MCQs for CBSE Class 12 Accountancy All Chapters

Students should read the below MCQs for CBSE Class 12 Accountancy for all chapters prepared as per the latest syllabus and examination pattern for the current academic year. You should also refer to MCQ Questions for all other Class 12 Accountancy chapters provided on our website

- 1. Loss on issue of debentures is written-off out of

(a) Securities premium reserve

(b) General reserve and statement of profit and loss account

(c) Both (a) and (b)

(d) Discount on issue of debentures account

Answer

C

- 2. If a partner withdraws equal amount at end of each quarter, then…… are to be considered

for interest on total drawings.

(a) 5.5 months

(b) 6 months

(c) 4.5 months

(d) 7.5 months

Answer

C

- 3. Liquid ratio is calculated as

(a) (Current assets – Fictitious assets) / Current Liabilities

(b) (Current assets – Current Liabilities) / Current assets

(c) (Current assets – Liquid assets) / Current Liabilities

(d) (Current assets – Inventories – Prepaid Expenses) / Current Liabilities

Answer

D

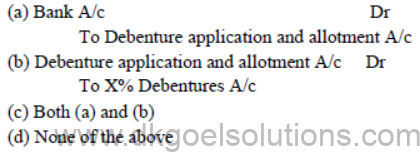

- 4. Debentures are issued at par with the condition that redemption will also be at par journalise it.

Answer

C

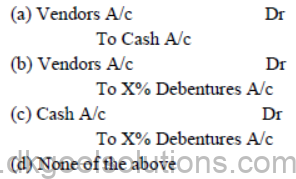

- 5. When an asset is purchased by a company and debentures are issued in consideration, then journal entry will be.

Answer

D

- 6. Ostensible partners are those who

A. Do not contribute any capital but get some share of profit for lending their name to the business

B. Contribute very less capital but get equal profit

C. Do not contribute any capital and without having any interest in the business, lend their name to the business

D. Contribute maximum capital of the business

Answer

C

- 7. Which of the following statement is true?

A. A minor cannot be admitted as a partner

B. A minor can be admitted as a partner, only into the benefits of the partnership

C. A minor can be admitted as partner but his rights and liabilities are same of adult partner

D. None of the above

Answer

B

- 8. Numbering of partnership firm may be:

A. Maximum Two

B. Maximum Ten

C. Maximum One Hundred

D. Maximum Fifty

Answer

D

- 9. In the absence of a partnership deed, the allowable rate of interest on partner’s loan account will be:

A. 6% Simple Interest

B. 6% p.a. Compound Interest

C. 12% Simple Interest

D. 12% Compounded Annually

Answer

A

- 10. Is rent paid to a partner appropriation of profits?

A. It is appropriation of profit

B. It is not appropriation of profit

C. If partner’s contribution as capital is maximum

D. If partner is a working partner

Answer

B

- 11. A, B and C are partners in the ratio of 5:3:2. Before B’s salary of ₹ 17,000 firm’s profit is ₹ 97,000. How much in total B will receive from the firm?

A. ₹ 17,000

B. ₹ 40,000

C. ₹ 24,000

D. ₹ 41,000

Answer

D

- 12. (i) Actual average profit ₹ 72,000

(ii) Normal rate of return 10%

(iii) Assets ₹ 9,70,000

(iv) Current Liabilities ₹ 4,00,000

Answer

- 13. Goodwill according to capitalization method will

A. ₹ 1,50,000

B. ₹ 1,40,000

C. ₹ 1,60,000

D. None of the three

Answer

A

- 14. A and B are equal partners with capitals of the ₹ 10,000 and ₹ 8,000 respectively. They admit C as a partner with 1/4th share in the profits of the firm. C brings ₹ 8,000 as his share of capital. Value of goodwill will be .

A. ₹ 6,000

B. ₹ 5,000 - C. ₹ 8,000

- D. None of the above

Answer

A

- 15. A, B and C were partners sharing profit or loss in the ratio of 7 : 3 : 2. From Jan. 1, 2019 they decided to share profit or loss in the ratio of 8 : 4 : 3. Due to change in the profit-loss sharing ratio, B’s gain or sacrifice will be:

A. Gain 𝟏𝟔𝟎

B. Sacrifice 160

C. Gain 260

D. Sacrifice 360

Answer

A

- 16. Ramesh and Suresh are partners sharing profits in the ratio of 2 : 1 respectively. Ramesh Capital is ₹ 1,02,000 and Suresh Capital is ₹ 73,000. They admit Mahesh and agree to give him 1/5th share in future profit. Mahesh brings ₹ 14,000 as his share of goodwill. He agrees to contribute capital in the new profit sharing ratio. How much capital will be brought by Mahesh?

A. ₹ 43,750

B. ₹ 45,000

C. ₹ 47,250

D. ₹ 48,000

Answer

C

- 17. If, at the time of admission, some profit and loss account balance appears in the books, it will be transferred to:

A. Profit & Loss Adjustment Account

B. All Partner’s Capital Accounts

C. Old Partner’s Capital Accounts

D. Revaluation Account

Answer

C

- 18. X, Y and Z are partners in the ratio of 12:25:110. What will be new ratio of remaining partners if X retires:

A. 2 : 1

B. 4 : 1

C. 5 : 1

D. 3 : 1

Answer

B

- 19. When only old profit and loss sharing ratio is given, gaining ratio of remaining partners will be .

A. 1 : 1

B. Old ratio

C. Capital ratio

D. Can not be calculated

Answer

B

- 20. A, B and C were partners in a firm sharing profits and losses in the ratio of 2:2:1. The capital balance are ₹ 50,000 for A, ₹ 70,000 for B, ₹ 35,000 for C. B decide to retire from the firm and balance in reserve on the date was ₹ 25,000. If goodwill of the firm was valued at ₹ 30,000 and profit on revaluation was ₹ 7,500 then, what amount will be payable to B?

A. ₹ 70,820

B. ₹ 76,000

C. ₹ 75,000

D. ₹ 95,000

Answer

D

- 21. A, B and C are partners in a firm sharing profit/loss in the ratio of 2 : 2 : 1. On March 31, 2019, C died. Accounts are closed on Dec., 31 every year. The sales for the year 2018 was ₹ 600,000 and the profits were ₹ 60,000. The sales for the period from Jan. 1, 2019 to March 31, 2019 were ₹ 2,00,000. The share of decreased partner in the current year’s profits on the basis of sales is:

A. ₹ 20,000

B. ₹ 8,000

C. ₹ 3,000

D. ₹ 4,000

Answer

D

- 22. ____________is the extra earning capacity of a business.

A. Sacrificing ratio

B. New ratio

C. Old ratio

D. Gaining ratio

Answer

D

- 23. As per legal provision, amount realized from the sale of assets at the time of dissolution of partnership firm be used first for________.

A. Dissolution expenses

B. Third party’s debts

C. Partner’s loan

D. Partner’s wife’s loan

Answer

B

- 24. At the time of dissolution, the goodwill is ₹ 50,000 in balance sheet. No specification has been given regarding it. What will be the effect?

A. Realization A/c Cr.

B. Realization A/c Dr.

C. Goodwill A/c Dr.

D. No effect.

Answer

B

- 25. On dissolution of a firm, firm’s Balance Sheet total is ₹ 77,000. On the assets side of the Balance Sheet items were shown preliminary expenses ₹ 2,000; Profit & Loss Account (Debit) Balance ₹ 4,000 and Cash Balance ₹ 1,800. Loss on realization was ₹ 6,300. Total assets (including cash balance) realized will be:

A. ₹ 69,200

B. ₹ 71,000

C. ₹ 64,700

D. ₹ 62,900

Answer

C

- 26. Investments valued ₹ 2,00,000 were not shown in the books. One of the creditors took over these investments in full satisfaction of his debt of ₹ 2,20,000. How much amount will be deducted from creditors?

A. ₹ 20,000

B. ₹ 2,20,000

C. ₹ 4,20,000

D. ₹ 2,00,000

Answer

B

- 27. In the event of dissolution of firm, the partner’s personal assets are first used for payment of the:

A. Firm’s liabilities

B. The personal liabilities

C. None of the two

D. Any of the two

Answer

B

- 28. What type of expenditure is any addition in building?

A. Capital expenditure

B. Revenue expenditure

C. Both (A) and (B)

D. None of these

Answer

A

- 29. Income and Expenditure Account is a:

A. Personal Account

B. Real Account

C. Nominal Account

D. Real and Nominal Account, both

Answer

C

- 30. Accounting treatment of Legacy is done as:

A. Credited to Income & Expenditure A/c

B. Debited to Income & Expenditure A/c

C. Transferred to liabilities side of closing Balance sheet

D. Transferred to assets side of closing Balance sheet

Answer

C

- 31. The public issue is said to be devolved, if applications are received for less than of amount called up.

A. 60%

B. 80%

C. 85%

D. 90%

Answer

D

- 32. The minimum subscription specified in the prospectus must be received within :

A. 90 days

B. 140 days

C. 130 days

D. 60 days

Answer

C

- 33. Following amounts were payable on issue of shares by a company : ₹ 3 on application, ₹ 3 on allotment, ₹ 2 on first call and ₹ 2 on final call. X holding 500 shares paid only application and allotment money whereas Y holding 400 shares did not pay final call. Amount of calls in arrear will be:

A. ₹ 3,800

B. ₹ 2,800

C. ₹ 1,800

D. ₹ 6,200

Answer

C

- 34. 400 shares of ₹ 10 each, ₹ 8 has been called and ₹ 5 has been paid, are forfeited. Out of these, 300 are re-issued for ₹ 9 as full paid. What is the amount to be transferred to Capital Reserve account?

A. ₹ 1,200

B. ₹ 1,600

C. ₹ 2,000

D. ₹ 1,700

Answer

A

- 35. XY Limited issued 2,50,000 equity shares of ₹ 10 each at a premium of ₹ 1 each payable as ₹ 2.5 on application. ₹ 4 on allotment and balance on the first and final call. Application were received for 5,00,000 equity shares but the company allotted to them only 2,50,000 shares. Excess money was applied towards amount due on allotment. Last call on 500 shares was not received and shares were forfeited after due notice. This is a case of:

A. Over Subscription

B. Pro-rata allotment

C. Forfeiture of Shares

D. All of the Above

Answer

A

- 36. Menon and Company issued 12% debentures of ₹ 4,00,000 at a discount of 5% redeemable at 10% premium. The loss on the issue of debentures will be_____.

A. ₹ 60,000

B. ₹ 40,000

C. ₹ 38,000

D. ₹ 20,000

Answer

A

- 37. Return on shares is while returns on debentures is .

A. interest, dividend

B. dividend, dividend

C. interest, interest

D. dividend, interest

Answer

D

- 38. Debentures which are converted into equity shares automatically after specified period are known as __ debentures.

A. convertible

B. non-convertibles

C. register

D. irredeemable

Answer

A

- 39. The comparative study of the sales of two firms is :

A. Inter firm analysis

B. Intra firm analysis

C. Horizontal analysis

D. Trend analysis

Answer

A

- 40. Comparative statements are also known as :

A. Dynamic analysis

B. Horizontal analysis

C. Vertical analysis

D. None of these

Answer

D

- 41. Current ratio of a firm is 9 : 4. Current liability is ₹ 1,20,000. Stock ₹ 30,000. Find liquid ratio?

A. 1 : 1

B. 1.5 : 1

C. 2 : 1

D. 1.6 : 1

Answer

C

- 42. A company’s Current Ratio is 2 : 1. After cash payment to some of its creditors, Current Ratio will:

A. Decrease

B. Increase

C. As before

D. None of the these

Answer

B

- 43. Which of the following item is not considered as cash equivalent?

A. Bank overdraft

B. Commercial paper

C. Treasury bill

D. Short term investment

Answer

A

- 44. What do you mean by “cash equivalents”?

A. Bank balance

B. Short-term highly liquid investments

C. Investments

D. Investment in debentures

Answer

B

- 45. Cash equivalent has_________.

A. Higher liquidity

B. Higher solvency

C. Higher profitability

D. All of the above

Answer

A

- 46. In a partnership, interest on drawings is a

(a) Income for partners

(b) Asset for firms

(c) Income for firms

(d) Liability of firms

Answer

A

- 47. A,B and C are partners sharing profits and losses in the ratio of 4/10, 4/10 and 1/5. B retires from the firm, A and C decided to share future profits and losses in the ratio of 3:2, Calculate gaining ratio.

(a) 1:2

(b) 1:1

(c) 3:2

(d) 2:1

Answer

B

- 48. If the value of current assets is twice the current liabilities and working capital is Rs. 80,000, what will be the value of current liabilities?

(a) Rs. 20,000

(b) Rs. 1,60,000

(c) Rs. 60,000

(d) Rs. 80,000

Answer

D

- 49. Which of these account has no ledger folio columns?

(a) Cash book

(b) Receipts and payments

(c) Journal

(d) None of these

Answer

B

- 50. If gross profit ratio is 20% and gross profit is Rs. 1,00,000. What will be the value of Cost of Goods Sold (COGS)?

(a) Rs. 4,00,000

(b) Rs. 2,00,000

(c) Rs. 3,00,000

(d) Rs. 3,50,000

Answer

A

- 51. Capital fund in non-profit organization will be

(a) Total assets – Total liabilities

(b) Total assets – External liabilities

(c) Total assets – Internal liabilities

(d) Total fund – Total external liabilities

Answer

A

- 52. Which of the following is not an example of solvency ratio?

(a) Quick ratio

(b) Proprietary ratio

(c) Debt-equity ratio

(d) Interest coverage ratio

Answer

A

- 53. Share of losses is transferred to …….. under fluctuating capital account method.

(a) Partners’ capital account

(b) Partners’ current account

(c) Profit and loss account

(d) None of these

Answer

A

- 54. Salaries Rs. 2,00,000, salaries outstanding at end of year Rs. 24,000, salaries paid in advance Rs. 15,000. Income and expenditure account will show ………. Balance of salaries.

(a) Rs. 2,08,000

(b) Rs. 2,10,000

(c) Rs. 2,09,000

(d) None of these

Answer

C

- 55. A and B are partners in a firms having a capital of Rs. 54,000 and Rs. 36,000 respectively. They admitted C for 1/3rd share in the profits C brought proportionate amount of capital. The capital brought in by C would be

(a) Rs. 90,000

(b) Rs. 45,000

(c) Rs. 5,400

(d) Rs. 3,600

Answer

B

- 56. %age of each item of any particular year in common-size balance sheet is calculated on the basis of particular item of that year and

(a) Balance Sheet Total

(b) Revenue from Operations

(c) Shareholders’ Fund

(d) Revenue from Operations

Answer

B

- 57. Amount payable on shares can be received in installments by the company. What is the first installments called?

(a) Application money

(b) Allotment money

(c) First call money

(d) Second call money

Answer

A

- 58. Which of the following cannot be recorded in the receipt and payment account of a club?

(a) Payment made to workers

(b) Sale of old newspaper

(c) Loss on sale of fixed asset

(d) All of these

Answer

C

- 59. If current assets are Rs. 1,00,000, current liabilities are Rs. 50,000, inventories Rs. 6,000 and prepaid expenses Rs. 10,000. What is the value of quick assets?

(a) Rs. 50,000

(b) Rs. 94,000

(c) Rs. 90,000

(d) Rs. 84,000

Answer

D

- 60. Company can only forfeit shares, if it is written in

(a) Article of association

(b) Memorandum

(c) Clause

(d) Deal document

Answer

A

Also read DK Goel Solutions Class 12