DK Goel Solutions Chapter 10 Accounting for Goods and Service Tax (GST)

Read below DK Goel Solutions Class 11 Chapter 10 Accounting for Goods and Service Tax (GST). These problem solutions have been prepared based on the latest Class 11 DK Goel Accountancy book issued for current academic year and the questions given in each chapter.

In this chapter of DK Goel Accounting Solutions Class 11, explaining about Concepts of GST, Theories of SGST and Numericals on GST and SGST.

The chapter also includes lot of good quality problems or questions which can be very helpful to understand the concepts for Class 11 students of Accountancy and will also help build a strong foundation.

DK Goel Solutions Class 11 Chapter 10 solutions are free and will help you to prepare for Class 11 Accountancy

Accounting for Goods and Service Tax (GST) DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 10

Short Answer Question

Question 1:

Solution 1: GST stands for Goods and Services tax. It is tax levied indirectly on the supply of goods and services.

Question 2:

Solution 2: Below are the two central taxes that have merged into GST:-

(i) Custom duty

(ii) Excise duty

Question 3:

Solution 3: Below are the two central taxes that have merged into GST:-

(i) VAT

(ii) Purchase Tax

Question 4:

Solution 4:

Below are the two advantages of GST:-

(i) GST reduce the sales without receipts and corruption.

(ii) GST reduce multiple tax evasion.

Question 5:

Solution 5: Central Goods and Services Tax is the full form of CGST.

Question 6:

Solution 6: State Goods and Services Tax is the full form of CGST.

Question 7:

Solution 7: Integrated Goods and Services Tax is the full form of IGST.

Question 8:

Solution 8: Integrated Goods and Service Tax applies to CGST. On intra-state or inside state transactions, it is charged. The central government oversees the CGST which is administered by the CGST Act.

For Example: A dealer of Delhi sells goods to a dealer of Delhi worth Rs. 1,50,000. Suppose the CGST and SGST rate is 12%. In the case the seller will charge 6% of CGST and 6% of SGST Rs. 9,000 as CGST and Rs. 9,000 as SGST.

Question 9:

Solution 9: Integrated Goods and Service Tax applies to IGST. It is imposed on purchases from inter-state outlets. The IGST is monitored by the IGST Act.

For Example: A dealer of Mumbai sells goods to a dealer in Uttar Pradesh worth Rs. 1,25,000. Suppose the IGST rate is 12%. In the case the seller will charge Rs. 15,000 as IGST.

Practical Question for DK Goel Solutions Class 11 Chapter 10

Question 1:

Solution 1:

Point in mind:-

GST Rate Structure:- Goods and Service are divided into five slabs for collection of GST:

Essential items including food 0%

Common Use Items 5%

Standard Rate 12%

Maximum Goods and all services Standard Rate 18%

Luxury items and tobacoo 28%

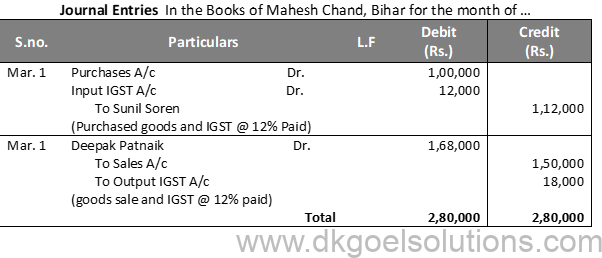

Question 2:

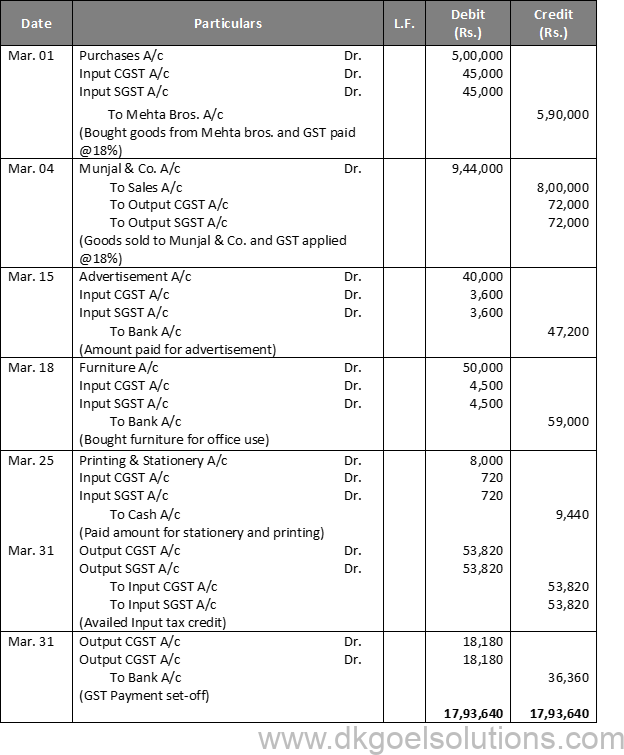

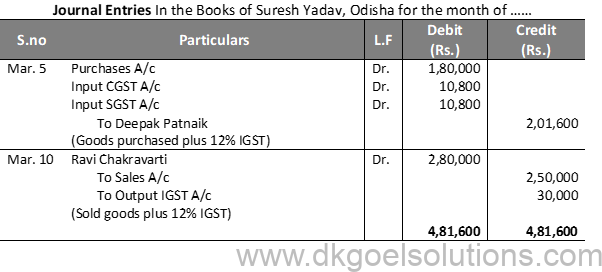

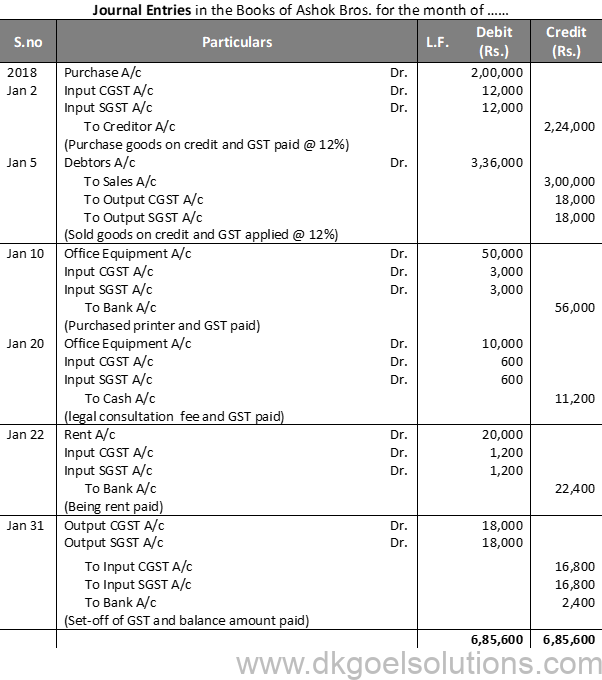

Solution 2:

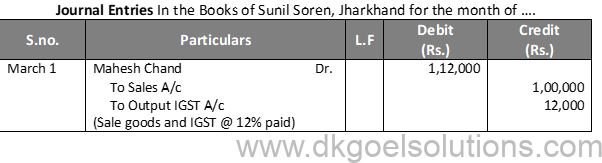

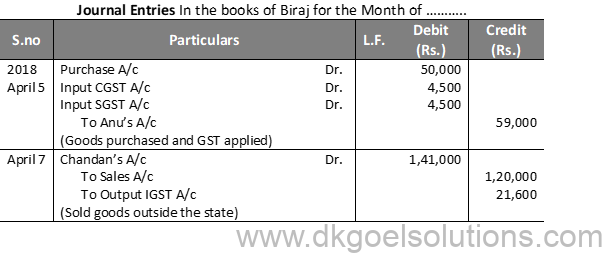

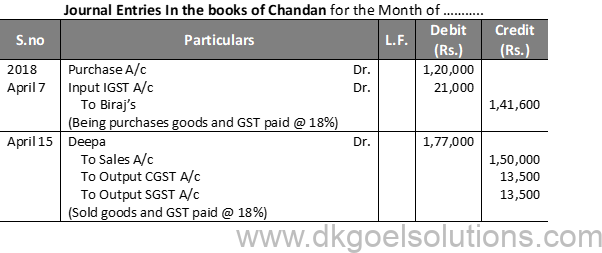

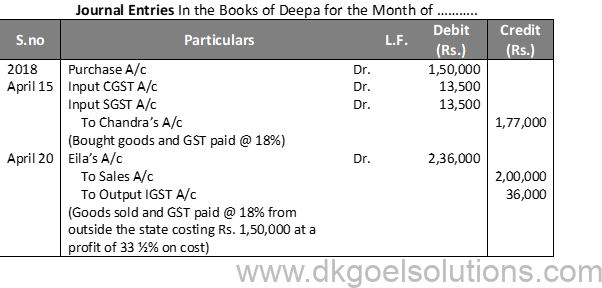

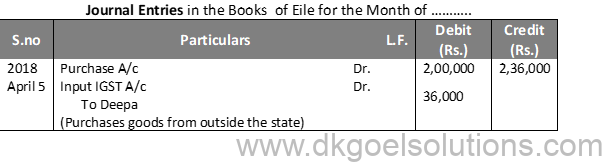

Question 3:

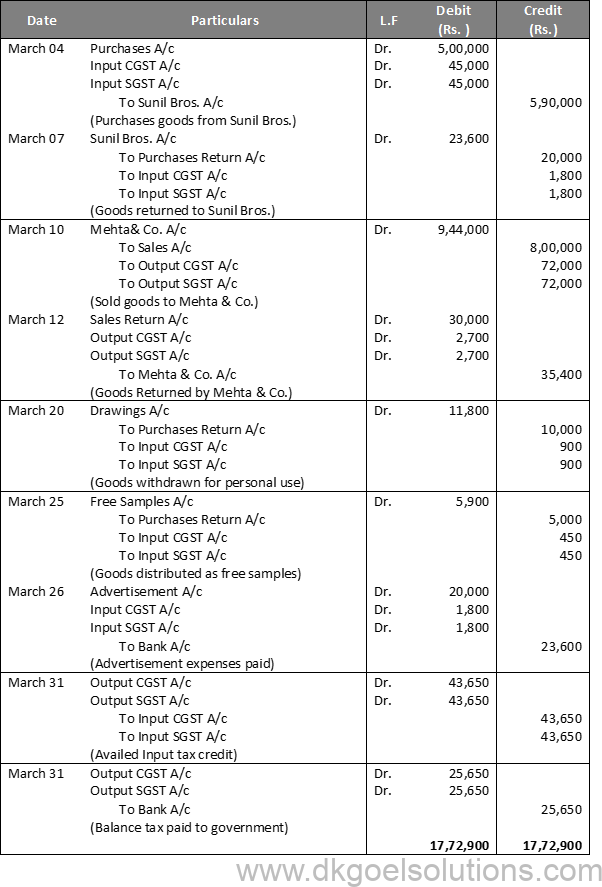

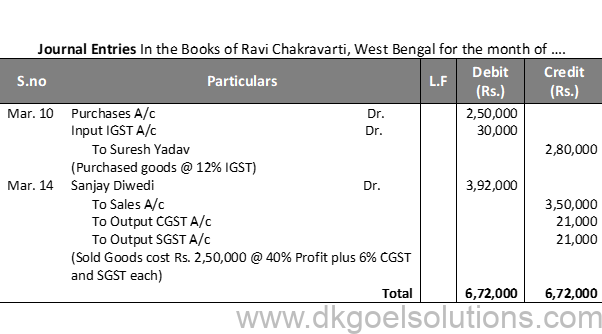

Solution 3:

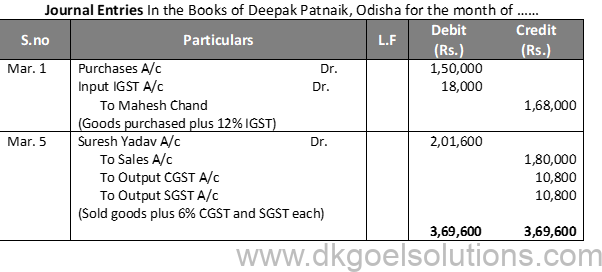

Question 4:

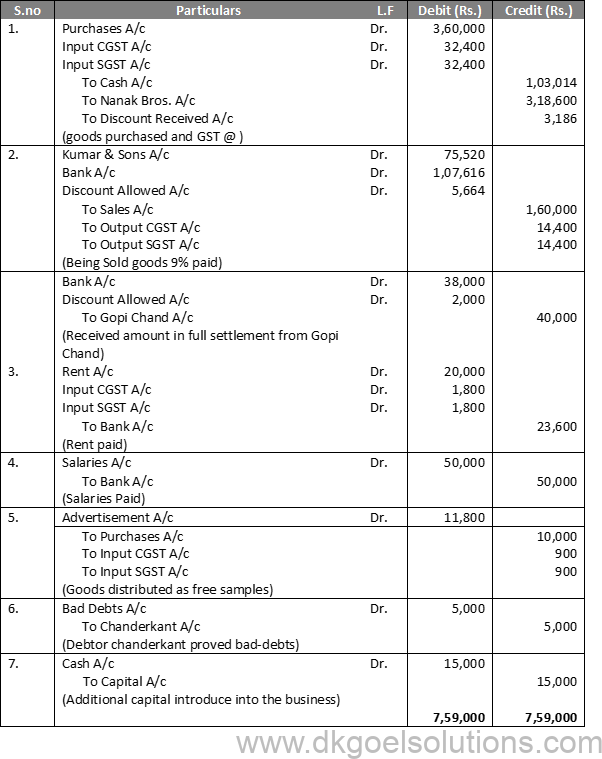

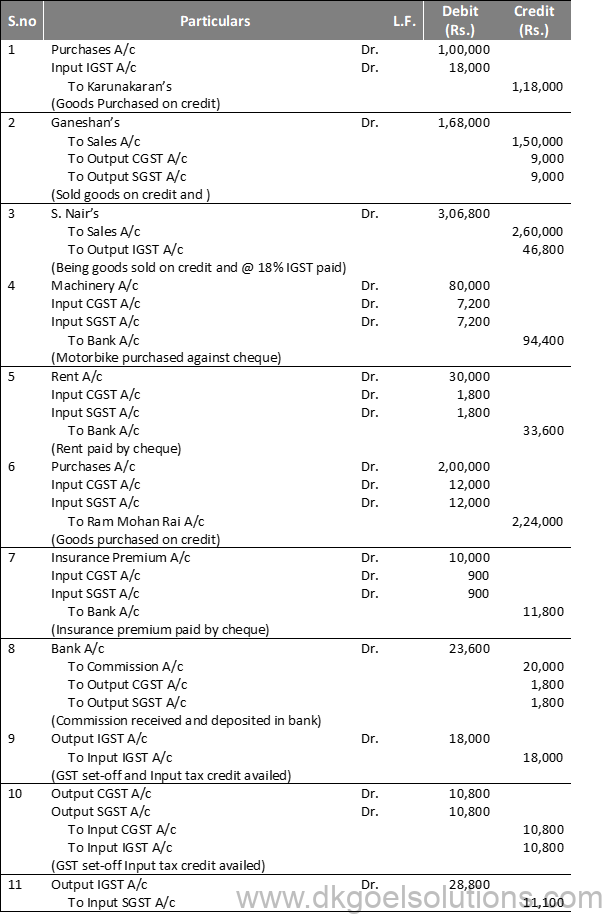

Solution 4:

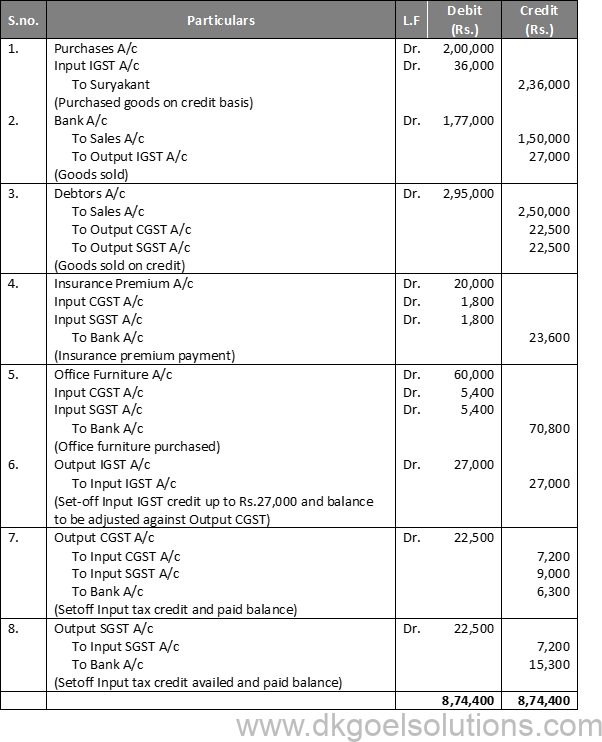

Working Note:-

Calculation of GST

Outstanding IGST = Output IGST – Input IGST

Outstanding IGST = Rs. 27,000 – Rs. 36,000

Outstanding IGST = (Rs. 9,000)

Set off of GST:-

Output CGST can set-off by both Input CGST and Input IGST

CGST outstanding = Output CGST – Input IGST – Input CGST

CGST outstanding = Rs. 22,500 – Rs. 9,000 – Rs. 7,200

CGST outstanding = Rs. 6,300

Outstanding SGST = Output SGST – Input SGST

Outstanding SGST = Rs. 22,500 – Rs. 7,200

Outstanding SGST = Rs. 15,300

Question 5:

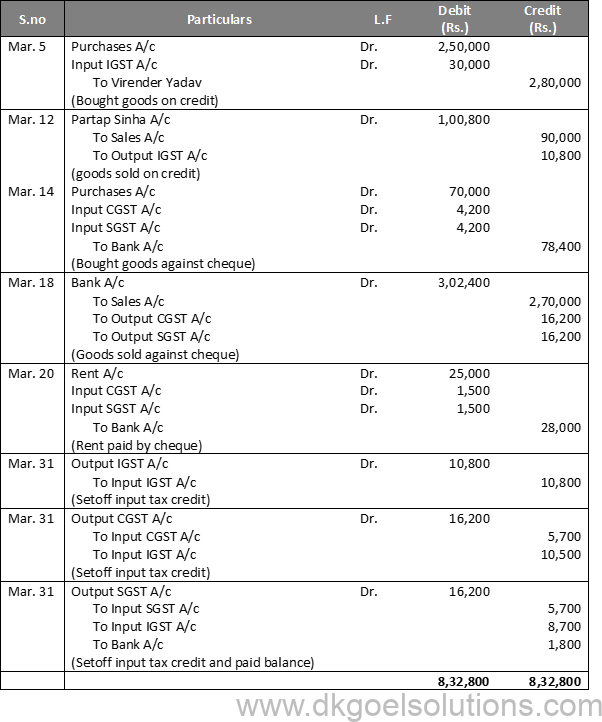

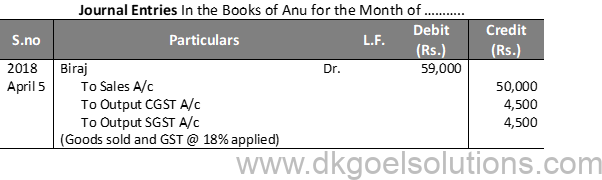

Solution 5 :

Question 6:

Solution 6:

Question 7:

Solution 7:

Question 8:

Solution 8:

Question 9:

Solution 9:

Working Note:-

Calculation of GST Outstanding:-

Output CGST can set-off by both Input CGST and Input IGST

Outstanding CGST = Output CGST – Input CGST

Outstanding CGST = Rs. 18,000 – Rs. 12,000 – Rs. 3,000 – Rs. 600 – Rs. 1,200

Outstanding CGST = Rs. 18,000 – Rs. 16,800

Outstanding CGST = Rs. 1,200

Output SGST can set-off by both Input SGST and Input IGST

CGST outstanding = Output SGST – Input SGST

CGST outstanding = Rs. 18,000 – Rs. 12,000 – Rs. 3,000 – Rs. 600 – Rs. 1,200

CGST outstanding = Rs. 18,000 – Rs. 16,800

CGST outstanding = Rs. 1,200

Total Amount paid by bank for GST = Rs. 1,200 + Rs. 1,200 = Rs. 2,400

MCQs for Accountancy Class 11 with Answers Chapter 10 Accounting for Goods and Service Tax (GST)

Question On intra-state purchase of goods, which of the following accounts are debited:

(a) Input IGST Account.

(b) Input CGST Account and Input SGST Account.

(c) Input IGST Account and Input CGST Account.

(d) Input IGST Account and Input SGST Account.

Answer

B

Question On inter-state (i.e., outside the state) purchase of goods, which of the following GST is levied:

(a) IGST.

(b) IGST and CGST.

(c) CGST.

(d) SGST.

Answer

A

Question On inter-state sale of goods, which of the following account is credited:

(a) Output CGST A/c.

(b) Output IGST A/c.

(c) Input IGST A/c.

(d) Output SGST A/c.

Answer

B

Question On intra-state (Le., within the state) purchase of goods, which of the following GST is levied:

(a) CGST.

(b) SGST.

(c) CGST and SGST.

(d) SGST and IGST.

Answer

C

As explained in DK Goel Solutions class 11 Chapter 10 Goods and Services Tax is abbreviated as GST. It is a type of tax that is indirectly proportional to the supply of goods and services.

Here are the main advantages of GST –

● GST eliminates the cascading tax effects by bringing indirect tax regimes together.

● GST drives out multiple tax evasions to promote a corruption-free tax administration.

● GST presents a bunch of transparent and clear rules.

● GST helps in the control and regulation of the price of goods.

CGST depicts the tax charged by the Central Government for the supply of goods and services around a state. Let’s take an example to clarify the concept – Suppose a seller in Chennai sells a product with a cost price of Rs. 500 in Chennai, and the CGST is 5%. The seller will charge Rs. 525 for the product.

The Goods and Services Tax comprises two central taxes, namely, the Central Customs Duty and the Excise Duty taxes. While at the state level, GST includes VAT and purchase taxes.

Integrated Goods and Services Tax is abbreviated as IGST. IGST is basically the tax charged by the State Government on the exchange of goods and services between states. For instance, if a seller from West Bengal sells the goods in Delhi with the cost price of the goods is Rs.1000, and the IGST is 10%. Then the seller will charge Rs.1100 for the goods.

State Goods and Service Tax is abbreviated as SGST.

GST is one of the most crucial topics in class 11, Accountancy. It is the most scoring topic, in which most students can secure full marks. With proper guidance, you can easily grab good marks in this chapter. Make sure you refer to the DK Goel Solutions Accountancy to get a handful of questions coupled with their solutions, and don’t miss the most important ones. Practice the previous year’s questions popping out from the topic.

Thnx for the know 🥰

It’s so good and useful ☺️