Sample Paper Class 12 Accountancy Set A

PART A

1. Give the average period , in months for charging interest on drawings of a fixed amount, withdrawn at the end of each quarter:

Answer: 4.5 Months

2. On the dissolution of a firm a creditor of Rs.75,000 accepted furniture at Rs.60,000 in full settlement of his claim. Pass the necessary journal entry.

Answer: No Entry

3. A part of the uncalled capital of a company to be called only in the event of winding up of the company is known as ______________ capital.

Answer: Reserve Capital

4. Asset taken over by a partner at the time of dissolution of a firm should be

(a) Credited to Realization Account

(b) Credited to Partner’s Capital Account

(c) Debited to Realization Account

(d) None of the above

Answer: Credited to Realization Account

5. ‘Subscription Received in advance’ during the current year by a Not for profit organization is :

(a) Asset

(b) Expense

(c) Liability

(d) Revenue

Answer: Liability

6. A, B and C were partners in a firm sharing profits in the ratio of 3:2:1. They admitted D as a new partner for 1/8th share in the profits, which he acquired 1/16th from B and 1/16th from C. The new profit sharing ratio of A, B, C and D will be :

(a) 24:13:5:6

(b) 24:13:6:5

(c) 24:6:13:5

(d) 24:5:13:6

Answer: 24:13:5:6

7. Average profit of a firm during the last few years is Rs.1,50,000. In similar business, the normal rate of return is 10% of the capital employed . Calculate the value of goodwill by capitalisation of super profit method if super profits of the firm are Rs.5,000.

Answer: Rs.5,00,000

8. Discount allowed on re-issue of forfeited shares is debited to

(a) Share Capital A/c

(b) Share Forfeiture A/c

(c) Statement of Profit and Loss A/c

(d) General Reserve A/c

Answer: Share Forfeiture A/c

9. Retirement or death of a partner will create a situation for the continuing partners, which is known as ‘Dissolution of _________________

Answer: Dissolution of Partnership

10. E, F and G are partners sharing profits in the ratio of 3:3:2. As per the partnership agreement, G is to get a minimum amount of `80,000 as his share of profits every year and any deficiency on this account is to be personally borne by E. The net profit for the year ended 31st March 2020 amounted to 3,12 ,000. Calculate the amount of deficiency to be borne by E?

a. 1,000

b. 4,000

c. 8,000

d. 2,000

Answer: Rs.2,000

11. Under which of the following circumstance, balance of fixed capital of partners may change.

a. Interest on capital provided to partners

b. Additional capital introduced by partners

c. Interest on drawings charged from partners

d. All of the above

Answer: Additional capital introduced by the partner

12. The relation of a partner with the firm is that of:

(a) An Owner

(b) An Agent

(c) An agent and An Owner

(d) Manager

Answer: An agent and and an owner

13. A, B and C are partners. C expired on 18th December 2019 and as per agreement surviving partners A and B directed the accountant to prepare financial statements as on 18th December 2019 and accordingly the share of profits of C (deceased partner) was calculated as `12,00,000. Which account will be debited to transfer C’s share of profits:

a. Profit and Loss Suspense Account.

b. Profit and loss Appropriation Account.

c. Profit and loss Account.

d. None of the above.

Answer: Profit and Loss Suspense A/c

14. From the following information, calculate the amount of sports material to be debited to Income and Expenditure of a sports club for the year ending 31st March,2019:

Rs.

Stock of Sports Material on 1st April,2018 10,000

Stock of Sports Material on 31st March, 2019 7,500

Creditors for Sports Material on 1st April,2018 20,000

Creditors for Sports Material on 31st March,2019 22,500

Payment made to creditors of Sports Material

during the year ending 31st March, 2019 1,00,000

Answer: 1,02,500

Or

How will the following items be presented in the Income and Expenditure Account of a club for the year ending 31st March, 2019 and the Balance sheet as on that date?

Rs.

Tournament Fund on 1st April, 2018 3,00,000

10% Tournament Fund Investments on 1st April , 2018 3,00,000

Interest received on Tournament Fund Investments 30,000

Sale of Tournament Tickets 75,000

Tournament prizes awarded 60,000

Answer: Balance Sheet of the Club as at…….

15. L, M and N are partners in a firm sharing profits & losses in the ratio of 2:3:5. On April 1, 2016 their fixed capitals were Rs.2,00,000, Rs.3,00,000 and Rs.4,00,000 respectively. Their partnership deed provided for the following:

(i) Interest on capital @ 9% per annum.

(ii) Interest on Drawings @ 12% per annum.

(iii) Interest on partners’ loan @ 12% per annum.

On July 1, 2016, L brought Rs.1,00,000 as additional capital and N withdrew Rs.1,00,000 from his capital. During the year L, M and N withdrew Rs.12,000, Rs.18,000 and Rs.24,000 respectively for their personal use. On January 1, 2017 the firm obtained a loan of Rs.1,50,000 from M. The net profit of the firm for the year ended March 31, 2017 after charging interest on M’s loan was Rs.85,000. Prepare Profit & Loss Appropriation Account.

Answer: Net Divisible Profits Rs.7,240, L: Rs.1,448, M: Rs.2,172, N Rs.3,620

OR

Rohit, Raman and Raina are partners in a firm. Their capital accounts on 1st April 2019, stood at 2,00,000, 1,20,000 and 1,60,000 respectively. Each partner withdrew 15,000 during the financial year 2019-20. As per the provisions of their partnership deed:

(a) Interest on capital was to be allowed @ 5% per annum.

(b) Interest on drawings was to be charged @ 4% per annum.

(c) Profits and losses were to be shared in the ratio 5:4:1.

The net profit of `72,000 for the year ended 31st March 2020, was divided equally among the partners without providing for the terms of the deed.

You are required to pass a single adjustment entry to rectify the error (Show workings clearly).

Answer: Rainas Capital a/c ….. Dr 11,410To Rohit Capital a/c 10,150

To Raman Capital a/c 1,260

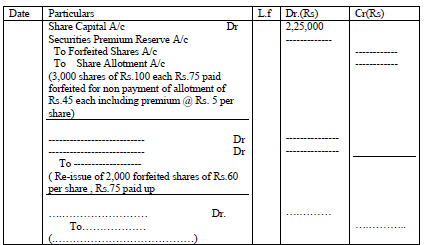

16. Fill in the missing figures:

Answer:

17. Give the necessary Journal Entries for the following transactions in case of dissolution of a partnership firm after various assets (other than cash and bank) and third party liabilities have been transferred to Realisation Account:

(i) Dissolution expenses Rs.5,000 were paid by the firm.

(ii) An unrecorded computer not appearing in the books of accounts realised Rs.2,200.

(iii) A creditor for Rs.1,40,000 accepted building valued at Rs. 1,80,000 and paid to the firm Rs.40,000.

(iv) Loss on realisation Rs.10,000 was divided between the partners Aman and Amit in the ratio of 4:1

Answer: Journal(i) Realisation a/c Dr 5,000

To Cash a/c 5,000

(ii) Cash a/c .. Dr 2,200

To Realisation a/c 2,200

(iii) Bank a/c Dr 40,000

To Realisation a/c 40,000

(iv) Aman a/c Dr 8,000

Amit a/c … Dr 2,000

To Realisation a/c 10,000

18. A, B and C are partners in a firm sharing profits in the ratio of 5:3:2, whose books are closed every year on 31stMarch. They are producing goods that can be purchased by low income group. They decided to change their profit-sharing ratio in 2:3:5, w.e.f. 1st April. They decided to record the effect of the following without affecting book figures.

General Reserve Rs.50,000

Contingencies Reserve Rs. 5,000

Profit and Loss A/c. (Dr.) Rs.10,000

Advertisement Suspense Rs.15,000

Pass the necessary journal entry.

Answer: A’s Sacrifice = 3/10 , B’s Gain/Sacrifice = 0

C’s Gain = 3/10

Net Amount for Adjustment = 30,000

C’s Capital A/c – Dr 9,000

To A’s Capital A/c 9,000

19. Prepare Income and Expenditure Account from the following particulars of Youth Club :

Receipt and Payments Account for the year ending March 31,2020

Additional Information:

(i) Subscription outstanding as at 31st March 2020 Rs. 16,200, Rs.1,200 is still in arrears for the year 2018-19 for subscription.

(ii) Value of sports material at the beginning and at the end of the year was Rs.3,000 and Rs.4,500 respectively.

(iii) Depreciation to be provided @ 10%p.a on furniture.

Answer: Surplus Rs.10,200

20. (A) Mohit Ltd. Took over assets of Rs.84,000 and liabilities of Rs.80,000 of Ram Ltd at an agreed value of Rs.7,20,000. Mohit Ltd. paid to Ram Ltd by issue of 9% debenture of Rs.100 each at a premium of 20%. Pass the necessary Journal Entries to record the above transactions in the books of Mohit Ltd.

(B) Give Journal Entries in each of the following cases if the face value of a 9% debenture is Rs.100.

(i) A debenture issued at Rs.100 repayable at Rs.105

(ii) A debenture issued at Rs.105 repayable at Rs.105

Answer: (A) Capital Reserve Rs.40,000

(B) (i) Bank A/c …Dr 100

To Debenture Application and Allotment A/c 100

Deb. Application and Allotment A/c..Dr 100

Loss on issue A/c Dr 5

To 9% Debentures A/c 100

To Premium on Redemption of Debentures A/c 5

(ii) Bank A/c …..Dr 105

To Debenture Application and Allotment A/c 105

Debenture Application and Allotment A/c ..Dr 105

Loss on issue of debentures A/c… Dr 5

To 9% Debentures A/c 100

To Securities Premium Reserve A/c 5

To Premium on Redemption of Debentures A/c 5

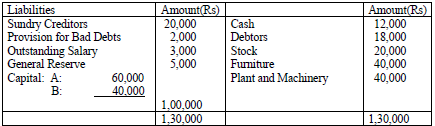

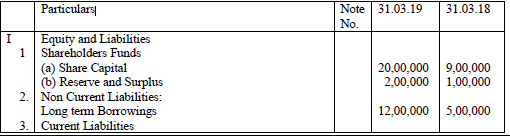

21. A and B are partners in a firm sharing profits in the ratio of 3:2. Their Balance Sheet as on 31st March,2019 was as follows:

Balance Sheet of A and B as on 31.03.19

On the above date C was admitted for 1/6th share in the profits on the following terms:

(i) C will bring Rs.30,000 as his capital and Rs.10,000 for his share of goodwill premium, half of which will be withdrawn by A and B.

(ii) Debtors Rs.1,500 will be written off as bad debts and a provision of 5% will be created for bad and doubtful debts.

(iii) Outstanding salary will be paid off.

(iv) Stock will be depreciated by 10%, furniture by Rs.500 and Plant and Machinery by 8%.

(v) Investments Rs.2,500 not mentioned in the balance sheet were to be taken into account.

(vi) A creditor of Rs.2,100 not recorded in the books was to be taken into account.

Pass necessary Journal Entries for the above transactions in the books of the firm on C,s Admission.

Answer: One Mark for each entry, Loss on Revaluation Rs 5,625

OR

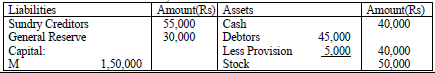

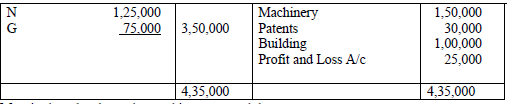

M,N and G were partners in a firm sharing profits and losses in the ratio of 5:3:2.On 31.3.19 Their Balance Sheet was as under:

Balance Sheet of M, N and G as on 31-3-2019

M retired on the above date and it was agreed that:

(i) Debtors of Rs.2,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) Patents will be completely written off and stock, machinery and building will be depreciated by 5%.

(iii) An unrecorded creditor of Rs.10,000 will be taken into account.

(iv) N and G will share the future profits in the ratio of 2:3.

(v) Goodwill of the firm on M’s retirement was valued at Rs.3,00,000.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the firm.

Answer: Loss on Revaluation Rs. 54,150

M’s Loan a/c Rs. 2,75,425

22. Ruchi Ltd. made an issue of 1,00,000 equity shares of Rs.10 each at a premium of 20% payable as follows:-

On application – Rs.2.50 per share

On allotment – Rs. 4.50 per share and

On first and final call – balance.

Applications were received for 2,40,000 Equity shares . Applications for 40,000 shares were rejected and pro rata allotment was made to the remaining applicants.

Renu who had applied for 800 shares did not pay the allotment and final call money, as a result her shares were forfeited . Later on 80% of the forfeited shares were reissued at Rs. 8 per share fully paid up.

Pass the necessary Journal entries for the above mentioned transactions in the books of the company.

Answer: JOURNAL OF RUCHI LTD.

i) Bank a/c Dr 6,00,000

To Share Application a/c 6,00,000

ii) Equity Share Application a/c Dr 6,00,000

To Equity Share Capital a/c 2,50,000

To Equity Share Allotment a/c 2,50,000

To Bank a/c 1,00,000

iii) Equity Share Allotment a/c Dr 4,50,000

To Equity Share Capital a/c 2,50,000

To Securities Premium Reserve a/c 2,00,000

iv) Bank a/c Dr 1,99,200

To Equity Share Allotment a/c 1,99,200

v) Equity Share First and Final Call a/c Dr 5,00,000

To Equity Share Capital a/c 5,00,000

vi) Bank a/c Dr 4,98,000

To Equity Share First and Final Call a/c 4,98,000

vii) Equity Share Capital a/c Dr 4,000

Securities Premium Reserve a/c Dr 800

To Equity Share Allotment a/c 800

To Equity Share First and Final Call a/c 2,000

To Forfeited Shares a/c 2,000

viii) Bank a/c Dr 2,560

Forfeited Shares a/c Dr 640

To Equity Share Capital a/c 3,200

ix) Forfeited Shares a/c Dr 960

To Capital Reserve a/c 960

Or

Shakti Ltd. issued a prospectus inviting applications for 50,000 Equity shares of Rs.10 each at a premium of 20% payable Rs 5 per share on application(including Rs. 2 premium), Rs 4 per share on allotment and the balance towards first and final call.

Applications were received for 75,000 shares . Applications money received on 15,000 shares was refunded and allotment were made on pro rata basis to the applicants of 60,000 shares. Excess application money including premium received was adjusted against amount due on allotment .

Mr. Sharma to whom 700 shares were allotted failed to pay the allotment money and his shares were forfeited by the Directors on his subsequent failure to pay the call money.

All the forfeited shares were subsequently issued to Mr. Jain for Rs.9 per share credited as fully paid.

Pass the journal entries in the books of Shakti Ltd. and prepare Cash Book assuming that Calls in Arrears Account is maintained.

Answer: JOURNAL OF SHAKTI LTD.

i) Share Application a/c Dr 3,00,000

To Share Capital a/c 1,50,000

To Securities Premium Reserve a/c 1,00,000

To Share Allotment a/c 50,000

ii) Share Allotment a/c Dr 2,00,000

To Share Capital a/c 2,00,000

iii) Calls in Arrears a/c Dr 2,100

To Share Allotment a/c 2,100

iv) Share First and Final Call a/c Dr 1,50,000

To Share Capital a/c 1,50,000

v) Calls in Arrears a/c Dr 2,100

To Share First and Final Call a/c 2,100

vi) Share Capital a/c Dr 7,000

To Calls in Arrears a/c 4,200

To Forfeited Shares a/c 2,800

vii) Forfeited Shares a/c Dr 700

To Share Capital a/c 700

viii) Forfeited Shares a/c Dr 2,100

To Capital Reserve a/ca/c 2,100

PART B

23. Which of the following is not an investment from cash flow?

(a) Purchase of marketable securities for 25,000 cash.

(b) Sale of land for 28,000 cash.

(c) Sale of 2,500 shares (held as investment) for 15 each.

(d) Purchase of equipment for 500 cash

Answer: Purchase of marketable securities for 25,000 cash.

24. Quick Assets do not include

(a) Cash in Hand

(b) Marketable Securities

(c) Prepaid Expenses

(d) Trade Receivables

Answer: Prepaid Expenses

25. Define Cash Equivalent.

Answer: Short term highly liquid investment

26. The debt equity ratio of a company is 2:1. State giving reason, if issue of shares of Rs.6,00,000 will increase,decrease or not affect the ratio.

Answer: Decrease because issue of shares will increase the equity

27. Name any two tools of Analysis of Financial Statements.

Answer: i) Comparative Statements ii) Common Size statements. iii) Trend Analysis iv) Ratio Analysis

28. When bad position of the business is tried to be depicted as good, it is known as ————

(a) Personal Bias

(b) Price Level Changes

(c) Window Dressing

(d) All of the above.

Answer: Window Dressing

29. What is Operating Cycle.

Answer: Operating cycle is the time between the acquisition of assets for processing and their realisation in Cash and Cash Equivalents.

30.Under which heads and sub heads will the following items will appear in the Balance Sheet of a company as per Schedule III, Part I of the Companies Act, 2013

(i) Unclaimed Dividend

(ii) Shares in State Bank of India

(iii) Loose Tools.

Answer: (i) Unclaimed Dividend-Current Liabilities-Other Current Liabilities

(ii) Shares in State Bank of India-Non Current Assets-Non Current Investments

(iii) Loose Tools.-Current Assets – Inventories

OR

(i) X Ltd has a Current ratio of 3:1 and Quick ratio of 2:1. The excess of current assets over quick assets are Rs.24,000. Calculate current assets and current liabilities.

(ii) From the following information , compute Total Assets to Debt Ratio:

Rs.

Long term borrowings 3,00,000

Long term provisions 1,50,000

Current Liabilities 75,000

Non current Assets 5,40,000

Current Assets 1,35,000

Answer: Current Ratio : Rs,72,000

Total Assets to Debt Ratio : 1.5:1

31. From the following statement of Profit and Loss of the XYZ Ltd, prepare Comparative Statement of Profit and Loss:

Answer: Comparative Statement of Profit and Loss for the year ended 31st March 2015 and 2016

0R

From the following Balance Sheet of BPL Ltd. as at 31st March 2019, prepare a Common Size Balance Sheet:

Balance sheet of BPL Ltd. As at 31st March 2019

Answer:

32. Following is the Balance Sheet of Synergy Ltd. as at 31-3-2019

Notes to Accounts:

Additional Information:

During the year a piece of machinery, costing Rs.24,000 on which accumulated depreciation was Rs.16,000 was sold for Rs.6,000

Prepare Cash Flow Statement.

Answer: A. Cash flow from Operating Activities :Rs. 1,53,000

B. Cash used in Investing Activities : Rs. (2,88,000)

C. Cash flows from Financing Activities Rs.1,70,000

D. Cash and Cash Equivalent at the end Rs: 5,60,000