DK Goel Solutions Chapter 14 Trial Balance and Errors

Read below DK Goel Solutions Class 11 Chapter 14 Trial Balance and Errors. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter of accountancy explains various concepts and theories of the trial balance system, with various numerical. At the end of the accounting period all accountants generate the trial balance to review the entries which have been posted in the books.

The trial balance should perfectly reconcile with no differences. The chapter also contains lot of questions which can be very helpful to understand the concepts for Class 11 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

DK Goel Solutions Class 11 Chapter 14 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Trial Balance and Errors DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 14

Short Answer Questions for DK Goel Solutions Class 11 Chapter 14

Question 1:

Solution 1:

Trail Balance is a statement showing the balances, or total of debits and credits, of all the accounts in the ledger with to verify the arithmetical accuracy of posting into the ledger accounts.

(i) Ascertain the Arithmetical Accuracy of Ledger Accounts: The purpose of preparing a trial balance is to ascertain whether all debits and credits are properly recorded in the ledger or not and that all account have been correctly balanced.

(ii) Help Prepare the Final Accounts: when the trail balance does not tally, we know that at least one error has occurred. The error may have occurred at one those stages in the accounting process like totalling of subsidiary books, posting of journal entries in the ledger, calculating account balances, carrying account balance to the trial balance and totalling the trial balance columns.

(iii) Summary of Each Account: The Trial Balance contains the Ledger summary. The Ledger can only have to be listened to when further evidence is needed in relation to an account.

(iv) To Help in Locating Errors: The Trial Balances help to find mistakes in the work of record keeping. It should, however, be held in mind that not all the mistakes in Record Keeping are revealed, but only the arithmetical inaccuracies.

Question 2:

Solution 2: At any time, at the end of a month, quarter, half-year, or year, a trial balance can be prepared. It is usually prepared at the close of the accounting cycle to validate the arithmetical consistency of the records in the ledger before the actual accounts are prepared. It should be noticed that it is often cooked on a specific date and not for a specific time.

Question 3:

Solution 3:

- Errors of Principle:- Where the accounting principle is broken while a transaction is registered, it is considered a principle mistake. For instance, instead of the machinery account, the purchase of machinery is debited to the purchase account.

- Errors of Omission:- There will be no effects on the trail balance where a transaction has been overlooked to report. If all parts of a transaction go unrecorded and despite being registered in the main entry books, a transaction is not posted in the ledger at all. Purchases of Rs. 20,000, for instance, were excluded from being posted in the purchase day book.

Question 4:

Solution 4: 1.) Goods sold to Mr. Kunal amounted Rs. 6000/- was recorded to the debit side of Mr. Kunal’s account by Rs. 600/-

2.) Commission account overcast by Rs. 2,000 and Electricity bill under cast by Rs. 2,000.

Question 5:

Solution 5: An error of omission is named whether a transaction lies unrecorded in the journal or subsidiary books. For instance:- Rs. 20,000 sales skipped to be posted in the daily book of purchases.

Question 6:

Solution 6: Where the accounting principle is broken while a transaction is registered, it is considered a principle mistake. For Instance:

- Machinery purchase is debited to the account of purchase instead of the Machinery Account.

- Instead of a furniture account, purchases of old furniture are attributed to a sales account.

Question 7:

Solution 7: Below are the errors cannot be disclosed by preparing a Trail Balance:-

- Compensatory Errors

- Error of Duplication

- Errors of Principle

- Errors of Omission

Question 8:

Solution 8: An account in which the disparity is held in the trail balance before errors are found and rectified. And where the trail balance does not tally, it encourages the planning of financial statements.

Question 9:

Solution 9:

Debit Balance

(ii) Furniture

(iv) Discounts Allowed

(vi) Drawings

(vii) Return Inwards

(viii) Bills Receivable

Credit Balance

(i) Purchases Return

(iii) Bank Loan

(v) Capital

Question 10:

Solution 10:

Debit Balance

(i) Plant and Machinery

(ii) Discount Allowed

(v) Interest Paid

(vi) Bad Debts

Credit Balance

(iii) Bank Overdraft

(iv) Sales

Question 11:

Solution 11:

Debit Balance

Drawings

Bad Debts

Sales Return

Furniture

Credit Balance

Advance Rent Received

Bank Overdraft

Question 12:

Solution 12: Below transactions are related to Errors of Omission:-

(iii) Goods amounting to Rs. 2,000 have been returned to Chakravati, but no entry has been made in the books.

(viii) Goods for Rs. 500 have been taken by the proprietor for his personal use, for which no entry has been passed in the books.

Below transactions are related to Error of Commission:-

(i) Purchased goods from Bhardwaj on credit for Rs. 600, but were recorded in the purchases book as Rs. 6,000.

(v) Goods sold to suresh for Rs. 650 were recorded as Rs. 560 in the Sales Book.

Below transactions are related to Compensating Error:-

(iv) An excess debit of Rs. 4,500 has been made in the account of X, whereas Y’s account has been credited by Rs. 5,000 instead of Rs. 500.

Below transactions are related to Error of Principle:-

(ii) Amount paid for the proprietor’s life insurance premium was debited to ‘General Expenses Account’.

(vi) Typewriter purchased for office use has been debited to purchases Account.

(vii) Wages paid for the construction of Building Rs. 15,000 were recorded in ‘Wages Account’.

Question 13:

Solution 13: Only transactions 1st will affect the trail balance because it is an error of posting in one account.

Question 14:

Solution 14: It is a statement prepared at the end of the financial year with the aid of ledger balances to assess the arithmetic precision of account books. Trial balance matching does not guarantee the consistency of account books.

Errors which, even if the trail balance accepts, remain undetected:

Errors of Omission:- There would be no effects on the trail balance if a transaction has been overlooked to report.

Errors of the Commission:- Either in the report or subsidiary books where the incorrect number is reached.

Compensating Error:- If one error’s impact is neutralized by another error’s effect.

Errors of theory:- Where the basic accounting principle is broken while a transaction is registered.

Numerical Questions for DK Goel Solutions Class 11 Chapter 14 :

Question 1:

Solution 1:

Question 2:

Solution 2:

Question 3 (A):

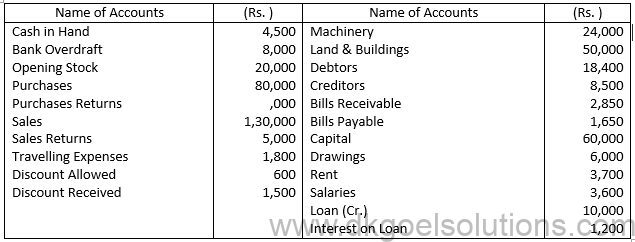

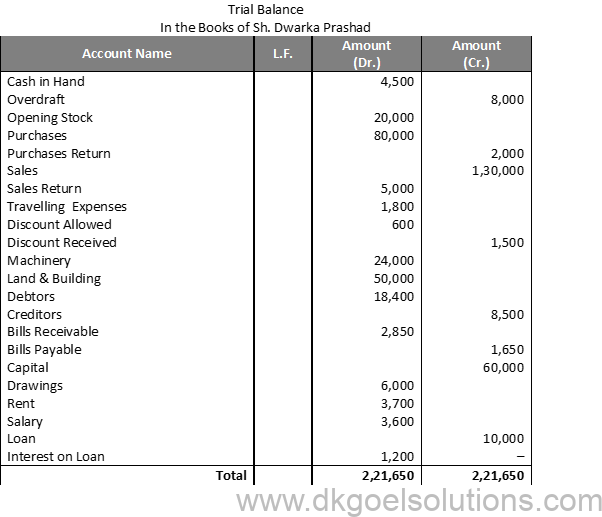

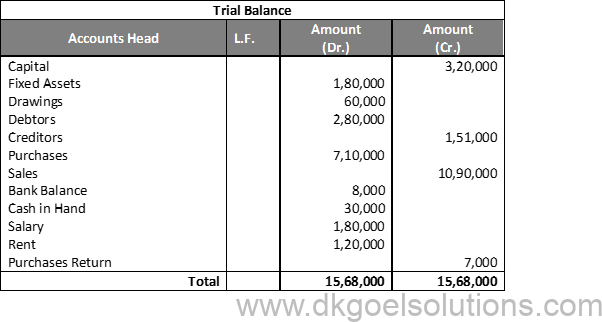

Solution 3 (A): Trial Balance as on March 31, 2017

Question 3 (B):

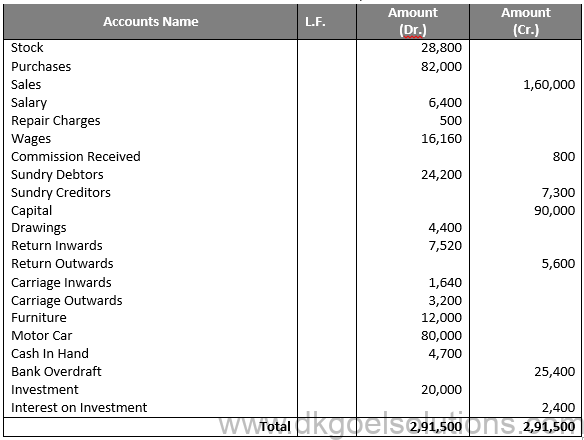

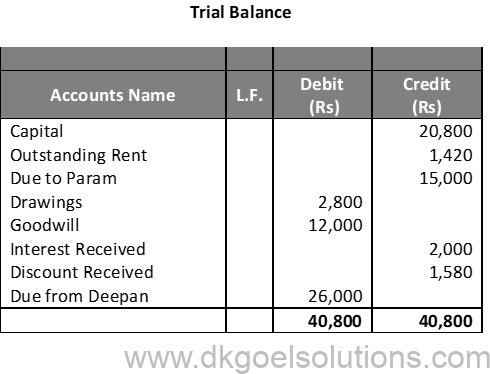

Solution 3 (B): Trial Balance in the books of ………….. for the year……….

Question 4:

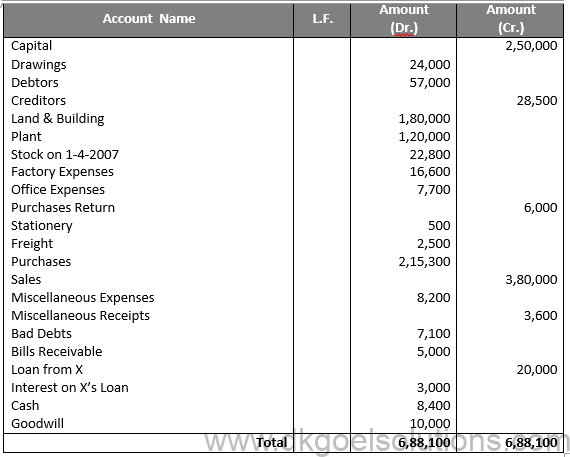

Solution 4:

Point in mind:-

Closing stock is not separately registered since it has not yet been paid for.

Question 5:

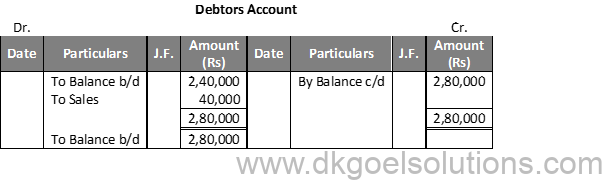

Solution 5:

Question 6:

Solution 6:

Journal Entries In the Books of Sh. Venkteshwar

Question 7:

Solution 7:

Question 8:

Solution 8:

Question 9:

Solution 9:

Trial Balance is the key to the financial stability of a business. It summarizes all the business activities most comprehensively. A trial balance is a record book that summarizes all the ledgers compiled into the credit and debit account.

Here are the main objectives of the trial balance –

● To compile the calculations of the ledger accounts.

● To analyze and detect the error in the financial activities.

● To check and summarize all ledger accounts.

● To prepare a final financial report of the companies based on the recorded data.

When an error in a particular account gets compensated with another error occurring in a different account simultaneously, then it is termed as compensating error. For instance, let us say, while posting one the debit side of account A, we post Rs.100 in place of Rs.1000. On the other hand, while posting on the debit side of account B, Rs.1000 is posted on the place of Rs.100. These are two crucial mistakes that turn each other’s effect to be void, and therefore instead of being two errors, it will satisfy the terms of the trial balance.

Trial Balance is one of the core components for designing the final accounts. A trial balance may be framed at any time of the year. Typically, it is designed at the end of the accounting period to verify the accuracy of the ledger accounts before creating the final accounts.

The error principle depicts the violation of the accounting regulations while recording the financial transactions. For instance, the purchase of a product is debited to the purchase account in place of the product account.

The error of omission occurs when some financial transactions, minor or major, get eliminated from the books of records or when they are entered and not posted. In this case, there are no debits or credits. Therefore, the trial balance remains unaffected during this error.

Very helpful site so when a question I was not prepare then I was see the site answer. Thankyou

Amazing content!!!! Whenever I need any help in a question or I get stuck in a question, this site clears my confusion to its fullest.

THANKS