HOTS Accountancy Class 12 Chapter 1 Accounting for Share Capital

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Accounting for Share Capital with solutions given below, this will help them to understand the concepts and related questions given in the Class 12 Accountancy textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations. Also refer to dk goel solutions class 12 here

Question: What is the nature of receipt of premium on issue of shares?

Answer: Capital Nature.

Question: Can a company issue shares at a premium in the absence of any express authority in its articles?

Answer: Yes. [ Hint See section 78]

Question: State with reason whether a company can issue its shares at a discount in its Initial Public Offer (IPO).

Answer: Section 79 Companies Act- the shares must be of a class already issued. So a company cannot issue shares at a discount in its Initial Public Offer.

Question: Why securities premium money can not be used for payment of cash dividend among shareholders?

Answer: It is restricted under section 78 of Indian Companies Act.

Question: Krishna Ltd. With paid-up share capital of Rs. 60,00,000 has a balance of Rs. 15,00,000 in securities premium account. The company management does not want to carry over this balance. You are required to suggest the method for utilizing this premium money that would achieve the objectives of the management and maximize the return to shareholders.

Answer: Mention the provisions of section 78.

Question: Distinguish between a share and a Debenture.

Answer: Basis of difference :

(i) Ownership

(ii) Return

(iii) Voting Right

(iv) Convertibility

Question: Can share premium be utilised for the purchase of fixed assets?

Answer: No.

Question: What is the restriction on reissue of forfeited shares at discount?

Answer: A Company can reissue forfeited shares at a discount not more than amount forfeited on these shares.

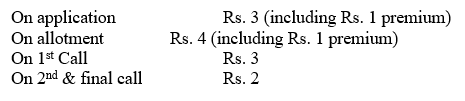

Question: X Ltd. issued 20,000 shares of Rs. 10 each at a premium of 10% payable as follows:-

On application Rs. 2 ( 1st Jan 2001), on allotment Rs. 4 (including premium) (1st April 2001), On first call Rs. 3 (1st June 2001), on second call & final call Rs. 2 (1st Aug. 2001).

Application were received for 18,000 shares and the directors made allotment in full. One shareholder to whom 40 shares were allotted paid the entire balance on his share holdings with allotment money and another shareholder did not pay allotment and 1st call money on his 60 shares but which he paid with final call.

Calculate the amount of interest paid and received on calls-in-advance and calls-in-arrears respectively on 1st Aug. 2001.

Answer: Interest on Calls in advance Rs. 2.80

Interest on Calls in arrears Rs. 5.50

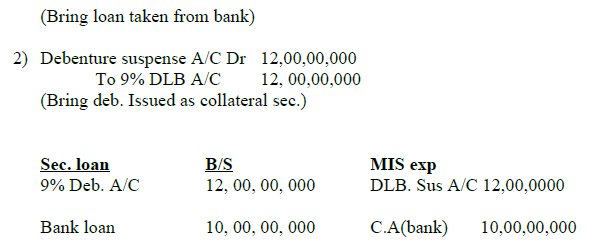

Question: X Ltd took over the assets of Rs. 6,60,000 and liabilities of Rs. 80,000, Y Ltd for Rs. 600,000. Show the necessary journal entries in the book of X Ltd. assuming that

Case-I : The consideration was payable 10% in cash and the balance in 54000 equity shares of Rs. 10 each.

Case-II : The consideration was payable 10% in cash and the balance in 45000 equity shares of Rs. 10 each.

Case-III : The consideration was payable 10% in cash and the balance in 60,000 equity shares of Rs. 10 each.

Question: X ltd. was formed with a capital of Rs. 500,000 divided into shares of Rs. 10 each out of these 2000 shares were issued to the vendors as fully paid as purchase consideration for a building acquired, 1000 shares were issued to signatories to the memorandum of association as fully paid. The directors offered 6500 shares to the public and called up Rs. 6 per and received the entry called up amount on share allotted. Show these transaction in the Balance sheet of a company.

Answer: Issued Capital Rs. 95000.

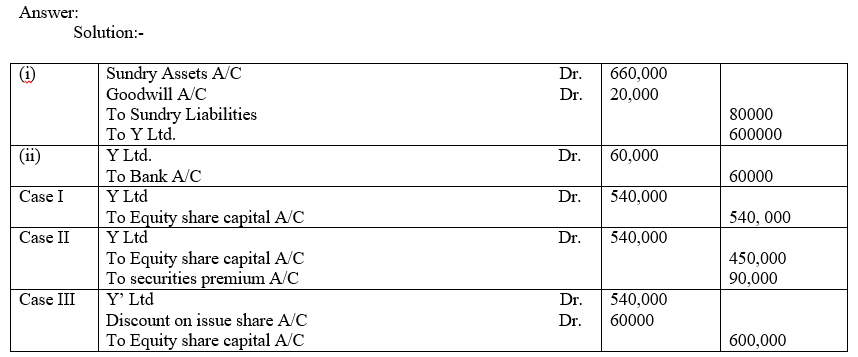

Question: X Ltd. invited applications for 11,000 shares of Rs. 10 each issued at 10% premium payable as:

Application were received for 24000 shares.

Category I : One fourth of the shares applied for allotted 2000 shares.

Category II: Three fourth the shares applied for allotted 9000 shares.

Remaining applicants were rejected. Mr. Mohan holding 300 shares out of category II failed to pay allotment and two calls and his shares were re issued @ Rs. 11 fully paid-up. Pass necessary journal entries.

Answer: Hint-

(i) Amount received on allotment Rs. 26,100.

(ii) Amount transferred to share forfeited A/C Rs. 900

(iii) Amount transferred to Capital Reserve Rs. 600.

Question: A company forfeited 240 shares of Rs. 10 each issued to raj at a a premium of 20%. Raman had applied for 300 shares and had not paid anything after paying Rs 6 per share including premium on application. 180 shares were reissued at Rs. 11 per share fully paid up. Pass journal entries relating to forfeiture and reissue of shares.

Answer: Capital Reserve Rs. 990.

Question: Sonu Ltd. company issued 15,000 shares of Rs. 10 each. Payment on there shares is to be made as follows:

On application Rs. 4 ( 1st Feb, 2003)

On allotment Rs. 3 (1st April, 2003)

On final call Rs. 3 (1st May, 2003)

Rakesh to whom 1000 shares were allotted paid the full amount on application and mohan to whom 200 shares were allotted paid the final call money on allotment. Interest @ 6% was paid on 1st May, 2003. Pass necessary journal entries.

Answer: Interest on Calls in advance = 15 + 3 = Rs. 18

Question: TPT Ltd. invited applications for issuing 1,00,000 equity shares of Rs. 10 each at a premium of Rs. 3 per share. The whole amount was payable on application. The issue was over subscribed by 30,000 shares and allotment was made on pro-rata basis. Pass necessary journal entries in the books of the company.

Answer:

(i) Dr. Bank A/C Rs. 16,90,000, Cr.Eq.share Application A/C Rs. 16,90,000.

(ii) Dr.Eq.Share Application A/C Rs. 16,90,000, Cr.Eq. share Capital A/C Rs.10,00,000, Cr. Security premium A/C Rs. 300,000, Cr. Bank A/C Rs. 3,90,000.

Question: 500 shares of Rs. 100 each issued at a discount of 10% were forfeited for the non-payment of allotment money of Rs. 50 per share. The first and final call of Rs.10 per share on these shares were not made. The forfeited shares were reissued at Rs. 80 per share fully paid-up.

Answer: Capital Reserve Rs. 10,000

Question: 200 shares of Rs. 100 each issued at a discount of 10% were forfeited for the non payment of allotment money of Rs. 50 per share. The first and final call of Rs. 10 per share on these shares were not made. The forfeited share were reissued at Rs. 14 per share fully paid up.

Answer: Capital Reserve Rs. 600

Question: 800 Shares of Rs. 10 each issued at per were forfeited for the non-payment of final call of Rs. 2 per share. These shares were reissued at Rs. 8 per share fully paid-up.

Answer: Capital Reserve Rs. 4,800.

Question: What is ESOP?

Answer: 2005

Question: What is issued capital? How does it differ from Authorized capital?

Answer:

Question: Differentiate between Reserve capital and Capital Reserve on the basis of time

when it can be used.

Answer: Debenture can be issued to vendors against purchase of assets or for purchase of a

business. This is called issue of debenture as purchase consideration or for consideration other

than cash.

Question: What do you mean by private placement of shares? What are the options for a

company?

Answer:

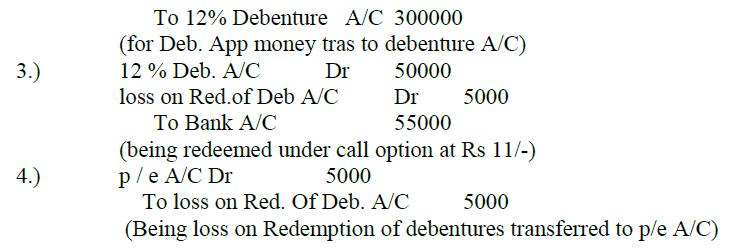

1.) Sundry Assets A/C Dr 4000000

To Sundry Liabilities 400000

To Sunil Enterprises A/C 3600000

(for Assets and liabilities acquired)

2.) Sunil Enterprises A/C Dr 3600000

Dis. On issue of Deb. A/C Dr 400000

To 12% Debenture A/C 40000

(for Debenture issued at 10% discount to Sunil Enterprises)

No. of Dib. = 3600000/(100-10)= 40000

Question; At what rate interest on Calls –in-Arrears can be charged by a company according

to table A.

Answer:

Question: Amex Ltd. Forfeited 10 shares of Re. 10 each (Re. 6 called up) issued at a discount

of 10 % to Mr. Y on which he has paid an application money of Re. 3 per share.

Out of these, 8 shares were re-issued to Z as Re. 8 called up for Re. 9 per share.

Journalize.

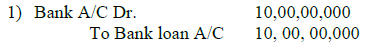

Answer: Issue of debenture as collateral security means, security provided to the lender

Over and above the principal security. The debenture issued as collateral

Security does not carry any right as long as the terms of the loan are not

Contended.

Question: Rohit Ltd. Purchased assets worth Re. 41,80,000 from Bhuvnesh Industrial

Corporation and issued equity shares of Re. 100 each, fully paid , in satisfaction of

the purchase consideration. Pass necessary Journal entries in the books of Rohit

Ltd. Assuming that shares were issued:

a.) at par; b.) at a premium of 10%;

c.) at a discount of 5%

Answer:

Question: A limited company has been in corporate with an authorized capital of RS

10,00,000 divided into 1,00,000 shares of Rs 10 each. It offended 90,000 shares

for subscription by the public and out of these 85,000 shares were subscribed for.

The director called for an amount of rs.6 per share and received the entire amount

except a call for rs.2 per share on 500 share. Calculate the amount of different

categories of share capital.

Answer: Debenture Trust dead is a document created by the company whereby trusts are

appointed to protect the interest of debenture holders before they are offered for public

subscription.

Question: Apex co. ltd. is registered with an authorized capital of rs5,00000 divided into

shares of Rs10 each . the company purchased various assets of kailash for Rs

200000 & payment is made by the issue of 15000 n shares at a premium of 10% &

the balance in cash 20000 shares were issued to the public at per & full amount

received on application. The company issued 400 shares at a discount of 5% to its

promoters against there services. Record Journal entries for the above transaction

Answer: