DK Goel Solutions Chapter 13 Ledger

Read below DK Goel Solutions Class 11 Chapter 13 Ledger. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

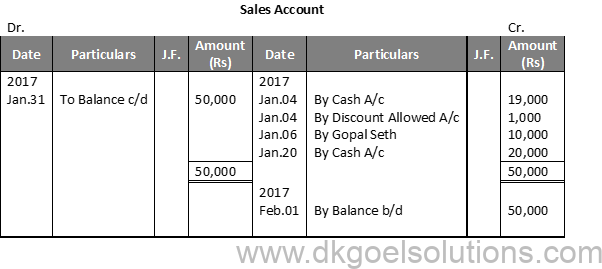

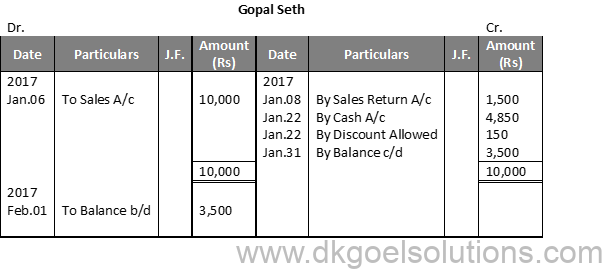

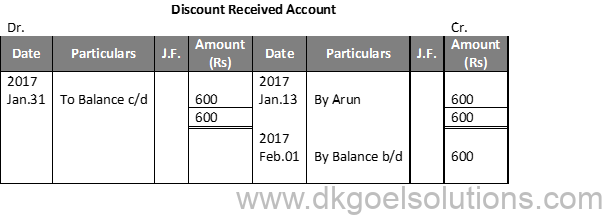

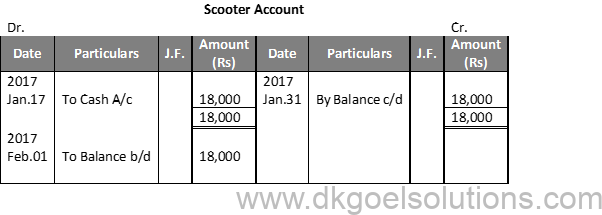

This chapter of DK Goel Accounting Solutions presents contains almost 13 types of numerical problems on Ledger Posting, this will also give you more understanding about how to understand ledgers and what type of entries get displayed in ledgers.

The chapter also contains a lot of questions that can be very helpful to understand the concepts for Class 11 commerce students of Accountancy and will also help build a strong foundation.

DK Goel Solutions Class 11 Chapter 13 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Ledger DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 13

Short Answer Questions for DK Goel Solutions Class 11 Chapter 13

Question 1:

Question 2:

Solution 2:

The benefits of the ledger are below:—

(1) In this book, all accounts are opened on different pages. Therefore, in one position in the register, all transactions relating to an account are collected.

(2) Using ledger balances, a trail balance may be prepared, which helps to assess the arithmetical consistency of the accounts.

(3) Only with the aid of ledger balances will a trade and benefit and loss account be planned.

(4) The balance sheet can also be prepared by means of ledger balances reflecting the company’s financial condition.

Question 3:

Solution 3:

The rules for posting in the ledger as below:-

I All account-related transactions should be reported in one location. There should be no opening of two separate accounts for posting transactions relating to the same account.

(ii) Before accounts that occur on the debit side of an account, the term ‘On’ is used. Similarly, before the accounts that exist on the credit side of an invoice, the expression ‘By’ is used.

(iii) If an account has been debited in the journal entry, it should also be posted in the ledger on the debit side of that account. The name of the other account that was credited in the journal entry should be written for comparison in the data columns.

Question 4:

Solution 4: The full form of J.F. is Journal Folio. Purpose of posting J.F. number is that it provides a ready reference for tracing the page of journal from where the entry has been posted.

Question 5:

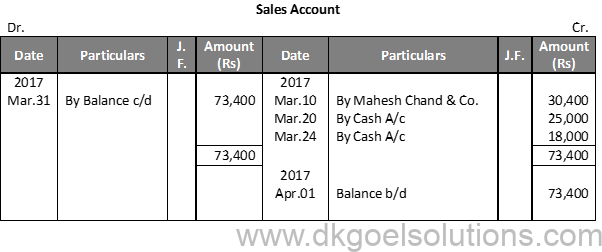

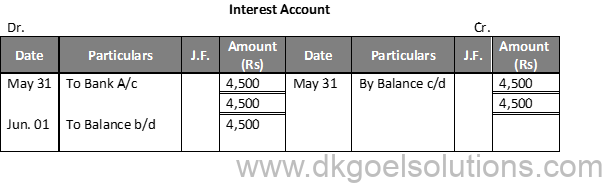

Solution 5: An account is balanced when we have to apply either debit or credit to the larger side, whichever it might be, and write the larger one on the parallel column.

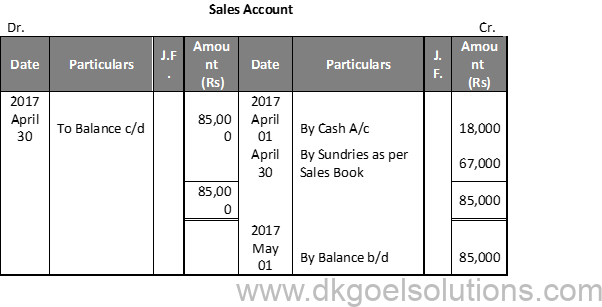

A debit column if it is greater than the column for credit. On the credit line, the disparity is written as ‘By Balance c/d’. In the two columns facing each other, the totals are first entered and then the balance is written as ‘To Balance b/d’ on the debit side to indicate the debit balance in hand at the beginning of the next date or vice versa on the credit balance.

Question 6:

Solution 6:

Question 7:

Solution 7:

Question 8:

Solution 8:

Question 9:

Solution 9:

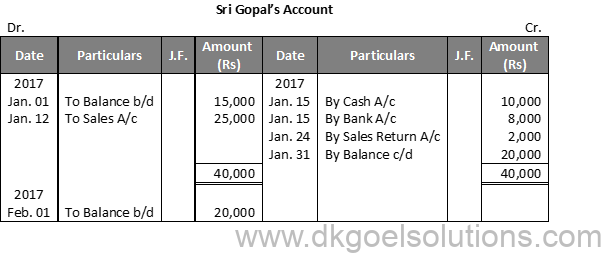

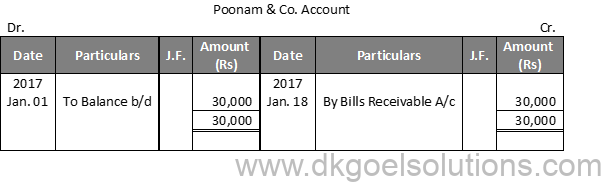

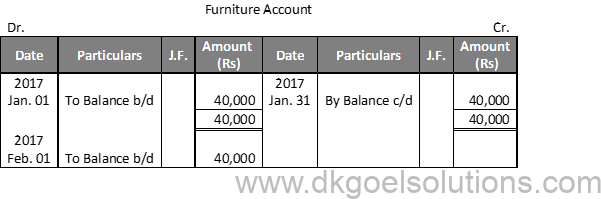

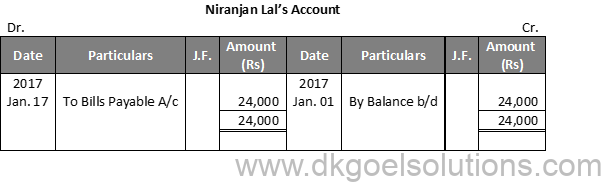

Numerical Questions:

Question 1:

Solution 1:

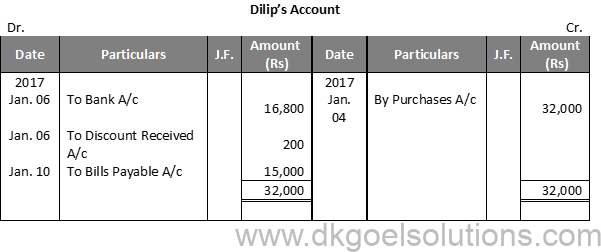

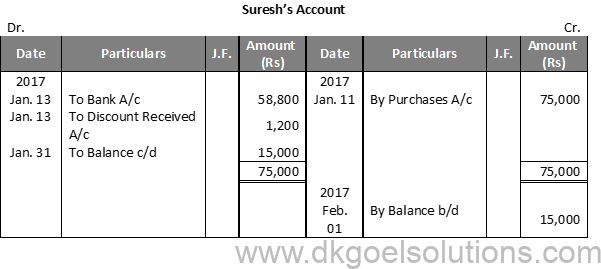

Question 2:

Solution 2:

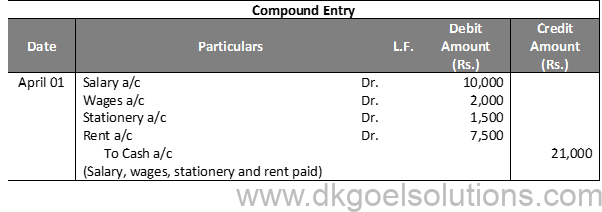

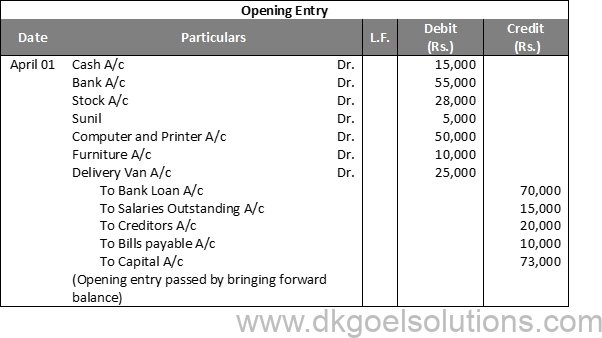

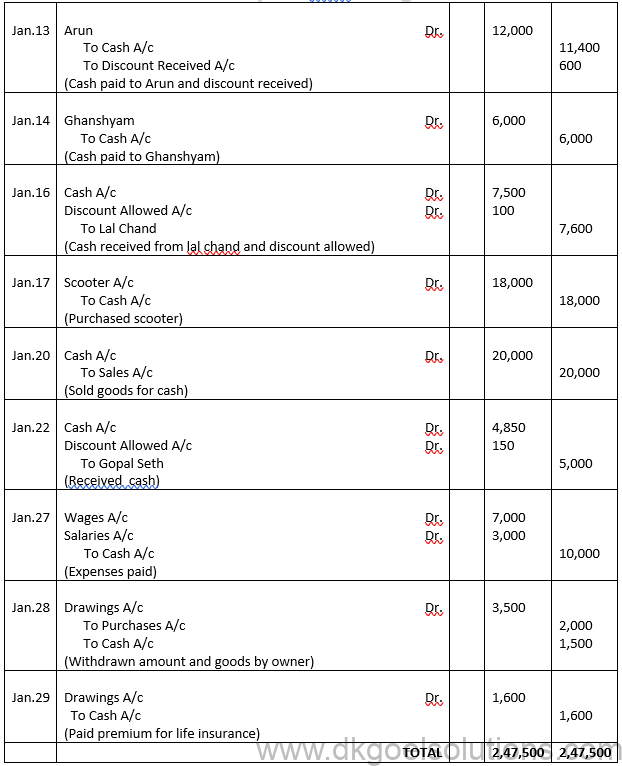

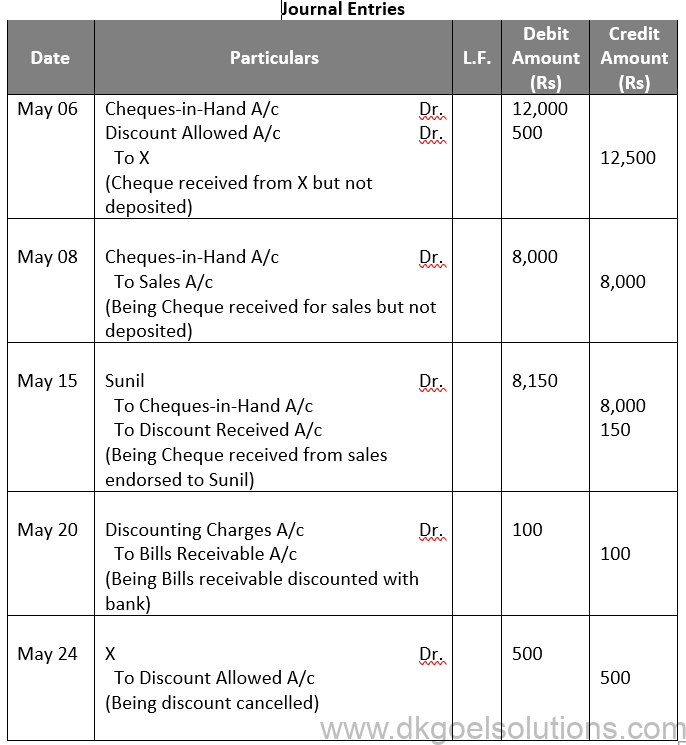

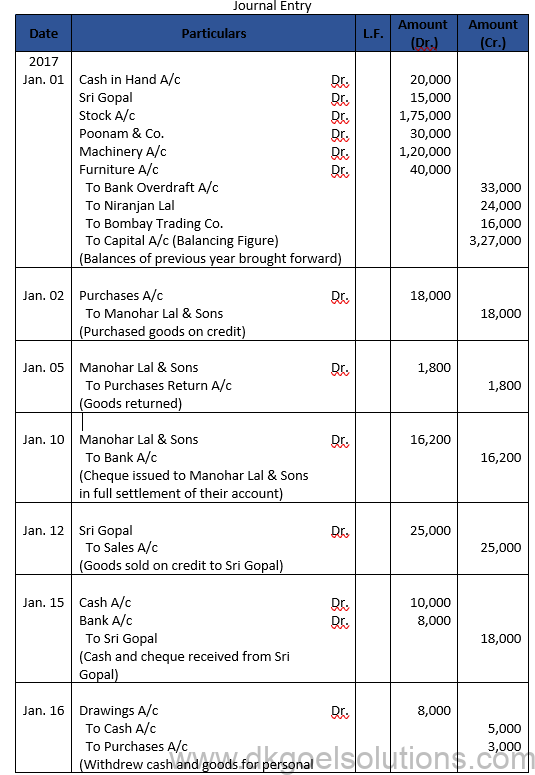

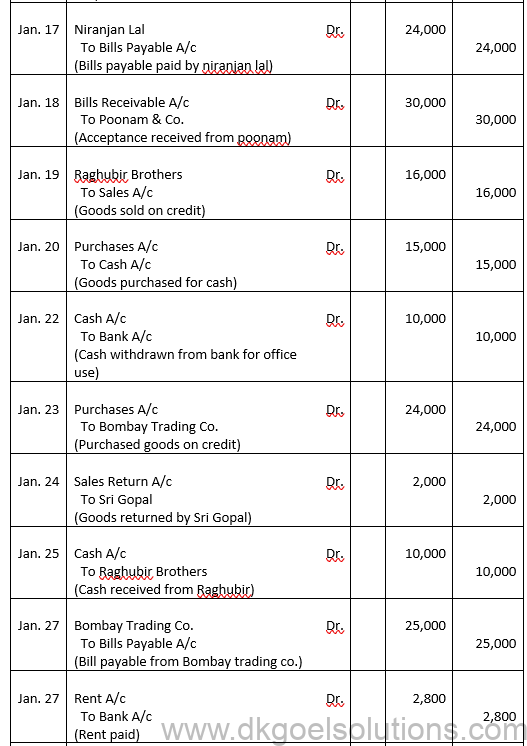

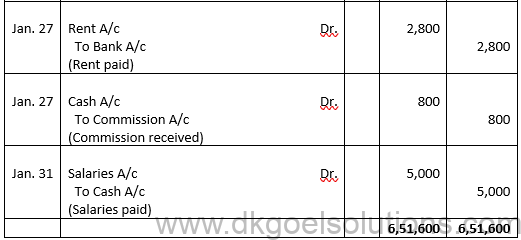

| Journal Entries in the Books of Ram & Shyam |

Question 3:

Solution 3:

Question 4:

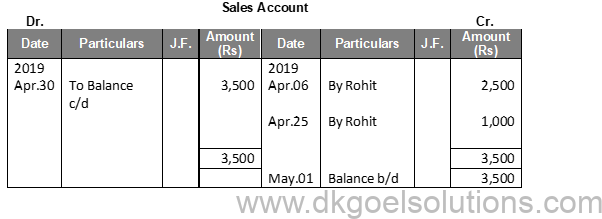

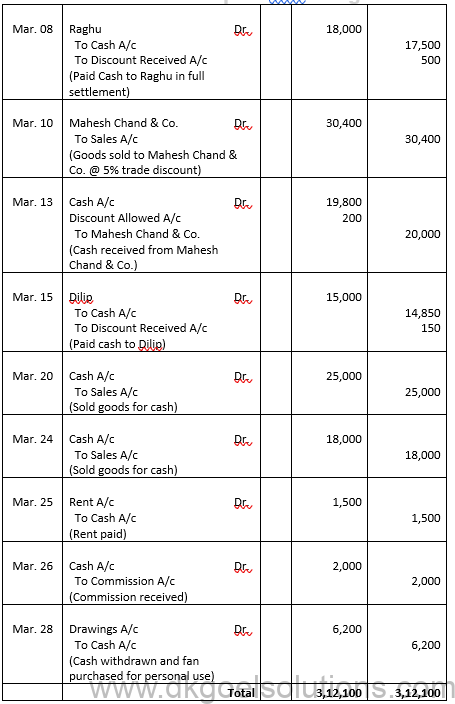

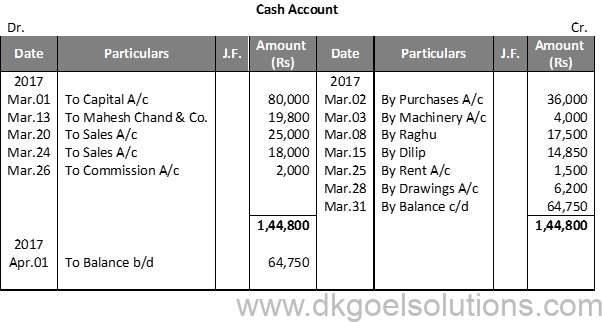

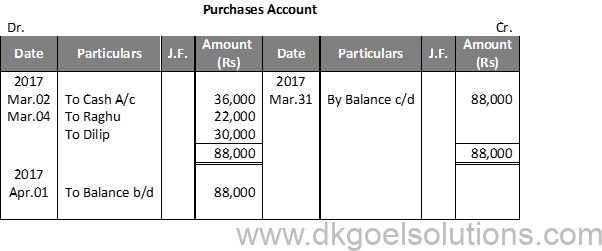

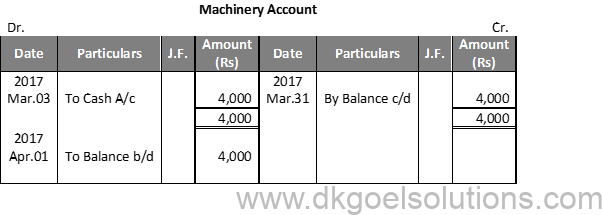

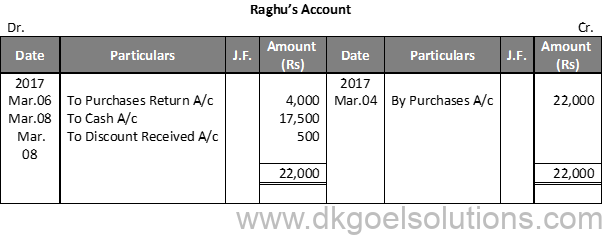

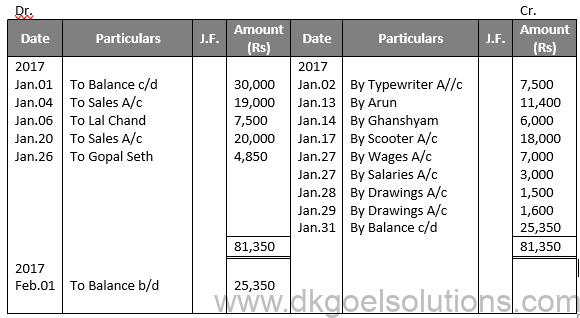

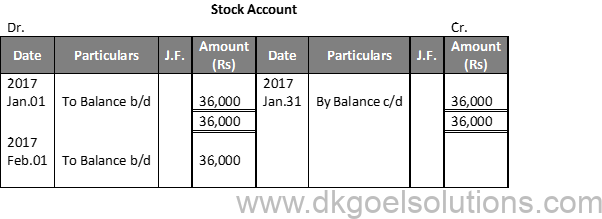

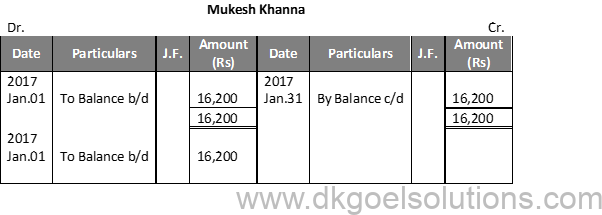

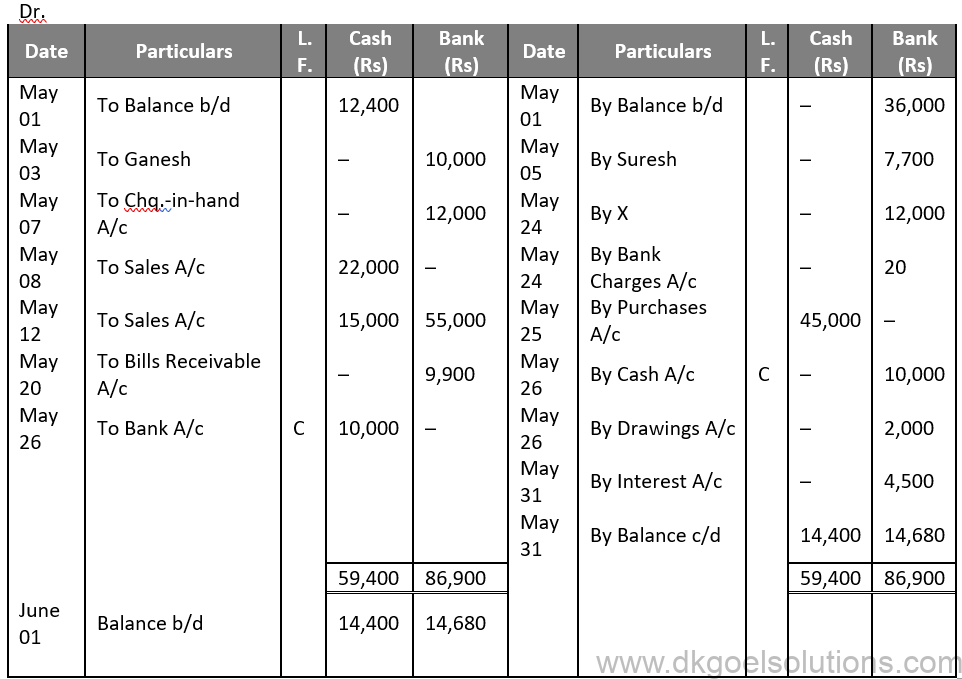

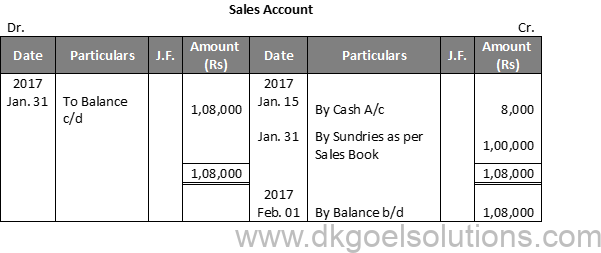

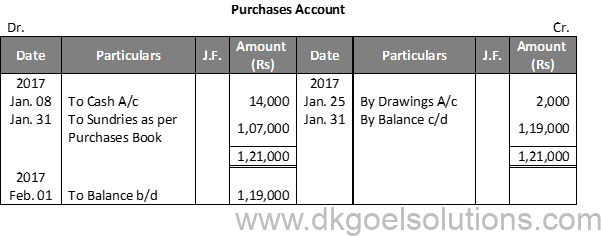

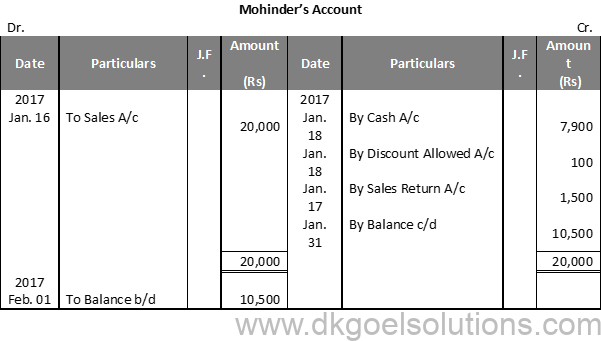

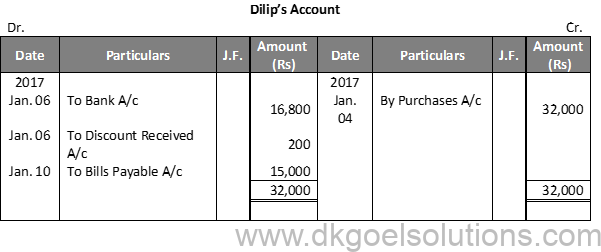

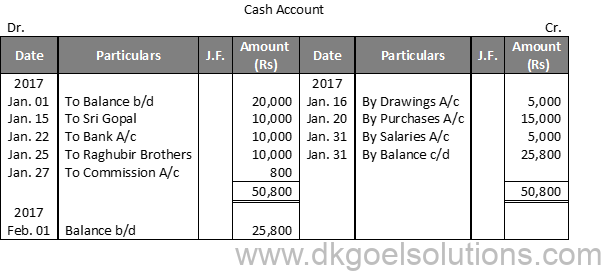

Solution 4: Cash Book

Point in mind (DK Goel Solutions Class 11 Chapter 13) :-

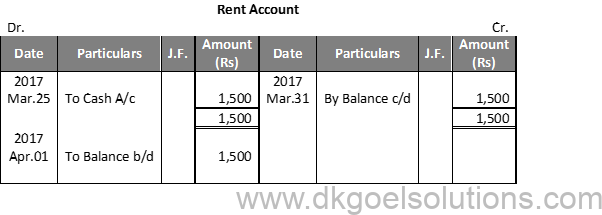

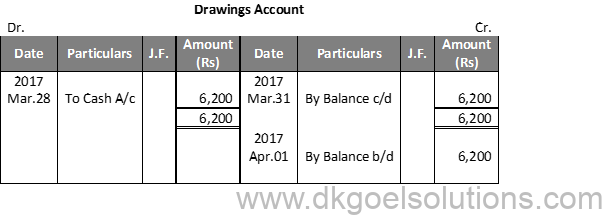

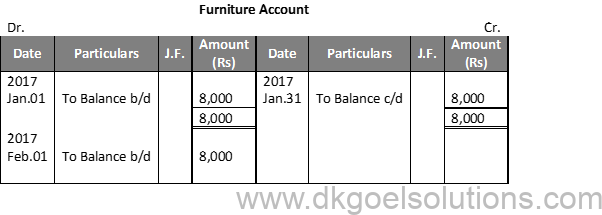

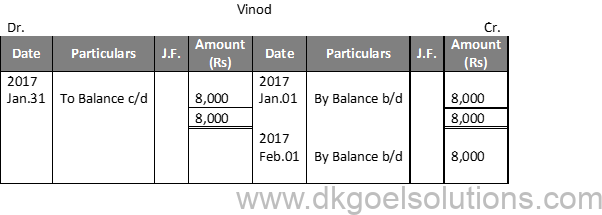

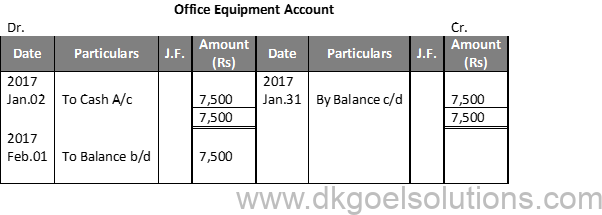

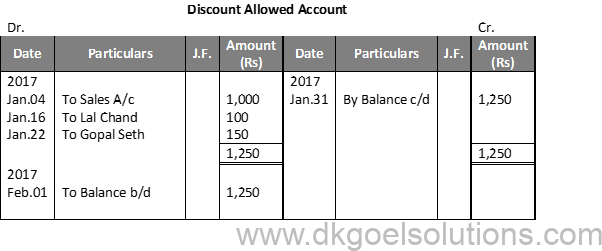

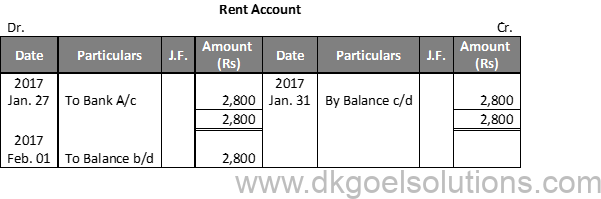

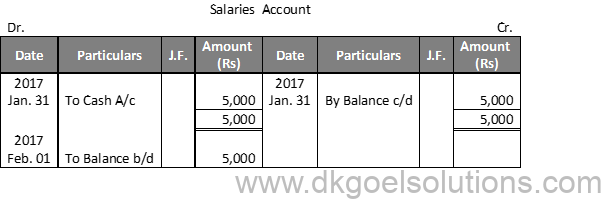

- Identify in the Ledger the account to be debited.

- Enter the date of the transaction in the ‘Date’ column on the debit side of the account.

- Write the name of the account which has been credited in the respective entry in the ‘Particulars’ column on the debit side of the amount as ‘To (name of account credited)’.

- Record the page number of the Journal where the entry exists in the Journal folio (J,F.) column.

- Enter the relevant amount in the ‘Amount’ column on the debit side.

Question 5:

Solution 5:

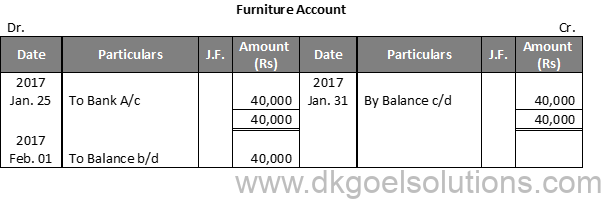

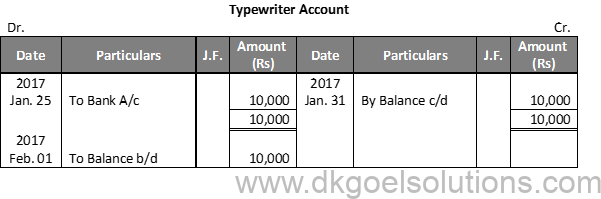

Question 6:

Solution 6:

Question 7:

Solution 7:

Question 8:

Solution 8:

Question 9:

Solution 9:

Question 10:

Solution 10:

Question 11:

Solution 11:

Point of Knowledge (DK Goel Solutions Class 11 Chapter 13) :-

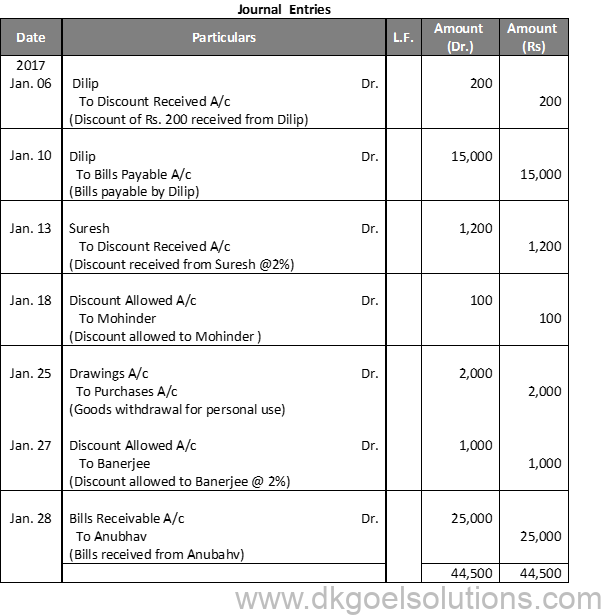

Journal Folio (J.F.) Column in the ledger records Page No. of the journal from which the posting to the Ledger has taken place. Purpose of posting J.F. number is that it provides a ready reference for tracing the page of journal from where the entry has been posted.

Question 12:

Solution 12:

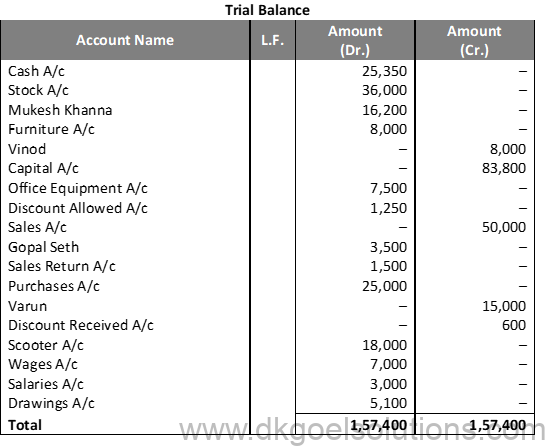

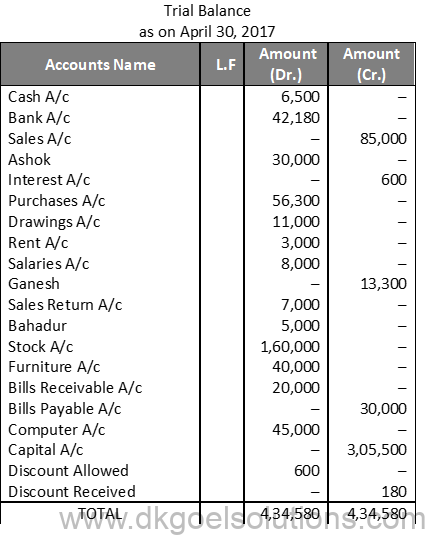

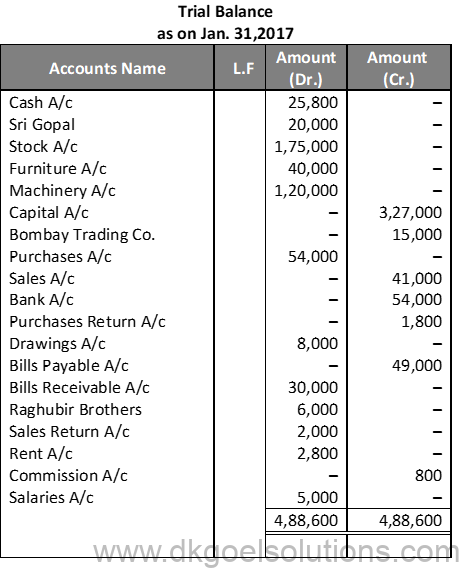

A ledger is a particular book that highlights all the financial transactions related to a specific account. Ledger allows the accountants to list all the transactions accurately in a chronological order, which helps them calculate the overview of the transactions much easier. Ledger gives a clear view of the current status of assets and liabilities of an organization and helps in preparing the ideal trial balances.

A Ledger brings a bunch of formats depending upon the purposes, such as journals, subsidiary books, and cash books. Typically, a ledger is divided into two sections – the debit part and the credit part. All the information of transactions is recorded on a debit and credit basis, which assists in preparing the financial statements of a business.

The benefits of Ledger are as follows –

● Ledger incredibly assists in designing a trial balance, which helps firms to analyze the consistency and comparability of the accounts.

● The ledger reflects the complete financial condition of a company. This helps the accountants to create the balance sheets of the company much conveniently.

● Ledger balances help businesses understand the benefits and loss of financial decisions and help them to plan strategically.

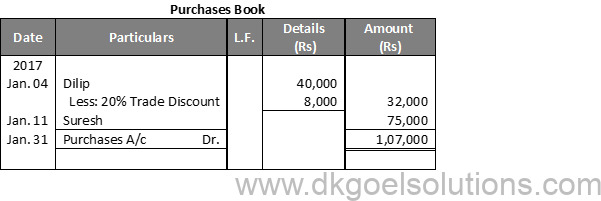

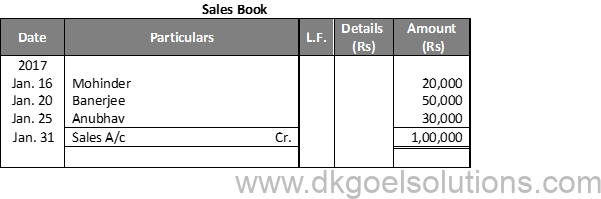

Posting in Ledger is the procedure of transferring the transaction details from the journal to the ledger accounts of a company.

Here are the rules of posting in the ledger –

● All the financial transactions surrounding a similar account must be added in one place.

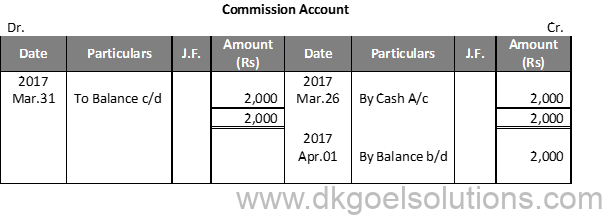

● The word ‘To’ must be added to the account on the debit side, and the word ‘By’ must be added to the account on the credit side.

● In a Journal entry, if an account gets debited, the details must be entered on the debit side of the ledger. Similarly, when an account gets credited, the posting in Ledger must be made on the credit side.

J.F or the Journal Folio number in the ledger defines the page number of the journal from which the posting to the ledger has been performed. The J.F number helps to get a quick reference and helps in the traceability of the transaction on the journal.