HOTS Accountancy Class 12 Chapter 2 Accounting for Partnership: Basic Concepts

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Accounting for Partnership with solutions given below, this will help them to understand the concepts and related questions given in the Class 12 Accountancy textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations.

Question: State the conditions under which capital balances may change under the system of a Fixed Capital Account.

Answer: (i) When additional capital is introduced.

(ii) When capital is withdrawn.

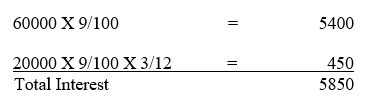

Question: A is partner in a firm. His capital as on Jan 01, 2007 was Rs. 60,000. He introduced additional capital of Rs. 20000 on Oct 01 2007. Calculate interest on A’s capital @ 9% p.a.

Question: Alka, Barkha and Charu are partners in a firm having no partnership agreement. Alka, Barkha and Charu contributed Rs. 20,000, Rs. 30,000 and Rs. 1,00,000 respectively. Alka and Barkha desire that the profit should be divided in the ratio of capital contribution. Charu does not agree to this. How will you settle the dispute.

Answer: Charu is correct as in the absence of partnership agreement, profits and losses are divided equally among partners.

Question: A and B are partners in a firm without a partnership deed. A is an active partner and claims a salary of Rs. 18,000 per month. State with reason whether the claim is valid or not.

Answer: A’s claim is not valid as in the absence of partnership deed, no salary is allowed to partners.

Question: Chandar and Suman are partners in a firm without a partnership deed. Chandar’s capital is Rs. 10,000 and Suman’s capital is Rs. 14,000. Chander has advanced a loan of Rs. 5000 and claim interest @ 12% p.a. State whether his claim is valid or not.

Answer: Chander’s claim is not valid as in the absence of partnership deed interest on partners loan is provided @ 6% p.a.

Question: R, S, and T entered into a partnership of manufacturing and distributing educational CD’s on April 01, 2006. R looked after the business development, S content development and T financed the project. At the end of the year (31-03-2007) T wanted an interest of 12% on the capital employed by him. The other partners were not inclined to this. How would you resolve this within the ambit of the Indian Partnership Act, 1932?

Answer: As per provision of Indian Partnership act 1932, when there is no partnership, no partner is entitled for interest on his capital contribution.

Question: A, B and C are partners in a firm. A withdrew Rs. 1000 in the beginning of each month of the year. Calculate interest on A’s drawing @ 6% p.a.

Answer: Interest on drawing = 12000 X 6/100 X 6.5/12 = 390

Question: A, B and C are partners in a firm, B withdrew Rs. 800 at the end of each month of the year. Calculate interest on B’s drawings @ 6% p.a.

Answer: Interest on drawing = 9600 X 6/100 X 5.5/12 = 264

Question: A, B and C are partners in a firm. They have omitted interest on capital @ 10 % p.a. for three years ended 31st march 2007. Their fixed capitals on which interest was to be calculated through –out were

A Rs. 1,00,000

B Rs. 80,000

C Rs. 70,000

Give the necessary Journal entry with working notes.

Answer:

Journal Entry :-

B’s current A/C Dr. 1000

C’s Current A/C Dr. 4000

To A’s current A/C 5000

(Adjustment entry for omission of interest on capital @ 10% p.a.)

Question: X, Y, and Z are partners sharing profits and losses in the ratio of 3:2:1. After the final accounts have been prepared it was discovered that interest on drawings @ 5 % had not been taken into consideration. The drawings of the partner were X Rs. 15000, Y Rs. 12,600, Z Rs. 12,000. Give the necessary adjusting Journal entry.

Answer:

Z’s Capital A/C Dr. 270

To X’s Current A/C 240

To Y’s current A/C 30

(Adjustment entry for omission of interest on drawings @ 5 % p.a.)

Question: A, B and C are partners sharing profits and losses in the ratio of 3:2:1. Their fixed capitals are Rs. 1,50,000, Rs. 1,00,000 and Rs. 80,000 respectively. Profit for the year after providing interest on capital was Rs. 60,000, which was wrongly transferred to partners equally. After distribution of profit it was found that interest on capital provided to them @ 10% instead of 12% . Pass necessary adjustment entry.

Show your working clearly.

B’s Current A/C Dr. 200

C’s Current A/C Dr. 9500

To A’s current A/C 9700

(Adjustment entry for interest on capital and distribution in wrong ratio.)

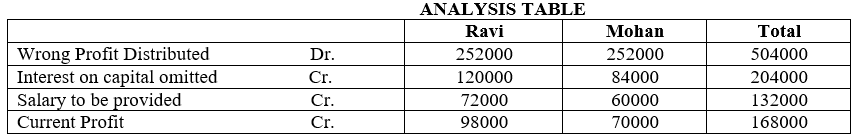

Question: Ravi and Mohan were partner in a firm sharing profits in the ratio of 7:5. Their respective fixed capitals were Ravi Rs. 10,00,000 and Mohan Rs. 7,00,000. The partnership deed provided for the following:-

(i) Interest on capital @ 12% p.a.

(ii) Ravi’s salary Rs. 6000 per month and Mohan’s salary Rs. 60000 per year.

The profit for the year ended 31-03-2007 was Rs. 5,04,000 which was distributed equally without providing for the above. Pass an adjustment Entry.

Answer:

Net adjustment Cr. 38000 Dr. 38000

Mohan’s current A/C Dr. 38000

To Ravi’s Current A/C 38000

(Adjustment entry for omission of certain provisions of partnership deed.)

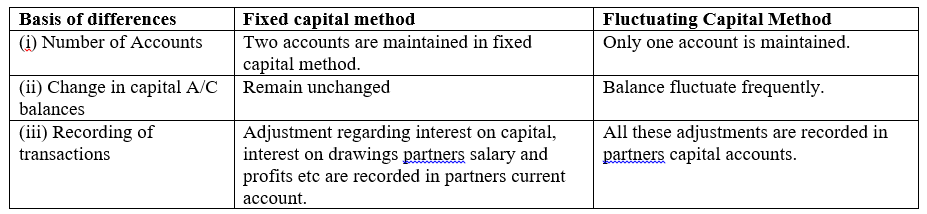

Question: Distinguish between fixed capital method and fluctuating capital method.

Answer: Distinction between Fixed and Fluctuating Capital method:-

Question: A, B and C were partners in a firm having capitals of Rs. 60,000, Rs. 60,000 and Rs. 80,000 respectively. Their current account balances were A- Rs. 10,000, B- Rs. 5000 and C- Rs. 2000 (Dr.). According to the partnership deed the partners were entitled to an interest on capital @ 5% p.a. C being the working partner was also entitled to a salary of Rs. 6,000 p. a. The profits were to be divided as follows:

(i) The first Rs. 20,000 in proportion to their capitals.

(ii) Next Rs. 30,000 in the ratio of 5:3:2.

(iii) Remaining profits to be shared equally.

During the year the firm made a profit of Rs. 1,56,000 before charging any of the above items.

Prepare the profit and loss appropriate on A/C.

Answer: Profit transferred to A’s current A/C Rs. 51,000

B’s current A/C Rs. 45,000

C’s current A/C Rs. 44,000

Question: A and B are partners sharing profits in proportion of 3:2 with capitals of Rs. 40,000 and Rs. 30,000 respectively. Interest on capital is agreed at 5 % p.a. B is to be allowed an annual salary of Rs. 3000 which has not been withdrawn. During 2001 the profits for the year prior to calculation of interest on capital but after charging B’s salary amounted to Rs. 12,000. A provision of 5% of this amount is to be made in respect of commission to the manager.

Prepare profit and loss appropriation account showing the allocation of profits.

Answer: Net profit transferred to A’s Capital A/C Rs. 4,650

B’s Capital A/C Rs. 3,100

Question: X is a partner who used the stock of the firm worth Rs. 10,000 and suffered a loss of

Rs. 2,000. He went the firm to bear the loss. How much ‘x’ is liable to pay to firm.

Answer: ‘X’ is liable to pay Rs 10,000

Question: Rajesh and Rakesh two partners draw for private use Rs 1,28,000 and Rs 86000 .

Interest is changeable at 6% per annum on drawings .What is the interest?

Answer: Rajesh’s interest on drawings

=Rs 1,28,0008 * 6/100 * 6/12 = Rs 3840

Rakesh’s interest on drawings

= Rs. 86,000 * 6/100 * 6/12 = Rs. 2580

Question: Pink, Black and White are partners sharing 5:3:2 White is guaranteed a minimum

amount of Rs 10,000 as share of profit every year. Any deficiency shall be met by

Black. The profit for the year ending 31st March 2005 where Rs 60,000. Prepare profit

& loss appropriation account

Answer:

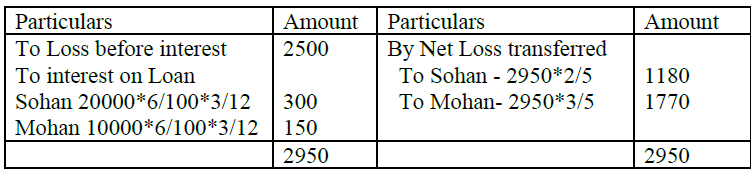

Question: Sohan and Mohan are partners sharing profits and losses in the ratio of 2:3 with the

capitals of Rs 5,00,000 and Rs 6,00,000 respectively. On 1st Jan 2006 Sohan and

Mohan granted loans of Rs. 20,000 and Rs 10,000 respectively to the firm. Show the

distribution of profit and losses for the year ended 31st March 2006 if the loss before

interest for the year amounted to Rs 2,500

Answer: Profit & Loss Account for the year ending 31st March 2006

Note : Profit & Loss appropriation a/c should not be prepared as Loan interest is

change against profits.

Question: Ramesh and Dinesh are partners sharing the profits and losses in the ratio of 2:3 with

capital of Rs. 4,00,000 and Rs 6,00,000 respectively. Show the distribution of profit

/Loss for the year ended 31st March, 2006, by preparing the relevant account if the

partnership deed provides for interest on capital @6% p.a and loss for the year is as

Rs. 15,000

Answer: Ramesh & Dinesh are partners

Profit & Loss a/c for the year ending on 31st March 2006

Note: * Profit and Loss appropriation account should not be prepared because there is

nothing to appropriate

*Interest on capital treated as appropriation

Question: Mala and Latha are partners in a business their fixed capitals at the end of the year

were Rs 48,000 and Rs 36,000 respectively. During the year ended March 31,2006

Mala’s drawings and Latha’s drawings were Rs. 8,000 and Rs 12,000 respectively.

Profits (before sharing interest on capital) during the year were Rs 32,000. Calculate

@5% for the year ending 31st, March 2006

Answer: Interest on Mala’s capital = Rs 48005/100 = Rs. 2400 Interest on Latha’s capital = Rs 36005/100 = Rs. 1800

Note: Because the capitals are fixed & will not change same in the beginning of

year.

Question: A,B and C shared the profits of Rs 15,00,000 in the ratio of 2:2:1 without providing

for interest on B’s loan . B granted a loan of Rs 10,00,000 in the beginning of

accounting year whereas the partnership deed is silent on interest on loan and the

profit sharing ratio. Give necessary adjusting entries.

Answer: Statement Sharing the adjustments to be made

Note :- 1. Interest on loan (Rs 10000*6/100) = Rs 60000 is a change against

profit.

2. Interest on loan is a gain to the partner and it is credited to

partner’s loan a/c & not to capital a/c.

Question: The partners of a firm distributed the profits for the year ended 31st March 2006 Rs

3,00,000 equally without providing for the following adjustments:

(i) Seema and Rita were entitled to a salary of Rs. 5,000 per annum.

(ii) Nega was entitled a Commission of Rs 5,000

(iii) Seema and Rita had guaranteed a minimum profit of Rs 1,20,000 per annum to

Nega

(iv) Profit were to be shared in the ratio of 2:2:1

Prepare necessary journal entries.

Answer: Journal

• Nega’s deficiency Rs (120000-114000) = Rs. 6000

Rita to bear = 60002/3=4000 Seema to bear = 60001/3=2000

• Profit calculation Rita =2850002/3 = 114000 Nega = 2850002/3 = 114000

Seema = 285000*1/3 = 57000

Question: A and B contribute Rs. 80,000 and Rs 40,000 respectively by way of capital on which

they agree to pay interest @ 6% p.a. Their respective share of profit is 2:3 and the

business profit (before interest) for the year is 6,000. Show the relevant account to

allocate interest about the treatment of interest on capital.

Answer:

Profit & Loss appropriate account

for the year ending

Question: It was discovered that in arriving at the profit for 2006, the following two items have

been ignored.

(i) Outstanding expenses of Rs 3500 and

(ii) Accurate interest on investment of Rs 2,000

Make journal entries relevant to adjustments.

Answer:

Question: A, B and C shared the profit of Rs. 9,00,000 in the ratio of 2:2:1 without providing for

interest on B’s loan, B granted a loan of Rs. 4,00,000 in the beginning of accounting

year. Whereas the partnership deed is silent on the interest on loan and the profit

sharing ratio. Give adjusting entry.

Question: Calculate interest on X’s drawings @ 12% if he withdraws Rs. 2,000 per month

during the year.

Answer: Interest on X’s drawings will be

(Rs 200012) = 2400012/100=2880

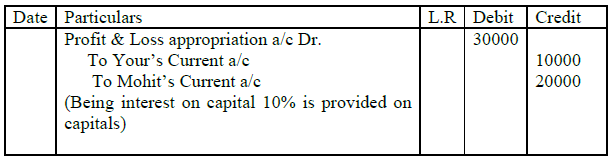

Question: You and Mohit are partners sharing profits and losses equally and contributed Rs

1,00,000 and Rs 2,00,000 respectively . Interest on capital is provided at 10%.

Journalise if capitals are fixed.

Answer:

Question: A and B are partners sharing profits on capital ratio. Their capitals were Rs 5,00,000

and Rs 7,00,000 respectively. They withdraw Rs 50,000 and 70,000 for the year

ending 31st March 2006. Interest on drawings was provided at 8% p.a . Journalise

Answer: A’s capital a/c Dr. 2000

B’s capital a/c Dr. 2800

To Profit & Loss appropriation a/c 4800

(Being interest on drawings at 8% p.a provided on drawings)

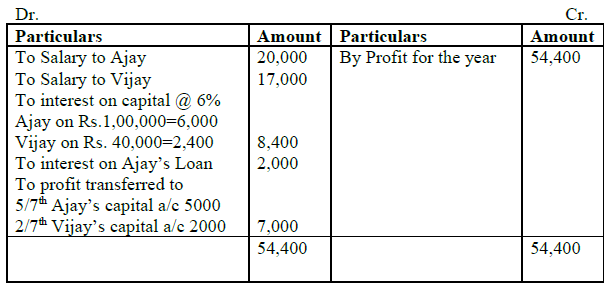

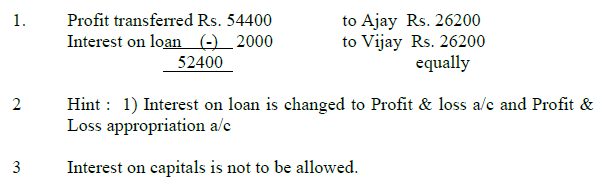

Question: Ajay presents the following Profit & Loss appropriate account to his partner Vijay

Profit & Loss appropriate

For the year ended 31st March 2006

There is no partnership deed. Vijay fees that he has not treated fairly. Point out Ajay

has contravened the provisions of law and draw out Profit and Loss Appropriation

account on proper lines.

Answer:

Question: If capital accounts are fixed, where will you record the following items

(i) drawings

(ii) interest on capital

(iii) withdrawal of capital

Answer: Debited to Current a/c

Credited to capital a/c

Debited to capital a/c

Question: Calculate the interest on drawings of Ramesh @ 10%p.a for the year ended 31st Dec

2002 in each of the following alternative cases.

(i) if he withdraw Rs 6,000 in the beginning of each quarter.

(ii) If he withdraw Rs 6,000 at the end of each quarter.

(iii) If he withdraw Rs 6,000 during the middle of each quarter.

(iv) If he withdraw Rs. 6,000 per quarter.

Answer: 1) Average period= (Time left after 1st withdrawal +Time left after last

withdrawal)

12+3/2=15/2 months

Interest on Drawings = 6000*4 Quarter * 10/10015/21/12

= Rs.1500

2) Interest on Drawings = 240010/1009/2*1/12 = Rs. 1500

3) Interest on Drawings = 2400 * 10/10012/21/12 = Rs. 1200

4) Interest on Drawings = Average period = Total period/ 2 = 9/ 2

= 240010/1009/2*1/12= Rs 900

Question: On April 1, 2001 an existing firm had assets of Rs. 1,50,000 including cash of Rs.

10,000. The partner’s capital accounts shared a balance of Rs. 1,20,000 and the

reserve contributed the rest. If the normal rate of return is 10% and the goodwill of the

firm is valued at Rs 48,000 at four year’s purchase of super profits, find the average

profits of the firm.

Answer: Goodwill = Super profit * 4 yrs purchase

48000 = Super profit 8 4

Super profits = 48000/4=12000

Normal profits = 150000*10/100=Rs 1500

Super profits = Average profits – 15000

12000 = Average profits – 15000

Average profits = Rs. 27000

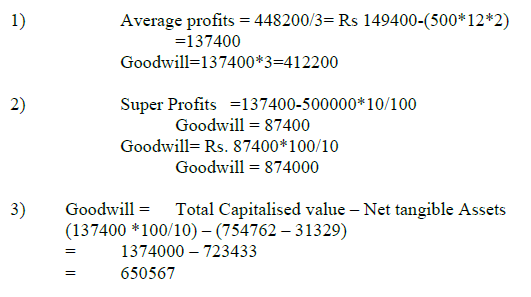

Question: From the following information, calculate the value of goodwill of Ramesh and Naresh

(i) At three years purchase of average profits.

(ii) On the basis of capitalisation of super profits

(iii) On the basis of capitalisation of average profits

Information :

(a) Average capital employed in the business Rs. 5,00,000

(b) Net trading results of the firm for the past years

Profit 2003 – Rs. 1,47,600

Loss 2004 – Rs 1,48,100

Profit 2005 – Rs 4,48,700

(c) Rate of interest expected from the capital having regard to the risk involved – 10%

(d) Remuneration to each partner for his service Rs. 500 p.m

(e) Assets (excluding goodwill) Rs 7,54,762

Liabilities Rs. 31,329

Answer:

Question: A and B are partners sharing profits & Losses in the ratio of 3:1. Their capitals were

Rs. 60,000 and Rs. 40,000 respectively. As from 1st April 2005 it was agreed to

change the profit sharing ratio to 3:2. According to the partnership deed goodwill

should be valued at three years purchase of the average of five year’s profits. The

profits of the previous five years were 2001- Rs 30,000, 2002 – Rs.40,000, 2003 – Rs

50,000, 2004 – Rs. 60,000 & 2005 – Rs. 70,000

Pass necessary Journal entry.

Answer:

Question: Calculate interest on X’s drawings @ 12% p.a if he withdraws Rs. 2,000 per

month during the year.

Answer: Interest on X’s drawings will be

(Rs 200012)=2400012/100 * 6/12 months = 1440

Question: Is a partner entitled to salary if he works more than others if partnership deed is silent?

Answer: No, he is not entitled to salary.

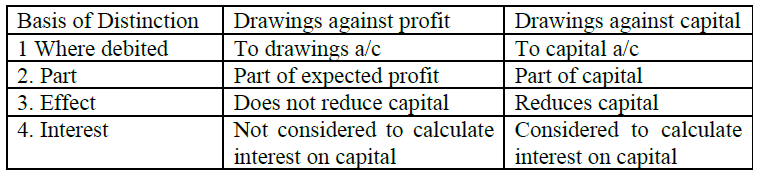

Question: Distinguish between drawings against profit and drawings against capital.

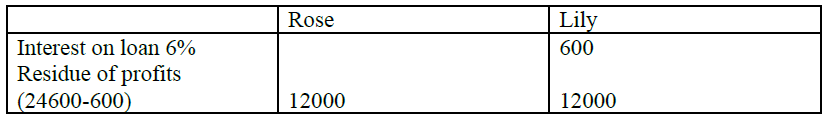

Question: There is no agreement regarding sharing of profits (or) partnerships salary. Rose is a

whole-time partner whereas Lilly does not attend business regularly. Rose claims Rs

3,000 salary a month and 60% of balance profits Rs 24,600 Lilly advanced Rs 1

Answer: