Notes for Class 11 Accountancy Chapter 7 Depreciation, Provisions and Reserves

Students can refer to Notes for Class 11 Accountancy Chapter 7 Depreciation, Provisions and Reserves given below. These notes have been prepared keeping into consideration the latest syllabus and examination guidelines issued by CBSE and NCERT. Class 11 Chapter 5 Bank Reconciliation Statement Notes is important to understand the topic and solve all questions given in DK Goel Class 11 Textbook

Unit at a glance:

• Meaning of Depreciation

• Features of depreciation

• Causes of depreciation

• Need or objectives of depreciation

• Factors or basis for providing depreciation

• Methods of calculating depreciation

• Difference between straight line method and written down value method

• Methods of recording depreciation

• Sale of an asset

• Disposal of an asset

• Provisions and reserves

• Types of reserves

“Depreciation is gradual and permanent decrease in the value of an asset from any cause.” – Carter

Introduction:

Every fixed asset loses its value due to use or other reasons. This decline in the value of asset is

known as depreciation.

Meaning of Depreciation:

Depreciation may be described as a permanent, continuing and gradual shrinkage in the book value of fixed

assets.

Features of Depreciation:

(1) It is decline in the book value of fixed assets.

(2) It is a continuing process.

(3) It includes loss of value due to efflux ion of time, usage or obsolescence.

(4) It is an expired cost and must be deducted before calculating taxable profit.

Causes of Depreciation:

(1) Wear and tear due to use or passage of time.

(2) Obsolescence.

(3) Expiration of legal rights.

(4) Abnormal factors.

Need or Objectives of Depreciation:

(1) To ascertain the true profit or loss.

(2) For consideration of tax.

(3) To ascertain the true and fair financial position.

(4) Compliance with legal provisions.

Factors or Basis for providing Depreciation:

(1) Cost of asset.

(2) Estimated net residual value.

(3) Depreciable cost.

(4) Estimated useful life.

Methods of calculating Depreciation:

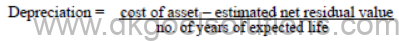

(1) Straight line method (Fixed installment method):

This method is based on the assumption of equal usage of time over asset’s entire useful life.

According to this method a fixed and equal amount is charged as depreciation in every accounting period during the life time of an asset. Depreciation amount can be calculated by the following formula:

(2) Written Down value method(Diminishing balance method):

In this method depreciation is charged on the book value of tha asset. The amount of depreciation reduces year after year.

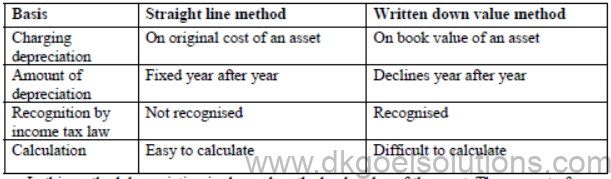

Difference between Straight line method and written down value method:

Methods of recording Depreciation:

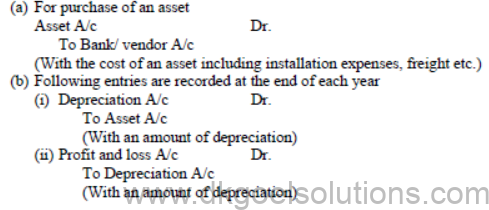

(1) When depreciation is charged to asset account:

In this method depreciation is deducted from the asset value and charged (debited) to profit and loss account. Journal entries for recording under this method are as follows.

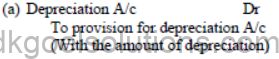

(2) When provision for depreciation/Accumulated depreciation account is maintained:

Following journal entries are recorded at the end of each year.

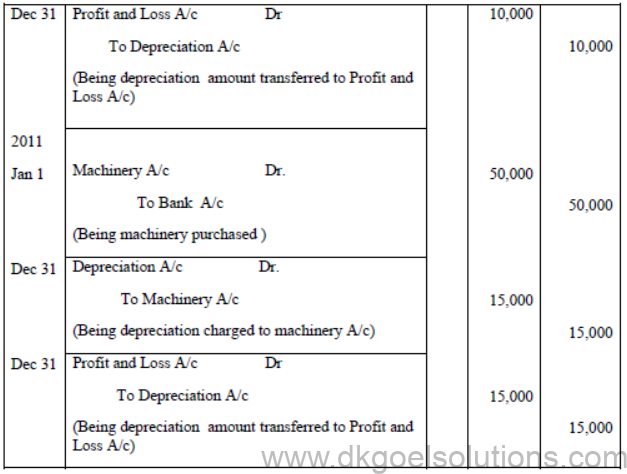

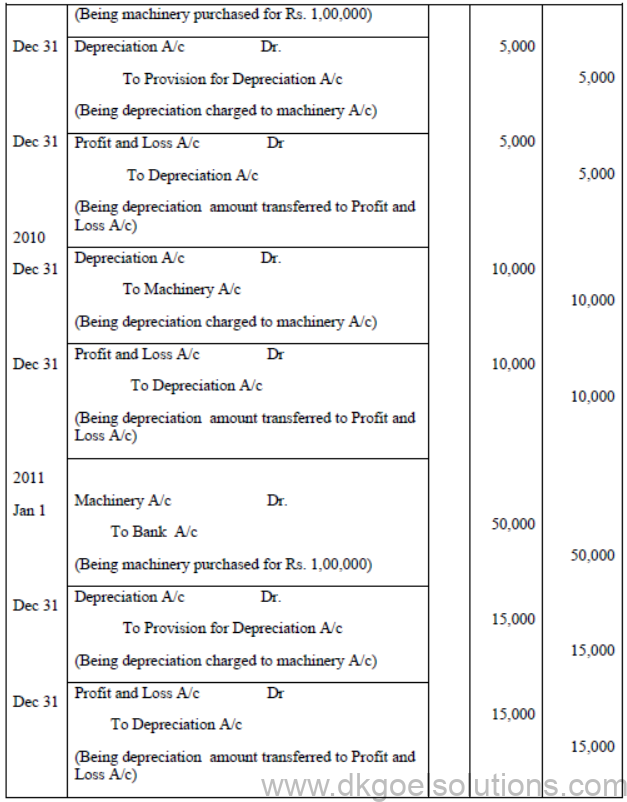

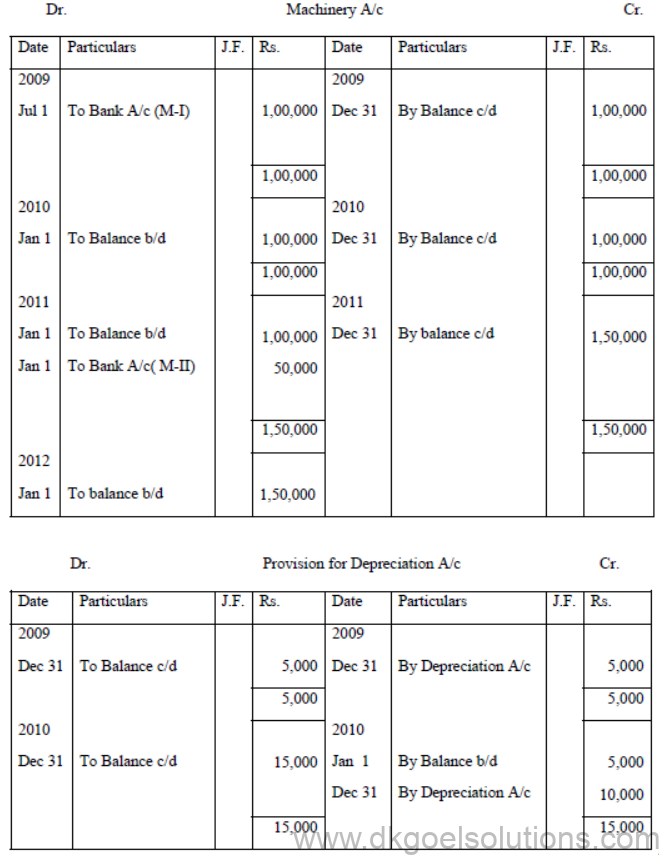

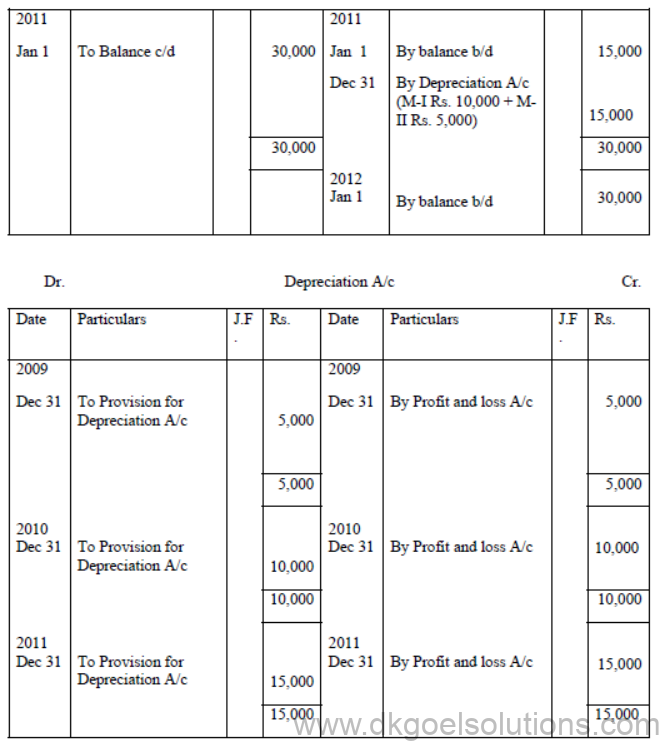

Illustration – 1. Soham purchased a machinery for Rs. 1,00,000 on 1st July, 2009. Another machine was purchased for Rs. 50,000 on 1st January, 2011. Depreciation is charged at 10% p.a. by straight line method. Accounts are closed on 31st December each year. Pass the necessary Journal entries, show machinery A/c and Depreciation A/c for the year 2009, 2010, 2011.

(a) When Provision for depreciation a/c is not maintained.

(b) When Provision for depreciation a/c is maintained

Solution:

(a) When Provision for depreciation a/c is not maintained.

(b) When Provision for depreciation A/c is maintained

Sale of an Asset

Illustration – 2. Rohan Ltd. purchased a Machinery on 1st May, 2009 for Rs. 60,000. On 1st July, 2010 it purchased another Machine for Rs. 20,000. On 31st March, 2011 it sold off the first machine purchased in 2009 for Rs. 39,000. Depreciation is provided at 20% on the original cost each year. Accounts are closed each year on 31st December. Show the Machinery account from 2009 to 2011.

Working notes:

Calculation of profit or loss on sale of machinery:

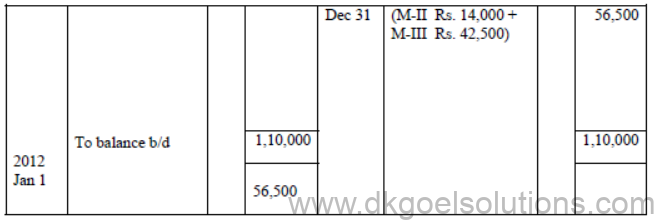

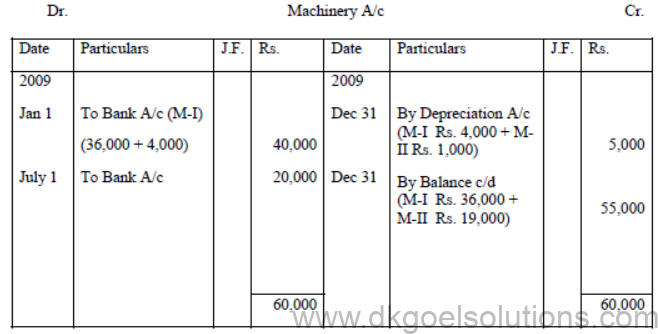

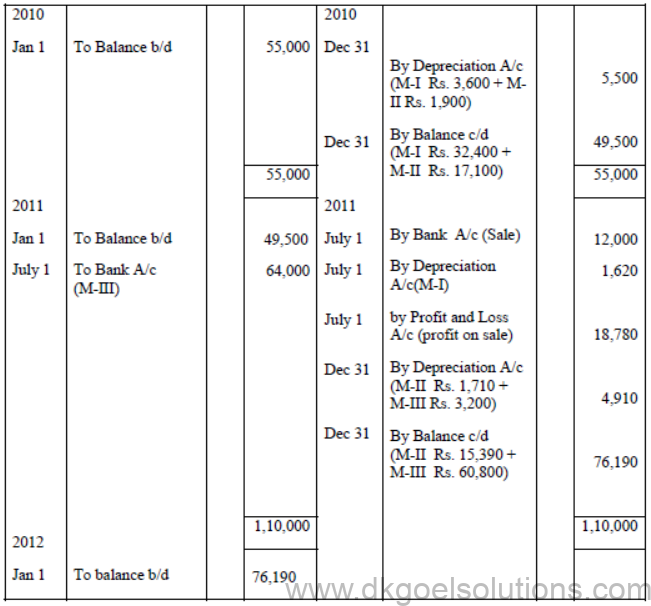

Illustration 3. Suyashi Ltd. purchased on 1st January, 2009 a machinery for Rs. 36,000 and spent Rs. 4,000 on its installation. On 1st July, 2009 another machine purchased for Rs. 20,000. On 1st July, 2011, machine bought on 1st January, 2009 was sold for Rs. 12,000 and a new machine purchased for Rs. 64,000 on the same date. Depreciation is provided on 31st December @ 10% p.a. on the written down value method. Prepare machinery A/c from 2009 to 2011.

Solution:

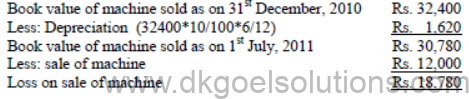

Working notes:

Calculation of Profit or loss on machine sold:

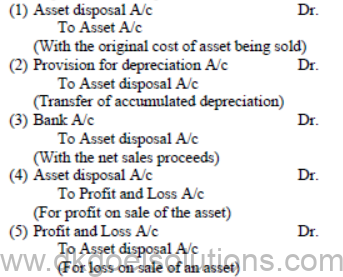

Disposal of an Asset:

Under this method a new account is opened named ‘Asset Disposal A/c’ at the time of sale of an asset. Following journal entries required for preparation of Asset Disposal A/c

(a) When provision for depreciation A/c is maintained.

(b) When provision for depreciation A/c is not maintained

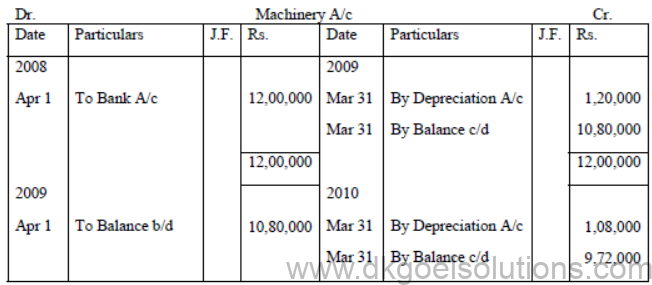

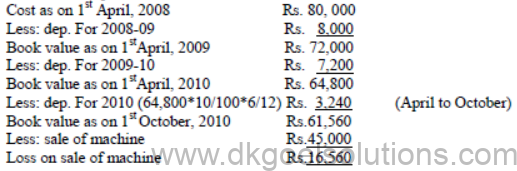

Illustration 4. On 1st April, 2008, Jasmeet Ltd. purchased a machine for Rs. 12,00,000. On 1st October, 2010, a part of machine purchased on 1st April, 2008 for Rs. 80,000 was sold for Rs. 45,000 and a new machine was purchased for Rs. 1,58,000 on the same date. Company provides depreciation @10% p.a. on written down value method. Prepare necessary ledger accounts

(a) When provision for depreciation A/c is not maintained.

(b) When provision for depreciation A/c is maintained.

Solution.

(a) When provision for depreciation A/c is not maintained.

Working notes:

Calculation of profit or loss on machine sold

Calculation of depreciation on remaining machine

Provisions and Reserves

Provisions

Provision is an amount set aside by charging (debited) it in the profit and loss account, to provide for

known liability the amount which can not be determined accurately because they are not yet incurred.

For example, Provision for Depreciation, Provision for Bad and doubtful debts etc.

Reserves

Reserves are the amount set aside out of profits. It is an appropriation of profits to strengthen the financial position of the business. For example, General reserve, Capital reserve etc.

Types of Reserves

(a) General reserve – It is the amount set aside out of profits for no specific purpose. It is available for strengthen the financial position or expansion of business.

(b) Specific reserve – This is created for specific purpose and can be utilized only for that purpose.

(c) Secret reserve – It is a reserve the existence or the amount of which is not disclosed in the balance sheet. It is also known as hidden reserve.

Distinguish between Reserves and Provisions

Questions

(1)Define Depreciation

(2) State any two causes of Depreciation

(3) Give two methods of providing Depreciation.

(4) Give two examples of provisions.

(5) What is meant by secret reserve?

(6) Which method of depreciation assumes that an asset should be depreciated more in earlier years and less in the later years of use?

(7) Depreciation cannot be provided in case of loss in a financial year. Comment.

(8) Distinguish between provisions and reserves

Numerical questions

(1) Shyam Ltd. purchased a machinery on 1st May, 2009 for Rs. 60,000. On 1st July, 2010 it purchased another machine for Rs. 20,000. On 31st March, 2011, it sold the first machine purchased in 2009 for Rs. 38,500. Depreciation provided @ 20% p.a. on the original cost every year. Accounts are closed 31st December every year. Prepare machinery A/c for three years.

[Profit on sale of machine Rs. 1,500: Balance of machine on 31st December, 2011 Rs. 14,000]

(2) The following balances appear in the books of Raghav Ltd. As on 1st April, 2006: Machine A/c Rs. 5,00,000

Provision for Depreciation A/c Rs. 2,25,000

The machine is depreciated at 10% p.a. on the original cost. The accounting year being April to March. On 1st October, 2006, a machinery which was purchased on 1st July 2003 for Rs. 1,00,000 was sold for Rs. 42,000 and on the same date a new machine was purchased for Rs. 2,00,000. Prepare machine A/c and Provision for depreciation A/c for the

year 2006-07.

[Loss on sale of machine Rs. 25,500; Balance of Provision for dep. A/c Rs. 2,47,500; Balance of machine A/c Rs. 6,00,000]

(3) Reema Ltd. Purchased on 1st on April, 2007 a machinery costing Rs. 30,000. It purchased another machinery on 1st October, 2007 costing Rs. 20,000 and on 1st July, 2008 costing Rs. 10,000.

On 1st January, 2009 1/3rd of the machinery purchased on 1st April, 2007 became obsolete and was sold for Rs. 3,000.

Show the machinery account assuming that the company’s accounting year is a calendar year. It is being given that machinery was depreciated by fixed installment method at 10% p.a. What would be the value of Machinery A/c on 1st January, 2010?

[Loss on sale of machine Rs. 5,250; Balance of machinery On 1st January, 2010 M-I (2/3) Rs. 14,500; M-II Rs. 15,500, M-III Rs. 8,500]

(4) Ankit Ltd. Purchased a machine on1st April 2006 for Rs. 1,80,000 and spent Rs. 20,000 on its installation.

On 1st January, 2007, it purchased another machine for Rs. 2,40,000. On 1st July 2008 the machine purchased on 1st April, 2006 was sold for Rs. 1,45,000. On 1st October, 2008 another machine was purchased for Rs. 3,60,000.

Prepare Machinery A/c from 2006 to 2008 after charging depreciation @ 10% p.a. by diminishing balance method. Accounts are closed 31st December each year.

[Loss on sale machine Rs. 13,175; balance of machinery A/c Rs. 5,45,500 – M-II Rs. 1,94,400; M-II Rs. 3,51,000]

(5) The following balance appears in the books of M/s. Palak Enterprise.

1st April, 2009 Machinery A/c Rs. 60,000

Provision for Depreciation A/c Rs. 36,000

On 1st April, 2009, they decided to dispose off a Machinery for Rs. 8,400 which was purchased on 1st April, 2005 for Rs. 16,000.

You are required to prepare the Machinery A/c and Machinery Disposal A/c for 2009-10.

Depreciation was charged at 10% on Original Cost Method.

[Balance of machinery A/c on 31st March, 2010 Rs 44,000; Provision for Dep. A/c on 31st March, 2010 Rs. 34,000; Loss on sale of machinery Rs. 1,200]

(6) A machinery was purchased for Rs.1,80,000 on 1st January, 2006. Depreciation was charged annually@ 10% on written down value method. 1/4th of this machinery was sold on 1st July, 2008 for Rs. 36,000. Prepare machinery A/c from 2006 to 2008, if the books are closed on 31st December each year.

[Profit on sale of machinery Rs. 412; Balance of machinery A/c on 31st December, 2008 Rs. 1,01,150]

Generally students commit the mistakes in these topics

• Time factor in calculation of depreciation.

• Estimation of profit and loss at the time of sale of asset.

• At the time of maintain provision for depreciation A/c.

• Preparation of asset disposal A/c.