HOTS Accountancy Class 12 Chapter 4 Analysis of Financial Statement

Students of Class 12 Commerce should refer to the HOTS Accountancy Class 12 Analysis of Financial Statement with solutions given below, this will help them to understand the concepts and related questions given in Class 12 Accountancy DK Goel textbook. It’s very important to understand High Order Thinking Skills questions and answers to get better marks in examinations. Also dont forget to refer to dk goel class 12 accountancy solutions

Question: Under What heads will you classify the followings:

1) Proposed Dividends

2) Interest Accrued and due on secured loans

3) Interest Accrued and due on unsecured Loans

4) Provision for Taxation

5) Arrears of fixed accumulative dividends

6) Security premium Account

7) Share Forfeiture account.

Answer:

1) Provisions :- Proposed Dividend

2) Secured Loans : – Interest Accrued and due on Secured Loans

3) Unsecured Loans:- Interest Accrued and due on unsecured Loans

4) Provision : Provision for Taxation

5) Contingent Liabilities :- Arrears of Fixed Cumulative dividend

6) Reserves & Surplus :- Security Premium Account

7) Share Capital Account: – Share forfeiture Account.

Question: Under What headings will you show the following items in the Balance sheet

of a company

1) Securities Premium account

2) Preliminary Expenses

3) Bills Receivable

4) Goodwill

5) Authorised share Capital

Answer:

1) Securities Premium Account :- Under Reserves & Surplus,

Liabilities side

2) Preliminary Expenses :- Under Miscellaneous Expenditures,

Assets side

3) Bills Receivables :- Under Loans & Advance on assets side.

4) Goodwill :- Under Fixed Assets, Assets side

5) Authorised Capital :- Under Share Capital, Liabilities side

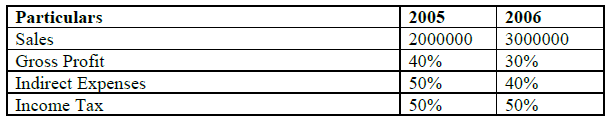

Question: Prepare a Comparative Income statement with the help of the following

information

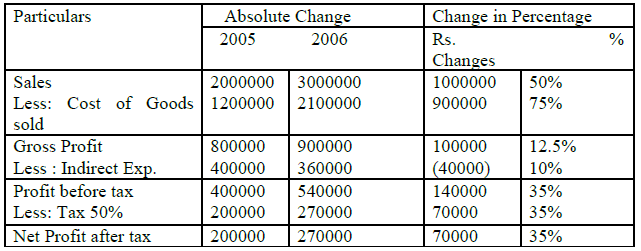

Answer:

Comparative Income Statement

For the year ended 31st Dec, 2006

Question: Explain three purposes or objectives of Financial Analysis.

Answer: Following are the purposes of Financial Analysis:

1) Judging earning capacity of business

2) Judging managerial efficiency of business

3) Judging short term long term Solvency

Question: Mention three limitations of financial statement Analysis.

Answer: Following are the Limitation of Financial statement Analysis

1) Historical Analysis

2) Ignore price level changes

3) Quantities aspect ignored

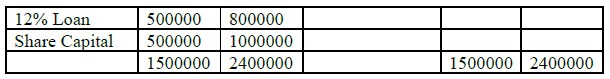

Q.6 From the following Balance Sheets U.K Ltd. on 31st Dec 2006 & 2007.Prepare

comparative Balance Sheet.

Balance Sheet

As on 31st Dec 2006 & 2007

Answer:

Comparative Balance Sheet

For the year ended 31st Dec, 2006 & 2007

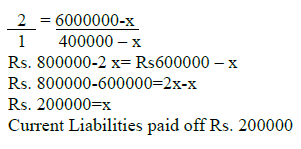

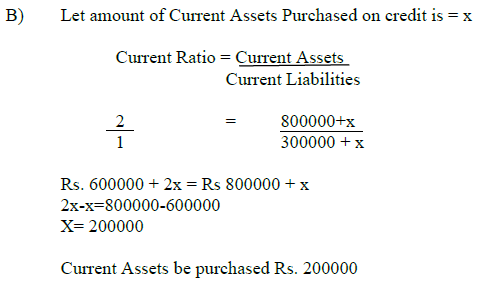

Question: (a) The ratio of current Assets (Rs. 600000) to current Liabilities ( Rs.

400000) is 1.5:1.The Accountant of the firm is interested in maintaining a

current Ratio be 2:1 by paying off a part of Liabilities. Calculate the amount of

Current Liabilities that should be paid.

(b) The Current Assets to Current Liability of a firm is Rs. 800000 to Rs.

b. The Accountant of the firm wishes that current Ratio be 2:1 by

acquiring current assets on credit. Calculate the amount of current Assets.

Answer: A)

a) Let Current Liabilities = X

b)

Current Ratio after making payment of x is 2:1

Current Ratio = Current Assets / Current Liabilities

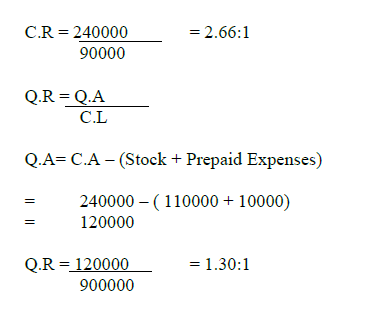

Question: (a) A business has current Ratio of 4:1 & a Quick Ratio of 1.2:1 . If

working capital is Rs. 180000. Calculate total current Assets and Stock

(b) Calculate current Ratio and Quick Ratio from the followings:

Working capital Rs. 150000, Total Debts Rs.400000, Long term debts Rs.

310000, Stock Rs. 110000, Prepaid Expenses Rs. 10000

Answer:

Question:(a) Calculate current Ratio and Quick Ratio from the following

information:

Total Assets Rs. 350000

Fixed Assets Rs. 175000

Investment Rs. 70000

Fictitious Assets Rs. 5000

Share holders fund Rs. 200000

Long term Debts Rs. 100000

Inventory Rs. 45000

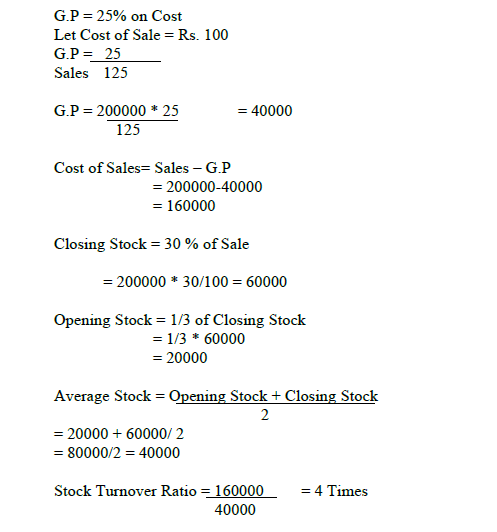

(b) From the following information calculate the stock turnover ratio.

Sales Rs. 200000, G.P 25% on cost, Opening Stock was 1/3rd of the

value of closing stock

Closing stock was 30% of sales

(3 + 3)=6 Marks

Answer: A) Total Assets = Fixed Assets + Investment + Current Assets +

Fictitious Assets

350000 = 175000+70000+Current Assets +5000

Current Assets = 350000-250000

Current Assets = 100000

Liquid Assets = Current Assets – Inventory

= 100000 – 45000 = 55000

Total Assets = Total Liabilities

Total Assets = Shareholders Fund + Long Term Debts +Current

Liabilities

350000 = 200000+100000+Current Liabilities

Current Liabilities = 350000- 300000

Current Liabilities = 50000

Question: (a) Determine the amount of gross profit and sales from the followings:

Debtors Turnover Ratio = 4 Times

Loss of goods sold = Rs. 640000

Gross Profit Ratio = 20%

Closing Debtors were Rs. 20000 more than at the beginning.

Cash sales being 33 1/3 % of credit sales.

Cost of Sales = 60000 * 6 = 360000

Case 1)

Let Cost of Sale = 100

G.P = 25 % above Cost

Sales = 125

If Cost of Sale 100 Sale = 125

If Cost of Sale 1 Sale = 125/100

If Cost of Sale 360000 = 125/100 * 360000

= 450000

Gross Profit = 450000 – 360000

= 90000

Case 2)

Let Sales= 100

G.P = -25/75

If Cost of Sale 75 Sales = 100

If Cost of Sale 1 Sale = 100/75

If Cost of Sales 360000 Sales = 100/75 * 360000

= 480000

Gross Profit = 480000 – 360000 = 120000

B) 1) Sales = Cost of Goods Sold – Gross Profit

Let Sales = 100

G.P = -20

Cost of Goods Sold = 80

If Cost of Good Sold 80 G.P = 20

If Cost of Goods Sold 1 G.P = 20/80

If Cost of Goods Sold 640000 G.P = 20/80*640000

= 160000

Thus Sales = 640000-160000 = 800000

2) Let Credit Sale = 100

Cash Sale = 33 1/3 = 100/3

Total Sale = 100 + 100/3 = 400/3

If Sales 400/3 Credit Sales = 100

If Sales 1 Credit Sales = 100* 3/400 = ¾

If Sale 800000 Credit Sales = ¾ * 80000 = 600000

Question: (a) If Current Ratio is 2:1 state giving reason of the following transaction would

(i) Improve (ii) Reduce or (iii) Not change Current Ratio

(1) Bills Receivable drawn

(2) Bills Receivable Dishonoured

(3) Bills Receivable endorsed to Creditors

(4) Sales of Goods for cash at par

(5) Sales of Goods for cash at Profit

(6) Sales of Assets for Cash

(7) Bills Payable given to creditors

(b) If the Liquid ratio is 1:1, find whether the following transactions

would

(ii) Improve (ii) Reduce or (iii) Not change Liquid Ratio

1) Purchase of goods for cash

2) Purchase of goods on credit

3) Payment of Tax Provision

4) Sales of short term investment at par

5) Sales of Investment at profit

Answer: A)

1) Not Change

2) Not Change

3) Improve

4) Not Change

5) Improve

6) Improve

7) Not Change

B)

1) Reduce

2) Reduce

3) Improve

4) Not Change

5) Improve

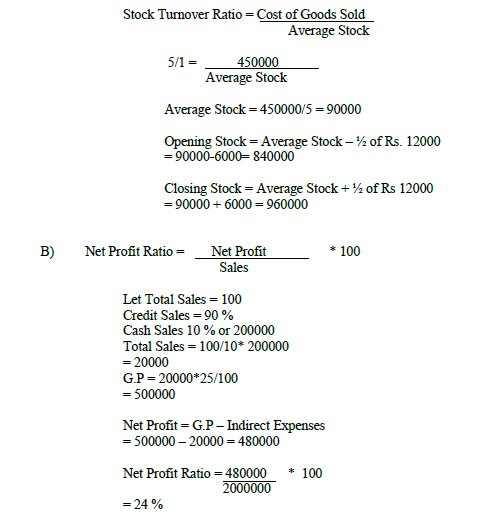

Question: (a) Calculate and Closing stock from the following information:-

Total sales Rs 600000

Gross Profit 25% on Sales

Stock Turnover Ratio = 5 times

Closing stock is Rs. 12000 more than opening stock

(b) Gross Profit Ratio of a company was 25%. Its cash sales were Rs. 200000

and its credit Sales was 90% of the total sales. If the indirect expenses of the

Company were Rs. 20000. Calculate net Profit ratio.

Answer: A) Sales = 600000

G.P = 600000*25/100 = 150000

Cost of Goods Sold = Sales – G.P

= 600000-150000 = 450000

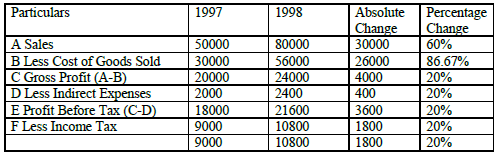

Question: With the help of the following information. Prepare Comparative Income

Statement of XYZ Ltd.

Question: With the help of the following information. Prepare Comparative Income

Statement of XYZ Ltd.

Answer:

Comparative Income Statement of XYZ Ltd.

For the year ended 31st, Dec 1997 & 1998

Question: (a) Calculate Return on Investment from the following

Gross Profit Rs.100000, Office Expenses Rs. 10000, Selling and Distribution

expenses Rs. 25000, Interest on Bank Loan Rs. 8000, Income tax Rs. 12000,

Fixed Assets Rs. 300000, Current Assets Rs. 150000 & Current Liabilities Rs.

125000

(b) Calculate the earning per share from the following data

15000 Equity Share of Rs. 10 each 150000

10 % Preference Share Capital 100000

Net Profit before Tax 55000

Question: The Debt-equity ratio of a company is 1:2, state giving reasons which of the

following would improve, reduce or no change the ratio:-

1) Debenture redeemed for cash

2) Issue new equity shares

3) Payment of Proposed dividends

4) Goods Purchased on Credit

5) Goods Purchased on Cash

6) Redemption of Debentures against the Purchase of a Fixed

Assets

Answer:

1) Reduce

2) Increase

3) Decrease

4) Increase

5) Not Change

6) Increase

7) Increase