DK Goel Solutions Chapter 4 Admission of a Partner

Read below DK Goel Solutions for Class 12 Chapter 4 Admission of a Partner. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

From time to time in any type of partnership firm, there are requirements to keep on adding new partners because of various reasons stop. Whenever this happens this is called admission of a partner in accounting terms. in this chapter, you will be able to understand what is accounting impact of getting a new partner in a firm as well as how the accounting should be performed.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Admission of a Partner DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Question 1.

Solution 1

Here are the problems that need be changed at the time of a partner’s admission:

(i) Net Gains, Reserves and Losses Adjustment.

(ii) Goodwill Change

Question 2.

Solution 2

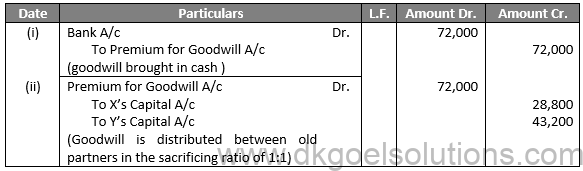

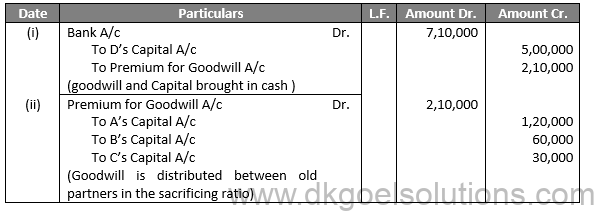

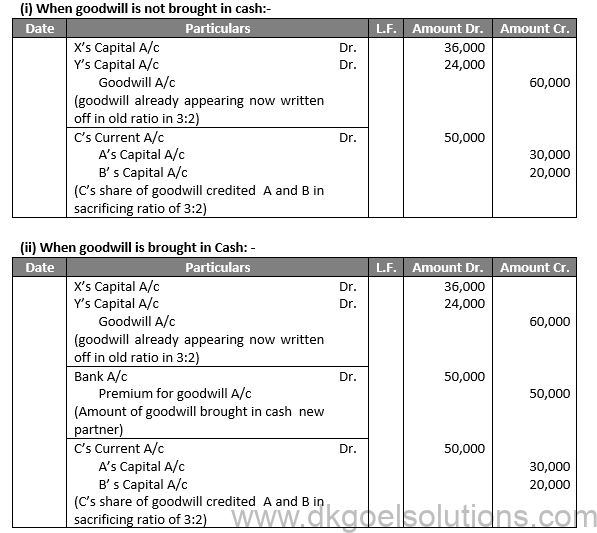

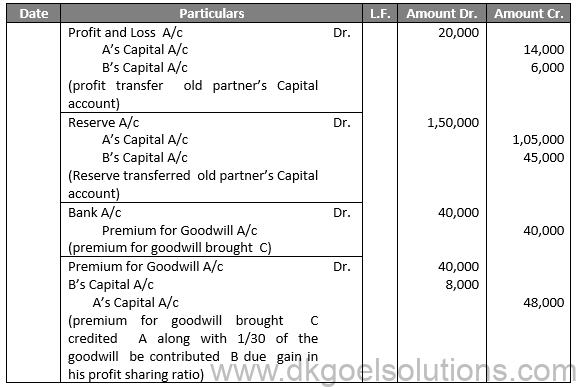

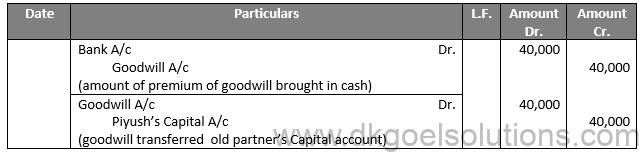

(i) New partner brings his share of goodwill in cash:

Bank A/c Dr.

Premium for goodwill A/c

(Partners bring his share of goodwill in cash)

(ii) Amount of goodwill brought in new partner; (in sacrificing ratio)

Premium for goodwill A/c Dr.

Sacrificing Partner’s Capital A/c

(Goodwill is sacrificed by partners)

Question 3.

Solution 3

(i) Goodwill account already appearing in the book:

Old Partner’s Capital A/c Dr.

Goodwill A/c

(Amount of goodwill appearing in book distributed in old partners)

(ii) Goodwill in cash:

Bank A/c Dr.

To Premium for goodwill A/c

(New partner bring his share of goodwill in cash)

(iii) Amount of goodwill brought in new partner (in sacrificing ratio)

Premium for goodwill A/c Dr.

To Sacrificing Partner’s Capital A/c

(New partner bring his share of goodwill in cash)

Question 4.

Solution 4

New Partner’s Current A/c Dr. (Share of goodwill)

Sacrificing Partner’s Capital A/c (sacrificing ratio)

Question 5.

Solution 5

Goodwill’s worth is hidden in the query. In such situations, the sum of goodwill is measured on the basis of the firm’s gross resources and the partners’ profit-sharing ratio.

Question 6.

Solution 6

When a new partner is added, assets are revalued and liabilities are reassessed such that the benefit or damage arising from any revaluation up the date of entry of a new partner will be ascertained and balanced in their old profit-sharing ratio in the Capital Account of the old partners and the new partner does not gain or lose due adjustments in the value of assets or sum of assets

Question 7.

Solution 7

The new partner’s Capital is often not provided in the issue. He will be expected to put in Capital proportionately. In both s, the Capital of the new partner would be determined on the basis of the old partner’s Capital left after all the changes and revaluations.

Question 8.

Solution 8

Puja may have made the statement that Disha and Gayatri were persuaded by the absence of the Partnership Deed Partnership Act 1932, which prevailed.

Question 9.

Solution 9

Mohan and Naresh may have argued that, while Om was not a collaborator, the General Reserve came into being. In their old profit-sharing mix, it should then be shared only by Mohan and Naresh.

Question 10.

Solution 10

Dushaynt may have argued that the time where he was not a partner was part of the responsibility. Therefore, in their old benefit sharing ratio, old partners should be born.

Numerical Question

Question 1.

(A)

Solution 1

(A)

C’s Share = 1/4

Remaining Share = 1 – 1/4 = 3/4

A’s New Share = 5/8 of 3/4 = 15/32

B’s New Share = 3/8 of 3/4 = 9/32

C’s Share = 1/4

Thus, the new profit sharing ratio = 15/32 : 9/32 : 1/4

New profit = (15 ∶ 9 ∶ 8)/32

New profit = 15 : 9 : 8

(A). Points for Students:-

Sometimes the old partners surrender a particular fraction of their share in favour of the new partner. In such cases the new partner’s share is calculated by adding the surrendered portion of share by the old partners. Old partner’s shares are calculated by deducting the surrendered share from their old shares.

Question 1.

(B)

Solution 1

(B)

C’s Share = 9/21

Remaining Share = 1 – 9/21 = 12/21

A’s New Share = 21/30 of 12/21 = 2/5

B’s New Share = 9/30 of 12/21 = 6/35

C’s Share = 9/21

Thus, the new profit sharing ratio = 2/5 : 6/35 : 9/21

New profit = (42 ∶ 18 ∶ 45)/105

New profit = 42 : 18 : 45 or 14 : 6 : 15

(B).Points for Students:-

Sometimes the new partner ‘Purchases’ his share of profit from the old partners equally. In such cases the new profit sharing ratio of the old partners will be ascertained by deducting the sacrifice made by them from their existing share of profit.

Question 2.

(A)

Solution 2

(A)

R is acquires 1/7th share equally form P and Q.

R acquires form P = 1/2 × 1/7 = 1/14

R acquires form Q = 1/2 × 1/7 = 1/14

Computation of New Share:-

P’s Share = 4/7-1/14=(8 – 1)/14= 7/14

Q’s Share = 3/7-1/14=(6 – 1)/14= 5/14

R’s Share = 1/7

Thus, the new profit sharing ratio = 7/14 : 5/14 : 1/7

New profit = (7 ∶ 5 ∶ 2)/14

New profit = 7 : 5 : 2

(A).Points for Students:-

Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favour of the new partner. The ratio in which they surrender their profits is called sacrifice ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of the new partner.

Calculation of Sacrifice Ratio is calculated as follows:

Sacrifice Ratio = Old Ratio – New Ratio

Question 2.

(B)

Solution 2

(B)

Profit Share give T = 1/8

T acquires form R = 1/2 × 1/8 = 1/16

T acquires form S = 1/2 × 1/8 = 1/16

Computation of New Share:-

R’s Share = 3/5-1/16=(48 – 5)/80= 43/80

S’s Share = 2/5-1/16=(32 – 5)/80= 27/80

T’s Share = 1/16+1/16=(1 + 1)/16=2/16

Thus, the new profit sharing ratio = 43/80 : 27/80 : 2/16

New profit = (43 ∶ 27 ∶ 10)/80

New profit = 43 : 27 : 10

(B). Points for Students:-

Calculation of Sacrifice Ratio is calculated as follows: Sacrifice Ratio = Old Ratio – New Ratio

Question 2.

(C)

Solution 2

(C)

New Share = Old Share – Sacrificing Share

P’s new share = 3/6-1/16=(24 – 3)/48= 21/48

Q’s new share = 2/6-1/16=(16 – 3)/48= 13/48

R’s new share = 1/6

S’s new share = 1/8

Thus, the new profit sharing ratio = 21/48 : 13/48 : 1/16 : 1/8

New profit = (21 ∶ 13 ∶ 8 ∶ 6)/48

New profit = 21 : 13 : 8 : 6

(C). Points for Students:-

When only the ratio of new partners is given in the question, then in the absence of any other agreement, it is presumed that the old partners will continue to share the remaining profits in the same ratio in which they were sharing before the admission of the new partner.

Question 3.

Solution 3

C’s Share = 1/4

Remaining Share = 1-1/4= 3/4

A’s new share = 3/5 of 3/4 = 9/20

B’s new share = 2/5 of 3/4 = 6/20

C’s new share = 1/4

New Ratio of A, B and C = 9/20:6/20:1/4

New profit = (9 ∶ 6 ∶ 5)/20

New profit = 9 : 6 : 5

D’s Share = 1/5

He will acquire 1/3 of 1/5 = 1/15 each from A, B and C

A’s new share = 9/20-1/15 = (27 – 4)/60 = 23/60

B’s new share = 6/20-1/15 = (18 – 4)/60 = 14/60

C’s new share = 5/20-1/15 = (15 – 4)/60 = 11/60

D’s new share = 1/5

New Ratio of A, B , C and D = 23/60:14/60:11/60:1/5

New profit = (23 ∶ 14 ∶ 11 ∶ 12 )/60

New profit of A, B, C and D = 23 : 14 : 11 : 12

Points for Students:-

Sometimes the new partner ‘Purchases’ his share of profit from the old partners equally. In such cases the new profit sharing ratio of the old partners will be ascertained by deducting the sacrifice made by them from their existing share of profit.

Q4.

(A)

X and Y are partners sharing profits in the ratio of 2 : 1. Z is admitted with 5/11th share which he takes 3/11th from X and 2/11th from Y. Calculate the new profit sharing ratio of the partners.

Solution 4

(A)

Z is acquire = 5/11 , X is surrender = 3/11 , Y is surrender = 2/11

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 2/3-3/11=(22 – 9)/33= 13/33

Y’s New Share = 1/3-2/11=(11 – 6)/33= 5/33

Z’s New Share = 5/11

New Profit Sharing Ratio = 13/33 ∶ 5/33 ∶ 5/11

New Profit Sharing Ratio = (13 ∶ 5 ∶ 15)/33

New Profit Sharing Ratio = 13 ∶ 5 ∶ 15

(A). Points for Students:-

Calculation of New profit Sharing Ratio:-

New Ratio = Old Ratio – Surrender Share

Q4.

(B)

A and B are partners sharing profits in the ratio of 5:3. They admit C on 1/4th share which he acquires 1/6th from A and 1/12th from B. Calculate the new profit sharing ratio of the partners.

Solution 4

(B)

C is acquire = 1/4 , A is surrender = 1/6 , B is surrender = 1/12

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 5/8-1/6=(15 – 4)/24= 11/24

B’s New Share = 3/8-1/12=(9 – 2)/24= 7/24

C’s New Share = 1/4

New Profit Sharing Ratio = 11/24 ∶ 7/24 ∶ 1/4

New Profit Sharing Ratio = (11 ∶ 7 ∶ 6)/24

New Profit Sharing Ratio = 11 ∶ 7 ∶ 6

(B). Points for Students:-

Following adjustments are needed at the time of the admission of a new partner:

1. Calculation of new profit sharing ratio.

2. Accounting treatment of Goodwill.

3. Accounting treatment of revaluation of assets and liabilities.

4. Accounting treatment of reserves and accumulated profits.

5. Adjustment of Capital on the basis of new profit sharing ratio.

Question 5.

Solution 5. Profit Sharing ratio of A, B and C = 1 : 2 : 3.

D’s Share = 1/6

A’s Share = 1/6-1/24=(4-1)/24=3/24

B’s Share = 2/6-1/24=(8-1)/24=7/24

C’s Share = 3/6-1/12=(6-1)/12=5/12

New Ratio of A, B, C and D = 3/24:7/24:5/12:1/6

New Ratio of A, B, C and D = (3∶7∶10∶4)/24

New Ratio of A, B, C and D = 3 : 7 : 10 : 4.

Points for Students:-

New Ratio = Old Ratio – Sacrificing Ratio

We can calculate below formulas also by above formula:-

Old Ratio = New Ratio + Sacrificing Ratio

Sacrificing Ratio = Old Ratio – New Ratio

Question 6.

Solution 6

C is acquire = 1/2 from A and B in the ratio of 3:1.

A is surrender = 3/4 , B is surrender = 1/4

A’s share = 1/2 of 3/4 = 3/8

B’s share = 1/2 of 1/4 = 1/8

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 3/5-3/8=(24 – 15)/40= 9/40

B’s New Share = 2/5-1/8=(16 – 5)/40= 11/40

C’s New Share = 1/2

New Profit Sharing Ratio = 9/40 ∶ 11/40 ∶ 1/2

New Profit Sharing Ratio = (9 ∶ 11 ∶ 20)/40

New Profit Sharing Ratio = 9 ∶ 11 ∶ 20

Points for Students:-

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

Question 7.

Solution 7

(i) If Z acquires his share from X and Y in their profit sharing ratio:-

Z is acquire = 1/5 from X and Y in the ratio of 3:2.

X is surrender = 3/5 , Y is surrender = 2/5

X’s share = 1/5 of 3/5 = 3/25

Y’s share = 1/5 of 2/5 = 2/25

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5-3/25=(15 – 3)/25= 12/25

Y’s New Share = 2/5-2/25=(10 – 2)/25= 8/25

Z’s New Share = 1/5

New Profit Sharing Ratio = 12/25 ∶ 8/25 ∶ 1/5

New Profit Sharing Ratio = (12 ∶ 8 ∶ 5)/25

New Profit Sharing Ratio = 12∶8∶5

(ii) If he acquires 3/20th from X and 1/20th from Y:-

X is surrender = 3/20 , Y is surrender = 1/20

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5-3/20=(12 – 3)/20= 9/20

Y’s New Share = 2/5-1/20=(8 – 1)/20= 7/20

Z’s New Share = 1/5

New Profit Sharing Ratio = 9/20 ∶ 7/20 ∶ 1/5

New Profit Sharing Ratio = (9 ∶ 7 ∶ 4)/20

New Profit Sharing Ratio = 9∶7∶4

(iii) If he acquires 1/10th from X and 1/10th from Y;

X is surrender = 1/10 , Y is surrender = 1/10

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5-1/10=(6 – 1)/10= 5/10

Y’s New Share = 2/5-1/10=(4 – 1)/10= 3/10

Z’s New Share = 1/5

New Profit Sharing Ratio = 5/10 ∶ 3/10 ∶ 1/5

New Profit Sharing Ratio = (5∶ 3 ∶ 2)/10

New Profit Sharing Ratio = 5∶3∶2

(iv) If he acquires 1/20th from X and 3/20th from y;

X is surrender = 1/20 , Y is surrender = 3/20

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5-1/20=(12 – 1)/20= 11/20

Y’s New Share = 2/5-3/20=(8 – 3)/20= 5/20

Z’s New Share = 1/5

New Profit Sharing Ratio = 11/20 ∶ 5/20 ∶ 1/5

New Profit Sharing Ratio = (11 ∶ 5 ∶ 4)/20

New Profit Sharing Ratio = 11∶5∶4

(v) If he acquires his share entirely from X;

Z is given 1/5th share which he acquires entirely from X.

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5-1/5=(3 – 1)/5= 2/5

Y’s New Share = 2/5

Z’s New Share = 1/5

New Profit Sharing Ratio = 2/5 ∶ 2/5 ∶ 1/5

New Profit Sharing Ratio = (2 ∶ 2 ∶ 1)/5

New Profit Sharing Ratio = 2∶2∶1

(vi) If he acquires his share entirely from Y.

Z is given 1/5th share which he acquires entirely from Y.

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 3/5

Y’s New Share = 2/5-1/5=(2 – 1)/5= 1/5

Z’s New Share = 1/5

New Profit Sharing Ratio = 3/5 ∶ 1/5 ∶ 1/5

New Profit Sharing Ratio = (3 ∶ 1 ∶ 1)/5

New Profit Sharing Ratio = 3∶1∶1

Points for Students:-

Following Journal entry is passed for this purpose:

New Partner’s Current A/c Dr. (From his share of goodwill)

To Old Partner’s Capital A/c (In sacrificing ratio)

(Current Account of new partner debited from his share of goodwill on his admission and Capital Accounts of old partner’s Credited in their sacrificing ratio)

Question 8 (new).

Solution 8 (new). Profit Sharing ratio of A and B = 3 : 2.

Share gifted by A = 1/5×1/2=1/10

Share acquired by C = 1/10×1/2=1/20

A’s Share = Old Share – Share Gifted – Share Acquired by C

= 3/5-1/10-1/20

= (12-2-1)/20

= 9/20

B’s Share = 2/5-1/20=(8-1)/20=7/20

C’s Share = 1/5

New Ratio of A, B and C = 9/20:7/20:1/5

New Ratio of A, B, C and D = (9∶7∶4)/20

New Ratio of A, B, C and D = 9 : 7 : 4.

Question 8.

(A)

Solution 8

(A)

A is surrender = 1/4 , B is surrender = 1/5

A’s share = 1/4 of 2/3 = 2/12 = 1/6

B’s share = 1/5 of 1/3 = 1/15

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 2/3-1/6=(4 – 1)/6= 3/6

B’s New Share = 1/3-1/15=(5 – 1)/15= 4/15

C’s New Share = 1/6+1/15=(5 + 2)/30=7/30

New Profit Sharing Ratio = 3/6 ∶ 4/15 ∶ 7/30

New Profit Sharing Ratio = (15 ∶ 8 ∶ 7)/30

New Profit Sharing Ratio = 15∶8∶7

Question 8.

(B)

Solution 8

(B)

A is surrender = 3/20 , B is surrender = 1/20

A’s share = 3/20 of 3/5 = 9/100

B’s share = 1/20 of 2/5 = 2/100

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 3/5-9/100=(60 – 9)/100= 51/100

B’s New Share = 2/5-2/100=(40 – 2)/100= 38/100

C’s New Share = 9/100+2/100=(9 + 2)/100=11/100

New Profit Sharing Ratio = 3/6 ∶ 4/15 ∶ 11/100

New Profit Sharing Ratio = (51 ∶ 38 ∶ 11)/100

New Profit Sharing Ratio = 51∶38∶11

Question 8.

(C)

Solution 8

(C)

X is surrender = 3/15 , Y is surrender = 6/15

X’s share = 3/15 of 9/15 = 27/225 = 3/25

Y’s share = 6/15 of 6/15 = 36/225 = 4/25

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

X’s New Share = 9/15-3/25=(45 – 9)/75= 36/75

Y’s New Share = 6/15-4/25=(30 – 12)/75= 18/75

Z’s New Share = 3/25+4/25=(3 + 4)/25=7/25

New Profit Sharing Ratio = 36/75 ∶ 18/75 ∶ 7/25

New Profit Sharing Ratio = (36 ∶ 18 ∶ 21)/75

New Profit Sharing Ratio = 36 ∶ 18 ∶ 21 or 12 : 6 : 7

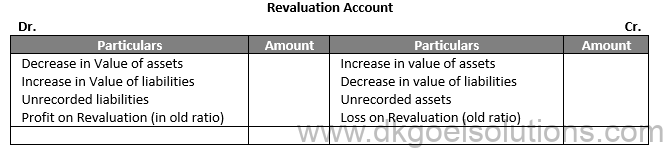

Points for Students:-

Revaluation Account: Sometimes this account is called as ‘Profit & Loss Adjustment A/c’. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 9.

Solution 9

A B C

Old Ratio 4/10 : 3/10 : 3/10

Surrender Share 1/4 1/5 1/6

A’s share = 4/10 of 1/4 = 4/40 = 1/10

B’s share = 3/10 of 1/5 = 3/50 = 3/50

C’s share = 3/10 of 1/6 = 1/20

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 4/10-1/10=(4 – 1)/10= 3/10

B’s New Share = 3/10-3/50=(15 – 3)/50= 12/50

C’s New Share = 3/10-1/20=(6 – 1)/20=5/20

D’s New Share = 1/10+3/50+1/20= (10+6+5)/100=21/100

New Profit Sharing Ratio = 3/10 ∶ 12/50 ∶ 5/20:21/100

New Profit Sharing Ratio = (30 ∶ 24 ∶ 25 ∶21)/100

New Profit Sharing Ratio = 30 ∶ 24 ∶ 25 ∶21

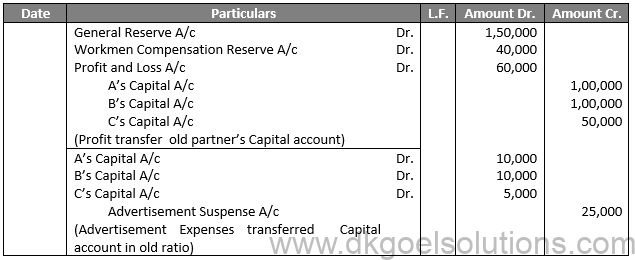

Points for Students:-

At the time of admission, if there is any General Reserve, Reserve Fund or the balance of Profit and Loss Account appearing in the balance sheet, it must be transferred to Old Partner’s Capital Accounts in their old profit sharing ratio. The new partner is not entitled to any share of such reserves of profits, as these are undistributed profits earned by the old partners.

Question 10.

Solution 10

A B

Old Ratio 3/5 : 2/5

Surrender Share 1/3 1/4

A’s share = 3/5 of 1/3 = 3/15 = 1/5

B’s share = 2/5 of 1/4 = 2/20 = 1/10

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 3/5-1/5=(3 – 1)/5= 2/5

B’s New Share = 2/5-1/10=(4 – 1)/10= 3/10

X’s New Share = 1/5

Y’s New Share = 1/10

New Profit Sharing Ratio = 2/5 ∶ 3/10 ∶ 1/5:1/10

New Profit Sharing Ratio = (4 ∶ 3 ∶ 2 ∶1)/10

New Profit Sharing Ratio = 4 ∶ 3 ∶ 2 ∶1

Points for Students:-

A new partnership deed is prepared at the time of admission of a new partner, as the old partnership deed comes to an end. According to Section 31 of the Indian partnership act, a new partner can be admitted only with the consent of all the existing partners.

Question 11.

Solution 11

(i) New profit sharing ratio of A, B and C:-

A’s share = 2/5 of 1/3 = 2/15

B’s share = 3/5 of 1/3 = 3/15

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 3/5-2/15=(9 – 2)/15= 7/15

B’s New Share = 2/5-3/15=(6 – 3)/15= 3/15

C’s New Share = 1/3

New Profit Sharing Ratio = 7/15 ∶ 3/15 ∶ 1/3

New Profit Sharing Ratio = (7 ∶ 3 ∶ 5)/15

New Profit Sharing Ratio = 7 ∶ 3 ∶ 5

(ii) New profit sharing ratio of A, B, C and D:-

A B C

Old Ratio 7/15 : 3/15 : 5/15

Surrender Share 1/2 1/2

A’s share = 1/2 of 1/5 = 1/10

C’s share = 1/2 of 1/5 = 1/10

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

A’s New Share = 7/15-1/10=(14 – 3)/30= 11/30

B’s New Share = 3/15

C’s New Share = 5/15-1/10=(10 – 3)/30= 7/30

D’s New Share = 1/5

New Profit Sharing Ratio = 11/30 ∶ 3/15 ∶ 7/30 ∶ 1/5

New Profit Sharing Ratio = (11 ∶ 6 ∶ 7 ∶ 6)/30

New Profit Sharing Ratio = 11 ∶ 6 ∶ 7 ∶ 6

Points for Students:-

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

We can calculate other formulas by the above formulas:-

Old Ratio = New Ratio + Surrender Share

Surrender Ratio = Old Ratio – New Share

Question 12.

Solution 12

Total Share of R and S = 1/4+1/5=(5 + 4)/20= 9/20

Remaining Share for P and Q = 1-9/20=11/20

P’s Share = 11/20× 3/5= 33/100

Q’s Share = 11/20× 2/5= 22/100

New Profit Sharing Ratio of P : Q : R : S = 33/100 ∶ 22/100 ∶ 1/4 ∶ 1/5

New Profit Sharing Ratio = (33 ∶ 22 ∶ 25 ∶ 20)/100

New Profit Sharing Ratio = 33 ∶ 22 ∶ 25 ∶ 20

Profit of the Firm Rs. 2,00,000 is distributed in new profit sharing ratio.

P’s Share in Profit = Rs. 2,00,000 × 33/100 = Rs. 66,000

Q’s Share in Profit = Rs. 2,00,000 × 22/100 = Rs. 44,000

R’s Share in Profit = Rs. 2,00,000 × 25/100 = Rs. 50,000

S’s Share in Profit = Rs. 2,00,000 × 20/100 = Rs. 40,000

Points for Students:-

Following adjustments are needed at the time of the admission of a new partner:

1. Calculation of new profit sharing ratio.

2. Accounting treatment of Goodwill.

3. Accounting treatment of revaluation of assets and liabilities.

4. Accounting treatment of reserves and accumulated profits.

5. Adjustment of Capital on the basis of new profit sharing ratio.

Question 13.

(A)

Solution 13

(A)

Sacrifice Ratio = Old Ratio – New Ratio

Saurabh’s Sacrificing Ratio = 1/2-4/9=(9 – 8)/18=1/18

Gaurav’s Sacrificing Ratio = 1/2-3/9=(9 – 6)/18=3/18

Sacrificing Ratio = 1 ∶ 3

(A) Points for Students:-

Calculation of Sacrifice Ratio:-

Sacrifice Ratio = Old Ratio – New Ratio

Question 13.

(B)

Solution 13

(B)

(i) 4 : 4 : 2 : 2

Sacrifice Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 3/6-4/12=(6 – 4)/12=2/12

B’s Sacrificing Ratio = 2/6-4/12=(4 – 4)/12=0

C’s Sacrificing Ratio = 1/6-2/12=(2 – 2)/12=0

Sacrificing Ratio = Only A Sacrifices = 2/12=1/6

(ii) 2 : 4 : 2 : 4

Sacrifice Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 3/6-2/12=(6 – 2)/12=4/12

B’s Sacrificing Ratio = 2/6-4/12=(4 – 4)/12=0

C’s Sacrificing Ratio = 1/6-2/12=(2 – 2)/12=0

Sacrificing Ratio = Only A Sacrifices = 4/12=1/3

(B) Points for Students:-

Calculation of Sacrifice Ratio:-

Sacrifice Ratio = Old Ratio – New Ratio

Question 14.

(A)

Solution 14

(A)

D’s Share = 1/6

Remaining Share = 1-1/6=5/6

A’s Share = 2/5 of 5/6 = 2/6

B’s Share = 2/5 of 5/6 = 2/6

C’s Share = 1/5 of 5/6 = 1/6

D’s Share = 1/6

Computation of Sacrificing Ratio:-

Sacrifice Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 2/5-2/6=(12 – 10)/30=2/30

B’s Sacrificing Ratio = 2/5-2/6=(12 – 10)/30=2/30

C’s Sacrificing Ratio = 1/5-1/6=(6 – 5)/30=1/20

Sacrificing Ratio = 2 : 2 : 1.

(A) Points for Students:-

Entries will be passed for distribution of profit:-

Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

(Profit transfer to Profit and loss appropriation Account)

Profit and Loss Appropriation A/c Dr.

To Partner Capital A/c

(profit distributed to partners in profit sharing ratio)

Question 14.

(B)

Solution 14

(B)

C’s Share = 1/4

Remaining Share = 1-1/4=3/4

A’s Share = 5/8 of 3/4 = 15/32

B’s Share = 3/8 of 3/4 = 9/32

C’s Share = 1/4

New Profit Sharing Ratio = 15/32 : 9/32 ∶ 1/4

New Profit Sharing Ratio = (15 ∶ 9 ∶ 8)/32

New Profit Sharing Ratio =15 ∶ 9 ∶ 8

Computation of Sacrificing Ratio:-

Sacrifice Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 5/8-15/32=(20 – 15)/32=5/32

B’s Sacrificing Ratio = 3/8-9/32=(12 – 9)/32=2/32

Sacrificing Ratio = 5 : 3.

(B) Points for Students:-

Entry for profit transfer:-

Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

(Profit transfer to Profit and loss appropriation Account)

Question 15.

Solution 15

A’s Surrendered = 1/7 of 7/10 = 1/10

B’s Surrendered = 1/3 of 3/10 = 1/10

Sacrificing Ratio = 1/10 ∶ 1/10

Sacrificing Ratio = 1 : 1

Computation of New Ratio :-

A’s New Share = 7/10-1/10=(7 – 1)/10= 6/10

B’s New Share = 3/10-1/10=(3 – 1)/10= 2/10

C’s New Share = 1/10+1/10=(1+ 1)/10= 2/10

New Ratio of A, B and C = 6/10:2/10:2/10

New Ratio of A, B and C = 6 : 2 : 2

New Ratio of A, B and C = 3 : 1 : 1

Points for Students:-

Computation of New Profit sharing ratio:-

New Ratio = Old Ratio – Surrender Share

We can calculate other formulas by the above formulas:-

Old Ratio = New Ratio + Surrender Share

Surrender Ratio = Old Ratio – New Share

Question 16.

(A)

Solution 16

(A)

A’s Surrendered = 1/3 of 3/5 = 1/5

B’s Surrendered = 1/10

Sacrificing Ratio = 1/5 ∶ 1/10

Sacrificing Ratio = (2 ∶ 1)/10

Sacrificing Ratio = 2 : 1

Computation of New Ratio :-

A’s New Share = 3/5-1/5=(3 – 1)/5= 2/5

B’s New Share = 2/5-1/10=(4 – 1)/10= 3/10

C’s New Share = 1/5+1/10=(2 + 1)/10= 3/10

New Ratio of A, B and C = 2/5:3/10:3/10

New Ratio of A, B and C = (4 ∶ 3 ∶ 3)/10

New Ratio of A, B and C = 4 : 3 : 3.

(A) Points for Students:-

Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favour of the new partner. The ratio in which they surrender their profits is called sacrifice ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of the new partner.

Calculation of Sacrifice Ratio is calculated as follows:

Sacrifice Ratio = Old Ratio – New Ratio

Question 16.

(B)

Solution 16

(B)

A’s sacrifices 1/2 of 5/8 = 5/16

B’s sacrifices = 1/4

Computation of New Ratio :-

A’s New Share = 5/8-5/16=(10 – 5)/16= 5/16

B’s New Share = 3/8-1/4=(3 – 2)/8= 1/8

New share of A, B, C and D = 5/16:1/8:5/16:1/4

New Ratio of A, B and C = (5 ∶ 2 ∶ 5 ∶4)/16

New Ratio of A, B and C = 5 ∶ 2 ∶ 5 ∶4.

(B) Points for Students:-

Calculation of Sacrifice Ratio:-

Sacrifice Ratio = Old Ratio – New Ratio

Question 17.

Solution 17 (i) New Ratio 2:2: 1; Sacrificing Ratio 6: 1.

(ii) New Ratio 6 : 8 : 4 : 2 : 5]

Solution 17

(i) Computation of new profit sharing ratio:-

C’s Share = 1/5

Remaining Share = 1-1/5 = 4/5

A’s New Share = 1/2 of 4/5 = 4/10 = 2/5

B’s New Share = 1/2 of 4/5 = 4/10 = 2/5

C’s New Share = 1/5

New Profit Sharing Ratio = 2/5 ∶ 2/5 ∶1/5

New Profit Sharing Ratio = 2 : 2 : 1.

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 4/7-2/5=(20 – 14)/35= 6/35

B’s Sacrificing Ratio = 3/7-2/5=(15 – 14)/35= 1/35

Sacrificing Ratio = 6 : 1.

(ii) Computation of Sacrificing Ratio:-

E’s Share = 20% or 20/100 or 1/5

Remaining Share = 1-1/5=4/5

Profit shared A, B, C and D in the ratio of 3/10:4/10:2/10:1/10

A’s New Ratio = 4/5 of 3/10 = 12/50

B’s New Ratio = 4/5 of 4/10 = 16/50

C’s New Ratio = 4/5 of 2/10 = 8/50

D’s New Ratio = 4/5 of 1/10 = 4/50

E’s New Ratio = 1/5

New Profit Sharing Ratio = 12/50:16/50:8/50:4/50:1/5

New Profit Sharing Ratio = (12 ∶ 16 ∶ 8 ∶ 4 ∶ 5)/50

New Profit Sharing Ratio = 12 ∶ 16 ∶ 8 ∶ 4 ∶ 5

Points for Students:-

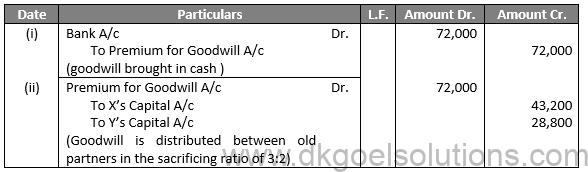

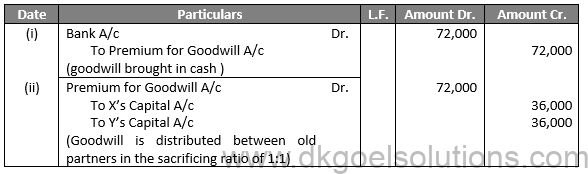

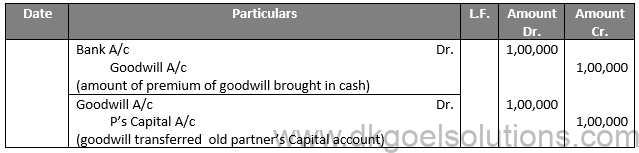

The following two entries are passed for this purpose.

(a) Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(The amount of goodwill/premium brought in cash by new partner)

(b) Premium for Goodwill A/c Dr.

To Old Partner’s Capital A/c

(The amount of goodwill/premium transferred to old partner’s capital accounts in sacrificing ratio)

Question 18.

Solution 18

Old Ratio of A and B = 3:1

New Ratio of B and C = 3:1.

C’s share = 1/4

Remaining Share = 1-1/4 = 3/4

A’s New Ratio = 3/4× 3/4=9/16

B’s New Ratio = 3/4× 1/4=3/16

C’s New Ratio = 1/4

New Ratio of A, B and C = 9 : 3 : 1.

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 3/4-3/16=(12 – 9)/16= 3/16

B’s Sacrificing Ratio = 1/4-3/16=(4 – 3)/16= 1/16

Sacrificing Ratio = 3 : 1.

Points for Students:-

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

Question 19.

Solution 19

Old Ratio of A, B and C = 4 : 3 : 2

D’s Share = 1/9

Remaining Share = 1-1/9=8/9

A’s New share = 4/9

Remaining Share = 8/9-4/9=4/9

B’s New Share = 3/5 of 4/9 = 12/45

C’s New Share = 2/5 of 4/9 = 8/45

The New Ratio A, B, C and D = 4/9:12/45:8/45:1/9

The New Ratio A, B, C and D = (20 ∶ 12 ∶ 8 ∶ 5)/45

The New Ratio A, B, C and D = 20 ∶ 12 ∶ 8 ∶ 5

Computation of Sacrificing Ratio:-

B’s Sacrificing = 3/9-12/45=(15 – 12)/45=3/45

C’s Sacrificing = 2/9-8/45=(10 – 8)/45=2/45

Sacrificing Ratio among B and C = 3:2

Points for Students:-

If new partner brings his share of goodwill in cash, and if the Goodwill Account already appears in the books of the firm, first of all the existing Goodwill Account will have to be written off. For this purpose old partner’s Capital Account are debited in their old profit sharing ratio and Goodwill Account is credited. Thus, the following entry is passed to write off the existing goodwill:

Old Partner’s Capital A/c Dr.

To Goodwill A/c

(Goodwill written off in old ratio)

Question 20.

Solution 20

Computation of Sacrificing Ratio:-

S’s Share = 1/5

P surrender for S = 1/10

Remaining Share of S = 1/5-1/10=(2 – 1)/10= 1/10

1/10 share of sacrificed Q and R in the ratio of 2:1

Q’s Sacrifice = 1/10 of 2/3 = 2/30

R’s Sacrifice = 1/10 of 1/3 = 1/30

Sacrifice Ratio of P, Q and R = 1/10:2/30:1/30

Sacrifice Ratio of P, Q and R = (3 ∶ 2 ∶ 1)/30

Sacrifice Ratio of P, Q and R = 3 ∶ 2 ∶ 1

Computation of New Ratio:-

P’s New Share = 5/10- 3/30=(15 – 3)/30=12/30

Q’s New Share = 3/10- 2/30=(9 – 2)/30=7/30

R’s New Share = 2/10- 1/30=(6 – 1)/30=5/30

S’s New Share = 1/5

New Ratio of P, Q, R and S = 12/30:7/30:5/30:1/5

New Ratio of P, Q, R and S = (12 ∶ 7 ∶ 5 ∶ 6)/30

New Ratio of P, Q, R and S = 12∶ 7∶ 5 ∶ 6

Points for Students:-

When the new partner does not bring his share of goodwill/premium in Cash: Accounting Standard (AS) 26 (Intangible Assets) Specifies that goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. It means that only purchased goodwill can be recorded in the books. At the time of admission, retirement or death of a partner or in case of change in profit sharing ratio among existing partners, goodwill account cannot be raised in the books of the firm because it will be non-purchased goodwill and no consideration in money or money’s worth has been for it.

Question 21.

Solution 21

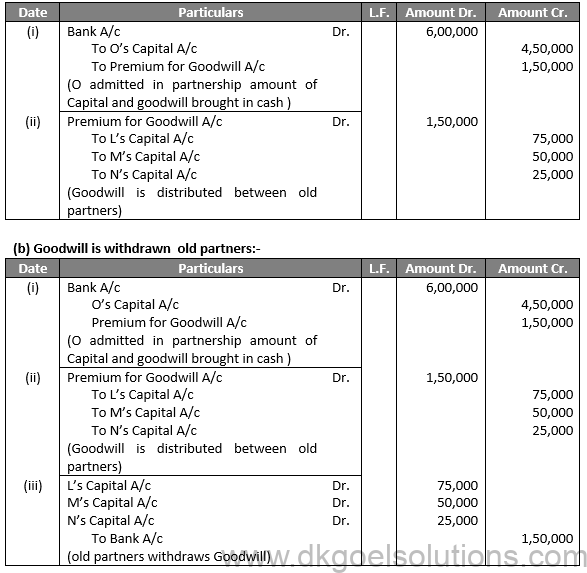

(a) Goodwill is retained in the firm:-

Working Note:-

O’s Share = 1/5

Remaining Share = 1-1/5=4/5

L’s New Ratio = 3/6 of 4/5 = 12/30=2/5

M’s New Ratio = 2/6 of 4/5 = 8/30=4/15

N’s New Ratio = 1/6 of 4/5 = 4/30=2/15

O’s New Ratio = 1/5

New Profit Sharing Ratio = 2/5:4/15:2/15:1/5

New Profit Sharing Ratio = (6 ∶ 4 ∶ 2 ∶ 3)/15

New Profit Sharing Ratio = 6 ∶ 4 ∶ 2 ∶ 3

Points for Students:-

New partner’s current account is debited from his share of goodwill and the old partner’s capital accounts are credited in their sacrificing ratio. Following Journal entry is passed for this purpose:

New Partner’s Current A/c Dr. (From his share of goodwill)

To Old Partner’s Capital A/c (In sacrificing ratio)

(Current Account of new partner debited from his share of goodwill on his admission and Capital Accounts of old partner’s credited in their sacrificing ratio)

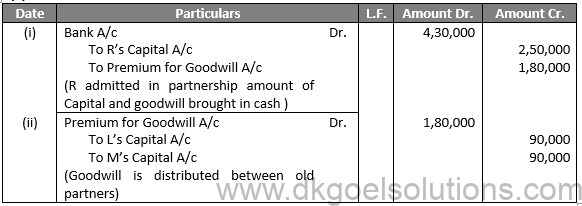

Question 22.

Solution 22

(a) Goodwill is retained in the firm:-

Working Note:-

R’s Share = 4/9 which he acquires from P and Q.

P’s surrender = 1/2 of 4/9 = 2/9

Q’s surrender = 1/2 of 4/9 = 2/9

Computation of New Profit Sharing Ratio:-

P’s New Ratio = 2/3 – 2/9 = (6 – 2)/9=4/9

Q’s New Ratio = 1/3 – 2/9 = (3 – 2)/9=1/9

R’s New Ratio = 4/9

New Profit Sharing Ratio = 4/9:1/9:4/9

New Profit Sharing Ratio = (4 ∶ 1∶ 4)/9

New Profit Sharing Ratio = 4 ∶ 1 ∶ 4

Points for Students:-

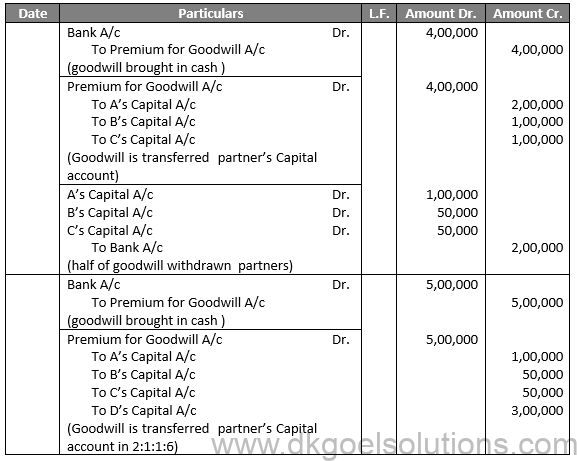

When the amount of goodwill/premium brought by the new partner is retained in the business: If the new partner brings in his share of goodwill in cash and this amount is retained in the business, the amount is credited to the Capital Accounts of old partners in their sacrificing ratio. The following two entries are passed for this purpose.

(a) Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(The amount of goodwill/premium brought in cash by new partner)

(b) Premium for Goodwill A/c Dr.

To Old Partner’s Capital A/c

(The amount of goodwill/premium transferred to old partner’s capital accounts in sacrificing ratio)

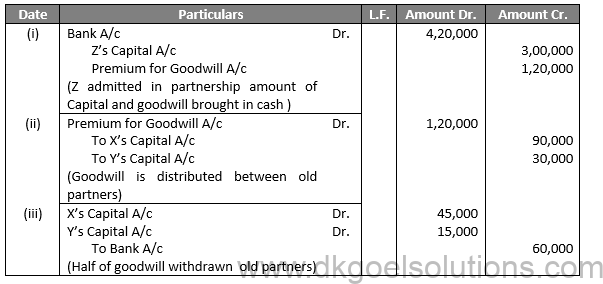

Question 23.

Solution 23

Working Note:-

Z’s Share = 4/9 which he acquires 3/4th from P and 1/4th from Q.

X’s surrender = 3/4 of 2/7 = 3/14

Y’s surrender = 1/4 of 2/7 = 1/14

Computation of New Profit Sharing Ratio:-

X’s New Ratio = 4/7 – 3/14 = (8 – 3)/14=5/14

Y’s New Ratio = 3/7 – 1/14 = (6 – 1)/14=5/14

Z’s New Ratio = 2/7

New Profit Sharing Ratio = 5/14:5/14:2/7

New Profit Sharing Ratio = (5 ∶ 5 ∶ 4)/14

New Profit Sharing Ratio = 5 ∶ 5 ∶ 4

Points for Students:-

At the time of admission, if there is any General Reserve, Reserve Fund or the balance of Profit and Loss Account appearing in the balance sheet, it must be transferred to Old Partner’s Capital Accounts in their old profit sharing ratio. The new partner is not entitled to any share of such reserves of profits, as these are undistributed profits earned by the old partners.

Question 24.

Solution 24

Working Note:-

K’s surrender = 2/5 of 1/3 = 2/15

Z’s surrender = 3/5 of 1/3 = 3/15

Computation of New Profit Sharing Ratio:-

K’s New Ratio = 3/5 – 2/15 = (9 – 2)/15=7/15

Y’s New Ratio = 2/5 – 3/15 = (6 – 3)/15=3/15

Z’s New Ratio = 1/3

New Profit Sharing Ratio = 7/15:3/15:1/3

New Profit Sharing Ratio = (7 ∶ 3 ∶ 5)/15

New Profit Sharing Ratio = 7∶ 3 ∶ 5

Points for Students:-

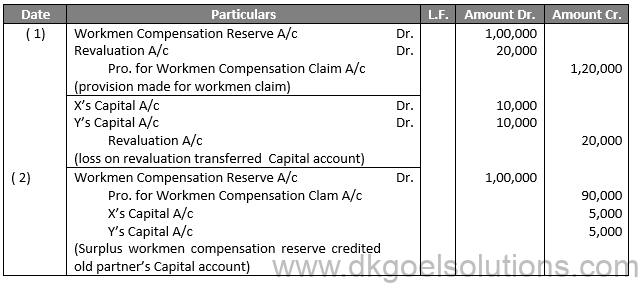

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Accounts of old partners in their old profit sharing ratio:

The Journal entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to old partner’s Capital Account in their old profit sharing ratio)

Question 25.

Solution 25

Working Note:-

Computation of New Profit Sharing Ratio:-

Anju’s New Ratio = 7/12 – 1/24 = (14 – 1)/24=13/24

Manju’s New Ratio = 5/12 – 1/8 = (10 – 3)/24=7/24

Meenu’s New Ratio = 1/6

New Profit Sharing Ratio = 13/24:7/24:1/6

New Profit Sharing Ratio = (13 ∶ 7 ∶ 1)/24

New Profit Sharing Ratio = 13∶ 7 ∶ 4

Computation of Profit:-

Anju’s Profit = Rs. 4,80,000 × 13/24 = Rs. 2,60,000

Manju’s Profit = Rs. 4,80,000 × 7/24 = Rs. 1,40,000

Meenu’s Profit = Rs. 4,80,000 × 4/24 = Rs. 80,000

Points for Students:-

If the claim for workmen compensation is lower than the amount of Workmen Compensation Reserve: The amount of claim is credited to ‘Provision for Workmen Compensation Claim A/c’ and balance is credited to the Capital Accounts of old partners in their old profit sharing ratio (Suppose Workmen Compensation Reserve is Rs.50,000 and liability for claim is Rs.20,000). The Journal entry passed is:

Workmen Compensation Reserve A/c Dr. 50,000

To Provision for Workmen Compensation Claim A/c 20,000

To Partner’s Capital A/c 30,000

Q26.

Solution 26

Working Note:-

A’s surrender = 1/4 of 2/(3 ) = 2/12

B’s surrender = 1/4 of 1/3 = 1/12

Computation of New Profit Sharing Ratio:-

A’s New Ratio = 3/6 – 2/12 = (6 – 2)/12=4/12

B’s New Ratio = 2/5 – 3/15 = (4 – 1)/12=3/12

C’s New Ratio = 1/6

D’s New Ratio = 1/4

New Profit Sharing Ratio = 4/12:3/12:1/6:1/4

New Profit Sharing Ratio = (4 ∶ 3 ∶ 2 ∶ 3)/12|

New Profit Sharing Ratio = 4∶ 3 ∶ 2∶3

Value of Goodwill = Rs. 6,00,000 × 1/4 = Rs. 1,50,000

A’s Share = Rs. 1,50,000 × 2/3 = Rs. 1,00,000

B’s Share = Rs. 1,50,000 × 1/3 = Rs. 50,000

Points for Students:-

If the claim is equal to Workmen Compensation Reserve: Entire amount of Workmen Compensation Reserve is transferred to Provision for Workmen Compensation Claim A/c:

Workmen Compensation Reserve A/c Dr.

To Provision for Workmen Compensation Claim A/c

(Provision made for Workmen Compensation Claim)

Q27.

Solution 27

First :-

Working Note:-

Old Ratio of X and Y = 3:2

Z’s Share = 1/4

Remaining Share = 1-1/4= 3/4

X’s New Share = 3/5 of 3/4 = 9/20

Y’s New Share = 2/5 of 3/4 = 6/20

Z’s New Share = 1/4

New Profit Sharing Ratio = 9/20:6/20:1/4

New Profit Sharing Ratio = (9 ∶ 6 ∶ 5)/20

New Profit Sharing Ratio = 9 ∶ 6 ∶ 5

Sacrificing Ratio = 3:2

Second :-

Working Note:-

Sacrificing Ratio = 1:1

Z acquires 1/2 of 1/4 = 1/8 from each of X and Y.

X’s New Ratio = 3/5- 1/8=(24 – 5)/40= 19/40

Y’s New Ratio = 2/5- 1/8=(16 – 5)/40= 11/40

Z’s New Ratio = 1/4

New Profit Sharing Ratio = 19/40:11/40:1/4

New Profit Sharing Ratio = (19 ∶ 11 ∶ 10)/40

New Profit Sharing Ratio = 19 ∶ 11 ∶ 10

Third :-

Points for Students:-

Concept Hidden Goodwill: Sometimes, the value of goodwill is hidden in the question. In such cases, the amount of goodwill is calculated on the basis of total capital of the firm and the profit sharing ratio of the partners. For example, A and B partners with capitals of Rs. 40,000 and Rs. 30,000 respectively. They admit C as a partner with 1/4 th share. C is to contribute Rs. 34,000 as his capital. In such a case, the total capital of the firm, based on C’s share ought to be Rs. 34,000 ×4/1 = 1,36,000. But the combined capital of A, B and C becomes only Rs.1,04,000 (Rs. 40,000 + Rs. 30,000 + Rs. 34,000). As such the value of total goodwill of the firm should be taken as Rs. 1,36,000 – Rs. 1,04,000 = Rs.32,000.

Question 28.

Solution 28

Working Note:-

A’s Surrender = 5/10 of 1/5 = 1/10

B’s Surrender = 3/10 of 1/6 = 1/20

C’s Surrender = 2/10 of 1/8 = 1/40

Sacrificing Ratio = 1/10:1/20:1/40

Sacrificing Ratio = (4 ∶ 2 ∶ 1)/40

Sacrificing Ratio =4 ∶ 2 ∶ 1

Points for Students:-

When the new partner brings in proportionate capital: Sometimes the capital of the new partner is not given in the question. He may be required to bring in proportionate capital. In such cases the new partner’s capital will be calculated on the basis of the capitals of the old partners remaining after all adjustments and revaluation.

Question 29.

Solution 29

Working Note:-

Computation of Sacrificing Ratios:-

Sacrificing Ratio = Old Ratio – New Ratio

(a)

A’s Sacrificing Ratio = 3/6-15/36=(18-15)/36=3/36

B’s Sacrificing Ratio = 2/6-10/36=(12-10)/36=2/36

C’s Sacrificing Ratio = 1/6-5/36=(6 – 5)/36=1/36

Sacrificing Ratio of A,B and C = 3/36:2/36:1/36

Sacrificing Ratio of A,B and C = 3∶2∶1

(b)

A’s Sacrificing Ratio = 3/6-5/12=(6 – 5)/12=1/12

B’s Sacrificing Ratio = 2/6-3/12=(4 – 3)/36=1/12

C’s Sacrificing Ratio = 1/6-2/12=(2 – 2)/12=0

Sacrificing Ratio of A,B and C = 1/12:1/12

Sacrificing Ratio of A,B and C = 1∶1

(c)

A’s Sacrificing Ratio = 3/6-2/6=(3 – 2)/6=1/6

B’s Sacrificing Ratio = 2/6-2/6=(2 – 2)/6=0

C’s Sacrificing Ratio = 1/6-1/6=(1 – 1)/6=0

A alone has sacrificed.

Points for Students:-

When the amount of goodwill/premium brought by the new partner is retained in the business: If the new partner brings in his share of goodwill in cash and this amount is retained in the business, the amount is credited to the Capital Accounts of old partners in their sacrificing ratio. The following two entries are passed for this purpose.

(a) Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(The amount of goodwill/premium brought in cash by new partner)

(b) Premium for Goodwill A/c Dr.

To Old Partner’s Capital A/c

(The amount of goodwill/premium transferred to old partner’s capital accounts in sacrificing ratio)

Question 30.

Solution 30

Working Note:-

Computation of New Profit Sharing Ratio:-

Z’s Share = 1/4

Remaining Share = 1-1/4= 3/4

X’s New Profit Ratio = 3/4 of 1/2 = 3/8

Y’s New Profit Ratio = 3/4 of 1/2 = 3/8

Computation of Sacrificing Ratio:-

X’s Sacrificing Ratio = 3/5 – 3/8 = (24 -15)/40 = 9/40

Y’s Sacrificing Ratio = 2/5 – 3/8 = (16 -15)/40 = 1/40

Sacrificing Ratio of X and Y is 9:1.

Points for Students:-

When the new partner does not bring his share of goodwill/premium in Cash: Accounting Standard (AS) 26 (Intangible Assets) Specifies that goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. It means that only purchased goodwill can be recorded in the books. At the time of admission, retirement or death of a partner or in case of change in profit sharing ratio among existing partners, goodwill account cannot be raised in the books of the firm because it will be non-purchased goodwill and no consideration in money or money’s worth has been for it.

Question 31.

Solution 31

Sacrificing Ratio B and C = 1,25,000 : 25,000, Which is 5 : 1.

B’s surrender = 1/4 of 5/6 = 5/24

C’s surrender = 1/4 of 1/6 = 1/24

Computation of New Profit Sharing Ratio:-

A’s New Ratio = 3/6

B’s New Ratio = 2/6 – 5/24 = (8 – 5)/24=3/24

C’s New Ratio = 1/6 – 1/24 = (4 – 1)/24=3/24

D’s New Ratio = 6/24

New Profit Sharing Ratio = 3/6:3/24:3/24:1/4

New Profit Sharing Ratio = (12 ∶ 3 ∶ 3 ∶ 6)/24

New Profit Sharing Ratio = 12∶ 3 ∶ 3∶6

New Profit Sharing Ratio = 4∶ 1 ∶ 1∶2

Points for Students:-

Adjustment of Old Partner’s Capital Accounts on the basis of new partner’s capital: Sometimes, on the admission of a new partner it is decided that the capitals of the old partners will be adjusted on the basis of new partner’s capital to make them proportionate to their share of profits. In such questions, first of all the entire Capital of the new firm should be determined on the basis of new partner’s capital. Then the Capital of each partner is ascertained by dividing the total Capital according to his profit sharing ratio

Question 32.

Solution 32

Working Note:-

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

X’s Ratio = 2/3-1/3=(2 – 1)/3=1/3

Y’s Ratio = 1/3-1/3=0

Points for Students:-

Sometimes, the value of goodwill is hidden in the question. In such cases, the amount of goodwill is calculated on the basis of total capital of the firm and the profit sharing ratio of the partners.

Question 33.

Solution 33

Computation of New Profit Sharing Ratio:-

(i) C admitted for 1/4th Share

Remaining Share = 1-1/4= 3/4

A’s Share = 2/3 of 3/4 = 2/4

B’s Share = 1/3 of 3/4 = 1/4

C’s Share = 1/4

New Share = 2:1:1

(ii) D admitted for 3/5th Share

Remaining Share = 1-3/5= 2/5

A’s Share = 2/4 of 2/5 = 4/20=2/10

B’s Share = 1/4 of 2/5 = 2/20=1/10

C’s Share = 1/4 of 2/5 = 1/10

D’s Share = 3/5=6/10

New Share = 2:1:1:6

(iii) E admitted for 1/6th Share

Remaining Share = 1-1/6= 5/6

A’s Share = 2/10 of 5/6 = 10/60=1/6

B’s Share = 1/10 of 5/6 = 5/60=1/12

C’s Share = 1/10 of 5/6 = 5/60=1/12

D’s Share = 6/10 of 5/6 = 5/10

E’s Share = 1/6

New Profit Sharing Ratio = 1/6:1/12:1/12:5/10:1/6

New Profit Sharing Ratio = (10 ∶ 5 ∶ 5 ∶ 30 ∶10)/60

New Profit Sharing Ratio = 10 ∶ 5 ∶ 5 ∶ 30 ∶10

New Profit Sharing Ratio = 2∶ 1 ∶ 1∶6∶2

Points for Students:-

Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favour of the new partner. The ratio in which they surrender their profits is called sacrifice ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of the new partner.

Question 34.

Solution 34

Working Note:-

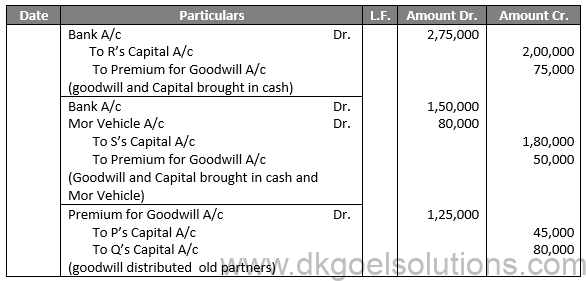

1.) Computation of goodwill of R’s Share and S’s Share:-

Total goodwill of the firm = Rs. 3,00,000

R’s Share of goodwill = Rs. 3,00,000 × 3/12 = Rs. 75,000

S’s Share of goodwill = Rs. 3,00,000 × 2/12 = Rs. 50,000

2.) Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

P’s Sacrificing Ratio = 2/5-3/12=(24 – 15)/60= 9/60

Q’s Sacrificing Ratio = 3/5-4/12=(36 – 20)/60= 16/60

Sacrificing Ratio = 9/60:16/60

Sacrificing Ratio = 9 : 16.

Points for Students:-

When the new partner brings in proportionate capital: Sometimes the capital of the new partner is not given in the question. He may be required to bring in proportionate capital. In such cases the new partner’s capital will be calculated on the basis of the capitals of the old partners remaining after all adjustments and revaluation.

Question 35.

Solution 35

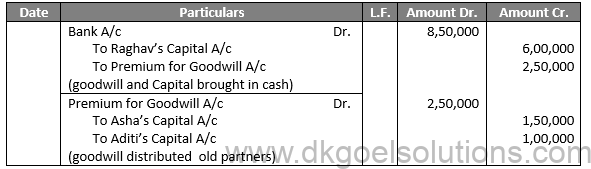

Working Note:-

Average Profit = Total Profit × (Total Profit)/(Number of Year)

Total Profit = Rs. 3,50,000 + Rs. 4,75,000 + Rs. 6,70,000 + Rs. 7,30,000

Average Profit = 22,25,000/4

Average Profit = Rs. 5,56,250

Net Average Profit = Average Profit –Management Cost

Net Average Profit = Rs. 5,56,250 – Rs. 56,250

Net Average Profit = Rs. 5,00,000

Value of Firm’s Goodwill = Rs. 5,00,000 × 2

Value of Firm’s Goodwill = Rs. 10,00,000

Raghav’s Share in Goodwill = Rs. 5,00,000 × 1/4 = Rs. 2,50,000

Points for Students:-

Adjustment of Old Partner’s Capital Accounts on the basis of new partner’s capital: Sometimes, on the admission of a new partner it is decided that the capitals of the old partners will be adjusted on the basis of new partner’s capital to make them proportionate to their share of profits. In such questions, first of all the entire Capital of the new firm should be determined on the basis of new partner’s capital. Then the Capital of each partner is ascertained by dividing the total Capital according to his profit sharing ratio.

Question 36.

Solution 36

Working Note:-

Computation of Sacrificing Ratio:-

Ram’s Share = 3/5-5/13=(39-25)/65=14/65

Rahim’s Share = 2/5-5/13=(26-25)/65=1/65

Sacrificing Ratio = 14/65:1/65

Sacrificing Ratio = 14 : 1

Raj’s Share in Goodwill = Rs. 5,20,000 × 3/13 = Rs. 1,20,000

Points for Students:-

Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favour of the new partner. The ratio in which they surrender their profits is called sacrifice ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of the new partner.

Calculation of Sacrifice Ratio is calculated as follows:

Sacrifice Ratio = Old Ratio – New Ratio

Question 37.

(A)

Solution 37

(A)

Working Note:-

Computation of Sacrificing Ratio:-

A’s Share = 3/5-2/5=(3-2)/5=1/5

B’s Share = 2/5-2/5=(2-2)/5=0

A’s alone has sacrificed.

(A) Points for Students:-

When the amount of goodwill/premium brought by the new partner is retained in the business: If the new partner brings in his share of goodwill in cash and this amount is retained in the business, the amount is credited to the Capital Accounts of old partners in their sacrificing ratio. The following two entries are passed for this purpose.

(a) Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(The amount of goodwill/premium brought in cash by new partner)

(b) Premium for Goodwill A/c Dr.

To Old Partner’s Capital A/c

(The amount of goodwill/premium transferred to old partner’s capital accounts in sacrificing ratio)

Question 37.

(B)

Solution 37

(B)

Working Note:-

Computation of New Ratio:-

R’s Share = 1/5

P’s Sacrificing = 1/10

S’s Sacrificing = 1/10

P’s Share = 3/5-1/10=(6-1)/10=5/10

S’s Share = 2/5-1/10=(4-1)/10=3/10

R’s Share = 1/10+1/10=(1+1)/10=2/10

New Share = 5:3:2

Profit Division:-

P’s Share = Rs. 1,00,000 × 5/10 = Rs. 50,000

S’s Share = Rs. 1,00,000 × 3/10 = Rs. 30,000

R’s Share = Rs. 1,00,000 × 2/10 = Rs. 20,000

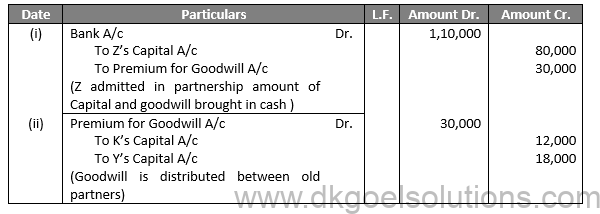

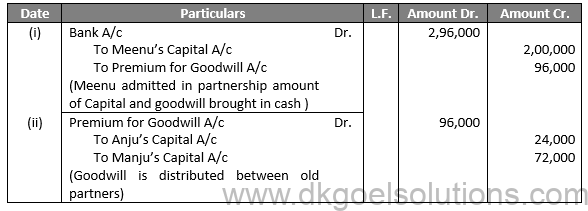

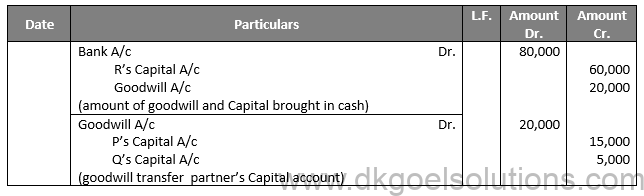

(B) Points for Students:-

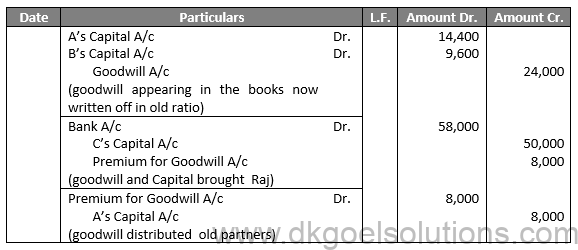

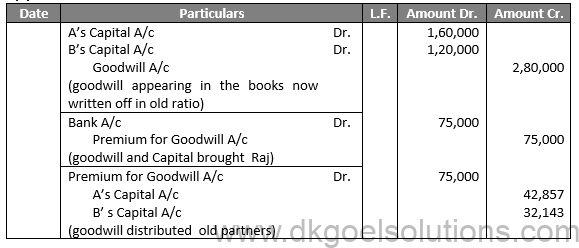

When goodwill appearing in the books:-

Partner’s Capital A/c Dr.

To Goodwill A/c

When new partners brought his capital and goodwill:-

Bank A/c Dr.

To New partners Capital A/c

To Premium for Goodwill A/c

When Goodwill distributed old partners

Premium for Goodwill A/c Dr.

To P’s Capital A/c

To S’ s Capital A/c

Question 37.

(C)

Solution 37

(C)

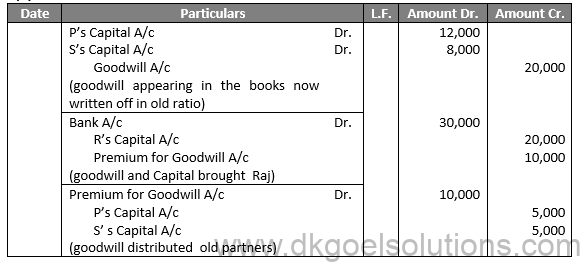

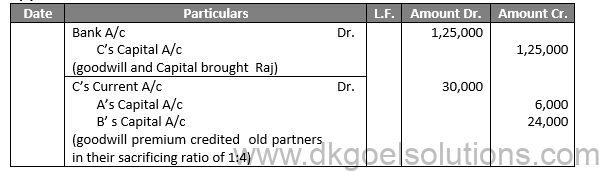

(C) Points for Students:-

When goodwill appearing in the books:-

Partner’s Capital A/c Dr.

To Goodwill A/c

When new partners brought his capital and goodwill:-

Bank A/c Dr.

To New partners Capital A/c

To Premium for Goodwill A/c

When Goodwill distributed old partners

Premium for Goodwill A/c Dr.

To P’s Capital A/c

To S’ s Capital A/c

Question 38.

Solution 38

Working Note:-

Goodwill = Rs. 25,000

C’s Share of goodwill = Rs. 25,000 × 1/5 = Rs. 5,000

Points for Students:-

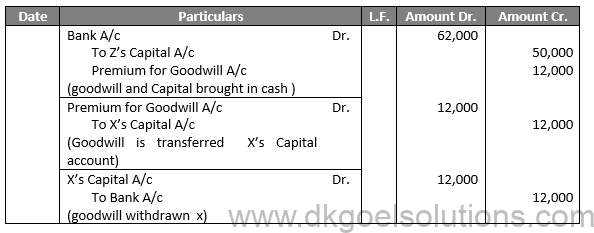

When Goodwill/Premium brought in by the new partner is withdrawn by the old partners: Sometimes, the amount of goodwill brought in by new partner is withdrawn by the old partners. In this case, in addition to the two Journal entries explained above, one more Journal entry is required to be passed:

Old Partner’s Capital A/c Dr.

To Cash/Bank A/c

(The amount of goodwill/premium withdrawn by the old partners)

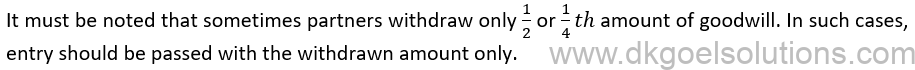

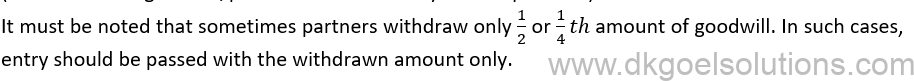

It must be noted that sometimes partners withdraw only 1/2 or 1/4 th amount of goodwill. In such cases, entry should be passed with the withdrawn amount only.

Question 39.

Solution 39

(i) Computation of C’s Share of Goodwill:-

| Years | Amount | |

| 31st March, 2014 | 50,000 | |

| 31st March, 2015 | (Rs. 1,20,000 – Rs. 40,000) | 80,000 |

| 31st March, 2016 | (Rs. 60,000 – Rs. 50,000) | (10,000) |

| 31st March, 2017 | (Rs. 1,00,000 – Rs. 1,50,000) | 50,000 |

| 31st March, 2018 | 1,90,000 | |

| to Total Profit | 3,60,000 |

Average Normal Profit = (toTotal Profit)/(Normal Year)

Average Normal Profit = 3,60,000/5

Average Normal Profit = Rs. 72,000

Capitalised Value of Average Profits = (Average Normal Profit)/(Normal Rate of Return)

Capitalised Value of Average Profits = 72,000/12 × 100 = Rs. 6,00,000

Capitalised Value of Average Profits = Rs. 6,00,000

Capital Employed = Total Assets – External Liabilities

Capital Employed = Rs. 7,00,000 – Rs. 2,20,000

Capital Employed = Rs. 4,80,000

Goodwill = Capitalised Value of Average Profits – Net Assets

Goodwill = Rs. 6,00,000 – Rs. 4,80,000

Goodwill = Rs. 1,20,000

C’s Share of Goodwill = Rs. 1,20,000 × 1/4 = Rs. 30,000

(ii)

Working Note:-

(1) C’s Share = 1/5

A’s Sacrificed = 1/4×1/5= 1/20

A’s Sacrificed = 1/4×4/5= 4/20

Sacrificing Ratio of A and B = 1 : 4

(2) Computation of New Profit Sharing Ratio:-

A’s New Ratio = 3/5-1/20=(12-1)/20=11/20

B’s New Ratio = 2/5-4/20=(8-4)/20=4/20

C’s New Ratio = 1/4

New Profit Sharing Ratio = 11/20:4/20:1/4

New Profit Sharing Ratio = (11 ∶ 4 ∶ 5 )/20

New Profit Sharing Ratio = 11 ∶ 4 ∶ 5

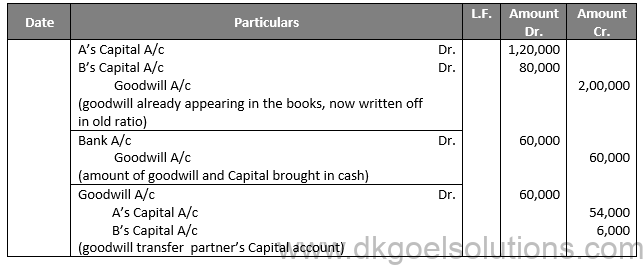

Points for Students:-

If new partner brings his share of goodwill in cash, and if the Goodwill Account already appears in the books of the firm, first of all the existing Goodwill Account will have to be written off. For this purpose old partner’s Capital Account are debited in their old profit sharing ratio and Goodwill Account is credited. Thus, the following entry is passed to write off the existing goodwill:

Old Partner’s Capital A/c Dr.

To Goodwill A/c

(Goodwill written off in old ratio)

Question 40 (new).

Solution 40 (new). Profit of year 2014 = Rs. 50,000

Profit of year 2015 = Rs. 1,20,000 – Rs. 40,000 = Rs. 80,000

Profit of year 2016 = (Rs. 60,000) + Rs. 50,000 = (Rs. 10,000)

Profit of year 2017 = (Rs. 1,00,000) + (Rs. 1,50,000) = Rs. 50,000

Profit of year 2018 = Rs. 1,90,000

Total Profit = Rs. 50,000 + Rs. 80,000 – Rs. 10,000 + Rs. 50,000 + Rs. 1,90,000

Total Profit = Rs. 3,60,000

Average Profit = (Total Profit )/(Number of Years)

Average Profit = 3,60,000/5

Average Profit = Rs. 72,000

Net Assets = Assets – Liabilities

Net Assets = 7,00,000 – 2,20,000

Net Assets = 4,80,000

Capitalised Value = Average Profits × 100/(Normal rate of return)

Capitalised Value = Rs. 72000 × 100/12

Capitalised Value = Rs. 6,00,000

Calculation of Goodwill:-

Goodwill = Capitalised Value – Net Assets

Goodwill = Rs. 6,00,000 – Rs. 4,80,000

Goodwill = Rs. 1,20,000

a) C’s Goodwill = Rs. 1,20,000 × 1/4 = Rs. 30,000

Question 40.

Solution 40

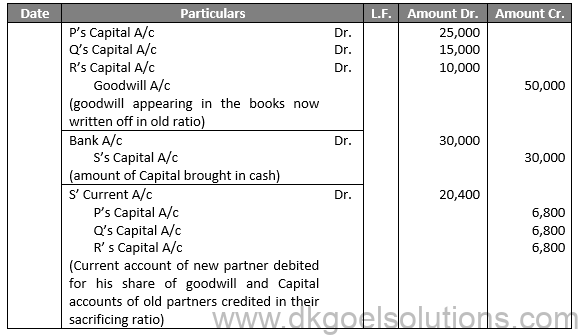

Working Note:-

Total Profit = Rs. 32,000 + Rs. 38,000 + Rs. 35,000 + Rs. 31,000 = Rs. 1,36,000

Average Profit = 1,36,000/4

Average Profit = Rs. 34,000

Goodwill = Rs. 34,000 × 3 = Rs. 1,02,000

S’s Share = Rs. 1,02,000 × 1/5 = Rs. 20,400

Points for Students:-

When the new partner does not bring his share of goodwill/premium in Cash: Accounting Standard (AS) 26 (Intangible Assets) Specifies that goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. It means that only purchased goodwill can be recorded in the books. At the time of admission, retirement or death of a partner or in case of change in profit sharing ratio among existing partners, goodwill account cannot be raised in the books of the firm because it will be non-purchased goodwill and no consideration in money or money’s worth has been for it.

Question 41.

Solution 41

Points for Students:-

New partner’s current account is debited from his share of goodwill and the old partner’s capital accounts are credited in their sacrificing ratio. Following Journal entry is passed for this purpose:

New Partner’s Current A/c Dr. (From his share of goodwill)

To Old Partner’s Capital A/c (In sacrificing ratio)

(Current Account of new partner debited from his share of goodwill on his admission and Capital Accounts of old partner’s credited in their sacrificing ratio)

Question 42.

Solution 42

Points for Students:-

Revaluation Account: Sometimes this account is called as ‘Profit & Loss Adjustment A/c’. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 43.

Solution 43

Working Note:-

A’s Share = 1/6

X’s Sacrifice = 1/12

Y’s Sacrifice = 1/12

Computation of New Share:-

X’s New Share = 1/2-1/12=(6-1)/12=5/12

Y’s New Share = 1/3-1/12=(4-1)/12=3/12

Z’s New Share = 1/6

A’s New Share = 1/6

New Ratio of X, Y, Z and A = 5/12:3/12:1/6:1/6

New Ratio of X, Y, Z and A = (5 ∶ 3 ∶ 2 ∶ 2)/12

New Ratio of X, Y, Z and A = 5 ∶ 3 ∶ 2 ∶ 2

Points for Students:-

At the time of admission, if there is any General Reserve, Reserve Fund or the balance of Profit and Loss Account appearing in the balance sheet, it must be transferred to Old Partner’s Capital Accounts in their old profit sharing ratio. The new partner is not entitled to any share of such reserves of profits, as these are undistributed profits earned by the old partners.

Question 44.

Solution 44

Points for Students:-

Following two entries are passed for goodwill:-

(a) Cash/Bank A/c Dr.

To Premium for Goodwill A/c

(The amount of goodwill/premium brought in cash by new partner)

(b) Premium for Goodwill A/c Dr.

To Old Partner’s Capital A/c

(The amount of goodwill/premium transferred to old partner’s capital accounts in sacrificing ratio)

Question 45. A and B are partners sharing profits in the ratio 3:1. C is admitted as a partner with 2/9th share; A and B will in future get 4/9th and 3/9th share of profits. C pays Rs. 2,00,000 for goodwill. Pass the necessary journal entries.

Solution 45

Working Note:-

Old Ratio = 3 : 1

New Ratio = 4 : 3 : 2

Sacrificing or Gaining Ratio:-

A’s Share = 3/4-3/4=(27-16)/36=11/36 (Sacrifice)

B’s Share = 1/4-3/9=(9-12)/36=3/36 (Gain)

C’s Share = 2/9 (Gain)

Sacrificing Ratio = 11/(36 ):3/(36 ):2/9

Sacrificing Ratio = (11 ∶ 3 ∶8)/(36 )

Sacrificing Ratio = 11 : 3 : 8

C’s Share in Goodwill = Rs. 2,00,000 × 9/2 = Rs. 9,00,000

The amount of goodwill be contributed B will be Rs. 9,00,000 × 3/36 = Rs. 75,000

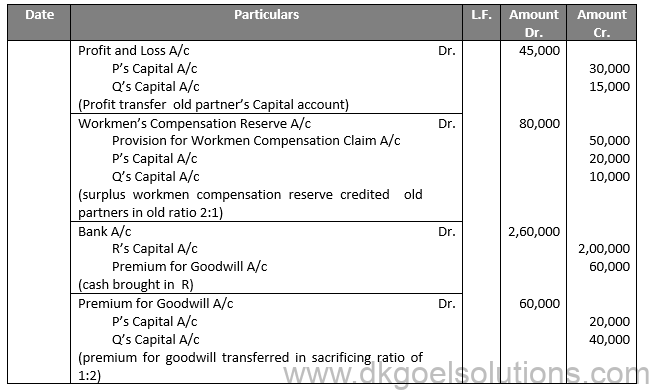

Points for Students:-

If the claim for workmen compensation is lower than the amount of Workmen Compensation Reserve: The amount of claim is credited to ‘Provision for Workmen Compensation Claim A/c’ and balance is credited to the Capital Accounts of old partners in their old profit sharing ratio (Suppose Workmen Compensation Reserve is Rs.50,000 and liability for claim is Rs.20,000). The Journal entry passed is:

Workmen Compensation Reserve A/c Dr. 50,000

To Provision for Workmen Compensation Claim A/c 20,000

To Partner’s Capital A/c 30,000

Question 46.

Solution 46

Working Note:-

1) Sacrificing Ratio = Old Ratio-New Ratio

X’s Sacrificing Ratio = 3/4-1/3=(9-4)/12=5/12(Sacrifice)

Y’s Sacrificing Ratio = 1/4-1/12=(3 – 4)/12=-1/12 (Gain)

2) Goodwill of the firm = Rs. 30,000 × 3/1 = Rs. 90,000

Y’s Gain = Rs. 90,000 × 1/12 = Rs. 7,500

Points for Students:-

When Goodwill/Premium brought in by the new partner is withdrawn by the old partners: Sometimes, the amount of goodwill brought in by new partner is withdrawn by the old partners. In this case, in addition to the two Journal entries explained above, one more Journal entry is required to be passed:

Old Partner’s Capital A/c Dr.

To Cash/Bank A/c

(The amount of goodwill/premium withdrawn by the old partners)

Question 47.

Solution 47

Working Note:-

Old ratio = 2:2:1

New ratio = 13:8:4:5

Sacrificing Ratio = Old Ratio – New Ratio

A’s Sacrificing Ratio = 2/5-13/30=(12 – 13)/30=-1/30(Gain)

B’s Sacrificing Ratio = 2/5-8/30=(12 – 8)/30=4/30 (Sacrifice)

C’s Sacrificing Ratio = 1/5-4/30=(6 – 4)/30=2/30 (Sacrifice)

Points for Students:-

Concept Hidden Goodwill: Sometimes, the value of goodwill is hidden in the question. In such cases, the amount of goodwill is calculated on the basis of total capital of the firm and the profit sharing ratio of the partners. For example, A and B partners with capitals of Rs. 40,000 and Rs. 30,000 respectively. They admit C as a partner with 1/4 th share. C is to contribute Rs. 34,000 as his capital. In such a case, the total capital of the firm, based on C’s share ought to be Rs. 34,000 ×4/1 = 1,36,000. But the combined capital of A, B and C becomes only Rs.1,04,000 (Rs. 40,000 + Rs. 30,000 + Rs. 34,000). As such the value of total goodwill of the firm should be taken as Rs. 1,36,000 – Rs. 1,04,000 = Rs.32,000.

Question 48.

Solution 48

Working Note:-

Old Ratio = 4 : 1

New Ratio = 5 : 3 : 2

Sacrificing Ratio = Old Ratio-New Ratio

A’s Sacrificing Ratio = 4/5-5/10=(8-5)/10=3/12(Sacrifice)

B’s Sacrificing Ratio = 1/5-3/10=(2 – 3)/10=-1/10 (Gain)

2) Goodwill of the firm = Rs. 80,000 × 5/1 = Rs. 4,00,000

Y’s Gain = Rs. 4,00,000 × 1/10 = Rs. 40,000

Points for Students:-

Premium for Goodwill A/c Dr.

Gaining partner’s Capital A/c Dr.

To Sacrificing partner’s Capital A/C

Question 49.

Solution 49

Points for Students:-

Revaluation Account: Sometimes this account is called as ‘Profit & Loss Adjustment A/c’. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 50.

Solution 50

Working Note:-

Computation of Cash Balance:-

| Opening Balance | 40,000 |

| Add: Amount of Capital brought in the new partner in cash | 1,00,000 |

| Add: Amount of Goodwill brought in the new partner in cash | 50,000 |

| 1,90,000 | |

| Less: Amount of goodwill withdrawn the old partners in cash | 25,000 |

| Closing Balance of Cash | 1,65,000 |

Points for Students:-

Computation of Cash Balance:-

Opening Balance

Add: Amount of Capital brought in the new partner in cash

Add: Amount of Goodwill brought in the new partner in cash

Less: Amount of goodwill withdrawn the old partners in cash

Closing Balance of Cash

Question 51.

Solution 51

Points for Students:-

If the existing capital of any partner is in excess of his newly calculated capital, the excess amount is either paid off immediately or credited to his current account. Following entry is passed for this purpose:

(i) Old Partner’s Capital A/c Dr.

To Bank A/c or Partner’s Current A/c

(ii) If the existing Capital of any partner is less than his newly calculated capital:

Bank A/c or Partner’s Current A/c

To Old Partner’s Capital A/c

Question 52.

Solution 52

Working Note:-

Old Ratio of A and B = 7 : 3

New Ratio of A, B and C = 3:2:1

Computation of Sacrificing and Gaining Ratio:-

A’s Ratio = 7/10-3/6=(21-15)/30=6/30(Sacrifice)

B’s Ratio = 3/10-2/6=(9-10)/30=1/30(Gain)

B’s Ratio = 1/6 (Gain)

Goodwill of the firm = Rs. 40,000 × 6/1 = Rs. 2,40,000

B’s Compensation in Goodwill = Rs. 2,40,000 × 1/30 = Rs. 8,000

Points for Students:-

Adjustment of Old Partner’s Capital Accounts on the basis of new partner’s capital: Sometimes, on the admission of a new partner it is decided that the capitals of the old partners will be adjusted on the basis of new partner’s capital to make them proportionate to their share of profits. In such questions, first of all the entire Capital of the new firm should be determined on the basis of new partner’s capital. Then the Capital of each partner is ascertained by dividing the total Capital according to his profit sharing ratio.

Question 53.

Solution 53

Points for Students:-

If the claim for workmen compensation is lower than the amount of Workmen Compensation Reserve: The amount of claim is credited to ‘Provision for Workmen Compensation Claim A/c’ and balance is credited to the Capital Accounts of old partners in their old profit sharing ratio (Suppose Workmen Compensation Reserve is Rs.50,000 and liability for claim is Rs.20,000). The Journal entry passed is:

Workmen Compensation Reserve A/c Dr. 50,000

To Provision for Workmen Compensation Claim A/c 20,000

To Partner’s Capital A/c 30,000

Question 54.

Solution 54

Points for Students:-

Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favour of the new partner. The ratio in which they surrender their profits is called sacrifice ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of the new partner.

Question 55.

Solution 55

Points for Students:-

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Accounts of old partners in their old profit sharing ratio:

The Journal entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to old partners Capital Account in their old profit sharing ratio)

Question 56.

Solution 56

Points for Students:-

If the existing capital of any partner is in excess of his newly calculated capital, the excess amount is either paid off immediately or credited to his current account. Following entry is passed for this purpose:

(i) Old Partner’s Capital A/c Dr.

To Bank A/c or Partner’s Current A/c

(ii) If the existing Capital of any partner is less than his newly calculated capital:

Bank A/c or Partner’s Current A/c

To Old Partner’s Capital A/c

Question 57.

Solution 57

Working Note:-

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

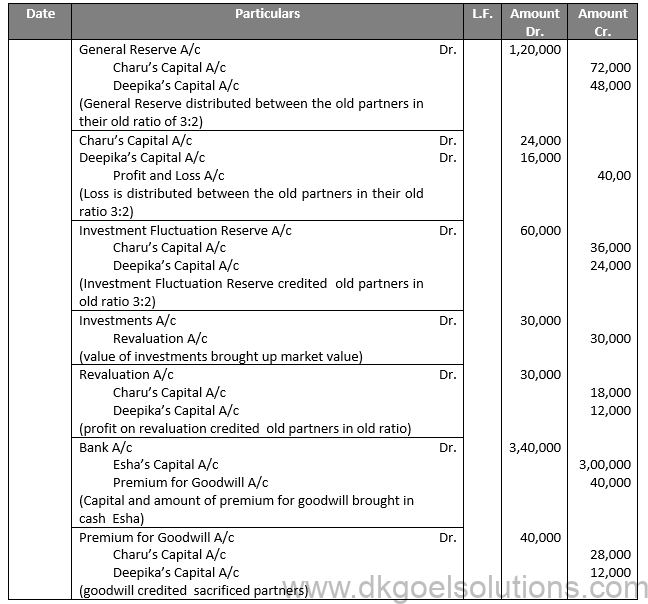

Charu’s Share = 3/5-4/9=(27-20)/45=7/45

Deepika’s Share = 2/5-3/9=(18-15)/45=3/45

Sacrificing Ratio = 7 : 3

Points for Students:-

If the claim for workmen compensation is lower than the amount of Workmen Compensation Reserve: The amount of claim is credited to ‘Provision for Workmen Compensation Claim A/c’ and balance is credited to the Capital Accounts of old partners in their old profit sharing ratio (Suppose Workmen Compensation Reserve is Rs.50,000 and liability for claim is Rs.20,000). The Journal entry passed is:

Workmen Compensation Reserve A/c Dr. 50,000

To Provision for Workmen Compensation Claim A/c 20,000

To Partner’s Capital A/c 30,000

Question 58.

Solution 58

Points for Students:-

Value of Investment brought down market value:-

Investment Fluctuation Reserves A/c Dr.

To Investments A/c

Reserves transfer partners’ Capital account:-

General Reserve A/c Dr.

Workmen Compensation Reserve A/c Dr.

Investment Fluctuation Reserve A/c Dr.

To A’s Capital A/c

To B’s Capital A/c

To C’s Capital A/c

Profit transfer partners’ Capital account:-

A’s Capital A/c Dr.

B’s Capital A/c Dr.

C’s Capital A/c Dr.

To Profit & Loss A/c

Question 59.

(A)

Solution 59

(A)

Working Note:-

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

Charu’s Share = 3/5-2/4=(12-10)/20=2/20

Deepika’s Share = 2/5-1/4=(8-5)/20=3/20

Sacrificing Ratio = 2 : 3

(A) Points for Students:-

Revaluation Account: Sometimes this account is called as ‘Profit & Loss Adjustment A/c’. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 59.

(B)

Solution 59

(B)

Working Note:-

C’s Share = 1/4

A’s Sacrifice = 2/3 of 1/4 = 2/12

B’s Sacrifice = 2/3 of 1/4 = 1/12

Computation of New Share:-

A’s New Share = 3/4-2/12=(9-2)/12=7/12

B’s New Share = 1/4-1/12=(3-1)/12=2/12

New Ratio of A, B, and C = 7/12:2/12:1/4

New Ratio of A, B, and C = = (7 ∶ 2 ∶ 3)/12

New Ratio of A, B, and C = = 7 ∶ 2 ∶ 3

(B) Points for Students:-

New Ratio = Old Ratio – Surrender Share

We can calculate other formulas by the above formulas:-

Old Ratio = New Ratio + Surrender Share

Surrender Ratio = Old Ratio – New Share

Question 60.

Solution 60

Working Note:-

Computation of Sacrificing Ratio:-

Sacrificing Ratio = Old Ratio – New Ratio

X’s Share = 3/5-2/4=(12-10)/20=2/20

Y’s Share = 3/8

Z’s Share = 1/8

Sacrificing Ratio = 4 : 3 : 1

Points for Students:-

Entry of Revaluation Loss:-

X’s Capital A/c

Y’s Capital A/c

Revaluation A/c

(Loss on revaluation transfer old partner’s Capital account)

Question 61.

Solution 61

Working Note:-

Z’s Share of Goodwill = Rs. 5,00,000 × 1/5 = Rs. 1,00,000|

Cash Balance = Rs. 2,40,000 + Rs. 1,00,000 + Rs. 3,00,000 = Rs. 6,40,000

Points for Students:-

When the new partner does not bring his share of goodwill/premium in Cash: Accounting Standard (AS) 26 (Intangible Assets) Specifies that goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. It means that only purchased goodwill can be recorded in the books. At the time of admission, retirement or death of a partner or in case of change in profit sharing ratio among existing partners, goodwill account cannot be raised in the books of the firm because it will be non-purchased goodwill and no consideration in money or money’s worth has been for it.

Question 62.

Solution 62

Points for Students:-

New partner’s current account is debited from his share of goodwill and the old partner’s capital accounts are credited in their sacrificing ratio. Following Journal entry is passed for this purpose:

New Partner’s Current A/c Dr. (From his share of goodwill)

To Old Partner’s Capital A/c (In sacrificing ratio)

(Current Account of new partner debited from his share of goodwill on his admission and Capital Accounts of old partner’s Credited in their sacrificing ratio)

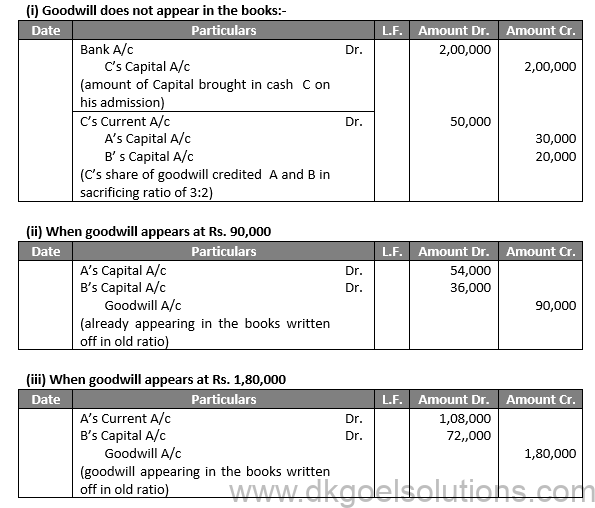

Question 63 (new).

Solution 63 (new).

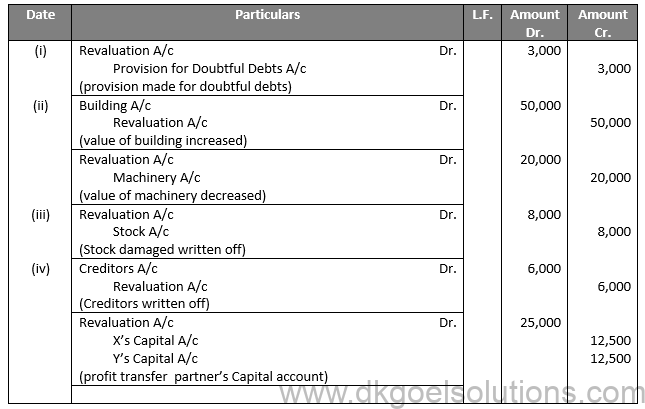

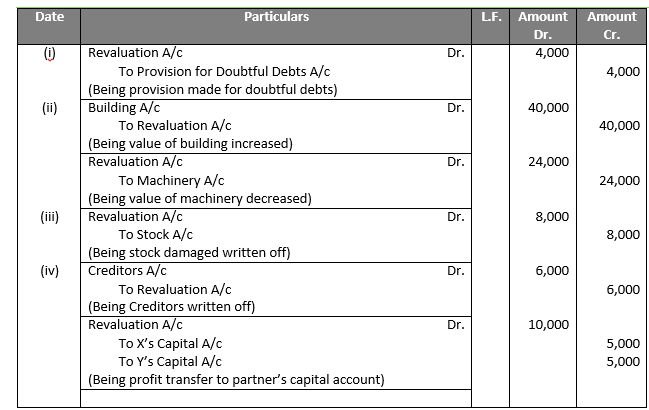

(i) Provision for doubtful debts is found in excess by Rs. 4,000.

(ii) Building was found under valued by 20% and Machinery overvalued by 20%.

(iii) Part of the stock which had been included at a cost of Rs. 10,000 had been badly damaged in storage and could only expect to realize Rs. 2,000.

(iv) Creditors were written off Rs. 6,000.

Pass necessary journal entries.

Solution 63 (new).

Question 63.

Solution 63

Points for Students:-

Revaluation Account: Sometimes this account is called as ‘Profit & Loss Adjustment A/c’. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 64.

Solution 64

Working Note:-

Old Ratio A and B = 3 : 1

New Ratio A, B and C = 3 : 2 : 1

Sacrificing and Gaining Ratio:-

A’s Share = 3/4-3/6=(9-6)/12=3/12 (Sacrifice)

B’s Share = 1/4-2/6=(3-4)/12=1/12 (Gain)

C’s Share = 1/6

Value of Goodwill of Firm = Rs. 30,000 × 6/1 = Rs. 1,80,000

Compensation paid B = Rs. 1,80,000 × 1/12 = Rs. 15,000

Points for Students:-

At the time of admission, if there is any General Reserve, Reserve Fund or the balance of Profit and Loss Account appearing in the balance sheet, it must be transferred to Old Partner’s Capital Accounts in their old profit sharing ratio. The new partner is not entitled to any share of such reserves of profits, as these are undistributed profits earned by the old partners.

Question 65.

Solution 65

Working Note:-

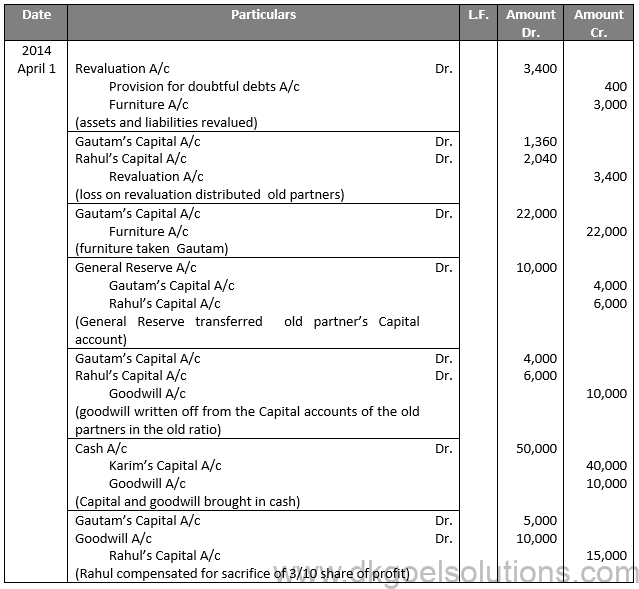

Old Ratio Gautam and Rahul = 2 : 3

New Ratio Gautam, Rahul and Kabir = 5 : 3 : 2

Sacrificing and Gaining Ratio:-

Gautam’s Share = 2/5-5/10=(4-5)/10=1/12 (Gain)

Rahul’s Share = 3/5-3/10=(6-3)/10=3/10 (Sacrifice)

Kabir’s Share = 2/10

Value of Goodwill of Firm = Rs. 10,000 × 10/2 = Rs. 50,000

Compensation paid B = Rs. 50,000 × 1/10 = Rs. 5,000

Points for Students:-

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Accounts of old partners in their old profit sharing ratio:

The Journal entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to old partners Capital Account in their old profit sharing ratio)

Question 66.

Solution 66

Points for Students:-

If the claim for workmen compensation is lower than the amount of Workmen Compensation Reserve: The amount of claim is credited to ‘Provision for Workmen Compensation Claim A/c’ and balance is credited to the Capital Accounts of old partners in their old profit sharing ratio (Suppose Workmen Compensation Reserve is Rs.50,000 and liability for claim is Rs.20,000). The Journal entry passed is:

Workmen Compensation Reserve A/c Dr. 50,000

To Provision for Workmen Compensation Claim A/c 20,000

To Partner’s Capital A/c 30,000

Question 67.

Solution 67

Working Note:-

Computation of Sacrificing Ratio:-

X’s Surrenders = 1/4th of 5/8 in favour of Z

X’s Surrenders = 1/4×5/8=5/32

Y’s Surrenders = 1/3th of 5/8 in favour of Z

Y’s Surrenders = 1/3×3/8=3/32=1/8

Sacrificing Ratio = 5/32 ∶ 1/8

Sacrificing Ratio = (5 ∶ 4)/32

Sacrificing Ratio = 5 : 4

Computation of New Ratio:-

X’s New Ratio = 5/8-5/32=(20 – 5)/32=15/32

Y’s New Ratio = 3/8-1/8=(3 – 1)/8=2/8

Z’s Share = 5/32+1/8=(5+ 4)/32=9/32

New Ratio = 15/32:2/8:9/32

New Ratio = (15 ∶ 8 ∶ 9)/32

New Ratio = 15 ∶ 8 ∶ 9

Computation of Goodwill:-

Z’s Goodwill = Rs. 1,60,000 × 9/32 = Rs. 45,000

Points for Students:-

If the claim is equal to Workmen Compensation Reserve: Entire amount of Workmen Compensation Reserve is transferred to Provision for Workmen Compensation Claim A/c:

Workmen Compensation Reserve A/c Dr.

To Provision for Workmen Compensation Claim A/c

(Provision made for Workmen Compensation Claim)

Question 68.

(A)

Solution 68

(A)

Question 68.

(B)

Solution 68

(B)

Working Note:-

Computation of Hidden Goodwill

Total Capital of the firm = Rs. 13,00,000 + Rs. 20,00,000 + Rs. 12,00,000 = Rs. 45,00,000

Total Capital of the firm based on Z’s Capital = 12,00,000 × 5/1 = Rs. 60,00,000

Goodwill of the firm = Rs. 60,00,000 – Rs. 45,00,000 = Rs. 15,00,000

Hidden Goodwill = Goodwill of the firm – Showing in P & L

Hidden Goodwill = Rs. 15,00,000 – Rs. 6,00,000

Hidden Goodwill = Rs. 9,00,000

Z’s Share of Goodwill = Rs. 9,00,000 × 1/5 = 1,80,000

Points for Students:-

Concept Hidden Goodwill: Sometimes, the value of goodwill is hidden in the question. In such cases, the amount of goodwill is calculated on the basis of total capital of the firm and the profit sharing ratio of the partners. For example, A and B partners with capitals of Rs. 40,000 and Rs. 30,000 respectively. They admit C as a partner with 1/4 th share. C is to contribute Rs. 34,000 as his capital. In such a case, the total capital of the firm, based on C’s share ought to be Rs. 34,000 ×4/1 = 1,36,000. But the combined capital of A, B and C becomes only Rs.1,04,000 (Rs. 40,000 + Rs. 30,000 + Rs. 34,000). As such the value of total goodwill of the firm should be taken as Rs. 1,36,000 – Rs. 1,04,000 = Rs.32,000.

Question 69.

Solution 69

Working Note:-

Computation of Hidden Goodwill

Net Worth = Sundry Assets – Outside Liabilities

Net Worth = Rs. 15,00,000 – Rs. 5,00,000

Net Worth = Rs. 10,00,000

Net Worth = Rs. 10,00,000 + Rs. 5,00,000 = Rs. 15,00,000

Total Capital of the firm based on Ajay’s Capital = 5,00,000 × 5/1 = Rs. 25,00,000

Goodwill of the firm = Rs. 25,00,000 – Rs. 15,00,000 = Rs. 10,00,000

Hidden Goodwill = Goodwill of the firm – Showing in P & L

Hidden Goodwill = Rs. 10,00,000

Ajay’s Share of Goodwill = Rs. 10,00,000 × 1/5 = 2,00,000

Points for Students:-

When the new partner brings in proportionate capital: Sometimes the capital of the new partner is not given in the question. He may be required to bring in proportionate capital. In such cases the new partner’s capital will be calculated on the basis of the capitals of the old partners remaining after all adjustments and revaluation.

Question 70.

Solution 70

Working Note:-

Computation of Hidden Goodwill