DK Goel Solutions Chapter 4 Common Size Statements

Read below DK Goel Solutions for Class 12 Chapter 4 Common Size Statements. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

In this chapter, the students will be able to understand the meaning of the common size statements, its uses, where are such kind of common size statements utilized. the students will be able to clear their basic concepts relating to these kinds of statements. they should really understand the concept given here as this will help them to solve complicated questions which are given in this chapter.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Common Size Statements DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Q1.

Solution 1 Standard Size Statement All elements in a financial statement are expressed as percentages on some common basis, such as profits from benefit and loss statement activities and overall balance sheet assets.

The uses of Typical Size Statements as below:—

(i) The presentation of adjustments in different products in reference to net profits, net assets or total liabilities.

(ii) To provide a standard basis for comparison.

Q2.

Solution 2. A Common Size Balance Sheet is a declaration in which it is assumed that all assets or equity and liabilities are equal to 100 and that all the numbers are presented as a percentage of the total. Each asset, in other words, is expressed as a percentage of total assets and each equity and liability item is expressed as a percentage of total equity and liabilities.

The uses of the Common Size Balance Sheet as below:-

(i) To evaluate adjustments to individual balance sheet products.

(ii) To assess the pattern for different asset and liability products.

Q3.

Solution 3. A Typical Size Statement of Profit and Loss is a statement in which it is assumed that the figure of operational revenue is equivalent to 100 and that all other estimates are expressed as a percentage of operational revenue.

The aim of the Common Size Benefit and Loss Statement:-

(i) Create a relationship between the individual products in the benefit and loss statement and the operating income statement.

(ii) To evaluate the shift of individual benefit and loss statement products in relation to operating income.

Q4.

Solution 4

Point for Students:-

Common size statements comprise of the following items:-

(i) Absolute figures of individual items of Statement of Profit and Loss and Balance Sheet for two or more successive periods.

(ii) Percentage to some common base. Normally, the figure of revenue from operations is taken as a base for the Statement of Profit and Loss items and the total of assets of equity and liabilities is taken as a base for the Balance Sheet items.

Q5.

Solution 5

Points for Students:-

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

Q6.

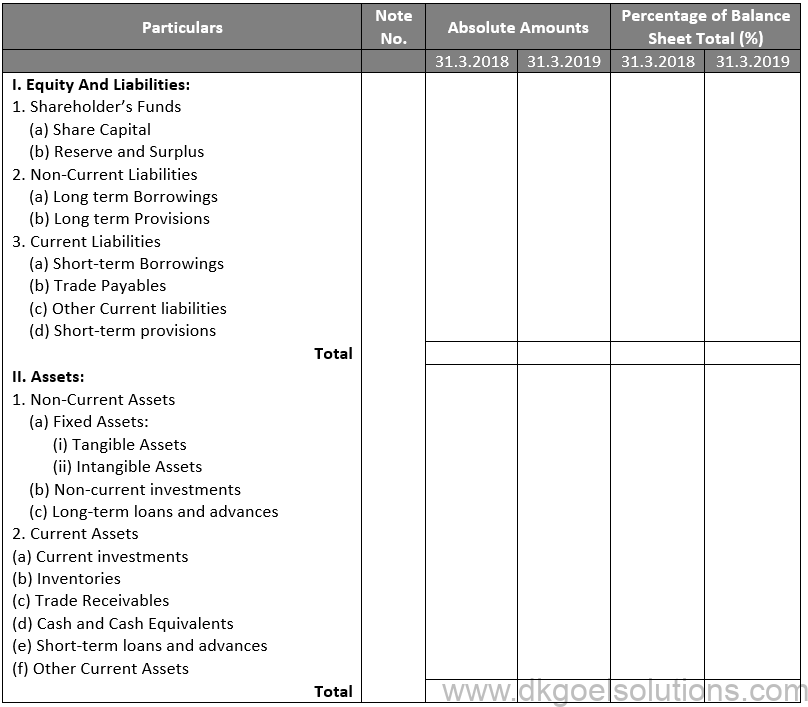

Solution 6

Q7.

Solution 7 Trend percentages are very useful in making comparative study of the financial statements for a number of years. These indicate the direction of movement over a long time and help an analyst of financial statements to form an opinion as to whether favourable or unfavourable tendencies have developed. This helps in future forecasts of various items.

Numerical Questions:-

Q1.

Solution 1

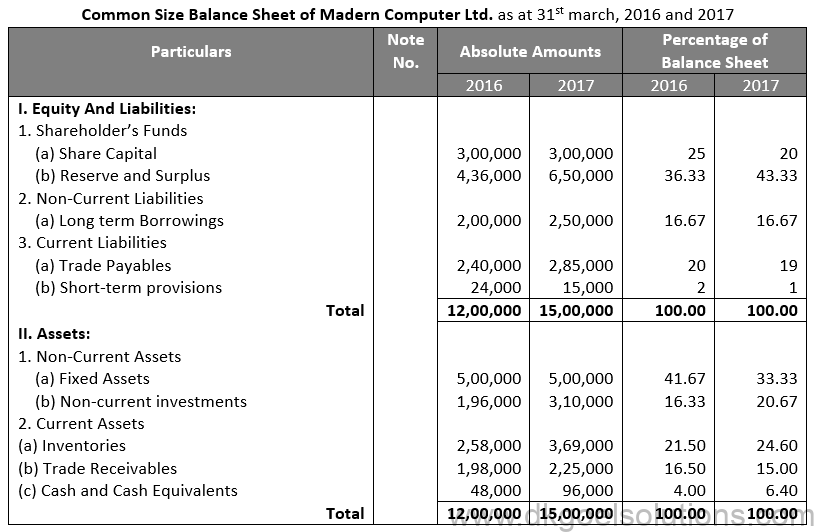

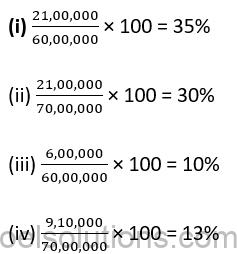

Working Note:-

All the Percentages will be calculated on the basis of total of Balance Sheet.

2016 percentages will be based on Rs. 60 Lakhs.

2017 percentages will be based on Rs. 60 Lakhs.

Point for Students:-

Common size statements comprise of the following items:-

(i) Absolute figures of individual items of Statement of Profit and Loss and Balance Sheet for two or more successive periods.

(ii) Percentage to some common base. Normally, the figure of revenue from operations is taken as a base for the Statement of Profit and Loss items and the total of assets of equity and liabilities is taken as a base for the Balance Sheet items.

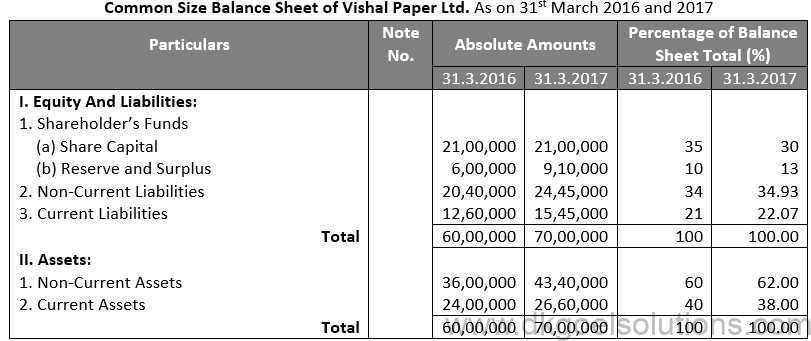

Q2.

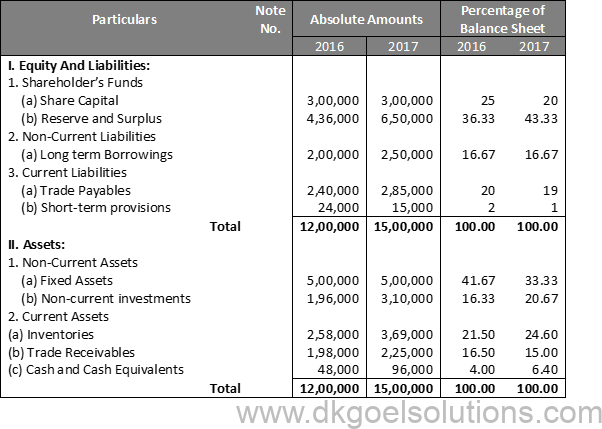

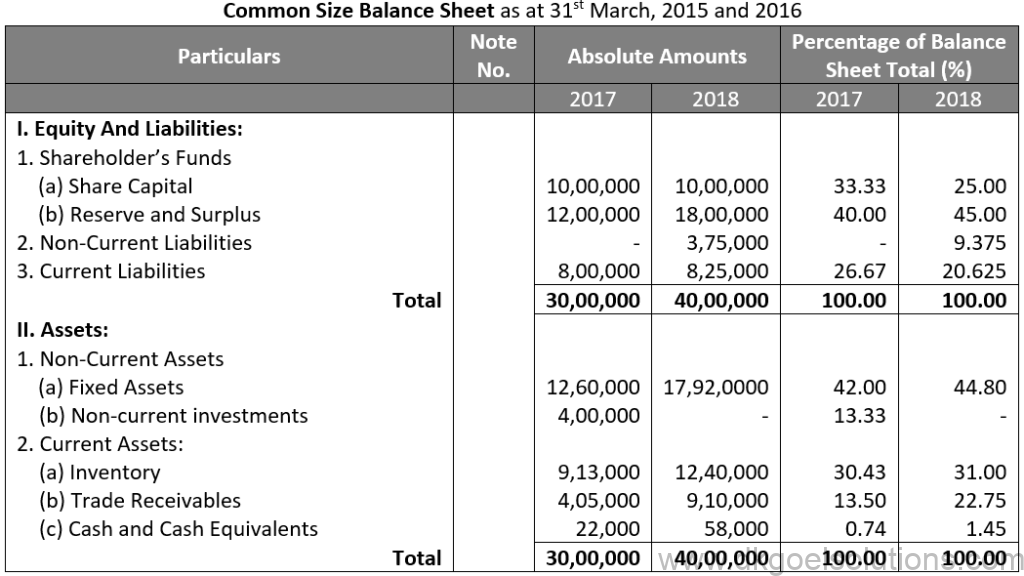

Solution 2

Interpretations:

The following conclusions can be drawn from the above comparative balance sheet analysis:

(i) In 2016, current assets accounted for 42% of total assets (21.50 + 16.50 + 4.00) and rose to 46% in 2017 (24.60 + 15 + 6.40).

(ii) In 2016, current liabilities were (20.00 + 2.00) 22% of total liabilities, but this was reduced to (19.00 + 1.00) 20% in 2017.

Q3.

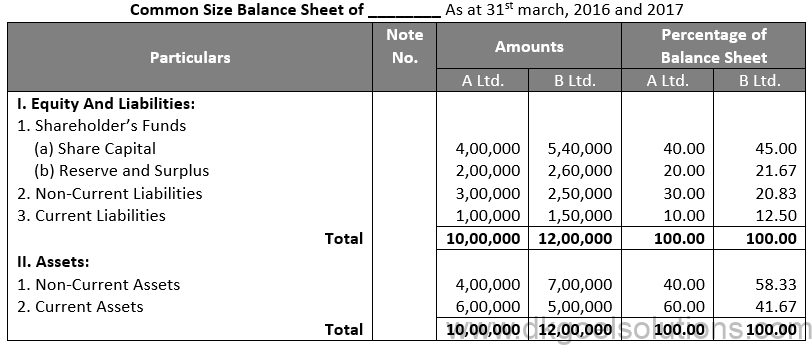

Solution 3

Comments:- On the basis of the above Common size balance sheet, the following assumptions in the financial condition of A Ltd. and B Ltd. are made:

(i) In comparison to A Ltd, B Ltd has a higher share capital.

(ii) In comparison to B Ltd., A Ltd.’s existing liabilities (10%) are in a stronger way (12.50%)

(ii) In comparison to A Ltd., B Ltd. has a stronger long-term status.

(iv) B Ltd.’s non-current assets are 18.33% higher than A Ltd.’s.

Q4.

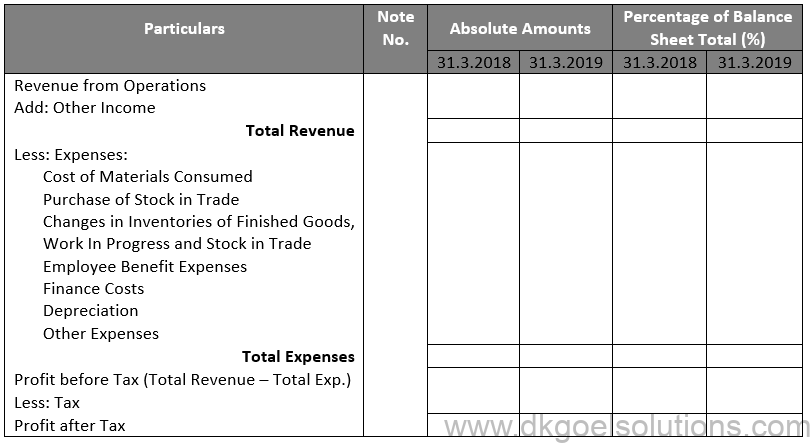

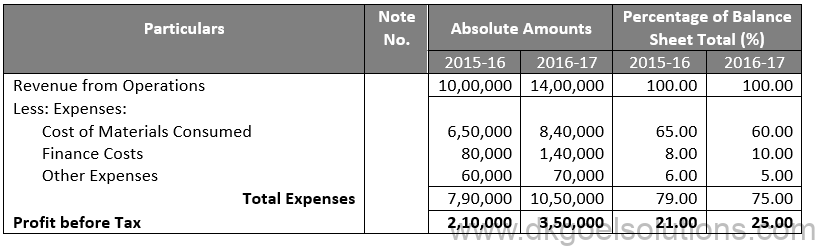

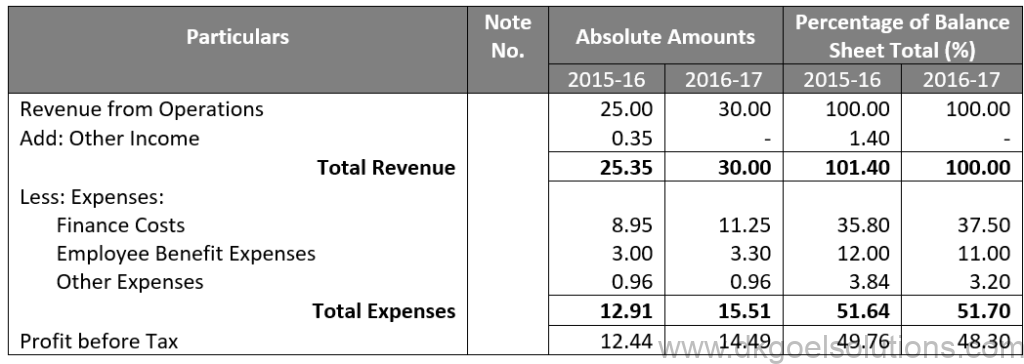

Solution 4. Common Size Statement of Profit and Loss for the year ended 31st March 2017

Working Note:-

All the Percentages will be calculated on the basis of total of Balance Sheet.

2015-16 percentages will be based on Rs. 10 Lakhs.

2016-17 percentages will be based on Rs. 14 Lakhs.

Points for Students:-

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

Q5.

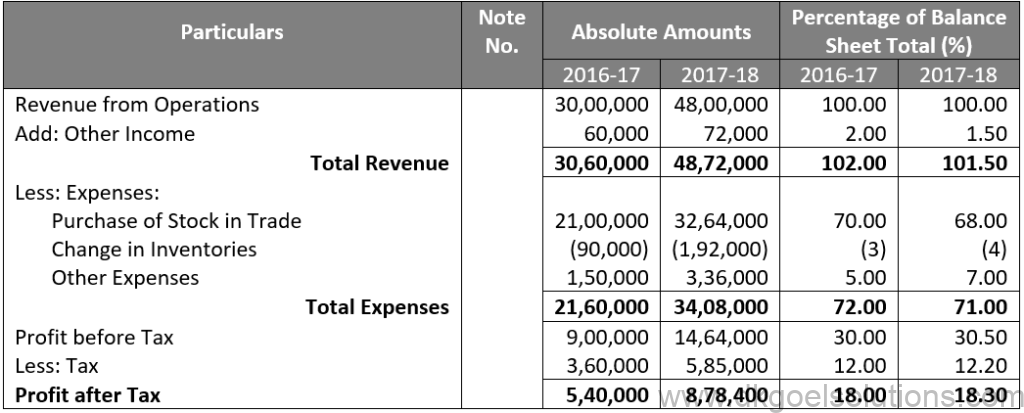

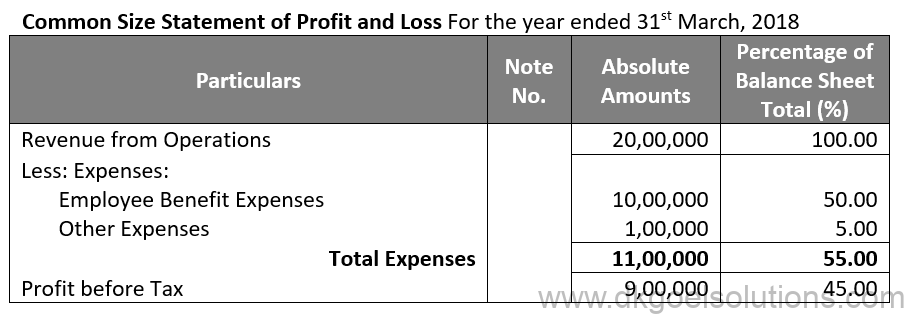

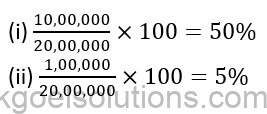

Solution 5 Common Size Statement of Profit & Loss for the year ended 31.03.2018

Points for Students:-

All the percentages will be calculated on the basis of Revenue from Operations.

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

Q6.

Solution 6

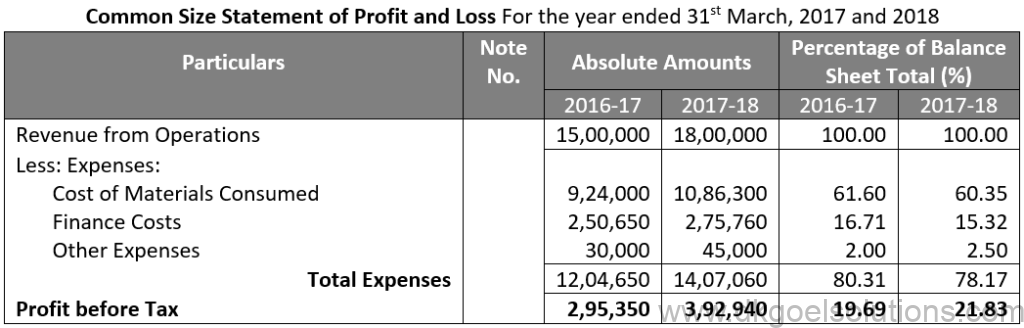

Interpretation:-

The following conclusions can be drawn from the above common Size Profit and Loss Statement:

(i) The cost of material consumed rose by 4% in 2018, bringing the total cost of material consumed to 48% in 2018 and 44% in 2017. This increase is due to an increase in the cost of raw materials.

(ii) Employee Benefit Expenses decrease by 2% in 2018, after dropping by 12% in 2017 and 10% in 2018.

(iii) Total Expenses dropped by 2% in 2018, from 63% in 2017 to 61% this year. This is the outcome of corporations’ increased productivity and growth.

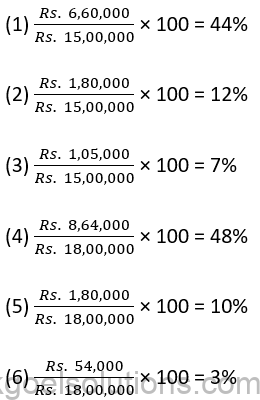

Working Note:-

All the Percentages will be calculated on the basis of total of Revenue of Profit and Loss.

2016-17 percentages will be based on Rs. 15,00,000.

2017-18 percentages will be based on Rs. 18,00,000.

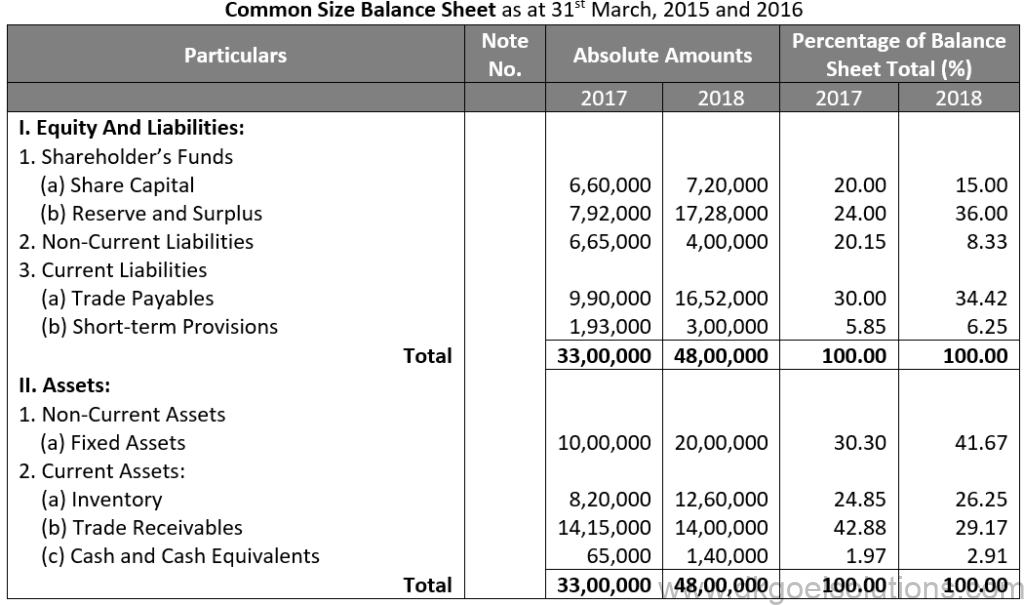

Q7.

Solution 7

Points for Students:-

All the percentages will be calculated on the basis of Revenue from Operations.

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

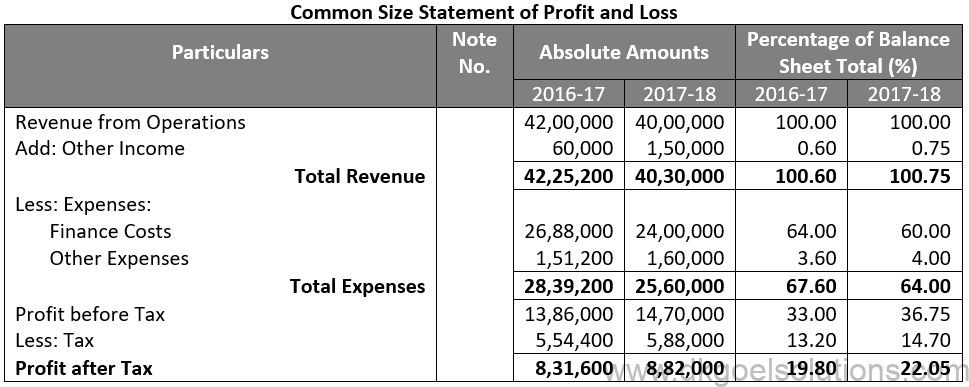

Q8.

Solution 8

Point for Students:-

All the Percentages will be calculated on the basis of total of Revenue of Profit and Loss.

2016-17 percentages will be based on Rs. 42,00,000.

2017-18 percentages will be based on Rs. 40,00,000.

Q9.

Solution 9

Points for Students:-

All the percentages will be calculated on the basis of Revenue from Operations.

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

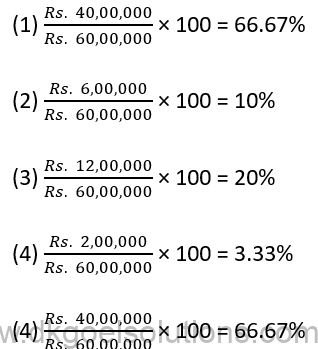

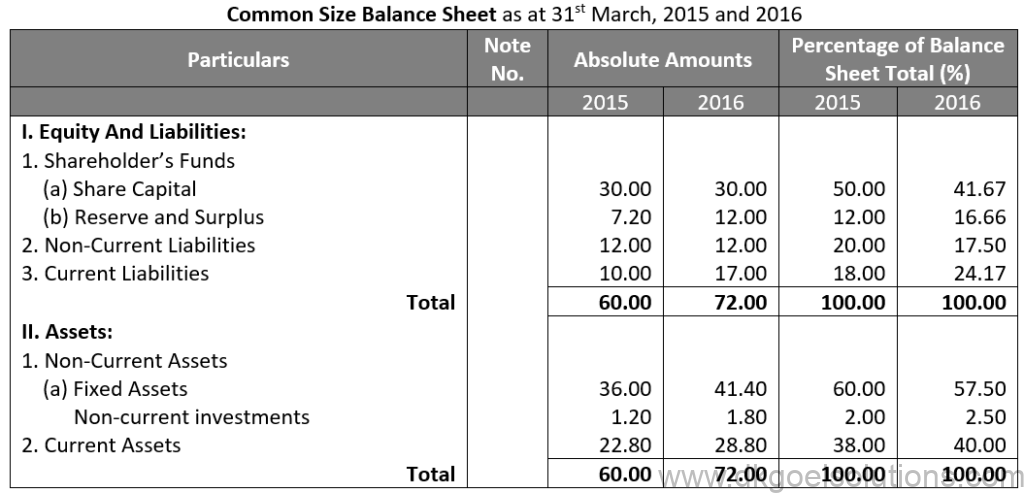

Q10.

Solution 10

Working Note:- All the Percentages will be calculated on the basis of total of Balance Sheet.

2017 percentages will be based on Rs. 60 Lakhs.

Q11.

Solution 11

Points for Students:-

A Common size balance sheet is a statement in which total of assets or equity and liabilities is assumed to be equal to 100 and all the figures are expressed as percentage of the total.

Q12.

Solution 12

Point for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favourable or unfavourable trends have formed. This aids in the forecasting of different things in the future.

Q13.

Solution 13

Point for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favourable or unfavourable trends have formed. This aids in the forecasting of different things in the future.

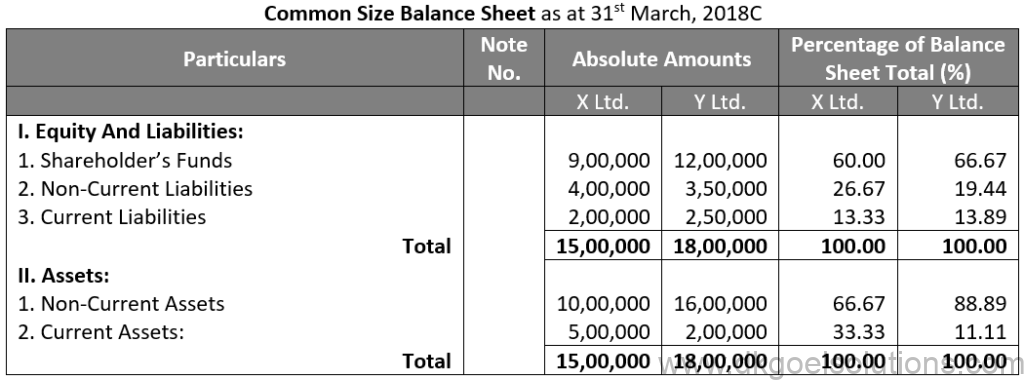

Q14.

Solution 14

Comment:- On the basis of the above Common size balance sheet, the following assumptions in the financial condition of X Ltd. and Y Ltd. are made:

(i) Y Ltd’s Shareholders Fund is larger than that of X Ltd.

(ii) X Ltd.’s non-current liabilities (26.67%) are higher than B Ltd.’s (19.44%)

(ii) X Ltd. and Y Ltd. have almost identical current liabilities.

(iv) Y Ltd.’s non-current assets are 89.89% higher than X Ltd.’s.

Q15.

Solution 15

Points for Students:-

All the percentages will be calculated on the basis of Revenue from Operations.

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

Q16.

Solution 16

Point for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favourable or unfavourable trends have formed. This aids in the forecasting of different things in the future.

Q17.

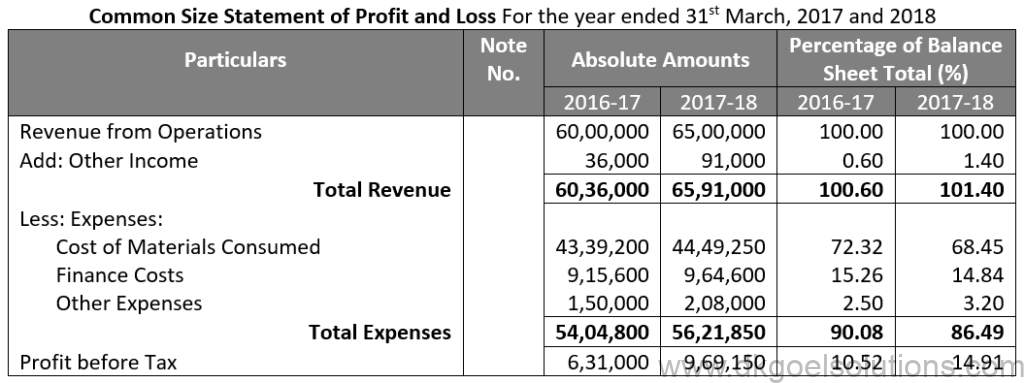

Solution 17 Common Size Statement of Profit and Loss For the year ended 31st March, 2017 and 2018

Points for Students:-

All the percentages will be calculated on the basis of Revenue from Operations.

A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures are expressed as percentage of revenue from operations.

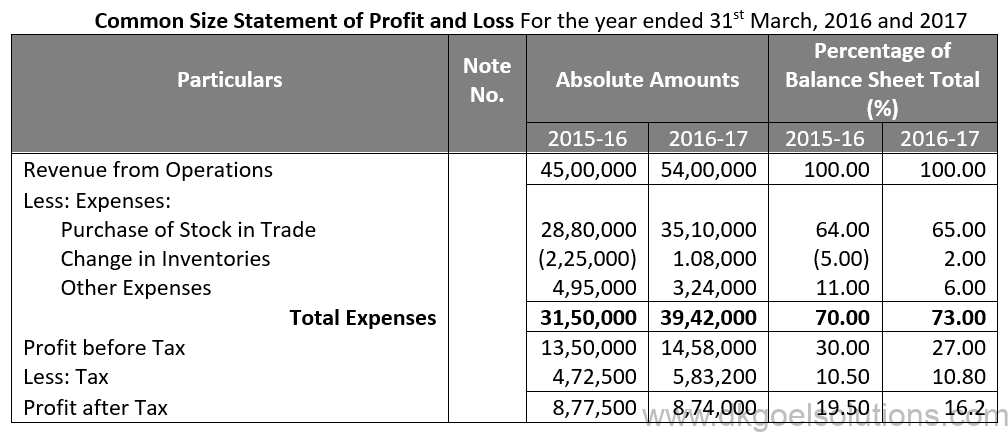

Q18.

Solution 18

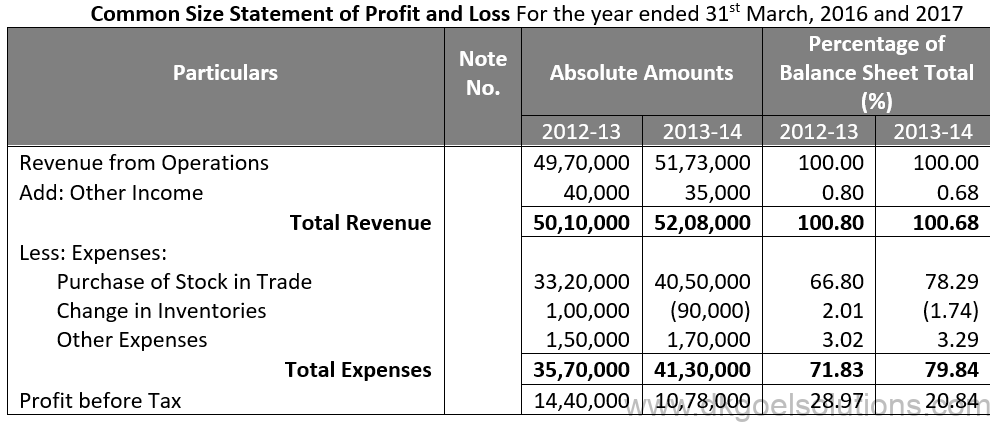

Common Size Statement of Profit and Loss For the year ended 31st March, 2016 and 2017

Points for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favorable or unfavorable trends have formed. This aids in the forecasting of different things in the future.

Q19.

Solution 19

Point for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favourable or unfavourable trends have formed. This aids in the forecasting of different things in the future.

Q20.

Solution 20

Points for Students:-

All percentages will be calculated on the basis of Revenue from Operations.

Calculation of percentages is:-

Q21.

Solution 21

Point for Students:-

Trend percentages are extremely useful when comparing financial results over a period of time. These show the direction of change over time and assist a financial statement analyst in determining if favorable or unfavorable trends have formed. This aids in the forecasting of different things in the future.

Common size statements are a technique of the vertical analysis of the financial statements of a company. These statements are often used to compare the balance sheets or the performance of various companies in several accounting years. The statements generally highlight the percentages with a common base like loss statement, revenue from profit, and more.

Here are the two most important uses of the common size statements –

● These statements present a common base of comparison for all financial aspects.

● It represents the variation in any items, including operations, total liabilities, or assets.

A common size balance sheet can be described as a statement that assumes the total assets and liabilities to be 100 and presents them as a percentage of the total. In simple words, each asset or liability of a company is represented as the percentage of the total assets or liabilities under the common size statements.

A common size statement of profit and loss is defined as the statement that assumes the total revenue of a company to be equal to 100. Therefore, all the profits or losses of the company are calculated and represented as the percentage of the total revenue.

Here are the objectives of the Common Size Statement of Profit and Loss –

● Create a bridge between an individual item of the statement of profit or loss and the revenue generated from the business.

● To track any variation in the individual item statement of profit or loss and the revenue from the business.

Common size income statements are the financial statements formulated by taking the overall income or sale of a company as a base. Therefore, every item is expressed in terms of percentage in the calculation table. This gives a clear picture of sales and profit as well as helps the business owners to understand the expense and sale margin.

Also refer to TS Grewal Solutions for Class 12