Notes for Class 11 Accountancy Chapter 12 Applications of Computers in Accounting

Students can refer to Notes for Class 11 Accountancy Chapter 12 Applications of Computers in Accounting I given below. These notes have been prepared keeping into consideration the latest syllabus and examination guidelines issued by CBSE and NCERT. Class 11 Chapter 12 Applications of Computers in Accounting I Notes is important to understand the topic and solve all questions given in DK Goel Class 11 Textbook

Learning Objective: After studing this Lesson the students will be able to:

- Classify the elements/Components of Computer system.

- Understand the characteristics/utilities of a computer system.

- Acquire knowledge about management information system & Accounting Information System.

- Apply Accounting Software in report generation.

- Develop the skill of different styles of computerized accounting

Meaning of Computers: A computer is an electronic device, which is capable of performing a variety of operations as directed by a set of instructions. This set of instructions is called a computer programme.

Elements of a Computer System:

A computer system is a combination of six elements:

1. Hardware: Hardware of computers consists of physical components such as keyboard, mouse, monitor, processor etc. These are electronic and electronic mechanical components.

2. Software: In order to solve a particular problem with the help of computers, a sequence of instructions written in proper language will have to be feed into the computers. A set of such instructions is called a ‘Program’ and the set of programs is called ‘Software’. For example, a computer by feeding a particular software can be used to prepare payroll, whereas by feeding a second software it can be used to prepare accounts, by feeding a third software it can be used for inventory control and so on.

3. People: People are basically those individuals who use hardware and software to develop, maintain and use the information system residing in the computer memory. They constitute the most important part of the computer System. The main categories of people involved with the computer system are:

a. System Analysis

b. Operators

c. Programmers

4. Procedures: The Procedure means a series of operations in a certain order or manner to achieve desired results. These are of three types:

a. Software-Oriented: Provides a set of instructions required for using the software of a computer system.

b. Hardware-Oriented: Provides details about the components and their methods of operations.

c. Internal Procedure: Helps to ensure smooth flow of data to computers sequencing the operations of each sub-system of overall computer system.

5. Data: These are facts (may consist of numbers, text etc.) gathered and entered into a computer system. The computer system in turn stores, retrieves, classifies, organises and synthesis the data to produce information when desired.

Examples:

1. Bio-data of various applicants when the computer is used for recruitment of staff.

2. Marks obtained by various students in various subjects when the computer is used to prepare results.

6. Connectivity: the manner in which a particular computer system is connected to others (say through telephone lines, microwave transmission satellite link etc.) is called element of connectivity.

Capabilities or Advantage of Computer System

A Computer system posses the following advantages in comparison of human beings:

1. High Speed: Computers are known for their lightening speed of operations and requires less time in comparison to human beings in performing a task. Most of modern computers perform millions of operations in one second.

2. Accuracy: Computers are extremely accurate. Their operations are error free and as such the information obtained from it is highly reliable. But sometimes errors occur due to bad programming or in accurate data feeding. In computer terminology, it refers is called Garbage in, garbage out (GIGO).

3. Reliability: Its reliability refers to the ability with which computer remains functional to serve the user. Unlike human beings these are immune to tiredness, boredom or fatigue, and can perform jobs of repetitive nature any number of times.

4. Versatility: It refers to the ability of computers to perform a variety of tasks. It can switch over from one programme to another. The same computer can be used for accounting work, stock control, sales analysis and even for playing games by the use of different softwares.

5. Storage: Memory or Storage capacity of a computer is so large that it can store any volume of information or data. Such data can be stored in it on magnetic discs, floppy discs, punched cards or microfilms etc. The information stored can be recalled at any time and also correction can be done within no time.

Limitations: Inspite of so many qualities, computers suffer from the following limitations.

1. Lack of Common sense: Since computer works according to the stored programms, it is simply lack of common sense.

2. Zero I.Q.: Computers are dumb devices with zero Intelligence Quotient (IQ). They can’t visualize and think what exactly to do under a particular situation unless they are programmed to tackle that situation.

3. Lack of Feeling: Computers lack feelings like human beings because they are machines. No computer passes the equivalent of a human heart and soul.

4. Lack of Decision-making: Decision making is a complex process involving information, knowledge, intelligence, wisdom & ability to judge, Computers cannot make decisions of their own.

Some more limitations related to computerised System in Accounting

1. High Cost of Training: Besides the high cost of computer system, huge money is required to get the trained specialised staff to ensure efficient and effective use of computerised systems.

2. Danger of System Failure: The danger of system crashing due to hardware failure and the subsequent loss of word is a serious limitation of this system.

3. Staff Opposition: Whenever the Accounting System is computerised, there is a significant degree of resistance from the existing staff because of the fear that they shall be less important to the organisation.

4. Disruption: The accounting process suffer a significant loss of work and time when an organisation switches over to this system. This is due to the changes in the working environment that requires accounting staff to adapt to new system and procedures.

Components of Computers

The functional components consist of Input Unit, Central Processing Unit (CPU) and the output Unit explained as follows:

1. Input Unit: This unit is for entering the data into the computer system. Keyboard and Mouse are the most commonly used input devices. Other such devices are magnetic tapes, disc, light pen, optical scanner, smart card reader etc. Besides there are some devices which respond to voice and physical touch.

2. Central Processing Unit (CPU): It is the main part of computer hardware that actually processes the data according to the instructions it receives. It has three units:

Monitor Printer

a. Arithmetic and Logic Unit (ALU): Responsible for performing all the arithmetic calculations such as addition, subtraction etc. and logical operations involving comparison among variables.

b. Memory Unit: For storing the data.

c. Control Unit: Responsible for controlling and coordinating the activities of all other units of the computer system.

3. Output Unit: After processing the data, the information produced is required in human readable and understandable form. Output devices perform this function. The commonly used devices are monitor, printer, graphic plotter (external) and magnetic stage devices (internal). A new device which is capable of producing verbal output that is sound in human speech is also developed.

Operating Software

Operating Software is a set of programmes that is used by computers for various purposes. Operating Software is essential part of computer system in absence of operating software computer cannot operate. There are many operating soft- wares like Windows, Excel etc.

Utility Software

Utility Software is a set of computer programmes used to perform supporting operations in a

computer. Utility Software are highly specialised and designed to perform only a single task

or a small range of tasks.

Application Software

Application Software is the set of programmes which is designed and developed for performing certain task like accounting, word processing etc. for example Tally is the application software.

Accounting Information System (AIS)

Accounting Information System is a system of collecting, processing, summarising and reporting information about a business organisation in monetary terms. It maintains a detailed financial record of the business operations and transfer the data into valuable information.

So, Accounting Information System (AIS) is a sub-system of Management information System (MIS).. AIS is a structure that allows its users to collect and use business data.

Management Information System (MIS)

It is a planned System of collecting, processing, storing & disseminating the data in the form of Information to perform the task of decision making and management of an organization.

Branches of MIS

- Accounting Information System

- Manufacturing Information System

- Human Resource Information System

- Marketing Information System

Application of Computers in Accounting

1. Recording of transactions: Record all the business transactions properly and timely.

2. Preparation of ledger accounts: Computers prepare all ledger accounts by given transactions, like cash, bank, debtors, sales a/c etc.

3. Preparation of Trial Balance: It prepares the Trial Balance according to ledger accounts.

4. Preparation of Final A/c: It has utility to prepare Trading A/c, Profit & Loss A/c and Balance Sheet.

Features of Computerised Accounting System

Computerised accounting system is based on the concept of database.

This system offers the following features:

1. Online input and storage of accounting data.

2. Printout of purchase and sales invoices.

3. Every account and transaction is assigned a unique code.

4. Grouping of accounts is done from the beginning.

5. Instant reports for management, for example: Stock Statement, Trial Balance, Income Statement, Balance Sheet, Payroll Reports, Tax Reports etc.

Automation of Accounting Process

When accounting functions are done by computerised accounting software that is known as automation of accounting process under the automation of accounting process human activity is less but accounting software is more used.

So, accounting functions like posting into ledger, Balancing, Trial Balance and Final Accounts are prepared by computer.

Stages of Automation

There are different stages of automation as:

i. Planning: Under this stage the assessment of size, and business transactions is done for which automation has to be made.

ii. Selection of Accounting Software: As there are many accounting softwares available in the market. So, in this stage appropriate accounting software is to be selected according to company’s need.

iii. Selection of Accounting Hardware: Under this stage of automation the computer hardware is selected. The hardware should be such that can fullfill the accounting requirement and support the accounting software.

iv. Chart of Accounts: Under this stage list of required heads of accounts is prepared.

v. Grouping of Accounts: There are various transactions for Expenses, Income, Assets, Liabilities. All these transactions cannot be shown directly. So, these transactions are grouped as salary, wages, discount and commission etc.

vi. Generation of Reports: This is final stage of automation under this final reports are prepared in from of Cash Book, Journal, Ledger, Trial Balance, P&L A/c and Balance Sheet etc.

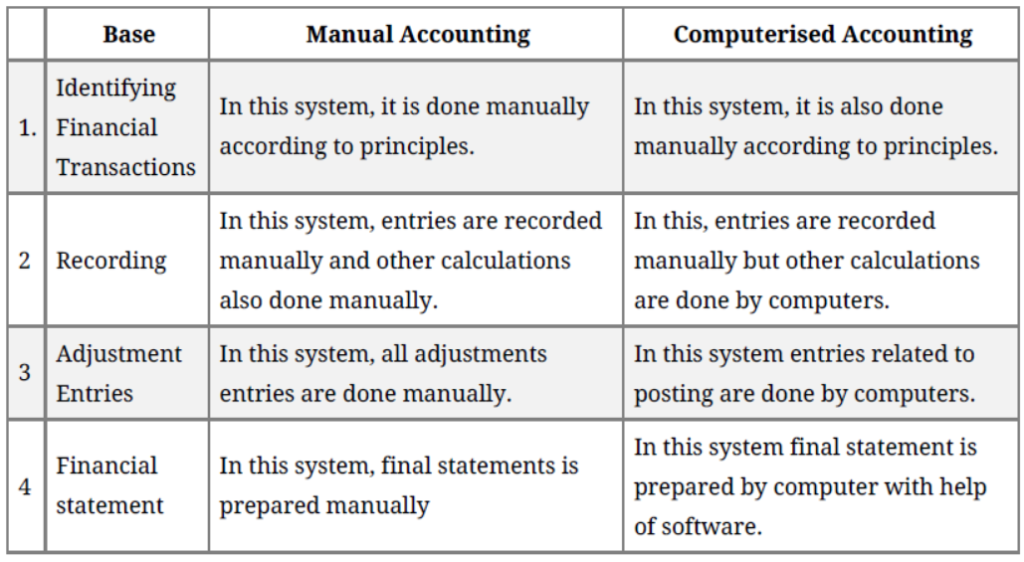

Comparison of Manual and Compute red Accounting System

Sourcing of Accounting Software

India is one of software making country. So, accounting softwares are easily available in Indian Market. But it is more important to know what is your need of accounting software. Generally, Tally accounting software is used in India which is easily available in market.

Accounting Softwares

1. Readymade Software: Readymade Softwares are the softwares that are developed not for any specific user but for the users in general. Some of the ready-made softwares available are Tally, Ex, Busy. Such softwares are economical and ready to use. Such softwares do not fulfill the requirement of very user.

2. Customised Software: Customised software means modifying the ready-made softwares to suit the specific requirements of the user Readymade softwares are modified according to the need of the business Cost of installation, maintenance and training is relatively higher than that of ready-made user. There packages are used by those medium or large business enterprises in which financial transactions are some what peculiar in nature.

3. Tailor-made Software: The softwares that are developed to meet the requirement of the user on the basis of discussion between the user and developers. Such softwares help in maintaining effective management information system. The cost of these softwares in very high and specific training for using these packages is also required.

Generic Considerations Before Sourcing Accounting Software

i. Flexibility: a computer software system must be flexible in respect of data handling and report preparing.

ii. Maintenance Cost: The accounting software must be such which has less maintenance cost.

iii. Size of organisation: The accounting software must be according to need and size of organisation.

iv. Easy to adaptation: The accounting software must be such which is easy to apply in organisation.

v. Secrecy of data: The accounting software provide the secrecy of business data.

Preparation of Accounts Groups

Groups of accounts means classifying the accounting transactions into different heads like Assets Group, Liabilities Group, Income Group and Expenses Group. By these grouping of accounts the final Accounts are meaningful for its users.

Generation of Accounting Reports

After collecting business data, it is converted into meaningful informations. Such summarised and converted information is known as a report.

The report is more effective if it is based on accurate and timely data.

A report must be relevant to users and contain all relevant information like Debtor’s Report, Creditor’s Report, Trial Balance and Financial Statement Report and others.