:- Long term Borrowing

iii) Loans repayable on demand

Sub-Heading:- Short term borrowing

iv) Vehicles

Sub-Heading:- Fixed Assets- Tangible Assets

v) Goodwill

Sub-Heading:- Fixed Assets -Intangible Assets

vi) Loose tools

Sub-Heading:- Inventories

Question 38 A (new)

Solution 39 A (new)

Question 39 (A)

Solution 39 (A) i) Computer Software

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Intangible Assets

ii) Bills Receivable

Major-Heading:- Current Assets

Sub-Heading:- Trade Receivables

iii) Interest Accrued and Due on Debentures

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

iv) Interest Accrued on Investments

Major-Heading:- Current Assets

Sub-Heading:- Other Current Assets

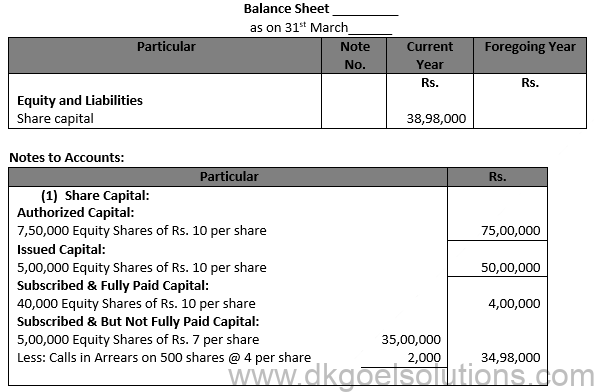

v) Calls in Arrears

Major-Heading:- Deducted from Subscribed but not fully paid Capital under the head ‘Shareholder’s Funds’

vi) Discount on Issue of Debentures written off

Major-Heading:- Financial Costs

vii) Fees received for arranging loans

Major-Heading:- Other Incomes

viii) Telephone and Internet Exp.

Major-Heading:- Other Expenses

Question 39 (B)

Solution 39 (B) (i) Authorized Capital

Heading:- Shareholder’s Fund under Share Capital to be shown only in the notes to Accounts

(ii) Share Forfeiture Account

Heading:- Shareholder’s Fund Added to ‘Subscribed Capital’

(iii) Capital Reserve

Heading:- Shareholder’s Fund under reserve and Surplus

(iv) Secured Debentures

Heading:- Non-Current Liabilities under Long Term Borrowing

(v) Provision for Tax

Heading:- Current Liabilities Under Short Term Provision

(vi) Trade Payable written back

Heading:- Other Income

(vii) Loan Processing Charges

Heading:- Finance Costs

Question 40 (new)

Solution 40 (new) These five items shown under Reserve and Surplus are:

i. Capital Reserves;

ii. Securities Premium Reserve;

iii. Debenture Redemption Reserve;

iv. Revaluation Reserve;

v. Capital Redemption Reserve

Question 40

Solution 40 i) Mining Rights

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Intangible Assets

ii) Debtors

Major-Heading:- Current Assets

Sub-Heading:- Trade Receivables

iii) Interest on Calls in Advance

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

iv) Working in progress

Major-Heading:- Current Assets

Sub-Heading:- Inventories

v) Mortgage Loan

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long-term Borrowings

vi) Bonds

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long term Borrowings

Question 41 (new)

Solution 41 (new)

Question 41

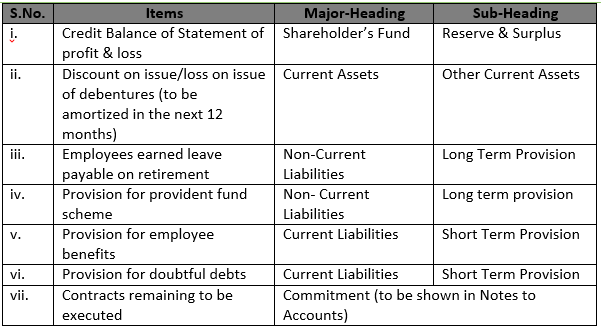

Solution 41 i) Credit Balance of Statement of profit & loss

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserve & Surplus

ii) Discount on issue/loss on issue of debentures (to be amortized in the next 12 months)

Major-Heading:- Current Assets

Sub-Heading:- Other Current Assets

iii) Employees earned leave payable on retirement

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long Term Provision

iv) Provision for provident fund scheme

Major-Heading:- Non- Current Liabilities

Sub-Heading:- Long term provision

v) Provision for employee benefits

Major-Heading:- Current Liabilities

Sub-Heading:- Short Term Provision

vi) Provision for doubtful debts

Major-Heading:- Current Liabilities

Sub-Heading:- Short Term Provision

vii) Contracts remaining to be executed

Major-Heading:- Commitment (it is shown in Notes to Accounts)

Question 42 (new)

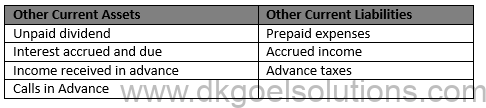

Solution 42 (new) Other Current Assets Other Current Liabilities

Unpaid dividend Prepaid expenses

Interest accrued and due Accrued income

Income received in advance Advance taxes

Calls in Advance

Question 42.

Solution 42 i) Stores and spares

Major-Heading:- Current Assets

Sub-Heading:- Inventories

ii) Debentures due for redemption

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

iii) Live stock

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

iv) Intellectual property rights

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Intangible Assets

v) Advance from customers

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

vi) Advance to suppliers

Major-Heading:- Current Assets

Sub-Heading:- Other Current Assets

vii) Commission received in Advance

Major-Heading:- Current Liabilities

Sub-Heading:- Other Current Liabilities

Question 43 (new)

Solution 43 (new)

Question 43

Solution 43

i) Plant and Machinery

Major-Heading:- Non-Current Assets

ii) Building

Major-Heading:- Non-Current Assets

iii) Equity Share Capital (Authorized)

Major-Heading:- Shareholder’s Fund

iv) Equity shares of Rs, 100 per share Rs. 70 called and paid up

Major-Heading:- Shareholder’s Fund

v) 10% Debentures

Major-Heading:- Non-Current Liabilities

vi) Furniture and Fixtures

Major-Heading:- Non-Current Assets

vii) Long term bank loan (secured)

Major-Heading:- Non-Current Liabilities

Question 44 (new)

Solution 44 (new) Rs. 45,00,000 as Long term Borrowings

Rs. 15,00,000 as Other Current Liabilities

Question 44

Solution 44 These five items shown under Reserve and Surplus are:

i. Capital Reserves;

ii. Capital Redemption Reserve

iii. Securities Premium Reserve;

iv. Debenture Redemption Reserve;

v. Revaluation Reserve;

Point for Students:-

Share Options Outstanding Account: It is a form of employee compensation wherein employees are offered an option to apply and get allotment of Company’s shares at a future date at a specified price which is usually sufficiently below the market price of the share.

Question 45 (new)

Solution 45 (new)

Question 45

Solution 45 i) Preliminary Expenses

Major-Heading:- Not shown in the Balance Sheet as these expenses are written off in the same year.

ii) Discount on Issue of Debentures

Major-Heading:- Current/Non-Current Assets

Sub-Heading:- Other Current/Non-Current Assets

iii) 10% debentures

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long Term Borrowing

iv) Stock -in -trade

Major-Heading:- Current Assets

Sub-Heading:- Inventories

v) Cash at Bank

Major-Heading:- Current Assets

Sub-Heading:- Cash and Cash Equivalents

vi) Bills Receivable

Major-Heading:- Current Assets

Sub-Heading:- Trade Receivables

vii) Goodwill

Major-Heading:- Non- Current Assets

Sub-Heading:- Fixed Assets-Intangible Assets

viii) Loose Tools

Major-Heading:- Current Assets

Sub-Heading:- Inventories

ix) Horses and Carts

Major-Heading:- Non- Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

x) Motor Truck

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets-Tangible Assets

xi) Provision for Taxation

Major-Heading:- Current Liabilities

Sub-Heading:- Short Term Provisions

xii) Sundry Creditors

Major-Heading:- Current Liabilities

Sub-Heading:- Trade Payables

Question 46

Point for Students:-

As per Section 2(41) of the Companies Act, 2013, all companies are required to have a uniform financial year which shall be a period from 1st April to 31st March every year. Only companies which are a holding or subsidiary of a foreign company required to follow different financial year for the purpose of consolidation of its accounts outside India may apply to the Tribunal for a different financial year.

Question 47

Point for Students:-

There is distinction between ‘Reserves’ and ‘Provision’. Reserves means accumulated profits and it is created to strengthen the financial position of the Company and to meet unforeseen liabilities and losses.

‘Provision’ is an amount provided for any known liability whose amount as yet is uncertain. Provision is made to meet a specific liability of which the amount cannot be determined with substantial accuracy. Provision is also made for known losses such as ‘Provision for Depreciation’.

Question 48 Show the following items in a company’s Balance Sheet as at 31st, March,2017:

Question 49

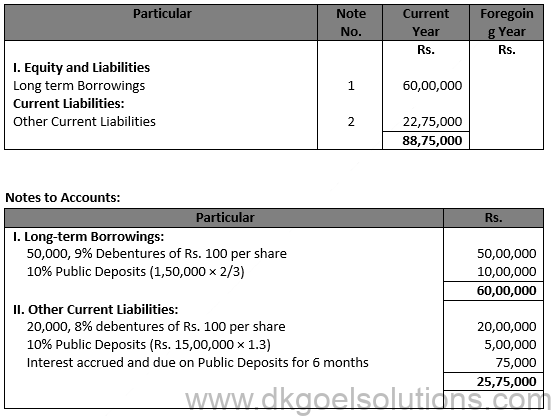

Solution 49 Long Term Borrowings RS. 60,00,000 Other Current liabilities Rs. 25,75,000.

Point for Students:-

There is distinction between ‘Reserves’ and ‘Provision’. Reserves means accumulated profits and it is created to strengthen the financial position of the Company and to meet unforeseen liabilities and losses.

‘Provision’ is an amount provided for any known liability whose amount as yet is uncertain. Provision is made to meet a specific liability of which the amount cannot be determined with substantial accuracy. Provision is also made for known losses such as ‘Provision for Depreciation’.

Question 50

Solution 50 i) Consumption of Loose Tools

Major-Heading:- Other Expenses

ii) Sale of Services

Major-Heading:- Revenue from Operations

iii) Trade Marks written off

Major-Heading:- Depreciation and Amortization Exp.

iv) Trade Payable written off

Major-Heading:- Other Income

v) Canteen Expenses

Major-Heading:- Employee Benefit Expenses

vi) Purchase of Stock in Trade

Major-Heading:- Purchase of stock in Trade

vii) Courier Charges

Major-Heading:- Other Expenses

viii) Revenue from Project Consultancy

Major-Heading:- Other Income

ix) Computer Hiring Charges

Major-Heading:- Other Expenses

x) Commitment Charges

Major-Heading:- Finance Cost

Question 51

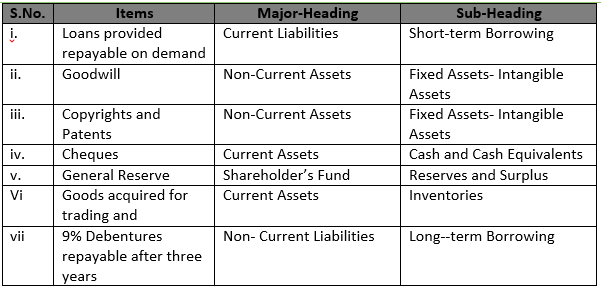

Solution 51 i) Loans provided repayable on demand

Major-Heading:- Current Liabilities

Sub-Heading:- Short-term Borrowing

ii) Goodwill

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets- Intangible Assets

iii) Copyrights and Patents

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets- Intangible Assets

iv) Cheques

Major-Heading:- Current Assets

Sub-Heading:- Cash and Cash Equivalents

v) General Reserve

Major-Heading:- Shareholder’s Fund

Sub-Heading:- Reserves and Surplus

vi) Goods acquired for trading and

Major-Heading:- Current Assets

Sub-Heading:- Inventories

vii) 9% Debentures repayable after three years

Major-Heading:- Non- Current Liabilities

Sub-Heading:- Long–term Borrowing

Question 52

Solution 52

Point for Students:-

There is distinction between ‘Reserves’ and ‘Provision’. Reserves means accumulated profits and it is created to strengthen the financial position of the Company and to meet unforeseen liabilities and losses.

‘Provision’ is an amount provided for any known liability whose amount as yet is uncertain. Provision is made to meet a specific liability of which the amount cannot be determined with substantial accuracy. Provision is also made for known losses such as ‘Provision for Depreciation’.

Question 53

Solution 53 i) Bank overdraft

Major-Heading:- Current Liabilities

Sub-Heading:- Short-term Borrowing

ii) Draft in hand

Major-Heading:- Current Assets

Sub-Heading:- Cash and Cash Equivalents

iii) Trade Marks

Major-Heading:- Non-Current Assets

Sub-Heading:- Fixed Assets- Intangible Assets

iv) Long-Term Provision

Major-Heading:- Non-Current Liabilities

Sub-Heading:- Long -term provision

v) Calls in Advance

Major-Heading:- Current Liabilities

Sub-Heading:- Other current Liabilities

vi) Interest on Calls in Advance

Major-Heading:- Current Liabilities

Sub-Heading:- Other current liabilit

The company’s financial statement is basically the output of the accounting process and generally designed after the company’s accounting period. The financial statements reveal the company’s financial position and allow them to have a clear picture of the end products of their financial decisions.

The financial statements of the companies primarily constitute of four fundamental components, which are –

● Balance Sheet or Position Statement of the company

● A statement of profit and loss of the company during the accounting period.

● Notes to Accounts.

● Cash Flow Statement.

A balance sheet is an official statement that depicts clear information about the assets, liabilities, and equities of a company. It is basically a document that depicts the financial position of the company at a specific time span. The balance sheet is a key element of the financial statement of a company, and it gives an in-depth picture of the company’s financial status.

Here are some of the limitations of the financial statements –

● Financial Statements only present the quantitative data of the transactions. It does not highlight any qualitative aspect of the transaction like size, quality, or capabilities.

● Financial Statements portray the pre-defined price of the products or services. It fails to quote any modifications in the price. Thereby giving no data about the current price.

● Financial Statements are designed by humans. Therefore, it may contain errors.

Here is the sole objective of the financial statements –

● The financial statement is one of the most reliable sources for companies to understand their financial positions. It periodically supplies the companies with updated financial data.

● It portrays all details about the financial status of the companies, including profitability, liquidity, etc.

● Financial Statements evaluate the estimated earning capacity of the companies.

Financial Statements are extremely fruitful for the shareholders as it allows them to understand the profit-making capacity of the firm. It supplies them with the most accurate information to grasp the company’s financial status, helping them make better business decisions.

Also refer to TS Grewal Solutions for Class 12