DK Goel Solutions Chapter 2 Accounting for Partnership Firms Fundamentals

Read below DK Goel Solutions Class 12 Chapter 2 Accounting for Partnership Firms Fundamentals. These solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter.

This chapter explains the basic concepts of accounting for partnership firms students will be able to understand what a partnership firm is, the basic fundamentals, understanding about partners, how the partnership firm is formed, basics about profit-sharing, and various other important topics.

This is a very basic chapter and in future chapters, students will be able to understand advanced accounting concepts for partnership firms.

The chapter contains a lot of questions which can be very helpful for Class 12 commerce students of Accountancy and will also help build strong concepts which will be really helpful in your career.

DK Goel Solutions Class 12 Chapter 2 solutions are free and will help you to prepare for Class 12 Accountancy. Just scroll down and read through the answers provided below

Accounting for Partnership Firms Fundamentals DK Goel Class 12 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 12 in Chapter 2

Short Answer Questions for DK Goel Solutions Class 12 Chapter 2

Question 1.

Solution 1

1.) Profit/Losses Sharing:- Profit/Losses are paid the partners equally.

2.) Return on Financial:- Capital interest is not paid partners.

3.) Interest on drawings:- Interest on drawings partners who are not paid.

4.) Debt Interest:- Interest at a rate of 6% p.a. It is be given the company on a partner’s loan. Such interest is be paid and in the case of damages the company.

Question 2.

Solution 2

In the absence of the Partnership Deed, following are the terms of the Partnership Act:

1.) If both the partners consent, for the good of the couple, a minor can be admitted.

2.) Either with the consent of all current partners or in compliance with an explicit agreement between the partners, an individual can be admitted as a partner.

3.) Firm enrolment is voluntary and not obligatory.

4.) A partner may withdraw from the business either with the permission of all the other partners or in compliance with an explicit agreement between the partners.

Question 3.

Solution 3

1.) Profit transferred Capital account

2.) Partners Salaries

3.) Partners Commission

4.) Partners Interest on Capital

5.) Interest on Partners Drawings

6.) Net Profit transferred from P&L account

Question 4.

Solution 4

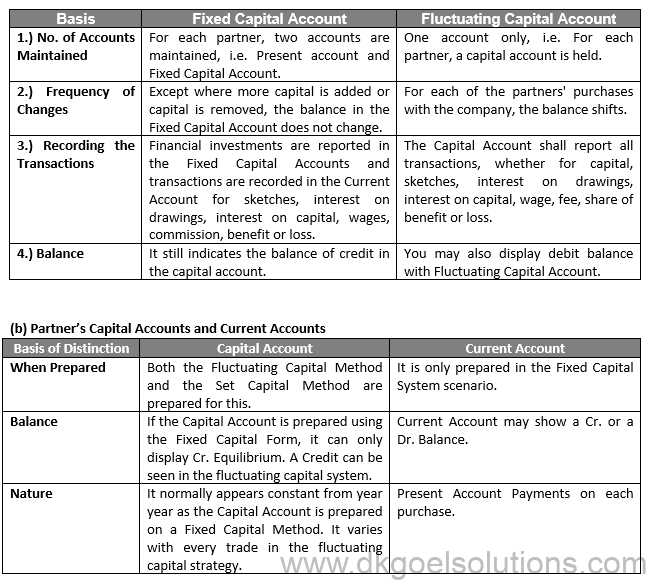

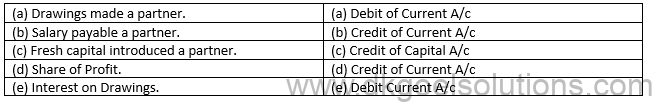

(a) Fixed Capitals and Fluctuating Capitals

Question 5.

Solution 5

(a) Salaries of Partners:- No partner shall be entitled any payment or commission for involvement in the conduct of the business of the company.

(b) Interest in the capital of the partner:- No interest in the capital of the partner is permissible.

(c) Return on a loan:- Interest at 6% p.a. It is be given the company on a partner’s loan. Such interest is be paid and in the case of damages the company.

(d) Benefit-sharing ratio:- Profit and expenses, irrespective of their financial contribution, are be divided equally.

(e) Interest in drawings of the partner:- No interest shall be levied on drawings.

Question 6.

Solution 6

Question 7.

Solution 7

Below are the things that appear while the money is fluctuating on the debit side of the partner’s capital account:—

(1) Drawings

(2) Interest on Drawings

(3) Share of loss

(4) Loss on revolution

(5) Any assets taken partner

(6) Closing Cr. Balance of the Capital

Question 8.

Solution 8

Below are the things that can occur as the funds fluctuate on the credit side of a partner’s capital account:—

(1) Opening credit balance of Capital

(2) Additional Capital introduced

(3) Share of profit

(4) Interest on capital

(5) Salary a partner

Question 9.

Solution 9

In the absence of a partnership deed, the terms of the 1932 Partnership Act referred above would apply:—

(1) Gains and losses are be equally divided.

(2) Interest in capital shall not be tolerated.

(3) No interest shall be paid in respect of sketches.

(4) No partner shall be entitled any commission salary for taking part in the conduct of the business of the company.

(5) A partner shall be entitled interest on the loan issued him the company at a rate of 6 per cent per annum.

(6) Each partner can take part in business actions.

Question 10.

Solution 10

Calculation of Interest on Drawings of equal amounts drawn on the first day of every month:-

Interest on Drawings = Total Amount of Drawings × (Rate of Interest)/100 × 6.5/12

Question 11.

Solution 11

Calculation of Interest on Drawings of equal amounts drawn on the last day of every month:-

Interest on Drawings = Total Amount of Drawings × (Rate of Interest)/100 × 5.5/12

Question 12.

Solution 12

Calculation of Interest on Drawings of equal amounts drawn in the middle of every month:-

Interest on Drawings = Total Amount of Drawings × (Rate of Interest)/100 × 6/12

Question 13 (new).

Solution 13. In the absence of partnership deed, the provision of partnership act 1932 will apply according to which:

1. No interest is payable on capitals.

2. Interest on loan by partner will be paid @ 6% p.a.

3. Profit will be shared equally.

4. No salary is payable to any partner.

Question 13.

Solution 13 (i) The profit would be equally divided.

(ii) B is not going get a Salary.

Question 14.

Solution 14 (i) B will be awarded interest on his loan @ 6% p.a.

(ii) In the absence of any provision the contrary, benefit shall be divided equally, regardless of the capital of the latter.

Question 15.

Solution 15 (a) Interest on capital will not be allowed.

(b) X shall not be entitled any salary.

(c) X’s son, if Y objects it, cannot be accepted as a partner.

(d) X shall be eligible claim interest on his loan @ 6% p.a.

Question 16.

Solution 16 (a) A Return Rs. 1,75,000

(b) A Return Rs. 50,000;

(c) Mohan cannot be admitted

(d) Goods may be purchased from Raghubir.

Numerical Questions:-

Question 1.

Solution 1

Trading and Profit and loss account

for the year ended 31st March, 2021

Balance Sheet

for the year ended 31st March, 2021

Points for Students:-

As per accounting viewpoint, partnership firms are treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 2.

Solution 2 Calculation of Interest on Capital For Girish:-

Capital for 4 months = Rs. 5,60,000

Rate of interest = 6%

Interest on Capital = Rs. 5,60,000 × 6% × 4/12

Interest on Capital = Rs. 11,200

Capital for 8 months = Rs. 5,00,000

Rate of interest = 6%

Interest on Capital = Rs. 5,00,000 × 6% × 8/12

Interest on Capital = Rs. 20,000

Total Interest on Capital paid Girish = Rs. 11,200 + Rs. 20,000

Total Interest on Capital paid Girish = Rs. 31,200

Calculation of Interest on Capital For Satish:-

Capital for 4 months = Rs. 4,75,000

Rate of interest = 6%

Interest on Capital = Rs. 4,75,000 × 6% × 4/12

Interest on Capital = Rs. 9,500

Capital for 8 months = Rs. 5,00,000

Rate of interest = 6%

Interest on Capital = Rs. 5,00,000 × 6% × 8/12

Interest on Capital = Rs. 20,000

Total Interest on Capital paid Satish = Rs. 9,500 + Rs. 20,000

Total Interest on Capital paid Satish = Rs. 29,500

Points for Students:-

The Limited Liability Partnerships (LLPs) in India came into existence with the enactment of ‘Limited Liability Partnership Act, 2008’ which lay down the law for the formation and regulation of Limited Liability Partnerships.

Question 3.

Solution 3 Calculation of Interest on Capital For X:-

Capital for 3 months = Rs. 5,00,000

Rate of interest = 8%

Interest on Capital = Rs. 5,00,000 × 8% × 3/12

Interest on Capital = Rs. 10,000

Capital for 9 months = Rs. 6,00,000

Rate of interest = 8%

Interest on Capital = Rs. 6,00,000 × 8% × 9/12

Interest on Capital = Rs. 36,000

Total Interest on Capital paid X = Rs. 10,000 + Rs. 36,000

Total Interest on Capital paid X = Rs. 46,000

Calculation of Interest on Capital For Y:-

Capital for 3 months = Rs. 4,00,000

Rate of interest = 8%

Interest on Capital = Rs. 4,00,000 × 8% × 3/12

Interest on Capital = Rs. 8,000

Capital for 7 months = Rs. 4,80,000

Rate of interest = 8%

Interest on Capital = Rs. 4,80,000 × 8% × 7/12

Interest on Capital = Rs. 22,400

Capital for 2 months = Rs. 4,65,000

Rate of interest = 8%

Interest on Capital = Rs. 4,65,000 × 8% × 2/12

Interest on Capital = Rs. 6,200

Total Interest on Capital paid Y = Rs. 8,000 + Rs. 22,400 + Rs. 6,200

Total Interest on Capital paid Y = Rs. 36,600

Calculation of Interest on Capital For Z:-

Capital for 3 months = Rs. 3,00,000

Rate of interest = 8%

Interest on Capital = Rs. 4,00,000 × 8% × 3/12

Interest on Capital = Rs. 6,000

Capital for 9 months = Rs. 3,50,000

Rate of interest = 8%

Interest on Capital = Rs. 4,80,000 × 8% × 9/12

Interest on Capital = Rs. 21,000

Total Interest on Capital paid Y = Rs. 6,000 + Rs. 21,000

Total Interest on Capital paid Y = Rs. 27,000

Points for Students:-

A LLP is a body corporate formed and incorporated under this Act. It is legal entity separate from of its partners. A LLP shall have perpetual succession. Any change in the partners of a LLP shall not affect the existence, rights or liabilities of the LLP.

Question 4.

Solution 4

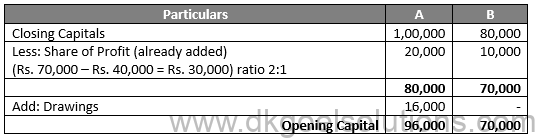

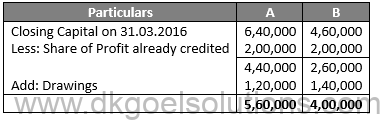

Calculation of Capital in the beginning of the year:-

Mountain:-

Capital at the end of the year on March 31, 2016 = Rs. 4,00,000

Add:- Drawings = Rs. 20,000

Less:- Share of Profit = Rs. 50,000

Capital in the beginning on 1st April, 2015 = Rs. 4,00,000 + Rs. 20,000 – Rs. 50,000 = Rs. 3,70,000

Calculation of Interest on Capital:-

Calculation of Interest on Capital = Rs. 3,70,000 × 10%

Calculation of Interest on Capital = Rs. 37,000

Hill:-

Capital at the end of the year on March 31, 2016 = Rs. 3,00,000

Add:- Drawings = Rs. 15,000

Less:- Share of Profit = Rs. 50,000

Capital in the beginning on 1st April, 2015 = Rs. 3,00,000 + Rs. 15,000 – Rs. 50,000 = Rs. 2,65,000

Calculation of Interest on Capital:-

Calculation of Interest on Capital = Rs. 2,65,000 × 10%

Calculation of Interest on Capital = Rs. 26,500

Rock:-

Capital at the end of the year on March 31, 2016 = Rs. 2,00,000

Add:- Drawings = Rs. 10,000

Less:- Share of Profit = Rs. 50,000

Capital in the beginning on 1st April, 2015 = Rs. 2,00,000 + Rs. 10,000 – Rs. 50,000 = Rs. 1,60,000

Calculation of Interest on Capital:-

Calculation of Interest on Capital = Rs. 1,60,000 × 10%

Calculation of Interest on Capital = Rs. 16,000

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 5.(A)

Solution 5 (A)

Working Note:-

Profit will be distributed in equal ratio = 1 : 1

A’s Profit = Rs. 1,35,000 ×1/2 = Rs. 67,500

B’s Profit = Rs. 1,35,000 ×1/2 = Rs. 67,500

(A). Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

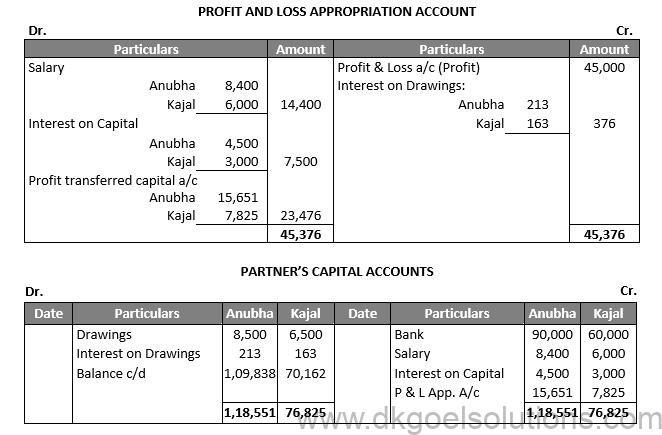

Question 5. (B)

Solution 5

(B)

Working Note:-

1. Salary of Anubha = Rs. 700 × 12 = 8,400

Salary of Kajal = Rs. 500 × 12 = 6,000

2. Profit distribution between partners:-

Anubha’s Profit = Rs. 23,476 × 2/3 = Rs. 15,651

Kajal’s Profit = Rs. 23,476 × 1/3 = Rs. 7,825

3. Calculation of Interest on Capital:-

Anubha = Rs. 90,000 × 5% = Rs. 4,500

Kajal = Rs. 60,000 × 5% = Rs. 3,000

4. Calculation of Interest on Drawings:-

Anubha = Rs. 8,500 × 5/100 × 6/12 = Rs. 213

Kajal = Rs. 6,500 × 5/100 × 6/12 = Rs. 163

(B).Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount.

Question 6.

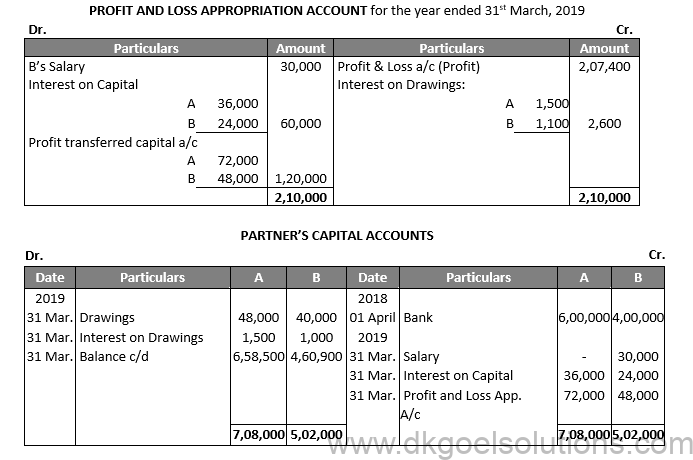

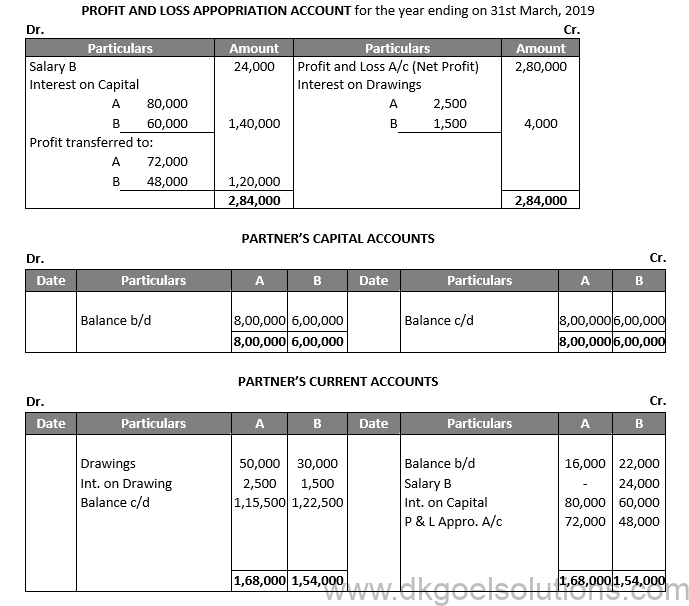

Solution 6

Working Note:-

1. B’s Salary = Rs. 2,500 × 12 = 30,000

2. Profit distribution between partners:-

Anubha’s Profit = Rs. 1,20,000 × 3/5 = Rs. 72,000

Kajal’s Profit = Rs. 1,20,000 × 2/5 = Rs. 48,000

1. Calculation of Interest on Capital:-

A = Rs. 6,00,000 × 6% = Rs. 36,000

B = Rs. 4,00,000 × 6% = Rs. 24,000

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 7.

Solution 7. PROFIT AND LOSS ACCOUNT

for the year ended 31st March, 2021

Working Note:-

- Calculation of Manager’s Commission = Rs. 50,000 × 10% = Rs. 5,000

- Calculation of Interest on Capital:-

X = Rs. 1,00,000 × 12% = Rs. 12,000

Y = Rs. 80,000 × 12% = Rs. 9,600 - Profit distribution between partners:-

X’s Profit = Rs. 17,400 × 2/3 = Rs. 11,600

Y’s Profit = Rs. 17,400 × 1/3 = Rs. 5,800

Points for Students:-

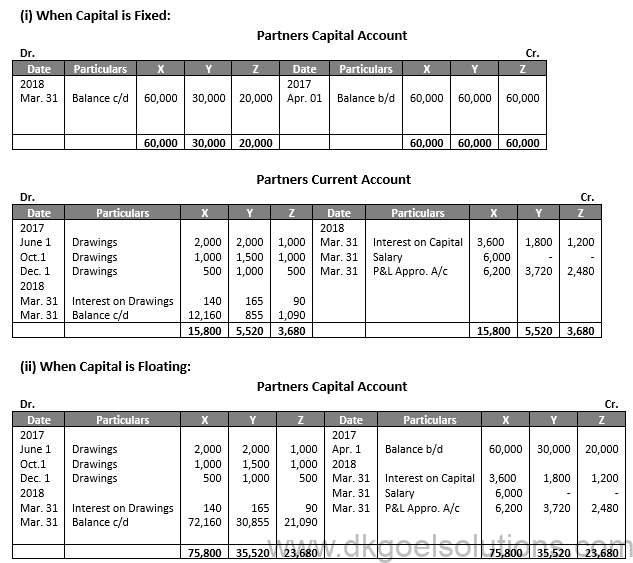

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 8.

Solution 8

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2021

Working Note:-

- Calculation of Commission:-

Asha’s Commission = Rs. 5,40,000 × 8/100 = Rs. 43,200

Lata’s Commission = Rs. 5,40,000 × 8/108 = Rs. 40,000

- Profit distribution between partners:-

Asha’s Profit = Rs. 2,56,600 × 1/3 = Rs. 85,600

Lata’s Profit = Rs. 2,56,600 × 2/3 = Rs. 1,71,200

Points for Students:-

When the capitals need not be fixed, the balances of capital accounts go on changing from time to time. The reason is that no separate Current Accounts are maintained, but all the entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profit or loss etc., are recorded in the capital account itself.

Question 9.

Solution 9

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2020

Working Note:-

Calculation of Partner’s Commission:-

Profit after charging Interest on capital = Rs. 6,00,000 – Rs. 1,20,000 = Rs. 4,80,000

B’s Commission = Rs. 4,80,000 × 10/100 = Rs. 48,000

Profit after charging Interest on capital and B’s Commission = Rs. 6,00,000 – Rs. 1,20,000 – Rs. 48,000

Profit after charging Interest on capital and B’s Commission = Rs. 4,32,000

A’s Commission (after charging B’s commission own commission) = Rs. 4,32,000 × 8/108 = Rs. 32,000

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 10.

Solution 10

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2021

Working Note:–

1. Calculation of Commission:-

Y’s Commission = Rs. 21,200 × 6/106 = Rs. 1,200

Z’s Commission = Rs. 21,200 × 6/106 = Rs. 1,200

2. Profit distribution between partners:-

Y’s Profit = Rs. 20,000 × 1/2 = Rs. 10,000

Z’s Profit = Rs. 20,000 × 1/2 = Rs. 10, 000

Points for Students:-

Rent paid to a partner is also treated as interest on partner’s loan, rent paid to a partner is also treated as a charge against profit and not an appropriation out of profit and hence it should be debited to Profit and Loss account and not to Profit and Loss Appropriation Account and Credited to partner’s Current Account in case of fixed capital system or to Partner’s Capital Account when Capitals are fluctuating.

Question 11.

Solution 11

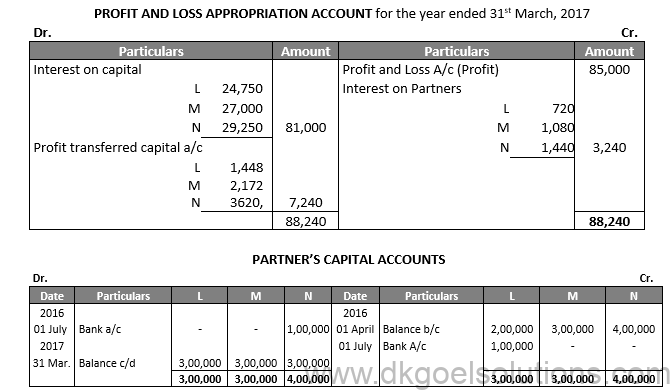

Working Note:-

- 1. Calculation of Interest on capital:-

Interest on Capital L:-

Rs. 2,00,000 for 3 months = Rs. 2,00,000 × 9/100 × 3/12 = Rs. 4,500

Rs. 3,00,000 for 9 months = Rs. 3,00,000 × 9/100 × 3/12 = Rs. 20,250

Interest on Capital N:-

Rs. 4,00,000 for 3 months = Rs. 4,00,000 × 9/100 × 3/12 = Rs. 9,000

Rs. 3,00,000 for 9 months = Rs. 3,00,000 × 9/100 × 3/12 = Rs. 20,250

(A).Points for Students:-

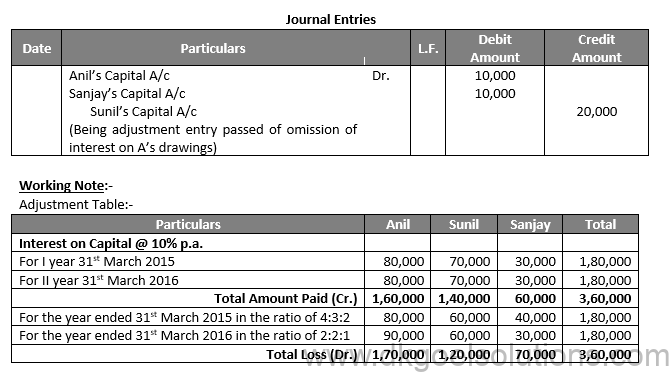

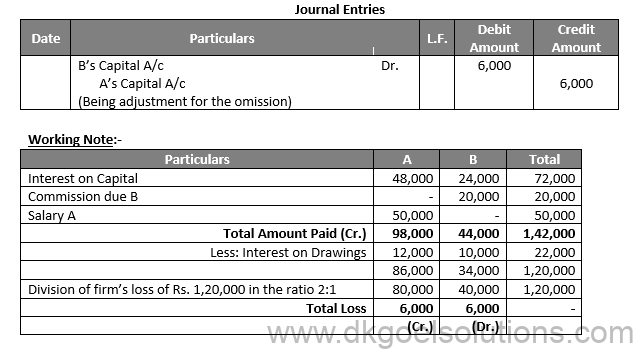

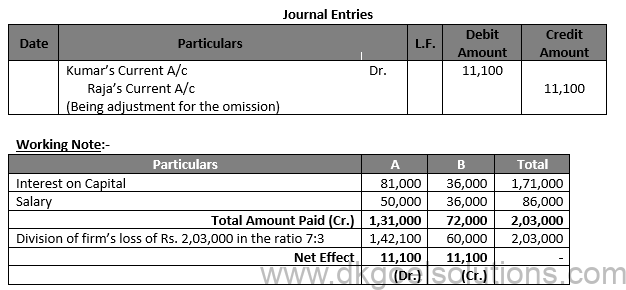

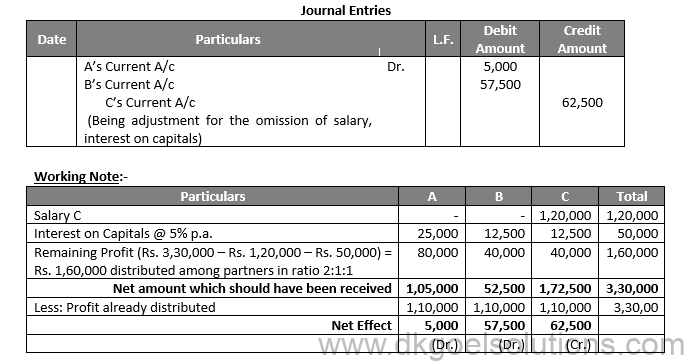

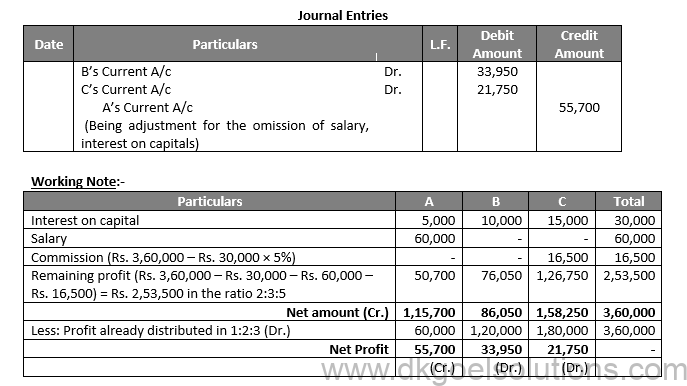

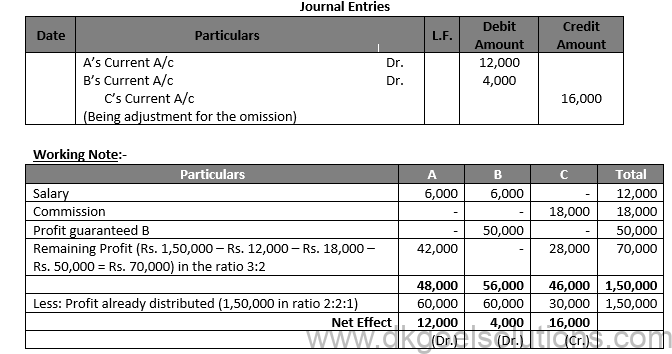

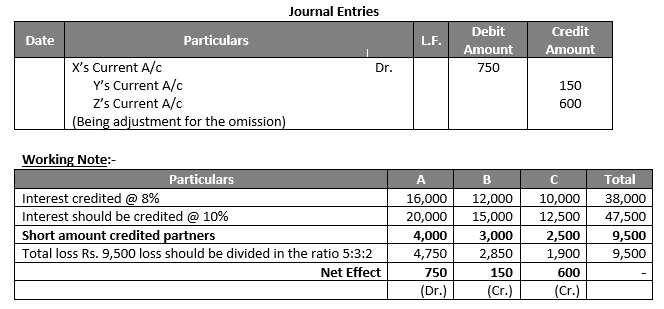

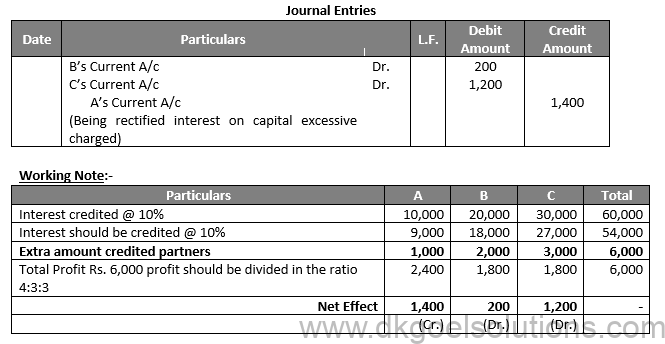

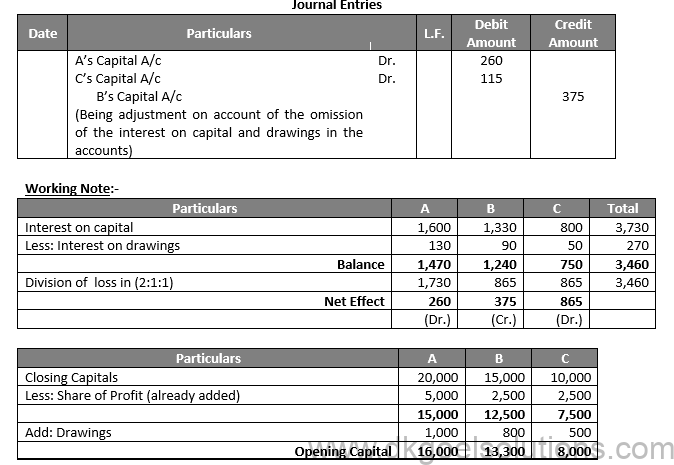

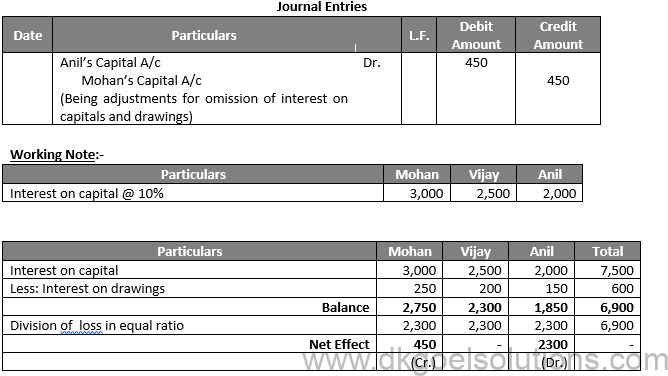

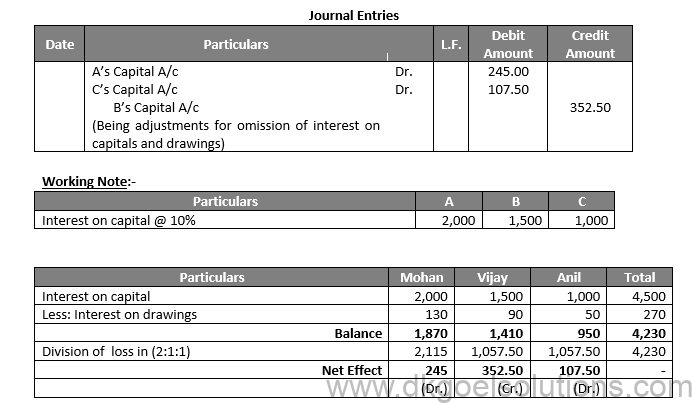

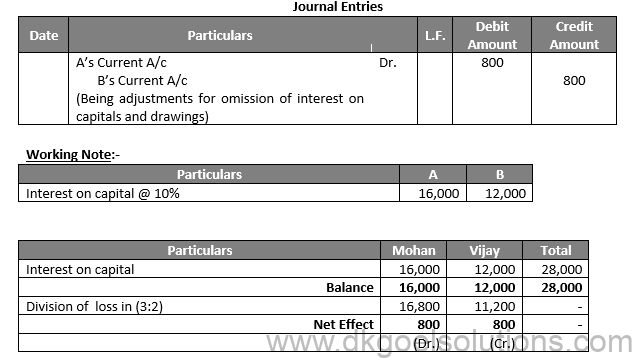

The accounts of the partnership firm have been closed after the financial year, it is discovered that there have been some errors or omissions in the accounts. In such cases, instead of altering the old accounts, the signed balance sheet and adjustment entry for such errors or omissions is made at the beginning of the next year. Usually the following types of adjustments are made:

(1) When Interest on Capital or Drawings may have been omitted.

(2) When Profits and Losses have been distributed among the partners in a wrong proportion.

(3) When profit sharing ratio has been altered with effect from some past date.

(4) When salary or commission payable to person has been omitted.

Question 11. (B)

Solution 11 (B)

Calculation of Adjustment of Capital:-

Total capital of the firm = Rs. 2,10,000 + Rs. 90,000 = Rs. 3,00,000

Profit sharing ratio = 2:1

A’s Capital will be = Rs. 3,00,000 × 2/3 = Rs. 2,00,000

B’s Capital will be = Rs. 3,00,000 × 1/3 = Rs. 1,00,000

Hence, on 1st August, 2016 A withdraw Rs. 10,000 and B will introduce additional capital of Rs. 10,000.

Calculation of Interest on Capital:-

A’s Interest on Capital:-

1st April, 2016 31st July, 2016 = Rs. 2,10,000 × 12/100 × 4/12 = Rs. 8,400

1st Aug., 2016 31st Mar., 2017 = Rs. 2,00,000 × 12/100 × 8/12 = Rs. 16,000

Total interest on capital = Rs. 8,400 + Rs. 16,000 = Rs. 24,400

B’s Interest on Capital:-

1st April, 2016 31st July, 2016 = Rs. 90,000 × 12/100 × 4/12 = Rs. 3,600

1st Aug., 2016 31st Mar., 2017 = Rs. 1,00,000 × 12/100 × 8/12 = Rs. 8,000

Total interest on capital = Rs. 3,600 + Rs. 8,000 = Rs. 11,600

(B).Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 12.

Solution 12

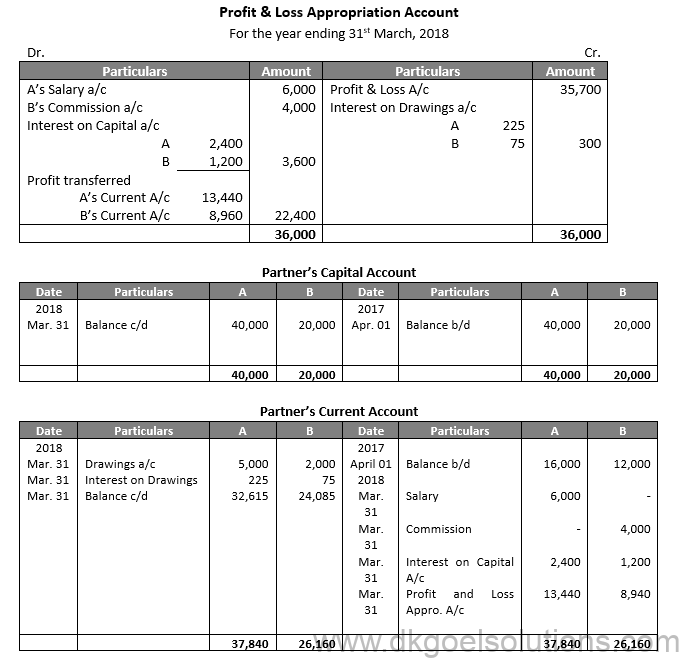

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2021

Working Note:-

1. Calculation of Interest on Capital:-

A = Rs. 2,00,000 × 10% = Rs. 20,000

B = Rs. 2,00,000 × 10% = Rs. 20,000

C = Rs. 80,000 × 10% = Rs. 8,000

2. Calculation of Profit and Loss:-

Capital Ratio = 2,00,000 : 2,00,000 : 80,000

Capital Ratio = 5 : 5 : 2

Profit = 2,80,000 – 48,000 – Rs. 24,000

Profit = 2,08,000

Points for Students:-

As per accounting viewpoint, partnership firms are treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 13.

Solution 13

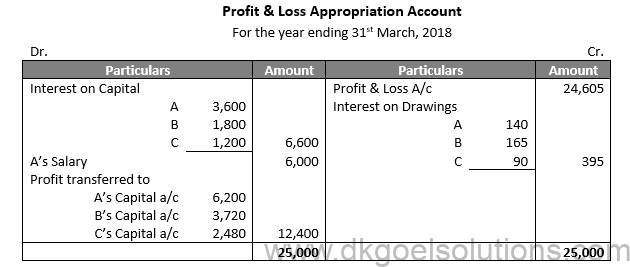

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2021

Points for Students:-

The Limited Liability Partnerships in India came into existence with the enactment of ‘Limited Liability Partnership Act, 2008’ which lay down the law for the formation and regulation of Limited Liability Partnerships.

Question 14.

Solution 14

Points for Students:-

A LLP is a body corporate formed and incorporated under this Act. It is legal entity separate from of its partners. A LLP shall have perpetual succession. Any change in the partners of a LLP shall not affect the existence, rights or liabilities of the LLP.

Question 15.

Solution 15

PROFIT AND LOSS ACCOUNT

for the year ended 31st March, 2021

Working Notes:-

(1) Interest on Mamta’s Loan has been calculated at 6% p.a.

(2) Interest on Drawings has been calculated for an average period of 6 months.

(3) Distributable Profit = Total of Credit side – Debit Side

Total Credit Side = Rs. 2,25,000

Total of Debit side (Rs. 35,000 + Rs. 30,000) = Rs. 65,000

Rs. 2,25,000 – Rs. 65,000 = Rs. 1,60,000

General Reserve is 10% of Rs. 1,60,000 = Rs. 16,000

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 16.

Solution 16

Case (a)

Working Note:-

(i) Interest on A’s Loan = Rs. 2,00,000 x 6/100 x 9/12 = Rs. 9,000

(ii) Interest on B’s Loan = Rs. 1,00,000 x 6/100 x 9/12 = Rs. 4,000

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 17.

Solution 17

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 18.

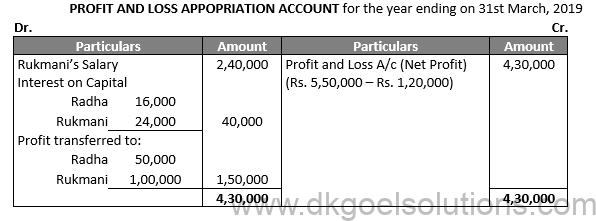

Solution 18

Working Note:-

1. Calculation of Net Profit = 5,50,000 – Rs. 1,20,000 = Rs. 4,30,000

2. Calculation of Interest on Capital:-

Radha = Rs. 2,00,000 × 8% = Rs. 16,000

Rukmani = Rs. 3,00,000 × 8% = Rs. 24,000

3. Calculation of Profit and Loss:-

Profit of transferred Capital account = Rs. 4,30,000 – (Rs. 2,40,000 + Rs. 40,000)

Profit of transferred Capital account = Rs. 1,50,000

Radha’s Profit = Rs. 1,50,000 × 1/3 = Rs. 50,000

Rukmani’s Profit = Rs. 1,50,000 × 2/3 = Rs. 1,00,000

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

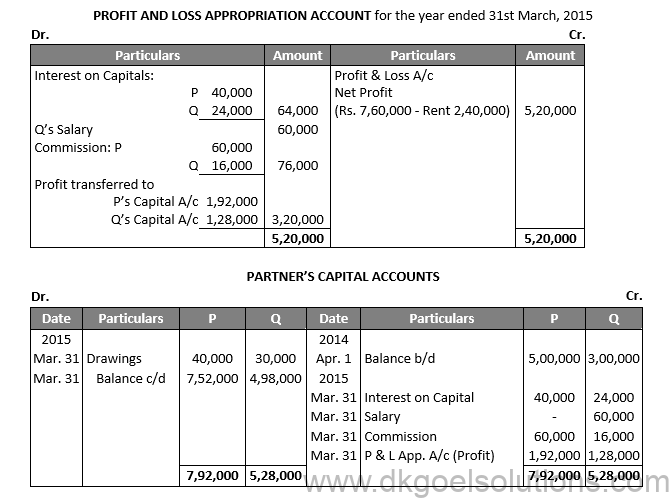

Question 19.

Solution 19

PROFIT AND LOSS APPOPRIATION ACCOUNT

for the year ending on 31st March, 2021

Working Note:-

1. Calculation of Net Profit = 7,60,000 – Rs. 2,40,000 = Rs. 5,20,000

2. Calculation of Interest on Capital:-

P = Rs. 5,00,000 × 8% = Rs. 40,000

Q = Rs. 3,00,000 × 8% = Rs. 24,000

3. Net Profit after deducting Expenses:-

Rs. 5,20,000 – (Rs. 64,000 + Rs. 60,000 + Rs. 60,000) = Rs. 3,36,000

Q’s Commission = 3,36,000 × 5/105 = Rs. 16,000

4. Calculation of Profit and Loss:-

P’s Profit = Rs. 3,20,000 × 60/100 = Rs. 1,92,000

Q’s Profit = Rs. 3,20,000 × 40/100 = Rs. 1,28,000

Points for Students:-

Rent paid to a partner is also treated as interest on partner’s loan, rent paid to a partner is also treated as a charge against profit and not an appropriation out of profit and hence it should be debited to Profit and Loss account and not to Profit and Loss Appropriation Account and Credited to partner’s Current Account in case of fixed capital system or to Partner’s Capital Account when Capitals are fluctuating.

Question 20.

Solution 20

Working Note:-

(1) Net Profit transferred from P & L A/c P & L App. A/c

Net Profit in P&L App. A/c = Net Profit in P&L A/c – Expenses (Rent)

Net Profit in P&L App. A/c = Rs. 7,60,000 – Rs. 2,40,000

Net Profit in P&L App. A/c = Rs. 5,20,000

(2) Net Profit after deducting interest on capitals, salary and P’s commission:

Rs. 5,20,000 – Rs. 64,000 – Rs. 60,000 – Rs. 60,000 = Rs. 3,36,000

Q’s Commission = 3,36,000 x 5/105 = 16,000

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

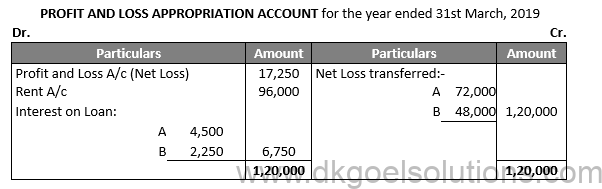

Question 21.

Solution 21

Working Note:-

Calculation of Interest in Loan:-

A = 1,00,000 × 6/100 × 9/12 = Rs. 4,500

B = 50,000 × 6/100 × 9/12 = Rs. 2,250

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

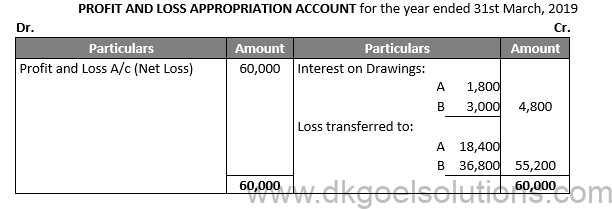

Question 22.

Solution 22

Working Note:-

Calculation of Interest in Drawings:-

A = 30,000 × 12/100 × 6/12 = Rs. 1,800

B = 50,000 × 12/100 × 6/12 = Rs. 3,000

Points for Students:-

When the capitals need not be fixed, the balances of capital accounts go on changing from time to time. The reason is that no separate Current Accounts are maintained, but all the entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profit or loss etc., are recorded in the capital account itself.

Question 23.

Solution 23

PROFIT AND LOSS APPROPRIATION ACCOUNT

for the year ended 31st March, 2021

Working Note:-

Calculation of Interest on Capital:-

A = 10,00,000 × 8/100 = Rs. 80,000

B = 5,00,000 × 8/100 = Rs. 40,000

Total profit needed = Rs. 80,000 + Rs. 40,000 = Rs. 1,20,000

Available profit = Rs. 45,000 which is less than appropriations Rs. 1,20,000. Profit will be distributed in the ratio of appropriations in interest on capital 80,000 : 40,000 = 2 : 1.

A’s share = 45,000 × 2/3 = 30,000

B’s share = 45,000 × 1/3 = 15,000

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 24.

Solution 24

Working Note:-

New Ratio = 1,08,000 : 27,000

New Ratio = 108 : 27

New Ratio = 4 : 1

Profit and Loss Appropriation:-

Akruti’s Share = 1,04,000 × 4/5 = 83,200

Vibhuti’s Share = 1,04,000 × 1/5 = 20,800

Points for Students:-

Rent paid to a partner is also treated as interest on partner’s loan, rent paid to a partner is also treated as a charge against profit and not an appropriation out of profit and hence it should be debited to Profit and Loss account and not to Profit and Loss Appropriation Account and Credited to partner’s Current Account in case of fixed capital system or to Partner’s Capital Account when Capitals are fluctuating

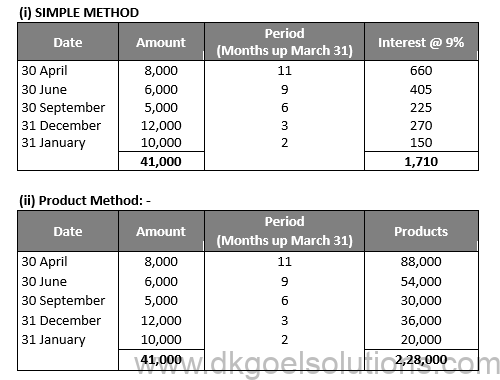

Question 25. (A)

Solution 25

(A)

Working Note:-

Calculation of Interest:-

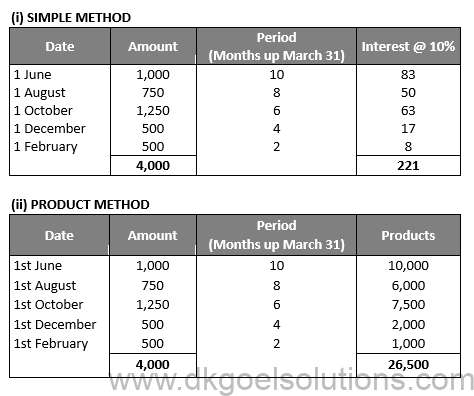

Interest = Total of Products x 9/100 x 1/12

Interest = 2,28,000 x 9/100 x 1/12 = Rs. 1,710

A). Points for Students:-

Under simple method, interest on drawing is calculated separately on each amount of drawing, from the date of drawing till the close of the accounting period. Interest on each amount of drawing is calculated with the help of the following formula:

Question 25. (B)

Solution 25

(B)

Working Note:-

Calculation of Interest:-

Interest = Total of Products x 10/100 x 1/12

Interest = 26,500 x 10/100 x 1/12 = Rs. 221

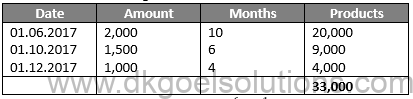

B). Points for Students:-

Under product method, first of all the products are computed by multiplying the each set of drawings from its duration. Thereafter, the different products are added and the interest is calculated on the total of products so arrived at for one month. The advantage of this system is that separate calculations are not required each time. Following formula is used for the calculation of interest under this method:-

Question 26. (A)

Solution 26 (A) Gopal withdrew Rs. 1,000 p.m. regularly on the first day of every month during the year ended 31st March, 2014 for personal expenses. His interest on drawings will be calculated as follows:

Calculation of Interest on Drawings:-

Interest on Drawings = Rs.12,000 × 15/100 × 6.5/12

Interest on Drawings = Rs. 975

(A). Points for Students:-

As per accounting viewpoint, partnership firms are treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 26.(B)

Solution 26 (B)

(i) Calculation of Interest on Drawings:-

Interest on Drawings = Rs.48,000 × 9/100 × 6.5/12

Interest on Drawings = Rs. 2,340

(ii) Calculation of Interest on Drawings:-

Interest on Drawings = Rs.48,000 × 9/100 × 5.5/12

Interest on Drawings = Rs. 1,980

(iii) Calculation of Interest on Drawings:-

Interest on Drawings = Rs.48,000 × 9/100 × 6/12

Interest on Drawings = Rs. 2,160

(B). Points for Students:-

Average period should be used only when:

(a) All amount of drawings are equal

(b) The time gap between drawings is equal.

Question 27.

Solution 27 Case (i)

Total Drawings for the year = Rs. 5,000 × 4 = Rs. 20,000

Period = 12 months + 3 months = 15 months

Average Period = (15 months)/2 = 7.5 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 20,000 × 8/100 × 7.5/12

Interest on Drawings = Rs. 1,000

Case (ii)

Total Drawings for the year = Rs. 6,000 × 4 = Rs. 24,000

Period = 12 months

Average Period = (9 months)/2 = 4.5 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 24,000 × 8/100 × 4.5/12

Interest on Drawings = Rs. 720

Case (iii)

Total Drawings for the year = Rs. 10,000 × 4 = Rs. 40,000

Period = 10.5 months + 1.5 months = 12 months

Average Period = (12 months)/2 = 6 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 40,000 × 8/100 × 6/12

Interest on Drawings = Rs. 1,600

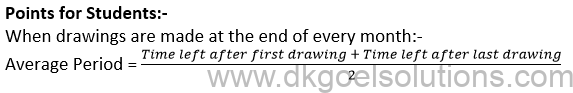

Points for Students:-

When a partner makes monthly drawings, the Interest may be calculated as follows:-

1. When drawings are made in the beginning of every month.

2. When drawings are made at the end of every month.

3. When drawings are made in the middle or at any time during the month.

4. When drawings of equal amount are made in the beginning of each quarter.

5. When drawings of equal amount are made at the end of each quarter.

6. When drawings of equal amount are made in the during the middle of each quarter.

7. When drawings of equal amount are made only during a period of 6 months.

8. When drawings of equal amount are made during 9 months.

Question 28.

Solution 28 Case (i)

Period = 12 months + 1 months = 13 months

Average Period = (13 months)/2 = 6.5 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 48,000 × 9/100 × 6.5/12

Interest on Drawings = Rs. 2,340

Case (ii)

Period = 11 months

Average Period = (11 months)/2 = 5.5 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 60,000 × 9/100 × 5.5/12

Interest on Drawings = Rs. 2,475

Case (iii) Assuming that the drawings were made in the middle of every month:-

Period = 11.5 months + 0.5 months = 12 months

Average Period = (12 months)/2 = 6 months

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 72,000 × 9/100 × 6/12

Interest on Drawings = Rs. 3,240

Case (iv) Calculated for an average period of 6 months:

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 72,000 × 9/100 × 6/12

Interest on Drawings = Rs. 3,240

Case (v)

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 4,01,000 × 9/100 × 1/12

Interest on Drawings = Rs. 3,008

Case (vi)

Period = 12 months + 3 months = 15 months

Average Period = (15 months)/2 = 7.5 months

Total Drawings for the year = 12,000 × 4 = Rs. 48,000

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 48,000 × 9/100 × 7.5/12

Interest on Drawings = Rs. 2,700

Case (vii)

Period = 9 months

Average Period = (9 months)/2 = 4.5 months

Total Drawings for the year = 18,000 × 4 = Rs. 72,000

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 72,000 × 9/100 × 4.5/12

Interest on Drawings = Rs. 2,430

Case (viii)

Period = 10.5 months + 1.5 months = 12 months

Average Period = (12 months)/2 = 6 months

Total Drawings for the year = 18,000 × 4 = Rs. 72,000

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 72,000 × 9/100 × 6/12

Interest on Drawings = Rs. 3,240

Points for Students:-

Drawings against profits means drawings made out of profit earned by the firm during the year. Durings against capital means drawings made in excess of profit. Such drawings do not reduce the capital of the firm. Such drawings reduce the capital of the firm. It is not considered while calculating interest in capital. It is deducted from capital while calculating interest on capital.

Question 29.(A)

Solution 29 (A) Gupta drew Rs. 800 at the beginning of every month for the six months ending 30th September, 2018. Hence, his drawings for the period of six months would be:

Period = 6 months + 1 months = 7 months

Average Period = (7 months)/2 = 3.5 months

Total Drawings for the year = 800 × 4 = Rs. 4,800

Calculation of Interest on Drawings:-

Interest on Drawings = Rs. 4,800 × 15/100 × 3.5/12

Interest on Drawings = Rs. 210

Working Note:-

Average Period = (Time left after first drawing + Time left after last drawing)/2

Average Period = (6 months + 1 months)/2

Average Period = (7 months)/2

Average Period = 3.5 months

Points for Students:-

Under product method, first of all the products are computed by multiplying the each set of drawings from its duration. Thereafter, the different products are added and the interest is calculated on the total of products so arrived at for one month. The advantage of this system is that separate calculations are not required each time. Following formula is used for the calculation of interest under this method:-

Question 29. (B)

Solution 29 (B) Gupta withdraws Rs. 800 at the end of every month for the six months ending 30th September, 2013.

Total drawings = 6 x Rs. 800 = Rs. 4,800

(Time left after first drawing + Time left after last drawing)/2

= (5 + 0)/2 = 2.5 months.

Rs. 4,800 x 15/100 x 2.5/12 = Rs. 150

Points for Students:-

Average period should be used only when:

(c) All amount of drawings are equal

(d) The time gap between drawings is equal.

Question 29. (C)

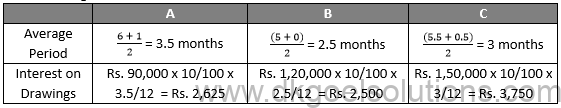

Solution 29 (C)

Total Drawings of A = Rs. 15,000 x 6 = Rs. 90,000

Total Drawings of B = Rs. 20,000 x 6 = Rs. 1,20,000

Total Drawings of C = Rs. 25,000 x 6 = Rs. 1,50,000

(C). Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 30. (A)

Solution 30 (A) Total Drawings = 9 × Rs. 10,000 = Rs. 90,000

Average Period = (9 months+1 month)/2

Average Period = 10/2

Average Period = 5 months

Interest on drawings = Rs. 90,000 × 9/100 × 5/12 = Rs. 3,375

Question 30. (B)

Solution 30 (B) Total Drawings = 9 × Rs. 10,000 = Rs. 90,000

Average Period = (8 months+0 month)/2

Average Period = 8/2

Average Period = 4 months

Interest on drawings = Rs. 90,000 × 9/100 × 4/12 = Rs. 2,700

Question 30. (C)

Solution 30 (C) Total Drawings = 9 × Rs. 10,000 = Rs. 90,000

Average Period = (8.5 months+0.5 month)/2

Average Period = 9/2

Average Period = 4.5 months

Interest on drawings = Rs. 90,000 × 9/100 × 4.5/12 = Rs. 3,038

Points for Students:-

When a partner makes monthly drawings, the Interest may be calculated as follows:-

Drawings are made in the beginning of every month.

Drawings are made at the end of every month.

Drawings are made in the middle or at any time during the month.

Drawings of equal amount are made in the beginning of each quarter.

Drawings of equal amount are made at the end of each quarter.

Drawings of equal amount are made in the during the middle of each quarter.

Drawings of equal amount are made only during a period of 6 months.

Drawings of equal amount are made during 9 months.

Question 31.

Solution 31 Case (i)

Interest on Drawings = Rs. 60,000 × 8/100 × 6/12

Interest on Drawings = Rs. 2,400

Case (ii)

Calculation for 12 months Interest on Drawings:

Interest on Drawings = Rs. 60,000 × 8/100

Interest on Drawings = Rs. 4,800

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 32.

Solution 32

Working Note:-

Calculation of Interest on Drawings:-

(i) Amit withdraw on the beginning of each month:-

Interest on Drawings = 24,000 × 12/100 × 6.5/12

Interest on Drawings = Rs. 1,560

(ii) Namit withdraw on the end of each month:-

Interest on Drawings = 24,000 × 12/100 × 5.5/12

Interest on Drawings = Rs. 1,320

(iii) Ruchi withdraw at the end of each quarter:-

Average Period = (9 months + 0 months)/2

Average Period = 4.5 months

Interest on Drawings = 24,000 × 12/100 × 4.5/12

Interest on Drawings = Rs. 1,080

Points for Students:-

Original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When a fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 33.

Solution 33

Working Note:-

1.) Calculation of Interest on Capital:-

Interest on Q’s Capital

Rs. 5,00,000 for 9 months = Rs. 5,00,000 × 10/100 × 9/12 = Rs. 37,500

Rs. 3,80,000 for 3 months = Rs. 3,80,000 × 10/100 × 3/12 = Rs. 9,500

2.) Calculation of Interest on Drawings:-

P’s Drawings = Rs. 10,000 × 12 = 1,20,000

Interest on P’s Drawings = 1,20,000 × 12/100 × 5.5/12 = Rs. 6,600

Interest on R’s Drawings = 1,20,000 × 12/100 × 6/12 = Rs. 7,200

Points for Students:-

Drawings against profits means drawings made out of profit earned by the firm during the year. Durings against capital means drawings made in excess of profit. Such drawings do not reduce the capital of the firm. Such drawings reduce the capital of the firm. It is not considered while calculating interest in capital. It is deducted from capital while calculating interest on capital.

Question 34.

Solution 34 Calculation of Interest on capitals:-

A = Rs. 3,00,000 × 10/(100 ) = Rs. 30,000B = Rs. 2,00,000 × 10/(100 ) = Rs. 20,000

Calculation of Interest on Drawings:-

A’s Interest on Drawings = Total Products × 1/12 × (Rate of Interest)/100

A’s Interest on Drawings = Rs. 3,36,000 × 1/12 × (10 )/100

A’s Interest on Drawings = Rs. 2,800

B’s Interest Drawings:-

Total Drawings = Rs. 6,000 × 12 = Rs. 72,000

B’s Interest on Drawings = Rs. 72,000 × 10/100 × (5.5 )/12

B’s Interest on Drawings = Rs. 3,300

Question 35.

Solution 35

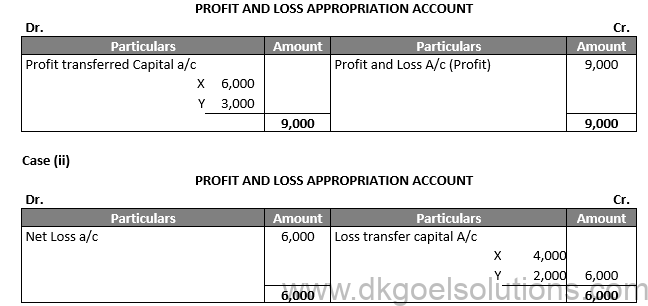

Case (i)

Working Note:-

In case of loss we cannot pay Interest on capital.

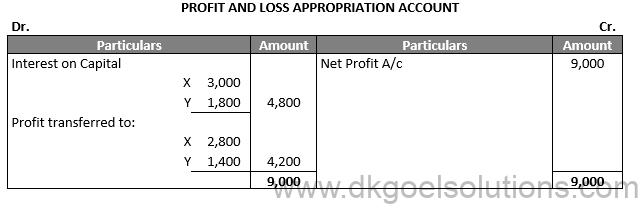

Profit and Loss Appropriation (Distribution of Loss):-

X’s Share = 6,000 × 2/3 = 4,000

Y’s Share = 6,000 × 1/3 = 2,000

Case (iii)

Working Note:-

Calculation of Interest on Capital:-

X’s Interest on Capital = 50,000 × 6% = 3,000

Y’s Interest on Capital = 30,000 × 6% = 1,800

Profit and Loss Appropriation (Distribution of Profit):-

X’s Share = 4,200 × 2/3 = 2,800

Y’s Share = 4,200 × 1/3 = 1,400

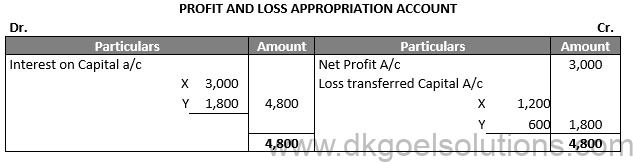

Case (iv)

Working Note:-

The profit is Rs. 3,000 whereas Interest on capital is Rs. 4,800. So the expenses divided intheir expenses ratio which is 3,000 : 1,800 or 5 : 3

Calculation of Interest on Capital:-

X’s Interest on Capital = 3,000 × 5/8 = 1,875

Y’s Interest on Capital = 3,000 × 3/8 = 1,125

Case (v)

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 36.

Solution 36

Case (i)

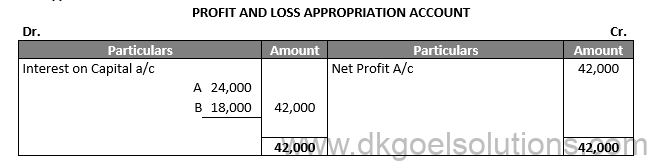

Working Note:-

Calculation of Interest on Capital:-

A’s Interest on Capital = 4,00,000 × 8% = 32,000

B’s Interest on Capital = 3,00,000 × 8% = 24,000

The profit is Rs. 42,000 whereas Interest on capital is Rs. 56,000. So the expenses divided intheir expenses ratio which is 32,000 : 24,000 or 4 : 3

A’s Interest on Capital = Rs. 42,000 × 4/7 = Rs. 24,000

B’s Interest on Capital = Rs. 42,000 × 3/7 = Rs. 18,000

Case (ii)

Points for Students:-

Below are the adjustment are made:

1. When Interest on capitals or drawings may have been omitted.

2. When Profits and Losses have been distributed among the partners in a wrong proportion.

3. When profit sharing ratio has been altered with effect from some part date.

4. When salary or commission payable to a person has been omitted.

Question 37.

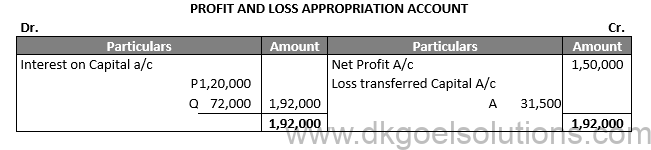

Solution 37

Working Note:-

Calculation of Interest on Capital:-

P’s Interest on Capital = 10,00,000 × 12% = 1,20,000

Q’s Interest on Capital = 6,00,000 × 12% = 72,000

Profit and Loss Appropriation (Distribution of Loss):-

P’s Share = 42,000 × 3/4 = 31,500

Q’s Share = 42,000 × 1/4 = 10,500

Points for Students:-

The accounts of the partnership firm have been closed after the financial year, it is discovered that there have been some errors or omissions in the accounts. In such cases, instead of altering the old accounts, the signed balance sheet and adjustment entry for such errors or omissions is made at the beginning of the next year.

Question 38.

Solution 38

PROFIT AND LOSS APPROPRIATION ACCOUNT

For the year ended 31st March, 2021

Working Note:-

Calculation of Interest on Capital:-

A’s Interest on Capital = 10,00,000 × 12% = 1,20,000

B’s Interest on Capital = 15,00,000 × 12% = 1,80,000

The profit is Rs. 2,00,000 whereas Interest on capital is Rs. 3,00,000. So the expenses divided intheir expenses ratio which is 1,20,000 : 1,80,000 or 2 : 3

A’s Interest on Capital = Rs. 2,00,000 × 2/5 = Rs. 80,000

B’s Interest on Capital = Rs. 2,00,000 × 3/5 = Rs. 1,20,000

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 39.

Solution 39

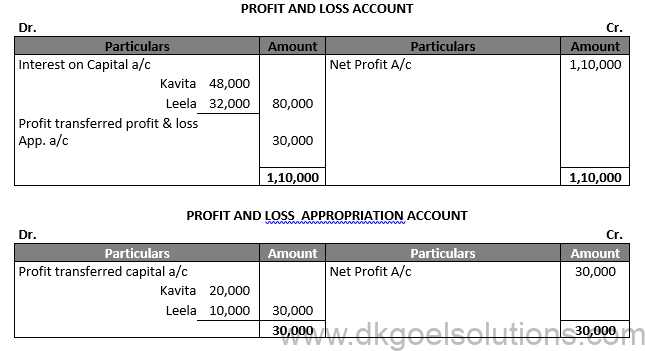

Case (i)

Working Note:-

Profit and Loss Appropriation:-

Kavita’s Share = 30,000 × 2/3 = 20,000

Leela’s Share = 30,000 × 1/3 = 10,000

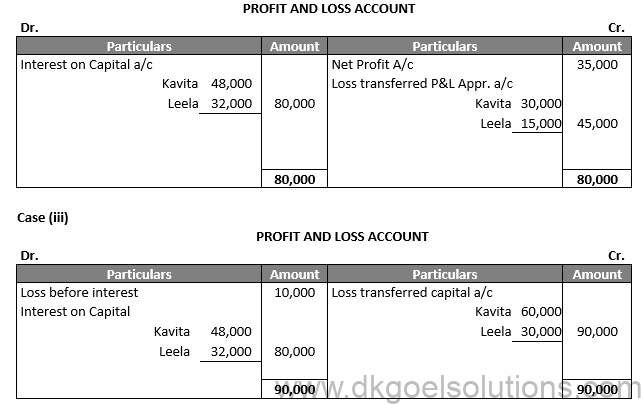

Case (ii)

Points for Students:-

As per accounting viewpoint, partnership firm is treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

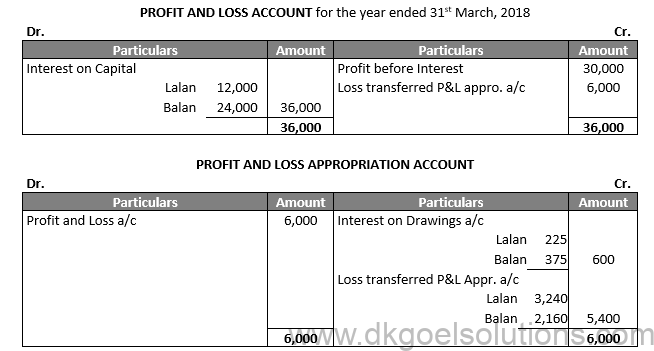

Question 40.

Solution 40

Working Note:-

Calculation of Drawings:

Lalan’s Interest on Drawings = Rs. 3,000 × 15/100 × 6/12 = Rs. 225

Balan’s Interest on Drawings = Rs. 5,000 × 15/100 × 6/12 = Rs. 375

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 41.

Solution 41

Calculation of Capital:-

X’s Capital

| Rs. 90,000 for 6 months | Rs. 5,40,000 |

| Rs. 60,000 for 6 months | Rs. 3,60,000 |

Total Capital of X = Rs. 9,00,000

Y’s Capital

| Rs. 75,000 for 4 months | Rs. 3,00,000 |

| Rs. 90,000 for 4 months | Rs. 3,60,000 |

| Rs. 60,000 for 4 months | Rs. 2,40,000 |

Total Capital of Y = Rs. 9,00,000

Y’s Capital

| Rs. 75,000 for 7 months | Rs. 5,25,000 |

| Rs. 1,35,000 for 4 months | Rs. 6,75,000 |

Total Capital of Y = Rs. 12,00,000

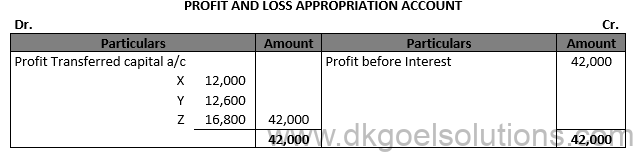

Calculation of Capital Ratio:-

9,00,000 : 9,00,000 : 12,00,000

9 : 9 : 12

3 : 3 : 4

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 42.

Solution 42

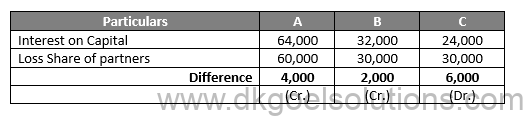

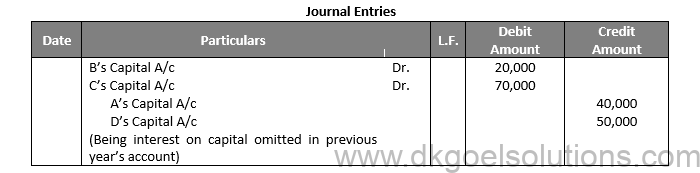

Working Note:-

Calculation of Interest on Capital:-

A’s Interest on Capital = Rs. 8,00,000 × 8% = Rs. 64,000

B’s Interest on Capital = Rs. 4,00,000 × 8% = Rs. 32,000

C’s Interest on Capital = Rs. 3,00,000 × 8% = Rs. 24,000

Interest on capita is a expense for the firm but this is omitted recorded on the debit side of Profit and loss appropriation a/c of the previous year. Hence, this is loss of Rs. 1,20,000 will be shared the partners in their profit sharing ratio 2:1:1.

A = Rs. 1,20,000 × 2/4 = Rs. 60,000

B = Rs. 1,20,000 × 1/4 = Rs. 30,000

C = Rs. 1,20,000 × 1/4 = Rs. 30,000

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 43.

Solution 43

Working Note:-

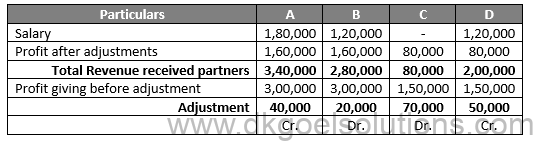

Calculation of Profit:-

A = Rs. 9,00,000 × 2/6 = Rs. 3,00,000

B = Rs. 9,00,000 × 2/6 = Rs. 3,00,000

C = Rs. 9,00,000 × 1/6 = Rs. 1,50,000

D = Rs. 9,00,000 × 1/6 = Rs. 1,50,000

A’s Salary = Rs. 15,000 × 12 = 1,80,000

B’s Salary = Rs. 30,000 × 4 = 1,20,000

D’s Salary = Rs. 30,000 × 4 = 1,20,000

Remaining Profit = Rs. 9,00,000 – Rs. 1,80,000 – Rs. 1,20,00 – Rs. 1,20,000

Remaining Profit = Rs. 4,80,000

Calculation of Profit after the adjustment of Salary:-

A = Rs. 4,80,000 × 2/6 = Rs. 1,60,000

B = Rs. 4,80,000 × 2/6 = Rs. 1,60,000

C = Rs. 4,80,000 × 1/6 = Rs. 80,000

D = Rs. 4,80,000 × 1/6 = Rs. 80,000

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 44.

Solution 44

Working Note:-

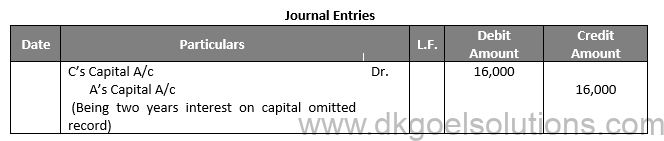

Calculation of Interest on Capital:-

A = Rs. 4,00,000 × 8% × 2 = Rs. 64,000

B = Rs. 6,00,000 × 8% × 2 = Rs. 96,000

C = Rs. 8,00,000 × 8% × 2 = Rs. 1,28,000

Total Expenses = Rs. 64,000 + Rs. 96,000 + Rs. 1,28,000 = Rs. 2,88,000

Interest on capital is the expense for the firm. Hence we should divide it in the given ratio.

A = Rs. 2,88,000 × 1/6 = Rs. 48,000

B = Rs. 2,88,000 × 2/6 = Rs. 96,000

C = Rs. 2,88,000 × 3/6 = Rs. 1,44,000

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 45.

Solution 45

Working Note:-

Calculation of Interest on Capital:-

Distribution of Profit:-

A’s Profit = Rs. 18,000 × 5/9 = Rs. 10,000

B’s Profit = Rs. 18,000 × 3/9 = Rs. 6,000

C’s Profit = Rs. 18,000 × 1/9 = Rs. 2,000

Points for Students:-

Rent paid to a partner is also treated as interest on partner’s loan, rent paid to a partner is also treated as a charge against profit and not an appropriation out of profit and hence it should be debited to Profit and Loss account and not to Profit and Loss Appropriation Account and Credited to partner’s Current Account in case of fixed capital system or to Partner’s Capital Account when Capitals are fluctuating.

Question 46.

Solution 46

Working Note:-

Calculation of Interest on Drawings:-

A = Rs. 20,000 × 6% × 6/12 = Rs. 600

B = Rs. 24,000 × 6% × 6/12 = Rs. 720

C = Rs. 32,000 × 6% × 6/12 = Rs. 960

D = Rs. 44,000 × 6% × 6/12 = Rs. 1320

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 47.

Solution 47

Working Note:-

A’s Drawings = Rs. 50,000 × 12 = Rs. 6,00,000

Interest on Drawings:-

Rs. 6,00,000 × 12/100 × 6.5/12 = Rs. 39,000

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 48.

Solution 48

Points for Students:-

When the capitals need not be fixed, the balances of capital accounts go on changing from time to time. The reason is that no separate Current Accounts are maintained, but all the entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profit or loss etc., are recorded in the capital account itself.

Question 49.

Solution 49

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 50.(A)

Solution 50 (A)

Points for Students:-

Rent paid to a partner is also treated as interest on partner’s loan, rent paid to a partner is also treated as a charge against profit and not an appropriation out of profit and hence it should be debited to Profit and Loss account and not to Profit and Loss Appropriation Account and Credited to partner’s Current Account in case of fixed capital system or to Partner’s Capital Account when Capitals are fluctuating.

Question 50. (B)

Solution 50 (B)

Points for Students:-

The accounts of the partnership firm have been closed after the financial year, it is discovered that there have been some errors or omissions in the accounts. In such cases, instead of altering the old accounts and the signed balance sheet and adjustment entry for such errors or omissions is made at the beginning of the next year. Usually the following types of adjustments are made:

(1) When Interest on Capital or Drawings may have been omitted.

(2) When Profits and Losses have been distributed among the partners in a wrong proportion.

(3) When profit sharing ratio has been altered with effect from some past date.

(4) When salary or commission payable to person has been omitted.

Question 51.

Solution 51

Points for Students:-

The accounts of the partnership firm have been closed after the financial year, it is discovered that there have been some errors or omissions in the accounts. In such cases, instead of altering the old accounts and the signed balance sheet and adjustment entry for such errors or omissions is made at the beginning of the next year. Usually the following types of adjustments are made:

(1) When Interest on Capital or Drawings may have been omitted.

(2) When Profits and Losses have been distributed among the partners in a wrong proportion.

(3) When profit sharing ratio has been altered with effect from some past date.

(4) When salary or commission payable to person has been omitted.

Question 52.

Solution 52

Points for Students:-

As per accounting viewpoint, partnership firm is treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 53.

Solution 53

Points for Students:-

The Limited Liability Partnerships (LLPs) in India came into existence with the enactment of ‘Limited Liability Partnership Act, 2008’ which lay down the law for the formation and regulation of Limited Liability Partnerships.

Question 54.

Solution 54

Points for Students:-

When the partnership agreement is silent about the interest on capital:- No interest will be allowed on capital.

Question 55.

Solution 55

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 56.

Solution 56

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 57.

Solution 57

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 58.

Solution 58

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 59.

Solution 59

Points for Students:-

Sometimes a partner is guaranteed that he shall get a certain minimum amount of profit of the firm. Such a guarantee may be given either by firstly any one of the partners, or second by all other partners in a particular ratio. When the profits of the firm are not adequate then the ‘excess’ paid to the guaranteed partner should be charged to the partner who has given guarantee.

Question 60.

Solution 60

Points for Students:-

When profit sharing ratio differs from capital ratio, the partners who contribute capital in excess of what is required as per profit sharing ratio need to be compensated. Interest in capital compensates those partners who have contributed relatively more amount of capital.

Question 61.(A)

Solution 61 (A)

(A).Points for Students:-

When the capitals need not be fixed, the balances of capital accounts go on changing from time to time. The reason is that no separate Current Accounts are maintained, but all the entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profit or loss etc., are recorded in the capital account itself.

Question 61. (B)

Solution 61 (B)

(B). Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 61. (C)

Solution 61 (C)

Question 62.

Solution 62

Case (i)

Case (ii)

Case (iii)

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 63 (new).

Solution 63 (new). Calculation of Partner’s Capital:-

A’s Interest on Capital = 3,70,000 × 8/100 = Rs. 29,600

B’s Interest on Capital = 2,45,000 × 8/100 = Rs. 19,600

C’s Interest on Capital = 1,45,000 × 8/100 = Rs. 11,600

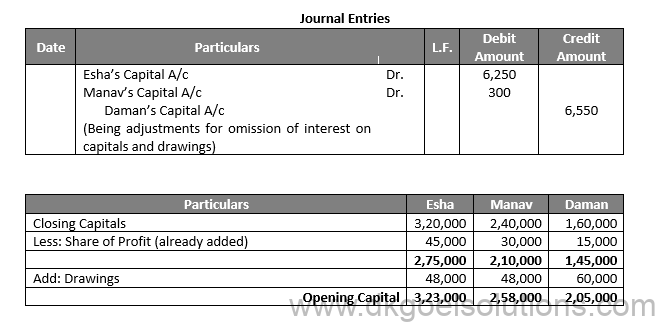

Question 63.

Solution 63

Working Note:-

Calculation of Interest on Capital:-

Esha’s Interest on Capital = Rs. 3,23,000 × 10% = 32,300

Manav’s Interest on Capital = Rs. 2,58,000 × 10% = 25,800

Daman’s Interest on Capital = Rs. 2,05,000 × 10% = 20,500

Total Interest on Capital = Rs. 32,300 + Rs. 25,800 + Rs. 20,500 = Rs. 78,600

Calculation of Interest on Drawings:-

Esha and Manav each withdrew a sum of Rs. 48,000 in middle of the every month.

= Rs. 48,000 × 5/100 × 6/12 = Rs. 1,200

Daman’s Interest on Drawings = Rs. 60,000 × 5/100 × 6/12 = Rs. 1,500

Points for Students:-

When the partnership agreement provides for interest on capital but is silent in treating interest as a charge or appropriation. Interest on capital will be allowed only when there is a profit. In case of loss no interest will be allowed on capital.

Question 64.

Solution 64

Points for Students:-

As per accounting viewpoint, partnership firm is treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 65.

Solution 65

Points for Students:-

The Limited Liability Partnerships (LLPs) in India came into existence with the enactment of ‘Limited Liability Partnership Act, 2008’ which lay down the law for the formation and regulation of Limited Liability Partnerships.

Question 66.

Solution 66

Points for Students:-

A LLP is a body corporate formed and incorporated under this Act. It is legal entity separate from of its partners. A LLP shall have perpetual succession. Any change in the partners of a LLP shall not affect the existence, rights or liabilities of the LLP.

Question 67.

Solution 67

Calculation Interest on capital:-

A’s Interest on Capital = Rs. 96,000 × 5% = Rs. 4,800

B’s Interest on Capital = Rs. 70,000 × 5% = Rs. 3,500

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 68.

Solution 68

Calculation of Interest on Capital:-

P’s Interest on Capital = Rs. 1,88,000 × 10% = Rs. 18,800

Q’s Interest on Capital = Rs. 1,38,000 × 10% = Rs. 13,800

R’s Interest on Capital = Rs. 94,000 × 10% = Rs. 9,400

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 69. (A)

Solution 69 (A)

Profit & Loss Appropriation Account

For the year ending 31st March, 2020

Working Note:-

Calculation of Share of Profit in 2015:-

A’s Share of Profit = Rs. 30,000 × 3/6 = Rs. 15,000

B’s Share of Profit = Rs. 30,000 × 2/6 = Rs. 10,000

C’s Share of Profit = Rs. 30,000 × 1/6 = Rs. 5,000

Calculation of Share of Profit in 2016:-

A’s Share of Profit = Rs. 90,000 × 3/6 = Rs. 45,000

B’s Share of Profit = Rs. 90,000 × 2/6 = Rs. 30,000

C’s Share of Profit = Rs. 90,000 × 1/6 = Rs. 15,000

Points for Students:-

Interest on drawings is to be charged from the partners, if the same is specifically provided in the partnership deed. If it is to be charged, it should be calculated from the date of the withdrawal of the amount. In the absence of the date of withdrawal, interest should be charged for six months on the whole of the amount because it will be assumed that the drawings were made evenly throughout the year.

Question 69.(B)

Solution 69 (B)

Working Note:-

Calculation of Interest on capital:-

X’s Interest on capital = Rs. 4,00,000 × 8% = Rs. 32,000

Y’s Interest on capital = Rs. 3,00,000 × 8% = Rs. 24,000

Z’s Interest on capital = Rs. 2,00,000 × 8% = Rs. 16,000

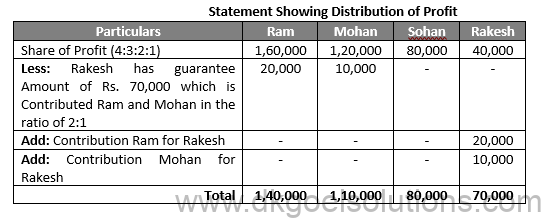

Calculation of Share of Profit in 2015:-

X’s Share of Profit = Rs. 1,80,000 × 3/6 = Rs. 90,000 – Rs. 20,000 = Rs. 70,000

Y’s Share of Profit = Rs. 1,80,000 × 2/6 = Rs. 60,000

Z’s Share of Profit = Rs. 1,80,000 × 1/6 = Rs. 30,000 + Rs. 20,000 = Rs. 50,000

Question 70.

Solution 70

Working Note:-

Calculation Profit Distribution:-

S’s Share of Profit = Rs. 6,50,000 × 4/10 = Rs. 2,60,000

T’s Share of Profit = Rs. 6,50,000 × 3/10 = Rs. 1,95,000

W’s Share of Profit = Rs. 6,50,000 × 2/10 = Rs. 1,30,000

X’s Share of Profit = Rs. 6,50,000 × 1/10 = Rs. 65,000

Share of X’s Profit in Total profit is Rs. 65,000 whereas the minimum guarantee amount is Rs. 80,000. Hence, the deficiency of Rs. 15,000 will be cover S, T, W equally.

S’s Share of Profit = Rs. 2,60,000 – Rs. 5,000 = Rs. 2,55,000

T’s Share of Profit = Rs. 1,95,000 – Rs. 5,000 = Rs. 1,90,000

W’s Share of Profit = Rs. 1,30,000 – Rs. 5,000 = Rs. 1,25,000

X’s Share of Profit = Rs. 65,000 + Rs. 5,000 + Rs. 5,000 + Rs. 5,000 = Rs. 80,000

Points for Students:-

Under this system the original capitals invested by the partner remain constant, unless additional capital is introduced or drawings are made against capital by an agreement. In other words, capitals of the partners are not allowed to change during the life-time of business except in extraordinary circumstances. When fixed capital method is adopted, all entries relating to drawings against profits, interest allowed on capitals, interest charged on drawings, salary to partner, share of profit or loss etc. are made in a newly-opened account for each partner. The account is called Current Account or Drawings Account.

Question 71.

Solution 71

Working Note:-

Calculation Profit Distribution:-

Vandana’s Share of Profit = Rs. 9,00,000 × 1/8 = Rs. 1,12,500

Profit for Vivek and Vikas = Rs. 9,00,000 – Rs. 1,12,500 = Rs. 7,87,500

Vikas’s Share of Profit = Rs. 7,87,500 × 3/5 = Rs. 4,72,500

Vivek’s Share of Profit = Rs. 7,87,500 × 2/5 = Rs. 3,15,000

Vandana’s deficiency = Rs. 1,50,000 – Rs. 1,12,500 = Rs. 37,500. Deficiency will be contributed Vikas and Vivek in the ratio 2:3.

Vikas’s Contribution = Rs. 4,72,500 – Rs. 15,000 = Rs. 4,57,500

Vivek’s Contribution = Rs. 3,15,000 – Rs. 22,500 = 2,92,500

Points for Students:-

When the capitals need not be fixed, the balances of capital accounts go on changing from time to time. The reason is that no separate Current Accounts are maintained, but all the entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profit or loss etc., are recorded in the capital account itself.

Question 72.

Solution 72

Working Note:-

Calculation of Interest on Drawings:-

A’s Interest on Drawings = Rs. 60,000 × 5.5/12 × 10/100 = Rs. 2,750

B’s Interest on Drawings = Rs. 60,000 × 4.5/12 × 10/100 = Rs. 2,250

C’s Interest on Drawings = Rs. 60,000 × 6/12 × 10/100 = Rs. 3,000

Calculation of Profit:-

Net Profit = 4,32,000 + 8,000 – Rs. 80,000 = Rs. 3,60,000

A’s Share of Profit = Rs. 3,60,000 × 3/6 = Rs. 1,80,000 – Rs. 40,000 = Rs. 1,20,000

B’s Share of Profit = Rs. 3,60,000 × 2/6 = Rs. 1,20,000

C’s Share of Profit = Rs. 3,60,000 × 1/6 = Rs. 60,000 + Rs. 40,000 = Rs. 1,00,000

C’s deficiency = Rs. 1,00,000 – Rs. 60,000 = Rs. 40,000. Deficiency will be contributed A.

Points for Students:-

If a partner has given loan to the firm, he is entitled to receive interest on such loan at an agreed rate of interest. However, if there is no agreement as to the rate of interest, he is entitled to receive interest on loan @ 6% per annum. Interest on partner’s loan is a charge against the profit and hence, such interest is allowed whether there are profits or not.

Question 73.

Solution 73

Working Note:-

Calculation of Interest on Drawings:-

A’s Interest on Drawings = Rs. 60,000 × 10/100 × 6.5/12 = Rs. 3,250

B’s Interest on Drawings = Rs. 60,000 × 10/100 × 5.5/12 = Rs. 2,750

C’s Interest on Drawings = Rs. 60,000 × 10/100 × 7.5/12 = Rs. 6,000

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 74.

Solution 74

Points for Students:-

As per accounting viewpoint, partnership firm is treated as a separate business entity distinct from its partners. However, as per legal viewpoint, a partnership firm is not a separate legal entity. In other words, it has no existence separate from its partners. It means that in case of bankruptcy of the partnership firm, private estates of the partners would be liable to meet the firm’s debts.

Question 75.

Solution 75

Working Note:-

Z’s Share of Loss = Rs. 1,20,000 × 1/4 = Rs. 30,000

Remaining Profit = Rs. 1,20,000 – Rs. 30,000 = Rs. 90,000

X’s Share of Loss = Rs. 90,000 × 2/5 = Rs. 60,000

Y’s Share of Loss = Rs. 90,000 × 3/5 = Rs. 30,000

Z’s guaranteed minimum profit of Rs. 1,00,000. Total loss of Z = Rs. 1,00,000 + Rs. 30,000 = Rs. 1,30,000. Which is distributed X and Y in the ratio of 3:2.

Points for Students:-

When the partnership agreement provides for interest on capital but is silent in treating interest as a charge or appropriation. Interest on capital will be allowed only when there is a profit. In case of loss no interest will be allowed on capital.

Question 76.

Solution 76

Profit & Loss Account

For the year ending 31st March, 2021

Working Note:-

A’s Share of Loss = Rs. 90,000 × 4/9 = Rs. 40,000

B’s Share of Loss = Rs. 90,000 × 3/9 = Rs. 30,000

C’s Share of Loss = Rs. 90,000 × 2/9 = Rs. 20,000

B’s guaranteed minimum profit of Rs. 1,50,000. Total loss of Z = Rs. 1,50,000 + Rs. 30,000 = Rs. 1,80,000. Which is paid A and C in the ratio of 4:2.

A’s Share B = Rs. 1,80,000 × 4/6 = Rs. 1,20,000

A’s Share B = Rs. 1,80,000 × 2/6 = Rs. 60,000

Points for Students:-

A LLP is a body corporate formed and incorporated under this Act. It is legal entity separate from of its partners. A LLP shall have perpetual succession. Any change in the partners of a LLP shall not affect the existence, rights or liabilities of the LLP.

Question 77 (new).

Solution 77 (new).

Working Note:

1. Calculation of interest on drawings:-

Drawings of Sonu = Rs. 20,000

Interest on Sonu’s drawings = Rs. 20,000 × 6/100 × 4/12

Interest on Sonu’s drawings = Rs. 400

Drawings of Rajat = 12 × Rs. 5,000 = Rs. 60,000

Interest on Rajat’s drawings = Rs. 60,000 × 6/100 × 5.5/12

Interest on Rajat’s drawings = Rs. 1,650

Question 77.

Solution 77

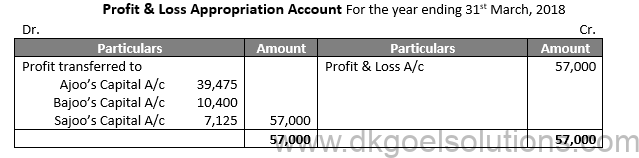

Working Note:-

Calculation of Profit:

| Profit before Sajoo’s Salary and Commission | Rs. 57,000 |

| Less: Salary | Rs. 2,400 |

| Rs. 54,600 | |

| Less: Commission Sajoo × Rs. 54,600 | Rs. 2,600 |

| Final Profit for distribution between Ajoo & Bajoo | Rs. 52,000 |

Sajoo’s Share of Profit = Rs. 57,000 × 1/8 = Rs. 7,125

Excess received Sajoo as a partner = Rs. 7,125 – Rs. 5,000 = Rs. 2,125

Calculation of Profit Distribution:

Ajoo’s Share of Profit = Rs. 52,000 × 4/5 = Rs. 41,600

Less: Excess of Sajoo will paid Ajoo = Rs. 41,600 – Rs. 2,125 = Rs. 39,475

Bajoo’s Share of Profit = Rs. 52,000 × 1/5 = Rs. 10,400

Points for Students:-

Profit and loss appropriation account prepared just after the Profit and Loss Account. Hence, it is an extension of Profit and Loss Account. It is prepared only by partnership firms. It is a nominal account. It shows how the net profit for the accounting period is appropriated among the partners. Entries in this account are made giving effect to the Partnership Deed and the Indian Partnership Act, 1932.

Question 78.

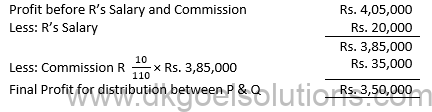

Solution 78

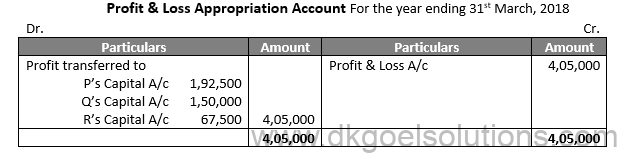

Working Note:-

Calculation of Profit:

R’s Share of Profit = Rs. 4,05,000 × 1/6 = Rs. 67,500

Excess received R as a partner = Rs. 67,500 – Rs. 55,000 = Rs. 12,500

Excess amount will be deducted from P = Rs. 12,500 × 3/5 = Rs. 7,500

Excess amount will be deducted from Q = Rs. 12,500 × 2/5 = Rs. 5,000

Calculation of Profit Distribution:

P’s Share of Profit = Rs. 3,50,000 × 4/7 = Rs. 2,00,000

Less: Excess of R will paid P = Rs. 2,00,000 – Rs. 7,500 = Rs. 1,92,500

Q’s Share of Profit = Rs. 3,50,000 × 3/7 = Rs. 1,50,000

Less: Excess of R will paid P = Rs. 1,50,000 – Rs. 5,000 = Rs. 1,45,000

Points for Students:-

Interest on partner’s capital is to be allowed only when it is expressly agreed to among the partners. If interest on capital is to be allowed as per agreement, it should be calculated with respect to the time, rate of interest and the amount of capital.

Question 79.

Solution 79

Working Note:-

Net Profit = Rs. 4,00,000 – Rs. 36,000 = Rs. 3,64,000

Calculation of Interest on Drawings:-

Asif’s Interest on Drawings = Rs. 60,000 × 4/100 × 6.5/12 = Rs. 1,300

Ravi’s Interest on Drawings = Rs. 60,000 × 4/100 × 6.5/12 = Rs. 1,300