DK Goel Solutions Chapter 3 Changing in Profit Sharing Ratio among the Existing Partners

Read below DK Goel Solutions Class 12 Chapter 3 Changing in Profit-Sharing Ratio among the Existing Partners. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

When a partnership firm is formed there can be a requirement to change the profit-sharing ratio of various partners because of various events which can happen in the partnership firm.

In this chapter, you will be able to understand such kinds of reasons, as well as the related accounting practice that has to be followed to ensure that the updated profit sharing ratio is made applicable in the partnership firm as well as correct accounting is performed.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

DK Goel Solutions Class 12 Chapter 3 solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Changing in Profit Sharing Ratio among the Existing Partners DK Goel Class 12 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 12 in Chapter 3

Short Answer Questions for DK Goel Solutions Class 12 Chapter 3

Question 1.

Solution 1

A business is reconstituted on the following occasions:—

1.) Change in the profit sharing ratio among the existing partners.

2.) Admission of an existing partner.

3.) Retirement of an existing partner.

4.) Death of a partner.

5.) Amalgamation of two or more partnership firms.

Question 2.

Solution 2

At the time of the reconstitution of a relationship company, the following changes are required:

(i) Determination of the ratio for sacrifice and ratio for benefiting

(ii) Goodwill Accounting.

(iii) Assets and Net Earnings Tax Treatment

(iv) Assets and Obligations Revaluation Accounting.

(v) Capitals Adjustment.

Question 3.

Solution 3

The aim of the measurement of the sacrifice ratio is to assess the value of the fee to be paid to the sacrificing partner by the purchasing partner (i.e. the partner whose share has risen as a result of the change) (i.e. the partner whose share has decreased as a result of change). In addition, such fee is received on the grounds of an adequate amount of goodwill.

Question 4.

Solution 4

The attributes of goodwill are below:-

1.) That is a commodity which is intangible.

2.) It doesn’t have a distinct life from that of an enterprise. Thus, as enterprise is sold, it has achievable worth.

3.) A subjective calculation of the worth is the value of goodwill.

Question 5.

Solution 5

The four factors that impact a relationship firm’s goodwill are below:—

1.) Desirable market position:- If the organization is situated in a comfortable or popular location, it can draw more buyers and therefore provide more goodwill.

2.) Management Efficiency:- Once the organization is managed by competent and effective management, the income will begin to grow, resulting in an increase in the valuation of goodwill.

3.) Essence of Goodwill:- If a corporation deals with everyday goods, it will get a steady profit as the market for these goods will be stable. Such an organization will have more goodwill.

4.) Capital Needed:- The valuation of goodwill would also affect the amount of capital required for a company. If the same rate of profit is received by two business companies, the business with a lower capital requirement may enjoy more goodwill.

Question 6.

Solution 6

In the following conditions, the need to valuate goodwill in cooperation arises:

1.) Where the benefit share ratio between the current parties varies.

2.) For the admission of a new partner.

3.) Whether a companion retires or dies.

4.) When they sell the business.

5.) Where the company is combined with another business.

Question 7.

Solution 7

1.) Average Benefit Method:- This is a goodwill valuation process that is very basic and commonly practiced. Goodwill is measured in this system based on the amount of earnings over the previous year. To figure out the worth of goodwill, the average of all earnings is compounded by the accepted number of years. The formula is thus:

Goodwill worth = average benefit = amount of sales for the year.

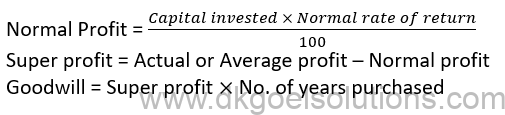

2.) Super Benefit Method:- Goodwill is measured in this manner on the basis of the surplus profit received by a corporation relative to the average profit earned by all companies. When a corporation does not have any planned surplus profits, it would have no goodwill. The formula is thus:

(i) Normal Profit = (Capital Invested × Normal rate of return)/100

(ii) Super Profit = Actual profit – Normal Profit

(iii) Goodwill = Super profit × No. of years purchased

Question 8.

Solution 8

Number of year purchase is used to measure the value of goodwill at the time of appraisal of goodwill in the average benefit method and mega profit method.

Question 9.

Solution 9

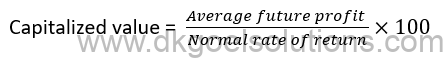

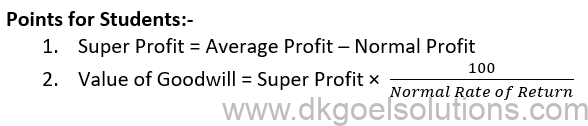

Under this method first of all we calculate the average profit and then we assess the capital needed for earning such average profits on the basis of normal rate of return. Such capital is also called capitalised value of average profit. It is calculated as under:

Capitalised Value of Average Profit:-

Average Profit × 100/(Normal Rate of Return)

Capitalised Value of Super Profit:-

Super Profit × 100/(Normal Rate of Return)

Example:- If a firm earns a profit of Rs. 50,000 p.a. on an average basis and the normal rate of return is 10% p.a. Capital employed amount Rs. 4,00,000. Capitalised value of average profit will be:

Rs. 50,000 × 100/10 = Rs. 5,00,000

Goodwill = Rs. 5,00,000 – Rs. 4,00,000 = Rs. 1,00,000

Question 10.

Solution 10

Question 11.

Solution 11

A shift in the profit-sharing ratio simply means that one partner buys a portion of profit previously belonging to the latter from another partner. By spending the proportional sum of gratitude, the buying or receiving partner must reimburse the sacrificing partner. In other words, the winning partner should pay the partner who loses the share of goodwill equal to the share he receives.

Question 12.

Solution 12

There are assets or cumulative profits/losses remaining in the company’s records at the time of the adjustment in the profit share ratio, which can be allocated to the Capital Accounts of the Partner or to Current Accounts in their old profit sharing ratio.

Question 13.

Solution 13

Yeah, it is essential to revalue the company’s assets and liabilities and it is also necessary to revalue the profit-sharing ratio of current shareholders at the time of the shift. The explanation for this is that the realisable valuation of the assets and liabilities which vary from that seen on the balance sheet. It is likely that certain of the assets may have appreciated in value over the course of time, whilst the value of some other assets may have diminished and no record has been made of those adjustments in the account books.

Question 14.

Solution 14

In their old benefit share mix, reserves and cumulative earnings are allocated to the capital accounts of both partners since they have been set aside from the profits received in the era before transition. If they are not already changed, their new benefit share ratio will be adjusted later, resulting in loss to the sacrificing partner and gain to the winning partner.

Question 15.

Solution 15

Anand may have claimed that since their profit-sharing ratio was 2: 1, the Workmen Benefit Pool was generated from earnings. It can then be compensated for in the old profit-sharing ratio.

Question 16.

Solution 16

Priya may have claimed that while the profit share ratio was 2: 1, unrecorded assets belonged to old firms. It should then be attributed to the Revaluation Account in order to share 2:1 of the benefit on account of this asset.

Question 17.

Solution 17

Dinesh would have claimed that responsibility for wages connected to the old business was 3:1 while the profit-sharing figure was 3:1. It could then be debited to the Revaluation Account so that the deficit due to this obligation will be 3:1 bome. If it is reported at the time of actual payment, the 2:1 deficit would be shared by the spouses.

Numerical Questions

Question 1.(A).

Solution 1 (A). Old Ratio of X and Y = 5 : 3

New Ratio of X and Y = 1 : 1

Calculation of Sacrifice or Gaining Ratio =

X’s Ratio = 5/8-1/2

X’s Ratio = (5 – 4 )/8

X’s Sacrifice Ratio = 1/8

Y’s Ratio = 3/8-1/2

Y’s Ratio = (3 – 4 )/8

Y’s Gaining Ratio = -1/8

Thus, X has sacrificed 1/8th share whereas Y has gained 1/8th share.

Point of Knowledge:-

Here the negative value of is gaining and positive value is sacrificing.

Question 1 (B).

Solution 1 (B). Old Ratio of A and B = 1 : 1

New Ratio of A and B = 4 : 3

Calculation of Sacrifice or Gaining Ratio =

A’s Ratio = 1/2-4/7

A’s Ratio = (7 – 8 )/14

A’s Gaining Ratio = 1/14

B’s Ratio = 1/2-3/7

B’s Ratio = (7 – 6 )/14

B’s Sacrificing Ratio = 1/14

Thus, B has sacrificed 1/14th share whereas A has Gained 1/14th share.

Point of Knowledge:- Here the negative value of is gaining and positive value is sacrificing.

Question 2. (A)

Solution 2 (A)

Old Ratio of A, B and C = 4 : 3 : 1

New Ratio of A, B and C = 5 : 4 : 3

Calculation of Sacrificing or Gaining Ratio =

A’s Ratio = 4/8-5/12

A’s Ratio = (12 – 10 )/24

A’s Sacrifice Ratio = 2/24

B’s Ratio = 3/8-4/12

B’s Ratio = (9 – 8 )/24

B’s Sacrificing Ratio = 1/14

C’s Ratio = 1/8-3/12

C’s Ratio = (3 – 6 )/24

C’s Gaining Ratio = 3/24

Thus, A has sacrifices 2/24th share, B has sacrifices 1/24th share and C gain 3/24th

Question 2. (B)

Solution 2 (B)

Old Ratio of Mahesh, Naresh and Om = 2 : 3 : 4

New Ratio of Mahesh, Naresh and Om = 1 : 2 : 3

Calculation of Sacrificing or Gaining Ratio =

Mahesh’s Ratio = 2/9-1/6

Mahesh’s Ratio = (4 – 3 )/18

Mahesh’s Sacrifice Ratio = 1/18

Naresh’s Ratio = 3/9-2/6

Naresh’s Ratio = (6 – 6 )/18

Naresh’s Sacrificing Ratio = 0

Om’s Ratio = 4/9-3/6

Om’s Ratio = (8 – 9 )/18

Om’s Gaining Ratio = 1/18

Thus, Mahesh has sacrifices 1/18th share, and Om gain 1/18th

Point of Knowledge:-

Here the negative value of is gaining and positive value is sacrificing.

Question 3.

Solution 3

Total Profit = Rs. 2,00,000 – Rs. 3,00,000 + (Rs. 4,50,000 – Rs. 50,000) + Rs. 3,50,000 + Rs. 2,60,000

Total Profit = Rs. 10,00,000

Average Profit = (Total Profit)/(Number of year)

Average Profit = 10,00,000/5

Average Profit = Rs. 2,00,000

Goodwill = Average Profit × Number of year purchases

Goodwill = 2,00,000 × 4

Goodwill = 8,00,000

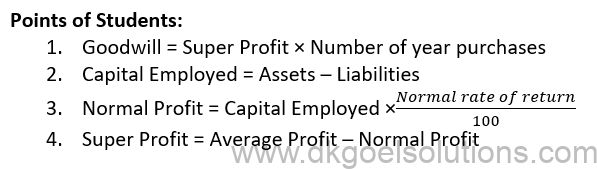

Points of Students:

Goodwill:- Goodwill means the ‘good-name’ or the reputation earned by a firm through the hard work and honesty of its owners. If a firm renders goods service to the customers, the customers who feel satisfied will come again and the firm will be able to earn more profits in future.

Question 4.

Solution 4

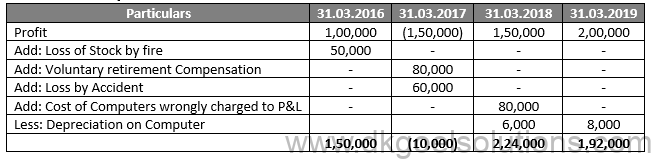

Calculation of Adjusted Profits

Total Profit = Rs. 1,50,000 – Rs. 10,000 + Rs. 2,24,000 + Rs. 1,92,000

Total profit = Rs. 5,56,000

Average Profit = (Rs. 5,56,000)/4

Average Profit = Rs. 1,39,000

Goodwill = 1,39,000 × 100% = Rs. 1,39,000

Working Note:-

Calculation of Depreciation:-

In 2018 = Rs. 80,000 × 10/100 × 9/12 = Rs. 6,000

In 2019 = Rs. 80,000 × 10/100 = Rs. 8,000

Points of Students:

Goodwill is an intangible asset since it has no physical existence and cannot be seen or touched. But it is not a fictitious asset because fictitious assets do not have a value whereas goodwill has a value in case of profit making concerns. It can be sold, though a sale will be’

Question 5.

Solution 5

Based on 4 Years of Profit

Total Profit = Rs. 1,20,000 + Rs. 1,50,000 + Rs. 1,10,000 + Rs. 2,00,000

Total Profit = Rs. 5,80,000

Average Profit = (Total Profit)/(Number of year)

Average Profit = 5,80,000/4

Average Profit = Rs. 1,45,000

Based on 5 Years of Profit

Total Profit = Rs. 1,30,000 + Rs. 1,20,000 + Rs. 1,50,000 + Rs. 1,10,000 + Rs. 2,00,000

Total Profit = Rs. 7,10,000

Average Profit = (Total Profit)/(Number of year)

Average Profit = 7,10,000/5

Average Profit = Rs. 1,42,000

Four years average profit is more than 5 years average profit. Therefore the value of goodwill will be

Goodwill = Average Profit × Number of year purchases

Goodwill = 1,45,000 × 3

Goodwill = 4,35,000

Points of Students:

This is a very simple and widely followed method of valuation of goodwill. In this method, goodwill is calculated on the basis of the number of past years profits. Average of such profits is multiplied by the agreed number of years (such as two or three) to find out the value of goodwill. Thus the formula is:

Value of Goodwill = Average Profit × Number of Years of purchase

Question 6.

Solution 6

Calculation of Average Profits:-

| Rs. | |

| 31st March 2013 | Rs. 60,000 (Profit) |

| 31st March 2014 | Rs. 1,50,000 (Profit) |

| 31st March 2015 | Rs. 20,000 (Loss) |

| 31st March 2016 | Rs. 2,00,000 (Profit) |

| 31st March 2017 | Rs. 2,20,000 (Profit) |

| Rs. 6,10,000 |

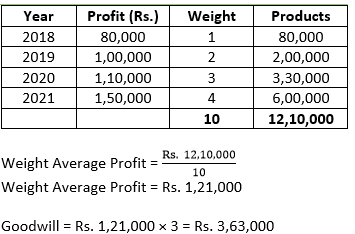

Weight Average Profit = (Rs. 12,10,000)/10

Weight Average Profit = Rs. 1,21,000

Goodwill = Rs. 1,21,000 × 3 = Rs. 3,63,000

Question 7.

Solution 7

Points of Students:

This method is a modified version of average profit method. As per this method each year’s profit is assigned a weight. The highest weight is attached to the profit of the most recent year. Thus, if profits are given for 2018, 2019, 2020 and 2016 and weighted average profit is to be calculated then weights will be assigned as follows: 2014—1; 2015—2; 2016—3; 2021—4. Thereafter, each year’s profit is multiplied by the weight assigned to it in order to find out the products and the total of products is then divided by the total of weights in order to calculate the weighted average profits. After this, the weighted average profit is multiplied by the agreed number of year’s purchase to find out the value of goodwill. Thus, the formula is:

Weighted Average Profit = Total of Products of Profits Total of Weights

Goodwill = Weighted Average Profit × Number of Year’s of Purchase.

Question 8.

Solution 8

Calculation of Adjusted Profits

Weight Average Profit = (Rs. 2,70,600)/6

Weight Average Profit = Rs. 45,100

Goodwill = Rs. 45,100 × 2 = Rs. 90,200

Question 9.

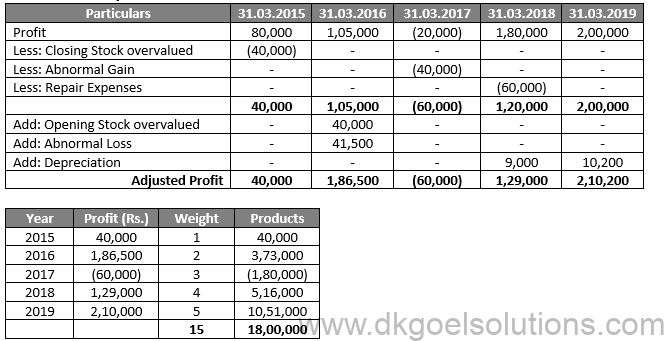

Calculation of Adjusted Profits

Weight Average Profit = (Rs. 18,00,000)/15

Weight Average Profit = Rs. 1,20,000

Goodwill = Rs. 1,20,000 × 3 = Rs. 3,60,000

Working Note:-

Calculation of Depreciation:-

In 2018 = Rs. 60,000 × 20/100 × 9/12 = Rs. 9,000

In 2019 = (Rs. 60,000 – Rs. 9,000) × 20/100 = Rs. 10,200

Points of Students:

As per this method each year’s profit is assigned a weight. The highest weight is attached to the profit of the most recent year. Thus, weighted average profit is to be calculated then weights will be assigned as follows: 2014—1; 2015—2; 2016—3; 2017—4. Thereafter, each year’s profit is multiplied by the weight assigned to it in order to find out the products and the total of products is then divided by the total of weights in order to calculate the weighted average profits. After this, the weighted average profit is multiplied by the agreed number of year’s purchase to find out the value of goodwill. The formula is: Weighted Average Profit = Total of Products of Profits Total of Weights

Goodwill = Weighted Average Profit × Number of Year’s of Purchase.

Question 10.

Solution 10

Total Profit = Rs. 80,000 + Rs. 1,00,000 + Rs. 1,20,000 + Rs. 1,80,000

Total Profit = Rs. 4,80,000

Average Profit = (Rs. 4,80,000)/4

Average Profit = Rs. 1,20,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 5,00,000 × 15/100

Normal Profit = Rs. 75,000

Super Profit = Actual Average Profit – Normal Profit

Super Profit = Rs. 1,20,000 – Rs. 75,000

Super Profit = Rs. 45,000

Goodwill = Super Profit × Number of year Purchases

Goodwill = Rs. 45,000 × 3

Goodwill = Rs. 1,35,000

Points of Students:

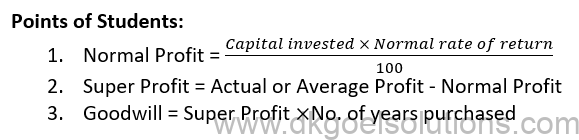

In this method goodwill is calculated on the basis of surplus (excess) profits earned by a firm in comparison to average profits earned by other firms. If a business has no anticipation excess earnings, it will have no goodwill. Such excess profits are called super profits and the goodwill is calculated on the basis of super profits. For example, if the normal rate of earning applicable in a particular type of business is 15% and of our firm is also engaged in the same type of business and we have invested Rs.1,00,000 as capital and if we are earning Rs.25,000, as profit, the Normal Profits at the rate of 15% on Rs.1,00,000 should be 15,000, whereas, we are earning Actual Profits of Rs.25,000 – Rs.15,000, – Rs.10,000 are Super Profits. Goodwill is calculated by multiplying the Super Profits by a reasonable number of years, such as two years purchase or three years purchase etc.

Thus the formula is:

Normal Profit = Capital invested × Normal rate of return100

Super profit = Actual or Average profit – Normal profit

Goodwill = Super profit No. of years purchased

Question

Solution 11

Calculation of Actual Average Profit:-

Actual Average Profit = Average Profit + Abnormal Loss

Actual Average Profit = Rs. 41,000 + Rs. 2,000

Actual Average Profit = Rs. 43,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 3,00,000 × 10/100

Normal Profit = Rs. 30,000

Super Profit = Actual Average Profit – Normal Profit

Super Profit = Rs. 43,000 – Rs. 30,000

Super Profit = Rs. 13,000

Goodwill = Super Profit × Number of year Purchases

Goodwill = Rs. 13,000 × 5

Goodwill = Rs. 65,000

Points of Students:

Under this method first of all we calculate the average profits and then we assess the capital needed for earning such average profits on the basis of normal rate of return. Such capital is also called capitalised value of average profits. It is calculated as under:

Capitalised Value of Average Profits = Average Profits × 100Normal Rate of Return

Question 12.

Solution 12

Calculation of Actual Average Profit:-

Actual Average Profit = Average Profit – Remuneration to Partners

Actual Average Profit = Rs. 1,00,000 – Rs. 10,000

Actual Average Profit = Rs. 90,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 5,00,000 × 15/100

Normal Profit = Rs. 75,000

Super Profit = Actual Average Profit – Normal Profit

Super Profit = Rs. 90,000 – Rs. 75,000

Super Profit = Rs. 15,000

Goodwill = Super Profit × Number of year Purchases

Goodwill = Rs. 15,000 × 2

Goodwill = Rs. 30,000

Points of Students:

This approach involves calculating average profits first, and then calculating the capital required to earn such average profits using a normal rate of return. The capitalised value of average earnings is another name for this type of capital. It’s computed as follows:

Average Profits x 100 = Return on Investment (ROI)

Question 13.

Solution 13

Goodwill = Super Profit × Number of year’s Purchases

Rs. 1,50,000 = Super Profit × 3

Super Profit = Rs. 1,50,000 ÷ 3

Super Profit = Rs. 50,000

Total Profit = Rs. 80,000 + Rs. 1,30,000 + Rs. 1,56,000

Total Profit = Rs. 3,66,000

Average Profit = (Rs. 3,66,000)/3

Average Profit = Rs. 1,22,000

Super Profit = Average Profit – Normal Profit

Rs. 50,000 = Rs. 1,22,000 – Normal Profit

Normal Profit = Rs. 1,22,000 – Rs. 50,000

Normal Profit = Rs. 72,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Rs. 72,000 = Capital Employed × 12/100

Rs. 72,000 × 100/12 = Capital Employed

Capital Employed = Rs. 6,00,000

Points of Students:

In this method first of all we calculate the average profits and then we assess the capital needed for earning such average profits on the basis of normal rate of return. Such capital is also called capitalised value of average profits. It is calculated as under:

Capitalised Value of Average Profits = Average Profits × 100Normal Rate of Return

Question 14.

Solution 14

Calculation of Capital Employed

Capital Employed = Rs. 5,00,000 + Rs. 4,00,000 + Rs. 1,50,000 + Rs. 30,000

Capital Employed = Rs. 10,80,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 10,80,000 × 15/100

Normal Profit = Rs. 1,62,000

Super Profit = Actual Average Profit – Normal Profit

Super Profit = Rs. 2,00,000 – Rs. 1,62,000

Super Profit = Rs. 38,000

Goodwill = Super Profit × Number of year Purchases

Goodwill = Rs. 38,000 × 3

Goodwill = Rs. 1,14,000

C’s Share of Goodwill = Rs. 1,14,000 × 1/4

C’s Share of Goodwill = Rs. 28,500

Points for Students:-

As per accounting viewpoint, partnership firms are treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 15.

Solution 15

Goodwill = Super Profit × Number of year Purchases

Rs. 60,000 = Super Profit × 4

Super Profit = (Rs. 60,000)/4

Super Profit = Rs. 15,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 1,10,000 × 8/100

Normal Profit = Rs. 8,800

Super Profit = Average Profit – Normal Profit

Rs. 15,000 = Average Profit – Rs. 8,800

Average Profit = Rs. 15,000 + Rs. 8,800

Average Profit = Rs. 23,800

Points for Students:-

Average profit method:- average of the profit of past few years.

Super Profit = Average Profit – Normal Profit

Average profit = super profit + Normal profit

Question 16.

Solution 16

Goodwill = Super Profit × Number of year Purchases

Rs. 64,000 = Super Profit × 4

Super Profit = (Rs. 64,000)/4

Super Profit = Rs. 16,000

Working Note:-

Calculation of Capital Employed:-

Capital Employed = Total Assets – Current liabilities

Capital Employed = Rs. 1,20,000 – Rs. 10,000

Capital Employed = Rs. 1,10,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 4,70,000 × 20/100

Normal Profit = Rs. 94,000

Super Profit = Average Profit – Normal Profit

Rs. 16,000 = Average Profit – Rs. 94,000

Average Profit = Rs. 16,000 + Rs. 94,000

Average Profit = Rs. 1,10,000

Working Note:-

Calculation of Capital Employed:-

Capital Employed = Total Assets – Creditors

Capital Employed = Rs. 5,00,000 – Rs. 30,000

Capital Employed = Rs. 4,70,000

Points of Students:

Average profit method:- average of the profit of past few years.

Goodwill = Super Profit × Number of year Purchases

Super Profit = Average Profit – Normal Profit

Average profit = super profit + Normal profit

Question 17.

Solution 17

Capitalised Value of Average Profits = Average Profits × 100/(Normal Rate of Return)

Capitalised Value of Average Profits = Rs. 48,000 × 100/12

Capitalised Value of Average Profits = Rs. 4,00,000

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 8,00,000 – Rs. 5,00,000

Capital Employed = Rs. 3,00,000

Goodwill = Capitalised Value of Average Profits – Capital Employed

Goodwill = Rs. 4,00,000 – Rs. 3,00,000

Goodwill = Rs. 1,00,000

Points of Students:

Goodwill is an intangible asset since it has no physical existence and cannot be seen or touched. But it is not a fictitious asset because fictitious assets do not have a value whereas goodwill has a value in case of profit making concerns. It can be sold, though a sale will be ‘

Capitalised Value of Average Profits = Average Profits ×100/ Normal Rate of Return

Question 18.

Solution 18

Capitalised Value of Average Profits = Average Profits × 100/(Normal Rate of Return)

Capitalised Value of Average Profits = Rs. 2,40,000 × 100/12

Capitalised Value of Average Profits = Rs. 20,00,000

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 6,00,000 + Rs. 5,00,000 + Rs. 5,00,000 – Rs. 60,000 – Rs. 30,000 + Rs. 10,000

Capital Employed = Rs. 15,20,000

Goodwill = Capitalised Value of Average Profits – Capital Employed

Goodwill = Rs. 20,00,000 – Rs. 15,20,000

Goodwill = Rs. 4,80,000

Points of Students:

This is a very simple and widely followed method of valuation of goodwill. In this method, goodwill is calculated on the basis of the number of past years profits. Average of such profits is multiplied by the agreed number of years (such as two or three) to fing out the value of goodwill. Thus the formula is:

Value of Goodwill = Average Profit × Number of Years of purchase

Average profit method:- As per this method each year’s profit is assigned a weight. The highest weight is attached to the profit of the most recent year.

Capitalized value = Average future profit ×100 / Normal Rate of return

Question 19.

Solution 19

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 8,00,000 – Rs. 5,00,000

Capital Employed = Rs. 3,00,000

Normal Profit = Rs. 3,00,000 × 12%

Normal Profit = Rs. 36,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 48,000 – Rs. 36,000

Super Profit = Rs. 12,000

Goodwill = Super Profit × 100/(Normal rate of return)

Goodwill = Rs. 12,000 × 100/12

Goodwill = Rs. 1,00,000

Points of Students:

Goodwill is an intangible asset since it has no physical existence and cannot be seen or touched. But it is not a fictitious asset because fictitious assets do not have a value whereas goodwill has a value in case of profit making concerns. It can be sold, though a sale will be ‘

Capital Employed = Assets – Liabilities

Goodwill = Super Profit × 100/(Normal rate of return)

Question 20.

Solution 20

Total Profit = Rs. 20,000 + Rs. 60,000 – Rs. 10,000 + Rs. 60,000 + Rs. 50,000 + Rs. 72,000

Total Profit = Rs. 2,52,000

Average Profit = (Rs. 2,52,000)/6

Average Profit = Rs. 42,000

(i) Four year’s purchase of average profits:

Value of goodwill at 4 year’s purchase of average profits = Rs. 42,000 × 4 = Rs 1,68,000

(ii) Four year’s purchases of super profits:

Normal Profit = Rs. 2,00,000 × 15%

Normal Profit = Rs. 30,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 42,000 – Rs. 30,000

Super Profit = Rs. 12,000

Value of Goodwill at 4 year’s Purchases of Super profit = Rs. 12,000 × 4 = Rs. 48,000

(iii) Capitalization of super profits:-

Goodwill = Super Profit × 100/(Normal Rate of Return)

Goodwill = Rs. 12,000 × 100/15

Goodwill = Rs. 80,000

Points of Students:

In this method goodwill is calculated on the basis of surplus (excess) profits earned by a firm in comparison to average profits earned by other firms. If a business has no anticipation excess earnings, it will have no goodwill. Such excess profits are called super profits and the goodwill is calculated on the basis of super profits. For example, if the normal rate of earning applicable in a particular type of business is 15% and of our firm is also engaged in the same type of business and we have invested Rs.1,00,000 as capital and if we are earning Rs.25,000, as profit, the Normal Profits at the rate of 15% on Rs.1,00,000 should be 15,000, whereas, we are earning Actual Profits of Rs.25,000 – Rs.15,000, – Rs.10,000 are Super Profits. Goodwill is calculated by multiplying the Super Profits by a reasonable number of years, such as two years purchase or three years purchase etc.

Thus the formula is:

Question 21.

Solution 21

Total Profit = Rs. 36,000 + Rs. 32,000 + Rs. 40,000

Total Profit = Rs. 1,08,000

Average Profit = (Total Profit)/(Number of Year)

Average Profit = (Rs. 1,08,000)/3

Average Profit = Rs. 36,000

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 36,000 × 2

Goodwill = Rs. 72,000

Calculation of Sacrificing and Gaining Ratio:-

A B

Old Ratio 3 : 1

New Ratio 5 : 3

A = 3/4-5/8 = (6 – 5)/8 = 1/8 (Sacrifice)

B = 1/4-3/8 = (2 – 3)/8 = -1/8 (Gain)

B’s Gained = Rs. 72,000 × 1/8 = Rs. 9,000

Hence, A has sacrificed Rs. 9,000 and B has gained Rs. 9,000.

Points of Students:

Under this method first of all we calculate the average profits and then we assess the capital needed for earning such average profits on the basis of normal rate of return. Such capital is also called Capitalized value of average profits. It is calculated as under:

Question 22.

Solution 22

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 1 : 1 : 1

New Ratio 3 : 3 : 1

P = 1/3-3/7 = (7 – 9)/21 = -2/21 (Gain)

Q = 1/3-3/7 = (7 – 9)/21 = -2/21 (Gain)

R = 1/3-1/7 = (7 – 3)/21 = 4/21 (Sacrifice)

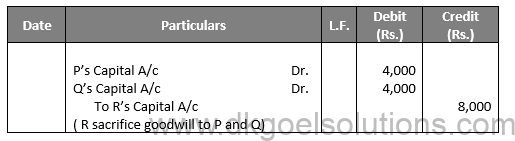

P’s Gained = Rs. 42,000 × 2/21 = Rs. 4,000

Q’s Gained = Rs. 42,000 × 2/21 = Rs. 4,000

R’s Sacrifice = Rs. 42,000 × 4/21 = Rs. 8,000

Points of Students:

(i) For Transfer of Reserve and Accumulated Profits:

Reserve A/c Dr.

Profit & Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr. (Excess of Reserve over Actual Liability)

Investment Fluctuation Reserve A/c Dr.

(Excess of Reserve over difference between Book value and Market value)

To Old Partner’s Capital or Current A/c (in Old Ratio)

(ii) For transfer of Accumulated Losses:

Old Partner’s Capital or Current A/c Dr. (in Old Ratio)

To Profit & Loss A/c

To Deferred Revenue Expenditure A/c (for example Advertisement Suspense A/c)

Question 23.

Solution 23

Total Profit = Rs. 48,000 + Rs. 60,000 + Rs. 90,000

Total Profit = Rs. 1,98,000

Average Profit = (Total Profit)/(Number of Year)

Average Profit = (Rs. 1,98,000)/3

Average Profit = Rs. 66,000

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 7 : 3 : 2

New Ratio 8 : 4 : 3

A = 7/12-8/15 = (35 – 32)/60 = 3/60 (Sacrifice)

B = 3/12-4/15 = (15 – 16)/60 = -1/60 (Gain)

C = 2/12-3/15 = (10 – 12)/60 = -2/60 (Gain)

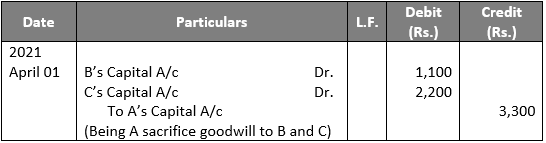

A’s Sacrifice = Rs. 66,000 × 3/60 = Rs. 3,300

B’s Gained = Rs. 66,000 × 1/60 = Rs. 1,100

C’s Gained = Rs. 66,000 × 2/60 = Rs. 2,200

Points of Students:

Calculation of Average Profit:-

Average Profit = Total Profit/Number of Year

Question 24.

Solution 24

Working Note:-

A’s Capital = Rs. 70,000 × 3/5 = Rs. 42,000

B’s Capital = Rs. 70,000 × 2/5 = Rs. 28,000

Points of Students:

Entries for transfer of Accumulated losses:-

Old Partner’s Capital A/c Dr.

To Profit and Loss A/c

To Deferred Revenue Expenditure A/c

Question 25.

Solution 25

Working Note:-

A’s Capital = Rs. 90,000 × 1/6 = Rs. 15,000

B’s Capital = Rs. 90,000 × 2/6 = Rs. 30,000

C’s Capital = Rs. 90,000 × 3/6 = Rs. 45,000

Points of Students:

Entries for transfer of Accumulated Profit:-

Reserve A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr.

To Old Partner’s Capital A/c

Question 26.

Solution 26

Points of Students:

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Account of partners in their old profit sharing ratio.

The Journal Entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

Question 27.

Solution 27

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 1 : 1 : 2

New Ratio 2 : 2 : 1

P = 1/4-2/5 = (5 – 8)/20 = -3/20 (Gain)

Q = 1/4-2/5 = (5 – 8)/20 = -3/20 (Gain)

R = 2/4-1/5 = (10 – 4)/20 = 6/20 (Sacrifice)

Goodwill = Rs. 4,00,000

P’s Gained = Rs. 4,00,000 × 3/20 = Rs. 60,000

Q’s Gained = Rs. 4,00,000 × 3/20 = Rs. 60,000

R’s Sacrifice = Rs. 4,00,000 × 6/20 = Rs. 1,20,000

Points for Students:-

As per accounting viewpoint, partnership firm is treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 28.

Solution 28

Points for Students:-

When Reserve and Accumulated Profits/Losses are not to be transferred to Capital Accounts: If in Case of change in profit sharing ratio, there are reserves and accumulated profits appearing in the Balance Sheet and the partners decide to leave the reserve and accumulated profits undistributed, it will be necessary to pass an adjusting entry for the same. This is, because, at present the partners are entitled to share such reserves and profits in the old profit sharing ratio whereas in future they will be entitled to share such reserve and profit sharing ratio whereas in future they will be entitled to share such reserves and profits in the new profits sharing ratio.

Question 29 (new).

Solution 29 (new).

Question 29.

Solution 29

(i) When they want to transfer the general reserve in their capital accounts.

(ii) When they don’t want to transfer general reserve in their capital accounts and prefer to record an adjustment entry for the same.

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 3 : 2 : –

New Ratio 4 : 3 : 2

A = 3/5-4/9 = (27 – 20)/45 = -7/45 (Sacrifice)

Q = 2/5-3/9 = (18 – 15)/45 = -3/45 (Sacrifice)

R = 2/9 or 10/45 (Gain)

Points for Students:-

Assets and liabilities of a firm must also be revalued at the time of change in profit sharing ratio of existing partners. The reason is that the realizable or actual value of assets and liabilities may be different from those shown in the balance sheet. It is possible that with the passage of time some of the assets might have appreciated in value while the value of certain other assets might have decreased and no record has been made of such changes in the books of accounts. Revaluation of assets and liabilities becomes necessary because the change in the value of assets and liabilities belong to the period prior to change in profit sharing ratio and hence must be shared by the partners in their old profit sharing ratio.

Entries for transfer of Accumulated Profit:-

Reserve A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr.

To Old Partner’s Capital A/c

Question 30.

Solution 30

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 1 : 1 : 1

New Ratio 3 : 4 : 5

A = 1/3-3/12 = (4 – 3)/12 = 1/12 (Sacrifice)

B = 1/3-4/12 = (4 – 4)/12 = 0

C = 1/3-5/12 = (4 – 5)/12 = 1/12 (Gain)

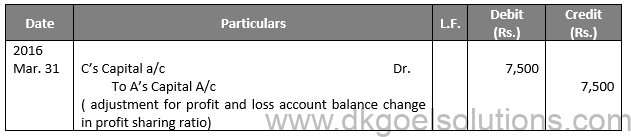

C’s Capital = Rs. 90,000 × 1/12 = Rs. 7,500

A’s Capital = Rs. 90,000 × 1/12 = Rs. 7,500

Points of Students:

As a result of change in profit sharing ratio, one or more of the existing partners gain some portion of other partner’s share of profit. The ratio of gain of profit sharing ratio is called gaining ratio. It is calculated as follows:

Gaining Ratio = New Ratio – Old Ratio

Question 31.

Solution 31

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

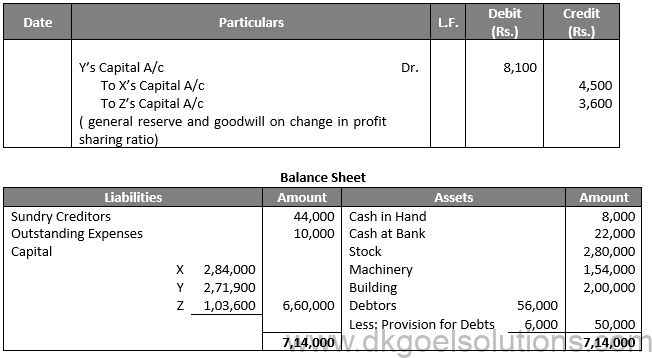

X Y Z

Old Ratio 5 : 3 : 2

New Ratio 2 : 3 : 5

X = 5/10-2/10 = (5 – 2)/10 = 3/10 (Sacrifice)

Y = 3/10-3/10 = 0

Z = 2/10-5/10 = (2 – 5)/10 = 3/10 (Gain)

Calculation of Net Profit:-

Profit and Loss Account Rs. 24,000

Less: Advertisement Suspense Account Rs. 12,000

Rs. 12,000

Z’s Capital = Rs. 12,000 × 3/10 = Rs. 3,600

X’s Capital = Rs. 12,000 × 3/10 = Rs. 3,600

Points of Students:

Gaining Partners a/c Dr.

To Sacrificing Partner’s A/c

(Adjustment for profit and loss account balance and advertisement suspense account on change in profit sharing ratio)

Question 32.(A)

Solution 32 (A)

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C D

Old Ratio 2 : 2 : 1 : 1

New Ratio 3 : 2 : 2 : 3

A = 2/6-3/10 = (10 – 9)/30 = 1/30 (Sacrifice)

B = 2/6-2/10 = (10 – 6)/30 = 4/30 (Sacrifice)

C = 1/6-2/10 = (5 – 6)/10 = 1/30 (Gain)

D = 1/6-3/10 = (5 – 9)/30 = 4/30 (Gain)

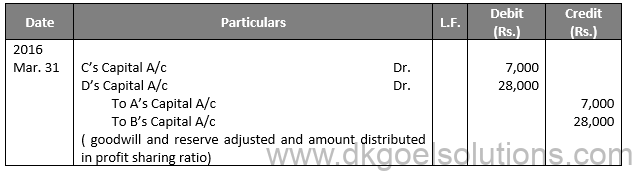

Value of Goodwill Rs. 1,50,000

Less: Reserve Rs. 60,000

Rs. 2,10,000

A’s Capital = Rs. 2,10,000 × 1/30 = Rs. 7,000 (Sacrifice)

B’s Capital = Rs. 2,10,000 × 4/30 = Rs. 28,000 (Sacrifice)

C’s Capital = Rs. 2,10,000 × 1/30 = Rs. 7,000 (Gain)

D’s Capital = Rs. 2,10,000 × 4/30 = Rs. 28,000 (Gain)

(A) Points of Students:

For Transfer of Reserve and Accumulated Profits:

Reserve A/c Dr.

Profit & Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr. (Excess of Reserve over Actual Liability)

Investment Fluctuation Reserve A/c Dr.

(Excess of Reserve over difference between Book value and Market value)

To Old Partner’s Capital or Current A/c (in Old Ratio)

Question 32.B (new).

Solution 32 B (new).

Value of Goodwill = Rs. 1,70,000 × 2 = Rs. 3,40,000

Value of Goodwill Rs. 3,40,000

Add: Reserve Rs. 1,10,000

Rs. 4,50,000

Calculation of Sacrificing and Gaining Ratio:-

A B

Old Ratio 2 : 3

New Ratio 1 : 2

Question 32. (B)

Solution 32 (B)

Working Note:-

Average Profit = (Total Profit)/(Number of Year)

Total Profit = Rs. 1,50,000 + Rs. 1,40,000 + Rs. 2,20,000 = Rs. 5,10,000

Average Profit = (Rs. 5,10,000)/3

Average Profit = Rs. 1,70,000

Value of Goodwill = Rs. 1,70,000 × 2 = Rs. 3,40,000

Value of Goodwill Rs. 3,40,000

Add: Reserve Rs. 1,10,000

Rs. 4,50,000

Calculation of Sacrificing and Gaining Ratio:-

A B

Old Ratio 2 : 3

New Ratio 1 : 2

Arun = 2/5-1/3 = (6 – 5)/15 = 1/15 (Sacrifice)

Varun = 3/5-2/3 = (9 – 10)/15 = 1/15 (Gain)

Arun will Sacrifice for Varun = Rs. 4,50,000 × 1/15 = Rs. 30,000

B). Points of Students:

For transfer of Accumulated Losses:

Old Partner’s Capital or Current A/c Dr. (in Old Ratio)

To Profit & Loss A/c

To Deferred Revenue Expenditure A/c (for example Advertisement Suspense A/c)

Question 33. (new).

Solution 33 (new).

Working Note:-

Value of Goodwill Rs. 1,50,000

General Reserve Rs. 75,000

Profit and Loss Rs. 15,000

Rs. 2,40,000

Calculation of Sacrificing and Gaining Ratio:-

X Y Z

Old Ratio 7 : 5 : 4

New Ratio 3 : 2 : 1

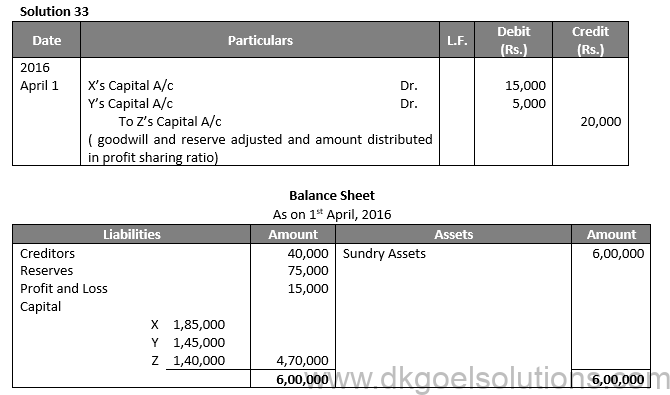

Question 33.

Solution 33

Working Note:-

Value of Goodwill Rs. 1,50,000

General Reserve Rs. 75,000

Profit and Loss Rs. 15,000

Rs. 2,40,000

Calculation of Sacrificing and Gaining Ratio:-

X Y Z

Old Ratio 7 : 5 : 4

New Ratio 3 : 2 : 1

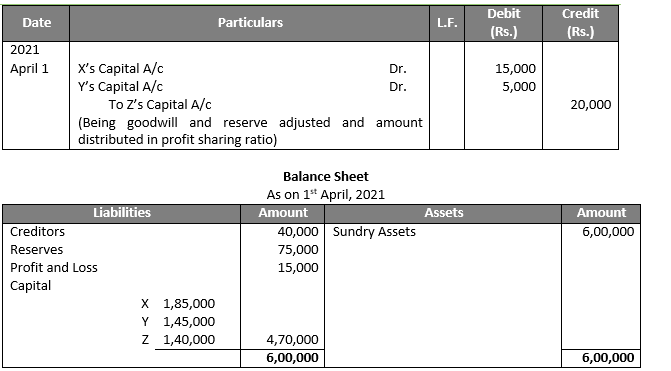

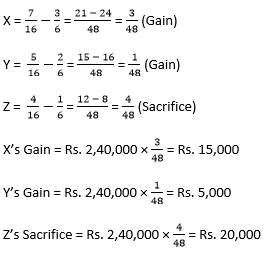

X = 7/16-3/6 = (21 – 24)/48 = 3/48 (Gain)

Y = 5/16-2/6 = (15 – 16)/48 = 1/48 (Gain)

Z = 4/16-1/6 = (12 – 8)/48 = 4/48 (Sacrifice)

X’s Gain = Rs. 2,40,000 × 3/48 = Rs. 15,000

Y’s Gain = Rs. 2,40,000 × 1/48 = Rs. 5,000

Z’s Sacrifice = Rs. 2,40,000 × 4/48 = Rs. 20,000

Points of Students:

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Account of partners in their old profit sharing ratio.

The Journal Entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to partner’s Capital Accounts in their old profit ratio)

Gaining Partners a/c Dr.

To Sacrificing Partner’s A/c

(Adjustment for profit and loss account balance and advertisement suspense account on change in profit sharing ratio)

Question 34.

Solution 34

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 2 : 2 : 1

New Ratio 1 : 2 : 3

A = 2/5-1/6 = (12 – 5)/30 = 7/30 (Sacrifice)

B = 2/5-2/6 = (12 – 10)/30 = 2/30 (Sacrifice)

C = 1/5-3/6 = (6 – 15)/30 = 9/30 (Gain)

Points of Students:

Revolution of assets and liabilities is done with the help of a new account called Revaluation Account. Sometimes this account is called Profit and Loss Adjustment A/c. This account is a nominal account in nature. Hence, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Question 35.

Solution 35

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 3 : 2 : 1

New Ratio 4 : 3 : 3

A = 3/6-4/10 = (15 – 12)/30 = 3/30 (Sacrifice)

B = 2/6-3/10 = (10 – 9)/30 = 1/30 (Sacrifice)

C = 1/6-3/10 = (5 – 9)/30 = 4/30 (Gain)

A’s Sacrifice = Rs. 48,000 × 3/30 = Rs. 4,800

B’s Sacrifice = Rs. 48,000 × 1/30 = Rs. 1,600

C’s Gain = Rs. 48,000 × 4/30 = Rs. 6,400

Points of Students:

Following entries are passed for the purpose of revaluation:-

(i) For decrease in the value of assets:

Revaluation A/c Dr.

To Assets A/c

(Decrease in the value of assets)

(ii) For increase in the value of assets:

Assets A/c Dr.

To Revaluation A/c

(Increase in the value of assets)

Question 36.

Solution 36

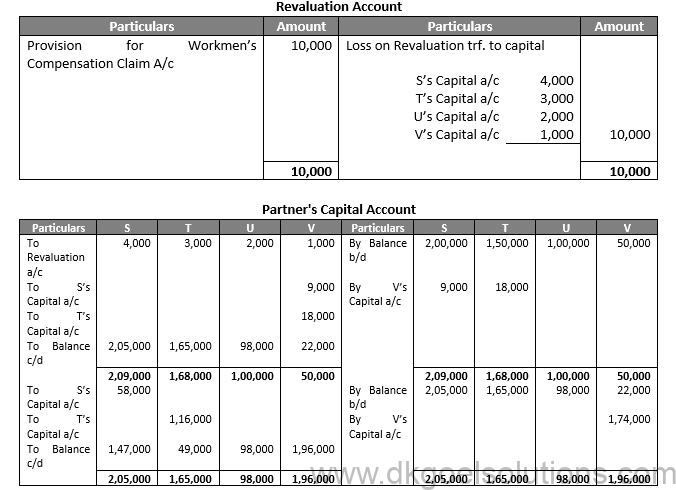

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

S T U V

Old Ratio 4 : 3 : 2 : 1

New Ratio 3 : 1 : 2 : 4

S = 4/10-3/10 = (4 – 3)/10 = 1/10 (Sacrifice)

T = 3/10-1/10 = (3 – 1)/10 = 2/10 (Sacrifice)

U = 2/10-2/10 = (2 – 2)/10 = 0

V = 1/10-4/10 = (1 – 4)/10 = 3/30 (Gain)

S’s Capital = Rs. 4,90,000 × 3/10 = Rs. 1,47,000

T’s Capital = Rs. 4,90,000 × 1/10 = Rs. 49,000

U’s Capital = Rs. 4,90,000 × 2/10 = Rs. 98,000

V’s Capital = Rs. 4,90,000 × 4/10 = Rs. 1196,000

Points of Students:

Following entries are passed for the purpose of revaluation:-

(i) For increase in the value of liabilities:-

Revaluation A/c Dr.

To Liabilities A/c

(Increase in the value of liabilities)

(ii) For decrease in the value of liabilities:-

Liabilities A/c Dr.

To Revaluation A/c

(Decrease in the value of liabilities)

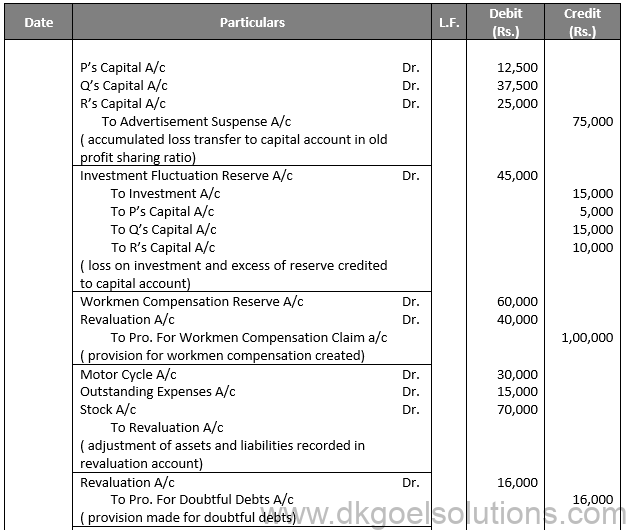

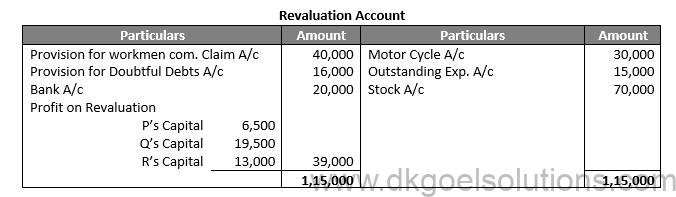

Question 37. :

Solution 37

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 1 : 3 : 2

New Ratio 4 : 6 : 5

P = 1/6-4/15 = (5 – 8)/30 = 3/30 (Gain)

Q = 3/6-6/15 = (15 – 12)/30 = 3/30 (Sacrifice)

R = 2/6-2/15 = (10 – 10)/30 = 0

Points for Students:-

Revaluation of assets and liabilities may be given effect to in two different ways:

(a) When revised values are to be recorded in the books.

(b) When revised values are not to be recorded in the books.

Question 38.

Solution 38

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 2 : 2 : 1

New Ratio 1 : 1 : 1

A = 2/5-1/3 = (6 – 5)/15 = 1/15 (Sacrifice)

B = 2/5-1/3 = (6 – 5)/15 = 1/15 (Sacrifice)

C = 1/5-1/3 = (3 – 5)/15 = 2/15 (Gain)

Points for Students:-

On this basis of above entries a Revaluation Account or Profit and Loss Adjustment A/c is prepared. It the credit side of this account is in excess, it reveals a profit and if the debit side is in excess, it will reveal a loss.

Such profit or loss will be divided between all the partners in their old profit sharing ratio. Following entries are passed for this purpose:

(A) When revaluation account shows profit:

Revaluation A/c Dr.

To Partner’s Capital A/c

(Profit on revaluation credited to partners capital a/c)

Question 39.

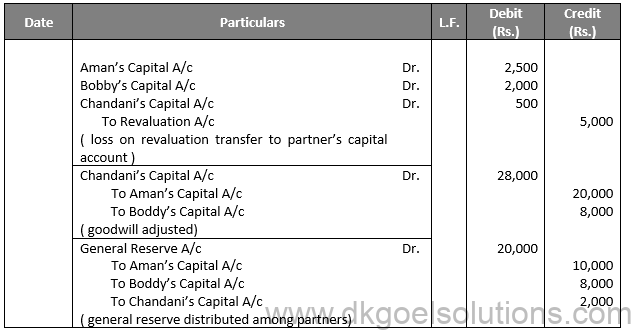

Solution 39

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

Aman Boddy Chandani

Old Ratio 5 : 4 : 1

New Ratio 1 : 1 : 1

Aman = 5/10-1/3 = (15 – 10)/30 = 5/30 (Sacrifice)

Boddy = 4/10-1/3 = (12 – 10)/30 = 2/30 (Sacrifice)

Chandani = 5/10-1/3 = (15 – 10)/30 = 7/30 (Gain)

Points for Students:-

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Account of partners in their old profit sharing ratio.

The Journal Entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to partner’s Capital Accounts in their old profit ratio)

Question 40 (new).

Solution 40 (new).

Question 40.

Solution 40

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

X Y

Old Ratio 4 : 3

New Ratio 2 : 1

X = 4/7-2/3 = (12 – 14)/21 = 2/21 (Gain)

Y = 3/7-1/3 = (9 – 7)/21 = 2/21 (Sacrifice)

Points of Students:

Following entries are passed for the purpose of revaluation:-

(i) For decrease in the value of assets:

Revaluation A/c Dr.

To Assets A/c

(Decrease in the value of assets)

(ii) For increase in the value of assets:

Assets A/c Dr.

To Revaluation A/c

(Increase in the value of assets)

Question 41.

Solution 41

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 5 : 4 : 3

New Ratio 4 : 3 : 2

P = 5/12-4/9 = (15 – 16)/36 = 1/36 (Gain)

Q = 4/12-3/9 = (12 – 12)/36 = 0/36 (nil)

R = 3/12-2/9 = (9 – 8)/36 = 1/36 (Sacrifice)

Average Profit = ((Rs.20,000) – Rs. 48,000 + Rs. 60,000 + Rs. 80,000)/4

Average Profit = Rs. 42,000

Goodwill = Rs. 42,000 × 2 = 84,000

Reserve and Surplus = Rs. 42,000

Total = Rs. 21,000 + Rs. 84,000 + Rs. 42,000 = Rs. 1,47,000

P’s Gain = Rs. 90,000 × 1/36 = Rs. 2,500|

R’s Sacrifice = Rs. 90,000 × 1/36 = Rs. 2,500

Question 42 (new).

Solution 42 (new).

Question 42.

Solution 42

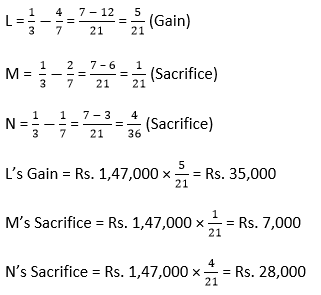

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

L M N

Old Ratio 1 : 1 : 1

New Ratio 4 : 2 : 1

L = 1/3-4/7 = (7 – 12)/21 = 5/21 (Gain)

M = 1/3-2/7 = (7 – 6)/21 = 1/21 (Sacrifice)

N = 1/3-1/7 = (7 – 3)/21 = 4/36 (Sacrifice)

L’s Gain = Rs. 1,47,000 × 5/21 = Rs. 35,000

M’s Sacrifice = Rs. 1,47,000 × 1/21 = Rs. 7,000

N’s Sacrifice = Rs. 1,47,000 × 4/21 = Rs. 28,000

Points of Students:

On this basis of above entries a Revaluation Account or Profit and Loss Adjustment A/c is prepared. It the credit side of this account is in excess, it reveals a profit and if the debit side is in excess, it will reveal a loss.

Such profit or loss will be divided between all the partners in their old profit sharing ratio. Following entries are passed for this purpose:

(B) When revaluation account shows loss:

Partner’s Capital A/c Dr.

To Revaluation A/c

(loss on revaluation credited to partners capital a/c)

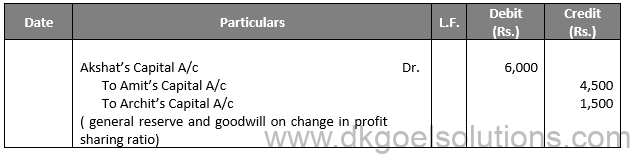

Question 43.

Solution 43

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

Amit Archit Akshat

Old Ratio 3 : 2 : 1

New Ratio 7 : 5 : 4

Amit = 3/6-7/16 = (24 – 21)/48 = 3/48 (Sacrifice)

Archit = 2/6-5/16 = (16 – 15)/48 = 1/48 (Sacrifice)

Akshat = 1/6-4/16 = (8 – 12)/48 = 4/48 (Gain)

Total Distributed Revenue = General Reserve + Profit on Revaluation

Total Distributed Revenue = Rs. 38,000 + Rs. 34,000

Total Distributed Revenue = Rs. 72,000

Amit’s Sacrifice = Rs. 72,000 × 3/48 = Rs. 4,500

Archit’s Sacrifice = Rs. 72,000 × 1/48 = Rs. 1,500

Akshat’s Gain = Rs. 72,000 × 4/48 = Rs. 6,000

Points of Students:

For Transfer of Reserve and Accumulated Profits:

Reserve A/c Dr.

Profit & Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr.

Investment Fluctuation Reserve A/c Dr.

To Old Partner’s Capital or Current A/c (in Old Ratio)

Question 44 (new).

Solution 44 (new).

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

L M N

Old Ratio 1 : 1 : 1

New Ratio 4 : 2 : 1

Question 44.

Solution 44

Working Note:-

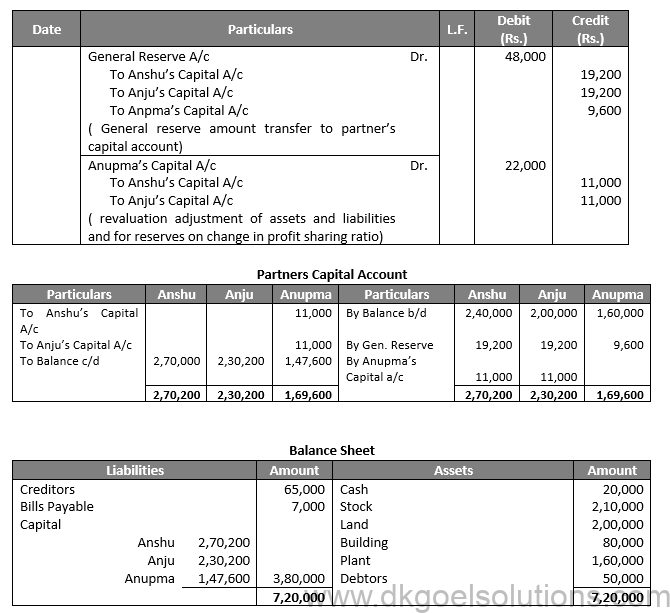

Calculation of Sacrificing and Gaining Ratio:-

Anshu Anju Anupma

Old Ratio 2 : 2 : 1

New Ratio 1 : 1 : 1

Anshu = 2/5-1/3 = (6 – 5)/15 = 1/15 (Sacrifice)

Anju = 2/5-1/3 = (6 – 5)/15 = 1/15 (Sacrifice)

Anupma = 1/5-1/3 = (3 – 5)/15 = 2/15 (Gain)

Total = Rs. 1,05,000 + Rs. 60,000 = Rs. 1,65,000

Anshu’s Sacrifice = Rs. 1,65,000 × 1/15 = Rs. 11,000

Anshu’s Sacrifice = Rs. 1,65,000 × 1/15 = Rs. 11,000

Anupma’s Gain = Rs. 1,65,000 × 2/15 = Rs. 22,000

Points of Students:

(i) For Transfer of Reserve and Accumulated Profits:

Reserve A/c Dr.

Profit & Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr.

Investment Fluctuation Reserve A/c Dr.

To Old Partner’s Capital or Current A/c (in Old Ratio)

(ii) For transfer of Accumulated Losses:

Old Partner’s Capital or Current A/c Dr. (in Old Ratio)

To Profit & Loss A/c

To Deferred Revenue Expenditure A/c (for example Advertisement Suspense A/c)

Question 45.

Solution 45

Normal Profit = Capita Employed × Normal Rate of Return

Normal Profit = Rs. 7,00,000 × 7/100

Normal Profit = Rs. 49,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 80,000 – Rs. 49,000

Super Profit = Rs. 31,000

Goodwill = Super Profit × Number of Year’s Purchase

Goodwill = Rs. 31,000 × 5

Goodwill = Rs. 1,55,000

Working Note:-

Adjustment Profit = Average Profit earned by the firm + Under Valuation of Stock

Adjustment Profit = Rs. 75,000 + Rs. 5,000

Adjustment Profit = Rs. 80,000

Points of Students:

Goodwill = Capitalised Value – Net Assets of Business

Calculate Average future maintainable profits

Calculate the Capitalised value of business on the basis of the Average Profits

Question 46.

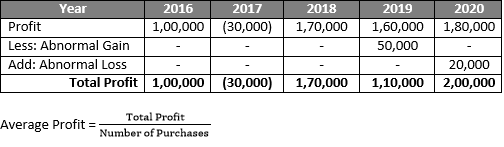

Solution 46

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 1,00,000 – Rs. 30,000 + Rs. 1,70,000 + Rs. 1,10,000 + Rs. 2,00,000

Total Profit = Rs. 5,50,000

Average Profit = (Rs. 5,50,000)/(5 )

Average Profit = Rs. 1,10,000

Goodwill = Rs. 1,10,000 × 2.5 = Rs. 2,75,000

Points of Students:

The weighted average profit is multiplied by the agreed number of year’s purchase to find out the value of goodwill. Thus, the formula is:

Weighted Average Profit = Total of Products of ProfitsTotal of Weights

Goodwill = Weighted Average Profit × Number of Year’s of Purchase

Question 47.

Solution 47

Average Profit = (Total Profit)/(Number of Purchases )

Average Profit = (Rs. 3,00,000)/3

Average Profit = Rs. 1,00,000

Goodwill = Rs. 1,00,000 × 2 = Rs. 2,00,000

Question 48. (new).

Solution 48 (new).

Total Profit = Rs. 1,00,000 – Rs. 30,000 + Rs. 1,70,000 + Rs. 1,10,000 + Rs. 2,00,000

Total Profit = Rs. 5,50,000

Average Profit = (Rs. 5,50,000)/(5 )

Average Profit = Rs. 1,10,000

Goodwill = Rs. 1,10,000 × 2.5 = Rs. 2,75,000

Question 48.

Solution 48

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 3,10,000 × 10/100

Normal Profit = Rs. 31,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 37,000 – Rs. 31,000

Super Profit = Rs. 6,000

Goodwill = Super Profit × 100/(Normal Rate of Return)

Goodwill = Rs. 6,000 × 100/10

Goodwill = Rs. 60,000

Working Note:-

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 4,00,000 – Rs. 90,000

Capital Employed = Rs. 3,10,000

Points of Students:

Super profit method first of all we calculate the super profits and then we assess the capital needed for earning such super profits on the basis of normal rate of return. Such capital is actually the amount of goodwill. Following formula is used to calculate goodwill:

Question 49.

Solution 49

Goodwill = Super Profit × Number of year purchases

50,000 = Super Profit × 2.5

Super Profit = 50,000/2.5

Super Profit = Rs. 20,000

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 4,00,000 – Rs. 20,000

Capital Employed = Rs. 3,80,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 3,80,000 × 10/100

Normal Profit = Rs. 38,000

Super Profit = Average Profit – Normal Profit

Rs. 25,000 = Average Profit – Rs. 38,000

Average Profit = Rs. 25,000 + Rs. 38,000

Average Profit = Rs. 63,000

Question 50.

Solution 50

Goodwill = Super Profit × Number of year purchases

75,000 = Super Profit × 3

Super Profit = 75,000/3

Super Profit = Rs. 25,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 4,00,000 × 12/100

Normal Profit = Rs. 48,000

Super Profit = Average Profit – Normal Profit

Rs. 20,000 = Average Profit – Rs. 48,000

Average Profit = Rs. 48,000 + Rs. 20,000

Average Profit = Rs. 68,000

Question 51.

Solution 51

(i) Value of Goodwill on the basis of two year’s purchase of Super profits:

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 1,90,000 + Rs. 2,20,000 + Rs. 2,50,000

Total Profit = Rs. 6,60,000

Average Profit = (Rs. 6,60,000)/(3 )

Average Profit = Rs. 2,20,000

Average Profit for Goodwill = Average Profit – Partners Remuneration

Average Profit for Goodwill = Rs. 2,20,000 – Rs. 1,00,000

Average Profit for Goodwill = Rs. 1,20,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 4,00,000 × 15/100

Normal Profit = Rs. 60,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 1,20,000 – Rs. 60,000

Super Profit = Rs. 60,000

Goodwill = Super Profit × Number of year purchases

Goodwill = Rs. 60,000 × 2

Goodwill = Rs. 1,20,000

(ii) Value of Goodwill by Capitalisation of Average Profit method:-

Capitalised Value of Average Profit = Average Profit × 100/(Noramal Rate of Return)

Capitalised Value of Average Profit = Rs. 1,20,000 × 100/15

Capitalised Value of Average Profit = Rs. 8,00,000

Goodwill = Capitalised Value of Average Profit – Net Assets

Goodwill = Rs. 8,00,000 – Rs. 4,00,000

Goodwill = Rs. 4,00,000

Points of Students:

This is a very simple and widely followed method of valuation of goodwill. In this method, goodwill is calculated on the basis of the number of past years profits. Average of such profits is multiplied by the agreed number of years (such as two or three) to find out the value of goodwill. Thus the formula is:

Value of Goodwill = Average Profit × Number of Years of purchase

Question 52.

Solution 52

Normal Profit = Rs. 20,00,000 × 12% = Rs. 2,40,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 3,00,000 – Rs. 2,40,000

Super Profit = Rs. 60,000

Value of Goodwill = Super Profit × 100/(Normal Rate of Return)

Value of Goodwill = Rs. 60,000 × 100/12

Value of Goodwill = Rs. 5,00,000

Question 53 (new).

Solution 53 (new). Calculation of Goodwill:-

Average profit of the firm = Rs. 5,00,000

Capitalised value of business = Average Profit × 100/Rate

Capitalised value of business = Rs. 5,00,000 × 100/10

Capitalised value of business = Rs. 50,00,000

Net Assets = All Assets – Outside liabilities

Net Assets = Rs. 6,00,000 + Rs. 4,00,000 + Rs. 4,00,000 + Rs. 5,00,000 + Rs. 1,00,000

Net Assets = Rs. 20,00,000

Capitalisation of average profit method:-

Goodwill = Capitalised value of business – Net Assets

Goodwill = Rs. 50,00,000 – Rs. 20,00,000

Goodwill = Rs. 30,00,000

Question 53.

Solution 53

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 50,000 – Rs. 10,000 + Rs. 1,64,000 + Rs. 1,80,000

Total Profit = Rs. 3,84,000

Average Profit = (Rs. 3,84,000)/(4 )

Average Profit = Rs. 96,000

(i) Three year’s purchase of average profit:-

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 96,000 × 3

Goodwill = Rs. 2,88,000

(ii) Three year’s purchase of super profit:-

Normal Profit = Rs. 6,20,000 × 12% = Rs. 74,400

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 96,000 – Rs. 74,400

Super Profit = Rs. 21,600

Goodwill = Super Profit × Number of year purchases

Goodwill = Rs. 21,600 × 3

Goodwill = Rs. 64,800

(iii) Capitalisation of average profit:-

Capitalised value of Average Profit = Average Profit × 100/(Normal Rate of Return)

Capitalised value of Average Profit = Rs. 96,000 × 100/12

Capitalised value of Average Profit = Rs. 8,00,000

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 6,80,000 – Rs. 60,000

Capital Employed = Rs. 6,20,000

Goodwill = Capitalised value of Average Profit – Capital Employed

Goodwill = Rs. 8,00,000 – Rs. 6,20,000

Goodwill = Rs. 1,80,000

(iv) Capitalisation of super profits:-

Goodwill = Super Profit × 100/(Normal rate of Return)

Goodwill = Rs. 21,600 × 100/12

Goodwill = Rs. 1,80,000

Points for Students:-

1. Goodwill = Average Profit × Number of year purchases

2. Goodwill = Super Profit × Number of year purchases

3. Goodwill = Capitalised value of Average Profit – Capital Employed

Question 54 (new).

Solution 54 (new). (i) Value of Goodwill on the basis of two year’s purchase of Super profits:

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 1,90,000 + Rs. 2,20,000 + Rs. 2,50,000

Total Profit = Rs. 6,60,000

Average Profit = (Rs. 6,60,000)/(3 )

Average Profit = Rs. 2,20,000

Average Profit for Goodwill = Average Profit – Partners Remuneration

Average Profit for Goodwill = Rs. 2,20,000 – Rs. 1,00,000

Average Profit for Goodwill = Rs. 1,20,000

Normal Profit = Capital Employed × (Normal Rate of Return)/100

Normal Profit = Rs. 4,00,000 × 15/100

Normal Profit = Rs. 60,000

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 1,20,000 – Rs. 60,000

Super Profit = Rs. 60,000

Goodwill = Super Profit × Number of year purchases

Goodwill = Rs. 60,000 × 2

Goodwill = Rs. 1,20,000

(ii) Value of Goodwill by Capitalisation of Average Profit method:-

Capitalised Value of Average Profit = Average Profit × 100/(Noramal Rate of Return)

Capitalised Value of Average Profit = Rs. 1,20,000 × 100/15

Capitalised Value of Average Profit = Rs. 8,00,000

Goodwill = Capitalised Value of Average Profit – Net Assets

Goodwill = Rs. 8,00,000 – Rs. 4,00,000

Goodwill = Rs. 4,00,000

Question 54.

Solution 54

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

X Y Z

Old Ratio 5 : 4 : 1

New Ratio 3 : 3 : 4

X = 5/10-3/10 = (5 – 3)/10 = 2/10 (Sacrifice)

Y = 4/10-3/10 = (4 – 3)/10 = 1/10 (Sacrifice)

Z = 1/10-4/10 = (1 – 4)/10 = 3/10 (Gain)

X’s Sacrifice = Rs. 1,00,000 × 2/10 = Rs. 20,000

Y’s Sacrifice = Rs. 1,00,000 × 1/10 = Rs. 10,000

Z’s Gain = Rs. 1,00,000 × 3/10 = Rs. 30,000

Points of Students:

If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Account of partners in their old profit sharing ratio.

The Journal Entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to partner’s Capital Accounts in their old profit ratio)

Gaining Partners a/c Dr.

To Sacrificing Partner’s A/c

(Adjustment for profit and loss account balance and advertisement suspense account on change in profit sharing ratio)

Question 55.

Solution 55

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

Dinesh Charu

Old Ratio 3 : 1

New Ratio 3 : 2

Dinesh = 3/4-3/5 = (15 – 12)/20 = 3/20 (Sacrifice)

Charu = 1/4-2/5 = (5 – 8)/20 = 3/20 (Gain)

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 60,000 + Rs. 50,000 + Rs. 90,000 + Rs. 1,20,000

Total Profit = Rs. 3,20,000

Average Profit = (Rs. 3,20,000)/(4 )

Average Profit = Rs. 80,000

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 80,000 × 2.5

Goodwill = Rs. 2,00,000

Dinesh’s Sacrifice = Rs. 2,00,000 × 3/20 = Rs. 30,000

Charu’s Gain = Rs. 2,00,000 × 3/20 = Rs. 30,000

Points of Students:

Gaining Partners a/c Dr.

To Sacrificing Partner’s A/c

(Adjustment for profit and loss account balance and advertisement suspense account on change in profit sharing ratio)

Question 56 (new).

Solution 56 (new). Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 50,000 – Rs. 10,000 + Rs. 1,64,000 + Rs. 1,80,000

Total Profit = Rs. 3,84,000

Average Profit = (Rs. 3,84,000)/(4 )

Average Profit = Rs. 96,000

(i) Three year’s purchase of average profit:-

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 96,000 × 3

Goodwill = Rs. 2,88,000

(ii) Three year’s purchase of super profit:-

Normal Profit = Rs. 6,20,000 × 12% = Rs. 74,400

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 96,000 – Rs. 74,400

Super Profit = Rs. 21,600

Goodwill = Super Profit × Number of year purchases

Goodwill = Rs. 21,600 × 3

Goodwill = Rs. 64,800

(iii) Capitalisation of average profit:-

Capitalised value of Average Profit = Average Profit × 100/(Normal Rate of Return)

Capitalised value of Average Profit = Rs. 96,000 × 100/12

Capitalised value of Average Profit = Rs. 8,00,000

Capital Employed = Assets – Liabilities

Capital Employed = Rs. 6,80,000 – Rs. 60,000

Capital Employed = Rs. 6,20,000

Goodwill = Capitalised value of Average Profit – Capital Employed

Goodwill = Rs. 8,00,000 – Rs. 6,20,000

Goodwill = Rs. 1,80,000

(iv) Capitalisation of super profits:-

Goodwill = Super Profit × 100/(Normal rate of Return)

Goodwill = Rs. 21,600 × 100/12

Goodwill = Rs. 1,80,000

Question 56.

Solution 56

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 5 : 3 : 2

New Ratio 5 : 4 : 3

A = 5/10-5/12 = (30 – 25)/60 = 5/60 (Sacrifice)

B = 3/10-4/12 = (18 – 20)/60 = 2/60 (Gain)

C = 2/10-3/12 = (12 – 15)/60 = 3/60 (Gain)

A’s Sacrifice = Rs. 2,00,000 × 3/20 = Rs. 30,000

B’s Gain = Rs. 2,00,000 × 3/20 = Rs. 30,000

C’s Gain = Rs. 2,00,000 × 3/20 = Rs. 30,000

Points of Students:

This is a very simple and widely followed method of valuation of goodwill. In this method, goodwill is calculated on the basis of the number of past years profits. Average of such profits is multiplied by the agreed number of years (such as two or three) to fing out the value of goodwill. Thus the formula is:

Value of Goodwill = Average Profit × Number of Years of purchase

Question 57.

Solution 57

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 5 : 3 : 2

New Ratio 1 : 1 : 1

P = 5/10-1/3 = (15 – 10)/30 = 5/30 (Sacrifice)

Q = 3/10-1/3 = (18 – 20)/30 = 1/30 (Gain)

R = 2/10-1/3 = (6 – 10)/30 = 4/30 (Gain)

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 60,000 + Rs. 1,50,000 + Rs. 1,70,000 + Rs. 1,90,000 – Rs. 70,000

Total Profit = Rs. 5,00,000

Average Profit = (Rs. 5,00,000)/5

Average Profit = Rs. 1,00,000

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 1,00,000 × 3

Goodwill = Rs. 3,00,000

P’s Sacrifice = Rs. 3,00,000 × 5/30 = Rs. 50,000

Q’s Gain = Rs. 3,00,000 × 1/30 = Rs. 10,000

R’s Gain = Rs. 3,00,000 × 4/30 = Rs. 40,000

Question 58.

Solution 58

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B

Old Ratio 2 : 1

New Ratio 3 : 2

A = 2/3-3/5 = (10 – 9)/15 = 1/15 (Sacrifice)

B = 1/3-2/5 = (5 – 6)/15 = 1/15 (Gain)

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 60,000 + Rs. 80,000 + Rs. 1,30,000

Total Profit = Rs. 1,80,000

Average Profit = (Rs. 1,80,000)/3

Average Profit = Rs. 90,000

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 90,000 × 3

Goodwill = Rs. 2,70,000

A’s Sacrifice = Rs. 3,00,000 × 1/15 = Rs. 18,000

B’s Gain = Rs. 3,00,000 × 1/15 = Rs. 18,000

Question 59.

Solution 59

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 1 : 3 : 2

New Ratio 4 : 6 : 5

A = 1/6-4/15 = (5 – 8)/30 = 3/30 (Gain)

B = 3/6-6/15 = (15 – 12)/30 = 3/30 (Sacrifice)

C = 2/6-5/15 = (10 – 10)/30 = 0 (Nil)

Goodwill = (Rs. 80,000) + Rs. 1,20,000 + Rs. 1,40,000 = Rs. 1,80,000

Total Distributable Amount = Goodwill + Reserve + Profit

Total Distributable Amount = Rs. 1,80,000 + Rs. 40,000 + Rs. 30,000

Total Distributable Amount = Rs. 2,50,000

A’s Gain = Rs. 2,50,000 × 3/30 = Rs. 25,000

B’s Sacrifice = Rs. 2,50,000 × 3/30 = Rs. 25,000

Points of Students:

Under this method first of all we calculate the average profits and then we assess the capital needed for earning such average profits on the basis of normal rate of return. Such capital is also called Capitalized value of average profits. It is calculated as under:

Question 60 (new).

Solution 60 (new).

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

P Q R

Old Ratio 5 : 3 : 2

New Ratio 1 : 1 : 1

P = 5/10-1/3 = (15 – 10)/30 = 5/30 (Sacrifice)

Q = 3/10-1/3 = (18 – 20)/30 = 1/30 (Gain)

R = 2/10-1/3 = (6 – 10)/30 = 4/30 (Gain)

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 60,000 + Rs. 1,50,000 + Rs. 1,70,000 + Rs. 1,90,000 – Rs. 70,000

Total Profit = Rs. 5,00,000

Question 60.

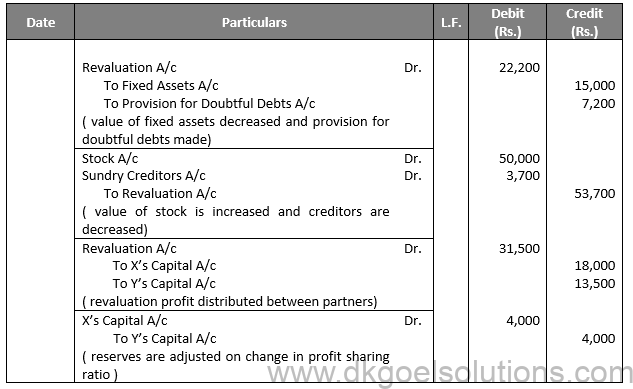

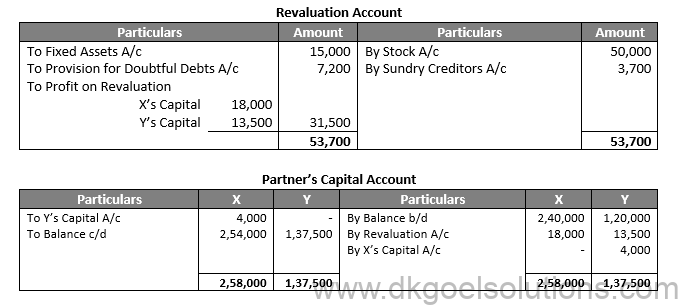

Solution 60

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

X Y Z

Old Ratio 5 : 3 : 2

New Ratio 3 : 3 : 1

X = 5/10-3/7 = (35 – 30)/70 = 5/70 (Sacrifice)

Y = 3/10-3/7 = (21 – 30)/70 = 9/70 (Gain)

Z = 2/10-1/7 = (14 – 10)/70 = 4/70 (Sacrifice)

Super Profit = Average Profit – Normal Profit

Super Profit = Rs. 1,08,000 – Rs. 66,000

Super Profit = Rs. 42,000

Goodwill = Super Profit × Number of year purchases

Goodwill = Rs. 42,000 × 2

Goodwill = Rs. 84,000

Distributable Profit = Goodwill – Loss on Revaluation

Distributable Profit = Rs. 84,000 – Rs. 21,000

Distributable Profit = Rs. 63,000

X’s Sacrifice = Rs. 63,000 × 5/70 = Rs. 4,500

Y’s Gain = Rs. 63,000 × 9/70 = Rs. 8,100

Z’s Sacrifice = Rs. 63,000 × 4/70 = Rs. 3,600

Points of Students:

(i) For Transfer of Reserve and Accumulated Profits:

Reserve A/c Dr.

Profit & Loss A/c Dr.

Workmen’s Compensation Reserve A/c Dr. (Excess of Reserve over Actual Liability)

Investment Fluctuation Reserve A/c Dr.

(Excess of Reserve over difference between Book value and Market value)

To Old Partner’s Capital or Current A/c (in Old Ratio)

(ii) For transfer of Accumulated Losses:

Old Partner’s Capital or Current A/c Dr. (in Old Ratio)

To Profit & Loss A/c

To Deferred Revenue Expenditure A/c (for example Advertisement Suspense A/c)

Question 61 (new).

Solution 61 (new).

Calculation of Sacrificing and Gaining Ratio:-

A B

Old Ratio 2 : 1

New Ratio 3 : 2

A = 2/3-3/5 = (10 – 9)/15 = 1/15 (Sacrifice)

B = 1/3-2/5 = (5 – 6)/15 = 1/15 (Gain)

Average Profit = (Total Profit)/(Number of Purchases )

Total Profit = Rs. 60,000 + Rs. 80,000 + Rs. 1,30,000

Total Profit = Rs. 1,80,000

Average Profit = (Rs. 1,80,000)/3

Average Profit = Rs. 90,000

Goodwill = Average Profit × Number of year purchases

Goodwill = Rs. 90,000 × 3

Goodwill = Rs. 2,70,000

A’s Sacrifice = Rs. 3,00,000 × 1/15 = Rs. 18,000

B’s Gain = Rs. 3,00,000 × 1/15 = Rs. 18,000

Question 61.

Solution 61

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C D

Old Ratio 5 : 4 : 2 : 1

New Ratio 4 : 3 : 2 : 1

A = 5/12-4/10 = (25 – 24)/60 = 1/60 (Sacrifice)

B = 4/12-3/10 = (20 – 18)/60 = 2/60 (Sacrifice)

C = 2/12-2/10 = (10 – 12)/60 = 2/60 (Gain)

D = 1/12-1/10 = (5 – 6)/60 = 1/60 (Gain)

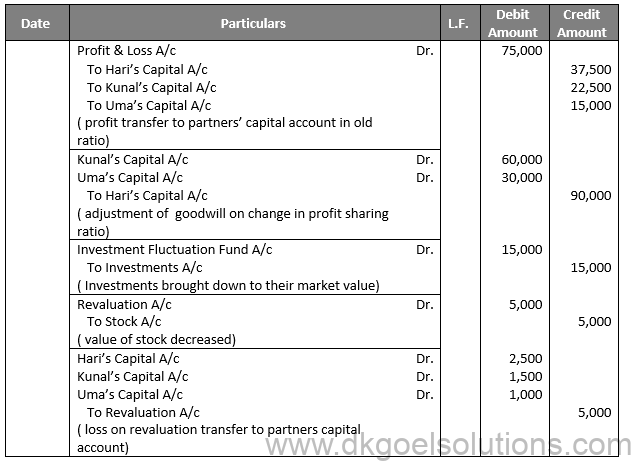

Distributable Profit = Goodwill + Reserves + Profit and Loss (Profit) – Loss on Revaluation

Distributable Profit = Rs. 1,70,000 + Rs. 1,50,000 + Rs. 90,000 – Rs. 86,000

Distributable Profit = Rs. 3,24,000

A’s Sacrifice = Rs. 3,24,000 × 1/60 = Rs. 5,400

B’s Sacrifice = Rs. 3,24,000 × 2/60 = Rs. 10,800

C’s Gain = Rs. 3,24,000 × 2/60 = Rs. 10,800

D’s Gain = Rs. 3,24,000 × 1/60 = Rs. 5,400

Points of Students:

1. If there is no claim against Workmen Compensation Reserve: In such a case, the entire amount of Workmen Compensation Reserve is credited to the Capital Account of partners in their old profit sharing ratio.

The Journal Entry passed is:

Workmen Compensation Reserve A/c Dr.

To Partner’s Capital A/c

(Workmen Compensation Reserve credited to partner’s Capital Accounts in their old profit ratio)

2. We can Calculate Distributable Profit:-

Distributable Profit = Goodwill + Reserves + Profit and Loss (Profit) – Loss on Revaluation

Question 62 (new).

Solution 62 (new).

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

A B C

Old Ratio 1 : 3 : 2

New Ratio 4 : 6 : 5

A = 1/6-4/15 = (5 – 8)/30 = 3/30 (Gain)

B = 3/6-6/15 = (15 – 12)/30 = 3/30 (Sacrifice)

C = 2/6-5/15 = (10 – 10)/30 = 0 (Nil)

Goodwill = (Rs. 80,000) + Rs. 1,20,000 + Rs. 1,40,000 = Rs. 1,80,000

Total Distributable Amount = Goodwill + Reserve + Profit

Total Distributable Amount = Rs. 1,80,000 + Rs. 40,000 + Rs. 30,000

Total Distributable Amount = Rs. 2,50,000

A’s Gain = Rs. 2,50,000 × 3/30 = Rs. 25,000

B’s Sacrifice = Rs. 2,50,000 × 3/30 = Rs. 25,000

Question 62.

Solution 62

Working Note:-

Calculation of Sacrificing and Gaining Ratio:-

Hari Kunal Uma

Old Ratio 5 : 3 : 2

New Ratio 2 : 5 : 3

Hari = 5/10-2/10 = (5 – 2)/10 = 3/60 (Sacrifice)

Kunal = 3/10-5/10 = (3 – 5)/10 = 2/60 (Gain)

Uma = 2/10-3/10 = (2 – 3)/10 = 1/60 (Gain)

Points of Students:

Following entries are passed for the purpose of revaluation:-

(i) For decrease in the value of assets:

Revaluation A/c Dr.

To Assets A/c

(Decrease in the value of assets)

(ii) For increase in the value of assets:

Assets A/c Dr.

To Revaluation A/c

(Increase in the value of assets)

Question 63 (new).

Solution 63 (new).

Working Note:-

Sacrificing Ratio = Old Ratio – New Ratio

L’s Sacrificing Ratio = 2/10-1/5 = Nil

M’s Sacrificing Ratio = 3/10- 2/5=-1/10 (Gain)

N’s Sacrificing Ratio = 5/10 – 2/5=1/10 (Sacrifice)

Question 64 (new).

Solution 64 (new).

Sacrificing ratio is a ratio of pre-existing profit of the old partners. The existing partners surrender a significant portion of this profit to the newly admitted partners. The share grab by the new partner is usually supplied by some of the existing partners or all the partners of the firm.

Sacrificing ratio can be calculated as the difference between the old profit ratio and the new ratio.

Sacrifice Ratio = Old Profit-Sharing Ratio – New Profit-Sharing Ratio

The gaining ratio is usually a tool to measure the distribution of the share of a retired or dead partner of a firm among the existing partners. It is basically used when a partner dies or retires from the business. By the gaining ratio, the other active partners of the firm can squeeze out the share of those partners.

Gaining Ratio can be defined as the difference between the old profit-sharing ratio and the new profiting-sharing ratio between the partners of a firm.

Gaining Ratio = New Profit-Sharing Ratio – Old Profit-Sharing Ratio

The gaining ratio is generally calculated on the admission, Retirement, death of any partner into the firm. However, there are certain pre-defined criteria for calculating the gaining ratio, which is as follows –

● When the partnership agreement does not specify about the new profit-sharing proportion.

● In case when the partnership contract defines unequal or inappropriate gains of the partners.

Here are the most important points when a firm reconstitutes –

● Admission of one or more new partners in the firm.

● Death or Retirement of one or more partners.

● Change in the profit-sharing ratio among the partners of the firm.

DK Goel Solutions are the most dedicated study resource to score well in the Class 12 Accountancy examination. The solutions are clear to understand and curated by experts to make learning easier and more interesting for the students. The precise solutions teach the students to deal with difficult questions and play a major role in their preparation for the exams.

Also refer to TS Grewal Solutions for Class 12