HOTS Accountancy Class 12 Chapter 5 Dissolution of Partnership Firm

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Dissolution of Partnership with solutions given below, this will help them to understand the concepts and related questions given in the DK goel class 12. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations

Question: Distinguish between dissolution of partnership and dissolution of partnership firm on the basis of continuation of business.

Answer: In case of dissolution of partnership, the firm may continue its business operation but in case of dissolution of partnership firm, the business operations are discontinued.

Question: Why is Realisation Account prepared on dissolution of partnership firm?

Answer: Realisation account is prepared to ascertain profit or loss on sale of assets and payment of liabilities.

Question: State any one point of difference between Realisation Account and Revaluation Account.

Answer: Yustin’s claim is valid as according to section 48 (b) of partnership Act, partners loan are to be paid before any amount is paid to partners on account of their capitals.

Question: On a firms dissolution debtors as shown in the Balance sheet were Rs. 17000 out of these Rs. 2000 became bad. One debtor of Rs. 6000 became insolvent and 40% could be recovered from him. Full recovery was made from the balance debtors. Calculate the amount received from debtors and pass necessary journal entry.

Answer: Cash A/C Dr. 11400

To Realisation A/C 11400

(For debtors realized on dissolution of firm)

Question: On dissolution of a firm, Kamal’s capital account shows a debit balance of Rs. 16000. His share of profit on realization is Rs. 11000. He has taken over firms creditors at Rs. 9000. Calculate the final payment due to /from him and pass journal entry.

Answer: Kamal’s capital A/C Dr. 4000

To cash A/C 4000

(for final payment to Kamal)

Question: A and B were partners in a firm sharing profits and losses equally. Their firm was dissolved on 15th March, 2004, which resulted in a loss of Rs. 30,000. On that date the capital A/C of A showed a credit balance of Rs. 20,000 and that of B a credit balance of Rs. 30000. The cash account has a balance of Rs. 20000. You are required to pass the necessary journal entries for the (i) Transfer of loss to the capital accounts and (ii) making final payment to the partners.

Answer: (i) A’s capital A/C Dr. 15000

B’s capital A/C Dr. 15000

To realization A/C 30000

(For transfer of loss on dissolution)

(ii) A’s capital A/C Dr. 5000

B’s capital A/C Dr. 15000

To cash A/C 20000

(For final payment to partners)

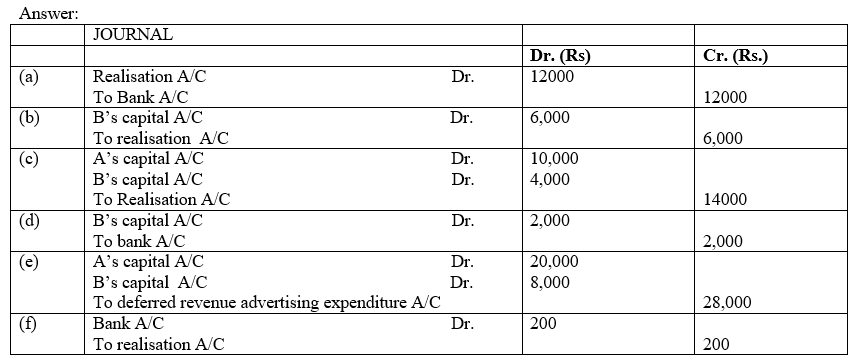

Question: What journal entries would be passed in the books of A and B who are partners in a firm, sharing profits in the ratio of 5:2, for the following transactions on the dissolution of the firm after various assets (other than cash) and third party liabilities have been transferred to Realisation Account?

(a) Bank loan Rs. 12,000 is paid.

(b) Stock worth Rs. 6000 is taken over by B.

(c) Loss on Realisation Rs. 14,000.

(d) Realisation expenses amounted to Rs. 2,000, B has to bear these expenses.

(e) Deferred Revenue Advertising Expenditure appeared at Rs. 28,000.

(f) A typewriter completely written off in the books of the firm was sold for Rs. 200.