Notes for Class 12 Accountancy Chapter 3 Reconstitution Of A Partnership Firm – Admission Of A Partner

Commerce students can refer to the Admission Of A Partner Notes Class 12 Accountancy given below which is an important chapter in class 12 accountancy book. These notes and important questions and answers have been prepared based on the latest CBSE and NCERT syllabus and books issued for the current academic year. Our team of Accountancy teachers have prepared these notes for the benefit of students so that you can read these revision notes and understand each topic carefully.

Admission Of A Partner Notes Class 12 Accountancy

Refer to the notes and important questions given below for Admission Of A Partner which are really useful and have been recommended by Class 12 Accounts teachers. Understanding the concepts in detail and then solving questions by yourself will help you to learn all topics given in your NCERT Books for Class 12 Accounts.

SHORT ANSWER TYPE QUESTIONS :

Question. Himanshu and Naman share profits & losses equally. Their capitals were Rs.1,20,000 and Rs. 80,000 respectively. There was also a balance of Rs. 60,000 in General reserve and revaluation gain amounted to Rs. 15,000. They admit friend Ashish with 1/5 share. Ashish brings Rs.90,000 as capital. Calculate the amount of goodwill of the firm.

Answer : Rs. 85,000

Question. Aarti and Bharti are partners sharing profits in the ratio of 5:3. They admit Shital for 1/4th share and agree to share between them in the ratio of 2:1 in future. Calculate new and sacrificing ratio.

Answer : Old ratio = 5:3

Shital = 1/4th Share

Let the profit be Rs. 1

Remaining profit = 1-1/4 =3/4

Arti : Babita = 2:1

Arti’s share = 3/4 X 2/3 = 1/2

Babita’s Share = 3/4 X 1/3 = 1/4

New Ratio = 1/2, 1/4, 1/4 Or 2:1:1

Sacrificing ratio = Old ratio – New ratio

Arti’s sacrifies = 5/8 – 2/4 = 1/8

Babita’s Sacrifies = 3/8 – 1/4 = 1/8

Sacrificing Ratio = 1:1

Question. On what occasions does the need for valuation of goodwill arise?

Answer : Need of valuation of goodwill arises on the following occasions:-

(i) Change in profit sharing ratio of existing partners.

(ii) Admission of a partner.

(iii) Retirement of a partner.

(iv) Death of a partner.

Question. The capital of a firm of Arpit and Prajwal is Rs. 10,00,000. The market rate of return is 15% and the goodwill of the firm has been valued Rs. 1,80,000 at two years purchase of super profits. Find the average profits of the firm.

Answer : (i) Super profit = Value of goodwill /Number of years purchase

= 180000/2

= 90000

(ii) Normal Profit = Capital employed X Normal rate of return /100

= 1000000 X 15/ 100

= 150000

(iii) Average Profit = Normal Profit + Super profit

= 150000 + 90000

= 240000

Question. X and Y are partners sharing profits in the ratio of 5:4. They admit Z in the firm for 1/3rd profit, which he takes 2/9th from X and 1/9th from Y and brings Rs. 1500 as premium. Pass the necessary Journal entries on Z’s admission.

Answer : Cash A/C Dr. 1500

To premium A/C 1500

(cash brought in by Z for his share of goodwill)

Premium A/C Dr. 1500

To X’s capital A/C 1000

To Y’s Capital A/C 500

(Goodwill distributed among sacrificing partners in the ratio of 2:1.)

Question. Why is it necessary to revalue assets and reassess liabilities at the time of admission of new partner?

Answer : It is necessary to revalue assets and reassess liabilities at the time of admission of new partners as if assets and liabilities are overstated or understated in the books then its benefits or loss should not affect the near partner.

Question. Yash and Manan are partners sharing profits in the ratio of2:1. They admit Kushagra into partnership for 25% share of profit. Kushagra acquired the share from old partners in the ratio of 3:2. Calculate the new profit sharing ratio.

Answer : 31:14:15

Question. A and B were partners sharing profits in the ratio of 3:2. A surrenders 1/6th of his share and B surren-ders 1/4th of his share in favour of C, a new partner. What is the new ratio and the sacrificing ratio.

Answer : Old ratio = A: B = 3:2

A surrender = 3/5 X 1/6 = 3/30 =1/10

B surrender = 2/5 X 1/4 = 1/10

A’s new share = 3/5 – 1/10 = 5/10

B’s new share = 2/5 – 1/10 = 3/10

C’s new share = 1/10 +1/10 = 2/10

New ratio = 5/10, 3/10, 2/10 OR 5:3:2

Sacrificing Ration = Old ratio – New ratio

A = 3/5 – 5/10 = 1/10

B = 2/5 – 3/10 = 1/10

Sacrificing ratio = 1:1

LONG ANSWER TYPE QUESTIONS :

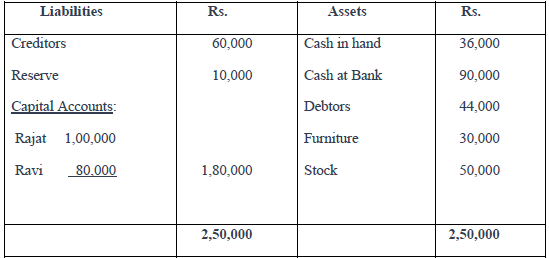

Question. Rajat and Ravi are partners in a firm sharing profits and losses in the ratio of 7:3. Their bal-ance sheet as on 31st March, 2017 is as follows:

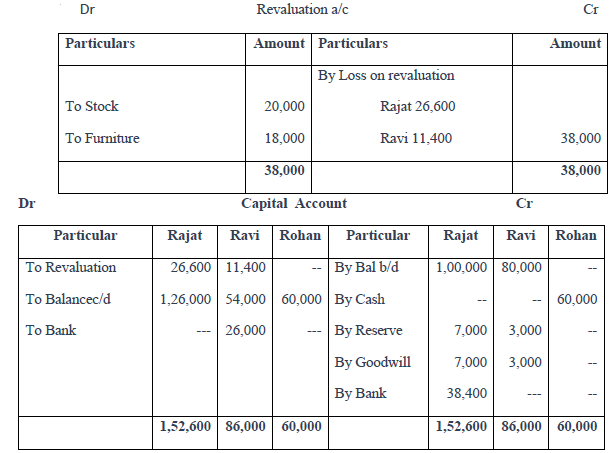

On 1st April 2017, they admit Rohan on the following terms: Goodwill is valued at Rs.40,000 and Rohan is to bring in the necessary amount in cash as premium for goodwill and Rs.60,000 as capital for 1/4th share in profits. Stock is to reduced by 40% and furniture is to reduced to 40%.Capitals of the partners shall be proportionate to their profit sharing ratio taking Rohan’s Capital as base. Ad-justments of capitals to be made by cash. You are required to prepare revaluation account and part-ner’s capital accounts.

Answer :

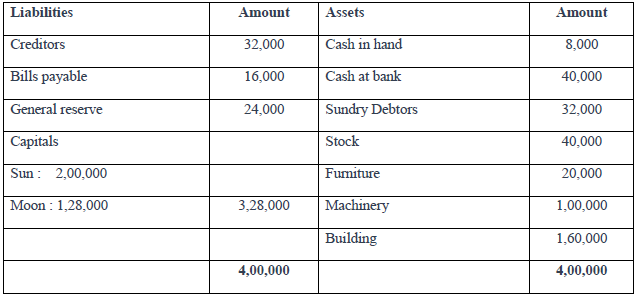

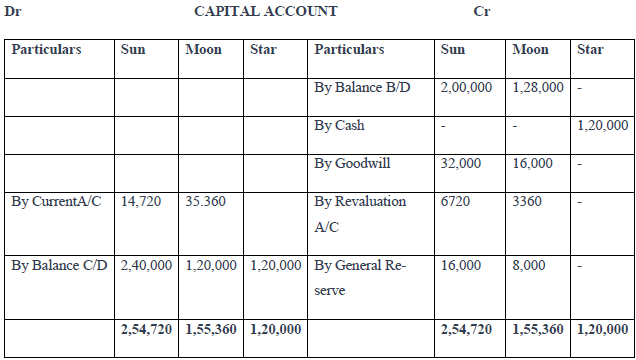

Question. Sun & Moon are partners in a firm sharing profits in the ratio of 2:1. Star is admitted into the firm with 1/4th share in profit. He will bring in Rs 1,20,000 as capital and capitals of Sun & Moon are to be adjusted in the profit sharing ratio. Their balance sheet as on 31st March 2009 was as follows

Other terms of agreement are as under

i) Star will bring in Rs 48,000 as his share of goodwill

ii) Building was valued at Rs 1,80,000 & Machinery at Rs 92,000

iii) A provision for bad debts is to be created at 6% on debtors

iv) The capital accounts of sun & Moon are to be adjusted by opening current accounts Prepare revaluation account, capital account & balance sheet of the new firm.

Answer :

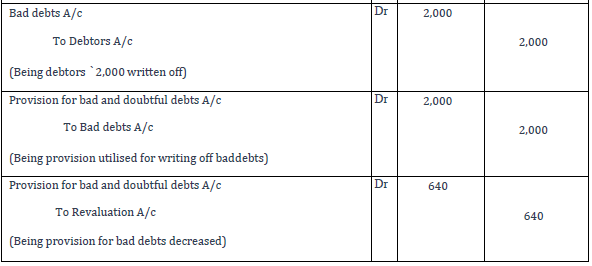

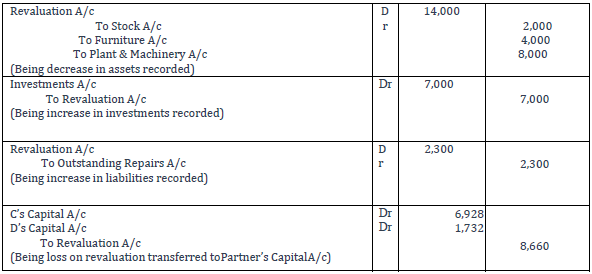

Question. C and D are partners in a firm sharing profits in the ratio of 4 : 1. On 31.3.2016, their Balance Sheet was as follows :

On the above date, E was admitted for 1/4th share in the profits on the following terms :

E will bring Rs. 1,00,000 as his capital and Rs. 20,000 for his share of goodwill premium, half of which will be withdrawn by C and D.

(i) Debtors Rs. 2,000 will be written off as bad debts and a provision of 4% will be created on debtors for bad and doubtful debts.

(ii) Stock will be reduced by Rs. 2,000, furniture will be depreciated by Rs. 4,000 and 10% depreciation will be charged on plant and machinery.

(iii) Investments of Rs. 7,000 not shown in the Balance Sheet will be taken into account.

(iv) There was an outstanding repairs bill of Rs. 2,300 which will be recorded in the books.

Pass necessary journal entries for the above transactions in the books of the firm on E’s admission.

Answer :

Question. A and B were partners in a Firm sharing profits in the ratio 3:2. They admitted C as a new partner for 1/6th share in the profits. C was to brings Rs.40000 as his capital and the Capitals of A and B were to be adjusted on the basis of C’s Capital having regard to profit sharing ratio. The balance sheet of A and B as on 31.3.2006 was as follows:

The other terms of agreement on C’s admission were as follows:

1. C will bring Rs.12000 as his share of Goodwill.

2. Building will be valued at Rs.185000 and Machinery at Rs.40000

3. A provision of 6% will be credited on Debtors for Bad Debts.

4. Capital Accounts of A and B will be adjusted by opening current accounts

Prepare Revaluation Account, Partner’s Capital Account and the Balance Sheet of A, B, and C.

Answer : Revaluation loss to A — Rs.11424

to B — Rs.7616

Capital A/cs A — Rs.120000

B —- Rs.80000

C —– Rs.40000 Balance sheet total —Rs.342960

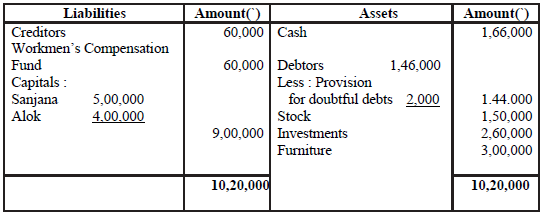

Question. Sanjana and Alok were partners in a firm sharing profits and losses in the ratio 3 : 2. On 31st March, 2018 their Balance Sheet was as follows :

On 1st April, 2018, they admitted Nidhi as a new partner for 1/4th share in the profits on the following terms :

(a) Goodwill of the firm was valued at ` 4,00,000 and Nidhi brought the necessary amount in cash for her share of goodwill premium, half of which was withdrawn by the old partners.

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at ` 3,00,000. Alok took over investments at this value.

(d) Nidhi brought ` 3,00,000 as her capital and the capitals of Sanjana and Alok were adjusted in the new profit sharing ratio.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the re-constituted firm on Nidhi’s admission.

Answer : Revaluation profit- Sanjana:24000 Alok:16000;Capital Balances -Sanjana:540000, Alok:360000,Nidhi:300000; Balance sheet Total-12,60,000

Sanjana will take Rs.50000 and Alok will bring Rs.200000

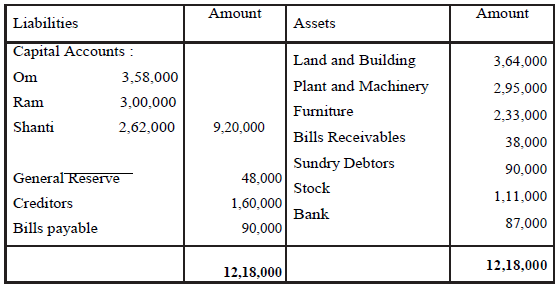

Question. Om, Ram and Shanti were partners in a firm sharing profits in the ratio of

3 : 2 : 1. On 1st April, 2014 their Balance Sheet was as follows :

On the above date Hanuman was admitted on the following terms :

(i) He will bring Rs. 1,00,000 for his capital and will get 1/10th share in the profits.

(ii) He will bring necessary cash for his share of goodwill premium. The goodwill of the firm was valued at Rs. 3,00,000.

(iii) A liability of Rs. 18,000 will be created against bills receivables discounted.

(iv) The value of stock and furniture will be reduced by 20%.

(v) The value of land and building will be increased by 10%.

(vi) Capital accounts of the partners will be adjusted on the basis of Hanuman’s capital in their profitsharing ratio by opening current accounts.

Prepare Revaluation Account and Partners’ Capital Accounts.

Answer :

Question. Badal and Bijli were partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 was as follows :

Balance Sheet of Badal and Bijli as at 31st March, 2019

Raina was admitted on the above date as a new partner for 1/6TH share in the profits of the firm. The terms of agreement were as follows :

(i) Raina will bring Rs. 40,000 as her capital and capitals of Badal and Bijli will be adjusted on the basis of Raina’s capital by opening current ac-counts.

(ii) Raina will bring her share of goodwill premium for Rs.12,000 in cash.

(iii) The building was overvalued by Rs. 15,000 and stock by Rs. 3,000.

(iv) A provision of 10% was to be created on debtors for bad debts.

Prepare the Revaluation Account and Current and Capital Accounts of Badal, Bijli and Raina.

Answer :