DK Goel Solutions Chapter 6 Accounting Equations

Read below DK Goel Solutions Class 11 Chapter 6 Accounting Equation. These solutions have been prepared based on the latest Class 11 DK Goel Accountancy book issued for this academic year.

DK Goel Solutions Class 11 Chapter 6 provides all the accounting equations and a lot of numerical problems. The chapter also includes a lot of good quality questions which are very well designed and can be very helpful to understand the concepts of Accountancy for Class 11 students.

DK Goel Solutions Class 11 Chapter 6 solutions are free and will help you to prepare for Class 11 Accountancy

Accounting Equations DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 6

Question 1:

Solution 1: Below are the purposes of the accounting equation:-

(i) Accounting equations despites the accuracy of a financial transaction.

(ii) From accounting equations we can easily prepare final accounts.

Question 2:

Solution 2: The correct equations from the above equations:-

I. Assets = Capital + Liabilities

IV. Capital = Assets – Liabilities

VIII. Liabilities = Assets – Capital

Hence, the correct equations are I, IV and VIII.

Question 3:

Solution 3:

It is given that

Capital = Rs. 75,000

Calculation of Total Assets:-

Total Assets = Cash + Debtors + Machinery + Stock

Total Assets = Rs. 5,000 + Rs. 20,000 + Rs. 60,000 + Rs. 25,000

Total Assets = Rs. 1,10,000

Calculation of Liabilities:-

Liabilities = Assets – Capital

Liabilities = Rs. 1,10,000 – Rs. 75,000

Liabilities = Rs. 35,000

Question 4:

Solution 4:

(a) Credit – Increase in revenue

(b) Credit – Decrease in expense

(c) Debit in Capital Account – Record drawing

(d) Credit in Capital Account – Record the fresh capital introduced by owner

Question 5:

Solution 5: (i) Assets decrease will be the credit.

(ii) Liability Decrease will be the debit.

Question 6:

Solution 6: (i) Decrease the assets and decrease the capital – Cash withdraw for personal use Drawings.

(ii) Increase the assets and increase the liabilities – Purchase an asset on credit basis.

(iii) Increase the assets and decrease another asset – Sale or purchases of stock on cash basis.

(iv) Decrease the assets and decrease the liabilities – Paid amount to creditors.

Question 7:

Solution 7: (i) Stock Increases by Rs. 20,000 on assets and Creditors Increases by Rs. 20,000 on liabilities.

(ii) Cash Increase by Rs. 10,000 on assets, Stock decrease by Rs. 8,000 on assets and Capital increase by Rs. 2,000.

(iii) Cash Decrease by Rs. 500 on assets and Capital decrease by Rs. 500.

(iv) Cash Decrease by Rs. 2,000 on assets and Capital decrease by Rs. 2,000.

(v) Cash Decrease by Rs. 2,000 on assets and creditors decrease by Rs. 2,000 on liabilities.

Question 8:

Solution 8:

Liabilities (Creditors) = Assets – Capital

Creditors = Rs. 2,00,000 – Rs. 1,50,000

Creditors = Rs. 50,000

Therefore, the amount of creditors are Rs. 50,000.

Question 9:

Solution 9:

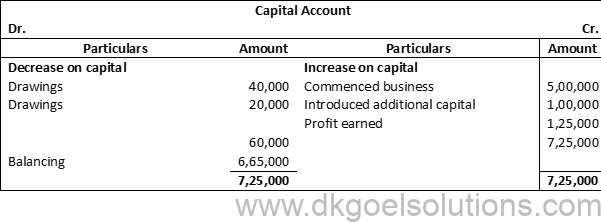

Calculation of Closing Capital:-

Closing Capital = Closing Assets – Closing liabilities

Closing Capital = Rs. 7,80,000 – Rs. 70,000

Closing Capital = Rs. 7,10,000

Calculation of Profit:-

Profit = Closing Capital – Opening Capital

Profit = Rs. 7,10,000 – Rs. 5,00,000

Profit = Rs. 2,10,000

Therefore, Profit of the firm is Rs. 2,10,000.

Question 10:

Solution 10:

- Cash

Nature of Account – Assets

Side of the Account – Debit - Machinery

Nature of Account – Asset

Side of the Account – Debit - Debtors

Nature of Account – Asset

Side of the Account – Debit - Creditors

Nature of Account – Liabilities

Side of the Account – Credit - Proprietor’s Accounts

Nature of Account – Capital

Side of the Account – Credit - Rent Received

Nature of Account – Income

Side of the Account – Credit - Salary paid

Nature of Account – Expenses

Side of the Account – Debit - Interest Received

Nature of Account – Income

Side of the Account – Credit

Question 11:

Solution 11: S.no.-Particulars-Nature of Account-Side of the Account

- Furniture

Nature of Account – Assets

Side of the Account – Debit - Bank-Assets-Credit

Nature of Account – Assets

Side of the Account – Debit - Proprietor’s Account-Capital-Debit

Nature of Account – Capital

Side of the Account – Debit - Salary Paid-Expenses-Credit

Nature of Account – Expenses

Side of the Account – Credit - Salary Outstanding

Nature of Account – Liabilities

Side of the Account – Debit - Subash

Nature of Account – Customer (Assets)

Side of the Account – Credit

Very Short Questions of Accounting Equations

Question 1:

Solution 1: Accounting equation signifies that the assets of a business are always equal to the total of its liabilities and capital. The equation reads as:-

Assets = Liabilities + Capital

Question 2:

Solution 2: Below is the fundamental accounting equation:-

Assets = Liabilities + Capital

Question 3:

Solution 3:

It is given that,

Capital = Rs. 5,00,000

Liabilities = Rs. 2,00,000

Assets = Liabilities + Capital

Assets = Rs. 5,00,000 + Rs. 2,00,000

Assets = Rs. 7,00,000

Therefore, the Total Assets will be Rs. 7,00,000

Question 4:

Solution 4:

Liabilities (Creditors) = Assets – Capital (Net worth)

Creditors = Rs. 10,00,000 – Rs. 4,00,000

Creditors = Rs. 6,00,000

Question 5:

Solution 5:

Calculation of closing stock:-

Closing Capital = Closing Assets – Closing liabilities

Closing Capital = Rs. 8,00,000 – Rs. 50,000

Closing Capital = Rs. 7,50,000

Calculation of Profit:-

Profit = Closing Capital – Opening Capital

Profit = Rs. 7,50,000 – Rs. 6,00,000

Profit = Rs. 1,50,000

Question 6:

Solution 6: The output of the growth in assets and the reduction in liabilities is debit. Debits are the equilibrium of credits that counter each other. It is considered a debit if a number is entered on the left-hand side of an account.

Question 7:

Solution 7: Credit is the result of a fall in savings and a growth in liabilities. Credits are the balance of debits, each of which is the reverse. It is considered a credit if a number is entered on the right-hand side of an account.

Question 8:

Solution 8: The credit and debit laws are the same on all resources and liabilities since the owner and company are the separate entities according to the concept of the business entity. It is believed that the company owner is the borrower of the company and the company is named to compensate its owners.

Question 9:

Solution 9: The capital rise is recoded on the side of credit.

Numerical Questions of DK Goel Solutions Class 11 Chapter 6 – Accounting Equations

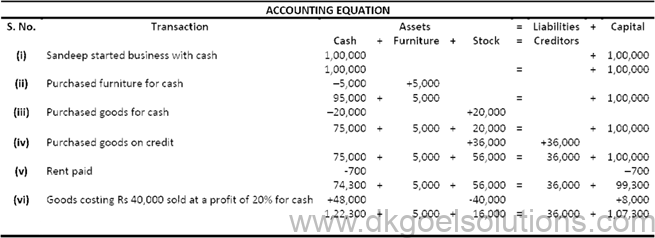

Question 1:

Solution 1:

Working Note:-

(i) In transaction 6 goods costing Rs. 40,000 sold on 20% profit (40,000 × 20%) = 40,000 × 20100 = Rs. 8,000.

Selling price of goods = 40,000 + 8,000 = Rs. 48,000.

Point in Mind DK Goel Solutions Class 11 Chapter 6 :-

Accounting equation is based on the dual concept of accounting, according to which, every transaction has two aspects namely Debit and Credit. It means that every transaction in accounting affects both Debit (Dr.) and Credit (Cr.)

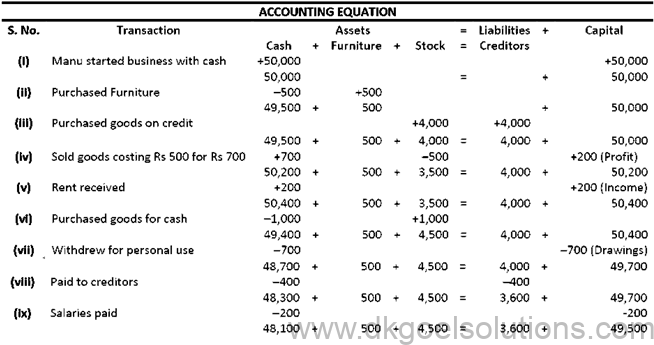

Question 2: (A)

Solutions 2: (A)

Working Note:-

In transaction 4 goods costing Rs. 500 sold at Rs. 700. So, the profit will be Rs. 700 – Rs. 500 = Rs. 200 it will rise our capital by Rs. 200.

Point in Mind:-

Accounting equation thus refers to an equation in which total assets are always equal to the total Liabilities (i.e. Capital + Liabilities).

Question 2: (B)

Solutions 2: (B)

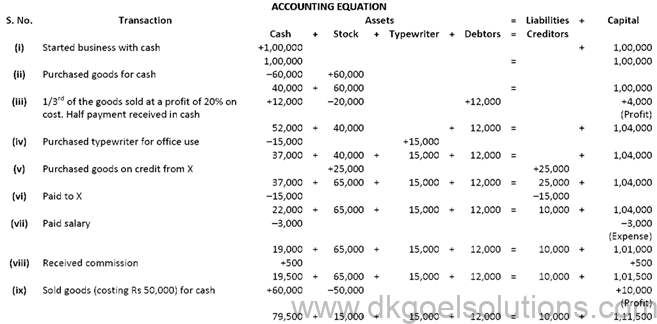

Working Note:-

In transaction 5 goods costing Rs. 60,000 sold at Rs. 80,000. So, the profit will be Rs. 80,000 – Rs. 60,000 = Rs. 20,000 it will rise our capital by Rs. 20,000.

Point in Mind:-

Accounting equation thus refers to an equation in which total assets are always equal to the total Liabilities (i.e. Capital + Liabilities).

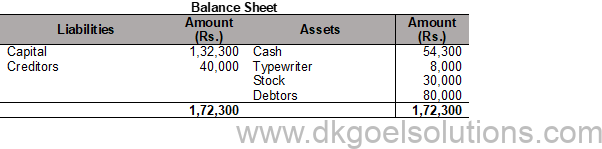

Question 3:

Solution 3:

Working Note:-

(i) In transaction 3 the

Cost of goods sold is Rs. 40,000. Sold on cash 20% of profit Rs. 40,000 × 20100 = Rs. 8,000.

Selling price = Rs. 40,000 + Rs. 8,000 = Rs. 48,000.

Cost of goods sold is Rs. 72,000. Sold on cash 20% of profit Rs. 72,000 × 25100 = Rs. 18,000.

Selling price = Rs. 72,000 + Rs. 18,000 = Rs. 90,000.

Total cost of goods sold = Rs. 40,000 + 72,000 = 1,12,000.

Point in Mind:-

The accounting equation is always equal from both sides debit and credit. It shows the accuracy of recording of a financial transaction.

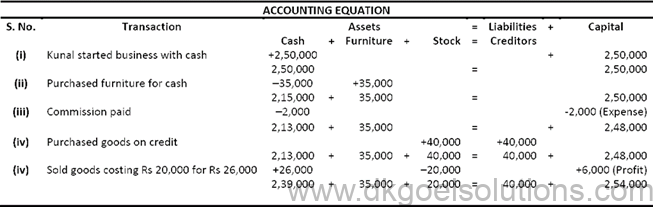

Question 4:

Solution 4:

Working Note:-

(i) In transaction 4 the cost of goods Rs. 20,000 sold at Rs. 26,000. So, the profit will be Rs. 26,000 – Rs. 20,000 = Rs. 6,000.

Point in Mind:-

The accounting equation is always equal from both sides debit and credit. It shows the accuracy of recording of a financial transaction.

Question 5:

Solution 5:

Working Note:-

(i) In transaction 3 the cost of goods Rs. 17,500 sold at Rs. 20,000. So, the profit will be Rs. 17,500 – Rs. 20,000 = Rs. 2,500.

Point in Mind:-

Every transaction has two aspects- debit and credit. It holds that for every debit there is a credit of equal amount and vice versa.

Question 6:

Solution 6:

Working Note:-

(i) In transaction 3 the cost of goods Rs. 24,000 sold at Rs. 40,000. So, the profit will be Rs. 17,500 – Rs. 20,000 = Rs. 16,000.

Point in Mind:-

Every transaction has two aspects- debit and credit. It holds that for every debit there is a credit of equal amount and vice versa.

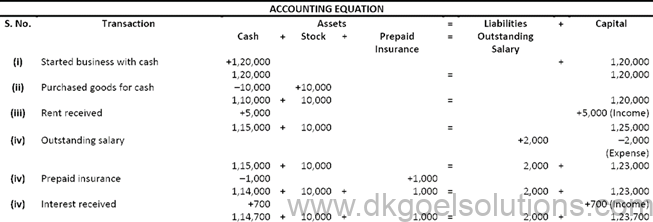

Question 7:

Solution 7:

Point in Mind:-

Outstanding transactions are the liability for the business firm and prepaid transaction are the assets for the business firm.

Question 8 (A):

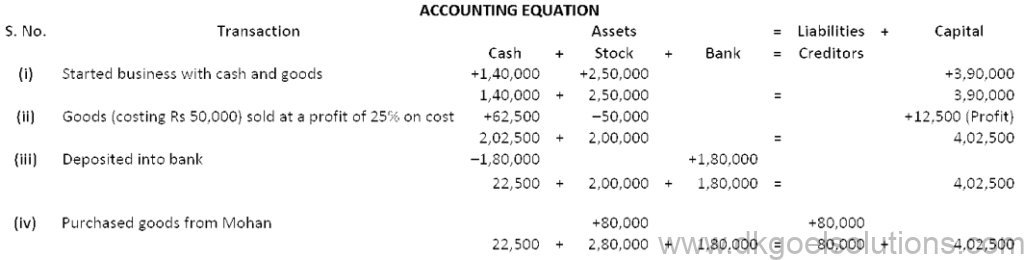

Solution 8 (A):

Working Note:-

(i) In transaction 4 the cost of goods Rs. 50,000 sold at Rs. 25% of profit.

So, the profit will be

Rs. 50,000 × 25100 = Rs. 12,500

Selling price = Rs. 50,000 + Rs. 12,500 = Rs. 62,500.

In which Cash Sale = 27,500 and Credit Sale = Rs. 35,000.

Point in Mind:-

Every transaction has two aspects- debit and credit. It holds that for every debit there is a credit of equal amount and vice versa.

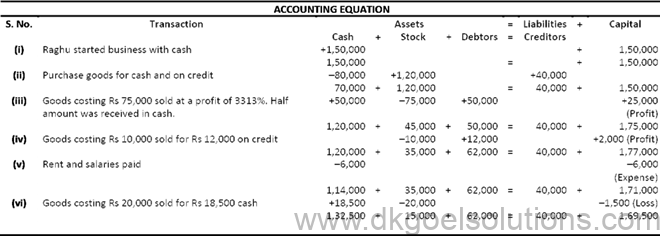

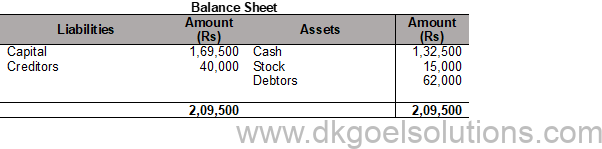

Question 8: (B)

Solution 8 (B):

Working Note:-

In transaction 3 the cost of goods Rs. 75,000 sold at Rs. 3313% of profit.

Hence, the profit will be Rs. 75,000 × 3313% = Rs. 25,000.

Selling price = Rs. 75,000 + Rs. 25,000 = Rs. 1,00,000.

In which Cash Sale = 50,000 and Credit Sale = Rs. 50,000.

Point in Mind:-

Every transaction has two aspects- debit and credit. It holds that for every debit there is a credit of equal amount and vice versa.

Question 9:

Solution 9: We know that

Assets = Liabilities + Capital

Assets = Rs. 20,000 + Rs. 1,20,000

Assets = Rs. 1,40,000

Point In Mind:-

The formulas using to calculate Assets, Liabilities and Capital are:-

Assets = Liabilities + Capital

Liabilities = Assets – Capital

Capital = Assets – Liabilities

Question 10:

Solution 10: Assets = Rs. 1,30,000

Capital = Rs. 80,000

We know that

Liabilities = Assets – Capital

Liabilities = Rs. 1,30,000 – Rs. 80,000

Liabilities = Rs. 50,000

Point in Mind:-

The accounting equation is always equal from both sides debit and credit. It shows the accuracy of recording of a financial transaction.

Question 11:

Solution 11: Opening Capital = Rs. 3,00,000

Assets = Rs. 5,00,000

Liabilities = Rs. 1,00,000

Calculation of Closing Capital:-

Closing Capital = Assets – Liabilities

Closing Capital = Rs. 5,00,000 – Rs. 1,00,000

Closing Capital = Rs. 4,00,000

Calculation of Profit:-

Profit = Closing Capital – Opening Capital

Profit = Rs. 4,00,000 – Rs. 3,00,000

Profit = Rs. 1,00,000

Point in Mind:–

Closing Capital = Opening Capital + Additional Capital + Profit – Drawings

Question 12: (A)

Solution 12: (A) Opening Capital = Rs. 5,00,000

Assets = Rs. 8,00,000

Liabilities (Loan) = Rs. 1,00,000

Calculation of Closing Capital

Closing Capital = Assets – Liabilities

Closing Capital = Rs. 8,00,000 – Rs. 1,00,000

Closing Capital = Rs. 7,00,000

Calculation of Profit

Profit = Closing Capital – Opening Capital

Profit = Rs. 7,00,000 – Rs. 5,00,000

Profit = Rs. 2,00,000

Working Note:-

(i) It is assumed that loan borrowed from Citi Bank has not been paid till the end of the accounting year.

Point in Mind:-

(i) Closing Capital = Opening Capital + Additional Capital + Profit – Drawings

Question 12 (B):

Solution 12: (B) Opening Capital = Rs. 5,00,000

Assets = Rs. 8,00,000

Liabilities (Loan) = Rs. 1,00,000

Calculation of Closing Capital

Closing Capital = Assets – Liabilities

Closing Capital = Rs. 8,00,000 – Rs. 1,00,000

Closing Capital = Rs. 7,00,000

Calculation of Profit

Closing Capital = Opening Capital + Additional Capital + Profit – Drawings

Rs. 7,00,000 = Rs. 5,00,000 + Rs. 40,000 + Profit – Rs. 10,000

Rs. 7,00,000 = Rs. 5,30,000 + Profit

Rs. 7,00,000 – Rs. 5,30,000 = Profit

Profit = Rs. 7,00,000 – Rs. 5,30,000

Profit = Rs. 1,70,000

Point in Mind:-

(i) Closing Capital = Opening Capital + Additional Capital + Profit – Drawings

Question 13:

Solution 13:

| Transaction | Example |

| 1. Increase in an asset and a liability | Purchases goods on credit basis. |

| 2. Decrease in an asset and a liability | Paid amount to creditors. |

| 3. Increase in assets and capital | Extra Capital introduces. |

| 4. Decrease in assets and capital | Amount withdraws by owners. |

Question 14:

Solution 14:

1.) Furniture

Nature of Account – Assets

Name of the side Debit

2.) Rent Paid

Nature of Account – Expenses

Name of the side Debit

3.) Commission Received

Nature of Account – Income

Name of the side Credit

4.) Salary Paid

Nature of Account – Expenses

Name of the side – Debit

5.) Proprietor’s Paid

Nature of Account – Capital

Name of the side – Credit

6.) Debtors

Nature of Account – Assets

Name of the side Debit

7.) Creditor

Nature of Account – Assets

Name of the side Debit

Question 15:

Solution 15:

- Cash Bank

Nature of Account:– Assets

Name of the side:– Credit - Bank Overdraft

Nature of Account:– Liabilities

Name of the side:– Debit - Rent Paid

Nature of Account:– Expenses

Name of the side:– Credit - Outstanding Rent

Nature of Account:- Liabilities

Name of the side:– Debit - Prepaid Insurance

Nature of Account:- Assets

Name of the side:- Credit - Manoj, Proprietor of the business

Nature of Account:- Capital

Name of the side:– Debit

Question 16:

Solution 16:

1.) Ganesh started business with Cash Rs. 2,00,000.

Nature of Account:– Assets

Debit Account:- Cash A/c

Nature of Account:- Liability

Credit Account:- Capital A/c

2.) Purchased goods for Cash Rs. 60,000

Nature of Account:- Assets

Debit Account:- Purchases A/c

Nature of Account:- Assets

Credit Account:- Cash A/c

3.) Sold goods for cash Rs. 75,000

Nature of Account:- Assets

Debit Account:- Cash A/c

Nature of Account:- Assets

Credit Account:- Sales A/c

4.) Purchased goods from Nakul on Credit for Rs. 80,000

Nature of Account:- Assets

Debit Account:- Purchases A/c

Nature of Account:- Liability

Credit Account:- Nakul’s A/c

5.) Sold goods to Bhushan on Credit for Rs. 50,000

Nature of Account:- Assets

Debit Account:- Bhushan’s A/c

Nature of Account:- Assets

Credit Account:- Sales A/c

6.) Paid Cash to Nakul Rs. 20,000

Nature of Account:- Liability

Debit Account:- Nakul’s A/c

Nature of Account:– Assets

Credit Account:- Cash A/c

7.) Received Cash from Bhushan Rs. 10,000

Nature of Account:- Assets

Debit Account:- Cash A/c

Nature of Account:- Assets

Credit Account:- Bhushan’s A/c

8.) Paid salary Rs. 20,000

Nature of Account:– Expenses

Debit Account:- Salary A/c

Nature of Account:– Assets

Credit Account:- Cash A/c

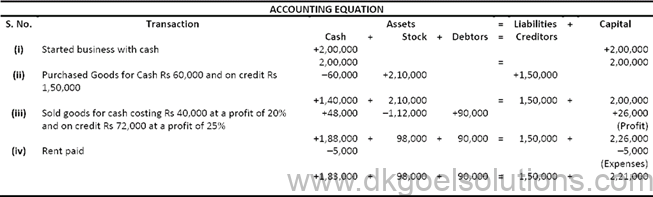

Question 17:

Solution 17:

Working Note:-

Increase in assets will be debit and decrease In assets will be credited. Here Machinery is an asset.

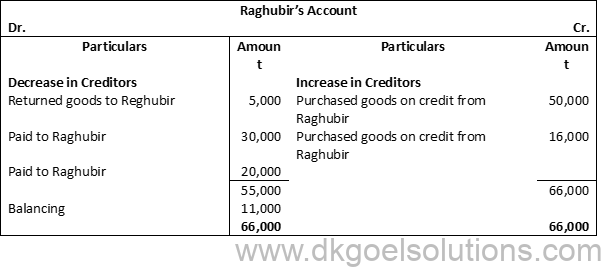

Question 18:

Solution 18:

Working Note for DK Goel Solutions Class 11 Chapter 6:-

Decrease in liabilities will be debit and increase in liabilities will be credited. Here Raghubir is a creditor (liability).

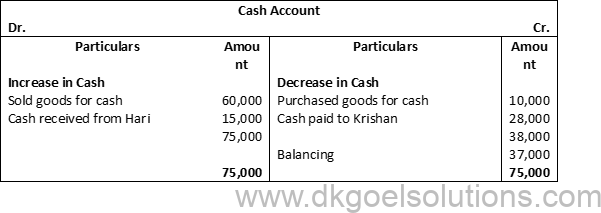

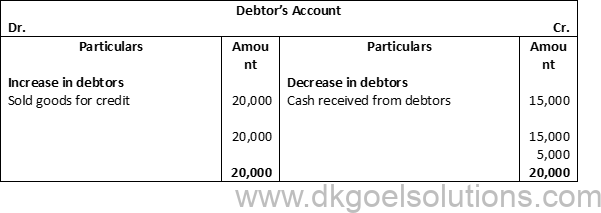

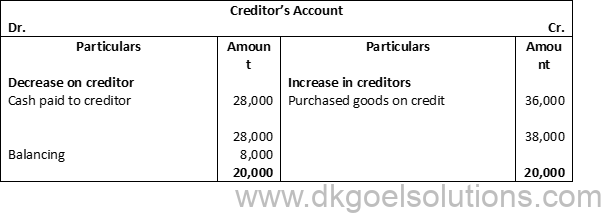

Question 19:

Solution 19:

Point of Knowledge:-

- Increase in asset will be debited and decrease will be credited.

- Increase in the liabilities will be credited and decrease will be debited.

- Increase in the capital will be credited and decrease will be debited.

- Increase in the revenue or income will be credited and decrease will be debited.

- Increase in expenses and losses will be debited and decrease will be credited.

Question 20:

Solution 20:

Point in mind:-

- Asset gains will be debited and credited with reductions.

- Increased liabilities would be credited and debited for a decline.

- The capital gain shall be credited and the reduction shall be debited.

- Revenue or benefit increases will be credited and reductions will be debited.

- Increased costs and deficits would be debited and compensated with a reduction.

Question 21:

Solution 21:

Working Note:-

In transaction 2 goods costing Rs. 50,000 sold at 25% profit on cost = Rs. 50,000 × 25100 = 12,500.

Point in mind:-

- Asset gains will be debited and credited with reductions.

- Increased liabilities would be credited and debited for a decline.

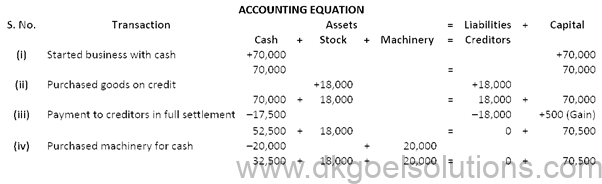

Question 22:

Solution 22:

Working Note:-

Amount paid to creditor Rs. 17,500 in full settlement instant of Rs. 18,000. The difference of Rs. 500 treated as discount received.

Point in mind:-

The credit and debit laws are the same on all resources and liabilities since the owner and company are the separate entities according to the concept of the business entity. It is believed that the company owner is the borrower of the company and the company is named to compensate its owners.

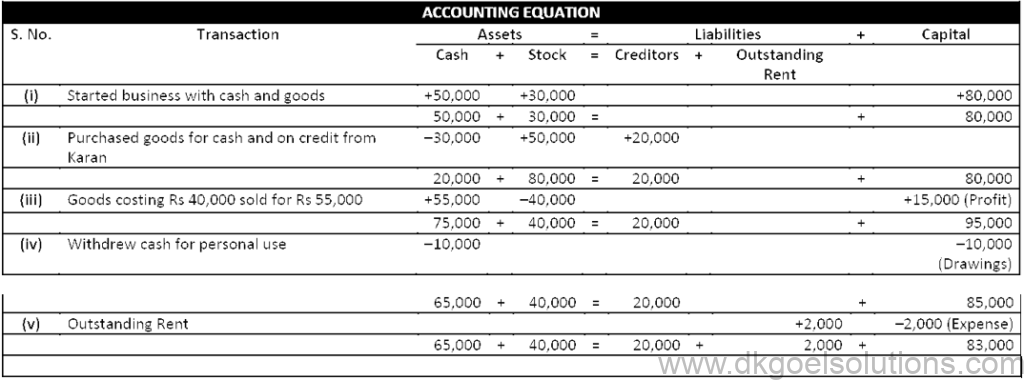

Question 23:

Solution 23:

Working Note:-

For transaction 3 costing of goods Rs. 40,000 sold at Rs. 55,000.

Profit = Selling price – Cost Price

Profit = Rs. 55,000 – Rs. 40,000

Profit = Rs. 15,000

Point in mind:-

In the accounting equation if the capital shows negative figure then it is drawings.

Question 24:

Solution 24:

Working Note DK Goel Solutions Class 11 Chapter 6 :-

For transaction 3 goods costing Rs. 3,000 sold at Rs. 4,000.

Profit = Selling price – Cost Price

Profit = Rs. 4,000 – Rs. 3,000

Profit = Rs. 1,000

Point in mind:-

Accounting equation thus refers to an equation in which total assets are always equal to the total Liabilities (i.e. Capital + Liabilities).

Question 25:

Solution 25:

Working Note:-

For transaction 3 goods costing Rs. 50,000 sold at Rs. 60,000.

Profit = Selling price – Cost Price

Profit = Rs. 60,000 – Rs. 50,000

Profit = Rs. 10,000

(ii)

Total Goods = Rs. 60,000

1/3 of goods sold = Rs. 60,000 × 1/3 = Rs. 20,000

Profit = Rs. 20,000 × 20%

Profit = Rs. 4,000

Selling price = Rs. 20,000 + Rs. 4,000

Selling price = Rs. 24,000

Cash Sale = 24,000 × 50% = Rs. 12,000

Credit Sales = 24,000 × 50% = Rs. 12,000

Point in mind for DK Goel Solutions Class 11 Chapter 6 :–

(1) Rule of Personal Account: Debit the receiver and credit the giver.

(2) Rule of Real Account: Debit what comes in and credit what goes out.

(3) Rule of Nominal Account: Debit all expenses and losses credit all incomes and gains.

The accounting equation is the core foundation of the double-entry accounting system. On the balance sheet, it defines that the set of assets of a company is proportional to the sum of the company’s shareholder’s equity and liabilities of the firm.

Assets are basically the economic resources of a company, it may be in liquid or materialistic form, like properties. The assets can be measured in terms of money. However, there are several aspects related to the assets, like tangibility, type, and many more. An asset account keeps track of a firm’s assets that the company owner brings into the business.

Capital is basically the funds or resources invested in the business by the company owner. The owner can introduce capital as liquid funds or assets. To frame a successful business model, the business must pay back the amount invested coupled with some profits. The record and presentation of these capital investments are quoted as capital accounting.

The Accounting equation is –

Assets = Capital + Assets of a firm

A good financial statement works on the grounds of a well-balanced accounting equation, i.e., each debit must have equal credit, defining the dual aspect of transactions.

Liability is basically the funds or resources borrowed by a firm from outsiders. In simple words, it is the debt payable to the outsiders by an entity. Liabilities can be either short-term or long-term. For instance, bills payable are a short-term liability. However, bank loans are long-term liabilities. Liabilities accounts track the payable debts by a company to help it clear all the overdue on time.

The basic purposes of the accounting equation are as follows –

● When the accounting equation is balanced and equal, it defines the accuracy in recording a company’s financial transactions.

● It primarily helps firms to frame the perfect balance sheets.