MCQs for Accountancy Class 12 with Answers Chapter 3 Reconstitution of a Partnership Firm Admission of a Partner

Refer to MCQ Questions for Accountancy Class 12 with Answers Chapter 3 Reconstitution of a Partnership Firm Admission of a Partner designed as per the latest syllabus issued by CBSE. All Multiple choice questions have been provided with solutions and have been prepared based on the expected pattern in upcoming board exams

Question: The ratio in which the continuing partners acquire the outgoing partners share is called

a) Gaining Ratio

b) New Profit sharing ratio

c) Old Profit sharing ratio

d) None of the options

Answer

A

Question. Goodwill is _

(a) tangible asset

(b) intangible asset

(c) fictitious asset

(d) both (b) & (c)

Answer

B

Question Which of the following is not the reconstitution of partnership?

a. Admission of a partner

b. Dissolution of Partnership

c. Change in Profit Sharing Ratio

d. Retirement of a partner

Answer

B

Question P, Q and R are partners sharing profits in the ratio of 8:5:3. P retires. Q takes 3/16th share from P and R takes 5/16th share from P. What will be the new profit sharing ratio?

a) 1:1

b) 10:6

c) 9:7

d) 5:3

Answer

A

Question. Goodwill of the firm on the basis of 2 years’ purchase of average profit of the last 3 years is Rs. 25,000. Find average profit.

(a) Rs. 50,000

(b) Rs. 25,000

(c) Rs. 10,000

(d) Rs. 2500

Answer

D

Question: In the event of death of a partner, the amount of general reserve is transferred to partners capital accounts in

a) The old profit sharing ratio

b) The new profit sharing ratio

c) the capital ratio

d) None of the options

Answer

A

Question.On the admission of a new partner:

a. Old partnership is dissolved

b. Both old partnership and firm are dissolved

c. Old firm is dissolved

d. None of the above

Answer

A

Question X, Y and Z are partners sharing profits and losses in the ratio of 4:3:2. Y retires and surrenders 1/9th of his share in favour of X and the remaining in favour of Z. The new profit sharing ratio will be:

a) 1:8

b) 13:14

c) 8:1

d) 14:13

Answer

B

Question. Calculate the value of goodwill at 3 years’ purchase when: Capital employed Rs. 2,50,000; Average profit Rs. 30,000 and normal rate of return is I0%.

(a) Rs. 3000

(b) Rs. 25,000

(c) Rs. 30,000

(d) Rs. 5,000

Answer

D

Question. On the Admission of a new partner, increase in the value of assets is debited to :

(a) P & L Adjustment Account

(b) Assets Account

(c) Old Partners’ Capital Accounts

(d) None of the above

Answer

(b) Assets Account.

Question: On the admission of a new partner, increase in the value of assets is debited to

a) Profit & Loss Account

b) Revaluation A/c

c) Assets Account

d) None of the options

Answer

C

Question. What are super profits

a)Actual profit – Normal Profit

b) Normal Profit – Actual profit

c) Actual profit + Normal Profit

d)None of the above

Answer

A

Question Gaining ratio is used to distribute —————— in case of retirement of a partner.

a) Goodwill

b) Revaluation Profit or Loss

c) Profit and Loss Account (Credit Balance)

d) Both b and c

Answer

A

Question Sacrificing ratio is used to distribute —————— in case of admission of a partner.

a. Goodwill

b. Revaluation Profit or Loss

c. Profit and Loss Account (Credit Balance)

d. Both b and c

Answer

A

Question: X and Y shares profits in the ratio of 2:3, how they decided to share profits equally in the future, Which partner will sacrifice and in which ratio

a) None of the options

b) X Sacrifice 1/10

c) Both

d) Y Sacrifice 1/10

Answer

D

Question. The net assets of the firm including fictitious assets of 5,000 are 85,000.The net liabilities of the firm are 30,000.The normal rate of return is 10% and the average profits of the firm are 8,000.Calculate the goodwill as per capitalization of super profits.

(a) Rs.20,000

(b) Rs. 30,000

(c) Rs. 25,000

(d) None of the above

Answer

B

Question X, Y and Z are partners in a firm. Y retires and his claim including his capital and his share of goodwill is R. 1,20,000. He is paid partly in cash and partly in kind. A vehicle at Rs. 60,000 unrecorded in the books of the firm and the balance in cash is given to him to settle his account. The amount of cash to be paid to Y will be:

a) Rs. 80,000

b) Rs. 60,000

c) Rs. 40,000

d) Rs. 30,000

Answer

A

Question. When the incoming partner brings his share of premium for goodwill in cash, it is adjusted by crediting to :

(a) His Capital Account

(b) Premium for Goodwill Account

(c) Sacrificing Partners’ Capital Accounts

(d) None of the above.

Answer

(c) Sacrificing Partners’ Capital Accounts.

Question. Which of the following items are added to previous year’s profits for finding normal profits for valuation of goodwill.?

a)Loss on sale of fixed assets

b) Loss due to fire, earthquake etc

c) Undervaluation of closing stock

d) All of the above

Answer

D

Question Himanshu and Naman share profits & losses equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respectively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Ashish with 1/5 share. Ashish brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

a. 1,00,000

b. 85,000

c. 20,000

d. None of the above

Answer

B

Question: Revaluation account or Profit & loss adjustment account is

a) Real Account

b) Nominal Account

c) Personal Account

d) None of the options

Answer

B

Question. Under which method of valuation of goodwill, normal rate of return is not considered?

a)Loss on sale of fixed assets

b) Loss due to fire, earthquake etc

c) Undervaluation of closing stock

d) All of the above

Answer

C

Question: The partners whose share Increase as a result of change in profit sharing ratio are known as

a) Gaining Partners

b) Sacrificing Partners

c) Sleeping Partners

d) None of the options

Answer

A

Question A and B were partners. They shared profits as A- ½; B- 1/3 and carried to reserve 1/6. B died. The balance of reserve on the date of death was Rs. 30,000. B’s share of reserve will be:

a) Rs. 10,000

b) Rs. 8,000

c) Rs. 12,000

d) Rs. 9,000

Answer

C

Question. Following are the methods of calculating goodwill except:

a)Super profit method

b) Average profit method

c) Weighted Average profit method

d) Capital profit method

Answer

D

Question Yash and Manan are partners sharing profits in the ratio of2:1. They admit Kushagra into partnership for 25% share of profit. Kushagra acquired the share from old partners in the ratio of 3:2. The new profit sharing ratio will be:

a. 14:31:15

b. 3:2:1

c. 31:14:15

d. 2:3:1

Answer

C

Question. A, B and C are partners in a firm, if D is admitted as a new partner :

(a) Old firm is dissolved

(b) Old firm and old partnership is dissolved

(c) Old partnership is reconstituted

(d) None of the above

Answer

(c) Old partnership is reconstituted.

Question If goodwill is already appearing in the books of accounts at the time of retirement, then it should be written off in ————-.

a) New Ratio

b) Gaining Ratio

c) Sacrificing Ratio

d) Old Ratio

Answer

D

Question. The excess amount which the firm can get on selling its assets over and above the saleable value of its assets is called :

a)Surplus

b) Super profits

c) Reserve

d) Goodwill

Answer

D

Question A and B are partners sharing profit and losses in ratio of 5:3. C is admitted for 1/4th share. On the date of reconstitution, the debtors stood at Rs 40,000, bill receivable stood at Rs. 10,000 and the provision for doubtful debts appeared at Rs. 4000. A bill receivable, of Rs 10,000 which was discounted from the bank, earlier has been reported to be dishonored. The firm has sold, the debtor so arising to a debt collection agency at a loss of 40%. If bad debts now have arisen for Rs 6,000 and firm decides to maintain provisions at same rate as before then amount of Provision to be debited to Revaluation Account would be:

a.Rs 4,400

b.Rs 4,000

c.Rs 3,400

d.None of the above

Answer

C

Question: A firm is reconstituted , whenever there is a

a) Death of a partner

b) Retirement of Existing Partner

c) All of the options

d) Admission of a new partner

Answer

C

Question. When Goodwill is not purchased goodwill account can :

(a) Never be raised in the books

(b) Be raised in the books

(c)Be partially raised in the books

(d)Be raised as per the agreement of the partners

Answer

A

Question As per Section 37 of the Indian Partnership Act, 1932, interest @ ———– is payable to the retiring partner if full or part of his dues remain unpaid.

a) 9% p.m.

b) 12% p.m.

c) 6% p.m.

d) None of the above

Answer

D

Question A, B and C were partners. Their partnership deed provided that they were to share profits as; A 26 per cent; B 34 per cent; C 40 per cent ; and that if a partner retires, his capital should remain in the business for a stated period at a fixed rate of interest, but that the retiring partner’s share should be credited with an amount for Goodwill, based upon one and a half year’s average profits, for the five years prior to his death, but be subject to deduction of 5 per cent from the book debts. C retired, and the profits of the firm for five years were agreed at Rs. 20,000; Rs. 30,000; Rs. 15,000 (loss); Rs. 5,000 (loss); and Rs. 45,000 respectively. Book Debts stood at Rs. 90,000.The share of Goodwill to be credited to C’s Account will be:

a) Rs. 2,700

b) Rs. 6,300

c) Rs. 7,200

d) Rs. 3,600

Answer

C

Question. The goodwill of the firm is not affected by:

(a) Location of the firm

(b) reputation of the firm

(c)Better customer services

(d)None of the above

Answer

B

Question Heena and Sudha share Profit & Loss equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respectively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Teena with 1/5 share. Teena brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

a.85,000

b.1,00,000

c.20,000

d.None of the above

Answer

A

Question: Profit & loss adjustment account, which

a) Increase value of the assets

b) Both

c) Decrease Value of Liabilities

d) None of the options

Answer

B

Question. Weighted average profit method of calculating goodwill is used when:

(a) Profits are not equal

(b) Profits show a trend

(c) Profits are fluctuating

(d)None of the above

Answer

B

Question: Z is admitted to a firm for 1/4 share in the profits for which he brings in Rs. 10000towards premium for goodwill, it will be taken by the old partners in

a) The new profit sharing ratio

b) The old Profit sharing ratio

c) the Sacrificing ratio

d) None of the options

Answer

C

Question When the balance sheet is prepared after retirement (subsequent to preparation of Revaluation Account), ————- values are shown in it.

a) Historical

b) Realisable

c) Market

d) Revalued

Answer

D

Question Which of the following is not true with respect to Admission of a partner?

a.A new partner can be admitted if it is agreed in the partnership deed.

b.If all the partners agree, a new partner can be admitted.

c.A new partner has to bring relatively higher capital as compared to the existing partners.

d.A new partner gets right in the assets of the firm

Answer

C

Question. Capital invested in a firm is 5,00,000.Normal rate of return is 10% .Average profit of the firm are 64,000(after an abnormal loss of 4,000).Value of goodwill at four times the super profits will be:

(a) Rs.72,000

(b) Rs. 40,000

(c) Rs. 2,40,000

(d) 1,80,000

Answer

A

Question. Balance in the Investment Fluctuation Reserve, after meeting the loss on Revaluation of Investments, at the time of admission of a partner will be transferred to :

(a) Old Partners’ Capital Accounts

(b) Revaluation Account

(c) Sacrificing Ratio

(d) None of the above

Answer

(a) Old Partners’ Capital Accounts.

Question On retirement of a partner, debtors of Rs. 34,000 were shown in the Balance sheet. Out of this Rs. 4,000 became bad. One debtor became insolvent. 70% were recovered from him out of Rs. 10,000. Full amount is expected from the balance debtors. On account of this item loss in revaluation account will be:

a) Rs. 10,200

b) Rs. 3,000

c) Rs. 7,000

d) Rs. 4,000

Answer

C

Question As per ———, only purchased goodwill can be shown in the Balance Sheet.

a. AS 37

b. AS 26

c. Section 37

d. AS 37

Answer

B

Question: X and Y are partners sharing profits in the ratio of 2:1, they admit Z into the partnership for 1/4th share in profits for which brings in Rs. 20000 as his share of capital. Hence the adjusted capital of X and Y will be

a) None of the options

b) 32000 and 16000 respectively

c) 60000 and 30000 Rs. Respectively

d) 40000 and 20000 Rs. Respectively

Answer

D

Question If at the time of retirement, there is some unrecorded asset, it will be ————- to ————- Account.

a) Debited, Revaluation

b) Credited, Revaluation

c) Debited, Goodwill

d) Credited, Partners’ Capital

Answer

B

Question A, and B are partners sharing profits in the ratio of 2:3. Their balance sheet shows machinery at ₹2,00,000; stock ₹80,000, and debtors at ₹1,60,000. C is admitted and the new profit sharing ratio is 6:9:5. Machinery is revalued at ₹1,40,000 and a provision is made for doubtful debts @5%. A’s share in loss on revaluation amount to ₹20,000. Revalued value of stock will be:

a. ₹62,000

b. ₹1,00,000

c. ₹60,000

d. ₹98,000

Answer

C

Question: When goodwill is withdrawn by old partners ____ a/c is credited.

a) cash/bank

b) capital

c) revaluation

d) Profit and Loss Adjustment

Answer

A

Question.Revaluation Account or Profit and Loss Adjustment A/c is a

(a) Real Account

(b) Personal Account

(c) Nominal Account

(d) Asset Account

Answer

C

Question.There is a change in profit sharing ratio of existing partners and the question is silent about investmentfluctuation reserve, then it is distributed among partners in

(a) Old Ratio

(b) New Ratio

(c) Sacrificing Ratio

(d) Gaining Ratio

Answer

A

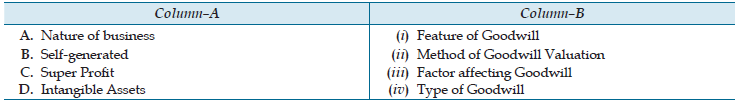

Question.Match the following:

(a) (a)—(iii), (b)—(ii), (c)—(iv), (d)—(i)

(b) (a)—(iii), (b)—(ii), (c)—(i), (d)—(iv)

(c) (a)—(ii), (b)—(i), (c)—(iv),

(d)—(iii) (d) (a)—(i), (b)—(ii), (c)—(iv), (d)—(iii)

Answer

Question.Identify the correct set for the following:

(a) (A)—(i), (B)—(ii), (C)—(iii), (D)—(iv)

(b) (A)—(iv), (B)—(ii), (C)—(i), (D)—(iii)

(c) (A)—(iv), (B)—(iii), (C)—(ii), (D)—(i)

(d) (A)—(iii), (B)—(ii), (C)—(i), (D)—(iv)

Answer

C

Question.Farhan, Saif and Abhishek share profits equally. They decide that in future Abhishek will get 1/5thshare in profits. In the day of change Firm’s goodwill is valued at ` 30,000. What will be the effect of thischange?

(a) Abhishek’s loss ` 5,000; Gain of Saif and Farhan `10,000 each.

(b) Farhan’s gain `10,000; Loss of Saif and Abhishek `5,000 each.

(c) Abhishek’s loss `4,000; Gain of Farhan and Saif `2,000 each.

(d) Farhan’s gain `4,000; Loss of Saif and Abhishek `2,000 each.

Answer

C

Question.Under the capitalisation method, the formula for calculating the goodwill is:

(a) Super Profits multiplied by the rate of return

(b) Average Profits multiplied by the rate of return

(c) Super Profits divided by the normal rate of return

(d) Average Profits divided by the rate of return

Answer

C

Question.Which of the following is True in relation to goodwill?

(a) Goodwill is a fictitious asset.

(b) Goodwill is a current asset.

(c) Goodwill is a wasting asset.

(d) Goodwill is an intangible asset.

Answer

D

Question.The partner whose share has increased as a result of change is called:

(a) Sacrificing partner

(b) Sacrificing ratio

(c) Gaining partner

(d) Gaining ratio

Answer

C

Question. Identify the correct set for the following:

(a) (A)—(i), (B)—(ii), (C)—(iii)

(b) (A)—(iii), (B)—(ii), (C)—(i)

(c) (A)—(ii), (B)—(iii), (C)—(i)

(d) (A)—(iii), (B)—(i), (C)—(ii)

Answer

D

Question. X, Y and Z are partners sharing profits and losses in the ratio 5 : 3 : 2. They decide to share the futureprofits in the ratio 3 : 2 : 1. Workmen compensation reserve appearing in the balance sheet on the dateif no information is available for the same will be

(a) Distributed to the partners in old profit sharing ratio

(b) Distributed to the partners in new profit sharing ratio

(c) Distributed to the partners in capital ratio

(d) Carried forward to new balance sheet without any adjustment

Answer

A

Question. What is gaining ratio:

(a) (A)—(iii), (B)—(ii), (C)—(iii), (D)—(i)

(b) (A)—(ii), (B)—(iii), (C)—(iv), (D)—(i)

(c) (A)—(iii), (B)—(ii), (C)—(i),

(D)—(iv) (d) (A)—(iii), (B)—(iv), (C)—(ii), (D)—(i)

Answer

D

Question. Ankush, Ravi and Riya are equal partners share in the firm. It is now agreed that they will share the futureprofits in the ratio 5 : 3 : 2. Sacrificing/gaining share of Ravi:

(a) 1/30 (Sacrifies)

(b) 1/3 (Gain

(c) 1/10 (Sacrifice)

(d) None of these

Answer

A

Question.Under Super Profit Method, goodwill is calculated by:

(a) Number of years’ Purchase × Average Profit

(b) Number of years’ Purchases × Super Profit

(c) Super Profit + Normal Rate of Return

(d) Super Profit – Normal Profit

Answer

B

Question.The excess amount which the firm can get on selling its assets over and above the saleable value of itsassets is called:

(a) Surplus

(b) Super profits

(c) Reserve

(d) Goodwill

Answer

D

Question.Any change in the relationship of existing partners which results in an end of the existing agreement and enforces making of a new agreement is called:

(a) Revaluation of Partnership

(b) Reconstitution of Partnership

(c) Realisation of Partnership

(d) None of the above

Answer

B

Question Anil, Bimal and Chetan are partners sharing their profits and losses in the ratio of 4:3:2. On 1.7.2013, Chetan retired and on that date the capitals of Anil, Bimal and Chetan after all necessary adjustments stood at Rs. 75,000, Rs. 65,000 and Rs. 45,000 respectively. Anil and Bimal continued to carry the business for 6 months without settling Chetan’s account. During the period of six months ending 31st December,2013, a profit of Rs. 50,000 is earned by the firm. Keeping Chetan’s interest in mind, the amount payable to Chetan will be:

a) Rs. 1,350

b) Rs. 13,362

c) Rs. 12,162

d) Rs. 1,362

Answer

C

Question At the time of admission of a partner, Employees Provident Fund is:

a. Distributed to partners in the old profit sharing ratio

b. Distributed to partners in the new profit sharing ratio

c. Adjusted through gaining ratio

d. None of the above

Answer

D

Question: Jay, Vijay and Ajay are three partners sharing profits in 3:2:1. They decided to admit Sanjay and give him 1/7th share, new profit sharing ratio of partners will be _____.

a) equal

b) 3:2:1:2

c) 3:2:1:1

d) 2:3:1:2

Answer

C

Question If at the time of admission if there is some unrecorded liability, it will be ————- to — ———— Account.

a. Debited, Revaluation

b. Credited, Revaluation

c. Debited, Goodwill

d. Credited, Partners’ Capital

Answer

A

Question Retiring partner is compensated for parting with the firm’s future profits in favour of remaining partners. The remaining partners contribute to such compensation amount in:

a) Gaining Ratio

b) Sacrificing Ratio

c) Capital Ratio

d) Profit Sharing Ratio

Answer

A

Question: If any asset is taken over by partner from the firm _____ account will be debited.

a) asset

b) revaluation

c) capital

d) Profit and Loss Adjustment

Answer

C

Question At the time of admission of a new partner, the balance of Workmen Compensation Reserve will be transferred to:

a. Old partners in the old profit sharing ratio

b. Sacrificing partners in the sacrificing ratio

c. Revaluation Account

d. All partners in the new profit sharing ratio

Answer

A

Question. If the incoming partner is to bring Premium for Goodwill in cash and also a balance exists in Goodwill Account, then this Goodwill Account is written among Old Partners in :

(a) New Profit Sharing Ratio

(b) Old Profit Sharing Ratio

(c) Sacrificing Ratio

(d) None of the above

Answer

(b) Old Profit Sharing Ratio.

Question. As per section ———— of the Indian Partnership Act, a retiring partner becomes entitled to profits after retirement if his dues remain unpaid

a) Section 73

b) Section 26

c) Section 4

d) Section 37

Answer

D

Question The firm of P, Q and R with profit sharing ratio of 6:3:1, had the balance in General Reserve Account amounting Rs. 1,80,000. S joined as a new partner and the new profit sharing ratio was decided to be 3:3:3:1. Partners decide to keep the General Reserve unchanged in the books of accounts. The effect will be:

a. P will be credited by Rs. 54,000

b. P will be debited by Rs. 54,000

c. P will be credited by Rs. 36.000

d. P will be credited by Rs. 36,000

Answer

A

Question: Excess of proportionate capital over actual capital represents…………………..

a) Equal capital

b) Surplus Capital

c) Deficit Capital

d) Gain

Answer

3

Question Which statement is true with respect to AS-26?

a. Purchased goodwill can be shown in the Balance Sheet

b. Revalued goodwill can be shown in the Balance Sheet

c. Both purchased goodwill and revalued can be shown in the Balance Sheet

d. None of the above

Answer

A

Question At the time of retirement, amount remaining in Investment Fluctuation Reserve after meeting the fall in value of Investment is:

a) Credited in Sacrificing Ratio

b) Credited in New Profit Sharing Ratio

c) Credited in Old Profit Sharing Ratio

d) Credited in Gaining Ratio

Answer

C

Question: Account is debited when unrecorded liability is brought into business.

a) liability

b) revaluation

c) capital

d) current

Answer

2

Question Premium brought by newly admitted partner should be:

a. Credited to sacrificing partners

b. Credited to all partners in the new profit sharing ratio

c. Credited to old partners in the old profit sharing ratio

d. Credited to only gaining partners

Answer

A

Question. The ratio which is computed to determine the sacrifice of the old partners made in favour of new partner which is admitted into partnership is :

(a) Gaining Ratio

(b) Old Profit Sharing Ratio

(c) New Profit Sharing Ratio

(d) Sacrificing Ratio

Answer

(d) Sacrificing Ratio.

Question P, Q and R were partners in a firm in the ratio of 5:4:3. They admit S for 1/7 share. It is agreed that Q would retain his original share. ———– will be the sacrificing ratio between P and R.

a) 5:4

b) 1:1

c) 5:3

d) 4:3

Answer

C

Question Sacrificing ratio is calculated because:

a. Profit shown by Revaluation Account can be credited to sacrificing partners

b. Goodwill brought in by the incoming partner can be credited to the new partner

c. Goodwill brought in by the incoming partner can be credited to the sacrificing partners

d. Both a and c

Answer

C

Question: The _ ratio is useful for making adjustment for goodwill among the old partners.

a) new

b) sacrifice

c) old

d) Profit and Loss Adjustment

Answer

B

Question Aryaman and Bholu are partners sharing profit and losses in ratio of 5:3. Chirag is admitted for 1/4th share. On the date of reconstitution, the debtors stood at Rs 40,000, bill receivable stood at Rs. 10,000 and the provision for doubtful debts appeared at Rs. 4000. A bill receivable, of Rs 10,000 which was discounted from the bank, earlier has been reported to be dishonored. The firm has sold, the debtor so arising to a debt collection agency at a loss of 40%. If bad debts now have arisen for Rs 6,000 and firm decides to maintain provisions at same rate as before then amount of Provision to be debited to Revaluation Account would be:

a. Rs 4,400

b. Rs 4,000

c. 3,400

d. None of the above

Answer

C

Question: In case of admission of a partner, the profit or loss on revaluation of assets and liabilities is shared by _____ partners.

a) all

b) none of these

c) new

d) old

Answer

D

Question Revaluation Account is a ———— Account.

a. Real

b. Nominal

c. Personal

d. Liability

Answer

B

Question. The account which is prepared to adjust the increase or decrease in the value of assets at the time of admission of partner is called :

(a) Realisation Account

(b) Revaluation Account

(c) P & L Account

(d) None of the above.

Answer

(b) Revaluation Account.

Question: Decrease in the value of Liabilities on reconstitution of the partnership firm results into

a) Gain to the Existing Partner

b) Loss to the Existing Partner

c) Neither Gain of loss to Existing partner

d) None of the options

Answer

A

Question: Change in partnership agreement

a) Dissolved the partnership firm

b) Results in end of partnership business

c) Changes in the relationship among the partner

d) None of the options

Answer

C

Question. General Reserve at the time of admission of a Partner is transferred to :

(a) Revaluation Account

(b) Old Partners’ Capital Accounts

(c) Neither of the two

(d) Both (a) and (b)

Answer

B

Question: If the incoming partner is to bring in premium for goodwill in cash and also a balance exists in the goodwill account, then this goodwill account is written of among the old partners in

a) None of the options

b) The new profit sharing ratio

c) The sacrificing ratio

d) The old profit sharing ratio

Answer

D

Question. Premium brought by newly admitted partner should be:

a) Credited to sacrificing partners

b) Credited to all partners in the new profit sharing ratio

c) Credited to old partners in the old profit sharing ratio

d) Credited to only gaining partners

Answer

A

Question. Heena and Sudha share Profit & Loss equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respec-tively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Teena with 1/5 share. Teena brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

a) Rs.85,000

b) Rs.1,00,000

c) Rs.20,000

d) None of the above

Answer

A

Question. A, and B are partners sharing profits in the ratio of 2:3. Their balance sheet shows machinery at ₹ 2,00,000; stock ₹ 80,000, and debtors at ₹ 1,60,000. C is admitted and the new profit sharing ratio is 6:9:5. Machinery is revalued at ₹ 1,40,000 and a provision is made for doubtful debts @5%. A’s share in loss on revaluation amount to ₹ 20,000. Revalued value of stock will be:

a) ₹62,000

b) ₹1,00,000

c) ₹60,000

d) ₹98,000

Answer

C

Question. On the admission of a new partner:

a) Old partnership is dissolved

b) Both old partnership and firm are dissolved

c) Old firm is dissolved

d) None of the above

Answer

A

Question. Sacrificing ratio is calculated because:

a) Profit shown by Revaluation Account can be credited to sacrificing partners

b) Goodwill brought in by the incoming partner can be credited to the new partner

c) Goodwill brought in by the incoming partner can be credited to the sacrificing partners

d) Both a and c

Answer

C

Question. Sacrificing ratio is used to distribute ——————— in case of admission of a partner.

a) Goodwill

b) Revaluation Profit or Loss

c) Profit and Loss Account (Credit Balance)

d) Both b and c

Answer

A

Question. A and B are partners sharing profit and losses in ratio of 5:3. C is admitted for 1/4th share. On the date of reconstitution, the debtors stood at Rs 40,000, bill receivable stood at Rs. 10,000 and the provision for doubtful debts appeared at Rs. 4000. A bill receivable, of Rs 10,000 which was discounted from the bank, earlier has been reported to be dishonored. The firm has sold, the debtor so arising to a debt collection agency at a loss of 40%. If bad

debts now have arisen for Rs 6,000 and firm decides to maintain provisions at same rate as before then amount of Provision to be debited to Revaluation Account would be:

a) Rs 4,400

b) Rs 4,000

c) Rs 3,400

d) None of the above

Answer

C

Question. If at the time of admission if there is some unrecorded liability, it will be to — Account.

a) Debited, Revaluation

b) Credited, Revaluation

c) Debited, Goodwill

d) Credited, Partners’ Capital

Answer

A

Question. At the time of admission of a new partner, the balance of Workmen Compensation Reserve will be transferred to:

a) Old partners in the old profit sharing ratio

b) Sacrificing partners in the sacrificing ratio

c) Revaluation Account

d) All partners in the new profit sharing ratio

Answer

A

Question. Which of the following is not the reconstitution of partnership?

a) Admission of a partner

b) Dissolution of Partnership

c) Change in Profit Sharing Ratio

d) Retirement of a partner

Answer

B

Question. As per ———– , only purchased goodwill can be shown in the Balance Sheet.

a) AS 37

b) AS 26

c) Section 37

d) AS 37

Answer

B

Question. At the time of admission of a partner, Employees Provident Fund is:

a) Distributed to partners in the old profit sharing ratio

b) Distributed to partners in the new profit sharing ratio

c) Adjusted through gaining ratio

d) None of the above

Answer

D

Question. The firm of P, Q and R with profit sharing ratio of 6:3:1, had the balance in General Reserve Account amounting Rs. 1,80,000. S joined as a new partner and the new profit sharing ratio was decided to be 3:3:3:1. Partners decide to keep the General Reserve unchanged in the books of accounts. The effect will be:

a) P will be credited by Rs. 54,000

b) P will be debited by Rs. 54,000

c) P will be credited by Rs. 36.000

d) P will be credited by Rs. 36,000

Answer

A

Question. Which of the following is not true with respect to Admission of a partner?

a) A new partner can be admitted if it is agreed in the partnership deed.

b) If all the partners agree, a new partner can be admitted.

c) A new partner has to bring relatively higher capital as compared to the existing partners

d) A new partner gets right in the assets of the firm

Answer

C

Question. Which statement is true with respect to AS-26?

a) Purchased goodwill can be shown in the Balance Sheet

b) Revalued goodwill can be shown in the Balance Sheet

c) Both purchased goodwill and revalued can be shown in the Balance Sheet

d) None of the above

Answer

A

Question. Where Accumulated Losses are transferred to ?

Answer

Debit side of Partners’ Capital Accounts.

Question “Retiring partner is not liable for firm’s acts after his retirement”. Is the statement True or False?

Answer

False

Question. State any one purpose of admitting a new partner in a firm.

Answer

Needs for more capital for expansion of business.

Question At the time of admission, old partnership comes to an end”. Is the statement true or false?

Answer

True

Question. When the interest of Partners towards the Partnership firm changes, it is called ____________

Answer

Re-constitution of Partnership Firm.

Question. Pawan and Jayshree are partners. Bindu is admitted for 1/4th share. State the ratio in which Pawan and Jayshree will sacrifice their share in favour of Bindu?

Answer

Old Ratio, i.e., 1 : 1.

Question. Sacrificing Ratio = ______________

Answer

Old Ratio – New Ratio.

Question. Under ———- method ,goodwill is the excess of capitalized value of business over actual capital employed.

Answer

Capitalisation of average profit

Question. List any one item that need adjustment in the books of accounts of a firm at the time of admission of a partner.

Answer

Goodwill.

Question. State the ratio in which the partners share profits or losses on revaluation of assets and liabilities,when there is a change in profit sharing ratio amongst existing partners.

Answer

Old profit sharing ratio.

Question. The value of goodwill is based on ———– judgment of the valuer .

Answer

Subjective

Question “A newly admitted partner cannot pay his share of the goodwill to the sacrificing partners privately”. Is the statement True or False?

Answer

False

Question. How will you treat the Accumulated loss at the time of change in profit sharing ratio?

Answer

Accumulated loss will be debited to All Partners’ Capital Account.

Question. .When the value of goodwill of the firm is not given but has to be inferred on the basis of the net worth of the firm ,it is called……………..

Answer

Hidden goodwill

Question. At the time of admission of a partner undistributed profits appearing in the balance sheet of the old firm is transferred to the Capital account of :

Answer

Old Partners in Old Profit Sharing Ratio.

Question. State the ratio in which the partners share the accumulated profits when there is a change in the profit sharing ratio amongst existing partners.

Answer

Old profit sharing ratio.

Question. Goodwill is not valued during ………….

Answer

Dissolution of the firm

Question. Gaining Ratio = ______________

Answer

New Ratio – Old Ratio.

Question “Unless agreed otherwise, Sacrificing Ratio of the old partners will be the same as their Old Profit Sharing Ratio”. Is the statement True or False?

Answer

True

Question. If Super profit of a firm is 10,000,its value of goodwill will be ………….if rate of return is 8

Answer

1,25,000

Question. State the ratio in which the partners share the gain or loss on revaluation of assets and liabilities.

Answer

Old profit sharing ratio.

Question. The account which is prepared to record the adjusting amount of Assets and Liabilities :

Answer

Revaluation Account.

Question. X and Y are partners. Y want to admit his son K into business. Can K become the partner of the firm ? Give reason.

Answer

Yes, if all partner are agree and he is not a minor.

Question. Give any one circumstance in which sacrificing ratio may be applied.

Answer

Change in profit sharing ratio of existing partners.

Question. In case Revaluation Account is prepared, the assets and liabilities appear in the books of reconstituted firm at their __ value.

Answer

Revalued figure.

Question. Where Accumulated Profits are transferred to?

Answer

Credit side of Partners’ capital Accounts.

Question. When the new partner brings cash for Goodwill, the amount is credited to which account ?

Answer

Premium for Goodwill Account.

Question. Give the formula for calculating Gaining Share of a partner in a partnership firm.

Answer

Gaining Share = New Share – Old Share

Question. Unless given otherwise, what will be the ratio of sacrifice of old partners in case of admission of a new partner ?

Answer

In old profit sharing ratio of old partners.

Question. State any one circumstance other than

(i) death of a partner,

(ii) admission of a partner and

(iii) retirement of a partner when need for valuation of goodwill of a firm may arise.

Answer

When the firm is amalgamated with another firm.

Question. Where is the balance of Revaluation Account transferred to ?

Answer

Partners’ Capital Accounts.

Question. What is the nature of Revaluation Account ?

Answer

Nominal Account.

Question. When a new partner is admitted, the balance of ‘General Reserve’ appearing in the Balance Sheet at the time of admission is credited to which account ?

Answer

Capital Accounts of old Partners.

Question. Kabir and Farid are partners sharing profits and losses in the ratio of 7 : 3. Kabir surrenders 2/10th from his share and Farid surrenders 1/10th from his share in favour of Jyoti, a new partner. Calculate New Profit Sharing Ratio and Sacrificing Ratio.

Answer

Calculation of Surrendered Share : Old ratio =7 : 3

Question. Under what circumstances will the premium for Goodwill paid by the incoming partner not be recorded in the books of accounts ?

Answer

When premium for Goodwill is brought and paid privately.

Question. The ratio in which old partners gain or loss arising from revaluation of assets and reassessment of liabilities.

Answer

Old Profit Sharing Ratio.

Question. Location of business does not affect the goodwill of business.

Answer

False

Question. “Average profit method” takes into consideration the future maintainable profits.

Answer

True

Question. Goodwill can be sold in part.

Answer

False

Question. Purchased goodwill may arise on acquisition of an existing business concern.

Answer

True

Question. Self-Generated goodwill is recorded in the books of accounts as some consideration is paid for it

Answer

False

Question. Goodwill is a fictitious asset

Answer

False

Question. Goodwill is valued during dissolution of a firm

Answer

False

Question. State the reason of contributing goodwill by a new partner at the time of his admission.

Answer

To compensate the old partners for their sacrifice of share of profit.

We hope the above multiple choice questions for Class 12 Accountancy for Chapter 3 Reconstitution of a Partnership Firm Admission of a Partner provided above with answers based on the latest syllabus and examination guidelines issued by CBSE, NCERT and KVS are really useful for you. Reconstitution of a Partnership Firm Admission of a Partner is an important chapter in Class 12 as it provides very strong understanding about this topic. Students should go through the answers provided for the MCQs after they have themselves solved the questions. All MCQs have been provided with four options for the students to solve. These questions are really useful for benefit of class 12 commerce students. Please go though these and let us know if you have any feedback in the comments section.