DK Goel Solutions Chapter 6 Dissolution of Partnership Firm

Read below DK Goel Solutions for Class 12 Chapter 6 Dissolution of Partnership Firm. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

A partnership firm can be dissolved because of various reasons such as the closure of Business or agreement amongst all partners to completely dissolve the partnership or maybe because of the death of partners. students will be able to understand in this chapter what are the different types of reasons for the dissolution of a partnership as well as how the accounting treatment has to be performed in such cases.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career. These solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Dissolution of Partnership Firm DK Goel Class 12 Accountancy Solutions

Short Answer Questions

Q1.

Solution 1 The conditions in which a corporation is dissolved are below:—

1.) Where an unsound spirit has become a companion.

2.) Where a partner has been permanently unaware of fulfilling his responsibilities as a partner, rather than the partner filing a suit.

3.) Where a partner is accused of wrongdoing that may damage the relationship, rather than the partner bringing a suit.

4.) When a partner, rather than the partner filing a suit, commits a violation of the relationship arrangement will fully or persistently.

5.) If a partner has passed all of his rights in the business to a third party, rather than the partner filing a suit.

Q2.

Solution 2

Q3.

Solution 3 To dispose of all the company’s properties and make payments to all the creditors, a ‘Realisation Account’ is opened. The account realization is a nominal account and the intent of such an account is to assess the benefit or loss on the asset realization and the payment of liabilities.

Q4.

Solution 4 The sum recognized by the selling of the company’s properties shall be spent in the following manner and order:

1.) Second of all, the company’s external debts would be paid for.

2.) The loans advanced by partners will be paid off out of the remaining sum.

3.) The balance of the Spouses’ Capital Account will be restored afterwards.

4.) If any amount exists, in their benefit share ratio it will be split among the partners.

Q5.

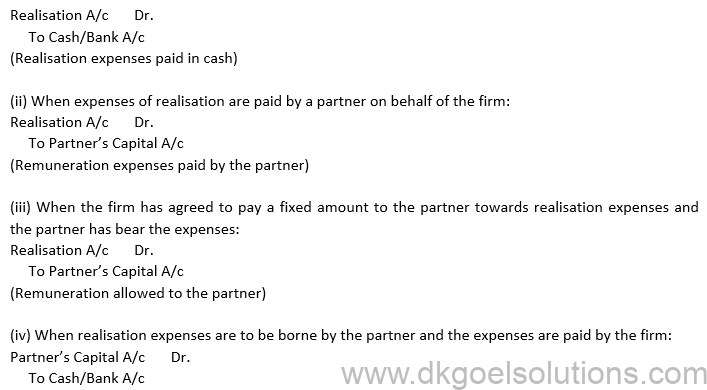

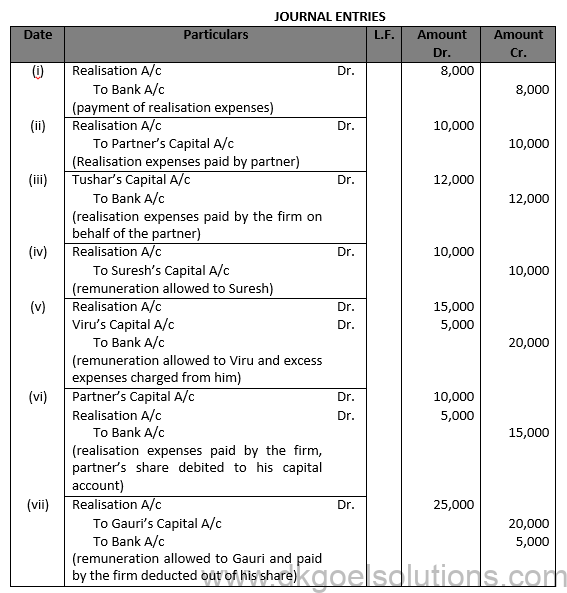

Solution 5 (i) When expenses are paid by the firm:

(Realisation expenses paid on behalf of the partner)

(v) No entry will be passed if the expenses are to be borne and paid by the partner out of his pocket.

Q6.

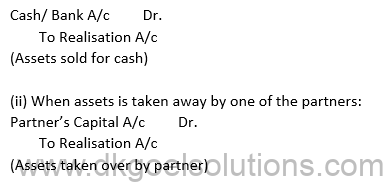

Solution 6 (i) When assets are sold for cash:

(iii) If an asset is given away to a Creditor in part or full payment of his dues, the agreed amount of the asset is deducted from the claim of the creditor and the balance is paid to him. No entry is passed for the transfer of assets to the creditor.

Q7.

Solution 7 The following accounts are opened in the order to dissolution of partnership firm:-

1.) Realisation Account

2.) Partner’s Loan Account

3.) Partner’s Capital Account

4.) Cash or Bank Account

Practical Questions

Q1.

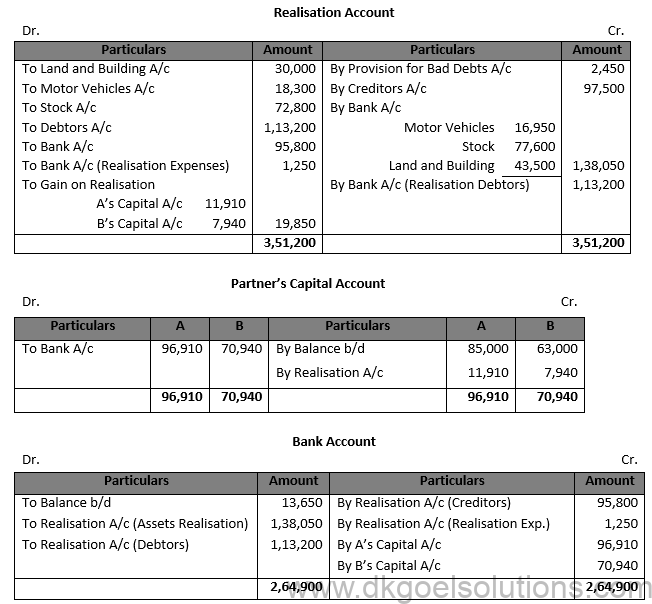

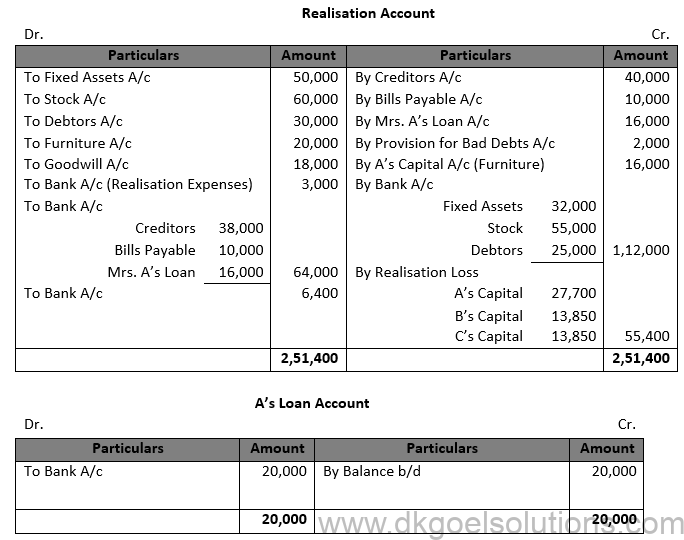

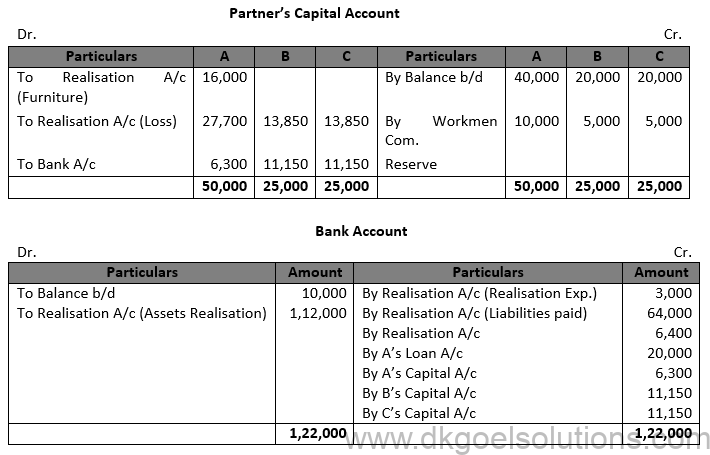

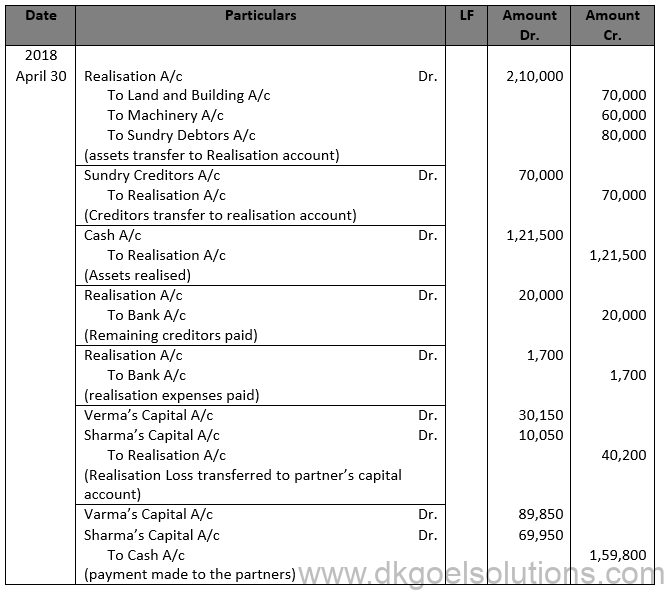

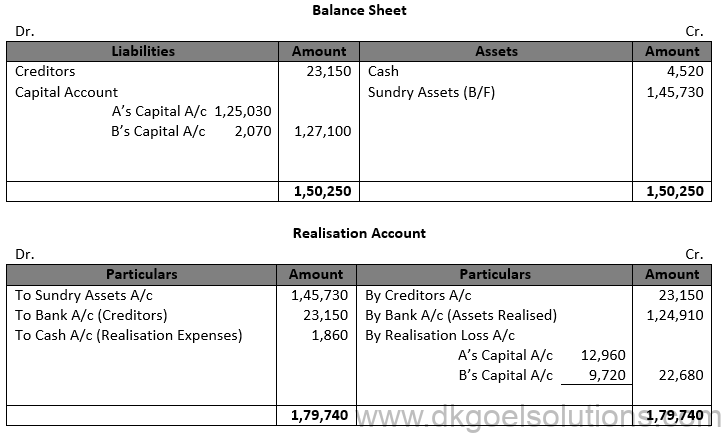

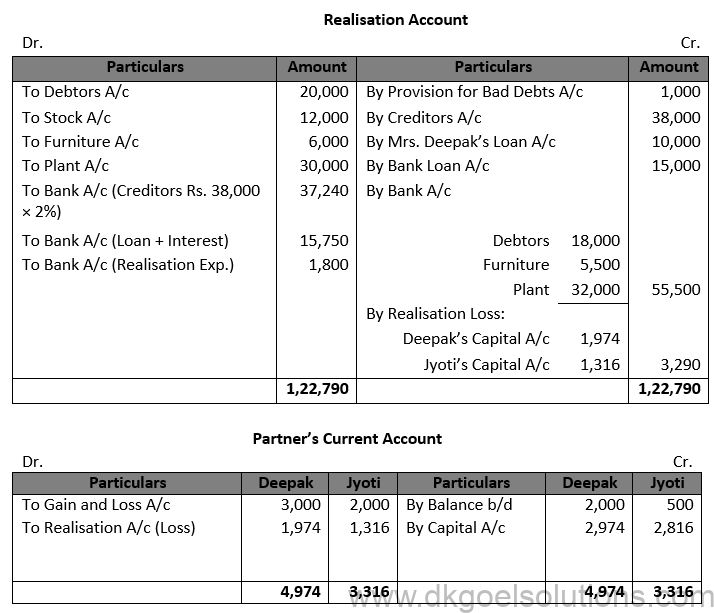

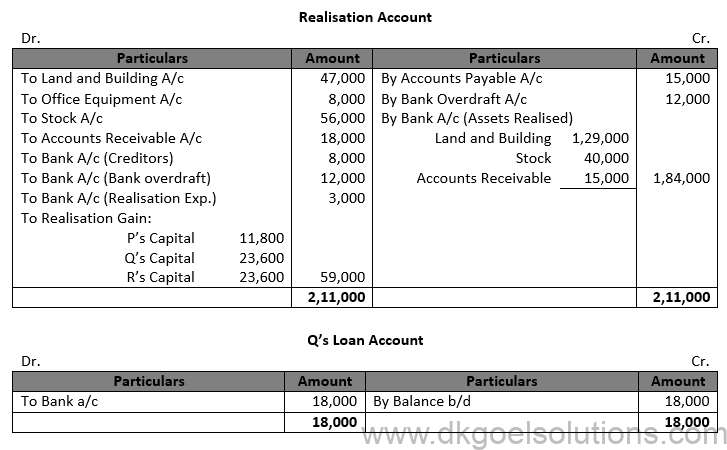

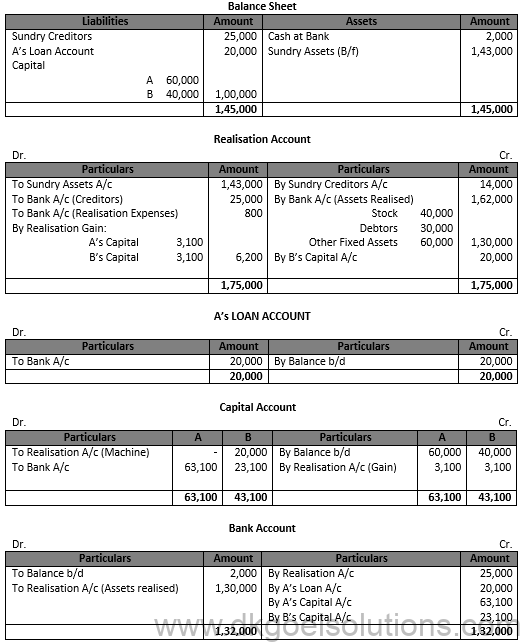

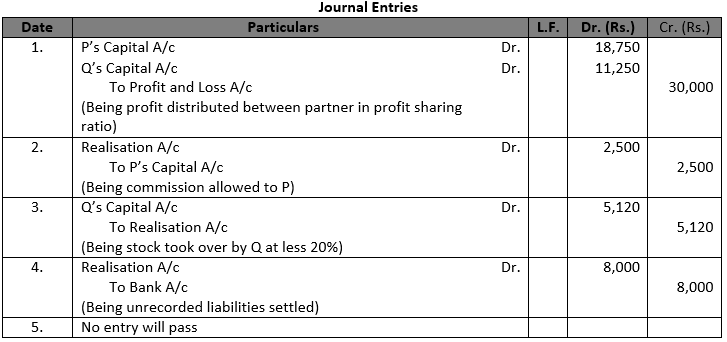

Solution 1

Points for Students:-

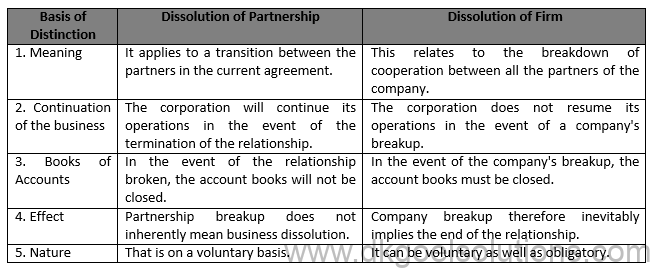

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q2.

Solution 2

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

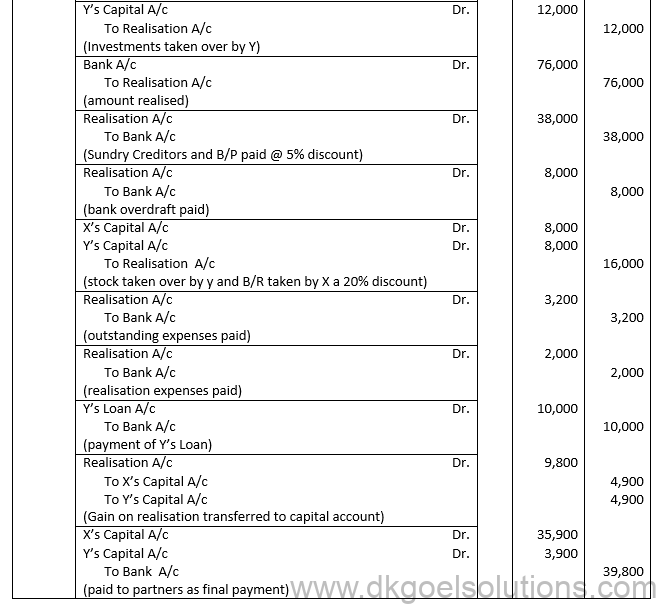

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan

Q3.

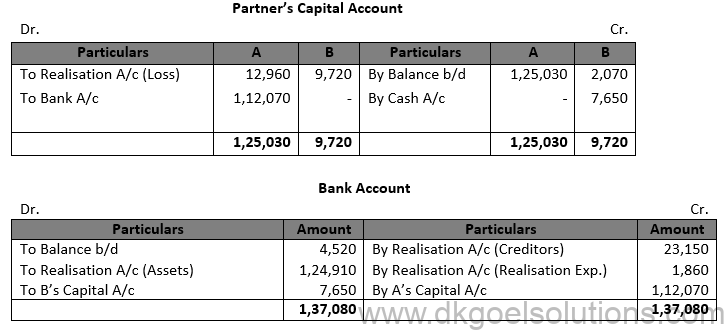

Solution 3

Point for Students:-

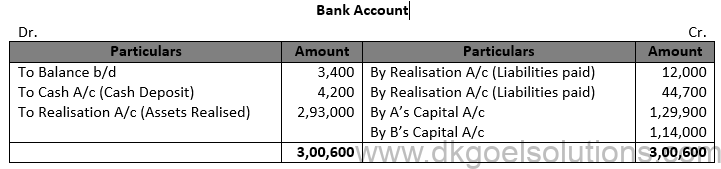

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q4.

Solution 4

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q5.

Solution 5

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan)

Q6.

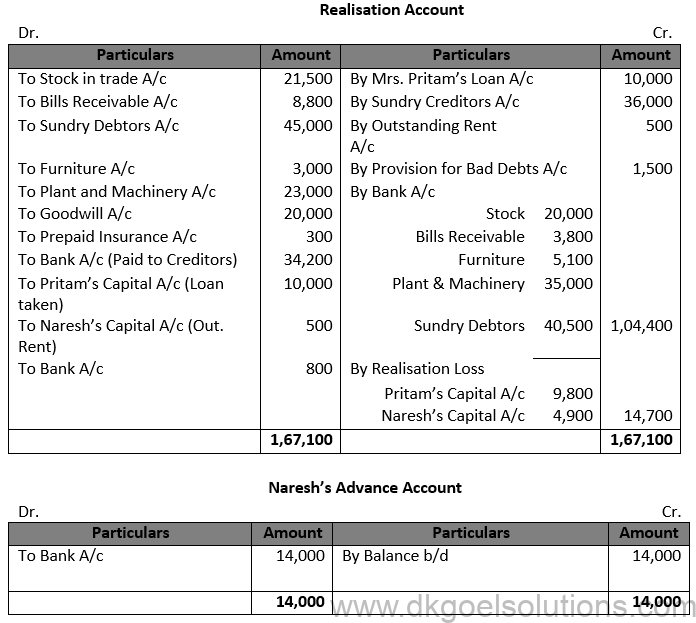

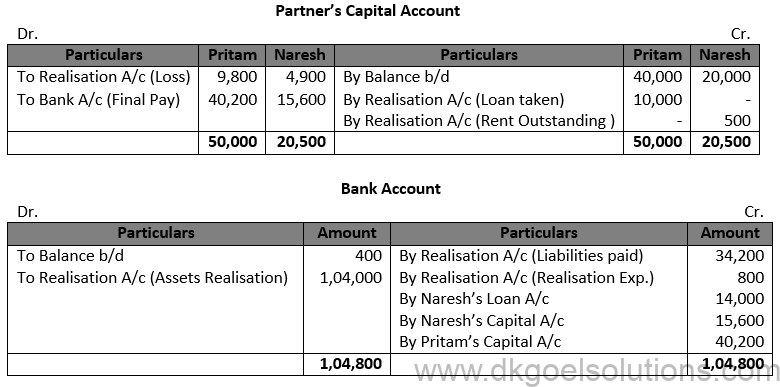

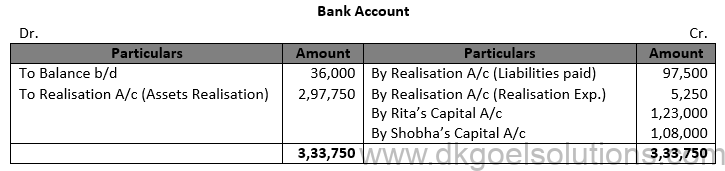

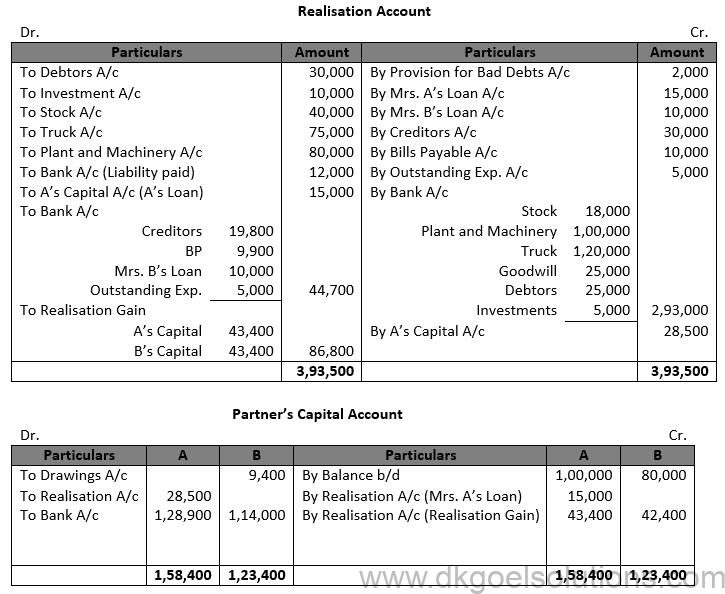

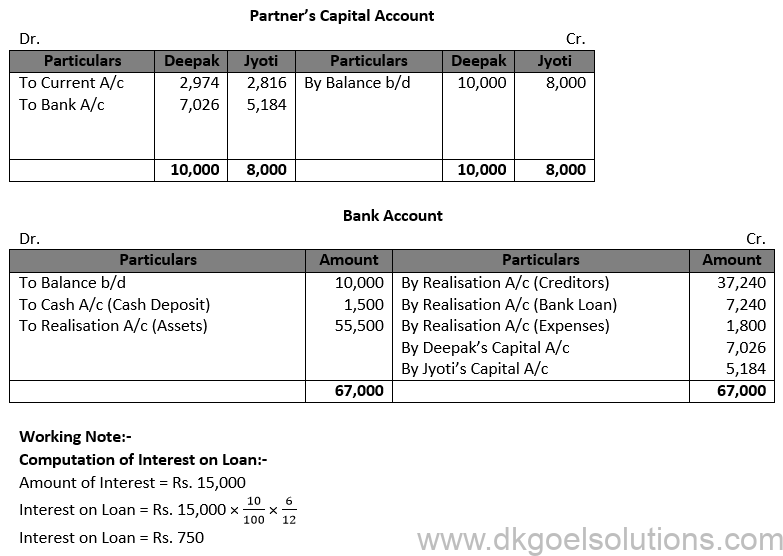

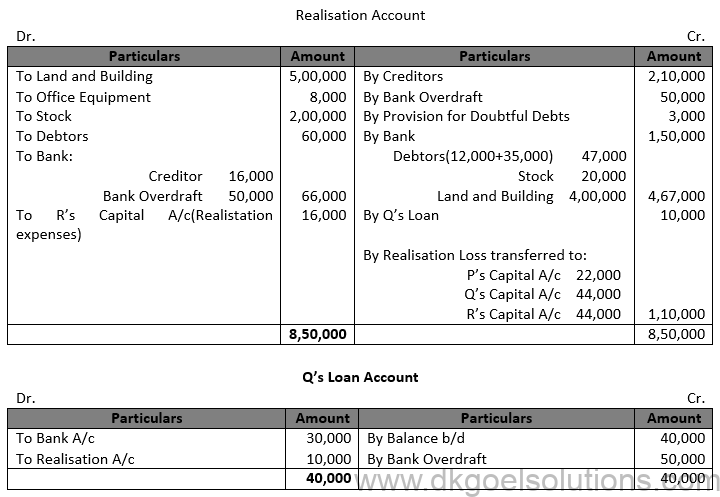

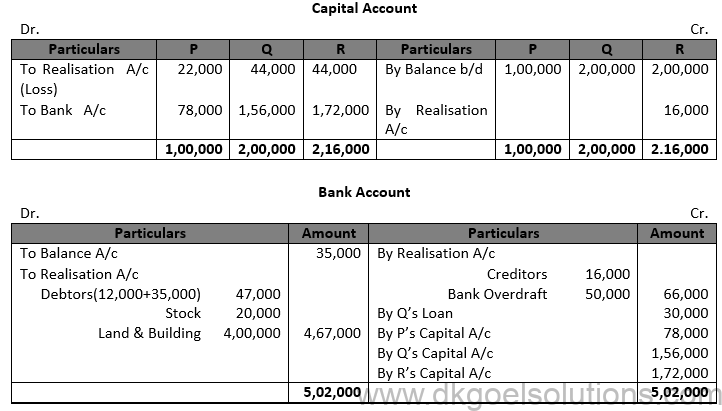

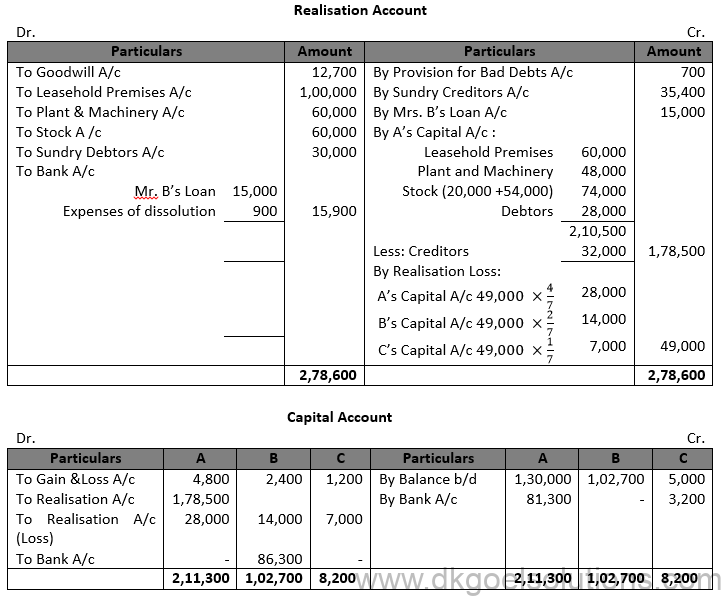

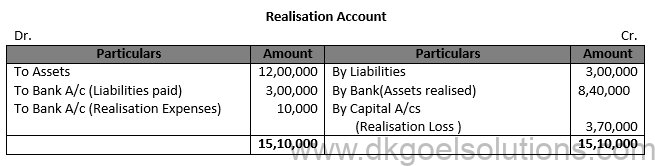

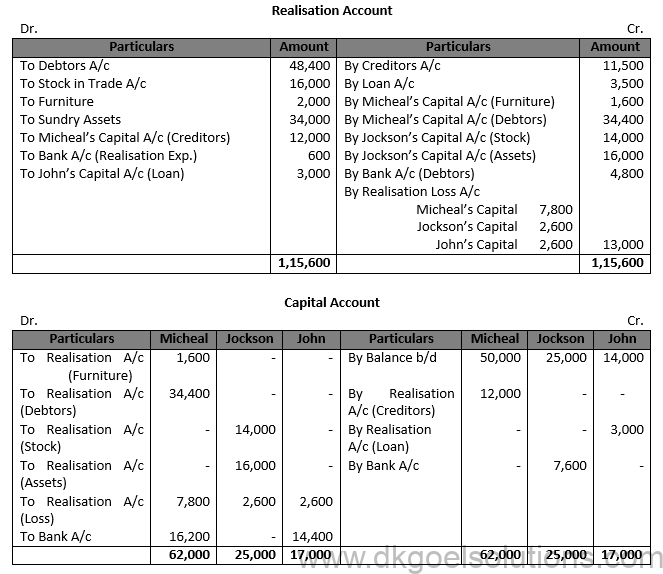

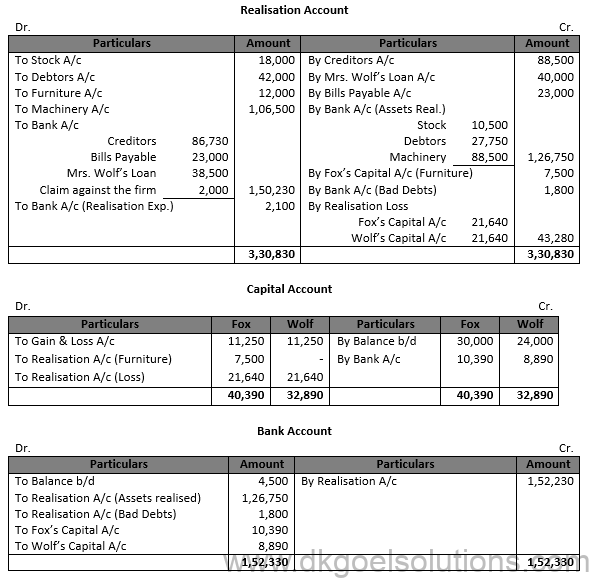

Solution 6 Realisation Account

For the year of 31 March, 2021

Point for Students:-

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q7.

Solution 7

Points for Students:-

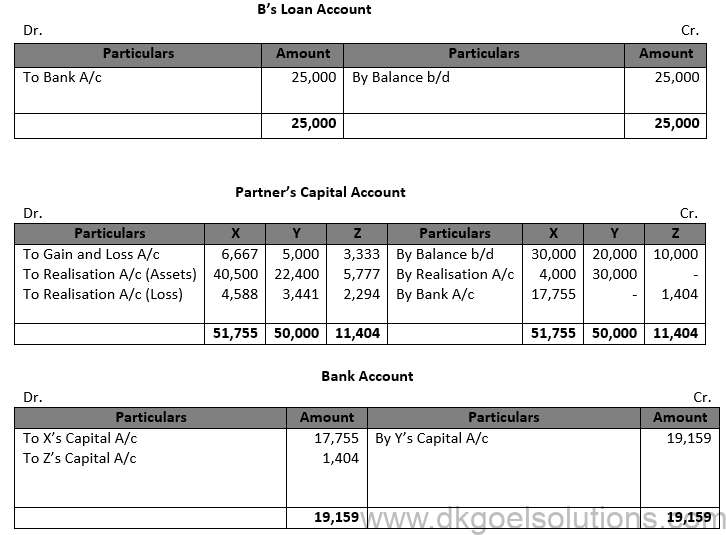

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q8.

Solution 8

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q9.

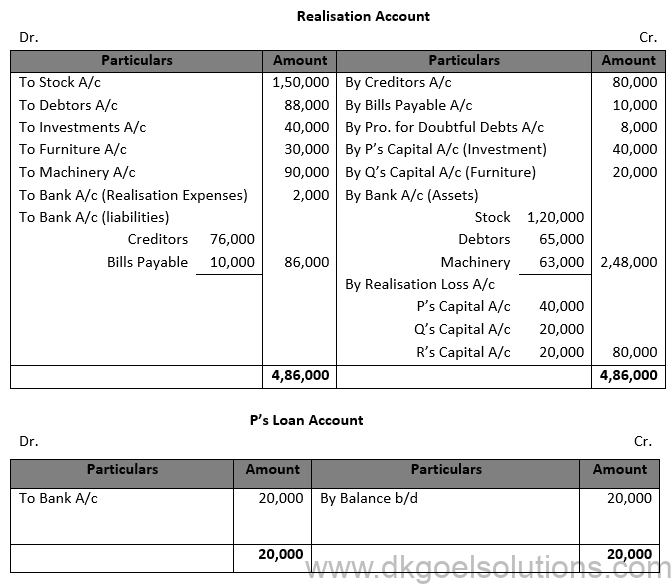

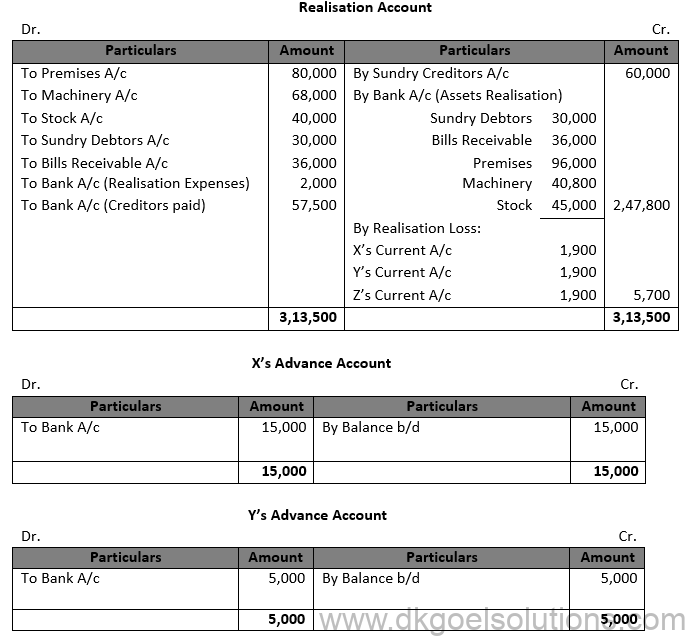

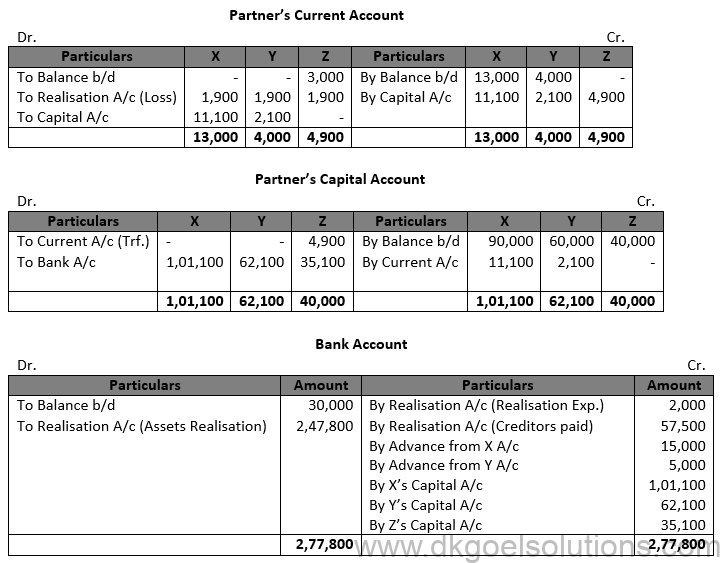

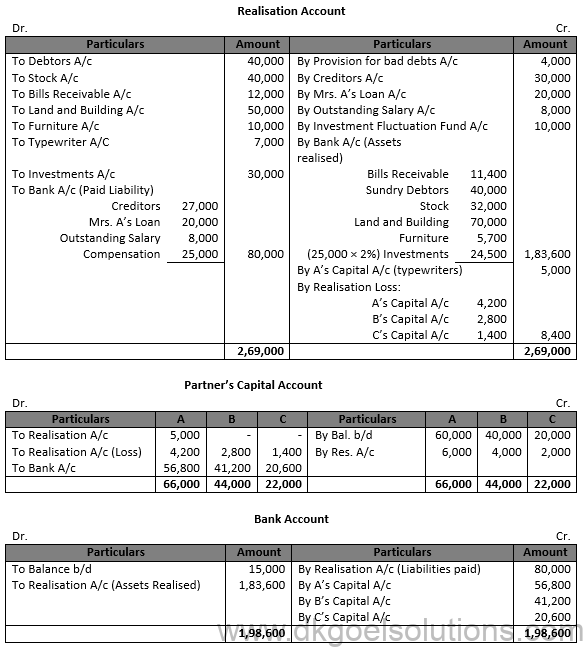

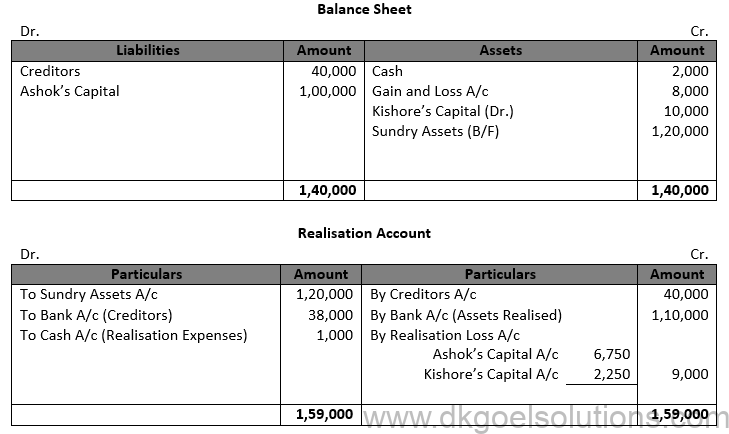

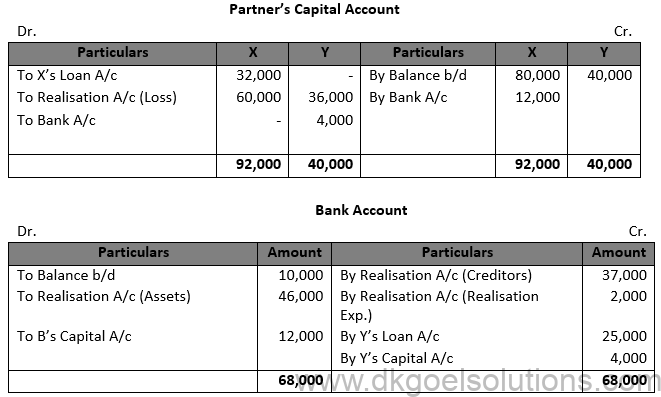

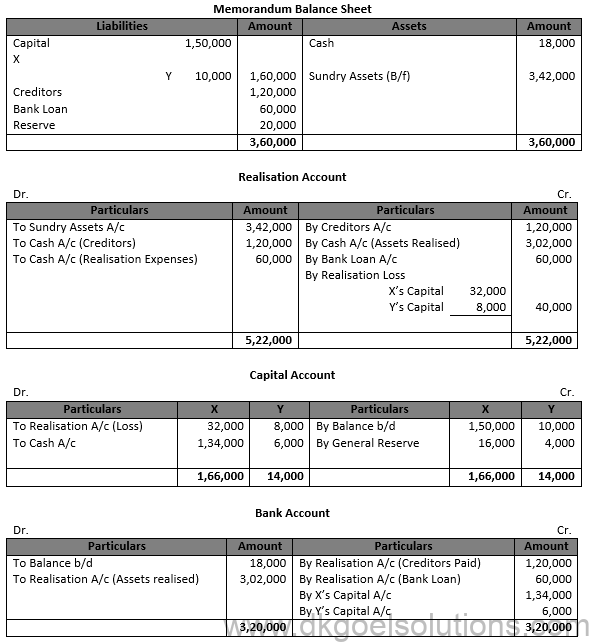

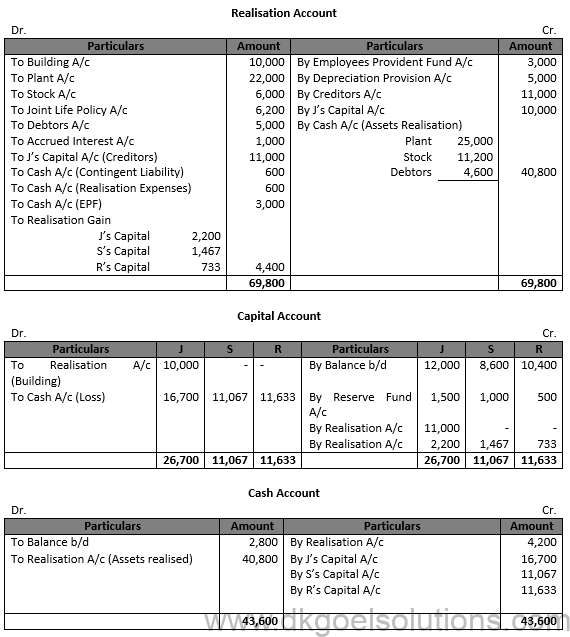

Solution 9 Realisation Account

For the year of 31 March, 2021

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Point of Knowledge:-

(i) When expenses are paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Being Realisation expenses paid in cash)

(ii) When expenses of realisation are paid by a partner on behalf of the firm:

Realisation A/c Dr.

To Partner’s Capital A/c

(Being Remuneration expenses paid by the partner)

Q10. (A)

Solution 10 (A)

Point of Knowledge:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below is the entry of if expenses realisations are paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

Q10. (B)

Solution 10 (B)

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q11. :

Solution 11

Q12.

Solution 12

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan

Q13.

Solution 13

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q14.

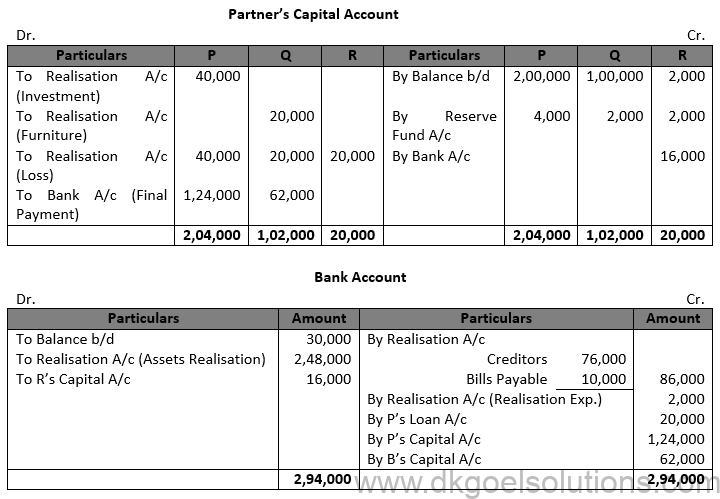

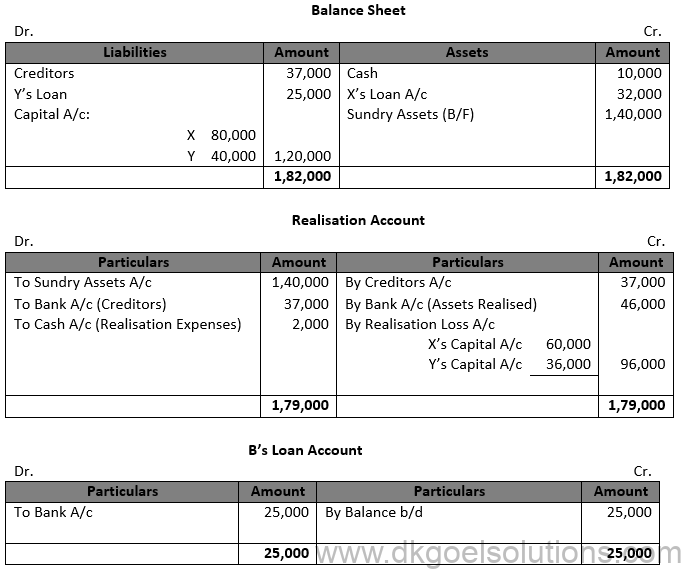

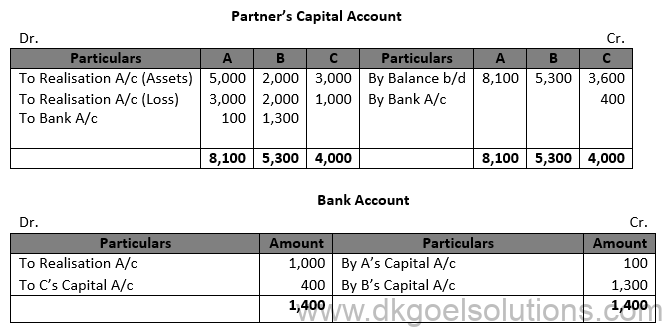

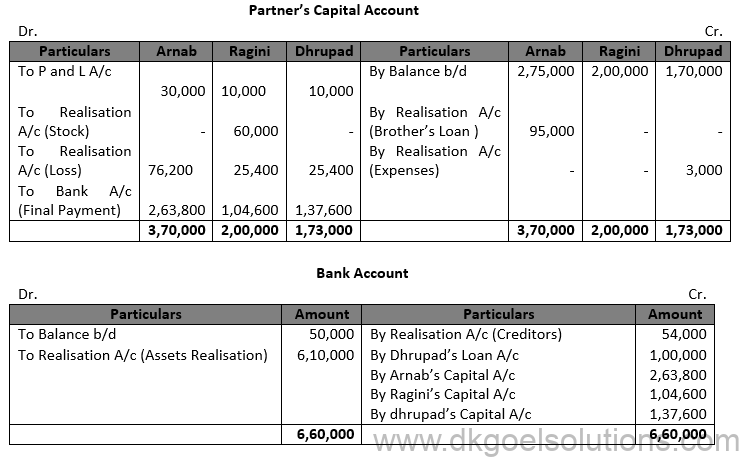

Solution 14 Realisation Account

as at 31 March, 2021

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan)

Q15.

Solution 15

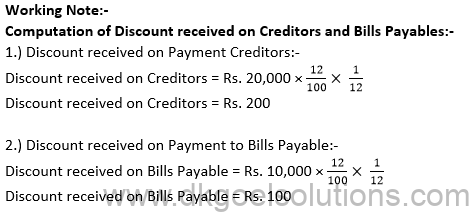

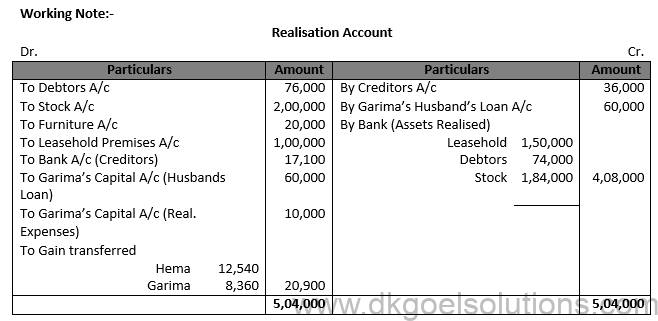

Working Note:-

1.) Computation of Realisation Loss/ Gain:-

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q16.

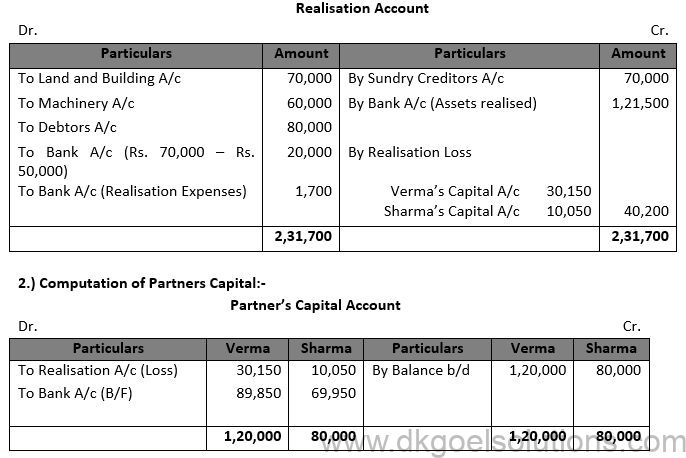

Solution 16

Working Note:-

1.) Computation of Realisation Loss:-

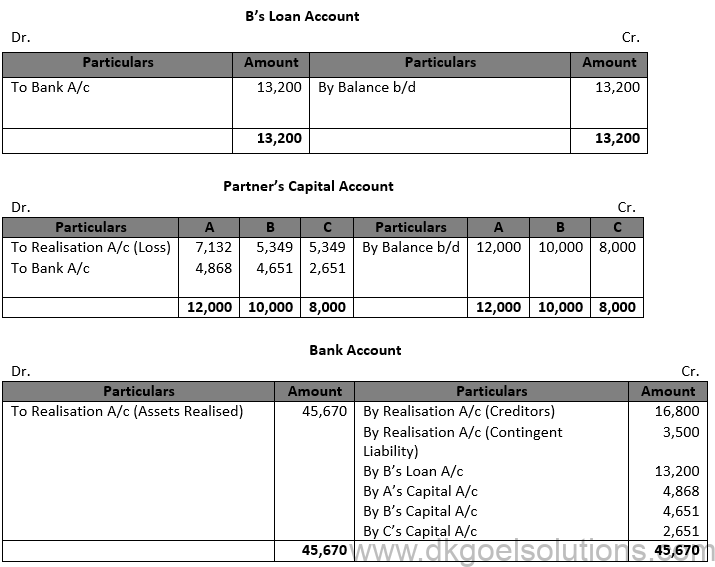

Q17.

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q18.

Solution 18

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan)

Q19.

Solution 19

Q20.

Solution 20

Points for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below is the entry of expenses on realisation paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

Q21.

Solution 21

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan)

Q22.

Solution 22

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q23.

Solution 23

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q24.

Solution 24

Points for Students:-

If a partner has given any loan to the firm, his loan will be paid off after all the outside liabilities are paid in full. Therefore, Partner’s loan account is not transferred to the realisation account and his loan account is prepare separately and paid off by passing the following entry:

Journal Entry:-

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Paid Partners loan)

Q25.

Solution 25

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q26. (A)

Solution 26 (A)

Point for Students:-

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q26. (B)

Solution 26

(B)

Points for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below is the entry of expenses on realisation paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

(iii) Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q27.

Solution 27

Point for Students:-

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q28. (A)

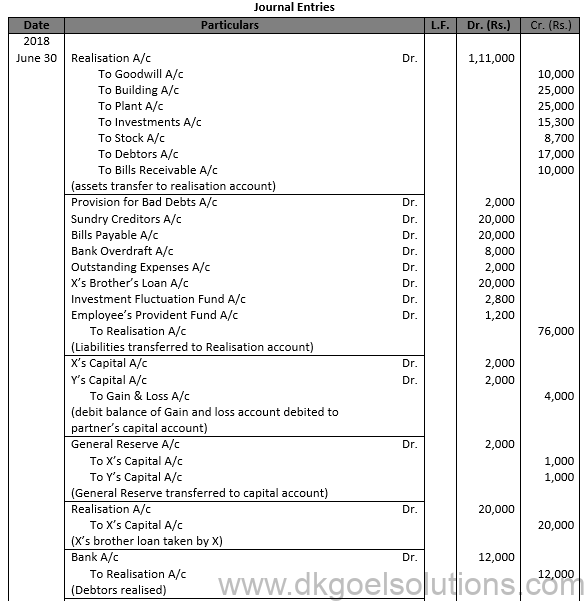

Solution 28 (A)

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q28. (B)

Solution 28 (B)

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q29.

Solution 29

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q30.

Solution 30

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q31.

Solution 31

Points for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

Q32.

Solution 32

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q33.

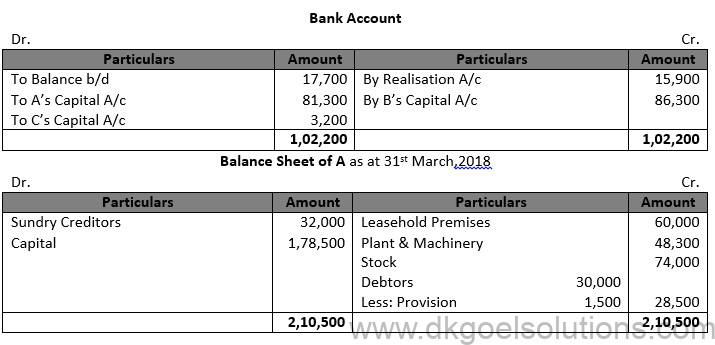

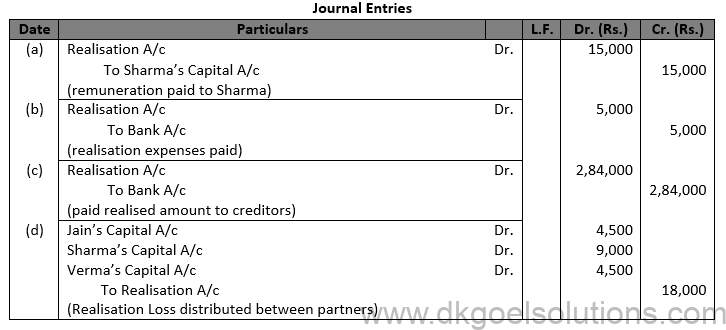

[Ans.(a) Debit Realisation A/c and Credit Sharma’s Capital A/c by Rs. 15,000.(b) Debit Realisation A/c and Credit Bank A/c by Rs. 5,000.

(c) Debit Realisation A/c and Credit Bank A/c by Rs. 2,84,000.

(d) Debit Partners Capital A/cs respectively by Rs. 4,500, Rs. 9,000 and Rs. 4,500 and Credit Realisation A/c by Rs. 18,000.]

Solution 33

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q34.

Solution 34

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q35.

Solution 35

Points for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

Q36.

Solution 36

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q37.

Solution 37

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q38.

Solution 38

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q39.

Solution 39

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q40 (new).

Solution 40 (new).

Q40.

Solution 40

Q41.

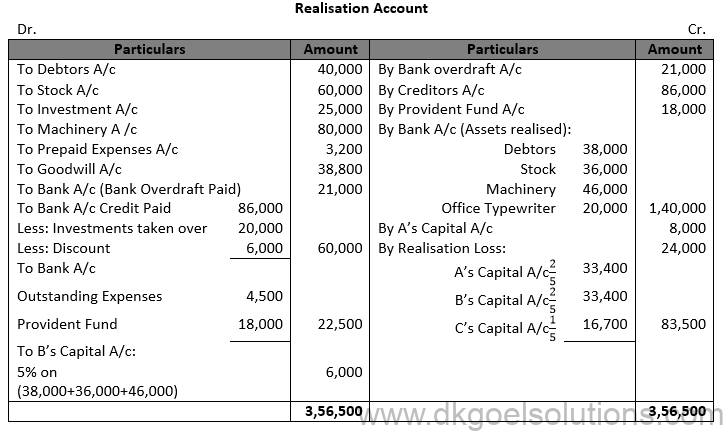

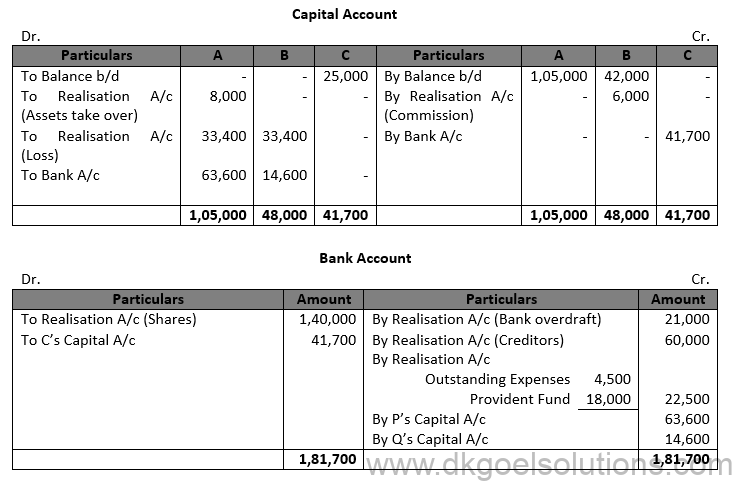

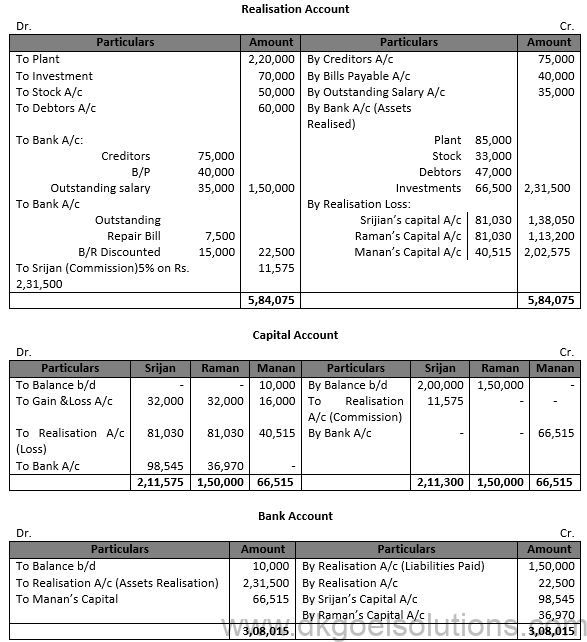

Solution 41 Realisation Loss can be easily calculated by preparing a realisation account:

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q42.

Solution 42

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q43.

Solution 43

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q44.

Solution 44

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q45.

Solution 45

Point for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below is the entry of expenses on realisation paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

Q46.

Solution 46

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q47.

Solution 47

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q48.

Solution 48

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q49.

Solution 49

Point for Students:-

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q50.

Solution 50

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q51.

Solution 51

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q52.

Solution 52

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q53.

Solution 53

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q54.

Solution 54

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q55.

Solution 55

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q56.

Solution 56

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

Q57.

Solution 57

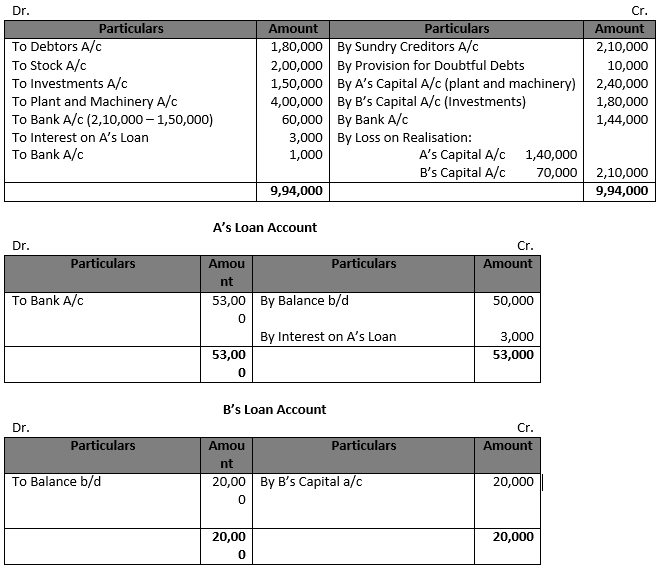

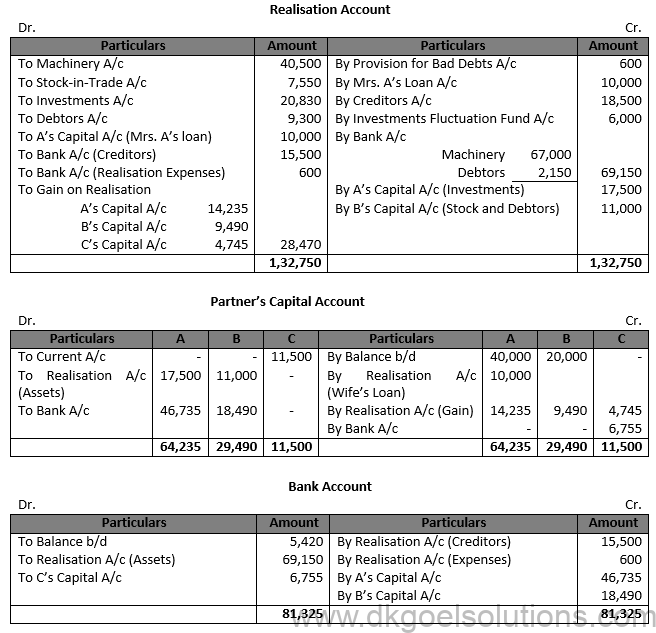

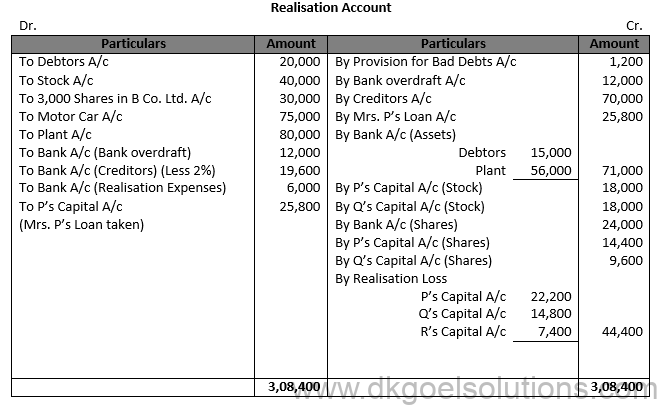

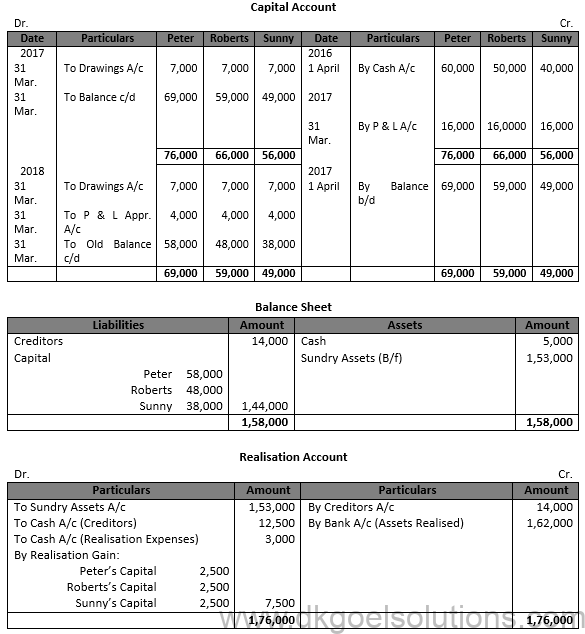

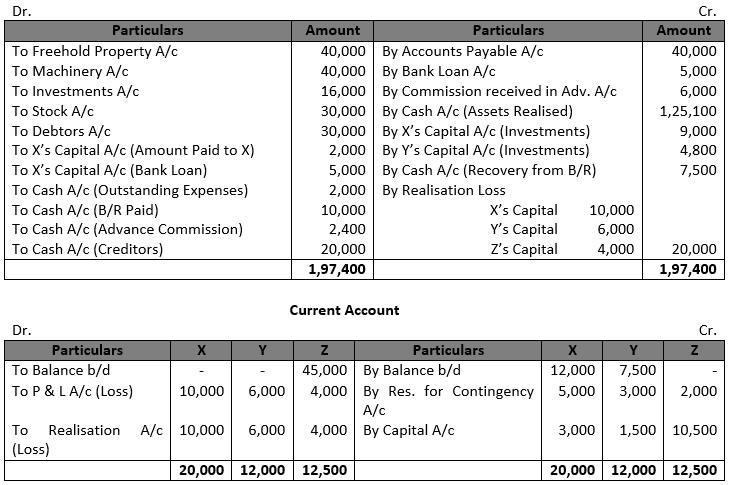

Realisation Account

as at 31st March, 2021

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Q58.

Solution 58

Point of Knowledge:-

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarised as under:

(i) If goodwill is already appearing in the Balance Sheet, it is treated like any other asset, and is transferred to the Realisation Account at the value given in balance sheet. Following entry will be passed for it:

Realisation A/c Dr.

To Goodwill A/c

(ii) If goodwill is not appearing in the Balance Sheet, the above mentioned entry will not be passed.

Q59.

Solution 59

Point for Students:-

(i) Below Entries will be passed if expenses are paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below Entries will be passed if expenses of realisation are paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

Q60.

Solution 60

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

Q61.

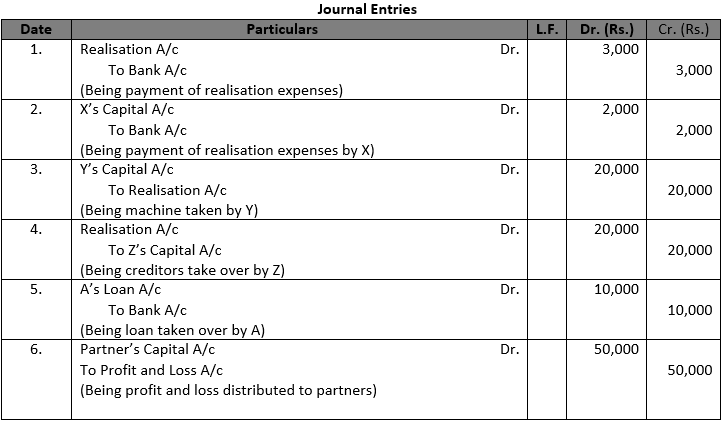

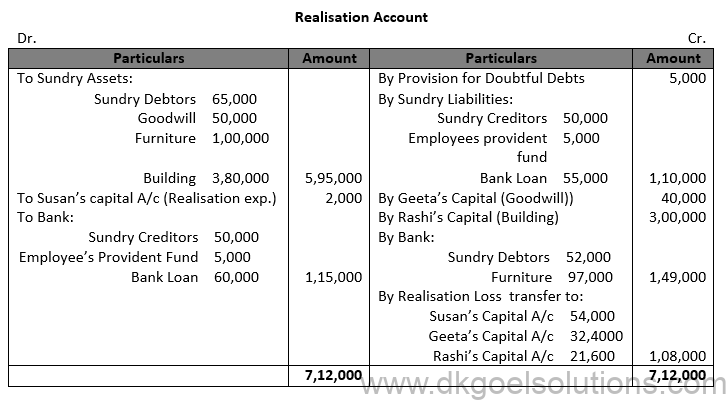

Solution 61 Realisation Account

As at 31st March, 2021

Point of Knowledge:-

(i) When expenses are paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Being Realisation expenses paid in cash)

(ii) When expenses of realisation are paid by a partner on behalf of the firm:

Realisation A/c Dr.

To Partner’s Capital A/c

(Being Remuneration expenses paid by the partner)

Q62.

Solution 62

Points for Students:-

In all questions it is necessary to prepare various accounts in the following order:

(a) First all realisation account should be prepared.

(b) Secondly, if a partner has given any loan to the firm, Partner’s Loan Account should be prepared.

(c) Thereafter Partner’s Capital Accounts are prepared.

(d) Bank Account is prepared last of all.

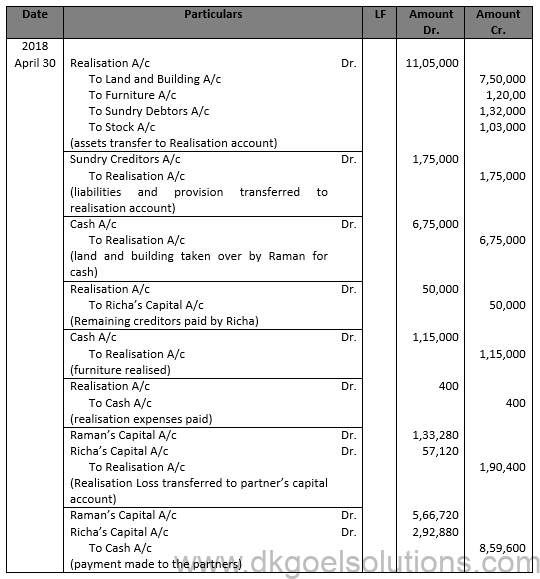

Q63 (new).

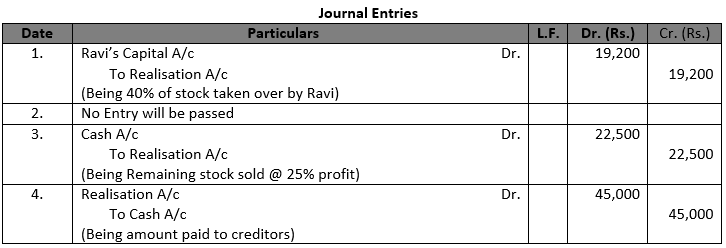

Solution 63 (new).

Q63.

Solution 63

Points for Students:-

(i) Below is the entry of expenses paid by the firm:

Realisation A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid in cash)

(ii) Below is the entry of expenses on realisation paid by a partner:

Realisation A/c Dr.

To Partner’s Capital A/c

(Remuneration expenses paid by the partner)

Q64 (new).

Solution 64 (new).

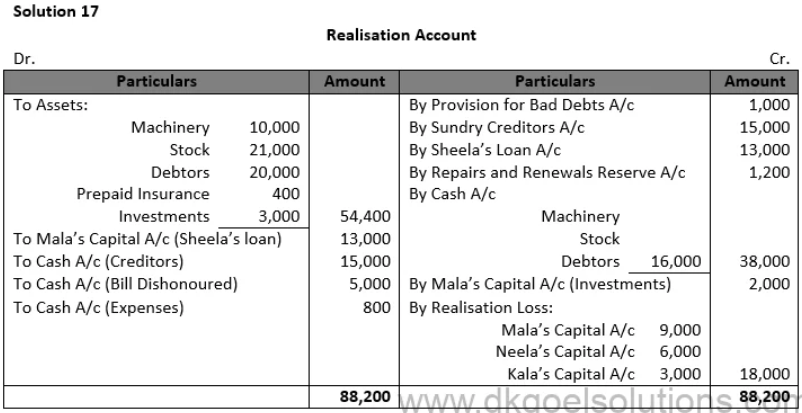

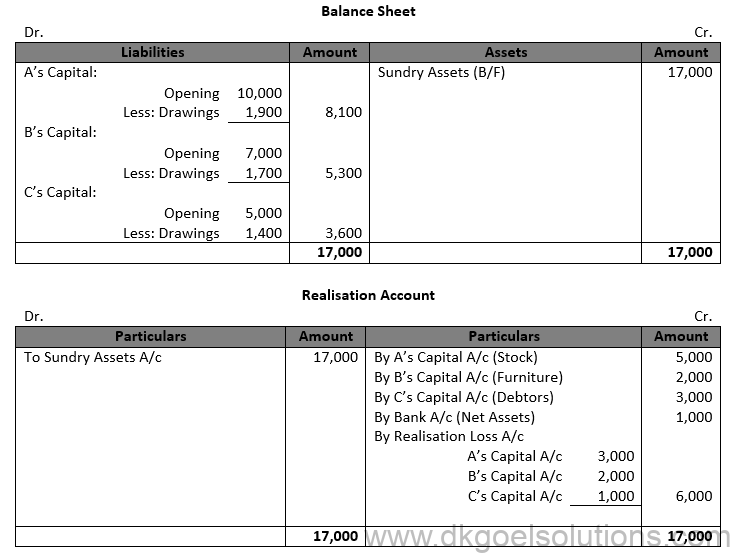

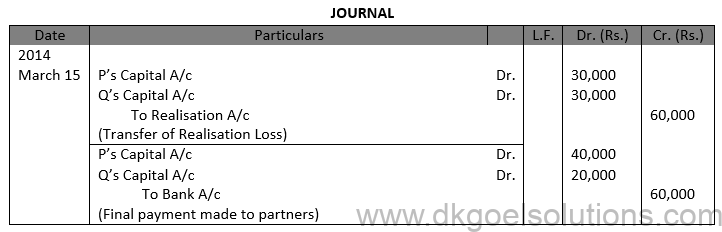

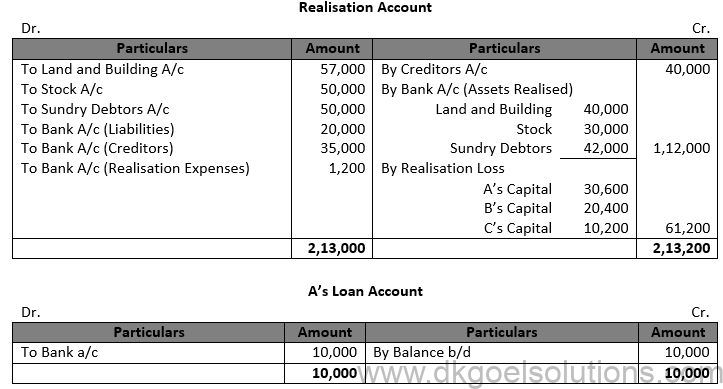

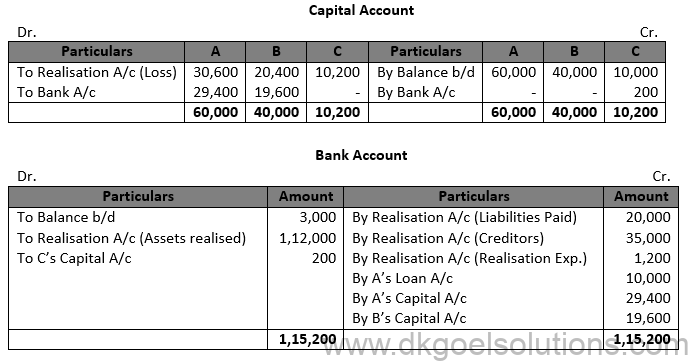

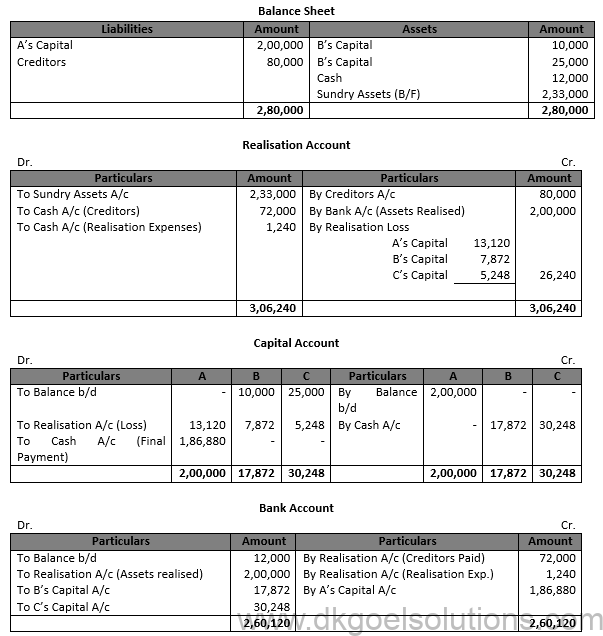

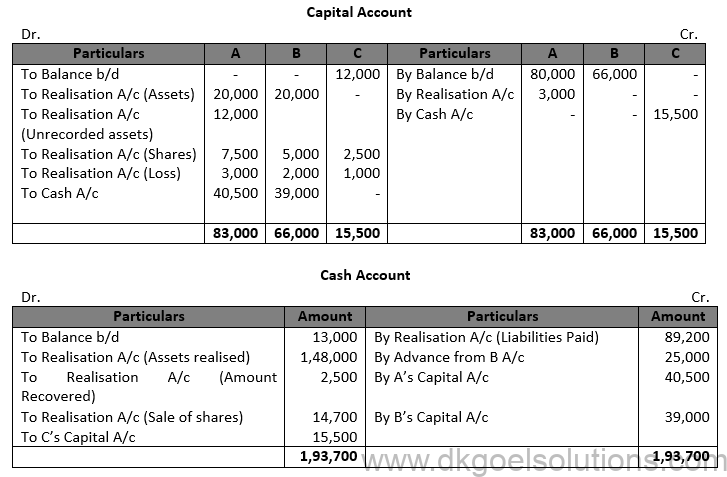

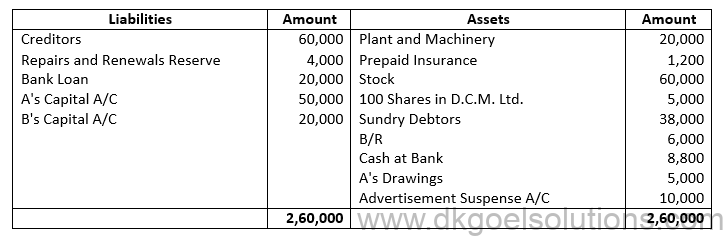

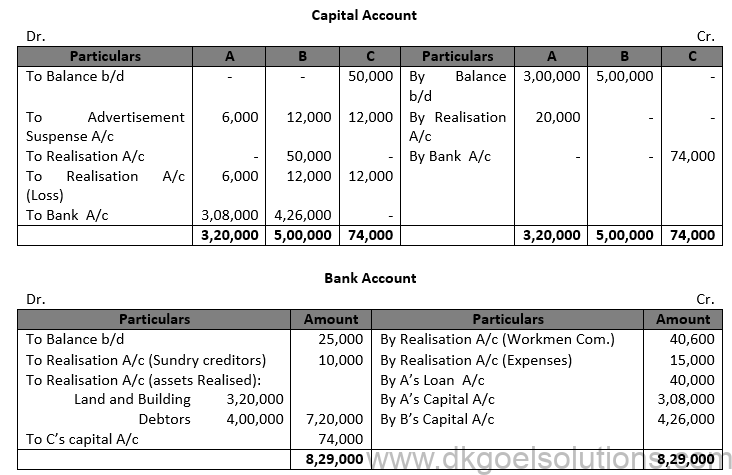

Q64. A, B and C shared Gains in the ratio of 1:2:2. Following is their Balance Sheet on the date of dissolution :

Solution 64

Point for Students:-

If Cash balance and Bank balance both are given in the balance sheet, only one account, either cash account or a Bank account is prepared. If cash account is prepared, an entry is passed for withdrawing the Bank balance and if a Bank account is prepare the cash balance is deposited into the bank.

Q65 (new).

Solution 65 (new).

Q65.

Solution 65

Points for Students:-

Dissolution of partnership means termination of the old partnership agreement and a reconstruction of the firm due to admission, retirement and death of a partner. Dissolution of partnership may or may result into closing down of the business as the remaining partners may agree to carry on the business under a new agreement.

Dissolution of partnership ‘firm’ means that the firm closes down its business and comes to an end. On the dissolution of the firm, the assets of the firm are sold and liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

The dissolution of a Partnership firm basically depicts the discontinuation of a business owned by two or more partners. This terminates all the contracts and bonds between the partners of the firm and clear-outs the operation of the business.

Generally, dissolution of a partnership firm occurs when all the partners of the respective firm are termed insolvent. It can also take place when the partnership agreement between the members needs to be subjected to modification. This change in the agreement can occur due to various reasons. For instance, a firm can be dissolved with the change in composition by either adding a new member or eliminating a partner. In these types of circumstances, the dissolution of a partnership, the firm comes into play.

Although there may be a bunch of reasons for the dissolution of a partnership firm, here are the most prominent ones –

● If there are any modifications in the current profit-sharing ratio between the existing members of the firm.

● If an existing partner retires or deceases.

● In case the partnership was created on the ground of pre-defined objectives, and they are fulfilled presently.

● In case there is any violation of the terms and conditions by the partners.

Here are the common ways to dissolve a partnership firm –

Pre-defined Contracts – In case the partnership was created for a pre-fined duration, it can be terminated at the accomplishment of the short-term objectives defined in the partnership deed at the time of its creation.

Legal Order – If a partner legally applies to the court to dissolve a firm, and the authority is satisfied to grant the permission, the firm may be dissolved.

A Partnership Dissolution Deed is a legal document that permits the dissolution of a partnership firm.

The three types of partnerships are –

● General Partnership

● Limited Liability Partnership

● Limited Partnership

Also refer to TS Grewal Solutions for Class 12