Notes for Class 12 Accountancy Chapter 1 Accounting for Share Capital

Commerce students can refer to the Accounting for Share Capital Notes Class 12 Accountancy given below which is an important chapter in class 12 accountancy book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Accountancy teachers have prepared these notes for the benefit of students so that you can read these revision notes and understand each topic carefully.

Accounting for Share Capital Notes Class 12 Accountancy

Refer to the notes and important questions given below for Accounting for Share Capital which are really useful and have been recommended by Class 12 Accounts teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books for Class 12 Accounts.

Say whether the following statements are true or false:

- Equity shareholders are the creditors of the Company

Answer

(True)

2. Promoters are the owners of the Company

Answer

(False)

3. Pro rata allotment is made in case of over subscrriptions

Answer

(True)

4. Application money should not be less than 25% of the face value of shares

Answer

(True)

5. Shares cannot be issued at discount

Answer

(True)

Fill in the blanks:

- A private Ltd. Company with only one person as its members is called ………….

Answer

One person company (OPC)

2.………….. Shareholders are given dividend at a fixed rate.

Answer

Preference shareholders

3. Share capital of a company is divided into small units. Each such unit is called …….

Answer

Shares

4. Actual number of shares offered to the public for subscription is known as ………..

Answer

Issued capital

5. At the time of forfeiture of shares , Share capital account will be debited with …….. value

Answer

Called up value of shares

6. A ……….. Company is one which restricts the rigt to transfer its shares.

Answer

Private

From the given alternatives choose the right answer:

1. Who are the real owners of the Company?

a) Government

b) Board of directors

c) Equity shareholders

d) Debenture holders

Answer

C

2. Maximum number of members in a private Company is :

a) 7

b) 200

c) 20

d) No limit

Answer

B

3. In case of private placement of shares to raise capital a company:

a) Invite the public through prospectus

b) Does not invite the public

c) Invite the public through advertisement

d) None of the above

Answer

B

4. As per SEBI Guidelines , Application money should not be less than ……. ..of the issue price of each shares:

a) 10%

b) 15%

c) 25%

d) 50%

Answer

C

5. If applicants for 80,000 shares were allotted 60,000 shares on pro rata basis , the shareholders who was allotted 1,200 shares must have applied for:

a) 900 shares

b) 3,600 shares

c) 1,600 shares

d) 4,800 shares

Answer

C

6. If shares of Rs 4,00,000 are issued for purchase of assets of Rs 5,00,000, Rs 1,00,000 will be treated as ……….

a) Discount

b) Premium

c) Profit

d) Loss

Answer

B

7. Forfeiture of shares result in reduction of :

a) Subscribed capital

b) Authorised capital

c) Reserve capital

d) None of the above

Answer

A

8. If the premium on forfeited shares has already been received , then securities premium A/c should be:

a) Credited

b) Debited

c) No treatment

d) None of these

Answer

C

9. 600 shares of Rs 10 each were forfeited for non payment of Rs 2 per share on first call and Rs 5 per share on final call. Share forfeiture account will be credited with:

a) Rs 1,200

b) Rs 1,800

c) Rs 3,000

d) Rs 4,200

Answer

B

10. Issued 20,000 , 12% debenture of Rs 100 each at a premium of 4%, redeemable at a premium of 10%. In such case:

a) Loss on issue will be debited by Rs 1,20,000

b) Loss on issue will be debited by Rs 2,00,000

c) Loss on issue will be debited by Rs 2, 88,000

d) None of the above

Answer

B

Very short answer questions

Question. What is a share?

Ans: Total capital of the Company is divided in units of small denominations such as Rs 10 or Rs 100. Each such unit is called share.

Question. What do you mean by Authorised Capital of a Company?

Ans: This is the maximum capital for which a Company is authorised to issue shares during its lifetime. It is also known as Registered or Nominal capital.

Question: What is meant by Capital reserve?

Ans: Capital reserve is the reserve created out of Capital profits.

Question: What is meant by forfeiture of shares?

Ans: If any shareholder fail to pay allotment and call money within the specified period, the directors may cancel his shares. This is called forfeiture of shares.

Question: Can a Company issue a shares having face value of Rs 10 at Rs 9?

Ans: No. Under section 53 of Companies Act 2013, a Company can not issue shares at a discount

PRACTICAL QUESTIONS:

Q No1: X Ltd has an authorised capital of Rs 40, 00,000 divided into 4, 00,000 Equity shares of Rs 10 each. Out of these shares ,the Company invited application for 3,00,000 equity shares. The public applied for 2, 80,000 shares and all the money was duly received.

Show how share capital will appear in the Balance sheet of the Company. Also prepare notes to accounts.

Answer:

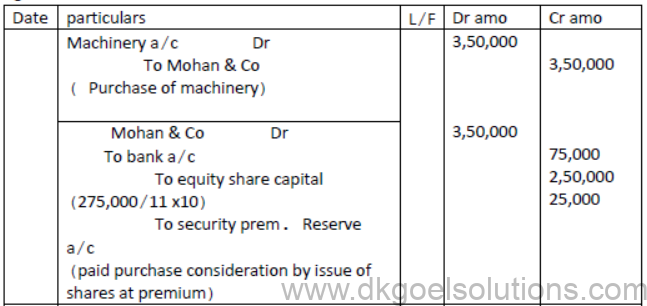

Q.no 2: Rohit Ltd purchased machinery from Mohan & Co. For Rs 3, 50,000. A sum of Rs 75,000 was paid by means of a bank draft and for the balance due Rohit Ltd issued equity shares of Rs 10 each at a premium of 10%. Pass journal entries in the books of Rohit Ltd.

Answer:

Note: Equity share capital= Amount to be paid/Issue price of shares x Nominal value of shares

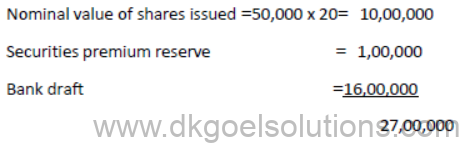

Q no 3: X Ltd took over the following assets and Liabilities of Y Ltd:

Land and building Rs 20,00,000; Stock Rs 5,00,000; Sundry debtors Rs 2,50,000 and sundry creditors Rs 2,00,000.

X Ltd paid the purchase consideration by issuing bank draft of Rs 16,00,000 and 50,000 equity shares of Rs 20 each at a premium of 10%. Calculate purchase consideration and pass journal entries in the books of X Ltd

Answer: calculation of purchase consideration:

Journal In the books of X Ltd

Q.NO 4: Ref: (partial reissue)

X Ltd forfeited 600 shares of Rs 10 each Rs 7 called up on which Mahesh has paid application and allotment money of Rs 5 per share. Out of these 400 shares were reissued to Naresh as fully paid up for Rs 6 per share. Pass journal entries for forfeiture and reissue of shares.

Answer:

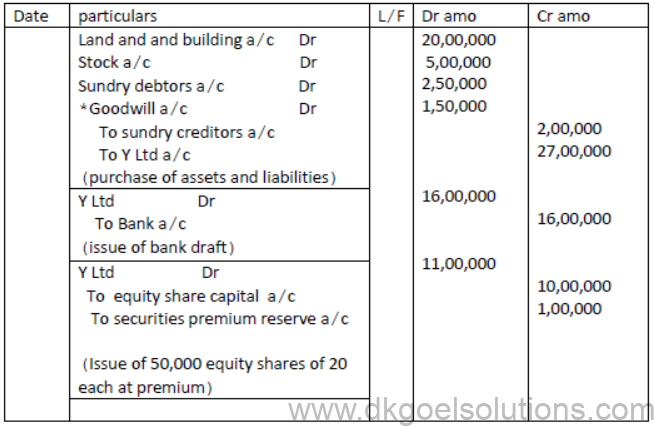

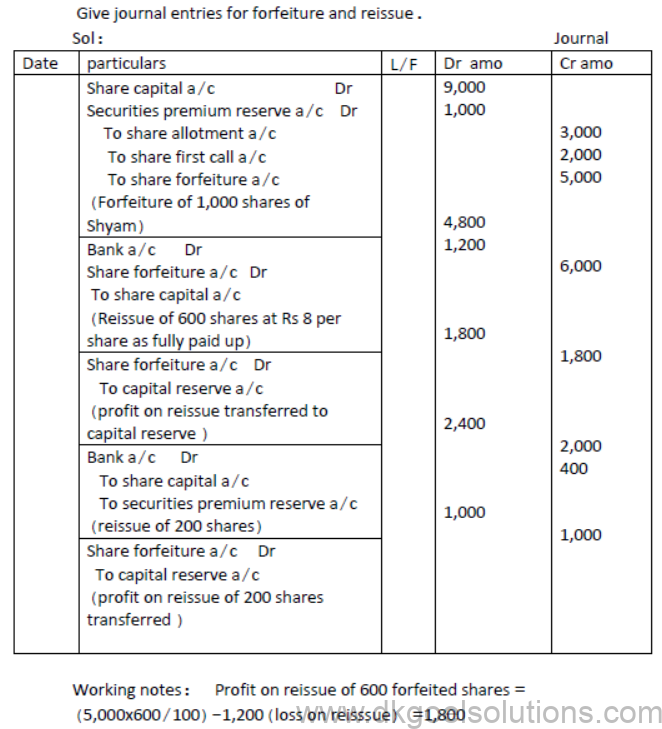

Q5: Y Ltd forfeited 1,000 shares of Rs 10 each issued at 10% premium to Shyam (Rs 9 called up) on which he did not pay Rs 3 on allotment(including premium) and on first call of Rs 2. Out of these ,600 shares were reissued to Ram as fully paid up for Rs 8 per share and 200 shares to Mohan as fully paid up @ Rs 12 at different intervals of time.

Q No6: Amrit Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows:

Rs 3 on application Rs 4 on allotment(including premium), Rs 2 on 1st call and the balance on 2nd call.

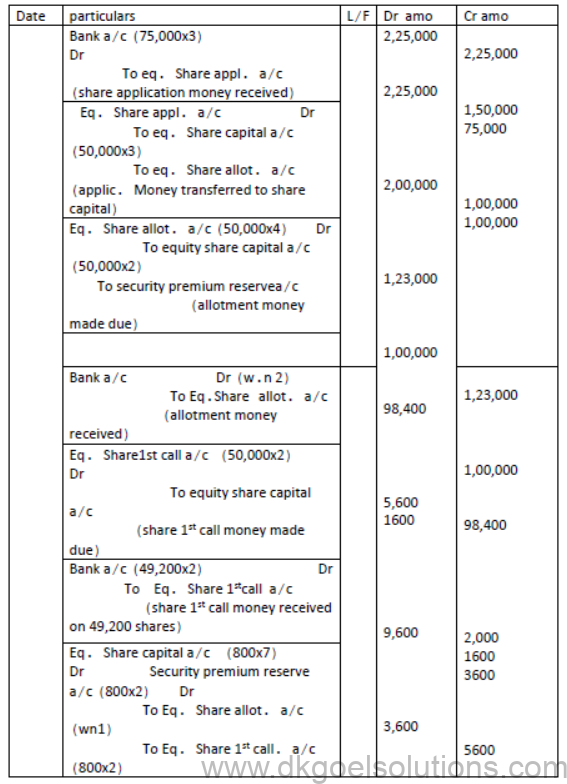

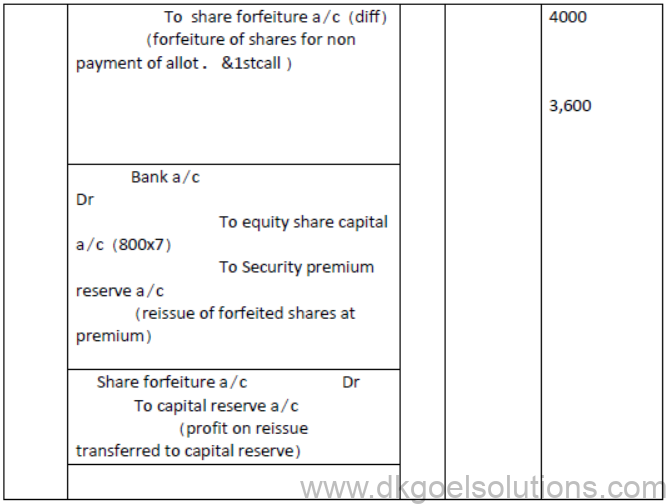

Application were received for 75,000 shares and prorate allotment was made to all the applicants. All money due were received except allotment and 1st call from Mohan who applied for 1200 shares. All his shares were forfeited. The forfeited shares were reissued for Rs 9,600. Final call was not yet made. Pass necessary journal entries.

Answer:

Workings:1. Allotment money not received:

Shares applied by Mohan = 1200 shares

Shares allotted to him =50,000/75,000 x1200 = 800 shares

Excess application money paid by Mohan = 400x 3 =1200

Allotment money due from Mohan = 800x 4 =3,200

Less : excess application money paid by him 1,200

Allotment money not received from Mohan =2,000

- Allotment money received:

Tota allotment money = 50,000 x 4 =2,00,000

Less Excess application money with the company= 25,000×3= 75,000

=1,25,000

Less : Allotment money not paid by Mohan 2,000

Total allotment received =1,23,000

3.profit on reissue of forfeited shares: 3600

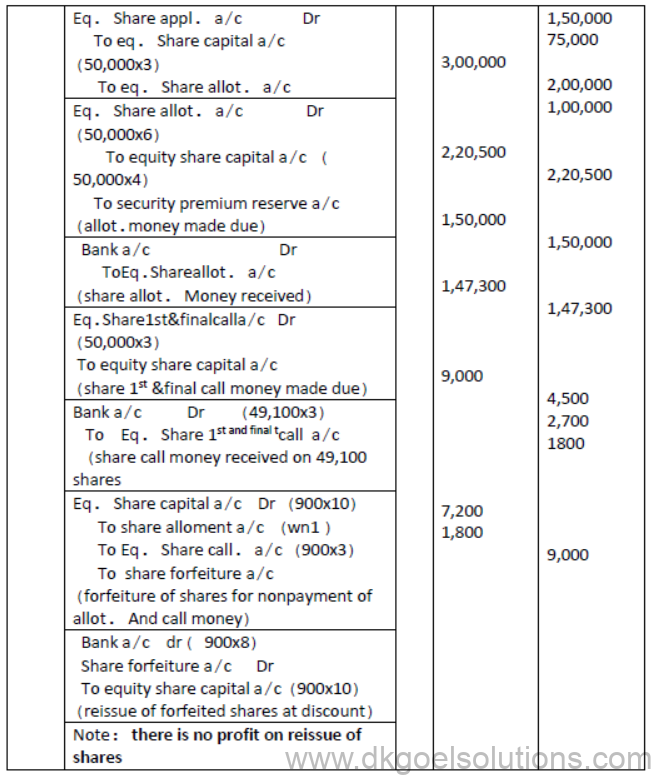

Q No 7: X Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows:

Rs 3 on application, Rs 6 on allotment (including premium) and Rs 3 on call.

Application was received for 75,000 shares and pro-rata allotment was made as follows:

To the applicants of 40,000 shares, 30,000 shares were issued and for the rest 20,000 shares were issued. All money due was received except the allotment and call money from Ram who had applied for 1,200 shares (out of group of 40,000 shares). All his shares were forfeited. The forfeited shares were reissued for Rs 8 per share as fully paid up.

Pass necessary journal entries for the above transactions.

Answer:

Notes forAccounting for Share Capital class 12 Accountancy

(Share and Share Capital: Nature and types)

“A Company is an artificial person created by law, having separate entity with a perpetual succession and a common seal.”

Definition given by Prof. Haney

Characteristics(Features) ofacompany

1. The certificate of incorporation of a company is issued by registrar of companies as per procedure/guidelines given in the Companies Act, 2013. The law considers a company as an artificial legal person.

2. A Company is a separate legal entity from its owner (shareholders).

3. A company has perpetual existence, not affected by the death, lunancy or insolvency of its shareholders. It can be wounded up only by the law (Court or registrar of company.)

4. Every company has it own common seal, which act as the official signature of the company.

5. The shares of a company is transferable subject to certain conditions (e.g. some conditions for private company.)

6. The company is managed by the ‘Board of Directors’, the directors are representative of the shareholders (owners). So, management and ownership are separate in company organization.

7. The liability of a shareholder is limited upto the nominal price of shares subscribed by one.

TypesofCompanies

i. Private Company – Section 2 (68) of the Companies Act, 2013 defines “A private Company means a company which has a minimum paid up capital of Rs. 100,000 and which by its Articles of Association –

(a) restricts the right to transfer its shares;

(b) limits the number of its members to 200 excluding its part or present employee members;

(c) Prohibits any invitation to public to subscribe for any of its securities.

ii. Public Company – According to section 2 (71) of the Companies Act, 2013 a public company means a company which is not a private company and has a minimum paid up capital of L 500,000 or higher capital as may be prescribed a private company which is a subsidiary of a company not being a private company shall be deemed a public company.

iii. One Person Company – Section 2 (62) of the Companies Act, 2013 states one person company is a company which has only one person as a member. Rule 3 of the Companies (In Corporation) Rules, 2014 provides that (i) only on Indian citizen resident in India can form one person company (ii) Its paid up capital is not more than 50 lakhs; (iii) Its Average annual turnover should not exceed Rs. 2 crores; (iv) It cannot carry out Non banking financial Investment activities.

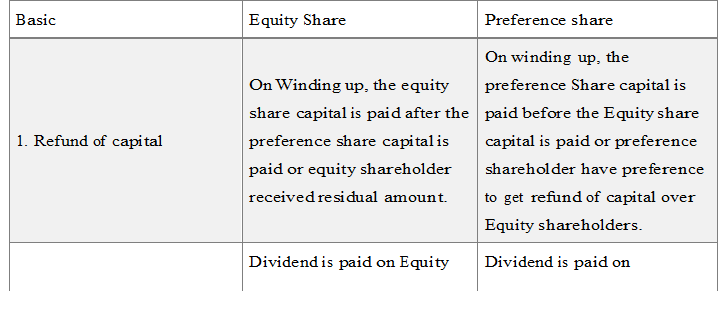

Class / Types of Shares : There are two classes of shares

1. Preference shares : The shares which get preferential right in respect of :

(a) Right of dividend

(b) Repayment of capital on winding up of the company.

2. Equity shares : The shares which are not preference shares are called equity shares and do not get preference in above respect.

Distinction between Equity Share and Preference Share

Types OR Classes of Preference Shares

(a) With Reference to Dividend :

i. Cumulative Preference shares : Cumulative preference shares are these preference shares, the holders of which are entitled to receive arrears of dividend before any dividend is paid on equity shares.

ii. Non-cumulative Preference shares : Non-cumulative preference shares are those preference share, the holders of which do not have the right to receive arrear of divided. If no dividend is declared in any year due to any reason. Such shareholders get nothing, nor they can claim unpaid dividend in any subsequent years.

(b) With Reference to Participation

i. Participating preference shares : such shares, in addition to the fixed preference dividend, carry a right to participate in the surplus profit, if any, after providing dividend at a stipulated rate to equity shareholders.

ii. Non-Participating preference shares : Such shares get only a fixed rate of dividend every year and do not have a right to participate in the surplus profit.

(c) With Reference to Convertibility

i. Convertible preference shares : are those preference shares which have the right/option to be converted into equity shares.

ii. Non-convertible preference shares : are those preference shares which do not have the right/option to be converted into Equity shares.

(d) With Reference to Redemption

i. Redeemable preference shares : are those preference shares the amount of which can be redeemed by the company at the time specified for their repayment or earlier.

ii. Irredeemable preference shares : are those preference shares the amount of which cannot be refunded by the company unless the company is wound up. Now a company cannot issue irredeemable preference shares.

Some Important Terms used in Accounting for Share Capital

Note 1 : Minimum Subscription (Section 39) – It is the minimum amount stated in the prospectus that must be subscribed by the public before an allotment of any security is made.

Prospectus : It is an invitation to public for subscription of shares or debentures.

Capital: means amount invested in the business for the purpose of earning revenue. In case of company money is contributed by public and people who contributed money are called shareholders.

Share Capital: Capital raised by issue of shares is called share capital.

Authorised Capital: Also called as Nominal or registered capital. It is the maximum amount of capital a company can issue. It is stated in Memorandum of Association.

Issued Capital: This is part of authorized capital which is offered to public for subscription. It cannot exceed authorized capital.

CalledUp Capital : It is the amount of nominal value of shares that has been called up by the company for payment by the subscriber towards the share.

Paid Up Capital : It is part of called up capital that the members of company or shareholders have paid.

ReserveCapital: It is part of increased capital and/or portion of uncalled share capital of an unlimited company which can be called only in case of winding up of the company.

CapitalReserve: It is capital profit not available for distribution as dividend. It is represented in balance sheet of company as Reserves and Surplus under the heading Shareholder’s Funds.

Issues of Shares At Premium : It is issue of share at more than face value. This premium can be utilized for : (Section 52)

1. Issue of fully paid bonus shares to the shareholders.

2. Write off preliminary expenses of the company.

3. Writing off securities issue expenses commission paid discount on issue of securities.

4. For providing the premium payable on redemption of Redeemable preference shares or debentures of the company.

5. For Buy back of its own shares as per Section 68.

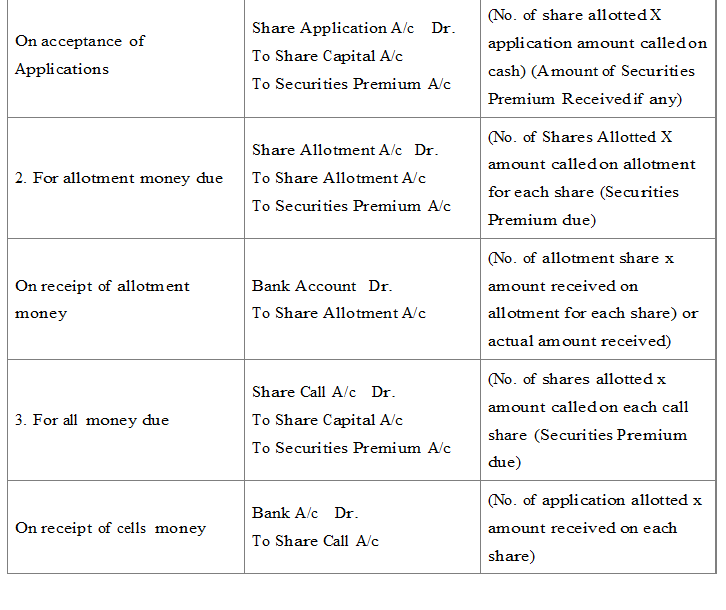

Journal Entries for accounting of securities premium, the securities premium may be collected by the company with application money / Allotment money / First call/Final Call depend upon the terms of issue of shares. If questions is silent regarding the securities premium amount due, it is assumed that securities premium money is due with the allotment money. Following are the various situation of securities premium received with application, allotment and call.

Issue of shares at discount [Section 53] : A company cannot issue shares at discount other than sweat equity shares.

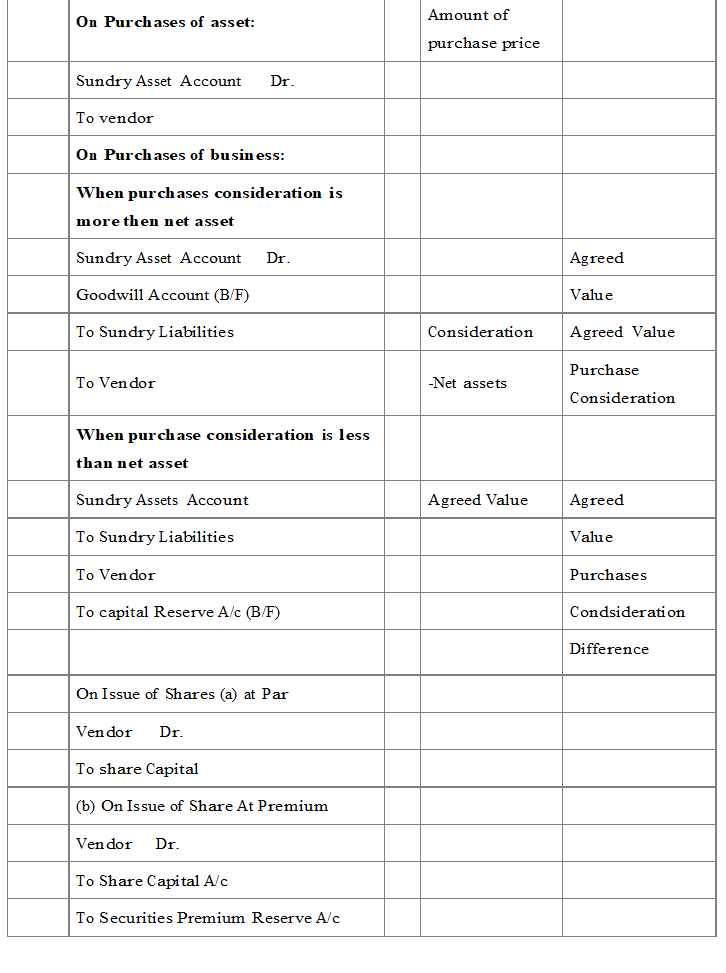

Shares Issue for Consideration Other than Cash

When a company purchases any fixed asset or business and makes the payment to the vendor in form of issue of shares in place of cash it is called the issue of shares for consideration other than cash.

Share can be issued at par, at premium.

Journal entries for issue of shares to vendors/consideration other than cash

Private Placement of Shares [Section 42]: This is an issue of shares to institutional investors or some selected group of persons subject to prior approval of existing shareholders.

There is no need of issuing formal prospectus and it is cost and time saving method of raising capital.

Under subscription : When the number of Share application received is less than the number of shares offered to public it is under subscription.

Over subscription : When the number of Share application received is more than the number of shares offered to public it is over subscription

1. Either reject the excess applications

2. Make pro-rata allotment

3. Partially refund amount and on other applications pro-rata allotment is made.

Calls in arrear : Any Amount which has been called or demanded by company from shareholders but not paid by the shareholder till the last date mentioned in call letter is called as call in arrear, Company can charge interest on this at rate mentioned in Article of Association or 10% p.a. as per Table F.

Calls in advance : Any amount paid in excess of what they has asked to pay is called as call in advance. Interest is paid on this at rate mentioned in Article of Association or 12% p.a. as per Table F.

Forfeiture of shares : If any shareholder fail to pay the amount on any call, his money is forfeited or withheld by company this is called forfeiture of shares. Forfeiture of share refers to the cancellation or termination of membership of a share holder by taking away the shares and rights of membership.

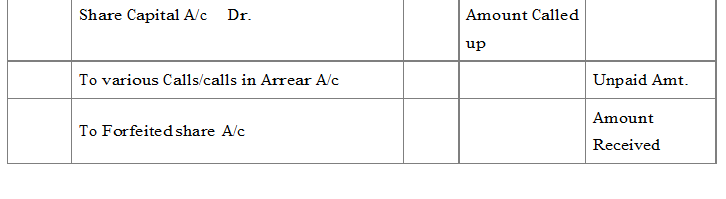

Forfeiture of Shares Issued at par

Also download : Question Papers for Class 12 Accountancy