Sample Paper Class 12 Accountancy Term 1 Set A

Please refer to Sample Paper Class 12 Accountancy Term 1 Set A with solutions provided below. We have provided CBSE Sample Papers for Class 12 Accountancy as per the latest paper pattern and examination guidelines for Standard 12 Accountancy issued by CBSE for the current academic year. The below provided Sample Guess paper will help you to practice and understand what type of questions can be expected in the Class 12 Accountancy exam.

CBSE Sample Paper Class 12 Accountancy for Term 1 Set A

Part – I

Section – A

1. ABC Ltd. forfeited 200 shares of ₹ 10 each (which were issued at par) held by Zen for non-payment of allotment money of ₹ 4 per share. The called-up value per share was ₹ 9. On forfeiture, the amount debited to share capital account will be

(a) ₹ 1,000

(b) ₹ 800

(c) ₹ 200

(d) ₹ 1,800

Answer

D

2. ……… goodwill is the excess of desired total capital of firm over the actual combined capital of all partners.

(a) Premium

(b) Share

(c) Hidden

(d) Old

Answer

C

3. As per Table F, the company is required to pay ……… interest on the amount of calls-in-arrears.

(a) 12% p.a.

(b) 5% p.a.

(c) 10% p.a.

(d) 6% p.a.

Answer

C

4. In case of guarantee to a partner by firm, sacrifice for the guarantee will be made by ……… .

(a) all partners equally

(b) only that partner who has maximum profit

(c) all partners in profit or loss sharing ratio

(d) All of these

Answer

C

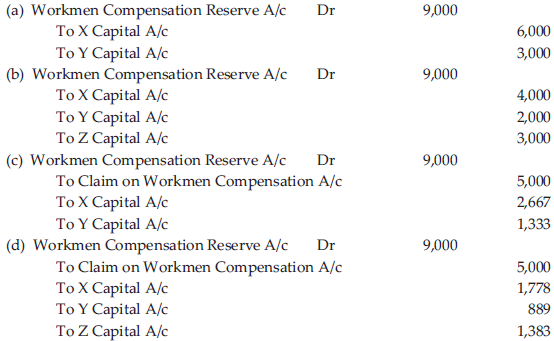

5. An Extract of Balance Sheet

X and Y were sharing profits in ratio of 2 :1 Z was admitted for 1/3rd share and claim on workmen compensation reserve was 5,000. Journalise.

Answer

C

6. Dividend is given to ……… at a fixed rate in a company.

(a) equity shareholders

(b) preference shareholders

(c) debenture holders

(d) promoters

Answer

B

7. The capital balance of a partner at the end of the year (after adjusting for his drawings ₹ 1,750 and his share in the profit ₹ 1,150) is ₹ 6,000. Interest on capital is payable to him at 5% per annum. What will be the amount of interest on capital?

(a) ₹ 330

(b) ₹ 300

(c) ₹ 270

(d) None of these

Answer

A

8. Holder of ……… have a right to convert their preference shares into equity shares at their option according to the terms of issue.

(a) cumulative preference shares

(b) non-cumulative preference shares

(c) convertible preference shares

(d) non-convertible preference shares

Answer

C

9. According to profit and loss account, the net profit for the year is ₹ 1,500. The total interest on partners capital is ₹ 180 and interest on partner’s drawings is ₹ 20. The net profit as per profit and loss appropriation account will amount to

(a) ₹ 1,960

(b) ₹ 1,700

(c) ₹ 1,300

(d) ₹ 1,340

Answer

D

10. At the time of admission of partners, new profit sharing ratio is concerned with ……… partner(s) while sacrificing ratio is concerned with ……… partner(s).

(a) new, old

(b) new, all

(c) old, new

(d) all, old

Answer

D

11. One of the conditions, in addition to others, for allotment of shares is

(a) resolution in general meeting

(b) receiving minimum subscription

(c) full subscription by public

(d) full payment on application

Answer

B

12. Vinesh is a partner in a firm. His drawings during the year ended 31st March, 2021 were ₹ 36,000. If interest on drawings is charged @ 9% p.a. the interest charged will be

(a) ₹ 162

(b) ₹ 3,240

(c) ₹ 1,620

(d) ₹ 324

Answer

C

13. D, E and F are partners in a firm sharing profits in ratio of 2 : 1 : 3. They decided to share profits in ratio of 4 : 5 : 3. What was D’s gain/sacrifice?

(a) No gain/sacrifice

(b) Sacrifice 2/6

(c) Gain 2/12

(d) Gain 2/6

Answer

A

14. At the time of admission, incoming partner become liable for the …… of the firm and also acquires right on the ……… .

(a) assets, liabilities

(b) goodwill, capital

(c) liabilities, assets

(d) None of the above

Answer

C

15. If the premium on forfeited shares has already been received, then securities premium account should be

(a) credited

(b) debited

(c) No treatment

(d) None of these

Answer

C

16. D,E and F are partners in a firm without any agreement. They have contributed ₹ 2,500, ₹ 1,500 and ₹ 1,000 by way of capital in the firm. D was unable to work for six months in a year due to illness. At the end of year, firm earned a profit of ₹ 750. D’s share in the profit will be

(a) ₹ 375

(b) ₹ 188

(c) ₹ 250

(d) ₹ 125

Answer

C

17. X, Y and Z are partners in a firm sharing profits equally. With effect from 1st April, 2021, they decided to share profits in the ratio 3 : 2 : 1. In adjustment entry, what will be the treatment and amount for Y if goodwill of firm is ₹ 5,000?

(a) Debit ₹ 5,000

(b) Credit ₹ 5,000

(c) Debit ₹ 10,000

(d) No treatment

Answer

D

18. A company issued 5,000 equity shares of ₹ 10 each. Amount is payable as ₹ 2 on application, ₹ 5 on allotment and ₹ 3 on first and final call. A shareholder who had 500 shares failed to pay allotment and first call amount on due date. What will be the amount received by company against issue of shares?

(a) ₹ 10,000

(b) ₹ 46,000

(c) ₹ 50,000

(d) ₹ 30,000

Answer

B

Section – B

19. Which of the following is correct?

(i) Aminor cannot be admitted as a partner.

(ii) Aminor can be admitted as a partner, only into the benefits of the partnership.

(iii) Aminor can be admitted as a partner but his rights and liabilities are same of adult partner.

(a) Only (i)

(b) (i) and (iv)

(c) Only (iii)

(d) Only (ii)

Answer

D

20. Tia, Pia, Sia were partners sharing profits in the ratio of 2 : 2 : 1. They decided to share future profits in the ratio of 7 : 5 : 3 with effect from 1st April, 2020. Their balance sheet as on that date showed a balance of ₹ 4,500 in advertisement suspense account for the amount to be debited respectively to the capital accounts of Tia, Pia and Sia for writing-off the amount in advertisement suspense account, following journal entry is passed.

Tia’s Capital A/c Dr X

Pia’s Capital A/c Dr Y

Sia’s Capital A/c Dr Z

To Advertisement Suspense A/c 45,000

Here X, Y, Z are

(a) ₹ 1,800, ₹ 1,800 and ₹ 900

(b) ₹ 1,500, ₹ 1,500 and ₹ 1,500

(c) ₹ 2,100, ₹ 1,500 and ₹ 900

(d) ₹ 2,250, ₹ 2,250 and Nil

Answer

A

21. Assertion (A) Goodwill is treated as an intangible asset.

Reason (R) Goodwill cannot be seen or touched, it can only be felt.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

22. Securities premium reserve account cannot be utilised for which of the following purpose?

(i) Amortisation of preliminary expenses

(ii) Distribution of dividend

(iii) Issue of fully paid bonus shares

(iv) Buy-back of own shares

(a) (i) and (ii)

(b) Only (ii)

(c) (ii) and (iii)

(d) (iii) and (iv)

Answer

B

23. Rahul draws ₹ 20,000 each in 1st April, 2020, 1st July, 2020, 1st October, 2020 and 1st January, 2021. For the year ended 31st March, 2021 interest on drawings @ 8% per annum will be

(a) ₹ 5,400

(b) ₹ 3,200

(c) ₹ 9,600

(d) ₹ 4,000

Answer

D

24. A new partner may be admitted ……… .

(a) in accordance with a contract between the existing partners or with the consent of all the existing partners

(b) in accordance with a contract between the existing partners or with the consent of all the existing partners subject to the provisions of Section 30 of the Act

(c) after obtaining specific approval of the Registrar of Firm and Societies to this effect

(d) by simply lasting the consent of the new partner

Answer

B

25. The maximum amount of share capital that a company is authorised to issue is

(a) nominal share capital

(b) subscribed share capital

(c) paid up share capital

(d) called-up share capital

Answer

A

26. Assertion (A) Interest on partner’s capital may be shown in profit and loss account.

Reason (R) If partners treat interest on capital as a charge, it is to be paid compulsorily.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

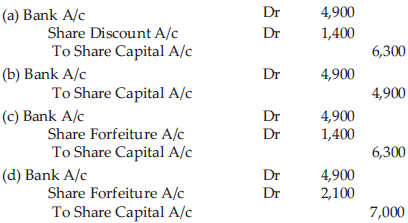

27. 700 shares of ₹ 10 each were reissued as ₹ 9 paid up for ₹ 7 per share. Journalise

Answer

C

28. Following amounts were payable on issue of shares by a company ₹ 3 on application, ₹ 3 on allotment, ₹ 2 on first call and ₹ 2 on final call. P holding 250 shares paid only application and allotment money whereas Q holding 200 shares did not pay final call. Amount of calls-in-arrear will be

(a) ₹ 1,900

(b) ₹ 1,400

(c) ₹ 900

(d) ₹ 3,100

Answer

B

29. Average profit of a business over the last five years was ₹ 30,000. The normal yield on capital invested in such a business is estimated at 10% p.a. The net capital invested in the business is ₹ 2,50,000. Amount of goodwill, if it is based on 3 years’ purchase of last 5 years super profits will be

(a) ₹ 50,000

(b) ₹ 90,000

(c) ₹ 15,000

(d) ₹ 75,000

Answer

C

30. A company issued 2,000 equity shares of ₹ 50 each at par payable as under. On application 20%, on allotment 40% on first call 10% on final call-balance. Applications were received for 5,000 shares. Allotment was made on pro-rata basis. How much amount will be received in cash on allotment?

(a) ₹ 3,000

(b) Nil

(c) ₹ 8,000

(d) ₹ 10,000

Answer

D

31. P and Q are partners sharing profits and losses in the ratio of 7 : 5. They agree to admit R their manager, into partnership who is to get 1/6th share in the profits. He acquires this share as 1/24th from P and 1/8th from Q. The new profit sharing ratio will be

(a) 13 : 7 : 4

(b) 7 :13 : 4

(c) 7 : 5 : 6

(d) 5 : 7 : 6

Answer

A

32. Assertion (A) Equity shares are paid dividends at a fixed rate even if there is no profit available after payment of dividend to preference shareholders.

Reason (R) Equity capital is returned only when preference share capital is returned in full on winding up of the company.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

33. Tim and Sim are partners in the ratio of 3 : 2. Their capitals are ₹ 2,000 and ₹ 1,000 respectively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of ₹ 150 for the year ended 31st March, 2021. Interest on capital payable for the year is

(a) Tim ₹ 160; Sim ₹ 80

(b) Tim ₹ 90; Sim ₹ 60

(c) Tim ₹ 100; Sim ₹ 50

(d) No interest will be allowed

Answer

C

34. Which of the following is not a part of change in profit sharing ratio?

(i) Determination of sacrificing ratio and gaining ratio

(ii) Accounting of goodwill

(iii) Accounting of reserves, accumulated profits and losses

(iv) Dissolution of partnership firm

(a) (i) and (ii)

(b) (iii) and (iv)

(c) (ii) and (iv)

(d) Only (iv)

Answer

D

35. Which one of the following items is not a part of subscribed capital?

(a) Equity shares

(b) Preference shares

(c) Forfeited shares

(d) Bonus shares

Answer

C

36. A and B were partners in a firm sharing profits in the ratio of 2 : 1. C was admitted as a new partner in the firm. New profit sharing ratio was 3 : 3 : 2. C bought the following assets towards his share of goodwill and his capital.

Amt (₹)

Machinery 20,000

Furniture 12,000

Stock 8,000

Cash 5,000

In his capital is considered as ₹ 38,000, the goodwill of the firm will be

(a) ₹ 7,000

(b) ₹ 28,000

(c) ₹ 4,000

(d) ₹ 14,000

Answer

B

Section – C

ANX Pvt Ltd. was incorporated on 1st April, 2020. The capital clause of memorandum of association reflected a registered capital of ₹ 7,00,00,000 divided into 7,00,000 shares of ₹ 100 each. As investments were required for purchasing building, the company in consultation with vendor, M/s Zen Ltd issued 50,000 shares to them in full consideration of building purchased.

The company issued 2,00,000 shares to public payable as follows

On application and allotment ₹ 20 per share

On first call ₹ 50 per share

On second and final call Balance

All calls were made and were duly received except on 100 shares held by Sonu, who failed to pay the second and final call. His shares were forfeited.

37. How many equity shares have been issued by the company?

(a) 7,00,000

(b) 2,00,000

(c) 2,50,000

(d) 5,00,000

Answer

C

38. What amount of shares have been subscribed by the company?

(a) ₹ 2,50,04,000

(b) ₹ 99,90,000

(c) ₹ 2,49,90,000

(d) ₹ 2,39,90,000

Answer

A

Vipul and Atul are partners engaged in the business of running fast food corner, sharing profits equally. Apart from selling at their fast food point. They did home deliveries too. Their initial capital contribution was ₹ 1,50,000 and ₹ 1,00,000 respectively. Over the years, they have build a reputation by selling good quality products and maintaining the qualities all these years. During the financial year, their profit was ₹ 75,000. Normal rate of return on the business is 20%. Vipul and Atul decided to calculate the goodwill of the firm for future purposes.

39. What is the capitalised value of business?

(a) ₹ 15,000

(b) ₹ 3,75,000

(c) ₹ 2,50,000

(d) ₹ 75,000

Answer

B

40. What is the normal profits of the business?

(a) ₹ 75,000

(b) ₹ 2,50,000

(c) ₹ 25,000

(d) ₹ 50,000

Answer

D

41. What is the super profits of the business?

(a) ₹ 75,000

(b) ₹ 50,000

(c) ₹ 25,000

(d) ₹ 1,25,000

Answer

C

Part- II

Section – A

42. Name the difference between capital employed and non-current liabilities.

(a) Shareholder’s funds

(b) Capital employed

(c) Total debts

(d) Total assets

Answer

A

43. Match the column.

Codes

A B C

(a) (i) (ii) (iii)

(b) (ii) (iii) (i)

(c) (iii) (ii) (i)

(d) (ii) (i) (iii)

Answer

B

44. Trade Receivables Turnover Ratio can be calculated using which of the following formula?

(a) Total Revenue from Operations / Average Debtors

(b) Credit Revenue from Operations / Average Debtors

(c) Net Credit Revenue from Operations / Average Debtors + Average Bills Receivables

(d) None of the above

Answer

C

45. Assertion (A) Calls-in-advance is shown under the head ‘Other Current Liabilities’.

Reason (R) All liabilities, the payment of which is expected to be made within 12 months from the data of balance sheet are current liabilities.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

46. Which of the following ratios are primarily measure of return?

(i) Liquidity

(ii) Activity

(iii) Solvency

(iv) Profitability

(a) (i) and (ii)

(b) Only (iv)

(c) (iii) and (iv)

(d) (ii) and (iv)

Answer

B

47. Cash and cash equivalent does not include

(i) cheques

(ii) balance with banks

(iii) bank deposit with more than 12 months maturity

(iv) inventories

(a) (iii) and (iv)

(b) (ii) and (iv)

(c) (i) and (iv)

(d) only (iv)

Answer

D

48. Which of the following is true?

(i) Financial analysis present data contained in financial statements in easy form

(ii) Financial analysis present data contained in financial statements in convenient and rational groups

(iii) Financial analysis present data contained in financial statements in comparable form

(a) Only (i)

(b) (i) and (iii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

Answer

D

Section – B

49. Main objective of analysis of financial statements is

(i) to know the financial strength.

(ii) to make a comparative study with other firms.

(iii) to know the efficiency of management.

(a) Only (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

Answer

D

50. Assertion (A) Shareholders or investors are interested in the analysis of financial statements.

Reason (R) Shareholders or investors want to judge the present and future earning capacity of the business and also the safety of their investment.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

51. A firm has current ratio of 4 : 1 and quick ratio of 2.5 : 1. Assuming inventories are ₹ 7,500 find out total current assets.

(a) ₹ 50,000

(b) ₹ 12,500

(c) ₹ 20,000

(d) ₹ 7,500

Answer

C

52. Interest accrued but not due on loans appear in a company’s balance sheet under the sub-head.

(a) Short-term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short-term Provisions

Answer

C

53. Which of the following is true?

(i) Cash collected from trade receivables will improve current ratio

(ii) Purchase of goods for cash will improve current ratio

(iii) Payment to trade payables will improve current ratio

(iv) Credit purchase of goods will improve current ratio.

(a) (i) and (ii)

(b) (iii) and (iv)

(c) (ii) and (iii)

(d) Only (iii)

Answer

D

54. Assertion (A) Redemption of debentures increases current ratio.

Reason (R) When debentures are redeemed both current assets and current liabilities decreased by the same amount.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

55. Calculate current ratio if current assets are ₹ 4,00,000 inventories ₹ 2,00,000, working capital ₹ 2,40,000.

(a) 1 : 1

(b) 1 : 2

(c) 2 : 1

(d) 2.5 : 1

Answer

D