DK Goel Solutions Chapter 15 Bank Reconciliation Statement

Read below DK Goel Solutions Class 11 Chapter 15 Bank Reconciliation Statements. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter of DK Goel accountancy stresses the concepts of bank reconciliation statements.

Its very important to make BRS at the end of accounting period or on period basis to ensure that all transactions that you expected in your bank account are displaying properly and related entries have been passed in your accounting books, all variances have to be identified and displayed in the bank reconciliation statement.

The chapter also contains lot of questions which can be very helpful to understand the concepts for Class 11 commerce students of Accountancy and will also help build a strong concepts which will be really helpful in your career.

These solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Bank Reconciliation Statement DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 15

Long Answer Questions for DK Goel Solutions Class 11 Chapter 15

Question 1:

Solution 1:

The Bank Reconciliation Statement is a statement prepared primarily to reconcile the difference between the Cash Book and Bank Pass Book’s ‘Bank Balance.’

Bank Reconciliation Statement Need and Importance:-

(1) A statement of bank reconciliation identifies the error or omissions that could have been committed by either the bank. The mistake thus detected can be corrected accordingly.

(2) The client becomes sure of the correctness of the bank balance shown by the cash book by preparing a bank reconciliation statement. It helps him to make further bank transactions.

(3) The preparation of a revised cash book is facilitated by a reconciliation statement.

(4) A declaration of reconciliation helps to reveal an unnecessary delay in the bank’s collection of cheques.

(5) It also helps to keep track of the cheques that have been sent for collection by the bank.

Short Answer Questions for DK Goel Solutions Class 11 Chapter 15

Question 1:

Solution 1:

For the following purposes, the Bank Reconciliation Document will be prepared:

- It identifies the mistakes in either the Cash Book or Bank Statement or Bank Pass Book that could have been committed.

- The reconciliation acknowledges an unreasonable pause in the clearing of deposited or released cheques.

- Embarrassments are discouraged by daily reconciliation. Reconciliation aims to validate the authenticity of entries registered in the Cash Book by management.

- The real bank statement is revealed.

Question 2:

Solution 2:

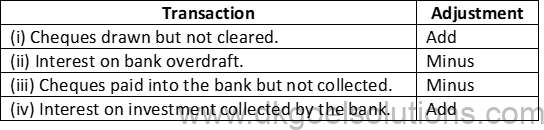

(i) Cheques drawn but not cleared.

(ii) Interest on bank overdraft.

(iii) Cheques paid into the bank but not collected.

(iv) Interest on investment collected by the bank.

Question 3:

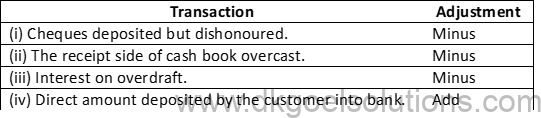

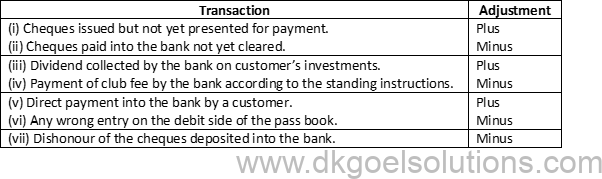

Solution 3:

Question 4:

Solution 4:

- Cheque issued but not yet presented for payment in the bank.

- Bank charges and commission charged by the bank.

- Direct deposit by customer into the bank.

- Direct payment made by the bank on behalf of customers.

- Transaction wrongly debited in cash book.

- Transaction wrongly credited in pass book.

Question 5:

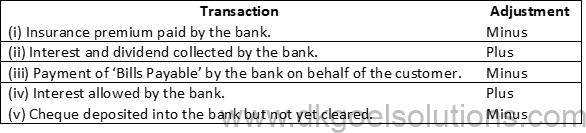

Solution 5:

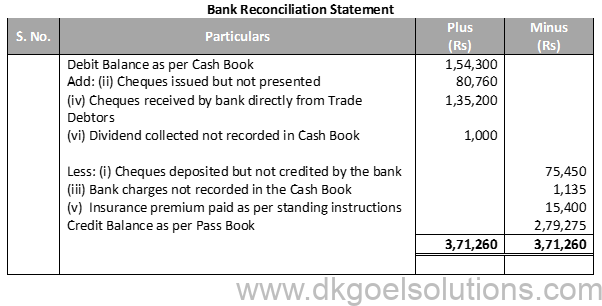

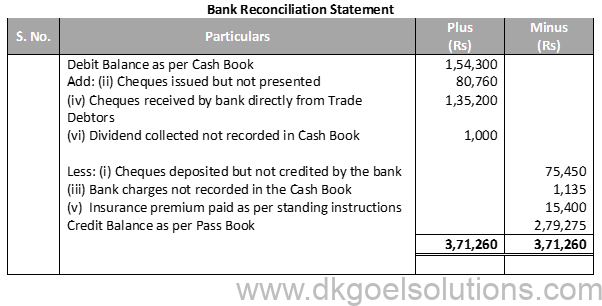

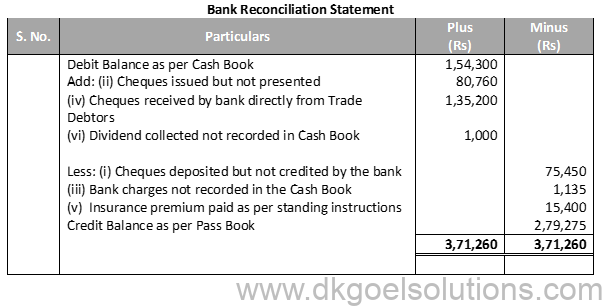

Question 6:

Solution 6:

Question 7:

Solution 7:

Question 8:

Solution 8:

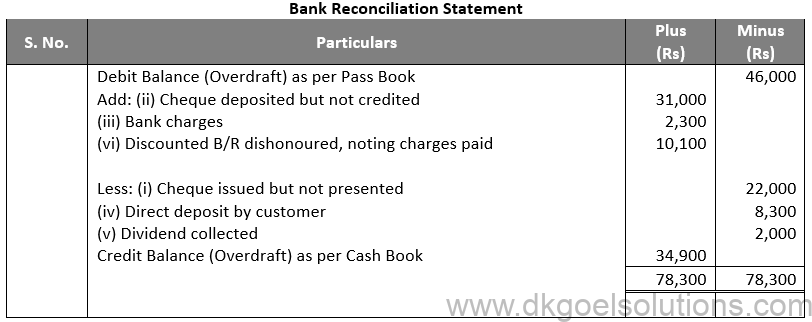

Numerical Questions (DK Goel Solutions Class 11 Chapter 15)

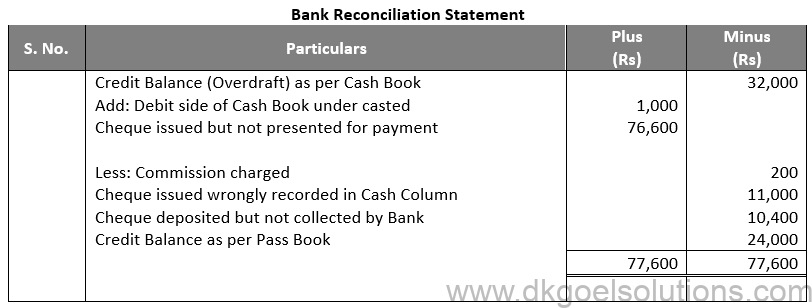

Question 1:

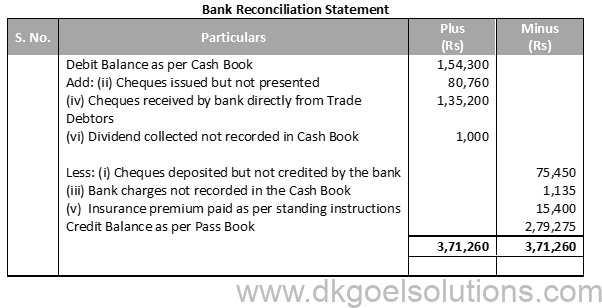

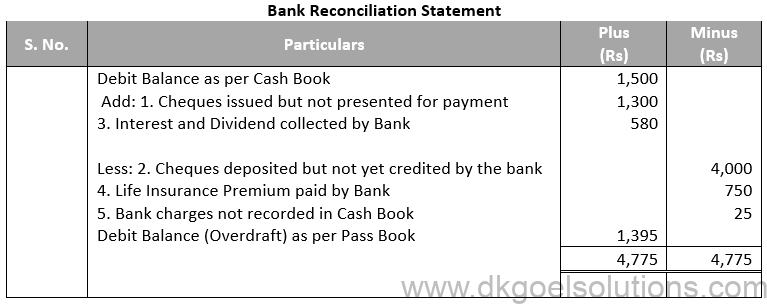

Solution 1:

Point of Knowledge:-

- Regular reconciliation discourages embezzlements. Reconciliation helps the management to verify the accuracy of entries recorded in the Cash Book.

- Bank reconciliation statement shows actual bank balance.

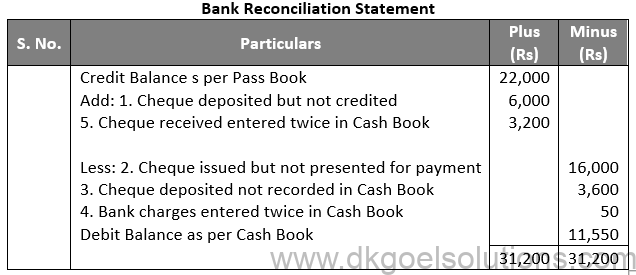

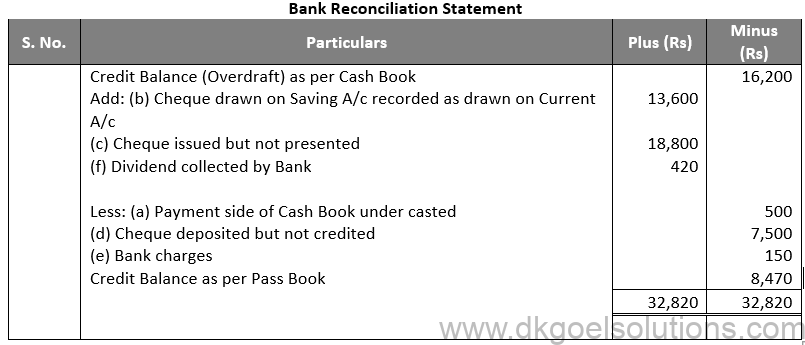

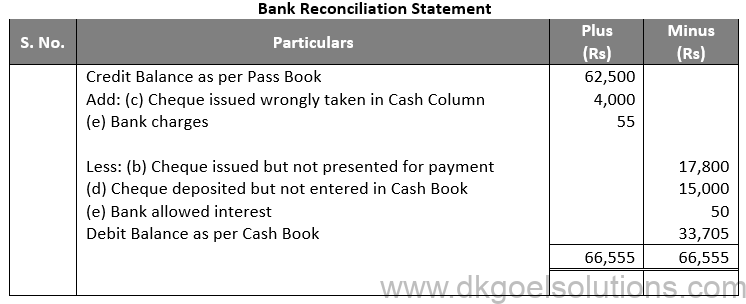

Question 2:

Solution 2:

Working Note:-

- Cheque issued but not presented for payment

= Rs. 600 + Rs. 800 + Rs. 1,200

= Rs. 2,600 - Cheque deposited but not credited by the bank

= Rs. 500 + Rs. 700

= Rs. 1,200

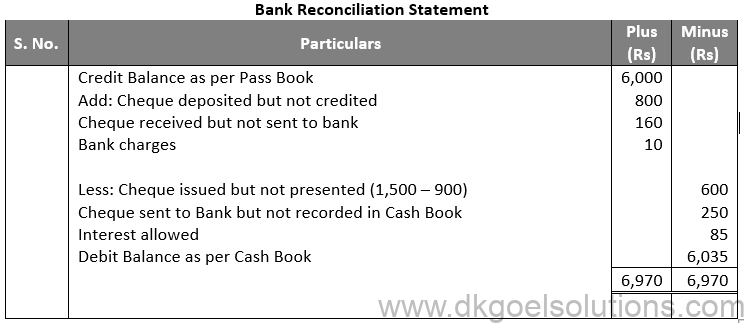

Question 3:

Solution 3:

Working Note:-

1.) Cheques issued but not presented

= 9,200 – 7,000

= 2,200

2.) Cheques deposited but not credited

= 8,000 – 6,500

= 1,500

Question 4:

Solution 4:

Point of Knowledge:- A bank reconciliation statement locates the error or omissions that may have been committed either on the part of the bank. The error so detected can be rectified accordingly.

Question 5:

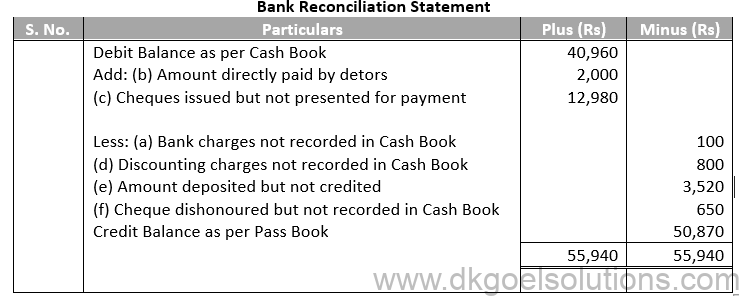

Solution 5:

Question 6:

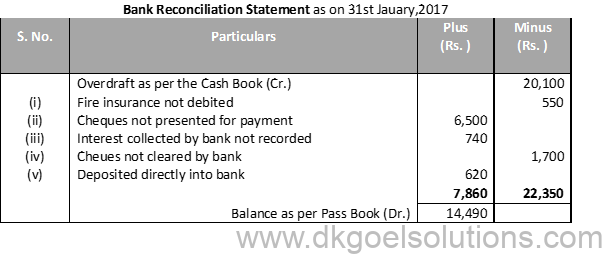

Solution 6:

Working Note:-

Balance As per Pass Book

= Rs. 22,350 – Rs. 7,860

= Rs. 14,490

Question 7:

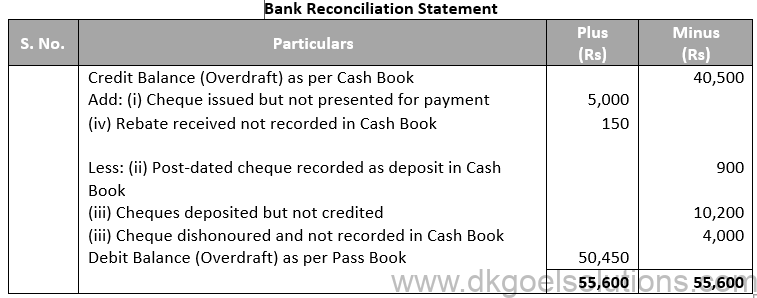

Solution 7:

Question 8:

Solution 8:

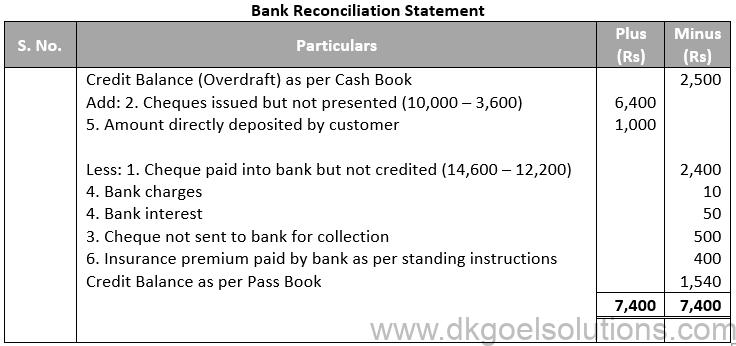

Working Note:-

Cheques issued but not presented

= Rs. 10,000 – Rs. 3,600

= Rs. 6,400

Cheque paid into bank but not credited

= Rs. 14,600 – Rs. 12,200

= Rs. 2,400

Question 9:

Solution 9:

Question 10:

Solution 10:

Point in mind:-

- It detects the errors that may have been committed either in the Cash Book or Bank Statement or Bank Pass Book.

- Undue delay in clearance of cheque deposited or issued is known from the reconciliation.

Question 11:

Solution 11:

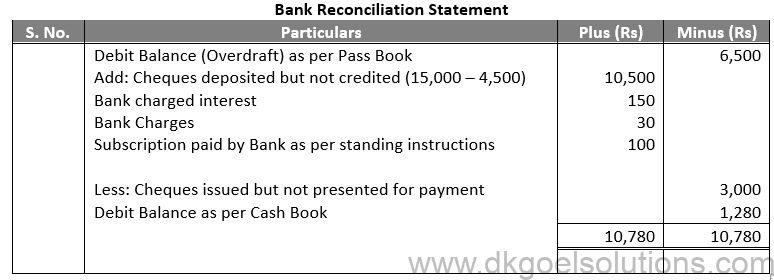

Working Note:-

Cheques deposited but not credited

= Rs. 15,000 – Rs. 4,500

= Rs. 10,500

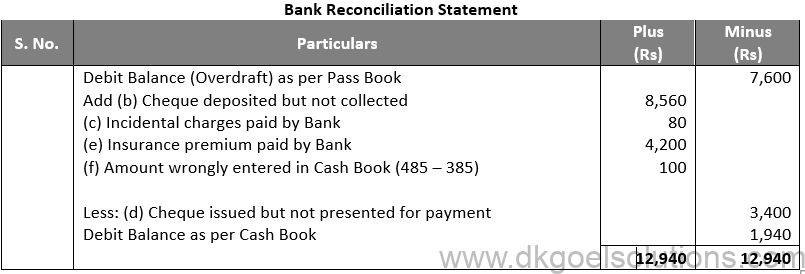

Question 12:

Solution 12:

Working Note:-

Amount wrongly entered in Cash Book

= Rs. 485 – Rs. 385

= Rs. 100

Question 13:

Solution 13:

Point in Mind:- (DK Goel Solutions Class 11 Chapter 15)

The Bank Reconciliation Statement is a statement prepared specifically to resolve the discrepancy between the Cash Book and Bank Pass Book’s ‘Bank Balance.’

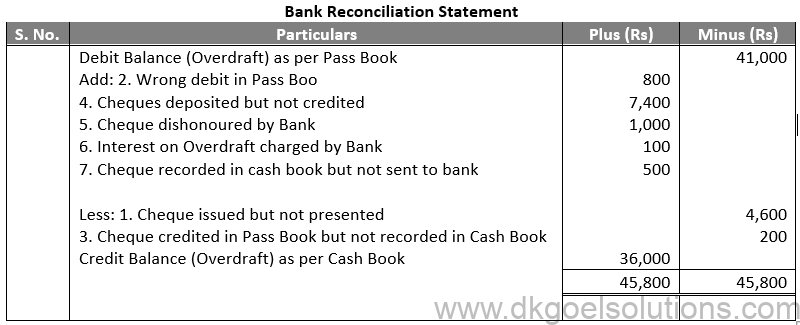

Question 14:

Solution 14:

Working Note:- (DK Goel Solutions Class 11 Chapter 15)

Cheque issued but not presented

= Rs. 15,600 – Rs. 11,000

= Rs. 4,600

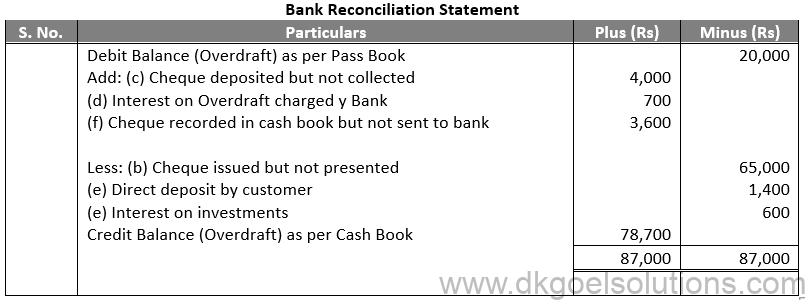

Question 15:

Solution 15:

Working Note:-

Cheque deposited but not collected

= Rs. 6,500 – Rs. 2,500

= Rs. 4,000

Cheque issued but not presented

= Rs. 80,000 – Rs. 15,000

= Rs. 65,000

Point in Mind:-

The Bank Reconciliation Statement is a statement prepared specifically to resolve the discrepancy between the Cash Book and Bank Pass Book’s ‘Bank Balance.’

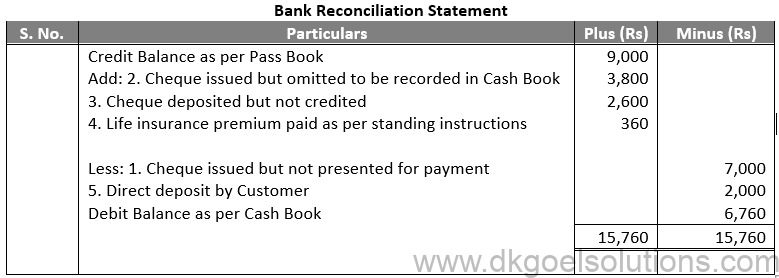

- Cheques issued but not yet presented for payment 7,000

- Cheques issued but omitted to be recorded in the Cash Book 3,800

- Cheques paid into bank but not yet collected by the bank 2,600

- Premium on Life Policy paid by the bank on standing advice 360

- Payments received from customers direct by the bank 2,000

Question 16:

Solution 16:

Point in Mind:-

A bank reconciliation statement describes either on the part of the bank the mistake or omissions that may have been committed. The mistake thus found may be corrected accordingly.

Question 17:

Solution 17:

Question 18:

Solution 18:

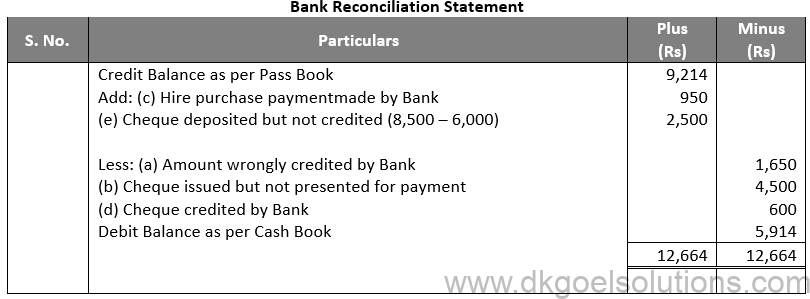

Working Note:-

Cheque deposited but not credited

= Rs. 8,500 – Rs. 6,000

= Rs. 2,500

Point of Knowledge:-

A bank reconciliation statement describes either on the part of the bank the mistake or omissions that may have been committed. The mistake thus found may be corrected accordingly.

Question 19:

Solution 19:

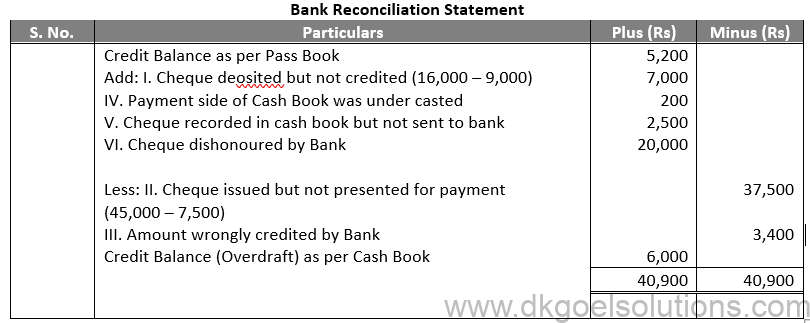

Working Note:-

Cheque deposited but not credited

= Rs. 16,000 – Rs. 9,000

= Rs. 7,000

Cheque issued but not presented for payment

= Rs.45,000 – Rs. 7,500

= Rs. 37,500

Point of Knowledge:-

A bank reconciliation statement describes either on the part of the bank the mistake or omissions that may have been committed. The mistake thus found may be corrected accordingly.

Question 20:

Solution 20:

Point in Mind:-

A bank reconciliation statement describes either on the part of the bank the mistake or omissions that may have been committed. The mistake thus found may be corrected accordingly.

Question 21:

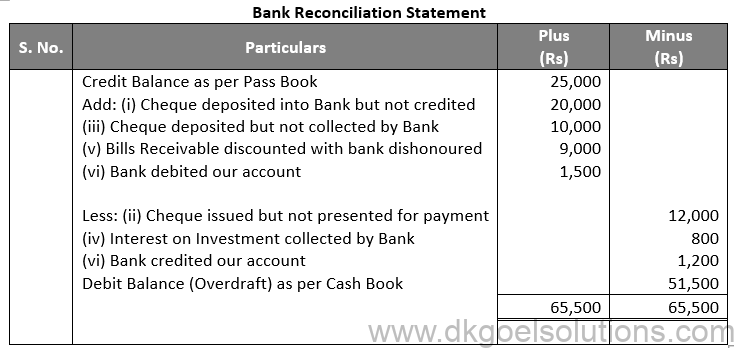

Solution 21:

Working Note:-

Cheque issued but not presented for payment

= Rs. 15,000 – Rs. 3,000

= Rs. 12,000

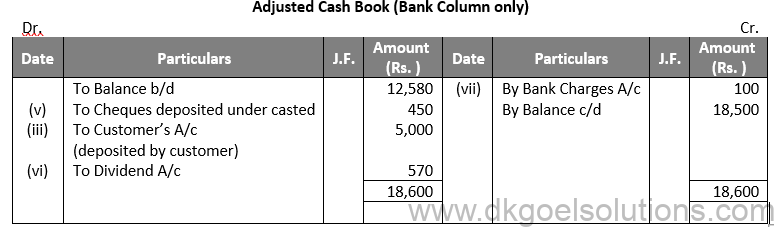

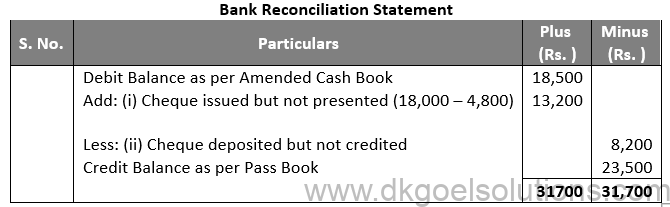

Question 22:

Solution 22:

Working Note:-

Cheques deposited under casted

= Rs. 12,720 – Rs. 12,270

= Rs. 450

Cheque issued but not presented

= Rs. 18,000 – Rs. 4,800

= Rs. 13,200

Question 23:

Solution 23:

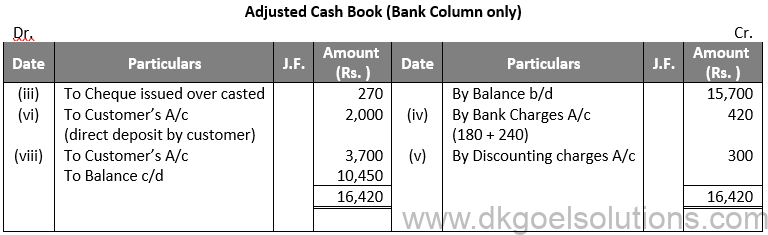

Working Note:-

Cheque issued over casted Rs. 4,520 – Rs. 4,250 = Rs. 270

Bank Charges = Rs. 180 + Rs. 240 = Rs. 420

Cheques issued but not presented = Rs. 8,300 – Rs. 2,000 = Rs. 6,300

Point in Mind:-

A bank reconciliation statement describes either on the part of the bank the mistake or omissions that may have been committed. The mistake thus found may be corrected accordingly.

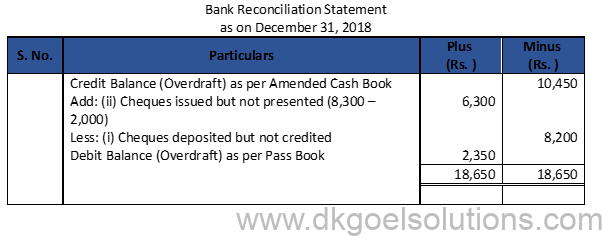

Question 24:

Solution 24:

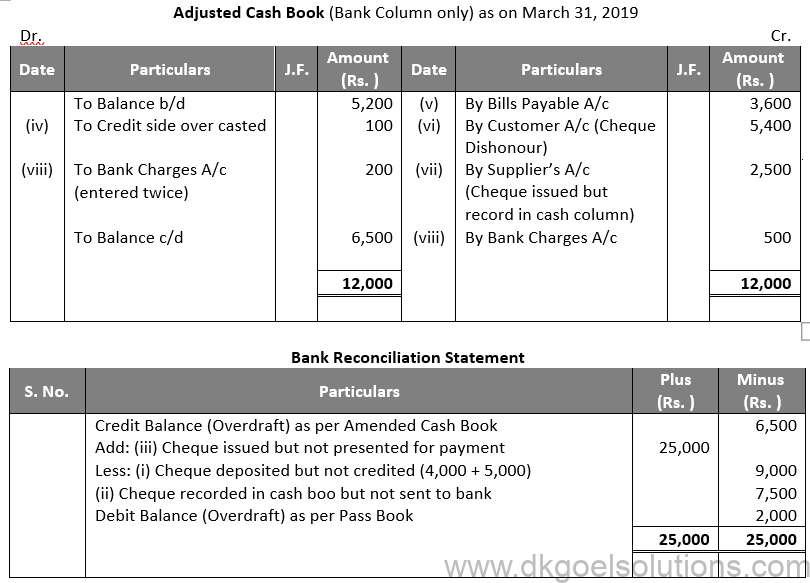

Question 25:

Solution 25:

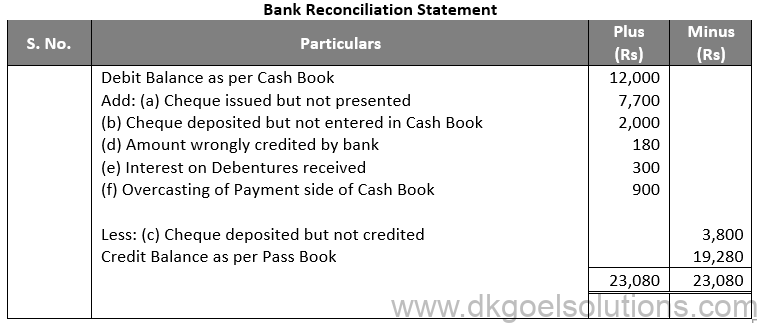

Question 26:

Solution 26:

Working Note:-

Amount wrongly credited by bank

= Rs. 530 – Rs. 350

= Rs. 180

Overcasting of Payment side of Cash Book

= Rs. 5,420 – Rs. 4,520

= Rs. 900

Point in Mind:-

Bank reconciliation statement is a statement prepared mainly to reconcile the difference between the ‘Bank Balance’ shown by the Cash Book and Bank Pass Book.”

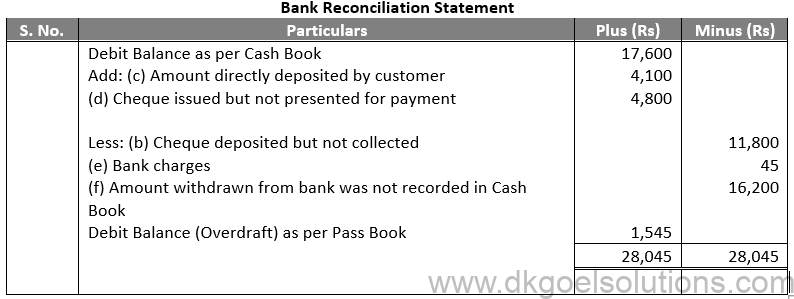

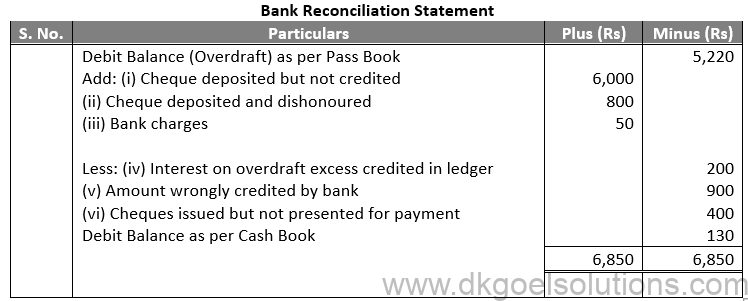

Question 27:

Solution 27:

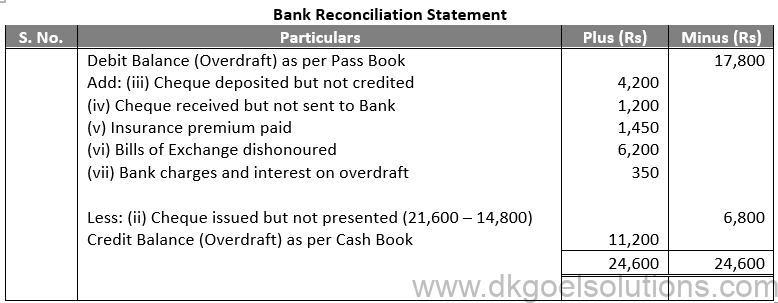

Question 28:

Solution 28:

Working Notes:-

Cheque issued but not presented

= Rs. 21,600 – Rs. 14,800

= Rs. 6,800

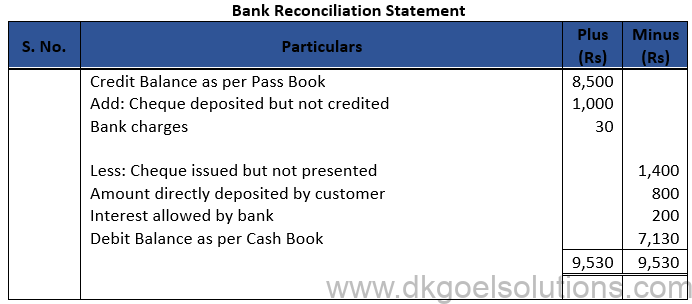

Question 29:

Solution 29:

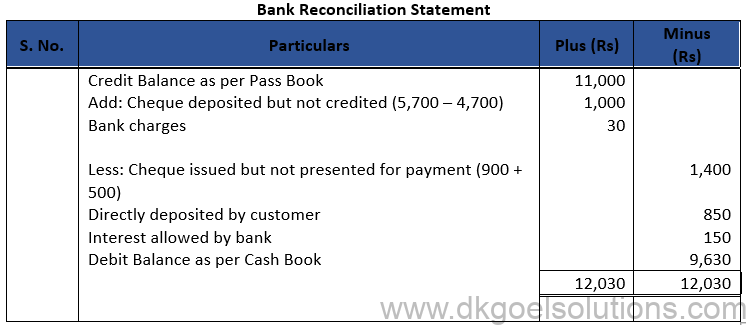

Working Note:-

Cheque deposited but not credited Rs. 4,800 – Rs. 3,800 = Rs. 1,000

Cheque issued but not presented Rs. 1,200 + Rs. 200 = Rs. 1,400

Point of Knowledge:- (DK Goel Solutions Class 11 Chapter 15)

A bank reconciliation statement locates the error or omissions that may have been committed either on the part of the bank. The error so detected can be rectified accordingly.

Question 30:

Solution 30:

Question 31:

Solution 31:

Point of Knowledge:-

A bank reconciliation statement locates the error or omissions that may have been committed either on the part of the bank. The error so detected can be rectified accordingly.

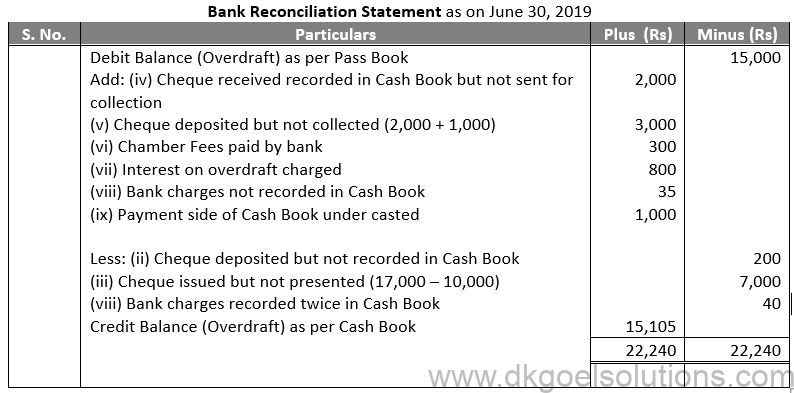

Question 32:

Solution 32:

Working Note:-

Cheque deposited but not collected

= Rs. 2,000 + Rs. 1,000

= Rs. 1,000

Cheque issued but not presented

= Rs. 17,000 – Rs. 10,000

= Rs. 7,000

Question 33:

Solution 33:

Point of Knowledge:-

Periodic preparation of this statement reduce the chances of embezzlement by the staff of this firm or even that of the bank. For example, if a cashier makes an entry in the cash book but does not deposited the cash and cheques into the bank, it will be disclosed by preparing a bank reconciliation statement.

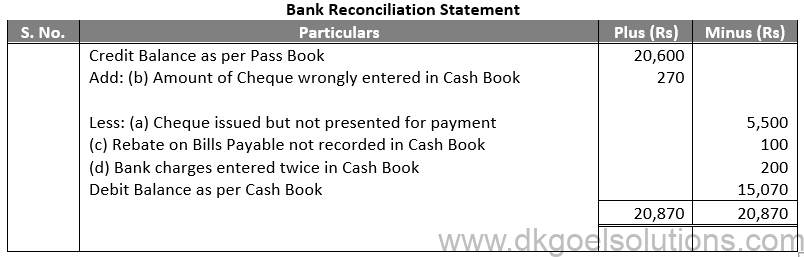

Question 34:

Solution 34:

Working Note:-

Amount of Cheque wrongly entered in Cash Book

= Rs. 5,745 – Rs. 5,475

= Rs. 270

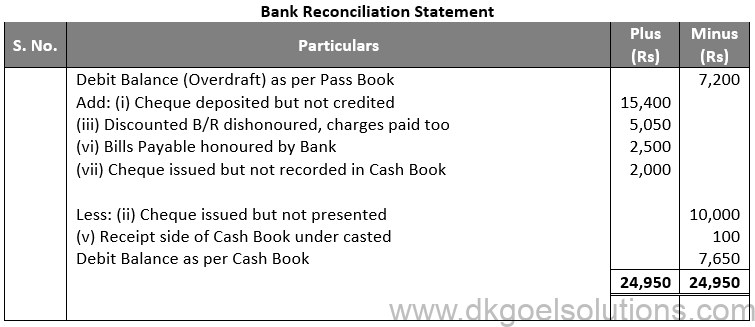

Question 35:

Solution 35:

Working Note:-

Cheque deposited but not credited

= Rs. 8,000 + Rs. 6,000 + Rs. 1,400

= Rs. 15,400

Cheque issued but not presented

= Rs. 12,000 – Rs. 2,000

= Rs. 10,000

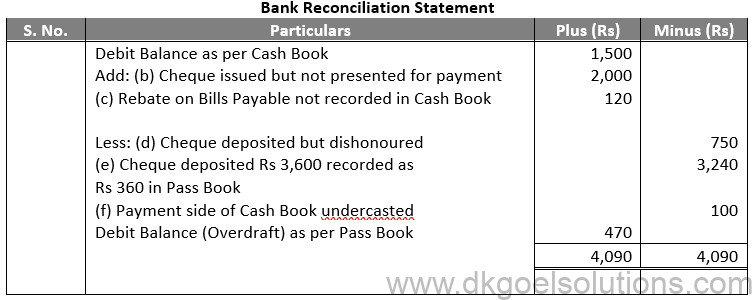

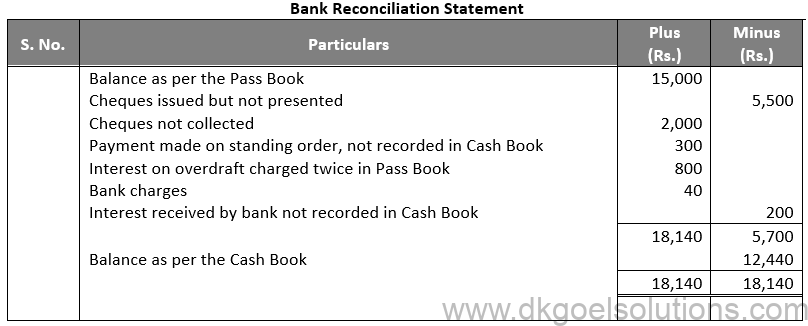

Question 36:

Solution 36:

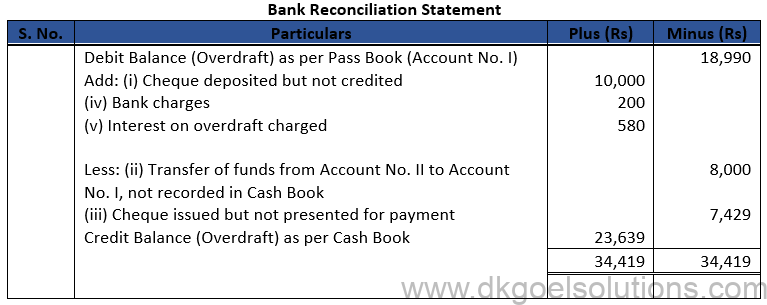

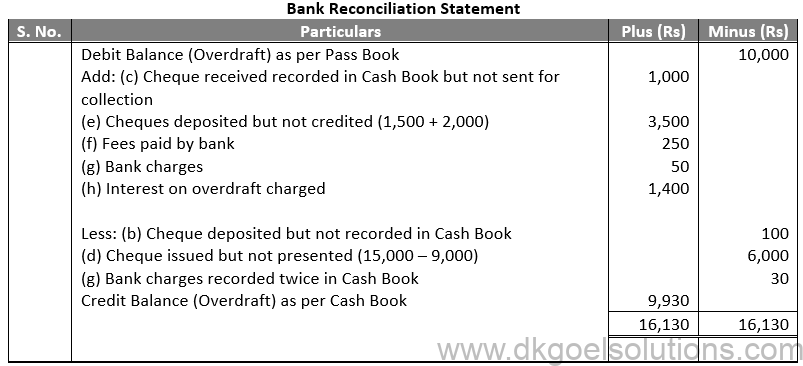

Question 37:

Solution 37:

Question 38:

Solution 38:

Working Note:-

Cheques deposited but not credited

= Rs. 1,500 + Rs. 2,000

= Rs. 3,500

Cheque issued but not presented

= Rs. 15,000 – Rs. 9,000

= Rs. 6,000

Question 39:

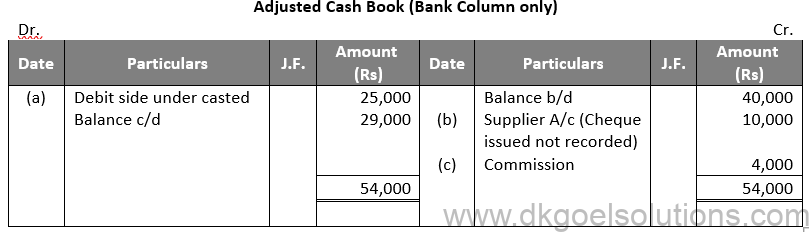

Solution 39:

Question 40:

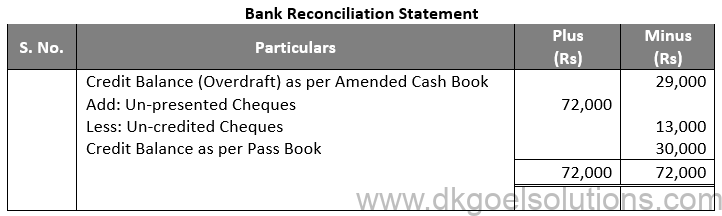

Solution 40:

Question 41:

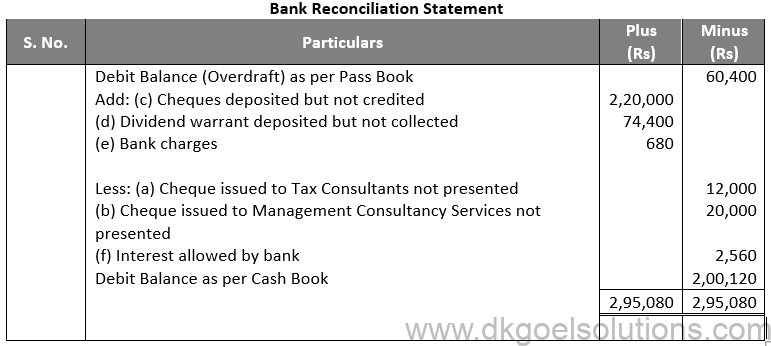

Solution 41:

Question 42:

Solution 42:

Question 43:

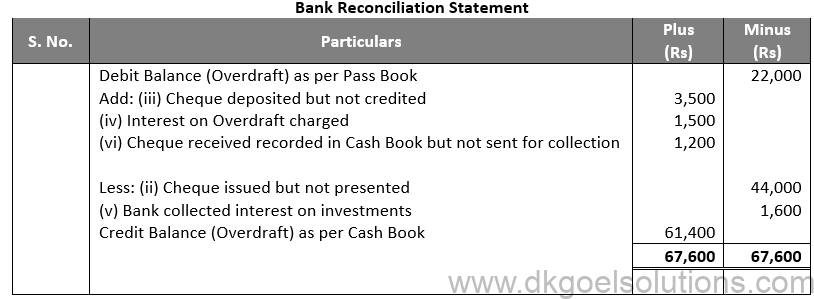

Solution 43:

Working Note:-

Cheque deposited but not credited

= Rs. 4,500 – Rs. 1,000

= Rs. 3,500

Cheque issued but not presented

= Rs. 50,000 – Rs. 6,000

= Rs. 44,000

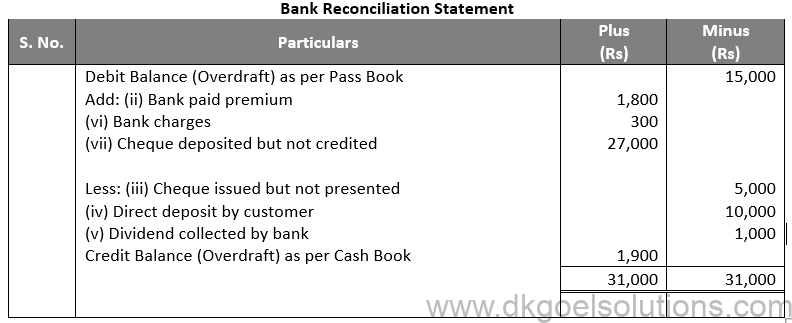

Question 44:

Solution 44:

Working Note:-

Bank paid premium

= Rs. 2,000 – Rs. 200

= Rs. 1,800

Cheque deposited but not credited

= Rs. 78,000 – Rs. 51,000

= Rs. 27,000

Cheque issued but not presented

= Rs. 55,000 – Rs. 50,000

= Rs. 5,000

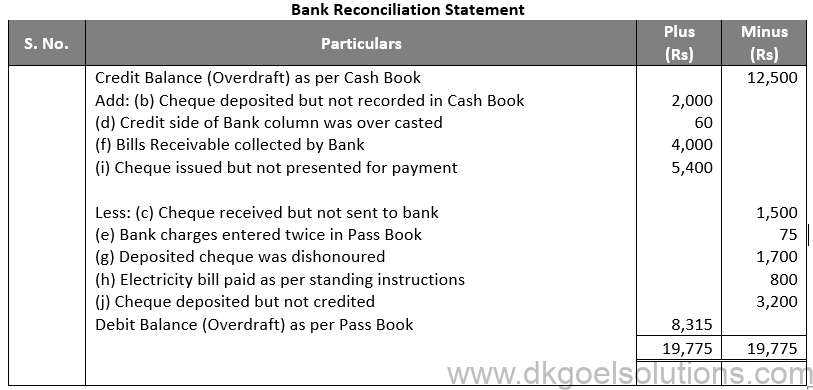

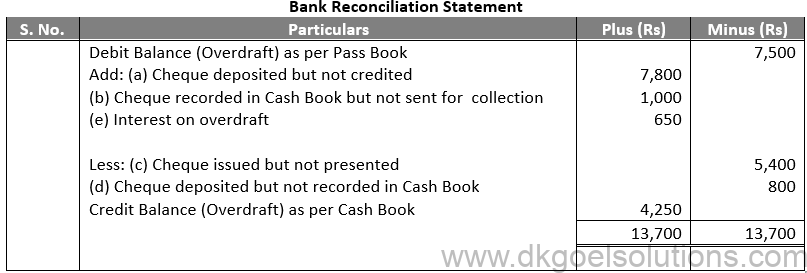

Question 45:

Solution 45:

Question 46:

Solution 46:

Working Note:- (DK Goel Solutions Class 11 Chapter 15)

Cheque issued but not presented

= Rs. 7,800 – Rs. 2,400

= Rs. 5,400

Question 47:

Solution 47:

A Bank Reconciliation Statement is a report designed by businesses to reconcile the bank transactions tracked in the accounting books with the actual bank statement. This statement helps to verify the authenticity of the entries recorded in the accounting books.

There can be tons of reasons to prepare the bank reconciliation statements. Some of which are listed below –

● Mismatch of cheque deposit and cheque credit dates.

● In case there are any errors in the entries of the accounting books.

● Bank errors while debiting or crediting transactions.

● Different dates of cheque issue and debiting of payment.

There is a bucket full of benefits of the bank reconciliation statements. Here are some major importance of these statements –

● Bank Reconciliation Statements help in detecting errors or omissions committed either by the accountant or the bank. This helps to rectify the mistakes quickly.

● A statement of bank reconciliation carries a mark of surety and assurance that the bank balance displayed on the cash book is 100% accurate.

● A statement of bank reconciliation casts the light on all the unwanted bank delays in processing the financial transactions and figures out their mistakes.

DK Goel Solutions holds great importance for the Class 11 students preparing for their Accountancy examination. The solutions accurately illustrate the bank reconciliation statements chapter with tons of examples. DK Goel Solutions bank reconciliation statement highlights the essential parts of the topic and supplies a bag full of questions to the students. To score well in the exams, the students can easily go through the easy-to-understand explanations.

Here the key points that cause the difference between the cash book and passbook balance –

● Cheque issued but not approved.

● Cheque paid into the bank but not recorded.

● Investment interest collected by the bank.

Some events when the cash balance can be higher than the passbook balance are as follows –

● The cheque drawn is not yet recorded in the payment section of the bank.

● Direct deposits of funds into the bank.

● Wrong credit or debit of transactions.

● Direct payments are performed by the bank on behalf of the account holders.