Notes for Class 12 Accountancy Chapter 2 Accounting for Partnership Basic Concepts

Class 12 commerce students can refer to the Class 12 Accounting for Partnership notes given below which is an important chapter in the Class 12 accountancy book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Accountancy teachers have prepared these notes for the benefit of students so that you can read these revision notes and understand each topic carefully.

Accounting for Partnership Notes Class 12 Accountancy

Refer to the notes and important questions given below for Accounting for Partnership which are really useful and have been recommended by Class 12 Accounts teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books.

OBJECTIVE TYPE QUESTIONS

- 1. Features of a partnership firm are :

- (A) Two or more persons are carrying common business under an agreement.

- (B) They are sharing profits and losses in the fixed ratio.

- (C) Business is carried by all or any of them acting tor all as an agent.

- (D) All of the above.

Answer

D

- 2. Following are essential elements of a partnership firm except:

- (A) At least two persons

- (B) There is an agreement between all partners

- (C) Equal share of profits and losses

- (D) Partnership agreement is for some business.

Answer

C

- 3. In case of partnership the act of any partner is : (A) Binding on all partners

- (B) Binding on that partner only

- (C) Binding on all partners except that particular partner

- (D) None of the above

Answer

A

- 4. Which of the following statement is true

- (A) a minor cannot be admitted as a partner

- (B) a minor can be admitted as a partner, only into the benefits of the partnership

- (C) a minor can be admitted as a partner but his rights and liabilities are same of adult partner

- (D) none of the

Answer

B

- 5. Ostensible partners are those who

- (A) do not contribute any capital but get some share of profit for lending their name to the business

- (B) contribute very less capital but get equal profit

- (C) do not contribute any capital and without having any interest in the business, lend their name to the business

- (D) contribute maximum capital of the business

Answer

C

- 6. Sleeping partners are those who

- (A) take active part in the conduct of the business but provide no capital. However, salary is paid to them.

- (B) do not take any part in the conduct of the business but provide capital and share profits and losses in the agreed ratio

- (C) take active part in the conduct of the business but provide no capital. However, share profits and losses in the agreed ratio.

- (D) do not take any part in the conduct of the business and contribute no capital. However, share profits and losses in the agreed ratio

Answer

B

- 7. The relation of partner with the firm is that of:

- (A) An Owner

- (B) An Agent

- (C) An Owner and an Agent

- (D) Manage

Answer

C

- 8. What should be the minimum number of persons to form a Partnership :

- (A) 2

- (B) 7

- (C) 10

- (D) 20

Answer

A

- 9. Number of partners in a partnership firm may be :

- (A) Maximum Two

- (B) Maximum Ten

- (C) Maximum One Hundred

- (D) Maximum Fifty

Answer

D

- 10, Liability of partner is :

- (A) Limited

- (B) Unlimited

- (C) Determined by Court

- (D) Determined by Partnership Act

Answer

B

- 11. Which one of the following is NOT an essential feature of a partnership

- (A) There must be an agreement

- (B) There must be a business

- (C) The business must be carried on for profits

- (D) The business must be carried on by all the partners

Answer

D

- 12. X, Y and Z are partners sharing profits and losses equally. Their capital balances on March, 31, 2012 are ₹80,000, ₹60,000 and ₹40,000 respectively. Their personal assets are worth as follows : X — ₹20,000, Y — ₹15,000 and Z — ₹10,000. The extent of their liability in the firm would be :

- (A) X — ₹80,000 : Y — ₹60,000 : and Z — ₹40,000

- (B) X — ₹20,000 : Y — ₹15,000 : and Z — ₹10,000

- (C) X — ₹1,00,000 : Y — ₹75,000 : and Z — ₹50,000

- (D) Equal

Answer

B

- 13. Every partner is bound to attend diligently to his in the conduct of the business.

- (A) Rights

- (B) Meetings

- (C) Capital

- (D) Duties

Answer

D

- 14. Forming a Partnership Deed is :

- (A) Mandatory

- (B) Mandatory in Writing

- (C) Not Mandatory

- (D) None of the Above

Answer

C

- 15. Partnership Deed is also called

- (A) Prospectus

- (B) Articles of Association

- (C) Principles of Partnership

- (D) Articles of Partnership

Answer

D

- 16. Which of the following is not incorporated in the Partnership Act.

- (A) profit and loss are to be shared equally

- (B) no interest is to be charged on capital

- (C) all loans are to be charged interest @6% p.a.

- (D) all drawings are to be charged interest

Answer

D

- 17. When is the Partnership Act enforced

- (A) when there is no partnership deed

- (B) where there is a partnership deed but there are differences of opinion between the partners

- (C) when capital contribution by the partners varies

- (D) when the partner’s salary and interest on capital are not incorporated in the partnership deed

Answer

A

- 18. In the absence of Partnership Deed, the interest is allowed on partner’s capital:

- (A) @ 5% p.a.

- (B) @ 6% p.a.

- (C) @ 12% p.a.

- (D) No interest is allowed

Answer

D

- 19. In the absence of a partnership deed, the allowable rate of interest on partner’s loan account will be :

- (A) 6% Simple Interest

- (B) 6% p.a. Simple Interest

- (C) 12% Simple Interest

- (D) 12% Compounded Annually

Answer

B

- 20. A and B are partners in partnership firm without any agreement. A has given a loan of ₹50,000 to the firm. At the end of year loss was incurred in the business. Following interest may be paid to A by the firm :

- (A) @5% Per Annum

- (B) @ 6% Per Annum

- (C) @ 6% Per Month

- (D) As there is a loss in the business, interest can’t be paid

Answer

B

- 21. A and B are partners in a partnership firm without any agreement. A has withdrawn RS50,000 out of his Capital as drawings. Interest on drawings may be charged from A by the firm :

- (A) @ 5% Per Annum

- (B) @ 6% Per Annum

- (C) @ 6% Per Month

- (D) No interest can be charged

Answer

D

- 22. A and B are partners in a partnership firm without any agreement. A devotes more time for the firm as compare to B. A will get the following commission in addition to profit in the firm’s profit:

- (A) 6% of profit

- (B) 4% of profit

- (C) 5% of profit

- (D) None of the above

Answer

D

- 23. In the absence of partnership deed, the following rule will apply :

- (A) No interest on capital

- (B) Profit sharing in capital ratio

- (C) Profit based salary to working partner

- (D) 9% p.a. interest on drawings

Answer

A

- 24. In the absence of agreement, partners are not entitled to :

- (A) Salary

- (B) Commission

- (C) Equal share in profit

- (D) Both (a) and (b)

Answer

D

- 25. Interest on capital will be paid to the partners if provided for in the partnership deed but only out of:

- (A) Profits

- (B) Reserves

- (C) Accumulated Profits

- (D) Goodwill

Answer

A

- 26. Which one of the following items cannot be recorded in the profit and loss appropriation account

- (A) Interest on capital

- (B) Interest on drawings

- (C) Rent paid to partners

- (D) Partner’s salary

Answer

C

- 27. If any loan or advance is provided by partner then, balance of such Loan Account should be transferred to :

- (A) B/S Assets side

- (B) B/S Liability Side

- (C) Partner’s Capital A/c

- (D) Partner’s Current A/c

Answer

B

- 28. A, B and C Were Partners with capitals of ₹50,000; ₹40,000 and RS 30,000 respectively carrying on business in partnership. The firm’s reported profit for the year was ₹80,000. As per provision of the Indian Partnership Act, 1932, find out the share of each partner in the above amount after taking into account that no interest has been provided on an advance by A of ₹20,000 in addition to his capital contribution.

- (A) ₹26,267 for Partner B and C and ₹27,466 for Partner A.

- (B) ₹26,667 each partner.

- (C) ₹33,333 for A ₹26,667 for B and ₹20,000 for C.

- (D) ₹30,000 each partner.

Answer

A

- 29. X, Y, and Z are partners in a firm. At the time of division of profit for the year, there was dispute between the partners. .Profit before interest on partner’s capital was ₹6,000 and Y determined interest @24% p.a. on his loan of ₹80,000. There was no agreement on this point. Calculate the amount payable to X, Y, and Z respectively.

- (A) ₹2,000 to each partner.

- (B) Loss of ₹4,400 for X and Z; Twill take ₹14,800.

- (C) ₹400 for A, ₹5,200 for Land ₹400 for Z.

- (D) None of the above.

Answer

C

- 30. X, Y, and Z are partners in a firm. At the time of division of profit for the year, there was dispute between the partners. Profit before interest on partner’s capital was ₹6,00,000 and Z demanded minimum profit of ₹5,00,000 as his financial position was not good. However, there was no written agreement on this point.

- (A) Other partners will pay Z the minimum profit and will share the loss equally.

- (B) Other partners will pay Z the minimum profit and will share the loss in capital ratio.

- (C) Xand T will take ₹50,000 each and Z will take ₹5,00,000.

- (D) ₹2,00,000 to each of the partners.

Answer

D

- 31. On 1st June 2018 a partner introduced in the firm additional capital ₹50,000. In the absence of partnership deed, on 31st March 2019 he will receive interest :

- (A) ₹3,000

- (B) Zero

- (C) ₹2,500

- (D) ₹1,800

Answer

B

- 32. On 1st January 2019, a partner advanced a loan of ₹1,00,000 to the firm. In the absence of agreement, interest on loan on 31st March 2019 will be :

- (A) Nil

- (B) ₹1,500

- (C) ₹3,000

- (D) ₹6,000

Answer

- 33. A partner introduced additional capital of ₹30,000 and advanced a loan of ₹40,000 to the firm at the beginning of the year. Partner will receive year’s interest:

- (A) ₹4,200

- (B) ₹2,400

- (C) Nil

- (D) ₹1,800

Answer

B

- 34. In the absence of partnership deed, partners share profits or losses :

- (A) In the ratio of their Capitals

- (B) In the ratio decided by the court

- (C) Equally

- (D) In the ratio of time devoted

Answer

C

- 35. In the absence of Partnership Deed :

- (A) Interest will not be charged on partner’s drawings

- (B) Interest will be charged @. 5% p.a. on partner’s drawings

- (C) Interest will be charged @ 6% p.a. on partner’s drawings

- (D) Interest will be charged @ 12% p.a. on partner’s drawings

Answer

A

- 36. In the absence of express agreement, interest @ 6% p.a. is provided :

- (A) On opening balance of partner’s capital accounts

- (B) On closing balance of partner’s capital accounts

- (C) On loan given by partners to the firm

- (D) On opening balance of partner’s current accounts

Answer

C

- 37. Which of the following items are recorded in the Profit & Loss Appropriation Account of a partnership firm

- (A) Interest on Capital

- (B) Salary to Partner

- (C) Transfer to Reserve

- (D) All of the above

Answer

D

- 38. Is rent paid to a partner appropriation of profits

- (A) It is appropriation of profit

- (B) It is not appropriation of profit

- (C) If partner’s contribution as capital is maximum

- (D) If partner is a working partner.

Answer

B

- 39. According to Profit and Loss Account, the net profit for the year is ₹1,50,000. The total interest on partner’s capital is ₹18,000 and interest on partner’s drawings is ₹2,000. The net profit as per Profit and Loss Appropriation Account will be :

- (A) ₹1,66,000

- (B) ₹1,70,000

- (C) ₹1,30,000

- (D) ₹1,34,000

Answer

D

- 40. According to Profit and Loss Account, the net profit for the year is ₹4,20,000. Salary of a partner is ₹5,000 per month and the commission of another partner is ₹10,000. The interest on drawings of partners is ₹4,000. The net profit as per Profit and Loss Appropriation Account will be :

- (A) ₹3,54,000

- (B) ₹3,46,000

- (C) ₹4,09,000

- (D) ₹4,01,000

Answer

A

- 41. A and B are partners. According to Profit and Loss Account, the net profit for the year is ₹2,00,000. The total interest on partner’s drawings is ₹1,000. As salary is ₹40,000 per year and B’s salary is ₹3,000 per month. The net profit as per Profit and Loss Appropriation Account will be :

- (A) ₹1,23,000

- (B) ₹1,25,000

- (C) ₹1,56,000

- (D) ₹1,58,000

Answer

B

- 42. According to Profit and Loss Account, the net profit for the year is ₹1,40,000. The total interest on partner’s capital is RS 8,000 and a partner is to be allowed commission of ₹5,000. The total interest on partner’s drawings is ₹1,200. The net profit as per Profit and Loss Appropriation Account will be :

- (A) ₹1,28,200

- (B) ₹1,44,200

- (C) ₹1,25,800

- (D) ₹1,41,800

Answer

A

- 43. Sangeeta and Ankita are partners in a firm. Sangeeta’s capital is ₹70,000 and Ankita’s Capital is ₹50.000. Firm’s profit is ₹60,000. Ankita share in profit will be :

- (A) ₹25,000

- (B) ₹3 0,000

- (C) ₹35,000

- (D) ₹20,00

Answer

B

- 44. A, B and C are partners. A’s capital is ₹3,00,000 and B’s capital is ₹1,00,000. C has not invested any amount as capital but he alone manages the whole business. C wants RS30,000 p.a. as salary. Firm earned a profit of ₹1,50,000. How much will be each partner’s share of profit:

- (A) A ₹60,000; B ₹60,000; C ₹Nil

- (B) A ₹90,000; B ₹30,000; C ₹Nil

- (C) A ₹40,000; B ₹40,000 and C ₹40,000

- (D) A ₹50,000; B ₹50,000 and C ₹50,000.

Answer

D

- 45. Net profit of a firm is ₹49,500. Manager is entitled to a commission of 10% on profits before charging his commission. Manager’s Commission will be :

- (A) ₹4,950

- (B) ₹4,500

- (C) ₹5,500

- (D) ₹495

Answer

A

- 46. Net profit of a firm is ₹79,800. Manager is entitled to a commission of 5% of profits after charging his commission. Manager’s Commission will be :

- (A) ₹4,200

- (B) ₹380

- (C) ₹3,990

- (D) ₹3,800

Answer

D

- 47. Ram and Shyam are partners in the ratio of 3:2. Before profit distribution, ‘ Ram is entitled to 5% commission of the net profit (after charging such commission). Before charging commission, firm’s profit was ₹42,000. Shyam’s share in profit will be :

- (A) ₹16,000

- (B) ₹24,000

- (C) ₹26,000

- (D) ₹16,400

Answer

A

- 48. A, B and C are partners in the ratio of 5 : 3 : 2. Before B’s salary of ₹17,000 firm’s profit is ₹97,000. How much in total B will receive from the firm

- (A) ₹17,000

- (B) ₹40,000

- (C) ₹24,000

- (D) ₹41,000

Answer

D

- 49. A, B and C are partners in a firm without any agreement. They have contributed 750,000, 730,000 and 720,000 by way of capital in the firm. A was unable to work for six months in a year due to illness. At the end of year, firm earned a pro lit of 7 15,000. A’s share in the profit will be :

- (A) 77.500

- (B) 73,750

- (C) 75,000

- (D) 72,500

Answer

C

- 50. In a partnership Firm, partner A is entitled a monthly salary of ₹7,500. At the end of the year, firm earned a profit of ₹75,000 after charging T’s salary. If the manager is entitled a commission of 10% on the net profit after charging his commission, Manager’s commission will be :Answer: C

- (A) ₹7,500

- (B) ₹16,500

- (C) ₹8,250

- (D) ₹15,000

Answer

D

- 51. Seeta and Geeta are partners sharing profits and losses in the ratio 4 : 1. Meeta was manager who received the salary of ₹4,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profit for the year is ₹6,78,000 before charging salary. Find the total remuneration of Meeta.

- (A) ₹78,000

- (B) ₹88,000

- (C) ₹87,000

- (D) ₹76,000

Answer

A

- 52. Which of the following statement is true

- (A) Fixed capital account will always have a credit balance

- (B) Current account can have a positive or a negative balance

- (C) Fluctuating capital account can have a positive or a negative balance

- (D) All of the above

Answer

D

- 53. Which accounts are opened when the capitals are fixed

- (A) Only Capital Accounts

- (B) Only Current Accounts

- (C) Capital Accounts as well as Current Accounts

- (D) Either Capital Accounts or Current Accounts

Answer

C

- 54. Which accounts are opened when the capitals are fluctuating

- (A) Only Capital Accounts

- (B) Only Current Accounts

- (C) Capital Accounts as well as Current Accounts

- (D) Either Capital Accounts or Current Accounts

Answer

A

- 55. Balance of partner’s current accounts are : (A) Debit balance

- (B) Credit balances

- (C) Debit or Credit balances

- (D) Neither Debit nor credit balances

Answer

C

- 56. Which item is recorded on the credit side of partner’s current accounts :

- (A) Interest on Fanner’s Capitals

- (B) Salaries of Partners

- (C) Share of profits of Partners

- (D) All of the Above

Answer

D

- 57. If the Partners’ Capital Accounts are fixed ‘salary payable to partner’ will be recorded :

- (A) On the debit side of Partners’ Current Account

- (B) On the debit side of Partners’ Capital Account

- (C) On the credit side of Partners’ Current Account

- (D) None of the above

Answer

C

- 58. It the Partner’s Capital Accounts are fixed, interest on capital will be recorded:

- (A) On the credit side of Current Account

- (B) On the credit side of Capital Account

- (C) On the debit side of Current Account

- (D) On the debit side of Capital Account

Answer

A

- 59. If the Partner’s Capital Accounts are fluctuating, in that case following item/items will be recorded in the credit side of capital accounts :

- (A) Interest on capital

- (B) Salary of partners

- (C) Commission of partners

- (D) All of the above

Answer

D

- 60. Interest on partner’s capitals will be debited to :

- (A) Profit and Loss Account

- (B) Profit and Loss Appropriation Account

- (C) Partner’s Capital Accounts

- (D) None of the Above

Answer

B

- 61. Interest on partner’s capitals will be credited to :

- (A) Profit and Loss Account

- (B) Profit and Loss Appropriation Account

- (C) Interest Account

- (D) Partner’s Capital Accounts

Answer

D

- 62. For the firm interest on drawings is

- (A) Capital Payment

- (B) Expenses

- (C) Capital Receipt

- (D) Income

Answer

D

- 63. Interest on Partner’s drawings will be debited to :

- (A) Profit and Loss Account

- (B) Profit and Loss Appropriation Account

- (C) Partner’s Current Account

- (D) Interest Account

Answer

C

- 64. When partners’ capital accounts are floating, which one of the following items will be written on the credit side of the partners’ capital accounts :

- (A) Interest on drawings

- (B) Loan advanced by partner to the firm

- (C) Partner’s share in the firm’s loss

- (D) Salary to the active partners

Answer

D

- 65. When partners’ capital accounts are fixed, which one of the following items will be written in the partner’s capital account :

- (A) Partner’s Drawings

- (B) Additional capital introduced by the partner in the firm

- (C) Loan taken by partner from the firm

- (D) Loan Advanced by partner to the firm

Answer

B

- 66. Interest on partner’s drawings will be credited to

- (A) Profit and Loss Account

- (B) Profit and Loss Appropriation Account

- (C) Partner’s Capital Accounts

- (D) None of the Above

Answer

B

- 67. For the firm interest on capital is :

- (A) Capital Payment

- (B) Capital Receipt

- (C) Loss

- (D) Income

Answer

C

- 68. On 1st April 2018, 2fs Capital was ₹2,00,000. On 1st October 2018, he introduces additional capital of ₹1,00,000. Interest on capital @ 6% p.a. on 31st March, 2019 will be :

- (A) ₹9,000

- (B) ₹18,000

- (C) ₹10,500

- (D) ₹15,000

Answer

D

- 69. X and Y are partners in the ratio of 3 : 2. Their capitals are RS2,00,000 and ₹1,00,000 respectively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of RS60,000 for the year ended 31st March 2019. Interest on Capital will be :

- (A) X ₹16,000; Y ₹8,000

- (B) V ₹8.000; Y ₹4,000

- (C) X ₹14,400; Y ₹9,600

- (D) No Interest will be allowed

Answer

A

- 70. X and Y are partners in the ratio of 3:2. Their capitals are ₹2,00,000 and ₹1,00,000 respectively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of ₹15,000 for the year ended 31st March 2019. Interest on Capital will be :

- (A) X ₹16,000; Y ₹8,000

- (B) X ₹9,000; Y ₹6,000

- (C) X ₹10,000; Y ₹5,000

- (D) No Interest will be allowed

Answer

C

- 71. X and Y are partners in the ratio of 3:2. Their capitals are RS2,00,000 and ₹1,00,000 respectively. Interest on capitals is allowed @ 8% p.a. Firm incurred a loss of ₹60,000 for the year ended 31st March 2019. Interest on Capital will be :

- (A) X ₹16,000; Y ₹8,000

- (B) A ₹8,000; Y ₹4,000

- (C) X ₹14,400; Y ₹9,600

- (D) No Interest will be allowed

Answer

D

- 72. X and Y are partners in the ratio of 3:2. Their capitals are ₹2,00,000 and ₹1,00,000 respectively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of ₹15,000 for the year ended 31st March 2019. As per partnership agreement, interest on capital is treated a charge on profits. Interest on Capital will be :

- (A) X ₹16,000; Y ₹8,000

- (B) X ₹9,000; Y ₹6,000

- (C) X ₹10,000; Y ₹5,000

- (D) No Interest will be allowed

Answer

A

- 73. A and B contribute ₹1,00,000 and RS₹60,000 respectively in a partnership firm by way of capital on which they agree to allow interest @ 8% p.a. Their profit or loss sharing ratio is 3 : 2. The profit at the end of the year was ₹2,800 before allowing interest on capital. If there is a clear agreement that interest on capital will be paid even in case of loss, then S’s share will be:

- (A) Profit ₹6,000

- (B) Profit ₹4,000

- (C) Loss ₹6,000

- (D) Loss ₹4,000

Answer

D

- 74. Partners are suppose to pay interest on drawing only when by the

- (A) Provided, Agreement

- (B) Permitted, Investors

- (C) Agreed, Partners

- (D) ‘A’ & ‘C’ above

Answer

D

- 75. Where will you record interest on drawings :

- (A) Debit Side of Profit & Loss Appropriation Account

- (B) Credit Side of Profit & Loss Appropriation Account

- (C) Credit Side of Profit & Loss Account

- (D) Debit Side of Capital/Current Account only

Answer

B

- 76. How would you close the Partner’s Drawing Account:

- (A) By transfer to Capital or Current Account Debit Side.

- (B) By transfer to Capital Account Credit Side.

- (C) By transfer to Current Account Credit Side.

- (D) Either ‘B‘ or ‘C’.

Answer

A

- 77. If date of drawings of the partner’s is not given in the question, interest is charged for how much time

- (A) 1 month

- (B) 3 months

- (C) 6 months

- (D) 12 months

Answer

C

- 78.Vikas is a partner in a firm. His drawings during the year ended 31st March, 2019 were RS72,000. If interest on drawings is charged @ 9% p.a. the interest charged will be :

- (A) ₹324

- (B) ₹6,480

- (C) ₹3,240

- (D) ₹648

Answer

C

- 79. If a fixed amount is withdrawn by a partner on the first day of every month, interest on the total amount is charged for …………… months :

- (A) 6

- (B) 61/2

- (C) 51/2

- (D) 12

Answer

B

- 80. If a fixed amount is withdrawn by a partner on the last day of every month, interest on the total amount is charged for …………… months :

- (A) 6

- (B) 61/2

- (C) 51/2

- (D) 12

Answer

C

- 81. If a fixed amount is withdrawn by a partner in the middle of every month, interest on the total amount is charged for …………… months

- (A) 6

- (B) 61/2

- (C) 51/2

- (D) 12

Answer

A

- 82. In a partnership firm, a partner withdrew ₹5,000 per month on the first day of every month during the year for personal expenses. If interest on drawings is charged @ 6% p.a. the interest charged will be : (C.S. Foundation, Dec. 2012)

- (A) ₹3,600

- (B) ₹1,950

- (C) ₹1,800

- (D) ₹1,650

Answer

B

- 83. Ajay is a partner in a firm. He withdrew ₹2,000 per month on the last day of every month during the year ended 31st March, 2019. If interest on drawings is charged @ 9% p.a. the interest charged will be :

- (A) ₹990

- (B) ₹1,080

- (C) ₹1,170

- (D) ₹2,160

Answer

A

- 84. Sushil is a partner in a firm. He withdrew ₹4,000 per month in the middle of every month during the year ended 31st March, 2019. If interest on drawings is charged @ 8% p.a. the interest charged will be :

- (A) ₹2,080

- (B) ₹1,760

- (C) ₹3,840

- (D) ₹1,920

Answer

D

- 85. If fixed amount is withdrawn by a partner on the first day of each quarter, interest on the total amount is charged for …………….. months

- (A) 4.5

- (B) 6

- (C) 7.5

- (D) 3

Answer

C

- 86. If a fixed amount is withdrawn by a partner on the last day of each quarter, interest on the total amount is charged for ……………… months

- (A) 4.5

- (B) 6

(C) 7.5 - (D) 3

Answer

B

- 87. If a fixed amount is withdrawn by a partner in each quarter, interest on the total amount is charged for ……………….. months

- (A) 3

- (B) 6

- (C) 4.5

- (D) 7.5

Answer

B

- 88. Anuradha is a partner in a firm. She withdrew ₹6,000 in the beginning of each quarter during the year ended 31st March, 2019. Interest on her drawings @ 10% p.a. will be :

- (A) ₹900

- (B) ₹1,200

- (C) ₹1,500

- (D) ₹600

Answer

C

- 89. Bipasa is a partner in a firm. She withdrew ₹6,000 at the end of each quarter during the year ended 31st March, 2019. Interest on her drawings @ 10% p.a. will be :

- (A) ₹900

- (B) ₹600

- (C) ₹1,500

- (D) ₹1,200

Answer

A

- 90. Charulata is a partner in a firm. She withdrew ₹10,000 in each quarter during the year ended 31st March, 2019. Interest on her drawings @ 9% p.a. will be:

- (A) ₹1,350

- (B) ₹2,250

- (C) ₹900

- (D) ₹1,800

Answer

D

Short answer questions

1. Anna and Bobby were partners sharing profits and losses in the ratio of 5 : 3. On 1st April 2014, their capital accounts showed balances of Rs 3,00,000 and Rs 2,00,000 respectively. Calculate the amount of profit to be distributed between the partners if the partnership deed provided for interest on capital @ 10% per annum and the firm earned a profit of Rs 45,000 for the year ended 31st March 2015.

Solution :No profit will be distributed as the amount of profit (i e., Rs 45,000) is not sufficient to pay the interest on capital (Rs 50,000),so Interest on capital i.e. Rs.45,000, to be provided in the interest ratio of the partners.

2. What do you understand by Sacrificing Partners?

Solution : The partners whose share stand decreased as a result of change in profit-sharing ratio are known as Sacrificing Partners. Sacrificing ratio shows the sacrifice of share of each sacrificing partner.

3. What do you understand by Sacrificing Ratio?

Solution : Sacrificing ratio is the ratio in which the partner or partners have agreed to sacrifice their share of profit in favour of one or more partners of the firm. Sacrificing ratio of each partner is calculated as follows: Sacrificing Ratio = Old Ratio – New Ratio

4. What is meant by Partnership? / Define Partnership.

Ans. According to Section 4 of Indian Partnership Act 1932, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”.

5. What is the status of partnership firm from an accounting viewpoint?

Ans. From the accounting view point, Partnership is a separate business entity from the partners.

6. Which Act of the Parliament specified the number of partners in Partnership?

Ans. Section 464 of Companies Act, 2013

7. Name the Act under which partnership is governed?

Ans. Partnership Act, 1932.

8. What is a legal status of a firm?

Ans. A firm is not a legal person it is merely a collection of partners.

9. Mention two items that are recorded in Partners Fixed Capital Account.

Ans. i) Capital Withdrawal ii) Fresh Capital Introduced.

10. What are the circumstances under which the balance of the ‘Fixed capitals Accounts’ may change?

Ans. i) Additional capital Introduced. ii) Capital Withdrawn.

11. Would a “Charitable Dispensary” run by 8 members be deemed a Partnership Firm? Give reason in support of your answer.

(i) In Partnership, there must be a business;

(ii) There must be sharing of profits from such business among the partners.

12. Why is it preferable to have a written agreement between the partners?

Ans. To avoid all kinds of misunderstanding and disputes among the partners

13. Why is that the Fixed Capital Account of a partner does not show “Debit Balance” in spite of regular and Consistent losses year after year?

Ans. When the capitals are fixed, the Capital Account of a partner will never show debit balance since, all transactions between the firm and the partner are recorded in Current Account.

14. A & B are two working partners whereas B is sleeping partner in the firm. B wants to inspect books of Accounts but A denies. What shall be done?

Ans. A is wrong, he cannot deny as B holds the right to inspect the accounts

15. Under fixed capital method, partner’s drawings are shown in which account?

Ans. Partners Current A/cs

16. Debit balance of Partners Current A/Cs is shown on which side of the balance sheet?

Ans. Assets side.

17. Give the journal entry of P & L credit balance.

Ans. Profit and Loss A/c Dr

To Profit and Loss Appropriation A/c.

18. If the partners’ capitals account are fixed where will you record drawings of partners?

Ans. Debit side of partners current A/c.

19. How will you calculate interest on drawings when date of withdrawal is not given?

Ans. It will be calculated on the average basis of 6 months.

20. In which account interest on partners loan is debited and why?

Ans. It is debited to Profit and Loss Account because it is a charge against theprofit

21. A and B are partners in a firm sharing profit in the ratio of 3:2. They had advanced to the firm a sum of Rs. 30,000 as a loan in their profits sharing ratio on 1st Oct. 2014. The partnership deed is silent on the question of interest on loan for partners. Compute the interest payable by the firm to the partners, assuming the firm closes its books on 31st March.

Ans. A- Rs.540 B- Rs. 360. (Note: In the absence of Partnership deed, 6% p.a will be allowed as Interest on Loan)

22. In the absence of Partnership deed, how are mutual relations of partners governed?

Ans. In the absence of |Partnership deed, mutual relations are governed by The Indian partnership Act 1932.

23. A,B and C are partners and decided that no interest on drawings is to be charged from any Partner. But after one Year ‘C’wants that interest on drawings should be charged from every partner. State how ‘C’ can do this?

Ans. He can do so only by changing the Partnership deed with the consent of all partners.

24. Can a Partner be exempted from sharing the losses in a firm? If yes, under what circumstances?

Ans. Yes, if Partnership Deed provides so.

25. What share of profits would a “sleeping partner” who has contributed 75% of the total Capital get in the absence of Partnership Deed?

Ans. In the absence of Partnership Deed, a sleeping partner will get equal share of profits.

26. Can a Partner be exempted from sharing the losses in a firm? If yes, under what circumstances?

Ans. Yes, if Partnership Deed provides so.

27. What share of profits would a “sleeping partner” who has contributed 75% of the total Capital get in the absence of Partnership Deed?

Ans. In the absence of Partnership Deed, a sleeping partner will get equal share of profits.

PRACTICAL QUESTIONS

1. A, B and C were partners in a firm. On 1 ST January, 2018, their fixed capitals were ₹ 60,000, ₹30,000 and ₹ 30,000 respectively. As per partnership deed, partners were entitled to

(a) Salary to C at ₹500 per month.

(b) Interest on Capital 5% p.a.

(c) Profits to be shared in the capital ratio.

Net profit for 20 18 amounting to ₹ 15,000 was divided equally without providing for above adjustments. Pass adjustment entry to rectify the above errors.

SOLUTION:

ANALYSE TABLE

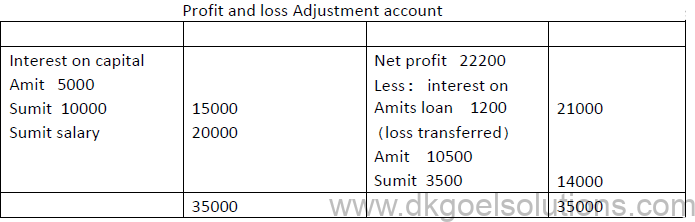

2. Amit and Sumit are partners in ratio of 3 :1. They invested ₹ 50,000 and ₹ 100,000 as their capitals. Amit has advanced a loan of ₹ 20,0O0 to the firm. Partners are entitled to:

1) Intereston capital @10% pa

2) Salary to a Rs 5000 per quarter

Net profit for the year was Rs 22,200

Prepare Profit & Loss Appropriation Account if :

(a) Interest on capital and salary are appropriation

(b) Interest on capital and salary are treated as charge against profits.

SOLUTION:

(a) PROFIT AND LOSS APPROPRIATION ACCOUNT

Working note:

Total appropriation

Amit’s IOC Rs 5000+ Sumit’s IOC 10000+ Sumi’s salary Rs 20000=35000

Profit is less than total appropriation I.e Appropriation will be in the ratio of =5000:10000:20000 or 1:2:4

(b)interest and salary considered as charged

3. Raju and Jai commenced business in partnership on April 1, 2019. No partnership agreement was made whether oral or written. They contributed `4,00,000 and `1,00,000 respectively as capitals. In addtion, Raju advanced `2,00,000 as loan to the firm on October 1, 2019. Raju met with an accident on July 1, 2019 and could not attend the business up to september 30, 2019. The profit for the year ended March 31, 2020 amounted to `50,000 before charging interest on Raju’s loan. Disputes have arisen between them on sharing the profits of the firm. Raju Claims:

(i) He should be given interest at 10% p.a. on capital and so also on loan. (ii) Profit should be distributed in the proportion of capitals. Jai Claims: (i) Net profit should be shared equally. (ii) He should be allowed remuneration of `1,000 p.m. during the period of Raju’s illness. (iii) Interest on capital and loan should be given @ 6% p.a. State the correct position on each issue as per the provisions of the Partnership Act, 1932.

SOLUTION: Settlement of disputes as per the provisions of the Partnership Act, 1932:

(i) No interest is payable on Partners’ capitals in the absence of partnership agreement.

(ii) Interest on Raju’s loan is payable @6% p.a., i.e., 2,00,000 × 6% × 6/12 = `6,000

(iii) Jai’s claim for remuneration @ `1,000 p.m. is not valid since no remuneration is payable when there is no partnership agreement.

(iv) Profits should be distributed equally among the partners irrespective of their capital contributions.

Net profit after charging interest on Raju’s loan = 50,000 – 6,000 = `44,000, which will be distributed equally between Raju and Jai, i.e. RS `22,000 each.

4. Harsh and Keshav are partners sharing profits and losses in the ratio of 3:1. Their capitals at the end of the financial year 2019-20 were `1,50,000 and `75,000. During the year 2019-20, Harsh’s drawings were `20,000 and the drawings of Keshav were `5,000, which had been duly debited to partner’s capital accounts. Profit before charging interest on capital for the year was `16,000. The same had also been distributed in their profit sharing ratio. Keshav had brought additional capital of `16,000 on October 1, 2019. Interest on capital is allowed @ 12% p.a.

SOLUTION:

Calculation of Opening Capitals:

Interest on Harsh’s Capital = 12% of 1,58,000 = `18,960

Interest on Keshav’s Capital =(12 %OF 60, 000 X6/12)+(76, 000 X12 X6/12 = 3,600 + 4,560 = `8,160

Total interest payable to the partners = 18,960 + 8,160 = `27,120.

But profit for the year is `16,000, which is less than total interest payable.

Therefore, the payment of interest on capital will be restricted to the amount of profits.

In that case, the profit will be effectively distributed in the ratio of interest on capital of each partner i.e. 18,960 : 8,160.

Interest on Harsh’s Capital = 18 960/27120X16000=11186

Interest on Keshav’s Capital = 8 160/27120X16000=4814

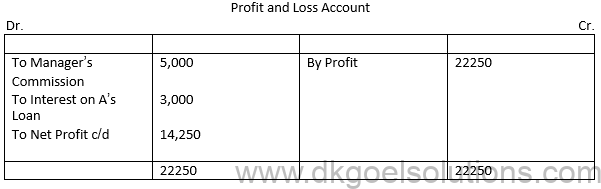

5. A and B are partners sharing profits in the ratio of 3:2, with capitals of `50,000 and `30,000 respectively. Interest on capital is agreed @ 6% p.a. B is to be allowed a quarterly salary of `625. Manager is to be allowed commission `5,000. A has also given a Loan on 1 October 2019 of `1,00,000 to the firm without any agreement. During the year 2019-20, the profits earned is `22,250.

SOLUTION:

Profit and Loss Appropriation Account for the year ending March 31, 2020

Working notes: Interest on A’s Loan = `1,00,000 × 6/100 × 6/12 = `3,000

Manager’s Commission and Interest on Partner’s Loan are charged to Profit and Loss Account.

6. Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

(i) Profits would be shared by Sukesh and Vanita in the ratio of 3:2.

(ii) 5% p.a. interest is to be allowed on capital.

(iii) Vanita should be paid a monthly salary of `600.

The following balances are extracted from the books of the firm, on March 31, 2019.

Net profit for the year, before charging interest on capital and after charging partner’s salary was `9,500.

Prepare the Profit and Loss Appropriation Account for the year ending 31 March 2020 and the Partner’s Current Accounts.

SOLUTION:

7. Alpha & Beta are partners with capitals of ₹ 2,00,000 and ₹ 1,00,000 respectively. Give journal entries for distribution of profit according to following provisions in the deed.

A) Partners are entitled to interest on capital@5% p.a.

B) B being a working partner was also allowed a half yearly salary of ₹10,000.

C) Profits were to be divided as follows:

(i) First ₹ 30,000 in proportion to their capitals

(ii) Next ₹ 20,000 in ratio of 3 : 2|

(iii) Remaining profits to be shared equally.

Profit for the year was ₹ 100000.

SOLUTION:

Notes for Accounting for Partnership Basic Concept class 12 Accountancy

According to Section -4 of the Indian Partnership Act, 1932:

“Partnership is the relations between two or more persons who have agreed to share the profits of a business carried on by all or any one of them acting for all”

Features of Partnership

1. Two or more persons: There must be at least two persons to form a valid partnership.

The maximum number of partners cannot exceed the number of partners prescribed by companies Act, 2013 which is 50 in any business whether banking or non- banking.

2. Agreement : Partnership comes into existence by an agreement (either written or oral among the partners. The written agreement among the partners is called Partnership Deed.

3. Existence of business and profit motive : A partnership can be formed for the purpose of carrying on legal business with the intention of earning profits. A joint ownership of some property by itself cannot be called a partnership.

4. Sharing of Profits : An agreement between the partners must be aimed at sharing the profits. If some persons join hands to run some charitable activity, it will not be called partnership. Futher, if a partner is deprived of his right to share the profits of the business, he cannot be called as partner.

5. Buiness carried on by all or any of them acting for all : It means that each partner can participate in the conduct of business and each partner is bound by the acts of other partners in respect to the business of the firm.

6. Relationship of Principal and Agent : Each partner is an agent ad well as a partner of the firm. An agent, because he can bind the other partners by his acts and principal, because he himself can be bound by the acts of the other partners.

Partnership Deed

Since partnership is the outcome of an agreement, it is essential that there must be some terms and conditions agreed upon by all the partners. Such terms and conditions mat be either written or oral. The law doesnot make it compulsory to have a written agreement.

However, in order to avoid all misunderstandings and disputes, it is always the best course to have a written agreement duly signed and registered under the Act.

The partnership deed is a written agreement among the partners which contains the terms of agreement. It is also called ‘ Articles of Partnership’ . A partnership deed should contain the following points:

- Name and address of the firm as well as partners.

- Name and addresses of the partners.

- Nature and place of the business.

- Duration, if any of partnership.

- Capital contribution by each partner.

- Interest on capital.

- Drawings and interest on drawings.

- Profit sharing ratio.

- Interest on loan.

- Partner’s Salary/commission etc.

- Method for valuation of goodwill and assets.

- Accounting period of the firm and duration of partnership

- Rights and duties of partners how disputes will be settled.

- Decisions taken if some partner becomes insolvent.

- Opening of Bank Account – whereas it will be in the name of firm or partners.

Rules to be followed in case of admission & Settlement of accounts or retirement or death - of partner.

- Revaluation of assets & liabilities, if any to be done.

- Method of recording of firm’s accounts

- Auditing

- Date of commencement of partnership

Benefits of Partnership Deed

(1) It regulates the rights, duties and liabilites of each partner.

(2) It helps to avoid any misunderstanding amongst the partners because all the terms and conditins of partnership have been laid down before hand in the deed.

(3) Any dispute amongst the partners may be settled easily as the partnership deed may be readiy referred to.

Hence, it is always best course to have a written partnership deed duly signed by all the partners and registered under the Act.

Rules applicable in the absence of partnership deed

Distribution of Profits among Partners

Transactiions of the partnerhsip firm are recorded according to the principles of Doubleentry book keeping system, and as in the case of a sole proprietorship concern a partnership firm will also prepare Trading account, Profit & Loss account and Balance Sheet at the end of every year. The only difference between accounting of a sole trader and partnership firm is that the profits of the partnership firm ar divided amongst the partners.

A Profit and Loss Appropriation Account is prepared to show the distribution of profits among partners as per the provision of Partnership Deed (or as per the provision of Indian Partnership Act, 1932 in the absence of Partnership Deed). It is an extension of profit and Loss Account. It is nominal account. It records entries for interest on capital, Interest on Drawings, Salary to the partner, and division of profits among the partners.

The Journal Entries regarding Profit and Loss Appropriation Account are as follows:

1.For transfer of balance of Profit and Loss Account

Profit and Loss A/cDr.

To Profit and Loss Appropriation A/c

2.For Interest on Capital

For allowing Interest on capital

1. Interest on Capital A/c

To Partner’s Capital/Current A/cs

(Being interest on capital allowed @ % p.a.)

2. For transferring Interest on Capital to p&L appropriation A/c.

Profit and Loss Appropriation A/cDr.

To Interest on Capital A/c.

(Being interest on capital transferred to p&L Appropriation A/c)

3. For Salary or Commission payable to a partner

i. For allowing Salary or Commission to a partner:

Partners Salary/Commission A/cDr.

To Partner’s Capital/Current A/cs

(Being salary/commission payable to a partner)

ii. For transferring Partner’s Salary/Commission A/c to Profit and Loss

Appropriation A/s:

Profit and Loss Appropriation A/cDr.

To Partner’s Salary/Commission A/c

4. For transfer of Reserves:

Profit and Loss Appropriation A/cDr.

To Reserve A/c

(Being reserve created)

5. For Interest on Drawings:

1. For charging interest on a partner’s drawings:

Partner’s Capital/Current A/c.Dr.

To Interest on Drawings A/c

(Being interest on drawings charged @ % p.a.)

2. For transferring interest on drawings to Profit and Loss Appropriation A/c

Interest on Drawings A/cDr.

To Profit and Loss Appropriation A/c

(Being interest on drawings transferred to P&L appropriation A/c)

6. For transfer to Profit (i.e. Credit Balance of Profit and Loss Appropriation Account

Profit and Loss Appropriation A/cDr.

To Partners Capital/Current A/cs

(Being profits distributed among partners)

SPECIMEN OF PROFIT AND LOSS APPROPRIATION ACCOUNT

Profit and Loss Appropriation Account

For the year ending on ___________________

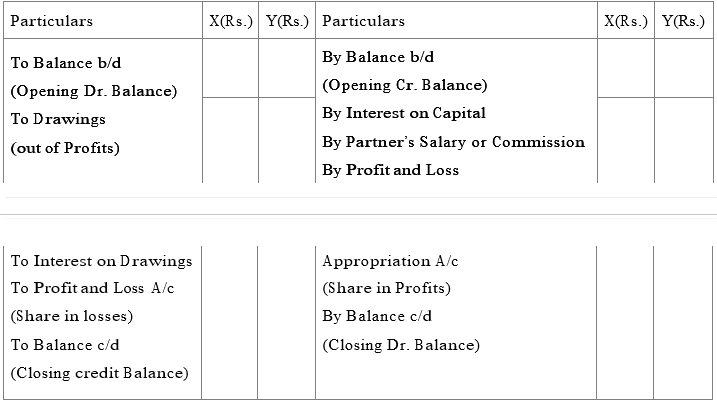

Parter’s Capital Accounts

Parter’s Capital Accounts : It is an account which represents the partners interest in the business.

In case of partnership business, a separate capital account is mainted for each partner. The capital accounts of partners may be maintained by any of the following two methods.

1. Fixed Capital Accounts

2. Fluctuating Capital Accounts

1. Fixed Capital Accounts

Under this method the original capitals invested by the partners remain constant, unless additional capital is introduced by an agreement. All entries relating to drawings, interest on capitals, interest on drawings, salary to partner, share of profits/losses are made in separate account whihc is called as Current Account. Thus the following two accounts are maintained when capitals are fixed.

(i) Capital Account

This account will always show a credit balance: Balance of Capital account remains fixed, it does not change every year that is why it is called fixed capital method and only the following two transactions are recorded in the Fixed Capital Accounts:

Permanent·Additional Capital Introduced

·Permanent Capital Withdrawn or Drawings out of Capital only

Partner’s Capital A/Cs

(ii) Current Account

The Current account may show a debit or credit balance. All the usual adjustments such as interest on Capital, partner’s salary/commission, drawings (out of profits), interest on drawings and share in profits or losses etc. are recorded in this account.All the Current Year’s adjustments are recorded in this account, that is why it is called Current account.

Partner’s Current A/Cs

Note :

1. Debit balance of Current Account is shown in Assets side of Balance Sheet.

2. Credits balance of Current Account A/c is shown in Liabilities side of balance Sheet.

3. Balance of Fixed Capital Accounts are always shown in Liabilities side of Balance Sheet as it will be always be credit balance.

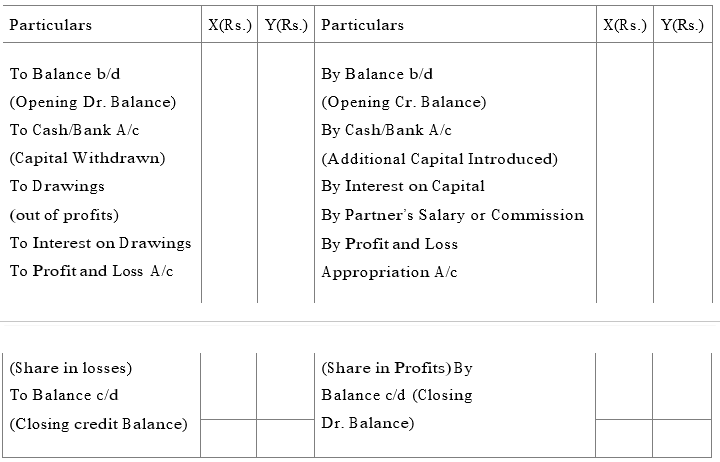

2. Fluctuating Capital Accounts

In this method only one account i.e., Capital Account of each and every partner is prepared and all the adjustment such as interest on capital interest on drawings etc, are recorded in this account under this method, Capital account may show a debit or credit balance and the balance of this account changes frequently from time to time therefore it is called fluctuating Capital Account.In this method the capitals are not fixed. In the absence of information, the Capital Accounts should be prepared by this method.

Partner’s Capital

INTEREST ON CAPITAL

Interest on partners capital will be allowed only when it has been specifically mentioned in the partnership deed. If interest on capital is to be allowed as per the agreement, it should be calculated with respect to the time, rate of interest and the amount of capital. Interest on Capital can be treated as either:

a. An Appropriation of profit; or

b. A charge against profit.

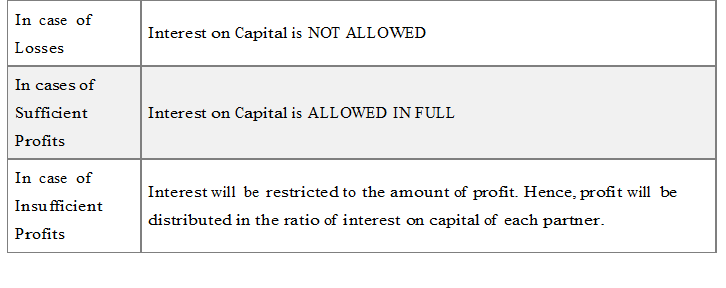

A. Interest on Capital: An Appropriation of Profits:

B. Interest on Capital: As a Charge against Profits:

Interest on Capital is always allowed in full irrespective of amount of profits of losses.

Note:

Interest on Capital is always calculated on the OPENING CAPITAL.

Il’ Opening Capital is not given in the question, it should be ascertained as follows:

INTEREST ON DRAWINGS

Interest on drawing is charged by the firm only when it is clearly mentioned in Partnership Deed. It is calculated with reference to the time period for which the money was withdrawn.

There are two cases in which calulation of interest on drawings may arise:

Case 1: When Rate of Interest on Drawings is given in %

Interest on Drawings is calculated on flat rate irrespective of period.

Case 2: When Rate of Interest on Drawings is given in % p.a.

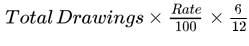

1. When date of Drawing is not given

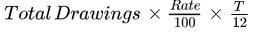

Interest on Drawing =

Note: Interest is calculated for a period of 6 months, we assume drawings have been done evenly during the year, that is why we take average six months tenure.

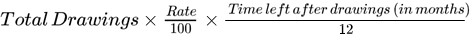

2. When date of Drawings is given

Interest on Drawing =

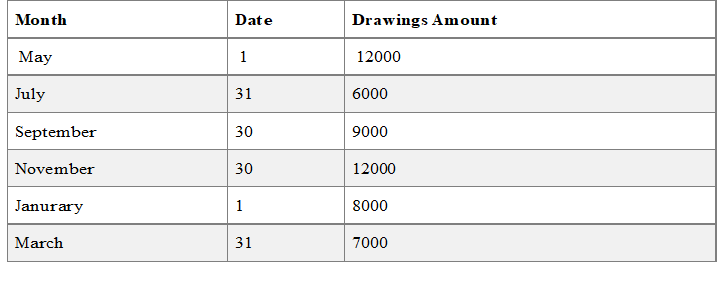

Case 3: When different amount are withdrawn on different dates:

We have the following two methods to calculate the amount of interest on Drawing:

1. Simple Interest Method

In this method, interest on drawing is calculated for each amount of drawing individually on the basis of periods for which it remained withdrawn till the close of accounting period.

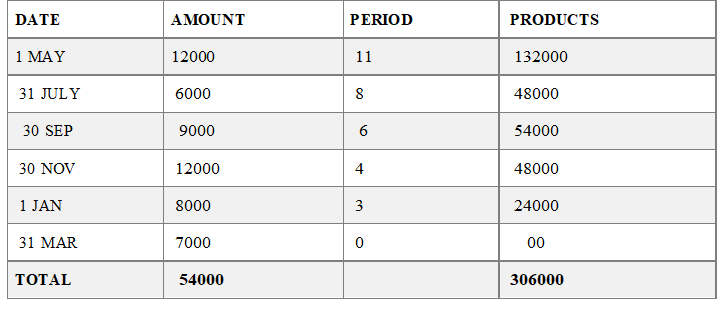

2. Product Method

In this method, the amounts of drawings are multiplied by the period for which it remained withdrawn during the period;Thereafter the products are added and interest is calculated on the total of products so arrived at for one month. The advantage of this system is that separate calculations are not required each time.

We can explain the above mentioned two methods with the help of an example.

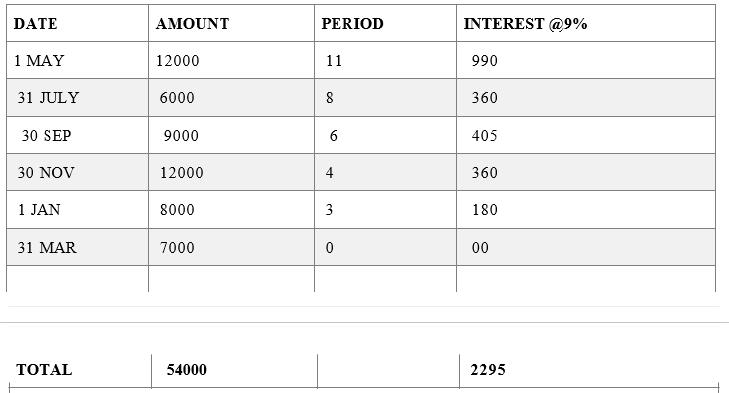

Interest on drawings is to be charged @ 9% p.a

SIMPLE METHOD

PRODUCT METHOD

Interest = Total of products * 9/100* 1/12= 306000*9/100*1/12 = Rs 2295/-.

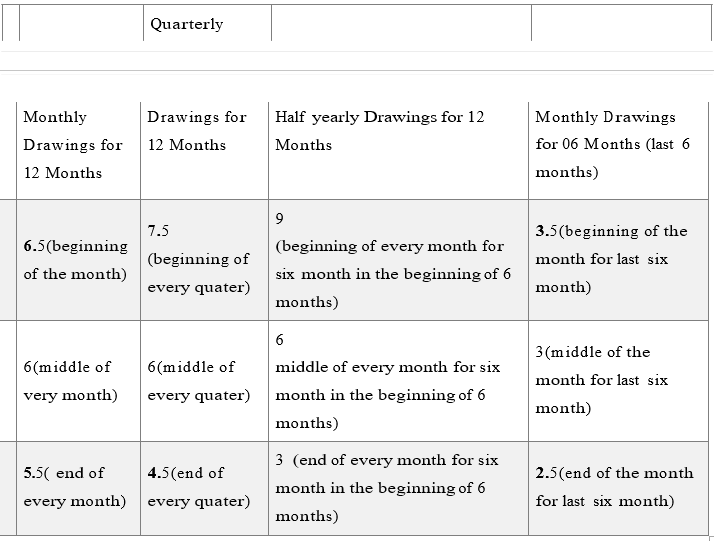

Case 4: When an equal amount is withdrawn regularly

Interest on Drawing can be calculated using either Product Method or Direct Method (i.e. Short Cut Method)

Direct Method will be used only if all the following three conditions are satisfied:

1. Amount should be same throughout the period

2. Date of Drawings should be same throughout the period

3. Drawings should be made regularly without any gap.

4. Interest on Drawing =

T = Time (in months) for which interest is to be charged

Value of T under Different circumstances will be as under:

INTEREST ON PARTNERS LOAN

If a partner has given loan to the firm, he is entittled to receive interest on such loan at an agreed rate.

It is a charge against profits. It is provided irrespective of profits or loss. It will also be provided in the absence of Partnership Deed @ 6% per annum.

The following entries are passed to record the interest on partner’s loan

1. For allowing Interest on loan:

Interest on Partner’s Loan A/cDr.

To Partner’s Loan A/c

(Being interest on loan allowed @ % p.a.)

2. For transferring Interest on Loan to Profit and Loss A/c:

Profit and Loss A/cDr.

To Interest on Loan A/c

(Being Interest on loan transferred to P & L A/c)

It is always DEBITED to Profit and Loss A/c

Rent Paid to Partner.

Rent paid to a partner is also a charge against profits and it will also be

DEBITED to Profit and Loss A/c

Note:

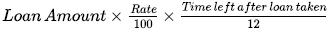

Interest on A’s Loan=

PAST ADJUSTMENTS

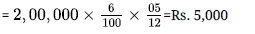

If, after preparation of Final Accounts of firm, it is found that some errors or commission in accounts has occurred than such errors or omissions are rectified in the next year by passing an adjustment entry.

A statement is prepared to ascertain the net effect of such errors or omissions on partner’s capital/current accounts in the following manner.

Statement showing adjustment

+ Indicates Amount to be Credited to Partner’s Capital Account – Indicates Amount to be Debited to Partners Capital Account

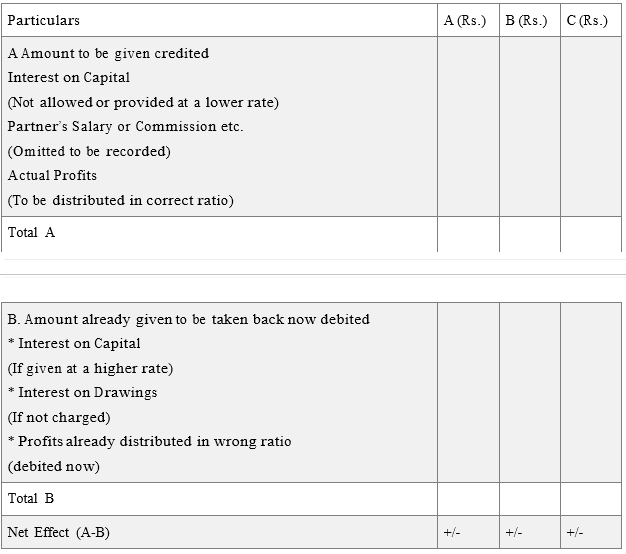

Journal

During Past Adjustment it is not compulsory that capital accounts of all partners are affected. More than one partners Capital Account may be debited or credited but amount of debit & credit should be equal.

GUARANTEE OF PROFITS TO A PARTNER

Guarantee is an assurance given to the partner of the firm that at least a fixed amount shall be given to him/her irrespective of his/her actual share in profits of the firm. If actual share in profits is less than the guaranteed amount in that case the deficit amount shall be borne either by the firm or by any partner as the case may be or as may have been decided bya na agreement.

Note:

Guarantee to a partner is given for minimum share in profits. If the actual share in profits is more than the minimum share in profits, then the actual profits will be allowed to the

partner.

Case: 1. When guarantee is given by FIRM (i.e. by all the Partners of the firm)

1. If share in actual profits is less than the guaranteed amount then. Guaranteed amount to a partner is first written off against the profits and then,

2. Remaining profits are distributed among the remaining partners in the remaining ratio.

Case: 2. When guarantee is given by a partner or partners to another partner.

1. Calculate the share in profits for the partner to whom guarantee is given.

2. If share in profits is more than the guaranteed amount, distribute the profit as per the profit and loss sharing ratio in usual manner.

3. If share in profits is less than the guaranteed amount, find the difference between the share in profits and the guaranteed amount and the difference known as deficiency.

Deficiency is contributed by the partner or partners who guaranteed in certain ratio and subtracted from his or their respective shares.

Goodwill Nature And Valuation

Goodwill is good name or the reputaion of the business, which is earned by a firm through the hardwork and honesty of its owners. If a firm renders good service to the customers, the customers who feel satisfied will come again and again and the firm will be able to earn more profits in future.

Thus, goodwill is the value of the reputaion of a firm which enables it to earn higher profits in comparison to the normal profits earned by other firms in the same trade.

Features of Goodwill

1. It is an intangible asset : Goodwill cannot be seen or touched, it does not have any physical existence, thus it belongs to the category of intangible assets such as patents, trade marks, copy rights, etc.

2. It is a valuable asset

3. It is helpful in earning excess profits.

4. Its value is liable to constant fluctuations : While goodwill does not depreciate, its value is liable to constant fluctuation, its vlaue is liable to constant fluctuations.It is always present as a silent asset in a business where there are super profits (i.e.more than the normal) but declines in value with the decline in earnings.

5. It is valuable only when entire business is sold : Goodwill cannot be sold in part. It can be sold with the entire business only. The only exception is at the time of admission or

retirement of the partner.

6. It is difficult to place an exact value on goodwill : This is beecause its value may fluctuate from time to time due to changing circumsatnces which are internat and external to business.

Goodwill is divided into two categories.

I. Purchased Goodwill: Purchased goodwill means goodwill for which a consideration has been paid e.g. when business is purchased the excess of purchase consideration of its net

assets i.e. (Assets – Liabilities) is the Purchased Goodwill. It is separately recorded in the books because as it is purchased by paying in form of cash or kind.

Characteristics

(i) It arises on purchase of a business or brand.

(ii) Consideration is paid for it so it is recorded in books.

(iii) Shown in balance sheet as on asset.

(iv) It is amortised (depreciated).

(v) Value is a subjective judgment & ascertained by agreement of seller & purchaser. It is approximate value and cannot be sold separately in the market or in parts.

II. Self-generated Goodwill also called as inherent goodwill. It is an internally generated goodwill which arises from a number of factors that a running business possesses due to which it is able to earn more profits in the future.

Features

(i) It is generated internally over the years.

(ii) A true cost cannot be placed on this type of goodwill.

(iii) Value depends on subjective judgment of the value.

(iv) As per Accounting Standard 26( Intangible Asset), it is not recorded in the books of accounts because consideration in money or money’s worth has not be paid for it.

Factors Affecting the Value of Goodwill

1. Efficient management : If the business is run by experienced and efficient management, its profits will go on increasing, which results in increase in the value of goodwill.

2. Quality of products : If the firm is suppyong good quality of products, then the customer will come again and again for the same and thus will create the goodwill and brand name for the same.

3. Location of business : If the business is located at a convenient or prominent place, it will atract more customers and therefore will have more goodwill.

4. The Longevity of the business : An older business is better known to its customers,

therefore it is likely to have more goodwill. When a business enterprise has built up good repuation over a period of time, the number of customers will be more in comparison to the

customers of new entrants. Number of customers is an indicator of profit earning capacity of a business.

5. Monopolistic and other Rights : If a buiness enjoys monopoly market, it will have assured profits. Similarly, if it holds some special rights such as patents, trade marks, copyrights or concessions, etc, it will have more goodwill.

6. Other factors:

(i) Good industrial relations.

(ii) Favourable Government regulations

(iii) Stable political conditions

(iv) Research and development efforts

(v) Effective advertising to establish brand popularity

(vi) Popularity of product in terms of quality.

Need for Valuing Goodwill: Whenever the mutual rights of the partners changes the party which makes a sacrifice must be compensated. This basis of compensation is goodwill so we need to calculate goodwill.

Mutual rights change under following circumstances

1. When profit sharing ratio changes

2. On admission of a partner

3. On Retirement or death of a partner

4. When amalgamation of two firms taken place

5. when partnership firm is sold.

Method of valuation of goodwill :

It is very difficult to assess the value of goodwill, as it is an intangible asset. In case of sale of a business, its value depends on the mutual agreement between the seller and the purchaser of the business. Usually, there are three methods of valuing goodwill:

1. average profit method

2. Super profit method

3. Capitalization method

Average Profit Method

This is a very simple and widely followed method of valuation of goodwill. In this method, goodwill is calculated on the basis of the number of past years years. Average of such profits

is multiplied by the agreed number of years (such as two or three) to find out the value of goodwill.

Formula for calculation of goodwill

Goodwill = Average Profits Number of years of purchase

Number of years of purchase means for how many years the firm will earn the same amount of profits in future.

Average Profits = Total Profits/Number of years

A buyer always wants to estimate the future profits of a business. Future profits depend upon the average performance of the business in the past. Past profits indicate as to what

profitsare likely to accrue in the future. Therefore the past profits are averaged. But before calculating the average profits, the profits earned in the past must be adjusted in the light of

future expectations and the following factors should be taken into account while calculating the average profits:

(i) Abnormal income of a year should be deducted out of the net profit of that year.

(ii) Abnormal loss of a year should be added back to the net profit of that year.

(iii) Income from investments should be deducted out of the net profits of that year, because this income is received from outside the business.

Weighted Average Profit Method: This method is a modified version of average profit method.In this Method each year’s profit is assigned a weight. The highest weight is attached to profit of most recent year.

Eg: 2011-1, 2012-2, 2013-3, 2014-4.

Each year profits are multiplied by assigned weights. Products are added & divided by total number of weights. Weighted average is multiplied by agreed Number of years of Purchase.

Weighted Average Profit: = Total product of profits / Total of weight

Goodwill = Weighted Average Profit No. of years of purchase.

Weighted average profit method is considered better than the simple average profit method because it assigns more weightage to the profits of the latest year which is more likely to be earned in future. This method is preferred when profits over the past years have been continously rising or falling.

Super profit Method : In this method goodwill is calculated on the basis of surplus (excess) profits earned by a firm in comparison to average profits earned by other firms. If a business has no anticipated excess earnings, it will have no goodwill. Super Profit are the excess of actual profit over normal profits. Where Normal profits are profits earned by similar business.

If a firm earns higher profit in comparison to normal profit (generally earned by other firms of same industry) then the difference is called Super Profit. Goodwill is calculated on the basis of Super profit due to future expectations of earning capacity of the firm.

Goodwill is calculated by the formula

Goodwill = Super Profit Number of years of purchase

Super Profit = Average profit – Normal profits

Normal Profit = Investment (Capital Employed) x Normalrate of return / 100

Capital Employed = Capital + Free Reserves – fictitious Assets (if any), or

All Assets – (Goodwill, fictitious assets and non-trade Investment) – Outsider’s Liabilities

Capitalised Method Under this method, goodwill can be calculated in two ways:

(A) Capitalisation of Average Profit Method: Under this method first of all we calculate the average profits and then we assess the capital needed for eanring such average profits on the basis of normal rate of return. Such capital is also called capitalised value of average profits.

It is calculated as under.

Capitalised value of the firm = Average profits x 100 / Normal rate of return

Goodwill is calculated by deducting the actual capital employed in business from the

capitalised value of average profits.There will be no goodwill if the actual capital employed

in the business exceeds or equals the capitalised value of the average profits.

Net Assets or Capital employed = Total assets – Outside liabilities

Goodwill = Capitalized value of average profits – Capital Employed

(B) Capitalisation of Super Profit Method: Underthis method first of all we calculate the super profits and then we assess the capital needed for earning such super profits on the basis of normal rate of return. Such capital is actually the amount of goodwill. Super profits are calculated in the same manner as calculated in super profits method.

Goodwill of the firm = Super Profits * 100 / Normal rate of return.

Also refer to Sample Papers for Class 12 Accountancy, Chapter 2: Fundamentals of partnership Firms