Notes for Class 11 Accountancy Chapter 11 Accounts from Incomplete Records

Students can refer to Notes for Class 11 Accountancy Chapter 11 Accounts from Incomplete Records given below. These notes have been prepared keeping into consideration the latest syllabus and examination guidelines issued by CBSE and NCERT. Class 11 Chapter 11 Accounts from Incomplete Records Notes is important to understand the topic and solve all questions given in DK Goel Class 11 Textbook

“A system of book-keeping in which, as a rule, only records of cash and of personal accounts are maintained, it is always incomplete double entry system, varying with circumstances”

Unit at a Glance:

• Introduction

• Salient features

• Uses

• Limitations

• Difference between double entry system and incomplete records

• Ascertainment of profit or loss from incomplete records

• Conversion into double entry method

• numerical exercises

Introduction:

Accounting records which are not prepared in accordance with double entry system method are described as accounts for incomplete records.

SALIENT FEATURES

1. Apply of personal accounts only ( ignores nominal and real accounts)

2. Maintenance of cash book.( Cash book is prepared )

3. Based on original vouchers. (Collection of data is made with original vouchers)

4. Lack of Similarity. (Method of preparation of books differs from firm to firm, it prepared as per the need of the business.

5. Preparation of final accounts. (After converting the information into double entry system final accounts are prepared. Due to this Statement of affairs is prepared instead of Balance sheet)

Uses

1. Easy method (Not requires any specific knowledge)

2. Economical( Can be prepared by without having more staff)

3. Suitable for small concerns (Few assets and liabilities are to be recorded)

4. Not – rigid (Can be modified/changed as per requirement of business)

5. Easy finding of profit & losses. (Only opening and Closing capital is required)

Limitations

1. Impossible to find fraud (As Trial balance is ignored)

2. Incomplete system (No set rules are followed)

3. Unable to find adequate profit & losses. (Ignorance of nominal accounts)

4. Difficulty in preparation of balance sheet.(Lack of valuation of goodwill)

5. Unable to retain full control on asserts. (Real accounts are ignored, it is difficult to make full control on assets)

6. Unsuitable for planning in control(Lack of reliable figure)

7. Lack of internal checking(Fails to adopt double entry system)

8. Improper evaluation of asserts (Ignorance of certain information like depreciation etc.)

DIFFERENCE BETWEEN DOUBLE ENTRY SYSTEM & INCOMPLETE RECORDS

Basis of difference

Recording of both aspects (Double entry records every transaction and incomplete records few transactions)

1. Type of accounts (All accounts are considered in double entry only personal account are considered in incomplete records)

2. Trial balance (Trial balance is prepared in double entry system,Trial balance is not prepared in incomplete records )

3. Net profit/ loss (Profit/Loss is calculated by preparing trading and profit &loss a/c in double entry system, Statement of profit is prepared in incomplete records to find the same.

4. Financial position (Balance sheet is prepared in double entry and statement of affairs is prepared in incomplete records)

5. Adjustment (Adjustment are considered in double entry ,while adjustments are not considered in incomplete records)

ASCERTAINMENT OF PROFIT OR LOSS FROM INCOMPLETE RECORDS

1. Statements of affairs method

2. Conversion into double entry method

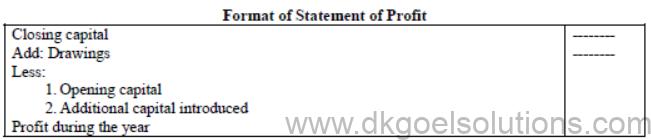

Statement of affairs method: Under this method Opening and Closing capital is calculated.

Then statement of profit is prepared to find profit/loss during the year.

Example:

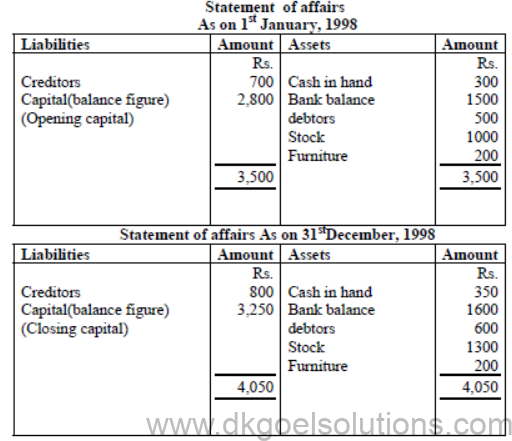

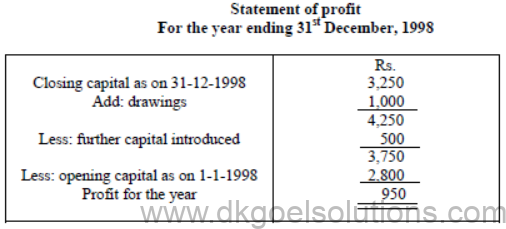

Mr. Ramesh,the owner of a mobile shop maintains incomplete records of his business. He wants to know the result of the business in 31stDec. 1998 and for that following information are available:

During the year he had withdrawn Rs.1000 for his personal use and invested Rs.500 as additional capital. Calculate his profit on 31st Dec, 1998.

SOLUTION:

Points to be remembered: If opening capital is given but closing capital is not given, only one statement of affairs will be prepared to find closing capital.

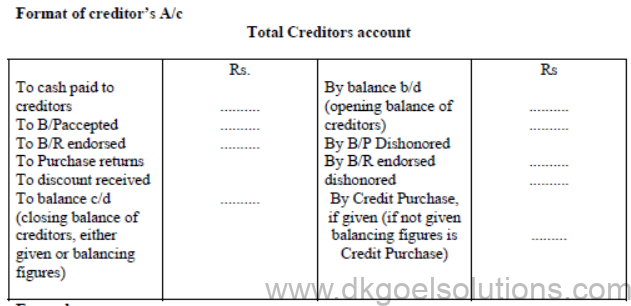

Conversion into double entry method: Under this method following steps are made :

1. Opening of statement of affairs

2. Preparation of subsidiary.

3. Opening of others account like debtors account.

Example: Find out credit and total purchases from the following particulars:

Generally commits these mistakes ,please avoid:

1. Do not forget to find opening/closing capital

2. Creditors has credit balance

3. Debtors has debit balance

4. Deduct additional capital from statement of profit while finding profit or loss.

Numerical question:

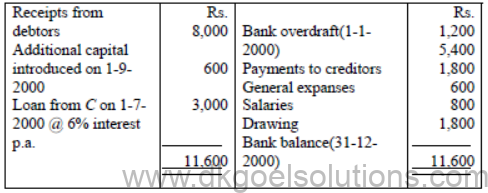

Q.1 AB Company keeps incomplete records. During 2000 the analysis of his cash book was as under:

On 1st Jan, 2000, The Following Balances were Recorded: Building Rs.5,000; Stock Rs. 3,600; Debtors Rs.10,600 And Creditors Rs.3,000.

The Balances On 31st Dec, 2000were: Debtors Rs.12,000; Building Rs.5,000; Creditors Rs.3,800 And Stock Rs.5,200.

Allow 5% Depreciation On Building. Provide Interest in C‘S Loan for Six Months. Prepare Trading, Profit And Loss Accounts and Balance Sheet on 31-12-2000

Answer:

1. Credit sales Rs.9,400

2. Credit purchase Rs.6,200

3. Opening Capital Rs.15,000

4. Gross profit Rs.4,800

5. Net profit Rs.2060

6. Balance sheet Rs.23,750

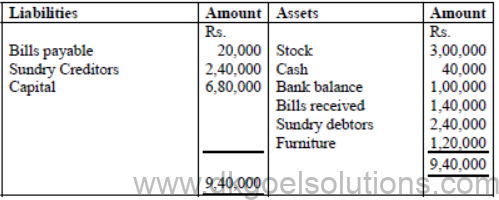

Q.2 Dr. Man Mohan maintains incomplete records. His accounts on 31st December 2005 were as follows:

During the six months ended 30th June, 2006 his position was as follows:

(i) His cash position improved by Rs.20,000 the bank balance was as Rs.1,00,000.

(ii) Stock decreased to Rs. 2,60,000 and debtors reduced by Rs.40,000.

(iii)Sundry creditors were the same as on 31st Dec, 2005.

(iv) There was no bills payable outstanding.

(v) The balance of the furniture was Rs.70,000 (Furniture costing Rs.50,000 was sold for Rs. 40,000)

(vi) There was no change in bills receivable.

The furniture was sold on 30th June, 2006. It was estimated that furniture depreciated during the period @10%p.a. of the original cost.

From the above information calculate Profit or Loss of Dr. Man Mohan` and also prepare his final statement of affairs.

Answer: Closing capital Rs.5,90,000, Net loss Rs.93,500. Total of final statement of affairs Rs.8,26,500

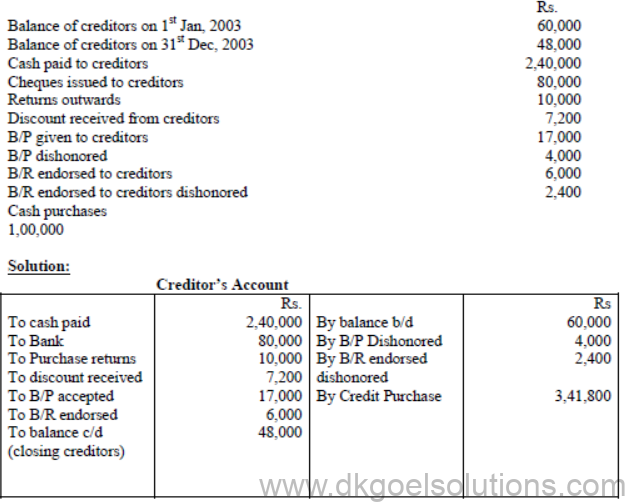

Q.3. From the following information are given of an accounting year:

1. Opening creditor Rs.10,000

2. Cash paid to creditors Rs.30,000

3. Return out ward Rs.2,000

4. Closing creditors Rs.24,000

5. Calculate credit purchase during the year.

Answer: Credit purchase Rs.46,000