HOTS Accountancy Class 12 Chapter 4 Reconstitution of a Partnership Firm – Retirement/Death of a Partner

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Death of a Partner with solutions given below, this will help them to understand the concepts and related questions given in the Class 12 DK Goel Accountancy textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations.

Question: Distinguish between Sacrificing Ratio and Gaining Ratio.

Question: Kamal, Kishore and Kunal are partners in a firm sharing profits equally. Kishore retires from the firm. Kamal and Kunal decide to share the profits in future in the ratio 4:3. Calculate the Gaining Ratio.

Answer: Gaining Ratio = New ratio – Old ratio

Kamal’s Gain = 4/7 – 1/3 = 5/21

Kunal’s Gain = 3/7 – 1/3 = 2/21

Gaining Ratio = 5:2

Question: P, Q and R are partners sharing profits in the ratio of 7:2:1. P retires and the new profit sharing ratio between Q and R is 2:1. State the Gaining Ratio.

Answer: Old ratio = P Q R

7 : 2 : 1

New ratio = Q R

2 : 1

Gaining Ratio = New ratio – Old ratio

Q’s gain = 2/3 – 2/10 = 14/30

R’s gain = 1/3 – 1/10 = 7/30

Gaining Ratio = 14:7 or 2:1

Question: A, B and C are partners in a firm sharing profits in the ration of 2:2:1. B retires and his share is acquired by A and C equally. Calculate new profit sharing ratio of A and C.

Answer: A’s gaining share = 2/5 X ½ = 1/5

A’s new share = 2/5 + 1/5 = 3/5

C’s gaining share = 2/5 X ½ = 1/5

C’s New share = 1/5 + 1/5 = 2/5

New ratio of A and C = 3:2

Question: X, Y and Z are partners sharing profits in the ratio of 4/9, 1/3 and 2/9. X retires and surrenders 2/3rd of his share in favour of Y and remaining in favour of Z. Calculate new profit sharing ratio and gaining ratio.

Answer:

Y’s gaining share = 4/9 X 2/3 = 8/27

Z’s gaining share = 4/9 – 8/27 = 4/27

Y’s new share = Old share + gain

= 1/3 + 8/27 = 17/27

Z’s new share = 2/9 + 4/27 = 10/27

New Ratio = 17:10

Gaining ratio = 8/27 : 4/27 or 2:1

Question: X, Y and Z have been sharing profits and losses in the ratio of 3:2:1. Z retires. His share is taken over by X and Y in the ratio of 2:1. Calculate the new profit sharing ratio.

Answer:

Old Ratio = 3:2:1

Z Retire

X’s Gaining = 1/6 X 2/3 = 2/18

X’s New share = 3/6 + 2/18 = 11/18

Y’s Gaining = 1/6 X 1/3 = 1/18

Y’s new share = 2/6 + 1/18 = 7/18

New Ratio = 11/18, 7/18 Or 11:7

Question: P, Q and R were partners in a firm sharing profits in 4:5:6 ratio. On 28-02-2008 Q retired and his share of profits was taken over by P and R in 1:2 ratio. Calculate the new profit sharing ratio of P and R.

Ans. 7 Old ratio = P Q R

= 4:5:6

Q retired

P’s gaining = 1/3 X 5/15 = 1/9

P’s new share = 4/15 + 1/9 = 17/45

R’s Gaining share = 2/3 X 5/15 = 2/9

R’s new share = 6/15 + 2/9 = 28/45

New Ratio = 17:28

Question: Mayank, Harshit and Rohit were partners in a firm sharing profits in the ratio of 5:3:2. Harshit retired and goodwill is valued at Rs 60000. Mayank and Rohit decided to share future profits in the ratio 2:3. Pass necessary journal entry for treatment of goodwill.

Answer: Rohit’s capital A/C Dr. 24000

To Mayank’s capital A/C 6000

To harshit’s Capital A/C 18000

(Adjustment Entry for treatment of goodwill in gaining ratio.)

Question: Ramesh, Naresh and Suresh were partners in a firm sharing profits in the ratio of 5:3:2. Naresh retired and the new profit sharing ratio between Ramesh and Suresh was 2:3. On Naresh retirement the goodwill of the firm was valued at Rs. 120000. Pass necessary journal entry for the treat.

Answer Suresh capital A/C Dr. 48000

To Ramesh’s capital A/C 12000

To Naresh capital A/C 36000

(Goodwill adjusted among the gaining partner in gaining ratio.)

Question: L,M and O were partners in a firm sharing profits in the ratio of 1:3:2. L retired and the new profit sharing ratio between M and O was 1:2. On L’s retirement the goodwill of the firm was valued Rs. 120000. Pass necessary journal entry for the treatment of goodwill.

Answer: O’s capital A/C Dr. 40000

To C’s capital A/C 20000

To M’s capital A/C 20000

(Adjustment of goodwill in gaining partners in their gaining ratio.)

Question: State the journal entry for treatment of deceased partners share of profit for his life period in the year of death.

Answer:11 Profit and loss suspense A/C Dr

To deceased partner’s capital A/C

Question: X, Y and Z were partners in a firm sharing profits and losses in the ratio of 3:2:1. The profit of the firm for the year ended 31st March, 2007 was Rs. 3,00000. Y dies on 1st July 2007. Calculate Y’s share of profit up to date of death assuming that profits in the year 2007- 2008 have been accured on the same scale as in the year 2006-07 and pass necessary journal entry.

Answer: Total profit for the year ended 31st March 2007 = Rs 300000

Y’s share of profit up to date of death = 300000 X 2/6 X 3/12

= 25000

Profit and Loss suspense A/C Dr. 25000

To Y’s capital A/C 25000

( Y’s share of profit transferred to Y’s capital A/C)

Question: In which case the following entries are required :

a) Partner’s Capital A/c Dr.

To Partners loan A/c

b) Stock A/c Dr.

Building A/c Dr.

To Revaluation A/c

Answer: (a) Partner’s capital A/C Dr

To partner’s loan A/C

(This entry is required when the amount due is transferred to retiring partner’s

loan A/C)

(b) Stock A/C ………..Dr

Building A/C……..Dr

To Revaluation A/C

(This entry is required when the stock and building are appericiated)

Question: Journalise the following :-

(a) Chander, Tara and Ravi were partners in a firm sharing profits in the ratio of 2:1:2

on 15.02.2007 Cander died and the new profit sharing ratio between Tara & Ravi

was 4:11. On Chander’s death the goodwill of the firm was valued at Rs. 90,000.

Calculate gaining ratio and pan necessary journal entry for the treatment of

goodwill on Chander’s death without opening goodwill account.

(b) A, B, C and D are partners sharing profits in the ratio of 3:4:3:2. On the retirement

of C, the goodwill was valued at Rs. 60,000. A, B and D decided to share future

profits equally. Pass the necessary journal entry for the treatment of goodwill,

without opening Goodwill Account.

Answer: (a)

Gaining Ration = 1:5

Goodwill of 90000 X 2/5 = 18000 X 2

Chander = 36000

Tara Capital A/C ………..Dr

Ravi Capital A/c…………Dr

To chander capital A/C 36000

(being the tara and ravi are debited in the gaining ratio)

Question:: A and B are partners sharing profits in the ratio of A 3/6, B 2/6 and transfer to reserve

1/6. Their Balance Sheet on 31st December 2007 was as follows:

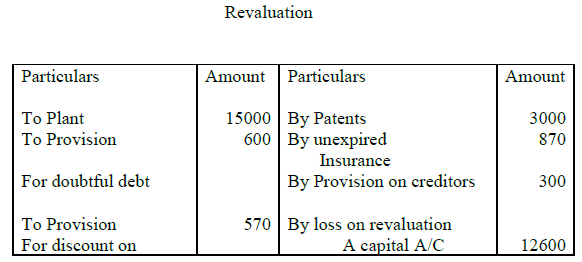

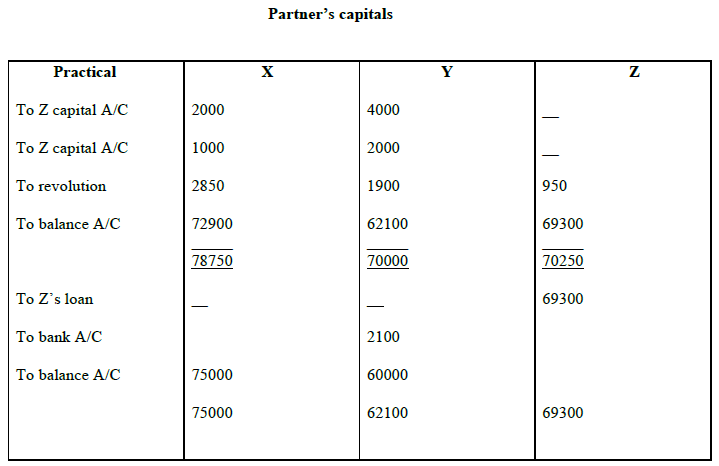

(i) Goodwill is to be valued at 50,000.

(ii) Value of patents is to be increased by Rs. 3,000 but plant was found over-valued

by Rs 15,000.

(iii) Prevision for doubtful debts should be 5% on Debtors and prevision for discount

should also be made on Debtors & creation at 3%.

(iv) Out of insurance which was entirely debited to profit and loss Account Rs 870 be

carried forward as unexpired insurance.

(v) Investments were revalue at Rs 16,000. Half of these investments were taken

over by B.

(vi) There is a claim for workmen’s compensation to the extent of Rs 5,ooo.

B was paid of in full. A borrowed the necessary money from the bank on the

security of plant and stock to pay off B. Prepare Revaluation A/C .capital A/c of

B/S of A.

Answer:

Question: X, Y, and Z were in partnership sharing profits in the ratio of 3: 2: 1 they had

taken a Joint life policy of Rs.50,000 , whose surrender value on 1st Jan 2007 was

Rs.18,000 . On this date B/S is as follows:-

Z retires on the above date and the new profit sharing ratio between X and Y will be 5:4

following terms were agreed:

1) Land and buildings be reduced by 10%.

2) Out of the Insurance premium paid during the year Rs.5,000 be carried forward as

unexpired.

3) There is no need of any provision for doubtful debts.

4) Goodwill of the firm be valued at Rs.36,000 and adjustment in this respect be made

without raising a goodwill a/c . The joint life policy was also not to appear in the

Balance sheet.

5) X and Y decided that their Capital will be adjusted in their new profit sharing ratio by

bringing in or paying cash to the partners is a/c will be transfered to his loan a/c.

a) Pan necessary journal entries : Prepare the capital accounts and the new balance

sheet.

Answer:

BALANCE SHEETS

Question: A, B and C were partners in a firm sharing profits in 3:2:1 ratio. The firm closes its books on 31st March every year. B died on 12-06-2007. On B’s death the goodwill of the firm was valued at Rs. 60000. On B’s death his share in the profit of the firm till the time of his death was to be calculated on the basis of previous years which was Rs.150000. Calculate B’s share in the profit of the firm. Pass necessary journal entries for the treatment of goodwill and B’s share of profit at the time of his death.

Answer: Profit and Loss suspense A/C Dr. 10000

To B’s capital A/C 10000

(B’s share of profit transferred to B’s capital A/C)

A’s capital A/C Dr. 15000

C’s capital A/C Dr. 5000

To B’s capital A/C 20000

(B’s share of goodwill transferred to B’s capital A/C and debited to remaining

partners capital A/C in their gaining ratio.)

B’s share of profit = Number of days from 1 April to 12th June 2007

= 73 Days

B’s share of profit = 150000 X 1/3 X 73/365

= Rs. 10000Question: A, B and C were partners in a firm sharing profits in the ratio of 2:2:1. C dies on 31st July, 2007. Sales during the previous year upto 31st march, 2007 were Rs. 6,00,000 and profits were Rs. 150000. Sales for the current year upto 31st July were Rs. 250000. Calculate C’s share of profits upto the date of his death and pass necessary journal entry.

Answer: Profit to be shared equally because at the time when Ramesh Retire the profit on revaluation is

divided in old ratio but not in the new ratio.

Question: From the following particulars.

Calculate the new profit –sharing ratio of the partners:-

(a) A , B and C are partners in a firm sharing profits and losses in the ratio of 5:3:2 B retires

from firm and his share was taken up by A and C in the ratio of 2:1.

(b) P , Q and R were partners sharing profits in the ratio of 5:4:1. P retires from the firm.

Answer: