Notes Chapter 9 Financial Management

Class 12 students can refer to Chapter 9 Financial Management Controlling notes given below which is an important chapter in the class 12 Business Studies book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Business Studies teachers has prepared these notes for class 12 Business Studies for the benefit of students so that you can read these revision notes and understand each topic carefully.

Financial Management Notes Class 12 Business Studies

Refer to the notes and important questions given below for Financial Management which is really useful and has been recommended by Class 12 Business Studies teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books.

FINANCIAL MANAGEMENT

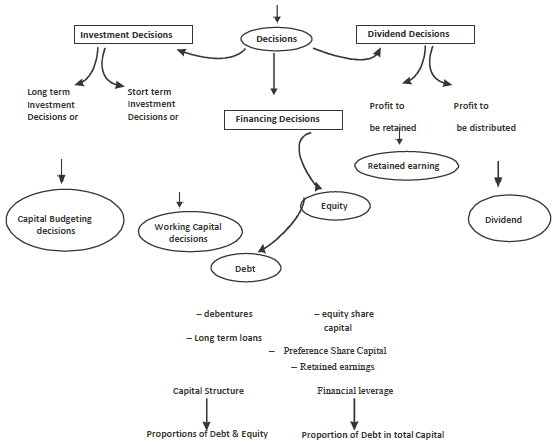

Financial Management is concerned with decisions relating to

1. Procurement of funds (financing decisions)

2. Investment of funds (investing decisions)

3. Distribution of earnings (dividend decision)

Meaning of Financial Management

Financial management is the activity concerned with the planning, raising, controlling and administering of funds used in the business. It is concerned with optimal procurement as well as usage of finance. It aims to reduce the cost of funds. It also aims at ensuring availability of enough funds whenever required as well as avoiding idle finance.

Objectives of Financial Management

(A) Primary Objective:

• Wealth Maximisation: The main objective of Financial management is to maximise shareholder’s wealth. The market price of a company shares is linked to three basic financial decisions and shareholder’s wealth maximisation.

Wealth of shareholders = number of shares x market price per share.

(B) Other objectives:

1. To procure sufficient funds for the organisation: Adequate and regular supply of funds is to be maintained for smooth operations of the business.

2. To ensure effective utilisation of funds.

3. To ensure safety of funds: The chances of risk in investments should be minimum possible.

Financial Decisions:

FINANCING DECISION

Decision is taken at two stages:

1. Estimating overall requirement of funds.

2. Deciding different sources

Deciding how much amount is to be arranged from which source.

FIRST STAGE: FINANCIAL PLANNING

The process of estimating the fund requirement of a business and specifying the sources of funds is called financial planning. It ensures that enough funds are available at right time so that a firm could honour its commitments and carry out its plans. STEPS

(i) Determination of Financial Objectives.

(ii) Formulation of Financial Policies and Rules.

(iii) Forecasting the Needs of Finance.

(iv) Developing Alternative sources of Finance.

(v) Selection of Best Alternative.

(vi) Implementing Financial Plans and Policies.

Importance of Financial Planning

1. To ensure availability of adequate funds at right time.

2. To see that the firm does not raise funds unnecessarily.

3. It results in preparation of plans for future. Thus new projects can be under taken smoothly.

4. It serves as the basis of financial control. The management attempts to ensure utilization of funds in tune with the financial plans.

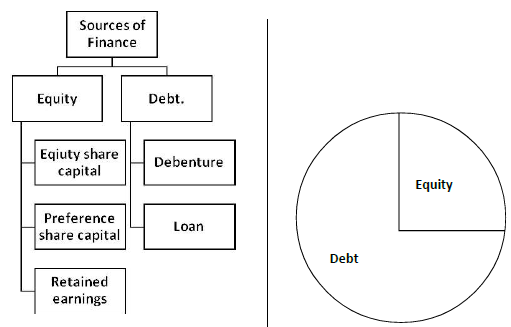

SECOND STAGE: CAPITAL STRUCTURE

Capital structure refers to the optimal mix between owner’s funds and borrowed funds. It will be said to be optimal when the proportion of debt and equity is such that it results in an increase in the value of the equity share. The proportion of debt in the overall capital of a firm is called Financial Leverage or Capital Gearing. When the proportion of debt in the total capital is high then the firm will be called highly levered firm but when the proportion of debts in the total capital is less, then the firm will be called low levered firm

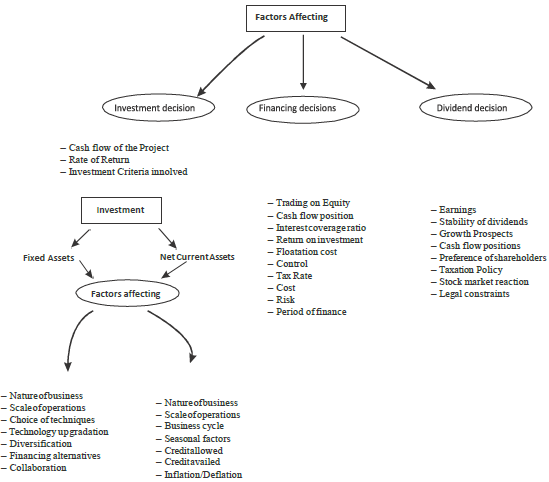

Factors affecting Capital structure or financing decision

1. Trading on Equity: It refers to the increase in profit earned by the equity shareholders due to the presence of fixed financial charges like interest. Trading on equity happens when the rate of earning of an organisation is higher than the cost at which funds have been borrowed and as a result equity shareholders get higher rate of dividend per share.

2. Cash Flow Position: In case a company has strong cash flow position then it may raise finance by issuing debts, as they are to be paid back after some time and interest has to be paid on debt.

3. Interest Coverage Ratio: It refers to the number of times earning before interest and taxes of a company covers the interest obligation. High interest coverage ratio indicates that company can have more of borrowed funds. Formula for calculating ICR = EBIT/interest.

4. Return on Investment: If return on investment is higher than the rate of interest on debt then it will be beneficial for a firm to raise finance through borrowed funds.

5. Floatation Cost: The cost involved in issuing securities such as brokers commission, under writer’s fees, cost of prospectus etc. is called floatation cost..

6. Risk: The risk associated with different sources is different. More risk is associated with borrowed funds as compared to owner’s fund as interest is paid on it and it is to be repaid also, after a fixed period of time or on expiry of its tenure

INVESTMENT DECISION

It relates to how the firm’s funds are invested in different assets. Investment decision can be long-term or short-term. Long term investment decision is called capitaL budgeting decision as they involve huge amounts of funds and are irreversible except at a huge cost.

Factors affecting Investment Decisions

1. Cash flows of the project : The series of cash receipts and payments over the life of an investment proposal should be considered and analysed for selecting the best proposal.

2. Rate of Return : The expected returns from each proposal and risk involved in them should be taken into account to select the best proposal.

3. Investment Criteria Involved : The various investment proposals are evaluated on the basis of capital budgeting techniques. These involve calculations regarding investment amount, interest rate, cash flows, rate of return, risk involved in project etc.

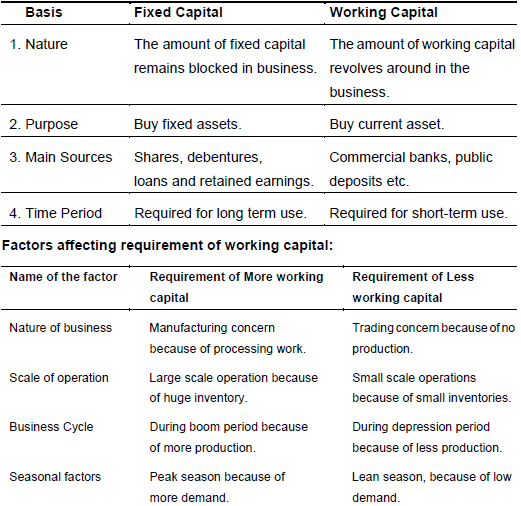

INVESTMENT: 1. FIXED CAPITAL 2. WORKING CAPITAL

Fixed Capital

Fixed capital refers to investment in long-term assets. Investment in fixed assets like land, plant and machinery for longer duration and they must be financed through long-term sources of capital.

Factors Affecting Requirement of Fixed Capital

1. Nature of Business : Manufacturing concerns require huge investment in fixed assets & thus huge fixed capital is required for them but trading concerns need less fixed capital as they are not required to purchase plant and machinery etc.

2. Scale of Operations : An organisation operating on large scale requires more fixed capital as compared to an organisation operating on small scale.

3. Choice of Technique : An organisation using capital intensive techniques requires more investment in plant & machinery as compared to an organisation using labour intensive techniques.

4. Technology upgradation : Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

5. Growth Prospects : Companies having more growth plans require more fixed capital. In order to expand production capacity more plant & machinery are required.

Working Capital

Working Capital refers to the capital required for day to day working of an organisation. Every business organisation needs to invest in current assets, which can be converted into cash or cash equivalents within a period of one year. They provide liquidity to the business. Working capital is of two types – Gross working capital and Net working capital. Investment in all the current assets is called Gross Working Capital whereas the excess of current assets over current liabilities is called Net Working Capital.

Networking Capital = Current Assets- Current Liabilities

Dividend Decision

Dividend refers to that part of the profit which is distributed to shareholders. A company is required to decide how much of the profit earned by it should be distributed among shareholders and how much should be retained.

Factors affecting Dividend Decision

1. Earnings : Companies having high and stable earning could declare high rate of dividends as dividends are paid out of current and past earnings.

2. Stability of Dividends : Companies generally follow the policy of stable dividend. The dividend per share is not altered/changed in case earnings change by small proportion or increase in earnings is temporary in nature.

Retained Retained Retained Retained Retained Retained Retained EarningsEarnings Earnings

Dividend Dividend Dividend

3. Cash Flow Positions : Dividends involve an outflow of cash and thus, availability of adequate cash is foremost requirement for declaration of dividends.

4. Preference of Shareholders : In case shareholders desire for dividend then company may go for declaring the same. There are always some shareholders who depend upon a regular income from their investments.

5. Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends

whereas if tax rates are lower then more dividends can be declared by the company.

Key terms to Crack Case Studies Financial Management

1. Financial blueprint of operations — Financial planning.

2. Decisions affecting liquidity and profitability of a business — Short term investment decisions.

3. Decisions affecting financial risk and profitability of a business — Capital structure decisions.

4. Long term investment decisions — Capital budgeting decisions

5. Proportion of debt and equity — Capital structure

6. Cheapest source of finance — Debt

7. Riskfree source of finance — Equity

8. Decisions relating to disposal of profits — Dividend decision

9. Decision relating to quantum of funds to be raised from varions long term sources — Financing decision

10. Most suitable combination of owners funds and borrowed funds to generate higher EPS — Trading on equity/Financial leverage.