Notes Chapter 10 Financial Markets

Class 12 students can refer to Chapter 10 Financial Markets notes given below which is an important chapter in the class 12 Business Studies book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Business Studies teachers has prepared these notes for class 12 Business Studies for the benefit of students so that you can read these revision notes and understand each topic carefully.

Financial Markets Notes Class 12 Business Studies

Refer to the notes and important questions given below for Financial Markets which is really useful and has been recommended by Class 12 Business Studies teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books.

MARKETS

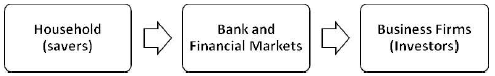

Financial Market is a market for creation and exchange of financial assets like shares, bonds etc. It helps in mobilising savings and channelizing them into the most productive uses.

Types of Financial Markets

Money Market

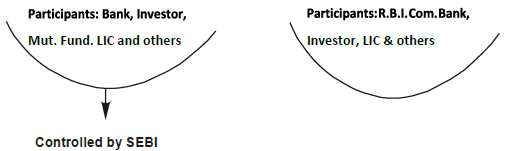

It is a market for short term funds/securities whose period of maturity is upto one year. The major participants in the money market are RBI, Commercial Banks, Non- Banking Finance Companies, State Government, Large Corporate Houses and Mutual Funds. The main instruments of money market are as follows:

1. Treasury Bills: They are issued by the RBI on behalf of the Central Government to meet its short-term requirement of funds. They are issued at a price which is lower than their face value and are repaid at par. They are available for a minimum amount of Rs. 25000 and in multiples thereof. They are also known as Zero Coupon Bonds. They are negotiable instruments i.e. they are freely transferable.

2. Commercial Paper: They are short term unsecured promissory notes issued by large credit worthy companies to raise short term funds at lower rates of interest than market rates. They are negotiable instruments transferable by endorsement and delivery with a fixed maturity period of 15 days to one year.

This source is usually used for-

(i) Working Capital requirements

(ii) Seasonal needs

(iii) Bridge financing

3. Call Money: It is short term finance repayable on demand, with a maturity period of one day to 15 days, used for interbank transactions. Call Money is a method by which banks borrow from each other to be Mut. Fund. LIC and others Mut. Fund. LIC and others Mut. Fund. LIC and others Mut. Fund. LIC and others Mut. Fund. LIC and othersMut. Fund. LIC and othersMut. Fund. LIC and others Mut. Fund. LIC and others Mut. Fund. LIC and othersMut. Fund. LIC and others Mut. Fund. LIC and others

Investor, LIC & others Investor, LIC & others Investor, LIC & others Investor, LIC & othersInvestor, LIC & others Investor, LIC & others Investor, LIC & others Investor, LIC & othersInvestor, LIC & othersInvestor, LIC & others able to maintain the cash reserve ratio as per RBI. The interest rate paid on call money loans is known as the call rate.

4. Certificate of Deposit: It is an unsecured instrument issued in bearer form by Commercial Banks & Financial Institutions. They can be issued to individuals, Corporations and companies for raising money for a short period ranging from 91 days to one year.

5. Commercial Bill: It is a bill of exchange used to finance the working capital requirements of business firms. A seller of the goods draws the bill on the buyer when goods are sold on credit. When the bill is accepted by the buyer it becomes marketable instrument and is called a trade bill. These bills can be discounted with a bank if the seller needs funds before the bill maturity

Capital Market

It is a market for long term funds where debt and equity are traded. It consists of development banks, commercial banks and stock exchanges. The capital market can be divided into two parts:

1. Primary Market

It deals with the new securities which are issued for the first time. It is also known as the New Issue Market.

Methods of Floatation of New Issues in Primary Market

1. Offer through Prospectus/ Initial Pubic Offer: It involves inviting subscription from the public through issue of prospectus. A prospectus makes a direct appeal to investors to raise capital through an advertisement in newspapers and magazines.

2. Offer for Sale: Under this method security are offered for sale through intermediaries like issuing houses or stock brokers. The company sells securities to intermediary/broker at an agreed price and the broker resells them to investors at a higher price.

3. Private Placements: It refers to the process in which securities are allotted to institutional investor and some selected individuals.

4. Rights Issue : It refers to the issue in which new shares are offered to the existing shareholders in proportion to the number of shares they already possess.

5. e-IPOs : It is a method of issuing securities through an on-line system of stock exchange. A company proposing to issue capital to the public through the on- line system of the stock exchange has to enter into an agreement with the stock exchange..

Secondary Market

It is also known as the stock market or stock exchange where purchase and sale of existing securities takes place. They are located at specified places and both the buying as well as selling of securities takes place.

Difference between Primary and Secondary Market

Stock Exchange/Share Market

A Stock Exchange is an institution which provides a platform for buying and selling of existing securities. It facilitates the exchange of a security i.e. share, debenture etc.

. Following are some of the important functions of a Stock Exchange:-

1. Providing liquidity and Marketability to Existing Securities : Stock Exchange provides a ready and continuous market for the sale and purchase of securities.

2. Pricing of Securities : Stock Exchange helps in constant valuation of securities which provide instant information to both buyers and sellers and thus helps in pricing of securities which is based on the forces of demand & supply.

3. Safety of Transaction : The members of a stock exchange are well regulated, who are required to work within the legal framework. This ensures safety of transactions.

4. Spreading of Equity Culture : Stock exchange helps in educating public about investments in securities which leads to spreading of Equity culture.

5. Providing Scope for Speculation : Stock exchange provides scope within the provisions of law for speculation in a restricted and controlled manner.

Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are famous stock exchanges in India.

Trading and Settlement Procedure on a Stock Exchange

1. Selection of Broker: In order to trade on a Stock Exchange first a broker is selected who should be a member of stock exchange as they can only trade on the stock exchange.

2. Opening Demat Account with Depository.

3. Placing the order: After selecting a broker, the investors specify the type and number of securities they want to buy or sell.

4. Executing the order: The broker will buy or sell the securities as per the instructions of the investor.

Difference between Capital and Money Market.

Depository Services and DEMAT Accounts:.

1. Depository Services: ‘Depository is an institution/organization which holds securities (e.g. shares, debentures, bonds, mutual funds etc.) in electronic form, in which trading is done. The services provided by a Depository are termed as ‘Depository Services’. At present there are two depositories in India: NSDL. (National Securities Depository Ltd.) and CDSL (Central Depository Services Ltd.).

Services provided by Depository

(i) Dematerialisation (usually known as demat) is converting physical certificates to electronic form.

(ii) Rematerialisation, known as remat, is reverse of demat, i.e getting physical certificates from the electronic securities.

(iii) Transfer of securities, change of beneficial ownership.

Demat Account

Demat account is the abbreviation of ‘Dematerialized Account’. Dematerialized account refers to an account which an Indian citizen must open with the depository participant (banks, stockbrokers) to trade in listed securities in electronic form wherein one can hold shares of various companies in the Dematerialized {electronic} form. Access to De-mat account requires an internet password and a transaction password. Transfer and purchase of

Securities and Exchange Board of India (SEBI)

SEBI was established by Government of India on 12 April 1988 as an interim administrative body to promote orderly and healthy growth of securities market and for investor protection. It was given a statutory status on 30 January 1992 through an ordinance which was later replaced by an Act of Parliament known as the SEBI Act, 1992. It seeks to protect the interest of investors in new and second hand securities.

Objectives of SEBI

1. To regulate stock exchange and the securities market to promote their orderly functioning.

2. To protect the rights and interests of investors and to guide & educate them.

3. To prevent mal-practices in trade such as insider trading.

4. To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc.

Functions of SEBI

The SEBI performs three important functions

1. Regulatory functions: These functions are performed by SEBI to regulate the business in stock Exchange.

2. Developmental functions: These functions are performed by SEBI to promote and develop activities in stock market.

3. Protective functions: These functions are performed by SEBI to protect the interest of investors and provide safety of investments.