DK Goel Solutions Chapter 19 Rectification of Errors

Read below DK Goel Solutions Class 11 Chapter 19 Rectification of Errors. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter teaches the students the art of coping up with mistakes. It teaches them to handle and rectify data under certain guidelines, its not always that the accounting can be always done perfectly.

There are accounting entry mistakes which sometimes happen, here you will be able to understand what type of entries have to be passed so that the mistakes can be rectified and correct accounting position of a company can be properly displayed.

The chapter also contains lot of questions which can be very helpful for Class 11 commerce students of Accountancy and will also help build a strong concepts which will be really helpful in your career.

DK Goel Solutions Class 11 Chapter 19 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Rectification of Errors DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 19

Numerical Questions for DK Goel Solutions Class 11 Chapter 19

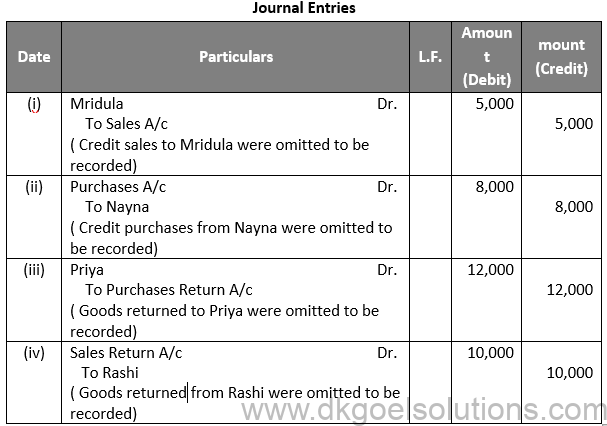

Question 1:

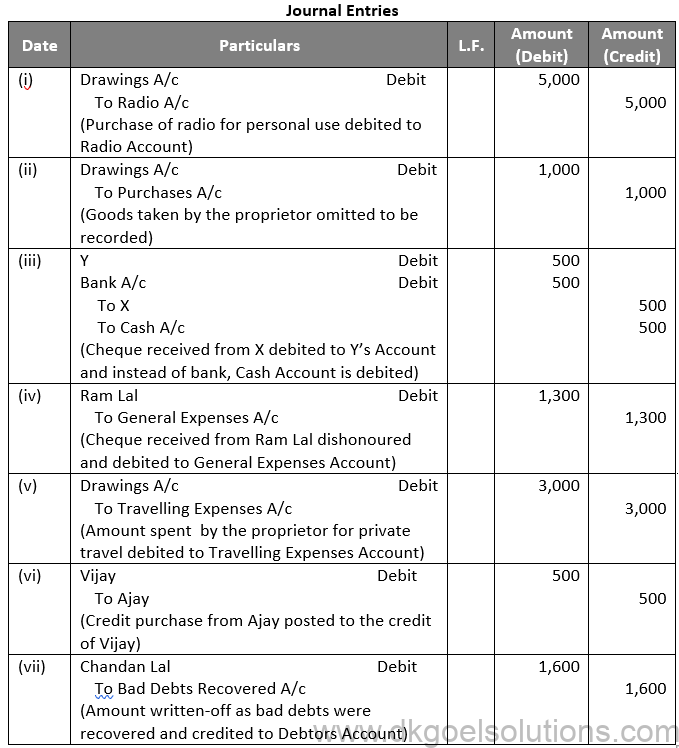

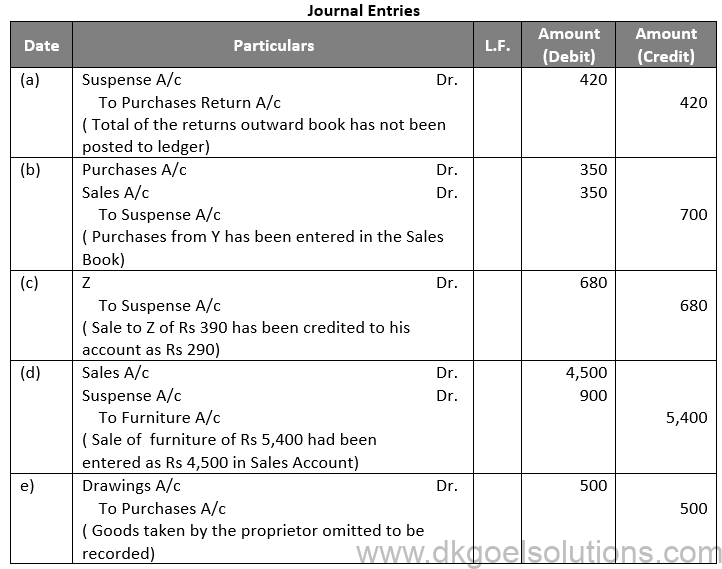

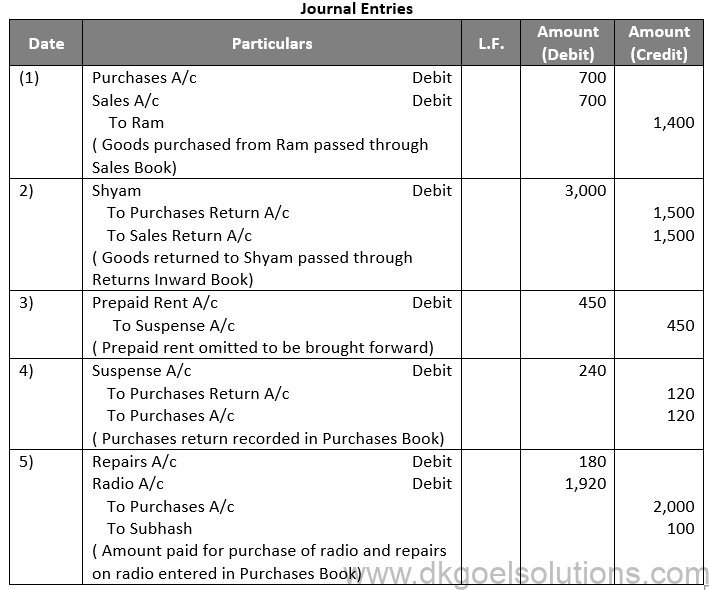

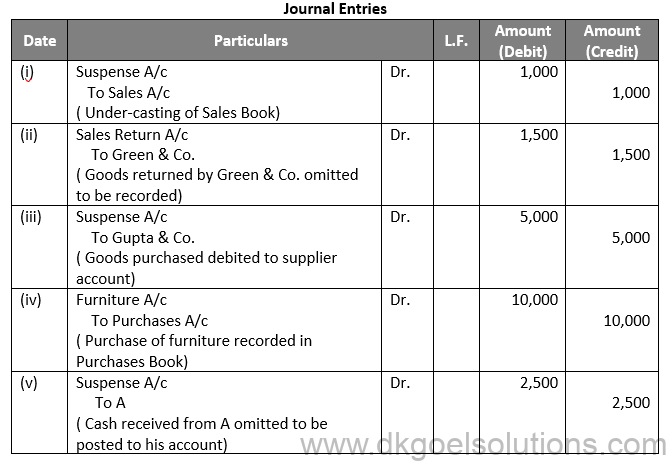

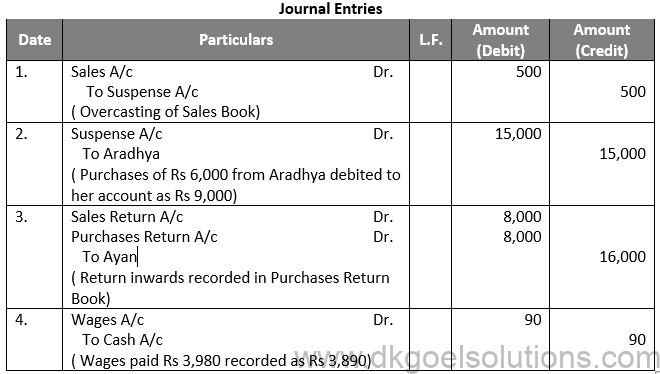

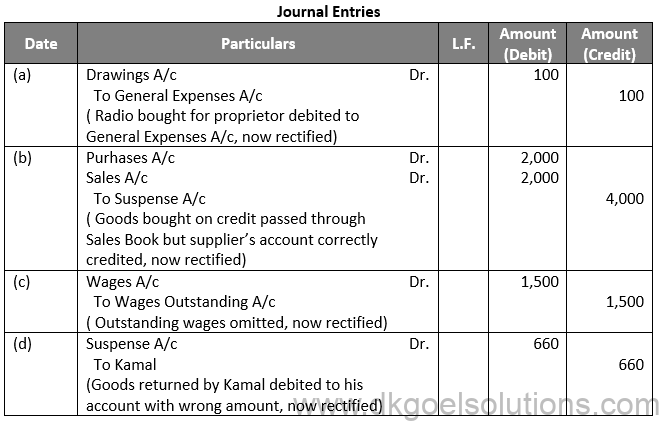

Solution 1:

Question 2

Solution 2:

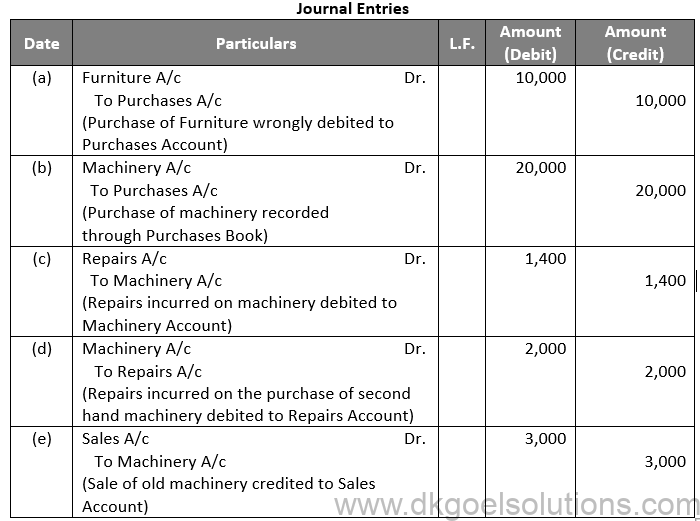

Question 3:

Solution 3:

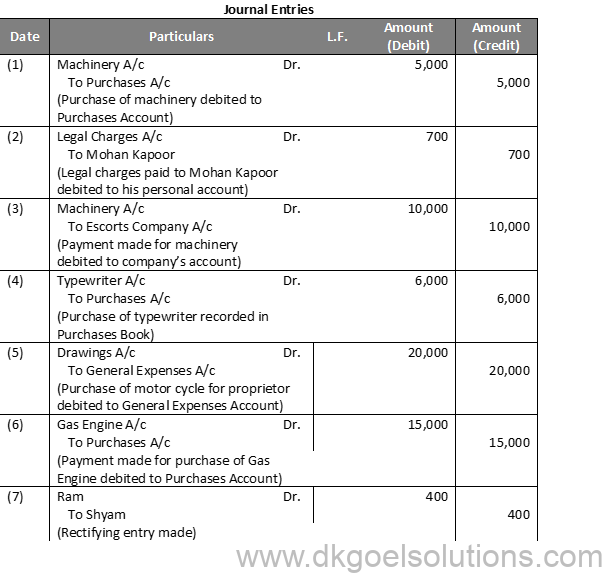

Question 4:

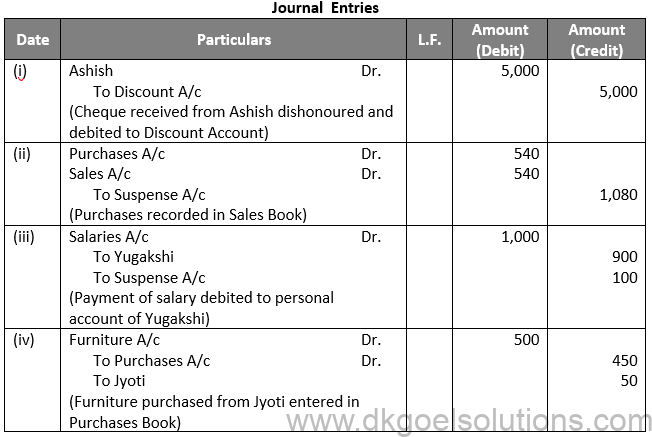

Solution 4:

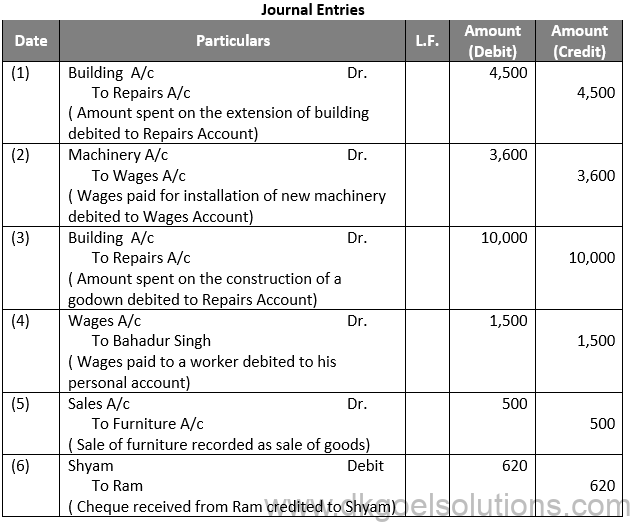

Question 5:

Solution 5:

Question 6:

Solution 6:

Question 7:

Solution 7:

Point in Mind:- DK Goel Solutions Class 11 Chapter 19

Errors may or may not affect the Trial Balance but it must be detected and rectified. The process of detecting errors and the procedure to correct the accounting records is called the rectification of errors.

Question 8:

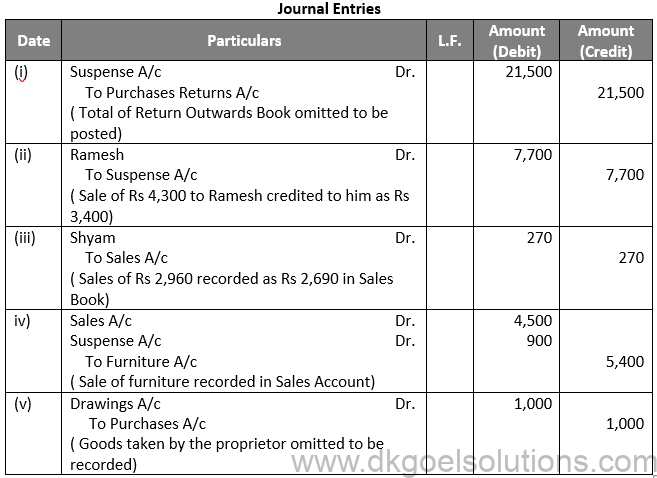

Solution 8:

Question 9

Solution 9:

Question 10:

Solution 10:

Question 11:

Solution 11:

Question 12:

Solution 12:

Question 13:

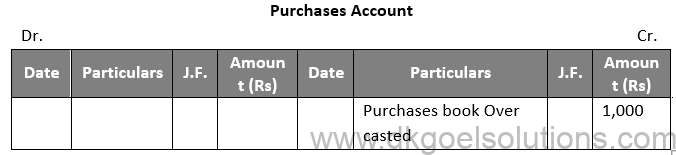

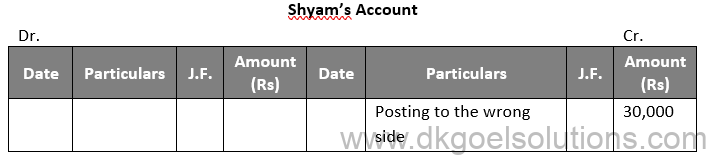

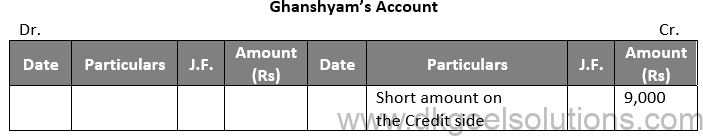

Solution 13:

(i) Purchases Book has been over-casted by Rs 1,000. Purchases Account will be rectified by recording Rs 1,000 on the credit side of Purchases Account

(ii) Purchases from Ram Rs 20,000 has been omitted to be posted to his account. To rectify this error Rs 20,000 should be posted on the credit side of Ram’s Account.

(iii) Purchase from Shyam Rs. 15,000 has been posted to the debit side of his account. To rectification will be done by posting the double amount Rs 30,000 on the credit side of Shyam’s Account

(iv) Purchases made from Ghanshayam Rs 10,000 have been posted to his account as Rs 1,000. Rs 9,000 more will be credited to his account for rectification of this error.

(v) Purchases made from Sitaram Rs 5,000 have been posted to his account as Rs 50,000. To rectify this error Rs 45,000 is debited to Sitaram’s Account.

Question 14:

Solution 14:

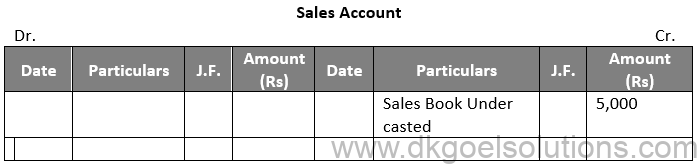

(i) Sales book has been undercasted by Rs 5,000. In this case it has been undercasted accordingly it would be rectified by crediting Sales Account with Rs 5,000.

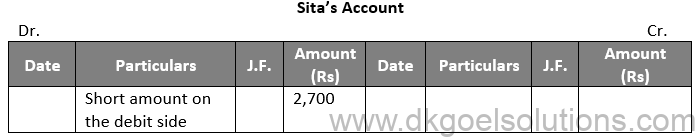

(ii) Credit sale to Sita Rs 6,300 has been posted to her account as Rs 3,600. Rs 2,700 more will be debited to her account for rectification of this error.

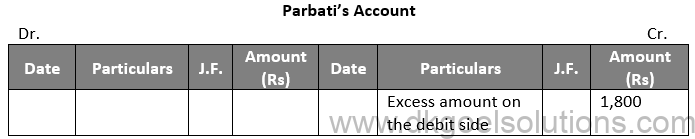

(iii) Credit sale to Radha Rs 2,400 has been posted to her account as Rs 4,200. In this case, Radha’s Account was debited with an excess amount of Rs 1,800 and accordingly Rs 1,800 should be credited to her account.

(iv) A credit sale to Parbati Rs 3,000 has been posted to the credit side of her account. Rs 6,000 must be debited to her account.

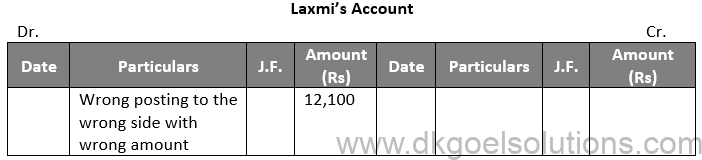

(v) A credit sale to Laxmi Rs 5,600 has been posted to the credit side of her account as Rs 6,500. Rs 12,100 (5,600 + 6,500) must be debited to her account.

Question 15 (A): Rectify the following errors assuming:-

That no suspense account has been opened with difference in the trial balance.

Solution 15(A):

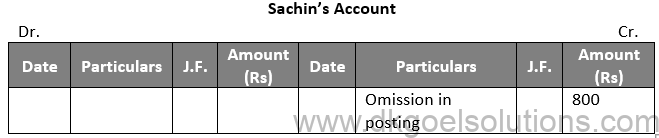

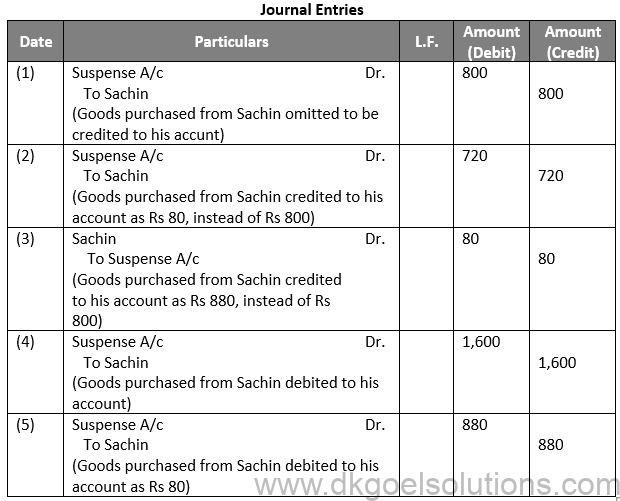

(i) Purchases of Rs 800 from Sachin have been omitted to be posted to his account. It would be rectified by crediting Sachin’s account with Rs 800.

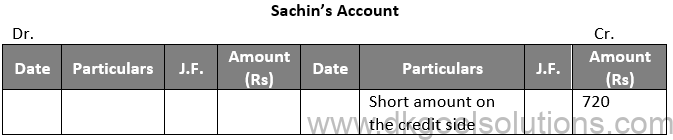

(ii) Purchases of Rs 800 from Sachin have been posted to his account as Rs 80. Rs 720 more will be credited to his account for rectification of this error.

(iii) Purchases of Rs 800 from Sachin have been posted to his account as Rs 880. Rs 80 will be debited to his account for rectification of this error.

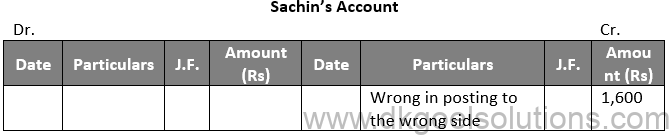

(iv) Purchase of Rs 800 from Sachin have been posted to the debit side of his account. Sachin’s account has been wrongly debited with Rs 800 instead of crediting his account. Hence rectification would be made by double the amount of entry.

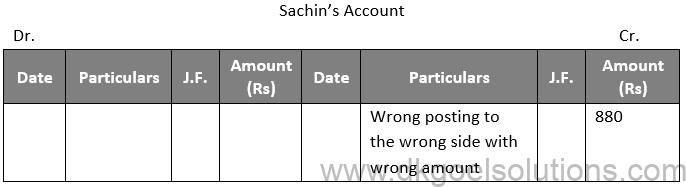

(v) Purchase of Rs 800 from Sachin have been posted to the debit side of his account as Rs 80. Sachin’s account has been wrongly debited with Rs 80 instead of crediting his account as Rs 800. Hence rectification would be made by adding these two amounts and Rs 880 will be credited to his account.

Question 15 (B):

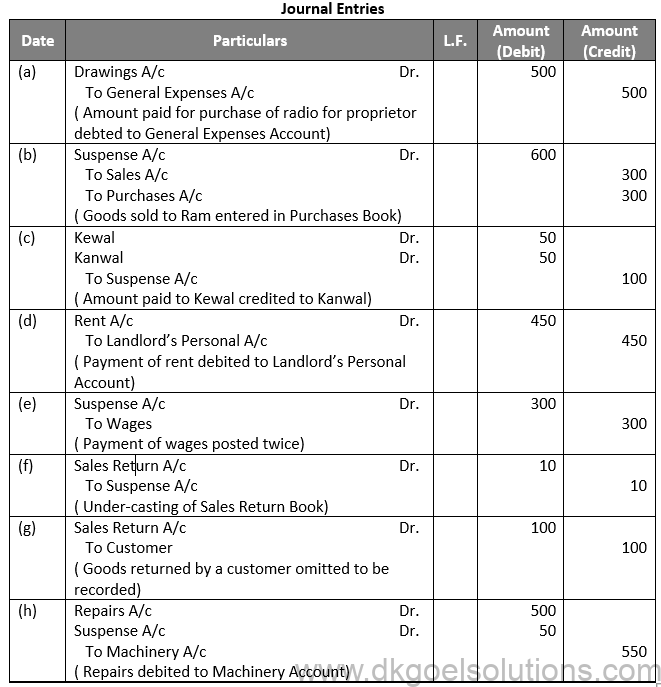

Solution 15 (B):

Point of Knowledge:- DK Goel Solutions Class 11 Chapter 19

Errors may or may not affect the Trial Balance but it must be detected and rectified. The process of detecting errors and the procedure to correct the accounting records is called the rectification of errors.

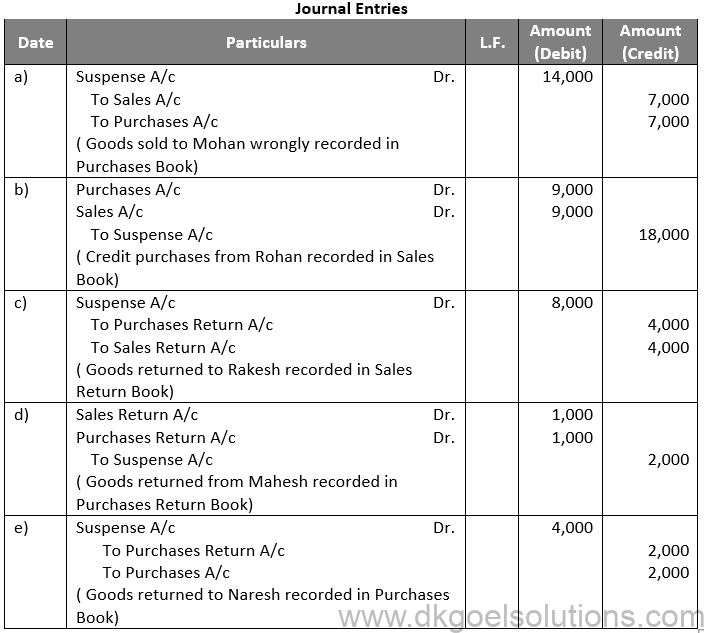

Question 16:

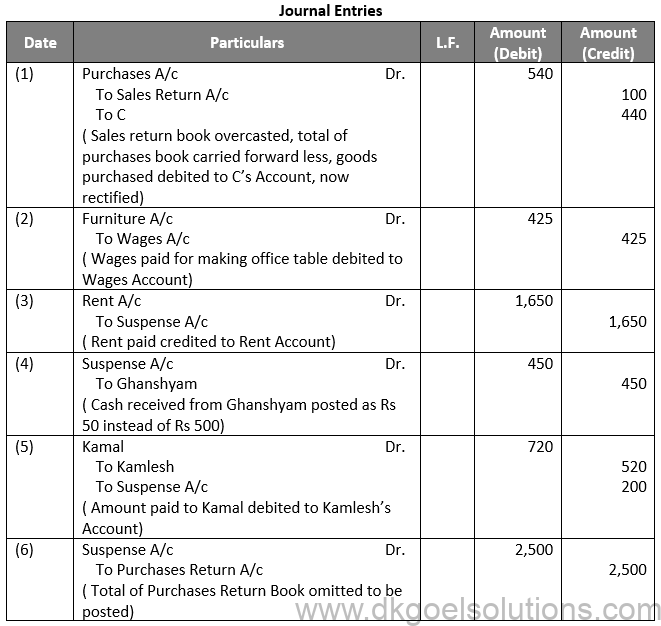

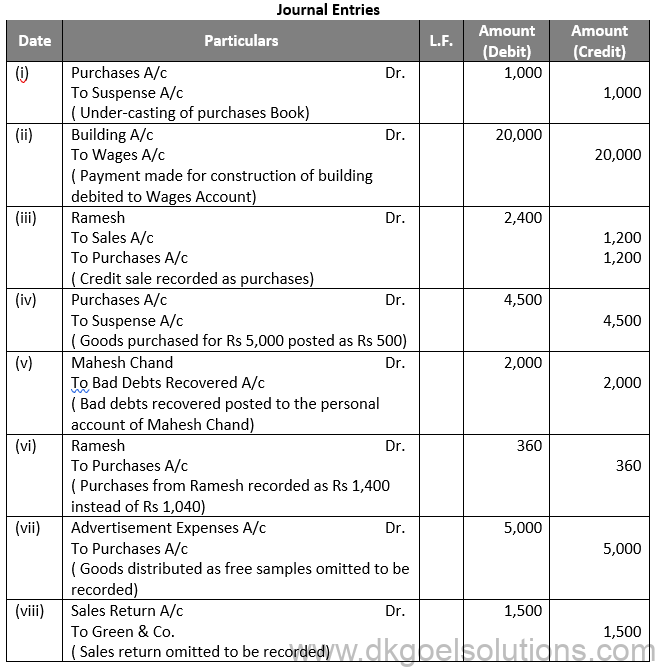

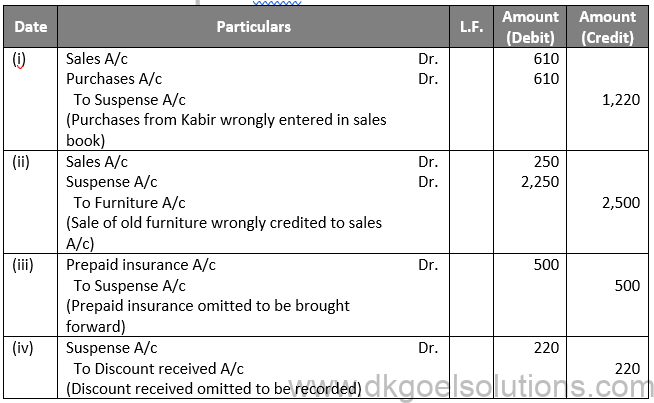

Solution 16:

Question 17:

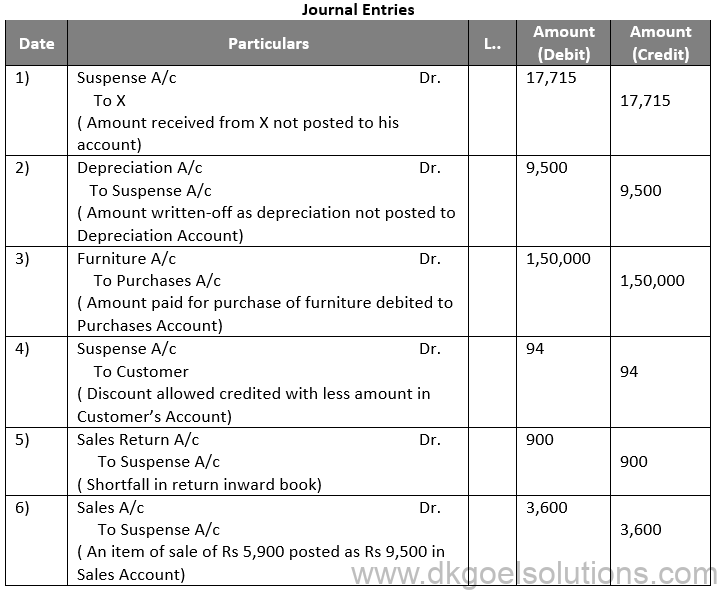

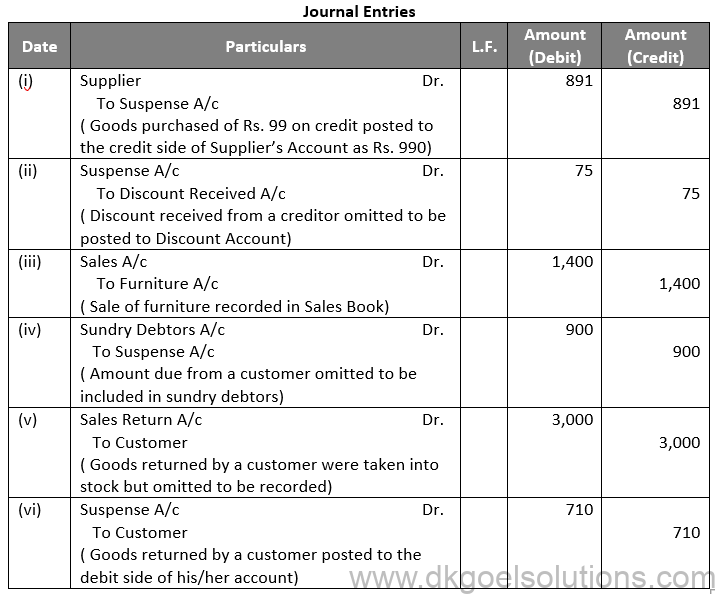

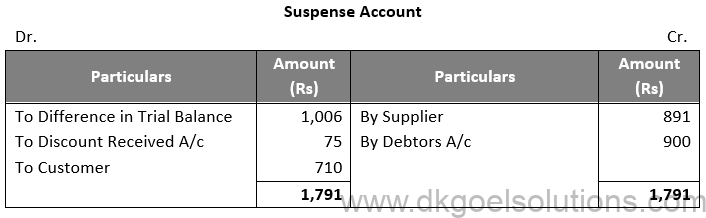

Solution 17:

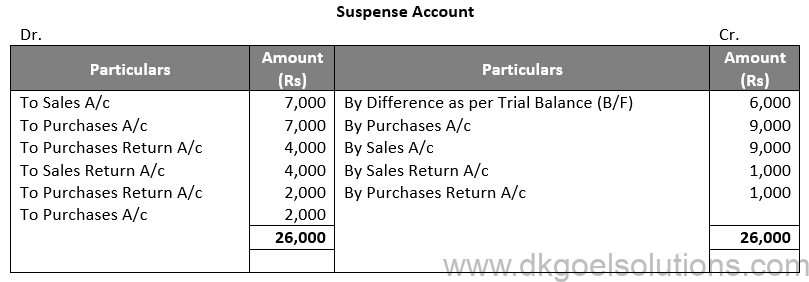

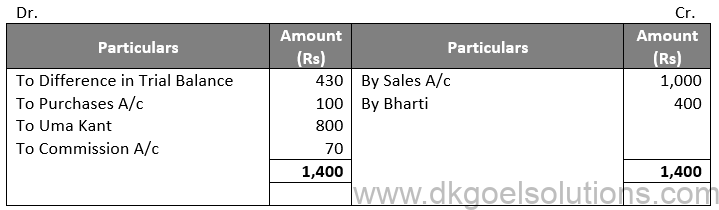

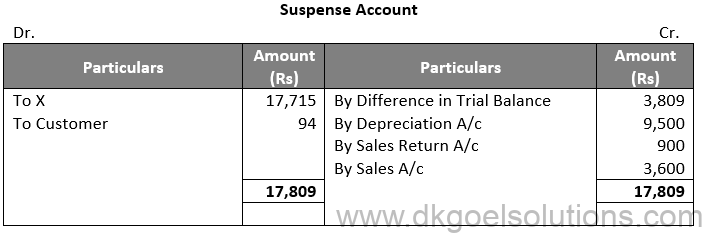

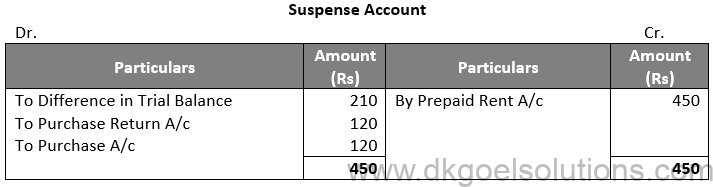

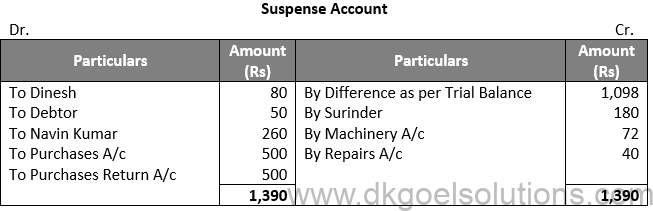

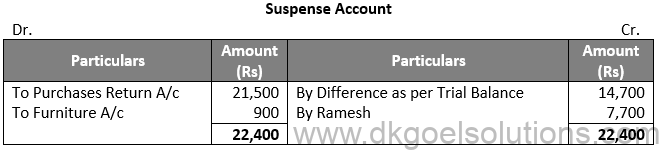

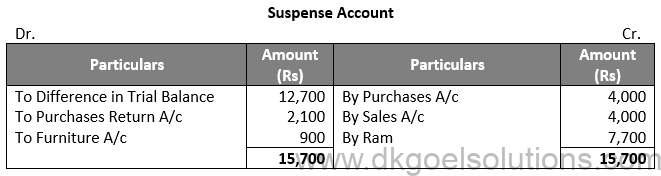

Suspense Account

Question 18:

Solution 18:

Question 19:

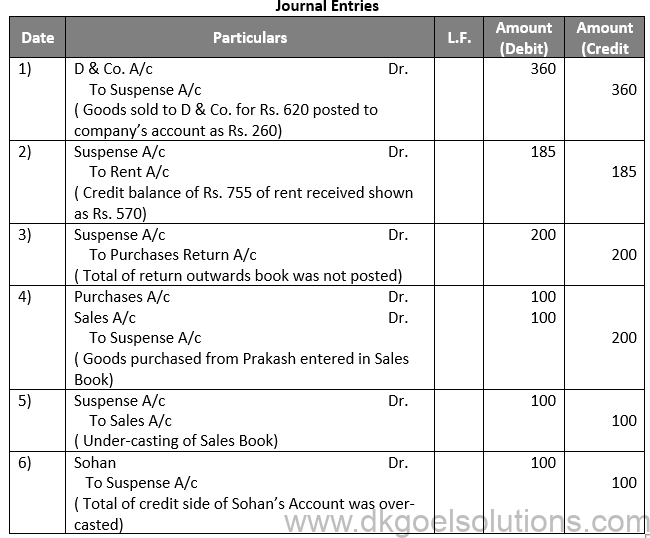

Solution 19:

- Goods amounting to Rs. 620 sold to D & Co. were correctly entered in the Sales book, but posted to the Company’s A/c as Rs. 260.

- A credit balance of Rs. 755 of Rent Received account was shown as Rs. 570.

- The total of Returns Outwards Book amounting to Rs. 200 was not posted to the Ledger.

- Goods worth Rs. 100 were purchased from Prakash but the amount was entered in the Sales Book. The account of Prakash was correctly credited.

- Sales Book was undercast by Rs. 100.

- The total of the credit side of Sohan’s account was overcast by Rs. 100.

Give journal entries to rectify these errors and prepare the Suspense Account.

Question 20:

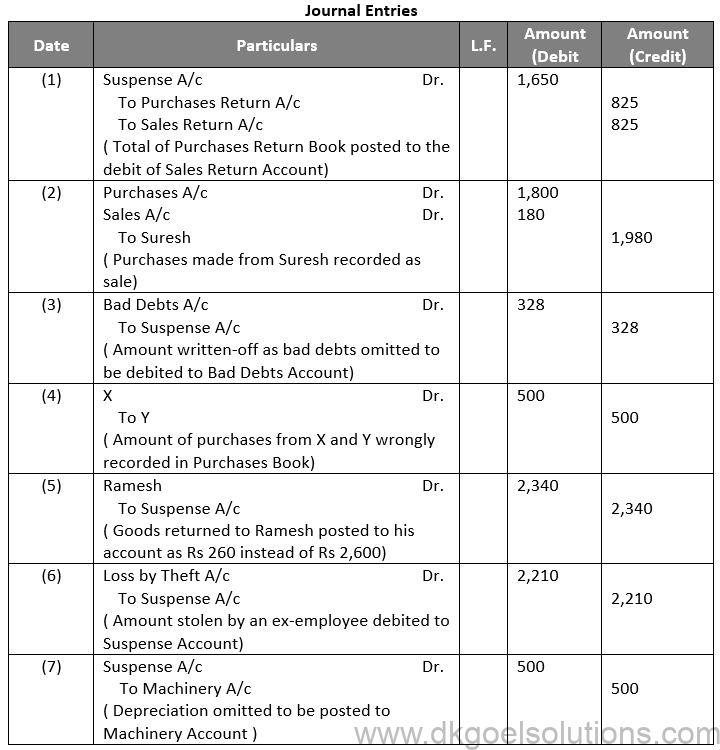

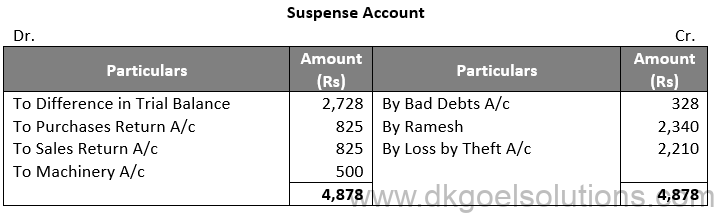

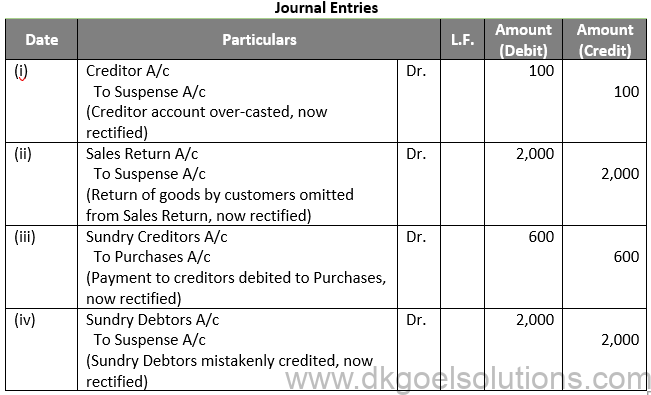

Solution 20:

Question 21:

Solution 21:

Question 22:

Solution 22:

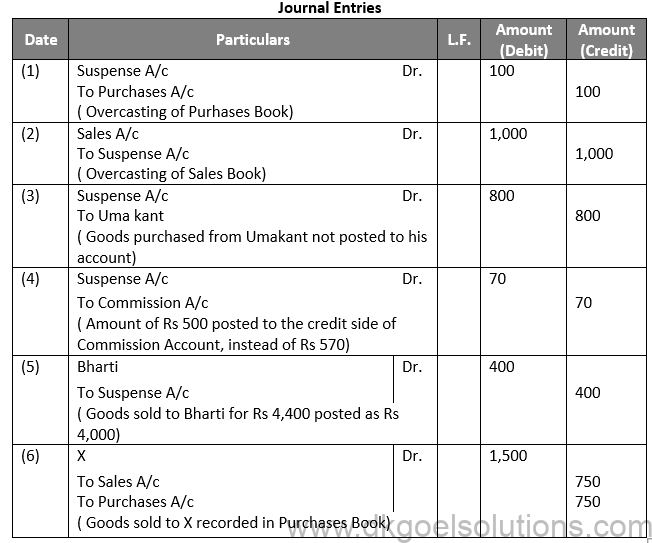

Question 23:

Solution 23:

Question 24:

Solution 24:

Question 25:

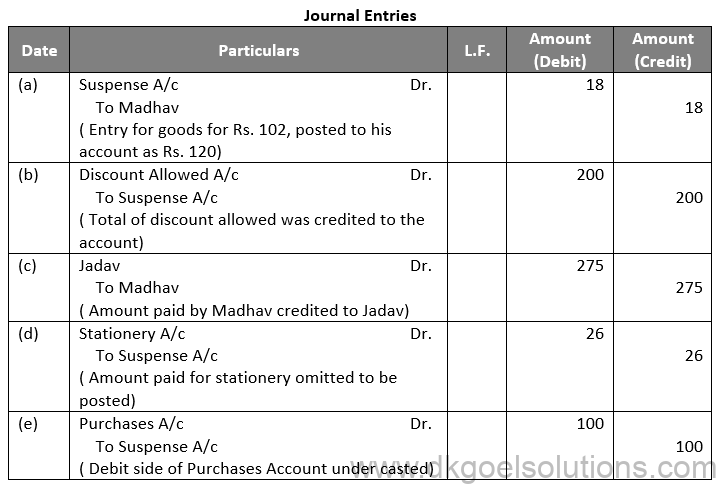

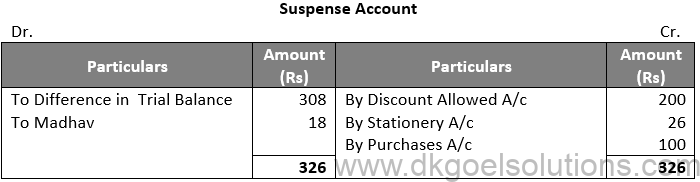

Question 26:

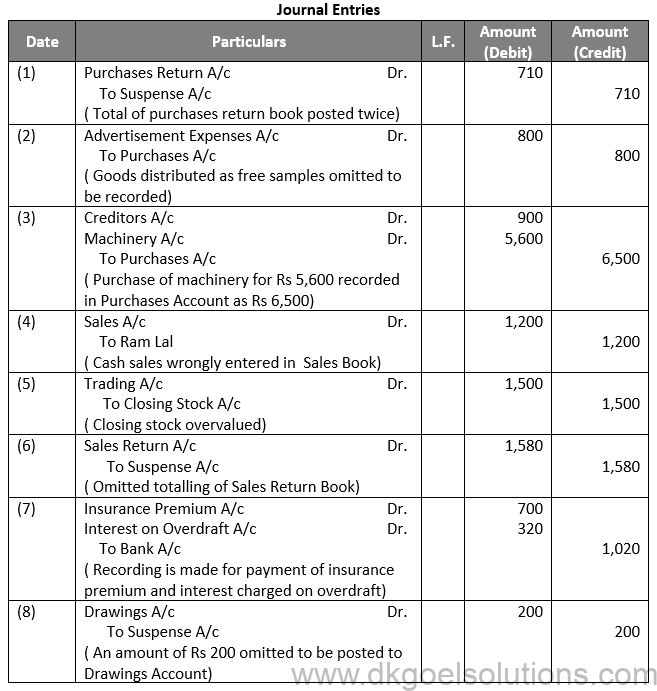

Solution 26:

Question 27:

Solution 27:

Question 28:

Solution 28:

Question 29:

Solution 29:

Question 30:

Solution 30:

Question 31:

Solution 31:

Question 32:

Solution 32:

Question 33:

Solution 33:

Question 34:

Solution 34:

Question 35:

Solution 35:

Point of Knowledge:-

Suspense Account is the account to which the difference in the Trial Balance is placed and it is opened when the Trial Balance doesn’t match. The Suspense Account is placed in the debit side if the total debit amount is less than the total credit amount and vice versa.

The Suspense Account is transferred to the asset side of the Balance sheet in case of a debit balance of a Suspense Account, otherwise transferred to the liabilities side of the in case of a credit balance. Suspense Account is used to rectify all one sided errors which affect the Trial Balance. Suspense Account is the net effect of one sided errors. Errors are rectified by entering the amount to the debit of the correct account and then credit is placed in the Suspense Account.

Question 36:

Solution 36:

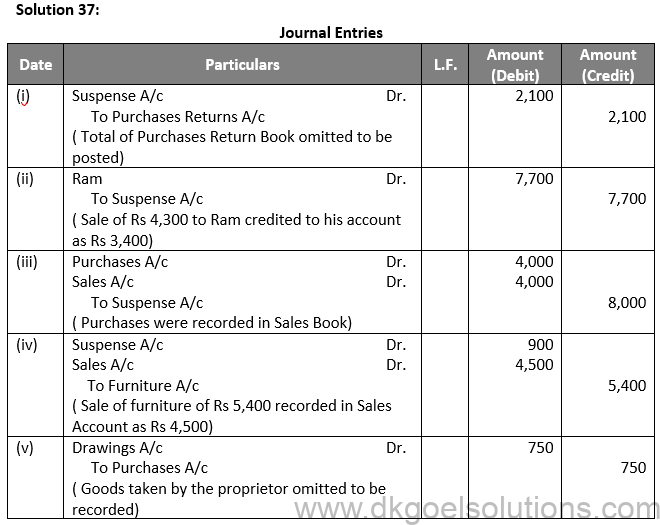

Question 37:

Point of Knowledge:-

Errors may or may not affect the Trial Balance but it must be detected and rectified. The process of detecting errors and the procedure to correct the accounting records is called the rectification of errors.

Question 38:

Question 39:

Solution 39:

Question 40:

Solution 40:

Question 41:

Solution 41:

Question 42:

Solution 42:

Question 43:

Solution 43:

Question 44:

Solution 44:

Point of Knowledge:-

- Errors of Omission

- Errors of Commission

- Errors of Principle

- Compensating Errors of omission and compensating errors do not affect the agreement of a Trial Balance.

Accounting errors are the general mistakes that occur while analyzing, recording, summarizing, or representing the entries of financial transactions of a business.

Here are the main types of accounting errors –

Error of Commission – This indicates a financial transaction is miscalculated. For instance, an error of commission is the addition of some figures, which should be subtracted.

Error of Omission – As the name suggests, is a mistake in recording the transaction. This type of error occurs when a financial transaction is not recorded in the accounting books.

Error of Principle – This is one of the most impactful mistakes. Error of principle occurs when a financial transaction violates the accounting principles (GAAP). For instance, a good example of the error of principle can be the entry of expenditure in an inappropriate category of accounting books.

An error of duplication takes place when an entry appears twice or more in the accounting book. This implies that the transaction possesses double debit or credit entries.

Error of entry reversal is one of the most common errors in accounting. It occurs due to the inappropriate entry of the transaction data, i.e. when the debited data is placed in the credit section or the credited data is entered in the debited section.

Clerical errors are the mistakes that pop out due to improper recording of financial transactions.

The value-based problems play a significant role in framing the overall score of the students. The questions asked from the rectification of error chapter in the Class 11 Accountancy exam are quite easy. With a proper understanding of the chapter, the students can solve the problem within a blink. To develop a firm grip on the chapter, the students can refer to DK Goel Solutions. The solutions offer a comprehensive overview of the chapter, including important explanations and questions that help the students score full marks on the topic.