DK Goel Solutions Chapter 21 Financial Statements

Read below DK Goel Solutions Class 11 Chapter 21 Financial Statements. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter in DK Goel Accountancy Class 11 Solutions educates the students about trading accounts and helps them to develop an understanding of adjusted purchase, gross profit, and direct expenditure, the cost of sold goods, the value of sales, and other important topics.

At the end of accounting period every organization extracts its financial statements to understand the final results. Students must understand what these financial statements are and how to read them.

The chapter contains lot of questions which can be very helpful for Class 11 commerce students of Accountancy and will also help build a strong concepts which will be really helpful in your career.

DK Goel Solutions Class 11 Chapter 21 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Financial Statements DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 21

Short Answer Questions for DK Goel Solutions Class 11 Chapter 21

Question 1: What is the used of financial statement for employees and trade union?

Solution 1: They will judge on the basis of the financial statement how much bonus and raise in their salary is probable from the company’s earnings.

Question 2: What is the use of financial statement for potential investors?

Solution 2: With the aid of financial statements, they will determine the short-term and long-term financial soundness and earning potential of the firm. The revenue pattern, earnings trend, shortcomings and the outlook for the company’s potential growth can also be analysed.

Question 3: What is meant by operating profit?

Solution 3: The benefit gained from the company’s regular operational operations is operating profit. It is done by deducting the express operating profit from the gross profit. Expenses that are linked to the company’s primary or regular functions are considered operational expenses.

Question 4: What is meant by Indirect Expenses? Give two examples.

Solution 4: Indirect costs are any costs that are borne that are not directly related to the procurement of products or the production of goods.

Below are the two indirect expense examples:

- Office Expenses

- Salaries

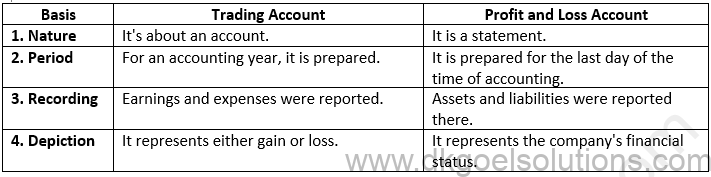

Question 5: Give four points of distinction between Trading Account & Profit and Loss Account.

Solution 5:

Question 6:

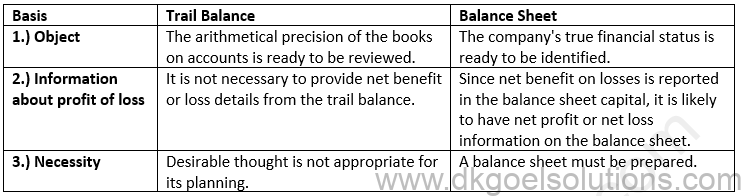

Solution 6: To determine the financial status of an organization on a given date, a balance sheet is compiled. This suggests liabilities on the left side and assets on the right side.

Question 7:

Solution 7: Grouping means showing common headings of assets or liabilities of a similar nature and Marshalling means showing the assets and liabilities in the correct order.

Question 8:

Solution 8: An asset that is more readily convertible into cash such as cash in hand is first written according to this process and then proceeds those assets that are relatively less readily convertible so that the least liquid asset such as goodwill is last seen.

Question 9:

Solution 9: An asset that is more readily convertible into currency, such as cash in hand, is first written and then follows those assets that are relatively less readily convertible in order to last reveal the least liquid asset, such as goodwill.

Question 10:

Solution 10: Current assets:- Current assets are those assets retained for resale or for cash conversion. This are the properties that are likely to be realized in one year or over the usual operational cycle time. By selling these properties, a corporation generates profit but not by holding them for a longer time as stock. These properties are transient in nature and, from time to time, can alter. This are also regarded as commodities that are floating or circulating.

Non-current assets:- Non-current properties, such as property and building, plant and equipment, motor vehicles, furniture, etc., are assets that are purchased for continual use and continue for several years.

Question 11:

Solution 11: Example of Fixed Assets:-

1.) Furniture

2.) Plant and Machinery

Example of Current Assets:-

1.) Cash

2.) Stock

Question 12:

Solution 12: These are the obligations that would be due only when a single incident happens, otherwise not those as:—

(i) Discounted bill liabilities

(ii) Liability related to a suit pending in a court of law

(iii) Obligation with respect to a promise offered to another person.

Question 13:.

Solution 13:

Question 14:

Solution 14: Those commitments that are to be paid at the earliest will first be set down. In other terms, first of all, current liabilities are written down, then non-current or long-term liabilities and eventually the wealth of the proprietor.

Numerical Questions for DK Goel Solutions Class 11 Chapter 21

Question 1:

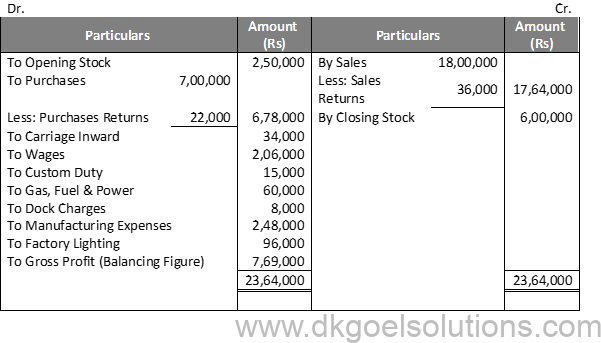

Solution 1

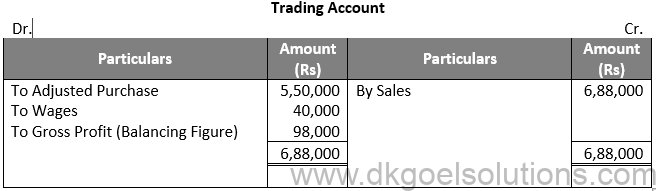

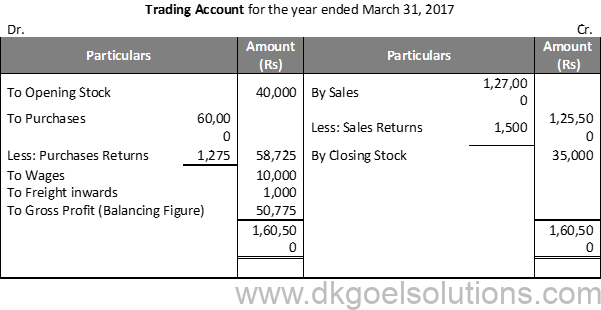

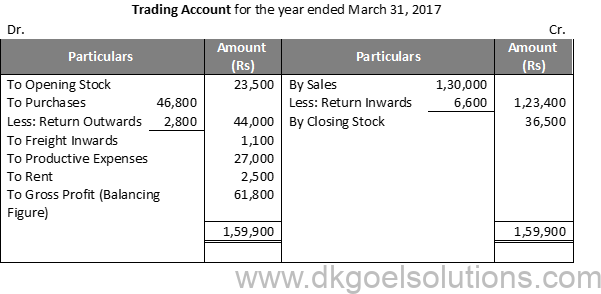

Trading Account for the year ended March 31,2017

Point of Knowledge:-

Trading Account is the account that reveals the gross profit or gross loss. It is credited with the amount of sales of goods and debited with the opening stock of goods along with the direct expenses related to the sales made. Trading Account is prepared to know gross profit or gross loss during the accounting period.

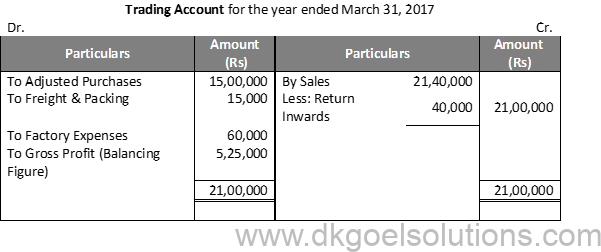

Question 2 (A):

Solution 2 (A):

Working Note:-

Computation of Adjusted Purchases = Opening Stock + Net Purchases – Closing Stock

Question 2 (B):

Solution 2 (B):

Question 3 (A):

Solution 3 (A):

Computation of Cost of Goods Sold:-

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Cost of Goods Sold = 40,000 + 50,000 + 10,000 – 15,000

Cost of Goods Sold = Rs. 85,000

Question 3 (B):

Solution 3 (B):

Computation of Gross Profit:-

Gross Profit = Net Sales – COGS (Cost of goods sold)

Gross Profit = Rs. 3,92,000 – Rs. 3,92,000 = Rs. 1,10,000

Computation of Cost of Goods Sold:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Cost of goods sold = Rs. 32,000 + Rs. 2,80,000 + Rs. 20,000 – Rs. 50,000

Cost of goods sold = Rs. 2,82,000

Computation of Net Sales:-

Net Sales = Sales – Sales Return

Net Sales = Rs. 4,00,000 – Rs. 8,000 = Rs. 3,92,000

Question 4:

Solution 4:

Computation of Gross Profit:-

Gross Profit = Net Sales – COGS (Cost of goods sold)

Gross Profit = Rs. 6,00,000 – Rs. 5,40,000

Gross Profit = Rs. 60,000

Computation of Cost of Goods Sold:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Cost of goods sold = Rs. 0 + Rs. 6,50,000 + Rs. 70,000 – Rs. 0

Cost of goods sold = Rs. 7,20,000

Cost of goods sold = 3/4 × 7,20,000

Cost of goods sold = Rs. 5,40,000

Computation of Net Purchases:-

Net Purchases = Purchases – Purchases Return

Net Purchases = Rs. 6,80,000 – Rs. 30,000

Net Purchases = Rs. 6,50,000

Computation of Direct Expenses:-

Direct Expenses = Carriage Inwards + Wages

Direct Expenses = Rs. 20,000 + Rs. 50,000

Direct Expenses = Rs. 70,000

Question 5 (A):

Solution 5 (A):

Computation of Closing Stock:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Closing Stock = Opening Stock + Purchases + Direct Expenses – COGS

Closing Stock = Rs. 5,000 + Rs. 9,100 + Rs. 1,000 – Rs. 9,000 = Rs. 6,100

Computation of Cost of Goods Sold:-

Cost of goods sold = Net Sales – Gross Profit

Cost of goods sold = Rs. 15,000 – Rs. 6,000 = Rs. 9,000

Computation of Net Purchases:-

Net Purchases = Purchases – Purchases Return

Net Purchases = Rs. 10,000 – Rs. 900 = Rs. 9,100

Question 5 (B):

Solution 5 (B): Computation of Closing Stock:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Closing Stock = Opening Stock + Purchases + Direct Expenses – COGS

Closing Stock = Rs. 38,000 + Rs. 3,36,000 + Rs. 26,000 – Rs. 3,75,000 = Rs. 25,000

Computation of Cost of Goods Sold:-

Cost of goods sold = Net Sales + Gross Loss

Cost of goods sold = Rs. 3,60,000 – Rs. 5,000 + Rs. 20,000 = Rs. 3,75,000

Computation of Net Purchases:-

Net Purchases = Purchases – Purchases Return

Net Purchases = Rs. 3,40,000 – Rs. 4,000 = Rs. 3,36,000

Question 6 (A):

Solution 6 (A):

Net Sales = Rs. 8,00,000

Gross Profit = Sales × 40%

Gross Profit = Rs. 8,00,000 × 40% = Rs. 3,20,000

Cost of Goods Sold = Sales – Gross Profit

Cost of Goods Sold = Rs. 8,00,000 – Rs. 3,20,000 = Rs. 4,80,000

Question 6 (B):

Solution 6 (B):

Net Sales = Rs. 12,00,000

Gross Profit = Sales × 331/3%

Gross Profit = Rs. 12,00,000 × 331/3% = Rs. 4,00,000

Cost of Goods Sold = Sales – Gross Profit

Cost of Goods Sold = Rs. 12,00,000 – Rs. 4,00,000 = Rs. 8,00,000

Question 7:

Solution 7:

Net Sales = Rs. 9,00,000

Gross Profit = Sales × 20/120

Gross Profit = Rs. 9,00,000 × 1/6

Gross Profit = Rs. 1,50,000

Cost of Goods Sold = Sales – Gross Profit

Cost of Goods Sold = Rs. 9,00,000 – Rs. 1,50,000

Cost of Goods Sold = Rs. 7,50,000

Question 8:

Solution 8:

Computation of Closing Stock:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Closing Stock = Opening Stock + Purchases + Direct Expenses – COGS

Closing Stock = Rs. 1,20,000 + Rs. 9,30,000 + Rs. 0 – Rs. 9,36,000

Closing Stock = Rs. 10,50,000 – Rs. 9,36,000 = Rs. 1,14,000

Computation of Cost of Goods Sold:-

Cost of Goods sold = Net Sales – Gross Profit

Cost of Goods sold = Rs. 15,60,000 – Rs. 6,24,000 = Rs. 9,36,000

Computation of Gross Profit:-

Gross Profit = 40% of Sales

Gross Profit = Rs. 15,60,000 × 40% = Rs. 6,24,000

Question 9:

Solution 9:

Computation of Closing Stock:-

Cost of goods sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

Closing Stock = Opening Stock + Purchases + Direct Expenses – COGS

Closing Stock = Rs. 4,80,000 + Rs. 13,60,000 + Rs. 0 – Rs. 15,00,000

Closing Stock = Rs. 18,40,000 – Rs. 15,00,000 = Rs. 3,40,000

Let us assumed that Cost of goods sold be ‘x’

Gross Profit = Cost × 30%

Gross Profit = x × 30%

Gross Profit = x × 30/100

Gross Profit = 30/100 x

Computation of Cost of Goods Sold:-

x = 19,50,000 – 30/100 x

x-30/100 x = 19,50,000

(100x – 30x)/100 = 19,50,000

70x = Rs. 19,50,00,000

x = Rs. 19,50,00,000/70

x = Rs. 15,00,000

Question 10:

Solution 10:

Gross Profit = 25% on sales

We know,

25% = 1/4

1/4th on sales = 1/3th on Cost

Computation of Gross Profit:-

Gross Profit = Rs. 4,50,000 × 1/3

Gross Profit = Rs. 1,50,000

Computation of Sales:-

Cost of goods sold = Sales + Gross Profit

Sales = Cost of goods sold + Gross Profit

Sales = Rs. 4,50,000 + Rs. 1,50,000

Sales = Rs. 6,00,000

Question 11:

Solution 11:

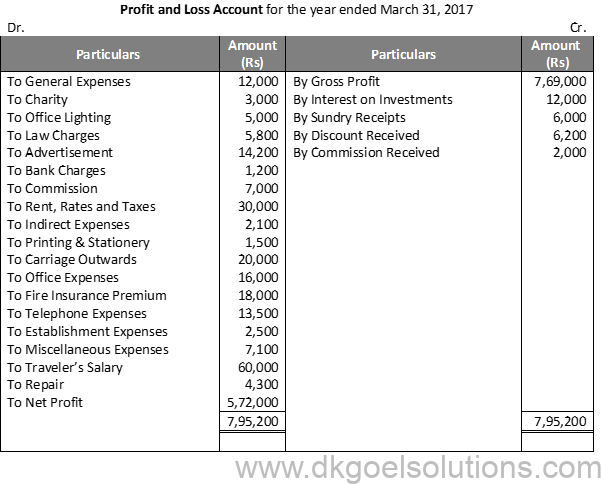

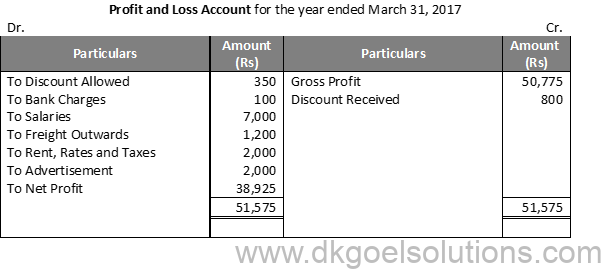

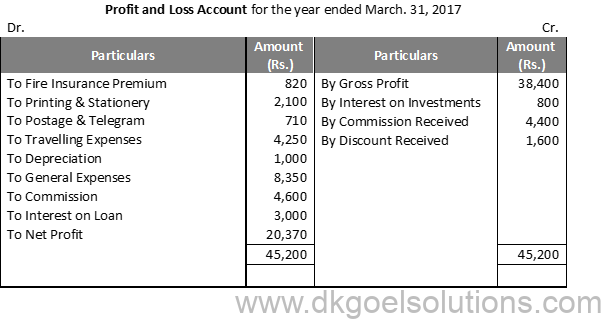

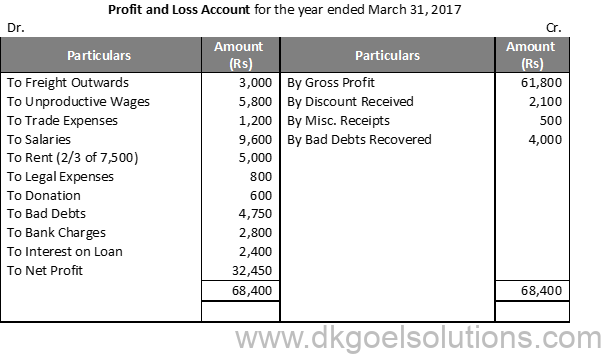

Profit and Loss Account for the year ended March 31, 2017

Question 12:

Solution 12:

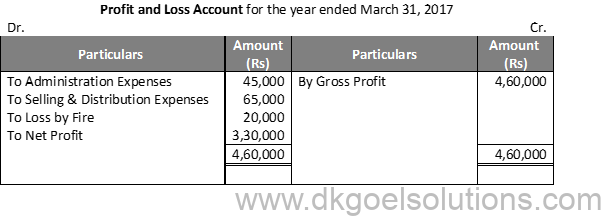

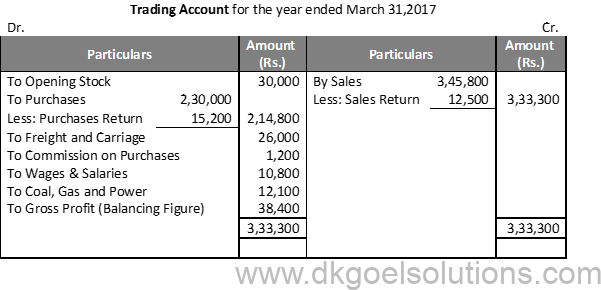

Trading Account for the year ended March 31, 2017

Profit and Loss Account for the year ended March 31, 2017

Working Note:- (DK Goel Solutions Class 11 Chapter 21)

Computation of Operating Profit:-

Operating Profit = Net Profit – Non-Operating Income + Non-Operating Expenses

Operating Profit = Rs. 3,30,000 – Rs. 0 + Rs. 20,000 = Rs. 3,50,000

Question 13:

Solution 13: Computation of Operating Profit:-

Operating Profit = Net Profit − Non-Operating Income + Non-Operating Expenses

Operating Profit = 5,00,000 − 30,000 + 77,100 = Rs 5,47,100

Non-Operating Income = Dividend Received + Rent Received

Non-Operating Income = 6,000 + 24,000 = 30,000

Non-Operating Expenses = Loss on Sale of Furniture + Loss by Fire + Interest on Loan + Donation

Non-Operating Expenses = 12,000 + 50,000 + 10,000 + 5,100 = Rs 77,100

Question 14:

Solution 14:

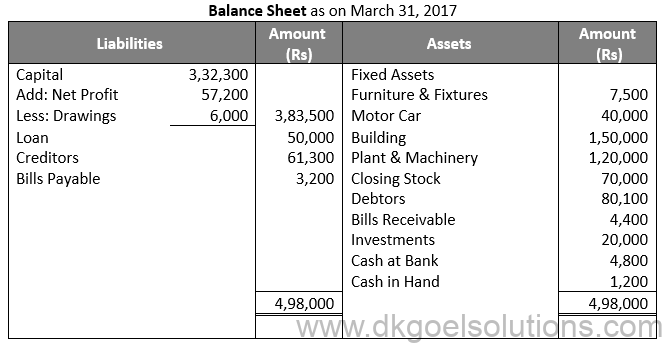

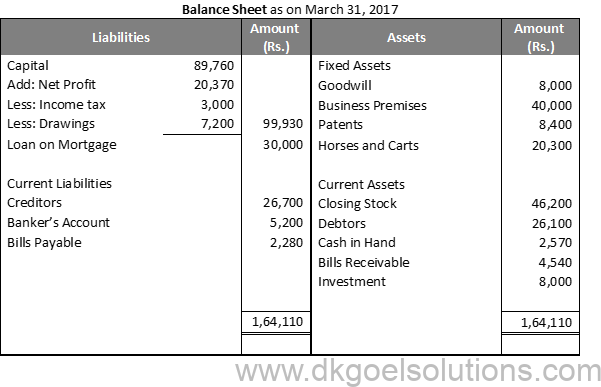

Working Note:-

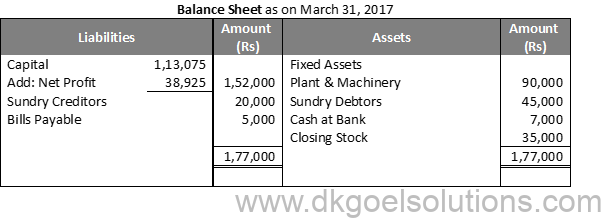

Balance Sheet is prepared with a view to measure true financial position of a business at a particular point of time. It is a method to show the financial position of a business in a systematic and standard form. The financial position of the business can be understood at a glance. The debit and credit balances of related accounts are shown on the assets and liabilities side of the Balance Sheet.

Question 15:

Solution 15:

Question 16:

Solution 16:

Point in mind:-

Present assets are those assets retained for resale or for cash conversion. This is the properties that are likely to be realized in one year or over the usual operational cycle time.

Question 17:

Solution 17:

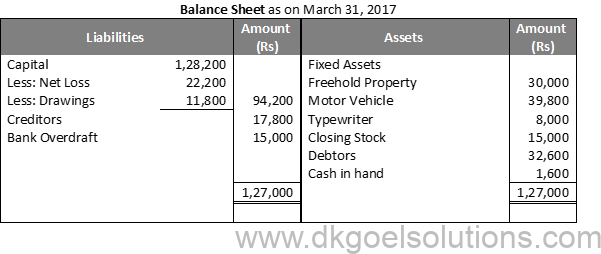

Working Note:-

Computation of Drawings:-

Drawings = Household Expenses + Life Insurance Premium

Drawings = Rs. 10,000 + Rs. 1,800 = Rs. 11,800

Question 18:

Solution 18:

Point in Mind:-

Present assets are those assets retained for resale or for cash conversion. This is the properties that are likely to be realized in one year or over the usual operational cycle time.

Question 19:

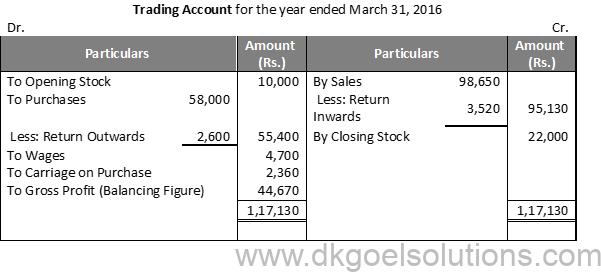

Solution 19:

Point of Knowledge:-

Direct expenses are those expenses incurred up to the point of taking them to the place of business for sales of products. In the case of a production firm, the losses accrued need to be made available for sale.

The two direct cost examples are:

- Octroi paid for the sales

- Expenses for Power

Question 20:

Solution 20: The Presentation of assets in the order of Permanence are:-

- Goodwill

- Land and Building

- Plant and Machinery

- Motor Vehicle

- Loose Tools

- Furniture

- Investment (Long-term)

- Stock

- Sundry Debtors

- Marketable Securities (Short-term)

- Cash at Bank

- Cash in Hand

A final statement depicts a written record that reflects the profitability and financial position of a business. A final statement is basically the collection of different essential accounting elements, including the statement of cash flow, balance sheets, income statement, and many more. This gives a clear picture of the company’s financial status of a specific accounting year and helps the firm to make better financial decisions.

Operating profit refers to the profits earned by a company from its core business operations, which excludes interest and tax deductions. The expenses connected to a company’s regular functions are termed operational profits. The operational profits are basically a financial measurement calculated by subtracting the express operating profit of a firm from its gross profit.

As explained in DK Goel Solutions class 11 Chapter 21, Indirect expenses are the costs that are not directly linked with the core business operations of a company. Although these expenses are not directly connected to the production of goods or services for a company, the indirect expenses play an important role in enhancing the performance of the company.

Some of the examples of indirect expenses are – Salaries and Office expenses.

A balance sheet compiles the financial transactions of a company arranged in chronological order in accordance with dates. The balance sheet represents the assets on the right side and the liabilities on the left side.

Current Assets – Current Assets are the holdings entered in an entity’s balance sheets that are presented either as cash or as a materialistic asset that can be transformed into cash. An asset of a company lasting for more than a year is termed as a current asset. Some examples of current assets are as follows – Cash, Investments, Prepaid expenses, and many more.

A non-current asset is a type of asset that is not usually turned into cash within one year of the date, represented on the firm’s balance sheet. These are generally long-term assets for a company. Examples of non-current assets are – Plant assets such as buildings, equipment, vehicles, and more.