Notes for Class 11 Accountancy Chapter 3 Recording of Transactions I

Students can refer to Notes for Class 11 Accountancy Chapter 3 Recording of Transactions I given below. These notes have been prepared keeping into consideration the latest syllabus and examination guidelines issued by CBSE and NCERT. Class 11 Chapter 3 Recording of Transactions I Notes is important to understand the topic and solve all questions given in DK Goel Class 11 Textbook

Unit at a Glance :

• Meaning of accounting equation

• Classification of transactions

• Rules of debit and credit

• Meaning of Source documents

• Meaning of voucher

• Meaning of journal

• Meaning and types of cash book

• Purchase journal

• Sales journal

• Purchase return journal

• Sales return journal

• Questions

Accounting Equation :

Total Assets = Total Liabilities Or

Total Assets = Internal Liabilities + External Liabilities Or

Total Assets = Capital + Liabilities

Classification of Transactions

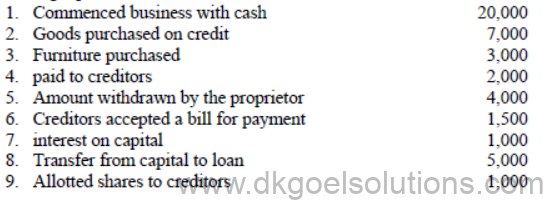

Following are the nine basic transactions:

- Increase in assets with corresponding increase in capital.

- Increase in assets with corresponding increase in liabilities.

- Decrease in assets with corresponding decrease in capital.

- Decrease in assets with corresponding decrease in liabilities.

- Increase and decrease in assets.

- Increase and decrease in liabilities

- Increase and decrease in capital

- Increase in liabilities and decrease in capital

- Increase in capital and decrease in liabilities.

Illustration :

Show the effect of the following business transactions on assets, liabilities and capital through accounting equations:

Solution

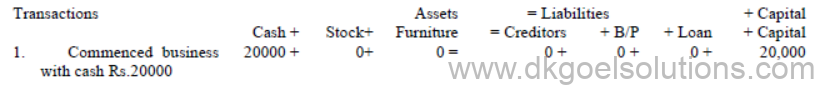

Question for Practice:

Prepare Accounting equation on the basis of following information:

Q. How the assets liabilities and capital will be affected under following cases:

(1) Purchase of building for cash

(2) Purchase of furniture on credit

(3) Receipt of commission

(4) Payment to creditors.

Generally Students commit these mistakes please avoid :

• Treatment of adjustment in accounting equation

• Dual or triple effect of transaction

• Omission in recording amount

• Interest on capital and drawing

• Debit and credit should be done properly

• Depreciation must be treated properly.

RULES OF DEBIT AND CREDIT

(I) Traditional or English Approach: This approach is based on the main principle of double entry system i.e. every debit has a credit and every credit has a debit. According to this system we should record both the aspects of a transaction whereas one aspect of a transaction will be debited and other aspect of a transaction will be credited.

(1) Personal Account: Debit the receiver and credit the giver.

(2) Real Account: Debit what comes in and credit what goes out.

(3) Nominal Account: Debit all expenses and losses credit all incomes and gains.

(2) Modern or American Approach: This approach is based on the accounting equation or balance sheet. In this approach accounts are debited or credited according to the nature of an account. In a summarised way the five rules of modern approach is as follows:

1. Increase in asset will be debited and decrease will be credited.

2. Increase in the liabilities will be credited and decrease will be debited.

3. Increase in the capital will be credited and decrease will be debited.

4. Increase in the revenue or income will be credited and decrease will be debited.

5. Increase in expenses and losses will be debited and decrease will be credited.

SOURCE DOCUMENTS

Meaning of Source documents:

Business transactions are recorded in the books of accounts on the basis of some written evidence called source document.

Common Source documents are Cash Memo, Invoice or Bill, Receipts, Debit Note, Credit Note, Cheque, Pay in slip

Meaning of Voucher:

Voucher is a source by which we record the transactions.

Meaning of Journal:

Journal is a book of prime entry in which transactions are copied in order of date from a memorandum or waste book.

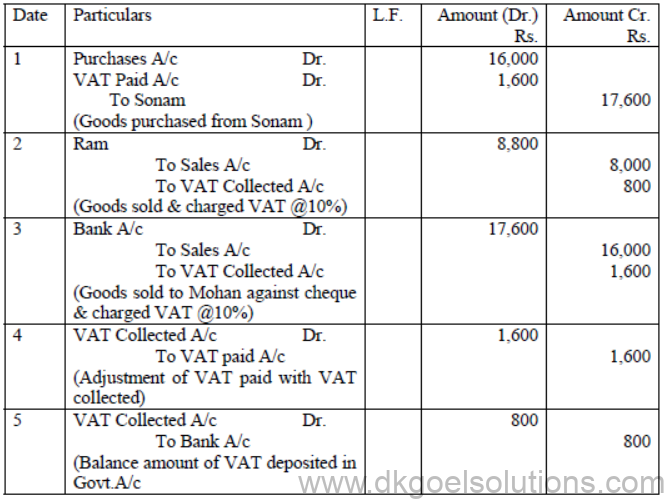

Illustration:

Journalise the following transactions in the books of Ravi:

1. Bought goods from Sonam Rs. 20,000 less trade discount 20% plus VAT @ 10%.

2. Sold goods costing Rs. 6,000 to Ram for Rs. 8,000 plus VAT @ 10%

3. Sold the balance goods for Rs. 16,000 and charged VAT @ 10% to Mohan against payment by cheque which was banked on the same day.

4. Deposited the VAT into government account by cheque.

Solution:

Question for Practice:

Journalise the following transactions:

- Paid sales tax Rs. 5,000.

- Sold goods for Rs. 80,000 to Diwan for cash and charged 8% sales tax.

- Purchased goods from Neelam for Rs. 50,000 plus VAT @ 10%

- Sold goods to Punam worth Rs. 80,000 plus VAT @ 10%.

- VAT was deposited into Government Account on its due date.

- Paid Income Tax Rs. 7,000.

CASH BOOK

Meaning: Cash book is a book in which all the transactions related to cash receipts and cash payments are recorded.

Types of Cash book:

1. Single Column Cash Book

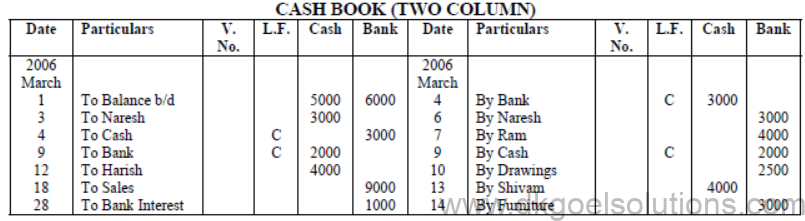

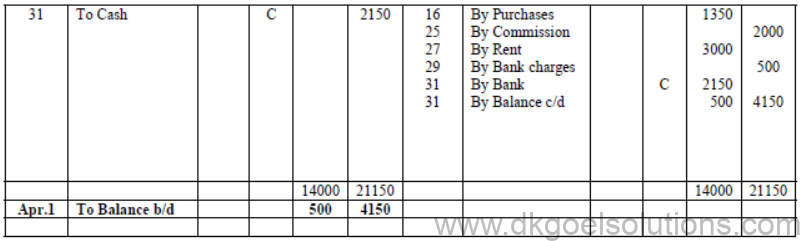

2. Double Column Cash Book

3. Petty Cash Book

Single Column Cash Book:

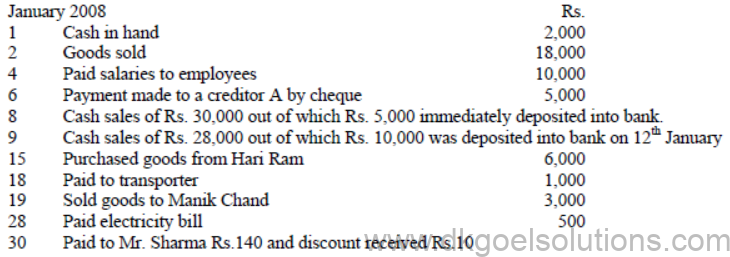

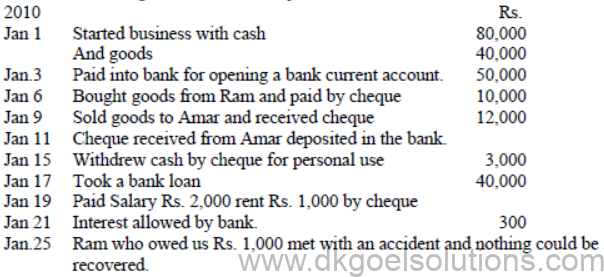

Illustration:

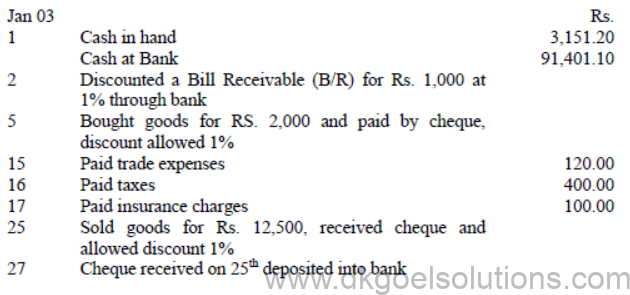

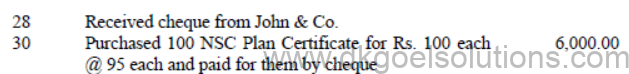

Enter the following transactions in a single column cash book for the month of January 2008 from the following particulars:

Solution :

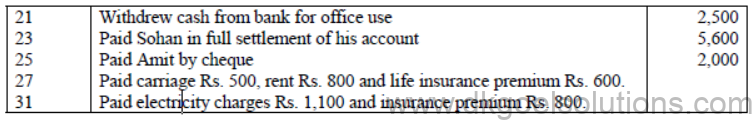

Question for Practice: Enter the following transactions in the cash book

Solution

Question for Practice:

Enter the following transactions in the cash book with cash and bank column of Rao & Sons.

PETTY CASH BOOK

Meaning

Petty Cash Book is the book which is used for the purpose of recording expenses involving petty amounts.

Recording of Petty Cash

Petty cash given to the Petty Cashier for small payments is recorded on the credit side of the Cash Book as ‘By Petty Cash Account’ and is posted to the debit side of the Petty Cash Account in the Ledger.

System of Petty Cash

Petty Cash Book may be maintained by ordinary system or by imprest system.

Imprest System

Under this system an estimate is made of amount required for petty expenses for a certain period.

Types of Petty Cash Book

1. Simple Petty Cash Book and

2. Petty Cash Book.

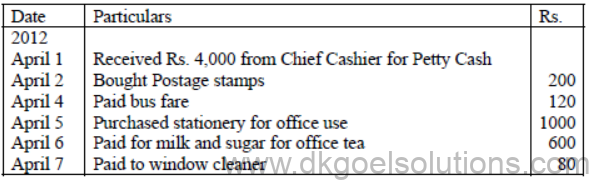

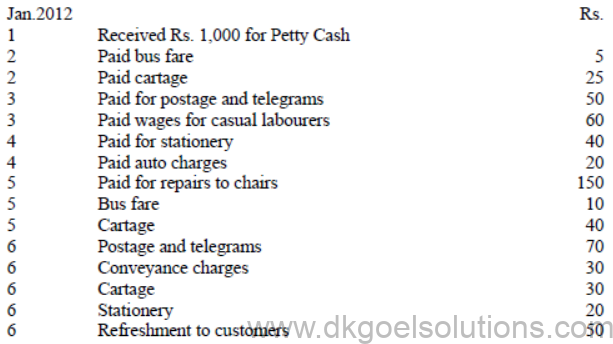

Illustration: From the following information, write up a Simple Petty Cash Book for the first

week of April 2012 :

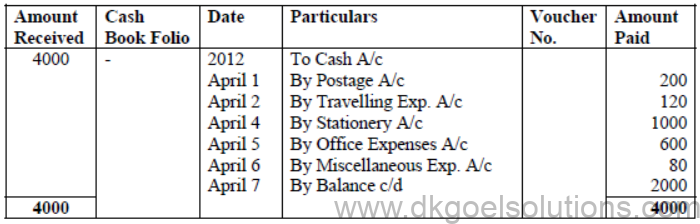

Solution:

Illustration: Prepare an Analytical Petty Cash Book on the Imprest System from the following:

Solution:

In the Books of_______________

PETTY CASH BOOK

SPECIAL PURPOSE BOOKS

Purchases Book:

It is a book in which all the credit purchases of goods are recorded.

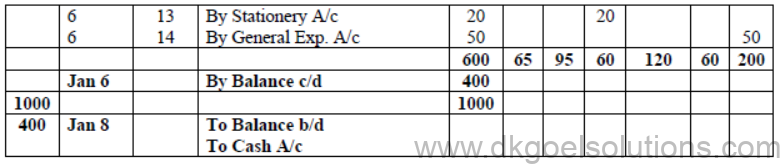

Illustration:

Enter the following transactions in the Purchases Book of Rozer Electronics Delhi.

Solution :

In the books of Rozer Electronics, Delhi

Question for Practice

From the following information prepare the Purchase Book of Moon Light House Gurgaon.

2007

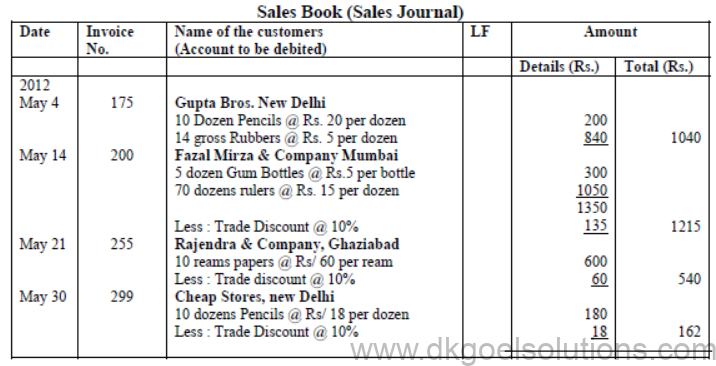

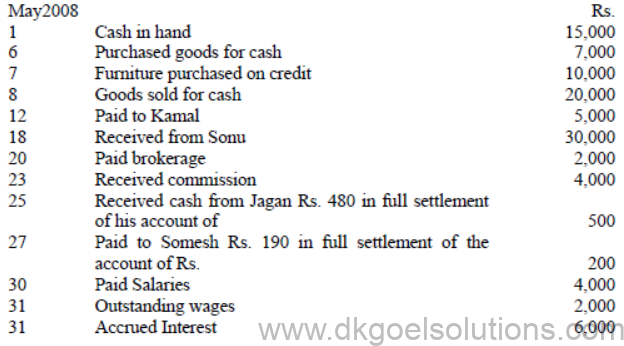

Sales Book

Meaning of Sales Book:

Sales Book or Sales Journal is a book in which all the credit sales of goods are recorded. Recording in Sales book is done on the basis of invoice issued to the customers.

Illustration:

Enter the following transactions in the Sales book of M/s Salim & Co. Hyderabad

2012

Solution:

Question for Practice :

Record the following transactions in the sales book of Sunny Furniture, Mumbai

2010

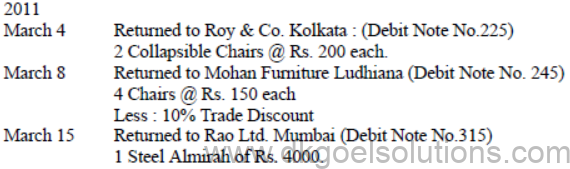

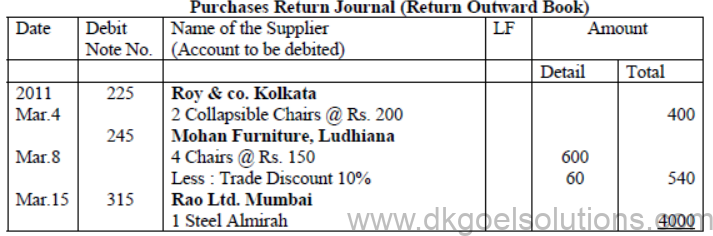

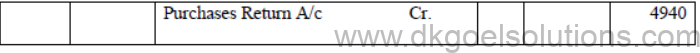

Purchases Return Book

This book is used to record return of goods which has been purchased earlier on credit basis.

Illustration:

Prepare purchase return book from the following transactions:

Solution :

Question for Practice:

Enter the following transactions in the Purchase Return Book of Maya Sharma.

2006

April 8 Returned goods to Sudha Ltd for Rs. 15,000 as the goods were not according to specifications. (Debit Note No. 214)

April 15 Allowance claimed from Ravi Taneja, on account of mistake in the invoice Rs. 800 (Debit Note No. 226).

April 26 Returned goods to Ankit and Sons for Rs. 4000. Trade discount 20% (Debit Note No. 252).

Sales Return Book

Meaning: Sales return book is a book in which sales return of goods are recorded.

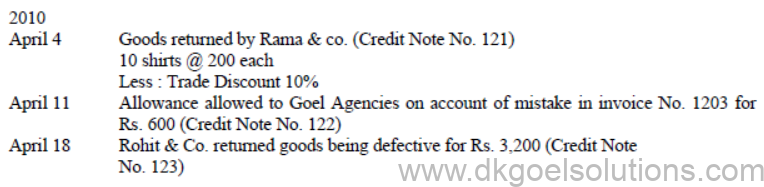

Illustration:

From the following information prepare Return Inward Book

2004

Solution :

Question for Practice:

Prepare Sales Return Book of Mohan Lal & Sons. Dehradun from the following transactions :

Questions for practice:

- Prepare Accounting equation :

- Started business with cash Rs. 3,30,000

- Commission received Rs. 22,000

- Interest received in advance Rs. 1,100.

- Salary paid Rs. 22,000

- Prepaid rent Rs. 4,400.

- Accrued commission Rs. 3,300

- Wages outstanding Rs. 11,000.

Ans. Total after final equation = 3,14,600

A= C + L

3,14,600= 3,02,500+ 12,100

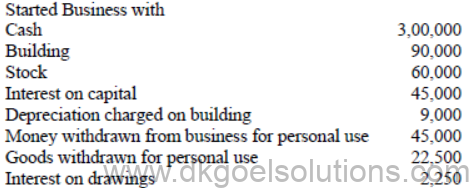

2. Show the effect of the following business transactions on assets, liabilities and capital with the help of accounting equation

Ans. Total after final equation 32,760

A = C + L

32,760 = 18720 + 14040

3. Prepare Accounting Equation for the following :

Ans. Total after final equation 3,73,500

A = C + L

3,73,500 = 3,73,500 + 0

4. Write Rules of Debit and Credit.

5. What is a Voucher ?

6. Define Journal ?

7. Enter the following transactions in the journal of Mohan:

8. Pass journal entries in the books of Shyam :

9. Journalise the following transactions:

10. Enter the following transactions in a One Column Cash Book.

Ans. 81,880.

11. Enter the following transactions in a One Column cash book.

Ans. 51,290.

12. Record the following transactions in a Cash Book with Cash and Bank Columns:

Ans. Cash = 12,995, Bank 700

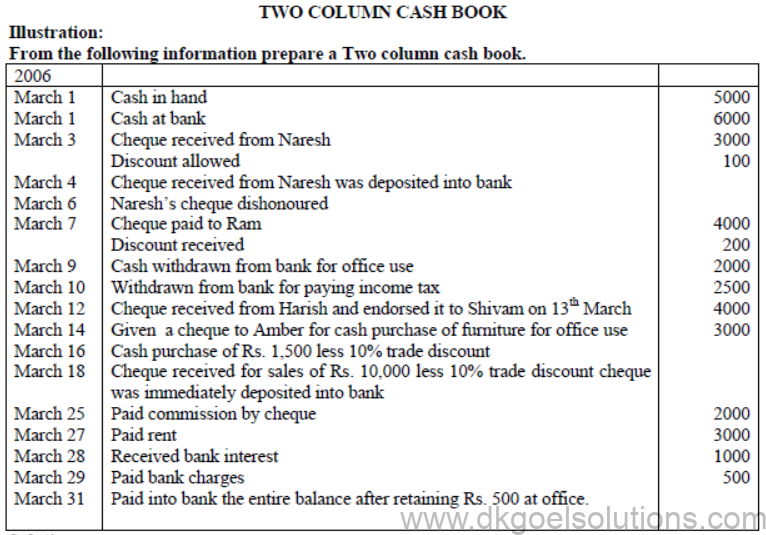

13. From the following information prepare Two Column Cash Book

Ans Cash 22,100 Bank 31,000

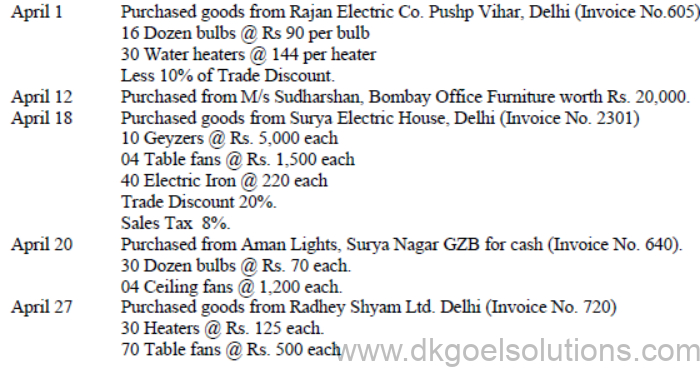

14. Enter the following transactions in the purchases book.

1. Purchased from Rajendra Bros. Mahendrgarh (Invoice

No. 324)

50 tins Ghee @ Rs. 500 per tin

100 bags sugar @ Rs. 900 per bag

Less : 10% trade discount

2. Bought from Bhartat Stores, Madurai (Invoice No.

377)

20 bags Gram @ Rs. 300 per bag

10 bags Sugar @ Rs. 1000 per bag

15 bags wheat @ Rs. 400 per bag

Less : 10%Trade Discount

30 Bought from Harish Kumar Chaudhary, Kotihar

(Invoice No. 390)

10 bag sugar @ Rs. 1000 per bag

30 tins Ghee @ Rs. 400 per tin

Ans. Total Purchases Book Rs. 1,45,300

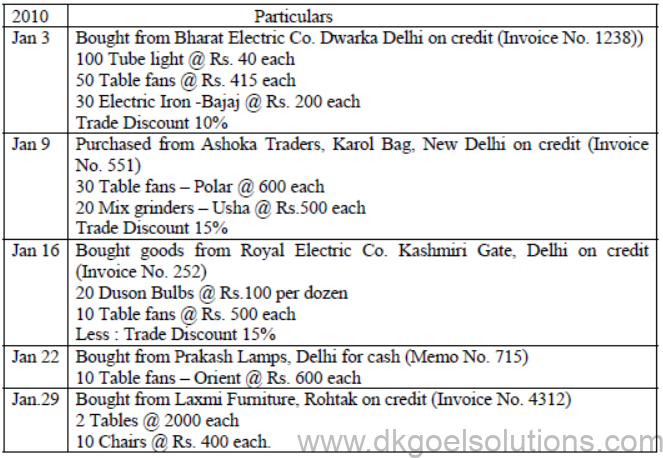

15. Enter the following transactions in the Columnar Purchases Book of Sudarshan Chavda :

2011

May 1 Purchased from Suresh Gupta, Jaipur (Invoice No.

2680)

100 bags wheat @Rs. 400 per bag

50 bags Gram @ Rs. 450 per bag

200 bags sugar @ Rs. 900 per bag

May 5 Bought of Virendra Vig. Delhi (Invoice No.2015)

100 bags wheat @ Rs. 400 per bag

100 bags Gram @ Rs. 450 per bag

May 8 Surendra Gupta, Agra sold to us : (Invoice No. 2950)

100 bags sugar @ Rs. 900 per bag

May 9 Rajesh Kumar, Dehradun sold to us (Invoice No. 350)

200 bags wheat @ Rs. 460 per bag.

Ans. Total of Purchases book Rs. 5,09,500

From the following particulars of Baljinder Flour Mills prepare a Sales Book :

2005

Mar. 3 Sold to Gupta Brothers

90 Bags of Sugar @ Rs. 85 per bag

20 Quintals Rice @ Rs. 300 per quintal

Less : 10% Trade Discount

Mar.6 Sold to Jugal Furniture House

80 Chairs of Rs. 10 each

Mar.20 Sold to M/s Kunal & Sons for cash

30 qtl. wheat @ Rs. 250 per qtl.

40 Tins Oil @ Rs. 150 per tin

Mar.28 Sold to M/s Chaman and Company

120 Bags of wheat @ Rs.90 per bag.

30 Tins oil @ Rs. 200 per tin

60 Bags of rice @ Rs. 150 per bag

Less: Trade Discount = 15%.

(Ans.Total of Sales Book = Rs. 21,930)

17. From the following information of M/s Gajadhar and Sons prepare a Sales Book

2007

July 3 Sold to Mohan vide invoice No. 325, 40 kg. Assam

Tea @ 66 per kg less trade discount of 5%. VAT @

10%. Freight and Packing charges were separately

charged in the invoice at Rs. 352.

July 8 Sold to Ramanand vide (Invoice No. 426), 5 chests of

tea for Rs. 3960 less trade discount @ 10% and VAT

is charged @ 10%.

July 20 Sold to Krishna & Sons vide Cash Memo No. 845, 80

kg butter @ Rs. 200 per kg; less trade discount @ 25%

and VAT @ 8%.

`

July 26 Sold to Shivhare vide invoice No. 189, 30 packets of

Darjeeling Tea @ Rs. 110 per packet less trade

discount Rs. 220, charged VAT @ 10%.

Ans. Total of Sales Book Rs. 10,419.

- 18. Enter the following transactions in the Purchases Return Book of Sh. Mukund.

2007

Jan.20 Returned goods to Arav & Sons for Rs. 410,000

Trade Discount 10% (Debit Note No.369).

Jan.24 Allowance Claimed from Rakesh on account of mistake in the invoice

Rs. 900 (Debut Note No. 2660)

Jan.29 Returned goods to Sweksha Ltd. For Rs. 26,000 as the goods were

defective (Debit Note No.3100).

(Ans.Total of Purchase Return Book = Rs. 35,900)

19.Prepare purchase return book of Madhav Rao Furniture House

2011

Feb.1 Returned to Chanakya Co. (Debit Note No. 123)

5 Chairs @ Rs. 80 per chair

10 stools @ RS. 150 per stool

Feb.10 Returned to Goyanka Furniture Stores (Debit Note No. 178)

5 Elmira @ Rs. 100 per Elmira

8 Tables @ Rs. 70 per table

Feb.28 Returned to Ashok & Co. : (Debit Note No.199)

7 Stools @ Rs. 120 per stool

5 tables @ Rs. 100 per table

(Ans. Total of Purchase Return Book = Rs. 4,300)

20. Enter the following transactions of Tanuj & Co. in the proper books :

2012

July 5 Sold on credit to Sethi & Co. (Invoice No. 515)

10 Electronics Iron @ Rs. 25

5 Electric Stoves @ Rs. 15

July 8 Purchased on credit from Hari & Sons : (Invoice No. 601)

25 Heaters @ Rs. 40

10 Water Heaters @Rs. 20

July 10 Purchased for cash from Mohan and Co.(Invoice No. 625)

10 Electric Kettles @ Rs. 30

July 15 Sold to Gopal Bros. on credit : (Invoice No. 648)

10 Heaters @ Rs. 50

5 Water Heaters @ Rs. 25

July 18 Returned to Hari & Sons : (Debit Note No.650)

5 Heaters, being defective

July 20 Purchased from Kohli & Co. (Invoice No. 712)

10 Toasters @ Rs. 20

10 Water Heaters @ Rs.30

July Gopal Bros. returned one water heater as defective. (Credit Note

No.425)