DK Goel Solutions Chapter 22 Financial Statements With Adjustments

Read below DK Goel Solutions Class 11 Chapter 22 Financial Statements With Adjustments. These answers have been developed based on the latest Class 11 DK Goel Accountancy book used by commerce stream students issued for current year and the questions given in each chapter.

This chapter of DK Goel includes various value-based calculations of financial statements after proper adjustment of the data. Once you extract the financial statements, there are times when some adjustments have to be passed to reflect the true financial position of an organization.

In this chapter you will understand what these adjustments are. The chapter contains lot of questions which can be very helpful for Class 11 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

DK Goel Solutions Class 11 Chapter 22 solutions are free and will help you to prepare for Class 11 Accountancy. Just scroll down and read through the answers provided below

Financial Statements With Adjustments DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 22

Short Answer Questions for DK Goel Solutions Class 11 Chapter 22:

Question 1:

Solution 1: Necessity to make modifications:

- To determine the company’s actual net profit or loss.

- To assess the company’s real financial status.

- To document a transaction that has been removed from the accounts.

Entries for adjustment:- - Wages A/c

To Outstanding wages A/c

(wages due) Dr. - Salary A/c

To outstanding Salary A/c

(salary due) Dr. - Prepaid Insurance A/c

To Insurance A/c

(Insurance prepaid in advance) Dr. - Depreciation A/c

To Machinery A/c

To Furniture A/c

(Depreciation charge) Dr.

Question 2:

Solution 2: Instead of reserve, the term provision should be used when the purpose is not to improve the business’s financial position, but to compensate an anticipated potential loss.

In balance sheet:

Liabilities Amount Assets Amount

Debtors 50,000

Less: Provision for bad

and doubtful debts 2,000

48,000

Question 3:

Solution 3:

This are the costs that were accumulated during the year but were left outstanding on the day of final account planning.

Name of Accounts Dr. Balances Cr. Balances

Wages paid 2,20,000

Salary paid 55,000

Question 4:

Solution 4:

i. Accrued Income: It is quite common that certain items of income such as interest on securities, commission, rent etc., are earned during the current year but have not been actually received by the end of the current year. Such incomes are known as accrued income.

ii. Unearned Income: Certain income is received in the current year but the whole amount of it does not belong to the current year. Such portion of this income which belongs to the next year is known as unearned income.

iii. Provision for doubtful debts: such a provision is created at a fixed percentage on debtors every year and is called ‘provision for bad and doubtful debts’.

Question 5:

Solution 5:

1) Capital Expenditure: If benefit of expenditure is received for more than one year, it is called capital expenditure. Example: Purchase of Machinery.

2) Revenue Expenditure: It is the amount spent to purchase goods and services that are used during an accounting period is called revenue expenditure. For Example: Rent, interest, etc.

3) Deferred Revenue Expenditure: There are certain expenditures which are revenue in nature but benefit of which is derived over number of years. For Example: Huge Advertisement Expenditure.

Question 6:

Solution 6:

i. Purchase of machinery.

ii.Expenditure on installation of machinery.

Question 7:

Solution 7:

1) Capital Expenditure: If benefit of expenditure is received for more than one year, it is called capital expenditure. Example: Purchase of Machinery.

2) Revenue Expenditure: It is the amount spent to purchase goods and services that are used during an accounting period is called revenue expenditure. For Example: Rent, interest, etc.

Question 8:

Solution 8:

a) Assets

b) Dr. of P & L A/c

c) Assets

d) Dr. of P & L A/c

e) Liabilities.

Question 9:

Solution 9:

Adjustment Entry Treatment in P & L A/c Treatment in Balance Sheet

i. Accrued income Accrued income A/c Dr.

To Income A/c Added in income on credit side of Profit & Loss A/c Shown on the Assets side.

ii. Unearned income Income A/c Dr.

To Unearned income A/c Deducted from income on the credit side of Profit and Loss A/c Shown on the liabilities side.

Question 10:

Solution 10:

a) Outstanding Salary

Adjustment Entry:-

Salary A/c Dr.

To Outstanding Salary

Treatment in Financial Statement:-

Outstanding Salary is added to debit side of Profit and loss account and shown in the Liabilities side of balance sheet.

b) Accrued interest

Adjustment Entry:-

Accrued Interest A/c Dr.

To Interest Received A/c

Treatment in Financial Statement:-

Accrued Interest is added to on the credit side of Profit and Loss Account and shown on the Assets side of balance sheet.

Practical Questions:-

Question 1:

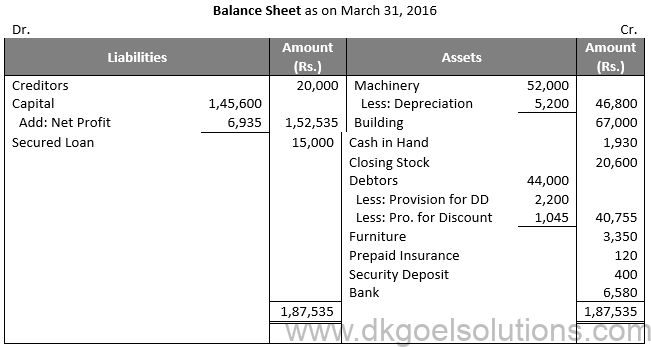

Solution 1:

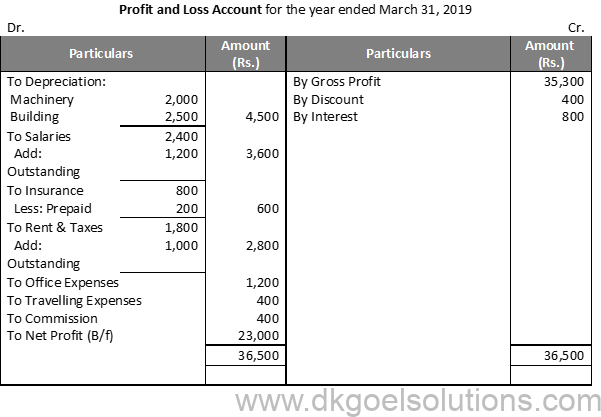

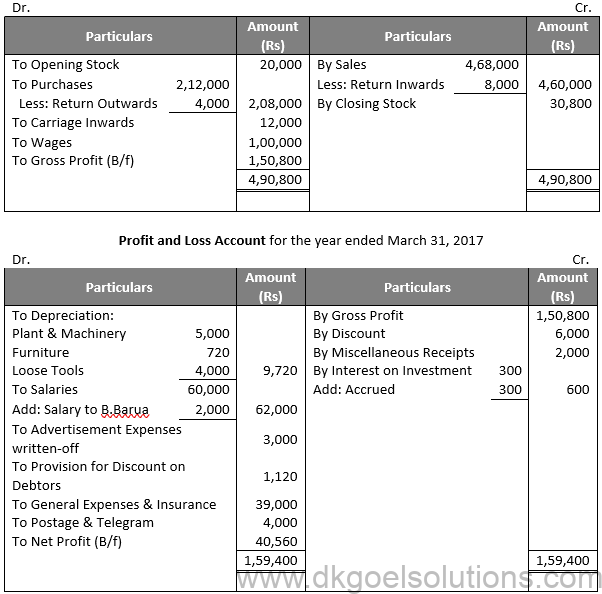

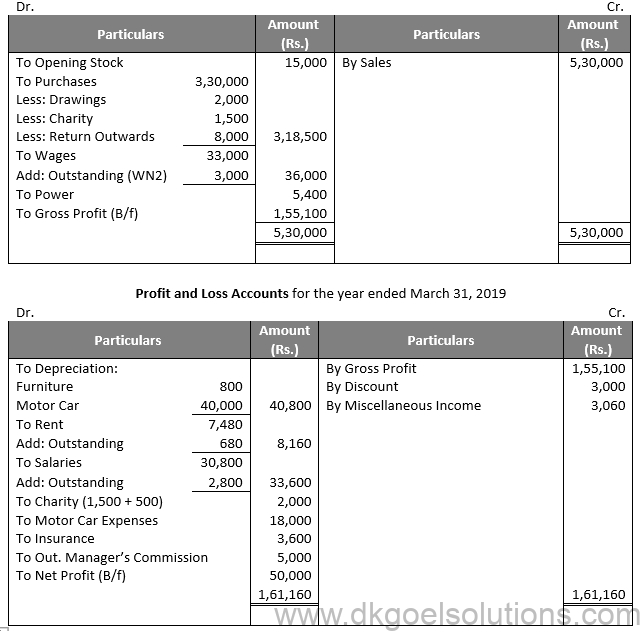

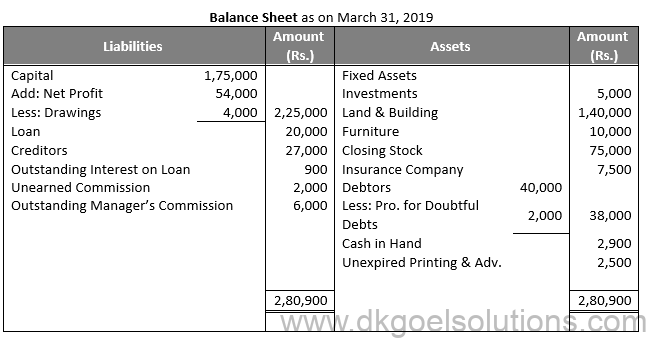

Profit and Loss Account for the year ended March 31, 2019

Working Note:-

Depreciation on Building = Rs. 50,000 × 5% = Rs. 2,500

Depreciation on Machinery = Rs. 20,000 × 10% = Rs. 2,000

Question 2:

Solution 2:

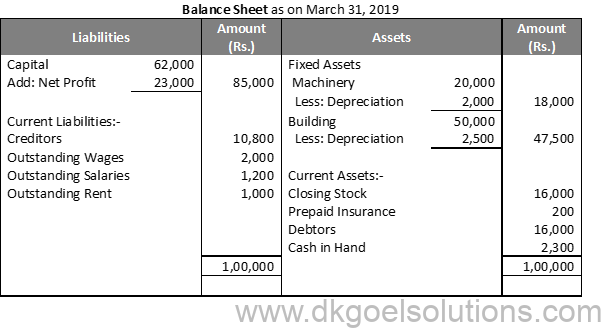

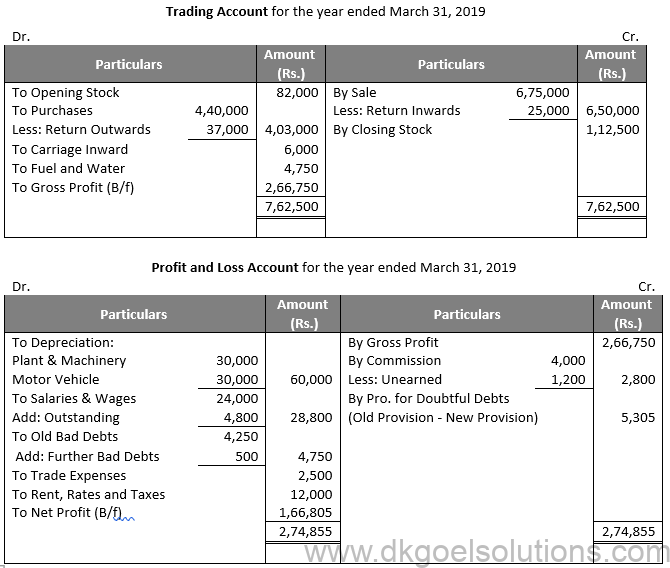

Trading Account for the year ended March 31, 2019

Working Note:-

Depreciation on Freehold Premises = Rs. 1,00,000 × 5% = Rs. 5,000

Depreciation on Office Furniture = Rs. 9,000 × 20% = Rs. 1,800

Interest on Capital = 1,50,000 × 6% = Rs. 9,000

Question 3:

Solution 3:

Working Note:-

Depreciation on Land & Building = Rs. 12,000 × 2.5% = Rs. 300

Depreciation on Motor Vehicles = Rs. 10,000 × 20% = Rs. 2,000

Interest on Capital = 20,000 × 5% = Rs. 1,000

Drawings = Rs. 5,000 + Rs. 4,000 = Rs. 9,000

Question 4:

Solution 4:

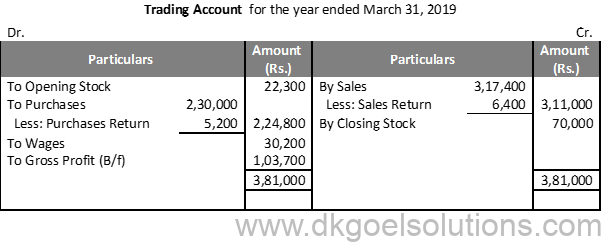

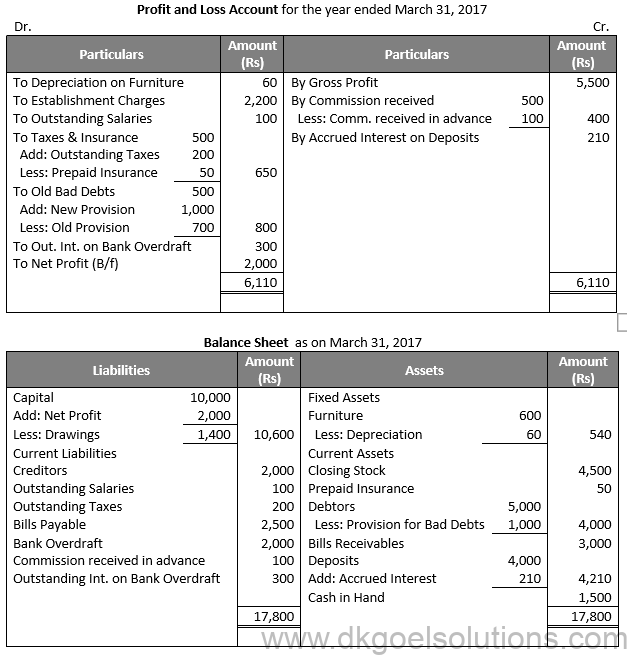

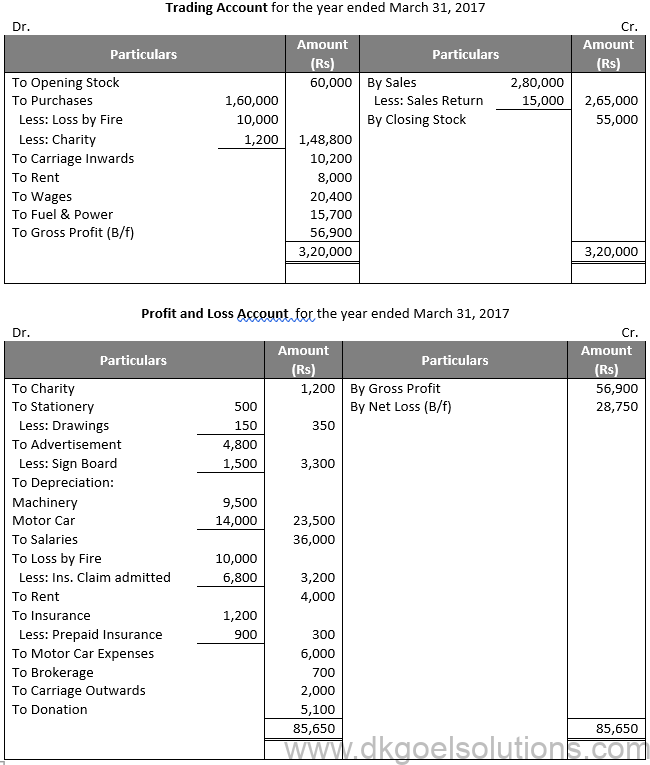

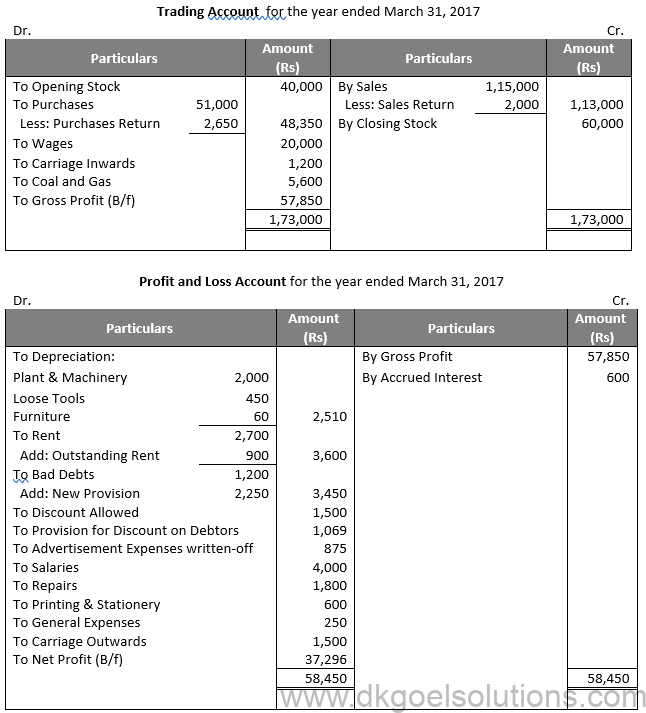

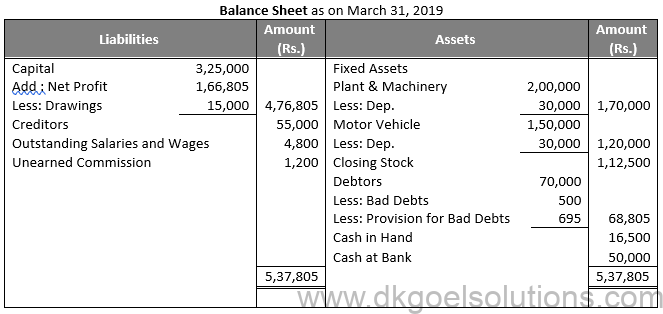

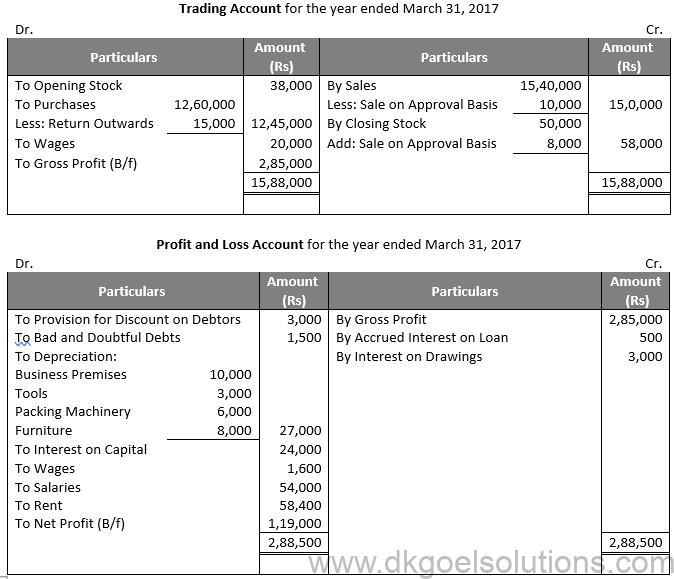

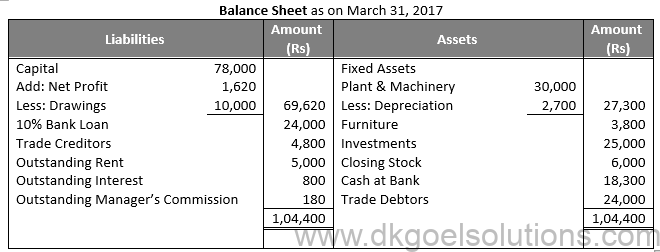

Trading Account for the year ended March 31, 2017

Working Note:-

Depreciation on Furniture = Rs. 600 × 10% = Rs. 60

Question 5:

Solution 5:

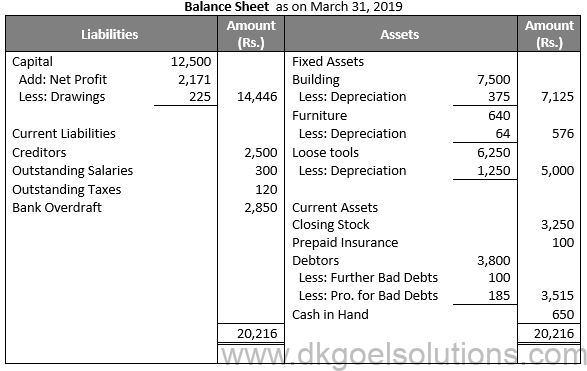

Working Note:-

Depreciation on Building = 7,500 × 5% = Rs. 375

Depreciation on Furniture = 640 × 10% = Rs. 64

Depreciation on Patents = Rs. 6,250 – Rs. 5,000 = Rs. 1,250

Provision for Doubtful Debts = Sundry Debtors – Bad Debts on Furniture × Rate of Provision

Provision for Doubtful Debts = (3,800 – 100) × 5% = 3,700 × 5% = Rs. 185

Question 6:

Solution 6:

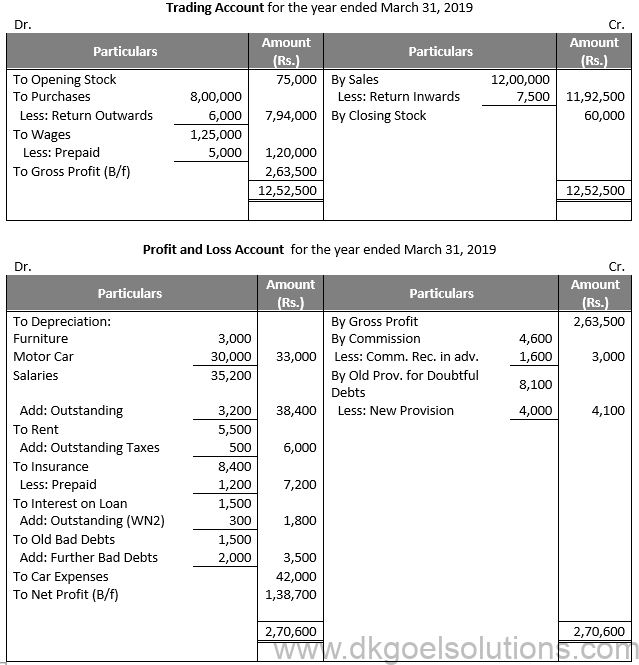

Working Note:-

Depreciation on Furniture = 20,000 × 15% = Rs. 3,000

Depreciation on Motor Car = 1,50,000 × 20% = Rs. 30,000

Provision Doubtful Debts = Sundry Debtors – Further Bad Debts × Rate

Provision Doubtful Debts = 82,000 – 2,000 × 5% = Rs. 4,000

Salaries for 11 months = Rs. 35,200

Salary per month = 35,200/11 = 3,200

Outstanding Salary for one month = 3,200×1 = Rs. 3,200

Rent for 11 months = Rs. 5,500

Outstanding Rent for one month = 5,500/11×1 = Rs. 500

Outstanding Interest on loan = Rs. 10,000 × 18/100 = Rs. 1,800

Total Interest paid = Rs. 1,500

Outstanding Interest = Rs. 1,800 – Rs. 1,500

Outstanding Interest = Rs. 300

Question 7:

Solution 7:

Working Note:-

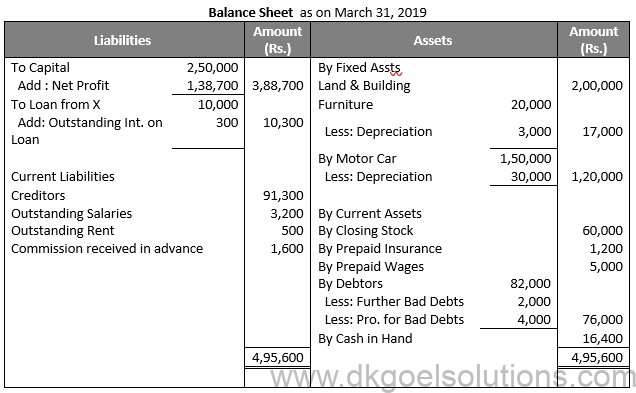

Provision Doubtful Debts = Sundry Debtors – Further Bad Debts × Rate

Provision Doubtful Debts = 1,02,000 – 2,000 × 5% = Rs. 5,000

Provision for Discount on Debtors = Debtors – Further Bad Debts – Provision for Doubtful Debts × Rate

Provision for Discount on Debtors = 1,02,000 – 2,000 – 5,000 × 2% = Rs. 1,900

Question 8:

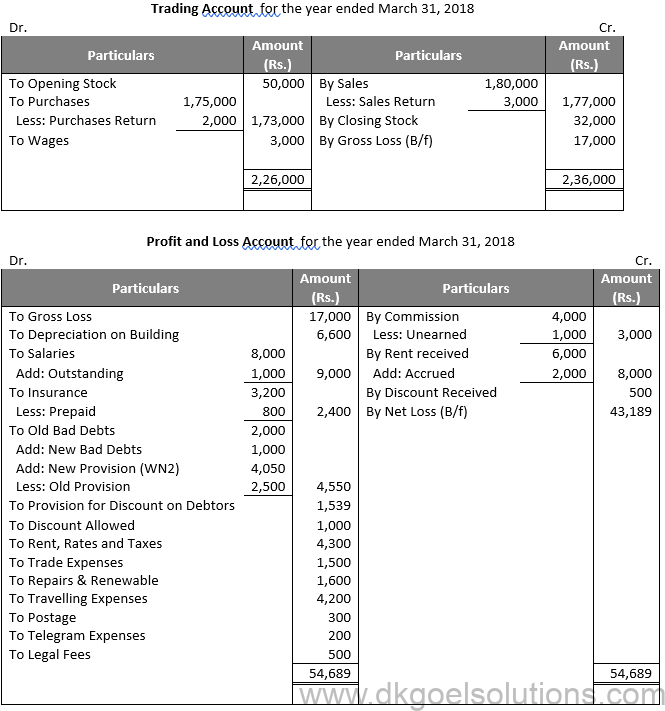

Solution 8:

Depreciation on Building = Rs. 1,10,000 × 6% = Rs. 6,600

Provision for doubtful debts = Debtors – Further Bad debts × Rate

Provision for doubtful debts = Rs. 82,000 – Rs. 1,000 × 5% = Rs. 81,000 × 5% = Rs. 4,050

Provision for Discount on Debtors = Debtors – Further Bad Debts – Provision for Doubtful Debts × Rate

Provision for Discount on Debtors = 82,000 – 1,000 – 4,050 × 2% = Rs. 1,539

Question 9:

Solution 9

Working Note:-

Outstanding Interest On bank loan:-

Interest on Bank Loan = Rs. 5,000 × 12% = Rs. 600

Interest charged by bank = Rs. 450

Outstanding Interest = Rs. 600 – Rs. 450 = Rs. 150

Provision for doubtful debts = Sundry Debtors × Rate

Provision for doubtful debts = Rs. 10,500 × 10% = Rs. 1,050

Question 10 (A):

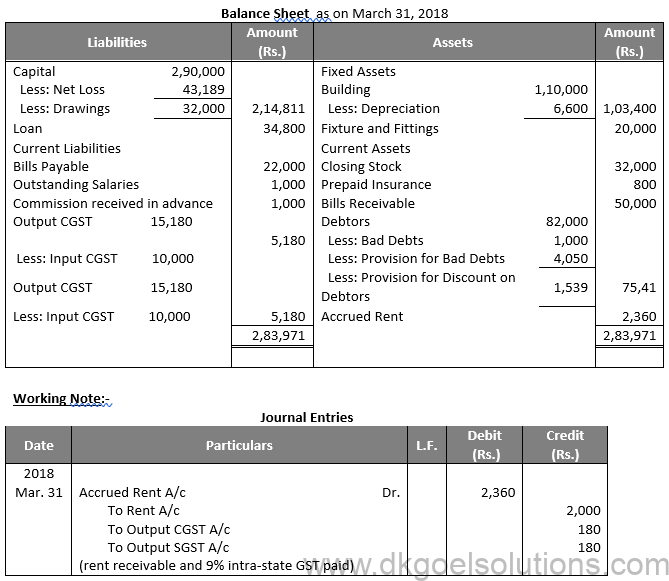

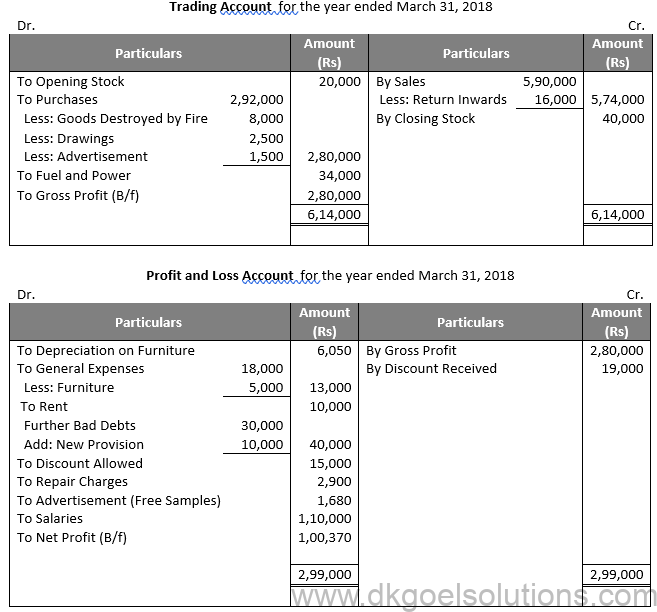

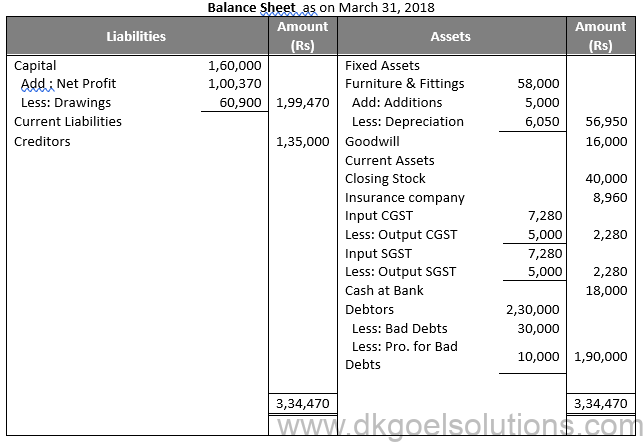

Solution 10 (A):

Working Note:-

Calculation of Drawings = Rs. 58,100 + Rs. 2,800 = Rs. 60,900

Depreciation on Furniture (i) = 58,000 × 10% = 5,800

Depreciation on Furniture (ii) = 5,000 × 10% × 6/12 = 250

Total Depreciation = Rs. 5,800 + Rs. 250 = Rs. 6,050

Outstanding Rent = 10,000 × 2/10 = Rs. 2,000

Calculation of Provision for Doubtful debts:-

Provision for doubtful debts = Sundry Debtors – further Bad debts × Rate

Provision for doubtful debts = (Rs. 2,30,000 – Rs. 30,000) × 5% = Rs. 10,000

Question 10 (B):

Solution 10 (B):

Working Note:-

Depreciation on Plant and Machinery (i) = Rs. 80,000 × 10% = Rs. 8,000

Depreciation on Plant and Machinery (ii) = Rs. 20,000 × 10% × 9/12 = Rs. 9,500

Depreciation on Motor Car = Rs. 70,000 × 20% = Rs. 14,000

Drawings = Rs. 12,000 + Rs. 150 = Rs. 12,150

Question 11:

Solution 11:

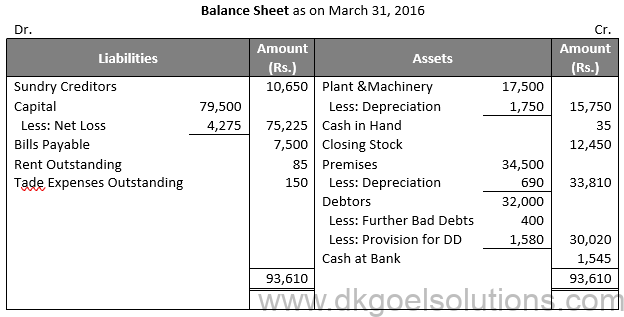

Question 12:

Solution 12:

Working Note:-

Calculation of bad debts

Question 13:

Solution 13:

Question 14:

Solution 14:

Working Note:-

Depreciation of Plant and Machinery = Rs. 40,000 × 5% = Rs. 2,000

Depreciation of Furniture and Fixtures = Rs. 1,200 × 5% = Rs. 60

Depreciation on Loose tools = Rs. 3,000 × 15% = Rs. 450

Rent paid for 3 quarters = Rs. 2,700

Rent for a quarter = 2700/3 = Rs. 900

Provision for doubtful debts = Sundry Debtors × Rate

Provision for doubtful debts = Rs. 45,000 × 5%

Provision for doubtful debts = Rs. 2,250

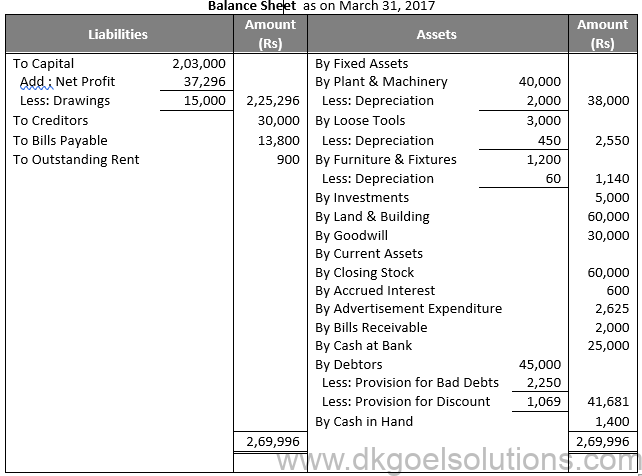

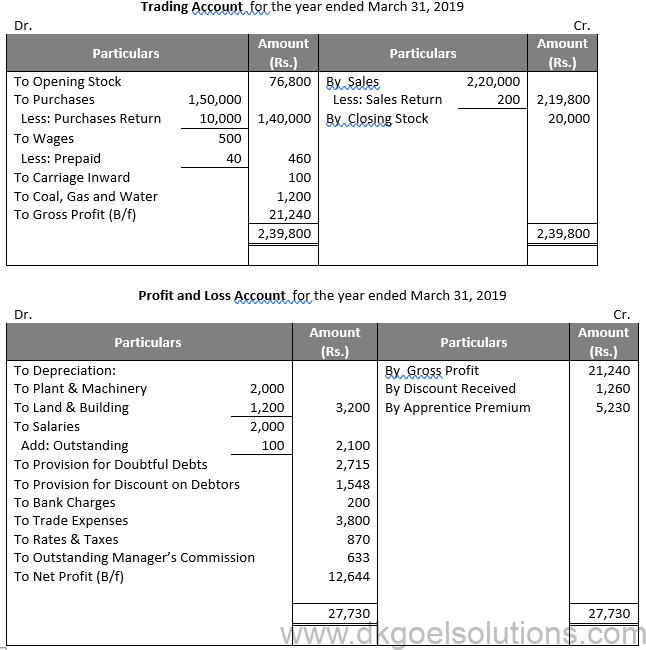

Question 15:

Solution 15:

Working Note:-

Depreciation of Plant and Machinery = Rs. 40,000 × 5% = Rs. 2,000

Depreciation of Building = Rs. 12,000 × 10% = Rs. 1,200

Provision for doubtful debts = Sundry Debtors × Rate

Provision for doubtful debts = Rs. 54,300 × 5% = Rs. 2,715

Provision for doubtful debts = Sundry Debtors – Provision for bad debts × Rate

Provision for doubtful debts = (Rs. 54,300 – Rs. 2,715) × 3% = Rs. 1,548

Question 16:

Solution 16:

Working Note:-

Depreciation of Machinery = Rs. 9,340 × 10% = Rs. 934

Provision for Manager’s Commission = Rs. 9,900 × 10/110 = Rs. 900

Calculation of Provision for Doubtful debts:-:-

Provision for doubtful debts = Sundry Debtors – Provision for bad debts × Rate

Provision for doubtful debts = (Rs. 6,280 – Rs. 160) × 5% = Rs. 306

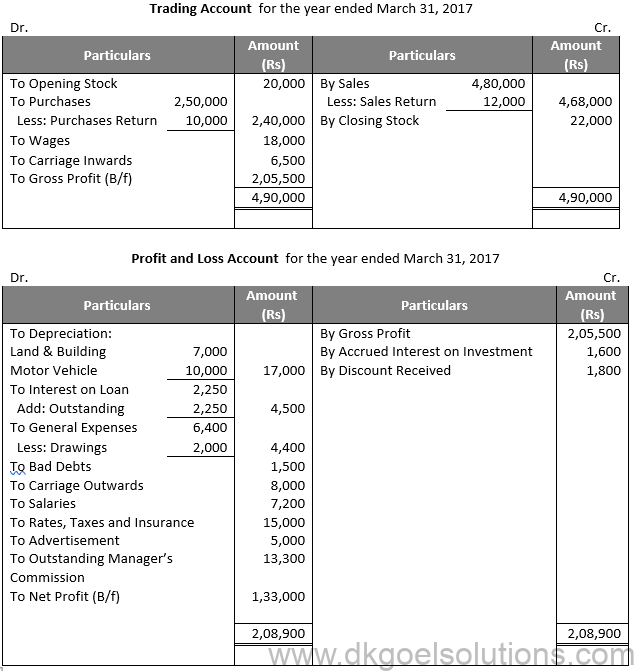

Question 17 (A):

Solution 17 (A):

Working Note:-

Depreciation of Land and Building = Rs. 2,80,000 × 2.5% = Rs. 7,000

Depreciation of Motor Vehicle = Rs. 50,000 × 20% = Rs. 10,000

Provision for Manager’s Commission = Rs. 2,08,900 – Rs. 62,600

Provision for Manager’s Commission = Rs. 1,46,300

Provision for Manager’s Commission = Rs. 1,46,300 × 10% = Rs. 13,300

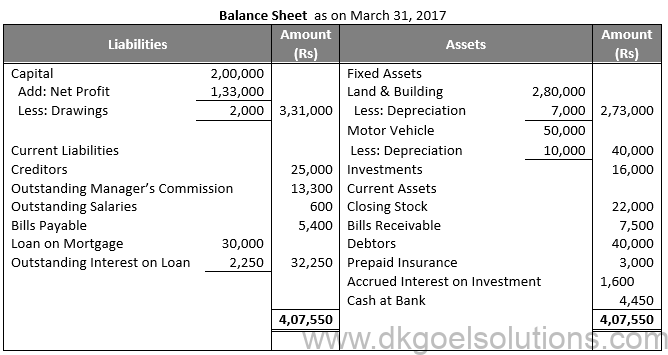

Question 17 (B):

Solution 17 (B):

Working Note:-

Depreciation of Plant and Machinery = Rs. 20,000 × 10% = Rs. 2,000

Depreciation of Traveller’s Samples = Rs. 2,700 × 100/300 = Rs. 900

Prepaid Insurance = Rs. 1,200 × 2/12 = Rs. 200

Point in Mind:-

In the event of loss managers are not entitled to get and commission.

Question 18:

Solution 18:

- Capital Expenditure

Reason: Purchases of machinery is a capital expenditure all expenses related to machinery on the purchasing date is treated as capital expenditure. - Capital Expenditure

Reason: Whitewashing on the new building will increase the revenue generating capacity of the building, thus, it will be capitalised and treated as capital expenditure. - Revenue Expenditure

Reason: Annual insurance premium is a recurring expenditure to carry on day-to-day business activities. Thus, it is a revenue expense. - Capital Expenditure

Reason: To enhance the working capacity of the assets if any expenditure is incurred once in a while, then it will be treated as capital expenditure. So, the expenses made on repairing of second hand machinery will be capitalised and treated as capital expenditure. - Revenue Expenditure

Reason: The expenditure on repairing of machinery will help to raise the working capacity of the machinery, so it is revenue expenditure. - Capital Expenditure

Reason: To enhance the working capacity of the assets if any expenditure is incurred once in a while, then it will be treated as capital expenditure. So, the expenses made on air conditioner will be treated as capital expenditure.

Question 19:

Solution 19:

Working Note:-

Depreciation of Machinery = Rs. 14,400 + Rs. 600 × 5% = Rs. 750

Provision for doubtful debts = Sundry Debtors – Further Bad debts – Amount recovered × Rate

Provision for doubtful debts = (Rs. 30,000 – Rs. 500 – Rs. 500) × 5%

Provision for doubtful debts = Rs. 1,450

Question 20:

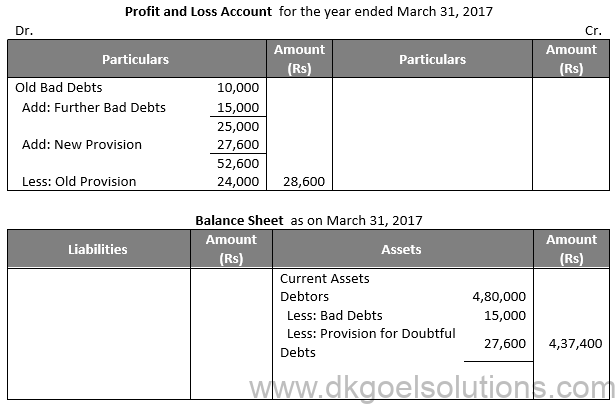

Solution 20:

Working Note:-

Provision for doubtful debts = Sundry Debtors – Further Bad debts – Amount recovered × Rate

Provision for doubtful debts = (Rs. 4,80,000 – Rs. 15,000 – Rs. 5,000) × 6% = Rs. 27,600

Question 21:

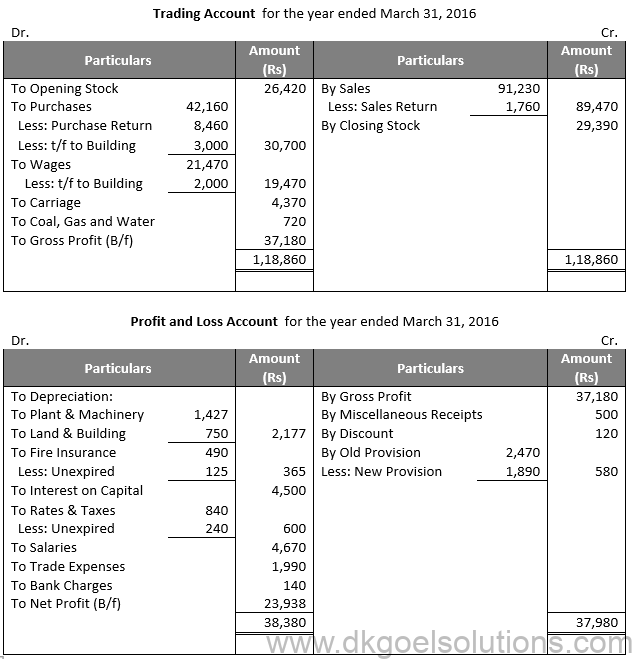

Solution 21:

Working Note:-

Land and Building = Rs. 25,000 + Rs. 3,000 + Rs. 2,000 = Rs. 30,000

Depreciation of Land and Building = Rs. 30,000 × 2.5% = Rs. 750

Depreciation of Plant and Machinery = Rs. 14,470 × 10% = Rs. 1,427

Provision for doubtful debts = Sundry Debtors – Further Bad debts × Rate

Provision for doubtful debts = Rs. 30,000 × 5% = Rs. 1,890

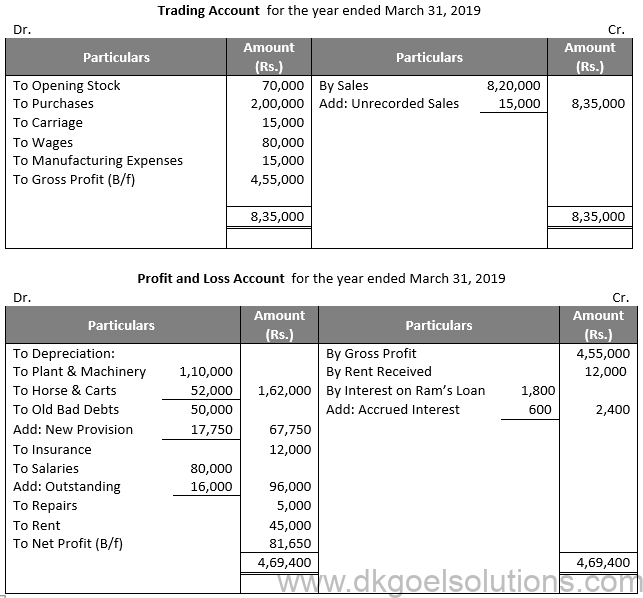

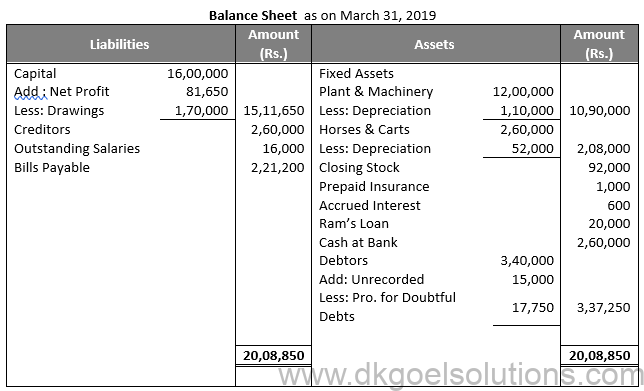

Question 22:

Solution 22

Working Note:-

Depreciation of Land and Building = Rs. 30,000 × 2.5% = Rs. 750

Depreciation of Plant and Machinery = Rs. 14,470 × 10% = Rs. 1,427

Calculation of Provision for Doubtful debts:-

Provision for doubtful debts = Sundry Debtors + Unrecorded sales × Rate

Provision for doubtful debts = (Rs. 3,40,000 + Rs. 15,000) × 5% = Rs. 17,750

Salaries for 10 months = Rs. 80,000

Salaries for 2 months = 80,000/10 × 2 = Rs. 16,000

Question 23:

Solution 23:

Working Note:-

Depreciation of Land and Building = Rs. 40,000 × 10% = Rs. 4,000

Depreciation of Plant and Machinery = Rs. 5,000 × 5% = Rs. 250

Provision for doubtful debts = Sundry Debtors – Sales on Approval × Rate

Provision for doubtful debts = (Rs. 20,600 – Rs. 7,200) × 5% = Rs. 670

Question 24:

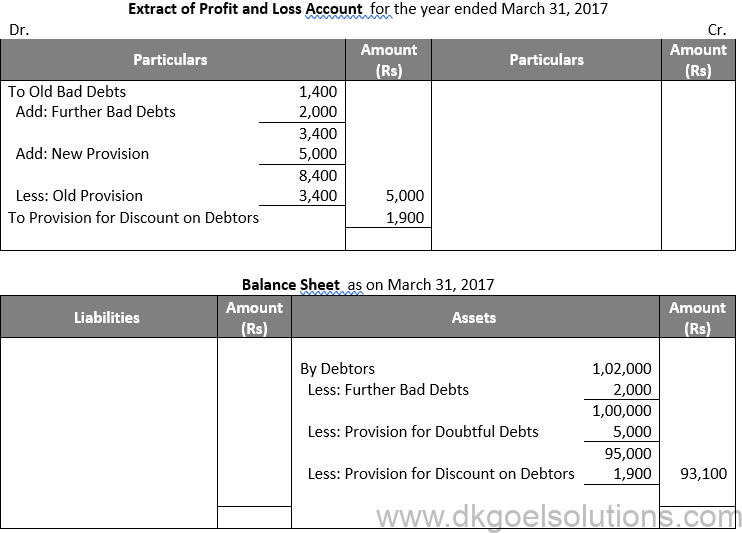

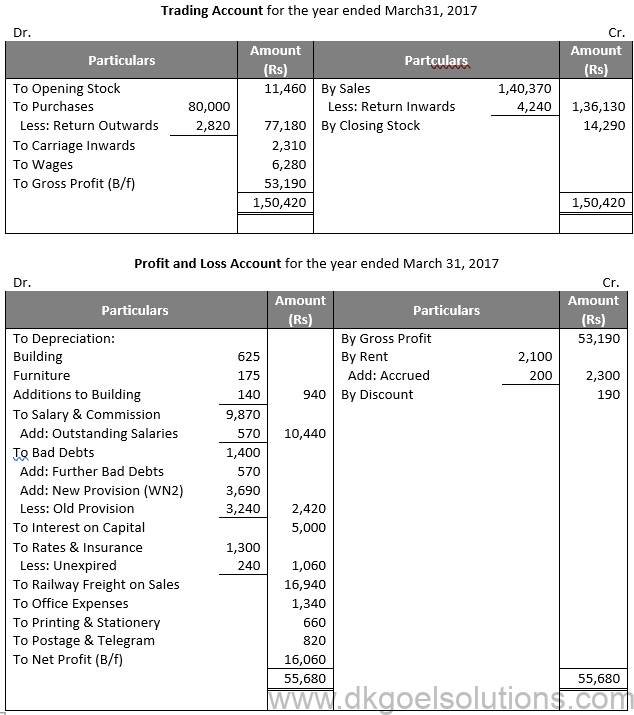

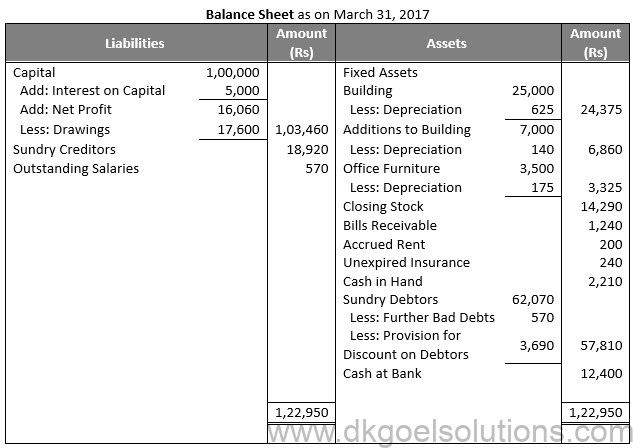

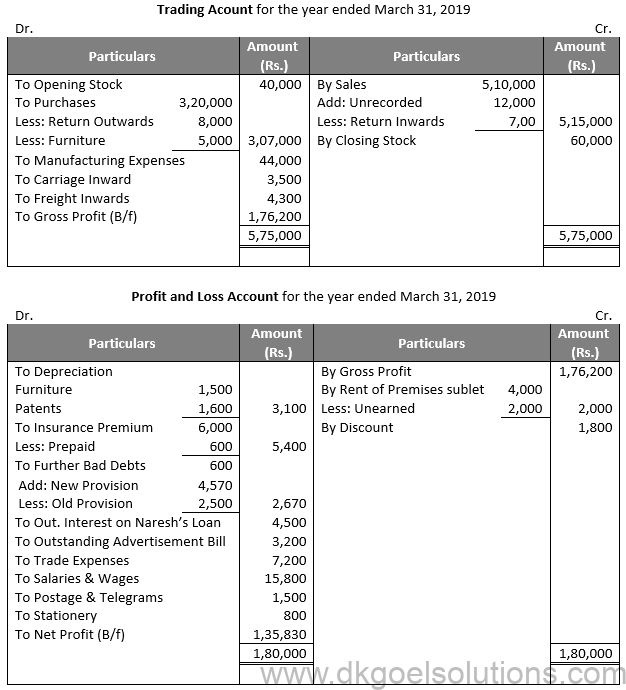

Solution 24: Trading Account for the year ended March 31, 2017

Working Note:-

Depreciation of Machinery = Rs. 1,00,000 × 5% = Rs. 5,000

Depreciation of Furniture = Rs. 12,000 × 6% = Rs. 720

Depreciation of Furniture = Rs. 20,000 – Rs. 16,000 = Rs. 4,000

Provision for doubtful debts = Sundry Debtors × Rate

Provision for doubtful debts = Rs. 56,000 × 2% = Rs. 1,120

Question 25:

Solution 25

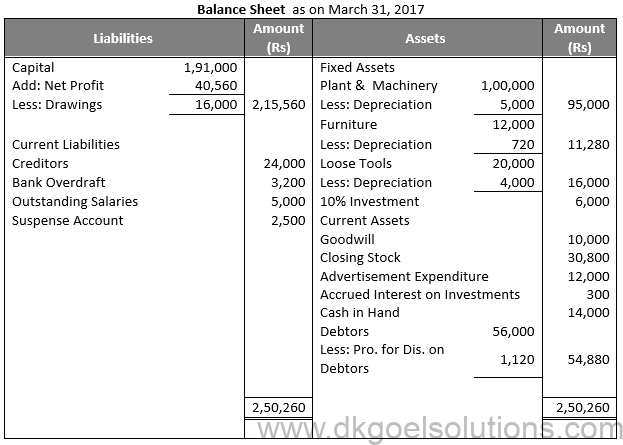

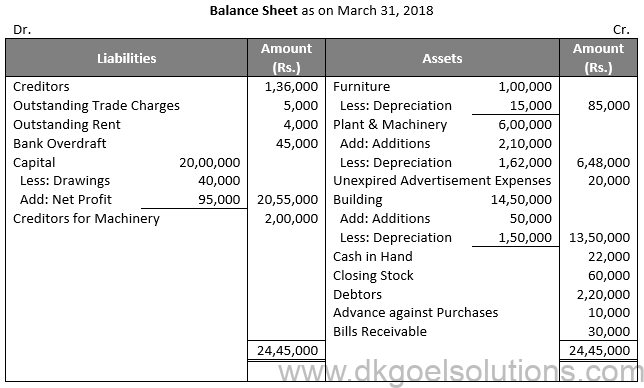

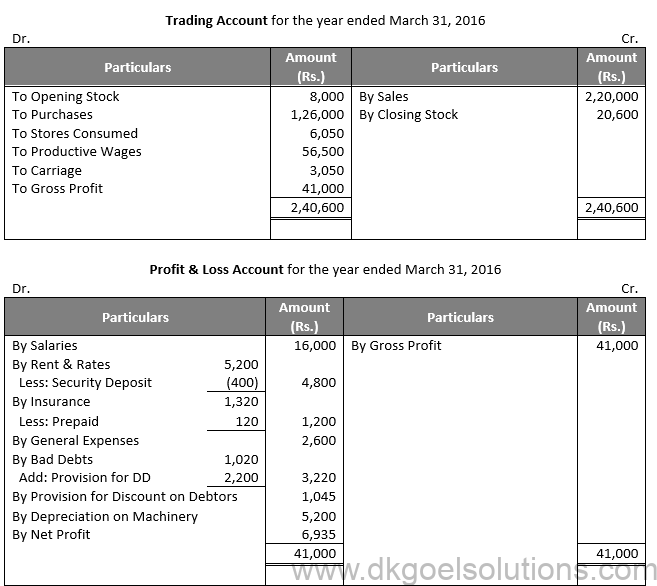

Question 26:

Solution 26:

Question 27:

Solution 27:

Question 28:

Solution 28:

Question 29:

Solution 29

Working Note:-

Depreciation of Machinery = Rs. 2,00,000 × 15% = Rs. 30,000

Depreciation of Motor Vehicle = Rs. 1,50,000 × 20% = Rs. 30,000

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = (Rs. 70,000 – Rs. 500) × 1% = Rs. 695

Question 30:

Solution 30:

Working Note:-

Depreciation of Building (i) = Rs. 25,000 × 2.5% = Rs. 625

Depreciation of Building (ii) = Rs. 7,000 × 2% = Rs. 140

Depreciation of office furniture = Rs. 3,500 × 5% = Rs. 175

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = (Rs. 62,070 – Rs. 570) × 6% = Rs. 3,690

Question 31:

Solution 31:

Working Note:-

Calculation of drawings = Rs. 45,000 + Rs. 5,000 = Rs. 50,000

Depreciation of Building = Rs. 3,00,000 × 5% = Rs. 15,000

Depreciation of Furniture = Rs. 80,000 × 10% = Rs. 8,000

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = Rs. 2,50,000 × 5% = Rs. 12,500

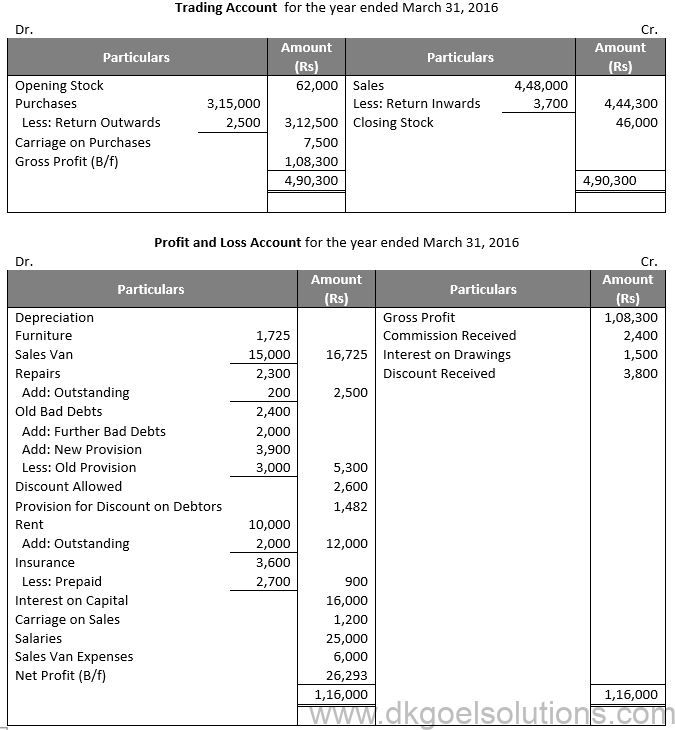

Question 32:

Solution 32:

Working Note:-

Depreciation of Sales van = Rs. 75,000 × 20% = Rs. 15,000

Depreciation of Furniture = Rs. 10,000 × 15% + Rs. 6,000 × 15% × 3/12 = Rs. 1,725

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = (Rs. 80,000 – Rs. 2,000) × 5% = Rs. 3,900

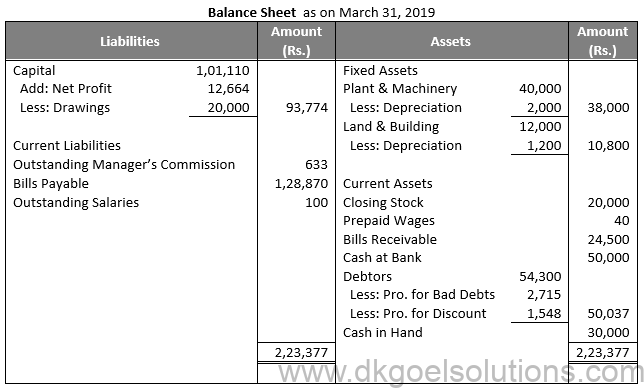

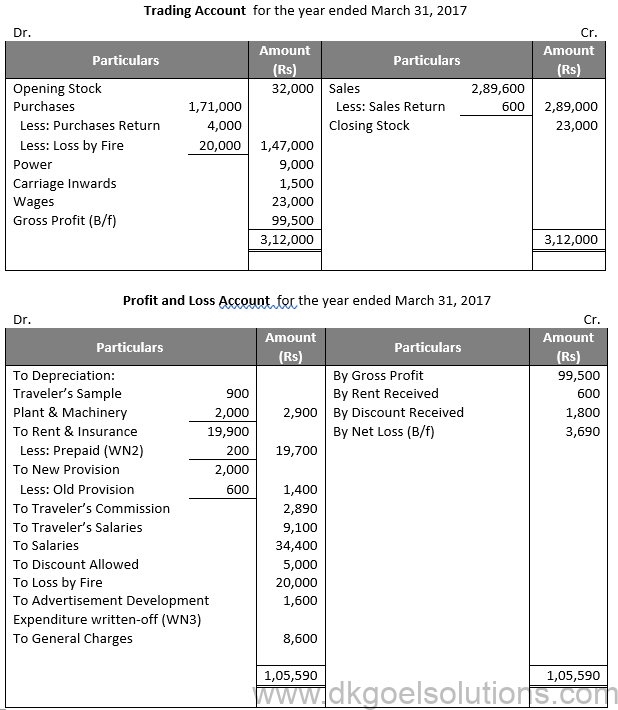

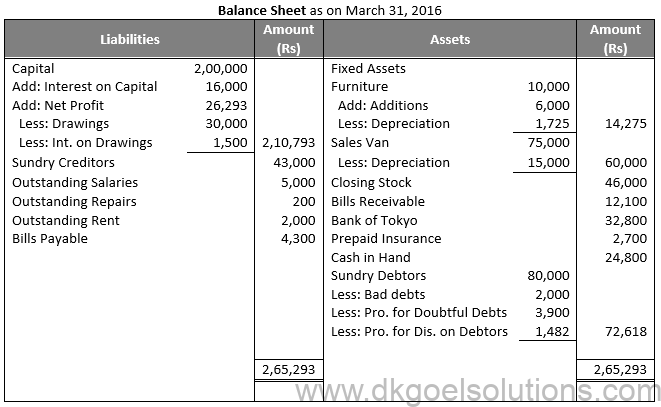

Question 33:

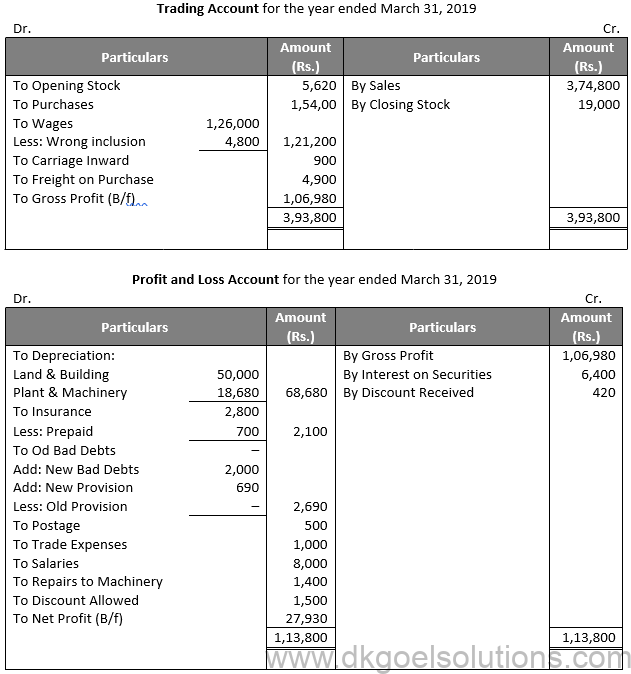

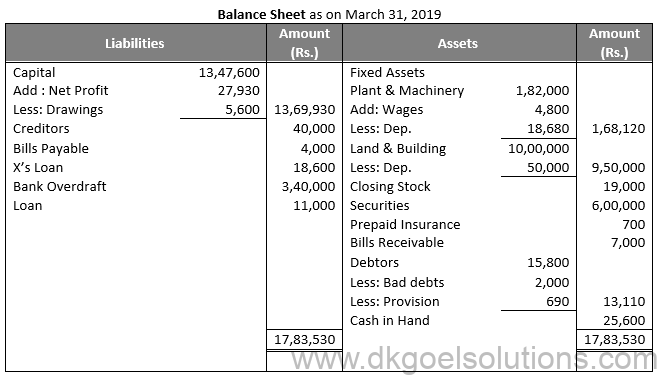

Solution 33

Trading Account for the year ended March 3 , 2019

Working Note:-

Depreciation of Sales van = Rs. 15,000 × 20% = Rs. 3,000

Depreciation of Furniture = Rs. 5,000 × 10% = Rs. 500

Depreciation of Machinery = Rs. 15,000 × 10% × 3/12 = Rs. 375

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = (Rs. 18,200 – Rs. 200) × 5% = Rs. 900

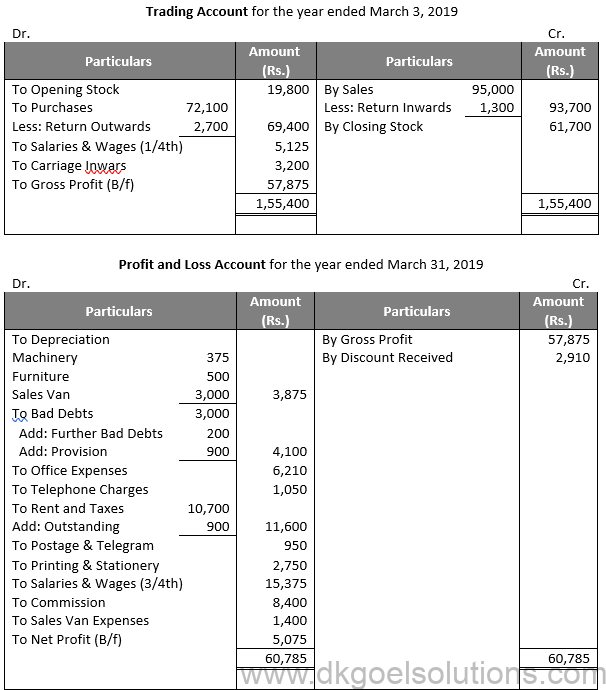

Question 34:

Solution 34:

Working Note:-

Depreciation of Machinery = Rs. 20,000 × 5% = Rs. 1,000

Provision for doubtful debts = Sundry Debtors – future Bad debts × Rate

Provision for doubtful debts = (Rs. 50,000 – Rs. 1,000) × 6% = Rs. 2,910

Provision for doubtful debts = Sundry Debtors – future Bad debts – Pro. For Bad debts × Rate

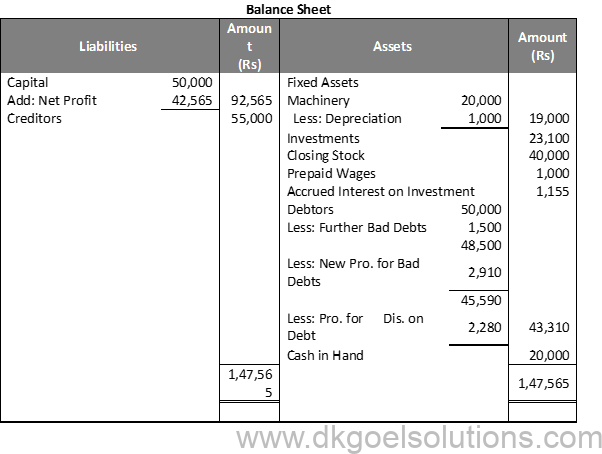

Provision for doubtful debts = (Rs. 50,000 – Rs. 1,500 – Rs. 2,910) × 5% = Rs. 2,280

Question 35:

Solution 35:

Working Note:-

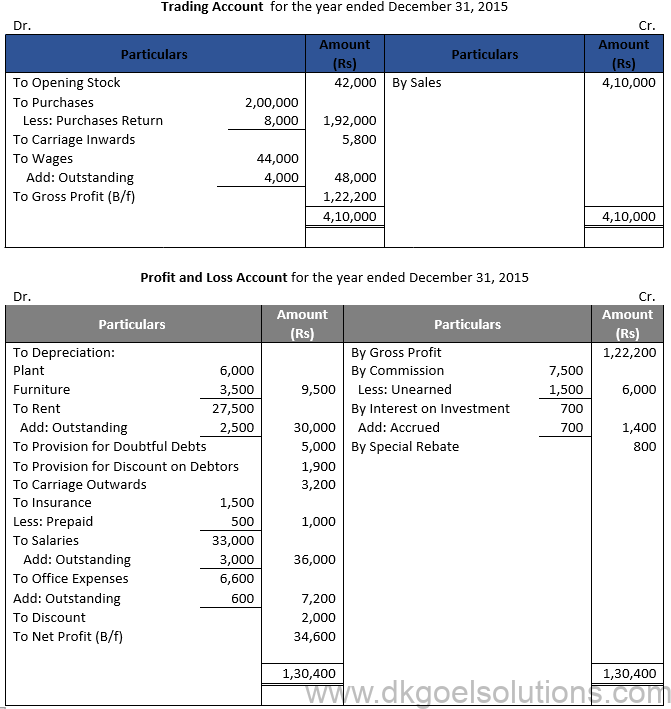

Depreciation of Plant = Rs. 60,000 × 10% = Rs. 6,000

Depreciation of Furniture = Rs. 15,000 × 20% = Rs. 3,000

Depreciation of Furniture-II = Rs. 5,000 × 20% × 6/12 = Rs. 500

Provision for doubtful debts = Sundry Debtors × Rate

Provision for doubtful debts = Rs. 1,00,000 × 5% = Rs. 5,000

Provision for doubtful debts = Sundry Debtors – Pro. For Bad debts × Rate

Provision for doubtful debts = (Rs. 1,00,000 – Rs. 5,000) × 2% = Rs. 1,900

Question 36:

Solution 36:

Working Note:-

Calculation of Salaries & Wages = 1/4 × 40,000 = Rs. 10,000

Depreciation of Furniture = Rs. 10,000 × 8% × 9/12 = Rs. 1,350

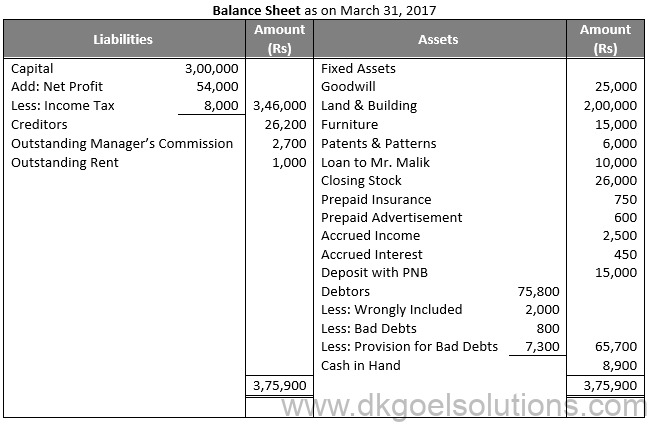

Accrued Interest = Rs. 1,350 – Rs. 900 = Rs. 450

Provision for doubtful debts = Sundry Debtors – Further Bad Debts × Rate

Provision for doubtful debts = (Rs. 73,800 – Rs. 800) × 5% = Rs. 7,300

Question 37:

Solution 37:

Working Note:-

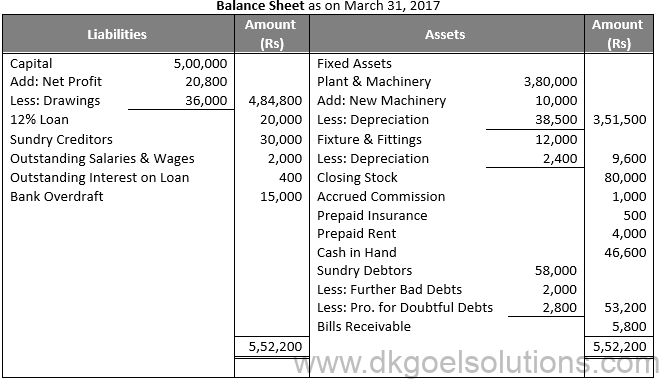

Calculation of Depreciation:-

Depreciation of Plant and Machinery = Rs. 3,80,000 × 10% = Rs. 38,000

Depreciation of Plant and Machinery-II = Rs. 10,000 × 10% × 6/12 = Rs. 500

Depreciation of Fixtures and Furniture = Rs. 12,000 × 20% = Rs. 2,400

Provision for doubtful debts = (Sundry Debtors – Further Bad Debts) × Rate

Provision for doubtful debts = (Rs. 58,000 – Rs. 2,000) × 5% = Rs. 2,800

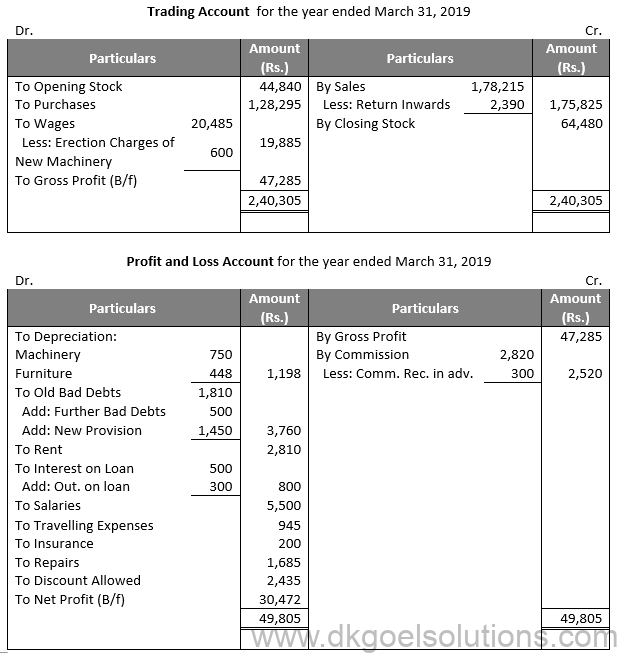

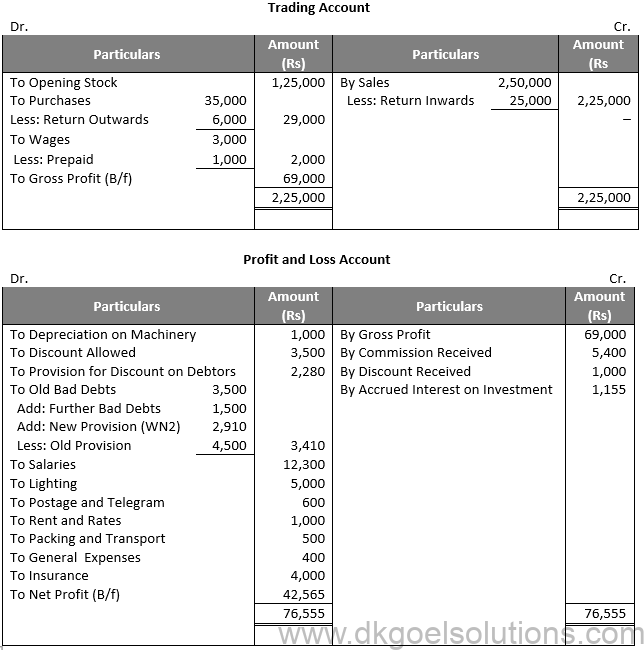

Question 38:

Solution 38:

Trading Account

for the year ended March 31, 2019

Working Note:-

Depreciation of Motor car = Rs. 2,00,000 × 20% = Rs. 40,000

Depreciation of Fixtures and Furniture = Rs. 8,000 × 10% = Rs. 800

Outstanding Rent = Rs. 7,480 × 1/11 = Rs. 680

Outstanding Wages = Rs. 33,000 × 1/11 = Rs. 3,000

Outstanding Rent = Rs. 30,800 × 1/11 = Rs. 2,800

Question 39:

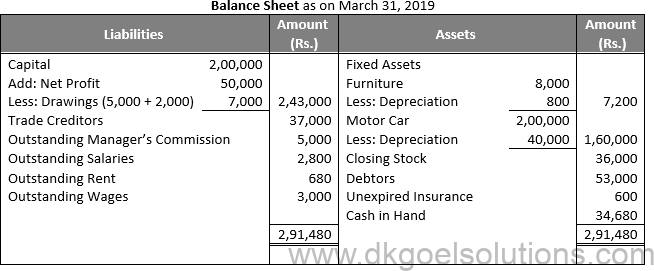

Solution 39:

Working Note:-

Depreciation of Patents= Rs. 8,000 × 1/5 = Rs. 1,600

Depreciation of Furniture = Rs. 15,000 × 10% = Rs. 1,500

Calculation of Prepaid Insurance = Rs. 1,200 × 6/12 = Rs. 600

Provision for doubtful debts = (Sundry Debtors + Unrecorded – Further Bad Debts) × Rate

Provision for doubtful debts = (Rs. 80,000 + Rs. 12,000 – Rs. 2,000) × 5% = Rs. 4,570

Question 40:

Solution 40:

Working Note:-

Interest on loan = Rs. 20,000 ×15/100 × 10/12 = Rs. 2,500

Interest paid = Rs. 1,500

Outstanding Interest = Rs. 2,500 – Rs. 1,500 = Rs. 1,000

Provision for doubtful debts = (Sundry Debtors – Further Bad Debts) × Rate

Provision for doubtful debts = (Rs. 1,42,000 – Rs. 2,000) × 5% = Rs. 7,000

Advance Rent = Rs. 3,900 × 1/13 = Rs. 300

Question 41:

Solution 41:

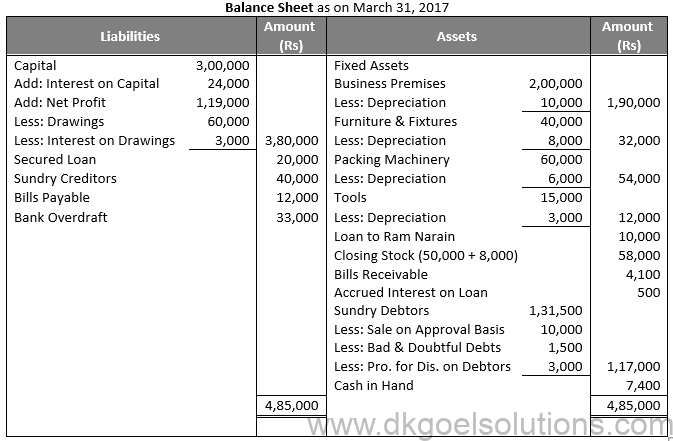

Working Note:- (DK Goel Solutions Class 11 Chapter 22)

Depreciation of Premise = Rs. 2,00,000 × 5% = Rs. 10,000

Depreciation of Furniture = Rs. 40,000 × 20% = Rs. 8,000

Depreciation of Packing Machinery = Rs. 60,000 × 10% = Rs. 6,000

Depreciation of Tools = Rs. 15,000 – Rs. 12,000 = Rs. 3,000

Provision for Discount on Debtors = (Sundry Debtors – Further Bad Debts) × Rate

Provision for Discount on Debtors = (Rs. 80,000 + Rs. 1,500) × 2.5% = Rs. 3,250

Question 42:

Solution 42:

Working Note:-

Provision for Doubtful Debts = Sundry Debtors × Rate

Provision for Doubtful Debts = Rs. 40,000 × 5% = Rs. 2,000

Manager’s Commission = Rs. 1,06,000 – Rs. 46,900

Manager’s Commission = Rs. 60,000 × 10% = Rs. 6,000

Question 43:

Solution 43:

Working Note:-

Depreciation of Machinery = Rs. 18,000 × 10% = Rs. 1,800

Depreciation of Machinery = Rs. 12,000 × 10% × 9/12 = Rs. 900

Manager’s Commission = Rs. 50,150 – Rs. 48,350

Manager’s Commission = Rs. 1,800 × 10% = Rs. 180

Here are the reasons why adjustments are essential –

● To calculate the actual net profit or loss of a company.

● To identify the actual financial position of the company.

● To track a transaction that has been eliminated from the accounts.

An outstanding expense depicts a personal account having a credit balance and which is considered as a liability for the companies. As these expenses are treated as liabilities, they are placed in the liability section of the balance sheets. In simple words, outstanding expenses can be defined as unpaid payments or dues that are not yet cleared. For example – Rent due is an outstanding expense.

Accrued income is defined as the outstanding revenue which has been earned but not yet received by a company. It is entered as receivable funds in the accounting books. Examples are – accrued rent to be received, a commission earned to be collected, etc.

Unearned income is the revenue received by a business in the current year. However, the whole income does not come from the current year. Some portion of this fund belongs to the next year and is termed as unearned income. Examples of unearned income are – bond interest, dividends from the stocks, etc.

The financial statements adjustment chapter is one of the most scoring topics in Class 11 Accountancy. With good knowledge and efficient practice, the students can easily score full marks on this topic. Students can refer to the DK Goel Solutions as it helps them comprehend all the concepts and theories of the topic. The solutions are presented in a simple and easy-to-learn manner, which helps the students quickly go through the topic. In Accountancy, understanding must be the primary goal of the students. Dk Goel Solutions helps the students understand all topics and score well in exams.

Provision gets preference when the company’s primary goal is not to strengthen its financial position but to compensate for a loss in business. In this case, provision plays the role of a trump card for businesses.