Notes for Class 12 Accountancy Chapter 4 Reconstitution of a Partnership Firm Retirement/Death of a Partner

Commerce students can refer to the Retirement/Death of a Partner Notes Class 12 Accountancy given below which is an important chapter in class 12 accountancy book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Accountancy teachers have prepared these notes for the benefit of students so that you can read these revision notes and understand each topic carefully.

Retirement/Death of a Partner Notes Class 12 Accountancy

Refer to the notes and important questions given below for Retirement/Death of a Partner which are really useful and have been recommended by Class 12 Accounts teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books for Class 12 Accounts.

1. P, Q and R are partners sharing profits in the ratio of 8:5:3. P retires. Q takes 3/16th share from P and R takes 5/16th share from P. What will be the new profit sharing ratio?

a) 1:1

b) 10:6

c) 9:7

d) 5:3

Answer

A

2. X, Y and Z are partners sharing profits and losses in the ratio of 4:3:2. Y retires and surrenders 1/9th of his share in favour of X and the remaining in favour of Z. The new profit sharing ratio will be:

a) 1:8

b) 13:14

c) 8:1

d) 14:13

Answer

B

3. Gaining ratio is used to distribute —————— in case of retirement of a partner.

a) Goodwill

b) Revaluation Profit or Loss

c) Profit and Loss Account (Credit Balance)

d) Both b and c

Answer

A

4. X, Y and Z are partners in a firm. Y retires and his claim including his capital and his share of goodwill is R. 1,20,000. He is paid partly in cash and partly in kind. A vehicle at Rs. 60,000 unrecorded in the books of the firm and the balance in cash is given to him to settle his account. The amount of cash to be paid to Y will be:

a) Rs. 80,000

b) Rs. 60,000

c) Rs. 40,000

d) Rs. 30,000

Answer

A

5. At the time of retirement of a partner, share of retiring partner’s goodwill will be credited to —————- Capital Account(s).

a) Remaining Partner(s)

b) Retiring Partner’s

c) Both Sacrificing and Gaining Partner(s)

d) Gaining Partner(s)

Answer

B

6. A and B were partners. They shared profits as A- ½; B- 1/3 and carried to reserve 1/6. B died. The balance of reserve on the date of death was Rs. 30,000. B’s share of reserve will be:

a) Rs. 10,000

b) Rs. 8,000

c) Rs. 12,000

d) Rs. 9,000

Answer

C

7. If goodwill is already appearing in the books of accounts at the time of retirement, then it should be written off in ————-.

a) New Ratio

b) Gaining Ratio

c) Sacrificing Ratio

d) Old Ratio

Answer

D

8. As per Section 37 of the Indian Partnership Act, 1932, interest @ ———– is payable to the retiring partner if full or part of his dues remain unpaid.

a) 9% p.m.

b) 12% p.m.

c) 6% p.m.

d) None of the above

Answer

D

10. What do you mean by gaining ratio?

ANS– The ratio in which remaining partners share the retiring or death partners share of profit is called gaining ratio.

11. Name two adjustments to be made at the time of death of partner

ANS– a) calculation of death partners share of goodwill

b) calculation of death partners share of profit to the date of death.

12. At what rate is interest payable to the amount remain unpaid to the executor of deceased partner?

Answer

6% p.a

13. “Retiring partner is not liable for firm’s acts after his retirement”. Is the statement True or False?

Answer– false

Answer

False

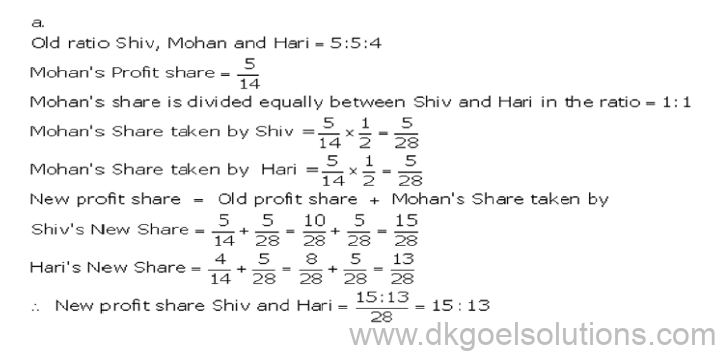

14. From the following particulars, calculate new profit-sharing ratio of the partners:

(a) Shiv, Mohan and Hari were partners in a firm sharing profits in the ratio of 5 : 5 : 4. Mohan retired and his share was divided equally between Shiv and Hari.

(b) P, Q and R were partners sharing profits in the ratio of 5 : 4 : 1. P retires from the firm.

Solution:

15. Write any three rights of a retiring partner?

Ans- Any three of these:

1.Share in Reserves and Profits or Losses

2.Share in Revaluation of Assets and Reassessment of Liabilities

3.Share in Goodwill

4.Right to get back his Capital

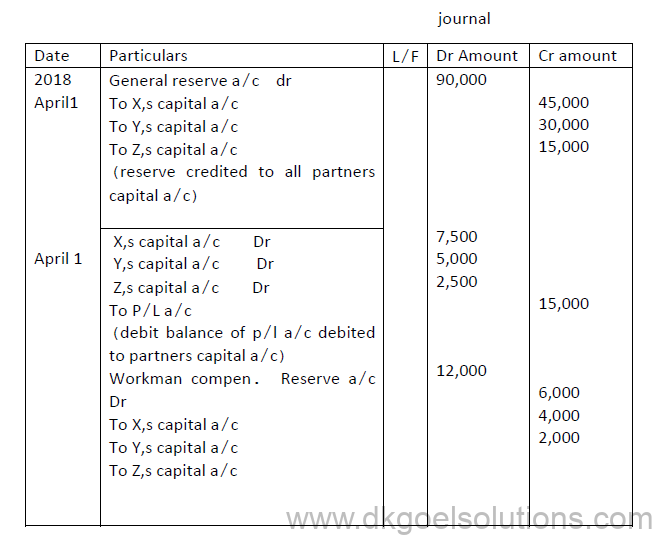

16. The date of Z,s retirement following balances appeared in the books of the firm:

General reserve Rs 90,000, Profit and loss a/c (Dr) Rs 15,000, Workman compensation reserve Rs12, 000 which was no more required. Pass necessary journal entries at the time of Z,s retirement

Ans

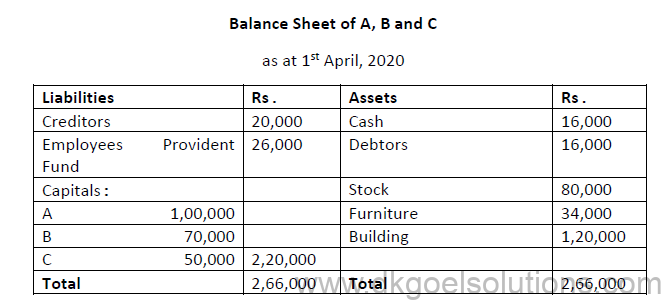

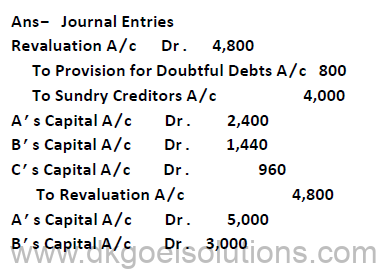

17. A, B and C were partners sharing profits in the ratio of 5:3:2. Their Balance Sheet as on 1st April, 2020 was as follows:

C retires on the above date and it was agreed that:

(i)C’s share of goodwill was Rs.8,000

(ii)5% provision for doubtful debts was to be made on debtors

(iii)Sundry creditors were valued Rs.4,000 more than the book value

Pass necessary journal entries for the above transactions on C’s retirement.

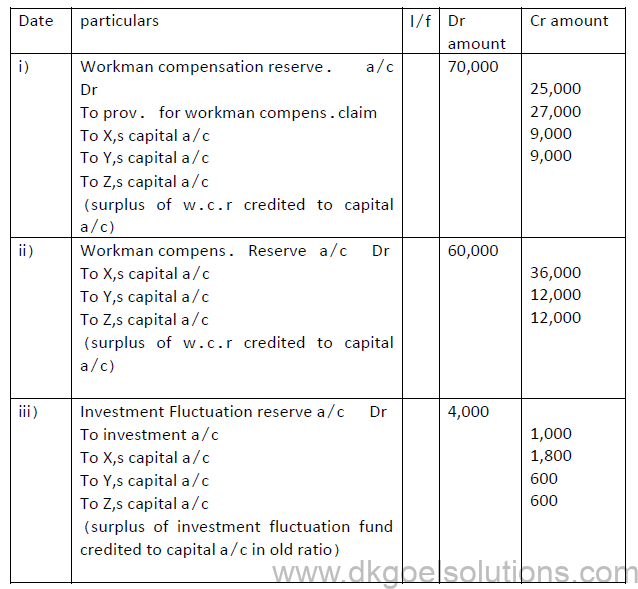

18. X,Y and Z are partners of a firm sharing profit and losses in the ratio of 3:1:1. Pass necessary journal entries at the time of Y,s death in the following cases.

i) There is a balance of workman’s compensation reserve Rs 70,000 and there is a claim of Rs 25,000 against it.

ii) Balance in workman compensation reserve Rs 60,000 and there is no any claim against it.

iii) Investment fluctuation reserve Rs 4,000. Investment appear at Rs 20,000 (market value Rs 19,000)

sol-

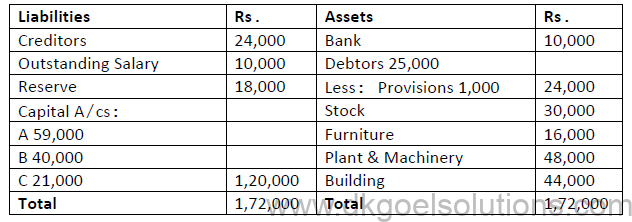

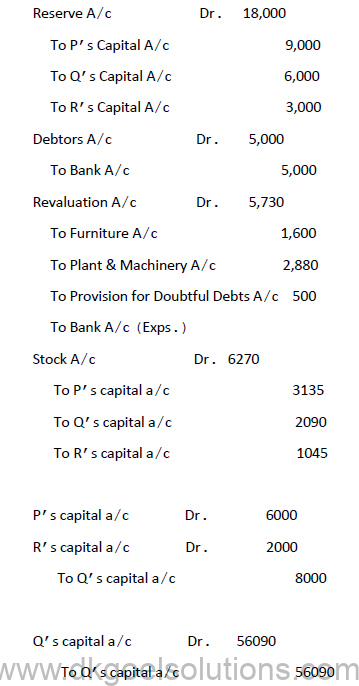

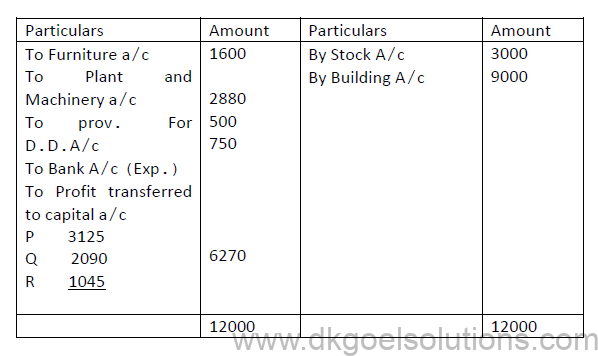

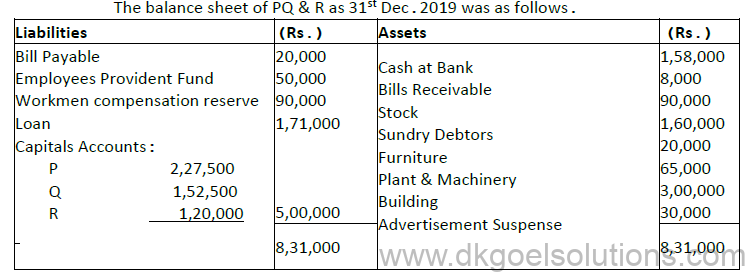

19. P, Q and R are partners sharing profits and losses in the ratio of 3:2:1 respectively. The balance sheet of the firm as on 1st April, 2016 was as under:

Q retires on the above date and it was agreed that:

(i)The goodwill of the firm is valued at Rs.24,000

(ii)Furniture, Plant and Machinery are depreciated by 10% and 6% respectively

(iii)Bills receivables of a customer Rs.5,000 discounted from bank was decided to create provision for doubtful debts on debtors @ 5%

(iv)Stock is appreciated by 10% and building is valued at Rs.53,000

(v)Revaluation expenses Rs.750 were paid by the firm

(vi)The amount due to Q is to be transferred to his loan account

Pass journal entries, Prepare Revaluation Account, Capital Accounts and Opening Balance Sheet of the new firm.

Ans- Journal Entries

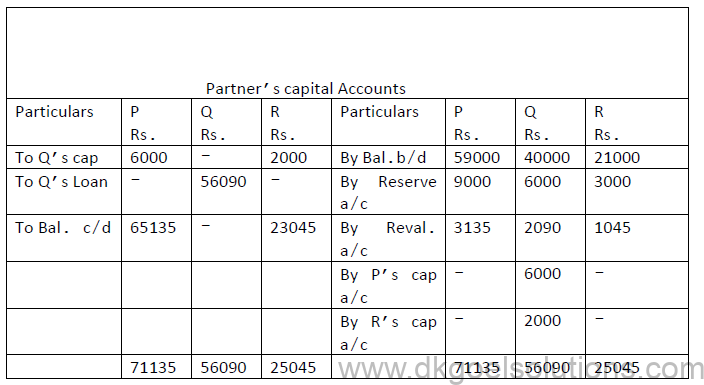

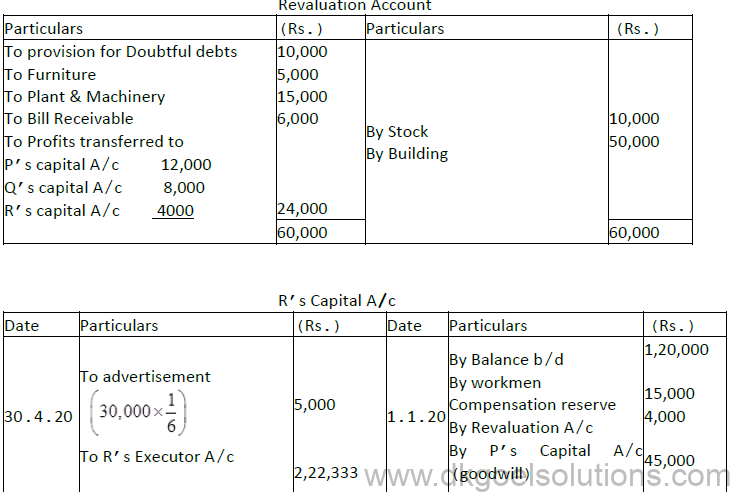

Revaluation Account

20

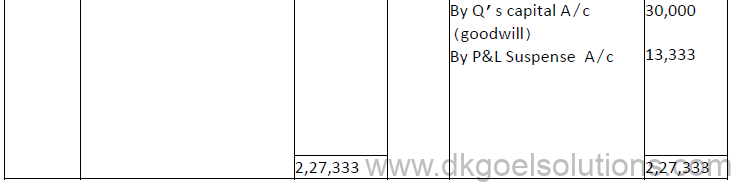

The profit ratio was 3:2:1 R died on 30th April 2020. The partnership deed provides that :

a. Goodwill is to be calculate on the basis of 3 years purchase of preceding 5 years average profits. The profits were Rs. 2,40,000, Rs. 1,60,000, Rs. 2,00,000 Rs. 1,00,000 and. Rs. 50,000.

b. Deceased partner should be given share of profits upto the date of death on the basis of previous your profits.

c. The assets have been revalued as under Stock Rs. 1,00,000 Debtors Rs. 3,50,000. A bill for Rs. 6000 was found worthless.

d. PREPARE R’s capital account.

Prepare Revolution account. Accounts are closed on 31st December.

Solution :

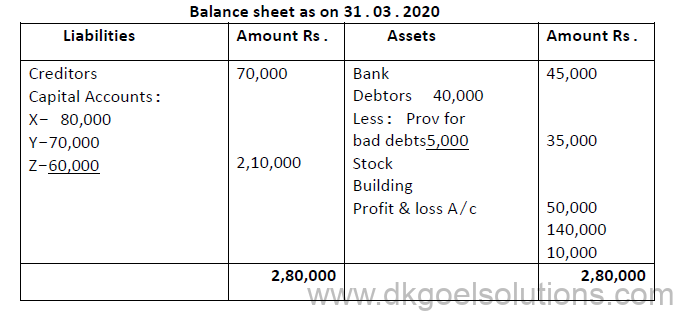

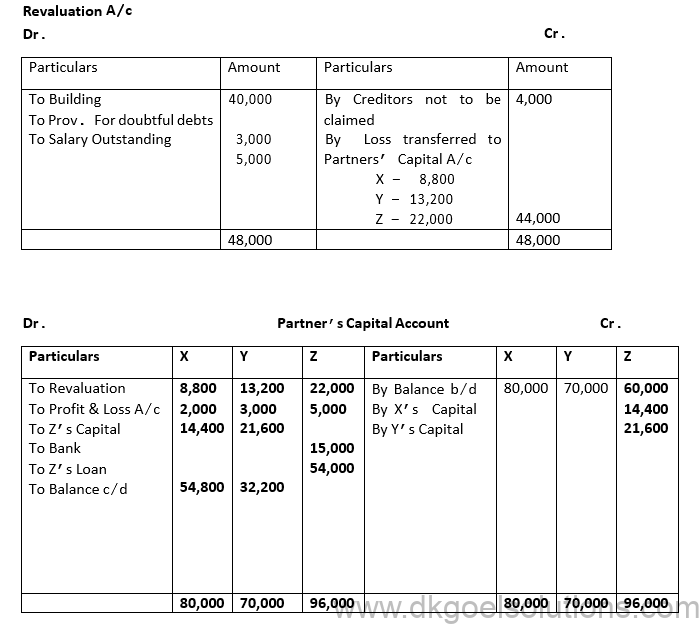

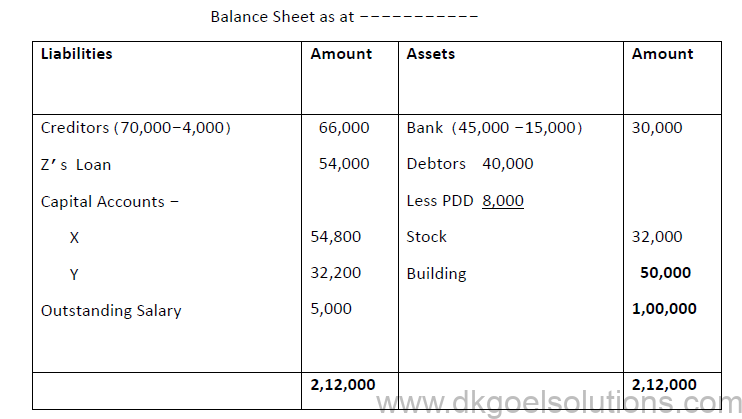

21. X,Y& Z were partners in a firm sharing profits in the ratio of 2:3:5. On 31.03.2020 their balance sheet was as follows:

On the above date Z retired from the partnership on the following terms:

I. Building was to be depreciated by Rs.40,000.

II. Provision for doubtful debts was to be maintained at 20% of the debtors.

III. Salary outstanding Rs.5,000 was to be recorded and creditors of Rs.4,000 will not be claimed.

IV. Goodwill of the firm was valued at Rs.72,000.

V. Z will be paid Rs.15,000 by cheque immediately and balance is to be transferred to his loan account.

Z decided to donate this amount to an orphanage. Name two values shown by Z with this act. Prepare Revaluation account, Partners’ capital Accounts and Balance sheet of the firm after Z’s retirement.

ANSWER-

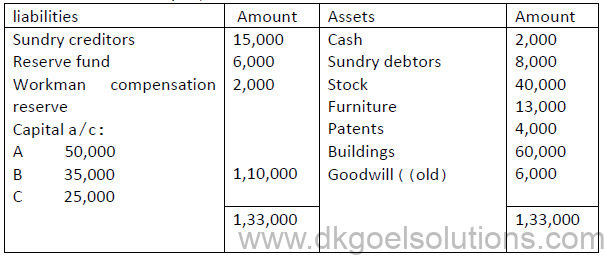

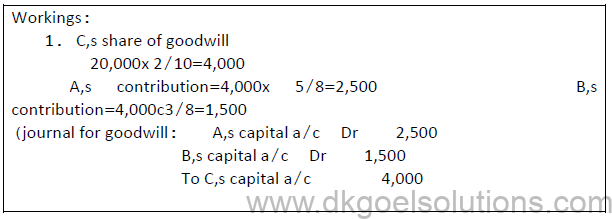

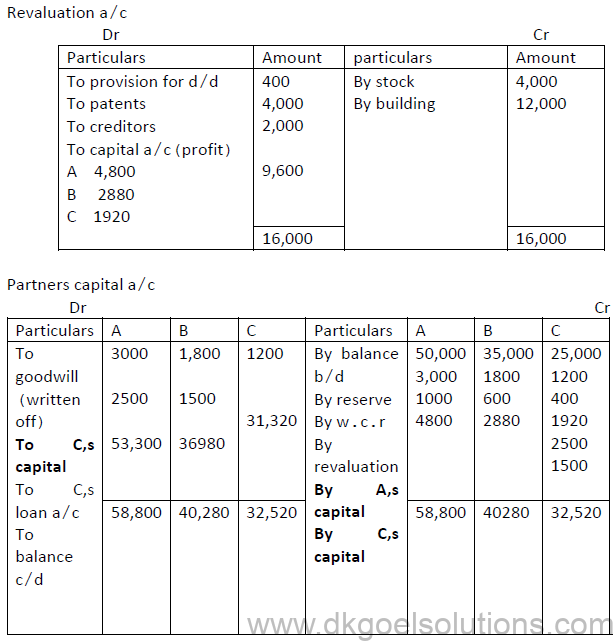

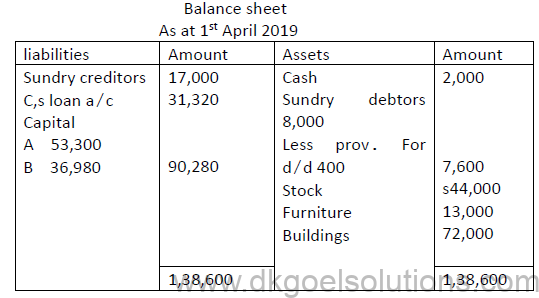

22. A, B and C were partners sharing profit and losses in the ratio of 5:3:2. Their balance sheet as at 1stApril ,2019 was as follows:

i) C retires on the above date on the following terms:

ii) Goodwill of the firm is valued at Rs 20,000

iii)Provision for doubtful debts is to be maintained at 5% on debtors

iv)Stock be appreciated by 10%

v)Patents are valueless

vi)Building be appreciated by 20%

vii)Sundry creditors to be paid Rs 2,000 more than book value.

Prepare revaluation a/c, partners’ capital a/c and balance sheet of new firm.

Solution:

Notes for Retirement or Death of a partner class 12 Accountancy

Retirement of a partner means ceasing to be partner of the firm. A partner may retire (i) of there is agreement of this effect (ii) all partners give consent (iii) At will by giving written notice.

Introduction

Like admission and changes in profit sharing ratio in case of retirement or death also the existing partnership deep comes to end and the new once comes into exist- tense among the remaining partner. There is not much difference in the accounting treatment at the time of retirement or in the event of death.

Amount due to Retiring/Deceased Partner (To be credited to his capital account)

1. Credit Blanca of his capital.

2. Credit Balance of his current account (if any).

3. Share of Goodwill. (By gaining partners)

4. Share of Reserves of Undistributed profits.

5. His share in the profit on revaluation of assets and liabilities.

6. Share in profits up to the date of Retirement/Death. (By p & L suspense A/c)

7. Interest on capital if involved.

8. Salary if any

Deduction from the above sum (to be debited to capital account)

1. Debit balance of his current account (if any)

2. Share of existing Goodwill to be written off.

3. share of accumulated loss.

4. Drawing and interest on drawings (if any)

5. Share of loss on account of Revaluation of assets and liabilities.

6. His share of business loss up to the date of Retirement/Death (To p & L) suspense A/C)

Accounting Treatment

1. Calculation of new profit sharing ratio and gaining ratio

2. Treatment of goodwill.

3. Evaluation a/c preparation with the adjustment in the respect of unrecorded assets /liabilities.

4. Distribution of reserves and accumulated profits/loss.

5. Ascertainment of share of profit/loss till the date of retirement. death.

6. Adjustment of capital if required.

7. Settlement of the Accounts due to Retired/Deceased partner.

New profit Sharing Ratio & Gaining Ratio

New profit Sharing Ratio: it is the ratio in which the remaining partners share future profits after retirement/death.

Gaining ratio: it is the ratio in which the continuing partners have acquired the share from the outgoing partner. Gaining Ratio = New Ratio -Old Ratio.

Calculation of the two ratios.

Following situations may arise

1. When no information about new ratio or gaining ratio is given in question

In this case it considered that the share of the retraining partner is acquired the remaining partners in the old ratio. Then no need to calculate the new paining ratio as it will be the

same as before.

2. Gaining ratio is given which is different than the old ratio in this New share of continuing partner = has old share + gained from outgoing partner.

3. if the new ratio is given the Gaining ratio = New Ratio -Old Ratio

TREATMENT OF GOOD WILL

According to accounting standards – 10, Good will account can’t be raised as only purchased goodwill is recorded in books. Therefore only adjustment entry is done for goodwill

Steps to be followed

1. When old good will appears in the books then first of all this is writer in the old ratio.

Remember Old Good will old Ratio

All Partner’s capital A/C Dr.

To Good Will A/c

2. After written off of goodwill adjustment of retiring partner’s share goodwill will be made through the following journal entry.

Remaining Partner’s Capital, A/C Dr. (in gaining

To Retiring/Deceased Partner’s Capital A/c

Hidden Goodwill

Sometimes goodwill is not given in the question directly, But if a firm agrees to pay a sum which is more than retiring partner’s balance in capital also after making all adjustment with respect to resaves, revaluation of assets and liabilities etc. then cases amount is treated as his share of goodwill (known as hidden goodwill).

3. Revaluation of Assets and Reassessment of Liabilities

Revaluation A/c is prepared in the same way as in the case of admission of a new partner.

Profit and loss on revaluation is transferred among all the partners in old ratio.

4. Adjustment of Reservation and Surplus (Profits)

(Appearing in the Balance Sheet – Liability Side)

(a) General Reserve A/cDr.

Reserve Fund A/cDr.

Profit & Loss A/c (Credit Balance)Dr.

To all partners Capital/Current A/c (in old ratio)

(b) Specific Funds – If the specific funds such as workmen’s compensation funds or investment fluctuation fund are in excess of actual requirement, the excess will be transferred to the Capital A/c in old ratio.

Workmen Compensation Fund A/cDr.

Investment Fluctuation Funds A/cDr.

To All Partner’s Capital A/cs

(c) For distributing accumulated losses

(i.e. P & L A/c debit balance shown on the Asset side of Balance Sheet)

All partner’s Capital/Current A/cDr. (in old ratio)

To P & L A/c

Disposal of the Amount Due to the Retiring Partner

This outgoing partners A/c is settled as per the terms of partnership deed. Three cases may be there as given below –

1. When the retiring partner is paid full amount either in cash or by coeque.

Retiring Partner’s Capital A/cDr.

To Cash Bank A/c

2. When the retiring partner is paid nothing in cash then the whole amount due is transferred to his loan A/c

Retiring Partner’s Capital A/cDr.

To retiring partner’s Loon A/c

3. When Retiring Partner is partly paid in cash and the remaining amount in treated Loan.

Retiring Partner’s Capital A/cDr. (Total Amount due)

To Cash Bank A/c (Amount Paid)

To Retiring Partner’s Loan A/c (Amount of Loan)

Settlement of loan of the Retiring Partner

Loan of the retiring partner is disposed off accordingly of the pre decided term and conditions among the partners. Normally the Principal amount is paid in few equal installments. In such cases interest is credited to the Loan A/c on the basic of the amount outstanding at the beginning of each year and the amount paid it debited to loan A/c. The following Journal entries are done

a. For interest on Loan.

Interest A/cDr.

To Retiring partner’s Loan A/c

b. For the payment of installment.

Retiring Partner’s Loan A/cDr.

To Cash/Bank A/c (including interest)

Adjustment of Capitals

At the time of retirement/death, the remaining partners may decide to adjust their capitals in their new profit sharing Ratio. Then

· The sum of their capitals will be treated as the total capital of the new firm which will be divided in their New Profit Sharing Ratio.

· Excess of Deficiency of capital in the individual capital A/c is calculated.

· Such excess or shortage is adjusted by withdrawal or contribution in case or transferring to their current A/cs.

Journal Entries

(a) For excess Capital withdrawn by the Partners

Partner’s capital A/cDr.

To Cash/Bank A/c

(b) For deficiency, cash will be brought in by the partner

Cash/Bank A/cDr.

To Partner’s capital A/c

DEATH OF A PARTNER

Accounting treatment in the case of death is same as in the case of return except the following:

1. The deceased partners claim is transferred to his executer’s account.

2. Normally the retirement takes place at the end of the Accounting pried but the death may occur at any time. Hence the claim of deceased part shall also include his share or profit or loss, interest on capital drawings if any from the date of the last balance sheet to the date his death.

1. Calculation of profit/Loss for the intervening Period.

It is calculated by any one of the two methods given below:

a. On Time Basis : In this method proportionally profit for the time period is calculated either on the basis of last year’s profit or on basis of average profits of last few years and then deceased profit share is calculated based on his share of profits.

b. On Turnover or Sales Basis : In this method the profits upto the date of death for the current year are calculated on the basis of current year’s sales upto the date of death by using the formula.

Profits for the current year upto the date of death =

(Sales of the current year upto the date of death/total sales of last year) Profit for the last year.

The from this profit the deceased partner’s share of profit is calculated.

Also refer to Printable Worksheets for Class 12 Accountancy