Sample Paper Class 12 Accountancy Term 1 Set B

Please refer to Sample Paper Class 12 Accountancy Term 1 Set B with solutions provided below. We have provided CBSE Sample Papers for Class 12 Accountancy as per the latest paper pattern and examination guidelines for Standard 12 Accountancy issued by CBSE for the current academic year. The below provided Sample Guess paper will help you to practice and understand what type of questions can be expected in the Class 12 Accountancy exam.

CBSE Sample Paper Class 12 Accountancy for Term 1 Set B

Part – I

Section – A

1. ……… is the ratio in which one or more partners of the firm forgoes i.e., sacrifice their share of profit in favour of one or more partners of the firm.

(a) Sacrificing ratio

(b) Gaining ratio

(c) No change in ratio

(d) Either (a) or (b)

Answer

A

2. PQR Ltd. company took over assets worth ₹ 5,00,000 and liabilities of ₹ 1,50,000 for purchase consideration worth ₹ 6,00,000, how much amount will be debited to goodwill account?

(a) ₹ 5,00,000

(b) ₹ 2,50,000

(c) ₹ 1,50,000

(d) ₹ 6,00,000

Answer

B

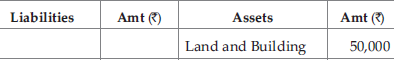

3. X and Y were partners sharing profits and losses in the ratio of 3 : 2. On 31st December, 2020 the extract of their balance sheet is as follows.

At the time of admission of new partner Z, if the value of land and building is to be appreciated by 10%, then what will be the amount of land and building which is to be?

(a) ₹ 45,000

(b) ₹ 50,000

(c) ₹ 5,000

(d) ₹ 55,000

Answer

D

4. Share capital account is debited with ……… at the time of forfeiture of shares.

(a) face value

(b) called-up value

(c) paid up value

(d) issued value

Answer

B

5. Milan is a partner in a firm. He withdrew regularly ₹ 1,000 at the beginning of every month for the six months ending 31st March, 2021. If interest on drawings is charged @ 8% p.a., the interest charged will be

(a) ₹ 240

(b) ₹ 140

(c) ₹ 100

(d) ₹ 120

Answer

B

6. A company allotted 10,000 shares to applicants of 25,000 shares after rejecting 5,000 applications. The ratio in which company allotted the shares will be

(a) 5 : 2

(b) 5 : 3

(c) 2 : 1

(d) 3 : 1

Answer

C

7. Profit and loss adjustment account is needed for ……… .

(a) appropriation of profits

(b) charge against profits

(c) rectification of errors or omissions

(d) None of these

Answer

C

8. When a partner is given guarantee by other partners, loss on such guarantee will be borne by

(a) partnership firm

(b) all the other partners

(c) partners who give the guarantee

(d) partner with highest profit sharing ratio

Answer

C

9. When incoming partner acquires his share form existing partners in their profit sharing ratio, the steps for calculation of new profit sharing ratio are given as

(i) Calculate old partners’ new share as part of combined share.

(ii) Convert the new shares of all partners and find out the new profit sharing ratio.

(iii) Calculate combined share of old partners in the new firm by deducting new partners share from (i).

(a) (i), (iii), (ii)

(b) (iii), (i), (ii)

(c) (ii), (iii), (i)

(d) (iii), (ii), (i)

Answer

B

10. At the time of reissue of all forfeited shares

(a) general reserve is debited with the credit balance left in the forfeited shares account.

(b) general reserve is credited with the credit balance left in the forfeited shares account.

(c) capital reserve is debited with the credit balance left in the forfeited shares account.

(d) capital reserve is credited with the credit balance left in the forfeited shares account.

Answer

D

11. When capitals are fixed, ……… accounts are opened.

(a) only capital

(b) only current

(c) capital as well as current

(d) Either capital or current

Answer

C

12. A and B are partners sharing profit or loss in ratio of 2 : 1. A surrenders 1/4th of his share and B surrenders 1/3rd of his share in favour of C a new partner. What will be C’s share?

(a) 7/12

(b) 5/12

(c) 13/36

(d) 5/18

Answer

D

13. Forfeiture of shares results in the reduction of

(a) subscribed capital

(b) authorised capital

(c) reserve capital

(d) fixed assets

Answer

A

14. Amanager gets 5% commission on net profit after charging such commission, gross profit ₹ 29,000 and expenses of indirect nature other than manager’s commission are ₹ 8,000. Amount of commission will be

(a) ₹ 1,050

(b) ₹ 1,000

(c) ₹ 750

(d) ₹ 1,100

Answer

B

15. X and Y are partners in a firm sharing profits equally. Their capitals were ₹ 45,000 and ₹ 50,000 respectively. Z was admitted for 1/3rd share in profits/losses and brought ₹ 85,000 as capital. Calculate the amount of goodwil.

(a) ₹ 2,55,000

(b) ₹ 1,60,000

(c) ₹ 75,000

(d) Can’t be determined

Answer

C

16. 300 shares of ₹ 10 each were forfeited for non-payment of ₹ 2 per share on first call and ₹ 5 per share on final call. Share forfeiture account will be credited with

(a) ₹ 600

(b) ₹ 900

(c) ₹ 1,500

(d) ₹ 2,100

Answer

B

17. P, Q and R are partners in a firm in ratio of 1 : 2 : 3. Debit balance of profit and loss account was ₹ 10,000 and general reserve was ₹ 25,000 when partners decided to share profits equally. If these balances are to be shown in balance sheet, what will be the journal entry?

(a) Dr P ₹ 2,500; Cr R ₹ 2,500

(b) Dr R ₹ 2,500; Cr P ₹ 2,500

(c) Cr P ₹ 2,500, Cr Q ₹ 2,500, Cr R ₹ 7,500

(d) Cr P ₹ 5,000, Cr Q ₹ 5,000, Cr R ₹ 2,500

Answer

A

18. Pro-rata allotment of shares is made when there is

(a) undersubscription

(b) oversubscription

(c) equal subscription

(d) as and when desired by directors

Answer

B

Section – B

19. Ram, Tom and Zen were partners sharing profits in the ratio of 2 : 2 : 1. They decided to share future profits in the ratio of 7 : 5 : 3 with effect from 1st April, 2019. After the revaluation of assets and re-assessment of liabilities, revaluation account showed a loss of ₹ 1,500. Journal entry for the amount to be debited in the capital account of partners because of loss on revaluation is

Ram’s Capital A/c Dr X

Tom’s Capital A/c Dr Y

Zen’s Capital A/c Dr Z

To Profit and Loss A/c 1,500

Here X, Y, Z are

(a) ₹ 600, ₹ 600, ₹ 300 respectively

(b) ₹ 300, ₹ 600, ₹ 600 respectively

(c) ₹ 600, ₹ 300, ₹ 600 respectively

(d) ₹ 300, ₹ 900, ₹ 300 respectively

Answer

A

20. Batra Ltd. forfeited 300 shares of ₹ 100 each, ₹ 70 called-up, for non-payment of first call of ₹ 20 per share. Out of these, 200 shares were reissued for ₹ 60 per share as ₹ 70 paid up. What is the amount to be transferred to capital reserve?

(a) ₹ 13,000

(b) ₹ 8,000

(c) ₹ 2,000

(d) ₹ 7,000

Answer

B

21. Assertion (A) A new partner should contribute towards goodwill on his admission.

Reason (R) A new partner gets his share of profits from old partners thus he must compensate the old partners for the share sacrificed by them.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

22. Casio Ltd issued 25,000 equity shares of ₹ 10 each at a premium of ₹ 1 each payable as ₹ 2.5 on application, ₹ 4 on allotment and balance on the first and final call. Applications were received for 50,000 equity shares but the company allotted to them only 25,000 shares. Excess money was applied towards amount due to allotment. Last call on 50 shares was not received and shares were forfeited after due notice. The above mentioned case highlights which of the following situation?

(a) Oversubscription

(b) Pro-rata allotment

(c) Forfeiture of shares

(d) All of these

Answer

D

23. When drawings of equal amount are made during the period of 9 months at the end of every month, the average period is ……… months.

(a) 5.5

(b) 6

(c) 4

(d) 7

Answer

C

24. XYZ Ltd. issued 25,000 shares of ₹ 100 each payable as ₹ 20 on application (on 1st May, 2021), ₹ 30 on allotment (on 1st June, 2021), ₹ 20 on first call (on 1st July, 2021) and the balance on first call (on 1st September, 2021). Bhola, a shareholder holding 2,500 shares did not pay the first call on due date. The second call was made and Bhola paid the first call amount along with second call. All sum due were received.

Total amount received on 1st September was

(a) ₹ 7,50,000

(b) ₹ 8,00,000

(c) ₹ 10,00,000

(d) ₹ 5,50,000

Answer

B

25. Which account will be debited, if 2,000 equity shares of ₹ 10 each were issued at 8% premium to the promoters of a company for their services?

(a) Share capital account

(b) Goodwill account/Incorporation cost account

(c) Securities premium reserve account

(d) Cash account

Answer

B

26. Assertion (A) Rent paid to a partner is recorded in profit and loss account.

Reason (R) Rent paid to a partner is a charge against profit.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

27. 2,000 shares of ₹ 10 each; called-up ₹ 9 per share, paid up ₹ 7 per share. Journal entry for forfeiture will be

Answer

C

28. X, Y and Z are partners sharing profits in ratio of 3 : 3 : 2. They agree to admit W into the firm for 4/7 profit. W acquired his share 2/7 from X, 1/7 from Y and 1/7 from Z. The share of profit of Y will be

(a) 5/56

(b) 13/56

(c) 6/56

(d) 32/56

Answer

B

29. Which of the following statement is true?

(i) Fixed capital account will always have a credit balance

(ii) Current account can have a positive or a negative balance

(iii) Fluctuating capital account can have a positive or a negative balance

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

30. Assertion (A) Calls-in-advance is a part of share capital.

Reason (R) No dividend is payable on the amount of calls-in-advance.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation

of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

D

31. A firm earns ₹ 11,000. The normal rate of return is 10%. The assets of the firm amounted to ₹ 1,10,000 and liabilities ₹ 10,000. Value of goodwill by capitalisation of average actual profits will be

(a) ₹ 20,000

(b) ₹ 1,000

(c) ₹ 500

(d) ₹ 10,000

Answer

D

32. A and B are sharing profits and losses in the ratio of 3 : 2. C is admitted with 1/5th share in profits of the firm which he gets entirely from X. Find out the new profit sharing ratio.

(a) 12 : 8 : 5

(b) 8 : 12 : 5

(c) 2 : 2 : 1

(d) 2 : 2 : 2

Answer

C

33. The amount of discount on reissue of forfeited shares cannot exceed

(a) 5%of the face value

(b) 10% of the face value

(c) the amount received on forfeited shares

(d) the amount not received on forfeited shares

Answer

C

34. X, Y and Z are partners in a firm sharing profits in the ratio of 5 : 3 : 2. As per partnership deed, Z is to get a minimum amount of ₹ 5,000 as profit. Net profit for the year is ₹ 20,000. Calculate deficiency (if any) to Z.

(a) ₹ 375

(b) ₹ 1,000

(c) ₹ 750

(d) None of these

Answer

B

35. P, Q and R are partners in profit sharing ratio of 2 : 3 : 4 with effect from 1st April, 2021, they decided to share profits is 4 : 3 : 3. What is Q’s gain/sacrifice?

(a) No gain/sacrifice

(b) Sacrifice 1/30

(c) Gain 3/100

(d) Gain 1/30

Answer

B

36. P and Q are partners in a firm which develops software for industries. P’s minor son ‘R’ is a computer wizard. Can he be admitted in the partnership firm?

(a) Yes, if P agrees

(b) Yes, if Q agrees

(c) Yes, if P and Q both agree

(d) No, he cannot be admitted

Answer

C

Section – C

ABC Ltd. was incorporated on 1st April, 2021 with registered office at Hyderebad. The capital clause of memorandum of association reflected on authorised capital of ₹ 12,50,000. Equity share capital being 75,000 shares of ₹ 10 each and preference share capital being 5,000 shares of ₹ 100 each.

The promoters of the company were compensated by issuing 500 equity shares for their efforts in the project and expenses incurred by them. Besides this, 5,000 equity shares were issued to underwriters for their underwriting services.

The company offered to public 62,500 equity shares and 2,500, 10% preference shares at par for subscription, amount being payable along with application.

Applications were received for 62,500 equity shares and 1,750, 10% preference shares.

37. What amount of equity share capital is issued by the company?

(b) ₹ 6,25,000

(b) ₹ 7,00,000

(c) ₹ 6,50,000

(d) ₹ 75,000

Answer

B

38. What will be the correct journal for issue of shares of underwriters?

(a) Underwriters A/c Dr

To Share Capital A/c

(b) Share Capital A/c Dr

To Underwriters A/c

(c) Underwriting Expenses A/c Dr

To Underwriters A/c

(d) Share Capital A/c Dr

To Underwriting Expenses A/c

Answer

A

Nona, Mona and Sona decided to start a partnership to manufacture toys. Nona contributed ₹ 10,000 and Mona contributed ₹ 5,000 as their capital. Sona is specially abled but is very creative and intelligent. She did not contribute any capital.

The terms of partnership were as follows

(i) Nona, Mona, Sona will share profit in 2 : 2 : 1 ratio.

(ii) Interest on capital will be provided to Nona, Mona @ 6% p.a.

(iii) Mona advanced a loan of ₹ 1,000 to the partnership firm on 1st October.

(iv) Nona will be entitled to a salary of ₹ 100 per month.

(v) Interest on loan to Mona was allowed @ 6% p.a.

Due to shortage of capital, Nona contributed ₹ 2,500 Mona on 30th September, 2020 and contributed ₹ 1,000 on 1st January, 2021 as additional capital. The profit of the firm for the year ended 31st March, 2021 was ₹ 16,890.

39. Nona will be entitled to a salary of ……… at the end of the accounting period.

(a) ₹ 1,000

(b) ₹ 1,100

(c) ₹ 1,150

(d) ₹ 1,200

Answer

D

40. Interest on capital allowed to Nona and Mona will amount to

(a) Nona ₹ 600, Mona ₹ 300

(b) Nona ₹ 675, Mona ₹ 315

(c) Nona ₹ 150, Mona ₹ 60

(d) Nona ₹ 750, Mona ₹ 360

Answer

B

41. Show the distribution of profit between Nona, Mona, Sona.

(a) Nona = ₹ 5,000, Mona = ₹ 6,000, Sona = ₹ 5,500

(b) Nona = ₹ 5,868, Mona = ₹ 5,868, Sona = ₹ 2,934

(c) Nona = ₹ 5,700, Mona = ₹ 5,750, Sona = ₹ 5,000

(d) None of the above

Answer

B

Part – II

Section – A

42. Ratio analysis under financial analysis is significant as it

(i) ignores qualitative factors.

(ii) helps in window-dressing.

(iii) does not requires any standards.

(iv) helps in locating weak points of the firm.

(a) (i) and (ii)

(b) (iii) and (iv)

(c) (ii) and (iii)

(d) Only (iv)

Answer

D

43. The formula for calculating the trade receivables turnover ratio is

(a) Total revenue from operations / Average debtors

(b) Credit revenue from operations / Average debtors

(c) Net credit revenue from operations / Average debtors + Average bills receivable

(d) None of these

Answer

C

44. Assertion (A) Ratio analysis is one of the tools to know the financial health of a business.

Reason (R) Ratio analysis considers both the qualitative as well as quantitative aspects.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

45. Which of the following is correct?

(i) Cash collected from trade receivables will improve the quick ratio.

(ii) Purchase of goods for cash will improve the quick ratio.

(iii) Bills receivable endorsed in favour of a trade payable will improve the quick ratio.

(iv) Credit purchase of goods will improve the quick ratio.

(a) (i) and (ii)

(b) Only (iii)

(c) (ii) and (iii)

(d) (ii) and (iv)

Answer

B

46. Out of the following, which is not included in sub-head inventory?

(i) Stock of finished goods

(ii) Work-in-progress

(iii) Stores and spares

(iv) Cheques in hand

(a) (i) and (iv)

(b) (ii) and (iv)

(c) (iii) and (iv)

(d) Only (iv)

Answer

D

47. Young India Ltd. has a operating profit ratio of 20%. To maintain this ratio at 25% management may

(i) increase selling price of stock-in-trade.

(ii) reduce cost of revenue from operations.

(iii) increase selling price of stock-in-trade and to reduce cost of revenue from operations.

(a) (ii) and (iii)

(b) (i) and (ii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

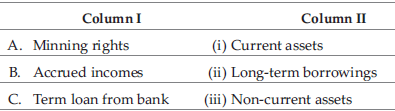

48. Match the column.

Codes

A B C

(a) (ii) (i) (iii)

(b) (iii) (i) (ii)

(c) (i) (ii) (iii)

(d) (iii) (ii) (i)

Answer

B

Section – B

49. Which of the following is correct in regards to objectives of analysis of financial statement?

(i) To judge the financial health of the firm

(ii) To judge the short-term and long-term liquidity position of the firm

(iii) To judge the reasons for change in the profitability of the firm

(iv) To judge the variations in the accounting practices of the business followed by different enterprises

(a) Only (iv)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (iii) and (iv)

Answer

A

50. Assertion (A) In vertical analysis, financial statements for a number of years are reviewed and analysed.

Reason (R) Vertical analysis is also called as state analysis.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

51. Revenue from operations ₹ 9,000, Gross profit 25% on cost, operating expenses ₹ 900, Operating ratio will be

(a) 100%

(b) 50%

(c) 90%

(d) 10%

Answer

C

52. The two basic measures of operational efficiency of a company are ……… .

(a) inventory turnover ratio and working capital turnover ratio

(b) liquid ratio and operating ratio

(c) liquid ratio and current ratio

(d) gross profit margin and net profit margin

Answer

A

53. Assertion (A) Debt-equity ratio will decrease with the repayment of long-term loan.

Reason (R) Repayment of long-term loan decreases the amount of long-term loan but total equity (shareholders’ funds) remains unchanged.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

54. What is the inventory turnover ratio, when the following is given?

COGS = ₹ 75,000; Closing Inventory = ₹ 30,000;

Excess of Closing Inventory over Opening Inventory = ₹ 10,000.

(a) 3 times

(b) 2.14 times

(c) 1.5 times

(d) 4 times

Answer

A

55. Which of the following items are included in sub-head current liabilities?

(i) Short-term borrowings

(ii) Trade payables

(iii) Short-term provision

(iv) Short-term investment

(v) Other current liabilities

(vi) Short-term loan and advances

(a) (i), (ii), (iii), (iv)

(b) (i), (iv), (v), (vi)

(c) (iii), (iv), (v), (vi)

(d) (ii), (iv), (v), (vi)

Answer

A