HOTS Accountancy Class 12 Chapter 1 Accounting for Not-for-Profit Organisation

Students of Class 12 Commerce should refer to the HOTS Class 12 Accounting for Not-for-Profit Organisation with solutions given below, this will help them to understand the concepts and related questions given in the Class 12 Accountancy textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations.

Question: Give to main sources of income of a ‘Not for profit organisation’.

Answer: (i) Subscription (ii) Donation.

Question: State any two characteristics of Receipt and Payment Account.

Answer: (i) Receipts and Payments Account is a summary of Cash Book.

(ii) Non- cash expenses such as depreciation and outstanding expenses are not shown in Receipts and Payments Account.

Question: How would you account for ‘subscription due to be received’ in the current year in the books of a non trading organisation?

Answer: Subscription due to be received is added with subscription received during the year in Income and Expenditure A/C and shown as an asset in the closing balance sheet.

Question: How would you account for ‘subscription received in advance’ in the current year in the books of a non trading organisation?

Answer: Subscription received in advance is subtracted from subscription received during the year in Income and Expenditure A/C and shown as a liability in the closing Balance sheet.

Question: Is it possible for one hospital to have an income and expenditure account whereas

another has a profit and loss account?

Answer: No. Both hospitals will have to prepare Income and Expenditure Account.

Question: What is meant by fund based accounting?

Answer: Fund based accounting is a book peeping technique where by separate self-balancing sets of assets, liability, income, expenses and fund balance accounts are maintained for each contribution for a specific purpose.

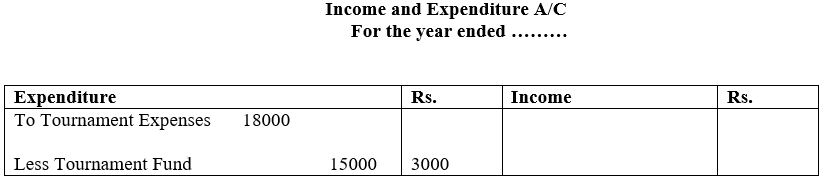

Question: Tournament fund appears in the books Rs. 15,000 and expenses on tournament during the year were Rs. 18000. How will you show this in format while preparing financial statement of a not-for-profit organisation?

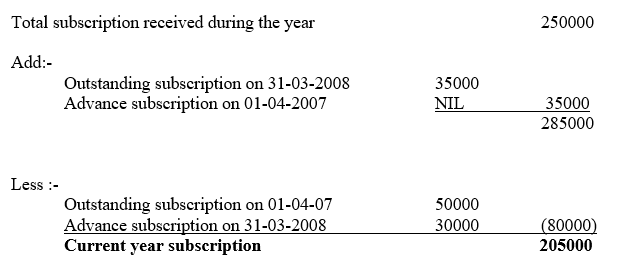

Question: As per Receipt and Payments account for the year ended on March 31, 2008, the subscription received were Rs. 2,50,000. Addition information given is as follows:-

(i) Subscriptions outstanding on 01-04-2007 Rs. 50,000.

(ii) Subscription outstanding on 31-03-2008 Rs. 35,000.

(iii)Subscription Received in advance as on 31-03-2008 Rs. 30000.

Ascertain the amount of income from subscription for the year 2007-08.

Answer: Calculation of current year subscription to be shown in Income and Expenditure A/C for the year ended March 31, 2008 :-

Question: Why depreciation on fixed assets is not recorded in receipts and Payment Account?

Answer: Depreciation is non cash Expenditure.

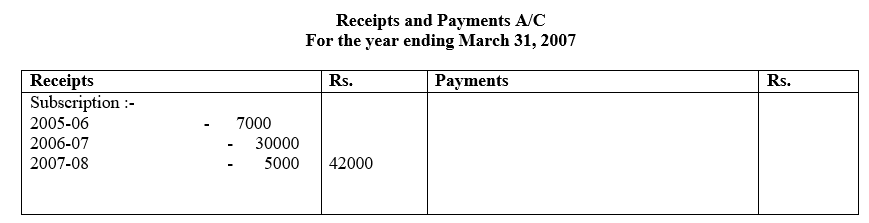

Question: From the following extracts of Receipts and Payments Account and the additional information given below, compute the amount of income from subscriptions and show us how they would appear in the Income and Expenditure Account for the year ending March 31, 2007and the Balance sheet on that date:-

Additional information:-

(i) Subscription outstanding on March 31, 2006 Rs. 8500.

(ii) Total subscriptions outstanding on March 31, 2007 Rs. 18,500.

(iii) Subscriptions received in advance as on March 31, 2006 Rs. 4000.

Answer:

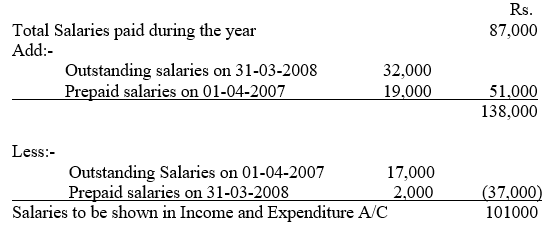

Question: From the following particulars of a club, calculate the amount of salaries to be shown in Income and expenditure account for the year ended 31 March, 2008:-

Total salaries paid during the year 2007-08 Rs. 87,000

Outstanding salaries on 01-04-2007 Rs. 17,000

Prepaid salaries on 01-04-2007 Rs. 19,000

Outstanding salaries on 31-03-2008 Rs. 32,000

Prepaid salaries on 31-03-2008 Rs 20,000

Question: Calculation of salaries to be shown in Income and Expenditure A/C for the year ended March 31, 2008:-

Question: “ Not – for –profit organisation” do not maintain any capital account”. What do they

maintain instead of capital account?

Answer: The amount of capital fund is the capital.

Question: Give two examples of capital receipts which are directly added to the capital fund

Answer: (I) Specific donations.

Question: One horse of a horse race club died. Insurance company has offered to settle the

claim at 60% will it be recorded in the Accounts of the club and how?

Question: (ii) Tournament Funds/Life membership Free.

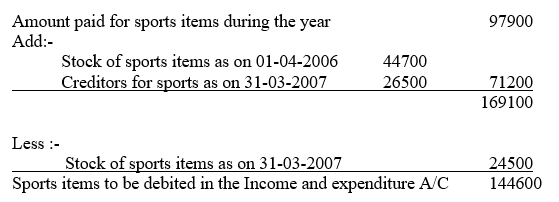

Question: Calculate the amount to be debited to Income and Expenditure account under the heading sports items for the year 2006-07 in respect of the Osmosis club:-

Stock of sports items on 01-04-2006 Rs. 44,700

Stock of sports items on 31-03-2007 Rs. 24,500

Paid for sports items during the year Rs. 97,900

Creditors for supplies of sports items 31-03-2007 Rs. 26,500.

Answer:

Question: Define Legacy. Explain its treatment while preparing financial statements of a “Not

– for –profit Organisation”.

Answer: Legacy is the money which NFPO gets because of the will of a person it is recorded in

Balance sheet.

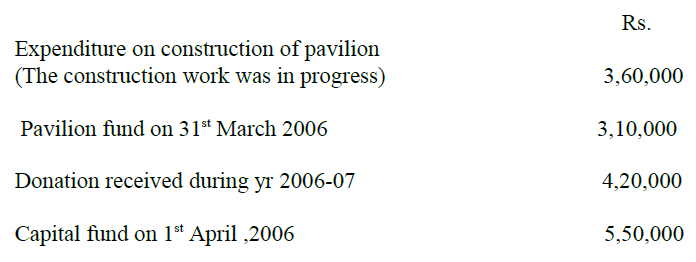

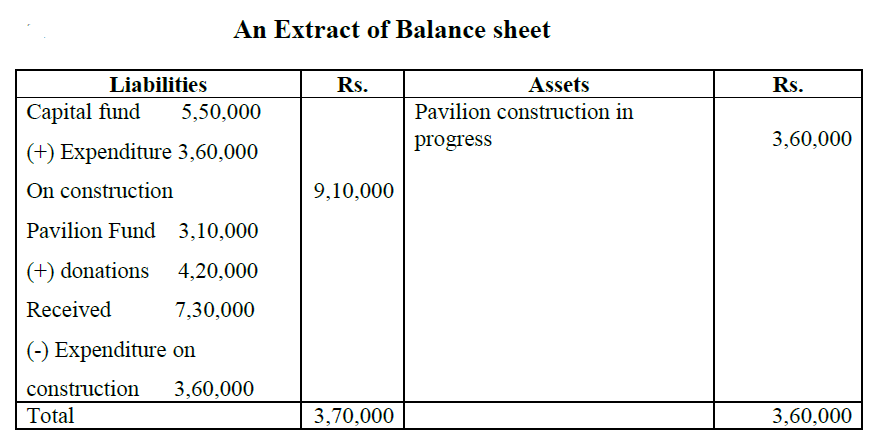

Question: How the following items are shown in the balance sheet of Not –for – profit

Organisation on 31st March 2007:

Answer:

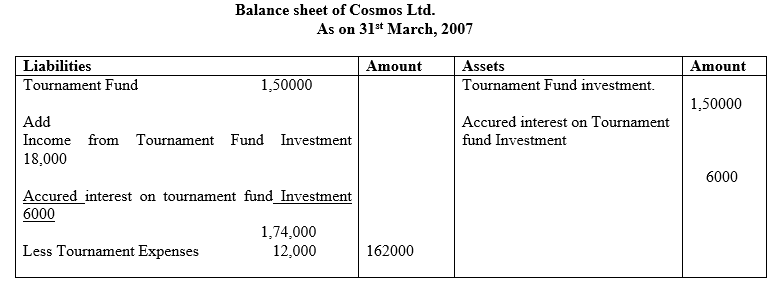

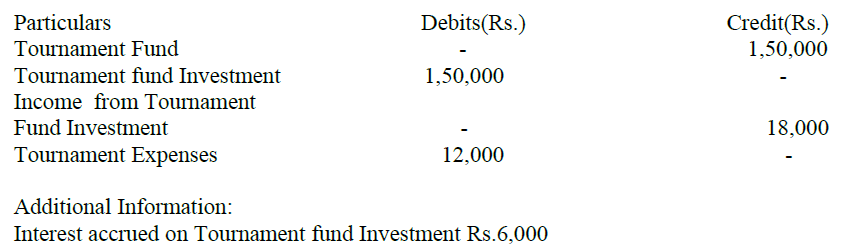

Question: Show the following information in the Balance Sheet of the Cosmos club as on 31st March 2007:-

Answer:

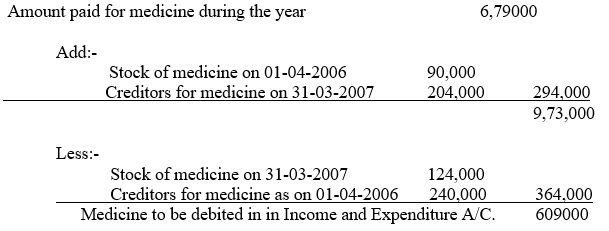

Question: Calculate the amount medicines to be debited in the Income and Expenditure Account of a Hospital on the basis of the following information:-

Answer:

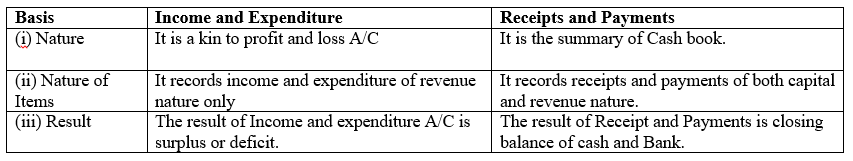

Question: Distinguish between Receipts and Payments A/C and Income and expenditure A/C.

Answer: 13 Difference between Receipts and Payments and Income and Expenditure.

Question: Extracts of receipt and payment Account for the year ended 31st March ,2007 are

given below:

Additional information:

Total number of members : 230

Annual membership fee : Rs 125

Subscription outstanding on April 1, 2006: Rs. 2,750

Prepare a statement showing all relevant items of subscriptions viz. income, advance,

outstanding etc.

Answer: Income from subscription of the current year : Rs.28,750

Where, outstanding subscription as on 31-03-2007 = Rs. 2,250

Question: Show the following information in the Balance Sheet of the cosmos club as on 31st March

2007:

Answer: Total of liabilities: Rs.1,62,000

(1,50,000+18,000+6000-12,000)

Total of Assets: Rs.1,56,000

(1,50,000+6000)

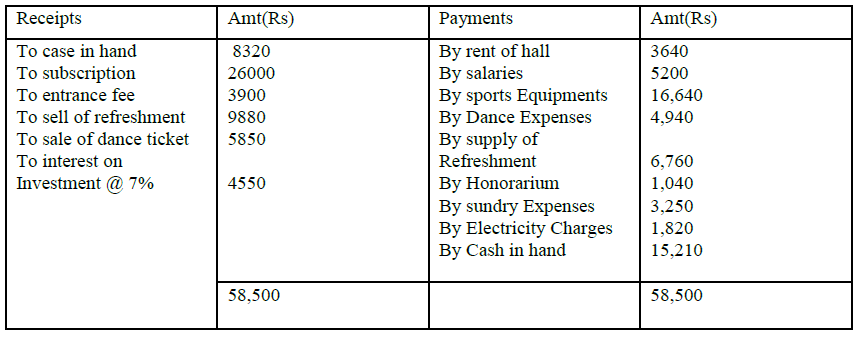

Question: Following is the receipts and payments accounts of Purveni recreation club for the year

ended 31st March 2007

RECEIPT AND PAYMENTS ACCOUNT

For the year ended 31st March 2007

Following additional information are also provided to your:

(i) The value of assets and liabilities on 31st March 2006 were as follows

Sport equipment Rs 6760 ; subscription in arrears Rs 1950 ,furniture Rs

12,480, outstanding sent Rs 780 subscription received in advanced Rs 520

(ii) Entrance fee is to be Capitalized

(iii) The value of assets and liabilities on 31st March 2007 were:

Sport equipment Rs 19,760 , subscription in arrears Rs 1,690, furniture Rs

11,180 , outstanding rent Rs 390 , subscription in advance Rs. 2340

Answer: Surplus = Rs.13000

Capital Fund = Rs.93,210

Balance sheet Total = Rs.1,12,840

[Hint : (i) Subscription Rs.23,920

(ii)Rent of Hall Rs.23,920

(iii)Investment to be a shown closing balance sheet at

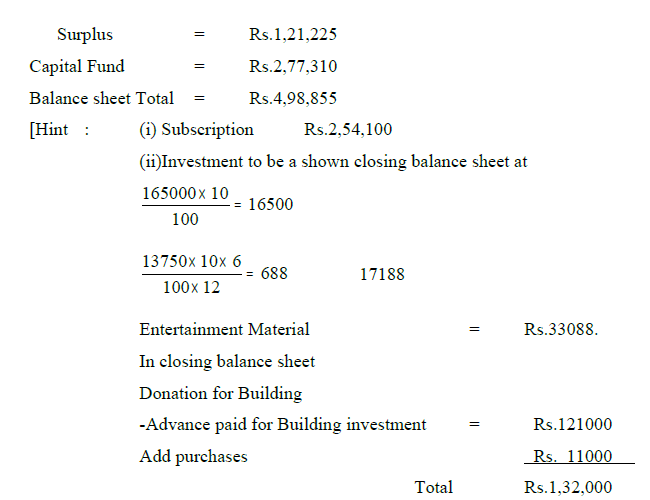

Question: Prepare Income and Expenditure account for the year ended 31st March 2008 and the

Balance sheet as it 31st march 2008 for the following information of Gandhi welfare society

RECEIPT AND PAYMENTS ACCOUNTS for the year ended 31st March 2008

Additional Information:

(i) On 31st March 2007 the society had following assets and liabilities:

Assets: 10 % investment Rs 1,21,000 ( face value Rs 165,000 furniture Rs 88,000

Musical Instruments Rs 13,420 , Machinery Rs 61,600 , Fax Machines Rs 18,700,

subscription in arrears Rs 17,600

Liabilities: Creditors for entertainment material Rs 5,500 subscription received in

advance Rs 2310 and building fund Rs 55,000

(ii) Charge depreciation @ 20% on furniture , machinery and fax machinery

(iii) On 31st march 2008 entertainment material was valued at Rs 28732

Internet charges outstanding Rs 1650

(iv) Each year subscription is paid by 110 members each paying Rs 2310

(v) Payment for entertainment material includes Rs 2200 for previous year

Answer:

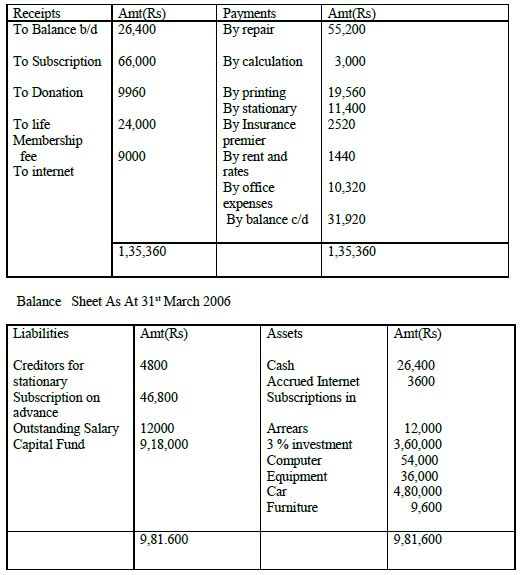

Question: From the following receipts and payments accounts for the year ended 31st March 2007

and Balance Sheet as at 31st March 2006 of Somnath Childrens welfare society prepare Income and Expenditure for the year ended 31st 2007 and Balance Sheet as at 31st 2007

RECEIPT AND PAYMENT ACCOUNT

For the year ended 31st March 2007

Additional Information:

(1) Rs 6000 were impaid for repairs as on 31st March 2007

(2) Subscription received during 2006-2007 included Rs 2400 for the year 2007-2008

(3) Subscriptions due but not paid on 31st March 2007 were Rs 10,080

(4) Rent and rates includes Rs 240 for the year 2007- 08

(5) Depreciations on the following

Car @ 5%p.a. ; Furniture @ 10 % pa

Equipment @ 20% pa

Computers @ 25% and Printer @ 30%pa

Answer:

(iii)Depreciation of building =55000

(825000-770000)

(iv) Profit on sale of refreshment

Sale of refreshment Rs.7040

Cost of refreshment (–) Rs.3960

Total Rs.3080

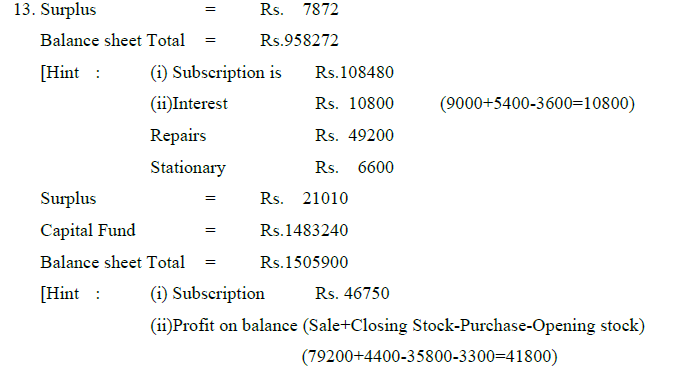

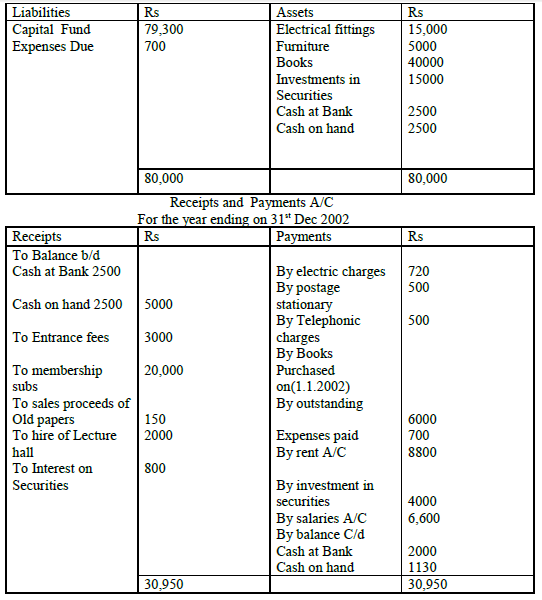

Question: Excellent Library Society showed the following position on 31st December 2001

Balance Sheet as at 31st Dec. 2001

You are required to prepare an Income and Expenditure Account for the year ending 31-12-

200 and Balance Sheet as on that date after making the following adjustments:

(a) Memberships subscription included Rs 1000 received in advance

(b) Provide for outstanding Rent Rs 400 and Salaries Rs 300

(c) Books to be depreciated @ 10% including additions. Electrical fittings and furniture

are also to be depreciated at the same rate.

(d) 75% of the entrance fees is to be capitalized.

(e) Interest on securities to be calculated @ 5% p.a. including purchases of investment

made as on 1.7.2002 for Rs 4000.

Answer: Deficit Rs. 1670

Capital funds Rs.79300

Balance sheet Rs.81580

[Hint – (i) Subscription Rs.19000

(ii)Interest on securities (800+50) Rs. 850