DK Goel Solutions Chapter 7 Company Accounts Issue of Share

Read below DK Goel Solutions for Class 12 Chapter 7 Company Accounts Issue of Share. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

DK Goel Class 12 Accountancy Company Accounts Issue of Shares, a company has to issue shares for expansion of business, there are accounting requirements which the company has to follow to ensure the correct display of the financial situation of the company. In this chapter, the students will learn about the basics of the issue of shares and how the related accounting entries have to be passed in the books.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Company Accounts Issue of Share DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Q1.

Sol.1

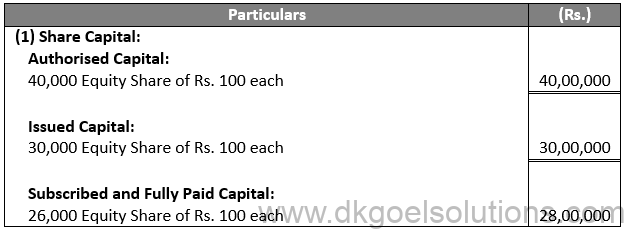

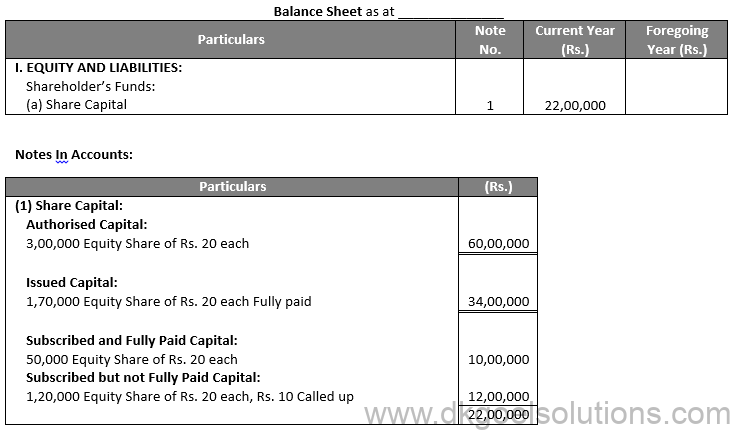

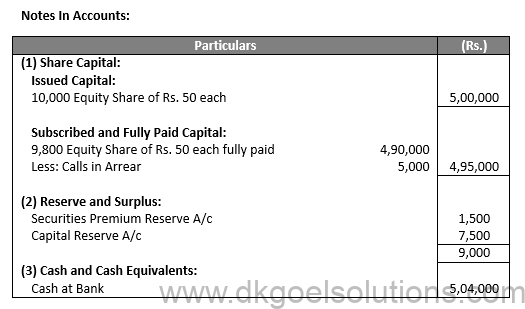

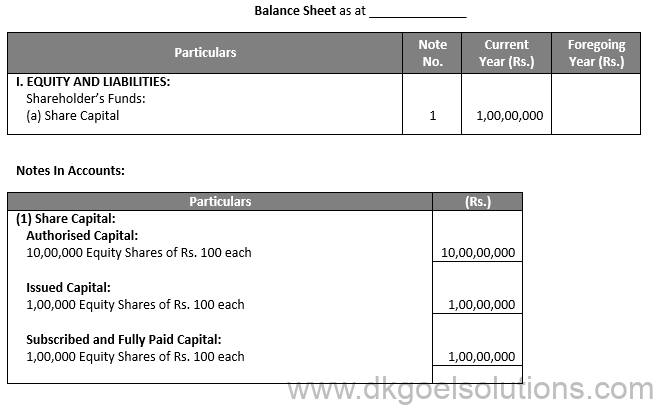

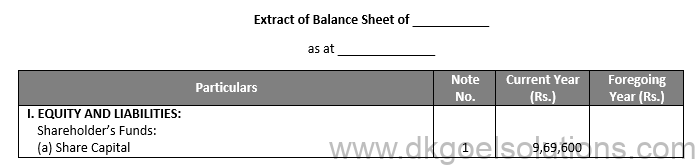

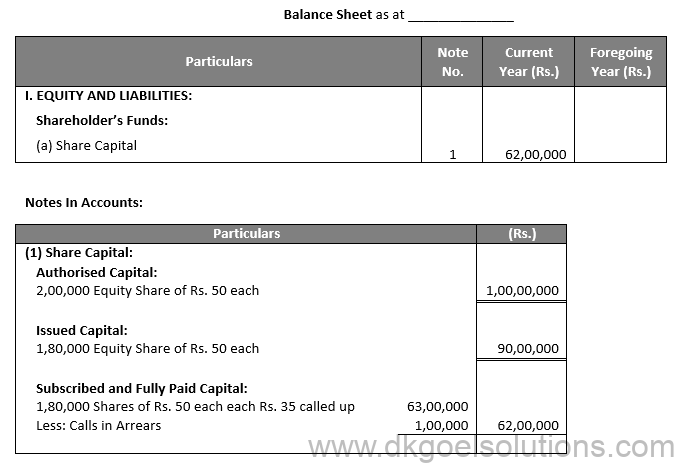

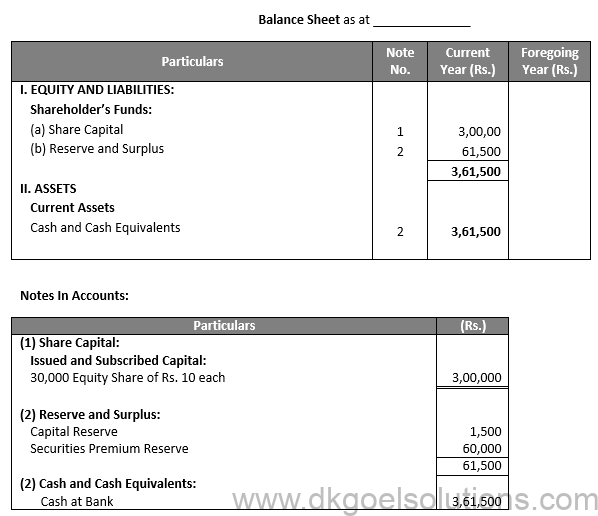

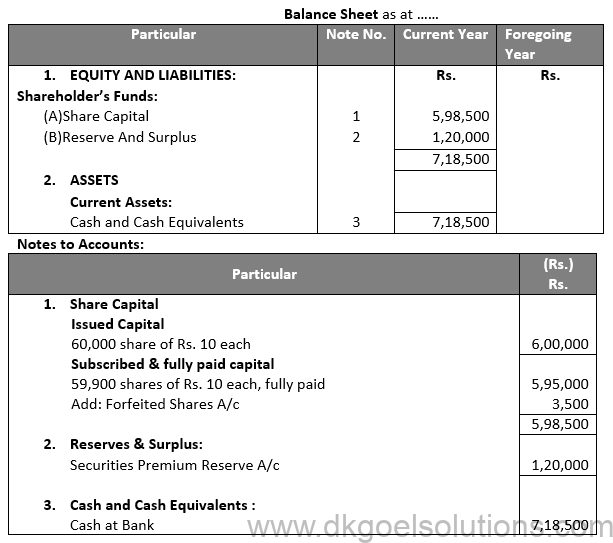

Extract of Balance Sheet of _ Ltd. as at ___

Notes in Accounts:

Question 2. At least how much portion of the nominal (Rs.) of a share must be called as application money?

Sol.2

At least 5 percent of share application money of the nominal value of shares. The money for the application must be deposited in a ‘Scheduled Fund’ by the corporation. Application money is a portion of the company’s equity capital and, as such, the application money is added to the share capital account as the directors assign the stock. Application funds raised by the organization when it shares are problems for the public.

Question 3.

Sol.3

The rules of table ‘F’ of Schedule I of the Companies Act, 2013 shall extend in the absence of the Articles of Association. The (Rs.) to be called up shall not exceed 25% of the complete quantity of the problem, either on application or on allotment or on any one call.

Question 4.

Sol.4

The rules of table ‘F’ of Schedule I of the Companies Act, 2013 shall extend in the absence of the Articles of Association. There must be an interval between making two calls for at least one month.

Question 5.

Sol.5

The sum of the securities premium can be paid on request or on allocation or also on calls by the Firm.

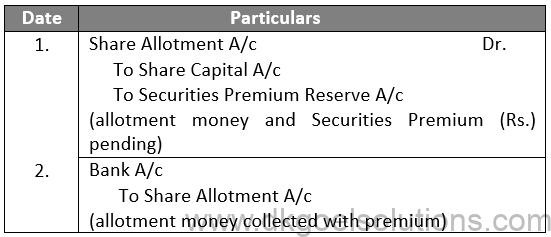

Entries will be passed, if the Amount of premium is collected along with application money:

If Amount of securities premium is collected along with allotment money.

Question 6.

Sol.6

No, the premium on shares cannot be used for the acquisition of fixed assets. Under Section 52(2) of the Companies Act, 2014, the (Rs.) of the Shares Prime can be used for the following purposes only:

1.) To pay down the company’s preliminary costs.

2.) To write off the costs, commission or discount permitted on the issuance of the company’s shares or debentures.

3.) In order to account for the premium owed upon redemption of the company’s redeemable preferred shares or debentures.

4.) For issuing incentive shares that are entirely charged.

5.) For the repurchase, as per section 68, of its own stock and other assets.

Question 7.

Sol.7

Securities Premium should be used for:—

1.) To pay down the company’s preliminary costs.

2.) To write off the costs, commission or discount permitted on the issuance of the company’s shares or debentures.

3.) In order to account for the premium owed upon redemption of the company’s redeemable preferred shares or debentures.

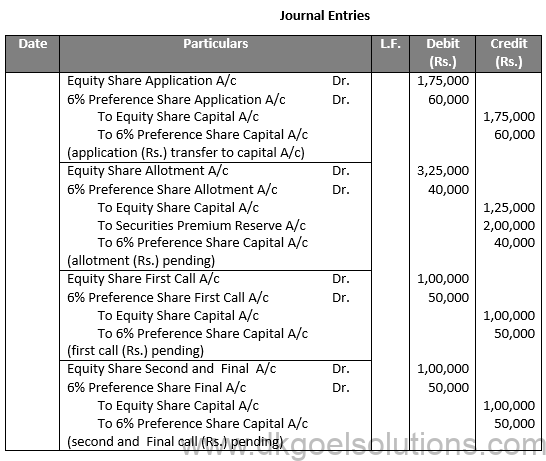

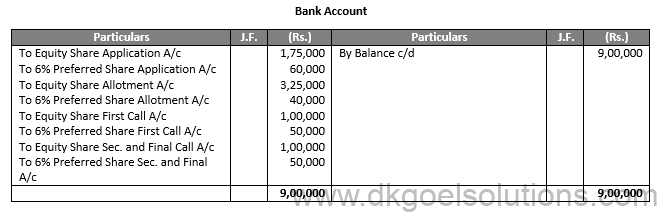

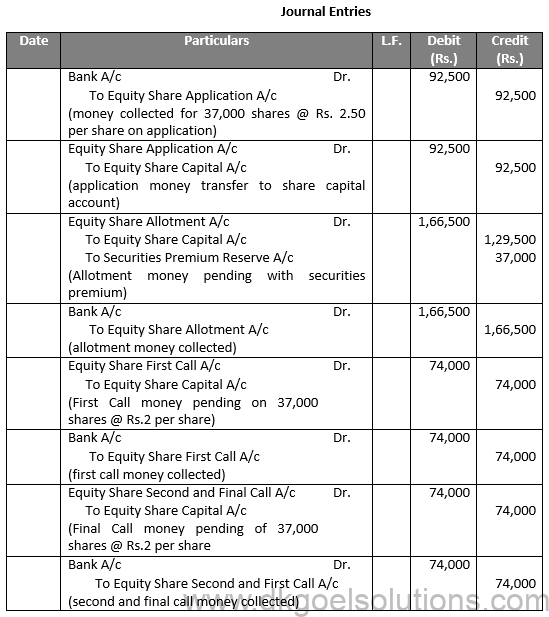

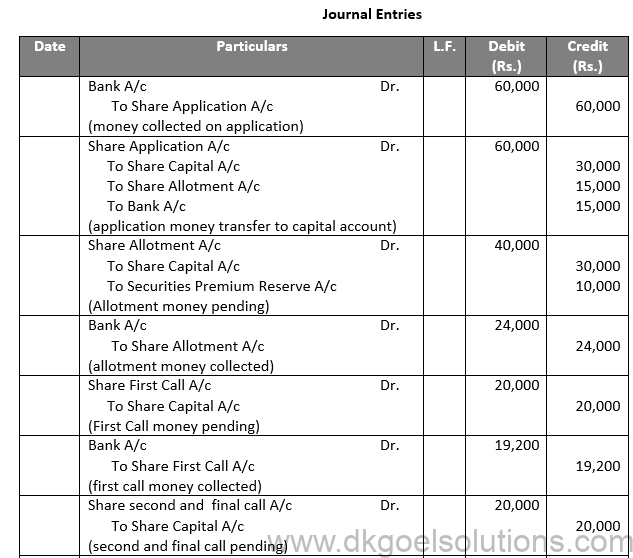

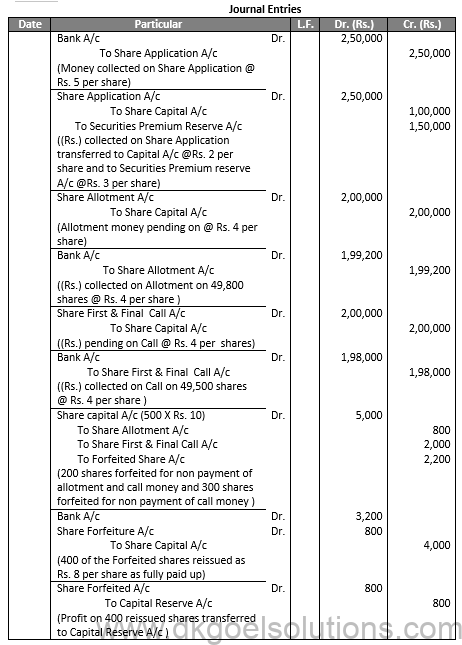

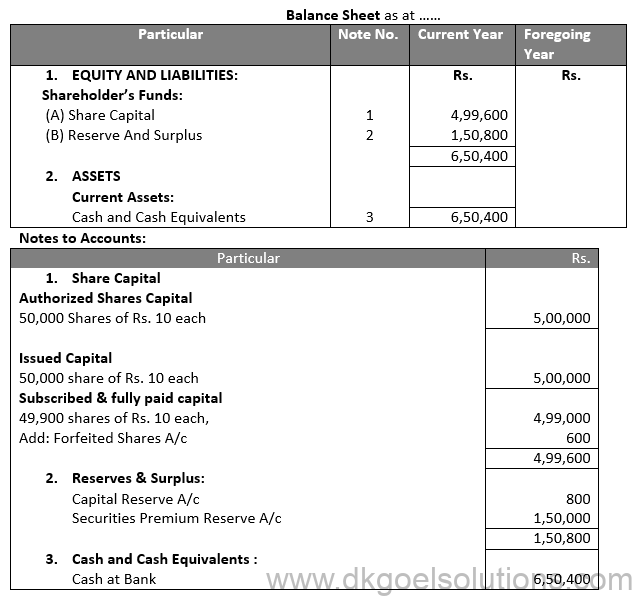

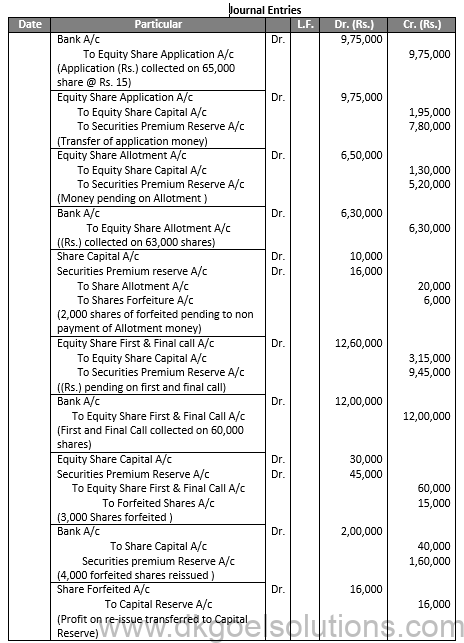

Numerical Questions:-

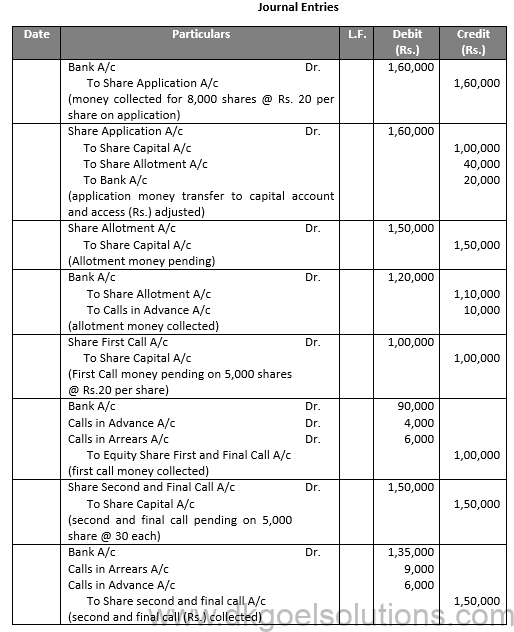

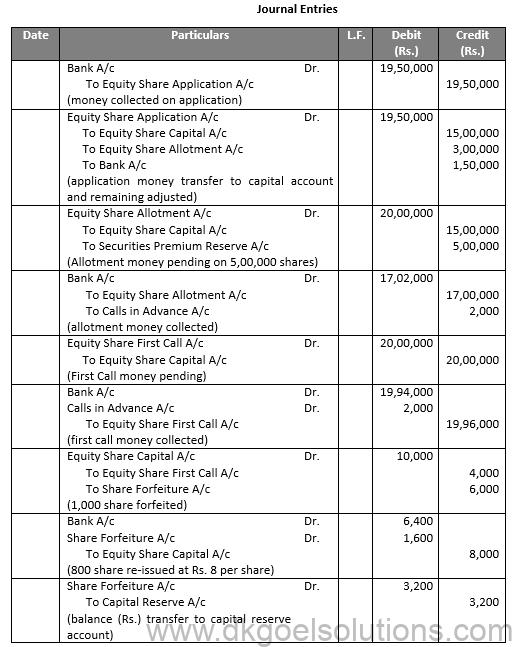

Question 1.

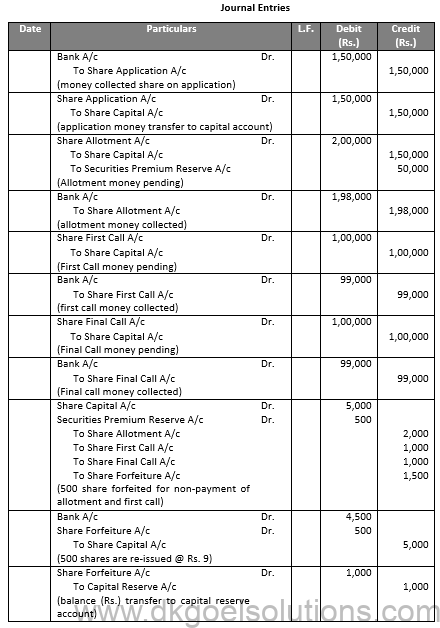

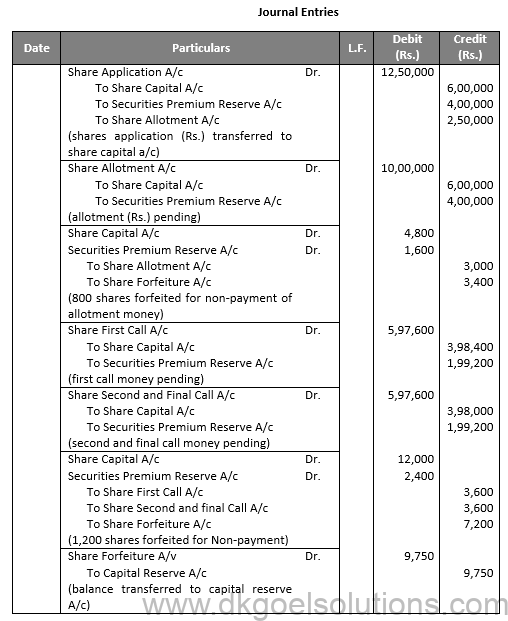

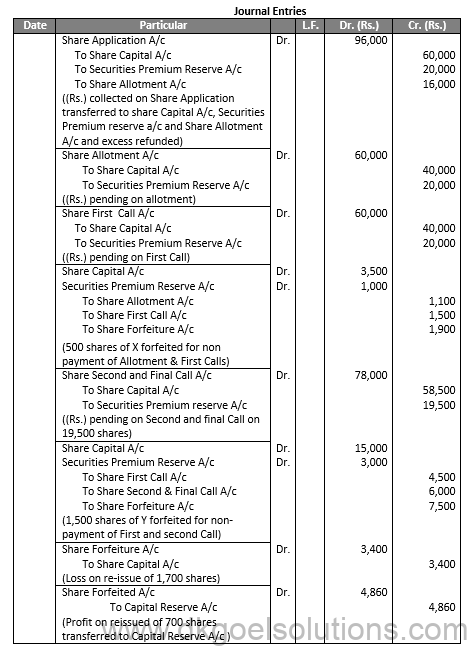

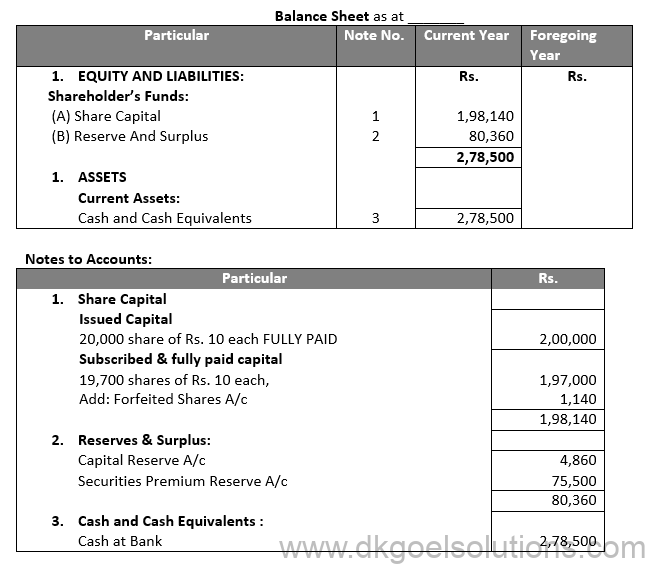

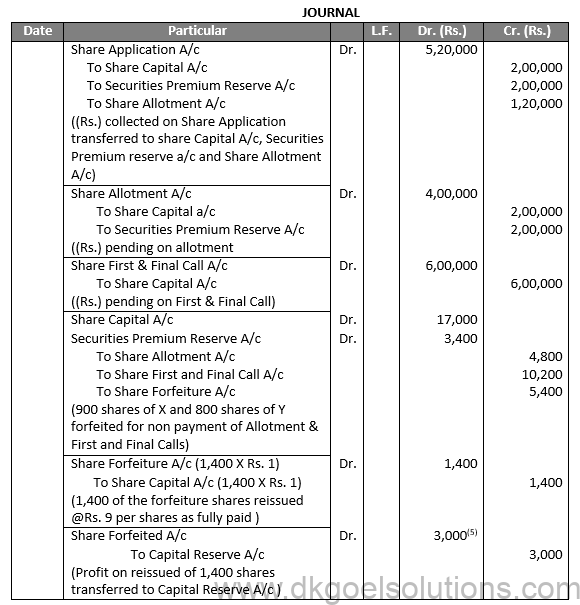

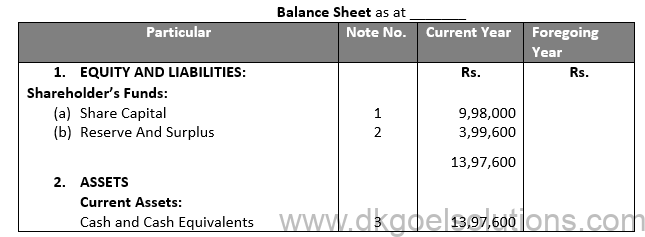

Sol.1

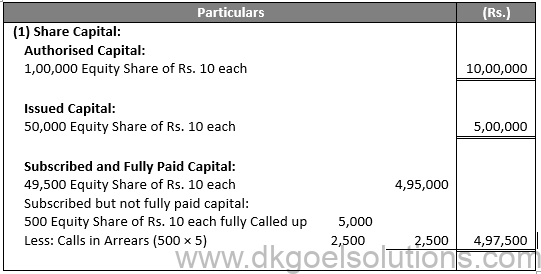

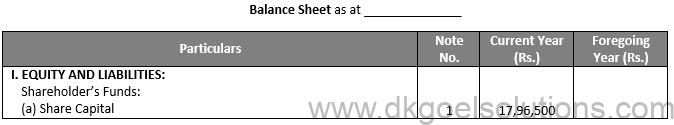

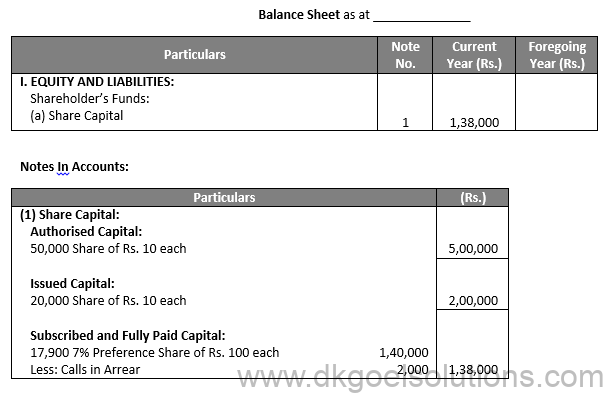

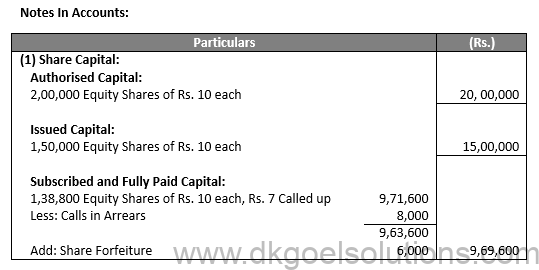

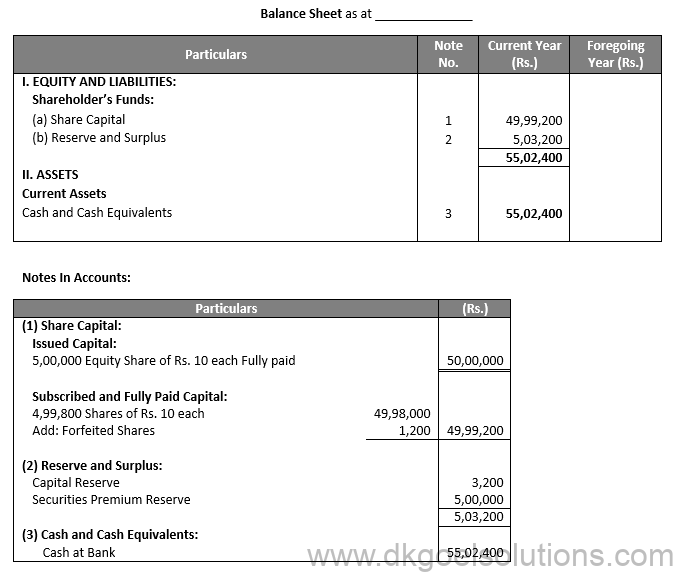

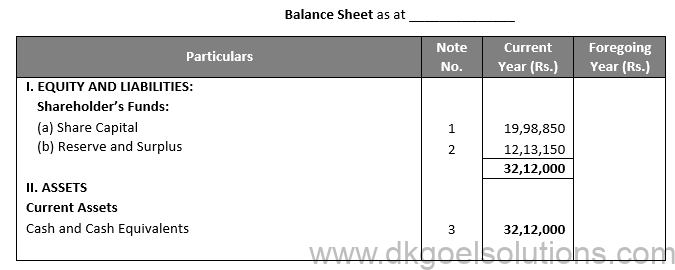

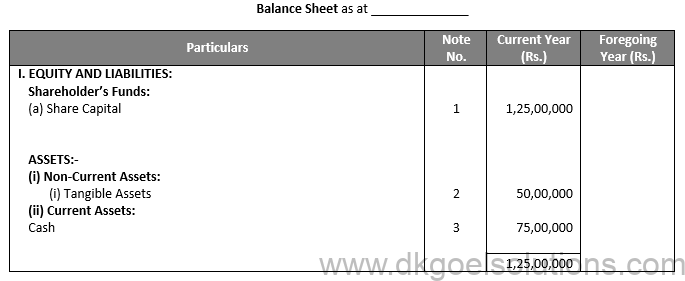

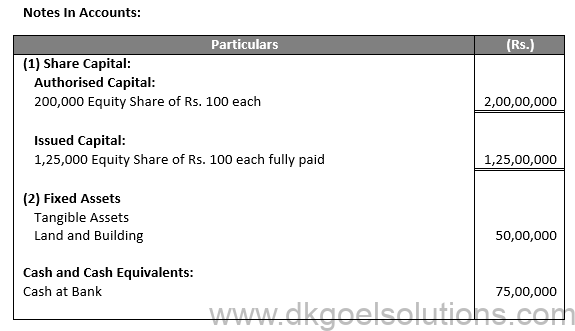

Balance Sheet as at __

Notes In Accounts:

Point for Students:-

Subscribed but not fully paid up: Shares are said to be ‘Subscribed but not fully paid-up’ under the following two situations:

(i) When the company has called-up the full nominal value of the share but the shareholder has not paid some part of the nominal value of the share.

(ii) When the company has not called-up the full nominal value of the share.

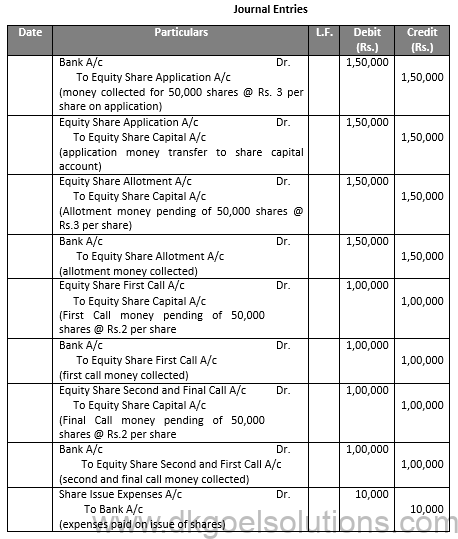

Q2.

Sol.2

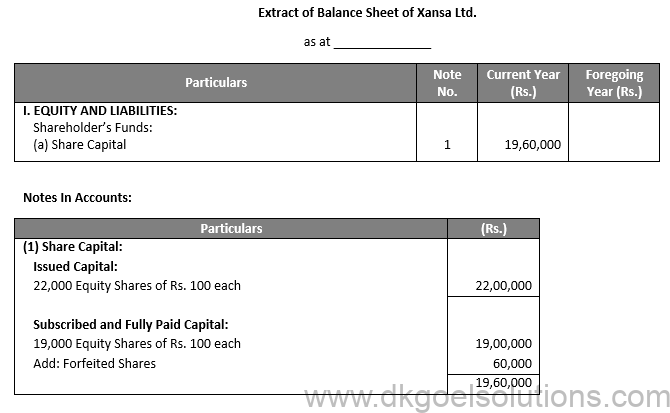

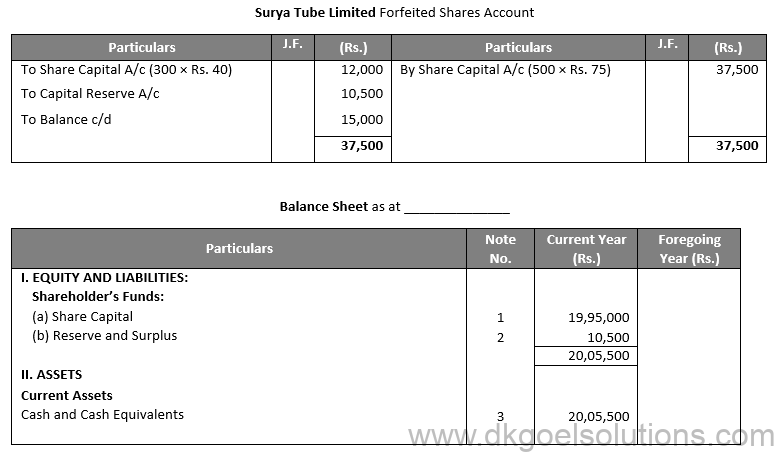

Extract of Balance Sheet of Tractors India Ltd. as at __

Notes In Accounts:

Point for Students:-

Authorised share capital refers to the amount which is stated in the Memorandum of Association. This is the maximum capital for which a Company is authorised to issue shares during its lifeline.

Q3.

Sol.3

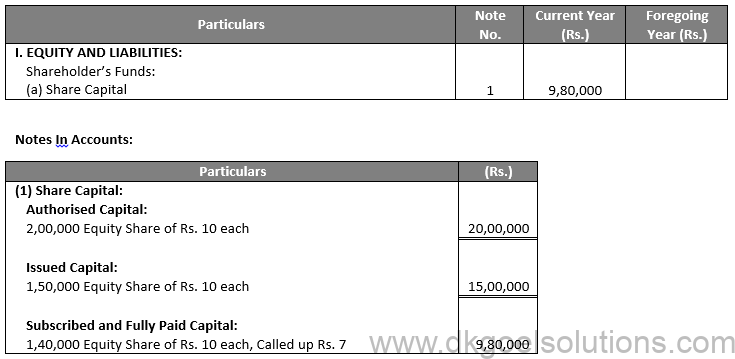

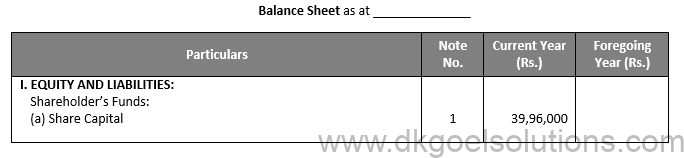

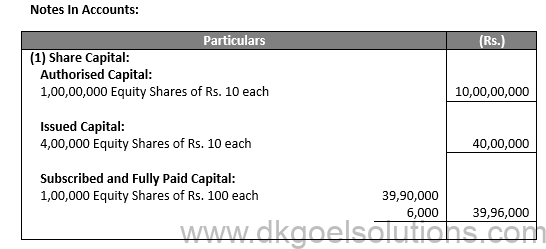

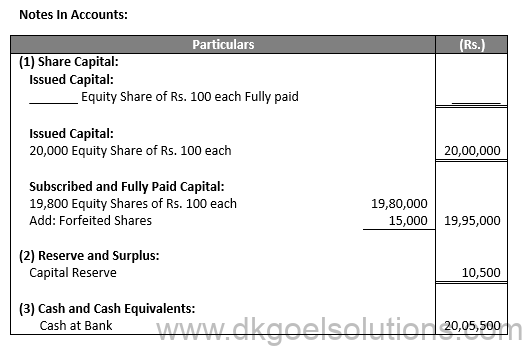

Balance Sheet as at __

Point for Students:-

Capital that has been issued According to Section 2(50) of the Companies Act of 2013, released capital refers to the capital that the corporation issues for subscription from time to time.

Q4.

Sol.4

Point for Students:-

The term “Paid-up” refers to that portion of called up capital which has been actually received from the shareholders. Usually the called-up Capital and the paid-up Capital are the same except that some shareholders may not have paid the amount of calls. Any update amount is called ‘Calls in arrear’. If a shareholder has paid Rs. 5 against the called-up amount of Rs. 8, then Rs. 5 is paid-up amount. Paid up capital will be called-up Capital less the amount of called in arrears.

Q5.

Sol.5

Point for Students:-

As per section 65 of the Companies Act, 2013 only an unlimited company having a share capital while converting into a limited company, may have reserve capital. In such a case, the company by a resolution may

(i) Increase the nominal amount of its share capital by increasing the nominal amount of each of its shares, and determine that no part of the increased capital shall be called up except in the event of winding up of the company.

(ii) Provide that a specified portion of its uncalled share capital shall not be called except in the event of winding up of the company.

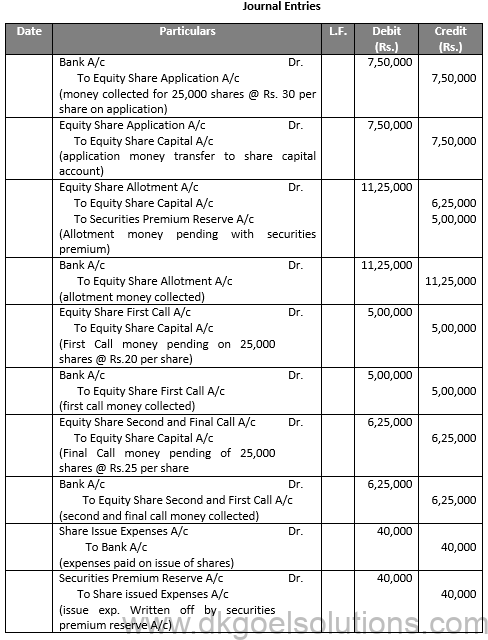

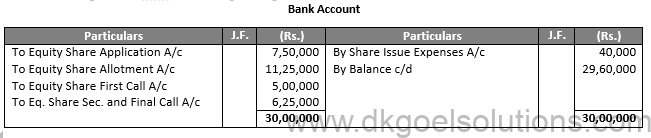

Q6.

Sol.6

Point for Students:-

Issue expenses are always written off by securities premium. Below are the necessary entries will be passed for this expense:-

Securities Premium Reserve A/c Dr.

To Share issued Expenses A/c

Q7.

Sol.7

Point for Students:-

Share may be issued in any of the following ways:

(i) For Cash: By Private Placement of shares.

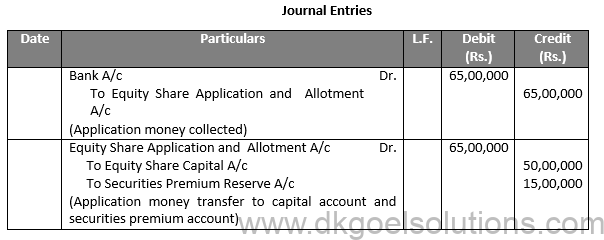

(ii) For Cash: By Public Subscription of shares.

(iii) For Consideration other than Cash.

Q8.

Sol.8

Point for Students:-

Sweat equity Shares are issued as per Section 54 of Companies Act, 2013. Sweat equity shares means equity shares issued by the Company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available intellectual property rights. Such shares cannot be resold by their holders within a period of 3 years, called lock-in period.

Q9.

Sol.9

Point for Students:-

Following steps are to be taken by a Public Company for the issue of shares to public:

(i) To Issue Prospectus

(ii) To Receive Applications

(iii) To Make Allotments

(iv) To Make Calls

Q10.

Sol.10

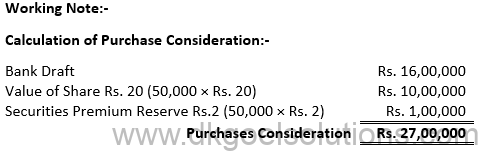

Working Note:-

Point for Students:-

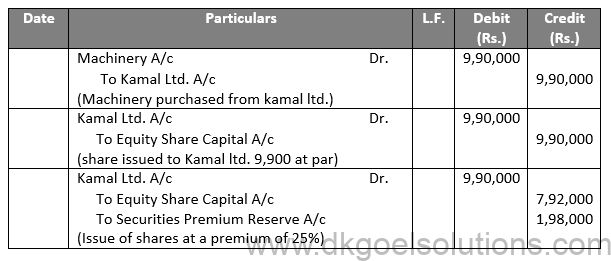

We can use shares for the purchases consideration. Below entries will be passed for the machinery purchased:-

Machinery A/c Dr.

To Seller’s A/c

Seller’s A/c Dr.

To Equity Share Capital A/c

Q11.

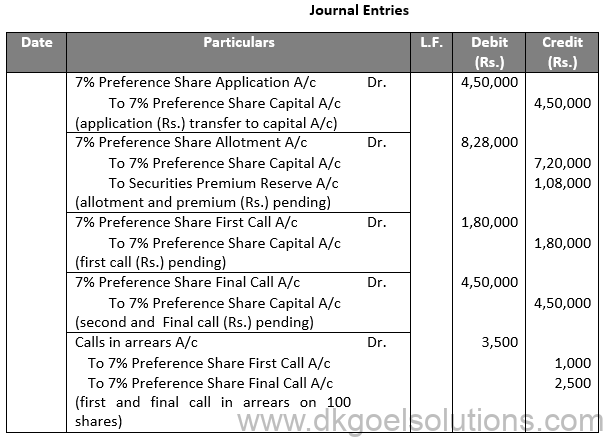

Sol.11

(i)

Point for Students:-

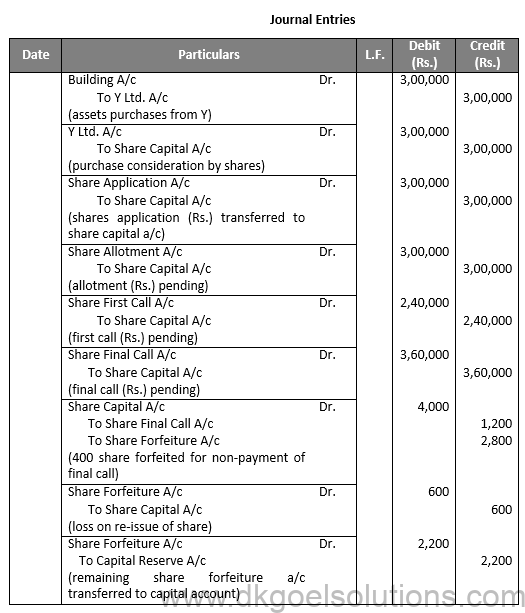

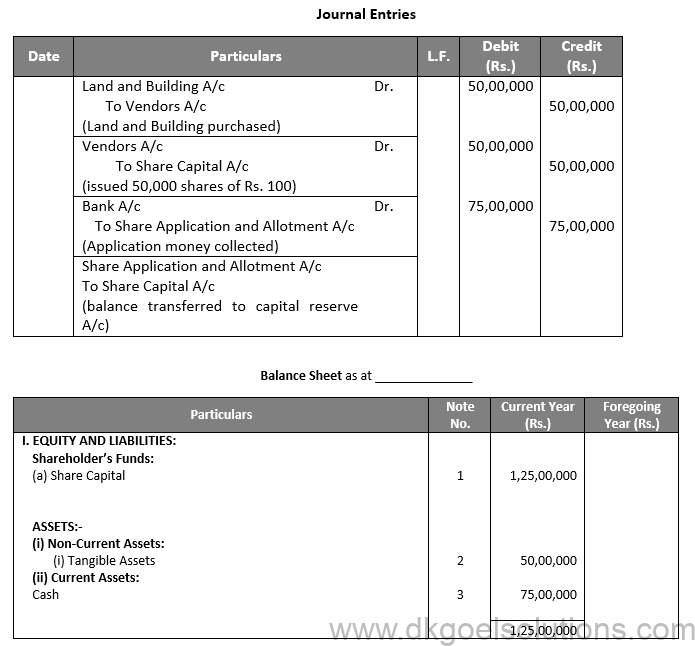

A company purchases some assets and instead of making the payment to the venders in the form of cash, it issues fully paid shares to the vendors. Following journal entries are made for this purpose:

(i) When assets are purchased from the vendors:

Sundry Assets A/c Dr.

To Vendor’s A/c

(ii) When shares are issued to vendors:

Vendor’s A/c Dr.

To Share Capital A/c

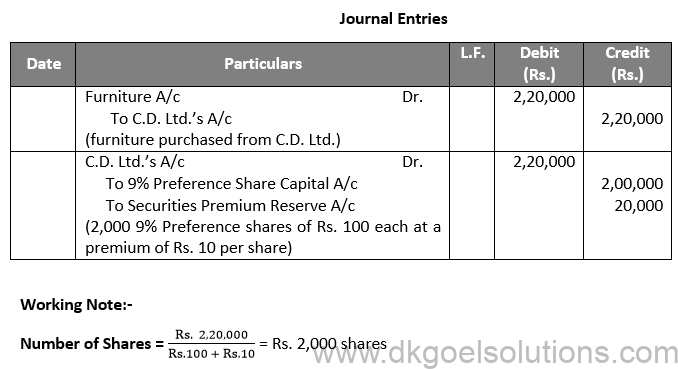

Q12.

Sol.12

Working Note:-

Point for Students:-

As per Section 53 of Companies Act 2013, Companies would no longer be permitted to issue shares at a discount. The only shares that could be issued at a discount are sweat equity wherein shares are issued to employees or directors in lieu of their services under Section 54 of 2013 Act.

Q13.

Sol.13

Point for Students:-

A Company may issue fully paid shares for consideration other than cash, in the following circumstances:

Issue of Shares to Promoters:

Promoters of a Company may be issued shares in the Company for the services rendered by them. The entry will be:

Incorporation Costs or Formation Exp. A/c Dr.

To Share Capital A/c

(Share issued to Promoters)

Q14.

Sol.14

Point for Students:-

We can use shares for the purchases consideration. Below entries will be passed for the machinery purchased:-

Machinery A/c Dr.

To Seller’s A/c

Seller’s A/c Dr.

To Equity Share Capital A/c

Q15.

Sol.15

Point for Students:-

It is not necessary to issue the shares only for cash. A Company may issue fully paid shares for consideration other than cash, in the following circumstances:

(i) Issue of shares to promoters:

Promoters of a Company may be issued shares in the Company for the services rendered by them. The entry will be:

Incorporation Costs or Formation Exp. A/c Dr.

To Share Capital A/c

(Shares issued to Promoters)

Q16.

Sol.16

Point for Students:-

Issue of Shares for Purchases of Assets:

Sometimes, a Company purchases some assets and instead of making the payment to the vendors in the form of Cash, it issued fully paid shares to the vendors. Following journal entries are made for this purpose:

1. When assets are purchased from the vendors:

Assets A/c Dr.

To Vendor’s A/c

2. When shares are issued to vendors:

Vendor’s A/c Dr.

To Share Capital A/c

Q17.

Sol.17

Point for Students:-

As per section 65 of the Companies Act, 2013 only an unlimited company having a share capital while converting into a limited company, may have reserve capital. In such a case, the company by a resolution may

(i) Increase the nominal amount of its share capital by increasing the nominal amount of each of its shares, and determine that no part of the increased capital shall be called up except in the event of winding up of the company.

(ii) Provide that a specified portion of its uncalled share capital shall not be called except in the event of winding up of the company.

Q18.

Sol.18

Point for Students:-

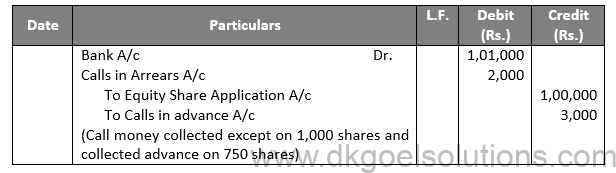

It often happens that some shareholders fall to pay the amount of allotment or call when it becomes due. This is known as calls in arrears. There are two methods to deal with calls in arrears:

(i) Without Opening Calls in Arrear Account: Under this method, there is no need to open calls-in-arrear account. In such a case the actual amount received from the shareholders is credited to the call account and the cell account will show a debit balance equal to the unpaid amount of the cell. On a subsequent date, when the unpaid amount is received, Bank Account is debited and the relevant call a/c is credited.

(ii) By Opening Calls in Arrear Account: Under the method, ‘Calls in Arrear A/c’ is opened and this account is debited when some amount of allotment or calls is not received. On a later date, when the arrear amount is received, Bank Account is debited and the Calls in Arrear A/c is credited.

Q19.

Sol.19

Point for Students:-

Some shareholders fail to pay the amount of allotment or call when it becomes due. This is known as calls in arrears. There are two methods to deal with calls in arrears:

Without Opening Calls in Arrear Account:

Under this method, there is no need to open calls-in-arrear account. In such a case the actual amount received from the shareholders is credited to the call account and the call account will show a debit balance equal to the unpaid amount of the call. On a subsequent date, when the unpaid amount is received, Bank Account is debited and the relevant call A/c is credited.

Q20.

Sol.20

Point for Students:-

Sweat equity Shares are issued as per Section 54 of Companies Act, 2013. Sweat equity shares means equity shares issued by the Company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available intellectual property rights. Such shares cannot be resold by their holders within a period of 3 years, called lock-in period.

Q21.

Sol.21

Point for Students:-

Following steps are to be taken by a Public Company for the issue of shares to public:

i) To Issue Prospectus

ii) To Receive Applications

iii) To Make Allotments

iv) To Make Calls

Q22.

Sol.22

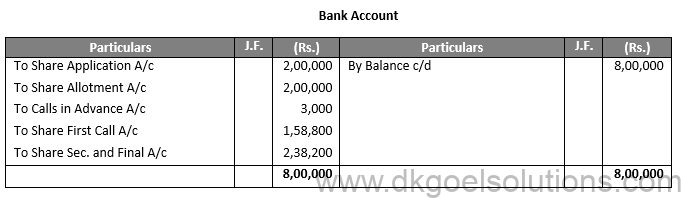

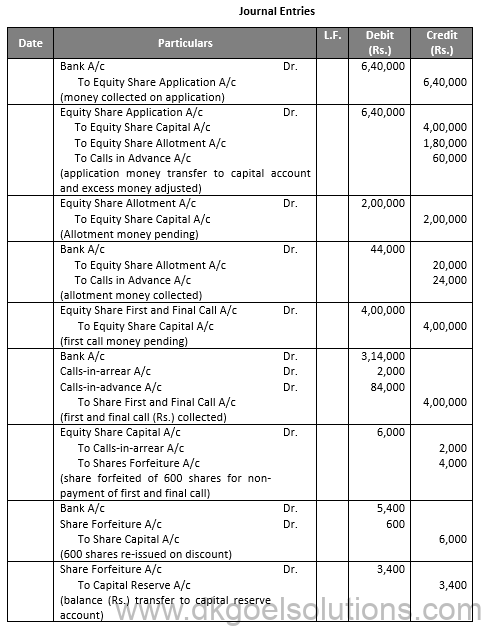

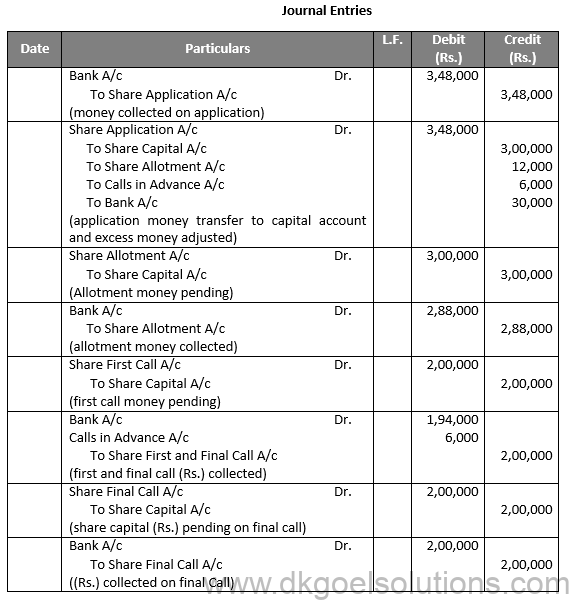

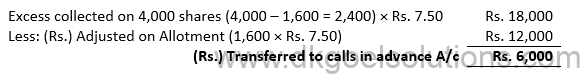

Working Note:-

Calculation of Access Money:-

Point for Students:-

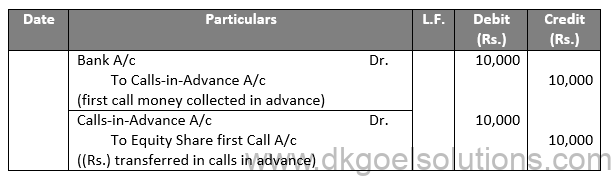

A shareholder may sometimes pay a part, or whole of the amount not yet called upon his shares is order to save him-self the trouble of paying different called at different times. Thus the amount of future calls is received in advance by the Company. According to Section 50 of the Companies Act 2013, such amount of calls in advance can be accepted by the Company only when it is so authorised by its Articles of Association.

Q23.

Sol.23

Point for Students:-

Following entries are passed for recording interest on call in advance:-

1.) On making due to the interest on call in advance:

Interest on call in advance A/c Dr.

To Sundry members A/c

Q24.

Sol.24

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Q25.

Sol.25

Point for Students:-

Forfeiture of shares means cancelling the shares for non-payment of calls due. But, shares can be forfeited only if the Articles of Association of the company allows forfeiture. If any shareholder does not pay the amount of call, the company may exercise the power of forfeit the shares held by him on which amount of call is not paid.

Q26.

Sol.26

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q27.

Sol.27

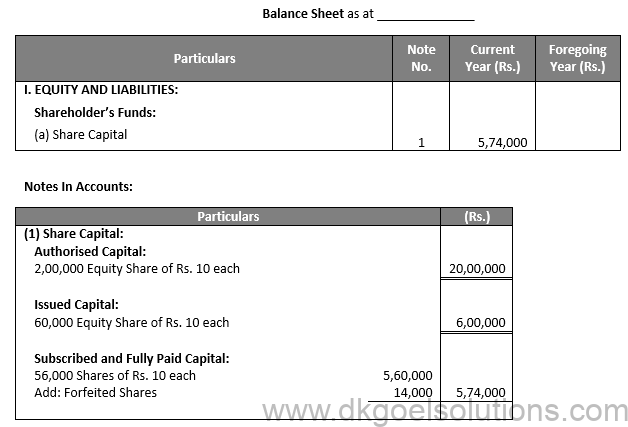

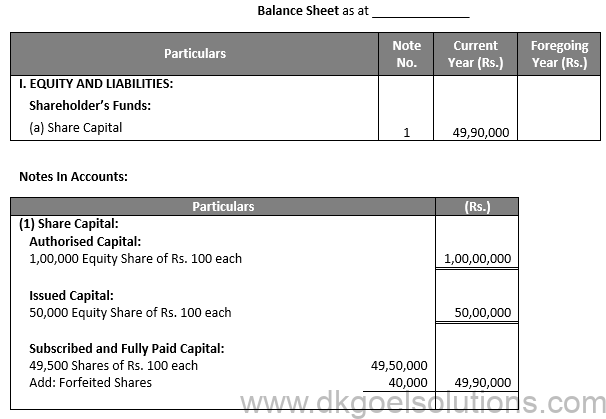

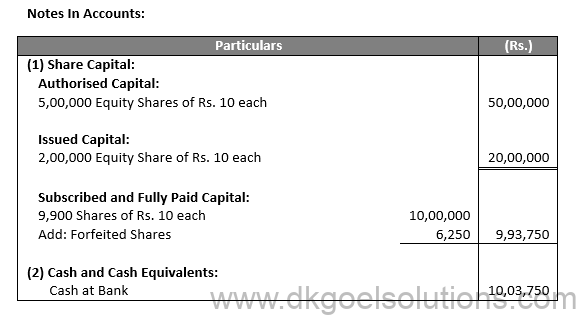

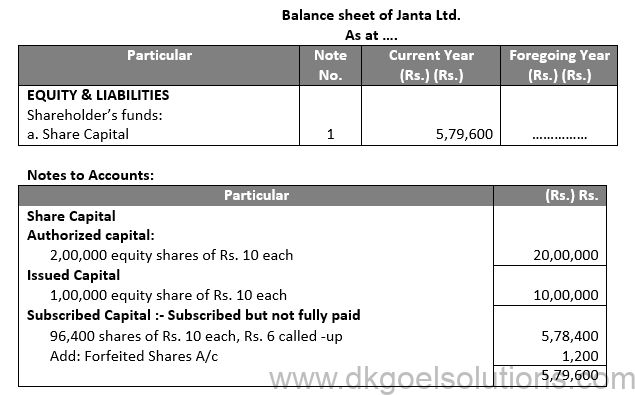

Point for Students:-

Till the time forfeited shares are reissued, balance of the Forfeited Shares Account is added to paid-up capital under Subscribed Capital in the Note to Accounts on ‘Share Capital’, being part of Shareholders’ Fund shown under Equity and Liabilities part of the Balance Sheet.

Q28.

Sol.28

Point for Students:-

If Forfeiture shares issued at par:-

In this case,

(i) Share Capital Account is debited with the amount called-up upto the date of forfeiture on shares forfeited;

(ii) Shares Allotment Account and/or Shares Call Account is credited with amount called-up on forfeited shares but not paid by the shareholders. If Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited

Q29.

Sol.29

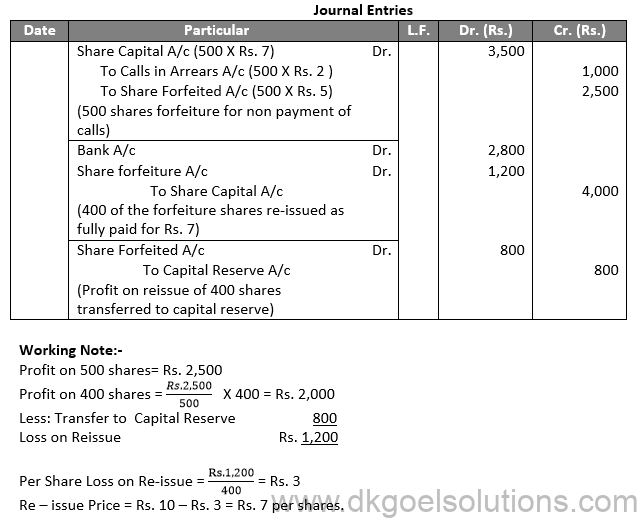

Working Note:-

Calculation of number of shares:-

Point for Students:-

Forfeited Shares Account is credited by the amount received on the shares forfeited. The entry for forfeiture of shares is:

Share Capital A/c Dr.

To Forfeiture Shares A/c

To Shares Allotment A/c

To Share Call A/c

Q30.

Sol.30

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Forfeiture of shares means cancelling the shares for non-payment of calls due. But, shares can be forfeited only if the Articles of Association of the company allows forfeiture. If any shareholder does not pay the amount of call, the company may exercise the power of forfeit the shares held by him on which amount of call is not paid.

Q31.

Sol.31

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q32.

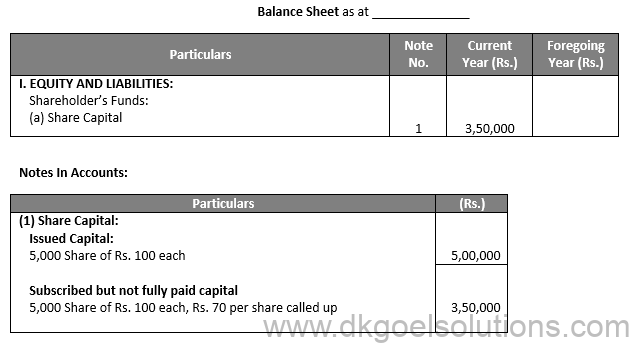

Sol.32

Point for Students:-

Subscribed but not fully paid up: Shares are said to be ‘Subscribed but not fully paid-up’ under the following two situations:

(i) When the company has called-up the full nominal value of the share but the shareholder has not paid some part of the nominal value of the share.

(ii) When the company has not called-up the full nominal value of the share.

Q33.

Sol.33

Point for Students:-

Issue of Shares for Purchases of Assets:

Sometimes, a Company purchases some assets and instead of making the payment to the vendors in the form of Cash, it issued fully paid shares to the vendors. Following journal entries are made for this purpose:

1. When assets are purchased from the vendors:

Assets A/c Dr.

To Vendor’s A/c

2. When shares are issued to vendors:

Vendor’s A/c Dr.

To Share Capital A/c

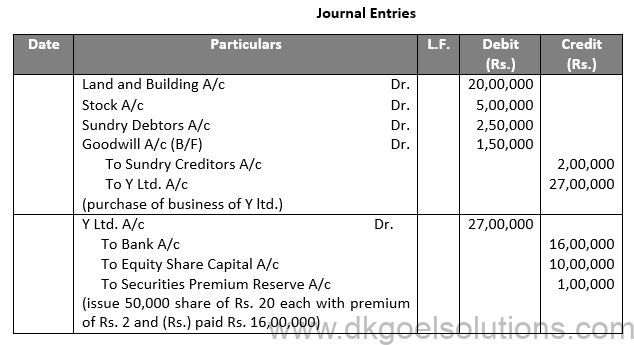

Number of Shares to be Issued = (Purchase Consideration)/(Issue Price of a Share)

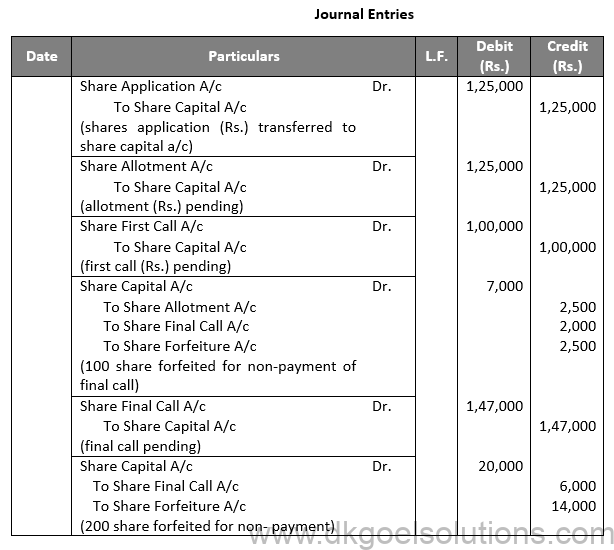

Q34.

Sol.34

Point for Students:-

The term “Paid-up” refers to that portion of called up capital which has been actually received from the shareholders. Usually the called-up Capital and the paid-up Capital are the same except that some shareholders may not have paid the amount of calls. Any update amount is called ‘Calls in arrear’. If a shareholder has paid Rs. 5 against the called-up amount of Rs. 8, then Rs. 5 is paid-up amount. Paid up capital will be called-up Capital less the amount of called in arrears.

Q35.

Sol.35

Working Note:-

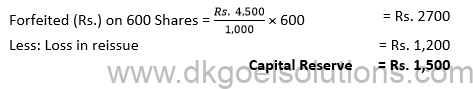

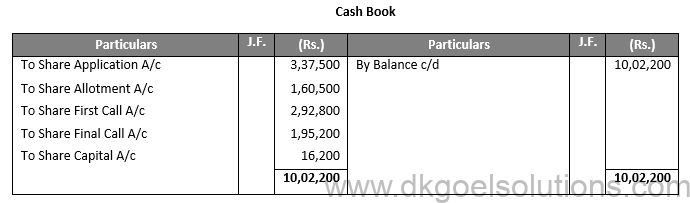

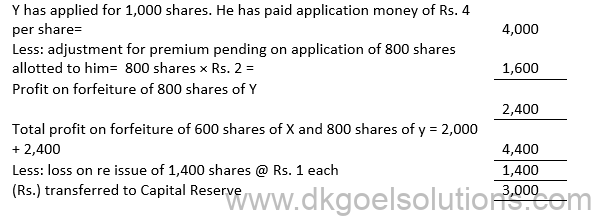

Calculation of Capital Reserve:

Point for Students:-

Shares issued for consideration other than cash are disclosed, i.e., shown in the Balance Sheet under Subscribed Capital (as subscribed and fully paid-up or subscribed but not fully paid-up as the case is) in the Note to Accounts on Share Capital.

Q36.

Sol.36

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Q37.

Sol.37

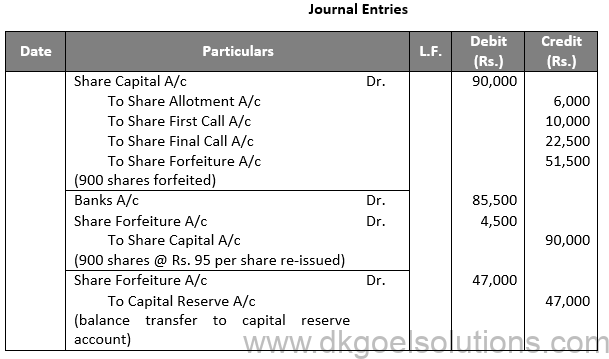

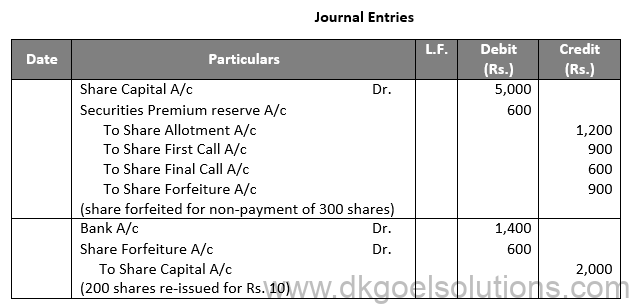

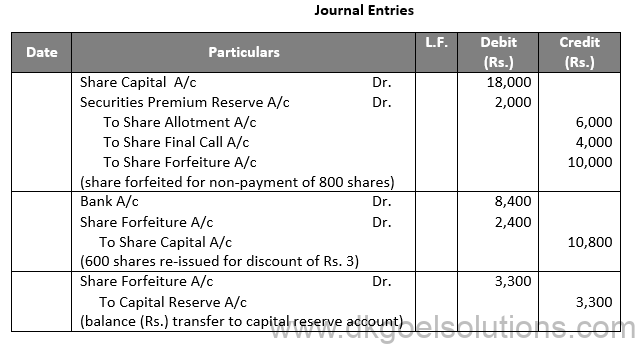

Case (i)

Point for Students:-

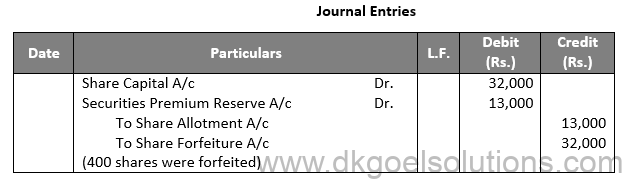

When Securities Premium Amount has been Received:-

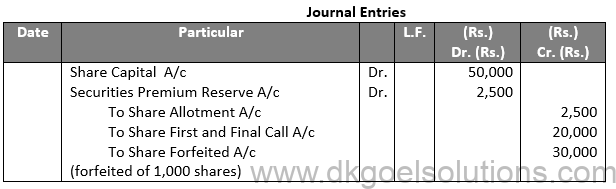

The amount received as Securities Premium is not cancelled i.e., Securities Premium Reserve Account is not debited when the shares are forfeited. Securities Premium Reserve Account is not debited with the amount relating to forfeited shares because Securities Premium credited to Securities Premium Reserve Account and also received can be used only for the purposes prescribed in Section 52(2) of the Companies Act, 2013.

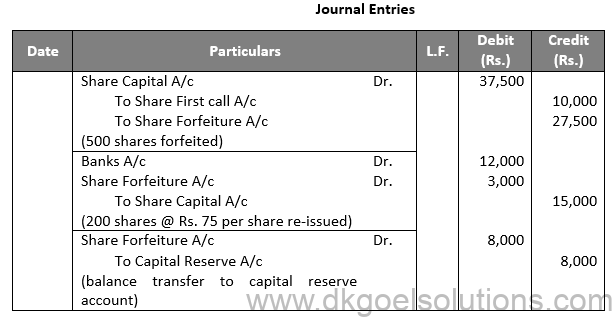

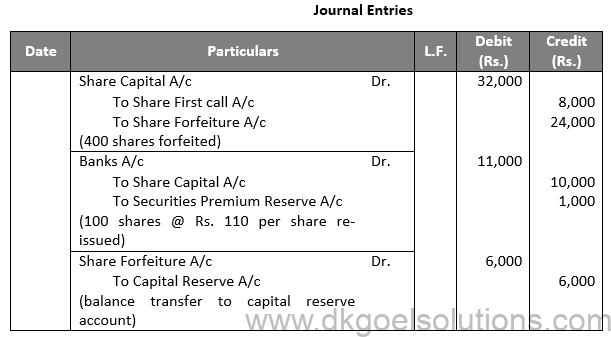

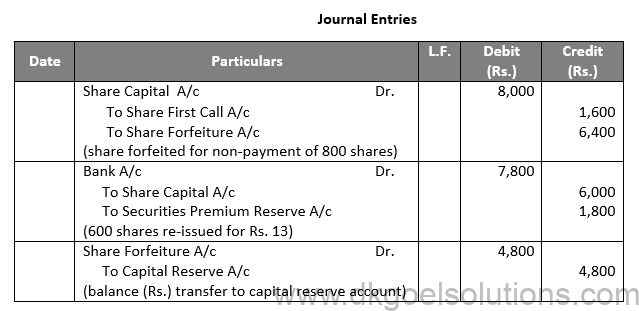

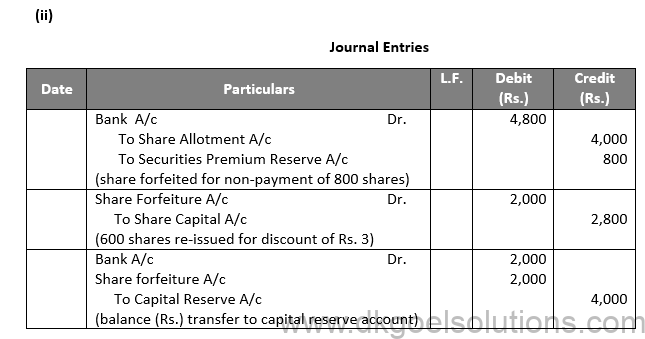

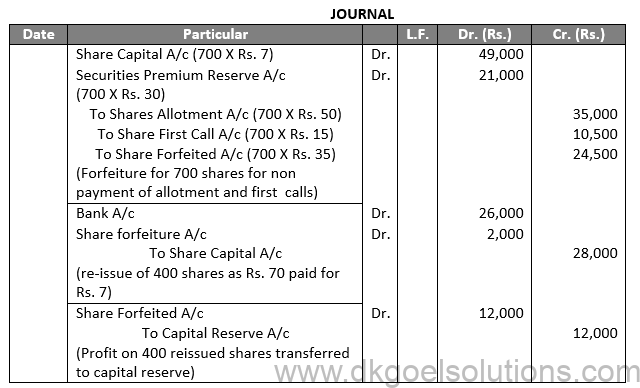

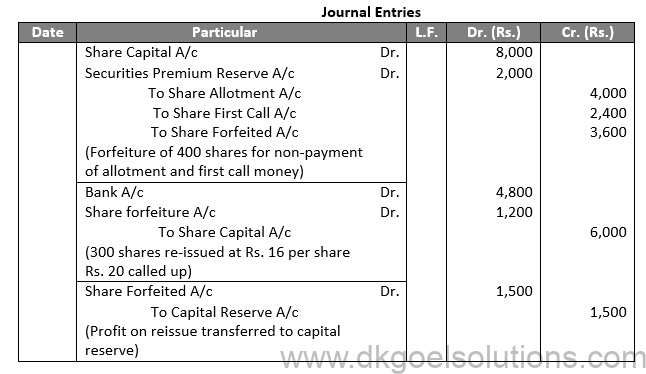

Q38.

Sol.38

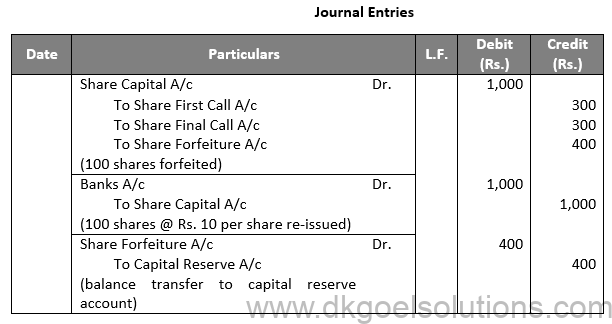

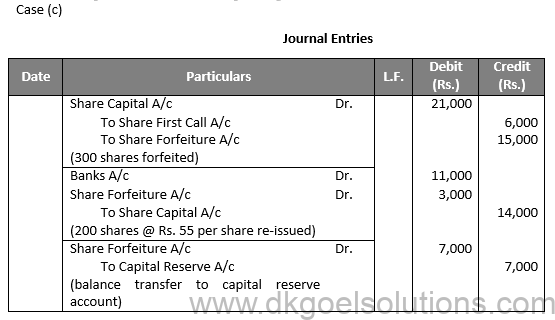

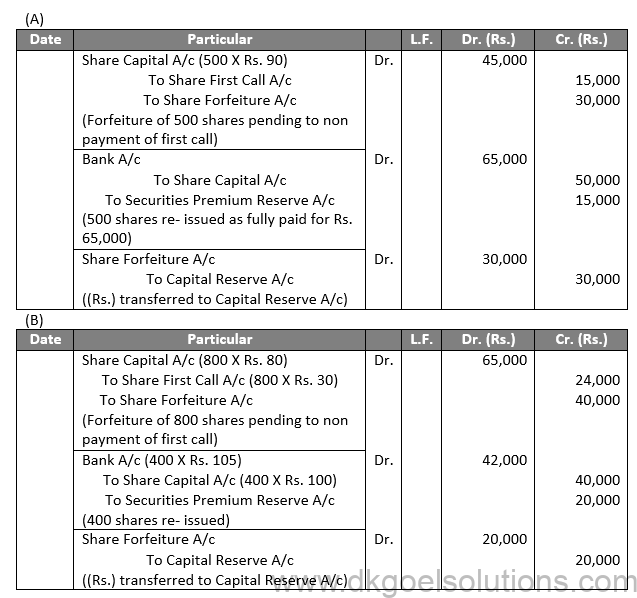

Case (a)

Point for Students:-

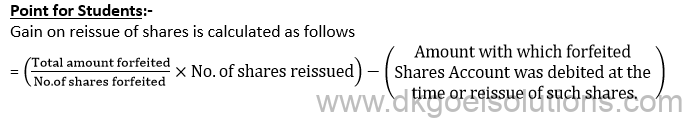

Re-issue of forfeited shares means selling the shares that were cancelled by the company. These shares may be reissued by the company on the terms as it may decide. Thus, forfeited shares may be reissued by the company at par, at premium or at discount. However, if forfeited shares are reissued at discount, the amount of discount allowed on reissue of forfeited shares should not exceed the amount forfeited on reissue shares

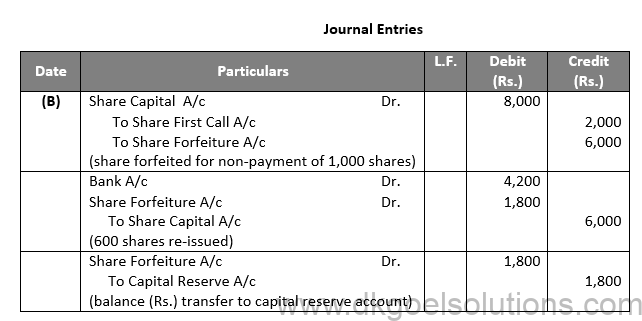

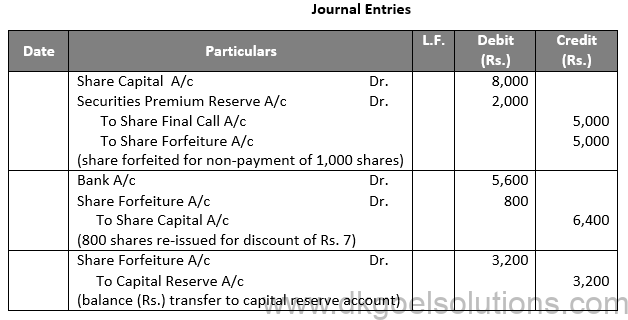

Q39.

Sol.39

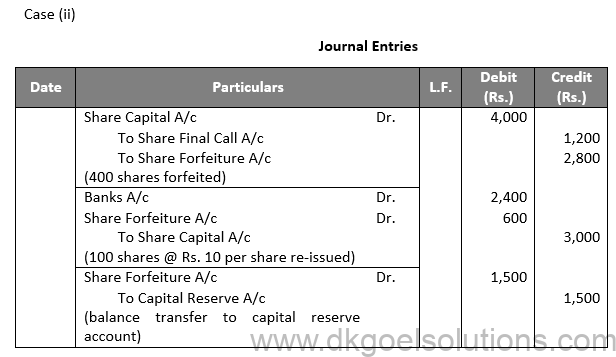

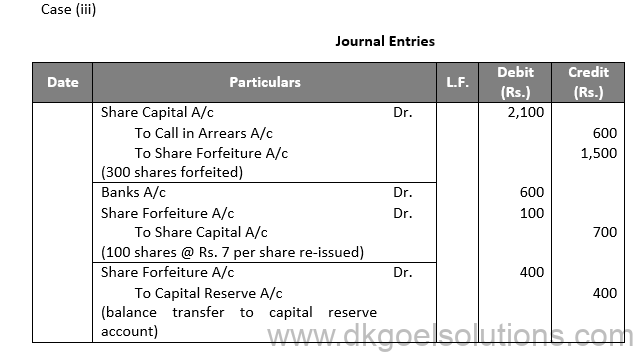

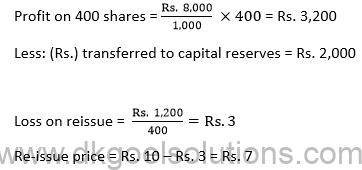

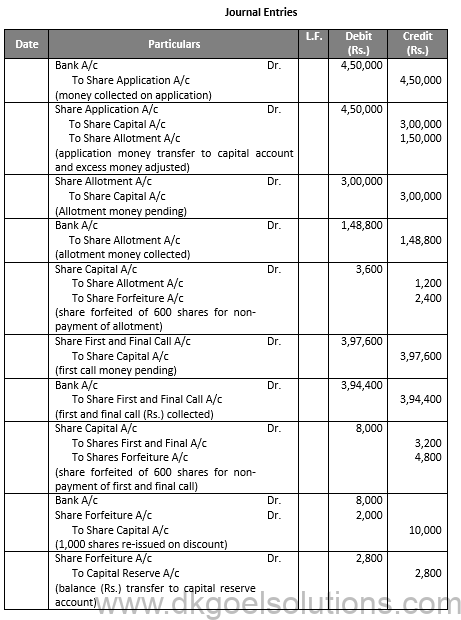

Case (i)

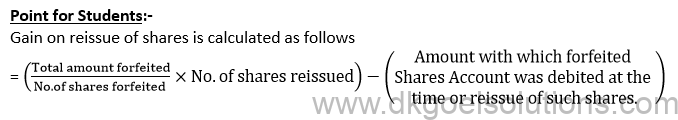

Working Note:-

Profit on 1,000 shares = Rs. 8,000

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends. Following are the item that gives rise to Capital profits and hence Capital reserves:

(i) Profit on sale of fixed assets.

(ii) Profit on revolution of fixed assets.

(iii) Premium on issue of shares and debentures.

(iv) Profit on redemption of debentures.

(v) Profit earned by a company prior to its incorporation.

(vi) Profit on forfeiture and re-issue of shares.

Capital Reserves are shown on the liabilities side of the Balance Sheet under the head “Reserve and Surplus.”

Q40.

Sol.40

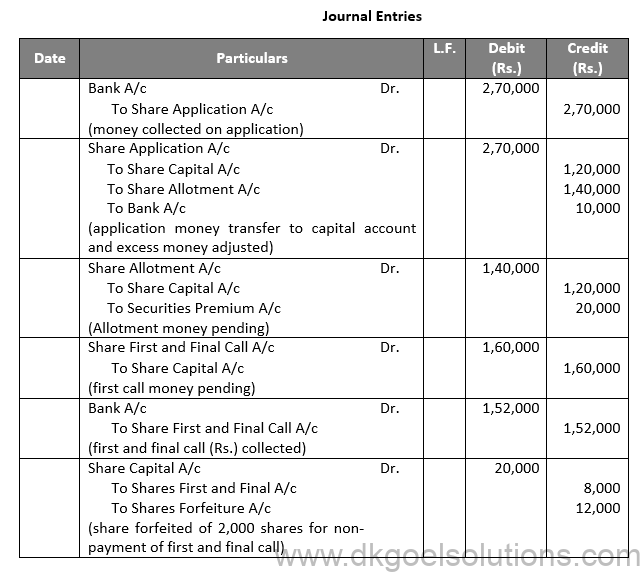

Working Note:-

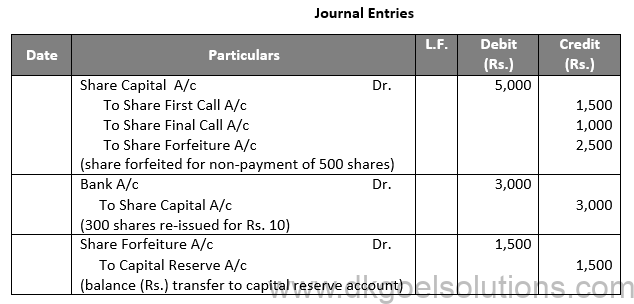

Point for Students:-

In case, forfeited shares are reissued at par, i.e. at nominal value of share, accounting entry passed is:

Bank A/c Dr.

To Share Capital A/c

In case, the forfeited shares are reissued at discount, accounting entry passed is:

Bank A/c Dr.

Forfeited Shares A/c Dr.

To Share Capital A/c

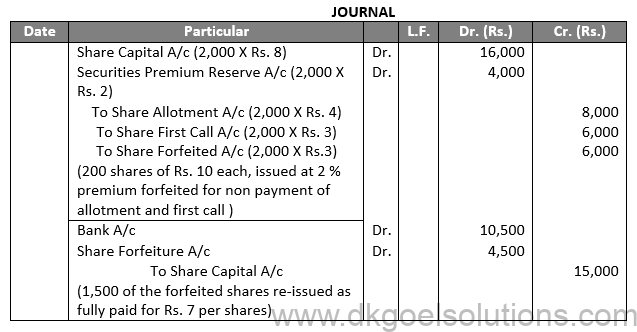

Q41.

Sol.41

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Forfeiture of shares means cancelling the shares for non-payment of calls due. But, shares can be forfeited only if the Articles of Association of the company allows forfeiture. If any shareholder does not pay the amount of call, the company may exercise the power of forfeit the shares held by him on which amount of call is not paid

Q42.

Sol.42

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends

Q43.

Sol.43

Point for Students:-

Amount debited to forfeited shares account is calculated as under:

No. of share reissue × (Paid-up Value – Reissue price per share)

If the forfeiture shares are reissue at a price higher than their nominal value. The excess of reissue price ever over nominal value is credited to Securities Premium Reserve Account. The entry passed is:

Bank A/c Dr.

To Share Capital A/c

To Securities Premium A/c

Q44.

Sol.44

Working Note:-

Working Note:-

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends. Following are the item that gives rise to Capital profits and hence Capital reserves:

(i) Profit on sale of fixed assets.

(ii) Profit on revolution of fixed assets.

(iii) Premium on issue of shares and debentures.

(iv) Profit on redemption of debentures.

(v) Profit earned by a company prior to its incorporation.

(vi) Profit on forfeiture and re-issue of shares.

Q45.

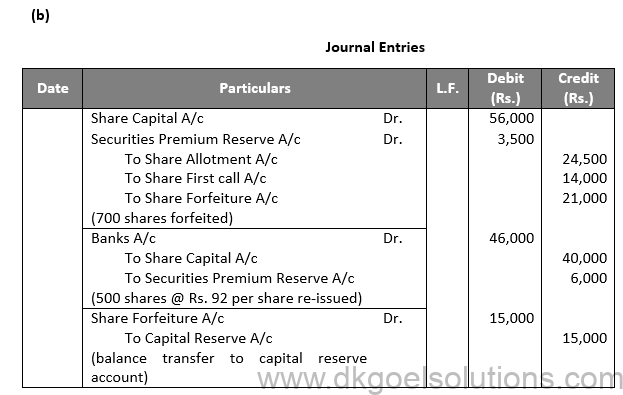

Sol.45

(a)

Point for Students:-

In case, forfeited shares are reissued at par, i.e. at nominal value of share, accounting entry passed is:

Bank A/c Dr.

To Share Capital A/c

In case, the forfeited shares are reissued at discount, accounting entry passed is:

Bank A/c Dr.

Forfeited Shares A/c Dr.

To Share Capital A/c

Q46.

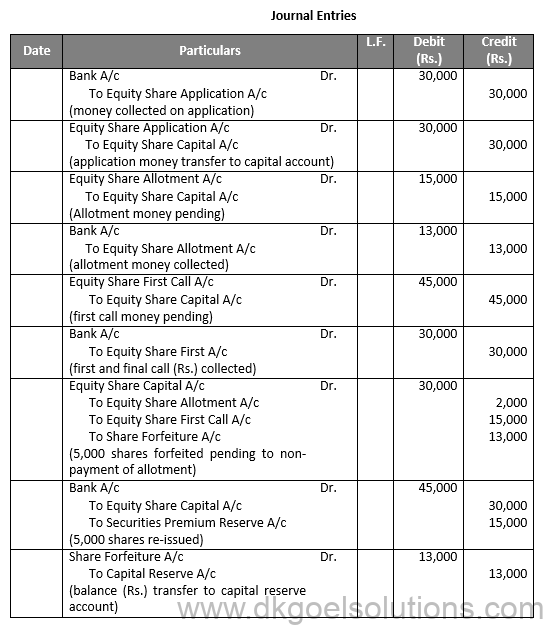

Sol.46

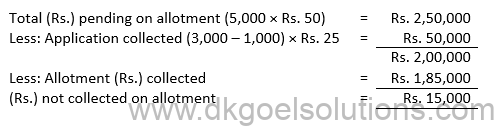

Working Note:-

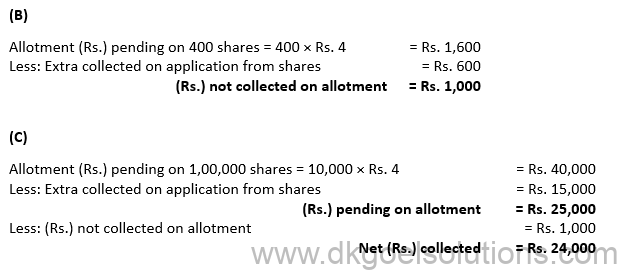

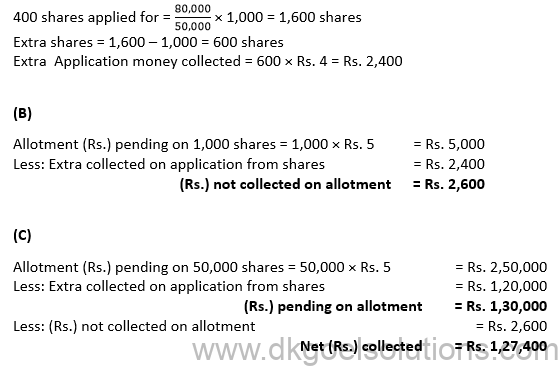

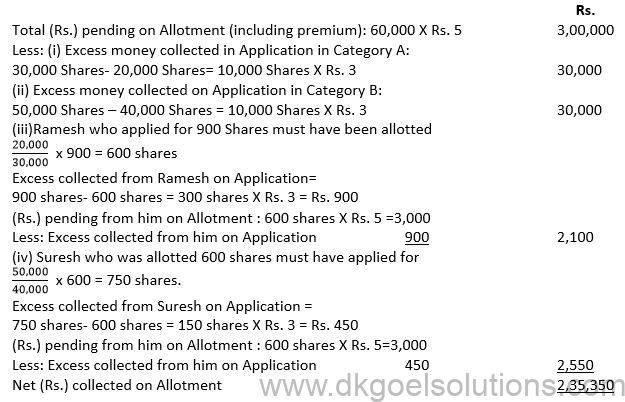

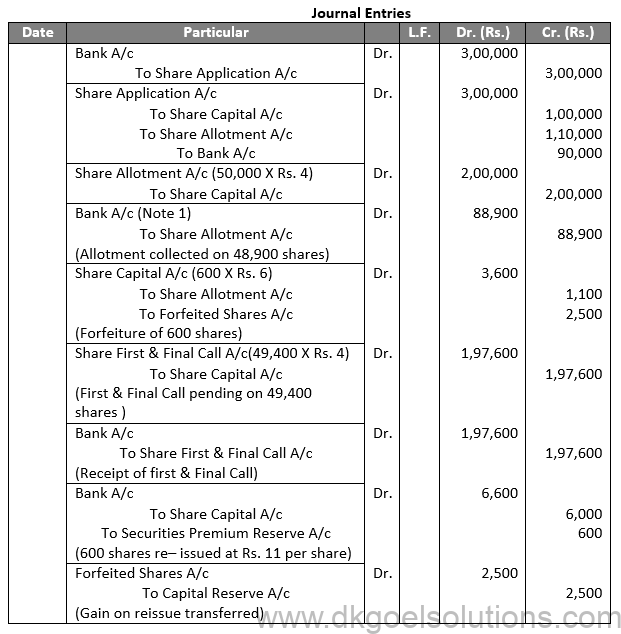

Calculation of (Rs.) collected on Allotment:-

Point for Students:-

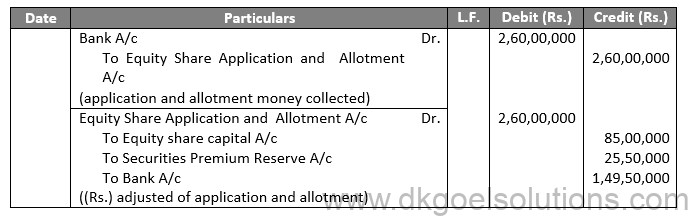

The premium on issue of shares is a Capital profit and not a revenue profit and as such, must be credited to a separate account called ‘Securities Premium Reserve Account’. It must be shown separately in the Balance Sheet on the equity and liabilities side under the head ‘Reserve and Surplus’.

Q47.

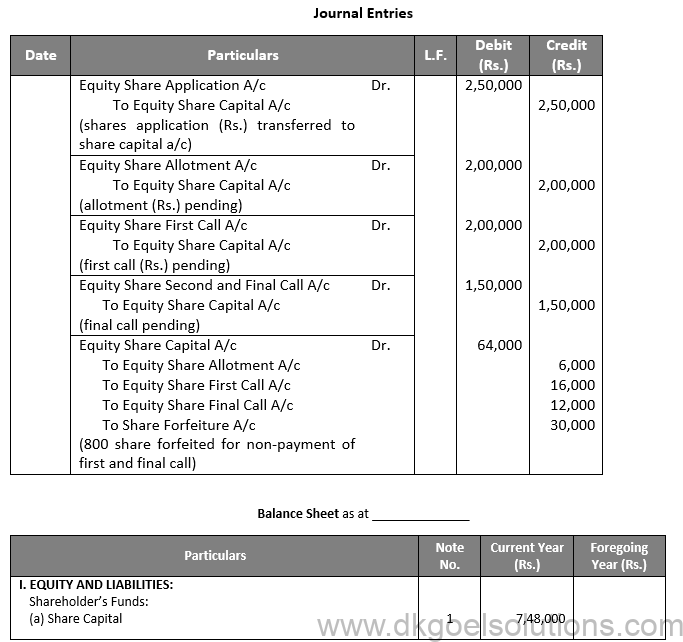

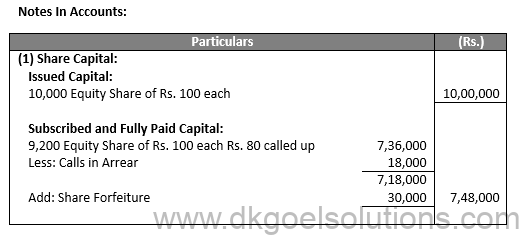

Sol.47

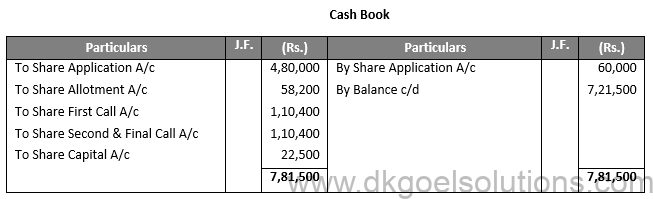

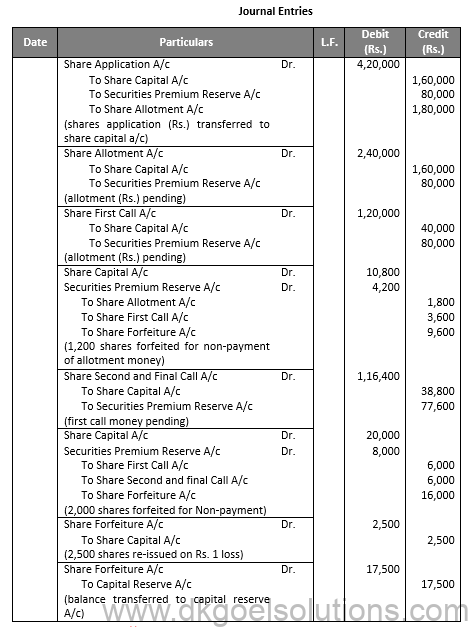

Working Note:-

Point for Students:-

Under section 52 of the Companies Act, 2013, the amount of securities premium reserve may be used only for the following purposes:

(1) In writing off the preliminary expenses of the company.

(2) For writing off the expenses, Commission or discount allowed on issue of shares or debentures of the Company.

(3) For issuing fully paid bonus shares to the shareholders of the company.

(4) For providing for the premium payable on redemption of redeemable preference share or debentures of the Company.

(5) For Buy back of its own shares and other securities as per Section 68.

Q48.

Sol.48

Point for Students:-

Revised Schedule VI does not contain the head ‘Miscellaneous Expenditure’ in the Balance Sheet. As per AS-26, Preliminary Expenses are to be written off in the year in which they are incurred. However, share issue expenses, underwriting commission, discount on shares, discount/premium on borrowing etc., being special nature items are excluded from the scope of AS-26 (Intangible Assets). These Items can be amortized over the period of benefit, i.e. normally 3 to 5 years.

Guidance notes on Revised Schedule VI issued by ‘The institute of Chartered Accounts of India’ suggests that unamortized portion of above mentioned expenses be shown on the assets side of the balance sheet as, ‘Unamortized Expenses’ under the hear ‘Other Current/Non-Current Assets’ depending on whether the amount will be amortized in the next 12 months or thereafter. Amount to be amortized in the next 12 months will be shown under the head ‘Other Current Assets’ and the amount to be amortized after 12 months will be shown under the hear ‘Other Non-Current Assets’.

Q49.

Sol.49

Point for Students:-

Discount on issue of shares is a loss of Capital nature. It is written off either against Securities Premium Reserve or from Statement of Profit and Loss. The journal entry for writing off the discount will be as under:

Securities Premium Reserve/ Statement of Profit and loss A/c Dr.

To Share Discount A/c

(Writing off the amount of discount)

Q50.

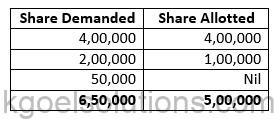

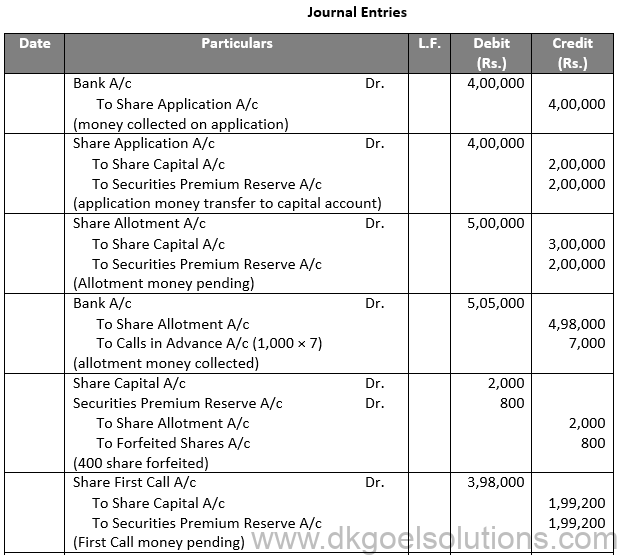

Sol.50

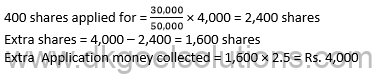

Working Note:-

Calculation of Allotment:-

Extra money collected from application:-

A applicant demand 2,00,000 shares allotted 1,00,000 shares = 1,00,000 × 3 = Rs. 3,00,000

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Q51.

Sol.51

Point for Students:-

After reissue of all the forfeited shares, balance left in forfeited shares account is transferred in capital reserve account by passing the following entry:

Forfeited Share A/c

To Capital Reserve A/c

(Gain on reissue of transferred to capital reserve)

Q52.

Sol.52

Point for Students:-

If forfeited shares are reissued at par or premium, the total amount forfeited on the shares is a gain o capital nature and is transferred to capital reserve account

Q53.

Sol.53

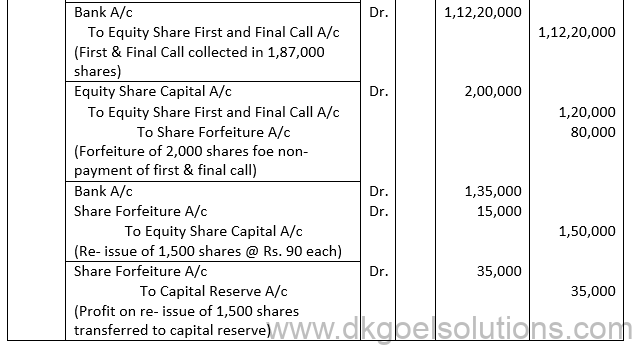

Working Note:-

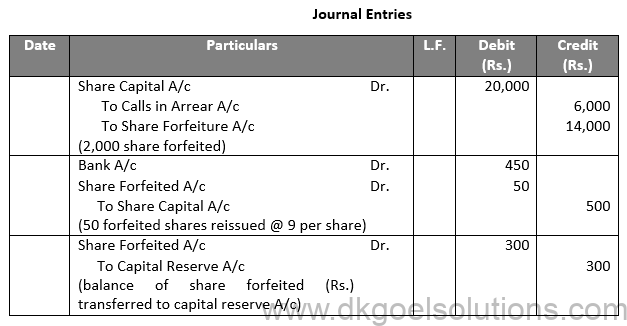

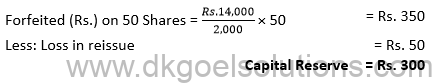

Number of Share Forfeited (2,000 × 7) = Rs. 14,000

Point for Students:-

Share Issue Expenses, underwriting commission, discount on shares etc. being special nature items are excluded from the scope of AS-26. These items can be amortized over the period of benefit, i.e. normally 3 to 5 years. ‘Unamortized portion’ of such expenses will be shown under the head ‘Other Current/Non-Current Assets depending on whether the amount will be amortized in the next 12 months or thereafter.

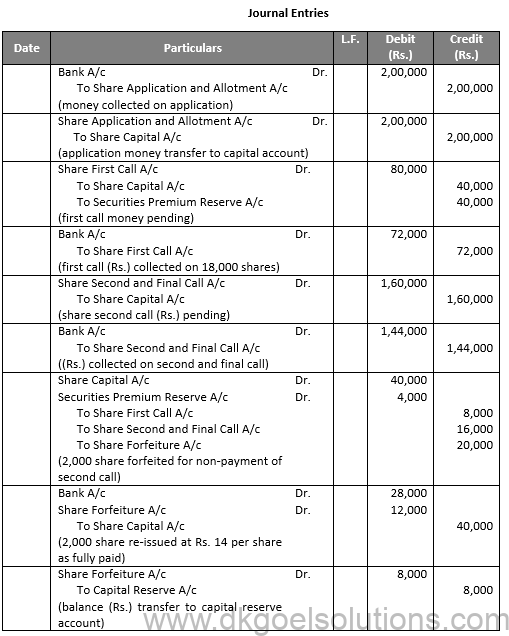

Q54.

Sol.54

Working Note:-

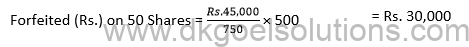

Number of Share Forfeited (750 × 60) = Rs. 45,000

Point for Students:-

It often happens that some shareholders fall to pay the amount of allotment or call when it becomes due. This is known as calls in arrears. There are two methods to deal with calls in arrears:

(i) Without Opening Calls in Arrear Account: Under this method, there is no need to open calls-in-arrear account. In such a case the actual amount received from the shareholders is credited to the call account and the cell account will show a debit balance equal to the unpaid amount of the cell. On a subsequent date, when the unpaid amount is received, Bank Account is debited and the relevant call a/c is credited.

(ii) By Opening Calls in Arrear Account: Under the method, ‘Calls in Arrear A/c’ is opened and this account is debited when some amount of allotment or calls is not received. On a later date, when the arrear amount is received, Bank Account is debited and the Calls in Arrear A/c is credited.

Q55.

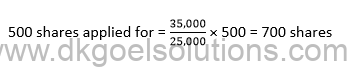

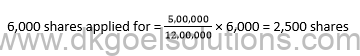

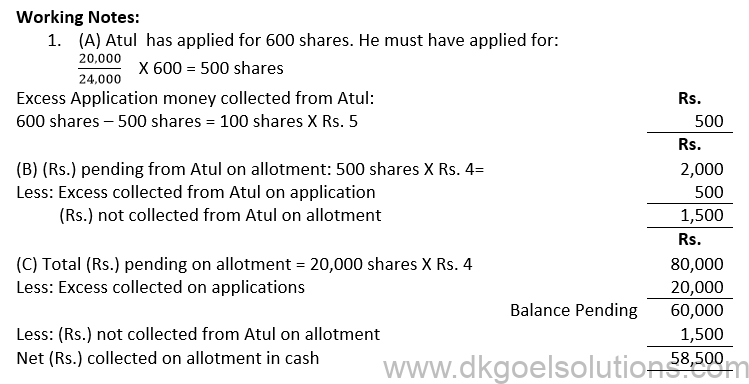

Sol.55

Working Note:-

(A)

Share applied 35,000 and Share allotted 25,000

Extra shares = 700 – 500 = 200 shares

Extra Application money collected = 200 × 25 = Rs. 5,000

Q56.

Sol.56

Working Note:-

Point for Students:-

The amount of forfeited shares not reissued will remain in forfeited share account till the off paid-up share capital under subscribed share capital under subscribed share capital in the note of accounts on shares capital and shown against the main head shares capital under shareholders fund is equity and liabilities part of the balance sheet.

Q57.

Sol.57

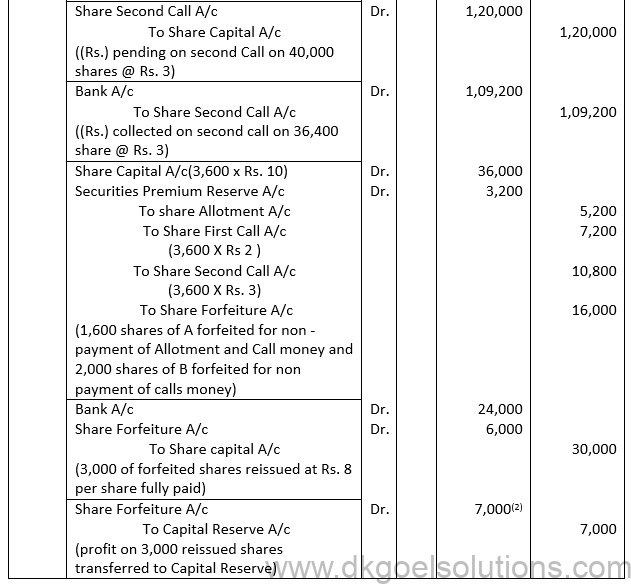

Working Note:-

(A)

Share applied 50,000 and Share allotted 30,000

Point for Students:-

After reissue of all the forfeited shares, balance left in forfeited shares account is transferred in capital reserve account by passing the following entry:

Forfeited Share A/c

To Capital Reserve A/c

(Gain on reissue of transferred to capital reserve)

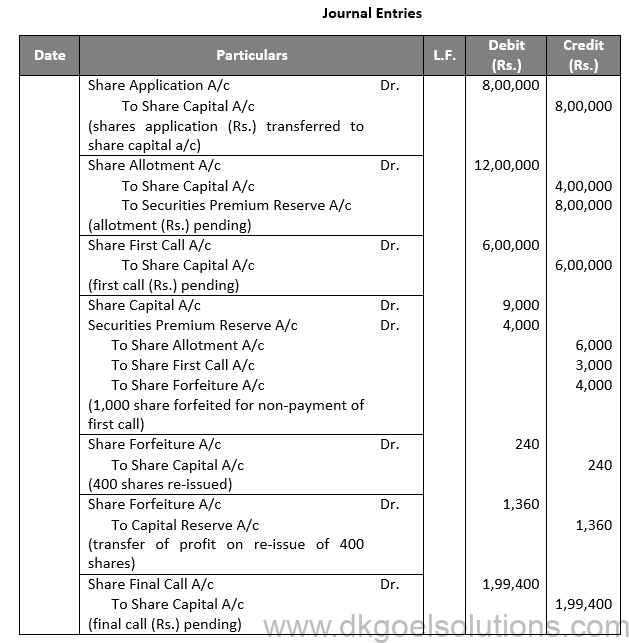

Q58.

Sol.58

Working Note:-

(A)

Share applied 12,00,000 and Share allotted 5,00,000

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends

Q59.

Sol.59

Working Note:-

(A)

Share applied 10,000 and Share allotted 15,000

Extra shares = 600 – 400 = 200 shares

Extra Application money collected = 200 × Rs. 3 = Rs. 600

Point for Students:-

The term “Called-up” refers to the part of the face value of a share called by the directors from shareholders. For example, if the directors call at the rate of Rs. 80 per share on 10,000 shares of Rs. 100 each, Rs. 8,00,000 will be the called up Capital. The remaining amount of Rs. 20 share will be uncalled Capital

Q60.

Sol.60

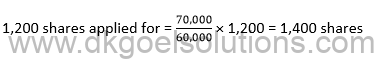

Working Note:-

(A)

Share applied 60,000 and Share allotted 70,000

Extra shares = 1,400 – 1,200 = 200 shares

Extra Application money collected = 200 × Rs. 4 = Rs. 800

Q61.

Sol.61

Working Note:-

(A)

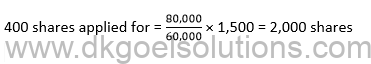

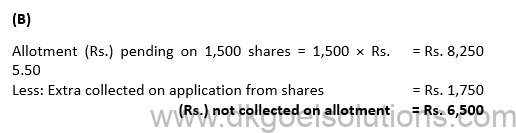

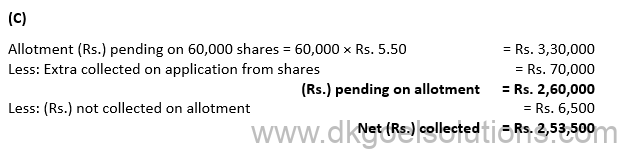

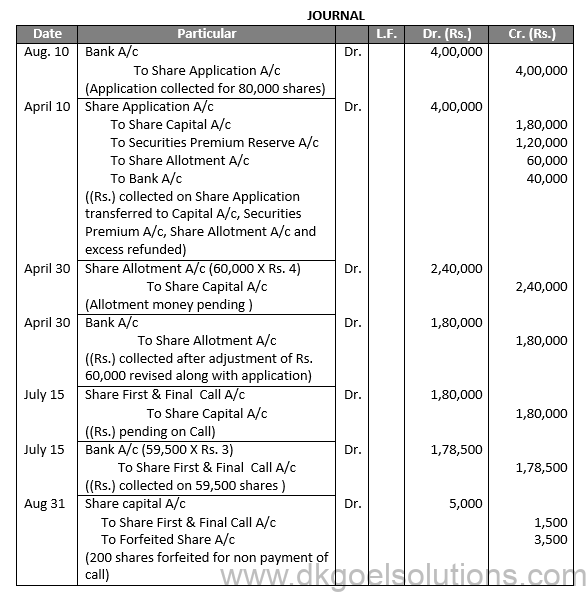

Share applied 80,000 and Share allotted 60,000

Extra shares = 2,000 – 1,500 = 500 shares

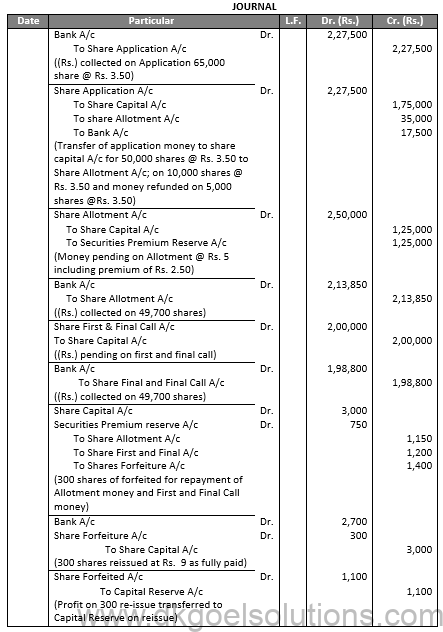

Extra Application money collected = 500 × Rs. 3.50 = Rs. 1,750

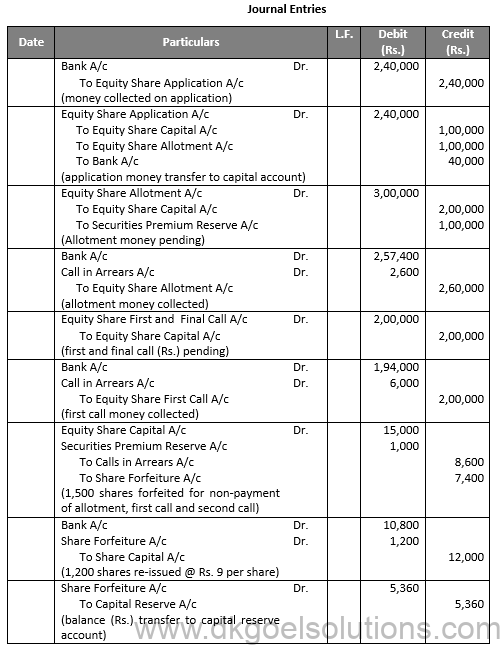

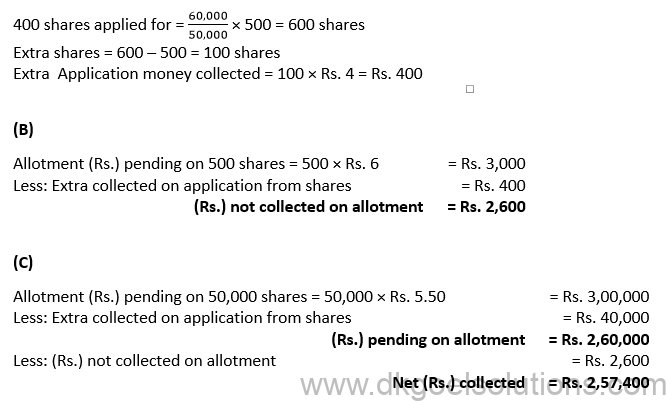

Q62.

Sol.62

Working Note:-

(A)

Share applied 60,000 and Share allotted 50,000

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends. Following are the item that gives rise to Capital profits and hence Capital reserves:

(i) Profit on sale of fixed assets.

(ii) Profit on revolution of fixed assets.

(iii) Premium on issue of shares and debentures.

(iv) Profit on redemption of debentures.

(v) Profit earned by a company prior to its incorporation.

(vi) Profit on forfeiture and re-issue of shares.

Capital Reserves are shown on the liabilities side of the Balance Sheet under the head “Reserve and Surplus.”

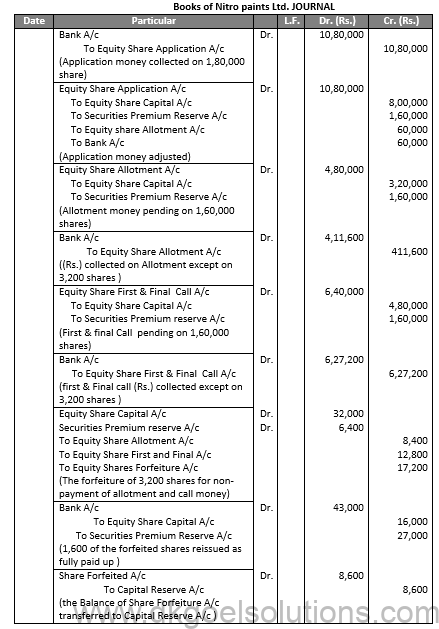

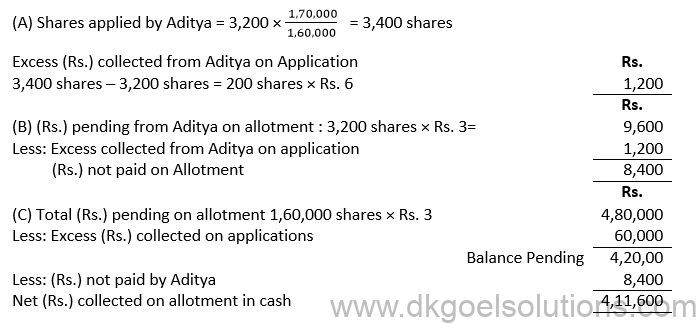

Q63.

Sol.63

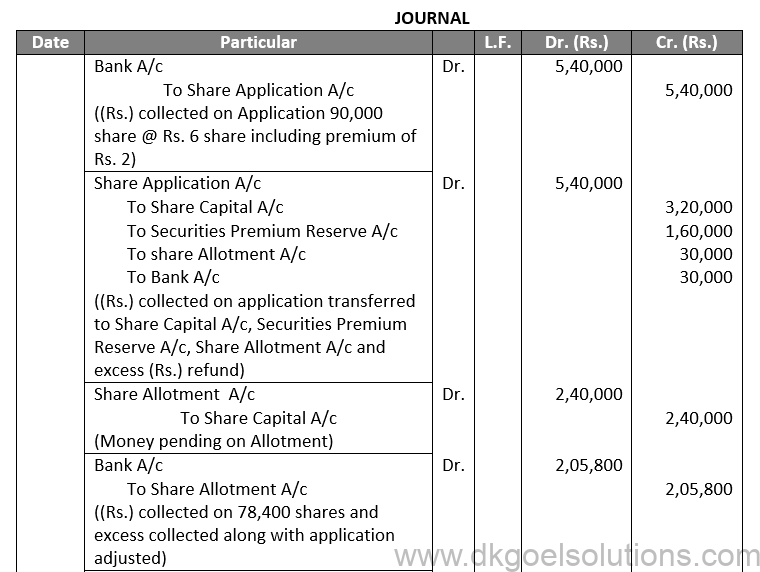

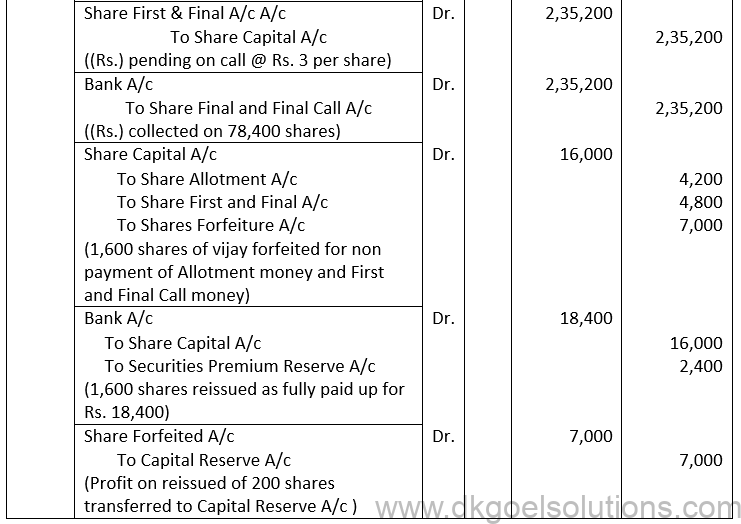

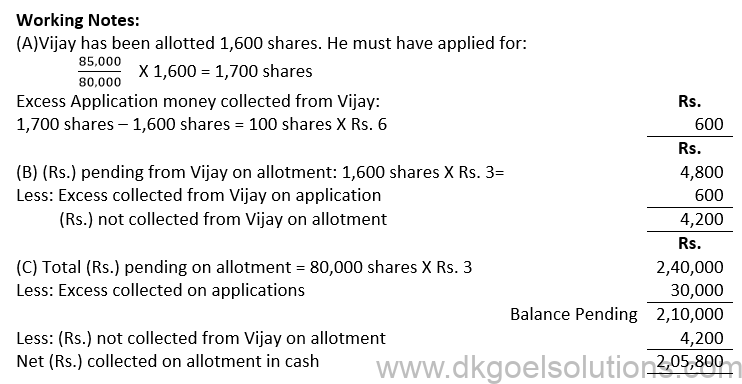

Working Note:-

(A)

Share applied 3,60,000 and Share allotted 3,20,000

Point for Students:-

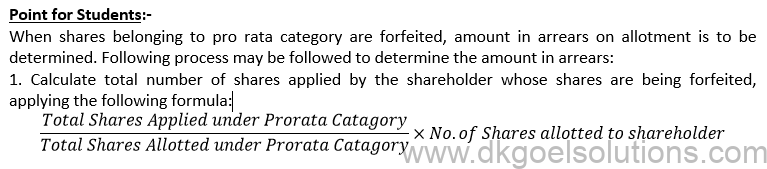

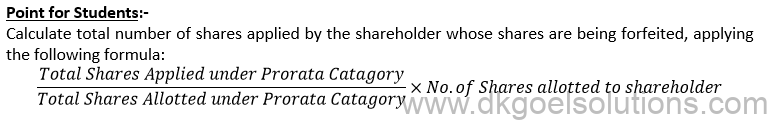

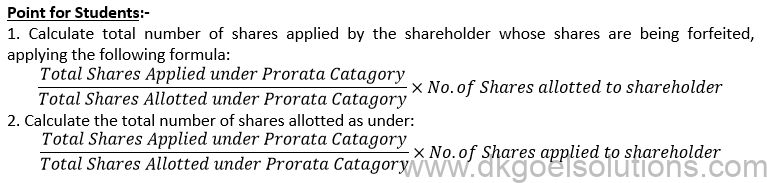

When shares belonging to pro rata category are forfeited, amount in arrears on allotment is to be determined. Following process may be followed to determine the amount in arrears:

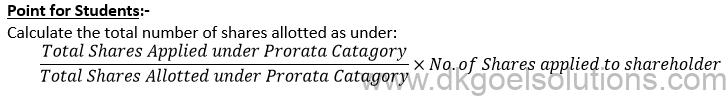

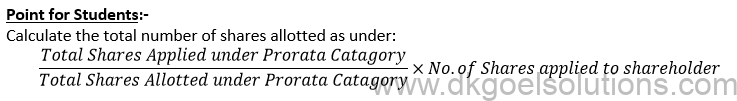

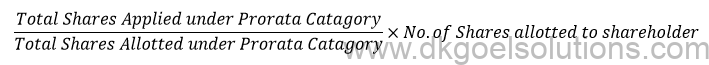

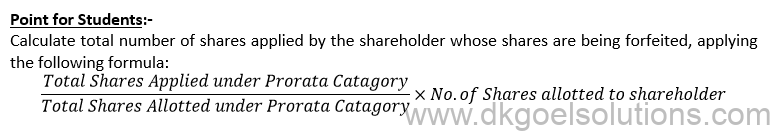

1. Calculate total number of shares applied by the shareholder whose shares are being forfeited, applying the following formula:

- 2. Calculate total application money received on shares applied by defaulting shareholder as under:

No. of shares applied by shareholder × Application money per share. - 2. Calculate application money due on shares allotted to defaulting shareholder as under:

No. of shares allotted to shareholder × Application money per share. - 3. Calculate excess application money received:-

= Application money received – Application money required - 4. Calculate amount due on allotment and deduct from it the excess application money. The result is the amount in arrears on allotment.

Q64.

Sol.64

Working Note:-

(A)

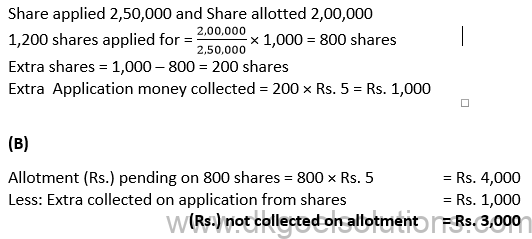

Share applied 2,50,000 and Share allotted 2,00,000

Q65.

Sol.65

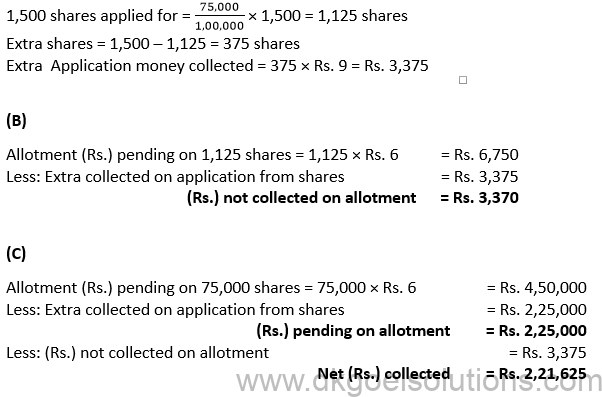

Working Note:-

(A)

Share applied 1,00,000 and Share allotted 75,000

Point for Students:-

Calculation amount due on allotment but not paid by the defaulting shareholder as follows:

Amount due on Allotment (No. of allotted share × Allotment amount per share)

Less: Excess Application Money Adjusted on Allotment

[{Applied Share – Allotted Share} × Application Money per share]

Amount not paid on Allotment

Q66.

Sol.66

Working Note:-

(A)

Extra shares = 600 – 400 = 200 shares

Extra Application money collected = 200 × Rs. 4 = Rs. 800

Point for Students:-

It often happens that some shareholders fall to pay the amount of allotment or call when it becomes due. This is known as calls in arrears. There are two methods to deal with calls in arrears:

(i) Without Opening Calls in Arrear Account: Under this method, there is no need to open calls-in-arrear account. In such a case the actual amount received from the shareholders is credited to the call account and the cell account will show a debit balance equal to the unpaid amount of the cell. On a subsequent date, when the unpaid amount is received, Bank Account is debited and the relevant call a/c is credited.

(ii) By Opening Calls in Arrear Account: Under the method, ‘Calls in Arrear A/c’ is opened and this account is debited when some amount of allotment or calls is not received. On a later date, when the arrear amount is received, Bank Account is debited and the Calls in Arrear A/c is credited.

Q67.

Sol.67

Working Note:-

(A)

Extra shares = 2,250 – 1,500 = 750 shares

Extra Application money collected = 750 × Rs. 5 = Rs. 3,750

Q68.

Sol.68

Working Note:-

(A)

Share applied 80,000 and Share allotted 60,000

Point for Students:-

The amount of forfeited shares not reissued will remain in forfeited share account till the off paid-up share capital under subscribed share capital under subscribed share capital in the note of accounts on shares capital and shown against the main head shares capital under shareholders fund is equity and liabilities part of the balance sheet.

Q69.

Sol.69

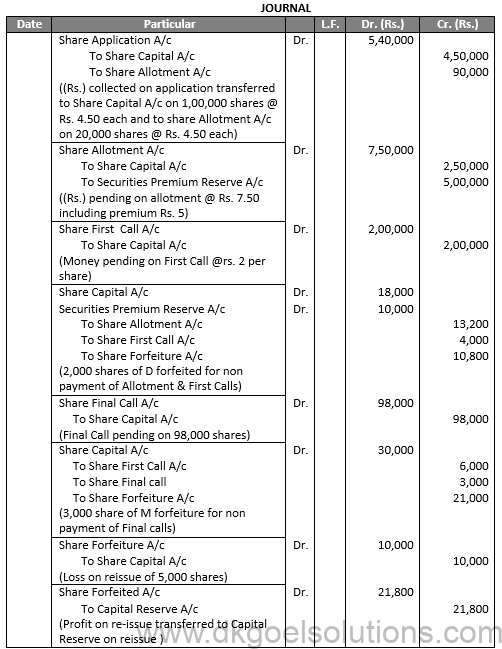

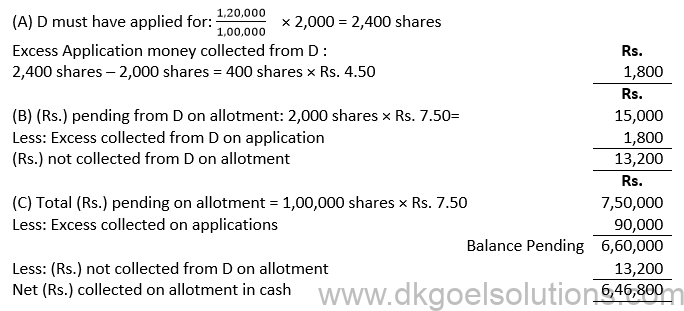

Working Note:-

(A) Calculation of Shares applied by A

Share applied 3,50,000 and Share allotted 2,50,000

Point for Students:-

After reissue of all the forfeited shares, balance left in forfeited shares account is transferred in capital reserve account by passing the following entry:

Forfeited Share A/c

To Capital Reserve A/c

(Gain on reissue of transferred to capital reserve)

Q70.

Sol.70

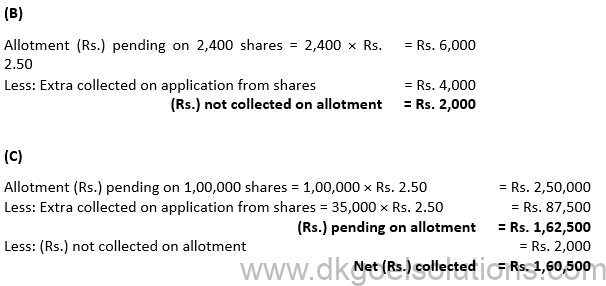

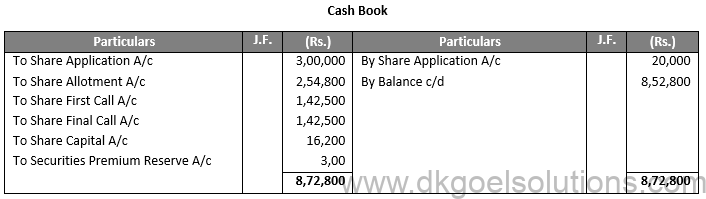

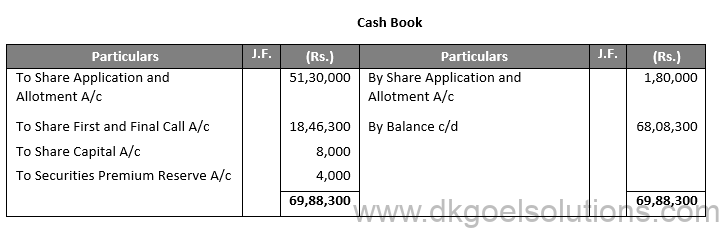

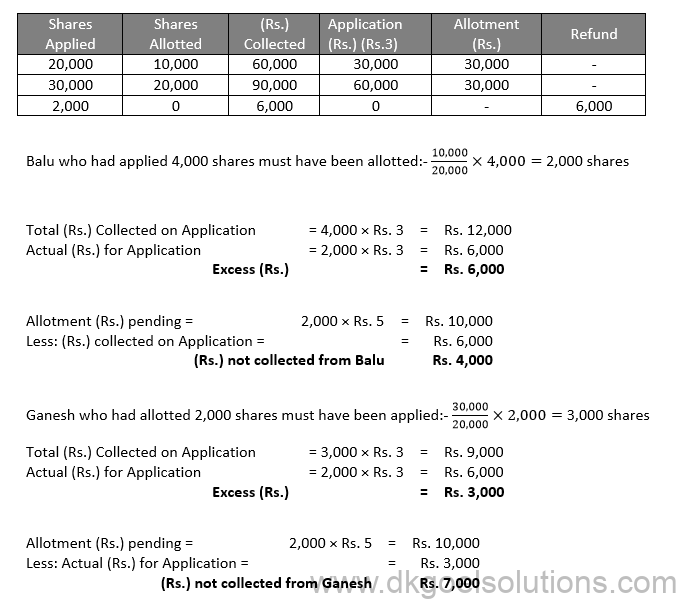

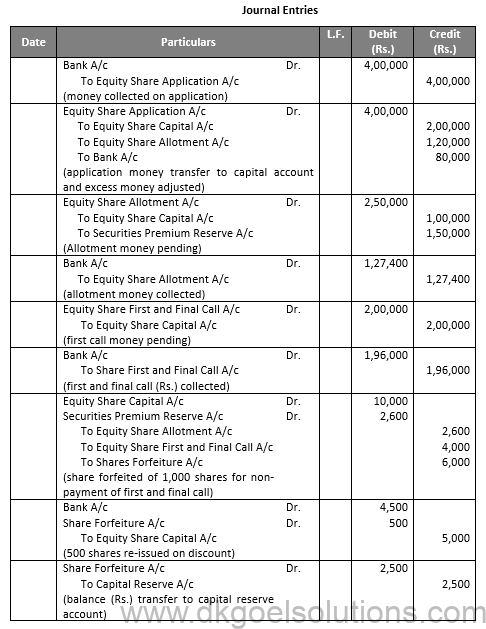

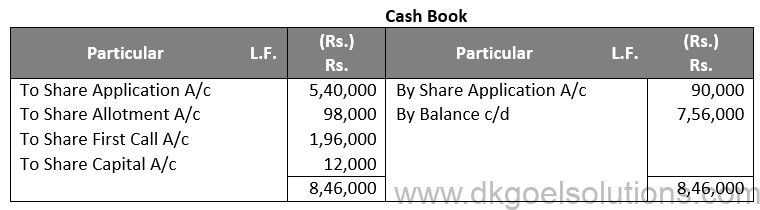

Calculation of Allotment (Rs.):-

(Rs.) pending on allotment with premium = 30,000 × Rs. 5 = Rs. 1,50,000

Pro-rata Table:-

Net (Rs.) collected on Allotment = Rs. 1,50,000 – Rs. 30,000 – Rs. 30,000 – Rs. 4,000 – Rs. 6,000

Net (Rs.) collected on Allotment = Rs. 79,000

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends.

Q71.

Sol.71

Working Note:-

(A)

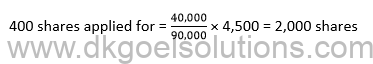

Share applied 90,000 and Share allotted 40,000

Point for Students:-

The term “Called-up” refers to the part of the face value of a share called by the directors from shareholders. For example, if the directors call at the rate of Rs. 80 per share on 10,000 shares of Rs. 100 each, Rs. 8,00,000 will be the called up Capital. The remaining amount of Rs. 20 share will be uncalled Capital.

Q72.

Sol.72

Point for Students:-

When shares belonging to pro rata category are forfeited, amount in arrears on allotment is to be determined. Following process may be followed to determine the amount in arrears:

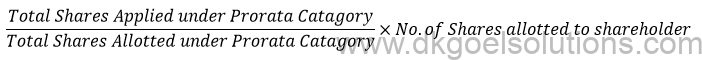

1. Calculate total number of shares applied by the shareholder whose shares are being forfeited, applying the following formula:

Q73.

Sol.73

Working Note:-

(A)

Share applied 1,50,000 and Share allotted 90,000

Q74.

Sol.74

Working Note:-

(A)

Share applied 80,000 and Share allotted 50,000

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends. Following are the item that gives rise to Capital profits and hence Capital reserves:

(i) Profit on sale of fixed assets.

(ii) Profit on revolution of fixed assets.

(iii) Premium on issue of shares and debentures.

(iv) Profit on redemption of debentures.

(v) Profit earned by a company prior to its incorporation.

(vi) Profit on forfeiture and re-issue of shares.

Capital Reserves are shown on the liabilities side of the Balance Sheet under the head “Reserve and Surplus.”

Q75.

Sol.75

Working Note:-

(A)

Share applied 70,000 and Share allotted 40,000

Point for Students:-

When shares belonging to pro rata category are forfeited, amount in arrears on allotment is to be determined. Following process may be followed to determine the amount in arrears:

1, Calculate total number of shares applied by the shareholder whose shares are being forfeited, applying the following formula:

2. Calculate total application money received on shares applied by defaulting shareholder as under:

No. of shares applied by shareholder × Application money per share.

3. Calculate application money due on shares allotted to defaulting shareholder as under:

No. of shares allotted to shareholder × Application money per share.

4. Calculate excess application money received:-

= Application money received – Application money required

5. Calculate amount due on allotment and deduct from it the excess application money. The result is the amount in arrears on allotment.

Q76.

Sol.76

Working Note:-

Excess application money collected from Vinita:

Extra shares = 700 – 400 = 300 shares

Extra Application money collected = 300 × Rs. 50 = Rs. 15,000

(ii) (Rs.) Pending from Vinita:-

Q77.

Sol.77

Point for Students:-

Calculation amount due on allotment but not paid by the defaulting shareholder as follows:

Amount due on Allotment (No. of allotted share × Allotment amount per share)

Less: Excess Application Money Adjusted on Allotment

[{Applied Share – Allotted Share} × Application Money per share]

Amount not paid on Allotment

Q78.

Sol.78

Q79.

Sol.79

Point for Students:-

Shares Application and Allotment Account is being increasingly used to record entries with respect to shares application and shares allotment when Shares Application Money is received in lump sum. In that case entries are as follows:

Bank a/c

To Share Application and Allotment A/c

Entry for appropriation of Money received and allotment of shares is passed as follows:

Shares Application and Allotment A/c Dr.

To Share Capital A/c

To Calls-in-Advance A/c

To Bank A/c

Q80.

Sol.80

Point for Students:-

Till the time forfeited shares are reissued, balance of the Forfeited Shares Account is added to paid-up capital under Subscribed Capital in the Note to Accounts on ‘Share Capital’, being part of Shareholders’ Fund shown under Equity and Liabilities part of the Balance Sheet.

Q81.

Sol.81

Point for Students:-

A company purchases some assets and instead of making the payment to the venders in the form of cash, it issues fully paid shares to the vendors. Following journal entries are made for this purpose:

(i) When assets are purchased from the vendors:

Sundry Assets A/c Dr.

To Vendor’s A/c

(ii) When shares are issued to vendors:

Vendor’s A/c Dr.

To Share Capital A/c

Q82.

Sol.82

Q83.

Sol.83

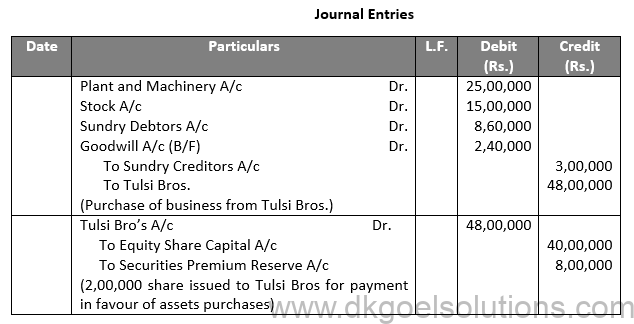

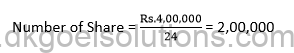

Point for Students:-

1. If purchase consideration given is more than net assets, then difference is debited to Goodwill Account. It is a case of Purchased Goodwill hence, will be recorded in the books.

2. If purchase consideration given is less than net assets, then the difference is credited to Capital Reserve. Either Goodwill or Capital Reserve will appear at a time.

Q84.

Sol.84

Point for Students:-

Entries are to be passed for each transaction:

1. On Purchase of Assets

Sundry Assets A/c Dr.

To Vendor A/c

2. On Purchase of Business

Sundry Assets A/c Dr.

Goodwill A/c Dr.

To Sundry Liabilities A/c

To Vendor’s A/c

To Capital Reserve A/c

3. When Shares are issued

At par:

Vendor’s A/c Dr.

To Share Capital A/c

At premium:

Vendor’s A/c Dr.

To Share Capital A/c

To Securities Premium Reserve A/c

Q85.

Sol.85

Point for Students:-

The term “Paid-up” refers to that portion of called up capital which has been actually received from the shareholders. Usually the called-up Capital and the paid-up Capital are the same except that some shareholders may not have paid the amount of calls. Any update amount is called ‘Calls in arrear’. If a shareholder has paid Rs. 5 against the called-up amount of Rs. 8, then Rs. 5 is paid-up amount. Paid up capital will be called-up Capital less the amount of called in arrears.

Q86.

Sol.86

Working Note:-

(i)

Point for Students:-

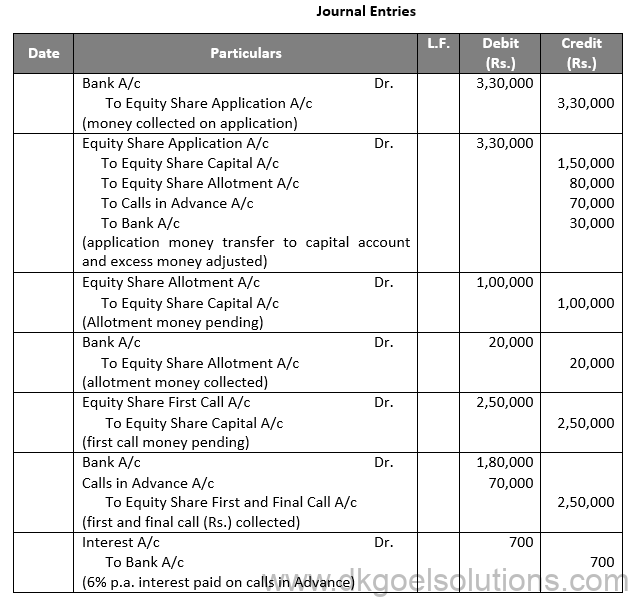

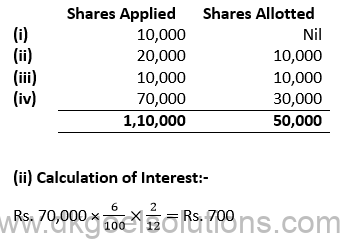

Interest on Calls-in-Advance is paid if the Articles of Association so provides. But if the Articles of Association is silent, Provision of Table F of the Companies Act, 2013 apply and the company is liable to pay interest on call-in-advance @ 12% p.a.

Q87.

Sol.87

Working Note:-

(i) Calculation of Allotted Shares:-

Point for Students:-

The Journal entry passed to record Calls-in-Advance is:

Bank A/c

To Call-in-Advance A/c

It is adjusted when the respective call is made due. The entry is:

Calls-in-Advance a/c Dr.

To Shares First Call A/c

Q88.

Sol.88

Point for Students:-

Entries are to be passed for each transaction:

1. On Purchase of Assets

Sundry Assets A/c Dr.

To Vendor A/c

2. On Purchase of Business

Sundry Assets A/c Dr.

Goodwill A/c Dr.

To Sundry Liabilities A/c

To Vendor’s A/c

To Capital Reserve A/c

Q89.

Sol.89

Point for Students:-

Rate of Interest:-

Calls-in-Arrears:- As per Table F of the Companies Act, 2013 interest is charged @ 10 p.a.

Calls-in-Advance:- As per Table F of the Companies Act, 2013 interest is paid @ 12% p.a.

Q90.

Sol.90

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q91.

Sol.91

Point for Students:-

Issue expenses are always written off by securities premium. Below are the necessary entries will be passed for this expense:-

Securities Premium Reserve A/c Dr.

To Share issued Expenses A/c

Q92.

Sol.92

Point for Students:-

Shares Application and Allotment Account is being increasingly used to record entries with respect to shares application and shares allotment when Shares Application Money is received in lump sum. In that case entries are as follows:

Bank a/c

To Share Application and Allotment A/c

Entry for appropriation of Money received and allotment of shares is passed as follows:

Shares Application and Allotment A/c Dr.

To Share Capital A/c

To Calls-in-Advance A/c

To Bank A/c

Q93.

Sol.93

Point for Students:-

In case, forfeited shares are reissued at par, i.e. at nominal value of share, accounting entry passed is:

Bank A/c Dr.

To Share Capital A/c

In case, the forfeited shares are reissued at discount, accounting entry passed is:

Bank A/c Dr.

Forfeited Shares A/c Dr.

To Share Capital A/c

Q94.

Sol.94

Point for Students:-

The amount of forfeited shares not reissued will remain in forfeited share account till the off paid-up share capital under subscribed share capital under subscribed share capital in the note of accounts on shares capital and shown against the main head shares capital under shareholders fund is equity and liabilities part of the balance sheet.

Q95.

Sol.95

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q96.

Sol.96

Point for Students:-

Till the time forfeited shares are reissued, balance of the Forfeited Shares Account is added to paid-up capital under Subscribed Capital in the Note to Accounts on ‘Share Capital’, being part of Shareholders’ Fund shown under Equity and Liabilities part of the Balance Sheet.

Q97.

Sol.97

Point for Students:-

If Forfeiture shares issued at par:-

In this case,

(i) Share Capital Account is debited with the amount called-up upto the date of forfeiture on shares forfeited;

(ii) Shares Allotment Account and/or Shares Call Account is credited with amount called-up on forfeited shares but not paid by the shareholders. If Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited.

Q98.

Sol.98

(i)

Point for Students:-

Re-issue of forfeited shares means selling the shares that were cancelled by the company. These shares may be reissued by the company on the terms as it may decide. Thus, forfeited shares may be reissued by the company at par, at premium or at discount. However, if forfeited shares are reissued at discount, the amount of discount allowed on reissue of forfeited shares should not exceed the amount forfeited on reissue shares.

Q99.

Sol.99

Point for Students:-

1. If Securities Premium has been received:-

Share Capital A/c Dr.

To Share Allotment A/c

To Share Call/Calls A/c

To Share forfeited A/c

2. If Securities Premium has not been received:-

Share Capital A/c Dr.

Securities Premium Reserve A/c

To Share Allotment A/c

To Share Call/Calls A/c

To Share forfeited A/c

Q100.

Sol.100

Point for Students:-

In case, forfeited shares are reissued at par, i.e. at nominal value of share, accounting entry passed is:

Bank A/c Dr.

To Share Capital A/c

In case, the forfeited shares are reissued at discount, accounting entry passed is:

Bank A/c Dr.

Forfeited Shares A/c Dr.

To Share Capital A/c

Q101.

Sol.101

Point for Students:-

The amount of forfeited shares not reissued will remain in forfeited share account till the off paid-up share capital under subscribed share capital under subscribed share capital in the note of accounts on shares capital and shown against the main head shares capital under shareholders fund is equity and liabilities part of the balance sheet.

Q102.

Sol.102

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q103.

Sol.103

Point for Students:-

Till the time forfeited shares are reissued, balance of the Forfeited Shares Account is added to paid-up capital under Subscribed Capital in the Note to Accounts on ‘Share Capital’, being part of Shareholders’ Fund shown under Equity and Liabilities part of the Balance Sheet.

Q104.

Sol.104

Point for Students:-

If Forfeiture shares issued at par:-

In this case,

(i) Share Capital Account is debited with the amount called-up upto the date of forfeiture on shares forfeited;

(ii) Shares Allotment Account and/or Shares Call Account is credited with amount called-up on forfeited shares but not paid by the shareholders. If Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited.

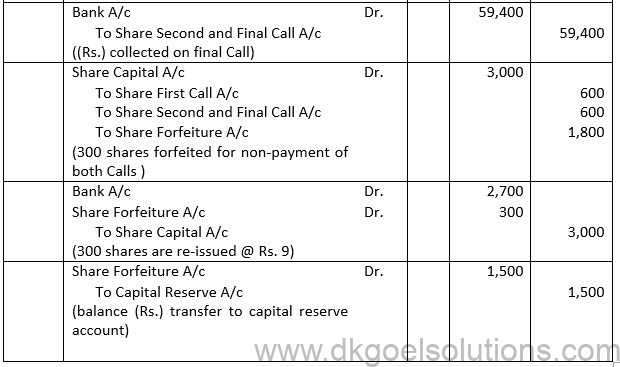

Q105.

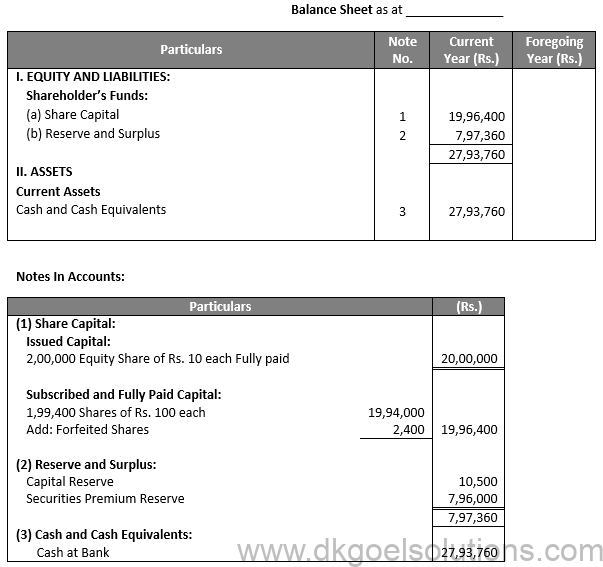

Sol.105

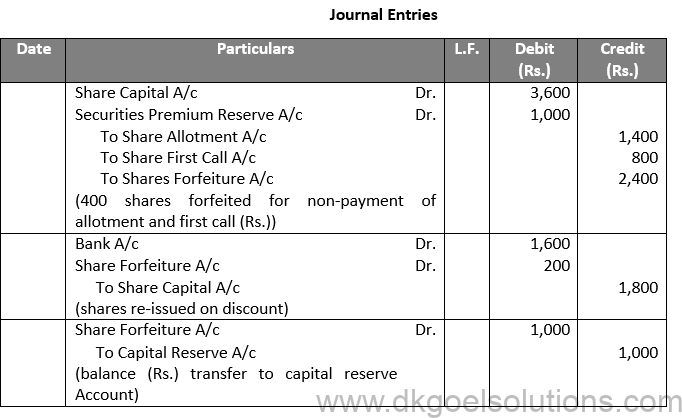

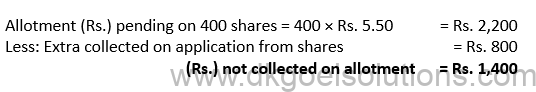

Note:

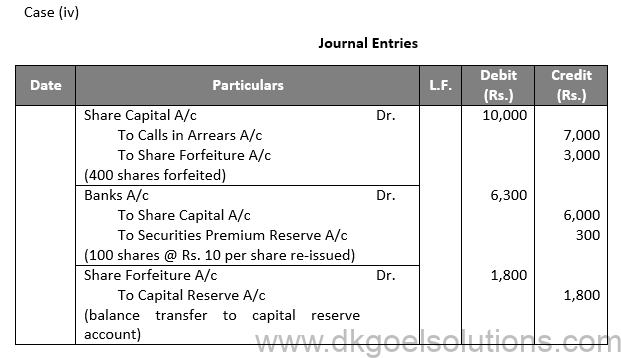

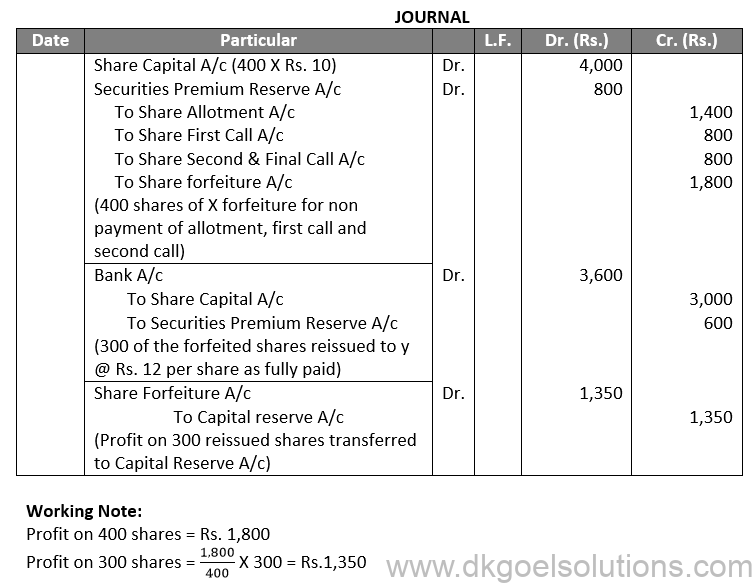

Profit on 400 shares= Rs. 3,600

Point for Students:-

Re-issue of forfeited shares means selling the shares that were cancelled by the company. These shares may be reissued by the company on the terms as it may decide. Thus, forfeited shares may be reissued by the company at par, at premium or at discount. However, if forfeited shares are reissued at discount, the amount of discount allowed on reissue of forfeited shares should not exceed the amount forfeited on reissue shares.

Q106.

Sol.106

Point for Students:-

1. If Securities Premium has been received:-

Share Capital A/c Dr.

To Share Allotment A/c

To Share Call/Calls A/c

To Share forfeited A/c

2. If Securities Premium has not been received:-

Share Capital A/c Dr.

Securities Premium Reserve A/c

To Share Allotment A/c

To Share Call/Calls A/c

To Share forfeited A/c

Q107.

Sol.107

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q108.

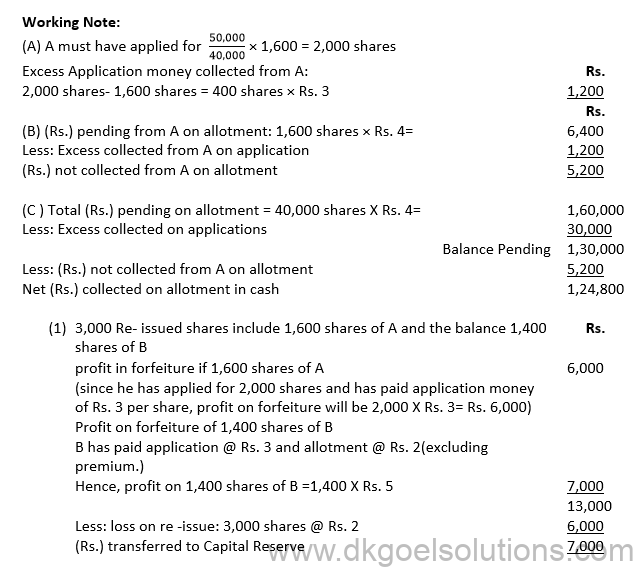

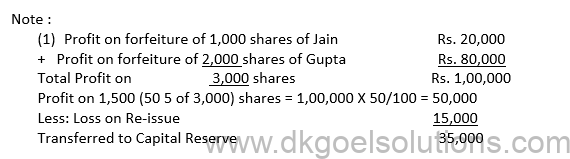

Working Note:

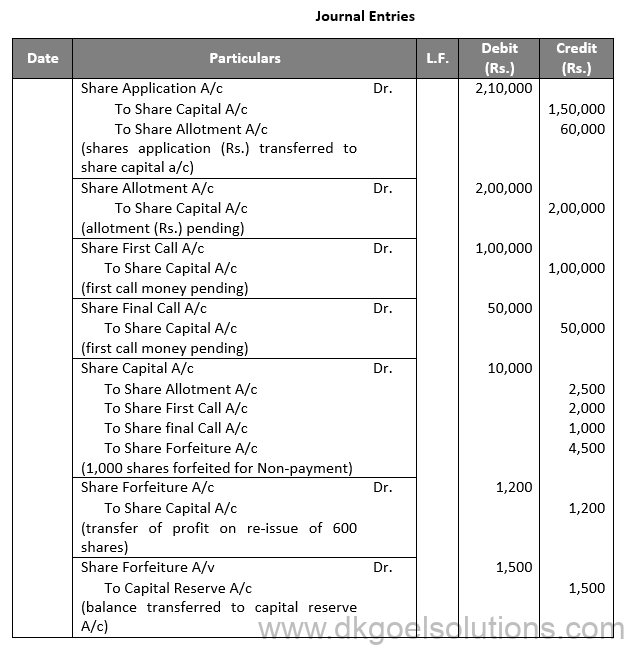

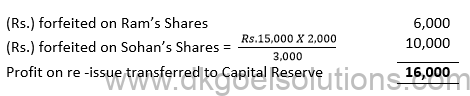

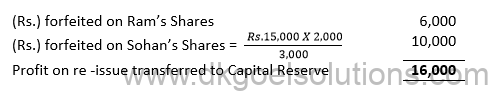

Calculation of Capital Reserve:

Point for Students:-

Issue expenses are always written off by securities premium. Below are the necessary entries will be passed for this expense:-

Securities Premium Reserve A/c Dr.

To Share issued Expenses A/c

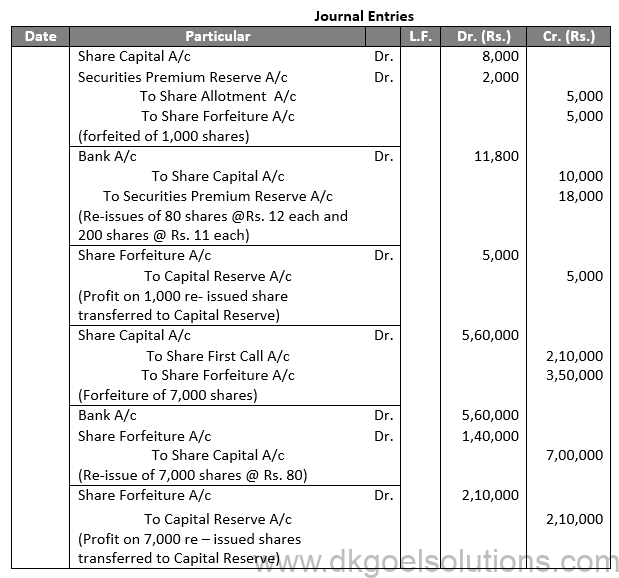

Q109.

Sol.109

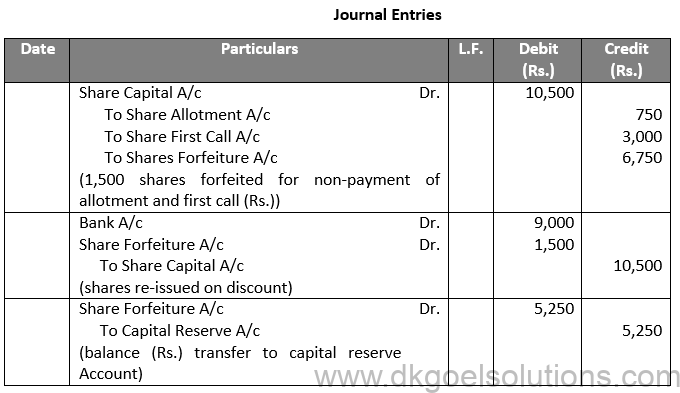

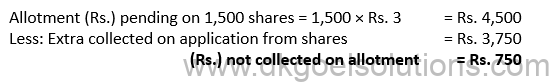

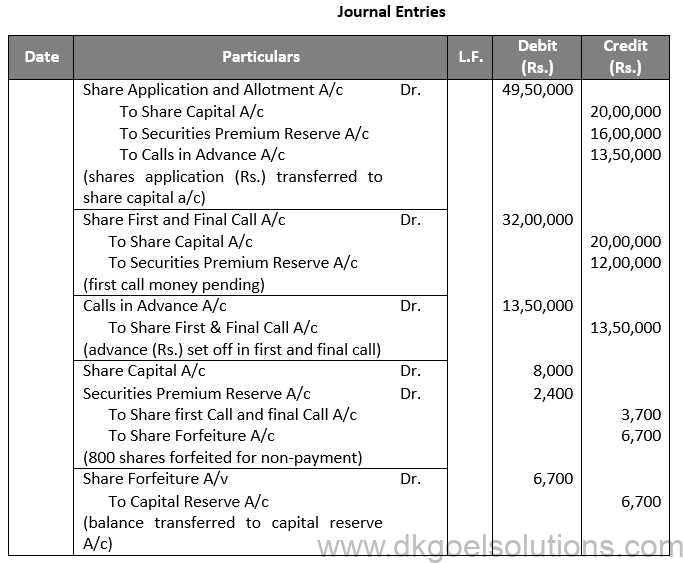

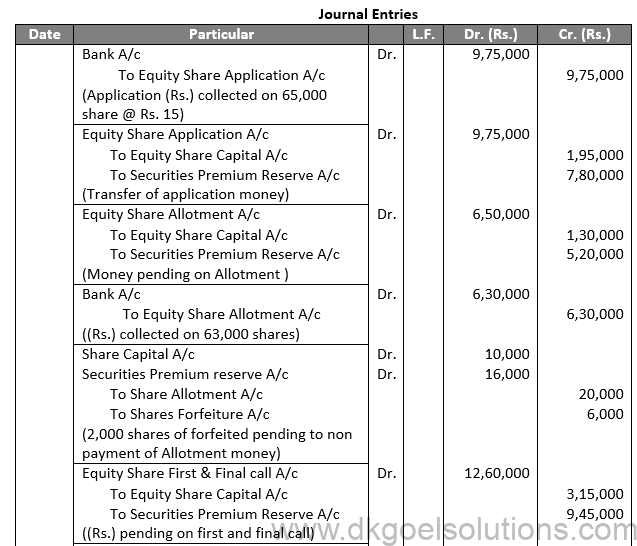

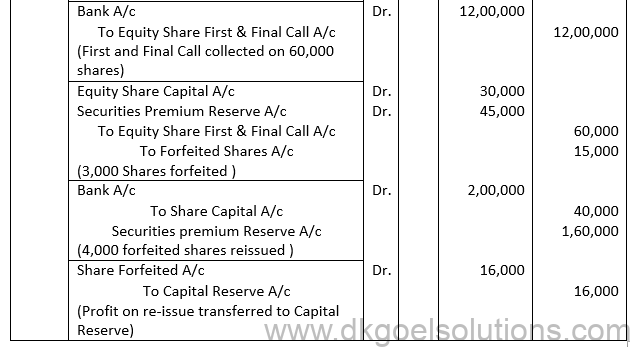

Working Note:

Calculation of Capital Reserve:

Point for Students:-

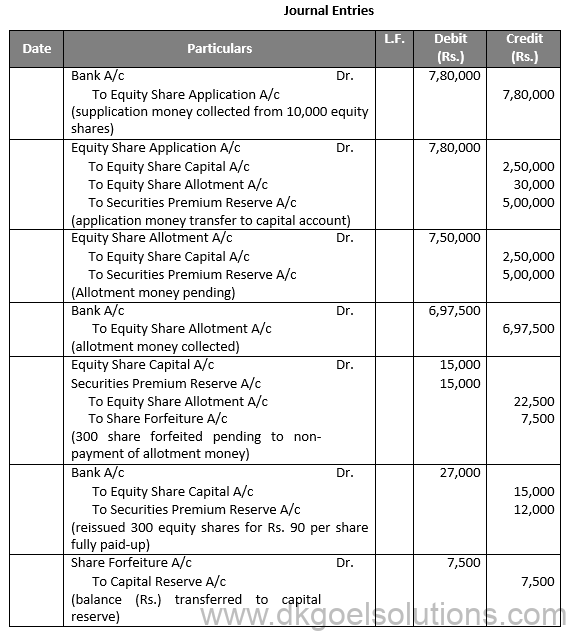

Shares Application and Allotment Account is being increasingly used to record entries with respect to shares application and shares allotment when Shares Application Money is received in lump sum. In that case entries are as follows:

Bank a/c

To Share Application and Allotment A/c

Entry for appropriation of Money received and allotment of shares is passed as follows:

Shares Application and Allotment A/c Dr.

To Share Capital A/c

To Calls-in-Advance A/c

To Bank A/c

Q109. :

Sol.109

Working Notes:

Point for Students:-

In case, forfeited shares are reissued at par, i.e. at nominal value of share, accounting entry passed is:

Bank A/c Dr.

To Share Capital A/c

In case, the forfeited shares are reissued at discount, accounting entry passed is:

Bank A/c Dr.

Forfeited Shares A/c Dr.

To Share Capital A/c

Q111.

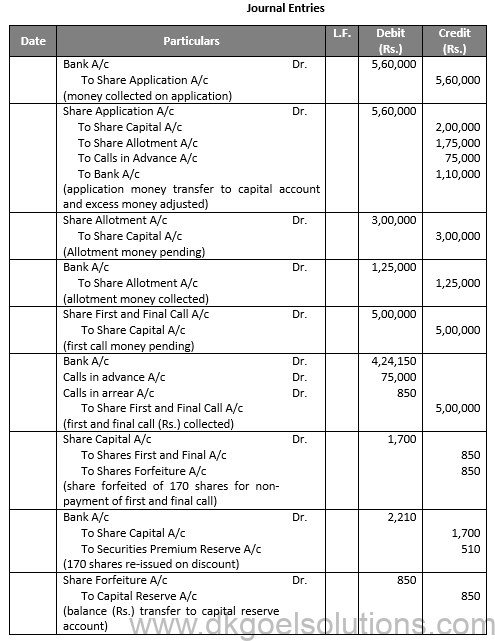

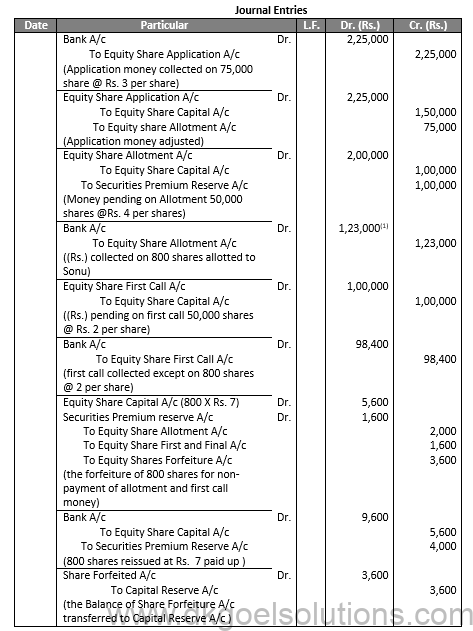

Sol.111

Working Notes:

Point for Students:-

A shareholder may sometimes pay a part, or whole of the amount not yet called upon his shares is order to save him-self the trouble of paying different called at different times. Thus the amount of future calls is received in advance by the Company. According to Section 50 of the Companies Act 2013, such amount of calls in advance can be accepted by the Company only when it is so authorised by its Articles of Association.

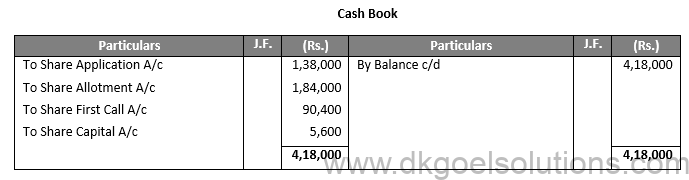

Q112.

Sol.112

Working Notes:-

Q113.

Sol.113

Working Notes:

1.Scheme of Allotment:

Point for Students:-

When shares belonging to pro rata category are forfeited, amount in arrears on allotment is to be determined. Following process may be followed to determine the amount in arrears:

1. Calculate total number of shares applied by the shareholder whose shares are being forfeited, applying the following formula:

We can chose one formula in above.

2. Calculate total application money received on shares applied by defaulting shareholder as under:

No. of shares applied by shareholder × Application money per share.

3. Calculate application money due on shares allotted to defaulting shareholder as under:

No. of shares allotted to shareholder × Application money per share.

4.Calculate excess application money received:-

= Application money received – Application money required

5. Calculate amount due on allotment and deduct from it the excess application money. The result is the amount in arrears on allotment.

Q114.

Sol.114

Working Notes:

Point for Students:-

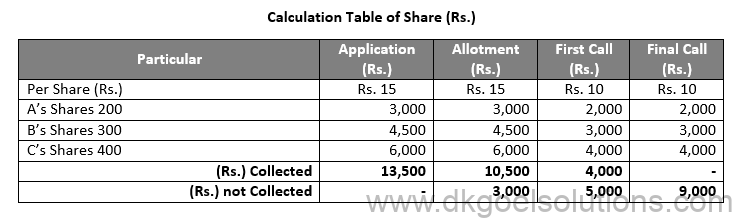

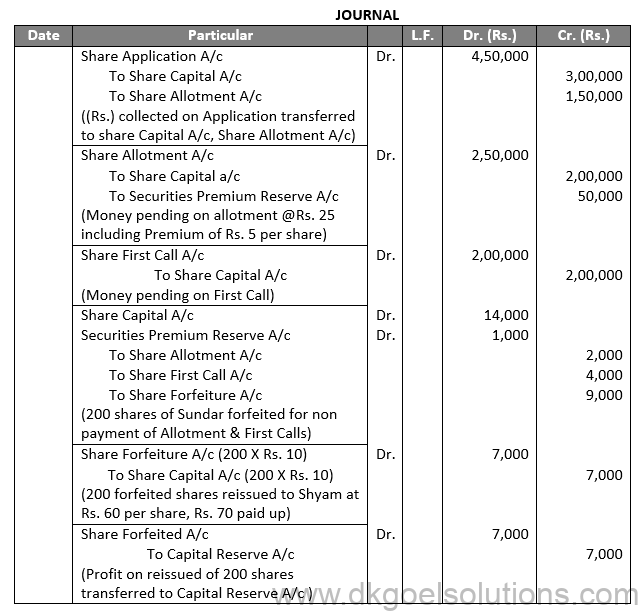

In the case of oversubscription, shares are allotted on pro rata basis, excess application money is adjusted toward allotment money. When the shares are allotted at premium, excess application money is first applied towards Share Capital and the balance, if any, towards Securities Premium Reserve.

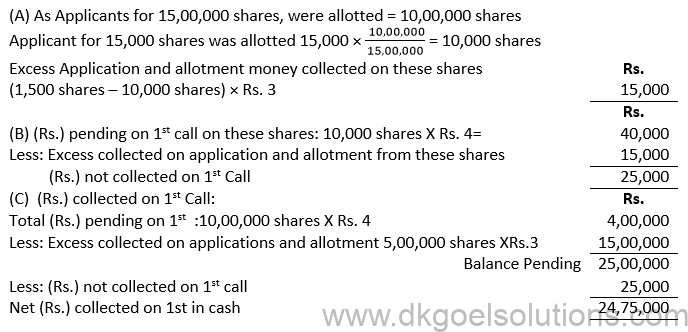

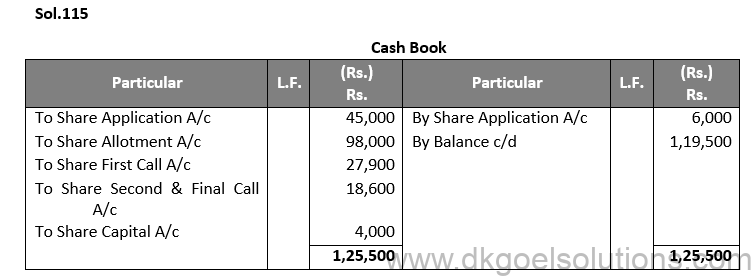

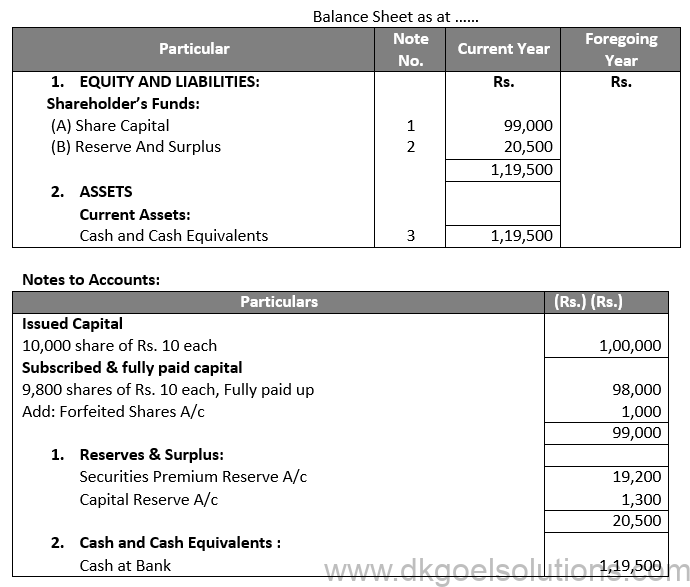

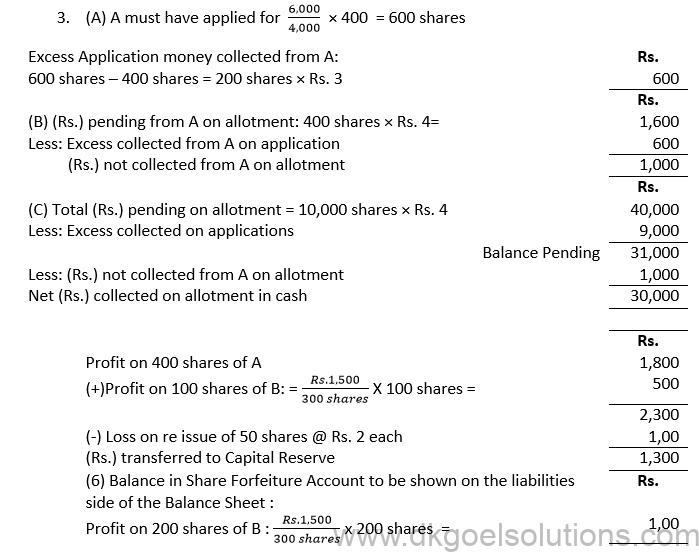

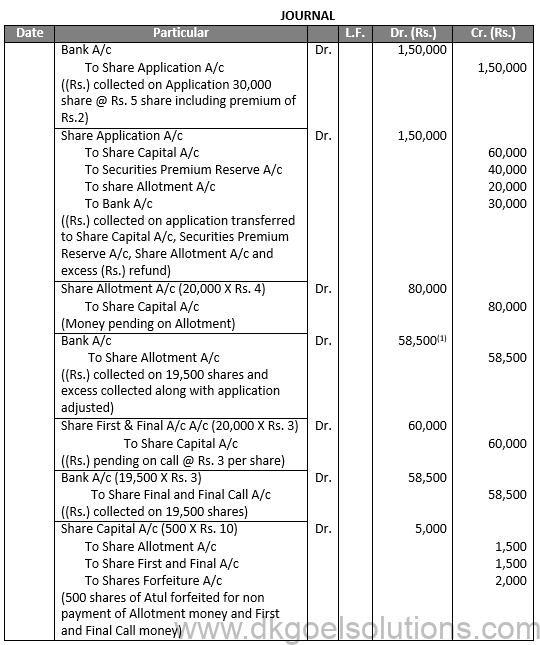

Q115.

Point for Students:-

If Forfeiture shares issued at par:-

In this case,

(i) Share Capital Account is debited with the amount called-up upto the date of forfeiture on shares forfeited;

(ii) Shares Allotment Account and/or Shares Call Account is credited with amount called-up on forfeited shares but not paid by the shareholders. If Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited.

Q116.

Sol.116

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q117.

Sol.117

Q118.

Sol.118

19.

Sol.119

Working Note:

Point for Students:-

Re-issue of forfeited shares means selling the shares that were cancelled by the company. These shares may be reissued by the company on the terms as it may decide. Thus, forfeited shares may be reissued by the company at par, at premium or at discount. However, if forfeited shares are reissued at discount, the amount of discount allowed on reissue of forfeited shares should not exceed the amount forfeited on reissue shares.

Q120.

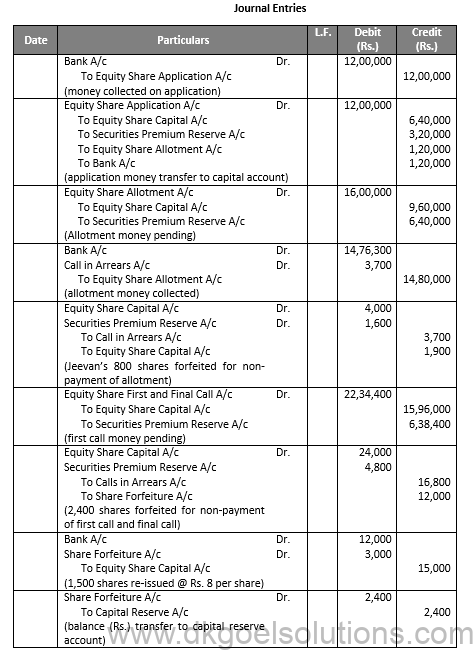

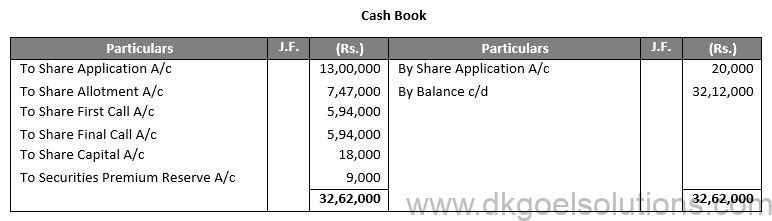

Sol.120

Working Note:-

(A) Excess (Rs.) collected from Manu on application:

Premium is pending with allotment and only Manu has not paid the (Rs.) of allotment. Therefore, Securities Premium Reserve account has been debited from the (Rs.) of premium pending from Manu only i.e., 2,400 shares × Rs. 2= Rs. 4,800.

Point for Students:-

When Securities Premium Amount has been Received:-

The amount received as Securities Premium is not cancelled i.e., Securities Premium Reserve Account is not debited when the shares are forfeited. Securities Premium Reserve Account is not debited with the amount relating to forfeited shares because Securities Premium credited to Securities Premium Reserve Account and also received can be used only for the purposes prescribed in Section 52(2) of the Companies Act, 2013.

Q121.

Sol.121

Point for Students:-

Subscribed but not fully paid up: Shares are said to be ‘Subscribed but not fully paid-up’ under the following two situations:

(i) When the company has called-up the full nominal value of the share but the shareholder has not paid some part of the nominal value of the share.

(ii) When the company has not called-up the full nominal value of the share.

Q122.

Sol.122

Calculation of (Rs.)

Point for Students:-

The term “Paid-up” refers to that portion of called up capital which has been actually received from the shareholders. Usually the called-up Capital and the paid-up Capital are the same except that some shareholders may not have paid the amount of calls. Any update amount is called ‘Calls in arrear’. If a shareholder has paid Rs. 5 against the called-up amount of Rs. 8, then Rs. 5 is paid-up amount. Paid up capital will be called-up Capital less the amount of called in arrears.

Q123.

Sol.123

Point for Students:-

As per section 65 of the Companies Act, 2013 only an unlimited company having a share capital while converting into a limited company, may have reserve capital. In such a case, the company by a resolution may

(i) Increase the nominal amount of its share capital by increasing the nominal amount of each of its shares, and determine that no part of the increased capital shall be called up except in the event of winding up of the company.

(ii) Provide that a specified portion of its uncalled share capital shall not be called except in the event of winding up of the company

Q124.

Sol.124

Point for Students:-

If Forfeiture shares issued at par:-

In this case,

(i) Share Capital Account is debited with the amount called-up upto the date of forfeiture on shares forfeited;

(ii) Shares Allotment Account and/or Shares Call Account is credited with amount called-up on forfeited shares but not paid by the shareholders. If Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited.

Q125.

ment.

Sol.125

Point for Students:-

Forfeited Shares Account is credited by the amount received on the shares forfeited. The entry for forfeiture of shares is:

Share Capital A/c Dr.

To Forfeiture Shares A/c

To Shares Allotment A/c

To Share Call A/c

Q126.

Sol.126

Point for Students:-

Sometimes, number of shares applied for by the public is less than the number of shares offered by the Company. Such an issue is said to be under-subscribed. In such a case the accounting entries are made on the basis of the number of shares applied for.

Forfeiture of shares means cancelling the shares for non-payment of calls due. But, shares can be forfeited only if the Articles of Association of the company allows forfeiture. If any shareholder does not pay the amount of call, the company may exercise the power of forfeit the shares held by him on which amount of call is not paid.

Q127.

Sol.127

Point for Students:-

The company before forfeiture must first give clear 14 days’ notice to the defaulting shareholder that unless due is paid the amount along with interest, if any, by the specified date, the shares shall be forfeited. If the shareholder still does not pay, the company may forfeit the shares by passing an appropriate resolution.

Q128.

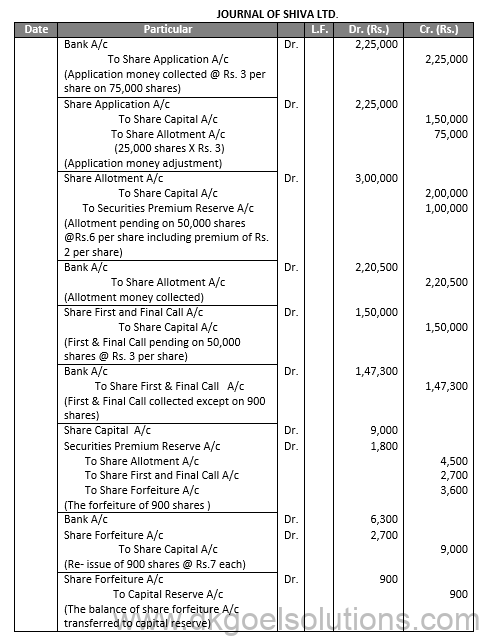

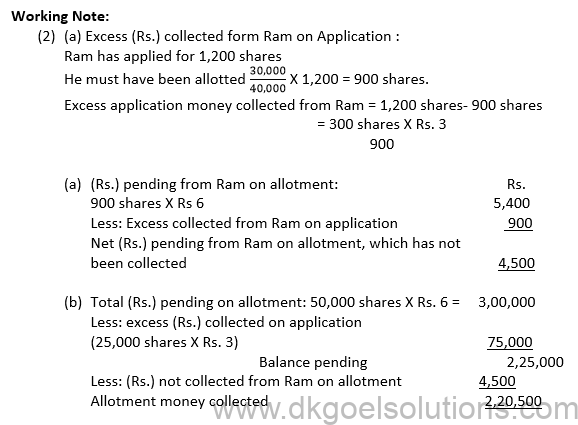

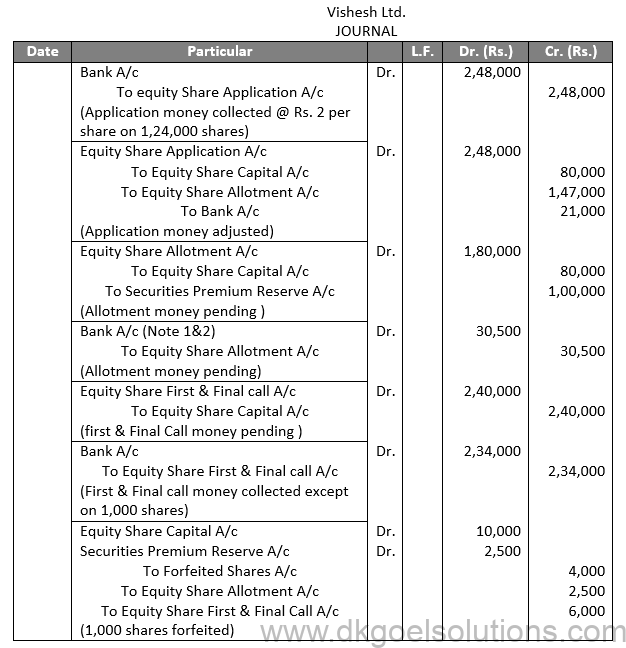

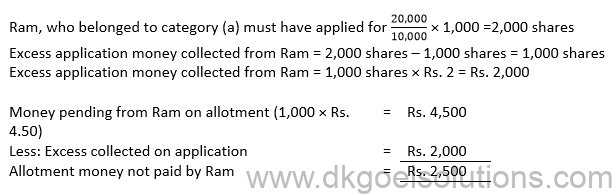

Working Notes:

Money pending from Ram an Allotment

Point for Students:-

Subscribed but not fully paid up: Shares are said to be ‘Subscribed but not fully paid-up’ under the following two situations:

(i) When the company has called-up the full nominal value of the share but the shareholder has not paid some part of the nominal value of the share.

(ii) When the company has not called-up the full nominal value of the share.

Q129.

Sol.129

Point for Students:-

When Securities Premium Amount has been Received:-

The amount received as Securities Premium is not cancelled i.e., Securities Premium Reserve Account is not debited when the shares are forfeited. Securities Premium Reserve Account is not debited with the amount relating to forfeited shares because Securities Premium credited to Securities Premium Reserve Account and also received can be used only for the purposes prescribed in Section 52(2) of the Companies Act, 2013.

Q130.

Sol.130

Working note:

Excess Shares applied from Dev = 2,500 shares – 1,000 shares = 1,500 Shares

Excess application money collected from Dev = 1,500 shares × Rs. 15 = Rs. 22,500

Point for Students:-

Entries Shares Forfeited of unpaid Share:-

Share Capital A/c Dr.(Total Called-up amount of share)

Securities Premium Reserve A/c Dr. (Amount of securities premium)

To Share Allotment A/c (Amount not received)

To Share First and Final Call A/c (Amount not received)

To Share Forfeited A/c (Received amount)

(Forfeited of unpaid shares)

Q131.

Sol.131

Working Notes:

Applications were collected for 50,000 × 3 = 1,50,000 shares.

Applications for 1,50,000 × 30% = 45,000 shares were rejected.

Point for Students:-

Capital reserves are those reserves which are created out of Capital profits. Capital profits are those profits which are not earned in the normal course of the business. These reserves cannot be utilised for the distribution of dividends. Following are the item that gives rise to Capital profits and hence Capital reserves:

(i) Profit on sale of fixed assets.

(ii) Profit on revolution of fixed assets.

(iii) Premium on issue of shares and debentures.

(iv) Profit on redemption of debentures.

(v) Profit earned by a company prior to its incorporation.

(vi) Profit on forfeiture and re-issue of shares.

Capital Reserves are shown on the liabilities side of the Balance Sheet under the head “Reserve and Surplus.”

Q132.

Sol.132

Point for Students:-

Revised Schedule VI does not contain the head ‘Miscellaneous Expenditure’ in the Balance Sheet. As per AS-26, Preliminary Expenses are to be written off in the year in which they are incurred. However, share issue expenses, underwriting commission, discount on shares, discount/premium on borrowing etc., being special nature items are excluded from the scope of AS-26 (Intangible Assets). These Items can be amortized over the period of benefit, i.e. normally 3 to 5 years.

Guidance notes on Revised Schedule VI issued by ‘The institute of Chartered Accounts of India’ suggests that unamortized portion of above mentioned expenses be shown on the assets side of the balance sheet as, ‘Unamortized Expenses’ under the hear ‘Other Current/Non-Current Assets’ depending on whether the amount will be amortized in the next 12 months or thereafter. Amount to be amortized in the next 12 months will be shown under the head ‘Other Current Assets’ and the amount to be amortized after 12 months will be shown under the hear ‘Other Non-Current Assets’.

Features of a Company are –

● Artificial Person

● Limited Liability

● Continued Existence

● Can Buy or Sell Assets

● Freely transferable

Forfeiture of a share is a legal process in which a firm, with the approval from its board of directors or partners, cancels the shares of an individual, which is usually done in case of any breach of terms in the purchase agreement, such as failure in payment of call money, selling of shares during the restricted duration, etc. In simple words, forfeiture is an official step taken to restrict a shareholder’s right in the firm.

Preferential Allotment depicts the allotment of a firm’s shares on a preferential basis to few selected investors. In this case, the share is distributed at a predefined price to a set of investors who desire to acquire a strategic stake in the company.

Generally, when the companies desire to scale up their business and accumulate a large share capital, they prefer preferential allotment. In these cases, the firms have three major options to allot shares, which are –

● Issue fresh shares to the existing shareholders.

● Make an open offer to investors.

● Bulk allotment of firm’s share to different companies or a group of individuals.

A company can only issue shares of discount if a resolution about the same is passed by all the company partners in a general meeting and is approved by the Central Government. The resolution must clearly highlight the maximum rate of discount to be availed on the shares to be issued. However, as per the pre-defined norms of the Central Government, the discount rate must not exceed 10%.

Here are the conditions when the shares can be issued at a discount –

● If a company desires to issue the share at a price lower than the face value, it must mandatorily get approval from the relevant authority.

● The discount on share comes with a limitation, i.e., the discount rate cannot exceed 10%.

● The company must issue the shares within 60 days after receiving permission from the authority.

Also refer to TS Grewal Solutions for Class 12