Notes for Class 12 Accountancy Chapter 3 Reconstitution of a Partnership Firm Admission of a Partner

Commerce students can refer to the Admission of a Partner Notes Class 12 Accountancy given below which is an important chapter in class 12 accountancy book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Accountancy teachers have prepared these notes for the benefit of students so that you can read these revision notes and understand each topic carefully.

Admission of a Partner Notes Class 12 Accountancy

Refer to the notes and important questions given below for Admission of a Partner which are really useful and have been recommended by Class 12 Accounts teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books for Class 12 Accounts.

Multiple Choice Question

- 1. When is Revaluation A/c prepared?

- a) At the time of admission

- b) At the time of retirement

- c) At the time of death

- d) All of the above

Answer

D

- 2. Profit or loss on revaluation of assets is transferred to Partners’ Capital account in which ratio?

- a) Equally

- b) Profit sharing ratio

- c) Fixed capital ratio

- d) Current capital ratio

Answer

B

- 3. New partner may be admitted to partnership:

- a) With the consent of all the old partners

- b) With the consent of any one partner

- c) With the consent of 2/3rd of the old partners

- d) With the consent of 3/4th of the old partners

Answer

A

- 4. When a new partner is admitted into the firm the old partner stands to :

- a) Gain in profit sharing ratio

- b) Lose in profit sharing ratio

- c) Not affected at all

- d) Only one partner gain other loose

Answer

B

- 5. The proportion in which old partners make a sacrifice:

- a) Ratio of capital

- b) Ratio of sacrifice

- c) Gaining ratio

- d) Profit sharing ratio

Answer

B

- 6. General reserve at the time of admission of a partner is transferred to:

- a) Revaluation a/c

- b) Partners’ capital a/c

- c) Neither of two

- d) Profit and loss a/c

Answer

B

- 7. All accumulated losses are transferred to the capital a/c of the partners in:

- a) New profit sharing ratio

- b) Old profit sharing ratio

- c) Capital ratio

- d) None of the above

Answer

B

- 8. When goodwill is not recorded in the books at all on admission of a partner:

- a) If paid privately

- b) If brought in cash

- c) If not brought in cash

- d) If brought in kind

Answer

A

- 9. The need of revaluation of assets and liabilities on admission:

- a) Assets and liabilities should appear at revised value

- b) Any profit and loss on account of change in values belong to old partners

- c) All unrecorded assets and liabilities get recorded

- d) None of the above

Answer

B

- 10. On admission of a partner, which of the following items of the balance sheet is transferred to the credit of capital accounts of old partners in the old profit sharing ratio, if capital accounts are maintained on fluctuating capital accounts method:

- a) Deferred revenue expenditure

- b) Profit and loss account (debit balance)

- c) Profit and loss account (credit balance)

- d) Balance in drawing account of partners

Answer

C

- 11. If the new partner brings his share of goodwill in cash, it will be shared by old partners in:

- a) Sacrificing ratio

- b) Old profit sharing ratio

- c) New ratio

- d) Capital ratio

Answer

A

- 12. Revaluation account is a :

- a) Real account

- b) Nominal account

- c) Personal account

- d) None of the above

Answer

B

- 13. When new partner brings cash for goodwill, the amount is credited to:

- a) Realization account

- b) Cash account

- c) Premium for goodwill account

- d) Revaluation account

Answer

C

- 14. The balance in the investment fluctuation fund after meeting the fall in book value of investment, at the time of admission of partner will be transferred to:

- a) Revaluation account

- b) Capital accounts of old partners

- c) General reserve

- d) Capital account of all partners

Answer

B

- 15. A and B are partners sharing profits in the ratio of 3:2. They admit C for ¼ Rs.30000 for his share of goodwill. The total value of the goodwill of the firm will be:

- a) 150000

b) 120000

c) 100000

d) 160000

Answer

B

- 16. The credit balance of profits abnd loss account appears in the books at the time of admission of partner will be transferred to:

- a) Profit and loss appropriation account

- b) All partners capital account

- c) Old partners capital account

- d) Revaluation account

Answer

C

- 17. Goodwill of the firm is valued at Rs.100000. Goodwill also appears in the books at RS.50000. C is admitted for ¼ share. The amount of goodwill to be brought in by C will be:

- a) 20000

b) 25000

c) 30000

d) 40000

Answer

B

- 18. If the new partner brings any additional cash other than his capital contributions then it is termed as:

- a) Capital

- b) Reserves

- c) Profits

- d) Premium for goodwill

Answer

D

- 19. A and B are partners sharing profits and losses in the ratio of 3:2. C is admitted for 1/5 share in profits which he gets from A. New profit sharing ratio will be:

- a) 12:8:5

- b) 8:12:5

- c) 2:2:1

- d) 2:2:2

Answer

C

- 20. A and B are partners sharing profits and losses in the ratio of 3:2. A’s capital is Rs.120000 and B’s capital is Rs.60000. they admit C for 1/5th share of profits. C should bring as his capital:

- a) 36000

b) 48000

c) 58000

d) 45000

Answer

D

- 21. If at the of admission, some balance of profit and loss account appears in the books, it will be transferred to :

- a) Profit and loss adjustment account

- b) All partners’ capital account

- c) Old partners’ capital account

- d) Revaluation account

Answer

C

- 22. When a new partner brings his share of goodwill in cash, the amount is debited to:

- a) Cash account

- b) Capital accounts of the new partner

- c) Goodwill account

- d) Capital accounts of the old partner

Answer

A

- 23. When new partner does not bring his share of goodwill in cash, the amount is debited to:

- a) Current account of the new partner

- b) Premium account

- c) Capital account of the old partners

- d) Cash account

Answer

C

- 24. At the time of admission of a new partner, the entry for unrecorded investment will be:

- a) Dr. Investment A/c and Cr. Revaluation A/c

- b) Dr. Partners’ Capital A/c and Cr. Investment A/c

- c) Dr. Revaluation A/c and Cr. Investment A/c

- d) None of the above

Answer

A

- 25. A, B, C, and D are partners. A and B share 2/3rd of profits equally and C and D share remaining profits in the ratio of 3:2. Find the profit sharing ratio of A/ B, C and D.

- a) 5:5:3:2

- b) 7:7:6:4

- c) 2.5:2.5:8:6

- d) 3:9:8:3

Answer

A

- 26. X and Y are partners in a firm with capital of Rs.180000 and Rs.200000. Z was admitted for 1/3rd share in profits and brings Rs.340000 as capital. Calculate the amount of goodwill

- a) 240000

b) 100000

c) 150000

d) 300000

Answer

D

- 27. A and B are partners sharing profits and losses in the ratio of 5:3. On admission, C brings Rs.70000 as capital and Rs.43000 against goodwill. New profit ratio between A, B and C is 7:5:4. The sacrificing ratio of A and B is:

- a) 3:1

- b) 1:3

- c) 4:5

- d) 5:9

Answer

A

- 28. Ramesh and Suresh are partners sharing profits in the ratio of 2:1 respectively. Ramesh’s capital is Rs.102000 and Suresh capital is Rs.73000. they admit Mahesh and agreed to give him 1/5th share in future profit. Mahesh brings Rs.14000 as his share of goodwill. He agrees to contribute capital in the new profits sharing ratio. How much capital will be brought by Mahesh?

- a) 43750

b) 45000

c) 47250

d) 48000

Answer

C

- 29. A and B are partners in a firm having capital of Rs.54000 and Rs.36000 respectively. They admitted C for 1/3rd share in the profits. C brought proportionate amount of capital. The capital brought in by C would be

- a) 90000

b) 45000

c) 5400

d) 36000

Answer

B

- 30. Anil and Aman are partners sharing profits and losses in the ratio of 3:2. Akhil is admitted as a new partner for 1/3rd share in the profits. Goodwill of the firm is valued at Rs.60000 and goodwill already appears in the books at Rs.18000. It is decided that the existing goodwill should continue to appear in the books at its old value. Akhil’s share of goodwill is:

- a) 26000

- b) 14000

- c) 20000

- d) 6000

Answer

B

- 31. Ajay and Vijay are partners sharing profits in the ratio of 2:1. Ajay’s son Anil was admitted for ¼ share of which 1/8 was gifted by Ajay to his son. The remaining was contributed by Vijay. Goodwill of the firm is valued at Rs.40000. How much of the goodwill will be credited to each of old partners’ capital account:

- a) 2500

- b) 5000

- c) 20000

- d) None of the above

Answer

B

- 32. On the admission of a new partner increase in the value of assets is debited to :

- a) Profit and loss adjustment account

- b) Assets account

- c) Old partners’ capital account

- d) None of the above

Answer

B

- 33. At the time of admission of a partner, undistributed profits appearing in the balance sheet of the old firm is transferred to the capital accounts of :

- a) Old partners in old profit sharing ratio

- b) Old partners in new profit sharing ratio

- c) All the partner in the new profit sharing ratio

- d) None of the above

Answer

B

- 34. Which of the following is not the reconstitution of partnership?

- a) Admission of a partner

- b) Dissolution of Partnership

- c) Change in Profit Sharing Ratio

- d) Retirement of a partner

Answer

B

- 35. On the admission of a new partner:

- a) Old partnership is dissolved

- b) Both old partnership and firm are dissolved

- c) Old firm is dissolved

- d) None of the above

Answer

A

- 36. Sacrificing ratio is used to distribute —————— in case of admission of a partner.

- a) Goodwill

- b) Revaluation Profit or Loss

- c) Profit and Loss Account (Credit Balance)

- d) Both b and c

Answer

A

- 37. Himanshu and Naman share profits & losses equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respectively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Ashish with 1/5 share. Ashish brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

- a) Rs.1,00,000

b) Rs. 85,000

c) Rs.20,000 - d) None of the above

Answer

B

- 38. Yash and Manan are partners sharing profits in the ratio of2:1. They admit Kushagra into partnership for 25% share of profit. Kushagra acquired the share from old partners in the ratio of 3:2. The new profit sharing ratio will be:

- a) 14:31:15

- b) 3:2:1

- c) 31:14:15

- d) 2:3:1

Answer

C

- 39. A and B are partners sharing profit and losses in ratio of 5:3. C is admitted for 1/4th share. On the date of reconstitution, the debtors stood at Rs 40,000, bill receivable stood at Rs. 10,000 and the provision for doubtful debts appeared at Rs. 4000. A bill receivable, of Rs 10,000 which was discounted from the bank, earlier has been reported to be dishonored. The firm has sold, the debtor so arising to a debt collection agency at a loss of 40%. If bad debts now have arisen for Rs 6,000 and firm decides to maintain provisions at same rate as before then amount of Provision to be debited to Revaluation Account would be:

- a) Rs 4,400

- b) Rs 4,000

- c) Rs 3,400

- d) None of the above

Answer

C

- 40. Heena and Sudha share Profit & Loss equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respectively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Teena with 1/5 share. Teena brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

- a) Rs.85,000

- b) Rs.1,00,000

- c) Rs.20,000

- d) None of the above

Answer

A

- 41. Which of the following is not true with respect to Admission of a partner?

- a) A new partner can be admitted if it is agreed in the partnership deed.

- b) If all the partners agree, a new partner can be admitted.

- c) A new partner has to bring relatively higher capital as compared to the existing partners

- d) A new partner gets right in the assets of the firm

Answer

C

- 42. As per ———, only purchased goodwill can be shown in the Balance Sheet.

- a) AS 37

- b) AS 26

- c) Section 37

- d) AS 37

Answer

B

- 43. A, and B are partners sharing profits in the ratio of 2:3. Their balance sheet shows machinery at ₹2,00,000; stock ₹80,000, and debtors at ₹1,60,000. C is admitted and the new profit sharing ratio is 6:9:5. Machinery is revalued at ₹1,40,000 and a provision is made for doubtful debts @5%. A’s share in loss on revaluation amount to ₹20,000. Revalued value of stock will be:

- a) ₹62,000

- b) ₹1,00,000

- c) ₹60,000

- d) ₹98,000

Answer

C

- 44. At the time of admission of a partner, Employees Provident Fund is:

- a) Distributed to partners in the old profit sharing ratio

- b) Distributed to partners in the new profit sharing ratio

- c) Adjusted through gaining ratio

- d) None of the above

Answer

D

- 45. If at the time of admission if there is some unrecorded liability, it will be ————-to ————– Account.

- a) Debited, Revaluation

- b) Credited, Revaluation

- c) Debited, Goodwill

- d) Credited, Partners’ Capital

Answer

A

- 46. At the time of admission of a new partner, the balance of Workmen Compensation Reserve will be transferred to:

- a) Old partners in the old profit sharing ratio

- b) Sacrificing partners in the sacrificing ratio

- c) Revaluation Account

- d) All partners in the new profit sharing ratio

Answer

A

- 47. The firm of P, Q and R with profit sharing ratio of 6:3:1, had the balance in General Reserve Account amounting Rs. 1,80,000. S joined as a new partner and the new profit sharing ratio was decided to be 3:3:3:1. Partners decide to keep the General Reserve unchanged in the books of accounts. The effect will be:

- a) P will be credited by Rs. 54,000

- b) P will be debited by Rs. 54,000

- c) P will be credited by Rs. 36.000

d) P will be credited by Rs. 36,000

Answer

A

- 48. Which statement is true with respect to AS-26?

- a) Purchased goodwill can be shown in the Balance Sheet

- b) Revalued goodwill can be shown in the Balance Sheet

- c) Both purchased goodwill and revalued can be shown in the Balance Sheet

- d) None of the above

Answer

A

- 49. Premium brought by newly admitted partner should be:

- a) Credited to sacrificing partners

- b) Credited to all partners in the new profit sharing ratio

- c) Credited to old partners in the old profit sharing ratio

- d) Credited to only gaining partners

Answer

A

- 50. Sacrificing ratio is calculated because:

- a) Profit shown by Revaluation Account can be credited to sacrificing partners

- b) Goodwill brought in by the incoming partner can be credited to the new partner

- c) Goodwill brought in by the incoming partner can be credited to the sacrificing partners

- d) Both a and c

Answer

C

- 51. Aryaman and Bholu are partners sharing profit and losses in ratio of 5:3. Chirag is admitted for 1/4th share. On the date of reconstitution, the debtors stood at Rs 40,000, bill receivable stood at Rs. 10,000 and the provision for doubtful debts appeared at Rs. 4000. A bill receivable, of Rs 10,000 which was discounted from the bank, earlier has been reported to be dishonored. The firm has sold, the debtor so arising to a debt collection agency at a loss of 40%. If bad debts now have arisen for Rs 6,000 and firm decides to maintain provisions at same rate as before then amount of Provision to be debited to Revaluation Account would be:

- a) Rs 4,400

- b) Rs 4,000

- c) Rs.3,400

- d) None of the above

Answer

C

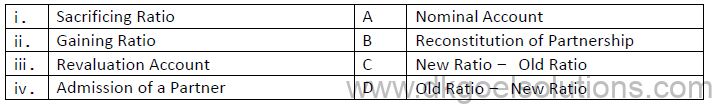

52. Match the following:

a) i- B, ii-C, iii-A, iv-D

b) i- D, ii-B, iii-A, iv-C

c) i- D, ii-C, iii-A, iv-B

d) i- D, ii-C, iii-B, iv-A

Answer

C

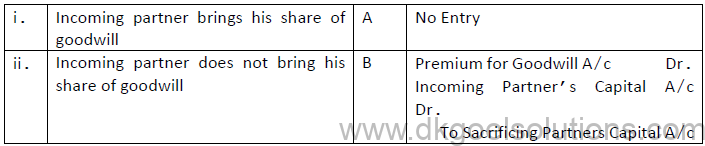

53. Match the following with respect to journal entries for treatment of goodwill.

a) i- B, ii-C, iii-A, iv-D

b) i- C, ii-D, iii-A, iv-B

c) i- D, ii-C, iii-A, iv-B

d) i- D, ii-C, iii-B, iv-A

Answer

B

- 54. A and B are partners in a firm sharing profits in 4:1. They admit Pal as a new partner for ¼ share in the profits, which he acquired wholly from A. New profit sharing ratio of the partners is:

- a) 4:1:1

- b) Equally

- c) 11:4:5

- d) none of the above

Answer

C

- 55. A and B are partners sharing profits in the ratio of 3:1. C is admitted to partnership firm for 1/4th share. The sacrificing ratio of A and B will be:

- a) Equal

- b) 2:1

- c) 3:2

- d) 3:1

Answer

D

- 56. The profit sharing ratio of Seeema and Ghosh was 5:3. They admitted Munmun as a new partner and the new profit sharing ratio of Seema, Gosh and Munmun was 4:3:3. The sacrificing ratio Seem and Gosh will be:

- a) 5:3

- b) 4:3

- c) 1:1

- d) 3:1

Answer

D

- 57. A and B are partners sharing profits in the ratio of 7:3. A surrenders 1/7th of his share and B surrenders 1/3rd of his share in favour C the new partner. The sacrificing ratio will

- be:

- a) 3:7

- b) 1:1

- c) 7:3

- d) 3:2

Answer

B

- 58. The share of new partner and the sacrificing ratio of old partners is decided by:

- a) the new partner only

- b) the old partners only

- c) the old partners and the new partner

- d) the accountant of the firm

Answer

C

- 59. On admission of a new partner, the method of valuation of goodwill is decided by:

- a) the new partner only

- b) the old partners only

- c) the old partners and the new partner

- d) the accountant of the firm

Answer

C

- 60. Share of goodwill brought by the new partner in cash is shared by old partners in:

- a) ratio of sacrifice

- b) old profit sharing ratio

- c) new profit sharing ratio

- d) none of the above

Answer

A

True/ False:

1. “At the time of admission, old partnership comes to an end”.

Answer

True

2. “As per Section 26 of the Indian Partnership Act, 1932, a person can be admitted as a new partner if it is agreed in the Partnership Deed”.

Answer

False

3. “A newly admitted partner cannot pay his share of the goodwill to the sacrificing partners privately”.

Answer

False

4. “Unless agreed otherwise, Sacrificing Ratio of the old partners will be the same as their Old Profit Sharing Ratio”.

Answer

False

5. In the case of admission of a partner, all existing partners sacrifice.

Answer

False

6. New partner may or may not contribute capital at the time of admission.

Answer

True

7. New partner may bring his share of goodwill premium in kind.

Answer

True

8. At the time of admission of partner, the partnership firm is dissolved.

Answer

False

9. The goodwill brought at the time of admission of partner will be distributed among all the partners in new profit sharing ratio.

Answer

False

10. Claim of workmen compensation if more than workmen compensation reserve, is debited to revaluation account.

Answer

True

11. Increase in provision for doubtful debts will credited to revaluation account.

Answer

False

12. New partner brings goodwill in the firm to get share in the past profits.

Answer

False

13. Reserve and accumulated profits are distributed in old profit sharing ratio at the time of admission of a partner.

Answer

True

14. Admission of a partner changes the relationship between / among existing partners.

Answer

True

15. Hidden goodwill arises when total capital is computed based on the new partner’s capital is less than total capitals of remaining partners after all adjustments.

Answer

False

16. Employee Provident Fund is a part of Accumulated profits and reserves.

Answer

False

17. At the time of admission, reserves may be carried forwarded by the partners.

Answer

True

18. Admission of a new partner does not amount to reconstitution of the partnership firm.

Answer

False

19. Goodwill exists only when firm earns super profits.

Answer

True

20. The need for valuation of goodwill also arises when the firm is dissolved involving sale of business as a going concern.

Answer

True

Fill in the blanks

1. when the value of goodwill of the firm is not given but has to be inferred on the basis of net worth of the firm, it is called…………….

Answer

Hidden goodwill

2. Vinay and Naman are partners sharing profit in the ratio of 4:1. Their capitals were Rs.90000 and Rs.70000 respectively. They admitted Pratik for 1/3 share in the profits. Pratik brings Rs.100000 as his capital. The value of firm’s goodwill be…………..

Answer

40000

3. Goodwill appearing in the books oat the time of admission of a new partner is written off by debiting …………..and crediting ………….

Answer

Old partners’ capital accounts, goodwill account

4. On the admission of a new partner, after revaluation has been done, the value of assets and liabilities appear in the books of the firm at………….

Answer

their current value

5. Debit balance in the profit and loss account indicates…………….

Answer

Accumulated loss

6. General reserve account indicates ………..and shows ………..balance.

Answer

Accumulated profits, credit

7. If, at the time of admission of a new partner, provision for doubtful debts is to be reduced, it shall be …………to profit and loss adjustment account.

Answer

credited

8. Gain or loss arising from revaluation is shared by ………..partners in …………ratio.

Answer

Old partners, old profit sharing ratio

9. If the revaluation account finally shows a debit balance then it indicates ………….., which will be transferred to …………

Answer

Net loss, debit side of old partners’

capital accounts

10. A and B are partners sharing profits equally. They admit C for 1/3 share in profits. A debtor whose dues of Rs.5000 were written off as bad debts, paid Rs.4000 in full settlement.

Bad debts recovered Rs.4000 will be debited to …………and credited to ……………

Answer

Cash account, revaluation account

11. At the time of admission, the assets are revalued and liabilities are reassessed. The increase or decrease in the values is debited or credited in ……………..

Answer

Revaluation account

12. Revaluation account is a …………………

Answer

Nominal account

13. In the case of downward revaluation of an asset, revaluation account is ………………

Answer

Debited

14. Revaluation account shows ………….in the values of assets and liabilities.

Answer

Increase or decrease

15. In case of upward revaluation of a liability, revaluation account is …………….

Answer

Debited

16. At the time of admission of a partner, new profit sharing is used for sharing future………

Answer

Profits

17. At the time of admission, it the book value and the market value of investment is same then investment fluctuation reserved is transferred to …………….account of the old partners in their ………..ratio.

Answer

Capital accounts of old partners, old profit sharing ratio

18. The newly admitted partner brings his/ her share of capital for which he/she will get ……….in firm.

Answer

Profit share

19. A, B and C are partners sharing profits and losses in the ratio of 3:2:1. On admission of D, they agree to share profits and losses in the ratio of 5:4:2:1. Sacrificing ratio of A, B and C will be………..

Answer

Only A sacrifice- 1/12

20. R and S are partners sharing profits equally. They admitted T for 1/3 share in the firm. New profit sharing ratio will be………..

Answer

Equal

LONG QUESTIONS

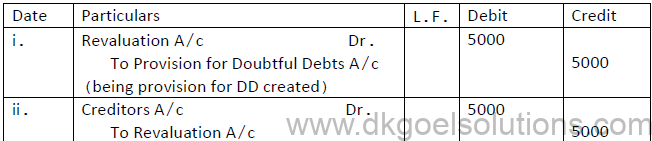

1. At the time of admission of a new partner, the assets and liabilities of A and B were revalued as follows.

i) A provision for Doubtful Debts @10% was made on sundry debtors (Sundry Debtors Rs.50,000)

ii) Creditors were written back by Rs.5,000.

iii) Building was appreciated by 20% (Book Value of Building Rs.2,00,000)

iv) Unrecorded investments were worth Rs.15,000.

v) A provision of Rs.2,000 was made for an outstanding bill for repairs.

vi) Unrecorded Liability towards suppliers was Rs.3,000.

Pass necessary journal entries.

Solution:

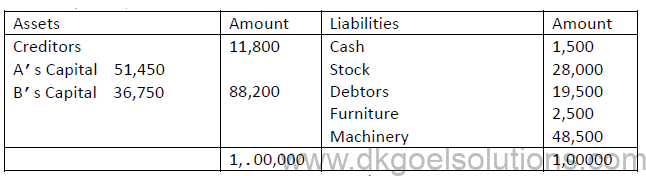

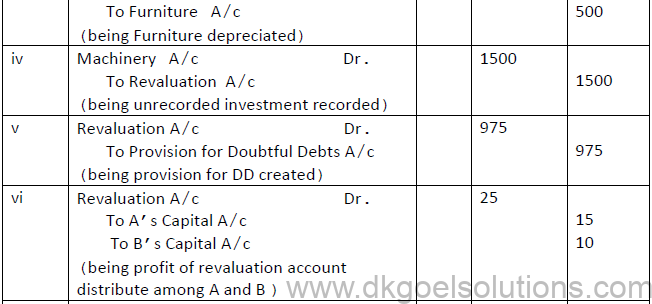

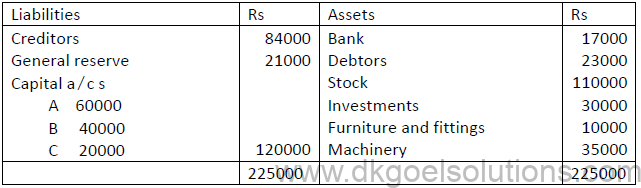

2. A & B carrying on business in partnership and sharing profits and losses in the ratio of3:2 require a partner when their Balance Sheet stood as follows:

They admit C into partnership and gave him 1/8th share in the future profits in the following terms.

i. Goodwill of their firm will be valued twice the average of the last three years profits which amounted to Rs.21000; Rs.24000 and Rs.25560.

ii. C is to bring in cash for the amount of his share of goodwill.

iii. C is to bring Rs.15000 as his capital.

iv Furniture decreased by Rs.500

v Machinery increased to Rs50000

vi. Make a provision @5% for DD on debtors.

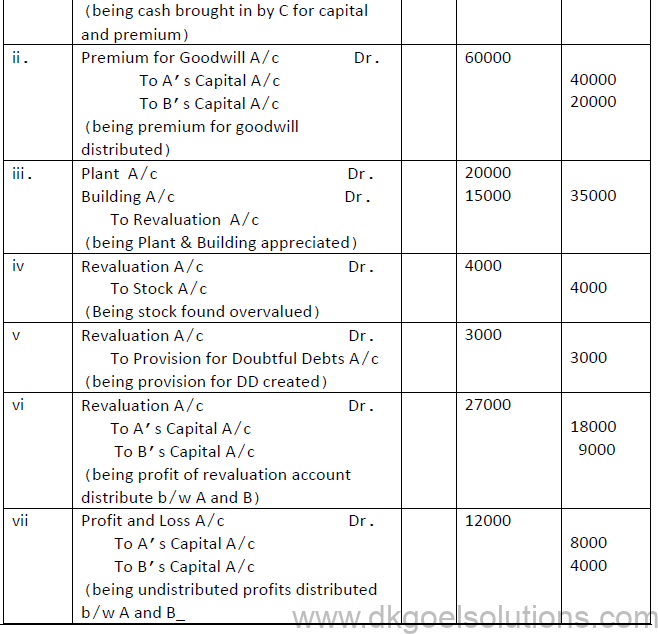

Pass journal entries to record these transactions.

Solution:

Working note:

Total Profit=21000+24000+25560=70560

Average profit= 70560/3=23520

Goodwill= 23560*2=47040

C’s share of goodwill premium=47040/8=5880

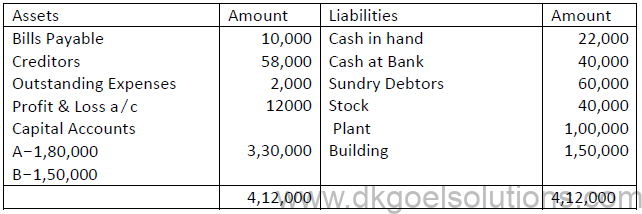

3. Given below is the balance sheet of A and B who are carrying partnership business on 31st March 2018 A and B share profits and losses in the ratio of 2:1 –

Balance Sheet of A and B as on 31st March 2018

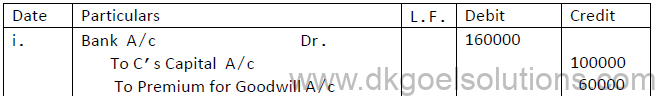

C is admitted as a partner on the date of the Balance Sheet on the following terms

i. C will bring in Rs.1,00,000 as his capital and Rs. 60,0000 as his share of goodwill for 1/4th share in the profits.

ii. Plant is to be appreciated to Rs.1,20,000 and the value of Building is to be appreciated by 10%.

iii. Stock is found overvalued by Rs.4,000

iv. A provision for doubtful debts is to be created at 5% of Sundry Debtors.

v. A creditors were unrecorded to the extent of Rs.1,000.

Pass the necessaries journal entries.

Solution:

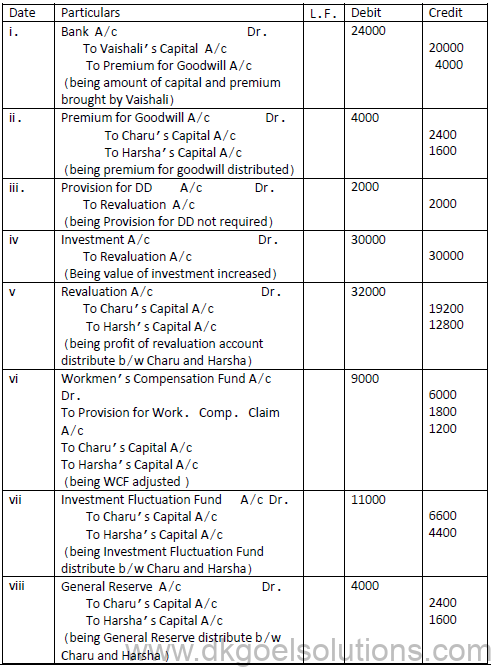

4. Charu and Harsha were partners in a firm sharing profits in the ratio of 3:2. On 1stApril, 2014 their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms.

i. Vaishali will bring Rs.20,000 for her capital and Rs.4,000 for her share of goodwill premium.

ii. All Debtors were considered good.

iii. The market value of Investments was Rs.50,000.

iv. There was a liability of Rs.6,000 for Workmen’s compensation.

Pass necessary entries.

Solution:

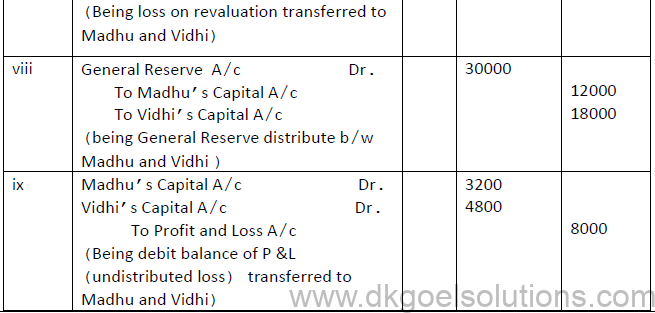

5. The balance sheet of Madhu and Vidhi who are sharing profits in the ratio of 2:3 as at 31st March 2016 is given below

Madhu and Vidhi decided to admit Gayatri as a new partner from 1stapril 2016 and their new profit sharing ratio will be 2:3:5.Gayatri brought Rs 400000as capital and goodwill premium in cash.

A. Goodwill of the firm was valued at Rs.300000

B. Land and building was found undervalued by Rs.26000

C. Provision for doubtful debts was to be made equal to 5% of the debtors.

D. There were unrecorded supplier to the extent of Rs.20000.

E. There was a claim of Rs.6000 on account of workmen compensation.

Pass necessary journal entries.

Solution:

6. A, B and C were partners sharing profits and losses in the ratio of 4:3:2. They admit D as a new partner on April 1, 2020. An extract of their Balance Sheet as at 31st March, 2020 is as follows:

Show the accounting treatment under the following alternative cases:

Case 1: If there is no claim made against WCR.

Case 2: If a claim on account of WCR is estimated at Rs.18000.

Case 1: If a claim on account of WCR is exactly Rs.63000

Case 1: If a claim on account of WCR is Rs.18000.

Solution:

7. A, B and C were partners sharing profits and losses in the ratio of 2:1:1. They admit D as a new partner on April 1, 2020. On that date their Balance Sheet had following items appearing in it.

You are required to pass necessary journal entries in each of the following situation in connection with investment Fluctuation Fund:

a) There is no additional information given.

b) Market value of investment is Rs.175000

c) Market value of investment is Rs.165000

d) Market value of investment is Rs.198000

e) Market value of investment is Rs.155000

Solution:

8. The Balance Sheet of Madan and Mohan who share profits and losses in the ratio of 3:2 as at 31st March 2017 was as follows.

They decided to admit Gopal on 1st April 2017 for 1/4th share on the following terms.

i. Gopal shall bring Rs.25,000 as his share of premium for goodwill and capital Rs.80000.

ii. That unaccounted accrued income of Rs.500 be provided for.

iii The market value of investment was Rs.45,000.

iv. A debtor whose dues of Rs.1,000 were written off as Bad Debts paid Rs.800 in full settlement.

v. A claim of Rs.2,000 on account of Workmen’s Compensation to be provided for.

vi. Patents are undervalued by Rs.5,000.

Pass journal entries.

Ans: Loss on revaluation- 8700

9. A,B and C were partners in a firm sharing profits in the ratio 3:2 :1. On 31st march,2015, their balance sheet was as follows:

On the above date, D was admitted as a new partner, he brought Rs.100000 as capital and further it was decided that:

a. The new profit sharing ratio between A,B,C and D will be 2:2:1:1

b. Goodwill of the firm was valued at Rs 90000 and D bought his share of goodwill premium in cash

c. The market value of investments was Rs 24000

d. Machinery will be reduced to Rs 29000

e. A creditor of Rs 3000 was not likely to claim the amount and hence to be written off

Pass necessary journal entries.

Ans: profit on revaluation- 3000

10. X, Y and Z were partners sharing profits and losses in the ratio of 5:3:2. They admit S as a new partner on April 1, 2020. On that date their Balance Sheet had following items appearing in it.

You are required to pass necessary journal entries in each of the following situation in connection with investment Fluctuation Fund:

i) There is no additional information given.

ii) Market value of investment is Rs.180000

iii) Market value of investment is Rs.172000

iv) Market value of investment is Rs.224000

v) Market value of investment is Rs.160000

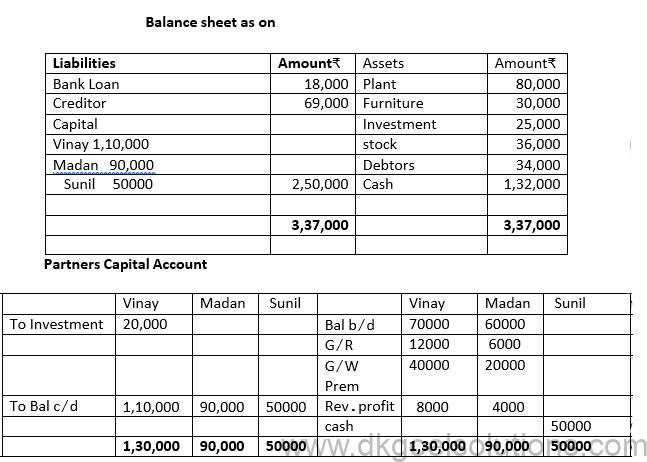

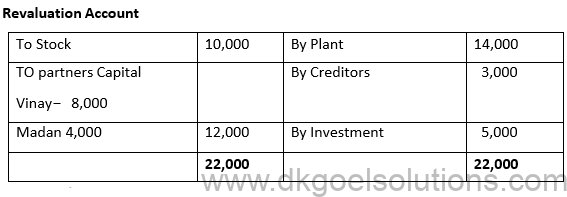

11. Vinay and Madan were partners sharing profits in the ratio of 2:1. On 1st April 2019, They admitted Sunil, a retired army officer who had lost his legs while servicing in army, as a new partner for 1/4 share in profits. Sunil will bring 60,000 for Goodwill and ₹ 50,000 as capital, At the time of admission of Sunil the Balance Sheet Vinay and Madan was as under :-

It was decided to

(i) Reduce the value of stock by ₹.10, 000.

(ii) Plant to be valued at ₹ 80,000.

(iii) An amount of ₹.3,000 included in creditors was not payable.

(iv) Half of the investment were taken over by Vinay and remaining were valued at ₹.25,000.

Prepare revaluation account, partners ‘capital account and Balance sheet of the reconstituted firm.

Solution:-

Notes for Reconstitution of a Partnership Firm Admission of a Partner class 12 Accountancy

ReconstitutionofPartnership

Meaning of Reconstruction

Any change in agreement of partnership or profit sharing ratio is called reconstitution of partnership firm. In following circumstances a partnership firm may be reconstituted:

1. Change in Profit Sharing Ratio

2. Admission of a partner

3. Retirement/Death of a partner.

CHANCEIN PROFIT SHARING RATIO AMONG THE EXISTING PARTNERS

Meaning : A Change in profit sharing ratio means one or more partners acquires interest form another partner or partners. Here it share of profit of one or more partners increases then share of one or more partner decreases to same extent.

When all the partners of a firm agree to change their profit sharing ratio. the ratio may be changed

New profit sharing ratio : The ratio in which the partners are to share the profits in future on reconstitution is known as New profit sharing ratio.

Gaining Ratio : It is the ratio in which the profit sharing ratio of gaining partners increases. It is calculated by taking difference between New profit sharing ratio and old profit sharing ratio.

Sacrificing Ratio : It is the ratio in which the profit sharing ratio of sacrificing partners decreases. It is calculated by taking difference between old profit sharing ratio and new profit sharing ratio.

Note : If old ratio-new ratio is positive it means sacrifice and if it is negative it means gain.

In case of change in profit sharing ratio, the gaining partner must components the sacrificing partner by paying the proportionate amount of goodwill.

Note :

(i) Increase in the value of an Asset and decrease in the value of a liability result in profit.

Assets A/cDr.

To Revaluation

(ii) Decrease in the value of any asset and increase in the value of a liability gives loss.

Revaluation A/cDr.

To Assets A/c

(iii) For increase in the value of liabilities.

Revaluation A/cDr.

To Liabilities A/c

(Increase in value of Liability)

(iv) For decrease in the value of Liabilities

Liabilities A/cDr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) When Revaluation account shows profit

Revaluation A/cDr.

To Partner’s Capital A/c

(Profit credited to Partner’s Capital A/c in old ratio)

(vi) In case of Revaluation Loss

Partner’s Capital A/c’sDr.

To Revaluation A/c

(Loss debited to Partner’s Capital A/cs in old ratio)

SPECCIMEN/PROFORMA OF REVALUATION ACCOUNT

Revaluation Account

Admission of a Partner

Meaning

When a new partner is admitted in a running business due to the requirement of more capital or may be to take advantage of the experience and competence the newly admitted partner or any other reason, it is called admission of a part in partnership firm.

According to section 31(1) of Indian partnership Act, 1932, “A new partner be admitted only with the consent of all the existing partners”

At the time of admission of new partner, following adjustments are requires

1. Calculation of new profit sharing ratio and sacrificing ratio.

2. Accounting treatment of Goodwill.

3. Accounting treatment of accumulated profit, reserves and accumulated loss.

4. Accounting treatment of revaluation of assets and reassessment of liabilities.

5. Adjustment of capital in new profit sharing ratio.

1. Calculation of new profit sharing ratio

Following types of problems may arise for the calculation of new profit share ratio.

Case(i)Whenold ratio is given and share of new partner is given.

Note : Unless agreed otherwise, it is presumed that the new partner acquires his share in profits from the old partners in their old profit sharing ratio.

Alternative Method :

Old Ratio = A : B

1 : 2

Left the profit of the firm = 1C’s share (New Partner) = 1/3

Remaining Profit = 1-1/3 = 2/3

Now this profit 2/3 will be divided between the old partners in their future profit sharing ratio (old ratio) i.c., 1:2

A’s new Profit = 1/3 of 2/3 = = 1/3 x 2/3 = 2/9

B’s new Profit = 2/3 of 2/3 = 2/3 x 2/3 = 4/9

C’s profit = 1/3 or = 1/3 x 3/3 = 3/9

Hence the new ratio = 2:4:3

Note : In this case only New Partners share is given then Sacrificing ratio = Old

Ratio = 1 : 2 there is not need to calculate it

Case (ii) When new partner acquires his/her share from old partners in agreed share.

2. Accounting Treatment of Goodwill

At the time of admission of a partner, treatment of Goodwill is necessary to compensate theold partners for their sacrifice. The incoming partner must compensate the existing partners because he is going to acquire the right to share future profits and his share is sacrificed by by the new partner then on entry is required in the books of the firm.

There may be different situations about the treatment of goodwill at the time of the admission of the new partner.

(i) Goodwill (premium) brought in by the new partner in cash and retained in the business

Note : Sacrificing = Old ratio – New ratio

A = 3/5 – 3/8 =24-15/40=9/40

B = 2/5 – 3/8 =16-15/40=1/40

This sacrificing ratio between A and B i.e., 9 : 1.

3. Accounting treatment of Accumulated Profits

Accumulated profits and reserves are distributed to partners in their old profit sharing ratio. If old partners are not interested to distribute, these accumulated profits are adjusted in the same manner as goodwill and the following adjusting entry will be passed.

New Partner’s capital A/c Dr. (New share)

To old partner’s capital A/c (Sacrificing ratio)

4. Accounting treatment for revaluation of assets and re-assessment of liabilities

The assets and liabilities are generally revalued at the time of admission of a new partner. Revaluation Account is prepared for this purpose in the same way was in case of change in

profit sharing ratio. This account is debited with all losses and credited with all gains.

Balance of Revaluation Account is transferred to old partner in their old ratio.

5. Adjustment of Capital in New Profit Sharing Ratio

Working Notes :

Gauri’s share of goodwill = Rs.45000×1/3=RS15000

Total adjusted capital of old partner for 2/3 share = Rs. 1,42,433 + Rs. 91,217 = Rs. 2,33,650

Proportionate capital of Gauri 1/3 share = Rs. Rs. 2,33,650 x 3/2 x 1/3 =Rs. 233650/2 = Rs. 1,16,855

Bank A/c

Also download Sample Papers for Class 12 Accountancy