HOTS Accountancy Class 12 Chapter 3 Financial Statements of a Company

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Financial Statements of a Company with solutions given below, this will help them to understand the concepts and related questions given in the Class 12 Accountancy textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations. Also don’t forget to read dk goel accountancy class 12 solutions

Question: How will you show the following items in the Balance sheet of a company.

(i) Calls in Arrears (ii) Calls in Advance.

Answer: (i) Calls in Arrears: It is deducted from the subscribed capital.

(iii) Calls in Advance: It is shown separately under the subscribed capital.

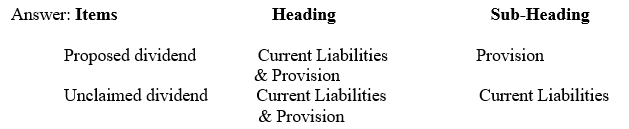

Question: Under what heads the following items on the Liabilities side of the Balance sheet Of a company will

be presented

(i) Proposed Dividend.

(ii) Unclaimed Dividend.

Question: State any two items which are shown under the head ‘Investment’ in a company balance sheet.

Answer: (i) Government Securities.

(ii) Sinking Fund Investment.

Question: Give the format of the Balance sheet of a company(main headings only) as per the requirement of

Schedule VI of the companies Act.1956.

Question: Give the heading under which the following items will be shown in a company’s Balance sheet:

(i) Goodwill.

(ii) Preliminary Expenses

(iii) Loose Tools

(iv) Capital Redemption Resave.

(v) Live Stock.

Answer: (i) Fixed Assets.

(ii) Miscellaneous Expenditures

(iii)Current Assets Loans & Advance under Current Assets.

(iv)Reserve and Surplus.

(v)Fixed Assets.

Question: The following balance have been from the book of Sahara Ltd. Share capital Rs.10,00,000, securities Premium Rs. 1,00,000, 9% Debentures Rs. 500,000, Creditors Rs. 200,000., Proposed Dividend Rs. 50,000. ,Freehold property RS. 9,00,000, share of Reliance Industries Rs. 4,00,000, Work-in-

Progress Rs. 4,00,000, Discount on Issue of Debentures Rs. 1,00,000.

Prepare the balance sheet of the company as per schedule VI part 1 of the companies Act.1956.

Answer: Total of Balance Sheet Rs.18,50,000.

Question: List any three items that can be shown as contingent Liabilities in a company’s Balance sheet.

Answer: (i) Claims against the Company not acknowledged as debts .

(ii) Uncalled Liability on partly paid shares.

(iii)Arrears of Dividend on Cumulative preference shares.

Question: Give two example each of Non-Current Assets and Non- Current Liabilities.

Answer: Non-Current Assets – Building, Machinery.

Non-Current Liabilities – Share Capital , Debentures.

Question: What is Horizontal Analysis?

Answer: The analysis which is made to review and compare the financial statements of two or more then two

Years is called Horizontal Analysis.

Question: Give the example of Horizontal Analysis.

Answer: Comparative Financial Statement.

Question; What is Vertical Analysis?

Answer: The Analysis which is made to review the financial statements of one particular year only is called

Vertical Analysis.

Question: Give the example of Vertical Analysis?

Answer: Ratio Analysis.

Question: How is a Company’s balance sheet different from that of a Partnership firm? Give Two point only.

Answer: (i) For company’s Balance Sheet there are two standard forms prescribed under the companies Act.1956

Whereas there is no standard form prescribed under the Indian partnership Act,1932 for a partnership

Firms balance sheet.

(ii) In case of a company’s Balance sheet previous years figures are required to be given whereas it is

not so in the case of a partnership firms balance sheet.

Question: List any two information required to be given in the balance sheet of a company or by way of foot

Notes.

Answer: (i) Uncalled Liability on share partly paid up .

(ii) Arrears of fixed Cumulative Dividend.

Question:. State whether the Balance sheet of a Company is prepared ’ as on a particular date ‘ or ‘ as at a

Particular date ‘ ?

Answer: Balance of a Company is prepared ‘ as at a particular date ‘ .

Question: Which part of Schedule VI to the Companies Act.1956 prescribes the forms of the balance sheet ?

Answer: Part I of Schedule VI to the Companies Act.1956.

Question; How is analysis of Financial statements suffered from the limitation of window dressing ?

Answer: Analysis of financial statements is affected from the limitation of window dressing as companies hide

Some vital information or show items at incorrect value to portray better profitability and financial

Position of the business, for example the company may overvalue closing stock to show higher profits.

Question: What is the interest of Shareholders in the analysis of Financial statements?

Answer: (i) They want to judge the present and future earning capacity of the business.

(ii) They want to judge the safety of their investment.

Question: Name two tools of Financial Analysis ?

Answer: (i) Comparative Financial Statements.

(ii) Ratio Analysis etc.

Question: Which item is assumed to be 100 in the case of common size Income statement .

Answer: Sales.

Read more HOTS Accountancy Class 12 Financial Statements of a Company

Question: Prepare Comparative income statement from the following information for the years ended march

31,2003 and 2004.

Answer: Percentage Change –

Net sale 25%

Cost of Goods sold 25%

Gross profit 25%

Indirect Expenses 87.50%

Net profit before Tax 18.05%

Income Tax 41.67%

Net Profit after Tax 5.56%